The pharmaceutical industry stands at a fascinating crossroads, where scientific innovation meets complex legal frameworks and intense market pressures. In this dynamic environment, intellectual property (IP) is not merely a legal formality; it is the very bedrock of business models, dictating market exclusivity, driving investment, and ultimately shaping the availability of life-saving medicines.1 But how do business leaders and innovators truly harness the power of patents to secure a competitive edge? This report delves into the often-underestimated value of method-of-use patent claims, revealing how they can become a potent weapon in protecting therapeutic assets and ensuring sustained profitability.

The Strategic Imperative: Unlocking Value with Method-of-Use Patents in Pharma

Why Patent Strategy is Your Competitive Edge in Pharmaceuticals

The pharmaceutical sector operates under unique economic realities, where the path from discovery to patient access is fraught with immense challenges. Understanding these underlying dynamics is crucial for appreciating the indispensable role of patent strategy.

The High Stakes of Drug Development: Investment, Risk, and Reward

Developing a new drug is an arduous, multi-year journey, often consuming 12-13 years from initial patent filing to regulatory approval.2 This extensive process significantly erodes the effective market exclusivity period, leaving typically only 7-10 years for commercialization.2 This inherent time crunch compels pharmaceutical companies to pursue aggressive and layered patent strategies. Every additional year of exclusivity gained through secondary patents translates directly into billions in revenue, making these strategies a core business imperative rather than just a legal tactic.1

The financial investment required is staggering, with research and development (R&D) costs running into billions of dollars, compounded by high failure rates where most drug candidates never make it through clinical trials.2 Without robust patent protection, recouping these colossal investments would be nearly impossible, stifling future innovation and access to new therapies.1 This highlights a fundamental policy tradeoff: patents incentivize innovation by granting a temporary monopoly, but this monopoly also leads to higher drug prices and concerns about patient access.1 Companies must be acutely aware of this public perception and regulatory scrutiny, as method-of-use patents, by extending market exclusivity, intensify this ongoing debate.

Beyond the Molecule: The Evolving Landscape of Pharmaceutical IP

The traditional “composition of matter” patent, covering the core chemical compound, is undeniably valuable, offering the broadest protection for a novel drug molecule.1 If the molecule is present in a product, the patent applies, offering broad protection against generic versions. However, it is increasingly just one layer in a multi-pronged IP defense.1

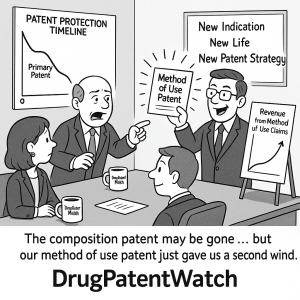

Pharmaceutical companies now construct a “patent thicket” – a dense and overlapping network of patents – to secure comprehensive protection and deter competitors.1 This strategy involves layering various patent types, including formulation, process, and crucially, method-of-use patents.1 This approach reflects a strategic evolution from a “molecule-centric” to a “lifecycle-centric” IP strategy. Historically, the composition of matter patent was the primary focus. However, with lengthy development cycles and the need for extended exclusivity, the emphasis has shifted. A significant portion, 72%, of patents for top drugs are filed

post-FDA approval, with method-of-use patents constituting a substantial 41% of these post-approval filings. This indicates that companies are no longer just protecting the initial discovery but are continuously innovating and patenting improvements throughout the drug’s lifecycle – new uses, formulations, delivery methods, and manufacturing processes. Method-of-use patents are central to this “evergreening” strategy, turning existing assets into new revenue streams.

The complexity of these patent thickets, averaging 74 granted patents per top-selling drug in the U.S. , makes it significantly harder and more costly for generics to navigate, thereby delaying market entry and extending the brand’s monopoly. This intricate web of protection is a direct response to the aggressive strategies of generic manufacturers, particularly under the Hatch-Waxman Act, which incentivizes generic challenges. The patent thicket creates a high-stakes legal battleground where every patent claim, especially method-of-use claims, becomes a strategic piece in a complex chess game.

Demystifying Method-of-Use Patents: A Foundational Understanding

Before leveraging method-of-use patents, one must first truly understand their nature, how they differ from other patent types, and how to craft them effectively. Think of a patent claim as the fence around intellectual property – it defines the precise boundaries of exclusive rights.18 A well-defined claim is crucial for preventing infringement and securing competitive advantage.

What Exactly is a Method-of-Use Patent?

A method-of-use patent, often referred to as a “process” patent, protects a specific way of using a product to achieve a particular result.20 Unlike product patents that protect the physical entity itself, method-of-use patents cover the application or utilization of a product.21 For instance, in the pharmaceutical industry, while a composition claim might cover a new drug formulation, a method-of-use claim focuses on

how that drug is applied, such as its use for a specified therapeutic indication.5 This capability makes method-of-use patents particularly powerful for repurposing existing, even off-patent, compounds. It opens significant opportunities for companies to breathe new life into their portfolios, demonstrating that innovation isn’t always about discovering a new molecule, but often about discovering a new application.15

Distinguishing Method-of-Use from Composition-of-Matter and Formulation Claims

To fully grasp the strategic utility of method-of-use patents, it is essential to differentiate them from other common pharmaceutical patent types:

- Composition of Matter Patents: These are considered the “gold standard,” covering the chemical entity or active pharmaceutical ingredient (API) itself.1 If the molecule is present in a product, the patent applies, offering broad protection against generic versions.

- Formulation Patents: These protect the unique combination of an API with excipients, defining the dosage form (e.g., capsule, tablet, spray) or how the drug is released (e.g., extended-release).5 They are critical for extending the lifespan of aging products by improving delivery or patient compliance.11

- Method-of-Use Patents: These differ by focusing on the application or process of using a drug, such as treating a specific disease, a new route of administration, or a particular dosage regimen.5 For example, a drug initially approved for heart disease might be patented for a newly discovered application in treating cancer.

Pharmaceutical companies rarely rely on a single patent type. Instead, they build a multi-layered “fortress” of IP protection, combining these various types. Method-of-use patents are crucial for this layering, especially when the original compound patent is nearing expiration, as they offer new avenues for exclusivity and revenue generation. This strategy acknowledges that no single patent can withstand all challenges, necessitating a comprehensive approach to IP defense.1

The “Process” vs. “Use” Nuance: Clarity in Claiming

While “method” and “process” are often used interchangeably, a subtle but important distinction exists. “Method” typically refers to a way to use a product to accomplish a given result, while “process” often refers to a series of steps involved in manufacture.20 In U.S. patent law, “use” claims without active steps are often considered indefinite under 35 U.S.C. 112(b), making “method” claims, which outline specific steps, generally more acceptable.31 This means a method claim must describe a “series of steps for performing a function or accomplishing a result”.

