Executive Summary & Key Takeaways

The global pharmaceutical landscape is increasingly defined by a tension between the imperative for innovation and the demand for affordable access to medicine. At the heart of this conflict lies the strategic use of intellectual property, most notably the formation of “patent thickets”—dense, overlapping webs of patents protecting a single drug. This report provides a comprehensive comparative analysis of the legal, regulatory, and economic frameworks that govern the creation and durability of these thickets across key global jurisdictions: the United States, the European Union, India, China, and Brazil.

The central finding of this analysis is that the variation in the prevalence and density of drug patent thickets is not an arbitrary outcome but a direct consequence of deliberate, and often divergent, national policy choices. These choices manifest in patentability standards, litigation procedures, and the fundamental balance each jurisdiction strikes between incentivizing research and development (R&D) and promoting public health and market competition.

The United States emerges as a uniquely fertile environment for the cultivation of patent thickets. Its legislative framework, particularly the Biologics Price Competition and Innovation Act (BPCIA), combined with permissive patent examination standards at the U.S. Patent and Trademark Office (USPTO) and the high costs of litigation, creates a synergistic system that rewards the accumulation of numerous, often duplicative, patents. This strategy serves to extend a drug’s market monopoly far beyond the expiration of its foundational patent, as vividly illustrated by the case of AbbVie’s Humira.

In stark contrast, the European Union presents a more restrictive landscape. The European Patent Office (EPO) applies stricter standards for novelty and inventive step, and its “added matter” doctrine serves as a powerful structural barrier against the proliferation of sprawling patent families from a single invention. The EU’s use of Supplementary Protection Certificates (SPCs) provides a more transparent and circumscribed mechanism for patent term restoration, channeling the demand for extended exclusivity into a controlled process rather than the strategic chaos of a thicket.

Emerging economic powers have forged their own distinct paths. India, through the “enhanced efficacy” requirement of Section 3(d) of its Patents Act, has established one of the world’s most formidable legal barriers to the secondary patents that form the basis of thickets. China is undergoing a rapid transformation, adopting U.S.-style mechanisms like patent linkage and specialized intellectual property courts, which could foster the growth of domestic patent thickets in the future. Brazil’s journey, marked by the rise and fall of its health regulator’s role in patent examination, showcases the profound impact of political economy and domestic industry interests on the shaping of patent law.

The economic and social consequences of these divergent systems are staggering. The five-year delay in the U.S. market entry of Humira biosimilars, compared to Europe, is directly attributable to its U.S. patent thicket and is estimated to have cost the American healthcare system tens of billions of dollars. These extended monopolies lead to sustained high drug prices, which in turn create significant barriers to patient access and strain public and private healthcare budgets worldwide.

Ultimately, this report concludes that addressing the challenges posed by patent thickets requires a multi-faceted approach. While litigation-focused reforms may treat the symptoms, a more durable solution lies in strengthening patent quality at the source by reforming examination standards. The path forward demands a recalibration of the global intellectual property regime to ensure that it rewards genuine, breakthrough innovation without enabling legal strategies that prioritize perpetual monopoly over public health.

Key Takeaways

- Patent Thickets are a Product of Legal and Regulatory Design: The prevalence of dense drug patent thickets is not a universal phenomenon. It is most pronounced in the United States, where specific legal mechanisms—such as unlimited patent assertions for biologics, permissive patent examination, and high litigation costs—create a favorable environment for their growth.

- Europe’s Stricter Standards Act as a Structural Barrier: The European Union’s patent system, governed by the European Patent Convention, imposes a higher bar for patentability. Crucially, its strict “added matter” doctrine prevents the kind of incremental claim expansion that is used to build large, duplicative patent families in the U.S., making dense thickets far less common.

- Emerging Markets Have Unique, Policy-Driven Approaches: Key emerging markets have not simply adopted Western patent models but have tailored them to national priorities. India’s Section 3(d) is a powerful anti-evergreening tool designed to protect its generic industry. China is rapidly building a robust IP enforcement regime that mirrors U.S. structures, potentially paving the way for future thickets.

- The Humira Case Quantifies the Staggering Economic Cost: The tale of AbbVie’s Humira provides definitive proof of the real-world impact of these legal differences. AbbVie’s massive U.S. patent thicket (over 165 granted patents) delayed biosimilar competition for five years longer than in Europe (where it held far fewer patents), costing the U.S. healthcare system an estimated $19 billion or more.

- The “Innovation vs. Exploitation” Debate is a False Dichotomy: Secondary patents can protect valuable follow-on innovations that benefit patients (e.g., a less painful formulation). The core problem is not the existence of secondary patents, but the ability to leverage a single minor improvement into a thicket of dozens of overlapping patents, creating a barrier to competition that is disproportionate to the inventive contribution.

- U.S. Antitrust Law Currently Offers No Remedy: The dismissal of the antitrust lawsuit against AbbVie signals that U.S. courts are unwilling to treat the accumulation of legally-obtained patents as an antitrust violation. This places the onus for reform squarely on Congress and the U.S. Patent and Trademark Office.

- Policy Reforms Must Address Patent Quality at the Source: While proposals to limit the number of patents that can be asserted in litigation are a positive step, they only address the symptoms. A more fundamental solution requires strengthening patent examination standards to prevent the issuance of low-quality, non-inventive secondary patents in the first place.

Introduction: The Architecture of Extended Exclusivity

In the high-stakes world of pharmaceutical research and development, the patent system serves as the foundational bargain between the innovator and society. In exchange for disclosing an invention, the state grants a temporary monopoly, typically for 20 years, allowing the innovator to recoup substantial R&D investments and fund future discovery.1 However, this straightforward bargain has evolved into a complex strategic landscape where the patent itself is not just a shield for a single invention but a building block in a sophisticated architecture of extended market exclusivity. Central to this modern strategy is the “drug patent thicket.”

Defining the Drug Patent Thicket: Beyond a Single Patent

A patent thicket is a “dense web of overlapping intellectual property rights that a company must hack its way through in order to actually commercialize new technology”.3 In the pharmaceutical sector, this strategy manifests as the accumulation of dozens, or even hundreds, of patents covering various features of a single drug product.5 This dense web creates a formidable legal and economic barrier for generic and biosimilar manufacturers seeking to enter the market after the primary patent on a drug has expired. The European Commission has referred to this phenomenon as the creation of “patent clusters” 3, a term that underscores the deliberate and strategic nature of this patenting activity.

This practice is widely viewed by critics not as a tool for protecting innovation, but as a “systemic abuse of intellectual property protections that prioritizes corporate profits over patient access and market competition”.5 The term “patent thicket” itself, which first appeared in litigation in the 1970s, has become synonymous with anticompetitive behavior in the pharmaceutical industry.3 The objective is to create such a complex and costly litigation landscape that would-be competitors are deterred from challenging the monopoly, thereby extending it for years beyond what was envisioned by the original patent grant.

Primary vs. Secondary Patents: The Building Blocks of a Thicket

The construction of a patent thicket relies on the strategic distinction between two categories of patents: primary and secondary. Understanding this distinction is crucial to deconstructing the strategy of monopoly extension.

Primary Patents are the foundational intellectual property for a new medicine. They cover the core innovation, which is typically the active pharmaceutical ingredient (API)—the molecule or protein sequence that produces the therapeutic effect.8 These patents are filed early in the development process and provide the initial 20-year period of market exclusivity, which is intended to reward the breakthrough discovery.

