The Core Dilemma: Balancing Innovation Incentives with Public Access

At the heart of the pharmaceutical industry lies a fundamental, and often fraught, bargain. Society grants a temporary monopoly, in the form of a patent, to an inventor in exchange for the creation and disclosure of a new and useful invention . In the world of medicine, this bargain is amplified to an extraordinary degree. The journey from a promising molecule in a lab to an FDA-approved drug on a pharmacy shelf is notoriously long, costly, and fraught with risk. Industry advocates, such as the Pharmaceutical Research and Manufacturers of America (PhRMA), frequently cite an average cost of $2.6 billion to develop a single new medicine, a process that can take 10 to 15 years . While other studies present lower estimates, some as low as $985 million after accounting for failures, there is no dispute that the investment is substantial .

This is where the patent system steps in. It is, as many have noted, the “backbone of medical innovation”. The promise of a 20-year period of market exclusivity allows companies to recoup these massive R&D expenditures and, crucially, to attract the private investment necessary to undertake such a high-risk venture in the first place . Without this protection, the argument goes, the financial incentive to develop new treatments for diseases like cancer, Alzheimer’s, and countless rare conditions would evaporate, leaving patients without hope for future cures .

Yet, this powerful incentive mechanism is a double-edged sword. The very monopoly that fuels innovation is also the primary driver of high drug prices . During the patent term, the manufacturer faces no direct competition from chemically identical generic drugs, allowing them to set prices based on what the market—largely insulated by insurance coverage—will bear. This leads to the stark reality we face today: prices in the United States are, on average, nearly three times higher than in 33 other developed nations . This affordability crisis creates devastating barriers to access, forcing one in three Americans to skip medications due to cost and, in tragic cases like the rationing of insulin, leading to preventable deaths .

This dynamic has long been framed as a simple, unavoidable trade-off: we can have innovation or we can have affordability, but we can’t have both. This is a false dichotomy. A deeper analysis of patent data reveals a more nuanced and troubling picture. The system is not just rewarding the high-risk, decade-long quest for a breakthrough cure. It is also rewarding low-risk, incremental tinkering and shrewd legal maneuvering designed not to improve patient health, but to extend a lucrative monopoly. Data from I-MAK, a public interest group, shows that for the top-selling drugs in the U.S., 78% of new patents are for existing drugs, not novel therapies, and 72% of patent applications are filed after the drug has already received FDA approval .

This is the critical distinction that policymakers must grasp. There is a profound difference between the primary patent on a novel active ingredient—the fruit of years of high-risk research—and the dozens of secondary patents that follow, covering minor changes to dosage, formulation, or delivery devices. By targeting the strategic abuse of these secondary patents, it is possible to curb anticompetitive behavior and lower prices without blunting the core incentive for genuine, breakthrough R&D. The challenge, and the opportunity, lies in using patent data to tell the difference.

Thesis: From Obscure Data to Actionable Intelligence

This report advances a clear and urgent thesis: a granular, sophisticated understanding of drug patent data is no longer a niche academic pursuit but an indispensable tool for modern governance. The patterns hidden within these datasets—the timing of patent filings, the types of claims being made, the outcomes of litigation, and the stark contrasts with international systems—provide a diagnostic roadmap. They reveal precisely how the patent system is being weaponized to delay competition and inflate prices.

By leveraging this data, policymakers can move beyond broad, blunt instruments and craft surgical interventions that target specific anticompetitive strategies. This requires looking beyond the surface of public databases and utilizing specialized platforms that aggregate and analyze this complex information. Services like DrugPatentWatch play a crucial role in this ecosystem, transforming raw data from the FDA, USPTO, and global patent offices into the kind of actionable, biopharmaceutical intelligence that can inform portfolio management for a generic drug company or, just as importantly, legislative strategy for a congressional committee.

The following sections will provide a comprehensive guide to understanding this data and the system that generates it. We will decode the different types of patents and exclusivities, dissect the strategies used to exploit them, review the current counter-offensives from regulators and legislators, and draw lessons from abroad. Ultimately, this report will equip you with the knowledge needed to forge a new path—one that uses data-driven policy to restore the balance between rewarding true innovation and ensuring that all Americans can access and afford the medicines they need.

Decoding the Patent Fortress: A Policymaker’s Guide to Pharmaceutical IP

To craft effective policy, one must first understand the architecture of the system being reformed. The market exclusivity for a brand-name drug is not a monolithic wall; it is a complex fortress built from two distinct but complementary materials: patents granted by the U.S. Patent and Trademark Office (USPTO) and regulatory exclusivities granted by the Food and Drug Administration (FDA). Understanding the unique function of each, how they interact, and the administrative systems that track them is the foundational step in identifying points of leverage for policy intervention.

The Twin Pillars of Protection: Differentiating Patents and FDA Exclusivities

It is a common misconception that a drug’s period of market monopoly is defined solely by its patent life. In reality, two separate legal frameworks are at play, and they often overlap and interact in complex ways.

First, we have patents. These are property rights granted by the USPTO to an inventor for a new, useful, and non-obvious invention . For pharmaceuticals, this can cover a wide range of innovations, from the drug’s core chemical compound to its formulation or method of use. A patent’s term generally lasts for 20 years from the date the application is filed . This 20-year clock starts ticking long before the drug ever reaches a patient, often while it is still in preclinical or early clinical development. Consequently, the effective market life of a drug under its core patent is typically much shorter, often in the range of 7 to 12 years by the time it receives FDA approval.

Second, we have regulatory exclusivities. These are exclusive marketing rights granted by the FDA upon a drug’s approval, completely separate from patent status . They were created by legislation, primarily the Hatch-Waxman Act of 1984 and the Biologics Price Competition and Innovation Act (BPCIA) of 2009, to promote a balance between innovation and competition . Unlike patents, which protect an invention, exclusivities protect the clinical trial data submitted by the brand manufacturer to prove a drug’s safety and efficacy. They prevent the FDA from approving a generic or biosimilar application that relies on that data for a set period.

These two pillars of protection can run concurrently, but they serve different purposes and have different timelines . A drug’s core patent might expire after 14 years on the market, but it could still be protected by an additional period of regulatory exclusivity. Conversely, a drug might have no patent protection at all but still benefit from a period of exclusivity.

The most significant types of FDA exclusivity include:

- New Chemical Entity (NCE) Exclusivity: Provides five years of data exclusivity for small-molecule drugs containing an active ingredient never before approved by the FDA. During this time, the FDA cannot even accept a generic application for the first four years (unless it challenges a patent).

- Biologics Exclusivity: Provides a much longer 12-year period of exclusivity for new biologic products. No biosimilar application can be submitted for the first four years, and none can be approved for the full 12 years.

- Orphan Drug Exclusivity (ODE): Grants seven years of market exclusivity to drugs developed to treat rare diseases (affecting fewer than 200,000 people in the U.S.). This is a powerful incentive to develop drugs for small patient populations .

- New Clinical Investigation Exclusivity: Offers three years of exclusivity for changes to a previously approved drug, such as a new dosage form or a new indication, if new clinical studies were required for approval.

- Pediatric Exclusivity: Adds an additional six months to any existing patents and exclusivities as an incentive for manufacturers to conduct studies in children .

The interplay between these protections is critical. The 12-year exclusivity for biologics, for example, creates a much higher baseline barrier to competition than the 5-year NCE exclusivity for small-molecule drugs. This extended protection, combined with the fact that biologics are often shielded by more complex and numerous patents, means that biosimilar competition is often delayed for much longer than generic competition. This has a direct and substantial impact on healthcare spending, as many of the costliest drugs, particularly those covered under Medicare Part B, are biologics. This makes the regulatory and patent framework surrounding biologics a prime target for policy reforms aimed at controlling costs.

