Executive Summary

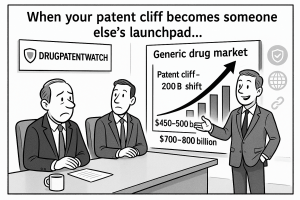

The global generic drug market stands at a strategic inflection point, poised for robust expansion yet simultaneously confronting unprecedented challenges that are fundamentally reshaping its competitive landscape. While market forecasts vary, a synthesized analysis projects the sector will grow from a baseline of approximately $450 billion to $500 billion in the mid-2020s to well over $700 billion by the early 2030s, driven by a compound annual growth rate (CAGR) in the range of 5% to 8%.1 This growth is propelled by powerful, long-standing tailwinds: an impending “patent cliff” set to release over $200 billion in branded drug sales into the competitive sphere, the unrelenting global pressure for healthcare cost containment, and the rising prevalence of chronic diseases demanding affordable, long-term therapies.

However, the traditional low-cost, high-volume model that defined the industry for decades is proving increasingly unsustainable. The very opportunities that fuel the market—lucrative patent expirations—are also the catalysts for its greatest challenge: intense price competition that leads to the rapid commoditization of products and severe margin erosion. This central paradox is forcing a strategic evolution. The future of the generic drug industry will no longer be defined by simply being the cheapest alternative but by a company’s ability to master a new triad of competitive differentiators.

First is the embrace of complexity, both in product development and regulatory navigation. The most significant growth is now concentrated in high-value segments like complex generics (e.g., injectables, inhalables) and biosimilars. These products, which are more difficult and costly to develop, create higher barriers to entry, offering a refuge from the hyper-competition of simple oral solids and promising more sustainable profitability.

Second is the integration of technology. Disruptive innovations such as artificial intelligence (AI) in drug formulation, continuous manufacturing for enhanced efficiency, and digital platforms for direct-to-consumer distribution are becoming critical levers for competitive advantage. These technologies promise to accelerate development timelines, reduce costs, and improve quality, but they also demand significant capital investment, threatening to create a divide between technologically advanced leaders and smaller, less capitalized players.

Third is the mastery of geography. The global market is not a monolith but a fragmented mosaic of distinct regional ecosystems. From the policy-driven shifts of the Inflation Reduction Act (IRA) in the United States and the centralized Volume-Based Procurement (VBP) system in China to the unique pricing and trust-related challenges in Europe and Japan, a one-size-fits-all strategy is a blueprint for failure. Success now requires highly tailored, region-specific approaches to market access, regulatory affairs, and supply chain management.

In this new era, the strategic imperatives for generic drug manufacturers are clear and urgent. They must innovate to escape commoditization, moving decisively up the value chain into more complex and defensible product categories. They must build resilient and agile supply chains, balancing the historical pursuit of low-cost production with the new geopolitical necessity of supply security. Finally, they must master the intricate complexities of a varied global regulatory and commercial landscape. The companies that successfully navigate these challenges will not only survive but will define the next chapter of the global generic drug market, solidifying their role as indispensable pillars of worldwide healthcare.

Introduction: The Unwavering Ascendancy of Generic Medicines

The Bedrock of Modern Healthcare

Generic medicines have evolved from a peripheral segment of the pharmaceutical industry into the bedrock of modern healthcare systems worldwide. Their ascendancy is a testament to a simple yet powerful value proposition: providing bioequivalent, safe, and effective alternatives to brand-name drugs at a fraction of the cost. In mature markets, their role is not just significant; it is dominant. In the United States, generic drugs account for over 90% of all prescriptions filled, yet they represent only about 18% of total prescription drug spending.7 Similarly, in Europe, generics constitute approximately 70% of the medicine volume.15

This high-volume, low-cost dynamic makes generics a critical tool for managing national health expenditures and ensuring broad patient access to essential treatments. The economic impact is staggering; over the past decade alone, the use of generic and biosimilar medicines has saved the U.S. healthcare system an estimated $3.1 trillion, with savings of $445 billion in 2023 alone.16 Consequently, generic medicines are no longer viewed merely as copies but as fundamental enablers of healthcare sustainability, freeing up resources for investment in novel, innovative therapies while ensuring that foundational treatments for chronic and acute conditions remain within reach for millions of patients.

A Brief History: From Policy Catalyst to Global Juggernaut

The trajectory of the generic drug industry has been inextricably linked to landmark legislation that created structured pathways for competition. In the United States, the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, is widely credited with creating the modern generic drug industry.17 By establishing the Abbreviated New Drug Application (ANDA) process, the Act allowed generic manufacturers to prove bioequivalence to a reference branded drug without having to repeat costly and time-consuming clinical trials, while also creating a framework for patent challenges that incentivized early market entry.

A parallel catalyst emerged in India with the passage of the 1970 Patent Act. This legislation did not recognize product patents for pharmaceuticals, only process patents, which empowered Indian companies to reverse-engineer and manufacture drugs using alternative methods.19 This policy cultivated a highly skilled and cost-efficient manufacturing base that would eventually transform India into the “pharmacy of the world.” These foundational policies in key regions unlocked the potential for generic competition, setting the stage for the industry’s growth from a domestic cost-saving mechanism into a formidable global economic force.

Thesis and Report Roadmap

While the foundational drivers of patent expirations and healthcare cost-containment pressures remain as potent as ever, the global generic drug market is entering a new, more complex era. The future landscape will not be shaped by these forces alone. Instead, success and market leadership will be determined by a company’s ability to navigate three critical and intersecting dimensions:

- Complexity: The strategic focus is shifting decisively from simple, oral solid dosage forms to more scientifically challenging and lucrative products, such as complex generics and biosimilars. This move up the value chain requires a parallel mastery of increasingly intricate and divergent global regulatory frameworks.

- Technology: The adoption of disruptive technologies, including artificial intelligence in R&D, continuous manufacturing in production, and digital platforms in commercialization, is becoming a key differentiator. These innovations are redefining efficiency, quality, and speed-to-market.

- Geography: The global market is increasingly fragmented. A deep understanding of and tailored strategic response to the unique dynamics of each major region—from policy shocks in the U.S. and centralized procurement in China to pricing systems in Europe and quality crises in Japan—is now essential for sustained growth.

This report will provide an exhaustive analysis of these dimensions. It begins by dissecting the global market’s size, growth drivers, and pervasive challenges. It then explores the innovation frontier, examining the technological and product-level shifts that are reshaping the industry. A detailed regional analysis follows, offering deep dives into the distinct market landscapes of North America, Europe, and Asia-Pacific. The report then profiles the competitive arena, comparing the strategies of industry leaders and the critical role of patent intelligence. The subsequent section brings in the human element, exploring patient and physician perspectives that are crucial for market adoption. Finally, the report concludes with a forward-looking outlook, offering strategic recommendations for stakeholders to navigate the evolving market through 2035.

Global Market Dynamics: Size, Scope, and Trajectory

The global generic drug market is characterized by a powerful and sustained growth trajectory, underpinned by fundamental economic and demographic trends. However, a closer examination reveals a landscape of considerable complexity, where immense opportunities are tempered by significant and persistent challenges. A comprehensive understanding of these dynamics is essential for any stakeholder seeking to navigate this vital sector of the global healthcare economy.

Synthesizing the Forecasts: A Multi-faceted View of Market Growth

Quantifying the precise size and growth rate of the global generic drug market is a complex task, with leading market research firms offering a range of projections based on different methodologies, base years, and market definitions. This variance itself provides a key piece of intelligence: while the direction of growth is undisputed, its exact magnitude is subject to the dynamic interplay of regulatory, competitive, and economic factors.

As illustrated in Table 1, forecasts for the market’s value in the mid-2020s typically range from approximately $435 billion to over $515 billion. Projections for the early 2030s extend from around $655 billion to over $775 billion. The compound annual growth rates (CAGRs) associated with these forecasts generally fall between 5% and 9%. Discrepancies often arise from factors such as the inclusion or exclusion of biosimilars, different assumptions about price erosion rates, and varying timelines for the impact of major patent expiries.

