The Imperative for an Evolved Generic Strategy: A New Paradigm of Value

In the intricate ecosystem of modern healthcare, the generic drug market stands as a colossal economic force, responsible for an estimated $408 billion in savings in 2022 alone and accounting for over 90% of all prescriptions filled in the United States.1 Yet, this immense societal value coexists with a profound and often painful “profitability paradox” for the companies that make it possible.3 This isn’t a new challenge, but an intensifying one, as the relentless pressure of competition and price erosion has compressed margins to razor-thin levels or, in some cases, eliminated them entirely.2 A single generic competitor can cut the brand price by a significant margin, but when that number swells to six or ten, prices can plummet by 80% to 95%.2 This creates a high-stakes, ruthless race to the bottom in the commoditized “vanilla” generics space.

This strategic dilemma has forced a fundamental shift in the industry’s focus. The old playbook, which centered on anticipating and capitalizing on the cyclical “patent cliff” of blockbuster drugs, is no longer sufficient.3 While patent expirations remain a powerful engine of market value transfer, the intense competition they unleash means that only the most efficient, high-volume manufacturers can sustain profitability.2 The future of the generic industry, therefore, is being defined by a strategic bifurcation. One path is to continue in the high-volume, low-margin space, and the other is a purposeful pivot toward higher-barrier, higher-value products like complex generics and biosimilars.3 The Competitive Generic Therapy (CGT) pathway is not just a regulatory nuance; it is a primary example of this second, more sustainable path.

The underlying issue the CGT pathway was designed to address is a specific market failure: the existence of drugs with a de facto monopoly due to a lack of generic competition, despite having no unexpired patents or exclusivities listed in the Orange Book.5 These are often older, essential medicines that have been overlooked because the commercial opportunity, particularly after the high cost of development and approval, simply didn’t justify a full-scale Paragraph IV challenge or a standard Abbreviated New Drug Application (ANDA).6 This inaction leaves the market in a state of “inadequate generic competition” and, crucially, makes the drug and its patients vulnerable to supply chain disruptions and drug shortages.6 The CGT pathway, therefore, is a direct legislative response to this systemic vulnerability, positioning it as a powerful tool for not only commercial advantage but also for national healthcare resilience.

Deconstructing the CGT Framework: Law, Purpose, and Mechanics

The Competitive Generic Therapy framework, established by the FDA Reauthorization Act of 2017 (FDARA), is a meticulously crafted legal mechanism with a clear purpose: to incentivize competition for drugs that have fallen into a state of “inadequate generic competition”.6 The FDA’s Drug Competition Action Plan identifies this pathway as a key component for encouraging the development of drug products for which there was previously insufficient generic competition.8 For a drug to be designated as a CGT, the FDA must determine that there is no more than a single approved drug in the active section of the Orange Book at the time the determination is made.6 This includes the reference listed drug (RLD) or a generic drug that references the same RLD as the product seeking designation.8 This pre-condition makes the pathway fundamentally different from a traditional Hatch-Waxman strategy, which often centers on a direct legal challenge to an innovator’s patents.

The absence of unexpired patents or exclusivities is a prerequisite for a drug to be eligible for CGT exclusivity.6 This re-wires the entire search process for potential candidates. It shifts the primary focus of a generic company’s intellectual property team away from identifying patent vulnerabilities to instead identifying a market void—a search for a lack of legal protection. The FDA aims to make its CGT designation decision within 60 calendar days of receiving a request.8 This targeted, proactive approach stands in stark contrast to the reactive nature of a Hatch-Waxman Paragraph IV (PIV) challenge, which is a direct legal confrontation often involving years of expensive and complex litigation over patent validity or non-infringement.10

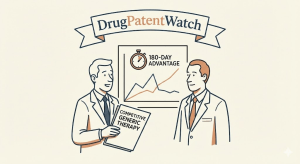

A Tale of Two Exclusivities: CGT vs. Hatch-Waxman 180-Day Advantage

While the Competitive Generic Therapy exclusivity and the more widely known Hatch-Waxman 180-day patent challenge exclusivity share a common duration and a powerful market-blocking effect, they are distinct and separate statutory schemes with different triggers and conditions.12 Understanding these differences is not a mere academic exercise; it is the cornerstone of a successful strategic approach.