Secondary Patents, in contrast, do not cover the core API but instead target a wide array of peripheral, incremental, or follow-on innovations related to the original drug.9 These are the essential building materials of a patent thicket and can include patents on:

- Formulations: New delivery mechanisms, such as tablets, capsules, or extended-release versions that may offer convenience benefits like less frequent dosing.11

- Dosage Forms: Specific dosing strengths or administration schedules for treating a particular patient population.9

- Methods of Use (New Indications): Patents covering the use of an existing drug to treat a different disease. These are also known as “second medical use” patents.11

- Polymorphs and Salts: Different crystalline structures or salt forms of the API, which may affect the drug’s stability or solubility.11

- Manufacturing Processes: Novel and more efficient methods of producing the drug substance or final product.11

- Delivery Devices: Patents on the devices used to administer a drug, such as specialized inhalers, auto-injectors, or pre-filled syringes.11

The strategic nature of secondary patenting is revealed not just by what is patented, but when. Research conducted by the Initiative for Medicines, Access & Knowledge (I-MAK) found that for the top-selling drugs in the U.S., an average of 66% of patent applications are filed after the drug has already received marketing approval from the Food and Drug Administration (FDA).8 This timing strongly indicates that the primary motivation is not to protect the initial invention but to construct defensive barriers against future competition. The patent system, therefore, shifts from being a tool to incentivize the creation of

new medicines to a tool to protect the market share of existing ones.

“Evergreening” as a Corporate Strategy: Lifecycle Management and Monopoly Extension

The overarching corporate strategy that employs secondary patents to build thickets is known as “evergreening”.16 From the perspective of innovator companies, this is often framed as “lifecycle management”—a prudent business practice of continuing to innovate on a product throughout its commercial life.18 From the perspective of critics, it is a deliberate effort to “artificially extend the life of a patent” to maintain monopoly pricing and block competition.16

The prevalence of this strategy is well-documented. One study found that 78% of newly issued pharmaceutical patents were for existing drugs, not novel therapies, while another found that the manufacturers of the 12 top-selling drugs in the U.S. had attempted to secure an average of 38 years of patent protection—nearly double the standard 20-year term.2

This unified corporate strategy works through a clear, linear process. The strategic objective is to “evergreen” the revenue stream of a blockbuster drug and avoid the sharp revenue decline known as the “patent cliff”.16 To achieve this, the company files numerous secondary patents on minor modifications to the drug or its use.9 The accumulation of these secondary patents creates the structure of the patent thicket.3 This thicket then serves its ultimate purpose: acting as a powerful litigation barrier. The sheer volume of patents, and the exorbitant cost of challenging each one, deters generic and biosimilar companies from entering the market, thereby fulfilling the evergreening objective of extending the monopoly.8 This cohesive strategy transforms the patent system into a tool for perpetual market control, setting the stage for a global conflict over the price and accessibility of medicine.

The United States: A Fertile Ground for Patent Thickets

The United States stands out globally as the jurisdiction where pharmaceutical patent thickets are most prevalent and dense. This is not an accident of legal interpretation but the direct result of a confluence of legislative frameworks, patent office practices, and a litigation environment that, together, create a uniquely permissive ecosystem for their growth. The U.S. system contains a series of interlocking mechanisms that, while perhaps designed with distinct purposes, synergistically incentivize the accumulation of vast patent portfolios as a primary commercial strategy.

The Legislative Framework: Hatch-Waxman, BPCIA, and the Creation of Linkage

The foundation of the U.S. system lies in two key pieces of legislation that link the country’s drug regulatory approval process with its patent system.

The Hatch-Waxman Act of 1984: Officially the Drug Price Competition and Patent Term Restoration Act, this landmark law created the modern abbreviated pathway for generic drug approval (the Abbreviated New Drug Application, or ANDA).21 As a grand compromise with the innovator drug industry, it also established a formal “patent linkage” system.23 This system ties the FDA’s ability to approve a generic drug directly to the patent status of the brand-name drug it references.

The FDA Orange Book: A central component of this system is the FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations, colloquially known as the “Orange Book.” Brand-name drug manufacturers are required to submit to the FDA a list of all patents for which a “claim of patent infringement could reasonably be asserted” against a generic competitor.22 The FDA’s role in this process is purely administrative; it lists the patents as submitted and does not verify their validity or even their relevance to the approved drug.22 This has created a significant loophole, as companies can engage in “improper listing” of patents that may be weak or irrelevant to delay competition, a practice the Federal Trade Commission (FTC) has recently begun to challenge.25 Patents eligible for listing are those that claim the drug substance (API), the drug product (formulation or composition), or an approved method of use.24 Patents covering manufacturing processes or packaging are not eligible for listing.24

The 30-Month Stay: The most powerful tool for delay created by Hatch-Waxman is the automatic 30-month stay of FDA approval. When a generic company files an ANDA, it must make a certification for each patent listed in the Orange Book. A “Paragraph IV certification” asserts that the generic manufacturer believes the patent is invalid, unenforceable, or will not be infringed by its product.23 This filing is considered a technical act of patent infringement. If the brand-name company responds by filing an infringement lawsuit within 45 days, it automatically triggers a stay of up to 30 months, during which the FDA cannot grant final approval to the generic drug.24 This mechanism effectively functions as a preliminary injunction for the brand company, granted without any judicial consideration of the underlying merits of the patent.27 It rewards the mere act of litigation and provides a powerful incentive for brand companies to list numerous secondary patents, each capable of triggering a potential lawsuit and delay.

The Biologics Price Competition and Innovation Act (BPCIA) of 2009: While Hatch-Waxman governs small-molecule drugs, the BPCIA created the regulatory pathway for biosimilars (versions of large-molecule biologic drugs). The BPCIA established a notoriously complex and arguably less efficient process for resolving patent disputes, known as the “patent dance”.28 Critically, and in a departure from the implicit structure of Hatch-Waxman, the BPCIA places no statutory limit on the number of patents that a brand-name biologic manufacturer can assert in litigation against a biosimilar competitor.28 This legislative omission is a key reason why patent thickets for biologics, such as AbbVie’s Humira, have grown to be exceptionally large, as there is no procedural check on the number of patents a company can deploy in its legal strategy.30

The Role of the USPTO: A Permissive Examination Environment

The legislative framework provides the incentive, but the U.S. Patent and Trademark Office (USPTO) provides the raw materials for building a thicket. The USPTO’s examination practices and rules have been criticized as being more permissive than those of its international counterparts, facilitating the issuance of the numerous, often overlapping, secondary patents that constitute a thicket.

Continuation Applications and Terminal Disclaimers: U.S. patent law allows applicants to file “continuation” applications, which enables them to pursue additional patents with new or modified claims that are based on the specification of an earlier-filed “parent” application. This practice allows a company to build a large “family” of patents from a single initial invention. To overcome rejections for “obviousness-type double patenting” (i.e., attempting to patent an obvious variation of a previous invention), applicants can file a “terminal disclaimer.” This legal instrument ties the expiration date of the later patent to that of the earlier patent.20 While this prevents the patent term from being extended, it does not prevent the patent from being issued. The strategic value lies in the fact that a generic challenger must still litigate and invalidate each of these patents separately, even if they are linked by a disclaimer and cover non-patentably distinct inventions.20 This dramatically multiplies the cost and complexity of litigation for the challenger.

Judicial Philosophy and Patent Quality: Historically, U.S. patent law has been more accommodating of patents on incremental innovations compared to the stricter standards applied in Europe.31 The USPTO has faced persistent criticism for issuing patents of insufficient quality, a charge seemingly substantiated by the high rate at which challenged patent claims are invalidated in post-grant proceedings.32 This permissive environment makes it easier for pharmaceutical companies to obtain the large volume of secondary patents needed to construct a formidable thicket.

