The pharmaceutical supply chain remains a largely invisible mechanism until the moment it ceases to function. Much like a Victorian butler, its excellence is measured by its discretion; yet, when a failure occurs, the results are considerably more catastrophic than a misplaced piece of silverware. In the world of drugmaking, a single contaminated batch or a mislabeled precursor is not merely an industrial hiccup. It represents a $25 million hole in a balance sheet, a potential license cancellation, and, most critically, a direct threat to the safety of the patient.1

For the modern pharmaceutical executive, sourcing is no longer a simple transactional exercise in cost-arbitrage. It has evolved into a high-stakes game of risk management where the value of a supplier is a multi-faceted calculus of regulatory standing, technical capability, and intellectual property (IP) hygiene.3 This report deconstructs the essential architecture of a world-class supplier qualification program, moving beyond the ossified questionnaires of the past to a dynamic, risk-managed sourcing framework.

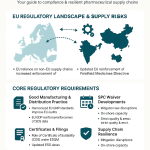

The Regulatory Moat and the Mandate for Oversight

The legal foundation for supplier qualification is not a suggestion but a strict mandate embedded in global pharmacopeial standards. The United States Food and Drug Administration (FDA), under 21 CFR 211.22, places the burden of quality squarely on the shoulders of the Quality Control Unit.4 This unit is not only responsible for the final product but has the explicit authority to approve or reject all components, drug product containers, closures, and even materials held under contract by another company.4 The regulation demands that adequate laboratory facilities for the testing and approval or rejection of these components be available to the unit, ensuring that no material enters the production stream without a scientific imprimatur.4

This oversight is echoed across the Atlantic. The European Union’s GMP Annex 15 emphasizes that manufacturers must control the critical aspects of their operations through qualification and validation throughout the life cycle of the product.5 The regulatory environment has moved away from retrospective validation—once a common, if lazy, practice—to a proactive, risk-based paradigm where every link in the chain must be justified before the first vial is filled.5 Annex 15 explicitly states that any planned changes to facilities, equipment, utilities, or processes which may affect the quality of the product should be formally documented and the impact on the validated status assessed.5

The Core Regulatory Pillars

To navigate this environment, R&D and business development teams must harmonize their sourcing strategies with several primary frameworks that define the boundaries of acceptable practice.

| Regulatory Framework | Core Focus | Key Requirement |

| FDA 21 CFR 211 | Domestic US GMP | Responsibility of the Quality Control Unit; mandatory testing of components; established reliability of supplier analyses.4 |

| EU GMP Annex 15 | European Union Standards | Life cycle approach to qualification; formal documentation of changes; rejection of retrospective validation.5 |

| ICH Q10 | Pharmaceutical Quality Systems | Comprehensive model for an effective PQS spanning development through product discontinuation; focuses on continual improvement.6 |

| ICH Q9(R1) | Quality Risk Management | Science-based risk assessments; linkage of quality to patient protection; reduction of subjectivity in decision-making.8 |

| ISO 9001:2015 | Quality Management | Establishing criteria to assess suppliers; assessment of a vendor’s financial stability and organizational health.10 |

| ISO 13485 | Medical Devices | Risk-based supplier management and quality agreements; specific focus on the safety of combined products.11 |

The responsibility of the manufacturer is absolute. As the FDA mandates, even if a supplier provides a report of analysis (CoA), the manufacturer must still conduct at least one specific identity test to verify each component of a drug product.4 Trust, in this context, is a luxury the regulations do not afford. The manufacturer must also establish the reliability of the supplier’s analyses through periodic verification of their test results.4

The Strategic Value of Intellectual Property Intelligence

While regulatory compliance ensures the safety of the drug, IP intelligence ensures the safety of the business model. For business development and IP teams, the sourcing process provides a unique opportunity to use data from platforms like DrugPatentWatch to verify supplier legitimacy and anticipate market shifts.3 In an environment where the “patent cliff” threatens to erase billions in revenue, understanding the IP position of a potential manufacturing partner is not just due diligence; it is survival.

