Executive Summary

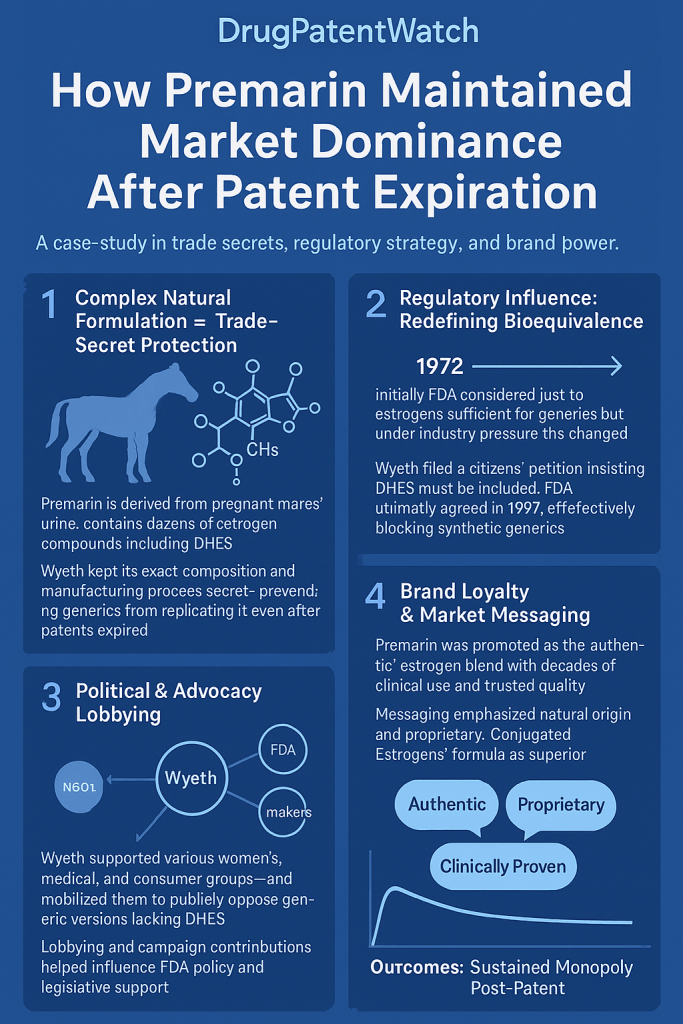

Premarin, a long-standing hormone replacement therapy (HRT), presents a compelling case study in pharmaceutical market resilience. Despite the expiration of its primary patents, a phase that typically ushers in rapid generic competition and significant market erosion, Premarin has maintained a remarkable degree of market dominance for decades. This report examines the multifaceted strategies employed by its manufacturer, Wyeth (later acquired by Pfizer), to achieve this sustained leadership. The analysis reveals that Premarin’s enduring market position is not attributable to a single factor, but rather a unique combination of intrinsic product characteristics, astute regulatory navigation, aggressive legal defense, and robust brand management. These elements collectively formed a formidable barrier to generic entry, allowing Premarin to defy conventional pharmaceutical lifecycle trends even in the face of significant market challenges, such as the Women’s Health Initiative (WHI) study.

1. Introduction: The Enduring Legacy of Premarin in the HRT Market

Premarin, a brand name for conjugated estrogens (CEEs), holds a foundational and historically significant position within the landscape of hormone replacement therapy. Its journey began with its initial market introduction in Canada in 1941, followed swiftly by its approval in the United States in 1942.1 This early market entry established Premarin as a cornerstone for treating menopausal symptoms, solidifying its role in women’s health for generations. The drug’s very name, an acronym derived from “pregnant mare urine,” highlights its unique natural origin, a characteristic that would prove pivotal in its market trajectory.1 By the late 1990s, Premarin had achieved “blockbuster” status within the pharmaceutical industry, with its gross sales in the United States soaring dramatically from over $500 million in 1992 to more than $2 billion by 2001.6 This impressive financial performance underscored its entrenched position as a dominant pharmaceutical product.

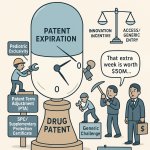

The trajectory of Premarin’s market presence presents a significant paradox: its sustained dominance despite the expiration of its primary patent protections. In the pharmaceutical sector, the expiration of a drug’s core patents typically triggers a phenomenon known as the “patent cliff.” This event usually leads to the rapid market entry of generic competitors, resulting in substantial price reductions and a significant erosion of the innovator drug’s market share.8 For Premarin, its foundational approvals occurred prior to January 1, 1982 9, and its key drug substance patent, US Patent 5,210,081, expired on February 26, 2012.10 Other analyses suggest that Pfizer’s original compositions saw their core patents expire even earlier, in the “early 2000s”.11 Yet, in stark contrast to the conventional industry pattern, Premarin has largely defied this trajectory, maintaining a unique and enduring position in the market. This remarkable resilience, often puzzling to industry observers, is a testament to the complex interplay of factors beyond traditional intellectual property rights that have safeguarded its market share.5 The sustained leadership of Premarin, in the absence of conventional patent protection, forms the central paradox that this report aims to unravel and explain. The continued market strength, despite early patent expirations, strongly indicates that the mechanisms protecting Premarin’s market share extend far beyond standard intellectual property rights. This immediately directs attention to the existence and strategic utilization of non-patent barriers as the primary drivers of its sustained competitive advantage.

2. The Intrinsic Complexity of Premarin: A Barrier to Generic Entry

Premarin’s unique nature as a pharmaceutical product stems fundamentally from its origin and complex chemical composition, which has served as a formidable, non-traditional barrier to generic competition.

- Natural Origin and Undefined Composition: The “Pregnant Mare Urine” Factor.