The Litigation Labyrinth: How High Stakes Deter Competition

The U.S. legal system’s structure and cost create the final layer of defense for a patent thicket. The sheer expense of patent litigation in U.S. federal courts serves as a powerful economic deterrent to competition.26 For a generic or biosimilar company, the prospect of challenging a thicket like Humira’s, with over 100 asserted patents, is often economically irrational, regardless of the perceived weakness of the individual patents.3

The legal burden is also asymmetrically high. To successfully enter the market, a challenger must win its case on every single patent asserted by the brand company. The innovator firm, by contrast, needs to win on only one patent to maintain its monopoly.36 This immense legal and financial pressure often forces would-be competitors into settlement agreements. These agreements typically involve the challenger agreeing to delay its market entry in exchange for avoiding further litigation costs. In some controversial cases, these settlements have included “reverse payments” or “pay-for-delay” terms, where the brand company pays the generic firm to stay off the market, a practice that has drawn intense scrutiny from antitrust regulators.11

The synergistic effect of these features is profound. The BPCIA allows a brand company to assert an unlimited number of patents against a biosimilar.28 The USPTO’s rules on continuations and terminal disclaimers allow the company to generate a large volume of these patents, many of which are not meaningfully distinct from one another.20 The high cost of U.S. litigation makes challenging this volume of patents prohibitively expensive.26 Finally, the 30-month stay for small-molecule drugs provides an automatic, guaranteed period of delay that rewards the brand company for simply initiating a lawsuit.23 This combination creates a system where a patent thicket derives its power not from the innovative quality of its individual patents, but from its sheer mass and the procedural and financial burdens it imposes on any challenger. The legal framework itself incentivizes the creation of the thicket as a rational business strategy.

The Patent Trial and Appeal Board (PTAB): A Contested Counterbalance

In 2011, the America Invents Act (AIA) established the Patent Trial and Appeal Board (PTAB), an administrative tribunal within the USPTO designed to offer a faster and less expensive alternative to federal court for challenging the validity of issued patents.32 The PTAB’s primary proceedings are the

inter partes review (IPR) and post-grant review (PGR).

Initially, the PTAB was seen as a powerful tool for generic and biosimilar companies to clear away the weak, low-quality secondary patents that often populate a thicket. Indeed, the invalidation rates for patent claims that make it to a final written decision at the PTAB are high, frequently cited as being around 70-78%.33 However, the PTAB has proven to be an imperfect and politically contentious counterbalance.

A major hurdle is the institution phase. Before the PTAB will review the merits of a challenge, it must first decide to “institute” the trial. The overall institution rate for challenges against biologic patents is approximately 61%, and for Orange Book-listed patents, it is 62%.39 This means that a significant portion of challenges are never heard on their merits. Furthermore, recent data indicates a sharp decline in the number of PTAB petitions filed against Orange Book patents, and while petitions against biologic patents are rising, denial of institution remains the most probable outcome.39

The PTAB has also been a target of intense lobbying by the pharmaceutical industry, which has sought to curtail its authority through legislative proposals like the PREVAIL Act.1 This political pressure, combined with procedural hurdles, has blunted the PTAB’s effectiveness as a deterrent. The intended “counterbalance” to low-quality patents is itself being counterbalanced by legal procedure and political influence, allowing the strategy of building patent thickets to persist as a viable and profitable corporate endeavor.

The European Union: A More Skeptical Approach to Secondary Patenting

In sharp contrast to the permissive environment of the United States, the legal and regulatory framework of the European Union presents a significantly more challenging terrain for the creation of dense pharmaceutical patent thickets. This is not the result of a single law explicitly targeting thickets, but rather a series of foundational principles within European patent law that collectively impose a higher standard for patentability and limit the strategic maneuvers used to build large, overlapping patent portfolios. The European system is characterized by a centralized, rigorous examination process, a structured approach to patent term restoration, and a judicial philosophy that is generally more skeptical of patents on incremental innovations.

The European Patent Convention (EPC): Stricter Standards for Patentability

The cornerstone of the European system is the European Patent Convention (EPC), which provides a single, unified procedure for the examination of patent applications for its 39 member states.42 While a “European patent” is ultimately a bundle of national patents that must be validated and enforced in each country, the centralized examination by the European Patent Office (EPO) creates a largely harmonized standard of patent quality across the continent.43 Several key features of the EPO’s examination practice make it inherently more difficult to build a U.S.-style patent thicket.

Stricter Inventive Step and Novelty Requirements: The EPO is widely regarded as applying a higher bar for what constitutes a non-obvious “inventive step” and what is truly “novel”.31 This makes it more difficult for applicants to secure patents on the kind of minor, incremental modifications—such as new salt forms or slight formulation changes—that frequently populate U.S. patent thickets.

The “Added Matter” Doctrine (Article 123(2) EPC): This is arguably the most critical difference between U.S. and European patent prosecution and a powerful structural barrier to thicket formation. Article 123(2) of the EPC strictly prohibits an applicant from amending a patent application or patent in a way that it contains subject matter not “directly and unambiguously derivable” from the application as it was originally filed.30 This doctrine prevents a common U.S. strategy where an applicant files a broad initial application and then, through a series of “continuation” applications, gradually amends and refines the claims to cover later-developed improvements, competitors’ design-arounds, or new experimental results.31 In Europe, such new information would be considered “added matter” and would be rejected. This legal principle fundamentally restricts the ability of an applicant to use a single inventive concept as a springboard for a sprawling family of dozens of slightly different, non-patentably distinct patents. The difference in the size of the Humira patent portfolio in the U.S. versus the EU is a direct result of this fundamental divergence in patent prosecution rules.30

Different Treatment of Prophetic vs. Working Examples: The EPO also places greater emphasis on the data and examples provided in a patent application. It tends to limit the scope of patent claims to what has been demonstrably achieved and disclosed in “working examples” (experiments that were actually performed). The USPTO, by contrast, is often more willing to grant broad claims that also cover “prophetic examples” (theoretical possibilities described without supporting data).31 This difference in approach results in narrower, more precisely defined patent claims in Europe, leaving more room for competitors to innovate and “design around” the patent without infringing.

Supplementary Protection Certificates (SPCs): A Structured Approach to Term Restoration

Both the U.S. and European systems recognize that the long time required for regulatory approval of a new drug erodes the effective life of a patent.45 However, their solutions to this problem are markedly different. While the U.S. uses a system of Patent Term Extension (PTE), the EU employs a

sui generis (unique) intellectual property right called a Supplementary Protection Certificate (SPC).47

An SPC is not an extension of a patent itself, but a separate right that extends the period of market exclusivity for a specific approved “product” (defined as the active ingredient or combination of active ingredients).47 It comes into force after the basic patent covering the product expires and can last for a maximum of five years, with a possible six-month extension for conducting pediatric studies.48

This system has a critical effect on evergreening strategies. An SPC provides a single, predictable, and transparent extension for the core product, tied directly to its first marketing authorization in the European Economic Area.46 It does not extend the life of an entire thicket of secondary patents. This structure provides a “pressure release valve” for the legitimate demand for longer exclusivity to compensate for regulatory delays, channeling it into a controlled and limited process. The U.S. system, lacking a similarly clear and sufficient singular extension mechanism, effectively encourages companies to seek that extra period of monopoly through the less transparent and more anticompetitive strategy of building a patent thicket.

Litigation in a Bifurcated System: The German Example

The enforcement of patents in Europe also differs significantly from the U.S. model. Many key European jurisdictions, most notably Germany, utilize a “bifurcated” system for patent litigation.49 In this system, the question of whether a patent has been infringed is decided in one court, while the question of whether the patent is valid is decided in a completely separate proceeding by a different body.

