Introduction: The Perfect Storm on the Horizon

In the boardrooms of the world’s leading pharmaceutical companies, a single, ominous term hangs in the air: the patent cliff. It’s a phrase that has echoed through the industry for decades, but what we face between 2025 and 2030 is not just another cyclical downturn. It is, by every measure, the most severe and concentrated wave of patent expirations in the history of modern medicine. This isn’t a storm on the distant horizon; the first waves are already crashing against the shore, threatening to erode the very foundations of the blockbuster-driven business model that has defined Big Pharma for a generation.

The numbers are, frankly, staggering. Depending on the analyst, the total revenue at risk is estimated to be anywhere from $236 billion to a jaw-dropping $400 billion in annual sales by 2030.1 This isn’t a slow leak; it’s a “catastrophic revenue hemorrhage”. Nearly 200 blockbuster drugs are set to lose their market exclusivity, allowing a flood of lower-cost generics and biosimilars to enter the market. The financial impact is both swift and brutal. Historical data and recent case studies show that a branded drug can lose between 80% and 90% of its revenue within the first year of facing generic competition.2

Consider the recent, sobering example of AbbVie’s immunology juggernaut, Humira. A perennial chart-topper, its sales peaked at over $21.2 billion in 2022. Following the entry of biosimilars in the U.S. market, sales plummeted to just under $9 billion by 2024—a greater than 50% decline in just two years. This is the reality of the cliff’s edge.

This phenomenon is not isolated to a single company or therapeutic area. It is a systemic shockwave. The list of casualties reads like a who’s who of the industry’s most successful products:

- Merck’s Keytruda: A revolutionary cancer immunotherapy with over $29 billion in 2024 sales, facing loss of exclusivity (LOE) in 2028.5

- Bristol Myers Squibb’s Eliquis: A leading anticoagulant co-marketed with Pfizer, generating over $13 billion for BMS in 2024, with key patents expiring between 2026 and 2028.2

- Johnson & Johnson’s Darzalex: The cornerstone of a $12 billion multiple myeloma franchise, with patents expiring by 2029.1

- Novartis’s Entresto: A heart failure blockbuster with $7.8 billion in sales, facing generic competition as early as mid-2025.1

The cumulative impact threatens to be company-altering. Analyst reports suggest that five of the top ten pharmaceutical firms face an exposure exceeding 50% of their current revenue. For giants like Bristol Myers Squibb, Pfizer, and Novartis, the revenue generated by just their top five drugs is projected to decrease by as much as 62% by 2030.7 This is not a challenge that can be solved by simple cost-cutting or incremental innovation; it is an existential threat that demands a fundamental rethinking of corporate strategy.

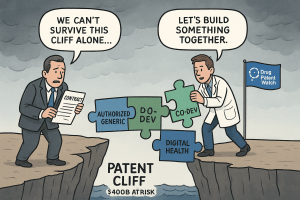

The very term “patent cliff” is, in many ways, a misnomer. A cliff implies a single, sudden event. What the industry is truly facing is a systemic crisis of its long-standing business model.2 For decades, the model has been simple: discover a blockbuster, patent it, market it aggressively for 15-20 years, and use the massive profits to fund the search for the next one. The unprecedented scale of the 2025-2030 expirations shatters this paradigm. The sheer volume of revenue evaporating across multiple therapeutic areas simultaneously means that no single new blockbuster, or even a handful of them, can fill the void. This forces a strategic pivot from a “winner-take-all” mentality centered on a few mega-drugs to a more resilient, diversified “portfolio of niche winners” approach. This new reality requires a fundamentally different engine for growth—one that is more agile, more collaborative, and more externally focused.

This report will argue that the primary engine for this new era of growth is the strategic partnership. We will explore how, in the face of this perfect storm, alliances are no longer a tactical option for filling pipeline gaps but have become the central, organizing principle for a new, more sustainable pharmaceutical business model. We will dissect the various forms these partnerships take, from co-development and co-marketing deals to authorized generic arrangements and “beyond the pill” digital health collaborations. Through in-depth analysis and real-world case studies, we will provide a comprehensive playbook for turning the existential threat of market erosion into a generational opportunity for strategic renewal and competitive advantage. The age of the lone pharma giant is over. The age of the alliance has begun.

Beyond the Old Playbook: The Limits of Traditional Defenses

For decades, the pharmaceutical industry has relied on a well-worn, two-pronged strategy to defend against the patent cliff: massive mergers and acquisitions (M&A) to buy new revenue streams, and herculean investments in internal research and development (R&D) to invent them. While these strategies remain part of the toolkit, the sheer scale of the 2025-2030 cliff exposes their profound limitations. Relying solely on the old playbook in this new environment is akin to bringing a shield to a siege; it may offer some protection, but it cannot win the war.

The M&A Paradox: A Mountain of Cash and a Shortage of Targets

On the surface, Big Pharma appears perfectly positioned for a shopping spree. The industry is sitting on an immense pile of “dry powder,” with an estimated deal capacity exceeding $1.5 trillion. Yet, despite this firepower, the era of the transformational mega-merger seems to be waning. The M&A landscape in recent years has been characterized by a curious paradox: deal volume is down, but deal values for specific types of assets are up, and the strategic focus has shifted dramatically.10

Instead of acquiring rivals to absorb their commercial-stage blockbusters, companies are increasingly executing smaller, more strategic “bolt-on” acquisitions focused on early-stage assets and innovative technology platforms.1 The data is telling: the value share of M&A deals for commercial-stage assets plummeted from 56.2% in 2023 to a mere 8% in 2024, while deals for preclinical and Phase I assets surged to account for over a quarter of total deal value. This signals a profound shift in M&A philosophy. Companies are no longer just “buying revenue” to patch a near-term hole in their P&L. They are “buying innovation” to build future growth engines.

This pivot is a tacit admission that the well of late-stage, de-risked blockbuster targets is running dry, and that internal innovation alone cannot keep pace. As one McKinsey analyst noted, drugmakers should be doing some “soul-searching” rather than simply trying to land assets for immediate revenue recognition. However, this new strategy of acquiring early-stage potential is not a simple transaction; it is the beginning of a long-term collaborative effort. These nascent assets require immense resources, expertise, and nurturing to bring to market—a process that looks far more like a co-development partnership than a traditional corporate integration. The acquisition becomes the starting point of an alliance, not the end of a deal. Furthermore, analysis from McKinsey has shown that companies engaging in a programmatic stream of smaller, strategic transactions consistently deliver higher total shareholder returns than those that pursue large, selective deals, a trend that is even more pronounced in the biopharma sector.11

The R&D Productivity Wall: Spending More, Inventing Less

The second pillar of the traditional defense—the internal R&D engine—is also showing signs of strain. Despite a massive increase in investment, the productivity of pharmaceutical R&D has failed to keep pace. Global R&D spending doubled from $40 billion to $80 billion between 2001 and 2019, yet key metrics like clinical trial success rates, development speed, and overall output have remained “stubbornly flat”.15

The cost of innovation continues to spiral upwards, with the average price tag to bring a single new drug to market now reaching an astonishing $2.23 billion.17 This immense investment comes with no guarantee of success. The sobering reality is that even after a drug clears the hurdles of development and regulation, its commercial success is far from certain. Analysis from McKinsey and EY shows that up to two-thirds of all new drug launches fail to meet their pre-launch consensus sales expectations.8 A launch that stumbles out of the gate is overwhelmingly likely to continue underperforming in subsequent years, making the replacement of a multi-billion-dollar blockbuster through internal efforts a high-risk, high-cost gamble.

This R&D productivity crisis is not merely a financial challenge; it is the primary strategic driver pushing the industry toward external innovation. When the internal engine sputters, sourcing innovation from the outside becomes an absolute necessity. The data confirms this direct causal link: the realization over the past two decades that internal R&D productivity is unsustainable has coincided directly with a sharp increase in discovery collaborations, in-licensing of external assets, and partnerships with smaller biotech firms. Indeed, over 70% of new molecular entity revenues now originate from products that were sourced externally. This elevates strategic partnerships from a “nice-to-have” option to a “must-have” core competency, essential for survival and growth in the post-blockbuster world. The old playbook is broken. A new, more collaborative one must be written.

