Introduction: The High-Stakes Battlefield of Generic Drug Market Entry

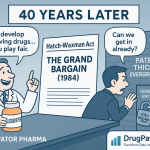

For a pharmaceutical company, the journey to market is a strategic war of attrition, but for a generic manufacturer, the battlefield is defined by a single, critical regulatory and legal mechanism: the Abbreviated New Drug Application (ANDA) with a Paragraph IV (Para IV) certification. This is not a mere bureaucratic process; it is a high-stakes competition with billions of dollars on the line. The very architecture of this conflict was forged in the halls of Congress with the enactment of the Drug Price Competition and Patent Term Restoration Act of 1984, more commonly known as the Hatch-Waxman Act.1

This landmark legislation was designed to serve two seemingly contradictory objectives: encouraging pharmaceutical innovation through robust patent protection while simultaneously promoting generic competition to make medications more affordable for consumers. The brilliance of the Hatch-Waxman framework lies in its elegant solution: it created an abbreviated pathway for generic drug approval, allowing manufacturers to rely on the safety and efficacy data of a previously approved Reference Listed Drug (RLD).1 This bypasses the need for costly and time-consuming clinical trials, provided the generic company can demonstrate its product is bioequivalent and meets all other regulatory requirements.3

The mechanism that transforms this streamlined process into a high-stakes contest is the Paragraph IV certification. A generic manufacturer files this certification as a bold assertion that a brand-name company’s listed patent is, in their opinion, “invalid, unenforceable, or will not be infringed” by their generic product.1 This declaration is far more than a statement of opinion; it is an “artificial act of patent infringement” that triggers a cascade of events governed by strict regulatory timelines.2 This bold assertion gives the brand manufacturer an opportunity to file a patent infringement lawsuit within 45 days, which in turn can trigger an automatic 30-month stay on final FDA approval of the generic application.2

The grand prize for successfully navigating this complex legal and regulatory gauntlet is the 180-day market exclusivity period.2 This powerful financial incentive is granted to the first generic company to file a “substantially complete” ANDA with a Para IV certification and subsequently prevail in the ensuing patent litigation.6 This first-to-file advantage is a significant financial opportunity, as it allows the generic manufacturer to be the sole competitor to the brand for six months. During this period, the first-to-file can capture a commanding market share at a price point only moderately discounted from the brand, with substantially higher margins than the post-exclusivity market where multiple generic entrants drive prices down to a fraction of the brand’s original cost.5 The staggering value of this period is perhaps best illustrated by the case of generic atorvastatin, the generic version of Lipitor. That product earned an estimated $1.9 billion in gross profits during its six-month exclusivity period, a figure that nearly matched the $1.8 billion it earned over the subsequent 3.5 years.8 This dramatic disparity is a stark reminder of why every day of delay matters, and why preventing FDA deficiencies is not a clerical task, but a strategic imperative.

The Anatomy of an ANDA: Where the Process Goes Right and Wrong

The FDA’s review of an ANDA is a multi-phased journey that begins long before a substantive review of the application’s scientific merits. It starts with a critical, but often overlooked, preliminary check for completeness.

The FDA’s First Line of Defense: The Refuse-to-Receive (RTR) Letter

An ANDA submission that is not “substantially complete” faces a swift and devastating consequence: a Refuse-to-Receive (RTR) letter.10 An RTR is not a request for more information; it is the FDA’s declaration that the application is so deficient on its face that it cannot even be accepted for a substantive review.10 For a pharmaceutical company, an RTR is a public and financially damaging failure. The damage can be “irremediable,” eroding corporate credibility and decimating a project’s financial viability.11 The FDA uses this tool as a means to “avoid unnecessary review of incomplete applications,” a practice that has become more common in recent years as the agency works to become more efficient.11