In Germany, infringement actions are heard by specialized chambers in a handful of regional courts (such as those in Düsseldorf, Mannheim, and Munich).50 Challenges to the validity of a European patent, however, must be filed either as an “opposition” at the EPO within nine months of the patent’s grant, or as a “nullity” action at the German Federal Patent Court in Munich.50

This separation can create what is known as an “injunction gap” or the “injunction risk.” An infringement court, which is not empowered to rule on validity, might issue an injunction to stop the sale of an allegedly infringing product before the Federal Patent Court has had a chance to rule on whether the patent is valid in the first place. This can give patent holders significant leverage. However, the system has a built-in check: if the defendant in an infringement case can demonstrate to the infringement court that there is a high probability that the patent will be invalidated in the parallel nullity action, the infringement court has the discretion to stay its own proceedings until the validity question is resolved.50 This mechanism serves to discourage the aggressive assertion of weak or low-quality patents, as the risk of a stay diminishes the patent’s value as a tool for immediate legal leverage.

Collectively, these features of the European system—stricter examination at the EPO, the structural barrier of the “added matter” doctrine, the circumscribed nature of SPCs, and the checks and balances within the bifurcated litigation system—create an environment that is far more hostile to the formation of dense patent thickets than that found in the United States.

Divergent Paths in Emerging Economic Powers

While the United States and the European Union represent two dominant and contrasting models of pharmaceutical patent law, the world’s major emerging economies have not simply copied one system or the other. Instead, nations like India, China, and Brazil have forged distinct legal and political paths, crafting patent regimes that reflect their unique national priorities, industrial capabilities, and historical contexts. An analysis of these systems reveals that they are not merely less-developed versions of Western frameworks but are, in fact, deliberately constructed, path-dependent models designed to achieve specific economic and public health goals.

India: Section 3(d) and the “Enhanced Efficacy” Hurdle

India’s approach to pharmaceutical patents is arguably the most distinct among major economies, shaped by its dual identity as a nation with immense public health needs and as the “pharmacy of the developing world,” a global leader in generic drug manufacturing.51

Historical Context and the TRIPS Transition: For decades, under its Patents Act of 1970, India only granted patents for manufacturing processes, not for the final pharmaceutical products themselves. This policy fostered a powerful domestic generic industry skilled in reverse-engineering drugs.52 In 2005, to comply with its obligations under the World Trade Organization’s (WTO) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), India amended its law to reintroduce product patents.53

Section 3(d) – A Unique Barrier to Evergreening: Anticipating the potential for evergreening strategies to undermine its generic industry and restrict access to medicines, the Indian Parliament included a unique and powerful provision in the 2005 amendment: Section 3(d).53 This clause explicitly defines what is

not an invention. It states that “the mere discovery of a new form of a known substance which does not result in the enhancement of the known efficacy of that substance” is not patentable.14 The law further clarifies that new forms include salts, esters, polymorphs, and other derivatives, which are considered the same substance unless they “differ significantly in properties with regard to efficacy”.56

The Landmark Novartis v. Union of India (2013) Case: The strength and meaning of Section 3(d) were tested and ultimately cemented in a landmark Supreme Court of India decision. The case involved the cancer drug Gleevec (imatinib mesylate). Novartis sought a patent for a new crystalline (beta) form of the known substance imatinib, arguing that the new form had significantly better bioavailability (it was better absorbed by the body).57 The Supreme Court rejected the patent, delivering a crucial interpretation of Section 3(d). It ruled that for a pharmaceutical substance, “efficacy” must be understood as “therapeutic efficacy”.53 An improvement in a physical property like bioavailability was not sufficient unless it resulted in a demonstrable improvement in the drug’s ability to treat the disease. This decision set an exceptionally high bar for obtaining secondary patents in India.53

Impact on Patent Thickets: Section 3(d), as interpreted by the Supreme Court, makes India one of the most difficult jurisdictions in the world for building a patent thicket.59 The provision has been lauded by public health advocates globally for its role in promoting access to affordable medicines.53 Conversely, it has been heavily criticized by multinational pharmaceutical companies, who argue that it stifles incremental innovation and violates the spirit, if not the letter, of the TRIPS agreement—an argument that has been consistently rejected by Indian courts.53

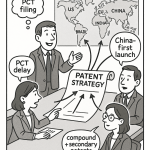

China: Rapid Evolution and a New Patent Linkage Regime

China’s intellectual property landscape has undergone a dramatic transformation over the past two decades. The nation has pivoted from a system that implicitly favored domestic imitation to one that is rapidly building a robust IP enforcement regime designed to encourage both foreign and domestic innovation.62 China is now the world’s leading filer of patent applications, signaling its ambition to become an innovation-based economy.65

Introduction of a U.S.-Style Patent Linkage System (2021): A key development in this transformation was the implementation in 2021 of a pharmaceutical patent linkage system, which bears a strong resemblance to the U.S. Hatch-Waxman framework.62 Under this system, holders of marketing authorizations for innovator drugs must list relevant patents on a public platform, often called the “Chinese Orange Book”.62 Eligible patents include those covering the API, compositions containing the API, and medical uses. When a generic company applies for marketing approval, it must make a declaration regarding each listed patent.66

Litigation, Enforcement, and Stays: If a generic applicant challenges a patent (a Category 4 declaration), the patent holder has 45 days to file a lawsuit or an administrative action.62 Filing a suit triggers an automatic 9-month stay on the final approval of the generic drug, providing a period for the patent dispute to be resolved.65 To handle these disputes, China has established specialized IP courts in major cities like Beijing, Shanghai, and Guangzhou. These courts are gaining a reputation for efficiency, often resolving cases within 12 months, and for issuing increasingly substantial damage awards.65 Notably, foreign plaintiffs have achieved a high success rate of 77% in these courts, indicating a move toward impartial enforcement.67

Patent Term Extension (PTE): Complementing the linkage system, China has also introduced a PTE system to compensate innovator companies for time lost during the lengthy drug approval process, a mechanism similar in principle to those in the U.S. and EU.62

The adoption of these Western-style legal mechanisms—patent linkage, PTE, and a robust litigation system—provides the necessary infrastructure for more complex lifecycle management strategies to take hold. As the value of the Chinese pharmaceutical market continues to grow, both domestic and multinational innovators will have a powerful incentive to use these tools to their fullest extent. This creates the potential for U.S.-style patent thickets to emerge in China in the coming years, a development that will be closely watched by global stakeholders.

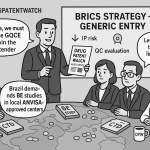

Brazil: The Political Economy of Patent Reform

Brazil’s patent system has been a dynamic battleground, shaped by intense political contestation between public health advocates and the domestic generics industry on one side, and multinational pharmaceutical corporations on the other.69 This struggle is vividly illustrated by the history of its health regulator’s involvement in patent examination.

The Era of ANVISA’s “Prior Consent”: For more than 15 years, from 2001 to 2017, Brazil operated a unique “dual-review” system for pharmaceutical patents. Under Article 229-C of its patent law, all pharmaceutical patent applications required the “prior consent” of the national health regulatory agency, ANVISA, before the national patent office (INPI) could even begin its technical examination.70 This measure was a direct result of lobbying by the Brazilian generics industry, which sought to create an additional hurdle for obtaining patents.72 ANVISA frequently went beyond assessing public health risks and conducted its own examination of patentability requirements like novelty and inventive step, often reaching conclusions that conflicted with the INPI’s. This created significant legal uncertainty and contributed to a massive backlog of unexamined patent applications.71

Reform and the End of Dual Review: The conflict and inefficiency of this system led to reforms. A 2017 joint resolution between the two agencies curtailed ANVISA’s role, specifying that its opinions on patentability should be treated as non-binding, third-party observations for the INPI to consider.70 The “soap opera,” as one commentator called it, came to a final end in 2021 when the Brazilian government formally revoked Article 229-C, completely removing ANVISA from the patent examination process.71

