Introduction: The Billion-Dollar Clock

In biopharmaceutical innovation time is the most valuable and fiercely contested asset. For an innovator company, the period of market exclusivity for a blockbuster biologic is not merely a stretch of calendar days; it is a finite window in which to recoup a staggering investment and fund the next generation of life-saving therapies. This window is governed by a relentless, multi-billion-dollar clock, and every decision, from the earliest days of research to the final stages of a product’s lifecycle, is a strategic move to add precious minutes, months, or even years to its countdown.

The economic realities underpinning this battle for time are stark and unforgiving. The journey to bring a single new biologic drug to market is an arduous odyssey of scientific discovery, clinical validation, and regulatory navigation. The capitalized cost of this journey—factoring in the high rate of failure for candidates that never reach the pharmacy shelf—is estimated to be between $1 billion and over $2.6 billion.1 This decade-plus development process consumes a significant portion of the standard 20-year patent term, often leaving an effective market exclusivity period of just 7 to 8 years post-approval.5

The market being protected is colossal. The global biologics market, valued at over USD 461 billion in 2022, is the fastest-growing segment of the pharmaceutical industry and is projected to surge past USD 1 trillion by 2030.7 These therapies, which have revolutionized the treatment of cancer, autoimmune disorders, and rare diseases, represent not only immense therapeutic value but also the primary revenue engines for the world’s leading biopharma companies.

When the clock runs out, the consequences are swift and severe. The loss of exclusivity triggers the so-called “patent cliff,” a catastrophic decline in revenue as lower-cost biosimilar competitors flood the market. It is not uncommon for a blockbuster biologic to lose 80-90% of its revenue within the first year of biosimilar entry, an existential threat that can reshape a company’s financial future overnight.10 Between 2025 and 2030 alone, nearly 70 high-revenue products are projected to face patent expiration, placing an estimated $236 billion in annual revenue at risk.10

This report provides a comprehensive strategic guide to managing this billion-dollar clock. It moves beyond a simple legal overview to deliver a multi-disciplinary analysis of how market exclusivity for biologics is built, defended, and extended. The core thesis is that maximizing a biologic’s commercial life is not a passive legal exercise but an active, integrated corporate function. It requires the masterful orchestration of two distinct but complementary pillars of protection: patent rights, granted by the U.S. Patent and Trademark Office (USPTO), and regulatory exclusivity, granted by the Food and Drug Administration (FDA).12 Success in this arena is achieved through the strategic layering of regulatory exclusivities, the calculated use of patent term extensions, and the construction of sophisticated, multi-layered patent portfolios known as “patent thickets”—all informed by continuous, data-driven competitive intelligence. This is the definitive playbook for building the fortress and withstanding the inevitable siege.

Section 1: The Biologic Blueprint: Why Complexity Defines the Strategy

To understand the unique and intricate intellectual property (IP) framework surrounding biologics, one must first appreciate the profound scientific chasm that separates them from traditional small-molecule drugs. These fundamental differences in size, structure, and manufacturing are not mere technical details; they are the bedrock upon which the entire legal, regulatory, and strategic landscape is built. The inherent complexity of a biologic is not a problem to be solved but a strategic asset to be leveraged in the quest for extended market exclusivity.

Defining Biologics: A World Beyond Chemical Synthesis

Unlike conventional drugs, which are typically synthesized through predictable chemical reactions, biologics are a diverse class of medicines derived from or produced within living organisms. As defined by the FDA, this category includes a vast range of products such as vaccines, blood components, gene therapies, tissues, and, most prominently in the context of blockbuster therapies, recombinant therapeutic proteins and monoclonal antibodies.14 They are isolated from natural sources—human, animal, or microbial—and manufactured using cutting-edge biotechnology in living systems like plant or animal cell cultures.15

These products represent the forefront of biomedical research, offering highly targeted treatments for conditions like cancer, rheumatoid arthritis, and Crohn’s disease, often where no other effective options exist.14 Blockbuster therapies like adalimumab (Humira), etanercept (Enbrel), and bevacizumab (Avastin) are prime examples of monoclonal antibodies and fusion proteins that have transformed patient care and generated tens of billions in annual revenue.

The “Product is the Process” Paradigm

The central concept that distinguishes biologics from small-molecule drugs is the paradigm that “the product is the process”.18 A small-molecule drug like aspirin has a simple, well-defined chemical structure consisting of just 21 atoms that can be perfectly replicated batch after batch.19 Its structure is known, and its purity can be precisely analyzed.

A biologic, in contrast, is a behemoth. A monoclonal antibody can be composed of over 25,000 atoms, folded into a complex, three-dimensional structure that is essential to its function.19 These molecules are produced in living cells, a process inherently subject to variability. The final product is not a single, pure substance but a complex, heterogeneous mixture of related molecules.14 It is often difficult, and sometimes impossible, to fully characterize all the components of a finished biologic using available laboratory methods.18

This reality means that the final therapeutic product is inextricably linked to the highly sensitive, proprietary, and tightly controlled manufacturing process used to create it. Even minor, imperceptible changes in the manufacturing environment—such as temperature, pH, or cell culture media—can significantly alter the final product’s structure, purity, potency, and, most importantly, its safety and efficacy in patients.15 Because the innovator’s exact process is a closely guarded trade secret, a competitor cannot simply replicate it. This scientific reality is the primary justification for the entire biosimilar regulatory pathway, which requires a competitor to demonstrate “high similarity” to the original product, a far more complex and costly endeavor than proving the chemical identity of a generic small-molecule drug.

This fundamental complexity provides innovator companies with a rich and multi-layered foundation for building a defensive IP strategy. The scientific uncertainty faced by competitors becomes a strategic advantage for the innovator, creating natural barriers to entry that are then amplified by a deliberately constructed patent estate.

Biologics vs. Small-Molecule Drugs: A Strategic and Scientific Comparison

The following table outlines the key differences between these two classes of drugs, moving beyond the science to highlight the direct strategic IP implications that flow from each distinction. This comparison serves as a critical reference for understanding why the strategies for maximizing market exclusivity are so different—and so much more complex—for biologics.

| Characteristic | Small-Molecule Drugs | Biologics | Strategic IP Implication |

| Size & Complexity | Low molecular weight (e.g., aspirin has 21 atoms); simple structure.19 | High molecular weight (e.g., monoclonal antibodies have >25,000 atoms); complex 3D structure.19 | The larger, more complex structure of a biologic offers numerous opportunities for patenting minor variations (e.g., glycosylation patterns, specific protein variants) that may not exist for a simple chemical. |

| Structure & Characterization | Well-defined, known chemical structure; can be fully analyzed and characterized.18 | Complex, heterogeneous mixture; difficult or impossible to fully characterize all components.14 | Patent claims for biologics can be functional (claiming what the molecule does) in addition to structural, making them harder for competitors to definitively design around. Proving “identity” for a biosimilar is impossible, necessitating a higher regulatory bar. |

| Manufacturing | Chemical synthesis; robust, predictable, and easily replicable process.16 | Produced in living cell cultures; highly sensitive to process changes; proprietary (“the process is the product”).18 | Manufacturing process patents are a primary and exceptionally powerful tool for extending biologic exclusivity, as competitors must develop their own non-infringing process to produce a highly similar molecule. |

| Stability | Generally stable at room temperature; long shelf life.22 | Often heat-sensitive and susceptible to microbial contamination; requires refrigeration (“cold chain”).14 | Patents on novel formulations that improve stability, reduce aggregation, or extend shelf life are a key area for secondary patenting and lifecycle management. |

| Administration | Frequently administered orally as pills or tablets.20 | Typically administered via injection or intravenous infusion due to degradation in the digestive system.20 | Patents covering delivery devices (e.g., auto-injector pens with specific usability features) become a critical and highly defensible component of a patent thicket. |

| Follow-on Products | Generics: Chemically identical copies approved via a simple bioequivalence pathway.17 | Biosimilars: “Highly similar” but not identical copies approved via a complex, data-intensive comparability pathway.15 | The higher scientific, regulatory, and financial bar for biosimilar approval creates a natural barrier to entry, which is then amplified and extended by strategic IP portfolio management. |

Section 2: The Foundation of Exclusivity: Navigating the BPCIA Framework

Before the first patent is ever filed, the commercial lifespan of a new biologic is governed by a foundational set of rules laid out in the Biologics Price Competition and Innovation Act (BPCIA). Enacted in 2010 as part of the Affordable Care Act, the BPCIA was a landmark piece of legislation designed to strike a delicate balance: providing robust incentives for the immense investment required to develop novel biologics while simultaneously creating a pathway for lower-cost biosimilars to enter the market and foster competition.31 Understanding the specific, patent-independent exclusivity periods established by the BPCIA is the essential first step in any lifecycle management strategy, as these timelines create the baseline clock that all subsequent patent-based extensions seek to modify and prolong.

