Welcome to the definitive guide for navigating the intricate, challenging, and ultimately rewarding world of generic drug development in Japan. If you’re reading this, you likely already know the headline figures: Japan is the world’s third-largest pharmaceutical market, a behemoth of opportunity that no global company can afford to ignore. But you also know it’s a market wrapped in layers of regulatory complexity, cultural nuance, and economic paradoxes that can confound even the most seasoned industry veterans. How can a market so aggressively focused on cost containment still offer such lucrative potential? How do you navigate a patent system that operates on unwritten rules? And how has a recent, unprecedented crisis in quality and supply completely reshaped the criteria for success?

This report is designed to be your strategic compass. We’re not just going to list regulations; we’re going to deconstruct them. We will move beyond the “what” and dive deep into the “why” and, most importantly, the “so what does this mean for my business?” Together, we will peel back the layers of the Japanese regulatory environment, from the dual-headed authority of the Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA), through the labyrinthine approval process, and into the high-stakes game of intellectual property and pricing.

We’ll explore the central paradox that defines the modern Japanese generic market: a government that, in its relentless and successful quest to drive up generic volume to slash healthcare costs, inadvertently pushed the industry to a breaking point. This has triggered a seismic policy shift—a pivot away from a singular focus on “cheapest price” to a new paradigm where supply stability and quality assurance are the most valuable currencies. For you, this shift represents both a threat and a monumental opportunity.

This is not a passive overview. This is an active, strategic briefing designed for decision-makers. My goal is to equip you with the nuanced understanding and actionable intelligence needed to turn Japan’s regulatory complexities into your competitive advantage. We will explore how to transform patent data into a predictive tool, how to build a business model that thrives in a deflationary pricing environment, and how to position your company to win in this new, quality-focused era. So, let’s begin our journey into the heart of the Japanese generic drug market—a landscape of paradox, peril, and profound potential.

The Japanese Pharmaceutical Landscape: A Market of Paradoxes and Potential

Before we dissect the intricacies of a generic drug application or the nuances of patent law, we must first understand the battlefield itself. The Japanese pharmaceutical market is a study in contrasts. It is a mature, high-income nation with a structurally guaranteed demand for medicines, driven by one of the most rapidly aging populations on earth. Yet, this demographic tailwind is met by a powerful headwind: a government with an ironclad commitment to controlling healthcare expenditure. This fundamental tension between demographic demand and fiscal restraint is the engine that drives nearly every regulatory and commercial dynamic you will encounter. Understanding this paradox is the first step toward mastering the market.

Sizing Up the World’s Third-Largest Market

The sheer scale of the Japanese pharmaceutical market is what initially draws the attention of every global player, and for good reason. It stands undisputed as the world’s third-largest, a cornerstone of the global pharmaceutical economy.1 While specific valuations for 2024 show minor variations depending on the methodology—ranging from USD 82.27 billion to USD 103.56 billion—they all paint the same picture of a massive and deeply established market.1

What about growth? Unlike the volatile, high-growth profiles of some emerging markets, Japan offers stability. Projections consistently point toward a market expanding to over USD 101 billion by 2032-2033, underpinned by a modest but steady compound annual growth rate (CAGR) of approximately 2.57%.1 This slow, predictable growth trajectory is not a sign of stagnation but of intense governmental management and market maturity.

The bedrock of this market, the undeniable and non-negotiable driver of long-term demand, is its demographic profile. Japan is at the global forefront of population aging.3 With over 20% of its population already over the age of 65 and that figure projected to approach 40% by 2050, the societal need for medications targeting age-related diseases and chronic conditions is structurally guaranteed.6 This demographic reality provides a solid, unshakeable foundation for any pharmaceutical company with a long-term vision, ensuring a persistent and growing patient base for decades to come.3

However, if a powerful demographic trend suggests high demand, why is the overall market growth so modest? The answer lies in the powerful counterforce of government policy. The Japanese market’s slow growth rate is not a reflection of weak demand but of a highly effective and stringent cost-containment regime. This tells us something critical about the nature of the opportunity here. Success in Japan is not about riding a wave of explosive, top-line market expansion. Instead, the strategic imperative is to skillfully navigate the internal market dynamics—capturing market share from high-value branded drugs as they lose exclusivity and outmaneuvering competitors within the generic space itself.

The Government’s Unwavering Push for Generics

To understand the modern generic market in Japan, you must appreciate the single-minded determination with which the government has pursued a single policy goal for over 15 years: increasing the use of generic drugs to control national healthcare expenditure.6 This is not a passing trend; it is a foundational pillar of Japan’s public health and fiscal policy, born from the necessity of sustaining its universal healthcare system in the face of an aging populace.

The results of this policy push have been nothing short of dramatic. The government’s efforts began in earnest in the mid-2000s when the generic market share was languishing. In 2007, the volume share was a mere 18.7%.6 By 2010, it had crept up to just 22.6%.10 Recognizing the slow progress, the MHLW began setting aggressive targets and implementing powerful policy levers to reshape the market.

Let’s trace this remarkable trajectory through the government’s stated goals:

- 2007: The MHLW announces a program to increase the volume share from 17% to 30% by 2012.8

- 2013: A new five-year plan is announced, targeting a 60% share by 2018.6

- 2015: The cabinet decision accelerates the timeline, setting a target of 70% by 2017 and a crucial goal of 80% by September 2020.11

How did the government achieve this? It deployed a multi-pronged assault on the traditional brand-loyal prescribing culture. Initially, this involved financial incentives for physicians and pharmacists who prescribed and dispensed generics.12 Then, prescription formats were changed; instead of physicians having to “opt-in” to allow generic substitution, they now had to actively “opt-out” by signing a “no substitutions” box, making generic dispensing the default pathway.6

Most recently, the government has moved to influence patient choice directly. A system reform that took effect in October 2024 introduces an extra charge for patients who specifically request a brand-name drug when a generic alternative is available.13 This charge, equivalent to a quarter of the price difference between the brand and the generic, is a powerful financial nudge for cost-sensitive Japanese patients to accept the generic option.13

The data confirms the stunning success of these policies. As the table below illustrates, the generic penetration rate has soared, meeting and then blowing past the government’s ambitious targets.

Table 1: The Relentless Rise of Generics in Japan (2010-2024)

| Fiscal Year | Volume Share (%) | Key Government Policy/Target |

| 2010 | 23.0% | Initial promotion policies in effect 14 |

| 2013 | 48.8% | Target of 60% by 2018 announced 15 |

| 2017 | 69.9% | Nearing the 70% by 2017 target 15 |

| 2020 | 78.3% | Approaching the 80% by Sep 2020 target 16 |

| 2023 | 82.7% | 80% target officially surpassed 17 |

| 2024 | 86.5% | Continued growth beyond initial targets 18 |

Note: Data points are from various sources and represent the volume-based share of generics in the replaceable market. Fiscal years in Japan end on March 31 of the following calendar year.

With the volume-based usage rate now approaching 90%, the government has effectively won the war for volume.18 The question of

whether a generic will be used is largely settled; the system is now hardwired to favor it. This marks a critical inflection point. The old strategic challenge for a generic company was about driving adoption and convincing stakeholders to switch. That battle is over. The new strategic battleground is about ensuring that, in a market flooded with generic options, your product is the one that gets dispensed. This shifts the entire strategic focus away from simple market access and toward the more nuanced challenges of supply chain reliability, quality perception, and relationship management—themes that will define the next chapter of the Japanese generic industry.

The Regulatory Gauntlet: Mastering the Approval Process

Having established the immense scale and unique dynamics of the Japanese market, we now turn from the “why” to the “how.” Gaining entry into this market requires successfully navigating one of the world’s most rigorous and meticulous regulatory systems. For any company, domestic or foreign, the path to marketing approval is a gauntlet that demands precision, preparation, and a deep understanding of the key players and their distinct roles. In this section, we will demystify this process, providing a practical, step-by-step guide through the Japanese regulatory machinery. We will introduce the two guardians of the system, break down the required application dossier, and detail the specific scientific evidence you must provide to secure approval for your generic drug.

The Dual Guardians: Understanding the MHLW and PMDA

A common point of confusion for those new to the Japanese market is the division of labor between its two primary regulatory bodies. While they work in concert, the Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA) have distinct roles, and a successful regulatory strategy must address the priorities of both. Think of them as the two keyholders to the market: one holds the key to scientific validation, the other to administrative and commercial approval.

