In the high-stakes world of pharmaceutical and biotechnology innovation, patent litigation is not merely a legal hurdle; it is a multi-million-dollar crucible where market dominance is forged and fortunes are decided. For C-suite executives, general counsel, and IP strategists, the costs associated with these disputes are not just line items on a budget—they are formidable strategic challenges that can divert critical resources, spook investors, and derail the entire lifecycle of a blockbuster drug. With the average cost of a single patent case soaring into the millions, the question is no longer if you will face a patent challenge, but how you will manage the staggering financial and operational impact when you do.

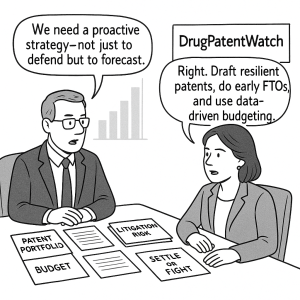

This is not a report for the faint of heart, nor is it a simple legal summary. This is a strategic playbook designed to transform your perspective on litigation costs. We will move beyond the reactive, defensive posture that treats litigation as an uncontrollable expense and embrace a proactive, business-centric approach. Our journey will take us from the foundational legal frameworks that define the battlefield to the granular details of budgeting and cost control. We will explore how to build a litigation-resistant patent fortress from the ground up, how to master the financial pressures of an active lawsuit, and how to leverage cutting-edge technology and data analytics to turn legal challenges into sources of competitive intelligence.

Ultimately, the goal is to reframe the entire conversation. Managing drug patent litigation costs is not about pinching pennies; it’s about strategic capital allocation. It’s about understanding that every dollar spent on a lawsuit is a dollar not spent on R&D. It’s about recognizing that in the pharmaceutical chess game, the ability to afford, manage, and strategically deploy litigation is as powerful an asset as the patent itself. Welcome to the new art of war in the pharmaceutical industry.

The High-Stakes Battlefield: Understanding the Landscape of Pharmaceutical Patent Litigation

Before we can control the costs of the battle, we must first understand the terrain, the rules of engagement, and precisely what is at stake. Pharmaceutical patent litigation is a unique theater of commercial conflict, shaped by specialized legislation and driven by economic incentives of an almost unimaginable scale.

The Strategic Imperative: Why Patent Protection is the Lifeblood of Pharma

Why are pharmaceutical patent disputes so uniquely intense and expensive? The answer lies in the fundamental economics of drug development. A patent is not just a legal document; it is the financial bedrock of the entire industry, the sole mechanism that allows companies to recoup the monumental, high-risk investments required to bring a new medicine from a laboratory bench to a patient’s bedside.2

The numbers are staggering. A widely cited study from the Tufts Center for the Study of Drug Development pegged the average capitalized cost to develop a new drug at $2.6 billion. Other estimates vary, but the consensus is clear: bringing a single new molecular entity to market is a billion-dollar gamble. This figure is not just the sum of out-of-pocket expenses; it is a sophisticated financial metric that accounts for two critical, often-overlooked realities.

First is the cost of failure. For every successful drug that receives FDA approval, thousands of promising compounds fail at some point during the arduous 10-15 year development process. Only about 12% of drugs that enter clinical trials ever make it to market. The billions of dollars spent on these failures are not simply written off; they are a necessary cost of discovery that must be financially carried by the few products that succeed.

Second is the opportunity cost. During that decade-plus development period, the capital invested in a drug candidate is tied up and cannot be used for other ventures. This “time cost”—the expected returns that investors forego—is a very real economic expense that can account for nearly half of the total capitalized cost of a new drug.

In this context, a patent’s 20-year term of market exclusivity is not a windfall; it is the essential period during which a company has the opportunity to generate the revenue necessary to cover the costs of its one success and its many failures, and to fund the next generation of research.2 Any threat to that patent—such as a challenge from a generic or biosimilar manufacturer—is a direct threat to billions of dollars in revenue. This is why a brand-name company will rationally spend millions on litigation to protect its market exclusivity. The cost of the fight is a calculated expense when weighed against the potential loss. This dynamic creates a “Goliath vs. Goliath” scenario, where the high cost of litigation, while a logical defense for incumbents, simultaneously erects a formidable barrier to entry for smaller, less-capitalized challengers, potentially stifling the very competition that regulatory frameworks were designed to foster.

The Twin Pillars of Pharma Litigation: Hatch-Waxman vs. BPCIA

The rules of engagement for pharmaceutical patent litigation are primarily defined by two landmark pieces of legislation: the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act, and the Biologics Price Competition and Innovation Act of 2009 (BPCIA). While both were designed to balance innovation with access to lower-cost medicines, they create fundamentally different strategic landscapes for small-molecule drugs and large-molecule biologics, respectively.2

The Hatch-Waxman Act: A Structured Duel for Small Molecules

The Hatch-Waxman Act is the legislative foundation of the modern generic drug industry, responsible for the fact that by 2012, generic drugs accounted for 84% of all U.S. prescriptions. It created an abbreviated new drug application (ANDA) pathway, allowing generic manufacturers to get their products approved without repeating the costly clinical trials of the brand-name drug, provided they could prove their product was bioequivalent.

To manage the inevitable patent disputes, the Act established a highly structured process:

- The Orange Book: The brand-name drug manufacturer must list relevant patents covering the drug substance, drug product, or method of use in an FDA publication officially titled Approved Drug Products with Therapeutic Equivalence Evaluations, but known colloquially as the “Orange Book”.3

- The Paragraph IV Certification: When a generic company files an ANDA, it must make a certification for each patent listed in the Orange Book. A “Paragraph IV” (PIV) certification states that the generic company believes the patent is invalid, unenforceable, or will not be infringed by its product.3 This certification is the key that unlocks the door to litigation.

- The Trigger and the Stay: Filing a PIV certification is considered a technical act of patent infringement.3 The generic must notify the patent holder, who then has 45 days to file a lawsuit. If a suit is filed within that window, the FDA is automatically barred from approving the generic’s ANDA for a period of

30 months, or until the court case is resolved, whichever comes first.3 This

30-month stay is a powerful tool for the brand company, providing a period of certainty and time to litigate without the generic product on the market. - The Reward: To incentivize these patent challenges, the first generic company to file a PIV certification is rewarded with 180 days of market exclusivity if it wins the litigation or successfully launches its product.

The BPCIA: A Strategic Dance for Biologics

Biologics—large, complex molecules derived from living organisms—could not be adequately addressed by the Hatch-Waxman framework. The BPCIA was enacted as part of the Affordable Care Act to create a similar abbreviated pathway for “biosimilars”. However, its patent resolution mechanism is far more complex and less rigid than its small-molecule counterpart.

- No Orange Book: There is no central, FDA-managed list of patents equivalent to the Orange Book for biologics. Instead, the relevant patents are identified through a private information exchange.

- The “Patent Dance”: The BPCIA outlines a complex, multi-step process for the biosimilar applicant and the reference product sponsor (the brand company) to exchange information and identify the patents that will be litigated. This intricate choreography, which can take up to eight months to complete, is colloquially known as the “patent dance”.3 It involves the biosimilar applicant providing its confidential application and manufacturing information, followed by both sides exchanging lists of patents and their contentions on infringement and validity.3

- No Automatic Stay: Crucially, there is no automatic 30-month stay of FDA approval under the BPCIA. If a brand company wants to prevent a biosimilar from launching, it cannot rely on an automatic stay; it must go to court and seek a preliminary injunction, a much higher legal bar to clear.

- Optional Participation: In a landmark decision in Amgen v. Sandoz, the Supreme Court held that the patent dance is not mandatory. A biosimilar applicant can choose to opt out. However, this is a critical strategic decision. Opting out cedes control of the litigation’s timing and scope to the brand sponsor, who can then immediately sue for infringement on any patent it believes is relevant.

The differences between these two frameworks are not merely procedural; they are deeply strategic, creating distinct risk-reward calculations for both brand and follow-on manufacturers.