The prevalence of this issue is significant. Between fiscal years 2013 and 2015, the FDA refused to receive 379 ANDAs for reasons other than a missed user fee payment. In fact, in fiscal years 2013 and 2015, approximately 14% of all original ANDA submissions received an RTR.13 A common reason for an RTR is the failure to pay the required Generic Drug User Fee Amendments (GDUFA) fee, which currently stands at over $321,000 for fiscal year 2025 and is projected to increase to over $358,000 in 2026.14 However, the most frequent bases for an RTR are often “unforced errors” that indicate a lack of meticulous preparation.11 These common deficiencies include submitting inadequate stability data, failing to justify proposed impurity limits, or simply missing or using incorrect official FDA forms.11 The financial penalty for an RTR is severe. A resubmission is treated as a new ANDA, requiring the company to pay the entire GDUFA fee again and resetting the review clock.13 This double penalty—in both time and money—is a powerful incentive to get the submission right the first time.

Common FDA Deficiencies: A Deep Dive into the Approval Process Delays

If an ANDA passes the initial RTR screening, it moves into a substantive review, where a new set of common, recurring deficiencies often arise, leading to a Complete Response Letter (CRL) and significant delays.14

Bioequivalence and Bioanalytical Deficiencies

Bioequivalence (BE) is the scientific cornerstone of the entire ANDA process. It is the crucial proof that the generic drug delivers the same therapeutic effect as the RLD, meaning the rate and extent of absorption are not significantly different.3 Deficiencies in this area are among the most common reasons for approval delays.19

A survey of BE submissions to ANDAs from 2001 to 2008 identified the two most common deficiencies as being related to dissolution (found in 23.3% of applications) and analytical method validation (found in 16.5% of applications).19 Beyond these top two issues, other common BE deficiencies include a lack of Standard Operating Procedures (SOPs), inadequate or missing long-term storage stability data for analytical samples, and the submission of mean concentration data instead of individual subject concentrations at every time point.19

There is a powerful and subtle check on a company’s integrity built into the BE submission process. The FDA requires generic applicants to submit data from all bioequivalence studies conducted on a drug product formulation, even those that fail to show bioequivalence.17 This requirement, codified in a 2009 final rule, was implemented because historically, ANDA applicants would only submit their “passing” studies.17 A company that attempts to hide a failed study is not only non-compliant but is also betraying a fundamental principle of data integrity that the FDA views as non-negotiable.

Chemistry, Manufacturing, and Controls (CMC) Deficiencies

The Chemistry, Manufacturing, and Controls (CMC) section of an ANDA—part of the Quality module of the eCTD dossier—is another major source of deficiencies.21 The FDA’s focus here is on ensuring that the proposed generic drug can be manufactured to consistently meet quality standards.14

One of the most frequently cited CMC deficiencies is an inadequate or incomplete Drug Master File (DMF), which is a key component for demonstrating the quality of the active pharmaceutical ingredient (API).22 Another common area of failure relates to impurities and polymorphism. A company must provide a full description of the drug substance, including its synthesis, purification, and controls for ensuring its identity and purity.12 The FDA may refuse to receive an ANDA for “failing to provide justification for proposed limits in drug substances and drug products for specified identified impurities that are above qualification thresholds”.12 Furthermore, a deep understanding of polymorphism—the ability of a compound to exist in different crystalline forms—is crucial. Polymorphism can impact the drug’s performance and stability, and a failure to address its control is a frequently cited deficiency.22

Labeling and Regulatory Deficiencies

A generic drug’s labeling must be “substantially identical” to the RLD’s, with specific, permissible differences.3 One of the most complex and high-stakes areas of labeling deficiencies relates to the “skinny label” strategy. This is a crucial strategic tool for generic manufacturers when the RLD has a method-of-use patent listed in the Orange Book that the generic product does not seek to infringe.2

In this scenario, the generic applicant must file a “Section viii statement” and “carve out” the patented method-of-use from its labeling.2 This is a delicate legal and regulatory dance. The label must be meticulously drafted to ensure it does not induce infringement of the remaining patents on the RLD.24 The FDA may issue a deficiency if the proposed label is not compliant or if it risks a claim of induced infringement.16 This strategic maneuver requires flawless execution to avoid a legal quagmire.

