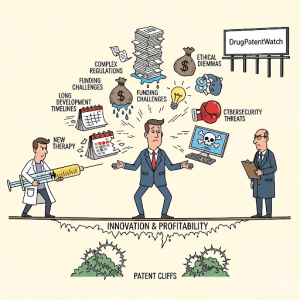

The path to market has never been more complex. The following analysis dissects the six core challenges defining the industry.5 For each, it moves beyond the problem-statement to identify the strategic, data-driven response, demonstrating how patent intelligence reframes each threat as a distinct competitive opportunity.

Issue 1: The Regulatory Maze — From Compliance Hurdle to IP Moat

Regulatory compliance remains one of the most formidable challenges, a complex web of evolving rules designed to ensure safety and efficacy.5 Many teams view this landscape as a costly, time-consuming barrier to entry. This is a junior-level perspective. Senior strategists understand that the regulatory framework is not just a hurdle to be cleared; it is a structuring element that, when navigated with precision, creates new, valuable, and highly defensible intellectual property assets. The rules of the maze, understood correctly, provide the blueprints for a moat.

The Great Divergence: Why FDA and EMA Misalignment Is a Strategic Minefield

For any company with global ambitions, the idea of a single, harmonized, international clinical trial is largely a fantasy. Navigating the disparate regulatory environments of major markets like the United States, European Union, China, and Japan presents a significant operational and financial challenge.5 This lack of standardization leads to redundancies, increased costs, and delayed market access, particularly for small- and mid-sized biotechs.5

This divergence is especially acute and costly in the cutting-edge fields of cell and gene therapies (CGTs). The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have markedly different expectations for trial design, approval pathways, and post-market requirements.6 A “one-size-fits-all” regulatory approach for a CGT is simply ineffective.6

A common case study illustrates the strategic bifurcation. A biotech company seeking approval for a novel oncology drug might leverage the FDA’s accelerated approval pathway, using surrogate endpoints to gain early market access.7 The EMA, however, may reject this approach and demand additional, lengthy confirmatory trial data before granting even a conditional marketing authorization.7

This is not merely a compliance issue; it is a fundamental split in the development path that can add years and tens of millions of dollars to a global launch. However, this is precisely where a sophisticated IP strategy finds its opening. The regulatory “problem” becomes a patent-generation opportunity.

If the EMA’s rigorous data requirements force an R&D team to discover, for example, a new, more specific dosing regimen that reduces toxicity, or a novel formulation that improves stability for European shipping routes, that new dosing regimen or new formulation is a distinct, non-obvious, and patentable invention. A savvy IP team does not just see a regulatory hurdle; it sees a new patent filing. This new patent can create a jurisdiction-locked layer of protection that is entirely independent of the original composition of matter (CoM) patent. The regulatory divergence itself is thus transformed into a “white space” for targeted IP creation.

Turning Regulation into ROI: The Strategic Interplay of Patents and Exclusivity

To truly master the regulatory game, one must first debunk the most common and damaging misconception in the industry: the “20-year monopoly” myth.8 Public discourse assumes that a new drug receives a 20-year, competition-free sales period starting from its launch date. This is fundamentally incorrect and leads to flawed strategic planning.

The reality is far more complex. A U.S. patent’s 20-year statutory term begins the day the patent application is filed, not the day the drug is approved.8 Given that the average drug development, clinical trial, and regulatory review process takes 10 to 15 years, a massive portion of the patent’s term is exhausted before a single dollar of revenue is generated.8 The actual “effective patent life” post-launch is often just 7 to 12 years.8

The real market protection for a drug is not a single patent. It is a “Composite Shield” woven from two entirely different legal threads:

- Patents: Granted by the U.S. Patent and Trademark Office (USPTO) under the Patent Act. These grant the negative right to exclude others from making, using, or selling the invention.8

- Regulatory Exclusivities: Granted by the FDA under the Food, Drug, and Cosmetic (FD&C) Act and other statutes. These are affirmative rights that block the FDA from approving a competitor’s application (like a generic) for a set period.8

These two protections run concurrently and are tracked separately. A patent can expire, but a regulatory exclusivity might still be in force, and vice-versa. Understanding this “dual-clock” system is the key to all modern lifecycle management.

| The Composite Shield: Patent Term vs. Regulatory Exclusivity | |||

| Protection Type | Governing Authority | Typical Duration | What It Protects |

| Patent Term | USPTO (Patent Act) | 20 years from filing date | The specific, claimed invention (e.g., the molecule, the method of use, the formulation).8 |

| New Chemical Entity (NCE) Exclusivity | FDA (FD&C Act) | 5 years from approval date | Protects the innovator’s clinical data; blocks the FDA from accepting a generic (ANDA) application for 4 years and approving it for 5 years.8 |

| New Clinical Investigation Exclusivity | FDA (FD&C Act) | 3 years from approval date | Protects new clinical studies essential for a change (e.g., new indication, new dosage form, OTC switch). Blocks FDA approval of a generic for that specific change.8 |

| Orphan Drug Exclusivity (ODE) | FDA (Orphan Drug Act) | 7 years from approval date | Blocks the FDA from approving the same drug for the same rare disease.8 |

| Pediatric Exclusivity | FDA (BPCA/PREA) | 6-month add-on | A powerful incentive. Adds 6 months of exclusivity onto all other existing patents and exclusivities for that drug.8 |

| Biologic Data Exclusivity (BPCIA) | FDA (BPCIA) | 12 years from approval date | A distinct and powerful protection for biologics. Blocks the FDA from approving a biosimilar application for 12 years.8 |

The strategic application is clear. A company whose core CoM patent is expiring can run a new clinical trial for a new indication, and upon approval, gain a new 3-year exclusivity for that use.9 It can conduct a pediatric study and add 6 months of life to all its protections.9

This profound complexity is precisely why sophisticated, specialized intelligence platforms are critical. A generic financial analyst might only see a single patent expiration date. A true strategist, using an integrated platform like DrugPatentWatch, can see the entire composite shield. Such platforms are indispensable because they do not just track patents; they integrate patent databases with global regulatory exclusivity data.10 A strategist must see both the patent expiry date and the regulatory exclusivity expiry date to identify the true date of generic or biosimilar entry.

Issue 2: The Capital Crunch — Securing Funding When “Hype” Is a Four-Letter Word

The financial landscape for biotech in 2025 is a mix of high-stakes opportunity and intense pressure.5 With elevated interest rates and cautious investors, the “pre-seed gap” for very early-stage companies has become a chasm.2 Overall venture funding has also fallen significantly.2

In this environment, “hype” and a compelling scientific story are no longer assets; they are often liabilities. Skeptical investors, particularly those in later-stage private financing rounds 5, are demanding hard, de-risked assets. For a pre-revenue biotech, there is only one way to demonstrate value and mitigate risk: a rock-solid, defensible, and well-prosecuted intellectual property portfolio.