The Hatch-Waxman 180-day exclusivity, for instance, is a reward for being the “first applicant” to submit an ANDA containing a PIV certification, which is a legal statement that a listed patent is either invalid, unenforceable, or will not be infringed by the proposed generic product.10 This exclusivity is a powerful incentive, but it is also a byproduct of a high-risk, high-cost legal battle. A key feature of this exclusivity is that it can be “parked,” meaning the approved generic can delay its commercial launch for an extended period, blocking subsequent approvals until the first-filer decides to come to market or forfeits its exclusivity.6

In contrast, the CGT exclusivity is not tied to a patent challenge. Its primary qualifying condition is that there were no unexpired patents or exclusivities listed in the Orange Book at the time of the ANDA’s original submission.6 The triggering event is also different. Both exclusivities are triggered by the first commercial marketing of the drug, but the CGT pathway includes a strict, non-negotiable 75-day forfeiture rule.6 If the “first approved applicant” fails to commercially market the drug product within 75 days of its ANDA approval, it forfeits its eligibility for the exclusivity.6 This legislative maneuver was designed to prevent the “parking” of exclusivity that has been a long-standing issue in the Hatch-Waxman context.6 This rule fundamentally changes the nature of the competitive race; it is no longer just a race to file or a race to approval but a true, end-to-end race to commercial launch.

To clearly illustrate these critical differences, a side-by-side comparison of the two exclusivity types provides valuable context.

| Criteria | Hatch-Waxman 180-Day Exclusivity | Competitive Generic Therapy (CGT) Exclusivity |

| Legislative Basis | FD&C Act, §505(j)(5)(B)(iv) 12 | FD&C Act, §505(j)(5)(B)(v) 12 |

| Purpose | Incentivize generic applicants to challenge weak or invalid patents 11 | Incentivize competition for drugs with inadequate supply 6 |

| Qualifying Condition | First applicant to submit a Paragraph IV certification 10 | Drug is designated a CGT; no unexpired patents/exclusivities at original ANDA submission 6 |

| Triggering Event | First commercial marketing of a Paragraph IV-certified product 10 | First commercial marketing of the CGT by any first approved applicant 9 |

| Forfeiture Conditions | Failure to market, withdrawal, or other specified conditions 10 | Failure to market within 75 days of approval 9 |

| Duration | 180 days 12 | 180 days 12 |

| Market Scope | Blocks approval of other ANDAs that contain a PIV certification to the same patents 10 | Blocks approval of other ANDAs for a drug that is the same as the CGT 13 |

This detailed comparison reveals the strategic nuance of the CGT pathway. It is not an alternative to the Hatch-Waxman model but a complementary tool that addresses a different type of market inefficiency. The CGT pathway provides a new, powerful incentive for companies willing to take on the operational challenge of rapid commercialization.

The Commercial Gold Standard: Quantifying the 180-Day Advantage

For the pharmaceutical business professional, the ultimate measure of any strategy is its commercial return. The 180-day exclusivity period, whether through the Hatch-Waxman or CGT pathway, is a financial bonanza because it creates a temporary, highly profitable duopoly with the brand company. It allows the first generic entrant to capture a significant market share and price its product at a much smaller discount than would be possible in a multi-competitor environment.15

The Economics of Scarcity: Market Share and Pricing

The evidence overwhelmingly demonstrates that the first generic drug to launch secures a commanding and enduring competitive position.15 A first entrant can capture a market share advantage of up to 90% over later entrants, a lead that can persist for years.15 When a single generic competitor enters the market, the price typically drops by only 15-30% relative to the brand price.15 This is a strategic pricing sweet spot that allows for robust profit margins while still providing substantial savings to patients and the healthcare system.1 The dynamic changes dramatically with the entry of additional competitors. With five or more generic rivals, price reductions can escalate to 70-80% of the brand price, and with ten or more competitors, prices can plummet by over 90%.10

The following table starkly illustrates the difference between entering a market first and entering it as a latecomer.