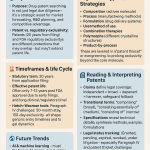

The Anatomy of a Patent Portfolio: Beyond the Active Ingredient

Policymakers must appreciate that a modern blockbuster drug is rarely protected by a single patent. Instead, it is shielded by a sophisticated, multi-layered portfolio of patents—a legal fortress designed to protect the product throughout its lifecycle. This strategy has evolved from being “molecule-centric” to “lifecycle-centric,” where continuous, incremental patenting extends exclusivity far beyond the expiration of the initial discovery. Understanding the different types of patents in this portfolio is key to identifying which ones represent genuine innovation and which are primarily tools for blocking competition.

Composition of Matter / Active Ingredient Patents

This is the foundational patent, often called the “gold standard” of pharmaceutical IP. It covers the active pharmaceutical ingredient (API) itself—the new chemical entity that produces the therapeutic effect . A composition of matter patent provides the broadest and strongest protection; if the molecule is present in a product, the patent applies, making it very difficult for a competitor to “design around” it without infringing. This is typically the first patent filed and represents the core invention that emerges from the high-risk discovery phase of R&D.

Formulation Patents

These patents do not cover the active ingredient itself, but rather the specific way it is prepared for administration to a patient . This can include:

- The specific combination of the API with inactive ingredients (excipients) that affect the drug’s stability, absorption, or taste.

- The dosage form, such as a tablet, capsule, injectable solution, or transdermal patch .

- Specialized delivery mechanisms, such as an extended-release formulation that allows for once-daily dosing instead of multiple times a day.

Formulation patents are a critical tool for product lifecycle management. A new, more convenient formulation can be patented just as the patent on the original formulation is about to expire, providing a new layer of protection .

Method-of-Use Patents

Instead of protecting the drug itself, these patents protect a specific method of using the drug to treat a particular disease or condition . For example, a company might discover that a drug initially approved to treat heart disease is also effective against a certain type of cancer. They can then obtain a new method-of-use patent covering the administration of that drug for the treatment of cancer.

These patents are a cornerstone of modern “evergreening” strategies. They represent a staggering 41% of all patents filed after a drug has already received FDA approval. This highlights a crucial trend: innovation is no longer confined to the discovery of new molecules but has expanded to include the discovery of new applications for existing ones. While this can represent genuine therapeutic advancement, it also provides a powerful mechanism for extending a drug’s monopoly.

Device and Process Patents

This category covers two other important areas of secondary patenting:

- Device Patents: These protect the physical devices used to deliver a drug, such as a specific type of inhaler for an asthma medication, an auto-injector for an epinephrine pen, or a pre-filled syringe for a biologic .

- Process Patents: These protect the specific method or series of steps used to manufacture a drug . While a competitor could legally sell the same final drug if they developed a different, non-infringing manufacturing process, this can be technically challenging and costly.

Crucially, under FDA regulations, patents covering manufacturing processes, packaging, metabolites, or intermediates are generally not eligible for listing in the FDA’s Orange Book . However, they can still be asserted in patent infringement litigation, adding another layer of legal risk for potential competitors. Device patents, on the other hand, have become a major point of contention, with many being improperly listed in the Orange Book to trigger delays in generic competition, a practice the FTC is now actively challenging .

The Gatekeepers of Competition: The FDA’s Orange and Purple Books

At the center of the interplay between patents, exclusivities, and generic drug competition are two critical FDA publications: the Orange Book for small-molecule drugs and the Purple Book for biologics. These databases are not merely informational resources; they are the administrative linchpins of the entire system that governs when and how lower-cost alternatives can reach the market .

The Orange Book (Small Molecules)

Officially titled Approved Drug Products with Therapeutic Equivalence Evaluations, the Orange Book is the public ledger connecting the worlds of drug approval and patent law. It lists all FDA-approved small-molecule drugs, their associated patents and exclusivities as submitted by the brand manufacturer, and the FDA’s determination of which generic products are therapeutically equivalent to a brand-name drug.

Its most critical function relates to the generic drug approval pathway established by the Hatch-Waxman Act. When a generic company wants to market a version of a brand-name drug, it files an Abbreviated New Drug Application (ANDA). As part of this filing, the generic manufacturer must make a certification for each patent listed in the Orange Book for the brand drug. The most consequential of these is the “Paragraph IV” certification, in which the generic company asserts that a listed patent is invalid, unenforceable, or will not be infringed by its product .

Filing a Paragraph IV certification is considered an act of artificial infringement, giving the brand company grounds to sue the generic manufacturer immediately. If the brand company files an infringement lawsuit within 45 days of receiving notice, it triggers an automatic 30-month stay of the FDA’s final approval for the generic drug . This stay is intended to provide time for the courts to resolve the patent dispute before the generic launches. However, as we will see, this automatic delay has become one of the most powerful and frequently abused tools for stifling competition.

The Purple Book (Biologics)

The Purple Book serves a similar function for biologics and their lower-cost follow-on versions, known as biosimilars. It is the official database of all FDA-licensed biological products, including which products are biosimilar to or interchangeable with an original brand (reference) product .

For years, a critical difference between the two books was that the Purple Book did not contain patent information. This created immense uncertainty for biosimilar developers, who had to navigate the complex pre-litigation information exchange known as the “patent dance” without a clear public registry of the patents they might face. This information asymmetry created significant risk and likely deterred investment in biosimilar development. Recognizing this deficiency, Congress passed the Biological Product Patent Transparency section of the Consolidated Appropriations Act of 2021, which now requires brand manufacturers to submit their patent lists to the FDA for publication in the Purple Book after they are exchanged with a biosimilar applicant .

The Critical Flaw: The FDA’s “Ministerial” Role

Herein lies the system’s single greatest vulnerability: the FDA’s role in listing patents is purely administrative, or “ministerial” . The agency does not substantively review the patents submitted by a brand company to verify their accuracy, relevance, or validity. As long as the submission forms are filled out correctly, the FDA publishes the information it is given. The agency’s long-standing position is that it lacks the legal authority, resources, and patent law expertise to act as an arbiter of patent scope.

This passive stance creates a powerful incentive for abuse. The commercial benefit of listing a patent in the Orange Book is immense—the ability to trigger an automatic 30-month delay in competition—while the historical downside for an improper listing has been minimal. This transforms the Orange Book from a transparent public ledger into a defensive weapon. A brand company can achieve a two-and-a-half-year delay in competition simply by listing a patent, regardless of its merit, and then filing a lawsuit. The act of listing itself becomes an anticompetitive tactic. This is the structural flaw that enables many of the strategies discussed in the next section and is the precise behavior that federal antitrust agencies have recently begun to aggressively target . Any meaningful policy reform must address this fundamental misalignment of incentives at the heart of the patent listing process.

Weaponizing the System: How Patent Strategies Delay Competition and Inflate Prices

The legal and regulatory framework described above, while complex, was designed with a clear purpose: to balance the need for innovation with the goal of timely generic competition. However, over the past two decades, this system has been systematically exploited through a series of sophisticated and aggressive strategies. These tactics are not aimed at creating better medicines but at building legal and financial barriers that make it prohibitively difficult for lower-cost alternatives to enter the market. Understanding these strategies—the patent thicket, evergreening, product hopping, and pay-for-delay settlements—is essential for any policymaker seeking to address the root causes of high drug prices.

The Patent Thicket: Building an Impenetrable Legal Fortress

The term “patent thicket” aptly describes one of the most formidable barriers to competition in the modern pharmaceutical landscape. It is not merely a large number of patents but a “dense web of overlapping intellectual property rights that a company must hack its way through in order to actually commercialize new technology”. The strategic objective is to create a litigation landscape so complex, costly, and time-consuming to navigate that would-be generic or biosimilar competitors are deterred from even attempting to enter the market .