The FDA’s increasing stringency, evidenced by the rising trend of RTRs, signals a deliberate and meaningful shift in the agency’s expectations.11 It is moving from a “review-and-repair” model to a “quality-by-design” expectation. The agency’s issuance of “stock deficiencies”—standardized requests for commonly missing information—reflects a concerted effort to achieve consistency in review and predictability for the industry.25 This trend means that what was once a correctable oversight is now grounds for outright refusal, placing immense pressure on generic manufacturers to front-load quality and due diligence. This is no longer a best practice; it is a regulatory necessity for any company hoping to achieve a first-cycle approval.

The Strategic Impact of Deficiencies: Turning Delays into Financial Loss

For business professionals, the true cost of an FDA deficiency cannot be measured solely in missed deadlines or user fees. It is measured in lost revenue, eroded market share, and a diminished competitive position.

The Erosion of ROI: Quantifying the Financial Impact of Delays

The financial stakes of a swift and successful ANDA launch are monumental. As the case of generic atorvastatin so vividly illustrates, the 180-day exclusivity period is the most profitable phase of a generic product’s lifecycle, often accounting for the majority of the manufacturer’s return on investment.5 A delay can decimate this opportunity. The average monthly opportunity cost of an ANDA delay is estimated at $50,000.8 When the price of success is so closely tied to the timeliness of market entry, every day that a product is not on the market represents a tangible, quantifiable loss.

The costs associated with a deficiency can be both direct and indirect. Direct costs include not only the new GDUFA fee for a resubmission but also the significant expenses of remediation, legal fees, and, in some cases, product recalls.8 An India-based manufacturer, for example, projected a loss of $50 million per year from a drug delay caused by a warning letter, while another saw its U.S. revenues drop by $760 million over a two-year period following regulatory action.8

Beyond these tangible costs, the strategic impact is profound. A delayed market entry can lead to lost pricing leverage, as the average price point of a generic drug during exclusivity is 73% of the pre-generic high, while after exclusivity, it drops to a mere 43%.8 It erodes strategic positioning, forcing a company to compete in a crowded market rather than dominating it.8 A company’s credibility with investors, clients, and employees can be damaged, leading to an increased cost of capital as its risk profile becomes higher.8 For a project to maintain its original Internal Rate of Return (IRR) and Return on Capital Employed (ROCE), it must get to market on time.8

The Paragraph IV Notice Letter: A Legal and Strategic Imperative

The Paragraph IV notice letter is not a bureaucratic formality; it is a critical legal document that can determine the outcome of a multi-million-dollar patent infringement lawsuit. The notice letter must be sent to the brand product sponsor and any patent holders within 20 days of the generic applicant’s receipt of the FDA’s Paragraph IV acknowledgment letter.2 Its content is strictly regulated and must include a “detailed statement of the factual and legal basis” for the invalidity or non-infringement claim.2

A poorly drafted notice letter can be a “litigator’s gift”.27 If the generic company’s later litigation arguments are inconsistent with the positions taken in the notice letter, their case can be weakened.27 A lack of detail can invite a lawsuit, while a position not made in “good faith” can lead to the court designating the case as “exceptional,” which could force the generic company to pay the brand’s attorneys’ and expert fees.2 A common pitfall is an unreasonably restrictive Offer of Confidential Access (OCA), which can be construed as a refusal to allow the brand to evaluate the ANDA, potentially removing a legal shield against a declaratory judgment action.2

A recent and powerful legal precedent has clarified the tax implications of this costly litigation. The Court of Appeals for the Federal Circuit ruled in Actavis Laboratories FL, Inc. v. United States that expenses incurred by generic companies in defending against Hatch-Waxman patent suits are deductible as “ordinary and necessary business expenses”.4 This decision is a subtle but profound piece of the puzzle. By ruling that these costs are not capital expenditures for acquiring the ANDA asset, the court reinforced the pro-competitive intent of the Hatch-Waxman Act, removing a potential financial disincentive for generic manufacturers and leveling the tax playing field with their brand-name counterparts.4

A Proactive Prevention Guide: Building a Culture of Regulatory Excellence

Successfully navigating the FDA and Para IV process is not a matter of luck; it is the result of a deliberate, proactive strategy that begins long before a single document is filed.