Turning Patent Data into Supply Chain Gold

We often think of drug patents and supply chains as two entirely separate universes, yet they are deeply intertwined.13 A supplier’s patent portfolio is an objective map of their technical competence. If a Contract Development and Manufacturing Organization (CDMO) claims expertise in complex delivery systems, such as microneedle patches or oral biologics, their patent filings should reflect that innovation.12 Analyzing specific patent application numbers allows IP teams to verify if a potential partner’s scientific claims align with their patented methods, such as specific solid-phase peptide synthesis or on-resin cyclization steps.12

Furthermore, monitoring the “patent cliff” allows procurement teams to align with vendors long before a drug goes off-patent. By tracking primary patent expirations (LOE) in over 130 countries, organizations can identify which generic players are likely to enter the market and which API suppliers have the legal freedom to operate.3 This is particularly crucial for R&D teams who need to ensure that their chosen manufacturing process does not inadvertently trigger a “cease and desist” from a competitor’s process patent.12

“IP is the invisible architecture supporting the entire pharmaceutical industry. It’s the moat around the castle, the legal framework that allows a company to recoup the billion-plus dollars and decade-plus of research invested in a new therapy.” 14

The Freedom-to-Operate Verification

Using specialized intelligence like DrugPatentWatch, teams can perform Freedom-to-Operate (FTO) analysis, which acts as a sonar to detect hidden legal threats.12 For instance, a leading pharmaceutical firm used systematic analysis to identify an emerging modulation approach for a specific immunology pathway that major competitors had overlooked.15 By focusing R&D there, they developed a first-in-class therapy that generated billions in revenue with limited competition.15 Conversely, a mid-sized firm used patent monitoring to detect an FTO issue years before their competitors. This early detection allowed them to implement a strategic workaround, saving an estimated $100 million in development costs and preserving a multi-billion dollar revenue opportunity.15

The Mechanics of a Risk-Based Qualification Checklist

The most pervasive error in supplier management is the application of uniform scrutiny to all vendors. A supplier of a high-potency Active Pharmaceutical Ingredient (API) poses a fundamentally different risk to the patient than a vendor providing tertiary packaging.16 A mature qualification program utilizes a tiered system to allocate resources where they matter most, focusing on the criticality of the material to the process and product quality.17

Tiered Supplier Categorization

Strategic tiering allows a firm to be thorough without becoming paralyzed by its own bureaucracy. The intensity of the audit and the depth of the documentation review should be proportional to the risk.

| Risk Level | Supplier Type Examples | Scrutiny Level | Requalification Frequency |

| High Risk | API Manufacturers, Sterilization Services, Bio-analytical Labs, Microbiology Labs | Mandatory on-site audits; full CoA verification; stringent CAPA monitoring; stability data review.16 | Annual or biennial.10 |

| Medium Risk | Primary Packaging (vials, stoppers), Critical Excipients, High-risk Secondary Packaging | Questionnaires combined with selective remote audits; customer list review; process flowcharts.18 | Every 2 to 3 years.16 |

| Low Risk | Tertiary Packaging, Logistics Providers, General Laboratory Supplies | Documentation review; ISO certification verification; W-9 tax standing.10 | Every 5 years or upon significant changes.11 |

The Essential Checklist Components

A robust checklist must be exhaustive and evidence-based. It should encompass several domains that, when taken together, provide a high-fidelity image of the supplier’s reliability.

