Executive Summary

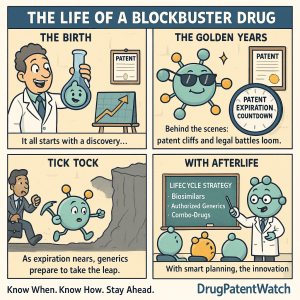

The pharmaceutical industry operates on a timeline fundamentally distinct from any other sector of the global economy. In technology or consumer goods, a product’s lifecycle is dictated by consumer preference, rapid innovation cycles, and obsolescence. In the biopharmaceutical sector, the lifecycle is dictated by a legal clock: the patent term. For investors, executives, and intellectual property (IP) strategists, the question “When does the patent expire?” is not merely a matter of compliance—it is the single most important variable in valuation, strategy, and competitive intelligence. It defines the “cliff” where revenue evaporates and the “bridge” where innovation must take over.

Between 2025 and 2030, the global pharmaceutical industry faces a “patent cliff” of historic proportions. An estimated $200 billion to $400 billion in branded drug revenue is at risk of erosion as the statutory monopolies of industry titans expire.1 Blockbuster assets like Merck’s Keytruda, Bristol Myers Squibb’s Eliquis, and Regeneron’s Eylea—drugs that collectively generate tens of billions of dollars annually—are approaching the end of their exclusivity.2 The financial violence of these events cannot be overstated; for small-molecule blockbusters, sales frequently plummet by 80-90% within the first year of generic entry.1

However, the date listed on a patent certificate rarely tells the whole story. The “Effective Patent Life”—the actual period of market exclusivity—is the result of a complex interplay between statutory terms, FDA regulatory exclusivities, Patent Term Extensions (PTE), and ruthless litigation strategies. In this high-stakes environment, data is the ultimate weapon. Platforms like DrugPatentWatch have become indispensable for stakeholders attempting to decipher the opaque web of Orange Book listings, “patent thickets,” and global expiration rules to forecast the true date of generic entry.4

This report provides an exhaustive analysis of the pharmaceutical patent lifecycle. We will dissect the diverging regulatory frameworks for small molecules and biologics, analyze the strategic maneuvers used to extend market dominance, and evaluate how the Inflation Reduction Act (IRA) is rewriting the rules of investment. By examining the 2025-2030 cliff through the lens of hard data and legal precedent, we offer a strategic roadmap for navigating the end of exclusivity.

The 20-Year Illusion: Statutory vs. Effective Patent Life

There is a popular and dangerously simplistic misconception among generalist investors that a new drug receives a 20-year monopoly. While a U.S. patent does indeed have a statutory term of 20 years from its filing date, the commercial reality is tragically shorter. This discrepancy creates the fundamental economic tension of the industry.

The Time-Cost of Innovation

Patents are the financial engine of the pharmaceutical industry, the core incentive that justifies the staggering R&D investment required to bring a novel medicine to patients. However, to ensure priority and secure the intellectual property, patents must be filed extremely early in the discovery process—often before the molecule has even been tested in humans, and sometimes before a lead candidate is fully optimized.6

From the moment the patent application is stamped at the USPTO, the 20-year clock begins to tick. Yet, the drug is nowhere near the market. It must endure a grueling developmental odyssey:

- Discovery and Preclinical Research: This initial phase involves identifying molecular targets and conducting extensive toxicology testing in animals. It can last 4 to 7 years.7

- Clinical Trials (Phase I, II, III): The drug must pass through three phases of human trials to demonstrate safety and efficacy. This process consumes 6 to 8 years.7

- FDA Review: Once the New Drug Application (NDA) is submitted, the FDA review process typically takes another 6 months to 2 years.5

The “Crucible” of Compressed Time:

By the time a drug is finally approved for sale, a massive portion of its patent life—frequently 10 to 15 years—has already burned away. This leaves an “effective patent life” (the period of on-market exclusivity) of only 7 to 12 years in many cases.5 It is within this compressed window that the company must recoup billions in R&D costs and generate a return for shareholders. This truncated timeline drives the industry’s aggressive pricing models and the litigious defense of IP assets.

Reclaiming Lost Time: Patent Term Restoration

Recognizing that lengthy regulatory delays were penalizing innovation and threatening the viability of the industry, Congress enacted the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act. A cornerstone of this legislation was the creation of Patent Term Extensions (PTE) to restore a portion of the time lost during the FDA review and clinical trial process.5

The PTE Calculus:

The extension is generally calculated as the time the drug was under FDA review plus one-half of the time it was in clinical testing. However, this restoration is not unlimited. It is subject to two critical statutory caps designed to balance innovation with public access:

- Five-Year Cap: The total extension granted cannot exceed five years.

- 14-Year Cap: The total remaining patent term (including the extension) cannot exceed 14 years from the date of FDA approval.5

Strategic Implication:

For a blockbuster drug generating $5 billion annually, a full five-year extension represents $25 billion in protected revenue. Consequently, the calculation, application, and litigation of PTEs is a high-stakes battlefield. Errors in calculation or missed deadlines can cost shareholders billions.

