The global generic drug market presents a fundamental paradox for the executives who navigate its complexities. On one hand, it is a sector of immense and sustained societal value, an economic engine that delivered a staggering $445 billion in savings to the U.S. healthcare system in 2023 alone by providing affordable alternatives to high-cost branded medicines. This market is fueled by powerful tailwinds: an aging global population, government policies aggressively promoting generic use to curtail spiraling healthcare costs, and the relentless, cyclical nature of pharmaceutical innovation that ensures a steady stream of blockbuster drugs losing patent exclusivity.1

On the other hand, for the companies competing within this arena, the operational reality is a “brutal, high-stakes gauntlet”. The very forces that create immense public value—intense competition, relentless price pressure, and stringent quality standards—are the same forces that threaten the industry’s long-term sustainability. The journey from identifying a potential generic candidate to a successful market launch is a labyrinth of scientific rigor, regulatory oversight, and high-stakes legal battles, where a single misstep can trigger a cascade of adverse consequences, from multi-million-dollar development losses to rejected applications and crippling legal repercussions.

In this environment, risk assessment transcends its traditional role as a compliance-focused, box-checking exercise. It becomes the central, dynamic, and strategic discipline required not just for survival, but for success. It is the art and science of identifying, analyzing, and mitigating the multifaceted risks that permeate every stage of the generic drug lifecycle. More than that, it is the strategic function that allows a company to convert uncertainty into a measurable competitive advantage. The firm that masters risk assessment is the one that can confidently select the most promising products, navigate the regulatory maze most efficiently, anticipate and neutralize quality failures before they occur, and strategically engage in the high-stakes legal chess match of patent challenges.

This report provides a definitive, expert-level guide to the role of risk assessment in generic drug development. We will journey through the entire risk landscape, beginning with the foundational regulatory hurdles of the Abbreviated New Drug Application (ANDA) pathway and the scientific tightrope of proving bioequivalence. We will then explore the strategic arsenal of proactive Quality Risk Management (QRM) frameworks like Quality by Design (QbD), Failure Mode and Effects Analysis (FMEA), and Hazard Analysis and Critical Control Points (HACCP). Following this, we will dissect the commercial battlefield, where market, legal, and intellectual property risks converge. Finally, we will look to the horizon, examining how the intelligence edge provided by platforms like DrugPatentWatch and the predictive power of Artificial Intelligence (AI) are reshaping the future of risk mitigation. This is a comprehensive roadmap for turning risk from a burden into your most powerful strategic asset.

Section 1: The Regulatory Gauntlet – Deconstructing the ANDA Pathway and Its Inherent Risks

The regulatory framework governing generic drugs is the arena where the first and often most significant risks are encountered. While designed to be an expedited route to market, the U.S. Food and Drug Administration’s (FDA) Abbreviated New Drug Application (ANDA) pathway is a complex and demanding process. Misunderstanding its nuances or underestimating its rigor is a common and costly pitfall that can delay or derail a product launch, erasing any potential competitive advantage.

The ANDA: An “Abbreviated” Process with Unabbreviated Complexity

The term “abbreviated” is, in many ways, a misnomer. It refers specifically to the fact that generic applicants are not required to repeat the extensive and costly preclinical (animal) and clinical (human) trials needed to establish the safety and effectiveness of a new drug. This is the very foundation of the generic business model, allowing for the development of lower-cost alternatives. However, this abbreviation in clinical work is replaced by an immense burden of proof in other areas, demanding meticulous scientific demonstration of “sameness” to the innovator product.

The Core Premise: Demonstrating Sameness and Bioequivalence

To gain FDA approval, a generic drug manufacturer must use the ANDA pathway to scientifically prove that its product is comparable to an already-approved brand-name drug, known as the Reference Listed Drug (RLD).7 This demonstration of sameness is multifaceted and requires the generic to match the RLD in several key areas 7:

- Active Pharmaceutical Ingredient (API): The active ingredient must be identical.

- Dosage Form and Strength: A 10mg tablet must be replicated as a 10mg tablet.

- Route of Administration: An oral drug must be an oral drug; an injectable must be an injectable.

- Conditions of Use and Labeling: The intended use and patient instructions must be the same (with certain limited exceptions for patented uses).

- Quality and Manufacturing Standards: The generic must be manufactured under the same high-quality standards (cGMP) as the brand.

The scientific cornerstone of this entire process is the demonstration of bioequivalence (BE). This involves conducting studies, typically in healthy human volunteers, to prove that the generic drug delivers the same amount of active ingredient into a patient’s bloodstream over the same period of time as the RLD.6 By proving bioequivalence, the generic manufacturer can leverage the brand’s original safety and efficacy data, as it is scientifically inferred that a bioequivalent product will have the same clinical effect and safety profile.9

A Step-by-Step Risk Analysis of the ANDA Lifecycle

The ANDA process is not a simple, linear submission but a multi-stage lifecycle, with each phase presenting its own unique set of risks. A failure to manage risk in an early phase inevitably creates larger, more costly problems downstream.

Step 1: Pre-ANDA Preparation. This initial phase is the most critical risk mitigation opportunity in the entire development process. It is far more than just laboratory work; it is the strategic foundation upon which the entire project is built. Key activities, each with inherent risks, include 7:

- RLD Analysis: Meticulously gathering and analyzing all available data on the RLD’s chemistry, formulation, labeling, and regulatory history. An incomplete understanding here can lead to developing a product that fails to match the RLD, a fatal flaw.

- Bioequivalence Studies: Designing and conducting the pivotal BE studies. A poorly designed study, incorrect statistical analysis, or unexpected results can invalidate the entire submission.

- Manufacturing and cGMP Compliance: Ensuring that all manufacturing processes, facilities, and quality control measures comply with the FDA’s stringent Current Good Manufacturing Practices (cGMP). Any compliance gaps identified later by FDA inspectors can halt the entire project.

- Regulatory Assessment: A deep dive into all relevant FDA guidance documents and submission requirements to avoid common pitfalls. Ignorance of a specific guidance can lead to an easily preventable deficiency letter from the FDA.

Step 2: Dossier Preparation & Submission. The ANDA dossier is the tangible output of the development process. It is not merely a collection of data but a “knowledge-rich submission” intended to demonstrate a profound understanding of the product and process. The primary risk at this stage is data integrity. From the very first experiment, all data must adhere to principles like ALCOA++ (Attributable, Legible, Contemporaneous, Original, Accurate, Complete, Consistent, Enduring, and Available). Any compromise in data integrity—a missing signature, a questionable data point, an uncalibrated instrument—can be grounds for the FDA to question the validity of the entire submission, leading to rejection and catastrophic delays.

Step 3: The FDA Review Black Box. Once submitted electronically via the FDA’s gateway, the ANDA enters the agency’s review process. The FDA’s Office of Generic Drugs (OGD) conducts a multi-phase, multi-disciplinary review, assessing everything from the BE data and labeling to the manufacturing site itself. The primary risk here is time and uncertainty. While the Generic Drug User Fee Amendments (GDUFA) have established goals to shorten review times, aiming for 10 months for a standard review, the practical reality can be much longer, often averaging around 30 months.2 This long and often opaque timeline is a major business risk, making it difficult to forecast launch dates, manage inventory, and align with commercial partners. Delays can erode or eliminate the financial viability of a product, especially if competitors reach the market first.

Step 4: The Complete Response Letter (CRL) – A Costly Setback. If the FDA review identifies significant deficiencies, the agency will not approve the ANDA. Instead, it will issue a Complete Response Letter (CRL). A CRL is a formal communication that meticulously details every identified deficiency, from major scientific flaws to minor documentation errors.5 The applicant must address every single point to the FDA’s satisfaction before the application can be reconsidered. Receiving a CRL is a major setback. It immediately pushes the launch timeline back by months or even years, adds significant cost for remediation and rework, and provides a window for competitors to move ahead.