Table 1: Hatch-Waxman vs. BPCIA Litigation Pathways: A Strategic Comparison

| Feature | Hatch-Waxman Act (Small Molecules) | BPCIA (Biologics) | Strategic Implication |

| Patent Listing | Publicly listed in the FDA’s “Orange Book”. | No central list. Patents identified through a private information exchange (the “patent dance”). | Certainty vs. Ambiguity: Hatch-Waxman provides clear, upfront notice of the patents at issue. BPCIA creates initial ambiguity, making the “dance” a critical discovery and negotiation phase. |

| Litigation Trigger | Generic files an ANDA with a Paragraph IV certification, an “artificial” act of infringement. | Biosimilar files an aBLA. Litigation can arise from the patent dance or a notice of commercial marketing. | Formal Trigger vs. Strategic Choice: The PIV certification is a clear, formal trigger. The BPCIA pathway is more fluid, with litigation timing dependent on strategic choices by both parties regarding the dance. |

| Approval Stay | Lawsuit filed within 45 days triggers an automatic 30-month stay of FDA approval.3 | No automatic stay of FDA approval. | Leverage vs. Urgency: The 30-month stay gives brand companies significant leverage and a predictable litigation window. Its absence in BPCIA forces brand companies to seek preliminary injunctions, creating urgency and raising the legal stakes to block a launch. |

| Information Exchange | Formal notice letter from the generic company to the patent holder. | The complex, multi-step “patent dance” involving exchange of confidential application and manufacturing information.10 | Limited Disclosure vs. Deep Disclosure: The patent dance requires the biosimilar applicant to share highly sensitive manufacturing process information, which is often a closely guarded trade secret. |

| Patents Litigated | Limited to patents listed in the Orange Book (drug substance, drug product, method of use).3 | Broader scope, including manufacturing process patents, which are often a key battleground. | Defined Scope vs. Broader Battlefield: The BPCIA’s inclusion of process patents makes a “patent thicket” around manufacturing methods a much more critical defensive strategy for biologics than for small molecules. |

Navigating the Gauntlet: The Typical Stages of a Pharmaceutical Patent Lawsuit

To effectively manage litigation costs, you must first understand the anatomy of a lawsuit—the distinct phases where time is spent, resources are consumed, and strategic decisions must be made. While every case is unique, a typical pharmaceutical patent lawsuit follows a predictable, albeit lengthy and complex, progression.

- Filing the Complaint and Initial Motions: The process begins when the patent holder (the plaintiff) files a formal complaint in federal court alleging patent infringement. In Hatch-Waxman cases, this is typically triggered by receiving a Paragraph IV notice. For biologics, it may follow the patent dance or a notice of commercial marketing. The defendant (the generic or biosimilar company) will file an answer, often including counterclaims that the patent is invalid or not infringed. This initial phase may also include motions to dismiss the case or, in BPCIA litigation, a motion for a preliminary injunction to block the biosimilar’s launch.

- Discovery: This is the longest, most labor-intensive, and almost always the most expensive phase of litigation.15 During discovery, both sides are required to exchange all information relevant to the case. This includes:

- Document Production: Exchanging millions of pages of internal documents, emails, lab notebooks, and regulatory filings.

- Interrogatories: Answering written questions under oath.

- Depositions: Conducting oral examinations of witnesses, including scientists, executives, and other key personnel, under oath.

- Claim Construction (The Markman Hearing): This is arguably the most critical stage of any patent case. Before a determination of infringement or validity can be made, the court must first interpret the meaning and scope of the patent’s claims. This process, known as claim construction, culminates in a special hearing called a Markman hearing. Here, both sides present arguments to the judge about how the key terms in the patent should be defined. The judge’s ruling on claim construction can be case-dispositive; a broad interpretation may favor the patent holder, while a narrow one may favor the accused infringer. A favorable ruling at this stage can force an early and advantageous settlement, saving millions in future costs.

- Expert Discovery and Summary Judgment: After claim construction, the focus shifts to expert witnesses. Each side retains technical experts to provide opinions on issues like infringement and validity, and financial experts to opine on potential damages. These experts produce detailed reports and are then deposed by the opposing side. Following expert discovery, either party may file a motion for summary judgment, asking the court to rule in their favor without a full trial, arguing that the key facts are not in dispute.

- Trial: If the case is not resolved through settlement or summary judgment, it proceeds to trial. This can be a bench trial (decided by a judge) or a jury trial. Both sides present their evidence, examine and cross-examine witnesses and experts, and make their arguments. Pharmaceutical patent trials are often highly technical and can last for days or even weeks.

- Post-Trial Motions and Appeals: The fight is often not over even after a verdict. The losing party can file post-trial motions asking the judge to set aside the verdict or order a new trial. Regardless of the outcome of these motions, the losing party almost invariably appeals the decision to the U.S. Court of Appeals for the Federal Circuit, the specialized appellate court that hears all patent appeals. This appeal process can add another one to two years and significant additional cost to the litigation.

This entire process, from complaint to the resolution of an appeal, can easily take three to five years or more. Understanding these distinct stages and their associated costs is the first step toward building a proactive and effective cost management strategy. The structure of this process itself creates leverage points. The high cost of discovery, for example, can be weaponized by well-capitalized incumbents to exhaust smaller challengers, forcing them to settle before the merits of the case are even argued at claim construction. This demonstrates that cost management is not just about efficiency; it’s about understanding and manipulating the financial pressures inherent in the litigation timeline.

The Anatomy of Litigation Costs: Deconstructing the Financial Burden

The multi-million-dollar price tag of pharmaceutical patent litigation is not a monolithic figure. It is a complex accumulation of both highly visible, direct expenses and a host of less obvious but equally damaging indirect costs. Like an iceberg, the most significant portion of the financial burden lies beneath the surface, hidden from the simple view of a legal bill. To truly manage the cost, you must understand its entire anatomy.

The Visible Costs: Direct Financial Outlays

These are the tangible, line-item expenses that make up the bulk of a litigation budget. They are the costs you can track, measure, and, with the right strategies, control.

- Legal Fees: This is, without question, the single largest component of any litigation budget. Elite patent litigation attorneys and their teams command premium hourly rates, often ranging from $400 for a junior associate to well over $1,200 for a senior partner at a top-tier firm. A complex case can involve a team of lawyers working for years, accumulating thousands of billable hours. The scientific complexity of pharmaceutical patents, which often involve intricate chemical compounds and biological processes, contributes to higher litigation expenses compared to other industries.

- Expert Witness Fees: In a pharmaceutical case, expert witnesses are indispensable. You will need technical experts—often leading academics or industry veterans in fields like medicinal chemistry, pharmacology, or molecular biology—to explain the complex science to the court and provide opinions on infringement and validity. You will also need economic experts to calculate potential damages, such as lost profits or a reasonable royalty. These experts command substantial fees for their analysis, report writing, deposition testimony, and trial appearances, easily running into the hundreds of thousands of dollars per expert.16

- Discovery and E-Discovery Costs: The discovery phase is a notorious cost driver. The sheer volume of data that must be collected, reviewed, and produced can be immense. This involves not only the attorney time for reviewing documents but also the costs associated with e-discovery vendors who use sophisticated software to process and host terabytes of electronic data. These technology and vendor costs can quickly escalate into the hundreds of thousands or even millions of dollars in a large case.

- Court and Administrative Costs: While smaller than other categories, these costs are not insignificant. They include court filing fees for the initial complaint and subsequent motions, fees for court reporters to transcribe depositions and hearings, and costs for creating trial exhibits and demonstratives.16

- Ancillary Costs: A host of other expenses contribute to the total, including travel and lodging for attorneys and witnesses for depositions and trial, fees for jury consultants in the rare event of a jury trial, and costs for translation services if foreign documents are involved.

The Hidden Iceberg: Quantifying the Immense Indirect Costs

While the direct costs are daunting, the indirect or “hidden” costs of litigation can be far more destructive to a company’s long-term health. These costs don’t appear on a legal invoice but are reflected in lost opportunities, diminished innovation, and eroded shareholder value.

- Opportunity Costs: This is perhaps the most significant indirect cost. Every dollar and every hour spent on litigation is a resource that cannot be invested elsewhere. A $5 million litigation budget is $5 million that is not being used to fund a promising new R&D project, acquire a new technology, or expand marketing for an existing product. The capital tied up in a decade-long drug development cycle already represents a massive opportunity cost; litigation only compounds this financial drag.