The Partnership Paradigm: A Taxonomy of Modern Strategic Alliances

As the limitations of purely internal or acquisition-based strategies become clear, the pharmaceutical industry is undergoing a profound evolution in how it collaborates. The paradigm is shifting away from straightforward, transactional exchanges of goods or services toward deeply integrated strategic alliances designed for long-term, mutual value creation. A true strategic partnership is not just a contract; it is a dynamic relationship where independent partners remain so, yet they share the benefits, risks, and control over joint actions, all while making ongoing contributions to acquire new capabilities that neither could develop as efficiently on their own.

This evolution is a direct reflection of the increasing complexity of the science itself. Developing and commercializing a simple small-molecule drug is a fundamentally different challenge than bringing a novel cell therapy, a complex biologic, or an integrated digital therapeutic to market. As the assets become more sophisticated, the collaborations required to shepherd them from lab to patient must become more deeply integrated and strategically aligned. A simple fee-for-service model is no longer sufficient to manage the intricate scientific, regulatory, and commercial risks of today’s cutting-edge therapies.

Understanding the different forms these modern alliances can take is the first step toward building a robust, patent-cliff-proof strategy. While the lines can often blur, most pharmaceutical partnerships fall into several key categories, each with a distinct structure and strategic rationale.

A Spectrum of Collaboration: From Contractual to Foundational

The universe of pharmaceutical partnerships exists on a spectrum of integration and commitment. At one end are highly flexible, non-equity alliances, while at the other are deeply integrated joint ventures.

Non-Equity Strategic Alliances

These are the most common and flexible forms of partnership, established through contractual agreements to pool resources and capabilities for a specific purpose without any exchange of ownership. They are particularly well-suited to the pharmaceutical industry—a “slow cycle” industry where long patent lives create a stable environment for long-term collaboration. Key variations include:

- Co-Development Agreements: Two or more companies collaborate on the R&D of a drug candidate, sharing the costs, risks, and subsequent successes. This is often a partnership between an innovative biotech with a promising asset and a large pharma company with the capital and clinical development expertise to run large-scale trials.

- Co-Marketing & Co-Promotion Agreements: Partners join forces to commercialize a drug, sharing the marketing expenses and sales efforts. This can be used to expand a drug’s reach by leveraging a partner’s larger sales force or its expertise in a specific geography or therapeutic area.

- In-Licensing Agreements: A company acquires the rights to develop and/or commercialize a drug or technology from another company in exchange for upfront payments, milestone payments, and royalties on future sales. This is a primary mechanism for large pharma to access external innovation and replenish their pipelines.

- R&D Collaborations: Often focused on early-stage discovery, these partnerships pool scientific expertise and resources to explore new targets, technologies, or therapeutic modalities. These frequently involve collaborations between pharmaceutical companies and academic institutions or specialized technology firms.

Equity Strategic Alliances

In this model, one company takes a minority equity stake in another, creating a tighter alignment of interests than a purely contractual relationship. This can provide a smaller biotech with crucial funding and validation, while giving the larger pharma partner a window into its technology and a potential first right of refusal on future assets. It serves as a middle ground, offering deeper integration without the complexity of a full merger.

Joint Ventures (JVs)

This is the most integrated form of partnership, where two or more parent companies create a legally separate, new child company to pursue a specific objective. JVs are often used for large-scale, high-risk projects, such as building a new manufacturing facility or entering a new and complex market where sharing risk and combining local expertise is paramount. They are less common for single-asset development but can be a powerful tool for building new, shared capabilities.

The table below provides a high-level overview of these primary partnership models, outlining their strategic goals and ideal applications in the context of mitigating patent cliff-related market erosion.

| Partnership Model | Primary Strategic Goal | Typical Structure | Capital Intensity | Degree of Operational Control | Risk/Reward Profile | Ideal Use Case for Patent Cliff Mitigation |

| Co-Development | Share R&D risk & cost; combine scientific & clinical expertise. | Contractual agreement with joint steering committees. | Medium to High (Shared) | Shared | Shared | De-risking and accelerating development of a key late-stage pipeline asset to replace a lost blockbuster. |

| Co-Marketing/Promotion | Maximize commercial reach; access new markets or physician segments. | Contractual agreement dividing sales territories or responsibilities. | Low to Medium | Shared (Lead Partner) | Shared | Maximizing revenue of a maturing blockbuster in the final years before patent expiry. |

| Joint Venture (JV) | Create a new, shared capability or enter a high-barrier market. | Formation of a new legal entity (e.g., Company C). | High | Shared (via JV Board) | Shared | Building shared manufacturing capacity for a new modality (e.g., cell therapy) or entering a complex emerging market. |

| In-Licensing | Rapidly acquire external innovation to fill pipeline gaps. | Contractual agreement with upfront, milestone, and royalty payments. | Varies (Low for early-stage, High for late-stage) | High (Licensee) | High Risk/High Reward (Licensee) | Proactively replenishing the R&D pipeline years in advance of a known patent cliff. |

| R&D Collaboration | Access novel science/technology; explore new therapeutic areas. | Contractual research agreement, often with academic institutions. | Low | Shared (Research Focus) | High Risk/High Reward (Long-term) | Seeding future innovation and building expertise in next-generation therapeutic areas. |

| Authorized Generic (AG) | Control market erosion; retain market share post-LOE. | Internal launch via subsidiary or licensing deal with a generics firm. | Low | High (Brand) | Low Risk/Moderate Reward | Managing the immediate revenue drop of a small-molecule drug upon patent expiration. |

| “Beyond the Pill” Digital | Create new value streams; build patient/provider “stickiness.” | Partnership with tech, data, or digital health companies. | Medium | Shared | Varies | Building a durable, non-patent-based competitive advantage around a branded product to slow biosimilar/generic uptake. |

Choosing the right partnership model is not a one-size-fits-all decision. It requires a deep understanding of a company’s strategic objectives, risk appetite, internal capabilities, and the specific nature of the asset or technology in question. The most resilient companies will not rely on a single approach but will instead build a sophisticated portfolio of alliances, using each model as a distinct tool to navigate the multifaceted challenges of the post-blockbuster era.

Deep Dive I: Co-Development & Co-Marketing Alliances – Forging Franchise Moats

Among the most powerful instruments in the strategic partnership arsenal are co-development and co-marketing alliances. These collaborations go beyond simple transactions, creating deeply integrated relationships where partners share the immense risks, costs, and ultimately, the rewards of bringing a new medicine to patients.26 When executed effectively, they do more than just mitigate the impact of a patent cliff; they can build formidable “franchise moats” that are far more defensible than a single product’s patent alone.

The logic is compelling. A smaller, innovative biotech may possess a groundbreaking molecule but lack the hundreds of millions—or even billions—of dollars and the global infrastructure required for Phase III trials and a worldwide launch. A large pharmaceutical giant, on the other hand, has the capital, regulatory experience, and commercial muscle but may be struggling with a stagnant internal pipeline. A partnership creates a powerful symbiosis, combining the biotech’s agility and cutting-edge science with Big Pharma’s scale and market access. The results speak for themselves: products developed through such collaborative efforts are a stunning four times more likely to reach the market than those developed by a single entity.

Case Study: The Lynparza Alliance (AstraZeneca & Merck)

A landmark example of this strategy in action is the 2017 alliance between AstraZeneca (AZ) and Merck to co-develop and co-commercialize Lynparza (olaparib), a first-in-class PARP inhibitor for cancer. At the time, Lynparza was a promising but relatively niche product for ovarian cancer. The deal was monumental: Merck agreed to pay AstraZeneca up to $8.5 billion, including a significant upfront payment and shared development and commercialization costs, in return for a 50% share of the drug’s future profits.