Step 5: Post-Approval – The Journey of Ongoing Compliance. Gaining FDA approval is the goal, but it is not the end of the regulatory journey. A marketed generic drug remains under constant FDA oversight. This creates ongoing risks in several areas 5:

- Pharmacovigilance: Companies must continue to monitor and report adverse events associated with their products.

- cGMP Adherence: FDA conducts routine inspections of manufacturing facilities to ensure ongoing compliance with cGMP. A failed inspection can lead to warning letters, import alerts, or even forced recalls.

- Post-Approval Changes: Any change to the product or process—a new supplier for an excipient, a modification to the manufacturing line—must be reported to the FDA through the appropriate supplement (e.g., CBE-0, CBE-30, PAS). Failure to manage these changes correctly is a common compliance violation.

Neglecting post-approval compliance can have severe consequences, including product recalls, reputational damage, and legal action, effectively squandering the millions of dollars and years of effort invested to bring the product to market.

The Anatomy of Failure: Common Deficiencies in ANDA Submissions

To effectively manage regulatory risk, it is crucial to understand where applications most often fail. Analysis of FDA data reveals clear patterns in the types of major deficiencies cited in the first review cycle of an ANDA. These are not random errors but systemic failure points that companies can and should proactively address.

The data shows that risks are distributed across the entire development process, but are heavily concentrated in manufacturing and product-related issues. This immediately tells a strategic leader where to focus resources: the biggest risks are often not in the clinical bioequivalence unit, but on the factory floor and in the formulation lab.

| Source of Major Deficiency | Percentage of Total Deficiencies |

| Manufacturing (Primarily Facility-Related) | 31% |

| Drug Product-Related | 27% |

| Non-Quality Disciplines (Total) | 29% |

| Bioequivalence | 18% |

| Pharmacology/Toxicology | 6% |

| Other | 5% |

| Drug Substance-Related | 9% |

| Source: Analysis of common ANDA major deficiencies in the first assessment cycle. |

A Deeper Look at Drug Product Deficiencies

While manufacturing facility issues are the single largest category, the drug product itself is a close second. These deficiencies are often highly technical and point to a lack of scientific rigor during development. Common examples include 5:

- Extractables and Leachables (E&L): Failure to conduct a proper safety assessment of compounds that could leach from packaging materials (e.g., bottles, caps, labels) or manufacturing components (e.g., tubing, filters) into the drug product. This is a particularly high-risk area for complex generics like injectables or inhalers.

- Unqualified Impurities: The presence of impurities that have not been adequately identified and assessed for toxicological risk. This includes failing to provide data for mutagenicity risk (as per ICH M7 guidelines) or other potential toxicities.

- Insufficient Drug Substance (DS) Sameness: Inability to provide enough data to prove that the generic active ingredient is identical to the brand’s, a challenge that is especially acute for complex molecules like peptides or polymers.

- Poor Control of Critical Quality Attributes (CQAs): Failure to identify the key physical and chemical attributes of the drug product that determine its performance and quality, and then failing to implement controls to ensure they are consistently met. This category has been thrown into the spotlight by the recent crisis over nitrosamine impurities, which are now considered a critical CQA that must be assessed and controlled.

A crucial takeaway from this data is the profound interconnectedness of these deficiencies. Problems are rarely isolated. A seemingly minor flaw in a manufacturing process can lead to the formation of an unexpected impurity (a drug substance and product quality issue). This impurity can then impact the drug’s stability over time, which in turn can cause it to fail bioequivalence testing. This cascade effect means that a siloed approach to risk management, where different departments manage their own risks in isolation, is a recipe for failure. A company’s quality system must be holistic, recognizing that a decision made in process development has direct consequences for the clinical and regulatory teams. This systems-thinking approach is the only way to effectively de-risk the complex web of the ANDA process.

The Evolving Regulatory Landscape: Navigating New and Unpredictable Risks

Regulatory risk is not a static checklist of known requirements. The landscape is constantly shifting due to new scientific understanding, new legislation, and unforeseen public health crises. A robust risk assessment program must not only ensure compliance with today’s rules but also build the organizational resilience to adapt to the rules of tomorrow.

The Nitrosamine Crisis: A Paradigm Shift in Risk Assessment

Perhaps no event in recent memory better illustrates the dynamic nature of regulatory risk than the nitrosamine impurity crisis that began in 2018. The discovery of potentially carcinogenic nitrosamine impurities, such as N-nitrosodimethylamine (NDMA), in widely used drugs like the blood pressure medication valsartan and the heartburn remedy ranitidine, sent shockwaves through the industry.

These impurities were not contaminants from an external source but byproducts of the chemical synthesis process itself, formed by reactions that had gone unnoticed for years. The crisis triggered global recalls, created massive drug shortages, and forced a fundamental re-evaluation of manufacturing process control. For generic companies, it introduced a significant and entirely unbudgeted layer of risk and cost. Firms across the industry had to scramble to :

- Conduct Risk Assessments: Proactively evaluate all manufacturing processes for the potential to form nitrosamines, including the more recently identified and complex Nitrosamine Drug Substance-Related Impurities (NDSRIs).

- Perform Confirmatory Testing: If a risk was identified, they had to develop and validate highly sensitive analytical methods to test for these impurities at trace levels.

- Mitigate and Report: If impurities were found, companies had to reformulate products, re-validate manufacturing processes, and report their findings and mitigation strategies to the FDA.

The nitrosamine crisis demonstrates that regulatory risk is no longer just about meeting established standards. It’s about having the scientific capability and organizational agility to respond to new, unforeseen quality challenges. It transformed risk assessment from a pre-approval activity to a continuous, lifecycle-long process.

The GDUFA Effect: A Double-Edged Sword of Speed and Cost

The Generic Drug User Fee Amendments (GDUFA), first passed in 2012, were intended to address the long and unpredictable wait times for ANDA approvals by allowing the FDA to collect user fees to hire more review staff. While GDUFA has succeeded in making review timelines more predictable, it has done so by introducing a new and significant financial risk.

For fiscal year 2025, the GDUFA fees are substantial: an ANDA filing fee of $321,920, a Drug Master File (DMF) fee of $95,084, and annual program fees that can reach nearly $1.9 million for a large company. Crucially, these fees are non-refundable. They act as a formidable barrier to entry, fundamentally changing the strategic calculation for pursuing a generic product. The decision is no longer purely scientific or legal; it is a major capital allocation decision. A company must be confident in its ability to navigate the scientific and regulatory hurdles before committing hundreds of thousands of dollars in upfront fees. This risk is particularly acute for smaller companies or those targeting niche products with modest revenue potential, as a single CRL can wipe out the entire financial case for the product.

The FDA’s Internal Tension: Balancing Access and Safety

A final, more subtle regulatory risk stems from the FDA’s own dual mandate. The agency is tasked with both ensuring the safety and quality of the nation’s drug supply and promoting public health, which includes facilitating access to affordable generic medicines.6 This can create an internal tension, forcing the agency to make difficult trade-offs between maintaining supply and enforcing the highest quality standards.

Recent investigative reporting and statements from former FDA officials have pulled back the curtain on this difficult balancing act. In a striking admission, Dr. Janet Woodcock, a long-time leader at the agency, acknowledged that to prevent critical drug shortages, the FDA has at times used a “secretive” process to allow drugs from otherwise banned foreign manufacturing plants to enter the U.S. market. She stated that publicizing this information would have caused “some kind of frenzy”. This reveals a pragmatic, but potentially risky, internal calculus.