By synthesizing these diverse data points, a clear and defensible picture emerges. The global generic drug market can be reasonably estimated to grow from a baseline of approximately $450-$500 billion in the mid-2020s to a value exceeding $700-$800 billion by the early 2030s. This corresponds to a blended and sustainable CAGR in the 5% to 8% range, confirming a robust and enduring expansion that outpaces many other mature industries.

Table 1: Comparative Analysis of Global Generic Drug Market Forecasts

| Research Firm | Base Year & Value (USD B) | Forecast Year & Value (USD B) | CAGR (%) | Forecast Period | Source(s) |

| BCC Research | 2023: $435.3 | 2028: $655.8 | 8.5% | 2023-2028 | 1 |

| Grand View Research | 2022: $361.7 | 2030: $682.9 | 8.3% | 2023-2030 | 3 |

| Precedence Research | 2024: $445.6 | 2034: $728.6 | 5.04% | 2025-2034 | 2 |

| Vision Research Reports | 2025: $515.1 | 2033: $775.6 | 5.25% | 2025-2033 | 4 |

| Mordor Intelligence | 2025: $431.1 | 2030: $530.3 | 4.23% | 2025-2030 | 9 |

| Nova One Advisor | 2023: $465.2 | 2033: $779.7 | 5.3% | 2024-2033 | 5 |

Core Growth Drivers: The Forces Propelling the Market Forward

The sustained expansion of the generic drug market is not speculative; it is anchored in a set of powerful and predictable drivers that create a continuous stream of opportunities for manufacturers.

The Approaching “Patent Cliff”: A Tsunami of Opportunity

The single most significant driver of the generic drug market is the cyclical expiration of patents on blockbuster brand-name drugs. This phenomenon, often termed the “patent cliff,” represents a massive transfer of market value from innovator companies to generic competitors. Between 2025 and 2030, the industry is set to witness one of the largest waves of patent expiries in history, with estimates suggesting that branded drugs generating between $217 billion and $236 billion in annual sales will lose their market exclusivity.2

This impending cliff encompasses some of the world’s best-selling medicines, creating multi-billion-dollar opportunities in high-value therapeutic areas such as oncology, immunology, and cardiovascular disease. As shown in Table 2, major products like Merck’s cancer immunotherapy Keytruda, Johnson & Johnson’s immunology drug Stelara, and Bristol Myers Squibb’s anticoagulant Eliquis are all slated to face generic or biosimilar competition before the end of the decade. The sheer scale of this opportunity ensures a robust pipeline for generic manufacturers and acts as a powerful catalyst for market growth, triggering intense R&D activity and strategic planning years in advance of the actual patent expiry dates.

Table 2: Key Blockbuster Drugs Facing Loss of Exclusivity (2025-2030)

| Drug Name (Brand) | Active Ingredient | Company | 2023/2024 Sales (USD B) | Primary Indications | Expected Patent Expiry Year | Source(s) |

| Keytruda | Pembrolizumab | Merck | ~$29.5 | Multiple Cancers | 2028 | 22 |

| Stelara | Ustekinumab | Johnson & Johnson | ~$10.9 | Psoriasis, Crohn’s Disease | 2025 | 20 |

| Eliquis | Apixaban | Bristol Myers Squibb / Pfizer | ~$12.0 (BMS only) | Thrombosis Prevention | ~2026-2028 | 24 |

| Opdivo | Nivolumab | Bristol Myers Squibb | ~$9.3 | Multiple Cancers | 2028 | 22 |

| Darzalex | Daratumumab | Johnson & Johnson | ~$11.7 | Multiple Myeloma | 2029 | 22 |

| Xarelto | Rivaroxaban | Bayer / J&J | ~$4.5 | Thrombosis Prevention | 2025-2026 | 20 |

| Farxiga | Dapagliflozin | AstraZeneca | ~$6.0 | Type 2 Diabetes, Heart Failure | 2025 | 20 |

The Unrelenting Pressure of Healthcare Costs

Across the globe, healthcare systems are grappling with the challenge of rising costs, driven by aging populations, technological advancements, and the high price of innovative medicines. In this environment, generic drugs are not just a market-based alternative but a critical policy tool for cost containment.1 Governments, public payers, and private insurers actively promote the use of generics to manage budgets and ensure the long-term sustainability of their healthcare systems.5 This top-down pressure creates a powerful and consistent demand driver, as policies are increasingly designed to favor generic substitution wherever clinically appropriate.

The Global Burden of Chronic Disease

The epidemiological shift towards chronic, non-communicable diseases is another fundamental driver of the generics market. Conditions such as cancer, diabetes, cardiovascular disease, and respiratory illnesses are on the rise globally, necessitating long-term, often lifelong, medication regimens.2 For millions of patients, the affordability of these maintenance therapies is a primary concern. Generic drugs provide the cost-effective solutions required for managing these conditions, creating a vast and growing patient population that relies on their availability. The oncology segment is a particularly strong growth vector, with the rising incidence of cancer and the high cost of branded treatments making generic and biosimilar alternatives essential for expanding patient access to care.2

Government and Regulatory Tailwinds

Recognizing the value of a robust generics market, regulatory bodies and governments in key regions are implementing initiatives to foster competition. The U.S. Food and Drug Administration’s (FDA) Drug Competition Action Plan, for example, aims to streamline the review process and remove barriers to entry for generic manufacturers.18 Similarly, national programs like India’s Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) actively promote the use of generics through dedicated retail outlets and public awareness campaigns, seeking to build trust and increase uptake among the population.19 These supportive policies create a more favorable environment for generic drug development and market entry, acting as a direct stimulus for industry growth.

Pervasive Challenges and Headwinds: Navigating a Treacherous Landscape

Despite the strong growth drivers, the generic drug market is fraught with significant challenges that test the resilience and strategic acumen of even the most established players. The market’s structure creates a direct and unavoidable tension between the opportunity for growth and the threat of unprofitability. The massive revenue potential unlocked by patent expiries acts as a powerful magnet, attracting numerous competitors into the same space. This influx of suppliers inevitably triggers intense price wars, which, while beneficial for consumers and healthcare systems, can decimate profit margins for manufacturers. This dynamic forces companies into a “race-to-the-bottom,” where the primary basis of competition becomes price alone, leading to the commoditization of the product.1 The economic consequences are severe; data shows that when a single generic enters the market, prices fall by an average of 39%, but when six or more generics are competing, the price can plummet by a staggering 95% relative to the pre-entry brand price.21 This commoditization trap is the central economic challenge of the industry, forcing companies to either achieve immense operational scale to survive on razor-thin margins or to seek refuge in higher-value, less crowded market segments.

The Labyrinth of Global Regulatory Compliance

Navigating the world’s regulatory landscape is a complex and costly endeavor. Each major market—be it the U.S. (FDA), Europe (EMA), or Japan (PMDA)—maintains its own rigorous standards for drug approval, manufacturing, and quality control.1 While the scientific principles of bioequivalence are universal, the specific data requirements, submission formats, and review timelines can vary significantly. This lack of global harmonization means that manufacturers must dedicate substantial resources to regulatory affairs, tailoring their development and submission strategies for each target region. These stringent and often lengthy approval processes act as a significant barrier to entry, particularly for smaller companies, and can delay the market launch of affordable medicines.1

Supply Chain Fragility and Geopolitical Risks

The pursuit of cost efficiency has led to a high degree of geographic concentration in the pharmaceutical supply chain, particularly for Active Pharmaceutical Ingredients (APIs). A vast majority of the world’s generic APIs are manufactured in China and India, leveraging their cost advantages and large-scale production capabilities.29 While this model has been instrumental in lowering drug costs, its vulnerabilities were starkly exposed during the COVID-19 pandemic, which triggered widespread supply chain disruptions and drug shortages.3 This over-reliance on a few key regions has now become a matter of national security for many countries. Consequently, there is a growing political and strategic push for onshoring or “friend-shoring” manufacturing to enhance supply chain resilience.31 This trend creates a fundamental conflict: diversifying the supply chain to more secure, higher-cost regions will inevitably increase production costs, putting direct pressure on the low-price model that is the core value proposition of generic drugs.