Debunking the $2 Billion Pill: What R&D Really Costs and Why It Matters to Investors

For decades, the industry and its lobbyists have cited the “high cost of innovation,” with the average cost to bring a new drug to market now frequently estimated to exceed $2 billion.2 A 2024 Deloitte report notes that high R&D costs, averaging $2.23 billion per asset, remain a significant challenge.14 While these figures reflect the immense expense and high failure rates 1, they are not the most effective data points to use when speaking to a skeptical venture capitalist.

A far more nuanced—and credible—picture emerges from a 2025 RAND study.15 This analysis of 38 recently approved drugs found that while the mean (average) adjusted R&D cost was $1.3 billion, this figure was heavily “skewed by a few ultra-costly outliers”.15 The median (midpoint) adjusted cost was a much more grounded $708 million.15

This is more than a statistical curiosity; it is a critical element of pitch strategy. A founder who enters a funding meeting repeating the $2 billion figure risks sounding like they are reciting talking points. A founder who cites the $708 million median from the 2025 RAND study accomplishes three things simultaneously:

- They demonstrate data literacy and intellectual honesty by using the more statistically appropriate figure.

- They reframe the conversation from “this is an impossibly expensive gamble” to “this is a high-stakes, quantifiable, and manageable investment.”

- They build immediate credibility, which allows them to pivot to the most important part of the pitch: the IP strategy that de-risks that $708 million investment.

The Patent-Powered Pitch: A Founder’s Guide to Investor Due Diligence

When investors conduct due diligence on a biotech startup, they are not just validating the science; they are “pressure-testing” the patent portfolio.16 They will bring their own expert patent attorneys to find any vulnerability a future competitor could exploit.16 A missing document or an incomplete filing is one of the biggest “red flags” that can derail a funding round.17

In pharma and biotech, intellectual property is not just a support system for the business; it is the business.18 A single patent on a molecule or a process can be worth hundreds of millions of dollars, and without strong, enforceable IP, there is no product to sell and no reason to make the deal.18

Therefore, a “patent-powered pitch” must proactively answer the investor’s core due diligence checklist before it is even asked:

- Patent Portfolio Strength: Are the patents, trademarks, and pending applications well-organized and comprehensive?17 Is the “chain of title” clean? That is, have all inventors, academics, and partners properly assigned their rights to the company?16 A broken chain of title is a deal-breaker.

- Freedom-to-Operate (FTO): Has the company conducted a thorough FTO analysis to prove it can commercialize its product without infringing on a competitor’s “blocking” patent?17 A missing FTO report signals naivety and massive future legal risk.16

- Prior Art Analysis: Has the company’s legal team done a deep search for prior art (all public knowledge that existed before the filing)?16 The investor’s team will be looking for a “knockout” piece of prior art that the original patent examiner missed, which could be used to argue the invention was not “novel” and thus invalidate the entire patent.16

A founder who leads their pitch with a robust, third-party-validated patent landscape analysis and a clean FTO report is signaling that they are not just a scientist; they are a C-suite-ready executive. They are not selling a “cool discovery.” They are selling a protected, government-granted monopoly on that discovery, which is the only thing an investor can actually value.

Issue 3: The $400 Billion Precipice — Surviving and Thriving in the Biologic Patent Cliff

The most significant financial event on the 2025-2030 horizon is the massive, looming patent cliff.5 This is not a distant threat; it is an immediate and existential challenge for established pharmaceutical giants.

Between now and 2033, pharma companies are projected to lose over $400 billion in revenue as patents expire on top-selling drugs like Keytruda, Eliquis, and Opdivo. The upcoming cliff is even more complex, as a wave of biologics nears expiration, with market share losses of 30%–70% expected in the first year due to the growing presence of biosimilars in the U.S. and Europe. 19

This “super-cliff” of blockbuster drugs going off-patent 20 is set to fundamentally reshape the competitive landscape. For small molecule drugs, generic entry can erase 80-90% of revenue in months.21 For biologics, the 30-70% first-year loss from biosimilars is a catastrophic blow.19 This precipice is a predictable, data-driven event that is the single largest driver of C-suite strategy today.

The “Cliff” as a Catalyst: Why M&A Is the Mandated Response

How does a large pharmaceutical company fill a $400 billion revenue hole?19 Internal R&D, while essential, is too slow and too fraught with risk to bridge that gap alone.20 The only viable, time-sensitive solution is to buy that revenue.

This patent cliff is a direct, predictable catalyst for a massive, multi-year surge in merger and acquisition (M&A) activity.20 The data is unequivocal: 77% of surveyed executives expect an increase in M&A in 2025 to manage this threat.2 Analysts at Goldman Sachs have predicted that 2026 could be a “record-breaking year for M&A” as a direct consequence of this cliff.20

This causal link—the patent cliff forcing an M&A boom—is the single most important strategic insight for every biotech founder, BD team, and investor. Big Pharma’s existential problem is the small biotech’s exit strategy.

The “super-cliff” is the starting gun for an acquisition “gold rush” that will likely last from 2025 through 2030.20 This creates a powerful seller’s market for biotechs that possess exactly what Big Pharma needs: de-risked, patent-protected, late-stage assets that can be acquired and plugged into their global commercial machine to replace lost blockbuster revenue.20 The strategic goal for a small biotech is no longer just to “get funded”; it is to build an IP portfolio that looks like the perfect, plug-and-play revenue replacement for a C-suite executive at Merck, BMS, or Pfizer.

The C-Suite Playbook: Lifecycle Management (LCM) as Offense, Not Defense

For the established companies facing the cliff, the primary strategy is proactive Lifecycle Management (LCM).9 This is not a reactive, last-ditch legal defense. It is a “forward-thinking strategy of continuous innovation” designed to maximize a drug’s value throughout its entire commercial life.9 As one consultant notes, it is a “delicate balance of commercial strategy and medical responsibility”.9

The goal of LCM is to continuously improve a product, building “the next, better version” from day one.9 This involves a sophisticated, cross-functional collaboration between R&D, regulatory, and IP teams to build new layers of protection.

Key LCM strategies include:

- New Clinical Investigations: This is the primary incentive.9 By running new trials to prove a drug’s efficacy for a new indication (a new use), a new dosage form, or a switch to over-the-counter (OTC) status, a company can be granted a new 3-year period of regulatory exclusivity for that specific change.9

- Pediatric Exclusivity: As mentioned, conducting pediatric studies on the FDA’s request grants a six-month “add-on” to all existing patents and exclusivities on the drug.9 This is often the most cost-effective “extension” available.