This perspective is reinforced by other experts who express deep concern. Daniel Hussar, a prominent pharmacist and academic, wrote that he no longer has confidence that the FDA is “effective and thorough enough to provide assurance of the quality and safety of the drug supply that we should be able to expect”. This gap between the FDA’s public messaging of absolute equivalence and its internal compromises creates a systemic “trust risk” for the entire generic industry. A quality scandal at one company, especially if it involves an overseas manufacturer, can tarnish the reputation of all generic drugs, impacting prescriber confidence and patient adherence. Therefore, a generic company’s risk assessment must now include the broader reputational risk of the industry itself and the potential for a competitor’s failure to create market-wide problems.

Section 2: The Scientific Tightrope – Navigating Technical and Quality Risks

Beyond the regulatory gates lies a landscape of formidable scientific and technical challenges. While the ANDA pathway abbreviates the clinical trial burden, it intensifies the scrutiny on chemistry, manufacturing, and controls (CMC). Proving that a generic product is a true therapeutic equivalent to its brand-name counterpart is a scientific tightrope walk, where a minor deviation in formulation or manufacturing can lead to a failed submission and millions in wasted investment.

The Bioequivalence Minefield: Proving Sameness is Harder Than It Looks

Bioequivalence (BE) is the scientific bedrock upon which the entire generic drug approval system rests. It is the bridge that allows a generic to rely on the brand’s safety and efficacy data. However, successfully crossing this bridge is one of the most significant hurdles in generic development, accounting for 18% of all major deficiencies in first-cycle ANDA reviews.

The Science of BE Studies: Beyond the 80-125% Rule

At its core, a BE study is a clinical trial, typically conducted in a small cohort of healthy volunteers, that compares the pharmacokinetic (PK) profile of the generic drug to the RLD. The key PK parameters measured are:

- Cmax: The maximum concentration of the drug in the blood, which reflects the rate of absorption.

- AUC (Area Under the Curve): The total exposure to the drug over time, which reflects the extent of absorption.

To be deemed bioequivalent, the 90% statistical confidence interval for the geometric mean ratio of the generic’s Cmax and AUC to the brand’s must fall entirely within the predetermined limits of 80.00% to 125.00%. It is a common misconception that this rule allows for a simple +/- 20% variance in drug delivery. In reality, it is a stringent statistical constraint. Because the confidence interval must be fully contained within the window, the actual measured difference between the average performance of the generic and the brand is typically very small. A large study comparing thousands of generic and brand-name drugs found the average difference in absorption to be approximately 3.5%.

Despite this precision, BE studies are a major source of risk. They are expensive, time-consuming, and their outcomes can be unpredictable, especially for “highly variable drugs” where inherent biological differences among subjects can make it difficult to meet the statistical criteria without enrolling a very large number of participants. A failed BE study is a catastrophic event, often requiring a complete reformulation of the product and a restart of the development clock, a delay that can be fatal in a competitive market.

The Formulation Enigma: Reverse-Engineering Performance

The central challenge for a generic formulator is to create a product that performs identically to the RLD in the human body, without having access to the brand company’s proprietary formulation or manufacturing “recipe”. This process of reverse-engineering is fraught with scientific risk.

API Challenges: The active pharmaceutical ingredient (API) itself presents numerous hurdles. Its fundamental physicochemical properties dictate how it will behave in a formulation and in the body. Key risk factors include :

- Solubility: Over 40% of new drug candidates are poorly soluble in water, which can make it difficult to achieve adequate absorption. Formulators must employ sophisticated techniques to enhance solubility to match the RLD’s performance.

- Polymorphism: More than half of all APIs can exist in multiple different crystalline forms, or polymorphs. Each polymorph can have a different solubility, dissolution rate, and stability. Using the wrong polymorph, or failing to control the polymorphic form during manufacturing, can lead directly to a BE failure.

- Particle Size: The size and distribution of API particles can dramatically affect the dissolution rate and, consequently, the rate of absorption.

Excipient Interactions: The so-called “inactive” ingredients in a drug product are anything but inert. The choice of binders, fillers, disintegrants, and lubricants can make or break a formulation. These excipients can interact with the API in unexpected ways, creating significant risk.4 For example, the common filler lactose can react with APIs containing primary amine groups (the Maillard reaction), leading to degradation and loss of potency. An excipient might also impede the dissolution of the API or affect its stability in the final dosage form. A single, seemingly innocuous choice of excipient can be the root cause of a failed BE study, forcing a costly and time-consuming reformulation effort.

Stability’s Silent Threats: A generic drug must not only be bioequivalent on day one but must remain so throughout its entire shelf life. Stability testing is a critical, and often lengthy, part of the development process. Risks to stability are numerous and include :

- API Degradation: The active ingredient can degrade over time due to hydrolysis (reaction with water), oxidation (reaction with oxygen), or photolysis (breakdown by light).

- Packaging Interactions: Components from the packaging system, such as plasticizers from a bottle or adhesives from a label, can leach into the drug product. These “leachables” can be toxic or can react with the API. This is a particularly critical risk for liquid and semi-solid formulations.

The Challenge of Complexity: When “Simple” Generics Aren’t Simple

As the market for simple, immediate-release oral tablets becomes increasingly commoditized, many generic companies are strategically pivoting towards more complex products. This is a calculated trade-off: accepting higher scientific and regulatory risk in exchange for higher barriers to entry, less competition, and more sustainable profit margins.4

Modified-Release and Narrow Therapeutic Index (NTI) Drugs

Even within the realm of oral solids, complexity varies greatly.

- Modified-Release (MR) Products: These products (e.g., extended-release, delayed-release) are designed to release the drug over a specific period or in a specific part of the gastrointestinal tract. Mimicking the brand’s complex release profile is a significant formulation and manufacturing challenge. It often requires sophisticated polymer chemistry and precise control over manufacturing parameters.

- Narrow Therapeutic Index (NTI) Drugs: These are drugs where a small difference in dose or blood concentration can lead to therapeutic failure or serious adverse events. For NTI drugs, the FDA requires more stringent BE studies and tighter manufacturing controls to ensure patient safety.

The Rise of Complex Generics

The term “complex generics” refers to a growing category of products that are inherently difficult to develop due to their formulation, route of delivery, or the active ingredient itself. Examples include :

- Injectable suspensions

- Long-acting injectables and implants

- Inhaled drugs (e.g., for asthma)

- Transdermal patches

- Topical creams and ointments

- Ophthalmic (eye) drops

Developing generic versions of these products presents a host of unique risks. Proving bioequivalence is often not possible through standard blood-level studies. For a topical cream, for instance, the drug acts locally on the skin, and blood levels may not reflect efficacy. This may require the FDA to ask for more complex in vitro characterization tests or even comparative clinical endpoint studies, which are essentially smaller-scale efficacy trials that can add millions of dollars ($2M to $6M) and years to the development timeline. Furthermore, these products often involve a drug-device combination (e.g., an inhaler, an auto-injector), which introduces risks related to device performance, human factors, and extractables and leachables from the device components. Because of these difficulties, complex generics are more likely to be in short supply, making their successful development a high-value proposition.

The Foundation of Quality: Adherence to Current Good Manufacturing Practices (cGMP)

Underpinning all scientific development is the absolute requirement to adhere to the FDA’s Current Good Manufacturing Practices (cGMP). This is not an optional quality standard; it is the law. Failure to comply with cGMP is a primary cause of regulatory action, product recalls, and drug shortages.

cGMP: A Mandate for a “Culture of Quality”

cGMP regulations provide a framework for systems that assure the proper design, monitoring, and control of manufacturing processes and facilities.5 The core principle of cGMP is that quality cannot be tested into a product at the end; it must be

built into the design and manufacturing process at every step. The “C” in cGMP stands for “Current,” which imposes a crucial obligation on manufacturers: they must use technologies and systems that are up-to-date in order to comply with the regulations. This means that simply maintaining decades-old processes, even if they once passed inspection, is not sufficient. This mandate for a “culture of quality” requires continuous investment, training, and management commitment.