The Enduring Shadow of Quality and Safety Concerns

Maintaining impeccable quality is not just a regulatory requirement but a matter of public trust. Any lapse in quality can have devastating consequences for patients and can irrevocably damage a manufacturer’s reputation, leading to regulatory actions such as warning letters, import alerts, and product recalls.1 High-profile scandals involving data integrity, contamination, and manufacturing deficiencies at various facilities have eroded confidence and invited intense scrutiny from regulators and the public alike.34 The challenge is not merely theoretical; documented cases of poorly formulated generics have led to significant patient harm, underscoring the critical importance of rigorous quality control.

“ConsumerLab tested the 300-milligram dose of Teva’s Budeprion XL against that of GSK’s Wellbutrin XL. The results revealed the likely source of patient distress: the generic dumped four times as much active ingredient during the first two hours as the brand name did. Graedon compared the effect to guzzling alcohol. ‘If you sip a glass of wine over the course of an hour, you’ll get a pleasant buzz,’ he explained. ‘But if you drink the whole thing in fifteen minutes, you’re getting too much too fast.’ The Graedons believed that this ‘dose dumping’ explained why many patients were experiencing signs of overdose, such as headaches and anxiety, followed by symptoms of withdrawal, including renewed depression and suicidal thoughts.” 37

Such incidents highlight that ensuring bioequivalence is a complex scientific challenge. Failures in this domain not only pose a direct risk to patient safety but also fuel skepticism among physicians and patients, creating barriers to the adoption of generic medicines even when they are properly manufactured. For manufacturers, the imperative is clear: quality cannot be compromised in the pursuit of cost reduction. It must be the foundation upon which any successful generic drug business is built.

The Innovation Frontier: Reshaping the Generic Landscape

In response to the relentless margin pressures and commoditization inherent in the traditional generics model, the industry is undergoing a strategic metamorphosis. The most forward-thinking companies are no longer content to compete solely on price. Instead, they are actively moving up the value chain, embracing product complexity and leveraging technological innovation to create more defensible market positions. This shift marks a new era for the industry, one defined by scientific sophistication, advanced manufacturing, and digital transformation.

The Strategic Imperative: Moving Up the Value Chain

The primary escape route from the commoditization trap is to focus on products that are inherently more difficult to develop, manufacture, and get approved. This strategy creates natural barriers to entry, resulting in less competition and more sustainable pricing power.

Complex Generics: The New Competitive Battleground

The market for simple, oral solid generics has become highly saturated, leading to the intense price erosion previously discussed.38 In response, a growing number of manufacturers are redirecting their R&D efforts toward “complex generics”.13 This category includes products with complex formulations, delivery systems, or active ingredients, such as sterile injectables, long-acting depot injections, transdermal patches, inhalation products, and drug-device combinations.

Developing these products presents a host of scientific and regulatory challenges that go far beyond what is required for a simple tablet or capsule. For example, demonstrating bioequivalence for a topical cream or an inhaled aerosol requires sophisticated in-vitro and in-vivo studies to prove that the drug is delivered to the site of action in the same way as the reference product.38 The manufacturing processes for these products, particularly sterile injectables, are also far more demanding, requiring specialized facilities and strict adherence to aseptic techniques to prevent contamination.39 These hurdles, while substantial, are also the source of the strategic opportunity. Because fewer companies possess the technical expertise and capital to overcome them, the competitive landscape for complex generics is less crowded, allowing successful entrants to command higher prices and achieve greater profitability.38

The Biosimilar Revolution: A Market Within a Market

The most significant and lucrative frontier in the off-patent market is the development of biosimilars. A biosimilar is a biological medicine that is highly similar to an already approved reference biologic, but not identical, due to the inherent complexity and variability of manufacturing large molecules in living systems.41 This distinction is critical, as it places biosimilars in a different regulatory and commercial category than traditional small-molecule generics.

The biosimilar market is projected to grow at a blistering pace, with some forecasts predicting a CAGR of over 17%, far outpacing the overall generics sector.44 This growth is fueled by the patent expiration of many of the world’s top-selling drugs, which are biologics used to treat complex diseases like cancer and autoimmune disorders. However, the barrier to entry is immense. The cost to develop a single biosimilar can range from $100 million to $250 million, orders of magnitude higher than the $1 million to $4 million required for a simple generic.41 The development process is also far more extensive, requiring not only sophisticated analytical and manufacturing capabilities but also comparative clinical trials to demonstrate no clinically meaningful differences from the reference product. This high-cost, high-risk environment limits the field of competitors to a handful of large, well-capitalized companies, effectively creating a high-value “market within a market” where the dynamics more closely resemble the innovative pharmaceutical sector than the traditional generics space.

Technological Disruption in Development and Manufacturing

Parallel to the shift in product focus, a technological revolution is underway that is transforming how generic drugs are developed and produced. These innovations offer a path to greater efficiency, higher quality, and faster speed-to-market.

Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence is rapidly moving from a futuristic concept to a practical tool in generic drug development. AI and ML algorithms can analyze vast datasets to accelerate and optimize nearly every stage of the process.11 In formulation development, AI can predict how different excipients (inactive ingredients) will affect a drug’s stability and dissolution profile, drastically reducing the number of costly and time-consuming lab experiments.7 AI can also be used to model and predict the outcome of bioequivalence studies, helping companies design trials more effectively and increase their probability of success.49 Furthermore, AI can automate aspects of the manufacturing process, improving consistency and reducing the risk of human error.7 Regulatory bodies are taking note; the FDA has seen a significant increase in submissions incorporating AI components and is actively developing a regulatory framework to support its use, signaling a clear path for its broader adoption.51

Continuous Manufacturing (CM)

The traditional method of pharmaceutical production, known as batch manufacturing, is an inefficient, multi-step process with significant downtime between stages. Continuous manufacturing represents a paradigm shift, transforming this fragmented process into a seamless, integrated flow where raw materials are fed in one end and finished products emerge from the other.52 The benefits are substantial. CM can reduce the physical footprint of a manufacturing plant by over 10 times, leading to lower capital and operational costs.53 It enhances product quality through real-time monitoring and control, reduces waste, and creates a more agile and flexible production line that can be reconfigured for different products in weeks rather than months.49 While innovator companies like Janssen and Vertex have been the early adopters, the potential for CM to revolutionize high-volume generic production is immense, offering a powerful tool to improve efficiency and profitability.52

3D Printing and Personalized Medicine

Looking further ahead, 3D printing technology holds the potential to upend the traditional mass-manufacturing model of generics. This technology could enable the on-demand production of personalized medications, where dosages are tailored to an individual patient’s specific needs based on factors like age, weight, and metabolism.49 For the generic industry, this could open up a new frontier of “personalized generics,” offering a way to add significant value and differentiate products in a crowded market, particularly for patients with complex or rare conditions.11

Digital Transformation of the Commercial Model

The technological disruption extends beyond the lab and factory floor to the commercial landscape itself. The rise of digital platforms is changing how generic drugs are distributed and accessed, creating new pressures and opportunities.

The Rise of Online Pharmacies

The emergence of direct-to-consumer online pharmacies, exemplified by ventures like the Mark Cuban Cost Plus Drug Company, represents a significant disruption to the traditional pharmaceutical supply chain.3 These platforms often operate on a transparent, cost-plus pricing model, bypassing the complex web of intermediaries like pharmacy benefit managers (PBMs) that dominate the U.S. market. By offering generic drugs directly to consumers at radically lower prices, they increase price transparency and empower patients, but also exert further downward pressure on manufacturer prices and margins.3 This trend is forcing generic companies to rethink their commercial and distribution strategies in an increasingly digital-first world.