The Political Context: The rise and fall of ANVISA’s power in patent examination is a clear reflection of the political economy of Brazil. The initial creation of the dual-review system was a victory for a powerful political coalition comprising the Ministry of Health and a strong, autonomous domestic pharmaceutical sector, both of which favored policies that would limit patent monopolies and promote generic competition.69 The eventual rollback of this system suggests a shift in the balance of power, with a greater emphasis on aligning Brazil’s patent system with international norms to improve the business environment and reduce examination delays.72 This history demonstrates how, in Brazil, the technical rules of patent law are deeply intertwined with and shaped by broader political and industrial struggles.73

Table 1: Comparative Overview of Pharmaceutical Patent Regimes

| Feature | United States | European Union | India | China | Brazil |

| Core Legislation | Hatch-Waxman Act; BPCIA | European Patent Convention (EPC) | The Patents Act, 1970 (as amended) | Patent Law of the PRC (as amended) | Industrial Property Law (Law No. 9,279/96) |

| Patent Term | 20 years from filing | 20 years from filing | 20 years from filing | 20 years from filing | 20 years from filing |

| Term Restoration | Patent Term Extension (PTE) | Supplementary Protection Certificate (SPC) | No | Patent Term Extension (PTE) | No (provision was ruled unconstitutional) |

| Patent Linkage System | Yes (FDA Orange Book) | No | No | Yes (“Chinese Orange Book”) | No |

| Automatic Stay | Yes (30 months for small molecules) | No | No | Yes (9 months) | No |

| Key Barrier to Secondary Patents | Permissive USPTO; high litigation costs | Stricter EPO standards; “Added Matter” doctrine | Section 3(d) “Enhanced Efficacy” requirement | Evolving; stricter examination than U.S. | Standard examination (post-2021 reform) |

| Litigation System Feature | Unified (infringement & validity in one court) | Often Bifurcated (e.g., Germany) | Unified | Unified (Specialized IP Courts) | Unified |

Case Study Deep Dive: The Global Tale of Humira (Adalimumab)

No single case better illustrates the profound real-world consequences of divergent international patent laws than that of adalimumab, marketed by AbbVie as Humira. For years the world’s best-selling drug, Humira became the quintessential example of a patent thicket strategy, generating nearly $200 billion in revenue over two decades of market exclusivity.74 The stark contrast between AbbVie’s patenting and litigation strategy in the United States versus the European Union provides a definitive, empirical demonstration of how legal frameworks directly translate into multi-billion-dollar differences in healthcare spending and years of delayed patient access. Humira is, as many observers have noted, the “poster child of really bad behavior” in the pharmaceutical industry.75

A Thicket of Unprecedented Scale: Comparing AbbVie’s U.S. and EU Portfolios

The core of AbbVie’s strategy was to construct a patent fortress around Humira that was so vast and complex as to be practically impenetrable for would-be biosimilar competitors. The scale of this fortress, however, differed dramatically depending on the legal jurisdiction.

In the United States: AbbVie executed an astonishingly aggressive patenting strategy. The company filed a total of 247 patent applications related to Humira in the U.S., ultimately securing at least 165 granted patents.76 The strategic intent behind this volume is clear from the timing: a staggering 89% of these patent applications were filed

after Humira had already received its initial FDA approval in 2002.77

A detailed academic analysis of Humira’s U.S. patent portfolio drilled down into a core group of 73 granted patents. The study’s most striking finding was that 80% of these patents—59 in total—were “non-patentably distinct” from one another, meaning they did not cover genuinely new and non-obvious inventions but were merely slight variations linked together by terminal disclaimers.30 This analysis revealed that the entire U.S. thicket was effectively built upon only about 14 truly distinct inventive concepts.30 The U.S. patent system, with its permissive rules on continuation applications and terminal disclaimers, allowed AbbVie to spin a small number of core ideas into a massive web of legal barriers.

In the European Union: The landscape was entirely different. At the European Patent Office (EPO), AbbVie filed only 76 patent applications for Humira—less than a third of the U.S. total.77 Due to the EPO’s stricter patentability standards, many of these applications were either withdrawn by AbbVie, refused by examiners, or revoked after being challenged by third parties.77 The same academic study that identified 73 core patents in the U.S. found only 8 corresponding granted patents in Europe. Where the USPTO allowed dozens of patents to issue from a single patent family, the EPO typically granted only one or two.30

This vast disparity is a direct consequence of the legal doctrines discussed previously. The EPO’s strict “added matter” doctrine prevented AbbVie from incrementally expanding its patent claims during prosecution, while its more critical assessment of inventive step and its different treatment of prophetic (theoretical) versus working (data-supported) examples resulted in fewer, narrower patents being granted.31

Litigation and Settlement: A Wall of Patents Forces Delayed Entry in the U.S.

The primary patent covering the adalimumab molecule itself expired in December 2016 in the United States and, with its Supplementary Protection Certificate (SPC), in October 2018 in Europe.76 The market outcomes that followed these dates could not have been more different.

In Europe: As soon as the SPC expired in October 2018, multiple biosimilar versions of Humira launched across the continent.30 While litigation did occur, it did not prevent immediate market entry and the onset of competition. A notable recent case in Germany in 2025 saw Samsung Bioepis’s biosimilar, Imraldi, temporarily removed from the market for infringing a

formulation patent.79 However, this was a dispute over a single patent held by another biosimilar competitor (Fresenius Kabi), not a delay caused by an originator’s patent thicket.

In the United States: The patent thicket worked exactly as intended. Despite the primary patent’s expiration in 2016, AbbVie’s wall of secondary patents successfully blocked all biosimilar competition until January 2023—a full five years and three months after biosimilars became available in Europe.30 AbbVie asserted dozens of patents against each biosimilar challenger, initiating the complex “patent dance” under the BPCIA.30 Faced with the staggering cost of litigating through the entire thicket and the asymmetric risk of needing to invalidate every single asserted patent, every major biosimilar developer—including Amgen, Samsung Bioepis, and Sandoz—capitulated. They each entered into settlement agreements with AbbVie, agreeing to license the patents and delay their U.S. launch until 2023.80

This strategy also survived a major legal challenge. A class-action antitrust lawsuit was filed by indirect purchasers, arguing that the creation of the patent thicket and the subsequent settlements constituted an illegal anticompetitive scheme designed to maintain a monopoly.82 However, in a landmark decision, the U.S. District Court for the Northern District of Illinois dismissed the lawsuit. The court ruled that AbbVie’s actions—obtaining presumptively valid patents from the USPTO and enforcing them through litigation and settlement—were permissible activities protected by patent law.81 The judge stated that if the USPTO was issuing low-quality patents, the proper remedy was to reform the patent office, not to use antitrust law to punish companies for utilizing the system as it exists.81 This ruling effectively gave a judicial green light to the patent thicket strategy under the current interpretation of U.S. law, signaling that reform would have to come from Congress or the USPTO, not the courts.

The Aftermath: Quantifying the Economic Impact of Divergent Market Entry Dates

The five-year gap in biosimilar market entry between Europe and the U.S. had enormous and quantifiable financial consequences.

Revenue for AbbVie and Costs to the U.S. System: The delay was incredibly lucrative for AbbVie. In the period after its main U.S. patent expired at the end of 2016, the company earned nearly $75 billion more in U.S. Humira sales before biosimilars finally launched.74 Between 2016 and 2023, AbbVie’s total U.S. revenue from Humira was $114 billion.76 This revenue was bolstered by aggressive price increases; from its launch in 2003 to 2021, the list price of Humira in the U.S. increased by 470%.83

The cost of this delay to the U.S. healthcare system was immense. A U.S. House of Representatives committee report, citing an internal AbbVie analysis, estimated that earlier biosimilar entry would have saved the U.S. health system at least $19 billion between 2016 and 2023.83 Another analysis calculated the cost of the delay at $7.6 billion for a single year.84

Savings in Europe: In stark contrast, the timely entry of biosimilars in Europe in 2018 triggered immediate and intense price competition. In several European countries, prices for adalimumab plummeted, with discounts of up to 80% reported.85 In the Netherlands, for example, AbbVie itself was forced to slash its price by over 80% to compete with the newly launched biosimilars, demonstrating that the pre-2018 price was not based on cost but on monopoly power.87 This competition generated substantial savings for national healthcare systems and led to a significant increase in patient access to the treatment.86

The Humira case study thus moves the debate over patent thickets from a theoretical legal problem to a tangible economic and public health issue. It provides a clear, causal link between specific, technical differences in patent law and multi-billion-dollar outcomes for patients, payers, and corporations.