- Diversion of Key Personnel: A patent lawsuit is not fought solely by outside lawyers. It demands a significant time commitment from a company’s most valuable internal resources. Senior executives, in-house counsel, and, most critically, the key scientists and inventors who developed the drug will spend hundreds of hours in meetings, reviewing documents, and preparing for and giving depositions. This is a massive distraction from their primary roles of running the business and driving the next wave of innovation.

- Market Uncertainty and Stock Price Volatility: For a publicly-traded company, a high-stakes patent challenge creates a cloud of uncertainty that can hang over its stock for years. Investors dislike uncertainty, and the risk of a patent being invalidated—potentially wiping out a key revenue stream—can depress a company’s valuation and make it more difficult and expensive to raise capital. The market reacts swiftly to litigation news. For example, when Axsome Therapeutics announced a favorable patent settlement with Teva for its top-selling drug Auvelity, its shares surged by more than 20% in a single day, demonstrating the immense value the market places on litigation certainty. Conversely, negative developments can be punishing. The mere act of a hedge fund filing an inter partes review (IPR) to challenge a patent’s validity while simultaneously short-selling the company’s stock has been used as a strategy to drive down share prices.

- Delayed or Deterred Market Entry: For a generic or biosimilar company, the threat of litigation can delay market entry, even if its case is strong. The sheer cost of defending a lawsuit can be a deterrent, forcing a company to wait for a more opportune moment or accept a settlement that delays its launch. For the brand company, while litigation can preserve its monopoly, the uncertainty can impact long-term strategic planning and lifecycle management for the product.

- Impact on Morale and Culture: Protracted, “bet-the-company” litigation is incredibly stressful. It can create a risk-averse culture, where scientists and managers become hesitant to pursue bold new ideas for fear of future legal challenges. It can also be draining on employee morale, as the company’s focus shifts from innovation to defense.

A company might “win” in court but find that its R&D pipeline has stalled, its market position has eroded, and its key talent has been burned out by the process. This is why over 95% of patent cases settle before a final verdict; the business risks of a protracted war often outweigh the legal risks of losing any single battle.

By the Numbers: A Data-Driven Look at Litigation Expenses

To move from abstract warnings to concrete figures, we can turn to the authoritative data compiled by the American Intellectual Property Law Association (AIPLA). Their biennial Economic Survey provides the most reliable industry benchmark for patent litigation costs, breaking them down by the amount of money at risk in the case.7

The data reveals a clear and dramatic escalation of costs as the stakes get higher. The complexity and intensity of the legal tactics employed by both sides increase exponentially when a blockbuster drug’s revenue is on the line.

Table 2: Breakdown of Median Patent Litigation Costs by Amount at Risk

(Based on 2019 AIPLA Report of the Economic Survey data for “PATENT INFRINGEMENT, ALL VARIETIES”)

| Amount at Risk | Median Cost Through Discovery & Claim Construction (USD) | Median Total Cost Through Trial & Appeal (USD) |

| Less than $1 Million | $250,000 | $700,000 |

| $1 Million – $10 Million | $600,000 | $1,500,000 |

| $10 Million – $25 Million | $1,225,000 | $2,700,000 |

| More than $25 Million | $2,375,000 | $4,000,000 |

*Source: *

These figures provide a sobering but essential framework for any company facing litigation. For a typical pharmaceutical patent case where more than $25 million is at stake, a company must be prepared to spend nearly $2.4 million just to get through the critical claim construction phase. If the case doesn’t settle and proceeds through trial and appeal, the total cost can easily double to $4 million or more. Some analyses place the median total cost for a high-stakes pharmaceutical case even higher, at $5.5 million.

This data provides more than just budget line items; it reveals the economic structure of patent litigation. The high “entry fee”—with even the smallest cases costing a median of $700,000 to see through to completion—effectively closes the courthouse doors to many smaller innovators who cannot afford to enforce their patents.7 This economic reality is a driving force behind the rise of alternative strategies like litigation financing and the ongoing debate about creating a more accessible “small claims” patent court.24 For any company, understanding these numbers is the first step toward making rational, data-driven decisions about when to fight, when to settle, and how much to invest in the battle.

Pre-Emptive Strategy: Building a Litigation-Resistant IP Fortress

The most effective method for managing drug patent litigation costs is to minimize the chances of being drawn into costly disputes in the first place. This requires a proactive, forward-thinking approach to intellectual property that begins long before any lawsuit is filed. A well-constructed IP fortress, built on a foundation of strong patents and strategic foresight, can deter challengers, force early and favorable settlements, and ultimately serve as a powerful competitive weapon rather than a mere defensive shield.

The First Line of Defense: Drafting Litigation-Resilient Patents

The strength of your entire IP position begins with the quality of your patent applications. A hastily drafted or strategically naive patent is an open invitation to challengers. A litigation-resilient patent, by contrast, is meticulously crafted with an eye toward surviving the intense scrutiny of a courtroom battle.

The Pillars of a Strong Patent

Drafting a robust patent requires a blend of scientific depth and legal precision. The key elements include:

- Clarity and Consistency: The language used in the patent specification and claims must be clear, precise, and internally consistent. Ambiguous or vague terms are a primary target for challengers during claim construction. It is crucial to define key technical terms within the specification itself to guide a court’s interpretation and prevent an opponent from introducing an unfavorable definition.26

- A Multi-Layered Claim Strategy: A sophisticated patent application should never rely on a single claim. The best practice is to employ a “picture frame” strategy with a mix of broad and narrow claims.

- Broad Independent Claims: These claims are written to provide the widest possible scope of protection, capturing the core inventive concept. For example, a broad claim might cover a class of chemical compounds defined by a core structure.28

- Narrow Dependent Claims: These claims build upon the independent claims, adding specific limitations or features. For example, a dependent claim might specify a particular compound from the class, a specific dosage, or a method of administration. This strategy creates multiple fallback positions. If a broad claim is invalidated by prior art, the narrower, more specific dependent claims may still survive, preserving a core of exclusivity.26

- Robust Specification and Data Support: The written description of the patent must provide adequate support for the full scope of every claim. This means providing enough detail, data, and examples to demonstrate to a person skilled in the art that the inventor was in “possession” of the full invention at the time of filing. This includes providing sufficient data from preclinical or clinical studies to demonstrate the drug’s efficacy and utility.

The Post-Amgen v. Sanofi Paradigm

The importance of a robust specification was thrust into the spotlight by the Supreme Court’s landmark 2023 decision in Amgen Inc. v. Sanofi. This case fundamentally reshaped the landscape for biotech patents, particularly for antibodies. Amgen’s patents claimed an entire class of antibodies based on their function: binding to the PCSK9 protein and blocking it from destroying LDL receptors. However, the patents only disclosed the specific amino acid sequences for a small number of these antibodies.31

The Supreme Court unanimously held that the claims were invalid for lack of “enablement.” The Court ruled that the patent’s specification did not provide enough information to allow a skilled scientist to reliably make and use the full scope of the claimed invention without “undue experimentation”.31 Justice Gorsuch, writing for the Court, articulated a simple but powerful principle:

“The more one claims, the more one must enable”. Amgen’s “roadmap” for discovering other functional antibodies was dismissed as little more than a “hunting license” or a “research assignment”.

The implications for patent drafting strategy are profound:

- Functional Claiming is Risky: Broadly claiming a class of molecules by their function alone is now highly vulnerable to an enablement challenge.

- Disclosure is Paramount: To support broad claims, the patent specification must now disclose a representative number of examples or identify a common structural feature that allows a scientist to reliably identify other members of the claimed class.

- The Rise of the “Patent Thicket”: The difficulty of securing and defending a single, broad patent post-Amgen provides a powerful incentive for companies to adopt a “patent thicket” strategy.2 Instead of relying on one foundational patent, companies will increasingly file dozens or even hundreds of narrower patents covering specific formulations, delivery devices, manufacturing processes, dosing regimens, and new indications. While more expensive to prosecute, this multi-layered defense creates a far more complex and costly challenge for any potential biosimilar or generic competitor to navigate.