- New Formulations & Drug Repositioning: This involves legitimate, patient-focused innovation.22 Switching a product from a complex intravenous (IV) infusion to a simple subcutaneous (sub-Q) injection, for example, dramatically improves patient compliance and quality of life. This new formulation is a patentable invention and can be used to “switch” patients to a next-generation product before the original’s patent expires.24

- Authorized Generics: In some cases, the brand-name company will launch its own generic version of the drug, often through a subsidiary.22 This allows them to enter the generic market first, leverage their manufacturing scale, and retain a significant portion of the market share, albeit at a lower price.25

- Logistical Optimization: Post-patent, the game shifts from monopoly to high-volume, low-margin competition. This requires a complete overhaul of logistics to focus on cost efficiency, inventory balancing, and leveraging extensive stability data to simplify shipping processes.26

Debunking the Skeptic’s View: “Patent Thickets” vs. “Strategic Fortresses”

This discussion must directly address the audience’s most common cynical objection. They frequently hear pejorative terms like “evergreening” 27 and “patent thickets” 28 used by critics to describe LCM strategies. As professionals in the field, they require a data-driven rebuttal to this political narrative.

The claim is that companies “game the system” by filing “junk patents” to create a “thicket” that improperly extends their monopoly.28 The facts, however, do not support this claim.

- Myth vs. Data on Exclusivity: The core myth is that more patents equals longer monopoly. This is false. A 2024 USPTO study focusing on Orange Book-listed patents found “no correlation” between the total number of patents on a drug and its actual length of market exclusivity.28

- “Junk Patents” vs. “Legitimate Innovation”: These follow-on patents are not “junk.” To be granted, each one must be independently examined by the USPTO and found to be novel, useful, and non-obvious.28 They represent legitimate, incremental innovations 28 that protect specific improvements—a new crystalline polymorph with better stability 31, a new formulation that is easier for a patient to take 31, or a new method of use for a different disease.29

- How Patents Actually Work: “Evergreening” is a legal misnomer. A company cannot extend its original patent.28 That original patent on the original molecule expires on its scheduled date. At that point, a generic manufacturer is free to produce that original version of the drug.28 The new patents only protect the new improvements.

- Industry Context: This practice is not unique to pharma. Tech companies file far more patents to protect incremental improvements on complex products. According to a 2023 report, only 2% of the top U.S. patentees are in the biopharma sector, compared to nearly a third from the tech sector.28

The term “patent thicket” is a misleading political pejorative. The correct strategic term is a “Patent Fortress”.31 A single CoM patent is a weak, easily besieged fence. A “Patent Fortress” is a rational, multi-layered, and legally sound strategy to protect a high-risk, $700M+ investment.15 It includes patents on the molecule, the manufacturing process, the polymorphs, the formulations, and the methods of use. This is not “gaming”; it is comprehensive, 360-degree product protection, and it is the hallmark of a mature IP strategy.

Issue 4: The New Frontier — Ethical & IP Chaos in AI and CRISPR

The fourth major challenge for biotech is the vertigo-inducing pace at which science is outpacing the law.5 The ethical dilemmas surrounding technologies like CRISPR gene editing and artificial intelligence are not just philosophical debates for academic symposia; they have created a legal vacuum that results in profound, multi-billion-dollar uncertainty for patent eligibility, inventorship, and commercial rights.

Case Study: The CRISPR Patent War—A Decade-Long Battle for Eukaryotic Supremacy

The “CRISPR controversies” 5 are a perfect illustration of this chaos. The battle for the foundational CRISPR-Cas9 patents has been a decade-long, globe-spanning legal war, primarily between two titans: the CVC group (University of California-Berkeley, University of Vienna, Emmanuelle Charpentier) and the Broad Institute (MIT, Harvard, and Feng Zhang).32

The core of the dispute is a perfect case study in the difference between discovery and invention.

- The Discovery: The CVC group, led by Nobel laureates Doudna and Charpentier 34, made the breathtaking foundational discovery: the CRISPR-Cas9 system could be engineered to function as a “genetic scissor” to cut purified DNA in a test tube.32

- The Invention (Enablement): Dr. Feng Zhang at the Broad Institute was the first to file a patent (the now-famous US 8,697,359) that enabled the CRISPR-Cas9 system to be delivered and used successfully inside eukaryotic cells—the complex cells that make up animals, plants, and, most critically, humans.32

In a series of complex interference proceedings, the U.S. Patent Trial and Appeal Board (PTAB) and the U.S. Court of Appeals for the Federal Circuit repeatedly ruled in Broad’s favor. The key finding was that Broad’s invention was patentably distinct.32 The courts determined that one of ordinary skill in the art would not have had a reasonable expectation of success in making the system work in a complex eukaryotic environment based on CVC’s test-tube data.32

The lesson from this multi-billion-dollar legal war 34 is profound for every R&D team: discovery is not invention. The Nobel Prize went to the team that made the discovery. The key commercial patents—the ones that unlock the technology’s therapeutic and financial potential—went to the team that first enabled that discovery in a commercially viable setting. For R&D leaders, this means the most valuable patentable “invention” is often not the discovery of a new biological target, but the novel application of a tool to that target in a way that is not obvious.

AI’s Inventorship Crisis: Can You Patent a Drug Discovered by a Machine?

An even more urgent legal and ethical crisis is unfolding at the intersection of AI and drug discovery. By 2025, it is estimated that artificial intelligence will drive 30% of new drug discoveries, accelerating timelines and cutting costs.35 Companies like Evotec, Exscientia, and Merck are already using AI platforms to identify novel drug candidates that are now in human clinical trials.36

This progress has created a legal paradox that threatens the very business model of AI-driven drug discovery.

- The Problem: An AI system can analyze petabytes of data to “conceive” of a novel, effective, and non-obvious small molecule.37

- The Law: The U.S. Federal Circuit, in the landmark 2022 case Thaler v. Vidal, unequivocally affirmed that under the U.S. Patent Act, an “inventor” must be a “natural person”—a human being.39 The USPTO has clarified that an AI system cannot be named as an inventor or co-inventor.38

- The Black Hole: This creates a scenario, no longer hypothetical, where a drug is entirely conceived by an AI. This drug could be novel, useful, and world-changing, but it would also be unpatentable.40 A drug developed without sufficient human contribution may be ineligible for patent protection, effectively placing it in the public domain upon disclosure.39

This is an existential threat to any company building its value on an AI-discovery platform. Competitors could challenge a patent’s validity by arguing that the human named on the patent did not actually contribute to the “conception” of the invention.38

The Human-in-the-Loop: A Legal Playbook for Protecting AI-Assisted Inventions

This crisis has a solution, but it requires an immediate and profound change in R&D standard operating procedures (SOPs). The USPTO’s February 2024 Inventorship Guidance 38 provides the roadmap: a human can be an inventor on an AI-assisted discovery if they made a “significant contribution” to the invention’s conception.37

Merely recognizing a problem for the AI to solve, or simply owning the AI platform, is not an inventive contribution.39 The R&D process itself must be re-engineered to ensure human inventorship is legally defensible.

This Legal & R&D Playbook for AI-Inventorship is now a business necessity:

- Meticulously Document All Human Input: This is the new, non-negotiable R&D-legal requirement. Teams must maintain comprehensive, contemporanous logs that answer:

- Who designed and refined the training data for the AI model?

