In the biopharmaceutical industry, a sales forecast is more than a line on a spreadsheet; it is the financial backbone of corporate strategy, the numerical expression of a company’s hopes and plans.1 These projections dictate multibillion-dollar R&D investments, inform high-stakes M&A valuations, guide the allocation of commercial resources, and ultimately determine a company’s ability to deliver life-altering medicines to patients.1 Yet, for an activity so critical, its track record is alarmingly poor. The landscape is littered with forecasts that have missed the mark not by inches, but by miles.

Consider the stark reality: a comprehensive study of 1,700 forecasts for 260 drugs revealed that actual peak sales diverged by a staggering 71% from predictions made just one year before launch. Many of these projections were not just optimistic; they were wildly inflated, overstating sales by more than 160%.4 Another rigorous analysis conducted in Austria found a median overestimation of 33%, with a majority of forecasts—55.9%—being severely inaccurate, either overshooting by more than 100% or undershooting by more than 50%. This isn’t a rounding error; it’s a systemic crisis of predictability. In an industry where a single late-stage clinical trial failure can erase billions in investment, such forecasting inaccuracy is an existential threat. It can, quite literally, “make or break a company”.

This “inaccuracy epidemic” is not a symptom of incompetence or a lack of effort. Rather, it is the direct result of attempting to navigate a uniquely complex and volatile ecosystem with inadequate tools. Unlike consumer goods or technology, biopharma sales are not driven by simple economic cycles or marketing campaigns alone. They are the unpredictable output of a deeply interconnected system, a chaotic dance between profound scientific discovery in clinical trials, the rigid legal frameworks of intellectual property, the labyrinthine pathways of regulatory approval, and the ever-shifting sands of market access and competitor actions.4 In such an environment, traditional, linear forecasting methods that rely on simple extrapolation are destined to fail. They are the equivalent of trying to predict the path of a hurricane with a weather vane.

This report is designed to be the antidote to that uncertainty. It is an expert-level guide to mastering biopharma sales forecasting through the power of regression analysis. We will move beyond the crystal ball of gut-feel and simple trend lines to build a robust, data-driven engine for prediction. This is not a purely academic exercise. It is a strategic manual for business leaders, designed to transform the very complexity that causes forecasting failures into a source of profound competitive advantage. We will deconstruct the forecaster’s toolkit, providing a step-by-step methodology for building and validating powerful regression models. More importantly, we will show how to integrate the unique, high-impact variables of our industry—from the nuances of clinical trial data and the strategic value of a patent portfolio to the market-shaping force of regulatory designations. By the end of this report, you will not only understand how to build a more accurate forecast; you will understand how to use that forecast as a strategic weapon to drive smarter R&D investment, sharper M&A decisions, and more profitable commercial execution.

Part 1 – Deconstructing the Forecaster’s Toolkit: The Foundations of Regression Analysis

Before we can build a superior forecasting engine, we must first understand the principles of its design. This section lays the groundwork, moving from the “why” of regression to the “what” and “how” of its various forms and outputs. It is a primer for the business strategist, translating the language of statistics into the language of competitive advantage.

Beyond the Crystal Ball: Why Regression Analysis is the Bedrock of Modern Forecasting

For decades, many pharmaceutical forecasting efforts have relied on simpler, extrapolative methods. The Naïve model, which assumes next month’s sales will be the same as last month’s plus a growth factor, or the moving average method, which smooths out historical data, have been common tools.3 While useful for establishing a baseline, these methods share a fundamental flaw: they are descriptive, not explanatory. They can tell you

what happened, but they offer no insight into why it happened. They treat the market as a black box, observing the outputs without understanding the internal wiring.

Regression analysis shatters that black box. It is the most “mathematically minded” method of forecasting, a statistical technique designed specifically to identify and, crucially, to quantify the relationships between variables.12 At its core, regression analysis has four primary purposes that elevate it from a simple prediction tool to a strategic instrument: description, estimation, prediction, and control.

- Description: It describes the nature of the relationship between a dependent variable (the outcome you want to predict, such as drug sales or market share) and one or more independent variables (the factors you believe influence that outcome, such as marketing spend, competitor actions, or clinical data).13

- Estimation: It uses the observed values of the independent variables to estimate the value of the dependent variable.

- Prediction: It allows you to forecast future outcomes by plugging in expected future values for your independent variables.

- Control: This is where its true strategic power lies. By understanding the quantified impact of each independent variable, you can perform “what-if” scenario planning. What if we increase our sales force by 10%? What if a new competitor enters the market? What if we achieve a superior clinical endpoint? Regression provides a quantitative framework to model the impact of these decisions before they are made.

This shift from extrapolation to explanation is not merely a technical upgrade; it represents a profound cultural shift in how strategic decisions are made. In an industry where choices can be swayed by the loudest voice in the room, internal politics, or institutional inertia, regression analysis provides an objective, evidence-based framework. It forces teams to move beyond vague assertions and to quantify their assumptions, testing their hypotheses against the unforgiving reality of data. This aligns perfectly with the “truth-seeking” culture that visionary leaders, such as Mene Pangalos, Executive Vice President of BioPharmaceuticals R&D at AstraZeneca, have championed as essential for success. When high-stakes decisions about which drugs to advance, which companies to acquire, and how to allocate billions in capital are on the line, relying on a data-driven, defensible methodology is not just good practice—it is a fiduciary responsibility. Regression analysis provides the statistical rigor to meet that standard.

The Forecaster’s Lexicon: A Practical Guide to Regression Models

The term “regression” is not monolithic; it encompasses a family of models, each tailored to answer a different type of question. For the biopharma strategist, understanding this lexicon is crucial. The choice of model is not a trivial statistical detail; it is a strategic decision that must align with the business objective. The model must follow the mission. A team forecasting monthly sales for a mature influenza vaccine will use a different tool than a market access team trying to predict the probability of a new oncology drug gaining preferred formulary status. A sophisticated forecasting function doesn’t have a single model; it has a toolkit, and knows when to use each tool.

Simple and Multiple Linear Regression: The Workhorse Models

The most foundational and widely understood models are linear regressions. They assume a straight-line relationship between the independent and dependent variables.

The equation for a simple linear regression is likely familiar to anyone who has taken a basic statistics course: Y=a+bX+ϵ.14 Here,

Y is the dependent variable (e.g., quarterly sales), X is a single independent variable (e.g., number of sales calls made), a is the intercept (the value of Y when X is zero), b is the coefficient (the slope of the line, representing the change in Y for a one-unit change in X), and ϵ is the error term, accounting for the variability that the model doesn’t explain.14 While illustrative, simple linear regression is rarely sufficient to capture the complexity of the biopharma market.

This is where multiple linear regression becomes the indispensable workhorse. As its name implies, it extends the simple model by incorporating multiple independent variables (X1,X2,X3,…) to analyze their combined effect on the dependent variable. The equation expands accordingly: Y=β0+β1X1+β2X2+…+βnXn+ϵ.

This is the model that allows a forecaster to simultaneously assess the impact of marketing spend, the number of competitors, time on the market, and pricing on a drug’s sales volume. Its applications are vast and strategically critical. For example, in high-stakes pharmaceutical antitrust litigation, economists frequently employ multiple regression to create a “but-for” world—a counterfactual scenario estimating what a drug’s price would have been absent an alleged anti-competitive action, like a “pay-for-delay” agreement that postpones generic entry. The difference between the actual price and the model’s “but-for” price can be used to quantify damages, turning the regression model into a central piece of evidence in legal disputes worth billions.

Time-Series Models: Capturing Momentum and Seasonality

While multiple linear regression is excellent at explaining the drivers of sales, a specialized class of models is designed to analyze the structure of the sales data over time. Any time-series data, such as monthly sales figures, can be decomposed into four constituent components:

- Level: The average value of the series.

- Trend: The long-term increasing or decreasing pattern.

- Seasonality: The repeating, short-term cycle in the series (e.g., higher sales of allergy medication in the spring).

- Noise: The random, unpredictable variation.

Time-series models are designed to capture these components to project future values. One of the most powerful and commonly used tools is the ARIMA (Auto-Regressive Integrated Moving Average) model.3 The name itself describes its three parts:

- AR (Auto-Regressive): It assumes that future values are dependent on past values. The model uses the relationship between an observation and a certain number of lagged observations.