Clearing the Path: The Strategic Imperative of Freedom-to-Operate (FTO) Analysis

Launching a new pharmaceutical product without first understanding the existing patent landscape is like navigating a minefield blindfolded. A Freedom-to-Operate (FTO) analysis is the process of mapping that minefield to ensure that the commercialization of your product will not infringe on the valid patent rights of others.

An FTO analysis is not a one-time legal check; it is a dynamic, strategic process that should be integrated into the entire product development lifecycle.

- Early-Stage FTO: Conducting an FTO analysis early in the R&D process provides the maximum strategic flexibility. If a blocking patent is identified, the research team has the opportunity to “design around” it by modifying the product or process to avoid infringement. This can prevent millions of dollars in sunk R&D costs and avert a future lawsuit.

- The FTO Process: A thorough FTO analysis typically involves searching patent literature for issued and pending patents, obtaining a legal opinion on potential infringement, and identifying potential barriers.36 If blocking patents are found, the company has several strategic options:

- Design Around: Modify the product to avoid the patented technology.

- License In: Negotiate a license from the patent holder to use the technology.

- Challenge the Patent: Attempt to invalidate the blocking patent through litigation or a post-grant proceeding like an IPR at the USPTO.

- Wait for Expiration: If the patent is nearing the end of its term, the company may simply decide to delay its launch.

The decision of how and when to conduct an FTO is a risk-management calculation. For a potential blockbuster drug in a crowded and litigious field like oncology, a comprehensive, formal FTO opinion from outside counsel is an essential investment. For a lower-value product in a less competitive space, a more limited, in-house analysis might be sufficient. Beyond risk mitigation, an FTO analysis is also a powerful competitive intelligence tool. The process can uncover “white space” for new innovation, identify patents that are expiring or have lapsed (opening up new market opportunities), or reveal potential technologies available for licensing.35

Playing Chess, Not Checkers: Proactive Patent Portfolio Management

A company’s patent portfolio should be treated as a dynamic strategic asset, actively managed to align with business objectives, not as a static collection of certificates gathering dust in a file cabinet. Effective portfolio management is a continuous cycle of evaluation, optimization, and strategic deployment.

- Alignment with Business Goals: The patent strategy must be inextricably linked to the company’s overall business strategy. If the goal is to dominate a specific therapeutic area, the patent filing and maintenance efforts should be concentrated on protecting innovations within that domain.

- Portfolio Auditing and Pruning: Not all patents are created equal. A portfolio should be regularly audited to assess the strategic value of each asset. Patents that no longer align with the business strategy, protect obsolete technology, or have low licensing potential should be considered for “pruning”—allowing them to expire to save on significant long-term maintenance fees.

- Strategic Use of the Portfolio: A well-managed portfolio can be used both defensively and offensively.

- Defense: A strong and deep portfolio—a “patent thicket”—can deter potential challengers by raising the complexity and cost of any potential lawsuit.2

- Offense: Patents can be monetized through licensing agreements, generating revenue streams from non-core technologies. They can also be used as bargaining chips in cross-licensing negotiations, providing access to a competitor’s technology.25

- Competitive Monitoring: Proactive portfolio management involves constantly monitoring the patent activities of competitors. Tracking their patent filings can provide early warnings of new competitive threats, reveal their R&D direction, and inform your own strategic planning.

There is a fascinating dynamic at play in the valuation of pharmaceutical patent portfolios. While patents are undeniably crucial for securing market exclusivity, data suggests that biopharmaceutical companies invest more per patent issued than any other industry, yet they rank only in the middle in terms of sales generated per patent. This indicates that the value of many patents in a portfolio is not in the direct revenue they generate, but in their collective defensive strength. They form the interwoven threads of a patent thicket, where the value lies not in any single thread, but in the strength of the entire web to entangle and deter would-be competitors. In this environment, portfolio management is evolving into a data science discipline, where companies that use advanced analytics to manage their assets will hold a decisive strategic advantage.39

In-Flight Control: Managing Costs During Active Litigation

Even with the most robust pre-emptive strategies, litigation is sometimes unavoidable. When a lawsuit is filed, the focus must shift to active, in-flight cost management. This is not about cutting corners or compromising the quality of your legal defense; it is about imposing discipline, demanding predictability, and making strategic decisions to ensure that every dollar spent is a dollar that moves you closer to your business objectives.

The Strategic Blueprint: Developing and Managing a Dynamic Litigation Budget

The foundation of in-flight cost control is a comprehensive and dynamic litigation budget. A budget should not be a “set it and forget it” document created at the start of a case. Instead, it must be a living tool for strategic planning, resource allocation, and communication with stakeholders.

Building the Initial Budget

An effective budget must be built from the ground up, with input from both in-house and outside legal counsel to ensure its accuracy and realism. The key components include:

- Phase-Gated Estimates: The budget should be broken down by the major phases of litigation: initial case assessment, discovery, claim construction, expert discovery, pre-trial, trial, and appeal. This phase-gated approach allows for strategic “off-ramps” where the company can re-evaluate its position and decide whether to settle or proceed after each major milestone, rather than committing to the entire potential cost upfront.

- Detailed Expense Categories: Within each phase, the budget should detail all anticipated expenses, including legal fees (broken down by attorney/paralegal), expert witness fees, e-discovery vendor costs, court fees, travel, and other administrative expenses.

- Contingency Fund: Litigation is inherently unpredictable. A contingency fund, typically 10-15% of the total estimated budget, should be set aside to cover unforeseen expenses, such as an unexpected motion or an extended hearing, without derailing the entire financial plan.

The Budget as a Management Tool

Once established, the budget becomes a powerful tool for managing the litigation and your relationship with outside counsel.

- Regular Reviews: The budget must be reviewed regularly—monthly or even weekly in active phases—against actual expenditures. A senior counsel at a major pharmaceutical company noted that they “are constantly revisiting our budget, even on a weekly basis”. This allows for early detection of potential overruns and prompts strategic conversations about the case’s direction.

- Cost-Benefit Analysis: The budget should be continuously weighed against a dynamic cost-benefit analysis. At each stage, you must ask: What is the likely cost to get to the next milestone? What is the probability of success? What is the potential reward (or avoided loss)? And critically, does it still make business sense to continue, or is this the right time to pursue a settlement?.

- Enforcing Discipline: By requiring outside counsel to bill against a detailed, phase-based budget, you can enforce discipline and ensure that their efforts are aligned with your strategic priorities. It shifts the dynamic from passively paying invoices to actively managing a critical vendor relationship and a multi-million-dollar project.

Taming the Billable Hour: Leveraging Alternative Fee Arrangements (AFAs)

For decades, the billable hour has been the standard model for legal services. However, it creates a fundamental misalignment of incentives: the law firm is rewarded for inefficiency, while the client desires a swift and cost-effective resolution. Alternative Fee Arrangements (AFAs) are designed to correct this misalignment by shifting some or all of the financial risk from the client to the law firm, rewarding efficiency and success.

The pharmaceutical industry, with its high litigation budgets, has been a leader in adopting AFAs. There is a spectrum of AFA models, each with its own risk-reward profile.