The anatomy of a thicket involves layering dozens, or even hundreds, of secondary patents on top of a drug’s primary patent . These secondary patents, often filed years after the drug’s initial FDA approval, target peripheral features like dosage forms, manufacturing methods, or new methods of use . For top-selling drugs, an astonishing 66% of patent applications are submitted post-approval . This strategy shifts the competitive battleground. Instead of a single, decisive legal fight over the validity of the core invention, a challenger must engage in a war of attrition, litigating numerous, often duplicative, patents simultaneously. The cost of challenging over 70 patents per drug can run into the millions, creating a barrier that only the most well-capitalized competitors can surmount .

Case Study: AbbVie’s Humira – The Archetype of a Patent Thicket

There is no better illustration of the patent thicket strategy than AbbVie’s blockbuster biologic, Humira (adalimumab). Approved by the FDA in 2002, Humira became the world’s top-selling drug, used to treat a range of autoimmune conditions like rheumatoid arthritis and Crohn’s disease . Its primary patent on the active ingredient was set to expire in 2016.

To protect this revenue stream, AbbVie constructed an unprecedented legal fortress around the drug. The company filed over 247 patent applications, securing at least 132 to 136 granted patents in the United States . This dense web covered every conceivable aspect of the product: dozens of patents on manufacturing processes, new formulations (such as a citrate-free version to reduce injection-site pain), and new method-of-use patents for each new indication for which the drug was approved .

The strategy was devastatingly effective. While multiple biosimilar versions of Humira were approved by the FDA, none could launch in the U.S. until 2023. The sheer number of patents created an insurmountable litigation barrier. Unable to afford the time and expense of challenging over 100 patents, every single biosimilar manufacturer capitulated and entered into a settlement agreement with AbbVie, agreeing to delay their market entry .

The contrast with Europe is stark and illuminating for policymakers. In Europe, where patenting standards are stricter, AbbVie held far fewer patents on Humira. As a result, biosimilar competition began in 2018, a full five years earlier than in the United States . This extended monopoly in the U.S. came at a staggering cost. One analysis estimated that the delay cost the American healthcare system over $19 billion, with another report quantifying the lost savings for Humira in a single year at $7.6 billion . The Humira case is a masterclass in how the U.S. patent system can be leveraged not to protect a single invention, but to build a legal wall that insulates a blockbuster product from competition for years beyond what was contemplated by its core patent.

Evergreening and Product Hopping: The Art of the Trivial Tweak

While patent thickets create a litigation barrier, “evergreening” and “product hopping” are strategies that manipulate the product and the market itself to thwart competition.

Evergreening is the broad term for strategies used to obtain new patents on minor modifications of existing drugs, thereby extending the product’s overall period of patent protection . This can include patenting new dosage forms, creating an extended-release version, patenting a new method of use, or even patenting a specific crystalline form of the active ingredient . While some of these changes may offer marginal patient benefits, their primary purpose is often to secure a new 20-year patent term for the modification, creating fresh obstacles for generic competitors just as the original patents are set to expire.

Product Hopping is a particularly aggressive form of evergreening that leverages the mechanics of the U.S. pharmacy system . Most state laws permit or require pharmacists to automatically substitute a lower-cost, bioequivalent generic when a patient presents a prescription for a brand-name drug. This automatic substitution is the economic engine of the generic drug market. Product hopping is designed to break this chain .

The tactic works like this: shortly before the patents on an existing drug (e.g., a twice-daily tablet) are set to expire, the manufacturer introduces a “new and improved” version (e.g., a once-daily extended-release tablet) and obtains new patents on it. They then engage in a massive marketing push to switch doctors and patients to the new version, often while simultaneously discontinuing the old product—a maneuver known as a “hard switch” . Because the new extended-release version is not bioequivalent to the old immediate-release version, pharmacists cannot automatically substitute the now-available generic of the old drug for a prescription written for the new one . Patients are effectively “hopped” to the new, patent-protected product, and the nascent generic market for the original drug is starved of customers.

Case Study: The Insulin Controversy – A Century of Incremental Patenting

The story of insulin is a tragic case study in how evergreening can turn a life-saving discovery into a source of financial hardship for millions. When Frederick Banting and his colleagues discovered insulin in the 1920s, they sold the patent to the University of Toronto for a symbolic $1 each, famously stating, “Insulin does not belong to me, it belongs to the world” .

A century later, the U.S. insulin market is an oligopoly controlled by just three manufacturers: Eli Lilly, Novo Nordisk, and Sanofi. These companies have maintained their market dominance through decades of incremental patenting. While the core insulin molecules have been off-patent for years, the companies have continuously filed for and obtained new patents on minor modifications to the drug’s formulation and, critically, on the delivery devices—the injector pens that patients use daily . Sanofi, for example, has filed 74 patents on its blockbuster insulin product, Lantus . Mylan extended the monopoly on its EpiPen, which delivers the century-old drug epinephrine, until 2025 by patenting minor tweaks to the auto-injector device .

This relentless evergreening has allowed manufacturers to maintain their monopolies and has contributed to an explosion in prices. The list price of a vial of Humalog insulin, for instance, skyrocketed by over 1,000% in two decades, from $21 to $332. The consequences have been devastating. An estimated one-quarter to one-third of Americans with diabetes report rationing or skipping their insulin doses due to cost, leading to severe health complications and preventable deaths .

Case Study: From Prilosec to Nexium – A Classic “Product Hop”

The switch from Prilosec to Nexium is the textbook example of a successful product hop. In the late 1990s, AstraZeneca’s heartburn medication Prilosec (omeprazole) was a blockbuster, earning the company an estimated $6 billion annually. But with its main patent set to expire in 2001, the company faced a looming “patent cliff” and a sharp decline in revenue.

In response, AstraZeneca initiated what it internally called the “Shark Fin Project,” designed to migrate the market to a new, patent-protected product before generic omeprazole could launch. The result was Nexium (esomeprazole). The innovation behind Nexium was minimal. Omeprazole is a “racemic mixture,” meaning it contains two molecules that are mirror images of each other (enantiomers), like a left and right hand. Nexium was simply one of those two molecules, isolated. Despite numerous studies showing no substantial clinical difference between the two drugs, AstraZeneca launched a massive marketing campaign hailing Nexium as a superior “purple pill” .

The strategy worked perfectly. By aggressively promoting Nexium to doctors and patients, AstraZeneca successfully “hopped” a significant portion of the market from Prilosec to its newly patented drug just as generic competition for Prilosec was arriving . This maneuver extended the company’s lucrative monopoly in the proton-pump inhibitor market for years, generating billions in additional revenue from a product that offered little to no therapeutic advantage over its predecessor. The success of these strategies reveals a critical misalignment: the patent system’s criteria for novelty and non-obviousness do not require an invention to be clinically superior or to provide a meaningful benefit to patients. A change can be legally patentable without being medically valuable, a loophole that has been exploited to the detriment of consumers and payers.

Pay-for-Delay: The Antitrust Red Flag

A final key strategy that leverages the patent system to block competition is the “pay-for-delay” settlement, also known as a “reverse payment” agreement. This tactic arises directly from the patent litigation process initiated under the Hatch-Waxman Act.

Here’s how it works: A generic company files an ANDA with a Paragraph IV certification, challenging the brand’s patents. The brand company, as expected, sues for patent infringement, triggering the 30-month stay. Now, both parties face risks. The brand company risks having its patents invalidated in court, which would open the floodgates to generic competition. The generic company risks losing the lawsuit and being liable for massive damages if it launches its product “at risk” and is later found to infringe.

To avoid these risks, the two parties often settle the litigation. In a pay-for-delay settlement, the brand manufacturer pays the generic challenger to drop its patent challenge and agree to delay the launch of its generic product until a specified future date . The payment can be a direct cash transfer or, more commonly today, disguised in a “side deal,” such as a co-promotion agreement or a restrictive supply arrangement where the money flows from the brand to the generic .

