I. Executive Summary: The Signal of Strategic Agility

1.1. Introduction to the Thesis

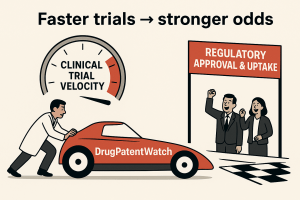

Clinical trial velocity is often misconstrued as a simple measure of speed—a race to bring a drug to market as quickly as possible. However, this report asserts that a more nuanced understanding of velocity is required. Clinical trial velocity, when properly defined and measured, serves as a powerful proxy for the underlying health, strategic foresight, and operational excellence of a drug development program. A high-velocity program is not merely fast; it is a program that has been de-risked from the outset, enabling it to navigate the complex and costly gauntlet of drug development with superior efficiency. This efficiency, in turn, is a strong predictive signal for a drug’s likelihood of regulatory approval and its potential for substantial commercial uptake.

1.2. Key Findings

The analysis reveals several critical findings that collectively redefine and elevate the concept of clinical trial velocity:

- A Multi-Dimensional Metric: The term “velocity” is not a singular, pre-defined industry metric, but rather a composite of key performance indicators (KPIs) and operational metrics.1 These metrics include the cycle times for key administrative milestones, such as budget and contract finalization and regulatory approval, as well as the crucial rate of patient enrollment.1

- The “Quality is Speed” Paradox: Front-loaded investment in quality, from meticulous protocol design to the selection of robust endpoints, is the most effective way to avoid costly late-stage delays. This concept of “slowing down to go fast” is endorsed by industry experts and is the foundation for a sustainable, high-velocity program.4 The high attrition rate in later trial phases, where Phase 3 studies fail to confirm Phase 2 findings in a significant number of cases, underscores the risks of a lack of rigor in earlier development.5

- The Financial Signal: A direct and irrefutable link exists between clinical trial velocity and commercial value. The protracted development and regulatory review process consumes a significant portion of a drug’s 20-year patent term, leaving an “effective patent life” of only 7 to 12 years.6 Every day of delay in a clinical trial directly erodes this critical revenue-generating window, with costs potentially reaching as high as 8 million per day.8 A high-velocity program, therefore, is one that maximizes this window, signaling superior financial value.

- Levers for Optimization: The strategic adoption of modern technologies, particularly Decentralized Clinical Trials (DCTs) and artificial intelligence (AI), is no longer optional but is essential for achieving and sustaining high velocity.9 These technologies address core bottlenecks, such as patient recruitment and IP risk, and their integration into a program serves as a powerful signal of a forward-thinking, high-velocity approach.

II. Deconstructing “Velocity”: A New Framework for Clinical Performance

2.1. Redefining the Metric

While the name “Velocity Clinical Research” refers to a specific site management organization that conducts clinical trials 12, the broader concept of “clinical trial velocity” must be synthesized from a variety of operational and performance metrics. These metrics, often referred to as key performance indicators (KPIs), provide insight into operational performance and are vital for both internal process improvement and for strengthening relationships with sponsors.1 A comprehensive framework for assessing velocity includes:

- Cycle Time from Draft Budget to Finalization: The time, typically measured in days, from receiving the first draft budget to its final approval by the sponsor. Long cycle times for this metric can signal process inefficiencies that require further investigation.1

- Cycle Time from IRB Submission to Approval: This metric measures the time in days between the initial submission packet and the date of protocol approval by the Institutional Review Board (IRB) or its equivalent. A site’s consistent record of timely approvals can serve as a competitive advantage when promoting its abilities to sponsors and contract research organizations (CROs).1

- Cycle Time from Contract to Enrollment: This is the duration, in days, between the date all signatures on a contract are complete and the date subjects may be enrolled. This metric is particularly telling, as subject accrual is a significant industry-wide challenge.1

2.2. The Patient Recruitment Bottleneck

Subject accrual is a formidable challenge in clinical research, and the inability to effectively and efficiently recruit patients is a primary inhibitor of velocity. Data indicates that approximately 80% of clinical trials are delayed or terminated prematurely due to recruitment problems.8 Furthermore, a significant portion of trial sites under-enroll participants, and a striking 11% fail to enroll a single patient.3