First, we have the MHLW. This is the cabinet-level ministry that holds ultimate administrative authority over the entire healthcare system.20 The MHLW is the policymaker. It drafts and administers the foundational legislation, the Pharmaceutical and Medical Devices Act (PMD Act), which governs everything from clinical trials to post-marketing safety.20 Crucially for any pharmaceutical company, the MHLW is responsible for two final, critical decisions: it grants the final marketing approval for a new drug, and it determines the price at which that drug will be reimbursed under the National Health Insurance (NHI) system.23 Its perspective is broad, encompassing not just the science of a drug but also its economic impact, its role in public health, and the stability of the pharmaceutical industry as a whole.

Second, we have the PMDA. Established in 2004, the PMDA functions as the MHLW’s expert scientific and technical arm.26 Its role is to conduct the deep, rigorous, science-based review of all drug and medical device applications.6 The PMDA’s teams of specialized reviewers—experts in pharmaceutical science, medicine, toxicology, and biostatistics—are tasked with meticulously evaluating the submitted data to ensure a product meets Japan’s high standards for quality, efficacy, and safety.28

The relationship between these two bodies is sequential and hierarchical. Your company will submit its application, and the PMDA will undertake the exhaustive review process. Upon completion, the PMDA provides a detailed review report and an approval recommendation to the MHLW.22 While the MHLW almost always follows the PMDA’s scientific recommendation, the final authority to issue the approval rests with the Ministry.26

This division of labor has a profound strategic implication. A scientifically flawless dossier that satisfies every one of the PMDA’s technical requirements is absolutely necessary, but it is not sufficient for success. Your company must also be cognizant of the MHLW’s broader policy objectives. The MHLW is not just asking, “Is this drug safe and effective?” It is also asking, “How does this product fit into our national healthcare goals? Does this company contribute to the stable supply of medicines? Does its pricing align with our fiscal constraints?” Therefore, a winning strategy requires a dual focus: you must present impeccable science to the PMDA while simultaneously demonstrating to the MHLW that your company is a responsible partner in achieving Japan’s public health goals.

For foreign manufacturers, there is an additional, non-negotiable structural requirement: the appointment of a Marketing Authorization Holder (MAH) or a Designated Marketing Authorization Holder (DMAH).1 This Japan-based entity is not merely a local agent; it is the legal entity responsible for all aspects of the product on the Japanese market, from quality assurance and safety management to the formal submission of the application.24 Choosing the right MAH/DMAH is one of the most critical early decisions a foreign company will make.

The Blueprint for Approval: The Common Technical Document (CTD)

The foundation of any drug application in Japan is the Common Technical Document, or CTD. As a core member of the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), Japan has long adopted the CTD format, making the structure of its application dossiers harmonized with those in the United States and Europe.30 This is a significant advantage for global companies, as it eliminates the need to completely reformat a dossier for each region. The mandatory use of the CTD for generic applications was implemented in July 2014, standardizing the process for all players.32

The CTD is organized into a five-module pyramid structure:

- Module 1: This is the only region-specific module. For a Japanese submission, it contains administrative documents like the official application forms, prescribing information tailored for Japan, and details about the MAH.31

- Module 2: This contains the high-level summaries of the entire dossier, including the Quality Overall Summary, the Non-clinical Overview and Summary, and the Clinical Overview and Summary.31

- Module 3: This is the Quality section, containing the detailed Chemistry, Manufacturing, and Controls (CMC) data for both the drug substance (API) and the finished drug product.31

- Module 4: This module houses the full non-clinical (toxicology and pharmacology) study reports.31

- Module 5: This module contains the complete clinical study reports, detailing the human trials conducted to prove efficacy and safety.31

Now, here is the single most important concept for a generic drug developer: your application is an abbreviated one. The entire business model of generic drugs rests on the principle that you do not have to repeat the decades of expensive and risky research conducted by the innovator. You are leveraging the innovator’s proven record of safety and efficacy.

This principle is reflected directly in the CTD requirements. For a generic application, you are not required to submit your own full, independent non-clinical data package (Module 4) or a comprehensive clinical trial program to re-prove the drug’s efficacy (Module 5).6 This is where the immense savings in time and development cost are realized. The table below starkly illustrates this difference.

Table 2: New Drug vs. Generic Drug Application Data Requirements in Japan (Abridged)

| Data Category | New Drug Application (NDA) | Generic Drug Application |

| Non-Clinical Studies (Pharmacology, Toxicology) | Required | Not Required (Relies on Originator’s Data) |

| Clinical Studies (Phase I-III Efficacy & Safety) | Required | Not Required (Relies on Originator’s Data) |

| Quality / Chemistry, Manufacturing & Controls (CMC) | Required | Required |

| Bioequivalence (BE) Study | Not Applicable | Required |

Source: Adapted from data presented in 6

This table distills the regulatory pathway down to its strategic essence. As a generic developer, your entire application hinges on two pillars: proving your product is of high Quality (Module 3) and proving it is the Same as the innovator product (Bioequivalence data). While the CTD format is harmonized globally, the content you provide is fundamentally different. The PMDA’s review will not be focused on whether the active ingredient works—that has already been established. Instead, their scrutiny will be laser-focused on your manufacturing processes, your quality control systems, and the scientific rigor of your bioequivalence studies. Any weakness in these two areas is not just a deficiency; it is a fatal flaw in your application. This reality must dictate your entire development and submission strategy, concentrating resources and expertise on perfecting these critical sections of the dossier.

Proving Sameness: The Critical Role of Bioequivalence Studies

If Quality/CMC is the first pillar of a generic application, Bioequivalence (BE) is the second, and it is the scientific heart of the entire submission. The core objective of a BE study is to provide definitive proof that your generic product is therapeutically equivalent to the innovator’s product.34 It achieves this by demonstrating that the rate and extent to which the active ingredient is absorbed into the bloodstream from your product are statistically indistinguishable from the innovator’s.

In Japan, the conduct and evaluation of these studies are governed by the PMDA’s highly detailed “Guideline for Bioequivalence Studies of Generic Products,” which was last significantly revised in 2012.35 Adherence to this guideline is not optional; it is the absolute standard by which your product will be judged.

Let’s break down the key technical requirements:

- Primary Pharmacokinetic (PK) Parameters: The PMDA, in line with global standards, focuses on two primary PK parameters derived from measuring drug concentrations in the blood of study subjects over time. The first is the AUC (Area Under the Curve), which represents the total exposure or the extent of drug absorption. The second is Cmax (Maximum Concentration), which represents the peak exposure or the rate of drug absorption.6

- The 80/125 Rule: The statistical acceptance criterion is famously known as the “80/125 rule.” For your generic product to be deemed bioequivalent, the 90% confidence interval for the geometric mean ratio (your generic vs. the innovator) of both AUC and Cmax must fall entirely within the range of 80.00% to 125.00% (or log(0.80) to log(1.25)).6 This is a strict, mathematically defined hurdle that leaves no room for ambiguity.

- Study Design: The standard BE study is a single-dose, two-way crossover study conducted in a small cohort of healthy adult volunteers.34 In this design, each volunteer receives both the generic and the innovator product on separate occasions, serving as their own control and reducing variability. However, the guidelines provide flexibility. For drugs with very long half-lives where a crossover design is impractical, a parallel group design may be used. Furthermore, if the drug has potent pharmacological or toxic effects, it may be unethical to administer it to healthy volunteers, in which case the study can be conducted in patients who are already prescribed the medication.34

While these core principles align with international standards, the Japanese system places a unique and critical emphasis on the relationship between the in vivo BE study and in vitro dissolution testing. Extensive dissolution testing, which measures how quickly the drug dissolves from the tablet or capsule in a laboratory setting, is required under a battery of different conditions (e.g., different pH levels simulating the journey through the digestive tract).34

This is not merely supportive data. The guidelines include provisions where the similarity of dissolution profiles can be used to support the declaration of bioequivalence, particularly in borderline cases.34 This creates a “belt and braces” requirement for formulation development. It is not enough to simply formulate a product that meets the 80/125 PK targets in a clinical study. You must also meticulously engineer your formulation to ensure its dissolution characteristics closely mirror those of the innovator product across a wide range of laboratory conditions. A failure to demonstrate this in vitro similarity can cast doubt on the robustness of your in vivo results and jeopardize your entire application. This dual focus on both pharmacokinetic and physicochemical properties is a hallmark of the PMDA’s rigorous approach to ensuring generic equivalence.