This emphasis on “active steps” and “definiteness” highlights a critical legal hurdle for patent validity. Vague claims are highly vulnerable to rejection during prosecution or invalidation during litigation. For business professionals, this means that merely identifying a new use is not enough; the how must be meticulously defined and claimed. This necessitates close collaboration with patent attorneys who understand the nuances of claim drafting, ensuring that the inventive step (the “new use”) is clearly and precisely articulated to withstand scrutiny from patent examiners and potential infringers. This precision directly impacts the strength and enforceability of the patent, which in turn affects its commercial value.

The Anatomy of a Robust Method-of-Use Claim

Crafting effective method-of-use claims is both an art and a science. Like all claims, they must fully define the invention, ensuring it works for its intended purpose and is unique (novel and non-obvious) compared to prior art.

Crafting Precise Language: Preamble, Transitional Phrases, and Active Steps

Patent claims are legal statements that define the scope of protection sought.18 They are typically written as a single, heavily punctuated sentence, appearing towards the end of the patent document. A well-structured method-of-use claim generally consists of three main parts:

- Preamble: This section identifies the category of the invention (e.g., “A method for treating malaria”) and may recite an object or purpose of the invention.

- Transitional Phrase: Often “comprising” or “comprising the steps of,” this phrase indicates an open-ended claim that does not exclude any additional unrecited elements, thereby expanding the potential scope of the claim.33

- Body: This is where the core of the method is described, reciting a sequence of active steps. These steps typically use gerunds (verbs ending in “-ing”) to direct the action (e.g., “boiling water; adding sugar…”).33 While the steps may be recited in a specific order of performance, they are usually interpreted as being performed in any order unless explicitly specified within the claim.34

The language used in claims serves a dual role: protection and disclosure. Claims define the boundaries of patent protection 18 and must “particularly point out and distinctly claim the invention” for public notice. This aligns with the fundamental “bargain” of the patent system: government-backed protection in exchange for full disclosure of the invention, enabling others to understand and replicate it once the patent term expires.2 This creates a tension: while the goal is broad protection, the claims must also be sufficiently detailed and clear to inform the public of the boundaries and enable replication after expiry. Overly broad or vague claims risk indefiniteness rejections 31, while overly narrow claims leave room for competitors. The art lies in balancing these two imperatives, especially for method-of-use claims where the “steps” are crucial for defining the inventive concept.

The Art of Dependent Claims: Broad Protection, Specific Detail

Patent applications typically begin with at least one independent claim, which stands alone and provides the broadest protection, covering the core inventive concept.18 Building upon these independent claims are dependent claims. Dependent claims incorporate all the features of the independent claim from which they depend and then add one or more further features or define existing features more specifically.18 This “chaining” allows for a broad general claim while also protecting specific embodiments or variations of the invention.

This layered approach offers a significant strategic advantage, particularly as a litigation shield. The ability to add “optional, dependent claim steps” until a method is “unique” compared to prior art is a critical defensive strategy. In litigation, if a broad independent claim is challenged or invalidated, narrower dependent claims can still provide protection. This layered approach, where method-of-use patents can have numerous dependent claims detailing specific dosages, patient populations, or administration routes, creates a more resilient patent portfolio. It forces generic challengers to invalidate multiple claims, significantly increasing their costs and risks, thereby enhancing the overall defensibility and commercial value of the therapeutic asset.

Strategic Deployment: Maximizing Market Exclusivity and Product Lifecycle

Method-of-use patents are not merely a legal checkbox; they are dynamic instruments that can fundamentally reshape a therapeutic asset’s commercial trajectory. By strategically deploying these claims, pharmaceutical companies can extend market exclusivity, unlock new value from existing drugs, and build an impenetrable fortress around their innovations.

Method-of-Use Patents as Pillars of Product Lifecycle Management (PLM)

Pharmaceutical Product Lifecycle Management (PLM) is a comprehensive framework that guides a drug’s journey from discovery through post-patent exclusivity, ensuring that critical decisions are timed and orchestrated to protect both public health and the bottom line. Method-of-use patents are integral to this process.

Extending the Commercial Lifespan of Therapeutic Assets

Method-of-use patents are granted for novel therapeutic uses discovered for existing drugs during later stages of PLM. This means that even after a drug has been initially approved for a specific medical condition, if new applications for that drug are found, a new patent can be obtained for that newly discovered use, thereby extending its commercial life.5 This strategy is crucial for maximizing the return on investment in R&D, especially given the high failure rates and long development timelines inherent in drug development. PLM, underpinned by strategic method-of-use patenting, is an economic imperative. Without it, companies would struggle to recoup their initial investments, leading to a decline in future drug discovery. Method-of-use patents provide a flexible mechanism to achieve this by allowing innovation

beyond the initial compound, ensuring continued revenue streams.

The Power of “Evergreening” and Patent Thickets: A Multi-Layered Defense

“Evergreening” is the practice of filing for new patents on secondary features of a pharmaceutical as earlier patents expire, thereby extending effective patent exclusivity past the original 20-year term.5 This often involves minor modifications like new dosages, formulations, delivery methods, or, critically, new methods of use.2 This strategy, combined with “patent thickets” (averaging 74 granted patents per top-selling drug in the U.S. ), creates a robust, multi-layered defense that significantly delays generic entry.1

The sophistication of evergreening has increased significantly. While it may involve seemingly “minor modifications” 9, it now encompasses complex techniques such as chiral switches, new dosage forms, controlled release mechanisms, and new indications.16 This implies a continuous R&D investment even for mature products, driven by the need to secure new, defensible IP. For instance, AbbVie’s Humira famously leveraged over 100 patents to push its exclusivity from 2016 to 2023, generating over $200 billion in cumulative sales.17

This practice, however, exists in a state of tension. While companies defend evergreening as protecting “new and useful inventions” and encouraging innovation 1, critics argue it “unduly extend[s] the period of exclusivity” and keeps drug prices high without significant benefits for consumers or innovation.9 This is a core ethical and policy debate. From a business perspective, evergreening via method-of-use patents is a rational strategy to protect investment. However, it fuels public and regulatory scrutiny, leading to calls for reforms and increased litigation risk. Companies must navigate this tension carefully, demonstrating genuine innovation rather than merely “gaming the system.”

