Listen to this article |

The theoretical construct of what happens when drug patents expire is simple and appealing (to consumers, anyway). A name brand drug patent expires, generics are waiting in the wings to fill pharmacy shelves at lower prices, and consumers can treat their illnesses at a lower cost.

Drug patent expiration can bring significant price relief to consumers.

The reality is similar to that, but not nearly as simple and straightforward. Drug patents must be understood in the context of drug exclusivity, and it’s also important to consider the many techniques that have been developed to prolong patent protection and forestall the introduction of generics.

The reality is similar to that, but not nearly as simple and straightforward. Drug patents must be understood in the context of drug exclusivity, and it’s also important to consider the many techniques that have been developed to prolong patent protection and forestall the introduction of generics.

The Importance of Understanding Both Patents and Exclusivity

A patent is a property right granted by the United States Patent and Trademark Office (PTO). It may be granted at any time during drug development and may cover multiple claims for the drug. Exclusivity refers to the practical prohibition on approval of competing drugs. While a patent term and a term of exclusivity may run in lock step, they don’t necessarily have to. The specifics and exceptions regarding exclusivity and patents were designed to strike a balance between drug innovation and better consumer access to drugs through generic competitors.

Periods of exclusivity may vary or may include extensions. For example, Orphan Drug exclusivity lasts seven years, while a winning a patent challenge provides 180 days of generic market exclusivity. Antibiotics created under the Generating Antibiotic Incentives Now (GAIN) program can often gain an added five years of exclusivity. Exclusivity periods are often tailored to encourage new drug development.

Lawsuits and Patent Extensions as Patent Expiry Approaches

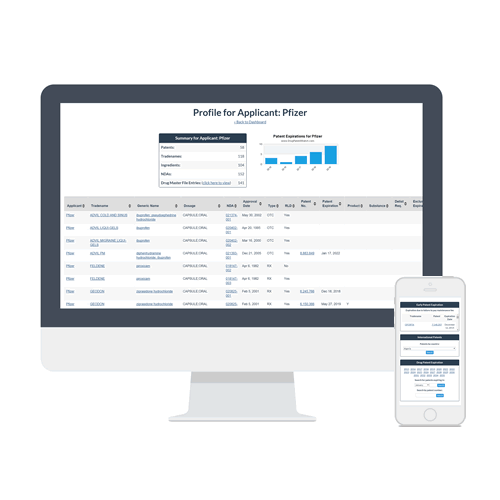

At its most basic, the term of a new patent runs 20 years from the date on which the patent application is filed in the US. This is not always iron-clad, because sometimes drug makers file additional patents later on, effectively prolonging their patent protection. As just one example, Pfizer, after having patented the formulation for Viagra, was later able to patent the drug specifically as a treatment for erectile dysfunction, effectively lengthening its patent protection in the United States for a few years after its patents ran out in many other countries.

At its most basic, the term of a new patent runs 20 years from the date on which the patent application is filed in the US. This is not always iron-clad, because sometimes drug makers file additional patents later on, effectively prolonging their patent protection. As just one example, Pfizer, after having patented the formulation for Viagra, was later able to patent the drug specifically as a treatment for erectile dysfunction, effectively lengthening its patent protection in the United States for a few years after its patents ran out in many other countries.

A flood of generics slashed prices for sildenafil citrate in the UK and the EU when Pfizer’s patent for Viagra ran out in 2013.

The majority of patents are filed before a drug is approved. Therefore, consumers may have far less than 20 years to wait before generic competitors arrive on the market.

Generics and Price Relief: Not as Straightforward as Many Think

Another factor clouding the water of patents and exclusivity is special licensing agreements. For example, Pfizer has agreed to allow two generic versions of Viagra on the market in the US before the patent finally runs out in the year 2020. Pfizer makes its own generic, and they’ve allowed generic giant Teva to make a generic since late 2017. It has caused prices for sildenafil citrate, the active ingredient in Viagra, to drop, but not as precipitously as prices dropped in the EU a few years ago when Pfizer’s patent ran out over there.

This means that for blockbuster drugs, pharmaceutical companies can sometimes take steps to avoid the “patent cliff” and create a sort of “patent step down” where prices come down more slowly and allow the original manufacturer to maintain blockbuster profitability a bit longer.

In summary, the conventional wisdom that drug prices fall instantly and precipitously once a name brand manufacturer reaches the end of its patent is not quite the entire story. Because exclusivity and patents may or may not run concurrently, and because name brand manufacturers may take steps to bring drug prices down for a softer landing by licensing generics before patent expiry, price relief doesn’t always come all at once for the consumer. Therefore, pharmaceutical investors must understand specific patents and exclusivity periods to make the most of their investments.