The Partnership Structure and Goals:

The alliance was structured as a true co-development and co-commercialization partnership. The primary goal was to combine AstraZeneca’s deep scientific leadership in the DNA Damage Response (DDR) pathway with Merck’s extensive global oncology development and commercialization expertise. The strategic intent was not merely to co-promote Lynparza for its existing indication but to dramatically accelerate and expand its development program into a multitude of other cancer types, including breast, prostate, and pancreatic cancers.

The Outcomes:

The results have been nothing short of transformative. The combined resources and expertise of the two giants allowed for an unprecedented number of parallel clinical trials. This rapid expansion of evidence quickly established Lynparza as a foundational therapy across multiple tumor types, transforming it from a single product into a franchise-level asset. It became a cornerstone of both companies’ oncology portfolios, with sales skyrocketing and far exceeding what either company could have achieved alone.

This case illustrates a critical insight: the partnership itself became a powerful competitive advantage. The alliance enabled a massive, parallel clinical development program that built a deep and wide evidence base for Lynparza. This, in turn, led to its integration into numerous global standards of care and built a powerful brand franchise that is incredibly difficult for any single competitor to challenge. When a rival product enters the market, it’s not just competing against a molecule; it’s competing against a mountain of clinical data, physician familiarity, and commercial presence built over years by the combined might of two of the world’s largest pharmaceutical companies. This is the essence of a franchise moat.

Case Study: The Eliquis Partnership (Bristol Myers Squibb & Pfizer)

Another quintessential example is the long-standing and highly successful alliance between Bristol Myers Squibb (BMS) and Pfizer for the anticoagulant Eliquis (apixaban).2 This partnership has been a cornerstone of both companies’ cardiovascular businesses for over a decade, turning Eliquis into one of the best-selling drugs in the world.

The Partnership Structure and Goals:

The collaboration, initiated in 2007, involved both co-development and co-commercialization. BMS, with its history in cardiovascular drug discovery, led the development, while Pfizer brought its formidable global commercial infrastructure to the table. The goal was to challenge the existing standard of care, warfarin, by developing a safer and more effective oral anticoagulant for stroke prevention in patients with atrial fibrillation and for treating blood clots.

The Outcomes:

The partnership has been a resounding commercial success, with Eliquis becoming a top-performing asset for both companies. In 2024 alone, the drug generated over $13 billion in revenue for BMS and $7.4 billion for Pfizer. The alliance’s joint marketing efforts successfully educated a vast global audience of physicians and patients about the benefits of Eliquis, displacing an entrenched, decades-old standard of care.

Now, however, the partnership faces its greatest challenge: the looming patent cliff, with key patents set to expire between 2026 and 2028. Both companies are now working in concert to manage the drug’s lifecycle and mitigate the inevitable revenue erosion. This shared fate underscores the double-edged nature of such deep alliances: they can generate immense value during the period of exclusivity, but they also create a shared, and massive, revenue gap that must be filled when that exclusivity ends.

Co-Marketing as a Late-Stage Lifecycle Tool

Beyond these large-scale co-development deals, co-marketing and co-promotion agreements serve as a crucial tactical tool, particularly as a product matures and approaches its patent cliff. A company with a blockbuster nearing its LOE can strategically partner with another firm to maximize revenue in the final years of exclusivity.

The structure is often straightforward: one company, the lead, handles manufacturing and books sales, while both partners’ sales forces promote the drug, often dividing their efforts by geography or physician specialty.26 This allows the originator to effectively double its “share of voice” with prescribers, defend its market share against new branded competitors, and extract the maximum possible value from the asset before generic entry. The additional revenue generated by this final commercial “surge” can be invaluable, providing the capital needed to fund the acquisition or development of the next generation of products that will carry the company beyond the cliff.

In essence, co-development and co-marketing alliances are not just defensive measures. They are proactive strategies for value creation and franchise-building. By pooling resources and combining complementary strengths, companies can accelerate development, expand market reach, and build powerful brands that are more resilient to the pressures of market erosion, turning a partnership into a durable competitive advantage.

Deep Dive II: The Authorized Generic (AG) Gambit – Controlling the Descent

As the moment of patent expiration arrives for a small-molecule drug, the innovator company faces a stark choice: cede the market entirely to a wave of independent generic competitors, or enter the fray itself. The latter option is executed through one of the most sophisticated and often controversial strategies in the pharmaceutical lifecycle playbook: the launch of an authorized generic (AG). This maneuver, which can be executed either directly by the brand manufacturer or through a strategic partnership, is a powerful tool for shaping the post-exclusivity market and managing the steep descent from the patent cliff.

Demystifying the Authorized Generic

At its core, an authorized generic is the brand-name drug’s identical twin, just without the famous family name. It is the exact same product—same active ingredient, same dosage form, same strength—manufactured under the brand’s original New Drug Application (NDA) approved by the FDA.31 The only differences are cosmetic, such as the labeling and perhaps the color or shape of the pill.

This is where the AG’s profound strategic advantage lies. An independent generic manufacturer must file an Abbreviated New Drug Application (ANDA) and prove to the FDA that its product is bioequivalent to the brand-name drug. This process takes time and resources. An AG, however, requires no such separate approval; it is already covered by the brand’s existing NDA. This regulatory shortcut grants the brand manufacturer unparalleled flexibility. It can launch its AG at any strategically opportune moment, most notably, at the very instant its patent expires or, crucially, during the 180-day market exclusivity period that is typically granted to the first independent generic company to challenge the brand’s patents.31

The AG Strategy: A Tool of “Controlled Erosion”

The decision to launch an AG is a calculated financial trade-off. The brand company knowingly sacrifices the high margins of its branded product. In return, it aims to capture a significant portion of the market volume that is about to switch to a lower-priced generic. Instead of watching its market share plummet from 100% to near zero, the company uses its AG to retain a substantial piece of the newly “genericized” market. It is a strategy of “controlled erosion”—an attempt to transform a catastrophic free-fall into a more manageable, and still profitable, descent.

The market impact is significant and well-documented. According to a comprehensive report by the Federal Trade Commission (FTC), the presence of an authorized generic during the first-filer’s 180-day exclusivity period leads to lower prices for consumers. The data shows that retail generic prices are 4-8% lower, and wholesale prices are 7-14% lower, when an AG is competing against a single independent generic.33

However, the impact on the independent generic competitor is devastating. The same FTC report found that the presence of an AG reduces the first-filer generic’s revenues by a staggering 40% to 52%.33 The AG, being an identical product from a trusted manufacturer, often captures a large portion of the market share that would have otherwise gone entirely to the first independent generic. This allows the brand company to effectively set a new price floor and control the economics of its own product’s post-patent life, rather than being a passive victim of market forces.

The Partnership Dimension: Launching an AG

A brand manufacturer has two primary avenues for launching an AG: do it itself or partner with another company.

- Internal Launch: Large, vertically integrated companies like Pfizer often have their own generic subsidiaries (in Pfizer’s case, Greenstone) specifically for this purpose. This keeps all the revenue and strategic control within the parent company but requires the infrastructure and expertise to compete in the low-margin, high-volume generics business. Pfizer famously used this strategy with its blockbuster Lipitor, launching an AG through Greenstone to manage the market transition.

- Partnership Launch: A brand company without its own generics arm can form a strategic alliance with an established generic manufacturer. In this model, the brand company provides the product under a licensing or supply agreement, and the generic partner handles the marketing, distribution, and sales.31 This approach outsources the logistical complexities of the generics market but requires sharing a portion of the revenue. This decision—whether to build or to partner—is a strategic one that reflects a company’s core capabilities and priorities. For a firm focused purely on cutting-edge R&D, partnering can be a lower-risk, capital-efficient way to execute an AG strategy.