Table 3: A Practical Guide to Alternative Fee Arrangements (AFAs)

| AFA Type | How It Works | Pros for Client | Cons for Client | Best For… |

| Standard Hourly | Client pays for every hour worked at set rates. | Maximum flexibility; easy to implement. | No cost predictability; incentivizes inefficiency. | Matters with highly uncertain scope or duration. |

| Capped Fee | Hourly billing, but the total fee will not exceed a pre-agreed maximum. | Provides a “ceiling” for total cost, offering some predictability. | Firm may do the minimum required to stay under the cap; less incentive for exceptional results. | Well-defined projects like an appeal or a specific motion. |

| Fixed / Flat Fee | A single, pre-agreed price for a specific phase (e.g., through claim construction) or the entire case. | Perfect cost predictability; incentivizes firm efficiency. | Can be inefficient if the case settles very early; requires precise scoping upfront. | Predictable, standardized litigation like many Hatch-Waxman cases. |

| Blended Rate | A single hourly rate is applied to all attorneys working on the case, regardless of seniority.16 | Simplifies invoicing; can provide a discount if senior partners do most of the work. | Can be more expensive if junior associates handle the bulk of the hours. | Cases requiring a mix of partner-level strategy and associate-level execution. |

| Success Fee / Holdback | Firm bills a reduced hourly rate (e.g., 80%), and the remaining portion (“holdback”) is paid, often with a multiplier, only if pre-defined success metrics are met.43 | Aligns incentives perfectly; client pays less if the outcome is poor. | Complex to negotiate success metrics; can be more expensive than hourly if the firm achieves a big win. | High-stakes cases where a clear “win” can be defined (e.g., invalidating a key patent). |

| Contingency Fee | The firm receives no hourly fees, but takes a percentage of the financial recovery (for plaintiffs) or a share of revenue from a successful product launch (for defendants). | No upfront cost for the client; maximum risk transfer to the law firm. | Firm takes a large share of the upside; may be less attractive to firms for defense-side work. | Plaintiffs with strong cases but limited capital; generic defendants in high-value ANDA cases. |

The most effective approach often involves a hybrid AFA. For example, a firm might agree to a fixed fee through the claim construction phase, then switch to a capped hourly rate with a success bonus for trial. This provides predictability in the early stages while aligning performance incentives for the high-stakes later stages. A law firm’s willingness to engage in an AFA can also be a powerful signal of its confidence in its ability to manage the case efficiently and achieve a favorable outcome.

Mastering the Discovery Beast: Technologies and Tactics

As noted, discovery is frequently the most expensive phase of litigation. Taming this beast is therefore essential for overall cost control. This requires a two-pronged approach: reducing the volume of data to be reviewed and increasing the efficiency of the review itself.

- Proactive Information Governance: The best way to reduce discovery costs is to have less data to review in the first place. A well-planned and consistently enforced document retention policy ensures that irrelevant, outdated documents are regularly discarded, legally and defensibly reducing the scope of what needs to be collected and produced in litigation.16

- Strategic Use of In-House Resources: Not every task requires a $1,200-per-hour partner. In-house legal teams and paralegals can handle many discovery-related tasks, such as initial document collection, preliminary research, and managing internal communications, at a fraction of the cost of outsourcing them to external counsel.

- Leveraging Technology: The days of armies of associates manually reading every document are over. Modern e-discovery platforms use sophisticated technologies like Technology-Assisted Review (TAR) and artificial intelligence to dramatically increase the speed and accuracy of document review. These tools can quickly identify relevant documents, cull irrelevant ones, and reduce the number of hours spent on manual review by orders of magnitude. While there is an upfront cost for these technologies, the long-term savings in legal fees are substantial. The rise of AI-powered e-discovery is not just about cost savings; it’s about finding the “smoking gun” faster. AI can identify patterns and connections in millions of documents that human reviewers might miss, potentially uncovering key evidence early in the process that can lead to a swift and favorable resolution.

Finally, a crucial but often overlooked tactic is strategic venue selection. Where a lawsuit is filed can have a massive impact on discovery costs. Some federal districts are known for allowing broad, far-reaching discovery, while others, like the “rocket dockets” in the Eastern District of Texas or the Western District of Virginia, are known for expedited processes that can reduce overall litigation time and costs.15 Where a choice exists, consulting with your patent attorney about the most cost-effective venue can lead to substantial savings.

Beyond the Courtroom: Alternative Resolutions and Strategic Settlements

While preparing for a courtroom battle is essential, the reality is that the vast majority of pharmaceutical patent disputes are resolved long before a final verdict is rendered. A savvy cost management strategy, therefore, must include a sophisticated approach to exploring alternatives to litigation and negotiating strategic settlements. The goal is not simply to end the dispute, but to do so on terms that align with your overarching business objectives.

Exploring the Alternatives: A Guide to ADR in Patent Disputes

Alternative Dispute Resolution (ADR) refers to a set of processes used to resolve legal disputes outside of the traditional court system. For complex, high-stakes patent cases, ADR offers several compelling advantages over litigation: it is generally faster, less expensive, and, crucially, confidential, which allows companies to protect sensitive trade secrets and business information from public view.47 The two primary forms of ADR used in patent disputes are mediation and arbitration.

- Mediation: This is a voluntary, non-binding process in which a neutral third-party—the mediator—helps the disputing parties negotiate a mutually acceptable settlement. The mediator does not impose a decision but rather facilitates communication, clarifies issues, and explores potential solutions.

- Strategic Value: Mediation is particularly well-suited for disputes where the parties have an ongoing or potential business relationship they wish to preserve. It allows for creative, business-oriented solutions that a court cannot order, such as a restructured licensing agreement, a joint venture, or a new supply contract. The parties retain complete control over the outcome; if no agreement is reached, they are free to continue with litigation.47

- Arbitration: This is a more formal process that resembles a private trial. The parties agree to present their case to a neutral arbitrator or a panel of arbitrators, who act as private judges. The arbitrator hears evidence and arguments and then issues a decision, known as an “award,” which is typically legally binding and enforceable in court.

- Strategic Value: Arbitration’s main advantages are speed, finality, and expertise. The process is generally much faster than court litigation, and the grounds for appealing an arbitrator’s award are extremely limited, providing a final resolution. Furthermore, the parties can select arbitrators who have specific technical or industry expertise (e.g., a Ph.D. in chemistry or a former pharmaceutical general counsel), ensuring the decision-maker is well-versed in the complex subject matter.

The choice between mediation and arbitration is a strategic one, representing a trade-off between control and finality. If your goal is to explore creative business solutions and maintain control over the outcome, mediation is the preferred path. If your goal is a fast, final, and expert-driven decision on a purely legal or financial issue, arbitration may be the better choice.

The Art of the Deal: Strategic Considerations in Settlement Negotiations

Settlement should not be viewed as a sign of weakness, but as a strategic tool to achieve a business objective at an acceptable cost and level of risk. The decision to settle is a “normal, legitimate settlement calculus” that involves weighing the potential costs of continued litigation against the probability of winning and the value of the potential outcome.

An early and objective case assessment is the foundation of any sound settlement strategy. This involves a frank evaluation of the strengths and weaknesses of your case, the potential outcomes, and a clear-eyed analysis of whether settling is more beneficial than pursuing a trial.

The timing of settlement negotiations can be a powerful strategic lever. Understanding the cost curve of litigation allows a company to time its offers for maximum impact. An offer made just before a major expense, such as the start of expert discovery or trial preparation, can be particularly compelling, as it allows the other side to avoid a significant, imminent cost.

Settlement terms themselves can also be used strategically. For instance, in Hatch-Waxman litigation, a brand-name company might grant a license to the first generic filer that allows for market entry on a specific date. That agreement might also include a “most-favored-entry” (MFE) clause, which stipulates that if another generic company manages to enter the market even earlier (perhaps by winning its own lawsuit), the settling generic’s entry date is accelerated to match. This can have the effect of discouraging later-filing generics from pursuing costly litigation, as the potential reward of being the sole early entrant has been neutralized. In this way, the first settlement is used as a tool to manage the risk of future litigation.

Navigating the Antitrust Minefield: “Reverse Payments” After FTC v. Actavis

Perhaps the most complex area of pharmaceutical patent settlements involves so-called “reverse payment” or “pay-for-delay” agreements. This occurs when, as part of a settlement, the brand-name patent holder pays the generic challenger to delay the launch of its product.51 Because the payment flows in the “reverse” of the usual direction (from plaintiff to defendant), and because it results in a delay of competition, these agreements have attracted intense scrutiny from antitrust regulators.

The legal landscape was fundamentally altered by the Supreme Court’s 2013 decision in FTC v. Actavis, Inc.. Prior to this case, some courts had held that such settlements were immune from antitrust attack as long as the generic’s delayed entry was within the scope of the patent’s exclusionary rights. In Actavis, the Supreme Court rejected this view, ruling that reverse payment settlements could violate antitrust laws and must be evaluated under a “rule of reason” analysis.53 The Court reasoned that a large and unexplained payment from a brand to a generic could be evidence of an illegal agreement to share monopoly profits at the expense of consumers.