“A patent expiration is not a sudden, unforeseen accident; it is the predictable climax of a multi-year strategic battle, a known variable on a corporate calendar that dictates strategy from the moment a new molecule is discovered.” — DrugPatentWatch 5

The Regulatory Fortress: FDA Exclusivity vs. Patent Rights

While patents are property rights granted by the U.S. Patent and Trademark Office (USPTO), Regulatory Exclusivity is a separate, parallel form of market protection granted by the Food and Drug Administration (FDA). Understanding the distinction is vital for accurate forecasting: Patents can be challenged and invalidated in court; regulatory exclusivity is absolute and generally cannot be breached by litigation.8

Regulatory exclusivity works as a “data shield.” It prevents the FDA from accepting or approving generic applications (ANDAs) or biosimilars for a specific period, regardless of the patent status. The two systems often run concurrently, but exclusivity can sometimes outlast patents or protect a drug that has no remaining patent coverage.

The Hierarchy of FDA Exclusivities

The FDA grants different periods of exclusivity based on the novelty of the drug, the population it serves, and the specific clinical data provided.

Table 1: Key FDA Regulatory Exclusivities

| Exclusivity Type | Acronym | Duration | Strategic Function & Mechanism |

| Orphan Drug Exclusivity | ODE | 7 Years | Awarded for drugs treating rare diseases (affecting <200,000 people in the U.S.). Bars the FDA from approving the same drug for the same condition. It is a powerful monopoly incentive for niche markets. 6 |

| New Chemical Entity | NCE | 5 Years | Granted to drugs containing an active moiety never before approved by the FDA. Acts as a fortress: Generics cannot even submit an application for 5 years (reduced to 4 years if they file a Paragraph IV patent challenge). 6 |

| New Clinical Investigation | NCI / OIE | 3 Years | Granted for changes to previously approved drugs (e.g., new indication, new dosage form) that required new clinical trials. Prevents approval of generics for that specific change, forcing competitors to “carve out” the new use from their labels. 6 |

| Biologic Exclusivity | BLA | 12 Years | Established by the BPCIA. Prevents biosimilar approval for 12 years; prevents biosimilar filing for 4 years. This reflects the higher complexity and cost of biologic development. 6 |

| Pediatric Exclusivity | PED | +6 Months | An “add-on” exclusivity. If a sponsor conducts pediatric studies requested by the FDA, 6 months are added to all existing patents and regulatory exclusivities for that moiety. 9 |

| GAIN Act (Antibiotics) | QIDP | +5 Years | For Qualified Infectious Disease Products. Adds 5 years to NCE or other exclusivities to incentivize the development of new antibiotics. 10 |

The “Six-Month Bonus”: Pediatric Exclusivity

Pediatric exclusivity is unique because it is not a standalone period; it attaches to existing protections. If a drug has a patent expiring in December and NCE exclusivity expiring in June, obtaining pediatric exclusivity extends both dates by six months. This “six-month bonus” acts as a definitive hard stop to generic entry that litigation cannot breach. For a drug like Lipitor or Humira, six months of monopoly sales can equate to hundreds of millions, or even billions, of dollars in additional revenue.12

Small Molecules vs. Biologics: The Hatch-Waxman and BPCIA Divide

The pathway to generic competition differs radically depending on whether the drug is a small molecule (chemistry-based, like aspirin) or a biologic (protein-based, like monoclonal antibodies). These two categories are governed by separate legal frameworks that dictate how patents are challenged and when competition arrives.

Small Molecules: The Hatch-Waxman Gauntlet

For small molecules (e.g., Revlimid, Eliquis), the process is governed by the Hatch-Waxman Act. This system relies on transparency and litigation incentives.

- The Orange Book: Innovators must list all relevant patents (active ingredient, formulation, method of use) in the FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations (the “Orange Book”). This listing puts the world on notice.6

- Paragraph IV Certification: To market a generic before patents expire, a challenger must file a “Paragraph IV” certification claiming the patents are invalid, unenforceable, or not infringed.

- The 30-Month Stay: If the innovator sues the generic applicant within 45 days of receiving notice, the FDA is automatically barred from approving the generic for 30 months (or until the court rules). This automatic stay is a powerful tool for delaying competition.13

- 180-Day Exclusivity: To encourage generics to challenge weak patents, the first applicant to file a Paragraph IV certification (“First-to-File”) is granted 180 days of generic market exclusivity. During this period, no other generic can launch. This creates a massive financial incentive—often worth hundreds of millions—to challenge patents early. Studies show generics succeed in these challenges roughly 76% of the time.14

Biologics: The BPCIA and the “Patent Dance”

Biologics (e.g., Humira, Keytruda) are larger, more complex molecules. The Biologics Price Competition and Innovation Act (BPCIA) created the biosimilar pathway, which differs significantly from Hatch-Waxman.

- No Orange Book Equivalent: While the FDA publishes the “Purple Book,” it lists licensure dates and exclusivity but does not list patents in the same binding manner as the Orange Book.