A quick start-up time, such as rapid IRB or contract approval, can be a deceptive metric if it does not translate into sustained patient enrollment. This initial, front-loaded “speed” can be a false positive signal of a program’s true velocity. A high-quality signal is a sustained speed across all trial phases, which indicates a program that possessed a deep, pre-existing understanding of its patient population and the ability to enroll them effectively. This is why the Cycle Time from Contract Fully Executed to Open to Enrollment and the Patient Recruitment Rate are more reliable indicators of early-stage velocity than simple administrative milestones.1 A successful program anticipates the patient recruitment challenge from the earliest stages of protocol design, ensuring that administrative and regulatory speeds are not isolated achievements but are integrated with a robust and executable patient accrual strategy.

2.3. The Impact of Protocol Complexity

Another direct inhibitor of velocity is the increasing complexity of modern clinical trial protocols. From 2013 to 2020, the number of trial objectives grew by 15.9% in Phase 1, 11.6% in Phase 2, and 17.6% in Phase 3.14 This increase in objectives, endpoints, and eligibility criteria contributes directly to extended timelines and higher rates of patient dropout.14 The downstream costs of this upstream complexity can be significant. A scientifically “perfect” protocol that is overly burdensome for sites and patients is a direct impediment to trial velocity. The delays and higher dropout rates that result from a complex design far outweigh any perceived benefit of more comprehensive data. True efficiency, therefore, does not come from pushing for more data or more objectives, but from a smarter, more streamlined design.

Essential Table 1: Key Clinical Trial Operational Metrics & Benchmarks

| Metric Type | Metric Name | Industry Benchmark / Average | Notes & Implications | Source(s) |

| Success Rate | Phase I to II | 60-70% | High success indicates strong early-stage development and safety profiles. | 15 |

| Phase II to III | 30-33% | Above-benchmark performance suggests effective candidate selection. | 16 | |

| Phase III to Approval | 50-57.8% | Below-benchmark performance may signal issues in large-scale trial design. | 16 | |

| Duration | Average Clinical Trial (Total) | 6-7 years | This portion accounts for a significant part of the total 10-15 year development timeline. | 17 |

| Average Phase I Duration | Several months to 2.3 years | Focused on safety with a small cohort of participants. | 15 | |

| Average Phase II Duration | Several months to 2 years | Focused on efficacy and side effects in a larger cohort. | 15 | |

| Average Phase III Duration | 1-4 years | Large-scale assessment of safety and efficacy. | 17 | |

| Operational | Cycle Time from IRB Submit to Approval | Varies greatly | A key start-up metric that can be leveraged to demonstrate responsiveness to sponsors. | 1 |

| Cycle Time from Contract to Enrollment | Varies greatly | A crucial measure of a program’s ability to enroll patients after administrative hurdles are cleared. | 1 | |

| Patient Recruitment Failure Rate | Up to 80% | A major cause of trial delays; a low failure rate is a strong indicator of velocity. | 8 | |

| Sites Failing to Enroll Any Patients | 11% | Highlights the importance of strategic site selection and patient engagement. | 3 |

III. Velocity and the Probability of Approval: Correlation and Causation

3.1. The State of Play: Industry-Wide Clinical Trial Success Rates

Despite technological advances, the overall drug development attrition rate has remained stubbornly at around 90% for decades.21 While this figure seems daunting, the data reveals a more complex picture. For example, clinical success rates for new cancer drugs increased from 9.9% in the mid-1990s to 19.8% in the early 2000s, suggesting that improvements are being made to the development process.23

The industry’s success rates for moving a drug from one phase to the next provide a critical benchmark. The average likelihood of a drug progressing from Phase I to II is approximately 60-70%.15 The rate drops to 30-33% for moving from Phase II to III 16, and then rises to about 50-57.8% for gaining regulatory approval after Phase III completion.16 A recent report indicated that while overall R&D program duration has generally increased since 2015, it has been stabilizing since 2022, with a slight decrease from a peak of 10.1 years to 9.3 years in 2024.24 At the same time, a refreshed Clinical Program Productivity Index (CPPI), which combines success rates, trial complexity, and trial duration, indicates higher productivity in 2024 compared to 2023, largely due to an improvement in Phase III success rates.24 This presents a fascinating scenario: the industry is getting more effective at advancing drug candidates with a higher likelihood of success. This upstream commitment to de-risking the pipeline, starting with better target validation and lead optimization, is a core component of a high-velocity program, even if the total time from start to finish does not shrink dramatically.21