The BPCIA’s Dual Mandate: Innovation and Competition

Prior to 2010, no abbreviated pathway for approving follow-on versions of biologics existed in the United States.34 This meant that once a biologic’s patents expired, there was no clear mechanism for competitors to enter the market, effectively granting many biologics an indefinite monopoly. The BPCIA was created to solve this problem, drawing inspiration from the success of the 1984 Hatch-Waxman Act, which created the modern generic drug industry for small molecules.31

The Act’s central purpose is twofold. First, to encourage continued innovation, it grants originator biologics a substantial, guaranteed period of market protection, free from biosimilar competition. Second, to increase patient access and reduce healthcare costs, it establishes a rigorous but abbreviated approval pathway for biosimilars, allowing them to rely in part on the safety and efficacy data of the original product, thereby avoiding the need to conduct duplicative and costly clinical trials.33

The 12-Year Reference Product Exclusivity: The Cornerstone Protection

The most powerful incentive granted by the BPCIA is the 12-year period of reference product exclusivity.30 This provision is the cornerstone of a biologic’s market protection. It dictates that the FDA may not license a biosimilar application until 12 years have passed from the date on which the innovator’s product—the “reference product”—was

first licensed under section 351(a) of the Public Health Service Act.37

This 12-year monopoly is a hard stop, operating entirely independently of the innovator’s patent portfolio. Even if every single patent protecting a biologic were to expire or be invalidated on day one, a biosimilar could not be approved and launched until this 12-year clock has run its course. This provides a critical baseline of certainty for innovators, guaranteeing them over a decade to recoup their R&D investments.

The 4-Year Data Exclusivity: A Strategic Head Start

In addition to the 12-year market exclusivity, the BPCIA provides a shorter, 4-year period of data exclusivity.37 This rule prevents a biosimilar developer from even

submitting an abbreviated Biologics License Application (aBLA) to the FDA for review until four years after the reference product’s date of first licensure. This provision effectively gives the innovator a strategic head start, preventing would-be competitors from initiating the regulatory review process during the first third of the exclusivity period and ensuring that the innovator’s commercial and lifecycle management teams have ample time to prepare their defensive strategies.

The Nuance of “First Licensure”

A critical and deliberately crafted limitation within the BPCIA is the definition of “first licensure.” The 12-year exclusivity clock is triggered only by the very first approval of a novel biologic. It does not reset for subsequent approvals of the same product for new indications, different dosing schedules, or minor modifications to its formulation or delivery device that do not result in a change to the product’s fundamental safety, purity, or potency.30 This is a key anti-evergreening provision designed to prevent companies from making incremental changes to their products simply to gain a new 12-year period of exclusivity. This forces innovators to rely on their patent portfolio to protect such follow-on innovations, a central theme of lifecycle management.

First Interchangeable Exclusivity: An Incentive for Challengers

The BPCIA also created an incentive for biosimilar developers. The first biosimilar product to be designated as “interchangeable”—meaning it can be substituted for the reference product at the pharmacy level without prescriber intervention—is granted its own 1-year period of market exclusivity.30 During this year, the FDA cannot approve any other biosimilar application for an interchangeable version of the same reference product. This rewards the significant additional investment required to conduct the switching studies needed to prove interchangeability and encourages robust competition among biosimilar manufacturers themselves.

The Purple Book: The Official Ledger of Exclusivity

To provide transparency and clarity to this complex system, the FDA maintains the “Lists of Licensed Biological Products with Reference Product Exclusivity and Biosimilarity or Interchangeability Evaluations,” more commonly known as the Purple Book.35 Analogous to the Orange Book for small-molecule drugs, the Purple Book is a publicly accessible, searchable online database that serves as the definitive resource for biologic exclusivity information.43 For any given biologic, the Purple Book lists its date of licensure, whether it is a reference product, biosimilar, or interchangeable, and, most importantly, the date that its 12-year reference product exclusivity expires.38 This database is an indispensable tool for both innovator and biosimilar strategists, providing the official timeline that governs all market entry calculations.

The BPCIA’s creation of a long, fixed, and predictable 12-year exclusivity period was intended to provide innovators with the security needed to invest in high-risk R&D. However, this very predictability has had an unintended strategic consequence. By establishing a clear, long-range timeline for when regulatory protection would end, the Act inadvertently provided a perfect framework for innovator companies to plan and execute multi-decade patent lifecycle management strategies. Knowing with certainty that the primary non-patent barrier to competition would fall at the 12-year mark, IP and R&D teams could systematically file waves of secondary patents—on new formulations, manufacturing processes, and methods of use—over the course of a decade. This allows them to construct a formidable “patent wall” timed to become legally relevant precisely when the 12-year regulatory exclusivity expires.48 Thus, a feature designed to provide clarity and security for innovators also became a strategic blueprint for building the very patent thickets that can challenge the BPCIA’s pro-competitive goals, transforming patent strategy from a near-term defense into a long-term siege preparation.

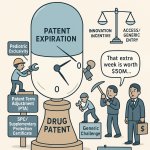

Section 3: Restoring Time: Strategic Use of Patent Term Extension and Adjustment

While the BPCIA’s 12-year exclusivity provides a foundational, patent-independent monopoly, the patent system itself offers powerful mechanisms to extend the life of the intellectual property that underpins a biologic’s value. The two most important of these are Patent Term Extension (PTE) and Patent Term Adjustment (PTA). These provisions are designed to compensate patent holders for administrative delays that erode the effective life of a patent—delays caused by the lengthy regulatory review at the FDA and by procedural slowdowns at the USPTO. For a strategic IP team, these are not passive entitlements but active tools to be managed and optimized to add valuable months or years to a product’s protected commercial life.

Patent Term Extension (PTE): Recapturing Time Lost to FDA Review

Patent Term Extension, governed by 35 U.S.C. § 156, was established by the Hatch-Waxman Act of 1984 to address a fundamental inequity: a significant portion of a patent’s 20-year term is often consumed by the rigorous clinical testing and regulatory review required by the FDA before a product can be marketed.51 PTE allows the patent owner to restore some of this lost time.

Eligibility and the “Active Ingredient” Challenge

To be eligible for PTE, a patent must claim the approved product itself, a method of using the product, or a method of manufacturing the product.52 A critical and often-litigated requirement is that the PTE is available only for the patent covering the

first permitted commercial marketing or use of a product’s “active ingredient”.54

For small-molecule drugs, defining the active ingredient is relatively straightforward. For biologics, however, this can be a complex and contentious issue, particularly for cutting-edge therapies. For example, in the case of a CAR-T cell therapy like YESCARTA®, which involves genetically engineering a patient’s own T cells, the USPTO has grappled with whether the “active ingredient” is the variable patient cells or the consistent, engineered chimeric antigen receptor (CAR) protein.54 This ambiguity presents both challenges and strategic opportunities for innovators of novel biologic platforms, as a favorable definition of a “new” active ingredient can open the door to a valuable PTE for a follow-on product.

The PTE Calculation

The length of the extension is calculated based on the “regulatory review period,” but it is not a simple day-for-day restoration. The formula is subject to several important limitations 53:

- The patent term is extended by a period equal to the time the product was in FDA review, plus half the time it was in clinical trials (the “testing period”).