| Number of Generic Competitors | Approximate Price Reduction vs. Brand Price | Strategic Implication |

| 1 (First Entrant) | 15% – 30% 15 | Supranormal profits, rapid recoupment of investment, market leadership |

| 2 | 54% 10 | Shared market, still healthy margins, but a significant drop from the monopoly phase |

| 3-5 | 70% – 80% 10 | Intense competition, thin margins, focus on operational efficiency |

| 6+ | 80% – 95% 2 | Razor-thin margins, survival of the most efficient, high-volume manufacturers |

This data confirms that the value of exclusivity lies not just in market dominance but in the ability to operate in a high-margin environment before the inevitable “race to the bottom” ensues.3 The CGT pathway, by creating this temporary, protected period, offers an antidote to the ruthless commoditization that has defined the generic industry.

A Financial Bonanza: Recouping R&D and Driving ROI

The financial rewards of being first to market are staggering. The U.S. Supreme Court has noted that a 180-day exclusivity period for a blockbuster drug can be worth “several hundred million dollars” to a generic manufacturer.15 While CGT-designated drugs may not be blockbusters, the principle remains the same. The exclusivity provides a powerful, de-risked revenue stream that can quickly recoup development and manufacturing costs.15 This is particularly valuable for drugs that have been overlooked due to a lack of legal complexity or a perceived small market size. For these products, the 180-day window can represent a disproportionately large percentage of the drug’s total annual sales, making it a highly attractive, risk-adjusted opportunity compared to the uncertain and costly outcomes of a PIV patent challenge.3

The Persistent Edge: Why First-Mover Advantage Endures

The benefits of being the first to launch extend far beyond the 180-day exclusivity period. The initial market share dominance achieved by the first generic is not a temporary gain but a persistent competitive edge that can last for years.15 This advantage stems from several factors, including:

- Establishing prescriber habits and physician trust: Physicians and pharmacists, who are a critical part of the supply chain, often prefer to work with a known, consistent supplier.15 The first entrant has the opportunity to build this reputation and embed its product into the routine behaviors of the medical community.

- Supply chain entrenchment: The first mover can establish favorable relationships with wholesalers and distributors, securing prime shelf space and fostering loyalty before later entrants even arrive.15

- Leveraging scale for lower costs: The high sales volume during the exclusivity period allows the first entrant to negotiate more favorable terms with suppliers, such as API manufacturers, which can lead to lower production costs and further cement their competitive edge.3

This enduring advantage suggests a compounding effect, where early market capture creates a deep entrenchment that is difficult for later entrants to displace, even when offering bioequivalent products.15

A Blueprint for Action: The Generic Company’s Playbook

A successful CGT strategy is not a matter of luck; it is the result of a coordinated, multi-disciplinary approach that integrates commercial analysis, intellectual property law, and technical feasibility from the outset.3 The process can be broken down into three critical phases: data-driven target identification, regulatory and operational execution, and strategic commercialization.

Phase I: Data-Driven Target Identification

The first and most crucial step is to identify the right product candidates.3 This requires a fundamentally different mindset than a traditional Hatch-Waxman strategy. Instead of looking for a patent to challenge, the focus is on identifying a market void.

The Role of Patent Intelligence and DrugPatentWatch

A successful CGT search begins with meticulous intellectual property intelligence. The core of this process is identifying drugs for which there are “no unexpired patents or exclusivities listed in the Orange Book at the time of the original submission of the ANDA”.6 This is a search for a lack of protection, a task that requires a sophisticated understanding of a drug’s entire patent and exclusivity history. This is where a modern, comprehensive database becomes an invaluable tool. Platforms like

DrugPatentWatch provide a single, integrated source of global drug, patent, and market data, allowing companies to pinpoint branded drugs with imminent patent expiration and minimal remaining exclusivity.3 This capability is the “first and most critical filter” for a portfolio strategy.3

Beyond just patents, a thorough analysis must also screen for unexpired exclusivities, such as New Chemical Entity (NCE) exclusivity (5 years), Orphan Drug Exclusivity (7 years), or New Clinical Investigation Exclusivity (3 years).21 The presence of any of these, even on a drug that appears off-patent, makes it ineligible for CGT exclusivity at the time of ANDA submission.9

Identifying “Inadequate Generic Competition”

Once the patent and exclusivity landscape has been cleared, the next step is to confirm the “inadequate generic competition” criterion.6 This involves reviewing the FDA’s public lists, including the Office of Generic Drugs’ list of CGT approvals, and the Orange Book itself, to confirm that there is no more than a single approved product in the active section.8 This dual-filter approach—screening for the absence of IP protection and the absence of generic competition—is the cornerstone of a successful CGT targeting strategy.