The Actavis decision did not declare all reverse payments illegal, but it did usher in an era of heightened scrutiny and legal uncertainty. Key takeaways for navigating this minefield include:

- Justifying Payments: The Court acknowledged that some payments could be legitimate, such as compensation for services rendered or payments that represent the brand’s saved litigation costs.55 This has led to a strategic shift where settlements are often structured to include payments capped at a level that can be plausibly justified as avoided litigation expenses. The Federal Trade Commission (FTC) has often used a threshold of around $7 million as a proxy for such costs in its own consent decrees.

- The Rise of Non-Cash Considerations: To avoid the “red flag” of a direct cash payment, settlements are increasingly structured with complex, non-cash forms of value. This can include side deals such as co-promotion agreements, manufacturing contracts, or licenses on other, unrelated products. While these structures make the settlement’s value harder for regulators to quantify, they also require far more sophisticated deal-making and legal analysis to ensure they can withstand antitrust scrutiny.

- Decline in Obvious Reverse Payments: The data shows that since the Actavis decision, the number of settlements containing the most obvious forms of reverse payments has declined significantly, while the overall number of patent settlements has continued to rise. This indicates that the industry has adapted, finding new ways to resolve disputes that are less likely to trigger an FTC investigation.

For any company considering a patent settlement, a thorough antitrust analysis is no longer optional; it is an essential component of risk management.

The Digital Advantage: Technology and Data in Modern Litigation Strategy

The practice of law, long seen as a bastion of tradition, is being fundamentally reshaped by technology. In the data-intensive and high-stakes arena of pharmaceutical patent litigation, companies that embrace the digital advantage—leveraging advanced analytics, artificial intelligence, and specialized intelligence platforms—can make smarter, faster, and more cost-effective decisions, turning legal data from a historical record into a predictive, strategic weapon.

The Power of Predictive Analytics: Using Litigation Data to Forecast Outcomes

We are now in an era where legal outcomes can be modeled and predicted with increasing accuracy. By applying big data analytics to the vast trove of information contained in court filings, regulatory databases, and patent office records, companies can gain unprecedented visibility into the future competitive landscape.

This process begins with aggregating data from multiple sources, including:

- PACER: The federal court’s electronic records system, containing millions of documents from past patent cases.

- FDA Databases: The Orange Book for small molecules and other regulatory filings that provide patent and exclusivity information.

- USPTO Records: The full prosecution histories of patents and records of administrative challenges like inter partes review (IPR) proceedings.

- SEC Filings: Disclosures from public companies about material litigation.

By applying sophisticated analytical tools to this data, it is possible to identify patterns and quantify key metrics that correlate with litigation outcomes. These include judge-specific tendencies in claim construction rulings, historical invalidation rates for different types of arguments (e.g., obviousness vs. lack of enablement), and the average time to resolution in various jurisdictions.

The strategic applications are powerful:

- For Brand Manufacturers: Predictive analytics can create an early warning system, modeling the likelihood that a specific patent will be challenged years in advance. This allows for proactive strengthening of the patent portfolio, better resource allocation for defense, and more informed life-cycle management planning.

- For Generic/Biosimilar Manufacturers: Data analytics can power critical “go/no-go” decisions, identifying the patents with the highest probability of being successfully invalidated. It can inform the decision of whether to launch a product “at risk” by modeling the potential damages against the probability of losing on appeal.

- For Investors: Litigation analytics provides valuable signals for valuing pharmaceutical companies, modeling the impact of a “patent cliff,” and predicting stock price movements based on litigation milestones.

This data-driven approach to legal strategy is creating a new “arms race” in competitive intelligence. Companies that invest in these capabilities will be able to make more informed decisions about which patents to challenge, which defenses to mount, and which settlements to offer.

The Rise of AI: Transforming Prior Art Searches, Invalidation, and Inventorship

Artificial intelligence (AI) is rapidly moving from a futuristic concept to a practical tool in the pharmaceutical IP toolkit, with profound implications for both creating and challenging patents.

- Streamlining Patent Invalidation: One of the most time-consuming and expensive aspects of patent litigation is the search for prior art to invalidate a competitor’s patent. AI-powered tools can now scan vast global databases of patents and scientific literature in a matter of hours, identifying relevant prior art that could take a team of humans weeks or months to find. This dramatically reduces the cost and increases the speed and comprehensiveness of invalidation challenges.

- Accelerating Drug Discovery: AI is also revolutionizing the front end of the innovation pipeline. By analyzing massive datasets and predicting molecular interactions, AI algorithms are significantly shortening drug development timelines. For example, Insilico Medicine used AI to move from novel target discovery to a preclinical candidate for fibrosis in just 18 months—a process that traditionally takes a decade or more.60

However, this new role for AI in innovation creates a monumental legal challenge: inventorship. Current U.S. patent law is unequivocal that an inventor must be a human being; an AI system cannot be named as an inventor.60 This means that for a patent on an AI-developed drug to be valid, a human must have made a “significant contribution” to the conception of the invention.

This creates a new and fertile ground for future patent litigation. We can anticipate a wave of challenges where defendants will seek to invalidate patents by arguing that the true “inventor” was the AI, and that the listed human scientists were merely overseeing the machine. To defend against this future threat, companies using AI in their R&D must act now to implement rigorous documentation protocols that meticulously record the human contributions at every stage of the inventive process—from designing the AI model and selecting the training data to validating and modifying the AI’s output through experimentation.

Competitive Intelligence Platforms: Leveraging Tools Like DrugPatentWatch

In this complex and data-rich environment, navigating the patent landscape without specialized tools is nearly impossible. Business intelligence platforms designed specifically for the pharmaceutical industry have become indispensable for strategic planning and competitive analysis.

Platforms like DrugPatentWatch provide a centralized, comprehensive database of global drug patents, litigation histories, regulatory exclusivity data, and information on generic and biosimilar manufacturers. They integrate data directly from official sources like the FDA and USPTO, often updating it daily to provide fresh, actionable intelligence.

The value of such a platform is not just in the data itself, but in the speed and efficiency it enables. Strategic use cases include:

- Portfolio Management: Tracking your own and competitors’ patent portfolios to identify threats and opportunities.

- Market Entry Planning: Using patent expiration alerts to strategically time a generic or biosimilar launch.

- Business Development: Identifying potential licensing opportunities or acquisition targets.

- Litigation Support: Uncovering prior art in expired patents and analyzing the litigation histories of specific drugs or competitors.

The availability of such powerful, aggregated data has a democratizing effect on the industry. It is no longer the exclusive domain of large pharmaceutical companies with massive internal analytics teams. Smaller biotech and generic firms can now access the same high-quality intelligence, leveling the playing field and increasing competitive pressure across the board. This makes it even more critical for all players to have a sophisticated strategy for using this data to gain a competitive edge.

Conclusion: From Cost Center to Competitive Edge

The journey through the intricate world of pharmaceutical patent litigation reveals a landscape of immense financial risk, complex legal strategy, and profound business implications. The costs, both direct and indirect, are formidable, capable of consuming vast corporate resources and shaping the very trajectory of innovation. Yet, to view these costs as merely an unavoidable burden is to miss the fundamental strategic opportunity they represent.

The paradigm for managing drug patent litigation costs has shifted. The old model of reactive defense—treating a lawsuit as a fire to be extinguished by the legal department—is obsolete. The new model is one of proactive, integrated strategic management, driven from the C-suite and embedded in every phase of a drug’s lifecycle.

This modern approach is built on several key pillars. It begins with pre-emptive strategy, building a litigation-resistant IP fortress through meticulously drafted patents that anticipate future challenges and comprehensive FTO analyses that clear the path for commercialization. It requires in-flight financial control, using dynamic, phase-gated budgets and innovative Alternative Fee Arrangements to impose discipline and predictability on the chaos of active litigation. It embraces alternatives to the courtroom, strategically employing mediation and arbitration to achieve faster, more cost-effective, and business-oriented resolutions. And it harnesses the power of the digital advantage, leveraging data analytics and AI to forecast outcomes, gain competitive intelligence, and make smarter decisions at every turn.