- Who crafted the specific, complex, and targeted prompts that guided the AI to a solution? A generic prompt (“find a kinase inhibitor”) is not inventive. A complex prompt incorporating multiple, non-obvious design factors might be.38

- Who analyzed the AI’s outputs, and based on their own scientific judgment, selected the lead candidate from a list of thousands? This act of selection and modification is a key human contribution.38

- Materially Modify the AI Output: This is the simplest and most legally defensible path. An R&D team should take the AI-generated molecule and have a human scientist materially modify it in a wet lab to improve performance—for example, to enhance bioavailability, reduce toxicity, or improve binding affinity in vivo.39 That human-driven modification is a clear, undeniable, and significant inventive contribution.39

- Train Specialized AI Models: The act of designing and training a specialized AI model to solve a specific, non-obvious problem can itself be the “significant contribution” to conception.39 A general-purpose AI may not create patentable outputs. But an AI platform that a human scientist specifically designed and trained to identify compounds with a particular set of properties (e.g., binding affinity to target X and in vivo performance metric Y) has a strong indication of human contribution built in.39

The “human-in-the-loop” is no longer just a supervisor. In the age of AI, the human-in-the-loop is a legal necessity to secure the patent and, with it, the entire value of the company.

Issue 5: The Fragile Blueprints — Securing IP in a World of Digital and Physical Threats

The fifth set of challenges concerns the physical and digital security of the intellectual property that forms the bedrock of every biotech’s value. An IP portfolio is not just a legal abstraction; it is a digital asset—the “blueprints” for a blockbuster drug—stored on servers, and its physical manifestation (the drug product) is sourced from an increasingly fragile and high-risk global network.12

Beyond HIPAA: Why Your Biotech IP Is a Prime Target

When biotech companies think “cybersecurity,” they often think of HIPAA compliance and protecting patient data (PHI/PII).44 This is dangerously myopic. The 2025 Biotech Cybersecurity Report from Sekurno highlights the real threat: biotech organizations are prime targets not just for patient data, but for their “invaluable intellectual property” and “proprietary research”.45 These digital assets are lucrative targets for nation-state actors and commercial competitors.45

The alarming findings from the Sekurno report, which reviewed 50 biotech platforms, reveal that this is not a problem of sophisticated, nation-state “hacks.” It is a problem of basic security hygiene. The report found 46:

- 36% had Leaked Credentials

- 34% had Insecure APIs

- 20% had Misconfigured Environments

- Over 50% had System Info Leaks

These are not “hacks”; they are open doors. The consequences are not just fines. They are “delayed deals or M&A problems” and “audit failures”.46 The average cost of a data breach in the U.S. ($10.22 million) 48 is a rounding error compared to the billions in value lost if a competitor steals the preclinical data package for a “crown jewel” asset, replicates it, and files for a patent first. This is an existential, C-suite-level risk.

The Hidden Risk in Your API: Geopolitical Supply Chains and IP Exposure

The second security threat is physical, not digital. It lies in the other “API”: the Active Pharmaceutical Ingredient. The U.S. drug supply chain is “broken” and “fragile”.43 There is a massive geographic concentration of API manufacturing in high-risk regions, particularly China and India.42

This is no longer a theoretical risk. Rising tariffs, drug pricing proposals, and geopolitical headwinds are rewriting the rules of global trade.12 A recent PwC report found that 89% of pharma leaders will change their supply chain strategies as a result of U.S. trade policies.42

For C-suite and operations leaders, PwC recommends a 3-step playbook for building a resilient supply chain 42:

- Assess Risk Across the Full Network: Conduct an end-to-end audit to map all dependencies. This must specifically flag single-source suppliers for critical APIs, especially those in high-risk regions like China and India.42

- Use Scenario Modeling: Employ digital tools like AI-driven simulations and “digital twins” to model the full financial and operational impact of tariff hikes, regulatory disruptions, or geopolitical shocks.42

- Identify and Close Gaps: Proactively dual-source critical materials. Begin the long-term, capital-intensive process of diversifying suppliers and, where possible, on-shoring or near-shoring production of critical components.12

This is not just a logistics problem. It is an IP security problem. When a company’s single-source API manufacturer is in a jurisdiction with weak IP laws or a hostile geopolitical relationship, that company is not just risking a supply disruption; it is risking the theft of its proprietary manufacturing process. That process is often a core trade secret or the subject of a key process patent. Supply chain diversification, therefore, is IP risk diversification.

Issue 6: The Hyper-Competitive Battlefield — Where All Threats Converge

The sixth and final issue, “Intense Market Competition” 5, is not a separate challenge. It is the sum total of the first five. In the 2025 landscape, the competitive battlefield is a convergence of every threat discussed.

A company’s competition is no longer just the firm with a similar molecule in Phase II.

- The competition is the company that masters the regulatory maze and uses EMA requirements to generate a new, blocking formulation patent (Issue 1).

- The competition is the startup that perfects its investor pitch with a de-risked $708M R&D-cost analysis and a bulletproof FTO, securing the funding that others could not (Issue 2).

- The competition is the Big Pharma giant, desperate to fill its $400B patent cliff-driven revenue gap, that acquires a key partner or competitor (Issue 3).

- The competition is the AI-first startup that rewrites its R&D protocols to legally secure human inventorship on its machine-discovered drugs (Issue 4).

- The competition is the nation-state or rival firm that steals proprietary IP through an insecure API, saving itself five years of R&D (Issue 5).

In this environment, the company with the best science does not win. The company with the best intelligence wins.49 Victory requires a “continuous situational awareness” 49 that integrates scientific, regulatory, commercial, and financial data. This provides the perfect pivot to the second half of this report: The actionable playbook for building that intelligence capability.

The Patent Intelligence Playbook: An Executive’s Guide to Turning Data into Decisive Advantage

The first half of this report reframed the industry’s six core challenges as strategic arenas where patent intelligence is the primary weapon. This second half provides the actionable, cross-functional playbook for R&D, Business Development, and C-suite teams on how to wield that weapon. This is the guide to transforming patent data from a reactive legal hurdle into the most powerful strategic asset for driving R&D, de-risking M&A, and securing a clear, quantifiable return on investment (ROI).

The R&D Compass: Using Patent Landscaping to Find “White Space” and Avoid “Minefields”

The most common and costly mistake in pharmaceutical R&D is viewing patent analysis as a sequential, end-of-pipe activity—a legal “checkbox” to clear just before initiating a costly clinical trial.50 This is akin to building a billion-dollar ship and only then checking the nautical charts for reefs.