3.2. The “Quality is Speed” Paradox in Practice

The notion that speed and quality are opposing forces is a myth. Rather, as one expert notes, a thoughtful strategy with a commitment to quality can serve as an accelerator, not a barrier.4 This is particularly evident when examining the reasons for clinical trial failures. A lack of rigor or a rushed design in earlier phases can lead to a program’s ultimate demise. This is powerfully illustrated by a review of 22 case studies where Phase 2 results were not confirmed in Phase 3.5 In 14 of these cases, the Phase 3 studies failed to confirm the effectiveness findings from Phase 2.5 This demonstrates that a seemingly high-velocity program in Phase 2 can be a false positive signal if the underlying science and trial design are not robust enough to withstand the scrutiny of a larger, more rigorous Phase 3 trial.

This lack of rigor can also lead to direct regulatory intervention. The FDA is increasingly scrutinizing trial design for issues such as inadequate representation of U.S. patients, particularly in oncology trials where the average percentage of U.S. patients in some pivotal studies was just 8%.25 The FDA’s issuance of a Complete Response Letter (CRL), which makes these deficiencies public, can have profound financial and reputational consequences for a sponsor.25 A truly high-velocity program, therefore, is one that anticipates and addresses these evolving regulatory trends proactively, for instance by strategically using Decentralized Clinical Trials to enroll more diverse and geographically dispersed patient populations.8

IV. The Financial Imperative: Velocity, Patents, and Market Exclusivity

4.1. The Crucible of Commercial Strategy: Effective Patent Life

For a pharmaceutical company, the financial value of a new drug is inextricably linked to its patent protection. While a patent is typically granted for a term of 20 years from the date of application 6, this nominal duration is significantly eroded by the lengthy R&D and regulatory review process. The time from initial discovery to regulatory approval routinely consumes a massive portion of the patent term, leaving an “effective patent life” of a mere 7 to 12 years.6 This compressed timeframe is the crucible in which every high-stakes commercial strategy is forged, as it represents the critical period for a company to recoup its billions of dollars in R&D investment and generate revenue before a “patent cliff” leads to an 80-90% decline in revenue.6

This creates a direct and compelling financial equation for velocity: every day of delay in a clinical trial is a day of lost market exclusivity, directly reducing the total revenue-generating window for a drug. Given that trial delays can cost a sponsor between $600,000 and 8 million per day, a high-velocity program is a powerful signal of a more valuable, de-risked asset from a financial perspective.8

4.2. Leveraging Regulatory Exclusivity

The financial signal of velocity is further complicated by the complex legal and regulatory frameworks designed to balance innovation with public access to medications. The Hatch-Waxman Act, for example, allows for a Patent Term Restoration to compensate for a portion of the time lost during the regulatory review process.27 A patent holder can request up to 5 additional years of protection, provided the total post-approval patent life does not exceed 14 years.27 This extension applies to the primary, core patent related to the drug’s active ingredients.29

In addition to patents and their extensions, the FDA grants separate regulatory exclusivity periods that run independently of patent rights.27 These periods provide a crucial layer of market protection, particularly for drugs that meet a significant unmet medical need.

Essential Table 2: FDA Regulatory Exclusivity Periods & Strategic Implications

| Exclusivity Type | Duration | Strategic Implications | Source(s) |

| New Chemical Entity (NCE) | 5 years | Bars the FDA from approving any application that references the innovator’s data for 5 years.27 This provides a strong, guaranteed period of protection, regardless of the remaining patent life.7 | 26 |

| New Clinical Study | 3 years | Granted for new clinical investigations (e.g., a new indication or dosage form) submitted with a New Drug Application (NDA) or Biologics License Application (BLA).30 This is a key strategy for prolonging market exclusivity beyond the primary patent.26 | 27 |

| Orphan Drug | 7 years | Awarded to treatments for rare diseases.26 This extended period incentivizes the development of therapies for conditions that would otherwise be commercially unviable.27 | 26 |

| Pediatric | 6 months | Adds 6 months to existing patent and/or exclusivity periods for sponsors who conduct requested pediatric studies.27 | 27 |

V. Strategic Levers for Optimizing Velocity and Driving Value

5.1. Technological and Operational Innovations

The future of drug development hinges on the proactive adoption of innovations that directly address the core inhibitors of velocity.