The effect of these agreements is profoundly anticompetitive. They eliminate the risk of patent invalidation for the brand and eliminate the possibility of early generic entry for consumers. Both companies share in the brand’s monopoly profits, while patients and payers continue to pay high prices. The Federal Trade Commission (FTC) has been a vocal opponent of these deals for over two decades, estimating that they cost consumers and taxpayers $3.5 billion in higher drug costs every year . The Supreme Court’s landmark 2013 decision in FTC v. Actavis affirmed that these settlements could be challenged under antitrust law, but the practice has not disappeared. Instead, the agreements have simply become more complex and opaque, presenting an ongoing challenge for antitrust enforcers.

The Counter-Offensive: Current Legislative and Regulatory Responses

The systemic exploitation of the patent system has not gone unnoticed. In recent years, a multi-front counter-offensive has been launched by federal agencies and lawmakers, signaling a growing consensus that the status quo is untenable. This response involves heightened antitrust enforcement by the Federal Trade Commission (FTC) and the Department of Justice (DOJ), a renewed focus on patent quality at the U.S. Patent and Trademark Office (USPTO), and a raft of bipartisan legislative proposals aimed at closing the loopholes that enable anticompetitive behavior.

Wielding the Antitrust Sword: FTC and DOJ Enforcement

For years, the FTC has been the primary federal agency pushing back against anticompetitive practices in the pharmaceutical industry. Its efforts, now increasingly coordinated with the DOJ, have intensified and expanded in scope.

The FTC’s longest-running battle has been against pay-for-delay settlements. Since 2001, the agency has filed numerous lawsuits to block these agreements . While the Supreme Court’s Actavis decision gave the FTC a stronger legal footing, enforcers note that the nature of these deals has evolved. Blatant cash payments have been replaced by more sophisticated and harder-to-detect side deals, such as restrictive supply agreements or asset sales where the value transferred from the brand to the generic company is disproportionate. This has forced the agency to adapt its enforcement strategies to scrutinize the full context of these settlements.

More recently, the FTC has opened a new and aggressive front against improper Orange Book listings. Recognizing that the automatic 30-month stay weaponizes the listing process, the agency has begun to treat the listing of “junk patents” as an unfair method of competition in violation of Section 5 of the FTC Act . In a series of highly publicized actions starting in late 2023, the FTC sent warning letters to numerous pharmaceutical companies, challenging the listing of hundreds of patents, primarily those covering drug delivery devices like asthma inhalers and epinephrine auto-injectors . The agency’s position is that patents that claim only a device, without claiming the drug itself, do not meet the statutory criteria for listing and serve only to improperly trigger stays and delay generic competition . This direct challenge to the listing practice itself is a significant escalation in enforcement and has already prompted several companies to delist contested patents.

This heightened scrutiny is part of a broader, coordinated effort. The FTC and DOJ have been holding joint public listening sessions to gather evidence on a range of anticompetitive practices, including patent thickets, product hopping, and the role of Pharmacy Benefit Managers (PBMs) in formulary design . This signals a whole-of-government approach to tackling the problem, with antitrust enforcers actively seeking to understand and address the complex interplay between patent law, regulatory loopholes, and market power.

Reforming the Gatekeeper: USPTO Initiatives to Improve Patent Quality

In parallel with enforcement actions, there is a growing recognition that many of these anticompetitive strategies are enabled by the issuance of low-quality patents in the first place. In response to President Biden’s 2021 Executive Order on Promoting Competition in the American Economy , the USPTO has launched several important initiatives aimed at improving patent quality and curbing abuse.

A key focus is enhanced collaboration with the FDA. The two agencies, which historically operated in separate silos, are now working more closely to ensure greater consistency and transparency . A primary goal is to address situations where a company might make contradictory statements to the two agencies—for example, arguing to the FDA that a new formulation is essentially the same as an old one to rely on prior safety data, while simultaneously arguing to the USPTO that the same formulation is a novel and non-obvious invention worthy of a new patent. To this end, the USPTO has issued guidance reminding applicants of their “duty of disclosure,” which requires them to submit all relevant information to the patent examiner, including statements made to other government agencies .

The USPTO is also re-examining its own internal procedures that have facilitated the growth of patent thickets. The agency has solicited public comment on several proposed rule changes that could significantly tighten the standards for so-called “continuation” applications. These applications, which allow an inventor to file multiple patents based on a single initial disclosure, are a primary tool for building a thicket. One key proposal would address the use of “terminal disclaimers.” Currently, when the USPTO rejects a patent for being an obvious variant of an earlier patent by the same owner, the applicant can overcome this rejection by agreeing that the second patent will expire on the same day as the first. This allows them to obtain numerous, often duplicative patents. A proposed rule, which was controversially withdrawn after industry pushback but remains a focus of reformers, would cause these terminally disclaimed patents to “stand or fall together” . This would mean that if the foundational patent in a family is invalidated by a court, all the secondary patents linked to it by a terminal disclaimer would also become unenforceable, dramatically reducing the defensive power of a thicket .

Action on Capitol Hill: Analyzing Key Legislative Proposals

Recognizing that some of these issues require statutory fixes, Congress has seen a surge in bipartisan activity aimed at pharmaceutical patent reform. Several key bills have advanced with broad support, indicating a real potential for legislative change.

The Affordable Prescriptions for Patients Act

Perhaps the most significant piece of legislation is the Affordable Prescriptions for Patients Act (APPA), sponsored by Senators John Cornyn (R-TX) and Richard Blumenthal (D-CT) . This bill, which passed the Senate unanimously in July 2024, takes direct aim at patent thickets in the biologics space .

Instead of trying to redefine the complex standards of what is patentable, the APPA takes a more direct, procedural approach. It targets the litigation process itself. The bill would amend the BPCIA to limit the number of patents that a brand biologic manufacturer can assert against a biosimilar challenger in the initial wave of litigation . The proposed cap is 20 patents, with a specific focus on limiting later-filed patents (those filed more than four years after the biologic was approved) and patents on manufacturing processes not actually used by the brand company .

The logic behind this approach is elegant. It doesn’t prevent a company from obtaining a large patent portfolio, but it significantly reduces the portfolio’s utility as a litigation barrier. A brand company would be forced to select its 20 strongest patents to litigate, rather than overwhelming a challenger with a hundred or more claims of varying quality. This would make the legal challenge more manageable and affordable for the biosimilar developer, leveling the playing field and encouraging challenges based on the merits of the patents rather than the depth of the litigants’ pockets. The bill also includes provisions that would establish a legal presumption that product hopping is an anticompetitive practice, giving the FTC clearer authority to challenge this tactic .

Other Bipartisan Efforts

The APPA is part of a broader suite of bipartisan bills that have been advanced by the Senate Judiciary Committee, signaling a comprehensive approach to reform. These include:

- The Preserve Access to Affordable Generics and Biosimilars Act, which would strengthen the FTC’s ability to challenge pay-for-delay settlements.

- The Interagency Patent Coordination and Improvement Act, which aims to formalize and improve collaboration between the USPTO and the FDA to prevent the gaming of the patent and regulatory systems.

- Bills to increase oversight and transparency of Pharmacy Benefit Managers (PBMs), whose role in drug pricing has come under intense scrutiny .

The momentum behind these bills demonstrates a significant shift in the political landscape. There is now widespread, bipartisan agreement that the patent system is being abused and that targeted, “surgical” reforms are needed. The current legislative focus is less on a radical overhaul of patent law and more on pragmatic changes to litigation procedures and regulatory oversight. This approach, by targeting the process of abuse rather than the fundamental definition of invention, may represent a more politically viable and effective path toward restoring balance to the system and delivering lower drug prices for consumers.

Harnessing Data for Negotiation: Patents and the Inflation Reduction Act (IRA)

The passage of the Inflation Reduction Act (IRA) in 2022 marked a seismic shift in U.S. healthcare policy. For the first time, it authorized the federal government, through the Centers for Medicare & Medicaid Services (CMS), to negotiate the prices of certain high-expenditure prescription drugs covered under Medicare . This new authority fundamentally alters the landscape for brand-name drugs and creates a powerful new context in which patent data becomes not just a tool for legal analysis, but a critical instrument for public policy and fiscal management.