The “No-AG” Agreement: The AG as a Bargaining Chip

The power of the AG strategy is so significant that even the threat of launching one can be a potent strategic weapon. In the complex dance of patent litigation, brand companies have historically used the promise of not launching an AG as a powerful bargaining chip to settle lawsuits with generic challengers.35

This arrangement, often called a “no-AG agreement,” is a form of reverse payment settlement. The brand company effectively “pays” the generic challenger by promising to keep its own AG off the market for a specified period, thereby guaranteeing the independent generic a period of highly profitable monopoly or duopoly. In exchange, the generic company typically agrees to delay its market entry. While this practice has come under intense scrutiny from regulators like the FTC for its potential to be anti-competitive, it highlights the immense strategic value placed on controlling the generic landscape. It transforms the AG from a market-entry product into a valuable piece of intellectual property to be leveraged in high-stakes negotiations, demonstrating the multifaceted nature of this powerful partnership gambit.

Deep Dive III: Beyond the Pill – The Digital Health Frontier

While co-development deals replenish the pipeline and authorized generics manage the immediate fallout of patent expiry, a third, more revolutionary strategy is emerging: moving “beyond the pill.” This paradigm shift involves forging partnerships with technology companies to create integrated health solutions that combine a pharmaceutical product with digital services, data analytics, and patient support tools. The ultimate goal is to build a new kind of competitive advantage—one that is not dependent on a molecule’s patent life but is instead rooted in the value of the overall patient outcome and experience.

The strategic rationale is grounded in a stark reality of modern healthcare: despite remarkable medical advancements, it is estimated that only 50% of patients with chronic conditions adhere to their prescribed treatments. This massive adherence gap leads to poor health outcomes, increased hospitalizations, and trillions of dollars in avoidable healthcare costs. This is not just a clinical problem; it is a monumental business opportunity. By creating solutions that help patients manage their disease more effectively, pharmaceutical companies can improve outcomes, demonstrate superior value to payers, and build a “sticky” relationship with both patients and providers that can endure long after a patent expires.39

Building a New Ecosystem of Collaboration

Executing a “beyond the pill” strategy requires a fundamental shift in a pharmaceutical company’s partnership ecosystem. The traditional collaborators—other pharma companies, biotechs, and academic centers—are being joined by a new and diverse set of players: software developers, data analytics firms, artificial intelligence (AI) specialists, and wearable device manufacturers.41 Even Big Tech giants like Apple and Google are moving aggressively into the healthcare space, forcing pharmaceutical companies to make a critical choice: compete with them, collaborate with them, or build complementary capabilities.42

These partnerships are giving rise to several innovative models:

- Digital Therapeutics (DTx): These are evidence-based, clinically validated software programs designed to treat, manage, or prevent a disease or disorder. They can be used as standalone treatments or in conjunction with a drug. A pharma company might partner with a DTx developer to create a companion app for its medication that provides cognitive behavioral therapy, tracks symptoms, and encourages adherence.

- AI-Powered Patient Engagement: Collaborations are forming to leverage AI and machine learning to create hyper-personalized patient support platforms. These systems can analyze data from health records and wearables to predict non-adherence, deliver customized “nudges” and reminders via a patient’s preferred channel (e.g., SMS, WhatsApp), and provide real-time decision support for clinicians. For example, Innominds partnered with a medical technology provider to develop a smart device using AI-driven image analysis for the early detection of breast cancer, empowering women through timely intervention.

- Data and Analytics Partnerships: Companies are partnering with health systems and data analytics firms to generate and analyze real-world evidence (RWE) on their products’ performance outside of controlled clinical trials. This data is invaluable for demonstrating a drug’s value to payers and regulators in an increasingly outcomes-based healthcare environment.

From Molecule to Outcome: The Ultimate Defensive Moat

The strategic genius of the “beyond the pill” approach lies in its ability to shift the fundamental value proposition. A patent protects a molecule. It does not protect a patient relationship, a proprietary dataset, or an integrated care pathway. By building an ecosystem of digital services around a branded drug, a company creates a powerful form of “stickiness.”

Imagine a patient with a chronic condition who is deeply integrated into a digital support platform co-developed by their drug’s manufacturer. The platform helps them track their symptoms, reminds them to take their medication, connects them with a support community, and provides their physician with actionable data to optimize their care. When a cheaper, standalone generic version of the molecule becomes available, the decision to switch is no longer a simple matter of cost. The patient and their physician must weigh the savings against the loss of the entire support ecosystem they have come to rely on. The digital value creates a “community effect” that transcends the pill itself. In this way, the partnership with a technology company becomes a strategy to build a new, non-patent-based barrier to entry, shifting the competitive battleground from price to holistic value and patient experience.

Lessons from the Frontier: The Culture Clash of Pharma and Tech

The path to a successful “beyond the pill” future is not without its challenges. The landscape is littered with high-profile but ultimately unsuccessful partnerships, such as the dissolution of the Sanofi-Onduo and Novartis-Pear Therapeutics ventures. These failures often stem from a fundamental culture clash between the worlds of pharmaceuticals and technology.

The pharmaceutical industry is characterized by long, linear development cycles, a deeply ingrained aversion to risk, and a regulatory-driven mindset. The tech world, in contrast, thrives on agile, iterative development, a “fail-fast” mentality, and rapid scaling. Forcing a digital health venture to operate under the traditional pharma governance structure and funding models—for example, funding it with short-term commercial marketing dollars—is often a recipe for failure.

Successful companies are learning that they must adopt a tech company mindset to manage these ventures. This may involve creating structurally separate entities, as Roche did with its subsidiary RoX Health, which acts as an internal incubator to bring digital health applications to market under a more appropriate operating model. The most effective approach appears to be not absorption, but insulation: creating joint ventures or deeply integrated but operationally distinct partnerships that allow the tech component to thrive according to its own rules, while still leveraging the pharma parent’s scientific expertise, regulatory know-how, and global market access. This hybrid model allows both partners to do what they do best, creating a whole that is far greater than the sum of its parts.

Fueling the Innovation Engine: In-Licensing and R&D Collaborations

While defensive strategies like authorized generics and “beyond the pill” services are crucial for managing the immediate impact of a patent cliff, the only true long-term solution to market erosion is relentless innovation. The most forward-thinking companies view the patent cliff not as a singular event to be weathered, but as a constant, cyclical pressure that necessitates a perpetual motion machine of pipeline replenishment. In an era of flagging internal R&D productivity, the primary fuel for this machine is sourced externally through in-licensing agreements and early-stage R&D collaborations.

These upstream partnerships are the proactive, offensive counterpart to the defensive maneuvers enacted at the end of a product’s lifecycle. They represent a fundamental acknowledgment that the next blockbuster is just as likely to come from a university lab in Boston, a biotech startup in Shanghai, or a research consortium in San Diego as it is from a company’s own internal discovery engine.21

From Opportunistic Deals to Systematic Portfolio Management

The nature of in-licensing has evolved significantly. It is no longer a purely opportunistic exercise of snapping up a promising late-stage asset when one becomes available. Instead, it has become a systematic, portfolio-based strategy akin to venture capital or strategic asset management. Leading pharmaceutical companies now meticulously map their projected future revenue gaps, analyze the competitive and scientific landscapes of various therapeutic areas, and then strategically target external assets that fit a long-term vision.

This portfolio approach involves balancing risk and reward. While late-stage assets are perceived as less risky, they are also intensely competitive and expensive to acquire. Consequently, many companies are diversifying their bets by building a portfolio that includes a mix of these high-cost, de-risked assets alongside a greater number of lower-cost, higher-risk assets at earlier stages of development. This strategy allows a company to place multiple bets on the future of science without concentrating all its capital on a single, make-or-break late-stage program.

The strategic focus of these partnering efforts is highly concentrated in areas of high unmet need and significant commercial potential. Recent data shows that the most popular therapeutic areas for in-licensing and collaboration are Oncology (sought by 67% of companies), Neuroscience (55%), and Immunology (55%).

Due Diligence: Assessing the Durability of Innovation

A critical component of any successful in-licensing strategy is rigorous and sophisticated due diligence. A potential partner is not just evaluating the science behind a molecule; they are evaluating the durability of its future revenue stream. This requires a deep dive into the asset’s intellectual property fortress.