Unlocking New Therapeutic Value: Repurposing and New Indications

One of the most powerful applications of method-of-use patents lies in unlocking new therapeutic value from existing compounds. This involves finding novel applications for drugs that may already be on the market, or even those that are off-patent.

Case Studies in Commercial Success: From Viagra to Humira

The pharmaceutical landscape is replete with examples where method-of-use patents have transformed the commercial trajectory of therapeutic assets:

- Pfizer’s Viagra: Beyond its initial compound patent for angina, Pfizer secured method-of-use patents specifically for erectile dysfunction, extending its exclusivity well into the 2010s. This demonstrates how a new application can create an entirely new market segment and revenue stream.

- AbbVie’s Humira (Adalimumab): This blockbuster drug, initially approved for rheumatoid arthritis, expanded its indications to a range of autoimmune diseases, with scientists continually discovering new applications. AbbVie’s layered patent strategy, including numerous method-of-use patents, pushed its exclusivity from 2016 to 2023, generating over $200 billion in cumulative sales.14 This success underscores the immense value of continuous R&D to identify new indications.

- Other Illustrative Examples:

- Bupropion: Initially marketed as Wellbutrin for depression, it was later patented for smoking cessation under the brand name Zyban.

- Prilosec to Nexium: A formulation switch that extended market life for a proton pump inhibitor.25

- Imitrex: A migraine drug that gained extended protection through a new route of administration (intranasal delivery).26

- Botox (Botulinum Toxin): This remarkable therapeutic asset began with patents for eye twitches but subsequently secured patents for migraines, excessive sweating, and cosmetic wrinkles, each new use backed by a method-of-use patent.

These repeated examples of successful drug repurposing demonstrate that finding new therapeutic uses for existing drugs is a highly effective and increasingly common strategy for extending market life. This trend incentivizes continued post-market research and clinical trials, not just for initial approval, but for discovering new patient populations, diseases, or administration methods. Method-of-use patents are the legal mechanism that converts this scientific discovery into sustained commercial value, making R&D a continuous, lifecycle-spanning activity.

The Oncology Frontier: Protecting Novel Treatment Protocols

In the dynamic field of oncology, method-of-use patents are particularly crucial. Innovations often involve highly specific novel treatment protocols, combination therapies, or the identification of particular patient populations that respond to a drug based on biomarkers.40

Examples of method-of-use patents in oncology include:

- Immunoscore®: A patented in-vitro diagnostic tool that quantifies the immune response of cancer patients, providing doctors with greater insight into cancer severity and relapse risk. This is a method of using diagnostic information to guide treatment.

- Protein Analysis and Blood Filtration (ISET®): Patented techniques for extracting and analyzing proteins from human cells or filtering blood to detect circulating tumor cells (CTCs) long before metastasis. These are methods for early diagnosis and monitoring, which can inform treatment decisions.

- Stabilized mRNA for New Therapies: Patents covering more stable messenger ribonucleic acid (mRNA) formulations, paving the way for new therapies for cancers and inherited genetic diseases. While this involves a composition, the method of using this stabilized mRNA for therapeutic delivery is also patentable.

- Next-Generation Cancer Treatments: Patents related to growth-inhibiting drugs that cut off blood supply to tumors or targeted therapies like Herceptin, which specifically targets tumors with the HER2 breast cancer gene. These are methods of treating cancer by specific mechanisms or in specific patient groups.

These examples illustrate that method-of-use patents are uniquely suited to protect innovations in precision medicine. As treatments become more personalized, defining who gets treated how becomes as critical as the drug itself. These patents allow companies to protect specific patient subgroups, dosing regimens, or diagnostic-guided therapies, which are hallmarks of modern oncology and personalized medicine. This suggests that method-of-use patents will only grow in importance as the industry shifts towards more targeted therapies and individualized treatment paradigms.

Navigating the Regulatory and Legal Labyrinth: Challenges and Enforcement

The strategic value of method-of-use patents is undeniable, but their protection is far from guaranteed. The pharmaceutical landscape is a minefield of regulatory complexities and high-stakes litigation, where even well-crafted patents can face formidable challenges. Understanding these challenges is paramount for any business professional seeking to leverage these assets effectively.

The Hatch-Waxman Act: A Double-Edged Sword for Method-of-Use Patents

The Hatch-Waxman Act of 1984 (officially the Drug Price Competition and Patent Term Restoration Act) aimed to strike a delicate balance between incentivizing pharmaceutical innovation and promoting greater consumer access to affordable generic drugs.42 It achieved this by creating an expedited pathway for generic drug approval while allowing brand-name drugs to extend their patents to compensate for time lost during the lengthy regulatory approval process.

Skinny Labeling: A Pathway Fraught with Peril?

A key provision of Hatch-Waxman allows generic manufacturers to receive FDA approval for non-patented uses by “carving out” or removing patent-protected indications from their drug’s label. This practice is known as “skinny labeling”. The intention behind this mechanism was to prevent delays in generic entry that would occur if generic manufacturers had to wait for all method-of-use patents on a brand-name drug to expire.

However, recent federal judicial decisions have significantly threatened the viability of this pathway, making it riskier for generic manufacturers.42 These judicial interpretations have, in effect, undermined the original legislative intent of Hatch-Waxman. This creates a chilling effect on generic competition, potentially extending brand monopolies and leading to prolonged periods of higher-priced drugs. For brand companies, this development highlights an unexpected strengthening of method-of-use patents, but it also prompts calls for increased scrutiny and potential policy interventions to re-balance the system. The legal landscape is actively reshaping the commercial viability of generic entry.

The Bolar Exemption: Balancing Innovation and Generic Access

The Bolar exemption, a crucial component introduced in the U.S. via the Hatch-Waxman Act, allows third parties (primarily generic manufacturers) to use patented inventions solely for purposes reasonably related to the development and submission of information to the FDA for marketing authorization, without infringing the patent.46 This exemption is critical for generic companies to prepare their products for market entry

before the brand patent expires, preventing a de facto extension of the brand’s monopoly due to lengthy regulatory approval times.46

The existence of the Bolar exemption globally underscores a widespread recognition of the need to balance patent rights with timely generic entry. While the specifics of the exemption vary by jurisdiction (e.g., the broader scope in Italy compared to the proposed EU Pharma Package ), its presence universally highlights the challenge of bridging the gap between patent expiry and generic market readiness. For pharmaceutical companies, understanding the nuances of the Bolar exemption in key markets is crucial for both defending their method-of-use patents and planning their generic entry strategies.