- The calculation is reduced by any period during which the applicant did not act with “due diligence.”

- The total extension granted cannot exceed five years.

- The total remaining patent term after the extension, measured from the date of FDA approval, cannot exceed 14 years.

- Crucially, only one patent can be extended for each approved product.

This “one patent per product” rule makes the selection of which patent to extend a pivotal strategic decision. It is not simply an administrative task of picking the patent with the latest expiration date. Instead, it requires a sophisticated, forward-looking analysis of the entire patent portfolio to determine which patent provides the broadest and most defensible barrier against potential biosimilar design-arounds. A biosimilar competitor will actively seek to circumvent an innovator’s patents. A patent on a specific formulation might be easier to design around than a core patent on a critical manufacturing step.57 A method-of-use patent can sometimes be negated by a competitor using a “skinny label” that omits the patented indication.58 Therefore, the innovator must weigh the scope and strength of each eligible patent. Extending a robust manufacturing process patent that is fundamental to producing the biologic might create a more formidable long-term barrier to entry than extending a narrower formulation patent, even if the latter has a slightly later original expiration date. This decision requires a deep and integrated understanding of the legal, R&D, and commercial landscapes.

Patent Term Adjustment (PTA): Compensating for USPTO Delays

While PTE addresses delays at the FDA, Patent Term Adjustment addresses delays at the patent office itself. Governed by 35 U.S.C. § 154, PTA was established to ensure that applicants receive the full benefit of their 20-year patent term by adding back, day-for-day, time lost due to certain administrative delays during the prosecution of the patent application at the USPTO.59

Types of USPTO Delays

PTA is calculated based on three types of delays, known as “A,” “B,” and “C” delays:

- “A” Delay: This accrues if the USPTO fails to meet specific deadlines, such as issuing a first office action within 14 months of filing or responding to an applicant’s reply within 4 months.59

- “B” Delay: This is triggered if the total time to prosecute a patent application exceeds three years from its filing date. This “three-year guarantee” is a key provision protecting applicants from protracted examination periods.59

- “C” Delay: This accounts for delays caused by secrecy orders, interference proceedings, or successful appeals to the Patent Trial and Appeal Board (PTAB) or federal courts.59

The total PTA is the sum of these delays, but with an important caveat: any period of delay that is attributable to the applicant is subtracted from the total adjustment.60 This “applicant delay” provision includes actions like failing to respond to an office action in a timely manner, requesting extensions, or filing late papers. This creates a strong incentive for applicants to prosecute their applications efficiently to maximize their potential PTA.

Recent research has highlighted that errors in PTA calculation are not uncommon, sometimes resulting in pharmaceutical companies receiving excess patent term, which can improperly delay generic competition and cost consumers hundreds of millions of dollars.61 This underscores the importance for all stakeholders—innovators, biosimilar developers, and investors—to carefully verify PTA calculations.

Section 4: The Art of Stacking: Layering Pediatric and Orphan Drug Exclusivities

Beyond the foundational BPCIA framework and patent term restoration mechanisms lie two powerful, indication-specific forms of exclusivity that can be strategically layered on top of existing protections to create a longer and more durable period of market monopoly. Pediatric Exclusivity and Orphan Drug Exclusivity are not automatic; they are earned by conducting specific clinical research that serves important public health goals. For the biopharmaceutical strategist, however, they represent invaluable tools for lifecycle management, capable of adding critical months or years of revenue to a blockbuster biologic’s commercial life.

Pediatric Exclusivity (PED): The Six-Month Bonus

The U.S. has long sought to encourage the study of medicines in children to ensure safe and effective dosing, as many drugs were historically only tested in adults. To incentivize this research, the FDA can issue a formal “Written Request” to a company to conduct specific pediatric studies for one of its products.62 If the company completes these studies to the FDA’s satisfaction, it is rewarded with Pediatric Exclusivity (PED).

The power of PED lies in its unique “stacking” ability. Unlike other exclusivities that often run concurrently with the main patent term, the six-month pediatric extension is tacked onto the end of all other existing patent and regulatory exclusivities that a drug holds for its active moiety.30

This makes it the most potent “pure” extension mechanism available. A company can secure its 12-year BPCIA reference product exclusivity and then add six months, resulting in a guaranteed 12.5-year monopoly, completely independent of its patent status.65 This extension applies to all of the applicant’s approved formulations and indications containing the same active ingredient, not just the one that was studied in the pediatric population.63 This transforms the decision to conduct a pediatric trial from a purely clinical or ethical consideration into a core component of financial lifecycle management. The multi-million-dollar investment in the trial can be directly weighed against the projected revenue from six additional months of monopoly sales for a blockbuster biologic, making it a clear and quantifiable return on investment calculation for business development and portfolio teams.

Orphan Drug Exclusivity (ODE): The Seven-Year Shield for Rare Diseases

The Orphan Drug Act of 1983 was created to stimulate the development of treatments for rare diseases and conditions, which are defined as those affecting fewer than 200,000 people in the United States.30 Because the small patient populations for these “orphan” diseases might not allow a company to recover its R&D costs, the Act provides several incentives, the most significant of which is Orphan Drug Exclusivity (ODE).

Upon receiving FDA approval for a designated orphan indication, a biologic is granted seven years of market exclusivity for that specific indication only.69 During this period, the FDA is barred from approving another sponsor’s application for the

same drug for the same rare disease or condition, unless the new product is shown to be “clinically superior” to the original.67

For biologics, ODE typically runs concurrently with the broader 12-year BPCIA exclusivity. While the 12-year protection is more powerful because it blocks all biosimilars for all indications, ODE can serve as a crucial fallback protection. If the 12-year BPCIA term were to be shortened by legislation, or if a company’s patents covering other, non-orphan indications were successfully challenged, the 7-year ODE would still protect the revenue stream from that specific rare disease indication, providing a valuable layer of strategic defense.

A Guide to U.S. Biologic Exclusivity Stacking

The interplay between these various patent-based and regulatory exclusivities is complex. The following table provides a strategic map for understanding how these different layers of protection can be combined to construct a comprehensive and extended period of market exclusivity.

| Exclusivity Type | Duration | Trigger | Key Strategic Feature |

| BPCIA Reference Product | 12 years | First licensure of the biologic | The foundational, patent-independent monopoly period that serves as the baseline for all lifecycle planning.34 |

| Orphan Drug (ODE) | 7 years | FDA approval for a designated orphan indication | Runs concurrently with BPCIA exclusivity; provides a durable shield for a specific high-value indication even if broader protections are lost.69 |

| Pediatric (PED) | 6 months | Completion of FDA-requested pediatric studies | Tacks onto the end of ALL other existing exclusivities and patent terms, making it a pure and highly valuable “extension” of the final monopoly expiration date.12 |

| Patent Term Extension (PTE) | Up to 5 years (capped at 14 years total post-approval) | FDA approval of the product | Restores patent life lost during regulatory review to a single, strategically chosen patent, often extending protection beyond the 12-year BPCIA term.53 |

| First Interchangeable | 1 year | Approval of the first interchangeable biosimilar | An incentive for the biosimilar developer, not the innovator, which can briefly delay competition from other interchangeable products.30 |

Section 5: Building the Fortress: The Architecture of a Modern Patent Thicket

In the modern biopharmaceutical landscape, the strategy for maximizing market exclusivity has evolved far beyond relying on a single patent for a core molecule. The most sophisticated, effective, and controversial strategy employed by innovator companies is the construction of a “patent thicket.” This is not merely a collection of patents but a deliberately engineered, dense, and overlapping web of intellectual property rights designed to protect a single blockbuster product. The strategic objective of a patent thicket is to create a legal and financial fortress so complex, so costly, and so time-consuming to navigate that would-be biosimilar competitors are deterred from even attempting a siege, thereby extending the innovator’s monopoly for years beyond the expiration of the foundational patent.