A simple composition-of-matter patent is no longer enough. A savvy licensor will want to see a robust and strategically layered portfolio of secondary patents—a “patent thicket”—that covers various aspects of the drug, such as its formulation, method of use for different indications, or manufacturing process. Each additional patent represents another legal and financial hurdle for a future generic competitor to overcome, thereby extending the product’s effective monopoly period. Platforms that specialize in pharmaceutical competitive intelligence, such as DrugPatentWatch, are indispensable tools in this process. They allow business development teams to conduct thorough patent landscaping, analyze the strength and breadth of a target’s IP portfolio, and ultimately make a more accurate forecast of the asset’s true commercial longevity.

The Global Hunt for Innovation: Emerging Trends in R&D Partnering

The search for external innovation is now a truly global endeavor, and the geopolitical landscape is actively reshaping partnership strategies. One of the most significant trends in recent years has been the emergence of China as a major hub for biotech innovation. In 2024, approximately one-third of all molecules in-licensed by Big Pharma originated from Chinese biotech companies, a testament to the rapidly advancing scientific capabilities in the region.1

However, this trend is unfolding against a backdrop of increasing geopolitical tensions between the U.S. and China. Legislation like the BIOSECURE Act, even if stalled, has prompted many Western pharmaceutical companies to re-evaluate their reliance on Chinese partners, particularly in the contract research (CRO) and manufacturing (CDMO) sectors. This is creating a complex new dynamic where companies are forced to build more resilient and geographically diversified partnership networks.

The future of R&D collaboration will likely involve a multi-pronged geographic strategy. A company might partner with a cutting-edge Chinese biotech for a novel drug candidate, simultaneously collaborate with an Indian firm for cost-effective manufacturing, and work with a European academic center on foundational discovery research. The partnership map is no longer bilateral; it is a complex, global web designed to maximize access to innovation while mitigating geopolitical and supply chain risks. This global, strategic sourcing of innovation is the lifeblood of the modern pharmaceutical company, providing the essential fuel to outrun the ever-present shadow of the patent cliff.

The Art of the Alliance: A Blueprint for Partnership Success

Forging a strategic partnership is only the first step. The sobering reality is that more than half of all alliances fail to meet their objectives. The difference between a partnership that creates billions in value and one that ends in a costly and acrimonious divorce often comes down to one critical, and frequently underestimated, corporate capability: alliance management. As the industry’s reliance on external innovation grows, with 82% of companies expecting their alliance activity to increase, mastering the “art of the alliance” is no longer a peripheral skill but a core strategic competency.

Effective alliance management is the disciplined, proactive process of managing the relationship, not just the contract, to maximize mutual value and mitigate risk.51 It requires a dedicated function, a specific skill set, and unwavering executive support.

“We look for partners who can complement and expand upon Regeneron’s extensive in-house capabilities, strengthening our collective ability to address serious diseases and help people in need.”

— Regeneron

The Pillars of a High-Performing Alliance

Decades of experience and analysis have revealed a clear blueprint for building successful and sustainable partnerships. This blueprint rests on four essential pillars: Structure & Governance, Alignment & Culture, Leadership & Skills, and Process & Tools.

1. Structure & Governance: Creating the Alliance’s Operating System

A successful alliance cannot be managed on an ad-hoc basis by a loose collection of individuals. It requires a formal operating system.

- Dedicated Alliance Management Function: Best-in-class organizations establish a centralized, dedicated alliance management department.50 This group serves as the “one-stop shop” for partnership expertise, ensuring consistency, institutionalizing best practices, and providing a clear point of contact for partners.

- Clear Governance: The foundation of any alliance is a well-defined governance structure, typically centered around a Joint Steering Committee (JSC) comprised of senior leaders from both organizations.22 The JSC’s charter must clearly delineate roles, responsibilities, and decision-making authority. As David Struttmann, Head of Alliance Management at Astellas, puts it, in a high-performing alliance, the JSC “operates like the brand’s board of directors,” with a singular focus on bringing value to patients and the brand.

2. Alignment & Culture: Building the “One Team” Mindset

The most common cause of partnership failure is misalignment of goals, incentives, or culture. Proactively building alignment is the most critical task in the early days of a collaboration.

- The “North Star”: Successful alliances begin by aligning on a shared vision or “North Star” that guides all subsequent decisions and actions. This goes beyond the contractual objectives to define a common purpose that inspires both teams.

- A Culture of Trust and Transparency: The relationship must be built on a foundation of trust, respect, and open communication.22 This means being transparent about challenges as well as successes and establishing clear channels for regular dialogue. The ultimate goal is to foster a “single brand entity” or “Brand, Inc.” mentality, where team members may not even be able to tell who works for which company.

3. Leadership & Skills: The Human Element

Alliances are managed by people, and having the right talent in key roles is non-negotiable.

- Executive Sponsorship: A partnership without active, engaged executive champions from both companies is destined to fail. Senior leaders must meet routinely with their counterparts to proactively align on strategy and resolve high-level issues.

- The Alliance Manager Skillset: The role of the alliance manager is unique and demanding. It requires senior-level leaders with a broad range of experience who can take a holistic view of the partnership. Critically, the most important skills are often the “soft” ones: emotional intelligence, cross-cultural communication, negotiation, and conflict resolution.58 As Rob Barber, Senior Director of Alliance Management at VaxEquity, notes, “Alliance management is clearly a relationship profession”.

4. Process & Tools: The Mechanics of Collaboration

Effective collaboration requires robust processes and tools to keep the alliance on track.

- Integration with Internal Processes: Alliance management cannot exist in a silo. It must be deeply integrated into the company’s core processes, from financial planning and legal review to R&D and commercial operations.

- Alliance Health Checks: The health of a partnership should be monitored just like any other critical asset. Best practices include conducting regular, formal “health checks” or operational effectiveness assessments to provide a quantifiable look at what is and isn’t working.51 These assessments allow the teams to identify areas for improvement and develop concrete action plans.

A fascinating and counterintuitive reality of alliance management is that the majority of an alliance manager’s effort is often directed inward, toward their own organization, rather than outward toward the partner. The partner organization is a single entity to negotiate with, but the alliance manager’s own company is a complex ecosystem of functions—R&D, commercial, legal, finance—often with competing priorities and incentives. The alliance manager must therefore be the internal champion of the partnership, constantly aligning stakeholders, securing resources, and playing “devil’s advocate” to protect the health and strategic intent of the collaboration.

Ultimately, as the pharmaceutical industry becomes ever more reliant on a network of external partners, a company’s reputation as a good collaborator becomes a strategic asset in itself. In a competitive environment where multiple pharma giants are vying for the same innovative biotech asset, the decision may not come down to the highest bidder. It may come down to which company is perceived as the “partner of choice”—the one with a proven track record of managing alliances fairly, transparently, and effectively.12 In this new world, investing in a world-class alliance management function is not just an operational cost; it is a strategic investment in securing future deal flow and the very future of the company.

The Intelligence Advantage: The Role of Data in Forging Winning Partnerships

In the high-stakes world of pharmaceutical dealmaking, intuition and experience are valuable, but data-driven intelligence is decisive. Every stage of the partnership lifecycle—from identifying the right target to structuring the deal, and from managing the alliance to anticipating competitive threats—must be underpinned by a robust and systematic approach to competitive intelligence (CI). A well-executed CI program transforms partnership strategy from a reactive, opportunistic exercise into a proactive, predictive discipline, providing a critical edge in a fiercely competitive landscape.61

Competitive intelligence is the systematic process of collecting, analyzing, and transforming raw information about competitors, markets, and technologies into actionable insights that support strategic decision-making. It is the foundation upon which sound portfolio management, effective market entry strategies, and proactive risk mitigation are built.