Phase II: Regulatory and Operational Execution

Once a promising candidate has been identified, the focus shifts to the flawless execution of the regulatory and operational plan. The CGT pathway offers both a carrot and a stick: expedited review and exclusivity, but with a strict and unforgiving forfeiture condition.

Securing the CGT Designation: Timing is Everything

An applicant may request a CGT designation concurrently with, or at any time prior to, the original ANDA submission.8 The FDA recommends an early determination, as this allows the applicant to develop a coordinated regulatory and commercial strategy necessary to reap the full benefits of potential CGT exclusivity.6 While the designation itself does not guarantee a shorter GDUFA goal date, the FDA “generally intends to expedite the review of ANDAs for drugs designated as CGTs” when the applicant has participated in the pre-ANDA meeting program.23

The Accelerated Pathway: Expedited Development and Review

The CGT pathway can expedite both the development and review of the ANDA.8 This may include product development meetings where the FDA can identify items or information that should be clarified before the submission of the ANDA.13 This early engagement is a powerful tool for de-risking the development process and preparing a submission that has a high probability of success. The FDA’s role is to ensure safe, effective drugs are available to patients, and the CGT pathway aligns with this mission by encouraging the development of drugs that can help mitigate drug shortages.7

A Race to the Finish Line: Mitigating Forfeiture Risk

The most critical and unforgiving aspect of the CGT pathway is the 75-day forfeiture rule.6 This rule is a direct response to the “parking” of exclusivity that has plagued the Hatch-Waxman system. It forces a perfect, end-to-end alignment between the regulatory team (which seeks approval), the manufacturing team (which must produce the product), and the commercial team (which must launch it).6 The clock starts ticking the day after the ANDA is approved, not on the date of approval itself.23

The following figure and table illustrate the sequence of events and the risks involved.

Figure 1: The CGT Approval and Launch Timeline

A successful CGT strategy moves the “finish line” from regulatory approval to commercial launch. The process begins with the ANDA submission, followed by a period of FDA review, which may be expedited due to the CGT designation. The moment the FDA grants final approval, a new clock starts. The applicant has a critical 75-day window to begin “first commercial marketing,” which is defined as the date of “introduction or delivery for introduction into interstate commerce outside the control of the manufacturer”.6 Failure to meet this deadline results in the forfeiture of the 180-day exclusivity, opening the door for any other competitor whose ANDA may be approved.

| Risk Factor | Description | Strategic Mitigation |

| Failure to Market Within 75 Days | The statutory requirement to commercially market the product within 75 days of approval, beginning on the calendar day after the approval date.9 | Pre-approval launch planning, supply chain readiness, pre-positioning inventory, and coordinated efforts between regulatory, manufacturing, and commercial teams.6 |

| Voluntary Relinquishment | A first approved applicant can voluntarily and completely abandon its eligibility for exclusivity at any time.13 | Monitor competitor activity and market conditions to assess the likelihood of a co-applicant relinquishing their rights. |

| Selective Waiver | A first approved applicant can waive exclusivity to permit the approval of a particular ANDA or ANDAs.13 | Factor this possibility into commercial projections and competitive analysis, especially in a multi-applicant scenario. |

Phase III: Launch and Commercialization

The culmination of a successful CGT strategy is a swift and decisive commercial launch. This is the moment when all the planning and preparation are put to the test.