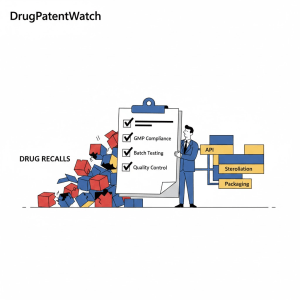

1. Quality Management System (QMS) The QMS evaluation confirms adherence to industry best practices and quality standards.11 Auditors should look for a defined Quality Manual, a summary of their deviation management system, and their history of product recalls over the past two years.10 A critical factor is the change control policy; an effective process ensures that changes are evaluated for impact, approved appropriately, and documented properly before implementation.19

2. Facility, Equipment, and Utilities The manufacturing environment must be controlled, maintained, and designed to prevent contamination or product mix-ups.19 Equipment used in production should be validated, calibrated, and maintained according to documented procedures, such as Total Productive Maintenance (TPM).6 For certain products, specialized controls are necessary—for instance, 21 CFR 211 requires that components liable to microbiological contamination be subjected to microbiological tests before use.4

3. Personnel Training and Competency Suppliers must demonstrate that staff are trained for their specific roles. Training records should show initial qualifications, ongoing refresher training, and competency assessments.19 The importance of this cannot be overstated; higher turnover—a symptom of the “Great Resignation”—is often a precursor to a rise in quality issues as training struggles to replace years of experience.20

4. Data Integrity and Electronic Record Controls For suppliers managing electronic records, verify that systems comply with 21 CFR Part 11 requirements.19 This includes secure user access, audit trails, electronic signatures, and backup procedures to protect against data loss or tampering.19 In the modern environment, data integrity is as critical as chemical purity.21

5. Regulatory and Inspection History The checklist must include a request for past regulatory inspection records (FDA, EMA, etc.) and any associated findings.19 A history of repeated observations, warning letters, or consent decrees may indicate systemic problems that could affect the quality of goods or services delivered.19 Verification of FDA registration numbers and accreditation certificates is a mandatory first step.10

6. Financial Stability and Supply Chain Security ISO 9001:2015 emphasizes assessing a vendor’s financial stability to ensure they can withstand economic turbulence without folding.10 Additionally, suppliers should demonstrate traceability from incoming materials through to finished goods and maintain contingency plans for supply disruptions.19 Mature establishments are expected to qualify backup suppliers as part of their own risk management plans.21

Risk Quantification and the Role of Formalism (ICH Q9R1)

The recent revision of ICH Q9(R1) highlights a critical challenge in sourcing: the inherent subjectivity of risk assessment.9 Two different auditors might view the same deviation and arrive at vastly different conclusions regarding its severity. The new guideline advocates for a more formal, data-driven approach to minimize this bias and ensure that decisions are based on sound scientific knowledge linked to patient protection.8

Quantifying Risk with FMEA

One of the most effective tools for structuring this analysis is the Failure Mode and Effects Analysis (FMEA). This methodology allows teams to calculate a Risk Priority Number (RPN) to rank potential failures.

$$RPN = Severity \times Occurrence \times Detection$$

In this equation:

- Severity measures the impact of the failure mode on the patient or product quality (scaled $1$-$10$).

- Occurrence measures the probability of the failure mode happening (scaled $1$-$10$).

- Detection measures the difficulty of spotting the error before it reaches the customer (scaled $1$-$10$).23

A high RPN mandates immediate corrective action, while a low RPN might only require monitoring. This mathematical approach helps ground sourcing decisions in objective reality rather than gut feeling. ICH Q9(R1) also introduces the concept of “formality” in quality risk management, suggesting that the level of effort and documentation should be commensurate with the level of risk.9

Addressing Subjectivity Through Knowledge Management

The revised guideline notes that subjectivity can impact every stage of the process, especially the identification of hazards and the estimation of their probabilities.22 To counter this, organizations are encouraged to use “knowledge management”—creating a shared body of relevant data and understanding to minimize individual biases.23 This includes leveraging real-world data, advanced analytics, and historical performance data to make more informed decisions across the entire life cycle.24

The Economics of Failure: A $12 Billion Warning

For business development teams, the “return on investment” of supplier qualification is often framed in terms of cost avoidance. The numbers are staggering. Since the year 2000, the pharmaceutical sector has lost an estimated $12 billion due to facility shutdowns attributed to process deficiencies.20 Furthermore, the cost of poor quality in manufacturing companies generally ranges from 5% to 35% of the sales dollar.25