- 12-Year Exclusivity: Biologics receive 12 years of protection from biosimilar competition, compared to just 5 years for small molecules (NCE). This reflects the higher complexity and cost of biologic development.16

- The “Patent Dance”: Instead of a public listing, the BPCIA mandates a private, structured exchange of information between the biosimilar applicant and the innovator (Reference Product Sponsor). This “dance” is designed to streamline litigation before launch.17

The Choreography of the Patent Dance

According to legal experts, the patent dance proceeds in specific steps 18:

- Step 1: The biosimilar applicant provides their full application (BLA) and manufacturing information to the innovator within 20 days of FDA acceptance.

- Step 2: The innovator has 60 days to provide a list of patents they believe are infringed.

- Step 3: The biosimilar applicant has 60 days to respond, detailing why those patents are invalid or not infringed.

- Step 4: The parties negotiate which patents to litigate immediately (“first wave”) and which to leave for later (“second wave”).

Strategic Ambiguity:

Critically, the Supreme Court ruling in Amgen v. Sandoz (2017) made participation in the patent dance optional. This has led to “strategic ambiguity,” where biosimilar applicants may choose to skip the dance to force the innovator’s hand, although this risks immediate litigation on all patents rather than a curated list.19

Strategies of Defense: Patent Thickets, Evergreening, and Product Hopping

Facing the “effective life” crunch, pharmaceutical companies deploy sophisticated lifecycle management strategies—often criticized by payers and activists as “evergreening”—to extend revenue beyond the expiration of the original molecule patent.

1. The Patent Thicket (The Humira Strategy)

A “patent thicket” involves filing dozens or hundreds of patents covering every conceivable aspect of a drug: formulation, manufacturing processes, delivery devices, crystalline forms, and dosing regimens. The goal is to create a dense web of IP that is too costly and time-consuming for competitors to clear, forcing them to settle.

Case Study: Humira (Adalimumab)

AbbVie’s Humira is the archetype of this strategy. While the core composition-of-matter patent expired in 2016, AbbVie filed over 130 additional patents (covering formulation and manufacturing).21 This “thicket” allowed them to sue potential biosimilar competitors and force settlements that delayed U.S. entry until 2023—seven years after the primary patent expired. This delay preserved nearly $200 billion in revenue over the drug’s lifetime.23

2. Product Hopping and Reformulation

This strategy involves slightly modifying a drug—e.g., moving from a tablet to a capsule, or intravenous to subcutaneous administration—and switching patients to the new form before the old one goes generic.

Case Study: Keytruda Subcutaneous (Keytruda Qlex)

Merck faces a critical patent cliff in 2028 for its intravenous blockbuster Keytruda, which generated nearly $30 billion in 2023. To defend this franchise, Merck developed a subcutaneous version, approved by the FDA in September 2025 as Keytruda Qlex (pembrolizumab and berahyaluronidase alfa-pmph). This new formulation allows administration in minutes rather than hours, offering a clinical advantage that serves as a commercial firewall. By migrating patients to Qlex before 2028, Merck aims to retain market share even after IV biosimilars launch, as the new formulation is protected by fresh patents.24

3. Method of Use and Indication Expansion

Innovators continue to research their drugs to find new therapeutic uses. Each new approved indication can grant 3 years of exclusivity (NCI). If a generic launches, they may have to “carve out” these protected uses from their label (known as a “skinny label”). However, recent litigation (e.g., GSK v. Teva) has made skinny labeling riskier, with courts finding generics liable for “induced infringement” if their marketing implies the drug can be used for the protected indication.27

When the Cliff Strikes: The 2025–2030 Expiration Wave

The industry is currently navigating one of the steepest patent cliffs in history. Between 2025 and 2030, nearly 200 drugs, including roughly 70 blockbusters, will lose exclusivity.29 This wave threatens to erode over $200 billion in annual revenue.2

Top Blockbusters at Risk (U.S. Market)

Table 2: Key U.S. Patent Expirations (2025–2030)

| Drug Name | Innovator | Primary Indication | Recent Annual Sales | Est. Generic/Biosimilar Entry | Impact Level |

| Keytruda (pembrolizumab) | Merck | Oncology | ~$29.5 Billion | 2028 | Critical |

| Eliquis (apixaban) | BMS / Pfizer | Anticoagulant | >$12 Billion | 2026-2029 | Critical |

| Stelara (ustekinumab) | J&J | Immunology | ~$10.8 Billion | 2025 | High |

| Opdivo (nivolumab) | BMS | Oncology | ~$9 Billion | 2028 | High |

| Eylea (aflibercept) | Regeneron | Ophthalmology | ~$5.9 Billion | 2025-2027 | High |

| Trulicity (dulaglutide) | Eli Lilly | Diabetes | ~$7.1 Billion | 2027 | High |

| Entresto (sacubitril/valsartan) | Novartis | Heart Failure | ~$6 Billion | Mid-2025 | High |

| Xarelto (rivaroxaban) | Bayer / J&J | Anticoagulant | ~$4.5 Billion | 2026 | Medium |

1

Strategic Analysis:

- Keytruda: The loss of Keytruda will be the single largest LOE event in industry history. Merck’s defense relies heavily on the subcutaneous conversion (Qlex) and extensive combination studies.25

- Eliquis: Litigation settlements have pushed generic entry to roughly 2028-2029, but the patent landscape remains fluid due to the complexity of the formulation patents and potential IRA impacts.1

- Entresto: Novartis faced a significant setback in July 2025 when a U.S. judge denied a preliminary injunction against a generic launch, exposing the drug to imminent competition.31

Financial Realities: How Deep is the Drop?