The IRA’s New Paradigm: Linking Price Negotiation to Market Exclusivity

The IRA’s Drug Price Negotiation Program is not a blanket authority to negotiate all drug prices. It is a carefully structured program with specific eligibility criteria that are directly and inextricably linked to a drug’s patent and exclusivity status.

To be selected for negotiation, a drug must first be one of the highest-spending drugs in Medicare Part B or Part D. But the crucial second step is that it must be a “qualifying single-source drug” . This means the drug has no generic (for small molecules) or biosimilar (for biologics) competition on the market. Furthermore, the drug must have been on the market for a specified period without such competition: at least 7 years for small-molecule drugs and 11 years for biologics.

This framework creates a direct causal link: the successful use of patents and exclusivities to maintain a monopoly is precisely what makes a drug eligible for government price negotiation. The program is explicitly designed to address the high prices that result from a lack of competition. It is therefore no surprise that the first 10 drugs selected for negotiation in 2023, including blockbusters like Eliquis, Jardiance, and Enbrel, are all shielded by numerous patents that have successfully delayed the entry of lower-cost alternatives for years . An analysis of the patent portfolios for these selected drugs reveals the very strategies this report has detailed: multiple layers of secondary patents covering formulations and methods of use, many of which were filed and listed in the Orange Book years after the drugs were first approved by the FDA.

The IRA also introduces a controversial distinction in its timelines, often referred to as the “pill penalty”. By making small-molecule drugs (“pills”) eligible for negotiation after only 9 years of FDA approval (7 years plus a 2-year negotiation period) while biologics are eligible after 13 years, the law creates a potential disincentive for investment in small-molecule drug development . Pharmaceutical companies and some analysts argue that this four-year difference in protected market life will skew R&D investment away from small molecules, which are often the basis for treating chronic diseases like cancer and heart disease, and toward biologics . This has led to legislative proposals, such as the bipartisan EPIC Act, aimed at harmonizing these timelines to eliminate this potential distortion of innovation incentives.

Using Patent Data as a Predictive and Strategic Tool

The structure of the IRA’s negotiation program transforms patent data into a powerful predictive and strategic tool for policymakers, particularly for CMS. As part of the negotiation process, manufacturers are required to submit a wealth of data to CMS, including information on their R&D costs, production and distribution costs, and, critically, all pending and approved patent applications for the selected drug.

However, policymakers do not need to wait for these submissions. By proactively analyzing public and private patent databases, such as the FDA’s Orange and Purple Books, the USPTO’s patent search tools, and integrated intelligence platforms like DrugPatentWatch, government agencies can gain significant strategic advantages. This data allows them to:

- Forecast Future Negotiation Candidates: By cross-referencing Medicare’s highest-spend drugs with their patent expiration and exclusivity data, CMS can create a predictive pipeline of drugs that are likely to become negotiation-eligible in the coming years. This allows for long-term budget forecasting and preparation for future negotiation cycles.

- Assess a Drug’s Monopoly Strength: A detailed analysis of a drug’s “patent estate” provides crucial context for negotiations. Is the drug protected by a single, strong composition of matter patent, or by a dense thicket of weaker secondary patents? Understanding the quality and breadth of a drug’s patent protection helps negotiators assess the likelihood of near-term generic or biosimilar competition, which is a key factor in determining a “maximum fair price”. A drug with patents that are vulnerable to legal challenge should, in theory, command a lower negotiated price than one with an ironclad patent portfolio.

- Identify and Counteract Gaming: Proactive monitoring of patent data can reveal strategic behavior by manufacturers. For example, a sudden flurry of new patent filings or Orange Book listings for a high-spend drug nearing its negotiation eligibility window could be a red flag. It might signal an attempt to build up a patent thicket to deter potential generic challengers and prolong the drug’s single-source status, thereby ensuring it remains on the negotiation list rather than facing market competition.

The IRA has also created a fascinating new dynamic in the world of patent litigation. It introduces a new strategic calculus for generic and biosimilar manufacturers. For a high-spend Medicare drug approaching its negotiation eligibility window, a challenger now has two potential pathways to profitability. The first is the traditional route: wait for patents to expire or be invalidated, and then compete in a market where the brand price has been significantly reduced by government negotiation.

The second, more aggressive path is to launch a patent challenge before the drug is selected for negotiation. If the challenger succeeds in invalidating key patents and launching its product, the brand drug is no longer “single-source” and becomes ineligible for negotiation. This creates a potentially lucrative, albeit high-risk, window of opportunity. The generic or biosimilar could enter a market where the brand drug is still priced at its monopoly peak, allowing the challenger to capture significant market share at a higher price point than would be possible post-negotiation. This suggests that the IRA, while designed to lower prices through negotiation, may inadvertently stimulate more patent litigation for drugs on the cusp of eligibility, as generic firms race against the clock to launch before CMS can intervene. This is a critical, evolving dynamic that policymakers must monitor closely in the years ahead.

Lessons from Abroad: A Comparative Analysis of Patent and Pricing Systems

The challenges facing the U.S. pharmaceutical market are not universal. While all developed nations grapple with the balance between innovation and affordability, the outcomes vary dramatically. The United States stands as a stark outlier, with brand-name drug prices that are, on average, more than three times higher than in comparable countries . This is not an accident; it is the direct result of a series of specific policy choices regarding patent standards, litigation rules, and pricing authority. By examining the systems in the European Union and Canada, U.S. policymakers can gain invaluable insights into alternative approaches and identify proven strategies for reform.

The European Model: Stricter Standards, Faster Competition

The European Union provides a powerful case study in how higher standards for patent quality can structurally inhibit the formation of the dense patent thickets that plague the U.S. market. While the goal of incentivizing innovation is the same, the European Patent Office (EPO) employs a more rigorous and skeptical approach to granting patents, particularly the secondary patents that are the building blocks of evergreening strategies .

Several key doctrinal differences between the EPO and the USPTO are responsible for this divergence:

- Higher Bar for “Inventive Step”: The EPO’s “problem-solution approach” for assessing what is known as “inventive step” (the European equivalent of “non-obviousness” in the U.S.) is generally considered more stringent . It is less permissive of patents on combinations of known elements or routine modifications that a person skilled in the art would be motivated to try with a reasonable expectation of success.

- Requirement for Verifiable Data: The USPTO allows applicants to include “prophetic examples”—hypothetical descriptions of experiments that have not actually been performed. The EPO, in contrast, generally requires verifiable experimental data to support the claims made in a patent application. This prevents the granting of patents for speculative inventions that may not be operable or reproducible.

- The “Added Matter” Doctrine: This is perhaps the most critical structural barrier against patent thickets in Europe . The EPO’s strict prohibition on “added matter” prevents a patent applicant from expanding the scope of their invention beyond what was disclosed in their initial application. This makes it much more difficult to use a series of continuation applications to build a sprawling family of patents with ever-broader claims based on a single early invention—a common tactic in the U.S. .

These stricter standards have a direct and observable impact on the market. As the Humira case demonstrated, brand companies hold far fewer patents in Europe, making it easier for biosimilar competitors to clear a path to market . As of 2020, there were 52 biosimilars available in Germany compared to only 15 in the U.S., and biosimilars for blockbuster drugs like Humira and Enbrel were available in Europe years earlier.

The litigation environment also differs significantly. Most European jurisdictions, including the new Unified Patent Court (UPC), employ “fee-shifting” rules, meaning the losing party in a lawsuit must pay a significant portion of the winning party’s legal costs. This contrasts sharply with the “American Rule,” where each party typically bears its own costs. Fee-shifting discourages lawsuits based on weak or frivolous patents, as the brand company faces a substantial financial penalty if its patents are invalidated. This reduces the incentive to use litigation as a tool for simple harassment and delay.