Beyond Small Molecules: The Biosimilar Approval Pathway

While the majority of the generic market consists of chemically synthesized small molecules, the landscape is rapidly evolving with the patent expiry of major biologic drugs. This has opened up the lucrative but far more complex field of biosimilars. The biosimilar market in Japan is on a steep growth trajectory, projected to more than double from approximately USD 543 million in 2025 to over USD 1.1 billion by 2033, with a robust CAGR exceeding 9-10%.37 This growth is fueled by the same cost-containment pressures driving the small-molecule market, with a particular focus on high-cost therapeutic areas like oncology.37

However, entering the biosimilar space requires a completely different regulatory and scientific mindset. A biologic drug—a large, complex protein produced in living cells—cannot be perfectly replicated in the same way a small molecule can. Consequently, the approval standard is not “bioequivalence” or “sameness.” Instead, the PMDA’s guidelines for biosimilars are built around the concept of “comparability”.39

Your goal as a biosimilar developer is to demonstrate, through a “totality of the evidence” approach, that your product is highly similar to the innovator’s reference product and that any minor, unavoidable differences in quality attributes have no clinically meaningful impact on safety or efficacy.39

This “totality of the evidence” approach translates into a much more extensive and costly data package than that required for a small-molecule generic:

- Foundation of Analytics: The process begins with an exhaustive series of comparative analytical studies. You must use a vast array of sophisticated techniques to compare the structural and physicochemical properties (e.g., amino acid sequence, higher-order structure, glycan profiles), biological activity (e.g., binding affinity, in vitro assays), and impurity profiles of your biosimilar against the reference product.39 This step alone is a massive undertaking.

- Addressing Uncertainty: If this analytical characterization reveals any residual uncertainty or minor differences between your product and the reference biologic, you must then conduct targeted non-clinical (animal) studies and, in most cases, at least one comparative clinical study in humans to resolve those questions.39

This pathway represents a regulatory and developmental middle ground. It is significantly less burdensome than developing a novel biologic from scratch, but it is orders of magnitude more complex and expensive than developing a small-molecule generic. It requires deep expertise in protein chemistry, biologics manufacturing, and clinical trial design.

This high barrier to entry creates a distinct strategic arena. The biosimilar market is not for every generic player. It presents a significant opportunity for companies that possess both advanced manufacturing capabilities and the clinical development expertise to bridge the gap between innovative R&D and traditional generic production. Success in this space requires a long-term investment and a skill set that goes far beyond what is needed to compete in the high-volume, small-molecule generic market.

The Intellectual Property Minefield: Turning Patent Data into Competitive Advantage

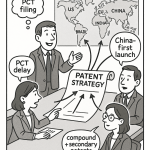

If the regulatory process is the gauntlet you must run to get your product approved, then the intellectual property (IP) landscape is the minefield you must cross to get it to market. In Japan, navigating this minefield is arguably the most complex and high-stakes challenge a generic developer faces. The system is unlike any other in the world—a unique blend of formal patent law and informal administrative guidance that can feel opaque and unpredictable.

But here’s the crucial point: this opacity is not just a risk; it’s a source of competitive advantage for those who can master it. Because the system does not provide a clear, simple roadmap, the company with the best map—the most comprehensive and insightful patent intelligence—wins. In this section, we will dissect Japan’s unique patent linkage system, clarify the non-patent exclusivities that define the true market entry date, and provide a practical guide for using powerful tools like DrugPatentWatch to turn raw patent data into a dominant market strategy.

Japan’s Unique Patent Linkage System: A Two-Stage Challenge

In most major markets, “patent linkage” refers to a formal, legally defined system that connects the drug approval process to the status of relevant patents. The US, with its Hatch-Waxman Act and the public “Orange Book,” is the prime example. Japan, however, has no such law.40 Instead, its patent linkage system is a de facto process that operates through a series of administrative notices and guidances issued by the MHLW.40 This informal nature makes it more flexible but also far less transparent and predictable.

The system effectively operates in two distinct stages, each with a different scope and set of challenges.

Stage One: The PMDA Approval Review

The first stage occurs during the PMDA’s scientific review of your generic drug application. This phase is governed by a 2009 MHLW notice that, from the perspective of ensuring a stable supply of medicines, tasks the PMDA with checking for potential patent infringement.40

- Scope: This review is narrowly focused. The PMDA will only consider potential infringement of the originator’s substance patents (covering the active ingredient itself) and use patents (covering a specific method of treatment).40 Critically, other types of patents, such as those covering the drug’s formulation or manufacturing process, are

not considered at this stage.40 - The “Secret” List: How does the PMDA know which patents to check? The process relies on the “Pharma Patent Information Sheet,” a document submitted by the brand company when it first applies for its new drug approval.42 This is Japan’s equivalent of the Orange Book, but with one massive difference: it is

not publicly available.42 This lack of transparency is a major source of uncertainty for generic developers. - The “At-Risk” Dilemma: The system’s informal nature creates another significant risk. If an originator’s patent is challenged and invalidated by the Japan Patent Office (JPO), the PMDA may proceed with approving a generic drug before that invalidation decision becomes final and irreversible through the court system.41 This can lead to an “at-risk launch” scenario. If the IP High Court later overturns the JPO’s decision and reinstates the patent, the generic company, which has already launched its product, could suddenly find itself liable for patent infringement.41

Stage Two: The Pre-NHI Listing Negotiation

Successfully navigating Stage One and receiving PMDA approval is a major milestone, but it does not mean you can launch your product. Before a drug can be prescribed and reimbursed, it must be listed on the NHI Drug Price Standard. The period between PMDA approval and NHI price listing constitutes the second stage of patent linkage.40

- Scope: This stage is designed to address all the other patents that were not considered during the PMDA review—primarily formulation patents and manufacturing process patents.40

- The Process: When a generic drug is approved, the information is posted on an NHI website, effectively notifying the brand manufacturer.40 The MHLW guidance encourages the two parties to negotiate and resolve any potential patent disputes during this window. Both sides are required to report the status of these negotiations to the MHLW.42

- No Guarantees: It is crucial to understand that reaching an agreement is not mandatory.42 The purpose is to facilitate a discussion and inform the MHLW. A brand company can still file a patent infringement lawsuit to try to block the NHI listing or sue for damages after the generic is launched, regardless of the outcome of these negotiations.40

This informal, two-stage system creates a complex strategic environment. A generic company cannot afford to be passive and simply wait for regulatory clearance. You must be proactive. This means conducting your own exhaustive, multi-faceted patent due diligence long before you even file your application. Your analysis must cover not only the core substance and use patents that will be scrutinized by the PMDA in Stage One but also the entire thicket of secondary formulation and process patents that will become the subject of negotiation in Stage Two. This transforms patent analysis from a legal compliance function into a core element of your business and market entry strategy.

Beyond Patents: Market Exclusivity and Term Extensions

While patents are the most visible form of intellectual property, they are not the only mechanism that grants market protection to an innovator drug in Japan. To accurately calculate the first possible day for a generic launch, you must understand two additional layers of protection: the re-examination period and patent term extensions.

The Re-examination Period: Japan’s Version of Data Exclusivity

Many countries have a formal “data exclusivity” system, where a generic company is prohibited from relying on the innovator’s clinical trial data for a set period. Japan achieves a similar outcome through a different mechanism: the post-marketing re-examination period.1

After a new drug is approved, it enters a mandatory surveillance period during which the MAH must continue to collect real-world safety and efficacy data. During this re-examination period, the MHLW will not approve any generic applications for that drug.1 This effectively functions as a period of market exclusivity, completely independent of the patent status.