Phase 1: Pre-Submission Due Diligence and Strategic Planning

The most successful ANDA submissions are born from seamless, cross-functional collaboration. Legal and regulatory teams should be involved from the earliest stages of drug development to ensure that a product is positioned for success and all potential risks are identified and mitigated.27 The first step is a thorough patent analysis and due diligence. This goes beyond a simple check of Orange Book listings; it involves a detailed review of patent prosecution history and a comprehensive prior art search to identify potential weaknesses in the brand’s patents.30

The non-negotiable foundation of this entire process is data integrity. The FDA’s position is unequivocal: “if something is not documented, it was not done”.32 This is not a matter of opinion but a hard regulatory fact. A company must establish a flawless record-keeping system guided by the ALCOA principles: data must be Attributable, Legible, Contemporaneous, Original, and Accurate.33 Best practices involve implementing robust access controls, automated audit trails, and regular data validation to ensure that all records are secure, reliable, and unalterable.34

Phase 2: Mastering the ANDA Dossier

Given the GDUFA fee of over $321,000, a successful first-cycle submission is a massive ROI driver.15 This reality demands a “check-and-recheck” mentality, where every document, form, and data point is meticulously prepared for completeness and accuracy.14 The ANDA dossier must be prepared in the Electronic Common Technical Document (eCTD) format, with every module compiled with excruciating attention to detail.14 For complex generics, an invaluable strategic move is to engage with the FDA through pre-ANDA meetings. These early interactions can clarify application requirements and address any uncertainties, mitigating the risk of a future RTR or CRL.14

Phase 3: Navigating the Post-Submission Landscape

Even the most well-prepared application may receive a deficiency letter. When this happens, a company must have a rapid and precise response plan.14 The first step is a triage approach: thoroughly review the letter to determine if the requested information already exists, needs to be generated, or was provided but requires clarification or re-phrasing.25 The response must be submitted “promptly, accurately, and with all requested documentation”.14 Delays in responding to deficiencies can extend the approval timeline, directly eroding the opportunity to be the first generic on the market and claim the 180-day exclusivity prize.9

The Role of Intelligent Data Platforms: From Information to Competitive Advantage

In this high-stakes environment, a generic company’s most powerful weapon is not a new formulation or a new patent, but a deeper, more accurate understanding of the competitive landscape. This requires moving beyond fragmented, free tools and leveraging integrated data platforms designed for the pharmaceutical industry.

The Pitfalls of Free Tools: Why Google Patents is a Dangerous Illusion

Free patent search tools like Google Patents can create a “powerful and perilous ‘illusion of thoroughness'” that is “fundamentally unsuitable” for high-stakes pharmaceutical IP analysis.37 These tools suffer from critical flaws that can lead to catastrophic strategic errors. The most dangerous flaw is a significant data lag, which can leave a company unaware of a newly published patent for weeks or even months, creating a “window of vulnerability”.37 Furthermore, these platforms have jurisdictional blind spots in commercially vital markets like China and India, offering a “dangerously fragmented view of a competitor’s global protection strategy”.37

Perhaps most importantly, these tools are incapable of integrated analysis. They are designed for looking up isolated documents and lack the ability to connect patent data to FDA regulatory information, clinical trial data, or litigation records.37 This fragmented view can lead to a “false negative” Freedom to Operate (FTO) assessment, a scenario where a company concludes it has FTO when a valid, in-force patent is actually being infringed.37