The convergence of these innovations—complex products, advanced manufacturing, and digital commercial models—is creating a profound divergence within the generic drug industry. Companies that possess the capital, expertise, and strategic foresight to invest in these new capabilities will be able to create a sustainable competitive advantage based on value, quality, and efficiency. Those who remain tethered to the old model of competing solely on the price of simple generics will find themselves in an increasingly precarious position, squeezed by commoditization on one side and technological obsolescence on the other. This dynamic is likely to accelerate market consolidation, as larger, more technologically advanced players acquire smaller competitors or force them from the market.

A World of Difference: In-Depth Regional Market Analysis

The global generic drug market is not a monolithic entity but a complex mosaic of distinct regional and national markets, each shaped by its own unique regulatory frameworks, reimbursement systems, competitive dynamics, and cultural attitudes. A successful global strategy requires a nuanced, localized approach that recognizes and adapts to these profound differences. This section provides a deep-dive analysis of the world’s three primary pharmaceutical theaters: North America, Europe, and the rapidly evolving Asia-Pacific region.

North America: The Epicenter of Value and Volatility

North America, dominated by the United States, represents the largest and most lucrative market for generic drugs globally.2 It is a mature, highly competitive environment characterized by a well-defined regulatory pathway, powerful market intermediaries, and, recently, seismic policy shifts that are reshaping the industry’s future.

The U.S. Market: A Mature Giant Facing Disruption

The U.S. generic drug market is built upon the foundation of the 1984 Hatch-Waxman Act, which created the Abbreviated New Drug Application (ANDA) pathway. This process allows generic manufacturers to gain approval by demonstrating that their product is bioequivalent to an already-approved brand-name drug, forgoing the need for duplicative, large-scale clinical trials.14 The system is funded in part by the Generic Drug User Fee Amendments (GDUFA), which provide the FDA with resources to hire reviewers and modernize its processes, with the goal of expediting the review of generic drug applications.25

A key feature of the U.S. market is the 180-day exclusivity period granted to the first generic company that successfully challenges a brand-name drug’s patents. During this six-month period, the first-filer often enjoys a duopoly with the brand, allowing for higher prices and significant revenue generation before full-scale competition begins.56 However, this dynamic is often complicated by the entry of “authorized generics”—a generic version of the drug produced by the brand company itself or with its permission. The presence of an authorized generic during the 180-day period can significantly reduce the first-filer’s revenues by 40% to 52%, though it also tends to lower prices for consumers.56

The Inflation Reduction Act (IRA): A Seismic Shift in Market Dynamics

The passage of the Inflation Reduction Act (IRA) in 2022 represents the most significant change to the U.S. pharmaceutical pricing landscape in decades, with profound and potentially disruptive implications for the generic drug industry. The IRA’s centerpiece is the Medicare Drug Price Negotiation Program, which empowers the federal government to negotiate a “maximum fair price” (MFP) for a selection of top-selling drugs covered by Medicare that lack generic or biosimilar competition.28

This policy fundamentally alters the economic calculus for generic manufacturers. Historically, the most attractive targets for generic development have been blockbuster drugs with high list prices, as this created the largest potential for revenue even after significant price reductions. The IRA, however, directly targets these same blockbuster drugs for price setting. By establishing a government-negotiated MFP, the law creates a much lower price anchor that a future generic would have to compete against.17 This drastically reduces the potential return on investment for developing a generic version, weakening the incentive for market entry that has long been the engine of the Hatch-Waxman system.17

Furthermore, the IRA includes a provision often called the “pill penalty,” which makes small-molecule drugs (typically pills and capsules) eligible for price negotiation just nine years after their initial approval, compared to thirteen years for large-molecule biologics.17 This disparity is expected to shift R&D investment away from small molecules and toward biologics. The downstream effect for the generic industry is a potential shrinking of the future pipeline of traditional generic drugs, as fewer innovative small-molecule medicines are developed in the first place.17 The full, long-term consequences of the IRA are still unfolding, but it is clear that the law has introduced a new layer of uncertainty and risk that is forcing a strategic reassessment across the entire off-patent industry.

Europe: A Complex Mosaic of National Systems

The European generic drug market is characterized by a dual structure: a harmonized regulatory framework at the European Union level and a fragmented patchwork of pricing, reimbursement, and substitution policies at the national level. This creates a complex operating environment that demands a country-by-country approach.

The EMA Framework: Harmonization and Hurdles

The European Medicines Agency (EMA) oversees a centralized procedure for the approval of most generic and biosimilar medicines. A single application submitted to the EMA can result in a marketing authorization that is valid across all EU member states, streamlining the regulatory process for pan-European launches.60 The EMA’s approach to biosimilars is particularly noteworthy. The agency, along with the Heads of Medicines Agencies (HMA), has issued a strong scientific statement affirming that EU-approved biosimilars are interchangeable with their reference products.42 This means a prescriber can switch a patient from an originator to a biosimilar (or vice versa) with confidence. However, the authority to allow automatic substitution at the pharmacy level remains with individual member states.42

Tendering Systems and Price Pressure

Many European countries utilize tendering systems to procure generic drugs, particularly for the hospital sector. Under these systems, national or regional health authorities issue contracts for the supply of specific medicines, which are typically awarded to the manufacturer offering the lowest price.64 These tenders can create intense price competition, often resulting in “winner-take-all” or “multi-winner” scenarios that drive prices down significantly.66 While effective for cost containment, these systems can also lead to market concentration and increase the risk of drug shortages if a winning supplier is unable to meet demand.

Deep Dive – Germany: Reference Pricing and Reimbursement

Germany, Europe’s largest pharmaceutical market, employs a sophisticated system of reference pricing to control generic drug costs. The Federal Joint Committee (G-BA) groups therapeutically similar drugs (e.g., all statins) into clusters and the National Association of Statutory Health Insurance Funds (GKV-Spitzenverband) sets a maximum reimbursement amount, or “reference price” (Festbetrag), for that entire group.67 If a manufacturer prices its product above this reference price, the patient must pay the difference out-of-pocket. This creates a powerful incentive for companies to price their generics at or below the reference level to remain competitive.67 The system is further reinforced by policies that encourage physicians to prescribe economically and allow pharmacists to substitute for a lower-cost generic unless the physician explicitly forbids it (“aut idem” rule).69 Despite its efficiency, the constant downward pressure on prices has contributed to tight margins for manufacturers and has been cited as a factor in recent, significant drug shortages affecting the country.70 The German generic drug market was valued at approximately $17.5 billion in 2024 and is projected to grow at a CAGR of around 6% through 2033.73

Deep Dive – The UK: Post-Brexit Landscape and NICE Guidelines

The United Kingdom has one of the highest generic penetration rates in Europe, with generics accounting for roughly 75% of all prescriptions by volume but only 28% of the drug spend.74 The market is characterized by a free pricing system where competition among manufacturers drives prices down, delivering some of the lowest generic prices in Europe.75 A key institution is the National Institute for Health and Care Excellence (NICE), which conducts health technology assessments to evaluate the clinical and cost-effectiveness of new medicines for use within the National Health Service (NHS). NICE’s position is that its guidance for an originator biologic generally applies to its licensed biosimilars as well, facilitating their adoption into clinical practice without requiring a separate, full appraisal.77 Since Brexit, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) operates as a sovereign regulator, meaning manufacturers must now seek separate marketing authorizations for the UK and EU markets.80

The Phenomenon of Parallel Trade

A unique feature of the EU’s single market is the legal framework allowing for parallel trade. This practice involves intermediaries purchasing pharmaceuticals in a member state where prices are low (often due to national price controls) and reselling them in a member state where prices are higher.81 This arbitrage creates an additional layer of competition, particularly for branded drugs, and exerts downward pressure on prices in higher-cost countries. While it generates savings for health systems, it also adds complexity to supply chains and is a source of ongoing tension between manufacturers, who seek to maintain price differentials, and parallel traders who profit from them.83

Asia-Pacific: The Engine of Global Growth

The Asia-Pacific region is the fastest-growing pharmaceutical market in the world, driven by rising incomes, expanding healthcare access, and large populations. Within this region, India, China, and Japan represent three vastly different but equally critical markets for the global generic drug industry.