- Decentralized Clinical Trials (DCTs): DCTs are a paradigm-shifting approach that leverages digital technologies to support remote participation.9 By removing the need for in-person site visits, DCTs expand access to diverse and geographically dispersed populations, which in turn leads to faster recruitment and improved patient retention and engagement.9 The use of digital tools like eConsent, wearable devices, and telehealth streamlines the process, leading to quicker timelines and more cost-effective operations.10 The FDA has issued guidance to support the use of DCTs, further normalizing their use and encouraging their adoption to meet diversity goals.8

- AI and Machine Learning: Artificial intelligence is transforming the drug development pipeline, shifting intellectual property (IP) strategy from a reactive to a proactive function.35 Historically, a compound’s patentability was assessed late in the preclinical stage, after significant investment had been made.35 AI platforms, however, can analyze vast datasets to forecast patentability early, preventing the catastrophic misallocation of resources to a compound that may fail in the patent office, not the clinic.35 This capability to de-risk the pipeline from the earliest stages is a powerful signal of a high-velocity program.

5.2. Organizational and Strategic Improvements

Beyond technology, organizational and strategic improvements are vital for achieving high velocity. The research material highlights that internal process improvements, such as streamlining IRB and budget negotiations, are key to increasing velocity.1 Furthermore, the role of a strong CRO partner is emphasized as a way to embed quality from the very beginning of a trial, helping sponsors avoid costly missteps and rework.4 The selection of a partner with deep therapeutic expertise, a global infrastructure, and integrated systems can enable scale without sacrificing speed or quality.4

VI. Case Studies in Velocity: Winners and Losers

The concepts of velocity and its predictive power are best understood through real-world examples.

- Case Study 1: The Accelerated Win. A successful example of a high-velocity program is the development of AZT, a drug for AIDS. The AIDS epidemic created an urgent, unmet medical need, which led activists to pressure the FDA for a faster approval pathway.37 AZT received accelerated provisional approval based on a surrogate endpoint—its ability to improve T cell counts, which predicted fewer infections.37 This demonstrated that a strategic focus on a well-chosen endpoint can facilitate a high-velocity outcome, bringing a desperately needed treatment to market years sooner than the traditional pathway.37

- Case Study 2: The Phase III Pitfall. The high rate of Phase 3 failures that failed to confirm earlier findings provides a cautionary tale. In one study of 22 such cases, Phase 3 trials did not confirm Phase 2 findings of effectiveness in 14 cases, safety in one case, and both safety and effectiveness in seven cases.5 These examples demonstrate how a seemingly high-velocity Phase 2—perhaps one that was fast but lacked rigor—can be a false positive signal. The eventual failure in Phase 3 carries immense financial and reputational costs, proving that a superficial measure of speed can be misleading and ultimately harmful to the program and its stakeholders.8

- Case Study 3: The Patent Cliff Rescue. A drug’s commercial value can be maintained or even enhanced by a high-velocity, late-stage strategy that focuses on securing new regulatory exclusivity. For example, a company with a drug nearing its patent cliff can conduct new clinical studies for a different indication to secure a new 3-year exclusivity period.27 This strategic lever can prolong the drug’s effective market life, providing additional time to generate revenue and demonstrating that velocity is not just about the initial race to market but also about the ability to dynamically manage an asset’s lifecycle.

VII. Outlook and Recommendations: A Playbook for the Future

7.1. Synthesizing the Signal

The concept of clinical trial velocity is not a single number but a dynamic, multi-factor signal that captures the convergence of scientific innovation and operational excellence. A high-velocity program is one that exhibits a combination of fast and efficient operational metrics (e.g., short cycle times and high enrollment rates), strategic foresight in protocol design (e.g., streamlined protocols), and the proactive adoption of de-risking technologies (e.g., DCTs and AI).1 This holistic approach is the true measure of a program’s strategic maturity and its potential to deliver meaningful outcomes.