Premarin’s distinctiveness begins with its natural origin, as it is derived from the urine of pregnant mares (PMU).1 This stands in sharp contrast to most modern synthetic drugs, which have precisely defined chemical structures. Premarin is not a single chemical entity but rather a highly complex mixture of conjugated estrogens (CEEs).1 While its manufacturer, Wyeth (now Pfizer), reports that it contains at least 10 estrogens, the complete composition and the precise contribution of each active component within this intricate blend remain largely undisclosed or “unknown”.3 Advanced analytical techniques have identified up to 60 steroidal components within Premarin, further highlighting its complexity.13 Pfizer has consistently maintained that Premarin’s safety and effectiveness are predicated on the therapeutic effects of the

entire mixture as a whole, rather than the isolated action of individual components.16 This holistic view of its efficacy and the sheer complexity of its composition pose a fundamental challenge for any prospective generic manufacturer attempting to replicate it. The natural origin and complex, largely undefined composition of Premarin fundamentally transform the generic approval pathway from a straightforward bioequivalence exercise, typical for small molecule drugs, into an almost insurmountable scientific and regulatory challenge. This effectively creates a form of market exclusivity, as generic manufacturers cannot precisely replicate what is not fully characterized, nor can they definitively prove “sameness” with an undefined reference product. - Manufacturing Process as a Trade Secret: The “Brandon Process.”

Adding another critical layer of protection, Wyeth developed and meticulously maintained a proprietary manufacturing process known as the “Brandon Process”.6 This chemical process is crucial for consistently producing Premarin’s active ingredient and was the result of “several decades” of Wyeth’s extensive experimentation.6 The “Brandon Process” derives “independent economic value from secrecy,” meaning that access to this proprietary method would provide any prospective competitor with a significant and immediate advantage in gaining market share.6 A key distinction between trade secrets and patents is their lifespan: unlike patents, which have a finite duration, trade secrets can potentially endure indefinitely, provided their secrecy is effectively maintained.12 While a startup company, Natural Biologics, claimed to have developed a generic equivalent using expired Wyeth patents and public records, the commercial success or FDA approval of such a generic based on this claim is not evident in the provided materials, underscoring the difficulty of replicating a trade-secret-protected process.6 The strategic maintenance of the “Brandon Process” as a trade secret complements the compositional complexity of Premarin, creating a formidable barrier to entry. Even if a generic manufacturer could theoretically deduce the complex mixture’s components, they would still lack the proprietary

method of consistently producing that exact, therapeutically equivalent mixture, thereby making replication nearly impossible without illegal misappropriation or an equally extensive and costly research and development effort. - Challenges in Demonstrating Bioequivalence for Complex Natural Products.

A cornerstone of generic drug approval is the requirement to demonstrate bioequivalence (BE) to the brand-name drug, ensuring that the generic product performs identically in the body in terms of absorption rate and extent.12 For Premarin, proving this bioequivalence has been “exceptionally challenging” for generic manufacturers due to its highly complex mixture of estrogens.5 The Food and Drug Administration (FDA) itself formally acknowledged this difficulty in its seminal “1997 Woodcock Memorandum.” This critical document stated that “the reference listed drug Premarin is not adequately characterized at this time” and that “the quantitative composition of Premarin with respect to potentially pharmacologically active components has not been defined”.13 This fundamental lack of characterization led the FDA to a significant conclusion: “without this information it is not possible to define the active ingredients of Premarin,” and consequently, “a drug product containing a synthetic version of the Premarin API could not be approved under an ANDA”.16

Further complicating matters, Pfizer developed its own analytical method to determine “sameness” between a proposed generic and Premarin, asserting that the FDA’s method “lacks a critical level of sensitivity,” “fails to account for all classes of components,” and “fails to adequately account for and quantify the non-steroidal components”.16 This suggests that even the regulatory body struggled with analytical precision for this complex product. Indeed, a draft FDA guidance for the chemical characterization of conjugated estrogens, published in 2000, was later withdrawn because the method was deemed “not robust”.13 This regulatory uncertainty was exacerbated by Wyeth-Ayerst’s 1994 citizen petition, which claimed the discovery of another critical component, delta-8,9-dehydroestrone sulfate (DHES), and presented preclinical evidence suggesting its unique clinical profile.18 This action prompted the FDA to shift the burden onto generic manufacturers to prove pharmaceutical equivalence, further increasing the hurdle for market entry.20 The FDA’s persistent difficulty in fully characterizing Premarin’s active pharmaceutical ingredient (API) and, consequently, in establishing a reliable and reproducible bioequivalence standard, inadvertently granted indefinite market exclusivity to the innovator. This situation highlights a systemic challenge within pharmaceutical regulation when dealing with highly complex, naturally derived products, where the scientific limitations of characterization become a powerful, non-statutory barrier to generic competition. As a direct result of these formidable scientific and regulatory hurdles, as of July 2025, there is “no therapeutically equivalent version of Premarin available in the United States”.5 - Table 1: Key Premarin Composition and Bioequivalence Challenges

| Characteristic | Description | Challenge for Generics |

| Source Material | Derived from Pregnant Mare Urine (PMU).3 | Ethical and logistical sourcing concerns; difficulty in consistent supply and quality control of raw material. |

| Number of Components | A complex mixture of 10 estrogens reported 3, with up to 60 steroidal components identified.13 | Near impossibility of precisely replicating the exact chemical fingerprint of a complex natural mixture; inherent difficulty in isolating and quantifying all potentially active ingredients. |

| Active Ingredient Characterization | Complete composition remains largely “undisclosed or unknown”.3 The FDA stated in 1997 that active ingredients “have not been adequately defined”.16 | Inability to define a clear reference standard for bioequivalence; FDA’s inability to approve synthetic generics via the Abbreviated New Drug Application (ANDA) pathway.16 |

| Manufacturing Process | The “Brandon Process” is a proprietary trade secret developed over decades.6 Involves complex extraction methods using resins and solvents.23 | Proprietary know-how and process patents 23 prevent direct replication; requires extensive and costly research and development to develop alternative, equivalent processes.24 |

| Bioavailability Profile | Premarin tablets have demonstrated a “slow-release bioavailability pattern”.20 | Requires generic manufacturers to match not only the chemical composition but also the complex pharmacokinetic profile and release characteristics for therapeutic equivalence. |