High-Stakes Litigation: Understanding Induced Infringement

Patent disputes are a significant concern in the pharmaceutical industry due to the high value of drug patents. Generic manufacturers frequently challenge patents under Hatch-Waxman, often leading to costly and time-consuming litigation. A particularly contentious area involves claims of induced infringement, especially concerning method-of-use patents.

The Coreg II Decision: Reshaping Generic Strategy

The case of GlaxoSmithKline LLC v. Teva Pharmaceutical USA, Inc. (Coreg II) (2021) dramatically reshaped the landscape for method-of-use patent enforcement. In this case, Teva, a generic manufacturer, was found liable for induced infringement of GSK’s method patent for Coreg (carvedilol), despite attempting to use a “skinny label” carve-out.30 The court ruled that Teva failed to fully carve out the patented use because its skinny label, combined with marketing materials and internal statements, implicitly encouraged use for an overlapping, patented indication.

This decision redefined the concept of “inducement” by moving beyond just the generic label, scrutinizing marketing materials and even internal company discussions. This significantly increases the financial risk for generic manufacturers using skinny labeling, as routine statements or internal expectations could now be interpreted as induced infringement.30 For brand companies, this ruling strengthens the enforceability of method-of-use patents, making them more valuable assets to assert, even against seemingly compliant generic labels. This will likely lead to an “uptick in litigation” arising from carve-outs previously considered low risk. The case underscores the imperative for integrated legal and commercial strategy: a generic’s legal and regulatory compliance (skinny label) might not be enough to avoid infringement if their commercial activities (marketing, internal communications) suggest inducement. This necessitates unprecedented collaboration between legal, regulatory, and commercial teams within generic companies. For brand companies, it means monitoring not just generic labels, but also their marketing and sales strategies to identify potential induced infringement. The lines between legal compliance and commercial conduct have blurred, making holistic strategy critical.

The Amarin Case: Expanding Liability to Insurers?

The Amarin Pharma, Inc. v. Hikma Pharms. USA Inc. (2021) case introduced a novel theory of liability that could further expand the reach of method-of-use patent enforcement. In this litigation, the patent owner sued a health insurer alongside the generic manufacturer, alleging that both induced physicians to infringe the patent by prescribing the generic for the patented indication. The court found the inducement claim against the health insurer “plausible,” denying a motion to dismiss.

If this theory succeeds, it could significantly increase the value and enforceability of method-of-use patents by expanding the pool of potential infringers to include entities like health insurers and pharmacy benefit managers (PBMs). This would force a re-evaluation of risk across the entire pharmaceutical supply chain and healthcare ecosystem, potentially leading to new forms of litigation and commercial agreements. The implications are profound, potentially shifting the burden of patent enforcement and compliance across a broader range of stakeholders.

Litigation Statistics: What the Numbers Tell Us

The pharmaceutical industry is characterized by persistent and costly litigation, which is a fundamental market reality. In 2023, approximately 3,700 patent litigation cases were filed in U.S. district courts, representing a 12% increase from 2022. Pharmaceutical patents accounted for 15% of all patent injunctions in 2023. The median time to trial for patent litigation cases in 2023 was 24.5 months, with an average cost of $3 million through trial. Biotechnology patent litigation, often involving complex scientific considerations, averages $2.5 million per case. Despite these costs, 40% of patent litigation cases were settled before trial, indicating a strategic choice to avoid the uncertainties and expenses of a full trial.

For business professionals, these figures mean budgeting for substantial legal defense and offense is a strategic necessity. The high stakes, often involving billions in revenue 17, justify these costs. The rising trend in cases suggests that IP protection is becoming even more fiercely contested, reinforcing the need for robust, defensible method-of-use patents.

Jurisdictional differences also play a critical role. In the Unified Patent Court (UPC), patentees have enjoyed a nearly 60% win rate in infringement proceedings, with decisions delivered swiftly (e.g., 3 months for preliminary injunctions). This contrasts with the longer timelines in U.S. district courts. This highlights the critical importance of global IP strategy and forum shopping. Companies must understand where their method-of-use patents are strongest and where litigation is most favorable, both in terms of speed and success rates. The UPC’s “rocket docket” nature 51 could make Europe an increasingly attractive venue for enforcing method-of-use patents, influencing global market access strategies.

Table 1: Key Pharmaceutical Patent Litigation Statistics (Illustrative Data)

| Metric | U.S. District Courts (2023) | Unified Patent Court (UPC) (as of Jan 2025) | Implications for Method-of-Use Patents |

| Total Patent Cases Filed | ~3,700 (12% increase from 2022) | Rising trend (16 to 23 cases/month average) | Indicates a highly litigious environment, necessitating proactive IP defense. |

Ensuring Definiteness and Non-Obviousness: USPTO Guidelines and Case Law

The strength of any patent, including method-of-use claims, hinges on its ability to satisfy fundamental patentability requirements: novelty, utility, and non-obviousness. The U.S. Patent and Trademark Office (USPTO) provides stringent guidelines, particularly concerning definiteness.

Under 35 U.S.C. 112(b), claims must “particularly point out and distinctly claim the invention”. This requirement ensures that the scope of the claims is clear, informing the public of the boundaries of what constitutes infringement. Claims that do not meet this standard are considered “indefinite” and will be rejected. The primary purpose of this requirement is to provide clear notice to the public, fostering innovation and competitiveness by defining protected subject matter. A secondary purpose is to provide a clear measure of what the inventor regards as the invention, allowing for assessment against other patentability criteria.

For method-of-use patents, the non-obviousness requirement can be particularly challenging, especially when dealing with slight modifications of existing drugs or new uses for old compounds. While a new use for an old invention does not render the old invention patentable per se, the new use itself might be patentable. The key lies in demonstrating that the new use is not a “trivial or common sense variation of the prior art”. Patentees have successfully overcome obviousness challenges where there were “unexpected results or properties” or where the prior art “taught away from the claimed invention”. This necessitates meticulous documentation and often requires elucidating and disclosing mechanistic information to prove that a claimed new use is truly novel and non-obvious.