- I (Integrated): It uses differencing of the raw data to make the time-series stationary (i.e., removing the trend and seasonality so its statistical properties don’t change over time), which is a prerequisite for the model.

- MA (Moving Average): It uses the dependency between an observation and the residual errors from a moving average model applied to lagged observations.

For data with a clear seasonal pattern, an extension called SARIMA (Seasonal ARIMA) is used, which adds seasonal parameters to the model. These models are particularly potent for forecasting in-market products with a stable history, such as forecasting demand for a drug based on past sales trends that show clear seasonal variations, like flu season.3 Research has also shown that hybrid models, such as one combining ARIMA with another technique like Holt-Winters exponential smoothing (ARIMA-HW), can produce even more accurate forecasts by leveraging the strengths of both approaches.

Logistic and Other Models: Answering Different Questions

The biopharma world is filled with critical questions where the outcome isn’t a continuous number like sales revenue. This is where other types of regression models become essential.

Logistic Regression is used when the dependent variable is binary, or dichotomous—that is, it can only take one of two values (e.g., Yes/No, 1/0, Success/Failure).17 Instead of predicting a value, it predicts the

probability of an outcome occurring. For example, a market access team could use logistic regression to model the probability of a patient adhering to a therapy regimen (Yes/No) based on independent variables like age, co-payment level, and disease severity. Or it could be used to predict the likelihood of a drug receiving regulatory approval based on the strength of its clinical data.21

Other specialized models in the forecaster’s toolkit include:

- Poisson Regression: Used when the dependent variable is count data (e.g., the number of adverse events reported in a month, the number of patients enrolled in a trial per week).17

- Cox Proportional Hazards Regression: A type of survival analysis used for time-to-event data. This is invaluable in a clinical context, for instance, to model the time until disease progression or death, and to understand how factors like treatment type, patient demographics, or biomarkers influence that survival time.17

By mastering this lexicon, the strategic forecaster can ensure they are always applying the right analytical tool to the right business problem, generating not just numbers, but relevant and actionable intelligence.

Reading the Tea Leaves: How to Interpret Regression Output Like a Strategist

A regression model is only as valuable as the insights it yields. For a business leader, the goal is not to become a statistician but to understand how to translate the model’s output into a coherent and actionable business narrative. The key is to look past the numbers and see the story they are telling about your market, your product, and your competition.

Understanding Coefficients: The Magnitude and Direction of Impact

The regression coefficient—the ‘b’ or ‘β’ in the equation—is the most direct link between your actions and the market’s reaction.17 Interpreting it involves looking at two things: its sign and its magnitude.

- The Sign (Positive or Negative): This tells you the direction of the relationship.13 A positive coefficient means that as the independent variable increases, the dependent variable also tends to increase. For example, a positive coefficient for “Sales Force FTEs” implies that adding more sales reps is associated with higher sales. A negative coefficient indicates an inverse relationship: as the independent variable increases, the dependent variable tends to decrease. A negative coefficient for “Number of Competitors” is the statistical confirmation of a fundamental business truth: more competition is associated with lower sales or prices for your product.

- The Magnitude (The Value): This quantifies the relationship. The coefficient’s value represents the average change in the dependent variable for every one-unit increase in the independent variable, while holding all other variables in the model constant.18 This last part is critical. It allows you to isolate the impact of a single factor. For instance, if you have a multiple regression model for monthly sales and the coefficient for “DTC Marketing Spend (in $1,000s)” is +2.5, it means that for every additional $1,000 you spend on direct-to-consumer advertising, you can expect to sell an additional 2.5 units of your drug, assuming all other factors (like pricing, competitor actions, etc.) remain unchanged. This transforms a marketing budget from a line-item expense into a quantifiable lever for growth.

P-values and Confidence Intervals: Separating Signal from Noise

Just because a model produces a coefficient doesn’t mean the relationship it represents is real. It could have occurred simply by random chance. This is where the p-value comes in. The p-value tests the null hypothesis that the coefficient is equal to zero (i.e., that there is no relationship between the independent and dependent variable). A small p-value indicates that you can reject the null hypothesis.13

The commonly accepted threshold for statistical significance is a p-value less than or equal to 0.05. This means there is a 5% or less probability that the relationship you’ve observed in your data is due to random noise. A significant p-value gives you the confidence to say that the independent variable has a real, measurable impact on your outcome. It allows you to separate the true drivers of your business from the statistical mirages. For a strategist, this is invaluable. It helps you focus resources and attention on the factors that actually move the needle.

Confidence Intervals provide a related and often more intuitive measure. A 95% confidence interval gives you a range of values within which you can be 95% confident the true coefficient lies. If this interval does not contain zero, it is equivalent to having a p-value of less than 0.05.

R-squared and Adjusted R-squared: Gauging Model Fit (with Caution)

The coefficient of determination, or R-squared (R2), is a measure of how well your model fits the data. It represents the proportion of the variance in your dependent variable that can be explained by your independent variables.21 It ranges from 0 to 1 (or 0% to 100%). An

R2 of 0.75 means that 75% of the variation in your sales can be explained by the variables included in your model.

However, R-squared must be interpreted with extreme caution. A common mistake is to chase a high R2 as the ultimate goal. The value of R-squared will always increase as you add more variables to the model, even if those variables are completely irrelevant. This can lead to “overfitting,” where the model perfectly explains your historical data but is useless for predicting the future.

This is why Adjusted R-squared is a superior metric. It adjusts the R-squared value based on the number of independent variables in the model. Adjusted R-squared will only increase if the new variable you add improves the model more than would be expected by chance. It penalizes you for adding useless variables, making it a much more honest measure of model fit.

Ultimately, the goal is not the highest possible R-squared, but the most logical and interpretable model. A model with a slightly lower Adjusted R-squared but with coefficients that all make business sense and are statistically significant is far more valuable than a complex, overfitted model with a high R-squared that no one can understand or trust. For a strategist, the narrative behind the numbers is paramount. A significant negative coefficient for a competitor’s marketing spend is not just a statistic; it is quantifiable proof of a market vulnerability that may demand a swift and decisive strategic response. The job of the forecaster is to uncover that narrative and present it with clarity and confidence.

Part 2 – Building the Engine: A Step-by-Step Guide to Your Biopharma Regression Model

With a firm grasp of the foundational concepts, we now turn to the practical task of construction. Building a robust regression model is a systematic process, akin to engineering a high-performance engine. Every component must be carefully selected, meticulously prepared, and rigorously tested. A flaw in any single step can compromise the integrity of the entire system. This section provides a step-by-step guide to this process, tailored specifically for the unique data landscape of the biopharmaceutical industry.

Step 1: Laying the Foundation – Data Sourcing, Cleaning, and Preparation

The axiom “garbage in, garbage out” has never been more true than in regression modeling. The ultimate quality and predictive power of your forecast are entirely contingent on the quality of the data you feed into it. This initial stage of data preparation is not a mundane, janitorial task; it is a deeply strategic exercise that shapes the very reality the model will interpret.

The process begins with sourcing and consolidating data from a wide array of disparate locations. Internally, this means pulling information from siloed sales, marketing, and finance systems.5 Externally, it involves gathering data on competitors, market trends, and regulatory changes. This is often a slow, manual process, with some teams still hand-transcribing data from websites and PDFs—a practice that is both inefficient and dangerously prone to error.

Once gathered, the raw data must undergo a rigorous process of cleaning and transformation. This involves several key activities:

- Handling Missing Values and Outliers: Real-world data is rarely perfect. It will have gaps and anomalies. Techniques must be employed to address these issues, such as imputation for missing values (e.g., using the mean, median, or a more sophisticated method like K-nearest neighbors) and statistical tests to identify and handle outliers.25 Critically, this should not be done in a vacuum. Collaboration with domain experts, such as pharmacists or clinicians, is essential to determine whether an anomaly is a true outlier or a data entry error that needs correction.