3. Strategic Regulatory Maneuvers and Legal Fortifications

Beyond the intrinsic scientific complexities, Wyeth (and later Pfizer) proactively engaged with the regulatory and legal systems to fortify Premarin’s market position, effectively creating additional layers of protection.

- Leveraging Regulatory Ambiguity: The 1997 Woodcock Memorandum.

In 1997, the FDA issued a pivotal document, the “1997 Woodcock Memorandum,” which formally acknowledged the profound complexity of Premarin’s Active Pharmaceutical Ingredient (API).16 This memorandum explicitly stated that Premarin was “not adequately characterized at this time” and that its “quantitative composition… has not been defined”.13 A direct consequence of this scientific uncertainty was the FDA’s conclusion that a synthetic generic version of Premarin could not be approved under an Abbreviated New Drug Application (ANDA) without this critical information.16 This regulatory stance, born from scientific intractability, effectively created a formidable barrier to generic entry. The FDA’s formal acknowledgment of Premarin’s uncharacterizable nature, rather than being a flaw in the product, became a powerful regulatory shield for Wyeth/Pfizer, effectively preventing generic competition through the standard ANDA pathway. This transformed a scientific limitation into a competitive advantage, demonstrating how a regulatory body, when faced with unique scientific challenges, can inadvertently create prolonged market exclusivity for innovator drugs, even without traditional patent protection. - Citizen Petitions and Their Impact on Generic Approvals.

Wyeth-Ayerst (now Pfizer) strategically utilized the citizen petition process to influence FDA decisions and delay generic entry. In November 1994, the company filed a petition, later amended in December 1996, requesting the FDA to recognize delta-8,9-dehydroestrone sulfate (DHES) as an “essential” (and later “active”) ingredient in Premarin. The petition further sought to prevent the approval of any generic versions that did not contain this specific component.18 This petition, and the subsequent FDA review, lasted for an “excessive period of time,” effectively delaying potential generic approvals.18 Furthermore, in July 1995, the FDA’s Fertility and Maternal Health Drugs Advisory Committee stated that it could not confirm whether previously identified active components (estrone sulfate and equilin sulfate) were sufficient to account for Premarin’s full activity, thereby shifting the burden of proof onto generic manufacturers to demonstrate pharmaceutical equivalence.20 Wyeth/Pfizer strategically deployed the citizen petition process, not merely to introduce new scientific arguments, but to generate procedural delays and regulatory uncertainty that further complicated and protracted the generic approval pathway. This highlights a deliberate legal and regulatory tactic designed to extend market exclusivity. - Analysis of Primary Patent Expiry and Subsequent Protections.

While Premarin, as an early market entrant, had formulations approved prior to January 1, 1982 9, its core patents, such as US Patent 5,210,081 covering the drug substance (specifically a sodium salt of delta-8,9-dehydroestrone-3-), expired on February 26, 2012.10 Other sources indicate that Pfizer’s original compositions saw their core patents expire even earlier, in the “early 2000s”.11 This indeed led to some market share erosion for Pfizer’s conjugated estrogen portfolio, which decreased from 80% in 2000 to around 50% today.11

However, Pfizer strategically pursued and leveraged a portfolio of “secondary patents” on various aspects of the product. These included patents on manufacturing processes, such as the process for isolating conjugated estrogens from PMU (e.g., US20040072812A1, which had an adjusted expiration of March 25, 2023).23 Additionally, patents on specific delivery methods and formulations, such as vaginal cream compositions, were secured, with some protections extending until “2025-2027”.11 Furthermore, method-of-use patents for combination therapies also contributed to the intellectual property landscape.27 This strategic pursuit and layering of secondary patents effectively created a “patent thicket” that deterred and delayed generic entry long after the initial compound patent expired. This demonstrates that while the primary drug substance patent expired, Pfizer strategically pursued and leveraged a portfolio of secondary patents on manufacturing processes and formulations, effectively creating a “patent thicket” that deterred and delayed generic entry long after the initial compound patent expired. - Aggressive Legal Battles and Anti-Competitive Practices.

Wyeth did not passively accept generic competition. In 1993, upon the FDA’s approval of the first generic version of Premarin (likely Cenestin, a synthetic conjugated estrogen approved in 1999 28), Wyeth “immediately challenged the approval in court, citing patent infringement”.12 This legal battle was protracted, “lasted for over a decade, effectively delaying the entry of generic competitors into the market”.12