Powering Due Diligence with Patent Intelligence

Nowhere is the value of CI more apparent than in the due diligence process for in-licensing and M&A. A primary determinant of an asset’s value is the strength and durability of its intellectual property protection. This is where specialized data platforms like DrugPatentWatch become indispensable tools.

These platforms provide the comprehensive data needed to conduct deep patent landscaping, which involves mapping the entire IP portfolio around a target drug.48 This goes far beyond simply checking the expiration date of the primary composition-of-matter patent. A thorough analysis, powered by a robust database, allows a business development team to:

- Assess the “Patent Thicket”: Identify and evaluate the entire web of secondary patents covering formulations, methods of use, and manufacturing processes. A dense and well-constructed thicket can significantly delay generic entry and add years of effective market exclusivity, dramatically increasing the asset’s value.

- Identify “White Space”: Pinpoint areas within a therapeutic landscape with limited patent activity, revealing opportunities for innovation and potential partnership where there is a clearer freedom to operate.48

- Forecast Generic Entry: By tracking patent litigation, Paragraph IV certifications, and the historical launch patterns of generic manufacturers, CI platforms provide critical intelligence for accurately forecasting when and from whom generic competition is likely to emerge.

The Orange Book: A Treasure Trove of Strategic Data

A cornerstone of pharmaceutical CI in the United States is the FDA’s publication, “Approved Drug Products with Therapeutic Equivalence Evaluations,” colloquially known as the Orange Book. It is, as described by experts at DrugPatentWatch, a “treasure trove of strategic insights”. The Orange Book provides a public, comprehensive listing of approved drugs, along with their associated patents and regulatory exclusivities.

For CI professionals, this data is foundational. Analyzing Orange Book listings allows a company to:

- Time Market Entry: By systematically tracking patent expiration dates and exclusivity periods, a generic company can identify the optimal window to launch its product, avoiding costly patent infringement litigation while maximizing first-to-market advantages.64

- Anticipate Competitive Threats: A brand-name company can monitor patent challenges and certifications listed in connection with its products to get an early warning of which generic competitors are planning to enter the market, allowing them to prepare defensive lifecycle management strategies.

- Inform Partnership Strategy: By analyzing a potential partner’s portfolio of listed patents and exclusivities, a company can better assess the strength of its assets and its sophistication in IP strategy, providing key inputs for valuation and deal structuring.

From Reactive to Predictive Strategy

The true power of a modern CI function, augmented by AI and advanced analytics, is its ability to move a company’s strategy from a reactive to a predictive posture. Without strong CI, a company is often left responding to market events, such as a competitor’s surprise acquisition announcement. With a world-class CI capability, that same company can anticipate market shifts and competitor strategies months or even years in advance.

AI-driven CI platforms can now provide real-time alerts on competitor activities, analyze vast datasets to predict clinical trial success rates, and even detect early signals of potential M&A activity. For example, a case study highlighted a mid-sized biopharma company that, through effective CI, identified a delay in a competitor’s Phase III trial. This intelligence allowed them to accelerate their own clinical timeline, adapt their regulatory submission strategy, and ultimately achieve a successful first-to-market launch.

By leveraging a tool like DrugPatentWatch to continuously monitor patent filings, litigation outcomes, and regulatory communications, a company can build a dynamic, predictive model of a competitor’s lifecycle strategy. This allows the business development team to proactively approach a potential partner with a highly tailored proposal that anticipates their strategic needs and pain points. Instead of waiting for an asset to be put up for auction in a competitive process, they can initiate a proprietary conversation, armed with data that demonstrates a deep understanding of the partner’s position and a clear vision for mutual value creation. This is the intelligence advantage, and in the race to forge winning partnerships, it is often the deciding factor.

The Future of Collaboration: Navigating the Next Decade

As we look toward 2030, it is clear that the pharmaceutical industry is at a major inflection point. The strategic partnerships being forged today to navigate the patent cliff are not just temporary solutions; they are the prototypes for a new, more interconnected, and technologically sophisticated model of drug development. The future of collaboration will be shaped by three powerful, converging forces: the exponential impact of artificial intelligence, the rise of personalized medicine, and an increasingly complex regulatory and pricing environment. These trends will fundamentally reshape the nature, structure, and purpose of pharmaceutical alliances.

Artificial Intelligence: The Connective Tissue of the New Ecosystem

Artificial intelligence is rapidly moving from a futuristic buzzword to a foundational technology across the entire pharmaceutical value chain. Its impact is transformative. By 2025, AI is projected to be a driving force in 30% of all new drug discoveries, with the potential to reduce preclinical development costs and timelines by as much as 25-50%.66 This is creating a new and urgent imperative for partnerships. The skills required to build and deploy sophisticated AI models for drug discovery are highly specialized and often reside outside the walls of traditional pharma companies.

This is giving rise to a new wave of collaborations between pharmaceutical giants and specialized AI firms, technology companies, and academic centers of excellence. We are already seeing this take shape with landmark partnerships like NVIDIA’s collaborations with genomics leader Illumina and the world-renowned Mayo Clinic to create AI platforms for drug discovery and personalized medicine.69

Crucially, AI will become more than just a tool for discovery; it will serve as the “connective tissue” for the complex, multi-party partnerships of the future. The old model of a linear, bilateral partnership is giving way to a more dynamic, multilateral “ecosystem” model. AI platforms will provide the common operating system that allows these ecosystems to function, enabling secure data sharing between collaborators, optimizing complex clinical trial logistics, and analyzing real-world outcomes to demonstrate value in a data-driven world.69

Personalized Medicine: The End of the One-Size-Fits-All Model

The scientific shift toward personalized medicine is perhaps the single greatest catalyst for the new partnership paradigm. The traditional blockbuster model was built on creating “one-size-fits-all” drugs for large patient populations. Personalized medicine, which aims to tailor treatments to an individual’s unique genetic profile, lifestyle, and disease characteristics, renders that model increasingly obsolete.71

Successfully developing and commercializing a personalized therapy requires a confluence of capabilities that no single company possesses. It demands expertise in genomics for biomarker discovery, diagnostics for patient identification, data analytics for interpreting complex biological information, and digital health tools for patient monitoring and support. This inherently necessitates the creation of a collaborative ecosystem.71

The future dominant partnership model will not be a simple chain from a biotech to a pharma company. It will be a complex network: a pharmaceutical company may partner with an AI firm to identify a novel drug target, a diagnostics company to develop a companion test to select the right patients, a digital health startup to build an adherence and monitoring app, and a large health system to generate the real-world data needed to prove the therapy’s value. Orchestrating these intricate, multi-party ecosystems, rather than simply managing one-to-one alliances, will become the next critical core competency for pharmaceutical leaders.

Evolving Headwinds: The Pressure for Value and Efficiency

The final force shaping the future of collaboration is the relentless external pressure on the industry’s economics. Around the world, governments and payers are intensifying their efforts to control drug prices. In the United States, the Inflation Reduction Act (IRA) has introduced direct government price negotiation for the first time, fundamentally altering the long-term revenue calculus for top-selling drugs.75

This sustained pressure on pricing makes the traditional, high-cost model of internal R&D even more precarious. It creates a powerful incentive to share the risks and costs of development through partnership. Alliances that can demonstrate greater efficiency, faster timelines, or superior outcomes will have a significant advantage. The future commercial model will not be focused on volume alone, but on demonstrating tangible value to a host of stakeholders—patients, providers, and payers. This outcomes-based environment is fertile ground for innovative partnerships, particularly those that integrate therapeutics with the data and digital tools needed to measure and prove their real-world impact.

In this new era, the ability to collaborate effectively will be the ultimate differentiator. The companies that thrive will be those that master the art of building and managing diverse, technologically enabled partnership ecosystems, turning the collective intelligence of a network into the next generation of life-changing medicines.