- Standardization and Classification: To enable meaningful comparisons, data must be standardized. This includes ensuring uniform metrics across the dataset and using a systematic classification system for products. A best practice in pharma is to employ the World Health Organization’s Anatomical Therapeutic Chemical (ATC) Classification System. This allows a forecaster to group a diverse range of products into distinct, therapeutically relevant categories (e.g., grouping all acetic acid derivatives used for pain under M01AB), which is pivotal for conducting focused and valid analysis.

- Structuring and Aggregation: The granularity of the data must be strategically chosen. Sales data might be available on an hourly or daily basis, but this level of detail often includes significant noise. Aggregating the data into a weekly or monthly framework can smooth out this daily variability, better capture significant trends, and align the forecast with operational and business planning cycles.

The decisions made at this stage are not mere technicalities. Choosing to aggregate data weekly versus quarterly can reveal or obscure the impact of a competitor’s short-term marketing blitz. The method used to handle an outlier can materially change a coefficient’s value. Data preparation is where the forecaster begins to impose a logical structure on the chaos of raw information, and this structure will fundamentally define the strategic insights the model can ultimately provide.

Step 2: Choosing Your Weapons – Selecting and Engineering Independent Variables

This is the creative and intellectual heart of model building. Here, the forecaster moves beyond a simplistic, product-centric view and adopts a holistic, market-centric perspective. The goal is to identify and quantify every significant factor that could plausibly influence sales. This requires a paradigm shift, looking outward at the entire marketplace—competitors, patients, payers, and regulators—not just inward at your own product’s history.

The selection of these independent variables is the single most important determinant of the model’s explanatory power. A comprehensive model must draw from multiple domains: commercial, clinical, intellectual property, regulatory, and macroeconomic. The following table provides a structured, actionable checklist for forecasters, consolidating the unique drivers of the biopharma industry into a single framework. It serves as both a brainstorming tool and a quality control checklist to ensure no critical factor is overlooked.

Table 1: Key Independent Variables for a Biopharma Sales Forecast Model

| Category | Variable | Potential Quantification | Rationale & Context | Data Sources |

| Commercial & Marketing | Marketing Spend (by channel) | Dollars ($) spent on DTC, HCP, Digital, etc. | To measure the ROI of specific marketing efforts and optimize budget allocation.22 | Internal Finance/Marketing Data |

| Sales Force Size / Detailing Reach | Number of Full-Time Equivalents (FTEs); % of target physicians detailed. | To quantify the impact of sales force presence and promotional activity on prescribing behavior.9 | Internal Sales Ops Data, CRM | |

| Pricing (List & Net) | Wholesaler Acquisition Cost (WAC); Average Sales Price (ASP) after rebates. | To model price elasticity and the impact of gross-to-net adjustments on demand and revenue.29 | Internal Finance, Payer Contracts | |

| Promotions & Rebates | Value of co-pay cards; % rebate offered to payers. | To understand how patient and payer incentives influence uptake and formulary placement.28 | Internal Market Access Data | |

| Time on Market | Number of months/years since launch. | To capture lifecycle effects, such as initial growth, maturity, and decline. | Internal Data | |

| Market & Competitive | Number of Competitors | Count of branded and/or generic competitors in the same therapeutic class. | A fundamental driver of price and volume erosion; a key measure of market saturation.9 | Market Research, DrugPatentWatch |

| Competitor Market Share | Competitor’s share of total prescriptions (TRx) or volume. | To model the direct impact of a dominant competitor’s position on your own sales. | IQVIA, Symphony Health | |

| Competitor Event (Launch/Withdrawal) | Binary variable (1/0) for the month a major competitor enters or exits the market. | To capture the sharp, event-driven shifts in market dynamics.9 | Press Releases, Industry News | |

| Market Size / Growth Rate | Total market revenue ($) or volume (units) and its annual growth rate (%). | To contextualize your product’s performance within the broader therapeutic area trends. | Market Research Reports | |

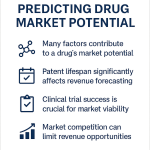

| Clinical & Epidemiological | Target Patient Population | Incidence (new cases/year) or Prevalence (total cases) of the disease. | The foundational variable for any patient-based forecast; defines the total potential market.8 | Epidemiology Reports, Literature |

| Diagnosis & Treatment Rates | Percentage (%) of prevalent population that is diagnosed; % of diagnosed who are treated. | To “haircut” the total population down to the addressable market of patients actively seeking care.28 | Market Research, Claims Data | |

| Clinical Trial Outcomes | E.g., Overall Survival benefit (months), Adverse Event rate (%), Objective Response Rate (%). | To quantify how clinical superiority (or inferiority) relative to the standard of care drives physician adoption and value perception. | Published Trial Data, ClinicalTrials.gov | |

| Patient Adherence / Compliance | Percentage (%) of patients who remain on therapy for the prescribed duration. | A critical factor for chronic therapies that directly impacts total volume sold per patient.4 | Real-World Evidence (RWE), Claims Data | |

| Intellectual Property (IP) | Years to Patent Expiry | Number of years until the primary composition of matter patent expires. | The single most important predictor of the “patent cliff” and subsequent revenue collapse.36 | DrugPatentWatch, USPTO, Orange Book |

| Patent Portfolio Strength | A composite score based on # of patents, % method-of-use, patent family size. | To create a more nuanced measure of IP defensibility beyond a single date, reflecting the strength of “patent thickets”.36 | DrugPatentWatch, Patent Analytics Platforms | |

| Litigation Status | Binary variable (1/0) indicating active patent litigation (e.g., Paragraph IV challenge). | To model the risk of an earlier-than-expected generic entry due to a successful legal challenge. | Legal Databases, DrugPatentWatch | |

| Regulatory & Payer | Special Designation (Orphan/BTD) | Binary variable (1/0) for having Orphan Drug or Breakthrough Therapy Designation. | These designations signal high unmet need and can accelerate uptake, justifying higher prices.40 | FDA, EMA Websites |

| Reimbursement Status / Tier | Payer formulary tier (e.g., 1=Preferred, 2=Non-Preferred, 3=Not Covered). | A direct measure of market access; higher tiers mean higher patient out-of-pocket costs and lower uptake.6 | Payer Coverage Policies, Formulary Data | |

| Payer Restrictions | Binary variable (1/0) for the presence of utilization management like Prior Authorization or Step Edits. | To model the friction and administrative hurdles that limit patient access and reduce filled prescriptions. | Payer Coverage Policies | |

| Macroeconomic & External | GDP Growth / Healthcare Spending | Annual GDP growth (%); changes in national healthcare spending policies. | To account for broad economic factors that can influence overall healthcare utilization and funding.9 | Government Statistics, Economic Reports |

| Major Health Event | Binary variable (1/0) for a significant event like a pandemic. | To account for massive, exogenous shocks that disrupt normal prescribing and patient behavior patterns.9 | News, Public Health Data |

Step 3: Building with Confidence – Model Training, Testing, and Validation

Once the data has been prepared and the variables selected, the model can be built. However, simply running the regression algorithm is not enough. A rigorous process of testing and validation is required to ensure the model is statistically sound, predictive, and not just an exercise in “overfitting” the historical data. This process is as much about building organizational trust in the forecast as it is about achieving statistical accuracy.2

The validation workflow involves several critical stages:

- Splitting the Data: The first step is to divide your historical dataset into at least two parts: a training set and a testing set (often a 70/30 or 80/20 split).21 The model is “trained” or built only using the training data. Its performance is then evaluated on the “unseen” testing data. This simulates how the model will perform in the real world when predicting future, unknown outcomes.

- Cross-Validation: A more robust technique is k-fold cross-validation. Here, the data is split into ‘k’ subsets (or folds). The model is trained on k-1 folds and tested on the remaining fold. This process is repeated ‘k’ times, with each fold serving as the test set once. The results are then averaged. This gives a more reliable estimate of the model’s performance and reduces the risk that the results are simply an artifact of one particular train/test split.

- Evaluating Performance with Metrics: The model’s accuracy is quantified using performance metrics. Common choices include MAPE (Mean Absolute Percentage Error), which measures the average percentage error, and RMSPE (Root Mean Square Percentage Error).43 The key is to select a metric and use it consistently to compare different models.