The Power of Integrated Intelligence: How DrugPatentWatch Transforms Strategy

To avoid these pitfalls, a modern pharmaceutical company must leverage an integrated business intelligence platform. Services like DrugPatentWatch are designed to provide a comprehensive, curated, and up-to-the-minute view of the pharmaceutical patent and regulatory landscape.37

DrugPatentWatch transforms a simple document lookup into a comprehensive intelligence-gathering exercise by connecting a wide range of disparate data sources. It links patent information from over 134 countries directly to FDA regulatory data, including Orange Book listings, as well as to clinical trial information and court litigation records.37 This integrated view allows a company to proactively identify weak patents ripe for a Para IV challenge by analyzing prior art and prosecution history for fatal flaws.31 It also enables a company to anticipate a brand’s counterstrategies and track litigation to predict early generic entry.39 The platform’s ability to provide a complete picture of a drug’s legal and regulatory status is a powerful tool for mitigating risk and identifying commercial opportunities.37

The FDA review process and Para IV litigation are not parallel, independent processes; they are deeply interconnected. A single deficiency in a CMC section can lead to an RTR, which delays the 20-day clock for sending the Para IV notice letter, potentially pushing the generic out of the “first-to-file” window and costing it the 180-day exclusivity prize.7 This demonstrates that success is not just about having a strong legal position or a well-documented ANDA, but about flawlessly executing a synchronized, cross-functional strategy where every regulatory detail and data point is treated as a potential vulnerability. An integrated data platform is the only way to manage this complex, interconnected risk profile.

Conclusion: A Prescription for Success

The path to a successful Paragraph IV ANDA is fraught with predictable, yet financially devastating, deficiencies. This journey requires a paradigm shift, from a reactive stance to a proactive, strategic posture. The stakes are monumental, with the 180-day exclusivity period representing the lion’s share of a generic product’s lifetime value. The most common failures are not random; they are found in the details—in the bioequivalence data, in the completeness of the CMC section, and in the legal precision of the Paragraph IV notice letter.

The cost of these failures extends far beyond the GDUFA fee. The true financial impact is measured in lost time, eroded market share, and a decimated return on investment. The modern pharmaceutical professional cannot rely on fragmented, outdated information from free tools. The path to a successful Para IV application requires an integrated, data-driven strategy that treats every detail with the precision it deserves, transforming the challenge of FDA deficiencies into a decisive source of competitive advantage.

Key Takeaways

- The Hatch-Waxman Act creates a high-stakes, structured conflict where the first-to-file generic that prevails in a Paragraph IV challenge can capture a commanding market share and secure substantially higher profits during the 180-day exclusivity period.

- FDA deficiencies are predictable and often preventable. The most common issues arise from a lack of completeness in the initial submission, particularly concerning bioequivalence and CMC data, and a failure to meet the precise legal requirements of the Paragraph IV notice letter.

- The financial consequences of a deficiency are severe, extending from direct costs like GDUFA fees and remediation to opportunity costs, lost market share, and a significant erosion of project ROI.

- Success demands a proactive, cross-functional strategy. This includes early collaboration between legal, regulatory, and R&D teams; a commitment to meticulous data integrity; and the strategic use of pre-submission interactions with the FDA.

- The use of integrated data platforms, such as DrugPatentWatch, is essential for strategic decision-making. These platforms provide a unified view of patent, regulatory, and litigation data, allowing companies to uncover vulnerabilities, anticipate counterstrategies, and mitigate risk in a way that free tools cannot.

Frequently Asked Questions (FAQ)

What is the difference between an FDA Refuse-to-Receive (RTR) letter and a Complete Response Letter (CRL), and why does the distinction matter?