Conclusion: From Surviving to Thriving Through Strategic Alliances

The pharmaceutical industry stands at a historic crossroads. The patent cliff of 2025-2030 is more than just a financial headwind; it is a force of creative destruction, dismantling the blockbuster-centric business model that has defined the sector for decades. The sheer magnitude of the revenue at risk—hundreds of billions of dollars—demands a response that is not merely tactical, but truly transformational. The old playbook of relying solely on mega-mergers and the high-risk gamble of internal R&D is no longer sufficient to ensure sustainable growth.

This report has argued that the new paradigm for success is built upon a foundation of strategic partnerships. We have moved from an era where alliances were a useful tool to an era where they are the central organizing principle of a resilient and innovative pharmaceutical enterprise. The journey from surviving the patent cliff to thriving in the post-blockbuster world is a journey of collaboration.

It begins with a clear-eyed understanding of the landscape, leveraging sophisticated competitive intelligence to anticipate threats and identify opportunities. It requires a diverse and flexible approach to dealmaking, utilizing a full spectrum of partnership models—from co-development and co-marketing alliances that build defensible franchise moats, to the shrewd deployment of authorized generics to control market erosion, and the visionary creation of “beyond the pill” ecosystems that shift the basis of competition from the molecule to the outcome.

Success in this new world demands more than just a sharp business development team. It requires building a true corporate competency in alliance management—a culture that values collaboration, and leaders who possess the unique skills to nurture complex relationships. It requires a mindset shift, embracing the agility and “fail-fast” ethos of the tech world to capitalize on the promise of digital health, and the global perspective to source innovation from an increasingly diverse international ecosystem.

The future of medicine will not be discovered in isolation. It will be co-created in a dynamic network of collaboration between pharmaceutical companies, biotech innovators, academic pioneers, technology giants, and data scientists. The companies that will lead the next generation of healthcare will be those that master the art of the alliance—not as a defensive reaction to market erosion, but as a proactive strategy to build a more innovative, efficient, and patient-centered future. The imperative is clear: partner, or perish.

Key Takeaways

- The Patent Cliff is a Systemic Business Model Crisis: The 2025-2030 patent cliff, with up to $400 billion in revenue at risk, is not a cyclical downturn but a fundamental threat to the traditional blockbuster-driven model. A portfolio of diverse partnership strategies is required, as no single new drug or acquisition can fill the gap.

- External Innovation is a Non-Negotiable Imperative: With internal R&D productivity flatlining despite massive investment, sourcing innovation externally through in-licensing, R&D collaborations, and bolt-on acquisitions is now the primary engine of pipeline replenishment and long-term growth.

- Alliance Management is a Core Strategic Competency: With over half of partnerships failing, the ability to effectively manage alliances is a critical differentiator. Becoming a “partner of choice” by building a reputation for fairness, transparency, and operational excellence is a competitive advantage that secures access to the best external science and assets.

- “Beyond the Pill” Strategies Build Durable, Non-Patent-Based Value: Partnerships with technology companies to create integrated digital health solutions are essential for building “stickiness” with patients and providers. This shifts the competitive battleground from a drug’s price to the holistic value of the patient outcome, creating a defensive moat that can outlast a patent.

- The Future is a Collaborative Ecosystem, Not a Bilateral Deal: The convergence of AI, personalized medicine, and pricing pressures is shifting the partnership model from a simple, two-party chain to a complex, multi-party network. The most successful future leaders will be those who can orchestrate these ecosystems, bringing together pharma, diagnostics, data, and digital partners to deliver a single, integrated patient solution.

- Competitive Intelligence Drives Proactive Partnering: Leveraging data-driven insights from platforms like DrugPatentWatch is crucial for transforming partnership strategy from reactive to predictive. Thorough patent landscaping and competitive analysis enable companies to identify the best partners and assets before they become widely known, securing a critical first-mover advantage.

Frequently Asked Questions (FAQ)

1. How can a mid-sized biotech best position itself to be an attractive partner for Big Pharma in the current environment?

A mid-sized biotech can maximize its attractiveness by focusing on three key areas. First, generate a robust and differentiated data package for your lead asset. In today’s risk-averse environment, Big Pharma partners are looking for clear scientific validation and a strong competitive advantage. Second, develop a sophisticated intellectual property strategy that goes beyond a single composition-of-matter patent. Building a “patent thicket” with secondary patents on formulations, methods of use, and manufacturing processes signals strategic savvy and increases the perceived durability of the asset. Third, articulate a clear and compelling commercial vision. Partners are increasingly looking for biotechs that have thought through the target product profile, potential for indication expansion, and the asset’s unique value proposition in a crowded market, not just the science.

2. What are the key legal and IP pitfalls to avoid when structuring a co-development agreement for a late-stage asset?

When structuring a late-stage co-development deal, three pitfalls are critical to avoid. The first is ambiguity in governance and decision-making rights. The agreement must clearly define which party has the final say on key development, regulatory, and commercial decisions to prevent future gridlock. The second is poorly defined ownership and rights to future intellectual property. The agreement must specify who owns improvements, new indications, or combination-product patents developed during the collaboration, and what rights (e.g., grant-backs) each party retains. The third pitfall is an inadequate exit or termination clause. Circumstances change, and the agreement must provide a clear, pre-negotiated process for unwinding the partnership, including the transition of responsibilities and the financial consequences of an early termination.

3. How is the Inflation Reduction Act (IRA) specifically changing the calculus for in-licensing and partnership decisions in the US market?

The IRA is profoundly impacting partnership strategy in two main ways. First, it shortens the effective period of peak profitability for top-selling drugs by subjecting them to price negotiation after a set number of years on the market (9 for small molecules, 13 for biologics). This increases the pressure on partners to execute flawless, rapid launches and to generate as much evidence as possible for multiple indications in parallel to maximize revenue before the negotiation window opens. Second, it is shifting the relative attractiveness of different asset types. Biologics, with their longer pre-negotiation period, may become more attractive in-licensing targets compared to small molecules. Furthermore, drugs for rare diseases that may fall under certain exemptions could become more valuable. This forces business development teams to incorporate a sophisticated IRA impact analysis into their valuation models for any potential US-facing asset.

4. What metrics should a board of directors use to measure the ROI and success of its company’s overall alliance portfolio, beyond the outcome of any single deal?

A board should look beyond single-deal metrics (like NPV or peak sales) and evaluate the portfolio’s strategic contribution. Key metrics should include: (1) Pipeline Contribution: What percentage of the company’s late-stage pipeline and recent product launches originated from partnerships? This measures the portfolio’s direct impact on innovation. (2) Capital Efficiency: How does the R&D cost per launched product from the partnered portfolio compare to the purely internal portfolio? This measures the financial efficiency gained through risk-sharing. (3) Strategic Capability Building: Has the portfolio provided access to new technologies, therapeutic areas, or geographic markets that the company could not have entered alone? This measures the portfolio’s contribution to long-term strategic growth. (4) Partnering Reputation: Tracking the company’s reputation as a “partner of choice” through industry surveys and the volume/quality of inbound partnership opportunities can be a leading indicator of future deal flow success.

5. Given the high failure rate of pharma-tech partnerships, what is the single most important factor to get right during the due diligence phase with a potential digital health partner?

While technical and regulatory due diligence are critical, the single most important factor to assess is cultural and operational compatibility. The fundamental operating models of pharma and tech are vastly different. During due diligence, the pharma partner must rigorously assess whether the tech company’s agile, iterative, and risk-tolerant culture can realistically coexist with pharma’s structured, linear, and risk-averse processes. This involves deep conversations about governance expectations, decision-making speed, and resource allocation. The key question is not just “Does the technology work?” but “Can our two organizations work together to make it successful?” A plan to create an “insulated” or hybrid governance model that allows the tech partner to maintain its operational DNA, rather than being stifled by pharma bureaucracy, should be a primary output of the due diligence process.