The Financial Impact of Batch Rejection and Shortages

When a batch is rejected due to a supplier’s raw material quality failure, the costs ripple far beyond the wasted ingredients. It represents a waste of valuable production time and disposal costs, while potentially preventing the firm from meeting its delivery commitments.26

| Cost Component | Impact Description | Financial Consequence |

| Internal Failure Costs | Scrap, rework, and re-testing of defective batches detected before shipment.27 | Loss of up to 35% of potential revenue per batch.25 |

| External Failure Costs | Product recalls, warranty claims, and compliance penalties after the product has reached the market.27 | Class I recalls can lead to penalties exceeding $65 million.2 |

| Labor of Shortage Management | The time spent by pharmacists and supply chain managers seeking alternative drugs when a supplier fails.3 | Estimated $359 million annually in additional labor costs for US hospitals.28 |

| Reputational Damage | Loss of prescriber confidence and damage to brand loyalty.29 | MedTech/Pharma firms with low recall ratios outperform peers by 256 percentage points in market value.25 |

| Operational Leakage | “Price creep” on lab consumables or raw materials due to lack of contract oversight.30 | A hidden $1 increase on a high-volume SKU can add up to millions in leakage globally.30 |

The pharmaceutical industry has seen a recovery in R&D returns recently, rising from a record low of 1.2% in 2022 to 5.9% in 2024.15 Sustaining this turnaround requires minimizing the friction caused by supply chain disruptions. In 2024, the average cost of developing a drug asset reached $2.23 billion.24 With such high stakes, allowing a $2.5 million environmental penalty or a $25 million loss due to a fraudulent API supplier is an avoidable tragedy.2

Case Studies: When the Chain Breaks

The fragility of the pharmaceutical supply chain is best understood through the lens of history. These incidents demonstrate how a failure in one node can trigger a global crisis, often stemming from the very internal failures that a robust checklist is designed to catch.31

The Heparin Contamination (2007-2008)

Heparin, a blood thinner derived from porcine intestines, became the center of a global health crisis when crude material sourced from slaughterhouses in China was intentionally adulterated. The production process spanned multiple locations with poor oversight, and hundreds of patients suffered adverse reactions before the products were recalled across nine countries.1 This crisis exposed how vulnerable the drug supply chain had become to fraud and the absence of end-to-end transparency.1

Hurricane Maria and the IV Saline Crisis (2017)

The concentration of pharmaceutical manufacturing in Puerto Rico—which produces about $40 billion worth of drugs—became a bottleneck when Hurricane Maria knocked out three plants run by Baxter International.1 These plants were the primary source of small-volume IV saline bags for the United States. Hospitals across the country were left scrambling for basic supplies, illustrating the risks of single-sourcing and geographical concentration.1

The Intas Pharmaceuticals Quality Failure (2023)

A major plant in India, run by Intas Pharmaceuticals, hit serious quality troubles that led to a global shortage of common chemotherapy drugs.1 Years of razor-thin profit margins had driven many competitors out of the market, leaving the system fragile. A disruption at this one plant triggered nationwide shortages, highlighting the danger of the “low-margin, high-volume” model when quality oversight falters.1

Onboarding Pitfalls and the Role of Leadership

Even with a perfect checklist, the onboarding of a new vendor can fail due to organizational misalignment or poor timing. R&D and business development teams must coordinate early to avoid treating quality as a post-approval hurdle.33

Common Pitfalls in Vendor Onboarding

- Redundant Qualifications: In clinical trials, sponsors often independently qualify a vendor even if another sponsor has already completed an assessment. This redundancy leads to wasted time and resources, causing unnecessary delays in trial initiation.34

- Misaligned Internal Teams: Execution falters when commercial, medical affairs, and market access teams are not fully aligned on the target product profile (TPP) and messaging.33