Case law, such as Eye Therapies, Inc. v. Glaukos Corp. , illustrates that while patent claims are typically accorded their plain and ordinary meaning, an inventor may act as their own lexicographer to define a patent term, or advance an atypical meaning through statements and evidence in the prosecution history. This means that the entire prosecution history of a patent application can be critical in interpreting the scope and meaning of method-of-use claims, especially when defending against challenges to their validity or scope.

Leveraging Data for Strategic Advantage: The Role of DrugPatentWatch

In the complex and highly competitive pharmaceutical landscape, access to comprehensive and actionable patent data is not just beneficial; it is a strategic imperative. Turning raw patent information into competitive advantage requires sophisticated tools and analytical capabilities.

Transforming Patent Data into Actionable Intelligence

Drug patent data, when properly analyzed, offers invaluable insights for strategic decision-making across the pharmaceutical value chain. It helps companies anticipate future budget requirements, proactively identify generic sources, assess the success rates of patent challengers, and elucidate the research paths of competitors. For branded manufacturers, it provides intelligence for global business intelligence and forecasting. For generic and API manufacturers, it informs portfolio management decisions and identifies market entry opportunities. Wholesalers and distributors can use it to predict branded drug patent expiration and prevent overstocking of off-patent drugs.

Platforms like DrugPatentWatch provide a fully integrated database of drug patents and other critical information, offering subscribers freeform searching and dynamic browsing of data pertaining to pharmaceuticals and patents, both in the US and internationally. This platform aggregates information directly from the U.S. Food and Drug Administration (FDA), Patent and Trademark Office (USPTO), and other global government sources, ensuring regular updates. This comprehensive data enables businesses to perform sector landscaping, conduct due diligence, and set up daily email alert watch lists to monitor competitive activity.

Monitoring Method-of-Use Patents: Identifying Opportunities and Threats

Effective monitoring of method-of-use patents is crucial for both innovators and generic challengers. For innovators, it means tracking their own patent portfolio to ensure optimal protection and identifying opportunities for new method-of-use claims. For generics, it means identifying market entry opportunities and assessing potential infringement risks.

DrugPatentWatch facilitates this by providing detailed regulatory status, information on patent expirations, and data on litigation, tentative approvals, and Paragraph IV challenges. Users can search by pharmacology, drug patent expiration, application name, trade name, and even by country for international patents. This granular level of detail allows for precise analysis of patent claims, helping to understand the exact scope of protection, identify potential vulnerabilities, and track ownership, which is crucial for assessing patent strength, potential infringement risks, and strategic competitive positioning. The platform’s ability to track litigation helps anticipate early generic entry and collect competitive intelligence by examining contractual disputes.

Analyzing Patent Use Codes and Litigation Trends

Patent use codes play a pivotal role in the pharmaceutical industry, serving as critical tools for balancing innovation incentives with generic drug competition. These alphanumeric identifiers, cataloged in the FDA’s “Orange Book,” define the specific approved methods of use protected by patents for branded drugs. This system, rooted in the Hatch-Waxman Act, governs how generic manufacturers navigate patent disputes while seeking regulatory approval.

DrugPatentWatch’s analysis of patent use codes and litigation data provides detailed insights for strategic decision-making, particularly for method-of-use patents.

- Understanding Carve-Out Viability: The analysis clarifies how well-defined use codes allow generics to remove protected indications, while ambiguous codes often force litigation over whether carve-outs avoid infringement. This insight is crucial for both brand-name companies, who can use it to draft more precise use codes, and generic companies, who can assess the feasibility and risks of carve-outs.

- Addressing Induced Infringement Claims: The platform’s analysis, by examining cases like AstraZeneca v. Alembic (2021), demonstrates how courts have upheld liability when a generic’s label, despite omitting a use code, included dosage information that overlapped with patented protocols. This provides a clear understanding of the legal risks involved in label design for generics and helps brands identify potential infringement even with carve-outs.

- Learning from Notable Case Studies: The analysis details specific cases, such as Horizon Pharma’s Vimovo®, where an overly broad use code was invalidated, serving as a cautionary tale for brand manufacturers. Similarly, Indivior’s Suboxone® case highlights the potential for anti-competitive practices through use code manipulation and the regulatory scrutiny such actions attract.

- Identifying Strategic Use Code Manipulation Tactics: The platform identifies “evergreening” tactics like “Umbrella Codes” (covering multiple indications under single patents), “Dosing Patents” (claiming specific titration schedules), and “Patient Subgroup Claims” (patenting biomarkers or genetic predictors of response). A 2023 JAMA study found that drugs with three or more use codes faced 78% more litigation than those with one to two codes, delaying generics by an average of 4.2 years. By recognizing these patterns, companies can anticipate and counter such strategies.

- Understanding the Impact on Generic Entry Delays: The FDA’s 2021 analysis revealed that 62% of Abbreviated New Drug Application (ANDA) delays stemmed from disputes over use code interpretation. This detailed understanding allows generic companies to better predict and prepare for potential delays, and for regulators to target areas for reform.

- Informing Regulatory Compliance and Strategy: The analysis outlines key changes in FDA guidance, such as requiring codes to match exact labeling language and banning “mechanism of action” claims. The reported 22% reduction in use code-related litigation since these reforms demonstrates their positive impact. Furthermore, the 2022 USPTO-FDA Collaboration Initiatives, establishing joint teams to assess use code alignment with patent claims, provide insight into future regulatory trends, enabling companies to align their patent and regulatory strategies more effectively.

Table 2: Impact of Patent Use Codes on Litigation (Illustrative Data)

| Metric | Observation | Implications for Method-of-Use Patents |

| Drugs with ≥3 Use Codes | Faced 78% more litigation than those with 1-2 codes | Highlights increased litigation risk and potential for generic delay with complex patent thickets. |

| Average Generic Delay (due to use code litigation) | 4.2 years | Demonstrates the significant commercial impact of strategic use code management. |

| ANDA Delays from Use Code Disputes | 62% of all ANDA delays | Pinpoints a major bottleneck for generic market entry, emphasizing the need for clarity. |

| Reduction in Use Code Litigation (post-2021 FDA guidance) | 22% reduction | Suggests that clearer guidelines can reduce disputes, benefiting both brand and generic firms. |

“Patent use codes are linchpins in balancing drug innovation and competition. Strategic misuse imposes $3.5 billion/year in excess U.S. healthcare costs, while recent FDA reforms show promise but require stricter enforcement.” \

Forecasting Market Dynamics with Patent Analytics

Beyond legal defense, patent data is a powerful tool for market forecasting and strategic investment decisions. Pharmaceutical sales estimation has evolved from simple revenue multipliers to sophisticated patent-driven models incorporating AI, global regulatory trends, and real-time analytics.