Defining the Patent Thicket: A Strategy of Attrition

A patent thicket is a “dense web of overlapping intellectual property rights that a company must hack its way through in order to actually commercialize new technology”.71 In the pharmaceutical context, it manifests as the accumulation of dozens, or even hundreds, of patents covering a multitude of features of a single drug.73 The power of this strategy lies not in the unassailable strength of any individual patent, but in the collective, prohibitive weight of the entire portfolio.75

The goal is to shift the competitive battleground. Instead of a single, high-stakes “war” over the validity of a primary patent, the innovator creates a multi-front, attritional “campaign” that drains the resources, capital, and resolve of a biosimilar challenger. The innovator does not need to win every legal battle; it only needs to make the overall cost of the campaign prohibitively high for the attacker. This creates a profound legal and financial asymmetry. The cost to develop a biosimilar is already substantial, ranging from $100 million to $300 million.2 Litigating against a thicket of dozens of patents, where each individual challenge can cost millions, multiplies this financial burden exponentially.77 The biosimilar developer must successfully “clear the path” by invalidating or designing around

every single asserted patent to launch its product without risk of a catastrophic infringement judgment.79 The innovator, funded by the monopoly profits of the very drug it is defending, needs only

one of its patents to be upheld to block market entry. This dynamic pressures biosimilar challengers into accepting settlement agreements with delayed entry dates, allowing the innovator to achieve its strategic goal of extending its monopoly.

The Building Blocks: Primary vs. Secondary Patents

The construction of a patent thicket relies on the strategic layering of two distinct categories of patents: primary and secondary.73

Primary Patents: The Foundation

Primary patents are the foundational IP for a new medicine. They cover the core innovation—typically the active pharmaceutical ingredient (API) or, in the case of a biologic, the composition of matter of the core molecule or protein sequence that produces the therapeutic effect.73 These patents are filed early in the development process and provide the initial 20-year period of protection that is essential for securing investment and undertaking costly clinical trials.

Secondary Patents: The Bricks and Mortar of the Fortress

Secondary patents are the true components of the thicket. They are filed later in a drug’s lifecycle, often years after it has been approved by the FDA, and target a wide array of peripheral, incremental, or follow-on innovations related to the original drug.73 While innovators argue these patents protect genuine improvements that benefit patients, critics contend they are often non-inventive and are filed primarily to obstruct competition—a practice known as “evergreening”.73 The key types of secondary patents used to build a biologic patent thicket include:

- Formulation Patents: These are among the most common and effective secondary patents. They do not claim the biologic molecule itself but rather the specific recipe used to make the final drug product stable and administrable. Claims can cover specific excipients, buffers (e.g., a citrate-free formulation to reduce injection pain), stabilizers, or specific high-concentration versions of the drug.81

- Method-of-Use Patents: These patents claim a specific method of using the biologic to treat a particular disease or patient population. As a blockbuster biologic is approved for new indications over its lifecycle, the innovator files new method-of-use patents for each one. They can also cover specific dosing regimens, such as a particular loading dose followed by a maintenance dose, or a switch from weekly to bi-weekly administration.84

- Manufacturing Process Patents: Given the “product is the process” paradigm, these patents are uniquely powerful for biologics. They can cover any number of specific steps in the complex biomanufacturing process, such as the specific host cell line used, the composition of the cell culture media, novel protein purification steps, or analytical methods used for quality control.3 A robust portfolio of process patents can be exceptionally difficult for a biosimilar developer to design around.

- Device Patents: Because most biologics are injected, patents on the delivery device are a critical layer of the thicket. These can cover features of an auto-injector pen or a pre-filled syringe that improve ease of use, reduce pain, or enhance safety.48 As innovators launch “new and improved” versions of their delivery devices, they file new patents that can block competitors who may be developing a biosimilar for the original device.

By strategically filing dozens of these secondary patents over many years, an innovator company can construct a legal fortress around its blockbuster biologic, ensuring that even after the primary patent expires and the 12-year BPCIA exclusivity ends, a long and costly siege through the courts awaits any competitor who dares to challenge its monopoly.

Section 6: The Thicket in Action: Landmark Case Studies

The strategic concepts of patent thickets and layered exclusivities are best understood not in theory, but through their real-world application. The histories of the world’s best-selling biologic drugs provide a series of powerful case studies that illustrate precisely how these strategies are executed and the multi-billion-dollar impact they have on markets, competitors, and healthcare systems. The divergent outcomes for the same drugs in the United States versus Europe, in particular, offer a stark demonstration of the power of the American patent thicket.

Case Study 1: Humira (adalimumab) – The Masterclass in Thicket Strategy

AbbVie’s Humira, a monoclonal antibody for treating autoimmune diseases, is the quintessential example of a successful patent thicket strategy. It became the world’s best-selling drug, and its extended monopoly in the U.S. serves as a masterclass in lifecycle management.

- The Thicket’s Architecture: AbbVie constructed an unparalleled legal fortress around Humira, filing over 247 patent applications in the U.S. and securing at least 132 granted patents.50 The timing of these filings is revealing: a staggering 89% of the patent applications were filed

after Humira was first approved by the FDA in 2002. Nearly half of the total applications were filed between 2014 and 2018, more than a decade into the drug’s commercial life, indicating a deliberate strategy to create a wall of late-expiring patents.50 The portfolio covered every conceivable aspect of the product, including dozens of method-of-treatment patents for its numerous indications and multiple patents on high-concentration, citrate-free formulations designed to reduce injection pain.57 - Litigation and Settlement Strategy: With its fortress in place, AbbVie aggressively enforced its patents. As biosimilar manufacturers began to seek FDA approval, AbbVie initiated litigation, leveraging the BPCIA framework to assert its massive portfolio. Ultimately, this strategy proved successful not by winning every case in court, but by forcing competitors into settlements. AbbVie reached agreements with nine different biosimilar manufacturers, granting them licenses to its IP in exchange for a staggered and delayed entry into the U.S. market, beginning in 2023.87

- The U.S. vs. Europe Disparity: The strategic impact of this U.S.-centric patenting approach is most evident when contrasted with the situation in Europe. AbbVie filed over three times as many patent applications in the U.S. as it did at the European Patent Office.88 As a result, with a much thinner patent portfolio to navigate, biosimilars launched in Europe in October 2018, more than four years earlier than their U.S. counterparts.92

- Financial Impact: The consequences of this disparity are monumental. In Europe, the entry of multiple biosimilars led to intense price competition, with the price of adalimumab plummeting by as much as 80% in some national markets.92 In the U.S., AbbVie maintained its monopoly pricing for over four additional years. This extended monopoly is estimated to have cost the American healthcare system tens of billions of dollars in lost savings.79 In 2019 alone, Humira’s U.S. sales were $14.9 billion, while its European sales, facing biosimilar competition, had fallen to $4.3 billion from $6.3 billion the prior year.87

The following table provides a stark, side-by-side comparison of the Humira case, illustrating how a divergent patent strategy led to dramatically different outcomes for patients and payers on opposite sides of the Atlantic.

| Metric | United States | European Union |

| Number of Patent Applications | ~247 50 | Significantly fewer (~1/3 of U.S. total) 88 |

| Primary Patent Expiration | 2016 97 | 2018 (including SPC) 95 |

| Biosimilar Market Entry | January 2023 92 | October 2018 93 |

| Years of Delay Post-Primary Patent Expiry | ~7 years | ~0 years |

| Resulting Price Impact | Maintained monopoly pricing until 2023 | Price reductions of up to 80% after 2018 95 |

| Estimated Cost to Healthcare System | Billions in excess costs due to delayed competition 79 | Billions in savings from early competition 94 |

Case Study 2: Enbrel (etanercept) – The Multi-Decade Monopoly

Amgen’s Enbrel, another blockbuster anti-inflammatory biologic, provides a different but equally compelling case study in extending exclusivity, this time through successful, high-stakes litigation that will ultimately provide the drug with an astonishing 31 years of market protection in the U.S.