- Cramming for the Sake of Coverage: Training programs often overload learners with technical manuals that are not remembered. Learning is stickiest when it solves a problem the learner is facing right now.35

- The Price-Only Trap: Procurement processes that rely solely on cost-based decisions significantly increase the likelihood of introducing non-compliant ingredients into the production line.36 True value is not found on the invoice alone; it must weigh cost against quality and resilience.3

Success in supplier management requires an unyielding commitment from senior leadership. The FDA’s emerging Quality Management Maturity (QMM) program aims to reward manufacturers who go beyond the minimum CGMP requirements to foster a quality culture.21 This shift moves quality from a “cost center” to a strategic framework that facilitates better decisions and provides regulators with greater assurance of a company’s ability to deal with disruptions.9

Future Outlook: Maturity over Compliance

The industry is moving toward a significant paradigm shift. The “Good Supply Practice” initiative reveals that manufacturers are often the cause of the very supply chain failures they experience.31 Instead of trying to “fix” suppliers, the most successful firms are adopting practices that result in breakthrough supply chain quality through proactive collaboration.31

By integrating advanced intelligence platforms like DrugPatentWatch with a rigorous, risk-based qualification protocol, pharmaceutical firms can transform their sourcing from a vulnerability into a competitive advantage. The goal is no longer just to stay compliant—it is to build a supply chain that is as robust and innovative as the drugs it produces.

Key Takeaways

- Quality is the Best Business Plan: Investing in prevention and mature quality management systems provides a significant ROI by reducing the billions lost annually to shutdowns and recalls.20

- IP is a Supply Chain Signal: Use patent data to verify the technical legitimacy of vendors and stay ahead of the “patent cliff” using platforms like DrugPatentWatch.12

- Tier Your Scrutiny: Focus on high-risk API and sterilization vendors with on-site audits, while using leaner documentation reviews for low-risk packaging suppliers.16

- Quantify the Risk: Use FMEA and RPN calculations to move from subjective assessments to data-driven risk management.23

- Total Cost of Ownership Matters: A “cheap” supplier that fails to deliver is more expensive than a reliable, premium partner once the costs of shortages and batch rejections are calculated.3

Frequently Asked Questions

1. How does the FDA’s QMM program differ from standard CGMP inspections? While CGMP inspections focus on whether a facility meets minimum safety and quality standards for a specific product, the Quality Management Maturity (QMM) program evaluates the proactive behaviors and quality culture of the establishment. It is a voluntary program that looks for “beyond-compliance” practices like business continuity planning and employee empowerment.21

2. Can we rely solely on a supplier’s Certificate of Analysis (CoA)? No. Regulatory authorities like the FDA require that at least one specific identity test be conducted by the manufacturer for each component, even if the supplier is deemed reliable. You must establish that reliability through periodic verification of the supplier’s results through independent testing.4

3. What role does DrugPatentWatch play in the supplier qualification process? DrugPatentWatch provides competitive intelligence that allows IP and procurement teams to verify a supplier’s technical claims, ensure they have the freedom to operate without infringing on others’ patents, and identify upcoming generic sourcing opportunities by tracking patent expirations in over 130 countries.3

4. How often should we audit a “high-risk” supplier? Typically, high-risk suppliers like API manufacturers require on-site audits every one to two years. However, this frequency should be adjusted based on their performance metrics, such as their deviation frequency, CAPA responsiveness, and on-time delivery rates.10

5. What is the most common cause of drug shortages today? Research indicates that 62% of drug shortages are linked to manufacturing or product quality issues rather than a lack of raw materials or demand spikes. This underscores the critical importance of selecting suppliers with mature quality management systems that prioritize reliability over cost.21

Works cited

- Not a One-Off: Real Stories Behind the World’s Most Damaging Healthcare Supply Chain Failures | THRIVE Project, accessed January 31, 2026, https://thrivabilitymatters.org/healthcare-supply-chain-failures-real-stories/