Patent portfolios explain 68% of the variance in drug revenue. Post-approval patents, including method-of-use claims, increase exclusivity periods by an average of 7.7 years. AI-driven patent analysis can improve sales forecasts by 32% compared to brand-based predictions. Machine learning models analyzing patent language patterns have shown a strong correlation with eventual sales volumes. A 2024 model combining natural language processing (NLP) patent analysis with clinical trial data achieved 89% accuracy in predicting first-year sales for new molecular entities, with key predictors including patent family size, international filings, and claim breadth. This indicates that method-of-use patents, especially those covering multiple therapeutic uses, can significantly increase a drug’s market potential and valuation.

For investors, leveraging drug patent data helps identify undervalued assets, anticipate generic competition, and mitigate risks through probabilistic modeling of litigation and regulatory outcomes. The economic rationale is clear: drugs protected by strong patents generate 80-90% of their lifetime revenue during exclusivity periods, with average revenue drops of 80-90% post-generic entry. This makes comprehensive patent analysis, including method-of-use claims, an indispensable part of any robust investment thesis in the pharmaceutical sector.

The Future Landscape: Innovations and Evolving IP Strategies

The pharmaceutical industry is on the cusp of transformative change, driven by technological advancements and evolving regulatory frameworks. Method-of-use patents will continue to play a critical role in this future, adapting to new modalities and global dynamics.

AI and Machine Learning: Revolutionizing Patent Analysis and Drug Discovery

Artificial intelligence (AI) and machine learning are rapidly reshaping both drug discovery and patent analysis. AI can analyze billions of compounds in days, predict drug interactions before human trials, and personalize treatments at an unprecedented scale. This will inevitably lead to the discovery of more novel methods of use for existing and new drugs.

In the realm of IP, AI-driven patent analytics are already improving sales forecasts by 32%. Machine learning models can predict litigation outcomes with 89% accuracy using claim language analysis. The pharmaceutical AI patent landscape grew at a 23% compound annual growth rate (2020-2022), with applications extending to predictive maintenance in manufacturing patent analysis. Real-time patent monitoring, enabled by AI, will allow for automated claim charts updating sales forecasts daily and blockchain-based patent tracking reducing data latency. This integration of AI will allow companies to identify patentable innovations, including methods of use, with greater speed and precision, and to monitor competitive landscapes with unprecedented granularity.

Global Harmonization and Emerging Jurisdictions

While patent systems share fundamental principles, significant differences exist across jurisdictions, particularly in the interpretation and enforcement of method-of-use claims and the application of exemptions like Bolar.47 The introduction of the Unified Patent Court (UPC) in Europe, offering a centralized system for enforcing European patents, is a significant development, potentially accelerating product launches and providing greater financial certainty across multiple member states. This move towards harmonization, albeit gradual, will influence global IP strategies, making cross-jurisdictional patent analysis even more critical.

Emerging markets and their evolving IP landscapes also present both opportunities and challenges. As countries like India develop their own innovation ecosystems, their interpretations of patent law, including those related to method-of-use claims and “evergreening,” will continue to evolve. Companies must maintain a global perspective, understanding the nuances of each jurisdiction to effectively protect their therapeutic assets worldwide.

Ethical Considerations: Balancing Innovation, Access, and Pricing

The strategic deployment of method-of-use patents, particularly through “evergreening” strategies, inevitably intersects with critical ethical considerations regarding drug pricing and patient access.3 While patents are essential to incentivize the colossal R&D expenditures required for medical breakthroughs, this exclusivity inherently leads to higher drug prices during the patent-protected period.1

Critics argue that certain patenting practices unduly extend exclusivity without significant benefits for consumers or innovation, contributing to high drug costs. Pharmaceutical manufacturers, however, counter that these practices protect new and useful inventions as intended by patent law, and that strong patent rights are necessary to encourage life-saving research. This ongoing debate necessitates a delicate balance. Future IP strategies will increasingly need to consider not just legal defensibility and commercial gain, but also public perception and the broader societal impact on healthcare accessibility. Companies that can demonstrate genuine innovation and a commitment to patient welfare, even while leveraging their IP, will likely navigate this complex ethical landscape more successfully.

Key Takeaways

- Method-of-Use Patents are Strategic Imperatives: In an industry defined by high R&D costs and truncated effective patent lives, method-of-use patents are not merely secondary protections but essential tools for extending market exclusivity and recouping investments. They are central to a lifecycle-centric IP strategy that goes “beyond the molecule.”

- Precision in Claim Drafting is Paramount: The enforceability and value of method-of-use patents hinge on meticulously crafted claims that clearly define active steps and distinguish the invention from prior art. Vague claims are highly vulnerable to invalidation.

- PLM and Evergreening are Economic Necessities: Strategic deployment of method-of-use patents through product lifecycle management and “evergreening” tactics is a direct response to market pressures and the need to maximize returns on significant R&D. These strategies, while contentious, are crucial for sustaining innovation.

- Repurposing Unlocks Significant Value: Method-of-use patents are exceptionally powerful for finding new therapeutic applications for existing drugs, breathing new commercial life into assets like Viagra, Humira, and Botox, and driving innovation in areas like precision oncology.

- Litigation Landscape is High-Stakes and Evolving: Recent court decisions like Coreg II and Amarin are reshaping the rules of engagement for induced infringement, increasing risks for generics and potentially expanding liability to new stakeholders like health insurers. This necessitates integrated legal and commercial strategies.

- Data Analytics is Your Competitive Compass: Leveraging platforms like DrugPatentWatch for real-time monitoring and analysis of method-of-use patent data, including patent use codes and litigation trends, is critical for identifying opportunities, mitigating risks, and accurately forecasting market dynamics.

- The Future is AI-Driven and Globally Nuanced: AI and machine learning will revolutionize patent analysis and drug discovery, while evolving global IP harmonization efforts and jurisdictional differences will require a sophisticated, adaptable IP strategy. Ethical considerations around access and pricing will remain central to the industry’s social license to operate.

Frequently Asked Questions (FAQ)

1. How do method-of-use patents specifically extend a drug’s market exclusivity when the original compound patent has expired?