- Benchmarking: A sophisticated model is only useful if it outperforms simpler alternatives. The regression model’s performance should always be compared against baseline models, such as the Naïve method, moving averages, or simple exponential smoothing.11 If your complex multiple regression model cannot produce a more accurate forecast than a simple benchmark, its added complexity is not justified.

- Residual Analysis: After the model is built, it’s crucial to examine the residuals (the differences between the model’s predicted values and the actual observed values). A residual plot should show a random scatter of points around zero. If any non-random patterns emerge (e.g., a curve, a funnel shape), it’s a red flag that the model’s underlying assumptions have been violated and it may be misspecified.

- Sensitivity Analysis: The final step is to “stress test” the model. A sensitivity analysis involves systematically changing key assumptions or input values to see how much the forecast changes. How sensitive is the forecast to a 10% change in price? What is the impact of removing a potential outlier? A robust model will produce stable forecasts that don’t swing wildly with minor changes in the inputs.

When a forecaster can walk into a boardroom and demonstrate that their model was trained and tested on separate datasets, that it robustly outperforms simple benchmarks, that its residuals are clean, and that its outputs are stable under sensitivity analysis, they are no longer presenting a mere opinion. They are presenting a piece of defensible, transparent, and trustworthy strategic intelligence. This validation process is the essential bridge between the data science lab and the C-suite, building the confidence required for leaders to make bold, data-driven decisions.

Part 3 – The Biopharma Edge: Integrating Advanced, Industry-Specific Variables

A generic sales forecasting model can predict revenue for soap or software. But to achieve true precision in the biopharmaceutical sector, the model must be imbued with the industry’s unique and complex DNA. This means going beyond standard commercial variables and learning how to quantify and integrate the powerful predictive signals embedded in clinical trial data, intellectual property landscapes, and special regulatory designations. This is where a good forecast becomes a great one, and where data is transformed into a decisive competitive edge.

Decoding the Clinic: How to Quantify and Model Clinical Trial Data

Clinical trial data is the scientific soul of a new medicine. It is also a rich, and often underutilized, source of predictive commercial information. The journey of a drug through its clinical phases is a story of progressive de-risking and information gathering, with each stage providing increasingly granular data that can be systematically integrated into a forecasting model. Transforming this scientific data into quantitative inputs is a critical skill for the modern biopharma forecaster.

The key is to understand that the degree of clinical differentiation a drug demonstrates over the existing standard of care is not just a talking point for marketing brochures; it is a direct, quantifiable predictor of its commercial velocity—the speed of market penetration. A regression model can be built to demonstrate, for example, that for every additional month of Overall Survival (OS) an oncology drug provides, the time it takes to reach its peak market share decreases by a predictable quantum. This allows companies to forecast not just what their peak sales will be, but how fast they will get there, a crucial insight for launch planning, manufacturing scale-up, and resource allocation.

The following table provides a clear, structured framework for this translation process. It operationalizes the concept of using clinical data for commercial forecasting by linking the specific data points collected in each phase to their strategic relevance and a potential quantifiable variable for a regression model.

Table 2: Forecasting Impact of Clinical Trial Data by Phase

| Phase | Primary Objectives | Key Data Collected | Forecasting Relevance | Potential Quantifiable Variable for Regression |

| Phase I | Assess safety, dosage, PK/PD | Maximum Tolerated Dose (MTD), Dose-Limiting Toxicities (DLTs), Pharmacokinetics (PK) & Pharmacodynamics (PD) profiles. | Early de-risking of the asset. Informs initial Probability of Success (POS) for rNPV models. Go/No-Go investment decisions. | Variable: Binary flag (1/0) for favorable vs. unfavorable PK/PD profile. Application: Used as an input to adjust the overall POS in a risk-adjusted Net Present Value (rNPV) valuation model. |

| Phase II | Preliminary efficacy and further safety | Objective Response Rate (ORR), Progression-Free Survival (PFS), biomarker prevalence in responders. | First concrete efficacy signal. Enables market segmentation and more precise definition of the addressable patient population.4 | Variable 1: ORR (%) or median PFS (months) as a continuous variable. Variable 2: Biomarker prevalence (%) to adjust the total patient population size. Application: Refines the addressable market size and provides the first quantitative input on potential clinical value. |

| Phase III | Confirm efficacy, monitor side effects, compare to Standard of Care (SoC) | Statistically significant Overall Survival (OS) or PFS benefit vs. SoC; comprehensive Adverse Event (AE) profile (% of Grade 3+ AEs); Quality of Life (QoL) data. | Drives physician adoption, payer reimbursement, and pricing power. Key for competitive differentiation and regulatory approval. | Variable 1: OS/PFS benefit vs. SoC (in months) as a continuous variable. Variable 2: Rate of severe AEs (% Grade 3+) as a continuous variable. Application: These become powerful predictors of peak market share, uptake speed, and net price realization. |

| Phase IV / RWE | Post-market surveillance, long-term effects, real-world use | Real-World Evidence (RWE) on adherence rates, long-term or rare safety signals, effectiveness in diverse populations. | “Reality check” for initial forecasts. Informs lifecycle management, potential label expansions, or new safety warnings. | Variable 1: Real-world adherence rate (%) to refine gross-to-net calculations. Variable 2: Binary flag (1/0) for the emergence of a new black box warning. Application: Used to update and refine in-market forecasts and model lifecycle scenarios. |

By systematically incorporating these variables, the forecast model becomes a living document, evolving in its sophistication and accuracy as the drug itself moves closer to market.

The Patent as a Predictive Tool: Modeling the Intellectual Property Landscape

In the pharmaceutical industry, a patent is not just a legal document; it is the financial fortress that protects a drug’s revenue stream. The period of market exclusivity granted by a patent is the single most important driver of a branded drug’s profitability. Consequently, the erosion of that exclusivity—the infamous “patent cliff”—is one of the greatest threats to a company’s financial stability. With over $200 billion in biopharma revenue facing loss of exclusivity (LoE) by 2030, accurately forecasting the timing and impact of this cliff is a strategic imperative.

A naive forecast might simply model a drug’s revenue falling off a cliff on the day its primary patent expires. This is a mistake. The reality of the intellectual property (IP) landscape is far more nuanced and, for the savvy forecaster, far more predictable. A sophisticated model moves beyond a single expiration date and quantifies the entire IP ecosystem.

This begins with understanding the phenomenon of “patent thickets.” Major pharmaceutical companies strategically build a dense web of overlapping patents around their blockbuster drugs to delay generic competition. For top-selling drugs in the U.S., this can average 74 granted patents, compared to just 18 in Europe. These thickets include not just the primary composition of matter patent, but dozens of secondary patents covering formulations, methods of use, and manufacturing processes. In fact, 72% of patents for top drugs are filed after FDA approval, and these late-filed patents are associated with an average of 7.7 years of additional exclusivity.21

This complexity, however, contains a predictive signal. Instead of using a single “years to expiry” variable, a forecaster can engineer a more powerful, composite “IP Strength Score.” This score, derived from comprehensive databases like those provided by DrugPatentWatch, moves beyond a binary “on/off patent” view to a continuous measure of IP defensibility. It could be constructed as a weighted average of several quantifiable factors:

- Patent Count: The total number of granted patents in the portfolio.

- Patent Family Size: The number of jurisdictions in which the core invention is protected.

- Patent Type Mix: The percentage of the portfolio consisting of strong method-of-use patents, which have been correlated with 18% higher peak sales.

- Post-Approval Filings: The number or percentage of patents filed after initial FDA approval, a key indicator of a life-cycle extension strategy.

- Litigation Data: The history of patent litigation, such as Paragraph IV challenges from generic manufacturers, and the brand’s historical success rate in defending its patents. Data on litigation patterns can offer unprecedented visibility into the likely timing of generic entry.

In a regression model, a higher IP Strength Score would be statistically associated with a longer period of effective market life and, critically, a slower erosion curve once the first generics do enter the market. This allows a company to more accurately forecast the entire lifecycle of its product, from launch to decline, turning the complex legal landscape of patents into a quantifiable and predictive asset.

The Regulatory Multiplier: Modeling the Impact of Special Designations

The regulatory pathway is not a one-size-fits-all process. Agencies like the FDA have created special designations to incentivize and accelerate the development of drugs for areas of high unmet medical need. For forecasters, these designations are more than just procedural milestones; they are powerful market signals that have a direct and quantifiable impact on a drug’s commercial trajectory. The two most significant are Orphan Drug Designation and Breakthrough Therapy Designation.