When a patent cliff hits, the financial impact is not a slow erosion—it is a collapse. For small-molecule drugs, the arrival of generics typically leads to a 90% volume loss within 12 months.

Case Study: Pfizer’s Lipitor (The Gold Standard of LOE)

When Lipitor (atorvastatin) lost exclusivity in November 2011, it was the world’s best-selling drug.

- The Drop: Sales halved within weeks of generic entry.

- The Defense: Pfizer deployed an aggressive “authorized generic” strategy and offered deep discounts to Pharmacy Benefit Managers (PBMs) to keep the brand on formularies for the 180-day exclusivity period. While this mitigated the initial blow, the revenue stream eventually evaporated, forcing Pfizer to restructure.32

Case Study: AbbVie’s Humira (The Biosimilar Erosion)

Humira’s U.S. LOE in 2023 offers a modern contrast for biologics.

- The Erosion: Unlike the rapid drop of small molecules, Humira retained significant market share initially due to formulary contracting, but forced price concessions decimated revenue.

- Financials: Global Humira revenues dropped nearly 41% in Q4 2023 alone ($3.3B vs previous highs).34

- Stock Resilience: Remarkably, AbbVie’s stock outperformed expectations because they successfully launched successor immunology drugs (Skyrizi and Rinvoq) well in advance. This “bridge strategy” is now the model for the industry.35

Case Study: BMS and Revlimid

Bristol Myers Squibb faced the LOE of Revlimid (lenalidomide) in 2022. Due to a tiered-entry settlement, generics entered with limited volume limits initially.

- The Result: Despite the controlled entry, Revlimid revenues declined by 22% in Q2 2022 and continued to slide. BMS has had to rely on its new product portfolio (Opdualag, Camzyos) to fill the gap, illustrating that even “managed” cliffs result in severe revenue contraction.37

The Inflation Reduction Act: Policy is Rewriting the Lifecycle

The Inflation Reduction Act (IRA) of 2022 has introduced a new variable that rivals patent expiration in strategic importance: Medicare Price Negotiation.

The “Small Molecule Penalty”

The IRA allows Medicare to negotiate prices for top-spending drugs. Crucially, the timeline for eligibility differs by molecule type:

- Small Molecules: Eligible for negotiation 9 years after approval.

- Biologics: Eligible for negotiation 13 years after approval.

Strategic Implication:

This 4-year disparity creates a massive disincentive for small-molecule investment. Since the effective patent life is often 12-14 years, a 9-year negotiation window effectively acts as an artificial, early patent expiration. This is forcing capital away from small molecules (like cancer pills) and toward biologics and complex modalities.39

The “New LOE”:

Industry analysts at IQVIA now view the “Maximum Fair Price” (MFP) implementation date as a de facto Loss of Exclusivity. Even if patents remain, the government-mandated price cut compresses the commercial opportunity, forcing companies to realize value faster and launch with broader indications earlier.41

The Global Chessboard: Europe, Japan, China, and India

For multinational corporations, patent strategy is a 3D chess game played across different jurisdictions with different rules.

Europe: Supplementary Protection Certificates (SPC)

The EU does not use the Hatch-Waxman system. Instead, it offers Supplementary Protection Certificates (SPCs).

- Mechanism: SPCs extend patent rights for up to 5 years to compensate for regulatory delays.

- Pediatric Extension: An additional 6 months is available for completing a Paediatric Investigation Plan (PIP), bringing the maximum total exclusivity to 15.5 years from the first marketing authorization.43

- Unitary Patent: Recent moves toward a Unitary SPC aim to simplify the fragmented national system, allowing a single application to cover most of the EU.45

Japan: The Re-examination Period

Japan uses a unique “Re-examination Period” (Sai-shinsa-kikan) which functions as a robust form of data exclusivity.

- Duration: Typically 8 years for a new drug (10 years for orphan drugs).

- Function: During this period, the PMDA (Japan’s FDA) monitors safety. Generics essentially cannot launch because they cannot rely on the innovator’s data until the period ends. This often runs independently of patents and effectively blocks entry.8

- Generics Push: The Japanese government has aggressively pushed for higher generic usage (targeting an 80% share) to control healthcare costs, putting immense pricing pressure on long-listed brands.48

China: The New Frontier of Patent Linkage (2024 Updates)

China has rapidly modernized its IP framework to attract innovation.