Method-of-use patents extend exclusivity by protecting new therapeutic applications for an existing drug, even if the active ingredient itself is off-patent. For example, a drug initially approved for one disease might later be found effective for a different condition, and a new method-of-use patent can be obtained for this novel indication. This creates a new period of exclusivity for that specific use, preventing generic manufacturers from marketing their versions for that particular indication, effectively extending the commercial life of the drug for new patient populations.5

2. What is “skinny labeling” and why has its viability become a major concern for generic drug manufacturers?

“Skinny labeling” is a practice under the Hatch-Waxman Act where generic manufacturers omit patent-protected indications from their drug’s label to avoid infringing method-of-use patents, allowing them to gain FDA approval for non-patented uses. Its viability has become a major concern due to recent judicial decisions, particularly GlaxoSmithKline v. Teva (Coreg II). This ruling expanded the concept of “induced infringement” to include not just the generic label, but also marketing materials and even internal company communications, making it significantly riskier for generics to avoid liability even with a carved-out label.30

3. How does the Bolar exemption impact the development timelines for generic drugs, especially concerning method-of-use patents?

The Bolar exemption allows generic manufacturers to use patented inventions, including those covered by method-of-use patents, solely for purposes reasonably related to generating data for regulatory approval (e.g., FDA submission) before the patent expires.46 This is critical because obtaining marketing authorization can take years. By enabling generics to conduct necessary research and trials during the brand’s patent term, the Bolar exemption prevents a de facto extension of the brand’s monopoly and facilitates the timely entry of generic competition immediately upon patent expiration.46

4. What role does DrugPatentWatch play in helping pharmaceutical companies manage their method-of-use patent portfolios?

DrugPatentWatch provides a comprehensive database and analytical tools that transform patent data into actionable intelligence. For method-of-use patents, it allows companies to monitor patent expirations, track litigation trends, analyze patent use codes (which link patents to specific indications in the Orange Book), and identify competitive threats or opportunities.54 This enables strategic decision-making, from refining claim drafting to forecasting market dynamics and identifying potential induced infringement by competitors.55

5. How are AI and machine learning expected to influence the future of method-of-use patent strategies in pharmaceuticals?

AI and machine learning are poised to revolutionize method-of-use patent strategies by enhancing both drug discovery and patent analysis. AI can accelerate the identification of new therapeutic uses for existing compounds, leading to more method-of-use patent opportunities.30 In patent analysis, AI-driven tools can improve sales forecasts, predict litigation outcomes with high accuracy, and enable real-time monitoring of patent landscapes, allowing companies to identify and protect new methods of use with greater speed and precision, and to respond more effectively to competitive challenges.14

References

- The Patent Playbook Your Lawyers Won’t Write: Patent strategy development framework for pharmaceutical companies – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-patent-playbook-your-lawyers-wont-write-patent-strategy-development-framework-for-pharmaceutical-companies/

- Filing Strategies for Maximizing Pharma Patents: A Comprehensive Guide for Business Professionals – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- The Pharmaceutical Innovation Ecosystem and Patent Protection – Chapter 1 – Unicamillus, accessed July 27, 2025, https://ughj.unicamillus.org/en/special-issue/the-pharmaceutical-innovation-ecosystem-and-patent-protection-chapter-1/

- Unique Challenges for Patents in the Pharmaceutical Industry | Gearhart Law, LLC, accessed July 27, 2025, https://gearhartlaw.com/unique-challenges-for-patents-in-the-pharmaceutical-industry/

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent Duration and Market Exclusivity – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- Drug Innovation: When Patents Work – Milken Institute Review, accessed July 27, 2025, https://www.milkenreview.org/articles/drug-innovation-when-patents-work

- How Drug Patents Shape the Competitive Landscape in Pharma, accessed July 27, 2025, https://www.pharmafocuseurope.com/articles/drug-patents-shape-pharma-competition

- Research and Development in the Pharmaceutical Industry | Congressional Budget Office, accessed July 27, 2025, https://www.cbo.gov/publication/57126

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed July 27, 2025, https://www.congress.gov/crs-product/R46679

- Drug patents: innovation v. accessibility – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3680575/

- Types of Pharmaceutical Patents, accessed July 27, 2025, https://www.obrienpatents.com/types-pharmaceutical-patents/

- Patent Litigation in the Pharmaceutical Industry: Key Considerations, accessed July 27, 2025, https://patentpc.com/blog/patent-litigation-in-the-pharmaceutical-industry-key-considerations

- The Role of Patents in Biopharmaceutical Market Exclusivity …, accessed July 27, 2025, https://patentpc.com/blog/role-of-patents-in-market-exclusivity

- Annual Pharmaceutical Sales Estimates Using Patents: A Comprehensive Analysis, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/annual-pharmaceutical-sales-estimates-using-patents-a-comprehensive-analysis/

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- Pharmaceutical Life Cycle Management | Torrey Pines Law Group®, accessed July 27, 2025, https://torreypineslaw.com/pharmaceutical-lifecycle-management.html

- Developing a Comprehensive Drug Patent Strategy – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/developing-a-comprehensive-drug-patent-strategy/

- Understanding the Different Types of Patent Claims – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/understanding-the-different-types-of-patent-claims-2

- Introduction and Theory of Patent Claims – Protection of Inventive Concepts James Davies – WIPO, accessed July 27, 2025, https://www.wipo.int/edocs/mdocs/africa/en/wipo_aripo_ip_hre_2_18/wipo_aripo_ip_hre_2_18_t_4b.pdf

- Method (patent) – Wikipedia, accessed July 27, 2025, https://en.wikipedia.org/wiki/Method_(patent)

- What is the difference between a process patent and a product patent?, accessed July 27, 2025, https://wysebridge.com/what-is-the-difference-between-a-process-patent-and-a-product-patent

- Method of Use Patents – (Intro to Pharmacology) – Vocab, Definition, Explanations | Fiveable, accessed July 27, 2025, https://library.fiveable.me/key-terms/introduction-to-pharmacology/method-of-use-patents

- synapse.patsnap.com, accessed July 27, 2025, https://synapse.patsnap.com/article/what-is-the-difference-between-composition-and-method-of-use-claims#:~:text=For%20instance%2C%20in%20the%20pharmaceutical,or%20utilization%20of%20a%20product.