Deep Dive – India: The “Pharmacy of the World”

India’s position in the global generic drug market is unparalleled. It is the world’s largest supplier by volume, manufacturing approximately 20% of all global generics and supplying around 40% of the generic drugs consumed in the United States.19 The Indian generic drug market was valued at over $28 billion in 2024 and is forecast to exceed $51 billion by 2033, growing at a CAGR of nearly 7%.26

This dominance is built on several key strengths: a vast and well-established manufacturing infrastructure with the highest number of FDA-approved plants outside the U.S.; low production and labor costs; and a large pool of skilled scientific talent.26 The government actively supports the industry through initiatives like the Production Linked Incentive (PLI) scheme to boost domestic API manufacturing and reduce reliance on China.87

However, the industry faces significant challenges. It is under constant and intense scrutiny from the U.S. FDA and other international regulators, with inspections frequently resulting in citations (Form 483s), Warning Letters, and Import Alerts for violations of Good Manufacturing Practices (GMP).32 Domestically, the industry grapples with government price controls, fierce competition from thousands of local players, and a persistent perception gap among some physicians and patients regarding the quality of generics versus branded drugs.19 To secure its future growth, India’s pharmaceutical export strategy is shifting from a focus on high-volume commodity generics to higher-value products like complex generics, biosimilars, and specialty drugs, aiming to transition from volume-led to value-led growth.91

Deep Dive – China: The VBP Revolution and Its Aftermath

China’s pharmaceutical market has been radically reshaped by the implementation of the National Volume-Based Procurement (VBP) policy. VBP is a centralized procurement system where the government leverages the promise of guaranteed sales volume across public hospitals—often 60-70% of the total market for a given drug—to solicit competitive bids from manufacturers.94 The policy has been brutally effective at its primary goal: reducing drug prices. Winning bids often involve price cuts of 50% to over 90% compared to previous levels.96

The impact of VBP has been profound. It has forced a dramatic strategic pivot for all companies operating in China. The traditional model, which relied on large sales forces and marketing to physicians, has become obsolete. Success now hinges on winning VBP tenders, which requires an aggressive pricing strategy and a highly efficient, low-cost manufacturing operation.94 For multinational corporations, VBP has severely eroded the profitability of their off-patent originator brands, which often lose out to lower-priced domestic generics.99 For domestic generic manufacturers, winning a VBP contract provides massive volume but at razor-thin margins, while losing a bid can mean being effectively shut out of the majority of the public market.94

Recently, however, the VBP system has come under scrutiny. Complaints from clinicians about the perceived lower efficacy and higher rates of adverse events with some VBP-winning drugs have prompted government investigations into quality and therapeutic equivalence, highlighting the potential trade-offs between radical cost reduction and consistent product quality.96 The regulatory landscape is overseen by the National Medical Products Administration (NMPA), which has been working to align its standards with international norms, including requiring generic drugs to pass a Generic Quality Consistency Evaluation (GQCE) to be eligible for VBP bidding.103

Deep Dive – Japan: A Market of Unique Complexities

The Japanese pharmaceutical market, one of the largest in the world, presents a unique and often paradoxical environment for generic drugs. The government, facing the fiscal pressures of a rapidly aging population, has been aggressively promoting the use of generics, setting a target to increase their market share by volume to 80%.36 However, the industry is beset by deep-seated challenges that hinder progress.

A series of major quality control scandals at prominent generic manufacturers, most notably Kobayashi Kako, has shattered trust and led to widespread production suspensions and severe, ongoing drug shortages.35 This has exacerbated a pre-existing “trust deficit,” where a significant portion of both physicians and patients harbor negative perceptions about the quality, safety, and efficacy of generics compared to their long-trusted branded counterparts.108

The pricing and reimbursement system also creates hurdles. Japan employs a system of regular, government-mandated price revisions—historically biennial, now often annual—that consistently drives down the prices of all drugs on the market, squeezing profitability for manufacturers.111 For biosimilars, the system can create perverse incentives. A “High-Cost Medical Expense Benefit” system caps patients’ monthly out-of-pocket payments. Because expensive originator biologics are more likely to hit this cap, patients can sometimes end up paying less for the originator than for a lower-priced biosimilar, which serves as a major deterrent to switching.113 These combined challenges of quality crises, low trust, and a difficult pricing environment make Japan a uniquely complex market to navigate, where success depends as much on building a reputation for reliability and quality as it does on price.

The starkly different operating environments across these key global markets underscore a critical strategic reality. The historical model of developing a generic drug and launching it with a largely uniform global strategy is no longer viable. The policy-driven market of China’s VBP requires a focus on cost and scale that is fundamentally different from the needs of the U.S. market, where navigating patent law and the IRA’s pricing provisions is paramount. Similarly, success in Japan is contingent on overcoming a deep-seated trust deficit, a challenge that requires investment in quality assurance and physician education that goes far beyond the typical commercial strategy in Europe or North America. This divergence forces global players to operate not as single monolithic entities, but as a federation of highly specialized regional businesses, each tailored to the unique demands of its local market.

The Competitive Arena: Strategies of Industry Leaders

The global generic drug market is a fiercely competitive arena dominated by a handful of multinational titans, a dynamic cohort of specialized players, and a vast number of smaller regional manufacturers. Success in this environment requires not only operational excellence and scale but also sophisticated strategic planning, astute portfolio management, and a deep understanding of the intellectual property landscape. The leading companies are not standing still; they are actively reshaping their business models to adapt to the industry’s evolving pressures and opportunities.

Profiles of the Global Titans

The top tier of the generic drug industry is characterized by companies with a massive global footprint, extensive product portfolios, and significant manufacturing capabilities. Key players consistently cited as market leaders include:

- Teva Pharmaceutical Industries Ltd.: Headquartered in Israel, Teva has long been recognized as the world’s largest generic drug manufacturer by revenue, with a commanding presence in both the U.S. and European markets.6

- Sandoz: The generics and biosimilars division of Novartis, recently spun off as an independent entity, is a global powerhouse, particularly strong in Europe and a leader in the rapidly growing biosimilars segment.8

- Viatris Inc.: Formed through the 2020 merger of Mylan and Pfizer’s Upjohn division, Viatris is a global giant with a diverse portfolio spanning generics, complex generics, and established branded products.6

- Sun Pharmaceutical Industries Ltd.: India’s largest pharmaceutical company, Sun Pharma has a significant global presence, including a strong foothold in the U.S. market, and is a leader in specialty generics.6

- Dr. Reddy’s Laboratories Ltd.: Another leading Indian multinational, Dr. Reddy’s has a robust portfolio of generics and APIs and is increasingly focused on developing complex and specialty products for global markets.7

These companies, along with other major players like Fresenius Kabi and Aurobindo Pharma, set the competitive tempo for the industry, leveraging their scale and experience to navigate the market’s complexities.10

Divergent Paths: A Comparative Analysis of the “Big Three”

The intense pressures of price erosion and commoditization have forced the industry’s largest players to a strategic crossroads, leading to a notable divergence in their long-term business models. An analysis of the “Big Three”—Teva, Sandoz, and Viatris—reveals three distinct blueprints for future growth.115