- Patent Linkage: Introduced in 2021 and refined in 2024, China now has a system similar to the U.S. Orange Book. It includes a 9-month stay on regulatory approval if a patent dispute is filed (shorter than the U.S. 30 months).49

- Data Exclusivity (2025 Drafts): New regulations proposed in 2025 aim to solidify data exclusivity: 6 years for innovative drugs and 12 years for biologics, aligning closer to global standards.51

- First-Generic Exclusivity: China offers 12 months of market exclusivity for the first generic to successfully challenge a patent—double the U.S. reward—creating a strong incentive for domestic challengers.50

India: The Anti-Evergreening Fortress

India plays a critical role as the “pharmacy of the world,” supplying a vast percentage of global generics. Its patent law contains a unique provision: Section 3(d).

- The Rule: Section 3(d) prevents the patenting of “new forms of known substances” (e.g., salts, esters, polymorphs) unless they demonstrate significantly “enhanced efficacy.”

- Novartis v. Union of India (2013): In this landmark case, the Indian Supreme Court rejected Novartis’s patent for a new form of the cancer drug Glivec (imatinib), ruling that increased bioavailability alone did not constitute “enhanced efficacy”.53

- Impact: This sets a much higher bar for “secondary” patents in India than in the US or EU, preventing the kind of patent thickets seen with Humira and ensuring faster generic entry domestically.55

“At-Risk” Launches: Gambling on Validity

One of the most dramatic scenarios in pharmaceutical competition is the “at-risk” launch. This occurs when a generic manufacturer begins selling its product before patent litigation concludes, betting that the courts will eventually rule the innovator’s patents invalid or not infringed.

The High Stakes:

- If the Generic Wins: They gain years of early revenue and market dominance.

- If the Generic Loses: They are liable for the innovator’s lost profits, often tripled (“treble damages”) if the infringement is found to be willful.

Case Study: Protonix (Pantoprazole)

Teva and Sun Pharma launched a generic version of the acid-reflux drug Protonix at risk. After years of litigation, the court upheld the validity of the innovator’s patent. The resulting settlement was $2.15 billion, one of the largest in history, illustrating the catastrophic downside of a failed at-risk launch.57

2024 Trend:

In 2024, the market saw renewed interest in at-risk launches for products where the innovator relied on weak “device” patents (e.g., inhalers) rather than strong compound patents, emboldened by the FTC’s crackdown on improper Orange Book listings.58

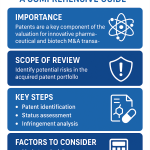

Leveraging Intelligence: The Role of DrugPatentWatch

In this environment of hidden exclusivities, shifting regulations, and global complexity, manual searches of the USPTO or Orange Book are insufficient. Platforms like DrugPatentWatch have become indispensable for translating raw legal data into commercial intelligence.4

For business development teams, DrugPatentWatch offers critical capabilities:

- Exclusivity Tracking: Automatically calculates “effective” expiration dates by integrating patent terms with FDA regulatory exclusivities (NCE, ODE, Pediatric) to predict the true “generic entry date”.5

- Generic Entry Prediction: Tracks Paragraph IV certifications and tentative approvals to forecast exactly when competition will arrive.

- Thicket Visualization: Maps out the web of secondary patents (formulation, method of use) that might block entry even after the compound patent expires.

- FTO Support: Connects patent data directly to clinical trial information and manufacturing details, supporting robust Freedom-to-Operate searches.60

Real-World ROI:

Users report that accessing consolidated expiration data allows them to “align with proper vendors” and “anticipate customer needs” years in advance.4 For investors, it distinguishes between a company facing a “cliff” (like BMS with Revlimid) and one with a “bridge” (like AbbVie with Skyrizi), enabling better valuation of assets during critical transition periods.

Key Takeaways

- The “20-Year” Myth: The effective commercial life of a drug is typically only 7–12 years due to long development timelines. Patent Term Extensions (PTE) and Regulatory Exclusivities (NCE, ODE) are critical tools for extending this window.

- The 2025–2030 Cliff is Historic: Over $200 billion in revenue is at risk as titans like Keytruda, Eliquis, and Opdivo lose exclusivity. This will trigger a massive wave of M&A, cost-cutting, and strategic pivots across the industry.

- Policy is the New Patent: The Inflation Reduction Act (IRA) fundamentally alters strategy, penalizing small molecules (9-year negotiation) and favoring biologics (13-year negotiation), effectively creating a “new LOE” independent of patents.

- Biologics Play by Different Rules: The BPCIA “Patent Dance” and 12-year exclusivity create a different competitive landscape than the Hatch-Waxman small molecule pathway. “Patent thickets” are more effective here but are facing increased scrutiny from the FTC.

- Global Strategy Requires Local Nuance: Expiration dates vary wildly by geography. Europe’s SPCs, Japan’s Re-examination Period, China’s new Patent Linkage, and India’s Section 3(d) create a fragmented map that requires country-specific expertise.

- Data is the Weapon: Tools like DrugPatentWatch are essential for navigating these complexities, offering predictive insights into generic entry, FTO, and global exclusivity that manual searches cannot provide.

FAQ

Q1: How does the Inflation Reduction Act (IRA) specifically disadvantage small molecule drugs compared to biologics regarding patent lifecycles?