Beyond direct patent enforcement, Wyeth employed aggressive commercial strategies to suppress emerging competition. Upon Cenestin’s FDA approval, Wyeth developed a “Premarin Preemptive Plan” with the explicit aim of limiting Cenestin’s market share to 2% of total estrogen replacement therapy (ERT) prescriptions in 1999.29 This plan involved a multi-pronged approach: emphasizing the differences between Premarin and Cenestin to consumers, limiting Cenestin’s distribution channels, and restricting Duramed’s (Cenestin’s manufacturer) contracting opportunities in the ERT markets.29 A particularly aggressive tactic involved the use of “sole conjugated estrogen” or “sole CE” clauses in rebate agreements with Managed Care Organizations (MCOs). These clauses conditioned the payment of rebates on a wide range of Wyeth pharmaceuticals on Premarin being listed as the “only conjugated estrogen drug” or the “exclusive branded conjugated estrogen” on the MCO’s formulary.29 This practice led to litigation under Section 2 of the Sherman Act, with appellants alleging anti-competitive conduct and increased prices on Premarin.29 Beyond direct patent enforcement, Wyeth/Pfizer employed aggressive legal and commercial strategies, including anti-competitive contractual clauses and prolonged litigation, to actively suppress and delay any emerging generic competition, demonstrating a multi-pronged approach to maintaining market control. - Table 2: Premarin Patent and Exclusivity Timeline

| Protection Type | Key Detail/Patent No. | Expiration/Impact |

| Initial FDA Approval | Approved Prior to Jan 1, 1982 (oral, injectable) 2 | Established first-mover advantage and market presence, predating modern generic pathways (e.g., Hatch-Waxman Act). |

| Drug Substance Patent | US Patent 5,210,081 (Drug Substance – Active Ingredient) 10 | Expired February 26, 2012 (for 0.3mg, 0.45mg strengths approved 2003). Provided traditional patent protection for a key component. |

| Process Patents (for PMU extraction) | US20040072812A1 (Process for isolating conjugated estrogens) and others (3,769,401, 5,723,454, 5,814,624) 23 | US20040072812A1 adjusted expiration March 25, 2023. Protected the proprietary manufacturing process, a significant barrier given the API’s complexity. |

| Formulation/Delivery Method Patents | Secondary patents on delivery methods and formulations 11 | Extend protection until 2025-2027. Extended legal protection for specific product variants, further complicating generic entry. |

| Regulatory Exclusivity (General) | “Pre-MMA” status 30; Cenestin (synthetic CE) had 1-year exclusivities.30 | Limited direct impact for Premarin’s core product due to its age. However, strategic use of citizen petitions influenced FDA’s generic approval standards for decades.16 |

4. Brand Strength and Adaptive Marketing Strategies

Beyond legal and regulatory fortifications, the cultivation of deep brand loyalty and the implementation of adaptive marketing strategies have been crucial in maintaining Premarin’s market dominance, particularly in the face of significant external challenges.

- Cultivating Deep Brand Loyalty Among Physicians and Patients.

Wyeth, and subsequently Pfizer, engaged in aggressive and extensive marketing campaigns for Premarin and its related product, Prempro. These campaigns vigorously promoted the long-term use of these medications and actively framed menopause as a medical condition requiring drug treatment, rather than a natural life stage.7 Tactics included celebrity endorsements, widespread outreach by sales representatives to physicians, and even the use of ghostwritten scientific papers to promote the drug’s benefits and downplay potential risks before the WHI study.7 This sustained and pervasive marketing effort successfully built significant brand trust and loyalty among both physicians and patients over several decades.7 This deep-seated trust was evident in the fact that, prior to the 2002 WHI findings, approximately 40% of American postmenopausal women were taking hormones, with Premarin being the “most commonly prescribed form of estrogen in the United States”.22 This established market presence and brand affinity made it exceptionally difficult for generic alternatives to gain traction, even when they theoretically became available.12 - Reputation Management and Physician Re-education Post-WHI Study.

The release of the Women’s Health Initiative (WHI) study findings in July 2002 represented an existential crisis for the hormone replacement therapy market, including Premarin. The study, which linked combined estrogen-plus-progestin therapy (Prempro, a combination of Premarin and Provera) to increased risks of breast cancer, stroke, heart disease, and blood clots, caused widespread panic among patients and a dramatic shift in prescribing patterns.32 Sales plummeted, with Prempro sales falling to $161 million annually, and overall HRT prescriptions dropping by nearly half within months.7

In response to this severe market disruption, Pfizer engaged in extensive and adaptive reputation management and physician re-education efforts. These strategies included:

- Highlighting the nuances and perceived flaws of the WHI study, such as the older average age of participants (63 years) who were already at higher baseline risk for cardiovascular disease and cancer.32

- Emphasizing that the estrogen-alone arm of the WHI study (which primarily involved Premarin) actually showed a reduction in breast cancer risk, a finding that was initially downplayed in the media.32

- Promoting the updated clinical recommendation to prescribe estrogens at the “lowest effective dose and for the shortest duration consistent with treatment goals and risks” for the individual woman.37

- Developing comprehensive patient and physician educational materials and online portals (e.g., PfizerMenopause.com) to guide informed conversations about menopause symptoms, treatment options, and safety information.42

- Funding and promoting ongoing research into new benefits or re-evaluations of Premarin’s effects, such as its potential immunological status, anti-cancer effects, or role in fostering beneficial vaginal flora, to counter negative publicity and find new value propositions.43

- These efforts, coupled with evolving scientific understanding of HRT (including a 2025 FDA expert panel convened to “correct the record” regarding HRT’s benefits 32), allowed Premarin to stabilize its sales and retain a significant market share despite the initial crisis. The WHI study represented an existential crisis for Premarin, yet Pfizer’s strategic reputation management and physician re-education efforts, coupled with evolving scientific understanding of HRT, allowed Premarin to stabilize its sales and retain a significant market share, demonstrating the power of adaptive marketing and medical affairs in crisis.

- Product Line Extensions and Dosage Form Diversification.