7.2. Recommendations for Investors and R&D Leaders

Based on this analysis, the following recommendations are provided to guide decision-making for both investors and R&D leaders:

- For Investors: When evaluating a pharmaceutical or biotechnology company, look beyond simple average trial durations. Use a composite “velocity” scorecard that includes metrics on cycle times, patient enrollment rates, and the strategic adoption of modern technologies. A high-velocity program is a signal of a more valuable, de-risked asset, with a longer effective patent life and higher potential for market uptake. This approach allows for a more robust assessment of a company’s pipeline and its long-term revenue potential.6

- For R&D Leaders: Adopt a “slow down to go fast” approach. Front-load investment in the early stages of a program by prioritizing meticulous protocol design, patient engagement strategies, and AI-powered analytics to de-risk the pipeline.14 Leverage technologies like Decentralized Clinical Trials to meet evolving regulatory requirements, such as the need for more diverse patient populations, and to accelerate recruitment.9 Prioritize quality at every stage to avoid costly late-stage failures and to ensure that the program’s initial velocity is not a misleading, false positive.4

Conclusion

The evidence suggests that clinical trial velocity, understood as a holistic measure of a program’s strategic and operational health, is a powerful and reliable signal for predicting the likelihood of regulatory approval and commercial success. By focusing on a composite of operational metrics, embracing a “quality is speed” mindset, and leveraging modern technologies to proactively mitigate risk, pharmaceutical companies can build high-velocity programs that not only accelerate the delivery of life-saving treatments but also maximize their value to all stakeholders. The future of drug development is not just about scientific innovation but also about operational excellence, and velocity is the metric that captures this convergence.

Works cited

- Beginner’s Guide to Clinical Trial Performance Metrics – Advarra, accessed September 10, 2025, https://www.advarra.com/blog/beginners-guide-clinical-trial-performance-metrics/

- vcccalliance.org.au, accessed September 10, 2025, https://vcccalliance.org.au/research/clinical-trial-innovations/metrics/#:~:text=Clinical%20trial%20metrics%20are%20data,evidence%20used%20in%20clinical%20trials.

- Clinical trial recruitment rate calculator and site selection – Antidote.me, accessed September 10, 2025, https://www.antidote.me/blog/clinical-trial-recruitment-rate-calculator

- Quality is Speed: The Clinical Trial Myth That’s Slowing You Down | PPD, accessed September 10, 2025, https://www.ppd.com/blog/quality-is-speed/

- 22 Case Studies Where Phase 2 and Phase 3 Trials Had Divergent Results – FDA, accessed September 10, 2025, https://www.fda.gov/media/102332/download

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage, accessed September 10, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management, accessed September 10, 2025, https://www.ajmc.com/view/a636-article

- What clinical trial statistics tell us about the state of research today – Antidote.me, accessed September 10, 2025, https://www.antidote.me/blog/what-clinical-trial-statistics-tell-us-about-the-state-of-research-today

- Decentralized Clinical Trials: Key Benefits & Challenges for Sponsors – Studypages, accessed September 10, 2025, https://studypages.com/blog/decentralized-clinical-trials-key-benefits-and-challenges-every-sponsor-should-know/

- What Are Decentralized Clinical Trials (DCTs)? A Complete Guide – Medrio, accessed September 10, 2025, https://medrio.com/blog/what-are-decentralized-clinical-trials/

- CTSWC25: The future of clinical trial supply hinges on risk management, accessed September 10, 2025, https://www.clinicaltrialsarena.com/news/ctswc25-the-future-of-clinical-trial-supply-hinges-on-risk-management/

- Q: What is a Velocity Clinical Research job? – ZipRecruiter, accessed September 10, 2025, https://www.ziprecruiter.com/e/What-is-a-Velocity-Clinical-Research-job

- Velocity Clinical Research – Clinical Trial Site Organization, accessed September 10, 2025, https://velocityclinical.com/

- Clinical Trial Agility: 3 Factors That Can Make or Break It, accessed September 10, 2025, https://blog.advancedclinical.com/clinical-trial-agility-three-factors-that-make-or-break-it

- Step 3: Clinical Research – FDA, accessed September 10, 2025, https://www.fda.gov/patients/drug-development-process/step-3-clinical-research

- Clinical Trial Success Rates – Umbrex, accessed September 10, 2025, https://umbrex.com/resources/industry-analyses/how-to-analyze-a-pharmaceutical-company/clinical-trial-success-rates/