The standard re-examination periods are:

- 8 years for a standard new drug.1

- Up to 10 years for an orphan drug.1

Patent Term Extension (PTE): Restoring Lost Time

The nominal term of a patent is 20 years from its filing date. However, a significant portion of this term is often consumed by the lengthy process of clinical development and regulatory review, during which the product cannot be sold. To compensate innovators for this “lost” time, Japan, like many other countries, has a system for Patent Term Extension (PTE).45

The length of the extension is calculated based on the “period during which the patented invention could not be worked,” which generally runs from the start of clinical trials or the patent grant date (whichever is later) until the date of marketing approval.45 However, there is a crucial cap: the maximum extension that can be granted is

5 years.45

These two mechanisms combine to create what can be thought of as a “double cliff” for brand exclusivity. A generic launch is blocked by two separate clocks running in parallel: the patent clock (the original 20-year term plus any PTE) and the regulatory clock (the 8- or 10-year re-examination period). Your first legal opportunity to enter the market is determined by whichever of these two clocks runs out last. A comprehensive launch strategy must therefore meticulously track both the patent estate and the regulatory exclusivity status of a target product to pinpoint the precise date the market opens. Overlooking one of these clocks can lead to a disastrously premature or unnecessarily delayed launch.

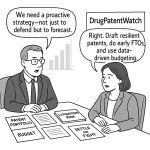

From Data to Dominance: A Practical Guide to Patent Intelligence

Given the opacity of the patent linkage system and the multiple layers of exclusivity, how can a company develop a winning strategy? The answer lies in building a superior intelligence capability. You must create your own “Orange Book” through diligent, continuous, and insightful analysis of the patent landscape.

This is where specialized platforms become indispensable. Services like DrugPatentWatch are designed to aggregate and analyze the vast amounts of global patent and regulatory data that are essential for strategic decision-making in the pharmaceutical industry.47 In a market like Japan, where official, consolidated information is scarce, leveraging such a tool shifts from a convenience to a strategic necessity.

Let’s outline a practical, three-step approach to turning this data into a competitive weapon:

1. Strategic Application: Freedom-to-Operate (FTO) Analysis for Risk Mitigation

Before a single yen is spent on formulation development, a deep FTO analysis is mandatory. This goes far beyond a simple search for the main compound patent. Using a comprehensive database, your team must identify and analyze the entire “patent thicket” surrounding the target brand drug.49 This includes:

- Composition of Matter Patents: The core patents on the API.

- Method-of-Use Patents: Patents covering specific indications or dosing regimens.

- Formulation Patents: Patents on the specific delivery system, excipients, or physical form (e.g., extended-release tablets, specific crystalline forms).

- Process Patents: Patents covering the method of manufacturing the API or the final drug product.

A thorough FTO analysis allows you to map the entire minefield, identifying which patents you must wait to expire, which you might be able to design around (e.g., by developing a non-infringing formulation), and which might be weak enough to challenge through an invalidation proceeding at the JPO.47

2. Strategic Application: Precision Timing for Market Entry

Your goal is to be ready to launch on “Day 1″—the very first day after the last piece of exclusivity expires. Achieving this requires a precise, integrated timeline. By using a patent intelligence platform to track not only the expiry dates of all relevant patents but also their PTE calculations and the separate re-examination period, you can build a reliable forecast of your market entry date.50 This allows you to reverse-engineer your development, manufacturing, and regulatory submission timelines to ensure you receive PMDA approval and are ready for NHI price listing at the optimal moment.

3. Strategic Application: “White Space” Analysis for Opportunity Creation

The most advanced use of patent intelligence is not just defensive but offensive. A systematic analysis of the patent landscape for a particular therapeutic area can reveal “white space”—opportunities where patent protection is thin or non-existent.47 This could be a class of compounds with few follow-on patents, an established drug with potential for a new, unpatented formulation, or a therapeutic area where the dominant patents are nearing expiry. This analysis can guide your portfolio selection, steering you toward products with a clearer path to market and a less crowded competitive landscape, ultimately leading to higher and more sustainable profitability.

Hypothetical Case Study: Turning Data into Strategy

Let’s imagine your company, “Genericorp Japan,” is considering a generic version of the blockbuster drug “Innovire.” A preliminary search shows the main substance patent expires in Q2 2028. A shallow analysis might suggest a 2028 launch.

However, a deeper dive using a platform like DrugPatentWatch reveals a more complex picture. You discover:

- The MHLW granted a 3-year Patent Term Extension on the substance patent, pushing its effective expiry to Q2 2031.

- The 8-year re-examination period for Innovire ends in Q4 2030.

- There is a secondary formulation patent on the extended-release version of Innovire that is valid until 2033.

- There is no patent covering the immediate-release formulation.

This data transforms your strategic options. A 2028 launch is impossible. The earliest possible launch date is now Q2 2031, when the extended substance patent expires (as this is later than the re-examination period). Furthermore, you can only launch an immediate-release version at that time. To launch the more lucrative extended-release version, you would either have to wait until 2033 or invest in developing a novel, non-infringing extended-release formulation. Suddenly, you have moved from a simple date on a calendar to a set of clear, data-driven strategic choices about which product to develop and when to launch it.

In Japan’s unique IP environment, the company that invests in superior intelligence and analysis will consistently outmaneuver its competitors. Patent data is not just for lawyers; it is one of the most powerful strategic assets a business leader can possess.

The Economics of Generics in Japan: Pricing, Profitability, and Peril

You’ve successfully navigated the regulatory gauntlet and the IP minefield. Your product is approved. Now comes the ultimate test: can you make money? The commercial reality of the Japanese generic market is defined by a relentless, structurally embedded system of price controls. For decades, the MHLW’s primary economic goal was to drive down drug costs, and the pricing system was its most powerful weapon.

This single-minded focus on cost reduction has had profound and, in some cases, devastating consequences. It has created an environment of razor-thin margins and, as we will explore, led to a crisis of quality that has forced a fundamental rethinking of the entire industry’s structure. Understanding the economics of this market is essential for building a sustainable and profitable business.

The NHI Pricing Mechanism: How Your Product Gets Its Price

The price of your generic drug in Japan is not determined by free market forces. It is set by the government through the National Health Insurance (NHI) drug pricing system. This centralized process dictates the revenue potential for every product.

The Initial Price Cut

Your product’s commercial life begins with a steep, mandated price reduction. When a generic drug is first listed on the NHI price list, its price is, as a general rule, set at 50% of the price of the originator’s branded product.11 This rule immediately cuts the potential market value in half.

Furthermore, this initial price can be pushed even lower. If a large number of generic companies launch the same product simultaneously, triggering intense competition from day one, the initial price is set at 40% of the brand price.11 The threshold for this 40% rule was historically more than 10 manufacturers, but in a recent move to discourage market fragmentation, the MHLW has tightened this, lowering the threshold to just 7 manufacturers.52 This means that for popular, off-patent drugs, a 60% price reduction from the brand level is the effective starting point.

The Deflationary Spiral: Annual Price Revisions

This initial price is not a stable floor; it is the top of a descending staircase. The Japanese system is built on a mechanism of periodic price revisions that ensures prices almost always move in one direction: down.

The process works as follows: the MHLW conducts regular, large-scale surveys to determine the actual market prices at which wholesalers are selling drugs to hospitals and pharmacies.25 Because of the intense competition among generic manufacturers, these real-world transaction prices are invariably lower than the official NHI price. In the next pricing revision, the MHLW uses this survey data to “true-up” the official NHI price, cutting it to reflect the lower market reality.25

For many years, these major revisions occurred biennially (every two years). However, in its quest for greater cost savings, the government has accelerated this process. Since 2021, Japan has effectively moved to a system of annual price revisions for a large portion of the market.54 This shift to annual cuts has dramatically increased the speed of price erosion, compressing product lifecycles and making it even more difficult for companies to maintain profitability.9

The long-term effect of this mechanism is a relentless downward pressure on prices. It is a system designed for deflation. This has created a harsh commercial environment where many older generic products eventually become unprofitable to manufacture, a key factor in the recent supply chain crisis.9 For a generic company, this means that a product’s profitability cannot be assessed based on its launch price. A successful business model must anticipate this inevitable price decay and be built upon a foundation of extreme cost efficiency and a portfolio strategy that relies on a continuous stream of new product launches to replace the revenue lost from older, price-eroded products.