Common cGMP Violations: A Pattern of Systemic Failure

A review of FDA warning letters issued to pharmaceutical manufacturers reveals disturbing and recurring patterns of failure. These are not typically isolated mistakes but rather symptoms of deep, systemic problems in a company’s quality management system. Common violations include 5:

- Pervasive Contamination: Repeated observations of poor aseptic (sterile) practices, inadequate environmental monitoring, and even physical signs of filth, such as mold growth or liquid dripping from ceilings in manufacturing areas.

- Failure to Investigate: A failure to thoroughly investigate any discrepancy, out-of-specification (OOS) result, or batch failure. This is one of the most frequently cited violations and points to a culture that ignores or explains away quality problems rather than finding and fixing their root cause.

- Inadequate Laboratory Controls: This includes everything from using unvalidated analytical test methods to poor documentation practices and, in the most egregious cases, data integrity issues where data is falsified or manipulated.

- Lack of Process Validation: Making changes to manufacturing processes or master batch records without sufficient scientific validation to prove that the change does not negatively impact product quality.

These failures have real-world consequences. The intense cost pressure in the generic industry, particularly for older products, can lead to underinvestment in facility maintenance and quality systems. This is especially a concern for the global supply chain, as the majority of APIs and finished generic drugs for the U.S. market are produced overseas, primarily in India and China.4 Studies and FDA reports have documented a higher incidence of quality issues and adverse events linked to drugs from some overseas facilities, where intense cost competition may lead to operational compromises. This means a generic company’s risk assessment must now extend far beyond its own four walls. It must include rigorous supply chain risk management, in-depth audits of foreign suppliers, and geopolitical risk analysis. A supplier’s quality culture is now an integral part of your own company’s risk profile.

Section 3: The Strategic Arsenal – Proactive Quality Risk Management (QRM) Frameworks

In the face of such complex and interconnected risks, a reactive, “test-and-inspect” approach to quality is insufficient and destined for failure. Leading pharmaceutical companies have shifted their paradigm, embracing a philosophy of proactive Quality Risk Management (QRM). This approach utilizes a strategic arsenal of systematic, science-based frameworks to anticipate, understand, and control risks throughout the product lifecycle. The goal is not to eliminate all risk—an impossible task—but to manage it intelligently, ensuring that product quality is built in from the very beginning. The most powerful tools in this arsenal are Quality by Design (QbD), Failure Mode and Effects Analysis (FMEA), and Hazard Analysis and Critical Control Points (HACCP).

Shifting the Paradigm: From Quality by Testing to Quality by Design (QbD)

Quality by Design (QbD) represents a revolutionary departure from traditional pharmaceutical development. The old paradigm often relied on trial-and-error, where a formulation was developed, and then extensive testing was performed on the final product to prove it met specifications. This resulted in “data-intensive submissions” with “disjointed information” and a validated process that was rigid and discouraged change.

QbD flips this model on its head. It is a systematic, proactive, and science-driven approach that begins with the end in mind.11 Instead of asking “Did we make the right product?” at the end, it asks “How do we ensure we make the right product every single time?” from the start.

The Core Principles of QbD

The implementation of QbD is guided by a series of interconnected principles that build upon one another to create a deep understanding of the product and process.11

- Define the Quality Target Product Profile (QTPP): The process begins by defining the QTPP, which is a prospective summary of the quality characteristics of a drug product that ideally will be achieved to ensure the desired quality, taking into account safety and efficacy. For a generic, this means defining the quantitative targets (e.g., for identity, assay, dissolution, purity) that will ensure it is therapeutically equivalent to the RLD.

- Identify Critical Quality Attributes (CQAs): Based on the QTPP, the team identifies the CQAs. These are the physical, chemical, biological, or microbiological attributes of the product that must be controlled within a specific limit, range, or distribution to ensure the desired product quality. For a tablet, CQAs would include its potency, purity, hardness, and dissolution rate.

- Identify Critical Process Parameters (CPPs): These are the parameters of the manufacturing process (e.g., blending time, compression force, drying temperature) whose variability has an impact on a CQA and therefore should be monitored or controlled to ensure the process produces the desired quality.

- Establish a Design Space: Through systematic experimentation (e.g., Design of Experiments, or DoE), the team establishes the relationship between the CPPs and the CQAs. The result of this work is the Design Space: the multidimensional combination and interaction of input variables (e.g., material attributes) and process parameters that has been demonstrated to provide assurance of quality.11 This is the scientifically-proven “safe operating region” for the manufacturing process.

The Business Case for QbD: De-risking Development and Manufacturing

Adopting a QbD approach is a strategic investment that pays significant dividends by de-risking the entire product lifecycle. The benefits are substantial and multifaceted 11:

- Scientific and Technical Benefits: It leads to a more robust and better-understood manufacturing process, which minimizes the likelihood of batch failures, rework, and out-of-specification results. This “right first time” approach reduces waste and process downtime.

- Financial Benefits: Fewer lost batches can save hundreds of thousands of dollars per incident, and fewer manufacturing deviations save time and money. Ultimately, a more efficient and reliable process leads to faster time-to-market and a more reliable supply, which is critical in a competitive environment.

- Regulatory Benefits: A QbD-based ANDA is a “knowledge-rich submission” that demonstrates a profound understanding of the product and process to regulators.11 This can build confidence and potentially lead to less intensive regulatory oversight. Crucially, operating within the approved Design Space provides

regulatory flexibility. A manufacturer can make adjustments to the process within the Design Space to account for normal variability (e.g., in raw materials) without needing to file a supplement and seek prior approval from the FDA. This allows for continuous improvement and avoids the regulatory burden that often discourages process optimization.

However, successful implementation is not trivial. Common pitfalls include simply using QbD terminology without genuine scientific understanding, presenting exhaustive data without interpretation or conclusions, or claiming a Design Space that is not adequately supported by data.

FMEA: Systematically Anticipating and Preventing Failure

While QbD provides the overarching strategic framework for quality, Failure Mode and Effects Analysis (FMEA) is a powerful tactical tool used to systematically identify and mitigate risks at the process level. It is a structured, proactive methodology for answering the question: “What could go wrong, and what can we do to prevent it?”

What is Failure Mode and Effects Analysis (FMEA)?

FMEA is a step-by-step approach to identify all possible failures in a design, a manufacturing process, or a product.22 Unlike a root cause analysis (RCA), which investigates a problem

after it has occurred, FMEA is used to anticipate and address potential failures before they happen. It is a “living document” that should be initiated early in the development of a new process and updated whenever changes are made.

The FMEA Process in Action

A cross-functional team, including engineers, operators, and quality personnel, typically conducts an FMEA. The process involves several key steps :

- Identify Potential Failure Modes: For each step in a process (e.g., “granulation of powder blend”), the team brainstorms everything that could potentially go wrong (e.g., “over-granulation,” “under-granulation,” “uneven wetting”).

- Identify Potential Effects: The team then determines the consequences of each failure mode (e.g., “over-granulation leads to tablets that are too hard and won’t dissolve properly”).

- Identify Potential Causes: Next, the team identifies the root causes of each failure (e.g., “uneven wetting is caused by a clogged spray nozzle”).

- Prioritize Risks with RPN/AP: This is the critical step where risks are quantified to prioritize mitigation efforts. Each potential failure mode is scored on three factors, typically on a scale of 1 to 10:

- Severity (S): How severe is the effect of the failure on the final product or patient? (1 = minor, 10 = catastrophic).

- Occurrence (O): How likely is the cause of the failure to occur? (1 = extremely unlikely, 10 = almost certain).