- Teva: The Pivot to Innovation: After a challenging period marked by massive debt from its $40.5 billion acquisition of Allergan’s generics business and the patent loss of its blockbuster branded drug Copaxone, Teva is executing a “Pivot to Growth” strategy under new leadership.115 This strategy involves a deliberate shift away from the highly competitive small-molecule generics space. While maintaining a significant generics business, Teva is increasingly focusing its investment and R&D efforts on its innovative branded pipeline, particularly in neurology, immunology, and respiratory diseases. The company is also building out its biosimilar portfolio through strategic partnerships, aiming to create a more balanced, hybrid model that is less exposed to the volatility of the commodity generics market.114

- Sandoz: The Pure-Play Powerhouse: Following its spinoff from parent company Novartis in October 2023, Sandoz has embraced a “pure-play” strategy, doubling down on its core identity as a global leader in generics and biosimilars.116 Instead of diversifying into innovative R&D, Sandoz is leveraging its deep commercial experience, global manufacturing network, and strong brand recognition to win in the off-patent market. A central pillar of its strategy is to aggressively pursue the upcoming wave of biosimilar opportunities, positioning itself as a dominant force in this high-growth segment. This approach bets on operational excellence and scale as the primary drivers of long-term value.115

- Viatris: The Move Toward Branded Specialty: Viatris is pursuing a third path, increasingly moving toward a branded and specialty-focused model. A key strategic move was the sale of its biosimilars business to its partner Biocon Biologics, signaling a departure from that segment.116 The company’s strategy now leverages the commercial infrastructure and brand equity inherited from the Upjohn portfolio (which included legacy Pfizer brands like Lipitor) to build out its presence in specific therapeutic areas such as ophthalmology and dermatology. While it maintains a generics business, the focus is increasingly on complex generics with limited competition rather than commodity oral solids. However, analysts have noted that its pipeline of new products appears weaker compared to its peers, posing a challenge to its long-term growth ambitions.114

This strategic divergence signals the end of a monolithic “generic company” model. The market is now forcing a choice: either become a hyper-efficient, scaled-up leader in the core generics and biosimilars business, like Sandoz, or evolve into a hybrid specialty pharmaceutical company that blends off-patent assets with higher-margin branded or innovative products, as Teva and Viatris are attempting.

The M&A Imperative: Consolidate or Be Acquired

Mergers and acquisitions (M&A) are a fundamental strategic lever in the generic drug industry. Consolidation is often seen as a necessary response to intense price pressure, allowing companies to achieve greater economies of scale in manufacturing and distribution, which is critical for competing on cost.117 M&A is also a powerful tool for portfolio expansion and market entry. Acquiring another company can instantly add a range of new products, including complex generics or biosimilars, and provide access to new geographic markets where the target company has an established presence.2

The 2020 merger of Mylan and Upjohn to form Viatris is a prime example of a large-scale consolidation designed to create a global powerhouse with a diversified portfolio and expansive reach.117 However, M&A is not without significant risks. The Teva-Allergan deal serves as a cautionary tale; while it expanded Teva’s portfolio, the massive debt incurred left the company financially vulnerable when its key branded product faced generic competition, highlighting the immense financial strain and integration challenges that can accompany large-scale acquisitions.115

The Strategic Role of Patent Intelligence: Navigating the IP Battlefield

For any generic drug company, mastering the intellectual property (IP) landscape is not just a legal function but a core competitive strategy. The entire business model is predicated on understanding when drug patents expire and navigating the complex legal framework that governs market entry. This requires sophisticated patent intelligence to identify opportunities, mitigate risks, and outmaneuver competitors.122

Generic companies must continuously monitor the patent estates of branded drugs to determine the optimal timing for launching a generic version. This involves not only tracking the expiration date of the primary compound patent but also analyzing a dense web of secondary patents—often called a “patent thicket”—that cover formulations, methods of use, and manufacturing processes, which brand companies use to extend their market exclusivity.124 A crucial part of the strategy is conducting a thorough “freedom-to-operate” (FTO) analysis to assess the risk of infringing on existing patents, which could lead to costly and time-consuming litigation.122

Spotlight on DrugPatentWatch

In this high-stakes environment, specialized competitive intelligence platforms are indispensable tools. A prime example is DrugPatentWatch, a service widely used across the industry to gain actionable insights into the pharmaceutical patent landscape.125 This platform serves as a comprehensive database and early warning system, enabling companies to make data-driven strategic decisions.122

Companies leverage DrugPatentWatch for several critical functions:

- Identifying Opportunities: The platform provides detailed information on drug patent expiration dates across more than 130 countries, allowing manufacturers to identify the most promising and profitable generic opportunities and plan their R&D pipelines accordingly.1

- Monitoring Competition: By tracking new patent filings and litigation activities, including Paragraph IV challenges in the U.S., companies can monitor the R&D pipelines and strategic intentions of their competitors, anticipating who might be the first to file for a generic version of a key drug.122

- Informing Portfolio Management: The data helps generic and API manufacturers manage their portfolios by identifying which products to develop, when to launch, and which markets to enter. It also helps healthcare payers and wholesalers anticipate when branded drugs will face generic competition, allowing for better formulary and budget management.125

- Supporting Legal Strategy: The platform’s detailed litigation histories help companies assess the past successes of patent challengers and prepare for potential legal battles, which are a common feature of generic market entry.123

By providing timely and accurate intelligence on patents, regulations, and litigation, tools like DrugPatentWatch empower generic drug companies to navigate the complex IP battlefield, reduce risk, and capitalize on market opportunities more effectively.

The Human Element: Patient and Physician Perspectives

While market dynamics, regulatory frameworks, and corporate strategies are critical components of the generic drug landscape, the ultimate success of any medicine—branded or generic—hinges on its acceptance by patients and prescribers. The human element, encompassing trust, education, and the lived experience of treatment, is the final and most crucial gatekeeper to market access and adoption. This is particularly true for the industry’s most important growth areas: complex generics and biosimilars.

The Voice of the Patient: Advocacy for Access and Affordability

Patient advocacy groups have become powerful and influential stakeholders in the healthcare ecosystem. Organizations like the Association for Accessible Medicines (AAM) in the U.S. and the National Association of Medication Access & Patient Advocacy (NAMAPA) play a vital role in shaping public policy and championing the needs of patients.16 Their primary mission is to ensure that patients have access to safe, effective, and affordable medicines.

These groups are vocal proponents of generic and biosimilar drugs, highlighting the massive cost savings they deliver to both patients and the healthcare system.16 They actively lobby policymakers to reform patent laws and curb anti-competitive practices by some brand-name companies, such as the use of “patent thickets” or other strategies designed to delay generic entry.16 Furthermore, they advocate for policies that minimize patients’ out-of-pocket costs, such as those targeting “copay accumulator” programs, which can prevent manufacturer assistance from counting toward a patient’s deductible.129 By amplifying the patient voice in legislative and regulatory debates, these organizations are crucial allies in fostering a competitive and sustainable market for affordable medicines.