Table 2: The Humira Case Study – U.S. vs. EU Comparison

| Metric | United States | European Union |

| Patent Applications Filed | 247 77 | 76 77 |

| Granted Patents (Core Portfolio) | ~165 total; 73 in one key study 30 | 8 in corresponding study 30 |

| % of Non-Patentably Distinct Patents | 80% 30 | Low / Not Applicable |

| Primary Patent/SPC Expiry | December 2016 76 | October 2018 78 |

| Biosimilar Market Entry Date | January 2023 30 | October 2018 30 |

| Resulting Delay in Competition | ~6 years post-patent expiry | 0 days post-SPC expiry |

| Estimated Cost of Delay | $19 Billion+ (2016-2023) 83 | N/A (Immediate Savings) |

| Observed Price Reduction Post-Entry | Gradual erosion post-2023 | Up to 80% 85 |

Beyond Humira: Broadening the Analysis

While the case of Humira provides the most dramatic example of a patent thicket’s impact, the strategies of evergreening and monopoly extension are widespread in the pharmaceutical industry, applied to both large-molecule biologics and traditional small-molecule drugs. Examining other blockbuster drugs reveals additional dimensions of these strategies, including the combination of patent thickets with regulatory gamesmanship and the rise of globalized, activist-led challenges to foundational patents.

Revlimid (Lenalidomide): Protecting a Small-Molecule Drug

The case of Revlimid (lenalidomide), a crucial oral medication for multiple myeloma, demonstrates that the patent thicket strategy is not exclusive to complex biologics. Celgene, which was later acquired by Bristol Myers Squibb, employed a multi-pronged approach to protect its blockbuster small-molecule drug, resulting in one of the most prolonged and successful monopoly extensions in recent history.

Celgene constructed a formidable patent thicket around Revlimid, filing over 200 patent applications and engaging in litigation that lasted for 18 years to fend off generic competition.1 This legal fortress successfully delayed broad generic entry in the U.S. until 2026, a full seven years after a key patent on the drug’s active ingredient expired in 2019.1

What makes the Revlimid case particularly instructive is Celgene’s use of a strategy that went beyond patent law, weaponizing a regulatory requirement to create a second, independent barrier to competition. Revlimid carries significant safety risks, and the FDA mandated a Risk Evaluation and Mitigation Strategy (REMS) program, called RevAssist, to ensure its safe distribution.88 This program tightly controlled the drug’s supply chain. Celgene exploited these restrictions by refusing to sell samples of Revlimid to generic companies, arguing that doing so would violate the REMS protocol. Without these samples, generic firms could not conduct the bioequivalence studies required by the FDA for approval.88 In a particularly audacious move, Celgene even filed 22 patents on the RevAssist program itself, attempting to merge the regulatory barrier with its patent thicket.89

This dual-barrier strategy was immensely profitable. During the period of extended monopoly, the price of Revlimid skyrocketed from approximately $6,000 per month in 2005 to over $24,000 per month by 2022.1 The total cost of this delay to the U.S. healthcare system has been estimated at $45 billion.1 Ultimately, Celgene resolved the numerous legal challenges by entering into settlement agreements with several generic manufacturers. These agreements permitted the launch of volume-limited quantities of generic lenalidomide starting in 2022, with fully unrestricted generic competition delayed until January 2026.89 The Revlimid case thus showcases a sophisticated corporate strategy that attacks the generic entry pathway at two distinct points: the legal/IP pathway via the patent thicket, and the regulatory/development pathway via the abuse of the REMS system.

Sovaldi (Sofosbuvir): Global Challenges to a Breakthrough Therapy

The case of Gilead Sciences’ Sovaldi (sofosbuvir) represents a different facet of the global struggle over pharmaceutical patents. Approved in 2013, Sovaldi was a revolutionary, curative treatment for Hepatitis C. However, its launch price in the United States of $1,000 per pill, or $84,000 for a standard 12-week course of treatment, sparked immediate and widespread global outrage.92

Unlike the thicket cases of Humira and Revlimid, the legal challenges against Sovaldi did not primarily focus on a web of secondary patents. Instead, they targeted the validity of the foundational patents themselves. A global coalition of public health organizations and patient advocacy groups, including I-MAK and Doctors Without Borders (MSF), launched coordinated patent opposition campaigns in dozens of countries.92 Their core legal argument was that the sofosbuvir molecule was not sufficiently novel or inventive over previously existing scientific knowledge and therefore did not meet the standards for patentability.92

These global challenges yielded mixed results, highlighting the significant variation in how different national patent offices apply patentability standards. The patent for sofosbuvir was rejected or revoked in key countries like China and Egypt, and faced significant legal hurdles in India.93 However, the key patents were largely upheld in the United States and at the European Patent Office, though often with amendments to their scope.94

The Sovaldi case is significant for two primary reasons. First, it marks the maturation of civil society organizations as sophisticated and powerful actors in the global pharmaceutical IP landscape. These groups demonstrated the ability to use complex legal mechanisms like patent opposition, traditionally the domain of corporate competitors, to pursue public health goals on a global scale. Second, the divergent outcomes of these challenges underscore the fragmented nature of the global patent system. The fact that the same invention could be deemed patentable in Europe but not in China reveals that, despite international agreements like TRIPS, the application of patent law remains a distinctly national affair, creating a complex and unpredictable landscape for both innovator companies and access-to-medicines advocates.

The Global Impact: Economic, Competitive, and Human Costs

The strategic deployment of patent thickets and evergreening tactics has profound and far-reaching consequences that extend beyond the courtroom and the boardroom. These strategies fundamentally reshape market dynamics, impose substantial costs on healthcare systems, create complex and often paradoxical incentives for innovation, and ultimately exact a significant human toll by impeding patient access to essential medicines. The impact is felt most acutely in high-cost systems like the United States, but the ripple effects of a patent-driven, high-price model are global, particularly affecting public health in developing nations.

Quantifying the Cost: The Effect on Drug Prices and Healthcare Systems

The primary economic effect of a patent thicket is the delay of generic and biosimilar competition, which directly results in sustained high prices for pharmaceuticals.26 The entry of generic competition for small-molecule drugs typically leads to dramatic price reductions, often in the range of 80-90%.96 For more complex biologic drugs, the entry of biosimilars also spurs significant price competition, with price reductions in Europe commonly ranging from 15-30%, and in some cases, much higher.85

By postponing this price-lowering competition, patent thickets impose massive costs on patients, insurers, and government payers. In the United States, the cost of evergreening strategies has been estimated to be as high as $52.6 billion annually for consumers and insurers.19 Controversial “pay-for-delay” settlements, a common outcome of thicket-related litigation, are estimated to cost the U.S. system an additional $3.5 billion per year.37 The impact is also significant in Europe, where a European Commission report estimated that legal tactics to delay generic entry cost the healthcare system €3 billion over a decade-long period.99

These strategies effectively extend the period of market monopoly. While the nominal patent term is 20 years, much of this is consumed by R&D and regulatory review. Studies have found that the average effective protection period for a drug in the EU is around 13 years.100 In the U.S., however, this period is often significantly longer due to the successful deployment of patent thickets that can add years of additional exclusivity.16

The Innovation Paradox: Does Thacketing Stifle or Stimulate R&D?