Pfizer has also employed robust lifecycle management strategies, including product line extensions and dosage form diversification, to maintain Premarin’s market relevance and capture a broader patient base. Premarin is available in various formulations, including oral tablets across multiple strengths (e.g., 0.3mg, 0.625mg, 0.9mg, 1.25mg) and a vaginal cream.9 The vaginal cream, notably, has seen increased demand and price hikes, partly because, due to its complex natural source and undefined blend, there is “no generic equivalent” available.5 This lack of generic competition for specific formulations provides a protected niche.

Furthermore, new indications have been pursued and approved, expanding Premarin’s therapeutic uses. For instance, FDA approval in 2020 for the prevention of postmenopausal osteoporosis contributed to sales growth.39 Premarin is also indicated for hypoestrogenism due to hypogonadism, castration, or primary ovarian failure, and for the palliation of certain breast and prostate cancers.15 To support patient access and adherence, Pfizer has implemented patient support programs, such as “Her Source” and Simplefill, which offer savings and treatment support, directly addressing affordability concerns that might otherwise drive patients to generic alternatives if available.22 Diversifying dosage forms and expanding indications allowed Pfizer to capture a broader patient base and maintain relevance, even as competition intensified in specific segments or as safety concerns shifted prescribing patterns for oral forms.

5. Evolving Market Dynamics and Competitive Landscape

Premarin’s market dominance has been maintained amidst a dynamic and evolving competitive landscape, shaped by both traditional and non-traditional pressures.

- Premarin’s Sales Trajectory and Market Share Evolution.

Premarin’s market performance has demonstrated remarkable resilience. After achieving peak gross sales of over $2 billion in 2001 6, the drug experienced a significant downturn following the 2002 WHI study, which caused Prempro sales to plummet to $161 million and overall HRT prescriptions to drop by nearly half.32 Despite this severe impact and the expiration of its core patents in the early 2000s, which eroded Pfizer’s market share for conjugated estrogens from 80% in 2000 to around 50% today 11, Premarin’s global sales stabilized at approximately $800 million by 2023.49 The U.S. market continues to account for a significant portion of this revenue (60%).49 Premarin currently holds a substantial U.S. market share of 15-20% of HRT prescriptions.49 Projections indicate continued growth, with global sales anticipated to reach $950 million by 2025 and $1.2 billion by 2030, reflecting a compound annual growth rate (CAGR) of 3.8%.49 This resilience is partly attributed to Pfizer’s strategic marketing efforts, including direct-to-consumer advertising and physician education programs.49 Price increases, such as a 68% hike for Premarin vaginal cream in 2012, also contributed to revenue maintenance, particularly for formulations with limited generic competition.46 While Premarin experienced a significant market share reduction post-WHI and with the emergence of generics, its ability to stabilize sales at a substantial level ($800M globally by 2023) demonstrates remarkable resilience, indicating that the non-patent barriers and brand loyalty were effective in preventing a complete market collapse. - The Rise of Synthetic and Bioidentical Estrogens: A Shifting Paradigm.

Premarin’s market position has been increasingly challenged by the rise of alternative estrogen therapies, particularly synthetic and bioidentical estrogens. Competitors like Cenestin, a synthetic conjugated estrogen, entered the market.28 More significantly, estradiol, a lab-made form of estrogen that is bioidentical to human estrogen, has emerged as a key competitor.1 While Premarin remains the most commonly used form of estrogen in menopausal hormone therapy in the United States, it has “begun to fall out of favor relative to bioidentical estradiol” in Europe, where estradiol is more widely used.1 This shift is partly driven by perceived safety differences; compared to estradiol, certain estrogens in CEEs like Premarin are more resistant to metabolism, leading to relatively increased effects in the liver and a higher risk of blood clots and cardiovascular problems.1 The WHI study further fueled the search for safer estrogen delivery systems, accelerating a shift towards transdermal or intravaginal bioidentical hormones, which may offer different risk profiles compared to oral CEEs.34 The market is also seeing a growing niche for compounded “bioidentical hormones”.4 The shift towards synthetic and bioidentical estrogens, partly driven by safety concerns post-WHI and ethical debates regarding PMU sourcing, represents a fundamental challenge to Premarin’s long-term dominance, forcing Pfizer to differentiate based on established efficacy and unique composition rather than just market exclusivity. - Ethical Considerations and Consumer Preferences.

A unique and growing challenge to Premarin’s market position stems from ethical concerns surrounding its sourcing. Premarin is derived from pregnant mare urine, a process that involves keeping mares in small standing stalls for extended periods during their pregnancy to facilitate urine collection, often leading to their foals being sold for slaughter.56 This practice has generated significant “public outcry over the horrible fates often suffered by the foals” and increasing pressure from animal welfare regulations.56 Consequently, much of the PMU production has moved overseas to regions with more lax regulations and less oversight.56 Animal welfare advocates have actively launched campaigns, such as the “Premarin Postcard Campaign,” to inform doctors and patients about the PMU source and encourage the use of “horse-friendly” synthetic alternatives like Estrace, Angeliq, and Enjuvia.58 This ethical debate has sparked consumer backlash and is increasingly influencing consumer preferences, potentially shifting demand towards synthetic alternatives.11 The ethical concerns surrounding Premarin’s sourcing from pregnant mare urine represent a non-scientific, non-regulatory, yet significant and growing threat to its market position, influencing consumer perception and potentially driving a long-term shift towards synthetic or plant-derived alternatives. - Table 3: Premarin Sales and Market Share Trends (1990s-Present)

| Period | US Sales / Global Sales (Premarin Portfolio) | Global HRT Market Share (Conjugated Estrogens) | Key Events/Context |

| 1992-2001 (Pre-WHI Peak) | Grew from >$500M to >$2B (US sales) 6 | 80% (Pfizer’s share of conjugated estrogens) 11 | Aggressive marketing, dominant market position established.7 |

| Post-WHI (2002-2012) | Plummeted (e.g., Prempro sales to $161M) 7 | Eroded to ~50% (Pfizer’s share of conjugated estrogens) 11 | Women’s Health Initiative study findings revealed increased risks, leading to widespread discontinuation of HRT.32 Core patent (5,210,081) expired in 2012.10 |

| 2018-2023 (Stabilization & Competition) | Stabilized at ~$800M (global sales by 2023).49 Pfizer revenue growth averaged 5% annually (2018-2022).11 | 15-20% (Premarin’s share of US HRT prescriptions) 49 | Pfizer’s marketing and physician education efforts, new indications (e.g., osteoporosis prevention in 2020), and ongoing competition from bioidentical estradiol.1 Ethical debates on PMU sourcing continued.56 |