A mature R&D organization uses patent intelligence from Day 1. It is the “innovator’s compass”.50 The goal is to shift R&D from asking the scientist’s question, “Can we build this?” to the strategist’s far more important question: “Should we build this?”.50

This is achieved through Patent Landscape Analysis (PLA), a systematic method of analyzing patent databases to create an overview of a technology field.51 The value of a PLA is multi-dimensional 53:

- Identify “White Spaces”: A PLA reveals gaps in the market—technological avenues or therapeutic areas with significant unmet needs but limited or no existing patent activity.54 This is the “blue ocean” for R&D, offering a path with higher potential for market exclusivity and less competitive crowding.10

- Track Competitors in Real-Time: A PLA is a powerful competitive intelligence tool. By monitoring competitors’ patent filings, a company can see their R&D focus, track their technological priorities, and identify their key assets long before they appear in a press release.10

- Spot Emerging Trends: The analysis can identify the convergence of different scientific disciplines (e.g., nanotechnology merging with biologics for new delivery systems) and pinpoint geographic “hotspots” of innovation where R&D funding is concentrating.56

- Avoid Catastrophic Infringement: Critically, a PLA maps the “minefields”—crowded patent areas where litigation is rampant and the risk of infringement is high. It allows R&D leaders to steer their programs away from these areas before investing hundreds of millions of dollars.53

A patent landscape analysis, however, only shows the terrain. A Freedom-to-Operate (FTO) analysis is the definitive legal opinion that tells an organization if it can safely walk on that terrain without being sued for infringement.57

FTO: The Non-Negotiable First Step, Especially for Biologics

An FTO analysis is always complex, but for today’s biologics and cell and gene therapies (CGTs), the traditional FTO playbook is dangerously insufficient.58

An FTO for a simple small molecule is (relatively) straightforward: clear the molecule’s structure, its formulation, and its method of use. An FTO for a biologic like a CAR-T therapy is a multi-dimensional nightmare.58

Why? Because the “product” is not just the final CAR-T construct. The entire manufacturing and delivery platform is a thicket of third-party patents.58 A company may have a brilliantly novel CAR-T construct, but it has no freedom to operate if its manufacturing protocol requires 58:

- A patented viral vector (e.g., a proprietary AAV vector).

- A proprietary, patented cell culture medium.

- A specific, patented host cell line (e.g., engineered CHO cells).

- A patented cryopreservation technique.

This leads to an iron-clad strategic mandate: for biologics and CGTs, the FTO analysis must begin at the platform selection stage—before the R&D team has even designed the final product.58 Choosing a vector, cell line, or culture method that is in the public domain or has a clear licensing path is a foundational strategic decision that will save (or cost) the company hundreds of millions of dollars in future litigation or forced licensing fees.

The M&A Crystal Ball: How BD Teams De-Risk Multi-Billion Dollar Bets

For business development (BD) teams and investors, patent intelligence is the “crystal ball” that de-risks multi-billion dollar acquisitions.59 In a pharma M&A deal, the tangible assets—labs, equipment, factories—are often rounding errors in the valuation. The intellectual property is the business.18

A patent due diligence investigation is therefore not a legal checkbox; it is the primary tool for financial valuation.59 Its purpose is to look into the future and quantify the strength, duration, and vulnerability of the target’s core revenue-generating assets.59

A best-practice M&A Patent Due Diligence Playbook involves three phases:

- Preliminary Landscape (Pre-Data Room): Before a target’s confidential data room is even opened, the acquiring team should use public and commercial databases (like DrugPatentWatch) to get a foundational inventory.59 This initial search maps all patents assigned to the target, their legal status (pending, granted, expired), and their global family relationships.59

- Cross-Functional Deep Dive (In the Data Room): Effective due diligence is a team sport. It requires robust, cross-functional collaboration between patent attorneys, R&D scientists, and BD/finance analysts.10 The patent attorney assesses claim strength and legal nuance. The scientist assesses the technical validity and potential for “design-arounds.” The BD executive integrates this information to model the financial impact.10

- Translate Risk to Dollars (The Valuation): The entire purpose of the diligence effort is to inform and refine the financial valuation.59 The team must quantify the risks to build scenario-based models (best-case, base-case, worst-case). This analysis is what transforms a “hope and hype” valuation into a defensible, data-driven negotiation tool.59

The “Go/No-Go” Framework: Identifying the Deal-Breakers

Ultimately, patent due diligence is a “go/no-go” gate. Its most important function is to find the “deal-breakers”—the fatal flaws that should cause the acquirer to walk away from the negotiating table, regardless of price.59

Key deal-breakers include:

- A Blocking FTO: The diligence team discovers a third-party “blocking” patent that definitively prevents the acquirer from commercializing the target’s main product.59 If this patent is strong, held by an unwilling competitor, and cannot be licensed or designed around, the deal is dead. The team would be acquiring an asset it cannot legally sell.59

- A Fatal Validity Flaw: The team uncovers a “knockout” piece of prior art (e.g., a forgotten academic paper) that clearly anticipates the “crown jewel” patent of the target.59 This means the patent is an illusion, almost certain to be invalidated once challenged. The core asset is worthless, and the deal is an unacceptable risk.59

- A Broken Chain of Title: The diligence reveals that a key inventor, perhaps a university professor or a former employee, never properly assigned their rights to the target company.59 This means the target does not even own its primary asset.

A BD team armed with this intelligence can enter a negotiation not just with an opinion, but with proof. They can state, “Your base-case valuation is $2 billion. Our diligence has uncovered a 30% risk of invalidation on your core patent. Our risk-adjusted valuation is $1.4 billion, and here is the 50-page legal and technical report to prove it.” This is how patent data is translated into decisive commercial advantage.

The Data Integrity Problem: A Note to the Skeptic

At this point, the experienced R&D or IP professional raises the most practical and cynical objection: “This all sounds great, but patent data is a mess.”

This objection is not only valid; it is correct. Raw, public patent data is “notoriously messy”.60 It is a “data crisis” that holds back effective analysis.61 This “dirty data” is riddled with:

- Misspellings and Variations: A search for “Pfizer” might miss critical patents filed under “Pfizr,” “Pifzer,” or dozens of international subsidiaries.60

- Mistranslations: Key technical terms in foreign-language patents are often poorly translated, obscuring their true meaning.

- Outdated Ownership Records: This is the most dangerous flaw. Patents are assets that are bought and sold. A patent filed by “Startup X” (which was acquired by “Biotech Y,” which then merged into “Big Pharma Z”) will still be listed under “Startup X” in raw databases. An analyst tracking “Big Pharma Z” would miss this critical patent entirely.60

Using this “dirty data” for a multi-million dollar R&D or M&A decision is a catastrophic case of “garbage in, garbage out”.60 A single incorrect ownership record can “send millions of dollars… down the wrong path”.60 This is why many R&D teams find patent data “overwhelming” and simply do not use it, reverting to guesswork.61

The Solution: Curation and Integration as a Strategic Imperative

This data integrity crisis defines the entire business case for specialized, paid intelligence platforms. A company does not pay for data access—which is largely free. It pays for curation, integration, and analysis.

The value of a professional-grade pharmaceutical intelligence platform, such as DrugPatentWatch, is built on two foundational principles:

- Harmonization (Curation): These platforms invest thousands of hours and use sophisticated AI to clean the “dirty” data.60 They harmonize assignee names, correcting misspellings and, most importantly, tracking M&A activity to link patents to their current, accurate corporate parent. This curation alone can save an internal team “more than two working years annually” that was previously spent just on data cleaning.60

- Integration (Context): This is the most critical function. A patent by itself is a single, isolated data point. Its true strategic value is only revealed when placed in context. A professional platform integrates disparate, complex datasets into a single, unified interface.10 It seamlessly combines:

- Patent Data (from USPTO, WIPO, etc.)