- Detection (D): How easily can the failure or its cause be detected before the product reaches the patient? (1 = certain to be detected, 10 = impossible to detect).

Traditionally, these three scores are multiplied to calculate a Risk Priority Number (RPN) (S×O×D=RPN). Failures with the highest RPNs are prioritized for action. However, a limitation of the RPN is that it gives equal weight to all three factors (e.g., a high-severity, low-occurrence risk can have the same RPN as a low-severity, high-occurrence risk). To address this, a more modern approach called Action Priority (AP) is now recommended. The AP system uses a logic table to classify risks as High, Medium, or Low priority, giving primary importance to Severity first, then Occurrence, and finally Detection. This ensures that any failure with a potentially severe outcome gets the highest level of attention, regardless of its frequency.

| Risk Factor | Description | Typical 1-10 Scale Anchors | Risk Prioritization Method | |

| Severity (S) | How badly could the failure affect the end user (patient)? | 1 (Minor Nuisance) to 10 (Catastrophic/Fatal) | RPN: S×O×D | |

| Occurrence (O) | How frequently is the root cause likely to occur? | 1 (Remote) to 10 (Very High/Inevitable) | Action Priority (AP): Prioritizes S, then O, then D to assign High, Medium, or Low priority. | |

| Detection (D) | How likely is the failure to be detected before it reaches the end user? | 1 (Almost Certain Detection) to 10 (No Chance of Detection) | ||

| Source: FMEA principles and methodologies.24 |

- Develop and Implement Corrective Actions: For the highest-priority risks, the team develops and implements actions designed to either reduce the severity of the effect, reduce the likelihood of occurrence, or improve the method of detection.

HACCP: A Systematic Approach to Hazard Control

While FMEA is a broad tool for analyzing process failures, Hazard Analysis and Critical Control Points (HACCP) is a more specialized, systematic approach focused on preventing specific safety hazards, particularly those that are biological, chemical, or physical in nature.

Adapting HACCP from Food Safety to Pharmaceuticals

HACCP was originally developed for the food industry to ensure the safety of astronaut food for NASA. Its success has led to its adoption in other industries, including pharmaceuticals. In the pharmaceutical context, HACCP is an excellent tool for identifying and managing risks associated with things like microbiological contamination, cross-contamination with other products, or the presence of physical contaminants (e.g., glass or metal particles).27

The Seven Principles of HACCP

The HACCP system is built on seven core principles 26:

- Conduct a Hazard Analysis: Identify all potential safety hazards at each step of the process.

- Determine Critical Control Points (CCPs): A CCP is a specific point in the process where control can be applied and is essential to prevent or eliminate a safety hazard or reduce it to an acceptable level. For example, a sterilization step for an injectable product would be a CCP for microbiological hazards.

- Establish Critical Limits: For each CCP, establish a measurable limit that separates acceptability from unacceptability (e.g., minimum temperature and time for a sterilization cycle).

- Establish Monitoring Systems: Put a system in place to monitor the control at each CCP (e.g., a calibrated temperature probe with continuous recording).

- Establish Corrective Actions: Define the actions to be taken when monitoring indicates that a CCP is not under control (e.g., quarantine and investigate the batch).

- Establish Verification Procedures: Periodically verify that the HACCP system is working effectively (e.g., through audits and testing).

- Establish Documentation: Keep thorough records of all procedures and monitoring related to the HACCP plan.

These three frameworks—QbD, FMEA, and HACCP—are not mutually exclusive. They are complementary components of a single, integrated Quality Risk Management system. QbD provides the high-level strategic framework for development. FMEA is the tactical workhorse used to analyze the risks within each unit operation of the process defined during QbD. And HACCP is a specialized tool deployed to design robust controls for specific, critical safety hazards identified during the FMEA. The greatest barrier to implementing these powerful tools is often not technical but cultural. Success requires a fundamental shift away from a siloed, reactive mindset toward a collaborative, data-driven culture of quality, championed and supported by leadership at all levels.

Section 4: The Commercial Battlefield – Market, Legal, and Intellectual Property Risks

While scientific and regulatory hurdles are immense, they are ultimately gateways to the commercial battlefield, an arena defined by fierce competition, brutal price pressures, and a complex web of legal and intellectual property (IP) risks. For a generic drug, achieving technical success and regulatory approval is not a guarantee of commercial success. The most significant financial risks are often encountered after the product leaves the lab, in the high-stakes world of patent litigation and market competition.

The Patent Gauntlet: Navigating a Thicket of IP Challenges

The entire generic drug industry is built upon the foundation of patent law. The expiration of a brand-name drug’s patents is the event that opens the door to generic competition. However, this process is rarely as simple as waiting for a date on a calendar. It is an adversarial process, a legal and strategic gauntlet that requires navigating a “patent thicket” of multiple, often overlapping patents that brand companies use to extend their monopolies.

The Hatch-Waxman Act: The Rules of Engagement

The Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, is the landmark legislation that created the modern generic industry in the United States.5 It struck a critical balance: it provided incentives for innovator companies to develop new drugs (e.g., by extending patent terms to compensate for time lost during FDA review), while simultaneously creating the abbreviated pathway (the ANDA) for generics to enter the market more quickly and affordably.

A key provision of the Act requires brand-name drug companies to list all patents that they believe cover their product or its method of use in an FDA publication called Approved Drug Products with Therapeutic Equivalence Evaluations, universally known as the Orange Book.8 The Orange Book serves as the essential roadmap for any generic company, outlining the specific patent hurdles that must be overcome to bring a competing product to market.

The Paragraph IV (P-IV) Challenge: A High-Risk, High-Reward Strategy

When submitting an ANDA, a generic applicant must make a certification for each patent listed in the Orange Book for the RLD. The most aggressive and strategically important of these is the Paragraph IV (P-IV) certification. By making a P-IV certification, the generic company is asserting that the brand’s patent is either invalid, unenforceable, or will not be infringed by the generic product.5

This is not a passive statement; it is an “artificial act of infringement” designed to provoke a legal confrontation. The brand company is notified of the P-IV filing and has 45 days to file a patent infringement lawsuit. If a suit is filed, it triggers an automatic 30-month stay on the FDA’s ability to grant final approval to the ANDA, giving the parties time to litigate the patent dispute in court.

Why would a generic company intentionally invite such a costly and time-consuming lawsuit? The answer lies in the immense prize created by the Hatch-Waxman Act: 180-day market exclusivity. The very first generic applicant to submit a substantially complete ANDA with a P-IV certification is rewarded with 180 days of exclusivity upon receiving final approval. During this six-month period, the FDA cannot approve any other generic versions of the same drug. This creates a highly lucrative duopoly between the brand and the first generic, a period that can be worth “several hundred million dollars” for a blockbuster drug.8 This first-to-file (FTF) incentive is the single biggest driver of patent litigation in the pharmaceutical industry.

The “At-Risk” Launch: A Calculated Gamble

In some scenarios, a generic firm may receive FDA approval for its product before the patent litigation is fully resolved (e.g., while a court decision is on appeal). The company then faces a critical strategic choice: wait for the legal process to conclude, or launch the product “at risk”.

An at-risk launch is one of the highest-stakes gambles in the business world. The generic company begins selling its product, capturing market share and revenue. However, if it ultimately loses the patent case on appeal, it can be found liable for willful infringement and forced to pay the brand company massive damages, which can include up to triple the brand’s lost profits. The decision to launch at risk is a complex financial calculation that weighs the enormous profits to be gained from early market entry against the potentially catastrophic damages of a legal loss. The calculation must also factor in the cost of not launching, which includes the risk that the market for the drug will shrink over time (e.g., due to the brand company’s “product hopping”) or that more generic competitors will be ready to launch once the litigation is over, eroding the profit potential.