The Canadian Approach: Direct Price Regulation

Canada presents a different but equally instructive model. Its patent laws and data protection regulations are, in many ways, quite similar to those in the United States . However, Canada has a powerful tool that the U.S. has historically lacked: a federal body with the authority to directly regulate the prices of patented medicines.

The Patented Medicine Prices Review Board (PMPRB) was established in 1987 with a clear mandate: to ensure that the prices charged by patentees for patented medicines sold in Canada are not “excessive” . The PMPRB does not set launch prices, but it reviews them and can, after a public hearing, order a manufacturer to reduce a price it deems excessive and even pay back excess revenues .

The PMPRB’s primary mechanism for determining whether a price is excessive is international price comparison. It benchmarks Canadian prices against the list prices in a basket of 11 other developed countries (the “PMPRB11”), including Australia, France, Germany, and the United Kingdom . This acts as a ceiling, preventing Canadian prices from dramatically exceeding those in other comparable markets.

The Canadian system demonstrates that it is possible to have strong patent protection co-exist with direct price oversight. However, it is not a panacea. Despite the PMPRB’s authority, Canada still has the second-highest per capita drug spending in the world, trailing only the United States . This highlights that while price regulation can moderate the worst excesses, the underlying monopoly power conferred by patents remains a powerful driver of high costs. It suggests that a comprehensive solution requires tackling both the price of drugs and the length and breadth of the monopolies that enable those prices.

Comparative Policy Table

To provide a clear, at-a-glance summary for policymakers, the following table contrasts the key features and outcomes of the pharmaceutical IP and pricing regimes in the United States, the European Union, and Canada. This comparison illuminates the direct relationship between specific policy choices and their real-world impact on drug prices and market competition.

Table 1: Comparative Analysis of Pharmaceutical IP and Pricing Regimes (U.S. vs. EU vs. Canada)

| Feature | United States | European Union | Canada |

| Patentability Standard | More permissive; allows prophetic examples; lower bar for non-obviousness. | Stricter; requires experimental data; “added matter” doctrine prevents claim expansion. | Similar to U.S. standards. |

| Secondary Patenting | Common and effective for extending monopoly (“thickets,” “evergreening”). | Less common due to stricter standards; harder to build dense thickets. | Common, but price impact is moderated by PMPRB. |

| Patent Litigation | “American Rule” (each party pays its own costs); high cost for challengers. | “Fee Shifting” (loser pays); lower risk for successful challengers. | Similar to U.S. system. |

| Patent Term Extension | Patent Term Adjustment (PTA) for USPTO delays; Patent Term Extension (PTE) for FDA delays. | Supplementary Protection Certificate (SPC) for regulatory delays; max 5 years. | Certificate of Supplementary Protection (CSP) for regulatory delays. |

| Direct Price Controls | None (until IRA negotiation for Medicare). Prices set by manufacturers. | National-level price negotiation and reference pricing common. | Federal-level price regulation via the PMPRB. |

| Market Outcome | Highest brand-name drug prices in the world; significant delays in biosimilar entry. | Lower brand prices; faster biosimilar market entry and uptake. | Second-highest prices; price growth moderated by regulation. |

This table starkly illustrates the consequences of different policy paths. The U.S. combination of permissive patent standards, a litigation system that favors incumbents, and a lack of direct price controls has resulted in the world’s highest drug prices. The EU’s stricter approach to patent quality and different litigation incentives lead to more robust competition and lower prices. Canada’s hybrid model shows that even with U.S.-style patent laws, direct price regulation can serve as a crucial check on monopoly power. For U.S. policymakers, this table offers a clear menu of potential reform pathways, each with a proven track record in a comparable market.

Forging a New Path: Data-Driven Policy Recommendations

The analysis presented in this report is not merely diagnostic; it is a call to action. The patterns revealed by drug patent data point directly to a series of specific, achievable policy reforms that can restore balance to the pharmaceutical ecosystem. The current crisis of affordability and access is not an inevitable byproduct of innovation. It is the result of identifiable loopholes and misaligned incentives that can be corrected through targeted interventions by Congress, the USPTO, the FDA, and federal antitrust agencies. The following recommendations represent a data-driven, multi-pronged strategy to foster a system that rewards meaningful scientific advancement while ensuring that life-saving medicines are accessible and affordable for all Americans.

For Congress: Legislative Reforms to Rebalance the System

Congress holds the ultimate authority to reshape the statutory framework that governs pharmaceutical patents and competition. Bipartisan momentum already exists for several common-sense reforms that would have a significant and immediate impact.

- Recommendation 1: Curb Patent Thickets by Limiting Litigation. The single most impactful step Congress could take to combat patent thickets is to pass the Affordable Prescriptions for Patients Act (APPA) . By limiting the number of patents a biologic manufacturer can assert in the initial phase of litigation, this bill directly attacks the strategy of overwhelming competitors through a war of attrition. It forces brand companies to rely on the quality of their best patents rather than the sheer quantity of their portfolio, thereby lowering the barrier to entry for biosimilars and fostering competition on the merits .

- Recommendation 2: Reform the 30-Month Stay. The automatic 30-month stay on generic approval is the lynchpin of anticompetitive Orange Book listings. Congress should amend the Hatch-Waxman Act to make this stay discretionary rather than automatic. For instance, a court could be required to find a “likelihood of success on the merits” for the brand’s infringement claim before granting a stay. Alternatively, Congress could require brand companies to post a bond when they file an infringement suit. If the litigated patents are ultimately found to be invalid or not infringed, the bond would be used to compensate the healthcare system for the costs incurred due to the delayed entry of the lower-cost generic. This would create a powerful financial disincentive against filing suits based on weak or non-infringed patents simply to obtain the 30-month delay.

- Recommendation 3: Codify a Presumption Against Product Hopping. The practice of “product hopping,” particularly the “hard switch” where an older product is removed from the market to force patients onto a new, patent-protected version, is clearly anticompetitive. Congress should enact legislation, as contemplated in early versions of the APPA, that creates a rebuttable legal presumption that such conduct is an unfair method of competition . This would empower the FTC to challenge these schemes more efficiently and would shift the burden to the manufacturer to prove that the product switch was motivated by a genuine and substantial clinical benefit for patients, not by a desire to block generic substitution.

- Recommendation 4: Harmonize IRA Exclusivity Periods. To ensure that R&D incentives are not skewed away from critically important small-molecule drugs, Congress should address the “pill penalty” in the Inflation Reduction Act. Aligning the negotiation eligibility window for small molecules (currently 9 years post-approval) with that of biologics (13 years) would create a more consistent and predictable investment landscape, encouraging innovation across all therapeutic modalities .

For the USPTO: Raising the Bar for Patent Quality

The USPTO is the frontline gatekeeper of the patent system. Strengthening its examination standards is a fundamental, upstream solution that can prevent the issuance of low-quality patents that are later used to build thickets and delay competition.

- Recommendation 1: Adopt Stricter Examination Standards Aligned with the EPO. The USPTO should undertake a comprehensive review of its examination guidelines with the goal of harmonizing them with the more rigorous standards of the European Patent Office. This should include three key changes: (1) eliminating the reliance on “prophetic examples” and requiring verifiable, reproducible experimental data to support patent claims; (2) applying a more stringent “obviousness” standard that is less permissive of patents on routine modifications and combinations; and (3) adopting a version of the “added matter” doctrine to prevent applicants from using continuation applications to improperly broaden the scope of their inventions after the initial filing .

- Recommendation 2: Mandate and Formalize Inter-Agency Data Sharing. The current collaboration between the USPTO and the FDA is a positive step, but it should be formalized and strengthened . Congress and the agencies should establish a formal process whereby patent examiners are not only given access to but are required to consider all material statements a pharmaceutical company has made to the FDA regarding a drug’s novelty, formulation, and relationship to prior art. This would prevent the “two-faced” strategy of making contradictory arguments to different federal agencies.