- Regulatory Data (FDA Orange Book listings, NCE/ODE/Biologic exclusivities) 12

- Clinical Trial Data (from global registries like ClinicalTrials.gov) 49

This integration is what enables the “dual, integrated IP and regulatory strategy”.10 It is the only way for a strategist to get a single, accurate, and immediate answer to the most important competitive question: “When does my competitor’s true monopoly end?”

Calculating the ROI: Justifying the Investment in Patent Intelligence

This entire playbook—from R&D guidance to M&A diligence—is contingent on investing in the people and platforms required to execute it. For a C-suite executive or department head, that budget must be justified with a clear, quantifiable return on investment (ROI).31

Patent intelligence is not a legal cost center. It is a strategic R&D and BD investment.31 Its ROI is massive and can be calculated across three pillars:

- Defense (Loss Prevention): This is the simplest and most direct ROI. The competitive intelligence function is, at its core, a “loss minimization strategy”.62 An FTO analysis that stops an R&D program from investing $150 million into a project that is blocked by a competitor’s patent provides an immediate, 1000x ROI on the salary and software costs.62

- Offense (Revenue Generation):

- For R&D: A patent landscape analysis 54 that identifies a novel, high-value, and uncrowded “white space” is the foundation for a future billion-dollar product.

- For M&A: Patent due diligence that uncovers a “fatal flaw” 59 and justifies a $500 million reduction in an acquisition price provides a return that can fund the entire intelligence department for a decade.

- Efficiency (Cost & Time Reduction):

- Labor Savings: As noted, curated data platforms save internal teams “more than two working years annually” in manual data-cleaning labor.60

- Capital Savings: AI-driven patent tools can reduce R&D cycle times and lower the high “write-off” costs associated with patent drafting.64

- Maintenance Savings: Systematic portfolio analysis allows a company to identify and prune low-value, non-strategic patents, saving millions of dollars in annual maintenance and annuity fees.63

In the final analysis, competitive and patent intelligence is the “indispensable tool” 31 for navigating the 2025-2026 landscape. It is the discipline that ensures brilliant science has a viable commercial future, transforming the industry’s greatest challenges into a company’s most profound competitive advantages.

Key Takeaways

For the time-constrained executive, R&D leader, or investor, the strategic imperatives from this analysis are clear:

- The 6 Industry Issues Are IP Battlegrounds: The industry’s top challenges (Regulatory, Financial, Patent Cliffs, Ethics, Cybersecurity, Competition) are not just operational hurdles. They are strategic arenas where patent and competitive intelligence are the primary weapons for creating a decisive advantage.

- The Patent Cliff Is an M&A Catalyst: The looming $400 billion patent cliff 19 is a direct, predictable driver of a 2025-2030 M&A “gold rush.” A de-risked, “Patent Fortress” 31 is now the single most valuable asset a biotech can build to ensure a successful, high-value exit.

- AI-Inventorship Demands New R&D Protocols: A drug discovered by an AI without a “significant human contribution” is likely unpatentable under Thaler v. Vidal and 2024 USPTO guidance.38 R&D teams must immediately implement new SOPs to meticulously document human-in-the-loop contributions (e.g., model design, complex prompting, and output modification) to ensure patent validity.

- Regulation Creates Patentable Opportunities: FDA/EMA divergence 6 is not just a problem. The solution (e.g., a new, jurisdiction-specific dosing regimen or formulation required by one agency) is often a new, patentable invention that creates another valuable layer of IP protection.9

- FTO for Biologics Is a Platform Problem: A Freedom-to-Operate (FTO) analysis for a biologic (CAR-T, mAb) must clear the entire manufacturing and delivery platform (vector, cell line, culture medium, cryopreservation).58 This analysis must be conducted at the platform selection stage, before R&D begins, to avoid catastrophic future litigation or licensing costs.

- “Dirty Data” Is a Multi-Million Dollar Risk: “Free” patent data is “notoriously messy”.60 The core value of professional intelligence platforms like DrugPatentWatch is not data access but data curation (fixing errors) and data integration (Patents + Regulatory Exclusivities + Clinical Trials).10 This is the only way to prevent catastrophic, data-driven errors in R&D and M&A.

- Patent Intelligence Is an Investment, Not a Cost: The ROI of patent intelligence is clear and quantifiable. It is measured in the prevention of multi-million dollar R&D dead-ends 62, the justification for M&A valuation reductions 59, and the efficiency gains from saving thousands of expert-hours in manual data cleaning.60

Frequently Asked Questions (FAQ)

1. What is the single biggest mistake R&D teams make with intellectual property?

The most common and catastrophic error is viewing intellectual property as a final, sequential hurdle. Teams often treat patent analysis as a “checkbox” to clear just before initiating clinical trials.50 This is strategically backwards. Patent analysis—specifically Patent Landscaping (PLA) and Freedom-to-Operate (FTO)—must be the first step in the R&D process. It is the “compass” 50 that guides R&D from Day 1, ensuring that every dollar of a $700M+ development budget 15 is spent on a target that is commercially viable, defensible, and non-infringing.

2. My critics call my LCM strategy a “patent thicket.” How do I defend this strategy to stakeholders?

This is a political narrative that must be countered with data. “Patent thicket” is a pejorative; “Patent Fortress” 31 is a rational business strategy. The key, data-driven counter-arguments are:

- A recent USPTO study found “no correlation” between the number of Orange Book-listed patents on a drug and its actual length of market exclusivity.28

- These are not “junk patents.” They are legitimate, follow-on innovations (e.g., new, more stable polymorphs; new, patient-friendly formulations) that must independently pass the USPTO’s test for being novel and non-obvious.28

- These patents do not extend the original patent. The original patent on the original molecule expires on schedule, at which point generic manufacturers are free to copy that original version.28 The new patents only protect the new improvements.

3. How early do we really need to start a Freedom-to-Operate (FTO) analysis for a new biologic or CAR-T therapy?

Immediately. It must be done before the R&D team selects its core platform.58 A traditional FTO clears the final product, but for a biologic, this is useless. The “product” is a platform.58 A novel CAR-T construct is commercially dead if it must be manufactured using a competitor’s “blocking” patented AAV vector, a proprietary cell line, or a patented cryopreservation method.58 The FTO analysis must inform the platform selection stage to ensure the entire R&D program is built on a non-infringing foundation.

4. My team used an AI platform to discover our lead candidate. Is that drug really unpatentable?

It is in a position of extreme legal vulnerability. The Thaler v. Vidal case and 2024 USPTO Guidance are clear: an inventor must be a human, and that human must have made a “significant contribution” to the invention’s conception.38 If an R&D team cannot produce logs and documentation proving a human guided the AI (e.g., by designing a specialized model) or materially modified the AI’s output, a competitor can—and will—sue to invalidate the patent, and they have a strong chance of winning.38

5. Why should my team pay for a patent intelligence platform like DrugPatentWatch when public databases like Google Patents are free?