6. Conclusion: A Confluence of Factors for Enduring Dominance

Premarin’s remarkable ability to maintain significant market dominance long after the expiration of its primary patents is a testament to a complex and multi-layered strategy, rather than reliance on any single protective mechanism. The analysis reveals that this enduring leadership is attributable to a unique confluence of factors:

Firstly, the intrinsic scientific complexity of Premarin’s natural, undefined composition served as a powerful, non-traditional barrier to generic entry. The sheer number of components and the FDA’s long-standing inability to fully characterize its active ingredients meant that synthetic generics could not meet the stringent bioequivalence requirements for approval.5 This scientific intractability effectively created a “de facto patent” that did not expire. This was further reinforced by the proprietary “Brandon Process,” a trade secret manufacturing method that made replication exceedingly difficult.6

Secondly, Wyeth (and later Pfizer) employed astute regulatory navigation and aggressive legal fortifications. The strategic use of citizen petitions to influence FDA’s generic approval standards and create procedural delays proved highly effective.18 Furthermore, while core patents expired, the company strategically layered “secondary patents” on manufacturing processes and formulations, extending some intellectual property protection well into the 2020s.11 Aggressive legal challenges and anti-competitive business practices, such as “sole conjugated estrogen” clauses in rebate agreements, actively suppressed emerging competition and maintained market control.12

Thirdly, resilient brand equity and adaptive marketing strategies played a pivotal role. Built over decades through aggressive promotion that medicalized menopause 7, Premarin enjoyed deep brand loyalty. This loyalty proved critical in navigating the severe crisis triggered by the 2002 Women’s Health Initiative (WHI) study, which led to a dramatic drop in HRT sales.32 Pfizer’s sophisticated reputation management, including physician re-education and highlighting the nuances of the WHI findings, allowed Premarin to stabilize its sales and retain a significant patient base.32 Continuous lifecycle management through product line extensions (e.g., vaginal cream with no generic equivalent 5) and new indications (e.g., osteoporosis prevention 49) further fortified its market position.

Finally, while the unique natural source created inherent barriers, it also introduced evolving competitive pressures from synthetic and bioidentical estrogens, often marketed as safer or “horse-friendly” alternatives, as well as ethical concerns regarding animal welfare.1 Despite these challenges, Premarin’s established efficacy and Pfizer’s multi-pronged defense have allowed it to maintain a substantial market share and projected growth, demonstrating its remarkable resilience in a dynamic pharmaceutical landscape. Premarin’s story is thus a compelling case study in how a pharmaceutical company can leverage scientific, regulatory, legal, and commercial levers in concert to maintain market control long after conventional patent protections have diminished.

7. Recommendations for Pharmaceutical Innovators and Regulators

The case of Premarin offers valuable lessons for both pharmaceutical innovators navigating product lifecycles and regulatory bodies shaping market competition.

- For Pharmaceutical Innovators:

- Invest in Non-Traditional IP and Technical Barriers: Innovators should recognize that true market exclusivity can stem from factors beyond traditional compound patents. Investing in the development of complex Active Pharmaceutical Ingredients (APIs), particularly those derived from natural sources or involving intricate manufacturing processes, can create inherent scientific and technical barriers to generic replication. Securing intellectual property around these processes (e.g., trade secrets like the “Brandon Process” or process patents) can provide long-term market protection that is less susceptible to standard patent expiry.6

- Proactive Regulatory Engagement and Advocacy: Companies should actively engage with regulatory agencies throughout a product’s lifecycle, not just during initial approval. Strategically utilizing regulatory pathways, such as citizen petitions, can help shape the generic approval landscape for complex drugs, ensuring that regulatory standards align with the product’s unique scientific profile and raising the bar for generic competitors.18

- Comprehensive Lifecycle Management: A robust lifecycle management strategy is essential to sustain market leadership. This includes continuously exploring and securing new indications for existing products, diversifying dosage forms and delivery methods (e.g., vaginal creams), and implementing patient support programs to enhance access and adherence. These strategies can expand the addressable market and maintain patient and physician loyalty, particularly in the face of patent expiry or safety concerns.22

- Adaptive Crisis Management and Reputation Building: The Premarin case underscores the critical importance of strong brand equity and adaptive communication. Companies must be prepared to manage significant market crises, such as adverse clinical trial results, through transparent and nuanced communication, physician re-education, and continuous scientific re-evaluation. Building and maintaining trust with healthcare professionals and patients through consistent messaging and support programs is paramount for long-term resilience.32

- For Regulators (e.g., FDA):

- Develop Clearer Pathways for Complex Generics: Regulatory agencies need to establish more explicit, robust, and scientifically sound guidelines for demonstrating bioequivalence and interchangeability for complex natural products, biologics, and other non-traditional drug formulations. This may involve developing advanced analytical and statistical techniques that can adequately characterize and compare such intricate mixtures, thereby fostering fair and timely generic competition where scientifically feasible.13

- Streamline and Monitor Citizen Petition Processes: The case of Premarin highlights how the citizen petition process can be utilized as a tool to delay generic competition. Regulators should review and potentially reform these processes to ensure they are not unduly extended and that decisions are made in a timely, evidence-based manner, without being leveraged for anti-competitive purposes.18

- Balance Innovation with Affordability and Access: Regulators must continuously evaluate the delicate balance between incentivizing innovator research and development (through patent and regulatory exclusivity) and ensuring timely access to affordable generic alternatives. For drugs with unique scientific complexities, this balance requires careful consideration to prevent unintended, indefinite monopolies.