The Biosimilar Experience: Overcoming the Trust Barrier

The transition from a well-established branded biologic to a biosimilar can be a source of significant anxiety and uncertainty for patients. While biosimilars are proven to be just as safe and effective as their reference products, the very term “similar” can create confusion and apprehension.130 This challenge is compounded by a significant lack of awareness; one survey found that 66% of patients with chronic inflammatory diseases were unaware of biosimilars before being asked.131

Patient experiences with switching are mixed and highly personal. Many patients transition to a biosimilar seamlessly, experiencing the same therapeutic benefit at a lower cost, which can be life-changing.132 For example, Jeni, a patient with pancolitis, stated, “A biosimilar gave me my life back!” after switching to a product that eliminated her out-of-pocket costs.133

However, other patients report negative experiences, which can be driven by both physiological and psychological factors. One patient with rheumatoid arthritis described a difficult seven-month period after being forced to switch, experiencing a flare-up of her condition and new side effects that she attributed to the new medication.134 This highlights the importance of the “nocebo effect,” where negative expectations about a treatment can lead to the perception of negative effects. These experiences underscore the critical need for shared decision-making, where patients are consulted before a switch, educated about what to expect, and closely monitored afterward—practices that are recommended by bodies like NHS England but are not always followed.135

The Prescriber’s Perspective: Balancing Cost, Efficacy, and Trust

Physicians are the primary gatekeepers for prescription medicines, and their confidence is essential for the uptake of generics and biosimilars. However, a persistent “trust deficit” exists in many parts of the world. Surveys have consistently shown that a significant proportion of physicians hold negative perceptions, expressing concerns about the quality, efficacy, and safety of generics compared to branded drugs they have used for years.108

These concerns are magnified in the context of biosimilars. Because biologics are complex molecules used to treat serious diseases, physicians are often cautious about switching a patient who is stable and doing well on a reference product.137 A survey of U.S. physicians found that while 60% believed non-medical switching (a switch mandated by an insurer for cost reasons) could positively impact healthcare system costs, a majority also anticipated a negative impact on treatment efficacy (57%) and patient safety (53%).137 In Japan, physicians regularly request extensive data on quality, efficacy, and switching studies before they feel comfortable adopting and prescribing a biosimilar.110

This highlights that regulatory approval alone is not sufficient to guarantee market success. The final barrier to access is often the information gap at the clinical level. For manufacturers of complex generics and biosimilars, commercialization strategies must therefore include a robust educational component. This involves proactively providing clear, transparent, and convincing data to healthcare professionals, supporting them in their conversations with patients, and ultimately building “trust equivalence” to complement the scientifically demonstrated bioequivalence. Without this investment in education and communication, even the most promising and cost-effective products may fail to achieve their full market potential.

Future Outlook and Strategic Recommendations (2025-2035)

The global generic drug market is on the cusp of a transformative decade. The convergence of immense opportunity from the patent cliff, disruptive technological innovation, and profound shifts in the global regulatory and geopolitical landscape will create a more complex, competitive, and dynamic industry than ever before. Stakeholders—from manufacturers to policymakers—must anticipate these changes and adapt their strategies to thrive in this new environment.

The Next Decade: Key Trends Defining the Future Market

The trajectory of the generic drug market through 2035 will be shaped by several overarching trends:

- The Dominance of Biosimilars: The biosimilar segment will continue to be the primary engine of growth, capturing an ever-larger share of the off-patent market as more blockbuster biologics lose exclusivity. The market is projected to surge, with some estimates suggesting it could reach $175 billion by 2034.44 This will cement the shift in the industry’s center of gravity from small molecules to large molecules.

- Pervasive Integration of AI and Digital Technology: Artificial intelligence will become a standard tool in the R&D toolkit, used to accelerate formulation, predict bioequivalence, and optimize manufacturing.87 Digital platforms and online pharmacies will continue to disrupt traditional distribution channels, increasing price transparency and changing how companies engage with patients and payers.49

- Supply Chain Reconfiguration: The strategic imperative for supply chain resilience will drive continued investment in diversifying manufacturing locations. While cost will remain a key factor, there will be a sustained push to reduce over-reliance on single countries for critical APIs and finished products, leading to more regionalized and technologically advanced supply networks.31

- Accelerated Industry Consolidation: The dual pressures of commoditization in the simple generics segment and the high capital requirements for complex generics and biosimilars will continue to drive M&A activity. The market will likely see further consolidation as larger players acquire smaller competitors to gain scale, technology, or portfolio assets, leading to a more concentrated competitive landscape.117

Strategic Imperatives for Generic Manufacturers

To succeed in this evolving landscape, generic drug manufacturers must adopt a set of clear strategic imperatives that move beyond the traditional playbook.

- Innovate or Evaporate: The most critical strategic mandate is to move up the value chain. Companies must actively shift their portfolio mix away from hyper-competitive commodity generics and toward higher-value, more defensible products.139 This means prioritizing investment in the development of complex generics and biosimilars, which offer higher barriers to entry and more sustainable profitability.138 This is not merely an R&D strategy but a fundamental business model choice to escape the downward spiral of price erosion.

- Build the Supply Chain of the Future: The supply chain can no longer be viewed as a simple cost center; it is a source of competitive advantage. Manufacturers must invest in creating supply chains that are not only low-cost but also resilient, agile, and transparent.139 This may involve strategies like vertical integration to control the supply of key APIs, selective onshoring of critical manufacturing processes, and the adoption of advanced technologies like continuous manufacturing to enhance flexibility and quality.31

- Embrace Digital and Data: A digital-first mindset is essential. Companies must integrate digital tools and data analytics across the entire value chain. In R&D, this means using AI to accelerate development. In manufacturing, it means leveraging automation and real-time data to improve efficiency. In commercial operations, it means using digital channels to engage with healthcare providers and understanding market dynamics through sophisticated data analysis.138

- Master the Art of Partnership: In an increasingly complex world, no company can do everything alone. Strategic collaborations are essential for growth and risk mitigation. This includes partnering with technology companies to access cutting-edge AI platforms, forming joint ventures with local players to navigate the intricacies of emerging markets, and collaborating with academic institutions to fuel early-stage R&D.2

Policy Considerations for a Sustainable Ecosystem

Policymakers play a crucial role in shaping a generic drug market that balances the goals of affordability, innovation, and supply security. To foster a healthy and sustainable ecosystem, several policy areas warrant careful consideration:

- Reforming Procurement and Reimbursement: Tendering and pricing policies should be designed to reward not just the lowest price but also reliability and supply chain security. Moving from “winner-take-all” tenders to “multi-winner” models can maintain a competitive supplier base and reduce the risk of shortages.141

- Promoting Regulatory Harmonization: Greater alignment of regulatory requirements for generic and biosimilar approval across major jurisdictions (e.g., FDA, EMA, PMDA) would reduce the duplicative burden on manufacturers, lower development costs, and accelerate patient access to affordable medicines globally.

- Balancing Cost Containment with Market Sustainability: Policies aimed at reducing drug prices, such as the U.S. Inflation Reduction Act, must be carefully designed and monitored to avoid unintended consequences. If price controls are so severe that they eliminate the economic incentive for generic entry, they risk undermining the very market competition that has been the most effective long-term driver of lower drug costs.17 A sustainable policy framework must ensure that while healthcare systems achieve savings, manufacturers can still earn a sufficient return to justify the investment and risk inherent in drug development and manufacturing.

The future of the generic drug market will be defined by the interplay of these strategic and policy choices. The companies and countries that successfully adapt to this new era of complexity and innovation will not only lead the industry but will also play a pivotal role in ensuring the future of accessible and sustainable healthcare for a global population.

Key Takeaways

- Growth is Concentrated in Complexity: The global generic drug market is projected to experience robust growth, but this expansion is not uniform. The most significant opportunities and highest growth rates are concentrated in high-value, complex segments, particularly biosimilars, which are growing at a much faster pace than the overall market. The era of relying on simple, oral solid generics for growth is ending.

- A Strategic Crossroads: Scale vs. Innovation: Intense price pressure and commoditization are forcing the industry’s largest players into a fundamental strategic choice. The future belongs to either hyper-efficient, scaled-up “pure-play” companies that can compete on cost (the Sandoz model) or to hybrid “specialty” companies that blend their off-patent business with higher-margin innovative or branded assets to escape price erosion (the Teva and Viatris models).

- Technology as a Competitive Moat: Disruptive technologies like Artificial Intelligence (AI) in R&D and Continuous Manufacturing are no longer futuristic concepts but present-day competitive necessities. These innovations require significant capital investment, which is likely to widen the performance gap between large, technologically advanced leaders and smaller, less capitalized laggards, further fueling industry consolidation.