- Recommendation 3: Scrutinize and Reform Terminal Disclaimer Practice. The use of terminal disclaimers to obtain numerous patents on obvious variations of a single invention is a primary enabler of patent thickets. The USPTO should revive and implement its proposed rule to ensure that patents linked by a terminal disclaimer “stand or fall together” . This would mean that a successful legal challenge to a single core patent would invalidate the entire family of obvious variants linked to it, drastically reducing the litigation burden on competitors and the anticompetitive power of the thicket.

For the FDA: Strengthening the Role of the Gatekeeper

The FDA’s “ministerial” role in the patent listing process is a critical vulnerability in the system. Empowering the agency to play a more active role as a gatekeeper is essential.

- Recommendation 1: Grant the FDA Authority for Substantive Review of Patent Listings. Congress should amend the Federal Food, Drug, and Cosmetic Act to grant the FDA the authority and resources to conduct a substantive review of patents submitted for listing in the Orange Book. This review should be focused on ensuring that the patents comply with the statutory listing criteria—that is, they must claim the approved drug substance, drug product, or a method of using the drug . The FDA should be empowered to reject listings for patents that clearly fall outside these categories, such as those claiming only a manufacturing process or a delivery device without claiming the drug itself. This would prevent the most egregious cases of improper listings designed solely to trigger the 30-month stay.

- Recommendation 2: Increase Transparency of Patent Listings. The Orange Book and Purple Book are invaluable data sources, and their utility can be enhanced. The FDA should augment these databases to provide more granular information that would help policymakers, researchers, and the public identify potential evergreening strategies. This could include adding flags to identify patents that were filed after the drug’s FDA approval date, patents that are part of a family linked by terminal disclaimers, and patents that have been challenged in court. Providing this information in a clear, searchable format would dramatically increase transparency.

For the FTC and DOJ: Continued and Expanded Enforcement

Vigorous antitrust enforcement is a critical backstop to prevent the abuse of lawfully granted patents. The recent actions by the FTC and DOJ are encouraging and should be continued and expanded.

- Recommendation 1: Aggressively Pursue Improper Orange Book Listings as an Antitrust Violation. The FTC’s new strategy of challenging improper patent listings as an unfair method of competition is a powerful deterrent . The agency should continue this enforcement action and seek monetary penalties or disgorgement of profits for companies that have benefited from delays caused by improper listings. This would create a significant financial risk that would outweigh the benefit of gaming the system.

- Recommendation 2: Develop and Advance “Scheme” Liability Theories. While courts have thus far been reluctant to find that the mere accumulation of patents in a thicket constitutes an antitrust violation , the antitrust agencies should not abandon this line of inquiry. They should continue to develop and advance legal theories that challenge the totality of a company’s conduct. An anticompetitive scheme may not consist of a single illegal act, but rather a combination of individually lawful (or borderline lawful) acts—such as amassing hundreds of weak patents, engaging in serial litigation, improperly listing patents, and executing a product hop—that, when viewed together, have the clear purpose and effect of unlawfully maintaining a monopoly. Pushing the boundaries of antitrust law to address these complex, multi-faceted strategies is essential for effective enforcement in the 21st century.

Conclusion: From Data to Actionable Policy

The intricate world of pharmaceutical patents, once shrouded in legal and technical complexity, is now at the forefront of the national conversation on healthcare. This report has sought to demystify this world, demonstrating that a deep and nuanced understanding of drug patent data is not only possible but essential for effective policymaking. The data tells a clear story: the patent system, intended to be a catalyst for breakthrough innovation, has been systematically manipulated into a tool for extending monopolies and blocking competition. The result is the highest drug prices in the developed world, a crisis that imposes an unsustainable burden on American families, businesses, and the government.

However, the story told by the data is not one of despair, but of opportunity. It reveals that the current state of affairs is not an immutable law of nature, but the direct consequence of specific, identifiable, and—most importantly—reformable policies and practices. The patent thickets, the evergreening of old medicines, the product hops that trap patients on high-cost drugs, and the improper listings that game the regulatory system are not inevitable. They are the predictable outcomes of a framework with misaligned incentives and exploitable loopholes.

The path forward requires a decisive shift from broad rhetoric to targeted, data-driven action. The recommendations outlined in this report—from legislative reforms that curb abusive litigation to administrative changes that raise the bar for patent quality and empower our regulatory agencies—offer a comprehensive roadmap. They are not radical proposals to dismantle the incentives for innovation. Rather, they are surgical interventions designed to prune the overgrowth of anticompetitive strategies that have choked the system, allowing the core principle of rewarding genuine scientific advancement to flourish once more.

The time for incrementalism has passed. By harnessing the power of patent data as a diagnostic and strategic tool, policymakers have an unprecedented opportunity to forge a new path. It is a path that restores integrity to the patent system, fosters a truly competitive marketplace, and, ultimately, honors the fundamental bargain of pharmaceutical innovation: to create life-saving medicines that are not just available, but accessible and affordable for all.

Key Takeaways

- The System is Gamed: The U.S. patent system is frequently exploited through strategies like “patent thickets,” “evergreening,” and “product hopping.” These tactics prioritize extending monopolies on existing drugs over developing novel therapies, directly contributing to high prices and delayed competition.

- Data is the Key to Reform: A granular analysis of drug patent data—including the type, timing, and litigation history of patents—provides a clear roadmap for policymakers to identify and target specific anticompetitive behaviors without harming incentives for true innovation.

- The FDA’s “Ministerial” Role is a Critical Flaw: The FDA’s passive role in listing patents in the Orange Book, without verifying their relevance or validity, creates a major loophole. This allows the automatic 30-month stay on generic approval to be weaponized as a tool to delay competition.

- U.S. Patent Standards are an Outlier: The U.S. Patent and Trademark Office (USPTO) has more permissive standards for granting patents than its European counterpart (the EPO). Adopting stricter standards, particularly regarding secondary patents, would structurally inhibit the formation of patent thickets.

- A Multi-Pronged Response is Underway but Must Accelerate: Federal agencies (FTC, DOJ, USPTO) and Congress are actively working to curb abuse through antitrust enforcement, initiatives to improve patent quality, and bipartisan legislation. These efforts must be sustained and expanded.

- Targeted Legislation is a Viable Path: Bills like the Affordable Prescriptions for Patients Act, which limit the number of patents that can be asserted in litigation, offer a pragmatic and politically viable way to neutralize the power of patent thickets.

- The IRA Creates New Dynamics: The Inflation Reduction Act’s price negotiation program directly links a drug’s monopoly status to its eligibility for negotiation, making patent data a critical tool for CMS. It also creates new incentives for patent litigation on high-spend drugs.

- Reform is Possible: The high cost of prescription drugs is not an inevitable price for innovation. It is the result of specific, reformable policy choices. Lessons from Europe and Canada show that alternative approaches can lead to greater affordability and faster competition.

Frequently Asked Questions (FAQ)

1. Won’t cracking down on secondary patents and “evergreening” harm innovation and stop companies from improving their medicines?

This is a central concern and a frequent argument from the pharmaceutical industry. However, the policy recommendations in this report are designed to be surgical, targeting low-value, anticompetitive patenting while preserving incentives for meaningful improvements. A key distinction must be made between a genuine innovation—like a new formulation that dramatically improves patient adherence or reduces severe side effects—and a trivial tweak designed primarily to reset the patent clock. Stricter examination standards at the USPTO, modeled after those in Europe, would help filter out patents on minor changes that lack a significant inventive step or demonstrated clinical benefit. Furthermore, legislation targeting “product hopping” would specifically focus on instances where a company’s actions impede competition without offering a substantial therapeutic advantage. The goal is not to stop all incremental innovation, but to stop rewarding legal gamesmanship that comes at the expense of patient access and affordability.