- The Thicket and Key Patents: Amgen built a formidable patent estate around Enbrel, filing a total of 57 patent applications, with 72% of them filed after the drug’s initial FDA approval in 1998.98 The linchpin of their long-term strategy, however, rested on two key patents acquired from Roche (U.S. Patent Nos. 8,063,182 and 8,163,522) related to the fusion protein and its manufacturing process. Due to a quirk in pre-TRIPS patent law, these patents were granted exceptionally long terms, not set to expire until 2029.98

- Litigation Success: When Sandoz and Samsung Bioepis developed biosimilar versions of Enbrel and challenged the validity of these key patents, Amgen went on the offensive. In a series of court battles culminating in 2021, Amgen successfully defended the validity of the ‘182 and ‘522 patents at the district court level, won the subsequent appeal at the Federal Circuit, and saw the Supreme Court decline to hear the case, thereby cementing its patent protection through 2029.98

- Financial Impact: This legal victory has been immensely lucrative. While Enbrel biosimilars have been available in Europe since 2016, leading to a dramatic decline in Pfizer’s ex-U.S. sales, Amgen’s U.S. monopoly remains intact.99 In 2020, Amgen reported nearly $5 billion in Enbrel revenues, almost all of which came from the U.S. market, a revenue stream that is now protected for nearly another decade.101

Case Study 3: Avastin (bevacizumab) – The Post-Exclusivity Reality

Roche’s cancer therapy Avastin offers a clear view of what happens when the patent fortress is finally breached and biosimilar competition begins in earnest.

- Biosimilar Entry: Avastin’s key patents expired, and the first biosimilars, Amgen’s Mvasi and Pfizer’s Zirabev, entered the U.S. market in 2019.106

- Market Impact: The effect on Roche’s revenue was immediate and significant. Global sales of Avastin, which had peaked at $7.1 billion in 2019, began a steep decline.107 In 2020, the first full year of U.S. competition, Avastin sales dropped by 37%, contributing to a $5.6 billion revenue loss for Roche across its three major biologics facing biosimilar entry.108 By the first quarter of 2022, Avastin sales had fallen another 32% compared to the prior year.109

- Savings and Uptake: The entry of biosimilars has generated substantial savings. One analysis found that bevacizumab biosimilars offered an average sales price (ASP) discount of 49% relative to the reference product.110 This price pressure has driven rapid uptake, with biosimilars capturing a significant share of the bevacizumab market and expanding patient access to this critical oncology treatment.106 The Avastin case vividly illustrates the financial stakes of the patent cliff and validates the BPCIA’s goal of fostering competition to lower drug costs.

Section 7: The Innovator’s Playbook: Integrating IP and Corporate Strategy

For an innovator biopharmaceutical company, maximizing market exclusivity is not a task confined to the legal department. It is a core business function that must be deeply integrated with R&D, business development, and commercial strategy from the earliest stages of discovery. The modern approach treats patent data not as a static legal archive but as a dynamic, profoundly rich source of competitive, scientific, and commercial intelligence—a strategic compass for navigating the high-risk, high-reward landscape of biologic development.112

“Today, patents are unequivocally recognized as far more than mere legal instruments. They are strategic business assets that fundamentally dictate market exclusivity, drive investment decisions, and ultimately shape the availability of life-saving medicines…. Mastering the art of patent defense is not merely a legal necessity; it is a strategic imperative for survival and market domination.” 115

Leveraging Patent Intelligence Platforms

Executing a sophisticated, data-driven IP strategy requires powerful tools. Specialized competitive intelligence platforms like DrugPatentWatch have become indispensable for innovator teams. These platforms aggregate and curate vast amounts of data from disparate sources—including global patent offices, regulatory agencies like the FDA, clinical trial registries, and court dockets—and transform it into actionable business intelligence.116 Innovator companies leverage these tools to:

- Monitor the Competitive Landscape: Continuously track the patent filings, clinical trial progress, and regulatory submissions of competitors. This provides an early warning system for emerging threats and reveals the strategies rivals are employing, allowing for proactive adjustments to one’s own portfolio.116

- Identify “White Space” and Guide R&D: Patent landscape analysis can reveal which biological targets or therapeutic mechanisms are heavily patented (“crowded”) and which are relatively unexplored (“white space”).114 This intelligence is invaluable for guiding R&D investment toward novel areas with a higher probability of securing strong, foundational patents and facing less competition.

- De-Risk R&D Investments: Before committing hundreds of millions of dollars to preclinical and clinical development, companies can use patent analytics to assess the patentability of a new biologic candidate. This early-stage due diligence helps prevent catastrophic misallocations of resources into projects that are likely to be blocked by existing patents or fail to meet the criteria for patentability.120

- Inform Lifecycle Management and Thicket Construction: By tracking the expiration dates of their own foundational patents and monitoring the development activities of potential biosimilar challengers, innovator companies can strategically time the filing of secondary patents on new formulations, manufacturing processes, and methods of use to construct a defensive patent thicket that will mature just as it is needed.10

Valuing a Patent Estate for M&A and Licensing

The strength of a biologic’s patent estate is a primary driver of its valuation in mergers, acquisitions, and licensing negotiations. Business development teams and potential partners or acquirers conduct rigorous IP due diligence that goes far beyond simply counting the number of patents. The assessment focuses on the strategic quality and defensibility of the portfolio.3 Key valuation questions include:

- Strength of Core Patents: Does the portfolio contain a robust, granted composition of matter patent in key commercial markets?

- Breadth of Claims: Are the patent claims broad enough to prevent competitors from easily “designing around” them, or are they narrow and vulnerable?

- Defensibility: How likely are the key patents to withstand a validity challenge, such as an Inter Partes Review (IPR), based on the prior art?

- Strategic Layers: Does the portfolio include a strategic mix of secondary patents (formulation, process, method-of-use) that create a multi-layered defense?

Financial models like the risk-adjusted net present value (rNPV) method are often used to quantify this assessment. This approach forecasts a product’s future revenue and then applies success probabilities at each stage of development and for key legal challenges, directly linking the strength of the IP to the asset’s financial value.122

Building a Proactive and Integrated Portfolio

The most successful innovators have abandoned a reactive, siloed approach to IP. The best practice today is a fully integrated model where the IP strategy team is embedded with R&D and business development from day one.112 This proactive approach involves:

- Strategic Filing: Instead of only patenting the final lead molecule, the team patents related compounds, potential metabolites, and alternative mechanisms of action to create a protective buffer around the core innovation.

- Portfolio Diversification: The strategy deliberately seeks to secure protection for every aspect of the product: the active ingredient, multiple formulations, the manufacturing process, delivery devices, and diagnostic methods. This creates multiple, independent layers of protection that a competitor must overcome.123

- Dynamic Management: The patent portfolio is treated as a living asset, not a static archive. It is regularly audited to ensure alignment with business goals. Patents that no longer serve a strategic purpose are pruned to free up resources, while new filings are targeted to protect emerging innovations and strengthen the competitive position of key commercial products.121

In this modern paradigm, the patent attorney is not just a scribe documenting an invention after the fact, but a core strategic partner who helps shape the entire innovation lifecycle, influencing which scientific avenues are pursued and which business development deals are necessary to secure long-term market leadership.

Section 8: The Challenger’s Gambit: Biosimilar Strategies for Clearing the Path

While the innovator builds a fortress, the biosimilar developer plots a siege. The path to launching a successful biosimilar is fraught with scientific, regulatory, and legal obstacles. Overcoming the innovator’s patent thicket is the central strategic challenge, requiring a multi-pronged approach that combines meticulous intelligence gathering, clever scientific design, and calculated legal aggression. For the biosimilar developer, success is not just about creating a highly similar molecule; it’s about clearing a viable path to market through a minefield of intellectual property.