Coordinated Launch: The Moment of Truth

Given the 75-day forfeiture rule and the fact that the exclusivity is triggered by the first commercial marketing by any first approved applicant, a seamless, coordinated launch is paramount.9 The FDA’s definition of “first commercial marketing” is not a minor detail. A district court considering the issue in the context of Hatch-Waxman determined that shipments to a third-party distributor were not “outside the control of the manufacturer” because the third party distributor halted shipments.6 This legal nuance highlights the need for robust supply chain agreements and clear communication with all partners to ensure the product is truly “in interstate commerce” and ready for sale.6

Strategic Pricing and Market Penetration

As a first entrant with a protected 180-day window, the generic company has a unique opportunity to use strategic pricing to penetrate the market rapidly.15 By pricing the product at a modest discount to the brand, the company can quickly gain market share and establish a strong commercial foothold, setting the stage for a dominant position that can persist for years even after the exclusivity period expires.15

The Innovator’s Perspective: Countering the CGT Threat

While the CGT pathway is a powerful offensive tool for generic companies, it also presents a new defensive challenge for innovator firms. The assumption that a product with a single, unexpired patent is safe is a dangerous fallacy. A savvy brand company must evolve its strategy to defend against a CGT challenge, which is not a legal battle but a commercial one.

Beyond the Patent Cliff: Proactive Lifecycle Management

The most successful pharmaceutical companies do not just react to generic threats; they anticipate them through meticulous lifecycle management (LCM).17 This involves a long-term, multi-pronged strategy that begins years, sometimes even a decade, before the first patent expires.17 The goal is to continuously add value to a product, making it a difficult target for generic competitors. This can involve new formulations, next-generation delivery systems, or new indications that are covered by new patents, creating a “fortress” of layered intellectual property.17

This practice, sometimes controversially referred to as “evergreening,” is more accurately described as strategic lifecycle patenting when it results from genuine innovation.17 A robust patent fortress includes multiple types of patents, each with its own expiry date, creating a staggered defense that is difficult and costly for generic challengers to untangle.17 The presence of even one unexpired patent or exclusivity in the Orange Book at the time of the original ANDA submission is enough to disqualify a drug from the CGT pathway.6

The Authorized Generic Gambit: Friend or Foe?

One of the most powerful and controversial tactics a brand company can employ is the launch of an authorized generic (AG).26 An AG is a version of the brand-name drug that is manufactured by the brand company itself or a partner and sold in the generic market.26 The launch of an AG has a multi-faceted impact. It is associated with a significant reduction in the first-filer generic’s revenues, with some studies estimating a 40% to 52% reduction during the exclusivity period.26

In the context of CGT, the AG is a potent defensive and offensive tool. By launching an AG, a brand company can proactively create “adequate competition,” effectively neutering a potential CGT strategy before it even begins.26 The decision to launch an AG on a smaller, overlooked product is no longer just a financial calculation about revenue recapture; it is a strategic maneuver in the game of competitive intelligence. It allows the innovator to retain a portion of the market that would otherwise be lost entirely to a generic competitor and, more importantly, to deter a CGT challenge that could result in a total loss of that market to a rival.4

The Importance of Competitive Intelligence in a CGT World

For both innovator and generic companies, the CGT pathway elevates the importance of competitive intelligence to an art form. It requires a constant, vigilant monitoring of the market for both the presence of rivals and the absence of protection. This involves a multi-pronged approach that goes beyond simply tracking patent expirations. It includes:

- Monitoring FDA databases and dockets: Keeping a sharp lookout for new CGT designations and ANDA approvals.9

- Analyzing corporate SEC filings: Tracking strategic shifts and product launch announcements from rivals.10

- Leveraging advanced data platforms: Using a single source of global drug, market, API, and patent data to gain a comprehensive view of the competitive landscape.20

The goal is to turn fragmented information into a clear, actionable trail that leads directly to a future launch or provides an early warning of a competitive threat.10

Real-World Case Studies: Theory in Practice

The strategic and commercial principles of the CGT pathway are best understood through the lens of real-world examples. The Venofer and Sertraline Hydrochloride cases are two recent and powerful illustrations of the pathway’s complexities and its potential for both challenge and reward.