“Pay-for-Delay” and Other Anti-Competitive Risks

The high cost and uncertainty of patent litigation have given rise to a controversial practice known as “pay-for-delay” or “reverse payment” settlements. In these agreements, the brand-name drug manufacturer pays the generic challenger to settle the lawsuit and agree to delay the launch of its generic product for a specified period.29

These settlements are highly problematic from a public policy perspective. They effectively allow a brand company to pay off its potential competitor, preserving its monopoly and keeping lower-cost generics off the market. The Federal Trade Commission (FTC) has aggressively pursued these cases, estimating that they cost consumers and the healthcare system billions of dollars each year. Landmark cases involving blockbuster drugs like the antibiotic ciprofloxacin, the wakefulness drug Provigil, and the cancer drug Gleevec have shown how these settlements delayed generic entry for years, costing the healthcare system billions and keeping affordable medicines out of the hands of patients. For generic companies, engaging in such a settlement carries its own significant legal risk of facing an antitrust lawsuit from the FTC or other parties.

The Unrelenting Price Crush: Surviving Commoditization

The commercial risk for a generic drug does not end with navigating the patent gauntlet. In fact, for many products, the greatest challenge is surviving the brutal economics of the market itself. The core value proposition of generics—affordability—is also the source of their greatest commercial vulnerability: rapid and severe price erosion.

The Brutal Economics of Generic Competition

The relationship between the number of competitors and the price of a generic drug is stark and unforgiving. The entry of the first generic competitor typically results in a significant price drop, but the real price crush begins when multiple players enter the market.

| Number of Generic Competitors | Typical Price Reduction vs. Brand |

| 1 Competitor | 30% to 39% Reduction |

| 2-3 Competitors | 50% to 70% Reduction |

| 6+ Competitors | 85% to 95% Reduction |

| Source: The economics of generic drug competition. |

This table visualizes the strategic window of opportunity for a generic product. The vast majority of a product’s lifetime profitability is captured in the early stages of the market, when it is the sole generic or one of only a few. This is why the 180-day exclusivity for the first filer is so valuable; it guarantees a period of limited competition and relatively high prices. Once the market becomes fully commoditized with numerous competitors, profit margins can shrink to near zero, and for some companies, the product may no longer be profitable to manufacture at all. An estimated 3,000 generic drug products have been withdrawn from the market in the past decade simply because they became unprofitable, a trend that is a major contributor to drug shortages.

The Power of Consolidated Buyers

The “race to the bottom” on price is accelerated by another powerful market force: the consolidation of purchasing power. In the U.S., the majority of prescription drugs are purchased by a small number of massive entities, including Group Purchasing Organizations (GPOs) that buy for hospitals and Pharmacy Benefit Managers (PBMs) that manage drug benefits for large health insurance plans. These organizations have immense negotiating leverage. They can demand steep discounts from generic manufacturers by threatening to exclude a company’s product from their formulary (the list of covered drugs). This dynamic further intensifies price competition and squeezes the already thin margins of generic producers.

The Hidden Risk: Product Liability and Post-Market Safety

A final, often overlooked, commercial risk lies in the unique area of product liability for generic drugs. A landmark 2011 Supreme Court decision has created a complex and controversial legal landscape.

The PLIVA v. Mensing Conundrum

In the case of PLIVA, Inc. v. Mensing, the Supreme Court ruled that generic drug manufacturers cannot be held liable in state court for “failure to warn” claims. The reasoning was that federal law requires generic drug labels to be identical to the brand-name drug’s label. Therefore, a generic company is preempted by federal law from independently changing its label to add a new warning, even if new safety information emerges.

This ruling effectively creates a liability shield for generic manufacturers that does not exist for their brand-name counterparts. While this may seem like a benefit, it has created a dangerous “gap in responsibility” for post-market drug safety. If the brand company stops actively marketing the drug after generic entry, it has little incentive to invest in ongoing safety surveillance. At the same time, the generic companies, shielded from liability, also have reduced incentives to perform pharmacovigilance and monitor for late-emerging safety risks. This creates a situation that is clearly unfair to patients, where their right to seek compensation for harm can depend entirely on whether their pharmacist dispensed a brand or a generic version of the same drug—a choice often made without their knowledge or consent. This legal reality poses a significant reputational and ethical risk for the entire generic industry.

The commercial landscape is a self-cannibalizing ecosystem. The very regulatory mechanisms that create opportunity—an efficient approval pathway and incentives for competition—are the same ones that lead to the rapid destruction of profitability. This creates a powerful strategic imperative for generic companies to constantly seek out products that can temporarily escape this dynamic. A successful long-term strategy cannot be based on simply producing commodity products. It must involve a sophisticated portfolio approach that balances these “race to the bottom” products with higher-barrier opportunities—such as complex generics or aggressive P-IV challenges—that offer a protected period of profitability. Risk assessment, therefore, is not just about managing the risks of a single product; it is the essential tool for managing the strategic balance of the entire company portfolio.

Section 5: The Intelligence Edge – Turning Data into Competitive Advantage

In the high-stakes, information-dense environment of generic drug development, the company with the best intelligence wins. Strategic decisions—which products to pursue, which patents to challenge, when to launch—are multi-million dollar bets made under conditions of extreme uncertainty. The ability to reduce that uncertainty, even by a small margin, provides an enormous competitive advantage. In the modern generic industry, risk assessment is no longer a matter of intuition or experience alone; it is a data-driven discipline powered by sophisticated market and patent intelligence.

From Guesswork to Strategy: The Role of Market Intelligence

The first and most fundamental risk mitigation step occurs before a single dollar is spent on R&D: selecting the right product to develop. A flawed portfolio decision cannot be fixed by brilliant science or flawless regulatory execution. A comprehensive market evaluation is therefore the critical first screen in any risk assessment process.

Evaluating the Market Landscape

The goal of market intelligence is to build a 360-degree view of a potential product’s commercial landscape. This involves answering a series of critical questions :

- What is the total market size? What are the annual sales of the brand-name drug? This determines the overall size of the prize.

- Who is the competition? How many other generic competitors are already on the market or have ANDAs pending with the FDA? Are there other branded drugs in the same therapeutic class that compete for the same patients?

- Where is the market headed? Is the brand company developing a line extension (e.g., a new dosage form or a once-daily version) to which they might switch patients before the original patent expires? This “product hopping” can dramatically shrink the market for the original generic.

- How mature is the market? Is this a well-developed therapeutic area with numerous competitors, or is it a more unique niche with fewer players?

Aligning Market Opportunity with Technical Capability

A lucrative market opportunity is worthless if a company lacks the capability to seize it. The market analysis must therefore be viewed through the realistic lens of the company’s own technical and financial resources. This internal risk assessment involves asking hard questions :

- Do we have the manufacturing capacity and expertise? If a company has only ever produced solid oral tablets, pursuing a sterile injectable or a complex ophthalmic solution requires a massive investment in new facilities, equipment, and personnel.

- Do we have the capital for development? Does this product require expensive or complex development studies that are beyond our R&D budget?

- Does the product fit our commercial infrastructure? An over-the-counter (OTC) product requires a completely different marketing and sales strategy than a prescription product that is automatically substituted at the pharmacy.

Only when a product clears both the external market opportunity screen and the internal capability screen should it be considered a viable candidate for the development pipeline.

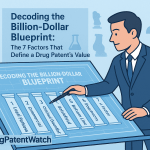

The Power of Patent Intelligence: Using Data to De-Risk Decisions

Once a product is selected, the focus of risk assessment shifts to the intellectual property landscape. As discussed, patent strategy is not a legal support function; it is the central pillar of commercial strategy in the generic industry. The ability to successfully navigate the patent gauntlet is a core source of competitive advantage, and this ability is built on a foundation of superior patent intelligence.