A Crisis of Confidence: Addressing Quality and Supply Chain Failures

For years, the MHLW’s pricing policies succeeded in their primary goal of driving down costs. But this success came at a hidden and dangerous price. The relentless pressure on margins forced many generic manufacturers to cut costs wherever possible, and for some, this included critical investments in quality control, manufacturing infrastructure, and compliance systems. In 2020, this simmering issue erupted into a full-blown crisis that has shaken the Japanese pharmaceutical industry to its core and triggered a fundamental regulatory paradigm shift.

The most infamous case was that of Kobayashi Kako, a mid-sized generic manufacturer. In December 2020, it was discovered that batches of their oral antifungal medication had been contaminated with a powerful sleep-inducing agent.59 The results were catastrophic: hundreds of patients reported adverse health effects, including serious accidents like car crashes, and two deaths were linked to the contaminated drug.59

The subsequent investigation by regulators uncovered a corporate culture of systemic failure. It was revealed that the company had engaged in deceptive “double-booking” practices for hundreds of drugs, falsified manufacturing records, and skipped required quality tests, in some cases for decades.59

“This decline in drug prices forced Japanese pharmaceutical companies to cut costs, leading to inadequate development and manufacturing management, and several scandals. With regard to this excessive trimming of drug prices, the government enacted a system of exceptional price reviews for unprofitable products in 2023 and 2024. However, the difficult situation for pharmaceutical companies has not improved.” 57

The Kobayashi Kako scandal was not an isolated incident. It was the catalyst that exposed deeper, industry-wide problems. In the months that followed, other major generic companies faced regulatory sanctions for similar compliance and quality failures.59 The root cause was widely acknowledged: years of punishing price cuts had created a “vicious cycle” where companies, struggling to remain profitable, underinvested in the very systems designed to ensure product quality and safety.9

The consequences have been severe and far-reaching. The regulatory actions against multiple manufacturers led to widespread production stoppages and product recalls. This, in turn, triggered a national crisis of drug shortages that continues to this day, disrupting patient care across the country.9 Perhaps most damagingly, the crisis has profoundly eroded the trust that patients, doctors, and pharmacists have in the quality and reliability of generic medicines.9

This crisis has served as a painful but necessary wake-up call for the MHLW. It has forced the ministry to confront the unintended consequences of its own policies and to recognize that a single-minded focus on cost containment, without a parallel emphasis on quality and sustainability, is both dangerous and ultimately counterproductive. This realization has led to a fundamental pivot in regulatory priorities. The new, overriding imperative for the Japanese generic market is no longer just cost, but supply stability and quality assurance. For any company operating in or considering entry into this market, this shift is the single most important strategic development to understand. Demonstrating a robust quality system and a resilient supply chain is no longer a simple matter of compliance; it is now the primary determinant of commercial success.

The Future of the Industry: Consolidation and the “Generic Supply Corporate Indicator”

In response to the quality and supply crisis, the MHLW has begun to actively re-engineer the structure of the generic drug industry. The ministry’s diagnosis is that the market is too fragmented, with too many small players engaged in unsustainable price competition, leading to the underinvestment in quality that caused the crisis.60 The stated goal now is to foster a “virtuous cycle of profit and investment” and to create a more sustainable industrial structure composed of a smaller number of larger, more stable, and more reliable companies.60

The primary policy tool designed to achieve this goal was introduced in the landmark FY2024 drug pricing reform: the “Generic Supply Corporate Indicator”.52

This is not just another tweak to the pricing rules; it is a powerful mechanism designed to reward stability and penalize unreliability. Here’s how it works:

- Mandatory Transparency: Generic companies are now required to publicly disclose detailed information related to their ability to provide a stable supply of their products.52

- Comprehensive Evaluation: This disclosure is evaluated against a scorecard of 17 specific items across four key perspectives:

- Disclosure of information on stable supply.

- Securing reserve capacity for stable supply (e.g., holding extra inventory, having multiple API suppliers).

- Supply track record (e.g., history of shortages).

- Market price discrepancy status (a measure of aggressive discounting).52

- Price Linkage: Based on their performance against these metrics, companies are graded into categories (e.g., Category A for the top performers, C for the lowest).52 This grade is then directly linked to the NHI prices of their products. Companies that demonstrate a commitment to stable supply will be rewarded with more favorable pricing, while those that do not will face financial penalties.52

The long-term strategic implication of this policy is clear and profound: the MHLW is actively engineering a market consolidation. This system is explicitly designed to favor companies with the scale and resources to invest in robust quality systems, redundant manufacturing capacity, and transparent supply chains. Larger, well-capitalized companies will be better positioned to score well on the indicator, earn better prices, and gain market share. Smaller, less efficient players who have historically competed solely on price will struggle to meet the new standards, face pricing penalties, and find it increasingly difficult to survive.61

This policy, supported by both the MHLW and the Japan Fair Trade Commission, signals a “flight to quality” that will fundamentally reshape the competitive landscape over the next five to ten years.61 The era of a fragmented market with dozens of small players is ending. A new era, dominated by a smaller cohort of consolidated, quality-focused, and supply-chain-resilient companies, is beginning. For any company in this space, the strategic imperative is to decide where you will fit into this new structure: will you be a consolidator, an attractive target for acquisition, or a niche player with an unassailable reputation for quality and reliability?

Strategic Synthesis: Charting a Course for Success

We have journeyed through the complexities of the Japanese generic drug market—from its immense scale and unique policy drivers to its intricate regulatory processes, opaque IP landscape, and challenging economic realities. We’ve seen how a relentless government push for volume has given way to an urgent new focus on quality and stability. The question now is, how do you synthesize this complex information into a coherent and actionable strategy? This final section distills our analysis into a clear set of strategic imperatives for both market entrants and established players, designed to help you not just survive, but thrive in this evolving environment.

Key Takeaways for Market Entrants and Incumbents

The old playbook for success in Japan is obsolete. A new set of rules governs the market, demanding a more sophisticated and strategic approach. Here are the essential takeaways that should form the foundation of your business plan.

- Quality and Stability Are the New Currencies: The single most important shift in the Japanese market is the pivot from a “cost-first” to a “stability-first” mindset. The Generic Supply Corporate Indicator is the enforcement mechanism for this new philosophy. Your strategic priority must therefore shift from being the cheapest supplier to being the most reliable supplier. This means tangible investments in redundant manufacturing, diversified API sourcing, robust quality management systems, and transparent communication with regulators and customers. Your score on this indicator will directly impact your profitability and market position.

- Master the IP Game with Proactive Intelligence: Do not wait for the MHLW or PMDA to clear a path for you through the patent minefield—you must clear your own. This requires an offensive, commercially-driven approach to IP. Invest heavily in continuous patent landscape monitoring using powerful tools like DrugPatentWatch. Your freedom-to-operate analysis must be multi-layered, covering not just substance and use patents for the PMDA review, but also the entire thicket of formulation and process patents that will be scrutinized before your product can be priced. Your launch timeline must be a precise calculation based on the “double cliff”—the later of the final patent expiry (including all extensions) and the regulatory re-examination period.

- Build a Deflation-Proof Portfolio and Business Model: The NHI pricing system is structurally designed to be deflationary. You must accept the reality of continuous price erosion and build your business model accordingly. This demands two things: first, a relentless focus on cost efficiency in your manufacturing and supply chain to protect margins as prices fall. Second, a dynamic portfolio strategy that treats products as having a finite profitable life. You must have a robust pipeline of new generic launches ready to replace the revenue from older products whose prices have eroded to unsustainable levels.

- For New Entrants: Differentiate on Reliability, Not Price: Do not attempt to enter the Japanese market by being the low-cost leader. That game is over, and it led the industry to a crisis. Your key point of differentiation in this post-crisis environment is reliability. Frame your market entry strategy around a narrative of superior quality, a transparent and resilient supply chain, and a commitment to being a stable partner for the Japanese healthcare system. This will resonate with regulators, hospitals, and pharmacies who are now acutely sensitive to the risks of supply disruption.

- For Incumbents: Consolidate or Be Consolidated: The MHLW’s new policies are an explicit signal that they favor a less fragmented, more consolidated industry. This presents a stark choice for existing players. You must critically re-evaluate your scale, your quality systems, and your supply chain resilience. Based on this assessment, you must make a strategic decision: Are you in a position to be an acquirer, leveraging a strong balance sheet and high stability score to absorb smaller competitors? Are you an attractive acquisition target for a larger player? Or can you carve out a defensible and profitable niche as a specialized player with an unparalleled reputation for quality in a specific therapeutic area or dosage form? Standing still is not an option.