The debate over the impact of patent thickets on innovation is complex and deeply polarized, revealing a fundamental tension in how “innovation” itself is defined.

The Argument that Thickets Stifle True Innovation: Critics contend that the evergreening strategies enabled by patent thickets distort R&D incentives and stifle breakthrough innovation. They argue that corporate resources—both financial and scientific—are diverted away from the high-risk, high-reward pursuit of novel therapies and are instead channeled into lower-risk activities aimed at generating secondary patents for existing products.8 This includes funding extensive litigation and conducting clinical trials for minor formulation changes or new uses of old drugs. The data showing that 78% of new pharmaceutical patents are for existing drugs, not new chemical entities, is often cited as evidence of this distorted focus.2 This strategic behavior creates a “congested legal environment” that can deter new entrants, particularly smaller, more innovative biotech firms that lack the resources to navigate or challenge a dense patent thicket.101

The Argument for the Value of Secondary Patents: Proponents of the current system, primarily from the innovator pharmaceutical industry, argue that secondary patents protect legitimate and valuable follow-on innovation.102 They contend that R&D does not stop once a drug is approved. Significant investment is required to develop improved formulations that might reduce side effects, create more convenient extended-release versions that improve patient adherence, or discover new therapeutic uses for a drug that can treat other diseases.104 This incremental R&D provides real benefits to patients and, they argue, deserves patent protection just as the initial discovery does. From this perspective, labeling all secondary patents as pejorative “evergreening” is an oversimplification that ignores the value of this continuous product improvement.103 Indeed, one economic study suggested that the monopoly extensions provided by secondary patents actually contributed to an increase in overall pharmaceutical R&D, as measured by the number of clinical trials, of between 21% and 69%.19

This debate highlights that the core policy problem may not be the existence of secondary patents per se, but rather the proportionality of the market protection they provide. While a single patent on a new, less painful formulation may be a justified reward for a genuine improvement, a legal system that allows that single improvement to be leveraged into a thicket of dozens of overlapping, non-patentably distinct patents creates a barrier to competition that is vastly disproportionate to the actual inventive contribution.

The Human Toll: Patient Access and the Global South

Ultimately, the economic costs of extended monopolies translate into a significant human toll. The high drug prices maintained by patent thickets create direct and often insurmountable barriers to patient access.105 In the United States, surveys consistently show that a substantial portion of the population is forced to ration or skip necessary medications due to cost. One report found that one in four Americans ration their medication 8, a figure that rises to 37% for individuals in lower-income brackets.40 Patient advocates describe the anguish of facing a lifetime of high drug prices and the fear of having to choose between life-saving treatment and basic necessities like food or rent.107

This tension is magnified in the developing world. The implementation of the WTO’s TRIPS Agreement in the mid-1990s mandated that all member countries, including developing nations, adopt a minimum standard of intellectual property protection, which included granting patents for pharmaceutical products.105 Critics argue that this imposition of a developed-world patent model has been profoundly detrimental to public health in the Global South, leading to higher medicine prices and severely restricted access.109

The struggle of South Africa during the height of the HIV/AIDS epidemic is a seminal case study in this conflict. In the late 1990s, the South African government passed legislation to allow for the importation of cheaper generic antiretroviral drugs to combat a crisis that was claiming hundreds of thousands of lives. This move was met with a lawsuit from 39 multinational pharmaceutical companies, who argued it violated their patent rights under the TRIPS agreement.111 The ensuing global public outcry eventually forced the companies to drop the lawsuit, but the episode became a powerful symbol of the clash between patent rights and the human right to health.

This fundamental conflict persists today. International humanitarian organizations like Doctors Without Borders (MSF) and global health bodies like the World Health Organization (WHO) consistently identify patent barriers as a primary obstacle to accessing essential medicines in low- and middle-income countries.113 The global IP framework has created an environment where developing countries must constantly engage in legal and political battles—whether through unique legislation like India’s Section 3(d) or through compulsory licensing—to carve out the necessary policy space to address their urgent public health needs.

Navigating the Thicket: The Role of Competitive Intelligence

The proliferation of dense patent thickets has fundamentally altered the strategic landscape of the pharmaceutical industry. In this complex and high-stakes environment, where a single drug’s market exclusivity is defended by a fortress of legal documents, comprehensive and timely competitive intelligence is no longer a luxury but an absolute necessity for survival and success. Both innovator and generic/biosimilar firms must now engage in sophisticated patent analytics to navigate the legal minefield, identify opportunities, and mitigate risks.118

Strategic Use of Patent Databases and Analytics

Modern pharmaceutical strategy requires a systematic and proactive approach to monitoring the intellectual property landscape. This goes far beyond a simple patent search and involves several key activities:

- Portfolio Tracking: Companies must continuously track the patent filings of their competitors to understand their R&D direction, anticipate future product launches, and identify emerging threats to their own market position.118

- Freedom-to-Operate (FTO) Analysis: Before launching a new product, generic and biosimilar firms must conduct exhaustive FTO analyses to identify all existing patents that their product might infringe. This process is made exponentially more difficult by patent thickets, requiring a meticulous review of dozens or even hundreds of patents to assess the risk of litigation.121

- “Design-Around” Strategy: For generic and biosimilar developers, a key goal of competitive intelligence is to identify weaknesses or gaps in a brand’s patent wall. By carefully analyzing the claims of secondary patents, a company may be able to develop a non-infringing version of a drug—for example, by creating a different formulation or using an alternative manufacturing process—allowing it to “design around” the thicket and enter the market.122

- Litigation Monitoring: Tracking the outcomes of patent litigation, including Paragraph IV challenges in the U.S. and patent oppositions in Europe and India, provides crucial data on the strength of a brand’s patents and the likelihood of a successful challenge.123

Leveraging Platforms like DrugPatentWatch for Portfolio Management

The sheer volume and complexity of the data required for this level of analysis make manual tracking practically impossible. This has given rise to specialized commercial databases and analytics platforms designed to provide structured, actionable intelligence. DrugPatentWatch is a prominent example of such a tool, aggregating and curating data from a wide array of global sources—including patent offices, regulatory agencies like the FDA, and court records—into a unified and searchable platform.122

The strategic value of such a platform differs depending on the user, but its core function is to translate raw, complex patent data into a high-value strategic asset:

- For Generic and Biosimilar Companies: These firms are primary users of platforms like DrugPatentWatch. They can use the service to identify the most promising market entry opportunities by tracking patent expiration dates, including all relevant patent term extensions and other exclusivities. Monitoring ongoing Paragraph IV litigation provides insights into which patents are being successfully challenged, helping to prioritize targets and inform legal strategy.123 The detailed information on formulations and manufacturing processes disclosed in patents can also aid in developing non-infringing alternatives.122

- For Innovator (Brand-Name) Companies: Innovator firms use these tools for defensive purposes. They can monitor the activities of generic and biosimilar challengers, receiving alerts when their patents are challenged. This allows for a rapid legal response. Furthermore, they can track the R&D and patenting trends of their direct competitors to anticipate new threats and identify potential gaps in their own patent portfolios that need to be filled.120 This intelligence is crucial for effective lifecycle management and for reinforcing the patent thicket around key products.

- For API Manufacturers, Investors, and Other Stakeholders: The utility of these platforms extends beyond the direct competitors. Active Pharmaceutical Ingredient (API) manufacturers can identify potential customers (generic firms) and gain insights into formulation requirements. Investment analysts and business development professionals use the data for due diligence, assessing the strength of a company’s patent portfolio and the durability of its revenue streams before making investment or acquisition decisions.123

In essence, the rise of the patent thicket as a dominant corporate strategy has catalyzed the development of a parallel industry focused on patent analytics and competitive intelligence. The very complexity of the problem has spurred the creation of its solution, making platforms like DrugPatentWatch indispensable tools for any stakeholder seeking to navigate the modern pharmaceutical IP landscape.