Because “free” data is “dirty” data, and “dirty data” leads to multi-million dollar mistakes.60 An investment in a professional platform is not for data access; it is for curation and integration.

- Curation: The platform cleans the “notoriously messy” data, correcting misspellings and, most critically, tracking M&A to fix outdated ownership records so a competitor’s patent is not missed.60

- Integration: This is the core value. A free tool only shows patents. A professional platform integrates patent data with regulatory exclusivity data (FDA Orange Book, NCE/ODE) and clinical trial data.10 This is the only way to get a single, accurate answer to the most important strategic question: “When does my competitor’s true monopoly end?”

Works cited

- The ROI of AI Patent Drafting: Building the Business Case – Solve Intelligence, accessed November 9, 2025, https://www.solveintelligence.com/blog/post/the-roi-of-ai-patent-drafting-building-the-business-case

- 2025 life sciences outlook | Deloitte Insights, accessed November 9, 2025, https://www.deloitte.com/us/en/insights/industry/health-care/life-sciences-and-health-care-industry-outlooks/2025-life-sciences-executive-outlook.html

- Biotech Challenges: 3 Barriers Affecting Industry Progress – Insight Global, accessed November 9, 2025, https://insightglobal.com/blog/biotech-challenges-affecting-progress/

- The Biotech Landscape in 2025 and Beyond: Is a Rebound in the Making or Not? – DCAT Value Chain Insights, accessed November 9, 2025, https://www.dcatvci.org/features/the-biotech-landscape-in-2025-and-beyond-is-a-rebound-in-the-making-or-not/

- Next in pharma 2025: The future is now – PwC, accessed November 9, 2025, https://www.pwc.com/us/en/industries/pharma-life-sciences/pharmaceutical-industry-trends.html

- Top 6 issues facing the biotechnology industry – DrugPatentWatch …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/top-6-issues-facing-biotechnology-industry/

- FDA vs. EMA: Navigating Divergent Regulatory Expectations for Cell …, accessed November 9, 2025, https://cromospharma.com/fda-vs-ema-navigating-divergent-regulatory-expectations-for-cell-and-gene-therapies-what-biopharma-companies-need-to-know/

- Global Regulatory Landscapes | Navigating FDA, EMA, PMDA Strategy Differences, accessed November 9, 2025, https://www.makrocare.com/blog/global-regulatory-landscape-regional-differences-in-strategy-development/

- The Grand Bargain Re-Examined: 8 Common Misconceptions About …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/the-grand-bargain-re-examined-8-common-misconceptions-about-drug-patents-debunked/

- A C-Suite Playbook for Navigating the Pharmaceutical Patent Cliff …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/a-c-suite-playbook-for-navigating-the-pharmaceutical-patent-cliff/

- Strategic Imperatives: Leveraging Patent Pending Data for Competitive Advantage in the Pharmaceutical Industry – DrugPatentWatch, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/leveraging-patent-pending-data-for-pharmaceuticals/

- Using Drug Patents to Block Competitors: The Tactics and Consequences, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/using-drug-patents-to-block-competitors-the-tactics-and-consequences/

- Future-Proofing Pharmaceutical Imports: Tactics for a Volatile 2025 | SupplyChainBrain, accessed November 9, 2025, https://www.supplychainbrain.com/blogs/1-think-tank/post/42177-future-proofing-pharmaceutical-imports-tactics-for-a-volatile-2025

- The Strategic Value of Orange Book Data in Pharmaceutical Competitive Intelligence, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/the-strategic-value-of-orange-book-data-in-pharmaceutical-competitive-intelligence/

- Measuring the return from pharmaceutical innovation 2025 | Deloitte Switzerland, accessed November 9, 2025, https://www.deloitte.com/ch/en/Industries/life-sciences-health-care/research/measuring-return-from-pharmaceutical-innovation.html

- Typical Cost of Developing a New Drug Is Skewed by Few High …, accessed November 9, 2025, https://www.rand.org/news/press/2025/01/07.html

- The Patent-Powered Pitch: A Founder’s Guide to Securing Biotech Funding, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/the-patent-powered-pitch-a-founders-guide-to-securing-biotech-funding/

- Checklist for Regulatory Due Diligence in Biotech – Phoenix Strategy Group, accessed November 9, 2025, https://www.phoenixstrategy.group/blog/regulatory-due-diligence-checklist-biotech

- IP in Pharma and Biotech M&A: What Makes It So Complex | PatentPC, accessed November 9, 2025, https://patentpc.com/blog/ip-in-pharma-and-biotech-ma-what-makes-it-so-complex

- Patent Cliff in Pharma: Navigating Disruption and Creating Opportunity, accessed November 9, 2025, https://globalpricing.com/patent-cliff-in-pharma-navigating-disruption-and-creating-opportunity/

- Will the Next Patent Cliff Further Spur M&A Activity and What Does …, accessed November 9, 2025, https://www.foley.com/insights/publications/2025/09/patent-cliff-ma-activity-for-companies-right-now/

- Patent Cliff 2025: Impact on Pharma Investors – Crispidea, accessed November 9, 2025, https://www.crispidea.com/pharma-investing-patent-cliff-2025/

- Patent cliff mitigation strategies: giving new life to blockbusters – PubMed, accessed November 9, 2025, https://pubmed.ncbi.nlm.nih.gov/26372691/

- Patent cliff and strategic switch: exploring strategic design possibilities in the pharmaceutical industry – PMC – NIH, accessed November 9, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4899342/

- Navigating pharma loss of exclusivity | EY – US, accessed November 9, 2025, https://www.ey.com/en_us/insights/life-sciences/navigating-pharma-loss-of-exclusivity

- How Patent Laws Impact Competition and Merger Regulations in Pharma – PatentPC, accessed November 9, 2025, https://patentpc.com/blog/how-patent-laws-impact-competition-and-merger-regulations-in-pharma

- Managing Patent Cliffs – Envirotainer, accessed November 9, 2025, https://www.envirotainer.com/resources/industry-insights/articles/20242/managing-patent-cliffs/

- Unlocking Pharma Fortunes: The 12 Must-Know Terms for Turning Pharmaceutical Patent Data into Competitive Advantage – DrugPatentWatch, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/unlocking-pharma-fortunes-the-12-must-know-terms-for-turning-pharmaceutical-patent-data-into-competitive-advantage/

- Fact Check: Debunking Myths About Patents in the Pharmaceutical …, accessed November 9, 2025, https://c4ip.org/fact-check-debunking-myths-about-patents-in-the-pharmaceutical-industry/

- IP Explained: Myth vs. fact about strong patent protections in the biopharmaceutical industry, accessed November 9, 2025, https://phrma.org/blog/ip-explained-myth-vs-fact-about-strong-patent-protections-in-the-biopharmaceutical-industry