Beyond the Orange Book: Comprehensive Freedom-to-Operate (FTO) Analysis

The FDA’s Orange Book is the starting point for any patent analysis, but it is not the endpoint. A robust Freedom-to-Operate (FTO) analysis involves identifying and evaluating all relevant patents that could be asserted against a generic product, including unlisted process patents or other IP that the brand company may hold.8

For each identified patent, the intelligence team must assess its scope, strength, and duration. This deep analysis informs the core strategic decision for each patent:

- Wait for Expiry: If the patent is strong and expires shortly after other exclusivities, the lowest-risk path may be to simply wait.

- Design Around (Non-Infringement): If the patent claims are narrowly drafted, it may be possible to develop a formulation or manufacturing process that does not technically infringe the patent. This can be a powerful strategy for early market entry.

- Challenge Directly (Invalidity): If the patent claims are broad and appear weak (e.g., there is strong prior art that was not considered by the patent office), a direct P-IV challenge asserting invalidity may be the best path to market.

Leveraging Competitive Intelligence Platforms like DrugPatentWatch

In the past, gathering and analyzing this vast amount of patent and regulatory data was a manual, time-consuming, and often incomplete process. Today, sophisticated competitive intelligence platforms are essential tools for modern risk assessment.

“DrugPatentWatch provides a fully integrated database of drug patents and other critical information. It offers subscribers freeform searching, as well as dynamic browsing, of all types of data pertaining to pharmaceuticals and patents, whether in the US or international countries. The platform also provides data on litigation, tentative approvals, patent expirations, clinical trials, Paragraph IV challenges, top patent holders, and more.”

Platforms like DrugPatentWatch are designed to transform this raw data into actionable business intelligence, directly supporting risk assessment across the organization.35 The benefits for a generic drug developer are immense and directly address the key risks in the commercial and legal domains:

- Anticipate Generic Entry and Competition: By tracking P-IV filings, ongoing litigation, and tentative FDA approvals, a company can build a dynamic map of the competitive landscape. This allows them to predict the timing of competitor launches and, crucially, identify potential first-to-file opportunities for themselves.

- Assess the Competitive Landscape: The platform allows for monitoring of not just standard ANDAs, but also more complex competitive threats from biosimilars and products approved via the 505(b)(2) pathway, providing a complete picture of the market.

- Inform and De-Risk Portfolio Management: The comprehensive data enables a more robust analysis of market opportunities. A business development team can quickly identify drugs with expiring patents and few or no generic competitors, flagging potential low-competition niches that offer higher profit margins.17

- Elucidate Competitor Strategy: By analyzing a competitor’s historical litigation success rates, the types of patents they challenge, and their R&D pipeline, a company can better predict their future actions and formulate a more effective counter-strategy.

In essence, these platforms democratize access to the critical information needed for high-level strategic risk assessment. They level the playing field and make it possible for companies to move beyond reactive decision-making and adopt a proactive, intelligence-driven approach. In the generic industry, where information asymmetry is a primary source of competitive advantage, investing in superior intelligence capabilities is not a cost center; it is a profit center.

Case Study: The First-Mover Advantage in Action

The immense value of strategic timing, informed by robust risk assessment and intelligence, is vividly illustrated by the well-documented first-mover advantage in generic launches. The evidence is overwhelming: the first generic drug to enter a market after brand patent expiry captures a dominant and enduring market share.

Studies consistently show that the initial generic entrant secures a commanding position. When the first generic version of the cholesterol blockbuster atorvastatin (Lipitor) launched, it rapidly captured over 70% of the generic market within months. Similar patterns were observed with the launches of generic escitalopram (Lexapro) and olanzapine (Zyprexa). More recently, Teva’s 2017 launch of generic Viagra, achieved through early filing and an aggressive strategy, resulted in the capture of 70% of the market within a year.

This dominance is not a fleeting phenomenon. The market share advantage of the first mover persists for at least three years, and in some analyses, for up to a decade. This creates a “virtuous cycle” for the early entrant. The initial high market share, often protected by the 180-day exclusivity period, allows the company to establish deep relationships with pharmacies and distributors, build prescribing habits among physicians, and gain patient loyalty. These factors create high “switching costs” that make it incredibly difficult for later entrants to displace the established leader, even if they offer a bioequivalent product at a slightly lower price.

This case study powerfully illustrates the ultimate goal of risk assessment. It is not simply about mitigating downside; it is about identifying and seizing the upside. The entire strategic apparatus—the market intelligence, the FTO analysis, the P-IV legal strategy, the QbD-driven development—is all geared towards one primary commercial objective: being first. The companies that use risk assessment to take the right risks, to confidently and aggressively pursue those high-reward first-to-file opportunities, are the ones that will win on the commercial battlefield.

Section 6: The Future of Risk Mitigation – AI, Machine Learning, and Predictive Analytics

The generic drug industry is standing at a critical inflection point. The traditional models of development and competition, while effective for decades, are being strained by increasing complexity, globalized supply chains, and relentless economic pressures. In this new era, the next frontier of competitive advantage lies in the ability to harness the power of data through Artificial Intelligence (AI) and Machine Learning (ML). These technologies are poised to revolutionize risk assessment, transforming it from a process of historical analysis and educated guesswork into a discipline of forward-looking, predictive intelligence.

The Dawn of Predictive Intelligence in Pharma

The pharmaceutical industry is drowning in data. From the molecular structures of APIs and the vast libraries of scientific literature to the real-time sensor data from manufacturing lines and the complex legal language of patents, the volume and velocity of information have far surpassed the capacity for human analysis.38 This data deluge creates both a challenge and an immense opportunity.

AI and its subset, Machine Learning, are emerging as the essential tools needed to navigate this complexity. ML algorithms excel at detecting subtle patterns, relationships, and trends in massive datasets that are invisible to the human eye. For generic drug development, this means moving beyond reactive problem-solving (e.g., “Why did this batch fail?”) to proactive, predictive optimization (e.g., “What is the probability that this formulation will fail a stability test in 18 months?”).

The FDA’s Evolving Stance: A Risk-Based Framework for AI

Recognizing this transformative potential, regulatory agencies are not standing still. The FDA has seen a significant increase in the number of drug submissions that include AI/ML components and is actively working to develop a flexible, risk-based regulatory framework that can promote innovation while safeguarding patient safety.42

In 2025, the agency issued a pivotal draft guidance, “Considerations for the Use of Artificial Intelligence to Support Regulatory Decision-Making for Drug and Biological Products”.42 This guidance, informed by extensive industry consultation, signals the agency’s expectations for model credibility, transparency, and governance. Furthermore, the FDA has launched proactive initiatives like the Emerging Drug Safety Technology Program (EDSTP), which creates a voluntary channel for sponsors to discuss their novel AI strategies with the agency in a non-binding format. This collaborative posture indicates that the FDA sees AI not as a threat to be controlled, but as a powerful tool to be responsibly harnessed for advancing public health.

Core Applications of AI/ML in Generic Risk Assessment

The application of AI/ML spans the entire generic drug lifecycle, offering the potential to de-risk virtually every critical stage of the process.

Revolutionizing Formulation and Stability Prediction

Formulation development has traditionally been an iterative, resource-intensive process of trial and error. ML is turning it into a digital-first science.

- Predictive Formulation: By training ML models on historical formulation data—including API properties, excipient choices, and process parameters—companies can now predict key quality attributes like tablet hardness, friability, and dissolution profile before a single physical batch is made. This allows formulators to run thousands of “virtual experiments” in a computer to rapidly identify the most promising formulation candidates, dramatically reducing lab time and material costs.

- Predictive Stability: Similarly, ML models can be trained on historical stability data, API chemical structures, and packaging information to predict a product’s degradation rate and shelf life. This provides early confidence in a formulation’s long-term viability and helps de-risk the lengthy and expensive stability programs required for an ANDA submission.