The Orphan Drug Effect: Smaller Populations, Higher Prices, Faster Uptake

The Orphan Drug Designation (ODD) was created to solve a “market failure” by providing incentives for companies to develop drugs for rare diseases (defined in the U.S. as affecting fewer than 200,000 people).40 These incentives, including a seven-year period of market exclusivity (independent of patent life), tax credits, and user fee waivers, have been wildly successful, transforming the rare disease space into a highly lucrative market. The global orphan drug market is projected to grow from around $193 billion in 2024 to over $621 billion by 2034.

From a forecasting perspective, ODD has several key effects:

- Higher Prices: With limited competition and high unmet need, orphan drugs command premium prices, on average 4.5 times that of non-orphan drugs. The median annual treatment cost for an orphan drug can exceed $218,000.40

- Smaller, Well-Defined Populations: The patient populations are small but often highly concentrated and easily identified through specialist centers and patient advocacy groups.

- Faster Uptake: The combination of high unmet need, strong KOL support, and a clear patient population often leads to a more rapid market penetration curve compared to drugs for more common diseases.

The Breakthrough Therapy Windfall: Accelerated Timelines and Market Primacy

The Breakthrough Therapy Designation (BTD) is granted to drugs that demonstrate substantial improvement over available therapy on a clinically significant endpoint for a serious or life-threatening condition. Its primary purpose is to expedite the drug’s development and review process. Like ODD, this has created a booming market, with various reports projecting its value to reach between $242 billion and $529 billion by the early 2030s.51

For a forecaster, BTD acts as a powerful market-priming signal:

- Signal of Superiority: The designation itself is a stamp of approval from the FDA that the drug represents a significant clinical advance. This creates immense “buzz” among physicians and payers long before launch.

- Accelerated Pathway: The expedited review can shorten the time to market, allowing the company to begin generating revenue sooner.

- Enhanced Market Access: The strong clinical evidence required for BTD makes it easier to negotiate favorable reimbursement and formulary placement with payers.

A simplistic approach would be to include these designations as a simple binary (1/0) variable in a regression model. However, this would only capture a fixed, average “lift” in sales, failing to represent their dynamic effect on the product’s lifecycle. A more sophisticated method is to model these designations as “uptake curve accelerants.” This can be achieved by using an interaction term in the regression equation.

For example, a model for sales since launch might look like this:

Sales=β0+β1×Time+β2×BTD_Flag+β3×(Time×BTD_Flag)+…

In this model, the coefficient for the interaction term, β3, captures the additional impact on the sales trajectory for having the designation. If β3 is positive and statistically significant, it means that for every month post-launch, a drug with BTD sees its sales increase by a larger amount (β1+β3) than a non-BTD drug (β1). This elegantly quantifies the “buzz” and accelerated adoption conferred by the designation, allowing the model to project a steeper, more realistic sales curve and providing a much more accurate picture of the drug’s true commercial potential.

Part 4 – The Strategic Imperative: Applying Forecasts to Drive Business Outcomes

A perfectly constructed, statistically validated regression model is an impressive analytical achievement. But in the world of biopharma, it is ultimately worthless if it sits on a shelf. The true value of a forecast is realized only when its insights are translated into action—when it is used to drive smarter investment, sharper strategy, and superior execution across the enterprise. This final section explores how to wield the regression-based forecast as a strategic weapon to optimize the commercial engine, guide M&A activity, and align R&D with market reality.

Optimizing the Commercial Engine: Using Regression to Guide Marketing and Sales Spend

For decades, marketing and sales budgets have often been set by historical precedent or gut feel. Regression analysis provides a powerful framework to move from this subjective approach to a rigorous, data-driven optimization of commercial resources.22

By building a multiple regression model where drug sales is the dependent variable, a company can include various commercial activities as independent variables: marketing spend by channel (DTC, digital, HCP events), sales force size, and promotional efforts.27 The resulting coefficients for each of these variables quantify their specific return on investment (ROI). For example, the model might reveal that a dollar spent on digital marketing to specialists yields three times the sales lift of a dollar spent on broad-based DTC advertising. This kind of insight allows commercial leaders to surgically reallocate their budgets away from less effective channels and toward those that demonstrably drive revenue, transforming the marketing function from a perceived cost center into a quantifiable engine of growth.

However, a truly advanced application goes beyond simple linear ROI to identify the point of diminishing returns. A basic linear model assumes that the tenth million dollars spent on advertising has the same impact as the first. This is rarely true. By using a more flexible model, such as a polynomial regression, a forecaster can capture the non-linear, curved relationship between spend and sales. The model might generate a curve showing that sales increase rapidly with the first $5 million in marketing spend, begin to flatten out between $5 million and $15 million, and show almost no additional growth beyond $15 million.

This analysis is strategically profound. It allows leaders to optimize their spend not just across different channels, but to determine the optimal level of investment within each channel. The goal shifts from simply maximizing revenue to maximizing profitability, by identifying the precise point where the marginal cost of one more marketing dollar equals the marginal revenue it generates. This level of precision is impossible with traditional forecasting methods and represents a significant source of competitive advantage.

Sharpening the Scalpel: Informing M&A and Licensing Strategy

Mergers, acquisitions, and licensing deals are critical levers for growth in the biopharmaceutical industry, particularly as companies face the revenue abyss of the patent cliff and seek to replenish their pipelines.47 Yet, the M&A track record is fraught with peril. A staggering number of deals fail to deliver their expected value, with a landmark study showing that

more than half of acquired lead assets fall short of pre-deal sales forecasts by an average of 40% over the three years following launch.

“More than half of acquired lead assets fall short of pre-deal sales forecasts by about 40% over three years post-launch due to overly optimistic commercial assumptions and execution challenges.”

This chronic failure is almost always rooted in overly optimistic commercial assumptions baked into the initial valuation models. A rigorous, data-driven forecast is the single most important tool for mitigating this risk. It is the cornerstone of an accurate valuation, whether using a risk-adjusted Net Present Value (rNPV) model or market comparables, and is essential for validating the entire deal thesis.45

A sophisticated acquirer can use its own internally developed regression model, calibrated on broad market data and dozens of historical analogs, to “pressure-test” a target company’s projections. During due diligence, the acquirer can take the target’s explicit assumptions—on pricing, market share, speed of uptake, patient compliance, etc.—and plug them into their own model. The model then provides an independent, objective assessment of whether the target’s projected sales are plausible.

Imagine a scenario where a target company is projecting a rapid, three-year time-to-peak for a new “me-too” drug in a crowded market. The acquirer’s regression model, trained on the launch trajectories of 20 similar drugs, might reveal that such a rapid uptake has never been achieved without a massive marketing spend far exceeding what the target has budgeted for, or without a clear clinical advantage that the drug lacks. This discrepancy is a major red flag. It highlights a fundamental flaw in the target’s valuation and provides the acquirer with a powerful, data-driven basis for renegotiating the deal price or even walking away. This turns the forecast from a simple input into a potent due diligence weapon, systematically identifying and quantifying deal risk before a single dollar is spent.

Guiding the Science: Aligning R&D Investment with Commercial Reality

The most forward-thinking application of forecasting is to connect it back to the very beginning of the value chain: the R&D portfolio. Pharmaceutical R&D is the lifeblood of the industry, but it is a brutal gauntlet of punishing costs and staggering risk, with over 90% of drug candidates that enter human testing failing to reach the market.7 In this environment, the ability to strategically select, prioritize, and, when necessary, terminate R&D projects is the single most critical determinant of long-term survival.

As Mene Pangalos of AstraZeneca powerfully stated, “A selective high-quality molecule will never become a medicine if it is modulating the wrong target. This is why target selection is the most important decision we make in research”. This philosophy is embodied in AstraZeneca’s highly successful “5R Framework” for R&D productivity: Right Target, Right Patient, Right Tissue, Right Safety, and Right Commercial Potential. A robust, regression-based forecast is the engine that drives the “Right Commercial Potential” pillar. It provides a data-driven methodology for assessing the potential value of assets at the earliest stages of development, long before traditional valuation discussions typically occur.