- Biden Administration report debunks myths around patent “evergreening” and “thickets”, accessed November 9, 2025, https://phrma.org/blog/biden-administration-report-debunks-myths-around-patents

- Patenting Strategies for Small Molecule Drugs to Maximize ROI and …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/patenting-strategies-for-small-molecule-drugs-to-maximize-roi-and-market-exclusivity/

- Statements and background on CRISPR patent process | Broad …, accessed November 9, 2025, https://www.broadinstitute.org/crispr/journalists-statement-and-background-crispr-patent-process

- Multiple outlets quote Sherkow on CRISPR patent dispute – College of Law, accessed November 9, 2025, https://law.illinois.edu/multiple-outlets-quote-sherkow-on-crispr-patent-dispute/

- CRISPR-Cas: Navigating the Patent Landscape to Explore Boundless Applications – WIPO, accessed November 9, 2025, https://www.wipo.int/en/web/global-health/w/news/2024/crispr-cas-navigating-the-patent-landscape-to-explore-boundless-applications

- How 2025 can be a pivotal year of progress for Biopharma | World …, accessed November 9, 2025, https://www.weforum.org/stories/2025/01/2025-can-be-a-pivotal-year-of-progress-for-pharma/

- Artificial Intelligence (AI) and Inventorship – Will the next blockbuster drug be denied patent protection? – Wiggin and Dana LLP, accessed November 9, 2025, https://www.wiggin.com/publication/artificial-intelligence-ai-and-inventorship-will-the-next-blockbuster-drug-be-denied-patent-protection/

- Navigating Inventorship in the Era of AI-Assisted Drug Discovery | MoFo Life Sciences, accessed November 9, 2025, https://lifesciences.mofo.com/topics/250304-navigating-inventorship

- Unravelling the challenge of AI inventorship in healthcare, accessed November 9, 2025, https://www.drugdiscoverytrends.com/the-challenge-of-ai-inventorship-in-healthcare/

- Patentability Risks Posed by AI in Drug Discovery | Insights | Ropes …, accessed November 9, 2025, https://www.ropesgray.com/en/insights/alerts/2024/10/patentability-risks-posed-by-ai-in-drug-discovery

- Pharmaceutical patents and data exclusivity in an age of AI-driven drug discovery and development | Medicines Law & Policy, accessed November 9, 2025, https://medicineslawandpolicy.org/2025/04/pharmaceutical-patents-and-data-exclusivity-in-an-age-of-ai-driven-drug-discovery-and-development/

- Navigating the USPTO’s AI inventorship guidance in AI-driven drug discovery – PMC – NIH, accessed November 9, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12317375/

- Future-proof your pharma supply chain: PwC, accessed November 9, 2025, https://www.pwc.com/us/en/industries/health-industries/library/pharma-supply-chains.html

- U.S. Pharmaceutical Manufacturing and Supply Chain: 2025 Risks, Opportunities for Stakeholders | Insights | Holland & Knight, accessed November 9, 2025, https://www.hklaw.com/en/insights/publications/2025/06/us-pharmaceutical-manufacturing-and-supply-chain-2025-risks

- 14 Biggest Healthcare Data Breaches [Updated 2025] – UpGuard, accessed November 9, 2025, https://www.upguard.com/blog/biggest-data-breaches-in-healthcare

- 2025’s Top Biotech Cybersecurity Threats & Risk Reduction Strategies – Pennant Networks, accessed November 9, 2025, https://www.pennantnetworks.com/blog/2025s-top-biotech-cybersecurity-threats-risk-reduction-strategies

- Biotech Security Report 2025 | Sekurno, accessed November 9, 2025, https://www.sekurno.com/biotech-cybersecurity-report-2025

- Understanding the National Security Commission on Emerging Biotechnology Report – CSIS, accessed November 9, 2025, https://www.csis.org/analysis/understanding-national-security-commission-emerging-biotechnology-report

- 139 Cybersecurity Statistics and Trends [updated 2025] – Varonis, accessed November 9, 2025, https://www.varonis.com/blog/cybersecurity-statistics

- Understanding Pharmaceutical Competitor Analysis – DrugPatentWatch, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/the-importance-of-pharmaceutical-competitor-analysis/

- The Innovator’s Compass: Navigating the Patent Landscape to Drive …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/the-innovators-compass-navigating-the-patent-landscape-to-drive-pharmaceutical-rd-and-secure-market-leadership/

- Patent landscape analysis—Contributing to the identification of technology trends and informing research and innovation funding policy – PubMed Central, accessed November 9, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10034625/

- Maximize opportunities with a patent landscape analysis – CAS.org, accessed November 9, 2025, https://www.cas.org/resources/cas-insights/maximize-opportunities-patent-landscape-analysis

- How Patent Landscape Analysis Drives Business Growth – Caldwell | Global Law Firm, accessed November 9, 2025, https://caldwelllaw.com/news/how-patent-landscape-analysis-drives-business-growth/

- Patent Analytics for competitive intelligence in the pharmaceutical industry – Intelacia, accessed November 9, 2025, https://intelacia.com/patent-analytics-for-competitive-intelligence-in-the-pharmaceutical-industry/

- Patent Landscape Analysis: Actionable Insights for Strategic Decision Making – UnitedLex, accessed November 9, 2025, https://unitedlex.com/insights/patent-landscape-analysis-actionable-insights-for-strategic-decision-making/

- Decoding Innovation: The Power of Biotechnology Patent Analysis – Patlytics, accessed November 9, 2025, https://www.patlytics.ai/blog/decoding-innovation-the-power-of-biotechnology-patent-analysis

- IP and Business: Launching a New Product: freedom to operate – WIPO, accessed November 9, 2025, https://www.wipo.int/en/web/wipo-magazine/articles/ip-and-business-launching-a-new-product-freedom-to-operate-34956

- Conducting a Biopharmaceutical Freedom-to-Operate (FTO …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/conducting-a-biopharmaceutical-freedom-to-operate-fto-analysis-strategies-for-efficient-and-robust-results/

- The Billion-Dollar Question: Using Drug Patent Data as Your Crystal …, accessed November 9, 2025, https://www.drugpatentwatch.com/blog/the-billion-dollar-question-using-drug-patent-data-as-your-crystal-ball-in-pharma-ma-due-diligence/

- The Hidden Costs of Dirty Patent Data – LexisNexis IP Solutions, accessed November 9, 2025, https://www.lexisnexisip.com/resources/the-hidden-costs-of-dirty-patent-data/

- The Hidden Data Crisis in Patent Practice – IP Service World, accessed November 9, 2025, https://www.ipserviceworld.com/blog/data-crisis-in-patent-practice.html

- Pharmaceutical Competitive Intelligence | 2025 Guide – BiopharmaVantage, accessed November 9, 2025, https://www.biopharmavantage.com/competitive-intelligence

- Maximizing ROI with AI-based Patent Portfolio Management – XLSCOUT, accessed November 9, 2025, https://xlscout.ai/maximizing-roi-with-ai-based-patent-portfolio-management/