- Third-party risks in the pharmaceutical supply chain – KPMG agentic …, accessed January 31, 2026, https://assets.kpmg.com/content/dam/kpmg/in/pdf/2025/03/third-party-risks-in-the-pharmaceutical-supply-chain.pdf

- Balancing Brand vs. Generic Procurement to Maximize …, accessed January 31, 2026, https://www.drugpatentwatch.com/blog/balancing-brand-vs-generic-procurement-to-maximize-pharmaceutical-value/

- 21 CFR Part 211 — Current Good Manufacturing Practice for Finished Pharmaceuticals – eCFR, accessed January 31, 2026, https://www.ecfr.gov/current/title-21/chapter-I/subchapter-C/part-211

- Draft Annex 15 – V12 200115 – for PICS and EC adoption – Public Health – European Commission, accessed January 31, 2026, https://health.ec.europa.eu/document/download/7c6c5b3c-4902-46ea-b7ab-7608682fb68d_en

- ICH Q10 PHARMACEUTICAL QUALITY SYSTEM GUIDANCE – PubMed Central – NIH, accessed January 31, 2026, https://pmc.ncbi.nlm.nih.gov/articles/PMC8689590/

- ICH Q10 Guide: Implementing a Pharmaceutical Quality System | IntuitionLabs, accessed January 31, 2026, https://intuitionlabs.ai/articles/ich-q10-pharmaceutical-quality-system-guide

- Implementing ICH Q9 for GMP quality risk management compliance – Eurofins, accessed January 31, 2026, https://www.eurofins.com/assurance/resources/articles/implementing-ich-q9-for-gmp-quality-risk-management-compliance/

- QRM, Knowledge Management, and the Importance of ICH Q9(R1), accessed January 31, 2026, https://www.pharmtech.com/view/qrm-knowledge-management-and-the-importance-of-ich-q9-r1-

- LPC Snapshot Dec 2021 – Vendor Qualification Under FDA Regulations and ICH/ISO Guidelines – ISCT, accessed January 31, 2026, https://www.isctglobal.org/telegrafthub/blogs/audrey-le/2022/02/01/lpc-snapshot-dec-2021

- Supplier Qualification: Definition, Process, and Guidelines – SimplerQMS, accessed January 31, 2026, https://simplerqms.com/supplier-qualification/

- Navigating the Patent Maze: A CDMO’s Guide to IP Risk …, accessed January 31, 2026, https://www.drugpatentwatch.com/blog/navigating-the-patent-maze-a-cdmos-guide-to-ip-risk-management-and-strategic-growth/

- The Unseen Connection: Turning Drug Patent Data into Supply …, accessed January 31, 2026, https://www.drugpatentwatch.com/blog/the-unseen-connection-turning-drug-patent-data-into-supply-chain-gold/

- The High-Stakes Game of Pharma IP: Why Benchmarking Your Pipeline is Non-Negotiable, accessed January 31, 2026, https://www.drugpatentwatch.com/blog/the-high-stakes-game-of-pharma-ip-why-benchmarking-your-pipeline-is-non-negotiable/

- Maximizing ROI on Drug Development by Monitoring Competitive …, accessed January 31, 2026, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- Strengthening Your Supply Chain: GMP Supplier Qualification and …, accessed January 31, 2026, https://www.cfpie.com/strengthening-your-supply-chain-gmp-supplier-qualification-and-oversight

- Guidance on Supplier Qualification – Phase 1 pharma manufacturing – Elsmar.com, accessed January 31, 2026, https://elsmar.com/elsmarqualityforum/threads/guidance-on-supplier-qualification-phase-1-pharma-manufacturing.86400/

- Supplier Qualification Protocol | PDF | Quality Assurance – Scribd, accessed January 31, 2026, https://www.scribd.com/document/959840975/Supplier-Qualification-Protocol

- QMS 101: Understanding Supplier Qualification in Life Sciences – Quality Forward, accessed January 31, 2026, https://www.qualityfwd.com/blog/supplier-qualification-management/