This creates a common language between the scientific and commercial sides of the organization. Historically, these two functions have often operated in separate worlds, speaking different languages. The R&D team is focused on publications, p-values, and mechanisms of action; the commercial team is focused on market share, revenue, and profit margins.2 This disconnect can lead to the development of scientifically elegant drugs that have no viable commercial path.

A well-constructed regression model, built on the principles outlined in this report, serves as the Rosetta Stone that bridges this divide. It explicitly and quantitatively links clinical variables (like the Overall Survival benefit from a Phase III trial) to commercial outcomes (like projected peak sales and market share). The model’s coefficients provide a direct translation: “An additional two months of Progression-Free Survival in this patient population is predicted to generate an additional $300 million in risk-adjusted peak sales.”

This common, quantitative language fosters a more integrated and productive dialogue. It allows the R&D team to understand the tangible commercial value of the clinical endpoints they are pursuing. Simultaneously, it enables the commercial team to grasp the profound revenue implications of specific clinical trial designs and outcomes. This alignment ensures that the precious and finite resources of R&D are focused on projects that are not only scientifically promising but also possess a clear, defensible, and profitable path to market success.

Conclusion: From Prediction to Strategic Supremacy

The challenge of forecasting sales in the biopharmaceutical sector is as immense as the stakes are high. We have seen that traditional methods, often built on simplistic assumptions and siloed data, have consistently failed to capture the industry’s unique volatility, leading to staggering inaccuracies that undermine strategic planning and destroy shareholder value. The path to precision lies in a fundamental shift in methodology and mindset—a move away from the crystal ball and toward the meticulously engineered engine of multiple regression analysis.

This report has laid out a comprehensive blueprint for making that shift. We began by establishing regression analysis not as a mere statistical technique, but as a strategic tool for uncovering the causal drivers of market performance. We then provided a practical, step-by-step guide to building, validating, and interpreting these models, emphasizing the critical importance of data quality and rigorous testing.

The true biopharma edge, however, was found in learning how to integrate the industry’s most unique and powerful predictive variables. By quantifying the data from clinical trials, deconstructing the intellectual property landscape with platforms like DrugPatentWatch, and modeling the market-shaping impact of regulatory designations, we can build forecasts that are not only more accurate but also far more strategically insightful. These are models that can translate a clinical endpoint into a market share projection, a patent portfolio into a revenue erosion curve, and a regulatory milestone into an uptake velocity.

Finally, we have demonstrated that the ultimate purpose of this analytical rigor is to drive superior business outcomes. A powerful forecast is the foundation for optimizing commercial spend, for conducting sharper M&A due diligence, and for forging a vital strategic alignment between the laboratory and the marketplace. It transforms the forecast from a passive, backward-looking report into an active, forward-looking tool for decision-making.

Looking ahead, the rise of artificial intelligence, machine learning, and algorithmic forecasting platforms will only accelerate this transformation.31 These technologies promise to automate much of the manual data wrangling and calculation that currently consumes forecasting teams, allowing for real-time updates and the analysis of ever-larger datasets. But this automation does not render the human expert obsolete. On the contrary, it elevates their role. By freeing the forecaster from the mechanics of the model, it allows them to focus on the highest-value tasks: interpreting the strategic narrative behind the numbers, pressure-testing the assumptions, and acting as a trusted advisor to the business leaders who must navigate the uncertain waters ahead. The future of forecasting is a powerful human-machine partnership, and the companies that master this synergy will not just predict the future of their markets—they will be the ones who create it.

Key Takeaways

- Embrace Complexity with Multiple Regression: Simple, single-variable forecasting methods are inadequate for the biopharma industry. Multiple regression analysis is the essential tool for modeling the complex, interconnected drivers of sales, from clinical outcomes to competitor actions.

- Data Preparation is a Strategic Act: The quality of a forecast is determined by the quality of its inputs. The process of cleaning, structuring, and standardizing data from disparate sources is not a technical chore but a critical strategic step that shapes the model’s view of reality.

- Quantify the Biopharma-Specific Drivers: The most powerful forecasts integrate variables unique to the industry. This means translating clinical trial endpoints (e.g., Overall Survival benefit), patent portfolio strength (e.g., an “IP Strength Score”), and regulatory designations (e.g., Breakthrough Therapy) into quantifiable inputs for your model.

- Validation Builds Trust and Defensibility: A model’s statistical accuracy must be proven through rigorous validation techniques like train/test splits, cross-validation, and benchmarking against simpler methods. This process is crucial for building the organizational trust required for leadership to act on the forecast’s insights.

- The Forecast is a Strategic Weapon, Not Just a Report: The ultimate value of a regression-based forecast lies in its application. Use it to optimize marketing ROI by identifying points of diminishing returns, to de-risk M&A by pressure-testing a target’s projections, and to align R&D investment with proven commercial potential.

- The Future is a Human-Machine Partnership: The rise of AI and algorithmic forecasting automates manual tasks, elevating the role of the human forecaster from a number-cruncher to a strategic advisor. The goal is to leverage technology to free up expert time for interpretation, scenario planning, and high-level strategic guidance.

Frequently Asked Questions (FAQ)

1. How can we use regression to forecast sales for a first-in-class drug with no direct market analogs?

This is a classic “cold start” problem where historical product data is unavailable. Regression is still highly valuable, but the approach shifts from time-series analysis to a causal, cross-sectional model built on analogs. Instead of forecasting your own drug’s sales over time, you build a model to predict the peak sales of other drugs at the market level. The dependent variable would be “Peak Sales ($)” for a set of 30-50 historical drug launches. The independent variables would include the factors discussed: clinical differentiation vs. prior SoC (e.g., efficacy improvement), patient population size, orphan/BTD status, company size/launch experience, and order of entry.34 You would then plug in the characteristics of your new, first-in-class drug into this model to generate a statistically-driven peak sales forecast. The uptake curve can be modeled using market diffusion curves from analogous launches in different therapeutic areas that shared similar characteristics (e.g., first-in-class biologics for chronic conditions).

2. What is the single biggest mistake companies make when implementing regression-based forecasting?

The most common and costly mistake is failing to invest in high-quality, centralized data infrastructure. Many teams attempt to build sophisticated models on a foundation of fragmented, error-prone, and manually-updated Excel spreadsheets. This leads to a vicious cycle: forecasters spend 80% of their time on low-value “data wrangling” instead of high-value analysis, the data inputs are inconsistent and untrustworthy, and the resulting forecasts are inaccurate. This erodes management’s confidence in the process, leading to underinvestment and a continued reliance on gut feel. Investing in a unified data platform that can automatically ingest and harmonize data from internal (sales, finance) and external (claims, market) sources is the essential prerequisite for successful regression-based forecasting.9

3. How do we handle conflicting data from different sources (e.g., different market research reports or varying IP databases)?

This is a common challenge that highlights the importance of the forecaster’s judgment. The first step is to investigate the source of the discrepancy. Does one report use incidence while another uses prevalence? Does one IP database include patent applications while another only includes granted patents? Understanding the methodology is key. If the discrepancy cannot be reconciled, there are three primary approaches:

- Prioritize the Highest Quality Source: Based on historical accuracy and methodological rigor, select one source as the “gold standard” and use it consistently.

- Create a Consensus Forecast: Run the model multiple times using the data from each source and present the results as a range or an average. This explicitly captures the uncertainty in the forecast.

- Use the Discrepancy as a Variable: In some cases, the difference itself can be an input. For example, the difference between list price and net price is a direct measure of rebating pressure and can be a powerful predictor of market access challenges.

4. Our sales data is highly volatile and seems random. Can regression analysis still work?

Yes, and in fact, this is where it can be most valuable. High volatility or “noise” often masks underlying patterns that are invisible to the naked eye. While it makes forecasting more difficult, a well-specified multiple regression model is designed to do exactly this: separate the signal (the impact of your independent variables) from the noise (the random error term, ϵ). If the volatility is truly random, the model’s R-squared may be low, but the coefficients for key drivers (like seasonality, promotions, or competitor actions) may still be statistically significant, providing crucial insights for strategic planning. Furthermore, techniques like aggregating data to a less granular level (e.g., from weekly to monthly) can help smooth out some of the random noise and make underlying trends more apparent.