A: The IRA makes small molecule drugs eligible for Medicare price negotiation just 9 years after FDA approval, whereas biologics are eligible after 13 years. Since price negotiation acts as a de facto loss of exclusivity (by capping revenue), small molecules effectively lose their commercial pricing freedom 4 years earlier than biologics, regardless of their remaining patent life. This is causing R&D investment to shift noticeably toward large-molecule programs.39

Q2: Can a drug remain exclusive even after all its patents have expired?

A: Yes. FDA Regulatory Exclusivity operates independently of patents. For example, if a drug receives Orphan Drug Exclusivity (ODE), the FDA cannot approve a competitor for the same indication for 7 years, even if the drug has no valid patents. Similarly, New Chemical Entity (NCE) exclusivity prevents the filing of generic applications for 5 years. Pediatric exclusivity can also extend these periods by 6 months.8

Q3: What is a “Skinny Label” and why is it becoming riskier for generics?

A: A “skinny label” allows a generic to launch for unpatented uses while “carving out” uses that are still protected by patents (e.g., a specific disease indication). Historically, this allowed early entry. However, recent court rulings (like GSK v. Teva) have found generics liable for “induced infringement” if their marketing or implied use encourages doctors to prescribe the generic for the protected indication, making this strategy much legally riskier.27

Q4: How does the “Patent Dance” for biosimilars differ from the Orange Book process for generics?

A: Small molecule generics rely on the Orange Book, where patents are publicly listed and challenges (Paragraph IV) are standardized. Biologics use the BPCIA “Patent Dance,” a private, multi-step exchange of information where the biosimilar applicant and innovator negotiate which patents to litigate. Crucially, the Supreme Court ruled the “dance” is optional, leading to varied and complex litigation strategies unlike the predictable 30-month stays of Hatch-Waxman.18

Q5: What is the “Re-examination Period” in Japan and how does it affect generic entry?

A: Japan’s Re-examination Period is a form of regulatory exclusivity, typically lasting 8 years for new drugs (10 for orphans). During this time, the safety of the drug is monitored, and generic companies cannot rely on the innovator’s clinical data for their own approvals. This effectively blocks generic entry for at least 8 years, regardless of the patent status, serving a function similar to data exclusivity in the West but with a stronger focus on post-market surveillance.46

Works cited

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Big Pharma’s impeding Patent Cliffs – BSIC | Bocconi Students Investment Club, accessed November 26, 2025, https://bsic.it/big-pharmas-impeding-patent-cliffs/

- Top 10 Blockbuster Drugs Facing U.S. Patent Expirations (2025–2029) – Clival Database, accessed November 26, 2025, https://clival.com/blog/top-10-blockbuster-drugs-facing-us-patent-expirations

- A Strategic Guide to Capitalizing on Patent Expiry, Generic Entry, and Product Reformulation, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/a-strategic-guide-to-capitalizing-on-patent-expiry-generic-entry-and-product-reformulation/

- A Strategic Investor’s Guide to Pharmaceutical Patent Expiration – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/a-strategic-investors-guide-to-pharmaceutical-patent-expiration/

- How Drugmakers Use the Patent Process to Keep Prices High | Commonwealth Fund, accessed November 26, 2025, https://www.commonwealthfund.org/publications/explainer/2025/nov/how-drugmakers-use-patent-process-keep-prices-high

- Predictive Insights: Leveraging AI for Smarter Drug Patent Searches – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/predictive-insights-leveraging-ai-for-smarter-drug-patent-searches/

- Using Drug Exclusivities for Unrivaled Market Dominance – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-strategic-labyrinth-navigating-drug-exclusivities-for-unrivaled-market-dominance/

- Patents and Exclusivity | FDA, accessed November 26, 2025, https://www.fda.gov/media/92548/download

- Drug Exclusivity in the US – RxDataLab, accessed November 26, 2025, https://rxdatalab.com/blog/fda-exclusivity/

- Drug Marketing Exclusivity: Types & Developer Benefits – Allucent, accessed November 26, 2025, https://www.allucent.com/resources/blog/types-marketing-exclusivity-drug-development

- Frequently Asked Questions on Patents and Exclusivity – FDA, accessed November 26, 2025, https://www.fda.gov/drugs/development-approval-process-drugs/frequently-asked-questions-patents-and-exclusivity

- A Strategic Guide to Managing Pharmaceutical Patent and Regulatory Overlaps, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/a-strategic-guide-to-managing-pharmaceutical-patent-and-regulatory-overlaps/

- The Paragraph IV Playbook: Turning Patent Challenges into Market …, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-paragraph-iv-playbook-turning-patent-challenges-into-market-dominance/

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- Post Exclusivity Issues For Biologics – Hunton Andrews Kurth LLP, accessed November 26, 2025, https://www.hunton.com/insights/legal/post-exclusivity-issues-for-biologics

- Patenting Strategies for Combination (Small Molecule and Biologic) Drugs, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/patenting-strategies-for-combination-small-molecule-and-biologic-drugs/