The distinction between an RTR and a CRL is a critical one, defining the stage and severity of an application’s deficiencies. An RTR letter is issued by the FDA after a preliminary, 60-day review and signifies that the ANDA is so fundamentally incomplete that it cannot even be accepted for a substantive review.10 It is an immediate stop sign that forces the applicant to resubmit a new application, which is treated as a new filing and requires a new GDUFA fee.13 A CRL, by contrast, is issued after the FDA has completed a full substantive review of a complete application and has identified deficiencies that prevent final approval.14 A CRL may require additional data, such as a new bioequivalence study or updated stability data, but the application remains in the review queue and does not require a new GDUFA fee for a response.14

How can a generic company mitigate the risk of a brand’s “patent thicket” strategy when preparing a Paragraph IV challenge?

A “patent thicket” is a defensive strategy where a brand manufacturer builds a portfolio of dozens of overlapping patents to make a generic challenge more difficult and costly.40 To mitigate this risk, a generic company must employ a sophisticated, data-driven approach. This involves conducting a thorough “patent landscaping” analysis using a professional platform like

DrugPatentWatch to identify weak patents susceptible to invalidity or non-infringement arguments.31 A company should strategically prioritize its challenges, focusing on the core composition of matter patents and those that are most critical to market entry.31 It may also consider leveraging proceedings at the Patent Trial and Appeal Board (PTAB), such as Inter Partes Review (IPR), to challenge the validity of multiple patents simultaneously.40

Beyond the 180-day exclusivity, what other factors determine the commercial success and profitability of a first-to-file generic launch?

While the 180-day exclusivity is the primary financial driver, other factors are equally critical for long-term commercial success. The first generic to market can capture up to a 90% market share, a lead that can persist for years even after other generics enter the market.9 This “first-mover advantage” creates a durable market position that is difficult for later entrants to displace.9 The generic’s pricing strategy during and after the exclusivity period, its ability to secure a favorable position on health plan formularies, and its relationship with distributors are all key to maintaining profitability.5 Furthermore, a company’s ability to manage its supply chain and manufacturing to meet initial demand is paramount to capitalize on the exclusivity window.14

Are there any circumstances where a generic company should choose a Paragraph III certification over a Paragraph IV, and what are the strategic considerations?

A Paragraph III certification states that the generic will not launch until the listed patent expires, thereby avoiding any potential patent infringement litigation.6 A generic company may strategically choose this path if the patents on the RLD are known to be particularly strong and the company determines that the costs and risks of litigation outweigh the potential benefits of an earlier market entry.4 A Paragraph III filing may also be a viable option if the patent is due to expire in the near future and the manufacturer is confident that it can be among the first to market on the natural expiration date without the need for a challenge.4

How has the rise of biologics and biosimilars changed the traditional Hatch-Waxman landscape, and what new challenges are emerging for generic manufacturers?

The rise of biologics and biosimilars has introduced a new layer of complexity to the competitive landscape. Unlike small-molecule drugs that have a clear pathway under the Hatch-Waxman Act, biologics are regulated under the Biologics Price Competition and Innovation Act (BPCIA), which established a similar, but distinct, abbreviated pathway for biosimilar approval.43 A key difference lies in the nature of the products themselves; biosimilars are not “identical” to their reference products in the way generics are, and their development can be more complex and costly.43 The legal disputes surrounding biologics, often called the “patent dance,” can be highly technical and involve different litigation strategies than those for small molecules.41 This shift has created a rational response for innovators to shift their R&D efforts from chemical-based products toward complex biologics, knowing that the “entry pathway for generic equivalents” is significantly more complex and challenging.43

Works cited

- Mastering Paragraph IV Certification – Number Analytics, accessed August 18, 2025, https://www.numberanalytics.com/blog/mastering-paragraph-iv-certification

- Hatch Waxman Litigation 101 | DLA Piper, accessed August 18, 2025, https://www.dlapiper.com/en/insights/publications/2020/06/ipt-news-q2-2020/hatch-waxman-litigation-101

- The ANDA Process: A Guide to FDA Submission & Approval – Excedr, accessed August 18, 2025, https://www.excedr.com/blog/what-is-abbreviated-new-drug-application