5. How does the rise of AI and automated forecasting platforms change the role of the human forecaster in a biopharma company?

AI and automated platforms do not replace the human forecaster; they supercharge them. These platforms excel at the tasks that are laborious and time-consuming for humans: ingesting massive datasets, running thousands of model variations, and providing real-time updates. This fundamentally changes the forecaster’s job description in three ways:

- From Data Janitor to Strategic Advisor: By automating the 80% of time spent on data wrangling, AI frees up the expert to focus on the 20% of work that creates the most value: interpreting results, developing strategic narratives, and advising leadership.

- From Static Reporter to Dynamic Scenario Planner: With traditional methods, running a single “what-if” scenario could take days. With an AI platform, it can be done in minutes. This transforms the forecast from a static, quarterly report into a dynamic, interactive tool for real-time decision support.

- From Model Builder to Model Curator: The forecaster’s role shifts from manually coding models to curating and validating the outputs of automated systems. They must understand the models well enough to spot biases, question assumptions, and ensure the “black box” is not producing nonsensical results, maintaining the critical layer of human oversight and business context.

References

- Importance of Forecasting in the Pharmaceutical Industry – Aspect Consulting, Inc, accessed August 6, 2025, https://aspect-consulting.com/importance-of-forecasting-in-the-pharmaceutical-industry/

- Predicting the Future The Business Case for Forecasting – PharmaVoice, accessed August 6, 2025, https://www.pharmavoice.com/news/2009-04-predicting-the-future/616112/

- Role of forecasting in the global pharmaceutical industry – Cliniminds, accessed August 6, 2025, https://cliniminds.com/blogs/role-of-forecasting-in-the-global-pharmaceutical-industry-38

- How Clinical Trial Data Supports Accurate Pharma Forecasting – Drug Patent Watch, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/how-clinical-trial-data-supports-accurate-pharma-forecasting/

- Commercial pharma forecasts are surprisingly inaccurate: Here are 5 ways to make them better – IQVIA, accessed August 6, 2025, https://www.iqvia.com/blogs/2020/02/commercial-pharma-forecasts-are-surprisingly-inaccurate-here-are-5-ways-to-make-them-better

- Assessing the Accuracy of Sales Forecasts Submitted by Pharmaceutical Companies Applying for Reimbursement in Austria – PubMed Central, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8414520/

- Mastering Strategic Decision-Making in the Pharmaceutical R&D Portfolio – DrugPatentWatch – Transform Data into Market Domination, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/decision-making-product-portfolios-pharmaceutical-research-development-managing-streams-innovation-highly-regulated-markets/

- Forecasting in Pharmaceutical Industry (Patient-Level) – Part 1 – Analytics Vidhya, accessed August 6, 2025, https://www.analyticsvidhya.com/blog/2021/05/forecasting-in-pharmaceutical-industry-patient-level-part-1/

- A Detailed Guide to Sales Forecasting Models – Varicent, accessed August 6, 2025, https://www.varicent.com/blog/sales-forecasting-models

- Patent cliff and strategic switch: exploring strategic design possibilities in the pharmaceutical industry – PMC, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4899342/

- Pharma sales data analysis and forecasting – Kaggle, accessed August 6, 2025, https://www.kaggle.com/code/milanzdravkovic/pharma-sales-data-analysis-and-forecasting

- Sales Forecasting Technique: Regression Analysis – SPOTIO, accessed August 6, 2025, https://spotio.com/blog/regression-analysis/

- Regression Analysis 101: Essential Guide for New Attorneys in Pharmaceutical Antitrust, accessed August 6, 2025, https://www.edgewortheconomics.com/antitrustprescription-essential-guide-pharma-antitrust

- Understanding and interpreting regression analysis | Evidence-Based Nursing, accessed August 6, 2025, https://ebn.bmj.com/content/24/4/116

- Time Series Analysis for Business Forecasting, accessed August 6, 2025, http://home.ubalt.edu/ntsbarsh/business-stat/stat-data/forecast.htm

- Transforming AstraZeneca’s R&D productivity, accessed August 6, 2025, https://www.astrazeneca.com/what-science-can-do/topics/disease-understanding/transforming-astrazenecas-rd-productivity.html

- Linear Regression Analysis: Part 14 of a Series on Evaluation of Scientific Publications, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC2992018/

- Statistics review 7: Correlation and regression – PMC – PubMed Central, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC374386/

- The financial forecast in the pharmaceutical sector – Izertis, accessed August 6, 2025, https://www.izertis.com/en/-/blog/financial-forecast-pharmaceutical-sector

- Full article: A hybrid demand forecasting model for greater forecasting accuracy: the case of the pharmaceutical industry – Taylor & Francis Online, accessed August 6, 2025, https://www.tandfonline.com/doi/full/10.1080/16258312.2021.1967081

- Regression Analysis for Pharmacoepidemiology: A Comprehensive Guide, accessed August 6, 2025, https://www.numberanalytics.com/blog/regression-analysis-pharmacoepidemiology-comprehensive-guide

- What is Regression Analysis? Definition, Types, and Examples – SurveySparrow, accessed August 6, 2025, https://surveysparrow.com/blog/regression-analysis/

- How to Interpret P-values and Coefficients in Regression Analysis – Statistics By Jim, accessed August 6, 2025, https://statisticsbyjim.com/regression/interpret-coefficients-p-values-regression/

- What’s a good value for R-squared? – Duke People, accessed August 6, 2025, https://people.duke.edu/~rnau/rsquared.htm

- Applying Machine Learning and Statistical Forecasting Methods for Enhancing Pharmaceutical Sales Predictions – MDPI, accessed August 6, 2025, https://www.mdpi.com/2571-9394/6/1/10

- Forecasting Model: The Case of the Pharmaceutical Retail – PMC, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9381873/

- A Comprehensive Guide to Predicting Drug Market Potential – DrugPatentWatch, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/predicting-drug-market-potential/

- Pharmaceutical Commercial Forecasting: – Triangle Insights Group, accessed August 6, 2025, https://triangleinsightsgroup.com/wp-content/uploads/2018/01/Pharmaceutical_Commercial_Forecasting-2.pdf

- Complexities of Biopharma/Pharma Net Revenue Forecasting – IntegriChain, accessed August 6, 2025, https://www.integrichain.com/blog/navigating-the-complexities-of-biopharma-pharma-net-revenue-forecasting/

- Factors Impacting Pharmaceutical Prices and Affordability: Narrative Review – PMC, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7838942/

- Can forecasting help identify market opportunities for pharmaceutical companies?, accessed August 6, 2025, https://pharmaphorum.com/sales-marketing/can-forecasting-help-identify-market-opportunities-pharmaceutical-companies

- Pharmaceutical Sales Forecast & Project Valuation, accessed August 6, 2025, https://www.e-projection.com/pharmaceutical-sales-forecast-project-valuation.html

- Pharma Valuations: When to Use Incidence and/or Prevalence, accessed August 6, 2025, https://www.alacrita.com/blog/pharma-valuations-when-to-use-incidence-prevalence

- Revenue Forecasting Techniques for New Pharmaceutical Drugs, accessed August 6, 2025, https://www.ihealthcareanalyst.com/revenue-forecasting-new-pharma-drugs/

- Patient/Epidemiology Based Forecasting for Pharmaceutical Industry – MarketsandMarkets, accessed August 6, 2025, https://www.marketsandmarkets.com/patient-based-forecasting.asp

- Annual Pharmaceutical Sales Estimates Using Patents: A Comprehensive Analysis – DrugPatentWatch – Transform Data into Market Domination, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/annual-pharmaceutical-sales-estimates-using-patents-a-comprehensive-analysis/

- How to Identify Profitable Generic Drug Opportunities Using Patent Expiration Data, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/how-to-identify-profitable-generic-drug-opportunities-using-patent-expiration-data/

- Guidelines for Preparing Patent Landscape Reports – WIPO, accessed August 6, 2025, https://www.wipo.int/edocs/pubdocs/en/wipo_pub_946.pdf