The Japanese generic market is in the midst of a profound transformation. The companies that succeed in the coming decade will be those that understand these new rules of engagement and strategically align their operations, investments, and portfolios accordingly.

Key Takeaways

- Paradigm Shift from Cost to Stability: Japan’s government has successfully achieved its goal of high generic volume penetration (over 86%). A recent crisis of quality and supply shortages has forced a major policy pivot. The new primary focus of the MHLW is ensuring a stable and reliable supply of high-quality generics, not just achieving the lowest possible price.

- The “Generic Supply Corporate Indicator” is Reshaping the Market: This new system, introduced in 2024, directly links a company’s drug prices to its demonstrated ability to ensure stable supply. It will reward companies with robust supply chains and quality systems while penalizing less reliable players, actively driving a market consolidation and a “flight to quality.”

- Proactive IP Intelligence is Non-Negotiable: Japan’s patent linkage system is informal, two-staged, and lacks a public patent list like the U.S. Orange Book. Success requires an offensive strategy, using tools like DrugPatentWatch to conduct deep FTO analysis on all patent types (substance, use, formulation, process) and to precisely time market entry after both patent expiry (including extensions) and the 8-10 year regulatory re-examination period have passed.

- The Pricing System Demands a Deflation-Proof Business Model: The NHI pricing mechanism, with its initial 50-60% price cut followed by annual downward revisions, creates a perpetually deflationary environment. Profitability depends on extreme cost efficiency and a dynamic portfolio that constantly introduces new products to offset the inevitable price erosion of existing ones.

- Approval Hinges on Quality and Equivalence: The abbreviated approval pathway for generics in Japan relies on the Common Technical Document (CTD) format. The PMDA’s review is intensely focused on two pillars: Module 3 (Chemistry, Manufacturing, and Controls) and robust Bioequivalence (BE) studies that meet the strict 80/125 criteria and are supported by extensive in vitro dissolution data.

Frequently Asked Questions (FAQ)

1. What is the single biggest mistake foreign companies make when entering the Japanese generic market?

The most common mistake is underestimating the complexity and opacity of the intellectual property landscape. Many companies accustomed to more transparent systems like the U.S. Orange Book are unprepared for Japan’s informal, two-stage patent linkage system and the lack of a public patent list. They may conduct a superficial FTO analysis focused only on the main substance patent, only to be blocked later by a secondary formulation or process patent during the pre-pricing negotiation stage. A winning strategy requires a deep, proactive patent intelligence effort from the very beginning.

2. How has the recent focus on supply stability changed the criteria for success in Japan?

It has fundamentally changed the competitive dynamic. Previously, success was largely driven by being first to market and competing aggressively on price. Now, with the introduction of the “Generic Supply Corporate Indicator,” success is increasingly defined by reliability. Companies are now evaluated and financially rewarded based on their ability to maintain a stable supply. This means factors like having multiple API suppliers, maintaining reserve inventory, having a strong quality compliance record, and transparent communication are now key commercial advantages, not just operational metrics.

3. Given the lack of a public “Orange Book,” what is the most effective way to manage patent risk before launching a generic in Japan?

The most effective way is to create your own “Orange Book” through comprehensive, continuous patent landscape analysis using specialized third-party databases and intelligence platforms like DrugPatentWatch. This process must be initiated very early in project evaluation and should not be a one-time event. It involves identifying and tracking the entire patent estate of a target brand—including substance, use, formulation, and process patents—and monitoring for new filings, litigation, and patent term extensions. This proactive intelligence is the only way to build a clear picture of the IP risks and accurately time a market entry.

4. With generic volume penetration already over 85%, where will future growth for generic companies in Japan come from?

Future growth will come from three primary sources, not from converting the remaining small slice of the brand market. First is the continuous pipeline of branded drugs losing exclusivity, particularly high-value specialty drugs and biologics (biosimilars), which represent larger revenue opportunities. Second is market share consolidation; as the MHLW’s policies favor larger, more stable suppliers, stronger companies will grow by acquiring smaller competitors or taking share from those who exit the market. Third is expansion into more complex generics and biosimilars, which have higher barriers to entry and potentially more sustainable margins.

5. How will the “Generic Supply Corporate Indicator” likely impact smaller vs. larger generic manufacturers in the next five years?

The indicator is expected to accelerate consolidation in the industry. Larger manufacturers with greater financial resources are better positioned to make the investments required to score well—such as building redundant manufacturing lines, holding larger inventories, and implementing sophisticated quality management systems. They will likely be rewarded with better pricing and gain market share. Smaller manufacturers may struggle to meet these new capital-intensive standards, face pricing penalties, and find their margins squeezed further. This will likely force many smaller players to either specialize in niche products, seek a merger or acquisition, or exit the market altogether.

References

- Expanding to Japan’s Pharma Market? Here’s What You Need to Know, accessed July 29, 2025, https://resource.ddregpharma.com/blogs/expanding-to-japans-pharma-market-heres-what-you-need-to-know/

- Forecast: Pharmaceuticals in Dosage Market Size Value in Japan – ReportLinker, accessed July 29, 2025, https://www.reportlinker.com/dataset/5099295dcdc690372cfc39ab88b94452ec17c79e

- Japan Pharmaceutical Market Size & Industry 2025-33 – IMARC Group, accessed July 29, 2025, https://www.imarcgroup.com/japan-pharmaceutical-market

- Japan Pharmaceutical Market Size, Trends & Scope, accessed July 29, 2025, https://www.verifiedmarketresearch.com/product/japan-pharmaceutical-market/

- Japan Generic Drugs Market Share, Size, Growth Forecast 2031, accessed July 29, 2025, https://www.marketsandata.com/industry-reports/japan-generic-drugs-market

- Regulation of Generic Drugs in Japan: the Current Situation and Future Prospects – PMC, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4540728/

- Japan Pharmaceutical Market 2025-2034 | Size,Share, Growth – MarkWide Research, accessed July 29, 2025, https://markwideresearch.com/japan-pharmaceutical-market/

- Report From: Japan – Pharmaceutical Technology, accessed July 29, 2025, https://www.pharmtech.com/view/report-japan-1

- The challenge for drug shortage: lessons learned from the quality issues of Japanese generic drug companies – GaBIJ, accessed July 29, 2025, https://gabi-journal.net/the-challenge-for-drug-shortage-lessons-learned-from-the-quality-issues-of-japanese-generic-drug-companies.html

- Japan Pharmaceutical Industry and Forecast-Focus on OTC and Prescription Drugs Market, accessed July 29, 2025, https://www.kenresearch.com/industry-reports/japan-pharmaceutical-market

- 6.2 Generic Drugs – Japan Health Policy NOW, accessed July 29, 2025, https://japanhpn.org/en/section-6-2/

- Japanese Pharma: Navigating a Challenging Market – L.E.K. Consulting, accessed July 29, 2025, https://www.lek.com/sites/default/files/insights/pdf-attachments/How_to_Navigate_Japan_Pharma_Market_LEK_Special_Report.pdf

- System Reform to Promote the Use of Generic Drugs | Abe, Ikubo & Katayama, accessed July 29, 2025, https://www.aiklaw.co.jp/en/whatsnewip/2024/09/24/5041/

- Volume-based Generics Market Share Up to 23.0% in FY 2010: JGA | PHARMA JAPAN, accessed July 29, 2025, https://pj.jiho.jp/article/p-1300863507214

- Change in the Japanese pharmaceutical market: Cradle … – McKinsey, accessed July 29, 2025, https://www.mckinsey.com/~/media/McKinsey/Industries/Pharmaceuticals%20and%20Medical%20Products/Our%20Insights/Change%20in%20the%20Japanese%20pharmaceutical%20market%20Cradle%20of%20innovation%20or%20grave%20of%20corporate%20profits/Change-in-the-Japanese-pharmaceutical-market.pdf

- Clinical Utilization of Generic Drugs and Biosimilars for Ulcerative Colitis Treatment: Insights from a Nationwide Database Study in Japan – PMC, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10857828/

- Japan’s Generic Use Rate at 82.7% in FY2023: JGA – PHARMA JAPAN, accessed July 29, 2025, https://pj.jiho.jp/article/251419