- ACTAVIS LABORATORIES FL, INC. v. US – United States Court of …, accessed August 18, 2025, https://www.cafc.uscourts.gov/opinions-orders/23-1320.OPINION.3-21-2025_2485837.pdf

- What Every Pharma Executive Needs to Know About Paragraph IV …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- Paragraph IV Explained – ParagraphFour.com, accessed August 18, 2025, https://paragraphfour.com/paragraph-iv-explained/

- Patent Certifications and Suitability Petitions – FDA, accessed August 18, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- The Real Cost of Poor Data Integrity in Pharmaceutical Manufacturing, accessed August 18, 2025, https://www.lachmanconsultants.com/wp-content/uploads/2019/11/data-integrity-whitepaper-1.pdf

- First Generic Launch has Significant First-Mover Advantage Over Later Generic Drug Entrants – DrugPatentWatch – Transform Data into Market Domination, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/first-generic-launch-has-significant-first-mover-advantage-over-later-generic-drug-entrants/

- 21 CFR 314.101 — Filing an NDA and receiving an ANDA. – eCFR, accessed August 18, 2025, https://www.ecfr.gov/current/title-21/chapter-I/subchapter-D/part-314/subpart-D/section-314.101

- Unforced Errors: FDA Refusal To File Or Receive Letters | Premier Consulting, accessed August 18, 2025, https://premierconsulting.com/resources/blog/unforced-errors-fda-refusal-file-receive-letters/

- ANDA Submissions – Refuse to Receive for Lack of Justification of Impurity Limits Guidance for Industry – FDA, accessed August 18, 2025, https://www.fda.gov/files/drugs/published/ANDA-Submissions-%E2%80%94-Refuse-to-Receive-for-Lack-of-Justification-of-Impurity-Limits.pdf

- ANDA Submissions – Refuse-to-Receive Standards Guidance for Industry – FDA, accessed August 18, 2025, https://www.fda.gov/media/86660/download

- Essential ANDA Checklist: Key Steps to Streamline Your Filing Process, accessed August 18, 2025, https://vicihealthsciences.com/anda-checklist-for-filing-process/

- Generic Drug User Fee Amendments – FDA, accessed August 18, 2025, https://www.fda.gov/industry/fda-user-fee-programs/generic-drug-user-fee-amendments

- FDA Helping the Generic Industry Submit Complete Applications, accessed August 18, 2025, https://www.fda.gov/media/111097/download

- Requirements for Submission of Bioequivalence Data; Final Rule – Federal Register, accessed August 18, 2025, https://www.federalregister.gov/documents/2009/01/16/E9-884/requirements-for-submission-of-bioequivalence-data-final-rule

- How to Ensure Your Generic Drug Meets FDA Standards: A Comprehensive Guide, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/how-to-ensure-your-generic-drug-meets-fda-standards/

- Common Deficiencies with Bioequivalence Submissions in …, accessed August 18, 2025, https://www.researchgate.net/publication/51843340_Common_Deficiencies_with_Bioequivalence_Submissions_in_Abbreviated_New_Drug_Applications_Assessed_by_FDA

- Common Deficiencies with Bioequivalence Submissions in Abbreviated New Drug Applications Assessed by FDA – PMC, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3291193/

- ANDA Submissions — Content and Format Guidance for Industry Rev. 1 – FDA, accessed August 18, 2025, https://www.fda.gov/media/128127/download

- FDA Perspectives: Common Deficiencies in Abbreviated New Drug Applications: Part 1: Drug Substance | Triclinic Labs, accessed August 18, 2025, https://tricliniclabs.com/reference-material/downloadable-documents/FDA%20Perspectives%20-%20Deficiencies%20in%20NDA%20-%20Drug%20Substance.pdf

- The Definitive Guide to Generic Drug Approval in the U.S.: From ANDA to Market Dominance – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/obtaining-generic-drug-approval-in-the-united-states/

- Paragraph IV Cases – Orange Book Blog, accessed August 18, 2025, https://www.orangebookblog.com/hatchwaxman_litigation/