Freedom-to-Operate (FTO) Analysis: The Critical First Step

Before significant resources are committed to development, every biosimilar project begins with an exhaustive Freedom-to-Operate (FTO) analysis.57 This is a deep and ongoing investigation to identify and assess every patent and published patent application that could potentially be infringed by the proposed biosimilar product or its manufacturing process. The FTO analysis serves as the strategic map for the entire development program, identifying the “blocking patents” that constitute the innovator’s fortress. This process must be dynamic, as innovator companies often have pending patent applications that they can amend to specifically target a competitor’s emerging process or formulation.57 The FTO analysis culminates in a formal legal opinion on non-infringement or invalidity, which is crucial for internal decision-making, securing investor confidence, and defending against potential charges of “willful infringement” in future litigation.

“Clearing the Path”: Strategies for Overcoming Blocking Patents

Once the patent landscape is mapped, the biosimilar developer employs several active strategies to clear the obstacles.

Designing Around Patents

The most elegant and scientifically intensive strategy is to “design around” the innovator’s patents.57 This involves a close collaboration between R&D and IP teams to develop a product or process that falls outside the literal scope of the innovator’s patent claims while still meeting the FDA’s strict requirements for biosimilarity. For example, if an innovator has a patent on a specific citrate-based formulation, a biosimilar developer might engineer a new, equally stable formulation using a non-patented histidine buffer. Similarly, a developer might create a novel, multi-step purification process that avoids infringing on the innovator’s patented manufacturing methods. This strategy requires significant innovation from the biosimilar developer and can, in turn, lead to its own patentable inventions.

Challenging Patent Validity

When designing around is not feasible, the developer must go on the offensive to invalidate the innovator’s patents.

- Inter Partes Review (IPR): The IPR process is a powerful tool for biosimilar challengers. It is a trial-like proceeding before the technically expert administrative patent judges of the USPTO’s Patent Trial and Appeal Board (PTAB) to determine a patent’s validity.57 IPRs are significantly faster (typically 12-18 months) and less expensive than district court litigation. They also have a lower burden of proof for invalidating a patent (“preponderance of the evidence”) compared to the “clear and convincing evidence” standard used in federal court.57 Biosimilar developers have frequently used IPRs to successfully invalidate weaker secondary patents, particularly those related to formulations and methods of use, thereby “thinning the thicket” before major litigation begins.

- BPCIA Litigation (The “Patent Dance”): Ultimately, clearing a path to market often requires litigation in federal court. The BPCIA establishes a complex, multi-step process for exchanging patent information and litigating disputes, informally known as the “patent dance”.80 This process is designed to identify the relevant patents and resolve disputes before the biosimilar launches. However, it is a massive and costly undertaking, with legal fees for a full-scale BPCIA litigation running into the tens or even hundreds of millions of dollars.78

The “At-Risk” Launch: A High-Stakes Business Decision

Even after years of development and litigation, some of the innovator’s patents may still be in dispute as the biosimilar’s potential FDA approval date nears. At this point, the biosimilar company may choose to make a high-stakes bet: an “at-risk” launch.57 This involves launching the product commercially while litigation is still pending, based on the company’s confidence that the remaining patents will ultimately be found invalid or not infringed.

The potential upside is enormous: gaining a first-mover advantage, securing favorable contracts with payers, and capturing significant market share. The potential downside is catastrophic. If the company loses the litigation after launching, it could be liable for massive damages, including the innovator’s lost profits, and face a permanent injunction that removes its product from the market. This is a bet-the-company decision that weighs the potential for immense reward against the risk of financial ruin.

Settlement Agreements: The Pragmatic End Game

Given the immense cost, duration, and uncertainty of patent litigation for both sides, the most common outcome of a BPCIA dispute is a settlement agreement.87 In these agreements, the innovator typically grants the biosimilar developer a license to its patent portfolio, allowing market entry on a specific, agreed-upon future date. In return, the biosimilar developer agrees to drop its patent challenges and often pays a royalty to the innovator once it begins selling its product.

The Humira case is a prime example, where AbbVie settled with numerous competitors to allow a staggered U.S. launch schedule beginning in 2023.90 For the biosimilar developer, a settlement provides certainty for investors and a clear, predictable timeline for market entry, which is often preferable to the open-ended risk and expense of fighting a patent thicket to the very end. For the innovator, a settlement preserves the majority of its monopoly period, avoids the risk of having its key patents invalidated in court, and converts a future competitor into a future licensee and royalty source. This dynamic, driven by the immense cost of challenging a patent thicket, has made strategic litigation and settlement negotiation a primary driver of biosimilar market entry timing, often superseding the actual expiration dates of the patents themselves.

Section 9: The Shifting Battlefield: The Future of Biologic Exclusivity

The strategic landscape of biologic market exclusivity is not static. It is a dynamic battlefield shaped by evolving legislation, disruptive technologies, and shifting public policy priorities. The intense scrutiny on high drug prices and the controversial success of patent thicket strategies have spurred a wave of proposed reforms aimed at recalibrating the balance between innovation and competition. Simultaneously, rapid advancements in fields like artificial intelligence and biomanufacturing are poised to redefine what is patentable, creating new opportunities and challenges for both innovators and biosimilar developers. The most successful companies in the coming decade will be those that not only master the current playbook but also anticipate and adapt to these transformative changes.

Legislative and Regulatory Reforms: Thinning the Thicket

There is significant political and public pressure to address the use of patent thickets to delay biosimilar competition. Several legislative and regulatory reforms have been proposed to “thin the thicket” and accelerate market entry for lower-cost alternatives.34

- Capping Asserted Patents: A leading proposal, embodied in bills like the Affordable Prescriptions for Patients Act, is to place a cap on the number of patents an innovator can assert against a biosimilar developer in BPCIA litigation. The current proposal sets this cap at 20 patents.130 The goal is to prevent innovators from overwhelming challengers with a sheer volume of litigation, forcing them to focus their legal arguments on their most significant and inventive patents. However, critics argue that such a cap may have a limited effect, as many BPCIA cases already involve fewer than 20 asserted patents by the time they reach trial, and the proposal does not limit the number of patents exchanged during the earlier, resource-intensive “patent dance”.130

- Increasing Transparency: Another key area of reform focuses on increasing transparency. Proposals have been made to amend the BPCIA to require innovator companies to publicly list all patents they believe cover a biologic product in the FDA’s Purple Book, similar to the requirement for the Orange Book for small-molecule drugs.133 This would provide biosimilar developers with greater clarity and certainty much earlier in their development process, reducing the risk of being surprised by newly asserted patents late in the game.

- Reforming the “Patent Dance”: Other proposals aim to adjust the incentives within the BPCIA’s litigation framework itself. These include allowing biosimilar developers to initiate patent challenges earlier in their development cycle (e.g., at the start of Phase 3 trials) to resolve disputes sooner, and creating stronger disincentives for parties that do not engage in the information exchange process in good faith.131

The Impact of New Technologies on Patent Strategy

While legislators seek to reshape the legal framework, technology is simultaneously reshaping the scientific one, creating new frontiers for patenting.

- Artificial Intelligence (AI) in Drug Discovery: The increasing use of AI and machine learning to predict drug-target interactions, design novel proteins, and optimize clinical trials is set to have a profound impact on patent law.120 A central question in patent law is whether an invention is “non-obvious” to a “person having ordinary skill in the art” (PHOSITA). As AI systems become the new standard for a PHOSITA, capable of analyzing vast datasets to predict outcomes, the bar for what is considered a truly inventive and non-obvious discovery will inevitably rise.120 Securing a patent in an AI-driven future may require demonstrating a level of human ingenuity that goes beyond what a standard algorithm could predictably generate, pushing R&D efforts toward more genuinely groundbreaking science.

- Advanced Manufacturing and Process Innovation: New biomanufacturing technologies, such as continuous processing and the use of single-use bioreactors, are creating new avenues for process patenting.135 For innovators, these advancements offer opportunities to create next-generation manufacturing platforms that are more efficient and can be protected by a new layer of patents. For biosimilar developers, these same technologies provide powerful tools for “designing around” an innovator’s existing manufacturing patents, allowing them to create novel, non-infringing processes to produce their biosimilar products.132

The future of biologic IP strategy will be defined by this dual dynamic. On one side, legislative and regulatory forces will likely seek to curtail the use of large volumes of low-quality secondary patents to extend monopolies. On the other, technological progress will continuously open up new and complex domains of high-quality, patentable subject matter. The companies that thrive will be those that can adapt to this new paradigm, shifting their strategic focus from the sheer quantity of patents in their thicket to the quality, defensibility, and true inventiveness of their IP in these emerging technological fields. The fortress of the future will likely be built with fewer, but far stronger and more sophisticated, bricks.