Ultimately, mastering the art of managing litigation costs is about more than just protecting the bottom line. It is about protecting the engine of innovation. It is about ensuring that capital is deployed not just to defend past discoveries, but to fund future ones. In one of the world’s most competitive and capital-intensive industries, the ability to navigate the legal battlefield with foresight, discipline, and strategic acumen is no longer a peripheral legal function. It is a core business competency and a powerful source of durable competitive advantage.

Key Takeaways

- Litigation Costs are a Strategic Issue, Not Just a Legal One: The multi-million-dollar cost of patent litigation is a rational economic response to the billions in revenue at stake. Managing these costs requires C-suite-level strategic oversight, not just tactical legal management.

- The Best Defense is a Proactive Offense: The most effective way to control litigation costs is to prevent or prepare for disputes long before they arise. This includes drafting litigation-resilient patents (especially in the post-Amgen v. Sanofi era), conducting early FTO analyses, and actively managing the patent portfolio as a strategic asset.

- Understand the Rules of Engagement: The legal frameworks for small molecules (Hatch-Waxman Act) and biologics (BPCIA) are fundamentally different. Key distinctions, such as the presence or absence of an automatic 30-month stay, create vastly different strategic landscapes and risk calculations.

- Budgets Must Be Dynamic Management Tools: A litigation budget should not be a static document. It must be phase-gated, reviewed constantly, and used to drive strategic decisions about when to fight and when to settle. Alternative Fee Arrangements (AFAs) are a powerful tool for aligning incentives and achieving cost predictability.

- The Indirect Costs are the Real Killers: The most significant financial damage from litigation often comes from indirect costs like diverted R&D funds, management distraction, and market uncertainty that can depress stock prices. These hidden costs create a powerful incentive to seek efficient resolutions.

- Embrace Alternatives to the Courtroom: Alternative Dispute Resolution (ADR), including mediation and arbitration, offers faster, cheaper, and more confidential pathways to resolve disputes. Strategic settlements, while navigating the antitrust risks of FTC v. Actavis, remain the most common outcome.

- Technology is a Force Multiplier: Data analytics and AI are transforming litigation strategy. Leveraging these tools to predict outcomes, streamline prior art searches, and gain competitive intelligence through platforms like DrugPatentWatch is no longer a luxury but a necessity for competing effectively.

Frequently Asked Questions (FAQ)

1. What is the single most critical stage in a patent lawsuit for managing costs?

While every stage incurs costs, the claim construction (or Markman) hearing is arguably the most critical strategic inflection point. The court’s interpretation of the patent’s claims at this stage often determines the ultimate outcome of the case. A favorable ruling can lead to a swift and advantageous settlement, saving millions in trial and appeal costs. Conversely, an unfavorable ruling can severely weaken a party’s position, forcing a disadvantageous settlement or a costly, uphill battle at trial. Therefore, a disproportionate amount of strategic focus and resources should be allocated to achieving a win at claim construction.

2. Is the “patent dance” under the BPCIA always the best strategic choice for a biosimilar applicant?

Not necessarily. While engaging in the patent dance provides a structured framework for identifying and narrowing patent disputes, the Supreme Court has confirmed it is optional. For a biosimilar applicant, the decision is a strategic trade-off. Engaging in the dance provides some control over the initial litigation scope and preserves the right to file a declaratory judgment action. However, it requires disclosing the highly confidential aBLA and manufacturing process information to a direct competitor. Opting out of the dance protects this confidential information but cedes control to the brand sponsor, who can then immediately sue on any patent they deem relevant, potentially creating a broader and more unpredictable initial lawsuit. The best choice depends on the specific circumstances, including the strength of the applicant’s non-infringement or invalidity positions and the sensitivity of its manufacturing trade secrets.

3. How has the Supreme Court’s decision in Amgen v. Sanofi changed the strategy for protecting biologic drugs?

The Amgen v. Sanofi decision significantly raised the bar for patenting broad classes of antibodies and other biologics based on their function. The key takeaway is that the patent’s specification must “enable” a person skilled in the art to make and use the full scope of the claimed invention without undue experimentation.31 This has forced a strategic shift away from relying on a single, broad “genus” patent. Now, the dominant strategy is to build a

“patent thicket”—a dense, multi-layered portfolio of numerous, narrower patents covering not just the molecule itself, but also its specific formulations, manufacturing processes, delivery devices (like autoinjectors), and methods of use for different indications. This approach, while more costly in terms of patent prosecution, creates a much more formidable and expensive defensive barrier for a biosimilar competitor to overcome.

4. Can a company use an Alternative Fee Arrangement (AFA) for defense-side litigation, and what would that look like?

Yes, AFAs are increasingly used for defense-side work. While a traditional contingency fee (a percentage of the recovery) doesn’t apply, creative structures can align incentives. For example, a generic company defending a Hatch-Waxman suit could agree to a “reverse contingency” arrangement. The law firm might work at a reduced hourly rate or for a flat fee, and if it successfully invalidates the patent and enables an early generic launch, it receives a success bonus tied to a percentage of the generic’s first-year revenue. Another option is a “holdback with success bonus,” where the firm bills 80% of its fees monthly, and the remaining 20% is paid with a multiplier only if the case is won or settled on favorable terms. These arrangements incentivize the law firm to achieve a successful business outcome for the defendant, not just to bill hours.

5. With the rise of AI in drug discovery, what is the biggest IP risk companies face right now?

The single biggest and most immediate IP risk is improper inventorship. U.S. law currently requires an inventor to be a human being.60 As companies increasingly use sophisticated AI platforms that can identify targets and design novel molecules with minimal human intervention, they risk creating inventions where no single human can claim to have made a “significant contribution” to the conception of the final claimed drug. A patent listing the wrong inventors—or listing human “inventors” who did not actually meet the legal standard for inventorship—is invalid. This creates a ticking time bomb. Companies must immediately implement rigorous internal processes to document the precise nature and significance of human contributions to AI-assisted inventions to defend against future invalidity challenges on these grounds.62

References

- Managing Drug Patent Litigation Costs – DrugPatentWatch, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/managing-drug-patent-litigation-costs/

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed August 4, 2025, https://www.congress.gov/crs-product/R46679

- Drug Pricing and the Law: Pharmaceutical Patent Disputes – Congress.gov, accessed August 4, 2025, https://www.congress.gov/crs-product/IF11214

- How Much Does a Drug Patent Cost? A Comprehensive Guide to Pharmaceutical Patent Expenses – DrugPatentWatch – Transform Data into Market Domination, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/how-much-does-a-drug-patent-cost-a-comprehensive-guide-to-pharmaceutical-patent-expenses/

- Pharmaceutical Patent Regulation in the United States – The Actuary Magazine, accessed August 4, 2025, https://www.theactuarymagazine.org/pharmaceutical-patent-regulation-in-the-united-states/

- How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management, accessed August 4, 2025, https://www.ajmc.com/view/a636-article

- The Hidden Price of Patent Wars: How Legal Costs Are Killing Innovation – Ramey LLP, accessed August 4, 2025, https://www.rameyfirm.com/the-hidden-price-of-patent-wars-how-legal-costs-are-killing-innovation

- Biosimilars | Health Affairs, accessed August 4, 2025, https://www.healthaffairs.org/do/10.1377/hpb20131010.6409/

- The Hatch-Waxman Act: A Primer – EveryCRSReport.com, accessed August 4, 2025, https://www.everycrsreport.com/reports/R44643.html

- What Are the Patent Litigation Differences Between the BPCIA and …, accessed August 4, 2025, https://www.winston.com/en/legal-glossary/BPCIA-Hatch-Waxman-Act-differences

- “Personal Jurisdiction in Hatch-Waxman Cases” by Michael Marusak – Catholic Law Scholarship Repository, accessed August 4, 2025, https://scholarship.law.edu/lawreview/vol66/iss1/10/

- What Is the Patent Dance? | Winston & Strawn Law Glossary …, accessed August 4, 2025, https://www.winston.com/en/legal-glossary/patent-dance

- Biosimilar Patent Dance: BPCIA Framework & Litigation Guide – Effectual Services, accessed August 4, 2025, https://www.effectualservices.com/article/biosimilar-patent-dance