The Venofer Case Study: A Multi-Party Race to Exclusivity

The approval of generic versions of Venofer (iron sucrose injection) in August 2025 provides a masterclass in the multi-party dynamics of the CGT pathway.28 Viatris, Amphastar, and Sandoz all received simultaneous FDA approval for their generic products.9 Viatris announced that it had secured CGT exclusivity for two of the three dose strengths, while Amphastar also announced that it had shared the 180-day generic exclusivity and had launched its product.28 The FDA’s public list of CGT approvals notes that the Venofer product’s CGT exclusivity period was triggered by the first commercial marketing on August 11, 2025, by ANDA 212559, which belongs to Mylan (now Viatris).9 The list also notes that International Medication Systems (IMS) also received a first approval, but its exclusivity was triggered by its own marketing a day later, and that it also shared in the exclusivity triggered by Mylan.9

This case demonstrates a critical nuance of the CGT program: the “first approved applicant” can be a cohort of companies that receive approval on the same day.23 Furthermore, the FDA’s guidance indicates that different strengths of the same drug can be considered distinct CGT-designated products, each with its own exclusivity period.13 This forces a co-applicant to be perfectly prepared to launch immediately to share in the exclusivity window, rather than risking being left behind.28 The Venofer case shows that the prize is not a guaranteed monopoly but a highly profitable share of a de-risked market, rewarding those companies with the operational and commercial readiness to act decisively.

The Sertraline Hydrochloride Blueprint: A High-Value Generic Success

In contrast to the multi-party Venofer case, the approval of Zenara Pharma’s generic Sertraline Hydrochloride Capsules illustrates the aspirational model for a CGT strategy.30 Zenara received the first FDA approval for a generic equivalent of the reference drug and was granted the CGT designation, securing 180 days of marketing exclusivity.30 With sales of the reference product totaling approximately $35.5 million in the 12 months ending June 2025, this was a high-value, albeit not blockbuster, target.31

Zenara’s success was not merely a regulatory victory; it was a testament to end-to-end operational excellence. The company was praised for its “strong R&D capabilities and operational excellence,” highlighting the value of a vertically integrated business model that can efficiently handle everything from API sourcing to formulation, manufacturing, and regulatory execution.30 This case serves as a clear blueprint for how a generic developer can leverage regulatory incentives to bring an affordable version of a widely used molecule to market, proving that the rewards of this pathway can be substantial for a company that can achieve a solo victory.

The Sertraline case demonstrates that the CGT pathway is a powerful tool for companies that prioritize robust formulation science and tight regulatory execution. It is a business model that targets established, high-volume drugs through accelerated pathways, leveraging operational supremacy to capture the exclusivity incentive and, in doing so, creating a sustainable and profitable revenue stream.30

“The first generic drug to launch after a brand-name patent expiration gains a significant and lasting first-mover advantage, which substantially impacts its market share and profitability. The ability of early entrants to capture higher margins before intense competitive pricing begins is a significant financial benefit.” 15

Key Takeaways

- CGT is a Strategic Game-Changer: The Competitive Generic Therapy pathway is not a side project; it is a fundamental pillar of an evolved generic strategy. It addresses a specific market failure and rewards companies with a data-driven approach and a focus on operational readiness.

- The Race to Market is the New Race to File: The 75-day forfeiture rule is a legislative game-changer that re-orients the entire generic drug playbook. Operational readiness—from supply chain resilience to commercial launch planning—is now a prerequisite for legal and regulatory success.

- Data is the New Currency: Identifying CGT opportunities requires a different type of intelligence than a traditional Hatch-Waxman strategy. It is a search for a market void, a task that demands sophisticated patent and market data analytics to pinpoint the absence of legal and commercial competition.

- Exclusivity is a Team Sport: As the Venofer case proves, the CGT pathway can create a co-exclusivity dynamic where multiple companies are “first approved applicants.” Companies must be prepared to compete fiercely but also to strategically coexist with other approved rivals.

Frequently Asked Questions (FAQ)

Q1: How does CGT exclusivity differ from Hatch-Waxman exclusivity in practice, not just in law?

In practice, the most significant difference is the nature of the competitive race and the degree of risk. Hatch-Waxman exclusivity is a reward for a high-cost, high-risk legal battle against a patent holder, and the commercial launch can be delayed for years (“parked”). In contrast, CGT exclusivity is a reward for being the first to fill a market void. The legal risk is minimal to non-existent, but the operational risk is paramount. The 75-day forfeiture rule creates an intense, non-negotiable race to launch, forcing a perfect alignment between a company’s regulatory, manufacturing, and commercial functions.