- Consider Broader Market Influences: Regulatory frameworks should increasingly account for non-traditional market influences, such as ethical sourcing concerns and evolving consumer preferences. While not directly related to drug safety or efficacy, these factors can significantly impact market dynamics and public health outcomes, potentially necessitating new considerations in regulatory policy for naturally derived products.11

Works cited

- Conjugated estrogens – Wikipedia, accessed July 27, 2025, https://en.wikipedia.org/wiki/Conjugated_estrogens

- Premarin: Uses, Dosage, Side Effects – Drugs.com, accessed July 27, 2025, https://www.drugs.com/premarin.html

- Premarin: the intriguing history of a controverisal drug – PubMed, accessed July 27, 2025, https://pubmed.ncbi.nlm.nih.gov/23974785/

- Premarin: The Intriguing History of a Controverisal Drug – ResearchGate, accessed July 27, 2025, https://www.researchgate.net/publication/256101271_Premarin_The_Intriguing_History_of_a_Controverisal_Drug

- 5 Ways to Save on Premarin Vaginal Cream for Menopause – GoodRx, accessed July 27, 2025, https://www.goodrx.com/premarin/heres-how-to-save-on-premarin-for-menopause

- Trends Special Edition_Wyeth Case.indd – Faegre Drinker Biddle & Reath LLP, accessed July 27, 2025, https://www.faegredrinker.com/webfiles/Trends_Special_Edition_WyethCase.pdf

- Prempro – Hormone Replacement Therapy – Hausfeld LLP, accessed July 27, 2025, https://www.hausfeld.com/how-we-work/case-studies/prempro-hormone-replacement-therapy-hrt

- The Impact of Patent Expiry on Drug Prices: A Systematic Literature Review – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6132437/

- Generic Premarin Availability – Drugs.com, accessed July 27, 2025, https://www.drugs.com/availability/generic-premarin.html

- 21-417 Premarin Administrative Documents – accessdata.fda.gov, accessed July 27, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/nda/2003/21-417_Premarin_admindocs.pdf

- Generic ESTROGENS, CONJUGATED INN equivalents …, accessed July 27, 2025, https://www.drugpatentwatch.com/p/generic-api/ESTROGENS%2C+CONJUGATED

- How Premarin Maintained Market Dominance Without Patent Protection – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-premarin-maintained-market-dominance-without-patent-protection/

- Marketplace Analysis of Conjugated Estrogens: Determining the Consistently Present Steroidal Content with LC-MS, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4627451/

- PREMARIN® (conjugated estrogens tablets, USP) | Dosing | Safety Info, accessed July 27, 2025, https://premarin.pfizerpro.com/dosing/dosage-forms-and-strengths

- Premarin (Conjugated Estrogens): Side Effects, Uses, Dosage, Interactions, Warnings, accessed July 27, 2025, https://www.rxlist.com/premarin-drug.htm

- Global Research & Development August 29, 2018 … – Regulations.gov, accessed July 27, 2025, https://downloads.regulations.gov/FDA-2018-P-3325-0001/attachment_1.pdf

- Stability and bioequivalence challenges in generic drug formulation: A regulatory perspective – GSC Online Press, accessed July 27, 2025, https://gsconlinepress.com/journals/gscbps/sites/default/files/GSCBPS-2025-0189.pdf

- Review of the Food and Drug Administration’s Handling of Issues Related to Conjugated Estrogens | Office of Inspector General, accessed July 27, 2025, https://oig.hhs.gov/reports/all/1997/review-of-the-food-and-drug-administrations-handling-of-issues-related-to-conjugated-estrogens/

- Federal Spending on Off-Patent Drugs That Lack Generic Competition – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7947060/

- The Strange Case of Premarin – ACS Publications, accessed July 27, 2025, https://pubs.acs.org/subscribe/archive/mdd/v03/i08/html/kling.html

- Estrace vs. Premarin Creams for Menopause Symptoms – GoodRx, accessed July 27, 2025, https://www.goodrx.com/conditions/menopause/estrace-vs-premarin

- Premarin Patient Assistance Programs – Simplefill, accessed July 27, 2025, https://simplefill.com/patient-assistance-program/premarin/

- US20040072812A1 – Process for isolating conjugated estrogens – Google Patents, accessed July 27, 2025, https://patents.google.com/patent/US20040072812A1/en

- Global Premarin-API Market Insights – Industry Share, Sales Projections, and Demand Outlook 2024-2030, accessed July 27, 2025, https://qyresearch.in/report-details/7185294

- US20080070882A1 – Vaginal cream compositions, kits thereof and methods of using thereof – Google Patents, accessed July 27, 2025, https://patents.google.com/patent/US20080070882A1/en

- EP1689372B1 – Compositions for conjugated estrogens and …, accessed July 27, 2025, https://patents.google.com/patent/EP1689372B1/en

- HORMONE REPLACEMENT THERAPY USING A COMBINATION OF CONJUGATED ESTROGENS AND MEDROXYPROGESTERONE ACETATE – European Patent Office, accessed July 27, 2025, https://data.epo.org/publication-server/rest/v1.0/publication-dates/20060517/patents/EP1265616NWB1/document.html