De-risking Bioequivalence with In Silico Modeling

The bioequivalence study is one of the highest-risk and highest-cost steps in generic development. AI is offering a path to mitigate this risk through in silico (computer-based) modeling.

- ML-Enhanced PBPK Modeling: Physiologically Based Pharmacokinetic (PBPK) models simulate how a drug is absorbed, distributed, metabolized, and excreted in the human body. When enhanced with ML algorithms trained on existing clinical data, these models can predict the key PK parameters (Cmax and AUC) for a new generic formulation with remarkable accuracy. This allows a company to simulate the outcome of a BE study before enrolling a single patient, enabling them to optimize the formulation to maximize the probability of success.

- Optimizing Clinical Trial Design: ML can also be used to optimize the design of the BE study itself. By analyzing data from previous trials, algorithms can identify demographic or genetic factors that contribute to PK variability, allowing for smarter subject selection. They can also predict patient dropout rates, helping to ensure the trial is adequately powered to succeed.

Supercharging Patent and Commercial Strategy

The complex, data-rich world of patent litigation and commercial forecasting is a perfect fit for machine learning.

- Predictive Litigation Analysis: Natural Language Processing (NLP) models can be trained to “read” and understand the complex legal language of patents and court rulings. By analyzing the specific claims of a patent, the history of the patent examiner, and the outcomes of thousands of previous litigation cases, these models can generate a “patent strength score” or a “likelihood of invalidation” probability. This transforms the high-stakes gamble of a P-IV challenge or an at-risk launch into a calculated, data-driven decision.

- Nuanced Commercial Forecasting: ML models can create far more sophisticated forecasts of market share and price erosion than traditional methods. By integrating dynamic variables like real-world prescription data, competitor clinical trial activity, and even sentiment analysis from physician forums, these models can provide a more accurate and probabilistic picture of a product’s future commercial viability.

Enhancing Quality and Manufacturing

AI brings predictive power directly to the factory floor, enabling a shift from reactive quality control to proactive quality assurance.

- Predictive Maintenance: By analyzing real-time sensor data from manufacturing equipment (e.g., temperature, pressure, vibration), ML models can detect subtle deviations from normal operation that are precursors to equipment failure. This allows maintenance to be scheduled proactively, preventing costly unplanned downtime and potential batch loss.

- Real-Time Anomaly Detection: ML models can be trained on the data from historical “golden batches” that represent ideal manufacturing runs. The system can then monitor a live production run in real-time and flag any deviation from the golden profile as an anomaly. This allows operators to intervene immediately to correct the process, ensuring consistent quality and preventing an entire batch from going out of specification.

The Implementation Challenge: Building the AI-Ready Organization

Harnessing the power of AI is not as simple as buying new software. It is a fundamental strategic transformation that requires significant investment and organizational change.38

- Data Infrastructure and Governance: The adage “garbage in, garbage out” is especially true for AI. The success of any ML model is entirely dependent on the quality and quantity of the data it is trained on. Companies must invest in building robust data infrastructure and implementing strong data governance policies. Adhering to the FAIR Principles—ensuring data is Findable, Accessible, Interoperable, and Reusable—is a critical prerequisite for a successful AI strategy.

- Talent and Culture: AI does not replace human experts; it augments them. A successful AI implementation requires building cross-functional teams that bring together data scientists with deep technical skills and formulation scientists, regulatory experts, and business leaders with deep domain knowledge. It also requires upskilling the existing workforce and fostering a culture that trusts data-driven insights and is empowered to act on them.

The adoption of AI in the generic pharmaceutical industry will inevitably create a new “digital divide.” The gap between the companies that successfully build these predictive capabilities and those that do not will widen rapidly. AI is not just a tool for improving efficiency; it is a tool for fundamentally changing the risk-reward calculation. By reducing the uncertainty around the biggest risks in development—formulation failure, BE failure, litigation loss—AI allows companies to take on higher-risk, higher-reward projects with greater confidence. The companies that master this new technology will be able to build portfolios that their less-advanced competitors would deem “too risky,” unlocking new, less-crowded market opportunities and securing a lasting competitive advantage.

Conclusion: Risk Assessment as the Engine of Sustainable Value Creation

The journey through the labyrinth of generic drug development reveals a landscape of profound and interconnected risks. From the exacting demands of the ANDA pathway and the scientific tightrope of bioequivalence to the brutal economics of the commercial battlefield, the challenges are relentless. In this environment, risk assessment has evolved far beyond a defensive, compliance-driven necessity. It has become the core offensive strategy for navigating the industry’s inherent paradoxes and achieving sustainable success.

The traditional, siloed approach to managing risk is no longer viable. A manufacturing failure is a quality failure, which can become a regulatory failure, which is ultimately a commercial failure. Success today demands a holistic, integrated Quality Risk Management system, where proactive frameworks like Quality by Design provide the strategic blueprint, and tactical tools like FMEA and HACCP are used to systematically identify and mitigate risks at every stage of the lifecycle.

Furthermore, in a market where the timing of entry dictates profitability, legal and IP strategy is inextricably linked with commercial strategy. The high-stakes decisions surrounding patent challenges and at-risk launches are not merely legal matters; they are the primary drivers of value creation. These decisions, in turn, must be fueled by superior business intelligence. The ability to gather, interpret, and act on patent, regulatory, and market data faster and more accurately than the competition is a key differentiator, and platforms like DrugPatentWatch have become indispensable tools in this intelligence-driven arms race.

Looking ahead, the very nature of risk assessment is being redefined by the advent of Artificial Intelligence and Machine Learning. The shift from historical analysis to predictive intelligence will create a new competitive chasm in the industry. Companies that invest in building the data infrastructure, talent, and culture to harness AI will be able to de-risk development, optimize their portfolios, and make strategic decisions with a level of confidence previously unimaginable.

Ultimately, the future of the generic drug industry belongs to those organizations that view risk not as a threat to be avoided, but as a landscape to be navigated with skill, intelligence, and strategic foresight. It belongs to the firms that can integrate deep scientific understanding, proactive quality management, and superior business intelligence into a single, cohesive engine of value creation. These are the companies that will not only survive the labyrinth but thrive within it, sustainably delivering the promise of affordable, high-quality medicines to patients around the world.

Key Takeaways

- Risk is Interconnected: Scientific, regulatory, quality, and commercial risks are deeply intertwined. A failure in one domain inevitably cascades into others. A holistic, integrated risk management approach that breaks down departmental silos is non-negotiable for success.

- Proactive QRM is a Competitive Advantage: Investing in frameworks like Quality by Design (QbD) and Failure Mode and Effects Analysis (FMEA) at the outset of development is a strategic imperative. This “build quality in” approach de-risks the entire lifecycle, reducing costly delays, batch failures, regulatory rejections, and accelerating time-to-market.

- Patent Strategy is Commercial Strategy: In the hyper-competitive generic world, legal and intellectual property strategy—particularly the aggressive pursuit of Paragraph IV challenges to secure 180-day exclusivity—is the primary driver of commercial success and long-term profitability.

- Intelligence is Power: The ability to gather, interpret, and act on patent, regulatory, and market intelligence faster and more accurately than competitors is a decisive advantage. Platforms like DrugPatentWatch are essential tools for transforming raw data into the actionable intelligence needed to make winning portfolio and litigation decisions.

- The Future is Predictive: Artificial Intelligence and Machine Learning are transforming risk assessment from a historical, reactive analysis to a forward-looking, predictive science. Early and effective adoption of these technologies to forecast formulation success, bioequivalence outcomes, and litigation probabilities will create a significant and lasting competitive divide in the industry.

Frequently Asked Questions (FAQ)

1. What is the single biggest “hidden” risk that generic drug developers often underestimate?