Q2: Can multiple companies share CGT exclusivity, and what are the strategic implications of a shared exclusivity period?

Yes, multiple companies can share CGT exclusivity. The FDA defines a “first approved applicant” as any company that receives approval for a CGT on the first day any application for that CGT is approved.9 If multiple ANDAs for the same CGT are approved on the same day, they all share in the exclusivity. The key strategic implication is that even in a multi-applicant scenario, the first-mover advantage remains highly valuable. All first approved applicants must still be ready to launch within the 75-day window to secure their share of the protected market and must be prepared to compete commercially with their co-applicants.

Q3: What role does an innovator’s Authorized Generic play in the CGT landscape? Is it a defensive or offensive tool?

An Authorized Generic (AG) is primarily a defensive tool in the CGT landscape. By launching an AG, a brand company can proactively create “adequate generic competition,” which makes the drug ineligible for CGT designation for any future ANDA applicants.8 This strategic maneuver allows the innovator to preemptively close a potential CGT loophole, retain a share of the generic market that would otherwise be lost entirely, and prevent a rival generic from seizing a 180-day exclusivity period.

Q4: How does the CGT pathway address the underlying issues of drug shortages and supply chain fragility?

The CGT pathway directly addresses these issues by incentivizing the creation of a more resilient supply chain. When a drug has only one supplier, it is highly vulnerable to shortages caused by manufacturing quality issues, production delays, or a company’s decision to discontinue the product.7 By providing the incentive of expedited review and a highly valuable 180-day exclusivity, the CGT pathway encourages a second, and in some cases, a third supplier to enter the market, creating redundancy and mitigating the risk of future shortages for essential medicines.6

Q5: What are the biggest risks for a generic company seeking CGT exclusivity, and how can they be mitigated?

The biggest risk is the forfeiture of the 180-day exclusivity due to a failure to commercially market the product within 75 days of approval.6 This risk is compounded if the company is not the sole first approved applicant, as a co-applicant can trigger the exclusivity and leave the unprepared company with no benefit. This risk can be mitigated through a relentless focus on operational readiness. This includes pre-launch planning, establishing and securing a robust supply chain, and ensuring a seamless, coordinated launch between the regulatory, manufacturing, and commercial teams.

Works cited

- Report: 2023 U.S. Generic and Biosimilar Medicines Savings Report, accessed August 18, 2025, https://accessiblemeds.org/resources/reports/2023-savings-report-2/

- Competing in the Generic Drug Market: A Strategic Playbook for the Next Decade, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/competing-in-the-generic-drug-market-strategies-for-success/

- Architecting a Competitive Generic Drug Portfolio: A Strategic …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/how-to-develop-a-competitive-generic-drug-portfolio/

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Why Some Off-Patent Drugs Have No Generic Rivals – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/drugs-with-no-patents-and-no-competition-heres-why/

- Competitive Generic Therapy Exclusivity Offers Benefits | ArentFox Schiff, accessed August 18, 2025, https://www.afslaw.com/perspectives/news/competitive-generic-therapy-exclusivity-offers-benefits

- Frequently Asked Questions about Drug Shortages – FDA, accessed August 18, 2025, https://www.fda.gov/drugs/drug-shortages/frequently-asked-questions-about-drug-shortages

- Competitive Generic Therapies – FDA, accessed August 18, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/competitive-generic-therapies

- Competitive Generic Therapy Approvals – FDA, accessed August 18, 2025, https://www.fda.gov/drugs/generic-drugs/competitive-generic-therapy-approvals

- The Pre-Approval Playbook: How to Identify Generic Entrants and Turn Data into Dominance, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/customer-success-how-do-we-identify-generic-entrants-before-they-get-fda-approval/

- Strategies that delay or prevent the timely availability of affordable generic drugs in the United States, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4915805/