- How Biosimilars Are Approved and Litigated: Patent Dance Timeline, accessed November 26, 2025, https://www.fr.com/insights/ip-law-essentials/how-biosimilars-approved-litigated-patent-dance-timeline/

- What Is the Patent Dance? | Winston & Strawn Law Glossary, accessed November 26, 2025, https://www.winston.com/en/legal-glossary/patent-dance

- “SHALL”WE DANCE?INTERPRETING THE BPCIA’S PATENT PROVISIONS, accessed November 26, 2025, https://btlj.org/data/articles2016/vol31/31_ar/0659_0686_Tanaka_WEB.pdf

- AbbVie’s Enforcement of its ‘Patent Thicket’ For Humira Under the BPCIA Does Not Provide Cognizable Basis for an Antitrust Violation | Mintz, accessed November 26, 2025, https://www.mintz.com/insights-center/viewpoints/2231/2020-06-18-abbvies-enforcement-its-patent-thicket-humira-under

- Why Pharmaceutical Patent Thickets Are Unique – Rutgers University, accessed November 26, 2025, https://scholarship.libraries.rutgers.edu/view/pdfCoverPage?instCode=01RUT_INST&filePid=13778612650004646&download=true

- Two decades and $200 billion: AbbVie’s Humira monopoly nears its end | BioPharma Dive, accessed November 26, 2025, https://www.biopharmadive.com/news/humira-abbvie-biosimilar-competition-monopoly/620516/

- As Exclusivity Loss Looms, Merck Wins Subcutaneous Approval for Keytruda – BioSpace, accessed November 26, 2025, https://www.biospace.com/fda/as-exclusivity-loss-looms-merck-wins-subcutaneous-approval-for-keytruda

- FDA approves pembrolizumab and berahyaluronidase alfa-pmph for subcutaneous injection, accessed November 26, 2025, https://www.fda.gov/drugs/resources-information-approved-drugs/fda-approves-pembrolizumab-and-berahyaluronidase-alfa-pmph-subcutaneous-injection

- FDA Approves KEYTRUDA QLEX for Subcutaneous Use in Solid Tumor Treatments, accessed November 26, 2025, https://digimedupdates.com/fda-approves-keytruda-qlex-for-subcutaneous-use-in-solid-tumor-treatments/

- Landmark Paragraph IV Patent Challenge Decisions: A Strategic Playbook for Generic Manufacturers – DrugPatentWatch – Transform Data into Market Domination, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/landmark-paragraph-iv-patent-challenge-decisions-a-strategic-playbook-for-generic-manufacturers/

- Call Off Chicken Little: The Sky is Not Falling for Skinny Labeling After GSK v. Teva, accessed November 26, 2025, https://ipwatchdog.com/2024/07/25/call-off-chicken-little-sky-not-falling-skinny-labeling-gsk-v-teva/

- Patent cliff: What strategies can help biopharma stay competitive? – Alcimed, accessed November 26, 2025, https://www.alcimed.com/en/insights/patent-cliff/

- Drug Patents Expiring in 2026: A Comprehensive Guide – IntuitionLabs, accessed November 26, 2025, https://intuitionlabs.ai/articles/drug-patent-expirations-2026

- Novartis faces “generic” threat with Entresto patent cliff – Parola Analytics, accessed November 26, 2025, https://parolaanalytics.com/blog/novartis-entresto-patent-cliff/

- Spotlight On: Pfizer’s Lipitor strategy – FirstWord Pharma, accessed November 26, 2025, https://firstwordpharma.com/story/1376635

- Pfizer’s 180-Day War for Lipitor – PM360, accessed November 26, 2025, https://www.pm360online.com/pfizers-180-day-war-for-lipitor/

- AbbVie Reports Full-Year and Fourth-Quarter 2023 Financial Results, accessed November 26, 2025, https://investors.abbvie.com/news-releases/news-release-details/abbvie-reports-full-year-and-fourth-quarter-2023-financial

- Has AbbVie Successfully Navigated Top-line Growth Post Humira LOE? – Nasdaq, accessed November 26, 2025, https://www.nasdaq.com/articles/has-abbvie-successfully-navigated-top-line-growth-post-humira-loe

- Berenberg upgrades Abbvie stock rating to Buy on successful post-Humira transition, accessed November 26, 2025, https://www.investing.com/news/analyst-ratings/berenberg-upgrades-abbvie-stock-rating-to-buy-on-successful-posthumira-transition-93CH-4241532

- Bristol Myers Squibb Reports Second Quarter Financial Results for 2022, accessed November 26, 2025, https://news.bms.com/news/details/2022/Bristol-Myers-Squibb-Reports-Second-Quarter-Financial-Results-for-2022/default.aspx

- BMS reports 2% revenue loss in 2023 after Revlimid generics hurt sales, accessed November 26, 2025, https://www.pharmaceutical-technology.com/news/bms-reports-2-revenue-loss-in-2023-after-revlimid-generics-hurt-sales/

- Early impact of the Inflation Reduction Act on small molecule vs biologic post-approval oncology trials – PMC – NIH, accessed November 26, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12392883/