- The Role of Litigation Data in Predicting Generic Drug Launches – DrugPatentWatch, accessed August 6, 2025, https://www.drugpatentwatch.com/blog/the-role-of-litigation-data-in-predicting-generic-drug-launches/

- From Market Failures to Lifesaving Innovations: The Evolution of Orphan Drugs, accessed August 6, 2025, https://www.pharmasalmanac.com/articles/from-market-failures-to-lifesaving-innovations-the-evolution-of-orphan-drugs

- Breakthrough Therapy Designation Market Size, Share 2025-2035 – Metatech Insights, accessed August 6, 2025, https://www.metatechinsights.com/industry-insights/breakthrough-therapy-designation-market-1606

- Exploring approaches to forecasting IP demand – GOV.UK, accessed August 6, 2025, https://www.gov.uk/government/publications/exploring-approaches-to-forecasting-ip-demand/exploring-approaches-to-forecasting-ip-demand

- Drug Store Sales Prediction – CS229: Machine Learning, accessed August 6, 2025, https://cs229.stanford.edu/proj2015/216_report.pdf

- (PDF) “SALES FORECASTING USING REGRESSION-BASED MACHINE LEARNING ALGORITHMS IN SUPPLY CHAIN ENVIRONMENT” – ResearchGate, accessed August 6, 2025, https://www.researchgate.net/publication/374290672_SALES_FORECASTING_USING_REGRESSION-BASED_MACHINE_LEARNING_ALGORITHMS_IN_SUPPLY_CHAIN_ENVIRONMENT

- 2025 Ultimate Pharma & Biotech Valuation Guide – BiopharmaVantage, accessed August 6, 2025, https://www.biopharmavantage.com/pharma-biotech-valuation-best-practices

- Forecasting considerations throughout the pharmaceutical product lifecycle | pharmaphorum, accessed August 6, 2025, https://pharmaphorum.com/rd/forecasting-considerations-throughout-pharmaceutical-product-lifecycle

- Biopharma M&A: Outlook for 2025 – IQVIA, accessed August 6, 2025, https://www.iqvia.com/locations/emea/blogs/2025/01/biopharma-m-and-a-outlook-for-2025

- The Orphan Drug Act: Legal Overview and Policy Considerations – Congress.gov, accessed August 6, 2025, https://www.congress.gov/crs-product/IF12605

- Orphan Drug Market Size Envisions USD 621.85 Bn by 2034 – Towards Healthcare, accessed August 6, 2025, https://www.towardshealthcare.com/insights/orphan-drug-market-sizing

- Breakthrough Therapy Designation Market Size, Growth, Trends 2034, accessed August 6, 2025, https://www.marketresearchfuture.com/reports/breakthrough-therapy-designation-market-9063

- Breakthrough Therapy (BT) Designation Market Size, Share, Analysis Report 2032, accessed August 6, 2025, https://www.zionmarketresearch.com/report/breakthrough-therapy-bt-designation-market

- Breakthrough Therapy Designation Market Report, 2030 – Grand View Research, accessed August 6, 2025, https://www.grandviewresearch.com/industry-analysis/breakthrough-therapy-bt-designation-market

- What Is Regression Analysis (and How Can Your Business Use It)? – Yurbi, accessed August 6, 2025, https://yurbi.com/blog/what-is-regression-analysis-and-how-can-your-business-use-it/

- How to Use a Regression Analysis for Marketing – K6 Agency, accessed August 6, 2025, https://www.k6agency.com/how-to-use-a-regression-analysis-for-marketing/

- Optimizing Pharmaceutical Portfolios Through M&A – L.E.K. Consulting, accessed August 6, 2025, https://www.lek.com/insights/hea/global/ei/optimizing-pharmaceutical-portfolios-through-ma

- M&A in Healthcare and Life Sciences: Why Companies That Adapt to the New Realities Will Come Out Ahead, accessed August 6, 2025, https://www.bain.com/insights/healthcare-and-life-sciences-m-and-a-report-2025/

- Reinventing R&D in the Age of AI – Accenture, accessed August 6, 2025, https://www.accenture.com/content/dam/accenture/final/accenture-com/document-2/Reinventing-RandD-In-The-Age-Of-AI-Report.pdf

- 50 Pharmaceutical Company CEO Interview Questions & Answers [2025] – DigitalDefynd, accessed August 6, 2025, https://digitaldefynd.com/IQ/pharmaceutical-company-ceo-interview-questions/

- Algorithmic Forecasting – a Game Changer for the Pharmaceutical Industry? – IQVIA, accessed August 6, 2025, https://www.iqvia.com/locations/united-states/blogs/2021/08/algorithmic-forecasting-a-game-changer-for-the-pharmaceutical-industry

- Machine-Learning Models for Sales Time Series Forecasting – MDPI, accessed August 6, 2025, https://www.mdpi.com/2306-5729/4/1/15

- 8 Data Milestones: Linear Regression Advancing Pharma Success – Number Analytics, accessed August 6, 2025, https://www.numberanalytics.com/blog/8-data-milestones-linear-regression-pharma-success

- Novel methodology for pharmaceutical expenditure forecast – PMC – PubMed Central, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4865799/

- Sales Forecasting Methods 101, And Who Uses Them, accessed August 6, 2025, https://lumel.com/blog/sales-forecasting/sales-forecasting-methods/

- 6 Ways to Use Clinical Trial Condition Data for Life Science Sales – The Bracken Group, accessed August 6, 2025, https://www.thebrackengroup.com/blog/6-ways-clinical-trial-condition-data-for-life-science-sales

- Predictive Analytics in Pharma: From Clinical Trials to Commercial Success, accessed August 6, 2025, https://www.hyperec.com/blog/predictive-analytics-in-pharma-from-clinical-trials-to-commercial-success/

- Predicting clinical trial duration via statistical and machine learning models – PMC, accessed August 6, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12005917/

- AI-Powered Clinical Trial Feasibility and Forecasting: Four Strategic Applications, accessed August 6, 2025, https://globalforum.diaglobal.org/issue/june-2025/ai-powered-clinical-trial-feasibility-and-forecasting-four-strategic-applications/

- (PDF) Drug sales data analysis for outbreak detection of infectious diseases: A systematic literature review – ResearchGate, accessed August 6, 2025, https://www.researchgate.net/publication/268743123_Drug_sales_data_analysis_for_outbreak_detection_of_infectious_diseases_A_systematic_literature_review

- Pharma Pipeline Deep Dive: Equity Report Analysis for Drug, accessed August 6, 2025, https://vasro.de/en/pharma-pipeline-equity-report-analysis-drug-development/

- An Analysis on leveraging the patent cliff with drug sales worth USD 251 billion going off-patent and analysis of different drug – Department of Pharmaceuticals, accessed August 6, 2025, https://pharma-dept.gov.in/sites/default/files/FINAL-An%20analysis%20on%20leveraging%20the%20patent%20cliff.pdf

- Beyond Lifecycle Management – Optimizing Performance Following Patent Expiry – Analysis Group, accessed August 6, 2025, https://www.analysisgroup.com/link/966075d23d094f98813dcc4903b51c43.aspx

- Patent Expiration and Pharmaceutical Prices | NBER, accessed August 6, 2025, https://www.nber.org/digest/sep14/patent-expiration-and-pharmaceutical-prices

- pre pub Forecasting Branded and Generic Pharmaceuticals.doc – Open Research Exeter (ORE), accessed August 6, 2025, https://ore.exeter.ac.uk/repository/bitstream/handle/10871/18983/pre%20pub%20Forecasting%20Branded%20and%20Generic%20Pharmaceuticals.doc?sequence=1

- Analysis of the Growth in the Number of Patents Granted and Its Effect over the Level of Growth of the Countries: An Econometric Estimation of the Mixed Model Approach – MDPI, accessed August 6, 2025, https://www.mdpi.com/2071-1050/14/4/2384

- Applying Quantile Regression to Assess the Relationship between R&D, Technology Import and Patent Performance in Taiwan – MDPI, accessed August 6, 2025, https://www.mdpi.com/1911-8074/14/8/358

- Pharmaceutical patent landscaping: A novel approach to understand patents from the drug discovery perspective | bioRxiv, accessed August 6, 2025, https://www.biorxiv.org/content/10.1101/2023.02.10.527980v3.full-text