- Improving Access to Emerging Lifesaving Drugs: Solving the Disclosure Problem Within the Patent Dance – Scholarship Commons, accessed August 4, 2025, https://scholarship.law.slu.edu/cgi/viewcontent.cgi?article=1282&context=jhlp

- Guide to Patent Litigation and Case Management – Lumenci, accessed August 4, 2025, https://lumenci.com/blogs/patent-litigation-case-management-strategies/

- Patent Litigation Costs: What You Need to Know, accessed August 4, 2025, https://patentpc.com/blog/patent-litigation-costs-what-you-need-to-know

- Claim Construction | Articles | Finnegan | Leading IP+ Law Firm, accessed August 4, 2025, https://www.finnegan.com/en/insights/articles/claim-construction.html

- Patent litigation 101 | Legal Blog, accessed August 4, 2025, https://legal.thomsonreuters.com/blog/patent-litigation-101/

- Report of the Economic Survey – IPWatchdog.com, accessed August 4, 2025, https://ipwatchdog.com/wp-content/uploads/2021/08/AIPLA-Report-of-the-Economic-Survey-Relevant-Excerpts.pdf

- How Can You Reduce Litigation Costs with AI Patent Invalidation Tools? – XLSCOUT, accessed August 4, 2025, https://xlscout.ai/how-can-you-reduce-litigation-costs-with-ai-patent-invalidation-tools/

- Axsome secures top drug’s future with Teva patent settlement | BioPharma Dive, accessed August 4, 2025, https://www.biopharmadive.com/news/axsome-teva-patent-settlement-auvelity-generic-launch/739664/

- HEDGE FUND CHALLENGES TO PHARMACEUTICAL PATENTS AND THE NEED FOR FINANCIAL REGULATION – Fordham Law News, accessed August 4, 2025, https://news.law.fordham.edu/jcfl/wp-content/uploads/sites/5/2018/01/Multak-Note.pdf

- Ten Tips to Save Costs in Patent Litigation // Cooley // Global Law Firm, accessed August 4, 2025, https://www.cooley.com/news/insight/2016/2016-01-01-ten-tips-to-save-costs-in-patent-litigation

- July 5, 2022 Small Claims Patent Court Comments Administrative Conference of the United States Suite 706 South 1120 20th Street – American Intellectual Property Law Association, accessed August 4, 2025, https://www.aipla.org/docs/default-source/advocacy/aipla-comments-to-acus-on-patent-small-claims-court.pdf

- Patent Assertion Entities: Strategies for Mitigation – Number Analytics, accessed August 4, 2025, https://www.numberanalytics.com/blog/patent-assertion-entities-mitigation-strategies

- The Ultimate Guide to Claim Breadth in Patent Drafting, accessed August 4, 2025, https://www.numberanalytics.com/blog/ultimate-guide-claim-breadth-patent-drafting

- Ten Common Patent Claim Drafting Mistakes to Avoid – IPWatchdog.com, accessed August 4, 2025, https://ipwatchdog.com/2021/10/20/ten-common-patent-claim-drafting-mistakes-avoid/id=139032/

- Patent Drafting: Key Elements, Considerations, and Strategies – UnitedLex, accessed August 4, 2025, https://unitedlex.com/insights/patent-drafting-key-elements-considerations-and-strategies/

- Understanding the Different Types of Patent Claims – PatentPC, accessed August 4, 2025, https://patentpc.com/blog/understanding-the-different-types-of-patent-claims-2

- Drafting Effective Drug Patent Applications: Turning Science into Market Power, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/drafting-effective-drug-patent-applications-turning-science-into-market-power/

- Amgen Inc. v. Sanofi | Oyez, accessed August 4, 2025, https://www.oyez.org/cases/2022/21-757

- Amgen Inc. v. Sanofi, No. 17-1480 (Fed. Cir. 2017) – Justia Law, accessed August 4, 2025, https://law.justia.com/cases/federal/appellate-courts/cafc/17-1480/17-1480-2017-10-05.html

- Amgen Inc. v. Sanofi – Food and Drug Law Institute (FDLI), accessed August 4, 2025, https://www.fdli.org/2024/05/amgen-inc-v-sanofi/

- STAT quotes Sherkow on pharmaceutical patents – College of Law, accessed August 4, 2025, https://law.illinois.edu/stat-quotes-sherkow-on-pharmaceutical-patents/

- When Is a “Freedom to Operate” Opinion Cost-Effective? | Articles – Finnegan, accessed August 4, 2025, https://www.finnegan.com/en/insights/articles/when-is-a-freedom-to-operate-opinion-cost-effective.html

- IP: Writing a Freedom to Operate Analysis – InterSECT Job Simulations, accessed August 4, 2025, https://intersectjobsims.com/library/fto-analysis/

- IP and Business: Launching a New Product: freedom to operate, accessed August 4, 2025, https://www.wipo.int/web/wipo-magazine/articles/ip-and-business-launching-a-new-product-freedom-to-operate-34956

- Patent Portfolio Management: Building A Monetizable IP Portfolio – Dilworth IP, accessed August 4, 2025, https://www.dilworthip.com/resources/news/patent-portfolio-management/

- Best Practices for Drug Patent Portfolio Management: Leveraging Patent Data for Competitive Advantage – DrugPatentWatch, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/best-practices-for-drug-patent-portfolio-management-2/

- Managing Patent Portfolios in the Pharmaceutical Industry – PatentPC, accessed August 4, 2025, https://patentpc.com/blog/managing-patent-portfolios-in-the-pharmaceutical-industry

- How to Leverage Pharma Competitive Intelligence for Growth – AMPLYFI, accessed August 4, 2025, https://amplyfi.com/blog/how-to-leverage-pharma-competitive-intelligence-for-growth/

- 2024 Annual Litigation Trends Survey: PERSPECTIVES FROM …, accessed August 4, 2025, https://www.nortonrosefulbright.com/-/media/files/nrf/nrfweb/knowledge-pdfs/norton-rose-fulbright—2024-annual-litigation-trends-survey.pdf

- Alternative Fee Arrangements for Paragraph IV Litigation – – Carlson Caspers, accessed August 4, 2025, https://www.carlsoncaspers.com/alternative-fee-arrangements-for-paragraph-iv-litigation/

- Legal finance for the pharma & life sciences sector | Burford Capital, accessed August 4, 2025, https://www.burfordcapital.com/insights-news-events/insights-research/legal-finance-for-pharma/

- Alternative Fee Models | Fish & Richardson, accessed August 4, 2025, https://www.fr.com/why-fish/alternative-fee-models/

- Managing Costs of Patent Litigation – IPWatchdog.com | Patents & Intellectual Property Law, accessed August 4, 2025, https://ipwatchdog.com/2013/02/05/managing-costs-of-patent-litigation/id=34808/

- Florida International Patent Law Firm Services | ADD+G, accessed August 4, 2025, https://allendyer.com/practice-areas/alternative-dispute-resolution/

- ADR in Intellectual Property Disputes: Efficiently Resolving Complex IP Conflicts, accessed August 4, 2025, https://www.schreiberadr.com/adr-in-intellectual-property-disputes-efficiently-resolving-complex-ip-conflicts

- Part III: You’ve Got Patents! Or Someone Else Does… Where Can You Find Resolution?, accessed August 4, 2025, https://www.iptechblog.com/2024/09/part-iii-youve-got-patents-or-someone-else-does-where-can-you-find-resolution/

- Most-Favored Entry Clauses in Drug-Patent Litigation Settlements | Cornerstone Research, accessed August 4, 2025, https://www.cornerstone.com/insights/articles/most-favored-entry-clauses-in-drug-patent-litigation-settlements/

- Pharmaceutical Patent Settlement Cases, accessed August 4, 2025, https://report.ndc.gov.tw/ReportFront/PageSystem/reportFileDownload/C09602410/005

- Pharmaceutical Patent Litigation Settlements: Implications for Competition and Innovation – UM Carey Law, accessed August 4, 2025, https://www2.law.umaryland.edu/marshall/crsreports/crsdocuments/RL33717_01272012.pdf

- FTC v. Actavis, Inc. – Wikipedia, accessed August 4, 2025, https://en.wikipedia.org/wiki/FTC_v._Actavis,_Inc.