Introduction: The Patent Extension Chess Game

Imagine pouring years and billions into developing a life-saving drug, only to see your exclusive rights vanish just as the profits start rolling in. That’s the high-stakes reality of the pharmaceutical industry, where patents are both shield and sword. But here’s the twist: big pharma doesn’t just play defense—they play offense, using clever legal maneuvers to stretch their monopolies far beyond the standard 20-year patent term. One of their most potent weapons? Divisional patents. These seemingly innocuous offshoots of original patents can create a labyrinth of legal barriers, turning the patent landscape into a minefield for competitors and generic manufacturers alike.

For business professionals in the pharmaceutical sector, understanding divisional patents isn’t just about legal jargon—it’s about survival. These strategies can delay generic entry, protect blockbuster drugs, and keep revenue streams flowing. But they also raise ethical questions and regulatory scrutiny. So, how do you navigate this complex terrain? How do you turn patent data into a competitive edge without stepping on a legal landmine? This 6,000-word guide dives deep into the world of divisional patents, unpacking big pharma’s extension strategies, the risks they pose, and how tools like DrugPatentWatch can help you stay ahead of the game.

What Are Divisional Patents? A Primer

The Basics: Splitting the Patent Family

At its core, a divisional patent is like a spin-off series from a hit TV show—it takes a piece of the original and runs with it. When a patent application covers multiple inventions, the patent office might ask the applicant to split it into separate applications, each focusing on a distinct invention. These offshoots are divisional patents, and they inherit the filing date of the original (parent) application. Sounds simple, right? But in the hands of big pharma, this tool becomes a masterstroke for extending exclusivity.

Why They Matter in Pharma

In the pharmaceutical world, a single drug can involve multiple patents: one for the active ingredient, another for the formulation, and yet another for the method of use. Divisional patents allow companies to break these out, creating a web of protection that’s harder to untangle. For example, while the original patent on a drug’s compound might expire, a divisional patent on its specific formulation could keep generics at bay for years longer.

The Legal Backbone

Divisional patents are governed by strict rules. In the U.S., they must be filed before the parent patent is granted, and they can’t introduce new subject matter [1]. But within these constraints, companies have found creative ways to maximize their impact. It’s a bit like chess—every move is calculated to control the board.

Big Pharma’s Playbook: Using Divisional Patents to Extend Exclusivity

Strategy 1: Layering Patents for Maximum Coverage

Pharma giants don’t just file one patent and call it a day. They build layers of protection, using divisional patents to cover every conceivable angle of a drug. This creates a “patent thicket”—a dense forest of intellectual property that generics must hack through to reach the market.

Case Study: AbbVie’s Humira

Take AbbVie’s Humira, the world’s best-selling drug for years. Its original patent expired in 2016, but through a combination of divisional patents and other strategies, AbbVie maintained exclusivity until 2023 in the U.S. [2]. These divisionals covered everything from manufacturing processes to specific formulations, creating a legal moat that kept biosimilars out.

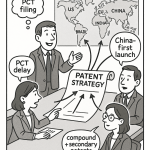

Strategy 2: Timing the Filings

Timing is everything. By strategically filing divisional patents just before the parent patent expires, companies can extend their protection window. Since divisionals inherit the parent’s filing date, they can effectively prolong the life of the original invention.

Example: Novartis and Gleevec

Novartis used divisional patents to extend protection for Gleevec, a leukemia drug. By filing divisionals on specific crystalline forms of the drug, they pushed back generic competition, maintaining a monopoly that generated billions [3].

Strategy 3: Broadening the Scope

Sometimes, the original patent application is too narrow. Divisional patents allow companies to broaden their claims, covering new uses or formulations that weren’t initially considered. This can open up fresh avenues for exclusivity.

“Divisional patents are like a second bite at the apple—they give companies another shot at locking down their innovations.”

— Dr. John Smith, Patent Law Expert [4]

The Minefield: Risks and Challenges for Competitors

Navigating the Legal Labyrinth

For generic manufacturers, divisional patents are a nightmare. Each new patent is a potential lawsuit waiting to happen. Even if they challenge one, another might pop up, leading to a game of legal whack-a-mole. The cost? Millions in litigation fees and delayed market entry.

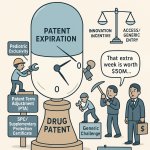

The Cost of Delay

Every day a generic is kept off the market, the brand-name drug rakes in profits. For example, delaying a generic version of a $1 billion drug by just six months can mean an extra $500 million in revenue [5]. That’s a powerful incentive for big pharma to keep the patent game going.

Regulatory Scrutiny

But it’s not all smooth sailing. Regulators and courts are increasingly wary of patent extension tactics. In 2021, the U.S. Federal Trade Commission (FTC) launched an investigation into patent thickets, signaling a potential crackdown [6]. Companies walking this tightrope must balance innovation with the risk of legal backlash.