The Path Forward: Policy, Reform, and the Future of Pharmaceutical IP

The growing controversy surrounding drug patent thickets has spurred a wave of proposals for legislative and regulatory reform, particularly in the United States. These proposals, along with ongoing global debates about the role of intellectual property in public health, point toward a future where the balance between innovation and access may be recalibrated. The fundamental challenge remains how to reform the system to reward genuine, high-value innovation without enabling anticompetitive strategies that harm patients and healthcare systems.

Legislative and Regulatory Proposals for Reform

In the United States, where patent thickets are most entrenched, policymakers have advanced several targeted reforms aimed at curbing the most egregious evergreening tactics.

- Limiting Patent Assertions in Litigation: A prominent bipartisan proposal, the Affordable Prescriptions for Patients Act, seeks to address the litigation barrier created by thickets for biologic drugs. The bill would place a reasonable limit on the number of patents an innovator company can assert in BPCIA litigation, with proposals often suggesting a cap of around 20 patents.20 This is intended to prevent brand companies from overwhelming biosimilar challengers with a deluge of lawsuits, thereby streamlining the dispute resolution process.

- Strengthening Patent Quality and Examination: Many reformers argue that the problem must be addressed at its source: the issuance of low-quality patents by the USPTO. Proposals in this area focus on enhancing collaboration between the USPTO and the FDA, with the goal of providing patent examiners with better information and training to reject applications for “obvious” secondary inventions that offer little to no therapeutic benefit.8 The USPTO itself has considered rule changes, such as a now-withdrawn proposal that would have altered the effect of terminal disclaimers, making it so that the invalidation of one patent in a disclaimer-linked family would render the other patents in that family unenforceable.20 While this specific rule was not adopted, it signals an awareness of the need for reform at the administrative level.

- Enhanced Antitrust Enforcement: The Federal Trade Commission (FTC) has taken a more aggressive posture in recent years. The agency has begun systematically challenging what it deems to be “improper” listings in the FDA’s Orange Book, targeting patents that it believes do not meet the statutory criteria for listing and are included solely to delay generic competition.25 This represents a new front in the effort to police anticompetitive behavior, focusing on the administrative mechanisms that enable thicket strategies.

While these U.S.-focused reforms are significant, they can be criticized as treating the symptoms of the problem rather than its root cause. Capping the number of patents that can be litigated, for example, does not stop a company from obtaining a thicket of 200 patents; it merely forces them to select their strongest 20 for litigation, which still represents a formidable barrier. A more durable solution would require fundamental changes to the standards of patentability and examination at the USPTO to prevent the thicket from being built in the first place.

The COVID-19 TRIPS Waiver: A Test Case for the Future?

The global COVID-19 pandemic brought the tension between intellectual property and public health into sharp focus, culminating in a proposal at the WTO, led by India and South Africa, to temporarily waive TRIPS obligations for patents related to COVID-19 vaccines and treatments.125 The debate reignited a decades-old global conversation about the role of patents in times of health crises.126

After lengthy and contentious negotiations, a limited waiver covering only vaccine patents was adopted in June 2022.125 However, it was widely criticized by public health advocates as being insufficient and coming too late. The waiver did not cover therapeutics or diagnostics, nor did it address other crucial forms of IP like trade secrets and manufacturing know-how, which are essential for technology transfer and scaling up production.127 A subsequent proposal to extend the waiver was unlikely to be accepted.128

The episode served as a powerful illustration of the deep geopolitical divisions on IP issues and the immense political influence wielded by the pharmaceutical lobby in shaping global health policy.126 It also highlighted that in a global health emergency, simply waiving patents is not a silver bullet; solutions must also address manufacturing capacity, technology transfer, and supply chain logistics.

Balancing Innovation Incentives with Public Health Imperatives

Looking ahead, the central challenge for policymakers worldwide is to recalibrate the patent system to achieve its intended balance. The system must continue to provide robust incentives for the costly and high-risk endeavor of discovering and developing new medicines. The Tufts Center for the Study of Drug Development famously estimated the cost of bringing a new drug to market at $2.6 billion, a figure that, while disputed by critics as inflated, underscores the significant investment required.129

However, this incentive structure cannot be so permissive that it allows for the indefinite extension of monopolies through legal gamesmanship that provides little corresponding benefit to patients.2 The future of pharmaceutical IP may involve a shift toward a system that more directly ties the strength and duration of exclusivity to the degree of novelty and therapeutic value of the innovation.15 This could involve raising the bar for patentability for secondary inventions, as India has done, or creating more structured and limited pathways for extending exclusivity, as the EU has with its SPC system. Ultimately, ensuring a sustainable future for both pharmaceutical innovation and public health requires a renewed commitment to the original bargain of the patent system: a temporary, and truly limited, reward for a genuine and valuable contribution to society.

Frequently Asked Questions (FAQ)

- What is a drug patent thicket?

A drug patent thicket is a dense, overlapping web of numerous patents that a pharmaceutical company accumulates to protect a single drug product. This strategy goes beyond the single, primary patent on the drug’s active ingredient and includes many “secondary” patents on aspects like the drug’s formulation, dosage, method of use, or manufacturing process. The primary purpose of a thicket is to create a formidable legal and financial barrier that deters or delays the market entry of lower-cost generic and biosimilar competitors.3 - Why are patent thickets more common in the U.S. than in Europe?

Patent thickets are more common in the U.S. due to a combination of factors in its legal and regulatory system. The U.S. patent office (USPTO) has historically been more permissive in granting patents on incremental innovations and allows for procedural tools like “continuation applications” that facilitate the creation of large patent families. For biologic drugs, the U.S. BPCIA law places no limit on the number of patents that can be asserted in litigation. In contrast, the European Patent Office (EPO) has stricter patentability standards, particularly its “added matter” doctrine, which prevents applicants from expanding claims beyond what was originally filed. The EU also uses a more structured system of Supplementary Protection Certificates (SPCs) for patent term restoration, which provides a single, limited extension rather than encouraging the accumulation of many patents.28 - Are all secondary patents bad?

No, not all secondary patents are inherently “bad.” Many secondary patents protect genuine follow-on innovations that provide significant benefits to patients, such as an extended-release formulation that reduces dosing frequency, a new delivery device that is less painful, or the discovery that an existing drug can treat a new disease. Proponents argue that the R&D required for these improvements deserves patent protection. The controversy arises not from the existence of individual secondary patents, but from the strategic practice of “thicketing”—accumulating dozens of low-quality, overlapping, and often non-inventive secondary patents with the primary goal of blocking competition rather than protecting a meaningful innovation.102 - How much do patent thickets cost the healthcare system?

The costs are substantial, running into the tens of billions of dollars. By delaying the entry of affordable generics and biosimilars, patent thickets keep drug prices artificially high. The most well-documented example is Humira; the five-year delay in U.S. biosimilar competition caused by its patent thicket is estimated to have cost the American healthcare system at least $19 billion. Broader estimates suggest that evergreening strategies cost the U.S. system over $50 billion annually, with “pay-for-delay” settlements adding another $3.5 billion per year.19 - What is India’s Section 3(d) and why is it important?

Section 3(d) is a unique provision in India’s Patents Act designed specifically to prevent the evergreening of pharmaceutical patents. It states that a new form of a known substance (such as a new salt or crystal form of an existing drug) cannot be patented unless it demonstrates a significant “enhancement of the known efficacy,” which India’s Supreme Court has interpreted to mean enhanced therapeutic efficacy. This creates a very high bar for secondary patents, making it extremely difficult to build a patent thicket in India. It is considered a landmark public health safeguard that has helped maintain India’s role as a major producer of affordable generic medicines for the world.53 - What reforms are being proposed to stop patent thickets?