- Japan’s Generic Use Rate Reaches 86.5% in FY2024: JGA …, accessed July 29, 2025, https://pj.jiho.jp/article/253352

- Generic Rate in Japan Reaches 89.3% at 2024-End: Payer, accessed July 29, 2025, https://pj.jiho.jp/article/252962

- Japan’s MHLW Highlights Four Key Themes in Pharmaceuticals and …, accessed July 29, 2025, https://www.ropesgray.com/en/insights/viewpoints/102jlvg/japans-mhlw-highlights-four-key-themes-in-pharmaceuticals-and-medical-devices-ac

- MHLW Role in Japan Drug Regulation | PBM – Pacific Bridge Medical, accessed July 29, 2025, https://www.pacificbridgemedical.com/ufaq/what-is-the-role-of-the-ministry-of-health-labour-and-welfare-mhlw-in-japan-drug-regulation/

- Japan MHLW & PMDA Medical Device and Pharmaceutical Regulations, accessed July 29, 2025, https://www.pacificbridgemedical.com/regulation/japan-medical-device-pharmaceutical-regulations/

- Regulations and Approval/Certification of Medical Devices – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/review-services/reviews/0004.html

- Regulatory Systems in Japan – CMIC Group, accessed July 29, 2025, https://en.cmicgroup.com/solutions/pharmaceutical-solutions/clinical-cro-solutions/regulatory-affairs/regulatory-systems-in-japan/

- Update of Drug Pricing System in Japan – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000221888.pdf

- An Overview of Pharmaceutical and Medical Device Regulation in Japan – Morgan Lewis, accessed July 29, 2025, https://www.morganlewis.com/-/media/files/publication/outside-publication/article/overview_pharma_device_reg.ashx

- ANNUAL REPORT – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000152119.pdf

- Reviews | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/review-services/reviews/0001.html

- Frequently Asked Questions (FAQ) | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/about-pmda/0004.html

- Japan Common Technical Document: Bracketing Strategies for the Manufacturing Process, accessed July 29, 2025, https://www.biopharminternational.com/view/japan-common-technical-document-bracketing-strategies-manufacturing-process-0

- Overview of the Common Technical Documents – International Journal of Pharmaceutical Research and Applications (IJPRA), accessed July 29, 2025, https://ijprajournal.com/issue_dcp/Overview%20of%20the%20Common%20Technical%20Documents.pdf

- Common Technical Document (CTD) – ICH, accessed July 29, 2025, https://www.ich.org/page/ctd

- GUIDELINE FOR GOOD CLINICAL PRACTICE – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000156342.pdf

- Guideline for Bioequivalence Studies of Generic Products, accessed July 29, 2025, http://www.nihs.go.jp/drug/be-guide(e)/Generic/GL-E_120229_BE.pdf

- Regulatory Considerations of Bioequivalence Studies for Oral Solid Dosage Forms in Japan, accessed July 29, 2025, https://pubmed.ncbi.nlm.nih.gov/27372551/

- Others | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/review-services/regulatory-info/0019.html

- Japan Biosimilars Market By Size, Share and Forecast 2030F | Techsci Research, accessed July 29, 2025, https://www.techsciresearch.com/report/japan-biosimilars-market/24578.html

- Japan Biosimilars Market Share, Growth and Forecast 2032 – Markets and Data, accessed July 29, 2025, https://www.marketsandata.com/industry-reports/japan-biosimilars-market

- Biosimilar Regulation and Guidelines in Japan – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000267474.pdf

- Pharma Patent Strategy Blog Vol. 2: Operation of Patent Linkage in …, accessed July 29, 2025, https://english.s-cubecorp.com/2024/09/19/operation-of-patent-linkage-in-japan/

- Japan: Problem of Japan’s patent linkage system comes to the surface by a set of IP High Court decisions – Wolters Kluwer, accessed July 29, 2025, https://legalblogs.wolterskluwer.com/patent-blog/japan-problem-of-japans-patent-linkage-system-comes-to-the-surface-by-a-set-of-ip-high-court-decisions/

- Understanding Patent Process for Generics and Biosimilars in Japan, accessed July 29, 2025, https://globalregulatorypartners.com/understanding-patent-process-for-generics-and-biosimilars-in-japan-2/

- Japan’s patent linkage policy faces domestic debate and foreign pressure – MLex, accessed July 29, 2025, https://www.mlex.com/mlex/articles/2340428/japan-s-patent-linkage-policy-faces-domestic-debate-and-foreign-pressure

- When a 20 year patent term just isn’t enough: Market and data …, accessed July 29, 2025, https://www.fpapatents.com/news-insights/insights/when-a-20-year-patent-term-just-isnt-enough-market-and-data-exclusivity/

- Overview of the Patent Term Extension in Japan – KAWAGUTI & PARTNERS, accessed July 29, 2025, https://www.kawaguti.gr.jp/aboutlaw/jp_practices/01_1.html

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent Duration and Market Exclusivity – DrugPatentWatch, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- How to Track Competitor R&D Pipelines Through Drug Patent Filings – DrugPatentWatch, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- DrugPatentWatch: Monitoring Patent Filings and Expirations Key to Pharma Profitability, accessed July 29, 2025, https://www.geneonline.com/drugpatentwatch-monitoring-patent-filings-and-expirations-key-to-pharma-profitability/

- Leveraging Drug Patent Data for Strategic Investment Decisions: A Comprehensive Analysis, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/leveraging-drug-patent-data-for-strategic-investment-decisions-a-comprehensive-analysis/

- Generic Drug Entry Timeline: Predicting Market Dynamics After Patent Loss, accessed July 29, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-timeline-predicting-market-dynamics-after-patent-loss/

- Drug Patent Watch – GreyB, accessed July 29, 2025, https://www.greyb.com/services/patent-search/drug-patent-watch/

- Reversing the Tide: Japan’s Promising FY2024 Drug Pricing Reform – Health Advances, accessed July 29, 2025, https://healthadvances.com/insights/blog/reversing-the-tide-japans-promising-fy2024-drug-pricing-reform

- 6.1 Pharmaceuticals – Japan Health Policy NOW, accessed July 29, 2025, https://japanhpn.org/en/section-6-1/

- Japan Pricing Policy Reform 2024 – Trinity Life Sciences, accessed July 29, 2025, https://trinitylifesciences.com/blog/japan-pricing-policy-reform-2024/

- Japan – Pharmaceuticals – International Trade Administration, accessed July 29, 2025, https://www.trade.gov/country-commercial-guides/japan-pharmaceuticals

- Japan at a Crossroads: Reconciling Drug Price Reform and Innovation | Insights, accessed July 29, 2025, https://www.gtlaw.com/en/insights/2022/1/japan-at-a-crossroads-reconciling-drug-price-reform-and-innovation

- Challenges introduced by Japan’s drug pricing policy – PMC – PubMed Central, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11776077/

- Navigating pharma frontiers: a comparative gaze at Japan and the U.S. – The Worldfolio, accessed July 29, 2025, https://www.theworldfolio.com/interviews/navigating-pharma-frontiers-comparative-gaze-at-japan-and-the-us/5920/

- Insight into Japan’s Generic Drug Industry (Part 1): Challenges and …, accessed July 29, 2025, https://www.brandancorjapan.com/post/japan-s-generic-drug-industry-part-1-challenges-and-consequences

- Publication of Government Committee Report for Rebuilding the Generic Drug Industry in Japan | Publications | Nagashima Ohno & Tsunematsu, accessed July 29, 2025, https://www.noandt.com/en/publications/publication20240613-2/

- Japan’s efforts to address drug supply issues: regulatory reforms and industry collaboration, accessed July 29, 2025, https://www.ibanet.org/Japan-drug-supply-issues-regulatory-reforms

- TOWA PHARMACEUTICAL 2024, accessed July 29, 2025, https://www.towayakuhin.co.jp/english/assets/En2024mihiraki.pdf

- Japan Generic Medicines Association|President’s Message, accessed July 29, 2025, https://www.jga.gr.jp/english/presidents-message.html

- Generic Firms Required to Disclose Supply Info from June after Pilot Rollout of Company Indicators | PHARMA JAPAN, accessed July 29, 2025, https://pj.jiho.jp/article/250374