References

- The $400 Billion Patent Cliff: Big Pharma’s Revenue Crisis, accessed August 7, 2025, https://americanbazaaronline.com/2025/08/04/the-400-billion-patent-cliff-big-pharmas-revenue-crisis-465788/

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage – DrugPatentWatch – Transform Data into Market Domination, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- The Impact of Patent Cliff on the Pharmaceutical Industry – Bailey Walsh, accessed August 7, 2025, https://bailey-walsh.com/news/patent-cliff-impact-on-pharmaceutical-industry/

- Strategic Patenting by Pharmaceutical Companies – Should Competition Law Intervene? – PMC, accessed August 7, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7592140/

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What They’re Doing About It, accessed August 7, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Big Pharma Prepares for ‘Patent Cliff’ as Blockbuster Drug Revenue Losses Loom, accessed August 7, 2025, https://www.tradeandindustrydev.com/industry/bio-pharmaceuticals/big-pharma-prepares-patent-cliff-blockbuster-drug-34694

- Blockbuster Drugs on Patent Cliffs Research Report 2025 | Top …, accessed August 7, 2025, https://www.businesswire.com/news/home/20250806579883/en/Blockbuster-Drugs-on-Patent-Cliffs-Research-Report-2025-Top-Pharma-Giants-Face-2030-Patent-Cliff-with-Revenue-Drops-Up-to-62-While-Eli-Lilly-Offsets-with-165-Surge—ResearchAndMarkets.com

- Major Pharma Companies Face Massive Revenue Losses as Patent Cliff Hits Key Blockbusters – MedPath, accessed August 7, 2025, https://trial.medpath.com/news/7895057a6650290c/major-pharma-companies-face-massive-revenue-losses-as-patent-cliff-hits-key-blockbusters

- Evolving Pharmaceutical Strategies in a Post-Blockbuster World: Navigating Innovation, Access, and Market Dynamics – Drug Patent Watch, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/evolving-pharmaceutical-strategies-in-a-post-blockbuster-world/

- Biopharma M&A: Outlook for 2025 – IQVIA, accessed August 7, 2025, https://www.iqvia.com/locations/emea/blogs/2025/01/biopharma-m-and-a-outlook-for-2025

- Five ways biopharma companies can navigate the deal landscape – McKinsey, accessed August 7, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/five-ways-biopharma-companies-can-navigate-the-deal-landscape

- Pulse check: Key trends shaping biopharma dealmaking in 2025 – McKinsey, accessed August 7, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/the-synthesis/pulse-check-key-trends-shaping-biopharma-dealmaking-in-2025

- The top 10 biopharma M&A deals of 2024 – Fierce Pharma, accessed August 7, 2025, https://www.fiercepharma.com/pharma/top-10-biopharma-ma-deals-2024

- For biopharma M&A, the best returns come from small deals: analysts – Fierce Pharma, accessed August 7, 2025, https://www.fiercepharma.com/pharma/analysts-prescription-big-pharma-take-ma-small-doses

- Transforming biopharma R&D at scale – McKinsey, accessed August 7, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/transforming-biopharma-r-and-d-at-scale

- Making more medicines that matter – McKinsey, accessed August 7, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/making-more-medicines-that-matter

- Global pharma R&D returns rise as GLP-1 drugs help drive forecast growth – Deloitte, accessed August 7, 2025, https://www.deloitte.com/uk/en/about/press-room/global-pharma-rd-returns-rise-as-one-glp-drugs-help-drive-forecast-growth.html

- Deloitte’s 15th Annual Pharmaceutical Innovation Report: Pharma R&D Returns Continue Upward for Second Consecutive Year – PR Newswire, accessed August 7, 2025, https://www.prnewswire.com/news-releases/deloittes-15th-annual-pharmaceutical-innovation-report-pharma-rd-returns-continue-upward-for-second-consecutive-year-302410138.html

- Measuring the return from pharmaceutical innovation 2024 | Deloitte US, accessed August 7, 2025, https://www.deloitte.com/us/en/Industries/life-sciences-health-care/articles/measuring-return-from-pharmaceutical-innovation.html

- Beyond the storm – Launch excellence in the new normal – McKinsey, accessed August 7, 2025, https://www.mckinsey.com/~/media/mckinsey/industries/healthcare%20systems%20and%20services/our%20insights/the%20secret%20of%20successful%20drug%20launches/beyond_the_storm_launch_excellence_in_the_new_normal.pdf

- What’s on Pharma’s Licensing Wish List? – Alacrita, accessed August 7, 2025, https://www.alacrita.com/whitepapers/pharma-licensing-trends-and-wishlist

- The Evolution of Strategic Partnerships in the Pharmaceutical Industry – Contract Pharma, accessed August 7, 2025, https://www.contractpharma.com/exclusives/the-evolution-of-strategic-partnerships-in-the-pharmaceutical-industry/

- What makes a good Strategic Partnership & How to succeed, accessed August 7, 2025, https://www.imd.org/research-knowledge/organizational-design/articles/strategic-partnerships/

- Biopharma’s Patent Cliff Puts Costs Front and Center – Boston Consulting Group, accessed August 7, 2025, https://www.bcg.com/publications/2025/patent-cliff-threatens-biopharmaceutical-revenue

- Strategic Alliances – Types and Benefits of Strategic Alliances, accessed August 7, 2025, https://corporatefinanceinstitute.com/resources/management/strategic-alliances/

- Licensing and Collaborations in Life Sciences – Bird & Bird, accessed August 7, 2025, https://www.twobirds.com/en/insights/2024/global/licensing-and-collaborations-in-life-sciences

- Research on Strategic Alliances in Biotechnology: An Assessment and Review, accessed August 7, 2025, https://www.researchgate.net/publication/226418813_Research_on_Strategic_Alliances_in_Biotechnology_An_Assessment_and_Review

- Successful Partnering in Drug Development, accessed August 7, 2025, https://law.shu.edu/documents/successful-partnering-drug-development.pdf

- The Art of the Second Act: A Six-Step Framework for Mastering Late …, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/6-steps-to-effective-late-stage-lifecycle-drug-management/

- What are Patent Cliffs and How Pharma Giants Face Them in 2024 – PatentRenewal.com, accessed August 7, 2025, https://www.patentrenewal.com/post/patent-cliffs-explained-pharmas-strategies-for-2024-losses

- Understanding the Impact of Authorized Generics on Drug Pricing: A Strategic Imperative for Market Domination – DrugPatentWatch, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/understanding-the-impact-of-authorized-generics-on-drug-pricing-the-entacapone-case-study/

- Utilizing Generic Drug Awareness to Improve Patient Outcomes with Dr. Sarah Ibrahim | FDA, accessed August 7, 2025, https://www.fda.gov/drugs/news-events-human-drugs/utilizing-generic-drug-awareness-improve-patient-outcomes-dr-sarah-ibrahim

- Authorized Generic Drugs: Short-Term Effects and Long-Term Impact | Federal Trade Commission, accessed August 7, 2025, https://www.ftc.gov/sites/default/files/documents/reports/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission.pdf

- What Are Authorized Generics? – Managed Healthcare Executive, accessed August 7, 2025, https://www.managedhealthcareexecutive.com/view/what-are-authorized-generics

- Authorized Generics: An Interim Report | Federal Trade Commission, accessed August 7, 2025, https://www.ftc.gov/sites/default/files/documents/reports/authorized-generics-interim-report-federal-trade-commission/p062105authorizedgenericsreport.pdf

- Authorized Generics – Woven Data, accessed August 7, 2025, https://www.wovendata.com/resources/articles/authorized-generics/

- Study: Delaying authorized generics is on the decline | RAPS, accessed August 7, 2025, https://www.raps.org/news-and-articles/news-articles/2025/6/study-delaying-authorized-generics-is-on-the-decli

- Beyond the Pill: How AI-Powered Patient Engagement is Transforming Pharma & MedTech, accessed August 7, 2025, https://www.innominds.com/blog/beyond-the-pill-how-ai-powered-patient-engagement-is-transforming-pharma-medtech

- Pharma’s Beyond the Pill Mental Health Opportunity – Informa Connect, accessed August 7, 2025, https://informaconnect.com/pharmas-beyond-the-pill-mental-health-opportunity/