- Generic Cenestin Availability – Drugs.com, accessed July 27, 2025, https://www.drugs.com/availability/generic-cenestin.html

- opinion – Sixth Circuit Court of Appeals, accessed July 27, 2025, http://www.ca6.uscourts.gov/opinions.pdf/07a0168p-06.pdf

- Paragraph IV Patent Certifications July 7, 2025 – FDA, accessed July 27, 2025, https://www.fda.gov/media/166048/download

- Prempro & Premarin – Farr Law Firm P.A., accessed July 27, 2025, https://farr.com/prempro-premarin/

- The WHI Study & Its Flaws: How They Defined Menopause Care – Hone Health, accessed July 27, 2025, https://honehealth.com/edge/womens-health-initiative-study-impact-menopause/

- Women’s Health Initiative | Hormone Therapy | Augusta Ga, accessed July 27, 2025, https://www.hormonetherapyaugusta.com/womens-health-initiative.html

- The History of Estrogen – February 2016 – menoPAUSE Blog – Gynecology, accessed July 27, 2025, https://www.urmc.rochester.edu/ob-gyn/ur-medicine-menopause-and-womens-health/menopause-blog/february-2016/the-history-of-estrogen

- Clearing Up Controversy about Hormones and Cancer | WorldLink Medical, accessed July 27, 2025, https://worldlinkmedical.com/resources/blog/prevention-by-disease-state/cancer/clearing-up-controversy-about-hormones-and-cancer

- How one controversial study shaped 20 years of menopause care – KION, accessed July 27, 2025, https://kion546.com/news/2025/07/21/how-one-controversial-study-shaped-20-years-of-menopause-care/

- Safety Profile – PREMARIN® (conjugated estrogens tablets, USP) | Home, accessed July 27, 2025, https://premarin.pfizerpro.com/efficacy-safety/safety-profile

- Premarin Dosage Guide: Oral Tablets and Vaginal Cream – GoodRx, accessed July 27, 2025, https://www.goodrx.com/premarin/dosage

- Premarin: Package Insert / Prescribing Information – Drugs.com, accessed July 27, 2025, https://www.drugs.com/pro/premarin.html

- PREMARIN® (conjugated estrogens) Patient information | Pfizer Medical – US, accessed July 27, 2025, https://www.pfizermedical.com/patient/premarin

- PREMARIN® (conjugated estrogens tablets, USP) Home Page | Safety Info, accessed July 27, 2025, https://www.premarin.com/

- Hormone Therapies for Menopause Symptoms | Pfizer, accessed July 27, 2025, https://www.pfizermenopause.com/

- Beneficial Effects of Oral Premarin Estrogen Replacement Therapy Assessed by Human Genome Array | ClinicalTrials.gov, accessed July 27, 2025, https://clinicaltrials.gov/study/NCT00318318

- Premarin® Vaginal Cream (Conjugated Estrogens, 0.625 mg/g), accessed July 27, 2025, https://labeling.pfizer.com/ShowLabeling.aspx?id=13939

- Premarin Vaginal Cream (conjugated estrogens, vaginal) dosing, indications, interactions, adverse effects, and more – Medscape Reference, accessed July 27, 2025, https://reference.medscape.com/drug/premarin-vaginal-cream-conjugated-estrogens-vaginal-999949

- 10 big brands keep pumping out big bucks, with a little help from price hikes | Fierce Pharma, accessed July 27, 2025, https://www.fiercepharma.com/sales-and-marketing/10-big-brands-keep-pumping-out-big-bucks-a-little-help-from-price-hikes

- Sign Up | PREMARIN® (conjugated estrogens) Vaginal Cream | Risk Info, accessed July 27, 2025, https://www.premarinvaginalcream.com/support-and-resources

- Premarin Vaginal Cream: Uses, Side Effects, Dosage & More – GoodRx, accessed July 27, 2025, https://www.goodrx.com/premarin-vaginal-cream/what-is

- PREMARIN historic drug sales – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/p/drug-sales/drugname/PREMARIN

- Conjugated estrogens: Uses, Interactions, Mechanism of Action | DrugBank Online, accessed July 27, 2025, https://go.drugbank.com/drugs/DB00286

- Pfizer | Robins School of Business, accessed July 27, 2025, https://robins.richmond.edu/files/Robins-Case-Network/Pfizer.pdf

- Cenestin (Synthetic conjugated estrogens): Side Effects, Uses, Dosage, Interactions, Warnings – RxList, accessed July 27, 2025, https://www.rxlist.com/cenestin-drug.htm

- Estradiol vs. Premarin: What to Know About Each – Healthline, accessed July 27, 2025, https://www.healthline.com/health/menopause/estradiol-vs-premarin

- Estradiol vs Premarin Comparison – Drugs.com, accessed July 27, 2025, https://www.drugs.com/compare/estradiol-vs-premarin

- Estradiol Transdermal Patches Market Size, Share & Trend, 2033 – Business Research Insights, accessed July 27, 2025, https://www.businessresearchinsights.com/market-reports/estradiol-transdermal-patches-market-122105

- P.M.U. Industry – Gentle Giants Draft Horse Rescue, accessed July 27, 2025, https://www.gentlegiantsdrafthorserescue.org/pmu-industry

- Pregnant Mares’ Urine (PMU) industries – Equine Advocates, accessed July 27, 2025, https://www.equineadvocates.org/the-issues/pmu-industry/

- The Premarin Postcard Campaign – HIDDEN POND FARM EQUINE RESCUE, accessed July 27, 2025, https://hiddenpondequinerescue.org/2019/03/join-our-premarin-postcard-campaign/