- FDA is issuing deficiency letters- why you should care (Part 1/4) – MedCrypt, accessed August 18, 2025, https://www.medcrypt.com/blog/fda-is-issuing-deficiency-letters–why-you-should-care-part-1-4

- 21 CFR 314.95 — Notice of certification of invalidity, unenforceability, or noninfringement of a patent. – eCFR, accessed August 18, 2025, https://www.ecfr.gov/current/title-21/chapter-I/subchapter-D/part-314/subpart-C/section-314.95

- STRATEGIES FOR FILING SUCCESSFUL PARAGRAPH IV CERTIFICATIONS – St. Onge Steward Johnston & Reens LLC, accessed August 18, 2025, https://www.ssjr.com/wp-content/uploads/2018/05/presentations/lawyer_1/92706VA.pdf

- STRATEGIES FOR FILING SUCCESSFUL PARAGRAPH IV CERTIFICATIONS – St. Onge Steward Johnston & Reens LLC, accessed August 18, 2025, https://www.ssjr.com/wp-content/uploads/2018/05/presentations/lawyer_1/61808DC.pdf

- Federal Circuit Confirms Deductibility of Hatch-Waxman Litigation Expenses | Insights & Resources | Goodwin, accessed August 18, 2025, https://www.goodwinlaw.com/en/insights/publications/2025/03/alerts-practice-cldr-federal-circuit-confirms-deductibility-of-hatch

- Navigating the Complexities of Paragraph IV – Number Analytics, accessed August 18, 2025, https://www.numberanalytics.com/blog/navigating-paragraph-iv-complexities

- The Challenger’s Gambit: A Strategic Guide to Identifying and Invalidating Weak Drug Patents in the U.S. – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/identifying-and-invalidating-weak-drug-patents-in-the-united-states/

- What are the best practices for dealing with FDA inspections? – Medmarc, accessed August 18, 2025, https://medmarc.com/life-sciences-news-and-resources/publications/what-are-the-best-practices-for-dealing-with-fda-inspections

- Experts offer advice on avoiding common warning letter citations – RAPS, accessed August 18, 2025, https://www.raps.org/news-and-articles/news-articles/2025/7/experts-offer-advice-on-avoiding-common-warning-le

- Top 10 Data Integrity Best Practices – Hevo Academy, accessed August 18, 2025, https://hevoacademy.com/data-management/data-integrity-best-practices/

- 6 Best Practices for Maintaining Data Integrity | Walacor Corporation, accessed August 18, 2025, https://www.walacor.com/2024/01/24/6-best-practices-maintaining-data-integrity/

- How to Successfully Navigate the ANDA Approval Process: A Step-by-Step Guide, accessed August 18, 2025, https://www.bioaccessla.com/blog/how-to-successfully-navigate-the-anda-approval-process-a-step-by-step-guide

- Using Google Patents to Find Drug Patents? Here’s 15 Reasons …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/using-google-patents-to-find-drug-patents-heres-15-reasons-why-you-shouldnt/

- DrugPatentWatch has been a game-changer for our business, accessed August 18, 2025, https://www.drugpatentwatch.com/

- Make Better Decisions with DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/pricing/

- Key Strategies for Successfully Challenging a Drug Patent – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/key-strategies-for-successfully-challenging-a-drug-patent/

- Multi-District Litigation in Para IV Cases: Strategic Considerations – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/multi-district-litigation-in-para-iv-cases-strategic-considerations/

- Abbreviated New Drug Application (ANDA) and Prior Approval Supplement (PAS) Fees, accessed August 18, 2025, https://www.fda.gov/industry/generic-drug-user-fee-amendments/abbreviated-new-drug-application-anda-and-prior-approval-supplement-pas-fees

- How Generic Drugs, Patents, and Price Controls Affect Markets | NBER, accessed August 18, 2025, https://www.nber.org/digest/jan15/how-generic-drugs-patents-and-price-controls-affect-markets