- How To Avoid A Quality Failure: Pharmaceutical Supplier Evaluation …, accessed January 31, 2026, https://lgmpharma.com/blog/how-to-avoid-a-quality-failure-pharmaceutical-supplier-evaluation/

- CDER’s Quality Management Maturity (QMM) Program … – FDA, accessed January 31, 2026, https://www.fda.gov/media/171705/download

- Quality Risk Management, ICH Q9(R1), accessed January 31, 2026, https://database.ich.org/sites/default/files/ICH_Q9%28R1%29_Step_2_Presentation_2021_1126.pdf

- Quality Risk Management Demystified: The Essential Steps (by ICH Q9) – Qualistery, accessed January 31, 2026, https://qualistery.com/quality-risk-management-demystified-the-essential-steps-by-ich-q9/

- Measuring the return from pharmaceutical innovation 2024 | Deloitte US, accessed January 31, 2026, https://www.deloitte.com/us/en/Industries/life-sciences-health-care/articles/measuring-return-from-pharmaceutical-innovation.html

- Calculating the True Cost of Quality: A GMP Perspective for Manufacturing Professionals, accessed January 31, 2026, https://www.auriacompliance.com/gmp-blog/calculating-the-true-cost-of-quality-a-gmp-perspective-for-manufacturing-professionals

- Recovering rejected product | CI Precision, accessed January 31, 2026, https://www.ciprecision.com/recovering-rejected-product/

- What is Cost of Quality in Manufacturing? – Parsec Automation, accessed January 31, 2026, https://parsec-corp.com/blog/cost-of-quality

- AHA Senate Statement on Trade in Critical Supply Chains – American Hospital Association, accessed January 31, 2026, https://www.aha.org/testimony/2025-05-14-aha-senate-statement-trade-critical-supply-chains

- Third-party risks in the pharmaceutical supply chain – KPMG agentic corporate services, accessed January 31, 2026, https://assets.kpmg.com/content/dam/kpmgsites/in/pdf/2025/03/third-party-risks-in-the-pharmaceutical-supply-chain.pdf

- The Cost of Compliance: How Pharma Supply Chains Can Optimize Supplier Relationships, accessed January 31, 2026, https://revenew.com/insights/the-cost-of-compliance-how-pharma-supply-chains-can-optimize-supplier-relationships

- Good Supply Practices for The 21st Century – Healthcare Products Collaborative, accessed January 31, 2026, https://www.healthcareproducts.org/wp-content/uploads/2022/07/GoodSupplyPracticesforthe21stCentury.pdf

- Causes and Consequences of Medical Product Supply Chain Failures – NCBI, accessed January 31, 2026, https://www.ncbi.nlm.nih.gov/books/NBK583734/

- 5 Common Pitfalls in Pharma Launches and How to Avoid Them – Sedulo Group, accessed January 31, 2026, https://sedulogroup.com/common-pharma-launch-pitfalls/

- Common Pitfalls in Clinical Trial Vendor Qualification & How to Avoid Them, accessed January 31, 2026, https://www.diligentpharma.com/resources/vendor-qualification-pitfalls

- 6 Common pitfalls of L&D in pharma and what to do instead – Metrix Group, accessed January 31, 2026, https://www.metrixgroup.com/6-common-pitfalls-of-ld-in-pharma-and-what-to-do-instead/

- Raw Material Quality Failures RCA: Causes & Fixes | ProSolvr, accessed January 31, 2026, https://www.prosolvr.tech/knowledgebase/raw-material-quality-failures-rca.html

- Best Quality Quotes by Pro QC International, accessed January 31, 2026, https://proqc.com/blog/quality-quotes/

- Chapter: 7 Mitigation Measures for Resilient Medical Product Supply Chains – National Academies of Sciences, Engineering, and Medicine, accessed January 31, 2026, https://www.nationalacademies.org/read/26420/chapter/11