Conclusion: The Enduring Value of a Proactive Exclusivity Strategy

The commercial lifecycle of a biologic drug is a high-stakes journey defined by the relentless ticking of the exclusivity clock. Maximizing the duration of market protection is not a matter of chance or a simple administrative process; it is a complex, proactive, and essential corporate function that demands the seamless integration of scientific innovation, legal acumen, and strategic business intelligence. The difference between a well-managed lifecycle and a poorly managed one is measured in billions of dollars of revenue and determines a company’s ability to fund the next wave of medical breakthroughs.

The foundation of this strategy rests on a deep understanding of the unique nature of biologics. Their inherent complexity—the “product is the process” paradigm—creates both challenges and immense opportunities, providing a rich landscape for multi-layered IP protection that simply does not exist for small-molecule drugs. This scientific reality is codified in the BPCIA, which provides a robust 12-year baseline of regulatory exclusivity, a predictable timeline that innovators have skillfully used to plan and build long-term defensive patent portfolios.

A successful exclusivity strategy is an exercise in strategic layering. It begins with the BPCIA’s foundational protection and then meticulously adds other forms of exclusivity. Patent Term Extension and Adjustment are used to reclaim valuable time lost to regulatory and administrative delays. Indication-specific protections like Orphan Drug and Pediatric Exclusivity are pursued not only for their clinical value but for their ability to add durable shields and valuable months of monopoly sales.

At the heart of modern strategy lies the patent thicket—a deliberately constructed fortress of primary and secondary patents covering every conceivable aspect of a product, from its formulation and delivery device to its myriad methods of use and manufacture. As landmark cases like Humira and Enbrel have demonstrated, the strategic purpose of the thicket is to create a formidable litigation barrier, shifting the competitive dynamic from a single battle over one patent to a war of attrition that pressures challengers into settlements and secures years of additional market exclusivity.

Navigating this complex terrain—whether as an innovator building the fortress or a biosimilar developer planning the siege—requires sophisticated, data-driven competitive intelligence. Platforms like DrugPatentWatch have become critical tools, transforming vast patent and regulatory datasets into the strategic foresight needed to guide R&D, de-risk investments, and anticipate competitive moves.

While the legal and technological battlefields are constantly evolving, with legislative reforms seeking to thin the thickets and new technologies creating new ground for patenting, the fundamental economic imperative remains unchanged. The colossal investment required to bring a novel biologic from the lab to the patient necessitates a period of protected return. The companies that will lead the next generation of biopharmaceutical innovation will be those that master the art and science of exclusivity—not as a defensive afterthought, but as a central, driving component of their corporate strategy.

Key Takeaways

- Complexity is a Strategic Asset: The inherent scientific complexity of biologics (“the product is the process”) is the foundation for a multi-layered IP strategy, enabling patents on manufacturing processes, formulations, and delivery devices that are less relevant for small-molecule drugs.

- Exclusivity is Layered: Maximizing market life involves strategically “stacking” different forms of protection. This starts with the BPCIA’s 12-year regulatory exclusivity and is extended through Patent Term Extension (PTE), Patent Term Adjustment (PTA), and, most powerfully, the 6-month Pediatric Exclusivity, which tacks onto the end of all other protections.

- Patent Thickets are a Strategy of Attrition: The primary goal of a patent thicket is not to win every lawsuit, but to make the cost and risk of challenging the entire patent portfolio prohibitively high for a biosimilar developer. This creates a powerful asymmetry that forces challengers into settlements with delayed market entry dates.

- The U.S. vs. Europe Disparity Proves the Thicket’s Power: The case of Humira, which saw biosimilars launch over four years earlier in Europe, provides definitive proof of the U.S. patent thicket’s effectiveness in delaying competition, directly linked to the far greater number of patents filed in the U.S.

- Competitive Intelligence is Non-Negotiable: A proactive exclusivity strategy is impossible without continuous, data-driven competitive intelligence. Platforms like DrugPatentWatch are essential tools for monitoring the landscape, guiding R&D, informing lifecycle management, and executing both innovator and biosimilar strategies.

- The Future is About Quality, Not Just Quantity: The strategic landscape is shifting due to potential legislative reforms aimed at curbing patent thickets and the rise of new technologies like AI. Future success will depend less on the sheer number of patents and more on the quality, defensibility, and true inventiveness of the IP portfolio.

Frequently Asked Questions (FAQ)

1. What is the difference between patent protection and the BPCIA’s 12-year exclusivity?

Patent protection and BPCIA exclusivity are two distinct, complementary pillars of market protection. Patent protection is granted by the USPTO for a specific invention (like a molecule, a manufacturing process, or a method of use) and typically lasts 20 years from the filing date. It can be challenged and invalidated in court. BPCIA exclusivity is a regulatory protection granted by the FDA upon a new biologic’s approval. It provides a guaranteed 12-year period during which the FDA cannot approve a biosimilar version of that product, regardless of the status of any patents. They run in parallel, and a biologic can be protected by both, one, or neither at any given time.

2. Can all the different types of exclusivities (PTE, Pediatric, Orphan) be “stacked” together?

Yes, but they stack in different ways. Orphan Drug Exclusivity (7 years) and the BPCIA’s 12-year exclusivity run concurrently. Patent Term Extension (PTE) restores up to 5 years to a single patent’s term to compensate for FDA review delays, often extending it beyond the 12-year BPCIA period. The most powerful “stacking” mechanism is Pediatric Exclusivity. The 6-month pediatric extension is added to the end of all other applicable patent and regulatory exclusivities a product has. For example, it can turn a 12-year BPCIA exclusivity into a 12.5-year exclusivity.

3. What is a “patent thicket,” and why is it more common for biologics than for small-molecule drugs?

A patent thicket is a dense, overlapping web of dozens or even hundreds of patents protecting a single product. The strategy is to deter competition by creating a prohibitively expensive and complex litigation landscape for challengers. Thickets are more common and effective for biologics for two main reasons. First, the scientific complexity of biologics offers far more patentable subject matter beyond the core molecule, including intricate manufacturing processes, specific formulations to ensure stability, and specialized delivery devices. Second, because the BPCIA created a long and predictable 12-year exclusivity period, it gave innovator companies a decade-long runway to strategically plan and file these numerous secondary patents, timed to create a defensive wall just as regulatory exclusivity expires.

4. Why did Humira biosimilars launch so much earlier in Europe than in the United States?

The primary reason for the more than four-year difference in launch timing was AbbVie’s divergent patent strategy. The company filed over three times as many patent applications for Humira in the U.S. as it did in Europe. This created a massive “patent thicket” in the U.S. that was extremely difficult and costly for biosimilar developers to challenge. In Europe, with a much smaller and less complex patent estate to navigate, biosimilar companies were able to clear the path for market entry shortly after the primary patent and its equivalent extension (the SPC) expired in 2018. In the U.S., the thicket forced competitors into settlement agreements that delayed their launch until 2023.

5. How can a company like mine use a tool like DrugPatentWatch to inform our biologic patent strategy?

A platform like DrugPatentWatch is a critical competitive intelligence tool for any company in the biologics space.

- For Innovators: You can monitor the patent and clinical trial activities of competitors to identify emerging threats and “white space” opportunities for your R&D pipeline. You can also track the development of biosimilars targeting your products, allowing you to proactively manage your patent portfolio and prepare your defensive lifecycle strategy.

- For Biosimilar Developers: You can use it to conduct initial freedom-to-operate (FTO) analysis by accessing comprehensive, curated data on a reference biologic’s patent estate, including accurately calculated expiration dates and litigation history. This helps in assessing the risk and viability of a potential biosimilar project and in identifying the key patents that will need to be challenged or designed around.