- The Inflation Reduction Act & the Small Molecule Penalty, accessed November 26, 2025, https://cahc.net/the-inflation-reduction-act-the-small-molecule-penalty/

- The Impact of the Inflation Reduction Act on the Economic Lifecycle of a Pharmaceutical Brand – IQVIA, accessed November 26, 2025, https://www.iqvia.com/locations/united-states/blogs/2024/09/impact-of-the-inflation-reduction-act

- A Brave New World: Implications of the IRA on Brand Strategy – Pharmaceutical Executive, accessed November 26, 2025, https://www.pharmexec.com/view/a-brave-new-world-implications-of-the-ira-on-brand-strategy

- Supplementary protection certificates for pharmaceutical and plant protection products – Internal Market, Industry, Entrepreneurship and SMEs, accessed November 26, 2025, https://single-market-economy.ec.europa.eu/industry/strategy/intellectual-property/patent-protection-eu/supplementary-protection-certificates-pharmaceutical-and-plant-protection-products_en

- Supplementary protection certificate – Wikipedia, accessed November 26, 2025, https://en.wikipedia.org/wiki/Supplementary_protection_certificate

- Supplementary Protection Certificates (SPCs): Extending Patent Protection in Europe (2025 Update) – Azami Global, accessed November 26, 2025, https://azamiglobal.com/blog/european-supplementary-protection-certificates-spcs-for-pharmaceuticals-a-practical-guide/

- China PASS and Japan PMS – PharmaSUG, accessed November 26, 2025, https://pharmasug.org/proceedings/china2019/DS/Pharmasug-China-2019-DS58.pdf

- What’s Japan’s “Re-examination Period”? – A Friendly Guide for U.S. Pharma Folks – note, accessed November 26, 2025, https://note.com/yoheikijima/n/ncda42918451f

- Understanding the Regulatory Environment in Japan for Generic Drug Development, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/understanding-the-regulatory-environment-in-japan-for-generic-drug-development/

- Further Updates on Patent Linkage and Patent Term Extension in China – Wolters Kluwer, accessed November 26, 2025, https://legalblogs.wolterskluwer.com/patent-blog/further-updates-on-patent-linkage-and-patent-term-extension-in-china/

- Navigating China’s new protections for life science patents – Law.asia, accessed November 26, 2025, https://law.asia/life-sciences-laws-china/

- Strengthening Pharma IP: China’s Boost to Data and Market Exclusivity – Bird & Bird, accessed November 26, 2025, https://www.twobirds.com/en/insights/2025/china/strengthening-pharma-ip-chinas-boost-to-data-and-market-exclusivity

- NMPA’s Releases Draft Measures for Data Protection (Data Exclusivity), accessed November 26, 2025, https://chinapatentstrategy.com/nmpas-releases-draft-measures-for-data-protection-data-exclusivity/

- Indian Patent Law Section 3d: Preventing Evergreening & True Innovation, accessed November 26, 2025, https://thelegalschool.in/blog/indian-patent-law-section-3d

- Novartis Ag v. Union of India: “Evergreening,” Trips, and “Enhanced Efficacy” Under Section 3(d), accessed November 26, 2025, https://jipl.scholasticahq.com/article/70768-novartis-ag-v-union-of-india-evergreening-trips-and-enhanced-efficacy-under-section-3-d/attachment/147752.pdf

- Understanding Evergreening of Patents in the Pharmaceutical Industry – Candour Legal – Best Lawyers in Ahmedabad, accessed November 26, 2025, https://candourlegal.com/understanding-evergreening-of-patents-in-the-pharmaceutical-industry/

- Strong IP laws prevent so-called “evergreening” of patents to enhance access to TB drugs in India – WIPO, accessed November 26, 2025, https://www.wipo.int/en/web/global-health/w/news/2023/news_0023

- The Role of Litigation Data in Predicting Generic Drug Launches – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-role-of-litigation-data-in-predicting-generic-drug-launches/

- Klobuchar urges drugmakers to remove patents FTC calls improper and inaccurate, accessed November 26, 2025, https://www.klobuchar.senate.gov/public/index.cfm/2024/1/klobuchar-urges-drugmakers-to-remove-patents-ftc-calls-improper-and-inaccurate

- Recent Developments in Orange Book Litigation: How Patent Disputes Shape Prescription Drug Affordability – O’Neill Institute for National and Global Health Law, accessed November 26, 2025, https://oneill.law.georgetown.edu/recent-developments-in-orange-book-litigation-how-patent-disputes-shape-prescription-drug-affordability/

- How to Conduct a Drug Patent FTO Search: A Strategic and Tactical Guide to Pharmaceutical Freedom to Operate (FTO) Analysis – DrugPatentWatch – Transform Data into Market Domination, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/how-to-conduct-a-drug-patent-fto-search/

- A Business Professional’s Guide to Drug Patent Searching – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-basics-of-drug-patent-searching/

- DrugPatentWatch Reviews 2025: Details, Pricing, & Features | G2, accessed November 26, 2025, https://www.g2.com/products/drugpatentwatch/reviews