- Definition: 180-day exclusivity period from 21 USC § 355(j)(5) – Law.Cornell.Edu, accessed August 18, 2025, https://www.law.cornell.edu/definitions/uscode.php?width=840&height=800&iframe=true&def_id=21-USC-1727272510-174134459&term_occur=999&term_src=title:21:chapter:9:subchapter:V:part:A:section:355

- Guidance for Industry: Competitive Generic Therapies – FDA, accessed August 18, 2025, https://www.fda.gov/media/136063/download

- www.fda.gov, accessed August 18, 2025, https://www.fda.gov/drugs/generic-drugs/competitive-generic-therapy-approvals#:~:text=This%20180%2Dday%20CGT%20exclusivity,reflect%20%E2%80%9CN%2FA.%E2%80%9D

- First Generic Launch has Significant First-Mover Advantage Over …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/first-generic-launch-has-significant-first-mover-advantage-over-later-generic-drug-entrants/

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed August 18, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- 13 Proven Tactics to Outmaneuver Generic Drug Rivals …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/13-proven-tactics-to-outmaneuver-generic-drug-rivals/

- Generic Drugs: Questions & Answers – FDA, accessed August 18, 2025, https://www.fda.gov/drugs/frequently-asked-questions-popular-topics/generic-drugs-questions-answers

- Why is the Drug Patent Linkage Database Important for Generics or …, accessed August 18, 2025, https://patentskart.com/why-is-the-drug-patent-linkage-database-important-for-generics-or-pharmaceutical-companies/

- Cortellis Generics & Products Intelligence – Clarivate, accessed August 18, 2025, https://clarivate.com/life-sciences-healthcare/manufacturing-supply-chain-intelligence/product-intelligence-analytics/

- Strategies to Maximize Product Value Amid Loss of Exclusivity in the Pharmaceutical Industry – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/strategies-to-maximize-product-value-amid-loss-of-exclusivity-in-the-pharmaceutical-industry/

- Exclusivity–Which one is for me? | FDA, accessed August 18, 2025, https://www.fda.gov/media/135234/download

- Competitive Generic Therapies: FDA Issues Final Guidance | News & Insights, accessed August 18, 2025, https://www.agg.com/news-insights/publications/competitive-generic-therapies-fda-issues-final-guidance/

- Competitive Generic Therapies October 2022 – FDA, accessed August 18, 2025, https://www.fda.gov/regulatory-information/search-fda-guidance-documents/competitive-generic-therapies

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed August 18, 2025, https://www.congress.gov/crs-product/R46679

- Authorized Generic Drugs: Short-Term Effects and Long-Term Impact | Federal Trade Commission, accessed August 18, 2025, https://www.ftc.gov/sites/default/files/documents/reports/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission.pdf

- Role of Competitive Intelligence in Pharma and Healthcare Sector – DelveInsight, accessed August 18, 2025, https://www.delveinsight.com/blog/competitive-intelligence-in-healthcare-sector

- CSL’s Venofer finally faces generic competition as FDA clears copycats from Viatris, Sandoz and Amphastar – Fierce Pharma, accessed August 18, 2025, https://www.fiercepharma.com/pharma/csl-venofer-finally-faces-generic-competition-fda-clears-copycats-viatris-sandoz-amphastar

- FDA Approves 2 Generic Iron Sucrose Injections for Iron Deficiency Anemia in CKD, accessed August 18, 2025, https://www.hcplive.com/view/fda-approves-2-generic-iron-sucrose-injections-for-iron-deficiency-anemia-in-ckd

- Zenara Secures First Generic Sertraline Approval from FDA, Plus Six Months of Market Exclusivity – Pharmaceutical Technology, accessed August 18, 2025, https://www.pharmtech.com/view/zenara-secures-first-generic-sertraline-approval-from-fda-plus-six-months-of-market-exclusivity

- Zenara Pharma Receives U.S. FDA Approval for First Generic of Sertraline Hydrochloride Capsules with 180-Day CGT Exclusivity | Morningstar, accessed August 18, 2025, https://www.morningstar.com/news/pr-newswire/20250731ny42353/zenara-pharma-receives-us-fda-approval-for-first-generic-of-sertraline-hydrochloride-capsules-with-180-day-cgt-exclusivity