- For Investors and Business Development: You can use the platform to conduct due diligence, evaluate the strength of a company’s patent portfolio, forecast revenue events based on patent and exclusivity expirations, and assess the long-term risk profile of a biologic asset.

Works cited

- Research and Development in the Pharmaceutical Industry …, accessed August 18, 2025, https://www.cbo.gov/publication/57126

- The Economics of Biosimilars – PMC, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4031732/

- Securing Innovation: A Comprehensive Guide to Drafting and …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/drafting-drug-patent-applications-for-biologic-drugs/

- Exploring Biosimilars as a Drug Patent Strategy: Navigating the Complexities of Biologic Innovation and Market Access – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/exploring-biosimilars-as-a-drug-patent-strategy-navigating-the-complexities-of-biologic-innovation-and-market-access/

- Filing Strategies for Maximizing Pharma Patents: A Comprehensive …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- Maximizing Drug Patents’ Value: Strategies for Biomedical Companies – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/maximizing-drug-patents-value-strategies-for-biomedical-companies/

- Biologics Market Size, Share & Growth Analysis Report, 2030, accessed August 18, 2025, https://www.grandviewresearch.com/industry-analysis/biologics-market

- Biologics Market Size, Advancements in Monoclonal Antibodies & Beyond – Towards Healthcare, accessed August 18, 2025, https://www.towardshealthcare.com/insights/biologics-market-size

- Biologics Market Size, Share and Trends 2025 to 2034 – Precedence Research, accessed August 18, 2025, https://www.precedenceresearch.com/biologics-market

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- The Impact of Patent Cliff on the Pharmaceutical Industry – Bailey Walsh, accessed August 18, 2025, https://bailey-walsh.com/news/patent-cliff-impact-on-pharmaceutical-industry/

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- Intellectual Property Protection for Biologics – Academic Entrepreneurship for Medical and Health Scientists, accessed August 18, 2025, https://academicentrepreneurship.pubpub.org/pub/d8ruzeq0

- What Are “Biologics” Questions and Answers – FDA, accessed August 18, 2025, https://www.fda.gov/about-fda/center-biologics-evaluation-and-research-cber/what-are-biologics-questions-and-answers

- Biological Product Definitions | FDA, accessed August 18, 2025, https://www.fda.gov/files/drugs/published/Biological-Product-Definitions.pdf

- What Are Biologics and How Are They Used in the Pharmaceutical Industry? – Oakwood Labs, accessed August 18, 2025, https://oakwoodlabs.com/what-are-biologics-and-how-are-they-used-in-the-pharmaceutical-industry/

- What are biologics? Definitions and potential benefits | Bioanalysis Zone, accessed August 18, 2025, https://www.bioanalysis-zone.com/biologics-definition-applications/

- How do Drugs and Biologics Differ? – BIO, accessed August 18, 2025, https://archive.bio.org/articles/how-do-drugs-and-biologics-differ

- Understanding Biologic and Biosimilar Drugs, accessed August 18, 2025, https://www.fightcancer.org/policy-resources/understanding-biologic-and-biosimilar-drugs

- Small Molecules vs. Biologics: Key Drug Differences – Allucent, accessed August 18, 2025, https://www.allucent.com/resources/blog/points-consider-drug-development-biologics-and-small-molecules

- Biologics vs Small Molecules: A New Era in Drug Development, accessed August 18, 2025, https://synergbiopharma.com/biologics-vs-small-molecules/

- Small Molecule vs Biologics – YouTube, accessed August 18, 2025, https://www.youtube.com/watch?v=WCC2dJGX7pQ

- How are biologic medicines different from other drugs? – Amgen Canada, accessed August 18, 2025, https://www.amgen.ca/stories/2022/08/how-are-biologic-medicines-different-from-other-drugs

- biologics, small molecules and cell/gene therapy – Drug Discovery and Development, accessed August 18, 2025, https://www.drugdiscoverytrends.com/an-overview-of-common-drug-types-biologics-small-molecules-and-cell-gene-therapy/

- What are the drugs of the future? – PMC, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6072476/

- Biologics vs Small Molecules %%sep%% – BA Sciences, accessed August 18, 2025, https://www.basciences.com/news/biologics-vs-small-molecules/

- Difference Between Small Molecule and Large Molecule Drugs – Caris Life Sciences, accessed August 18, 2025, https://www.carislifesciences.com/difference-between-small-molecule-and-large-molecule-drugs/

- Small molecules vs. Biologics: Understanding the differences – Pharmaoffer.com, accessed August 18, 2025, https://pharmaoffer.com/blog/small-molecules-vs-biologics-understanding-the-differences/

- Biologics (Biologic Medication & Drugs): What It Is & Types – Cleveland Clinic, accessed August 18, 2025, https://my.clevelandclinic.org/health/treatments/biologics-biologic-medicine

- Biologics, Biosimilars and Patents: – I-MAK, accessed August 18, 2025, https://www.i-mak.org/wp-content/uploads/2024/05/Biologics-Biosimilars-Guide_IMAK.pdf

- “The Biologics Price Competition and Innovation Act 10–A Stocktaking” by Yaniv Heled – Texas A&M Law Scholarship, accessed August 18, 2025, https://scholarship.law.tamu.edu/journal-of-property-law/vol7/iss1/3/

- Biologics Price Competition and Innovation Act of 2009 – Wikipedia, accessed August 18, 2025, https://en.wikipedia.org/wiki/Biologics_Price_Competition_and_Innovation_Act_of_2009

- Biological Product Innovation and Competition – FDA, accessed August 18, 2025, https://www.fda.gov/drugs/biosimilars/biological-product-innovation-and-competition

- Commemorating the 15th Anniversary of the Biologics Price Competition and Innovation Act, accessed August 18, 2025, https://www.fda.gov/drugs/cder-conversations/commemorating-15th-anniversary-biologics-price-competition-and-innovation-act

- The Purple Book – FDA, accessed August 18, 2025, https://www.fda.gov/media/90150/download

- Biosimilars | Health Affairs, accessed August 18, 2025, https://www.healthaffairs.org/do/10.1377/hpb20131010.6409/

- Guidance for Industry: Reference Product Exclusivity for Biological Products Filed Under Section 351(a) of the PHS Act – FDA, accessed August 18, 2025, https://www.fda.gov/media/89049/download

- The Purple Book: A Compendium of Biological and Biosimilar …, accessed August 18, 2025, https://www.uspharmacist.com/article/the-purple-book-a-compendium-of-biological-and-biosimilar-products

- Exclusivity for Biologic Products Under the USMCA: What Is Changing, and What Happens Next? – Center for Biosimilars, accessed August 18, 2025, https://www.centerforbiosimilars.com/view/exclusivity-for-biologic-products-under-the-usmca-what-is-changing-and-what-happens-next

- Would I FIE to You? FDA’s First Interchangeable Exclusivity Determination Results in Expiration, accessed August 18, 2025, https://www.thefdalawblog.com/2024/01/would-i-fie-to-you-fdas-first-interchangeable-exclusivity-determination-results-in-expiration/

- Purple Book: Lists of Licensed Biological Products with Reference Product Exclusivity and Biosimilarity or Interchangeability Evaluations | BBCIC, accessed August 18, 2025, https://www.bbcic.org/resources/fda-guidance/Purple-Book

- The “Purple Book” Makes Its Debut! – FDA Law Blog, accessed August 18, 2025, https://www.thefdalawblog.com/2014/09/the-purple-book-makes-its-debut/

- FDA Purple Book, accessed August 18, 2025, https://purplebooksearch.fda.gov/

- FDA Purple Book – PubChem Data Source, accessed August 18, 2025, https://pubchem.ncbi.nlm.nih.gov/source/25238

- About the Purple Book, accessed August 18, 2025, https://purplebooksearch.fda.gov/about

- Drug Patent Research: Expert Tips for Using the FDA Orange and Purple Books, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/drug-patent-research-expert-tips-for-using-the-fda-orange-and-purple-books/