- Global Markets are Diverging, Not Converging: A one-size-fits-all global strategy is obsolete. Success now demands highly tailored, region-specific approaches to navigate the unique and often contradictory demands of key markets: the post-IRA pricing landscape in the U.S., the tender- and reference-pricing-driven systems in Europe, China’s state-controlled Volume-Based Procurement (VBP), and Japan’s trust- and quality-focused market.

- Supply Chain Resilience is a Core Strategic Priority: Spurred by the COVID-19 pandemic and geopolitical tensions, supply chain security has been elevated from a logistical concern to a board-level strategic priority. This creates a fundamental tension between the industry’s historical drive for the lowest possible manufacturing cost and the new imperative for supply chain diversification and resilience, which will inevitably introduce new costs into the system.

- Trust is the Final Hurdle for Market Access: For advanced products like biosimilars, demonstrating bioequivalence to regulators is only the first step. The ultimate barrier to market adoption is often a “trust deficit” among physicians and patients. Overcoming this requires a proactive and sustained investment in education, transparent data sharing, and stakeholder engagement to build confidence in the safety and efficacy of these complex medicines.

Frequently Asked Questions (FAQ)

1. What is the projected size of the global generic drug market?

Forecasts vary, but a synthesized analysis suggests the market will grow from a baseline of approximately $450-$500 billion in the mid-2020s to over $700-$800 billion by the early 2030s, with a compound annual growth rate (CAGR) between 5% and 8%.1

2. What is the difference between a generic drug and a biosimilar?

A generic drug is an exact chemical copy of a small-molecule, chemically synthesized brand-name drug. A biosimilar is a “highly similar” but not identical copy of a large-molecule, complex biologic drug that is produced in living cells. Due to this complexity, biosimilars require a more extensive and costly development and approval process, including clinical trials, compared to simple generics.41

3. How do regulatory agencies like the FDA and EMA ensure generic drugs are safe?

Regulatory agencies require generic drug manufacturers to conduct studies demonstrating that their product is bioequivalent to the brand-name reference drug. This means the generic must deliver the same amount of active ingredient into a patient’s bloodstream over the same period of time. They must also meet the same stringent standards for quality, purity, and manufacturing as the original drug.14

4. What is the “patent cliff” and which major drugs are affected?

The “patent cliff” refers to a period when a large number of blockbuster brand-name drugs lose their patent protection, opening the market to generic and biosimilar competition. Between 2025 and 2030, major drugs facing patent expiry include Merck’s Keytruda, Johnson & Johnson’s Stelara, and Bristol Myers Squibb’s Eliquis, representing over $200 billion in branded sales at risk.20

5. How is the Inflation Reduction Act (IRA) affecting the U.S. generic market?

The IRA’s Medicare Drug Price Negotiation Program allows the government to set a “maximum fair price” (MFP) for top-selling branded drugs. This lowers the price that future generics must compete against, significantly reducing the financial incentive for generic companies to enter the market for these drugs. The IRA’s “pill penalty” also makes small-molecule drugs subject to negotiation sooner than biologics, which may reduce R&D in that area and shrink the future pipeline of traditional generics.17

6. What is China’s Volume-Based Procurement (VBP) policy?

VBP is a centralized drug purchasing system in China where the government uses the promise of guaranteed, large-volume sales in public hospitals to solicit highly competitive bids from manufacturers. This has resulted in dramatic price reductions, often over 90%, fundamentally reshaping the Chinese market to prioritize low-cost production and market access over traditional sales and marketing.94

7. Why are there shortages of some generic medicines?

Generic drug shortages are often caused by a combination of factors. Intense price competition leads to razor-thin profit margins, which can cause manufacturers to exit unprofitable markets, reducing the number of suppliers. Disruptions in the global supply chain, particularly for raw materials (APIs) concentrated in China and India, and quality control problems that lead to manufacturing shutdowns also contribute significantly to shortages.1

8. How will Artificial Intelligence (AI) change the generic drug industry?

AI is poised to accelerate and improve the efficiency of generic drug development. It can be used to optimize drug formulations, predict the outcomes of bioequivalence studies, automate manufacturing processes, and reduce R&D timelines and costs. This technological shift is expected to give a significant competitive advantage to companies that adopt it effectively.7

9. What are the biggest challenges for generic companies in emerging markets?

Key challenges include navigating diverse and sometimes underdeveloped regulatory systems, dealing with weak intellectual property (IP) enforcement, overcoming inadequate infrastructure and complex supply chain logistics, and adapting to unique local market and competitive dynamics.143

10. Why are some doctors and patients hesitant to use biosimilars?

Hesitancy often stems from a lack of awareness and education. Both physicians and patients may have concerns about the efficacy and safety of a product that is “highly similar” but not identical to a trusted reference biologic. This can lead to a “nocebo effect” (where negative expectations cause negative perceived outcomes) and a reluctance to switch a patient who is stable on their current treatment.108

11. What is an “authorized generic” and how does it impact competition?

An authorized generic is a generic version of a branded drug that is marketed by the brand-name company itself or with its permission. When an authorized generic enters during the 180-day exclusivity period of a “first-to-file” generic, it creates immediate competition, which typically lowers prices for consumers but significantly reduces the revenues and profitability for the first independent generic challenger.56

12. How does DrugPatentWatch help generic companies?

DrugPatentWatch is a competitive intelligence platform that provides critical data for strategic planning. It helps generic companies by tracking drug patent expiration dates, monitoring patent litigation, identifying first-to-file opportunities, and analyzing the R&D pipelines of competitors. This information serves as an early warning system, allowing companies to identify market opportunities and manage risks more effectively.1

Works cited

- The Global Generic Drug Market: Trends, Opportunities, and …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Generic Drugs Market Size to Hit USD 728.64 Billion by 2034, accessed July 28, 2025, https://www.precedenceresearch.com/generic-drugs-market

- Generic Pharmaceuticals Market Size & Share Report, 2030, accessed July 28, 2025, https://www.grandviewresearch.com/industry-analysis/generic-pharmaceuticals-market-report

- Generic Drugs Market Size to Hit USD 775.61 Billion by 2033 – BioSpace, accessed July 28, 2025, https://www.biospace.com/press-releases/generic-drugs-market-size-to-hit-usd-775-61-billion-by-2033

- Generic Drugs Market Size, Share And Trends Report, 2033 – Nova One Advisor, accessed July 28, 2025, https://www.novaoneadvisor.com/report/generic-drugs-market

- Navigating Global Pharma: The Rise of Generic Drugs – BCC Research Blog, accessed July 28, 2025, https://blog.bccresearch.com/navigating-global-pharma-the-rise-of-generic-drugs

- Generic Drugs Market Size, Research, Trends and Forecast – Towards Healthcare, accessed July 28, 2025, https://www.towardshealthcare.com/insights/generic-drugs-market

- Global Generic Drugs Market Size and Industry Growth Analysis – BCC Research, accessed July 28, 2025, https://www.bccresearch.com/market-research/pharmaceuticals/generic-drugs-markets-report.html

- Generic Drugs Market Size, Share, Industry Trends & Research …, accessed July 28, 2025, https://www.mordorintelligence.com/industry-reports/generic-drugs-market

- Global Generic Drug Market – Industry Trends and Forecast to 2030, accessed July 28, 2025, https://www.databridgemarketresearch.com/reports/global-generic-drug-market

- Generic Drugs Market 2024-2035: Trends, Innovations, and Future …, accessed July 28, 2025, https://www.pharmiweb.com/press-release/2025-02-12/generic-drugs-market-2024-2035-trends-innovations-and-future-growth

- Generic drug market growth: insights to 2030 – European Pharmaceutical Review, accessed July 28, 2025, https://www.europeanpharmaceuticalreview.com/article/166397/generic-drug-market-growth-insights-to-2030/

- The Future of Generic Pharmaceuticals: Innovations and Trends – WPRX, accessed July 28, 2025, https://www.wprx.com/news/the-future-of-generic-pharmaceuticals