- Japan Pharmaceutical Manufacturing Market Size [2033] – Astute Analytica, accessed July 29, 2025, https://www.astuteanalytica.com/industry-report/japan-pharmaceutical-manufacturing-market

- How Japan Squandered Its Biopharmaceutical Competitiveness: A Cautionary Tale | ITIF, accessed July 29, 2025, https://itif.org/publications/2022/07/25/how-japan-squandered-its-biopharmaceutical-competitiveness-a-cautionary-tale/

- Trend Analysis of Regulatory Approvals for Generics and Biosimilars in Japan: 15 Years of PMDA During Fiscal Years 2009-2023 – PubMed, accessed July 29, 2025, https://pubmed.ncbi.nlm.nih.gov/39532822/

- Pharmaceutical Regulations in Japan 2020 – CHAPTER 1.ORGANIZATION AND FUNCTION OF THE MINISTRY OF HEALTH, LABOUR AND WELFARE, accessed July 29, 2025, https://www.jpma.or.jp/english/about/parj/eki4g6000000784o-att/2020e_ch01.pdf

- FY 2023 GMP / GCTP Annual Report – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000273632.pdf

- Annual Reports | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/about-pmda/annual-reports/0001.html

- FY 2022 GMP / GCTP Annual Report – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000267516.pdf

- What’s New (FY2023) | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/0020.html

- Ministry of Health, Labor and Welfare (2023) Annual Report on Health and Welfare Statistics. Ministry of Health, Labor and Welfare. – References – Scientific Research Publishing, accessed July 29, 2025, https://www.scirp.org/reference/referencespapers?referenceid=3949976

- Ministry of Health, Labour and Welfare: Statistics & Other Data, accessed July 29, 2025, https://www.mhlw.go.jp/english/database/report.html

- Pharmaceutical Regulations in Japan 2020 – CHAPTER 3.DRUG DEVELOPMENT, accessed July 29, 2025, https://www.jpma.or.jp/english/about/parj/eki4g6000000784o-att/2020e_ch03.pdf

- Japan regulatory system for pharmaceutical products and Active Pharmaceutical Ingredients – NPRA, accessed July 29, 2025, https://www.npra.gov.my/images/Drug-Registration-Guidance-Document/april-2015/Japan-regulatory-system-for-pharmaceutical-products-API-H.Yamada.pdf

- DrugPatentWatch Guide Explains How to Research and Analyze Drug Patents Using Google Patents – GeneOnline News, accessed July 29, 2025, https://www.geneonline.com/drugpatentwatch-guide-explains-how-to-research-and-analyze-drug-patents-using-google-patents/

- GMP / QMS / GCTP Inspections | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/review-services/gmp-qms-gctp/0003.html

- GMP Compliance Inspection concerning Drugs and Quasi-drags of …, accessed July 29, 2025, https://www.pmda.go.jp/english/review-services/gmp-qms-gctp/0006.html

- GMP compliance inspection | Pharmaceuticals and Medical Devices Agency – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/english/review-services/gmp-qms-gctp/0001.html

- GMP system of Japan, accessed July 29, 2025, https://www.mhlw.go.jp/file/04-Houdouhappyou-11123000-Iyakushokuhinkyoku-Shinsakanrika/gmp.pdf

- Japan Updates 2025 NHI Drug Prices – Pacific Bridge Medical, accessed July 29, 2025, https://www.pacificbridgemedical.com/news-brief/japan-updates-2025-nhi-drug-prices/

- Japan’s NHI Drug Price System – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000248690.pdf

- Bridging the Gap: Going Overseas to Ensure a Stable Supply of Generic Drugs in Japan, accessed July 29, 2025, https://www.meiji.com/global/wellness-stories/bridging-the-gap.html

- Evolving Landscape of New Drug Approval in Japan and Lags from International Birth Dates: Retrospective Regulatory Analysis, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8246743/

- Japan to Fast-Track Generic Drug Manufacturing Integration from …, accessed July 29, 2025, https://www.navlindaily.com/article/25085/japan-to-fast-track-generic-drug-manufacturing-integration-from-april-1

- Comprehending Generic Drug Registration and Approval Requirements in Japan – Freyr., accessed July 29, 2025, https://www.freyrsolutions.com/white-papers/comprehending-generic-drug-registration-and-approval-requirements-in-japan

- Recent Pharmaceutical Regulatory Developments in Japan: A 2025 Update, accessed July 29, 2025, https://www.pacificbridgemedical.com/uncategorized/recent-pharmaceutical-regulatory-developments-in-japan-a-2025-update/

- Generic drug market – OECD Data Explorer, accessed July 29, 2025, https://stats.oecd.org/wbos/fileview2.aspx?IDFile=4c170032-1dcd-4324-a541-dcba0ac7ec38

- Japan’s M&A Boom – Pharmaceutical Technology, accessed July 29, 2025, https://www.pharmaceutical-technology.com/features/feature42973/

- Role of Pharmacists in Generic Pharmaceutical Adoption – Institute for Economic Studies, Keio University Keio-IES Discussion Paper Series, accessed July 29, 2025, https://ies.keio.ac.jp/upload/DP2024-015_EN.pdf

- Japan Pharmaceutical Market Size & Outlook, 2024-2030, accessed July 29, 2025, https://www.grandviewresearch.com/horizon/outlook/pharmaceutical-market/japan

- Japan Pharmaceutical Market Size, Forecast Report & Share Analysis 2030, accessed July 29, 2025, https://www.mordorintelligence.com/industry-reports/japan-pharmaceutical-market

- Japan’s Drug Innovation Incentive Policies: Policy Challenges Undermine Desired Goals – The Asia Group, accessed July 29, 2025, https://theasiagroup.com/wp-content/uploads/2024/10/TAG-White-Paper_2024_ENG-1.pdf

- (PDF) Contemporary generic market in Japan – Key conditions to successful evolution, accessed July 29, 2025, https://www.researchgate.net/publication/259875741_Contemporary_generic_market_in_Japan_-_Key_conditions_to_successful_evolution

- The generic drug market in Japan: Will it finally take off? – ResearchGate, accessed July 29, 2025, https://www.researchgate.net/publication/49728014_The_generic_drug_market_in_Japan_Will_it_finally_take_off

- GUIDANCE DOCUMENT FOR SUBMISSION OF APPLICATION ON FORM 5-F (CTD) FOR REGISTRATION OF PHARMACEUTICAL DRUG PRODUCTS FOR HUMAN USE, accessed July 29, 2025, https://www.dra.gov.pk/wp-content/uploads/2022/01/Guidance-Document-on-CTD-Doc-No.-PER-GL-AF-004.pdf

- CTD General Questions and Answers – PMDA, accessed July 29, 2025, https://www.pmda.go.jp/files/000156190.pdf

- Attractive Markets | Life Science – Industries – Investing in Japan – Japan External Trade Organization – JETRO, accessed July 29, 2025, https://www.jetro.go.jp/en/invest/attractive_sectors/life_science/attractive_markets.html

- A Pilot Study on the Drug Price Revision Strategy in Japan: A Comparison Among Fiscal Years 2018, 2020, and 2022, accessed July 29, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11569764/

- Market Report Biopharmaceuticals and Biosimilars, accessed July 29, 2025, https://www.jetro.go.jp/ext_images/usa/2018/PDF_files/mr_bio_en201712.pdf

- Japan – Pharmaceuticals | Privacy Shield, accessed July 29, 2025, https://www.privacyshield.gov/ps/article?id=Japan-Pharmaceuticals

- Positive Trends in the Drug Pricing System in Japan: Efforts to Reduce the Drug Lag, accessed July 29, 2025, https://globalforum.diaglobal.org/issue/june-2024/positive-trends-in-the-drug-pricing-system-in-japan-efforts-to-reduce-the-drug-lag/

- Japan’s MHLW Now Accepts Annual Reports for CMC Changes – Pacific Bridge Medical, accessed July 29, 2025, https://www.pacificbridgemedical.com/news-brief/japans-mhlw-now-accepts-annual-reports-for-cmc-changes/

- Japan Pharmaceutical Manufacturers Association Guide, accessed July 29, 2025, https://www.jpma.or.jp/news_room/issue/guide/2021/rfcmr000000034s1-att/JPMA_guide2021_EN.pdf