- How long do clinical trial phases take? – Antidote.me, accessed September 10, 2025, https://www.antidote.me/blog/how-long-do-clinical-trial-phases-take

- The Current Status of Drug Discovery and Development as Originated in United States Academia, accessed September 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6226120/

- Phases of clinical research – Wikipedia, accessed September 10, 2025, https://en.wikipedia.org/wiki/Phases_of_clinical_research

- What’s the average time to bring a drug to market in 2022? – N-SIDE, accessed September 10, 2025, https://lifesciences.n-side.com/blog/what-is-the-average-time-to-bring-a-drug-to-market-in-2022

- Why 90% of clinical drug development fails and how to improve it? – PMC – PubMed Central, accessed September 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9293739/

- Improving Efficiency in Drug Discovery and Development – Technology Networks, accessed September 10, 2025, https://www.technologynetworks.com/drug-discovery/articles/improving-efficiency-in-drug-discovery-and-development-394976

- Cancer Drug Clinical Success Rates Increase – The Oncology Pharmacist, accessed September 10, 2025, https://theoncologypharmacist.com/top-dail/cancer-drug-clinical-success-rates-incr

- Global Trends in R&D 2025: Signs of Higher Efficiency and Productivity – IQVIA, accessed September 10, 2025, https://www.iqvia.com/blogs/2025/06/global-trends-in-r-and-d-2025-signs-of-higher-efficiency-and-productivity

- Ensuring Representative US Enrollment in Oncology Clinical Trials: Navigating the Rising Tide of Regulatory Scrutiny | WCG, accessed September 10, 2025, https://www.wcgclinical.com/insights/ensuring-representative-us-enrollment-in-oncology-clinical-trials-navigating-the-rising-tide-of-regulatory-scrutiny/

- Generic Drugs – Friends of Cancer Research, accessed September 10, 2025, https://friendsofcancerresearch.org/glossary-term/generic-drugs/

- Drug Patents: Essential Guide to Pharmaceutical Patent Protection – UpCounsel, accessed September 10, 2025, https://www.upcounsel.com/how-long-does-a-drug-patent-last

- Small Business Assistance: Frequently Asked Questions on the Patent Term Restoration Program | FDA, accessed September 10, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-frequently-asked-questions-patent-term-restoration-program

- Patent Term Extensions and the Last Man Standing | Yale Law & Policy Review, accessed September 10, 2025, https://yalelawandpolicy.org/patent-term-extensions-and-last-man-standing

- Patents and Exclusivity | FDA, accessed September 10, 2025, https://www.fda.gov/media/92548/download

- Decentralized clinical trials in the trial innovation network: Value, strategies, and lessons learned – PMC – PubMed Central, accessed September 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10465321/

- Methods and perceptions of success for patient recruitment in decentralized clinical studies, accessed September 10, 2025, https://www.cambridge.org/core/journals/journal-of-clinical-and-translational-science/article/methods-and-perceptions-of-success-for-patient-recruitment-in-decentralized-clinical-studies/F59F77F599C08E9EC8246C577A478A69

- Opportunities and Challenges for Decentralized Clinical Trials: European Regulators’ Perspective – PMC – PubMed Central, accessed September 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9540149/

- Methods and perceptions of success for patient recruitment in decentralized clinical studies, accessed September 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10643920/

- How AI and Machine Learning are Forging the Next Frontier of Pharmaceutical IP Strategy, accessed September 10, 2025, https://www.drugpatentwatch.com/blog/how-ai-and-machine-learning-are-forging-the-next-frontier-of-pharmaceutical-ip-strategy/

- Real-Time Patent Intelligence: Unlock Pharma Market Opportunities – Arctic Invent, accessed September 10, 2025, https://www.arcticinvent.com/technologies/drug-patent-watch

- 30 Years of Accelerated Approvals: Fast-Tracking Innovation in Drug …, accessed September 10, 2025, https://www.pharmasalmanac.com/articles/30-years-of-accelerated-approvals-fast-tracking-innovation-in-drug-development

- 6 Effective Strategies To Improve Clinical Trial Enrollment – Studypages, accessed September 10, 2025, https://studypages.com/blog/how-to-improve-clinical-trial-enrollment-rates/