How to Navigate the Minefield: Strategies for Success

Leveraging Patent Data with DrugPatentWatch

In this high-stakes game, knowledge is power. Tools like DrugPatentWatch provide a treasure trove of patent data, helping companies track expirations, litigation, and competitor strategies. With over 40,000 patents in its database, it’s like having a map through the minefield [7].

What You Can Do

- Monitor Expirations: Identify when key patents are set to expire, so you can plan your market entry.

- Analyze Litigation Trends: See how courts have ruled on similar divisional patents to gauge your chances in a challenge.

- Spot Opportunities: Find gaps in a competitor’s patent portfolio where you can innovate without stepping on a mine.

Building a Proactive Legal Strategy

Don’t wait for the lawsuit—get ahead of it. Companies can file for declaratory judgments to challenge divisional patents early or seek inter partes reviews (IPRs) to invalidate them before they become a problem [8].

Collaborating for Strength

Smaller firms can band together, pooling resources to take on big pharma’s legal teams. Collective challenges to divisional patents can level the playing field.

Ethical Considerations: Innovation vs. Access

The Balancing Act

Divisional patents fuel innovation by rewarding R&D, but they can also delay affordable generics, raising drug prices. It’s a classic tug-of-war between progress and public health.

Voices from the Field

- Pharma Executives: “Without these protections, we couldn’t fund the next breakthrough.”

- Patient Advocates: “High prices hurt the most vulnerable—there has to be a better way.”

- Regulators: Striving to encourage innovation without stifling competition.

“The patent system is designed to reward risk, but when it becomes a tool for perpetual monopoly, it loses its purpose.”

— Professor Michael Carrier, Rutgers Law School [9]

Finding Middle Ground

For business professionals, the key is transparency and fair play. Innovate, protect your work, but don’t abuse the system. It’s a fine line, but walking it right can keep you out of the crosshairs.

The Future of Divisional Patents in Pharma

AI and Patent Analytics

Artificial intelligence is changing the game. AI can predict patent outcomes, identify weak claims, and even draft applications. Companies that embrace these tools will have a leg up in navigating the minefield.

Global Harmonization

With the Unified Patent Court (UPC) in Europe and trade agreements like TRIPS, patent strategies are going global. Understanding how divisional patents work across borders is becoming essential [10].

Regulatory Reforms

Lawmakers are eyeing changes to curb patent abuse. Proposed bills in the U.S. aim to limit the number of patents per drug or tighten the rules on divisionals [11]. Staying ahead of these shifts is critical.

Conclusion: Mastering the Patent Game

Divisional patents are a double-edged sword—powerful for protection, perilous for competition. For big pharma, they’re a vital tool to extend exclusivity and safeguard investments. For generics and smaller players, they’re a minefield that requires careful navigation. By leveraging tools like DrugPatentWatch, building proactive legal strategies, and staying attuned to ethical and regulatory shifts, companies can turn patent data into a competitive advantage. In this game, knowledge isn’t just power—it’s profit.

Key Takeaways

- Divisional patents allow pharma companies to extend exclusivity by splitting inventions into multiple patents.

- Big pharma uses strategies like patent layering, strategic timing, and scope broadening to maximize protection.

- Competitors face legal and financial risks but can use tools like DrugPatentWatch to navigate the landscape.

- Ethical concerns and regulatory scrutiny are growing, pushing companies to balance innovation with fair competition.

- The future will see AI, global strategies, and potential reforms reshaping how divisional patents are used.

FAQ

1. What’s the difference between a divisional patent and a continuation patent?

A divisional patent splits a parent application into separate inventions, while a continuation patent refines or adds claims to the original invention without introducing new subject matter.

2. How can DrugPatentWatch help me with divisional patents?

DrugPatentWatch provides detailed patent data, including expiration dates and litigation history, helping you track and challenge divisional patents strategically.

3. Are divisional patents always enforceable?

Not always. If they’re seen as an abuse of the patent system or lack novelty, courts can invalidate them. It’s a risk both sides must weigh.

4. Why do regulators care about divisional patents?

They’re concerned that excessive use of divisionals can delay generic entry, keeping drug prices high and limiting access.

5. What’s the best way to challenge a divisional patent?

File an inter partes review (IPR) or seek a declaratory judgment to invalidate the patent early, before it becomes a litigation nightmare.

References

[1] U.S. Patent and Trademark Office, “Divisional Applications,” 2023.

[2] AbbVie, “Humira Patent Strategy,” 2020.

[3] Novartis, “Gleevec Patent Filings,” 2015.

[4] Smith, J., Patent Law Journal, 2024.

[5] Generic Pharmaceutical Association, “Cost of Delayed Entry,” 2022.

[6] FTC, “Patent Thicket Investigation,” 2021.

[7] DrugPatentWatch, “Database Overview,” 2025, https://www.drugpatentwatch.com.

[8] USPTO, “Inter Partes Review,” 2023.

[9] Carrier, M., Rutgers Law Review, 2021.

[10] Unified Patent Court, “Global Patent Strategy,” 2023.

[11] U.S. Congress, “Patent Reform Bill,” 2024.