- Patenting New Uses for Old Inventions – Scholarship@Vanderbilt Law, accessed July 27, 2025, https://scholarship.law.vanderbilt.edu/cgi/viewcontent.cgi?article=2919&context=vlr

- Innovative Approaches to Extend the Life of Drug Patents – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/innovative-approaches-to-extend-the-life-of-drug-patents/

- Extending Life of Patents for Pharmaceutical Drugs, accessed July 27, 2025, https://www.obrienpatents.com/extending-life-patents-pharmaceutical-drugs/

- Formulation Patents and Dermatology and Obviousness – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3857063/

- Patent protection strategies – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3146086/

- What is the process of expanding a drug patent by changing the molecule (or formulation etc.) called again? – Patsnap Synapse, accessed July 27, 2025, https://synapse.patsnap.com/article/what-is-the-process-of-expanding-a-drug-patent-by-changing-the-molecule-or-formulation-etc-called-again

- Method-of-Treatment Patents Increasing Value Risk, accessed July 27, 2025, https://www.outsourcedpharma.com/doc/method-of-treatment-patents-increasing-value-risk-0001

- What are the key differences between “use” claims and method claims in patent applications? – BlueIron IP, accessed July 27, 2025, https://blueironip.com/ufaqs/what-are-the-key-differences-between-use-claims-and-method-claims-in-patent-applications/

- 2173-Claims Must Particularly Point Out and Distinctly Claim the Invention – USPTO, accessed July 27, 2025, https://www.uspto.gov/web/offices/pac/mpep/s2173.html

- Drafting Patent Applications: Writing Method Claims – IPWatchdog.com, accessed July 27, 2025, https://ipwatchdog.com/2016/06/18/patent-applications-method-claims/id=70212/

- PATENT CLAIM FORMAT AND TYPES OF CLAIMS – WIPO, accessed July 27, 2025, https://www.wipo.int/edocs/mdocs/aspac/en/wipo_ip_phl_16/wipo_ip_phl_16_t5.pdf

- Claim drafting – WIPO, accessed July 27, 2025, https://www.wipo.int/edocs/mdocs/aspac/en/wipo_ip_mnl_3_18/wipo_ip_mnl_3_18_p_10.pdf

- Ultimate Guide to Pharmaceutical Product Life Cycle Management (PLM) – TikaMobile, accessed July 27, 2025, https://www.tikamobile.com/resources/blog/ultimate-guide-to-pharmaceutical-product-life-cycle-management

- Humira: The Most Financially Successful Drug Ever! – YouTube, accessed July 27, 2025, https://www.youtube.com/watch?v=RDI7_E7QD7M

- Patenting strategies by pharmaceutical companies: a lawful use of the patent system or an abusive conduct? – CORE, accessed July 27, 2025, https://core.ac.uk/download/599344186.pdf

- From bench to blockbuster: the story of HUMIRA® – best-selling drug in the world, accessed July 27, 2025, https://www2.mrc-lmb.cam.ac.uk/news-and-events/lmb-exhibitions/from-bench-to-blockbuster-the-story-of-humira-best-selling-drug-in-the-world/

- How to Patent Innovations in Anti-Cancer and Chemotherapy Drugs – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/how-to-patent-innovations-anti-cancer-and-chemotherapy-drugs

- Taking precise aim: Fighting the cancer pandemic with patented technologies | epo.org, accessed July 27, 2025, https://www.epo.org/en/news-events/in-focus/medical-technologies/cancer

- Frequency of first generic drugs approved through “skinny labeling …, accessed July 27, 2025, https://www.jmcp.org/doi/10.18553/jmcp.2025.31.4.343

- Patent Term Extensions and the Last Man Standing | Yale Law & Policy Review, accessed July 27, 2025, https://yalelawandpolicy.org/patent-term-extensions-and-last-man-standing

- “Use Patents, Carve-Outs, and Incentives — A New Battle in the Drug-Pat” by Arti K. Rai, accessed July 27, 2025, https://scholarship.law.duke.edu/faculty_scholarship/2642/

- The “Skinny Labels, Big Savings Act” – What Are Its Implications? – Orrick, accessed July 27, 2025, https://www.orrick.com/en/Insights/2025/07/The-Skinny-Labels-Big-Savings-Act-What-Are-Its-Implications

- Bolar Provision: An Exemption to Patent Exclusivity, accessed July 27, 2025, https://www.globalpatentfiling.com/blog/bolar-provision-exemption-patent-exclusivity

- Bolar exemption, UPCA and Pharma Package: what to expect? An Italian perspective, accessed July 27, 2025, https://www.ibanet.org/bolar-exemption-upca-pharma-italy

- Patent Litigation Statistics: An Overview of Recent Trends – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/patent-litigation-statistics-an-overview-of-recent-trends

- Patent Injunction Statistics: Trends and Implications – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/patent-injunction-statistics-trends-and-implications

- Managing Drug Patent Litigation Costs – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/managing-drug-patent-litigation-costs/

- UPC Statistics: 60% Success Rate Patentees, Rapid, and Further Key Insights – JUVE Patent, accessed July 27, 2025, https://www.juve-patent.com/sponsored/simmons-simmons-llp/upc-statistics-60-success-rate-patentees-rapid-and-further-key-insights/

- Unlocking intellectual property potential in European pharma, accessed July 27, 2025, https://www.europeanpharmaceuticalreview.com/article/247140/unlocking-intellectual-property-potential-in-european-pharma/

- Prosecution History Can Inform an Atypical Meaning of a Patent Claim Term – Duane Morris, accessed July 27, 2025, https://www.duanemorris.com/alerts/prosecution_history_can_inform_atypical_meaning_patent_claim_term_0725.html

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 27, 2025, https://crozdesk.com/software/drugpatentwatch

- Decode a Drug Patent Like a Wall Street Analyst – DrugPatentWatch …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-to-check-if-a-drug-is-patented/

- Patent Use Codes for Pharmaceutical Products: A Comprehensive …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/patent-use-codes-for-pharmaceutical-products-a-comprehensive-analysis/

- Leveraging Drug Patent Data for Strategic Investment Decisions: A Comprehensive Analysis, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/leveraging-drug-patent-data-for-strategic-investment-decisions-a-comprehensive-analysis/

- The Future of Pharma: 2030 Market Predictions and Drug Innovation Stats | PatentPC, accessed July 27, 2025, https://patentpc.com/blog/the-future-of-pharma-2030-market-predictions-and-drug-innovation-stats

- Pharmaceutical patenting in the European Union: reform or riddance – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8592279/