2. Why can’t the U.S. just adopt European-style price controls or Canada’s PMPRB system to lower drug prices?

While both Europe and Canada have systems that result in lower drug prices, directly transplanting their price control mechanisms to the U.S. would face immense political and structural challenges. The U.S. healthcare system is a complex patchwork of private and public payers, unlike the single-payer or nationally regulated systems in many other countries. However, we can still learn critical lessons. The European experience teaches us that raising the bar for what constitutes a patentable invention can significantly reduce the patent thickets that delay competition. The Canadian model shows that a federal body can be empowered to provide price oversight. The Inflation Reduction Act’s negotiation program is a historic first step in this direction for Medicare. The most effective path for the U.S. is likely a hybrid approach: adopting the European model of higher patent quality to foster more robust competition, while expanding on the IRA’s framework to increase price negotiation and transparency.

3. If a company legally obtains patents from the USPTO, how can it be an antitrust violation to defend them in court?

This is a complex legal question at the heart of the “patent thicket” debate. The right to enforce a duly issued patent is a cornerstone of intellectual property law. A federal court decision in the Humira antitrust litigation affirmed that simply accumulating and enforcing a large number of patents, in itself, is not an antitrust violation. However, antitrust law can intervene when otherwise legal conduct is used as part of a broader scheme to unlawfully acquire or maintain a monopoly. The FTC’s current approach focuses on this distinction. For example, while obtaining a patent is legal, improperly listing it in the Orange Book to trigger an anticompetitive stay of competition can be challenged as an “unfair method of competition.” Future antitrust theories may argue that the totality of conduct—combining hundreds of weak patents with serial litigation and other exclusionary tactics—crosses the line from legitimate patent enforcement to an illegal scheme to monopolize a market.

4. What is the role of private, subscription-based patent databases like DrugPatentWatch when public data from the FDA and USPTO is available for free?

Public databases like the FDA’s Orange Book and the USPTO’s search portal are the primary sources of raw data and are indispensable. However, for policymakers, analysts, and industry professionals, they have significant limitations. These databases are often difficult to search comprehensively, do not integrate data from different sources (e.g., linking patents to litigation outcomes or international filings), and do not provide analytical tools to identify trends. Private, specialized services like DrugPatentWatch add value by aggregating, cleaning, and integrating this data from multiple global sources. They provide sophisticated search functionalities, analytics, and forecasting tools that transform raw data into actionable business and policy intelligence. For a policymaker, this means being able to quickly analyze a drug’s entire global patent estate, track its litigation history, and forecast generic entry dates—a level of analysis that would be incredibly time-consuming and difficult using only public sources.

5. The pharmaceutical industry argues that the high cost of R&D, including the cost of many failed drugs, justifies current prices. Is this argument valid?

The high cost and high failure rate of drug development are real and must be accounted for in any policy framework. The patent system is designed to provide a period of market exclusivity precisely to allow companies to recoup these investments. The debate is not about whether to reward innovation, but about how long and for what kind of innovation that reward should last. The data shows that the current system allows monopolies to be extended for decades through low-risk, secondary patenting on minor changes, long after the costs of the initial high-risk discovery have been recouped. For example, AbbVie earned $114 billion in revenue on Humira in the U.S. during the period after its primary patent expired but before biosimilars could enter the market. This suggests that revenues are far exceeding what is necessary to incentivize R&D and are instead being driven by the successful manipulation of the patent system to prolong a monopoly. Policy reform aims to recalibrate this system to ensure that the reward is proportionate to the innovation and that monopolies do not persist indefinitely at the public’s expense.

References

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed August 8, 2025, https://www.congress.gov/crs-product/R46679

- Composition of Matter Patents – (Intro to Pharmacology) – Vocab, Definition, Explanations, accessed August 8, 2025, https://library.fiveable.me/key-terms/introduction-to-pharmacology/composition-of-matter-patents

- glossary of common intellectual property concepts – NYIPLA, accessed August 8, 2025, https://www.nyipla.org/images/nyipla/Committees/LAC/NYIPLA%20Glossary%20of%20Common%20IP%20Concepts%20FINAL%20062620LT.pdf

- What are the types of pharmaceutical patents? – Patsnap Synapse, accessed August 8, 2025, https://synapse.patsnap.com/blog/what-are-the-types-of-pharmaceutical-patents

- The value of method of use patent claims in protecting your therapeutic assets, accessed August 8, 2025, https://www.drugpatentwatch.com/blog/the-value-of-method-of-use-patent-claims-in-protecting-your-therapeutic-assets/

- Types of Pharmaceutical Patent | MPA Business Services, accessed August 8, 2025, http://mpasearch.co.uk/product-process-formulation-patents

- What is the difference between a composition of matter and a method of treatment? – Wysebridge Patent Bar Review, accessed August 8, 2025, https://wysebridge.com/what-is-the-difference-between-a-composition-of-matter-and-a-method-of-treatment

- Drug Patents and Exclusivity – National CooperativeRx, accessed August 8, 2025, https://www.nationalcooperativerx.com/educational-materials/drug-patents-exclusivity/

- Drug Marketing Exclusivity: Types & Developer Benefits – Allucent, accessed August 8, 2025, https://www.allucent.com/resources/blog/types-marketing-exclusivity-drug-development

- Patents and Exclusivity | FDA, accessed August 8, 2025, https://www.fda.gov/media/92548/download

- Generic Drugs – Friends of Cancer Research, accessed August 8, 2025, https://friendsofcancerresearch.org/glossary-term/generic-drugs/

- Data & Market Exclusivity As Incentives in Drug Development – Scendea, accessed August 8, 2025, https://www.scendea.com/articles/blog-post-title-one-25srn-58l3m-hef63

- How can I better understand Patents and Exclusivity? – FDA, accessed August 8, 2025, https://www.fda.gov/industry/fda-basics-industry/how-can-i-better-understand-patents-and-exclusivity

- Pharmaceutical Patent Regulation in the United States – The Actuary Magazine, accessed August 8, 2025, https://www.theactuarymagazine.org/pharmaceutical-patent-regulation-in-the-united-states/

- Patent Use Codes for Pharmaceutical Products: A Comprehensive Analysis for Strategic Advantage – DrugPatentWatch, accessed August 8, 2025, https://www.drugpatentwatch.com/blog/patent-use-codes-for-pharmaceutical-products-a-comprehensive-analysis/

- Patent Listing in FDA’s Orange Book – Congress.gov, accessed August 8, 2025, https://www.congress.gov/crs-product/IF12644

- Drug Patent and Exclusivity Study available – USPTO, accessed August 8, 2025, https://www.uspto.gov/initiatives/fda-collaboration/drug-patent-and-exclusivity-study-available

- Orange Book 101 | The FDA’s Official Register of Drugs, accessed August 8, 2025, https://www.fr.com/insights/ip-law-essentials/orange-book-101/

- Pat-INFORMED – The Gateway to Medicine Patent Information – WIPO, accessed August 8, 2025, https://www.wipo.int/pat-informed/en/

- Pat-INFORMED – IFPMA, accessed August 8, 2025, https://www.ifpma.org/initiatives/pat-informed/

- Patents – WIPO, accessed August 8, 2025, https://www.wipo.int/en/web/patents

- Drug patents and intellectual property rights – PubMed, accessed August 8, 2025, https://pubmed.ncbi.nlm.nih.gov/25640303/

- The Dark Reality of Drug Patent Thickets: Innovation or Exploitation? – DrugPatentWatch, accessed August 8, 2025, https://www.drugpatentwatch.com/blog/the-dark-reality-of-drug-patent-thickets-innovation-or-exploitation/

- Unveiling the Secrets Behind Big Pharma’s Patent Thickets – DrugPatentWatch, accessed August 8, 2025, https://www.drugpatentwatch.com/blog/unveiling-the-secrets-behind-big-pharmas-patent-thickets/