Executive Summary

The pharmaceutical industry, characterized by its extensive research and development cycles, high investment costs, and intense competition, operates within a complex intellectual property landscape. Within this environment, “patent pending” data, while not conferring immediate legal enforcement rights, holds immense strategic value. This report elucidates how pharmaceutical companies can proactively analyze and integrate information derived from patent applications that are still under examination. Such integration provides crucial foresight into competitor activities, emerging market trends, and internal R&D opportunities. By understanding the nuances of this data, its applications across competitive intelligence, R&D pipeline management, M&A, licensing, and freedom-to-operate analyses, companies can transform raw information into actionable intelligence. Despite inherent legal ambiguities and data complexities, a strategic, integrated, and technologically advanced approach, coupled with robust ethical practices, is essential. This report concludes with specific recommendations for pharmaceutical leaders to effectively leverage patent pending intelligence, fostering sustained innovation and maintaining a formidable competitive edge in a rapidly evolving global market.

1. Introduction to Patent Pending Status in Pharmaceuticals

The journey of a pharmaceutical innovation from conception to market is protracted and capital-intensive, making robust intellectual property (IP) protection indispensable. A critical, yet often misunderstood, phase in this journey is “patent pending” status. This introductory section clarifies the legal standing of patent pending applications and highlights the strategic importance of provisional patent applications in establishing early priority.

1.1 Defining “Patent Pending”: Legal Status and Core Implications

“Patent pending” is a designation indicating that an application for a patent has been filed with a patent office, such as the United States Patent and Trademark Office (USPTO), and is currently undergoing examination, but the patent itself has not yet been granted.1 This status commences upon the filing of a patent application and persists until the application is either abandoned or the patent is approved.4 The duration of this period can vary, typically ranging from one to five years, with an average of approximately three years for patent applications in the U.S..3

It is crucial to understand that “patent pending” does not bestow any immediate patent rights or full legal protection upon the inventor.1 This means that, during the pendency period, an inventor cannot legally sue another party for infringing upon their ideas or invention.4 The full legal protection, including the right to prevent unauthorized use or to sue for infringement, only materializes once the patent is officially granted by the USPTO.1

Despite the absence of immediate legal enforceability, the phrase “patent pending” serves a significant strategic purpose. It functions as a warning to potential infringers, signaling that legal protection is being sought for the invention.1 This notice can act as a deterrent, discouraging competitors from investing substantial resources in developing a similar product, as they may face potential legal consequences once the patent is granted.1 For consumers, the “patent pending” label can also enhance the marketability of a product, implying uniqueness and cutting-edge innovation.1

The U.S. patent system operates on a “first-to-file” principle, which dictates that priority is assigned to the applicant with the earliest filing date, irrespective of who conceived the idea first.3 This fundamental aspect of patent law underscores the imperative for pharmaceutical companies to initiate the filing process as swiftly as possible to secure a priority date, especially in an industry where rapid innovation and competitive pressures are constant.3

The distinction between “patent pending” as a deterrent and as an enforceable right is a critical strategic nuance. While direct legal action for infringement is not possible during the pending phase, the implicit threat of future legal repercussions, particularly if the patent is eventually granted and allows for retroactive damages from its publication date, can significantly influence competitor behavior.1 This means that “patent pending” functions less as a legal shield and more as a strategic flag, influencing market dynamics through the perception of future risk rather than immediate legal force. This understanding is vital for pharmaceutical companies as they assess competitive threats and identify opportunities within the market.

The “first-to-file” imperative, as stipulated by the U.S. Patent Act, highlights a crucial aspect of the pharmaceutical innovation race.3 Given the extensive and costly R&D cycles characteristic of drug development, the speed at which a priority date for an invention is secured becomes paramount. Delaying patent filings, even for inventions in their nascent stages, carries the risk of losing priority to a faster-filing competitor. This could negate years of substantial R&D investment, regardless of the original inventor’s conception date. Consequently, there is a strong incentive for pharmaceutical companies to pursue rapid initial disclosure through patent applications to safeguard their intellectual assets.

1.2 The Role of Provisional Patent Applications in Establishing Priority

Provisional patent applications (PPAs) represent a strategic tool designed to provide inventors with a lower-cost and less formal method to establish an early effective filing date, or “priority date,” in the United States.1 Unlike non-provisional applications, PPAs do not necessitate formal patent claims, an oath or declaration, or a prior art statement, and they are not subject to substantive examination by the USPTO.7

Upon filing a PPA, an invention gains “patent pending” status for a period of 12 months.1 To maintain the benefit of this early priority date, a corresponding non-provisional application must be filed within this 12-month pendency period.1 This provisional period offers inventors valuable time to further refine their invention, conduct additional research, gather more data, explore market potential, and seek investment, all while benefiting from the “patent pending” notice that can deter potential infringers.7

A particularly relevant practice in the pharmaceutical industry is the use of “rolling provisional patent applications”.10 This strategy involves filing two or more provisional applications, where later applications incorporate additional subject matter or improvements not initially disclosed in prior provisional filings.10 All these provisional applications can claim priority from the earliest filing date, provided that the non-provisional patent application is filed within one year of the

first provisional application’s filing date.10

The strategic flexibility offered by PPAs is particularly advantageous in the context of the pharmaceutical industry’s lengthy and uncertain R&D cycles.12 The low cost and reduced formality requirements of PPAs allow companies to quickly establish an early priority date for nascent discoveries.1 This immediately confers “patent pending” status, which can be leveraged for marketing and competitive deterrence.7 The subsequent 12-month period becomes invaluable for conducting further research, collecting more comprehensive data, and thoroughly assessing commercial viability without committing the significant financial and human resources required for a full non-provisional application. This “wait-and-see” approach, while securing an early claim, is crucial for managing the substantial risks and investments inherent in high-cost drug development.

Furthermore, the pharmaceutical development process is rarely a linear progression; it often involves iterative improvements, new scientific discoveries, and continuous refinement of compounds, formulations, or methods of use. The “rolling provisional patent applications” strategy directly addresses this iterative nature.10 By filing successive provisional applications that incorporate new subject matter as it emerges, a company can continuously update and expand its priority claim. This ensures that the intellectual property protection evolves in tandem with the scientific and technical advancements of the drug, preventing competitors from “designing around” the original invention by exploiting later improvements.8 This dynamic approach to IP management is critical for adapting to the incremental nature of drug innovation and maintaining a comprehensive protective barrier.

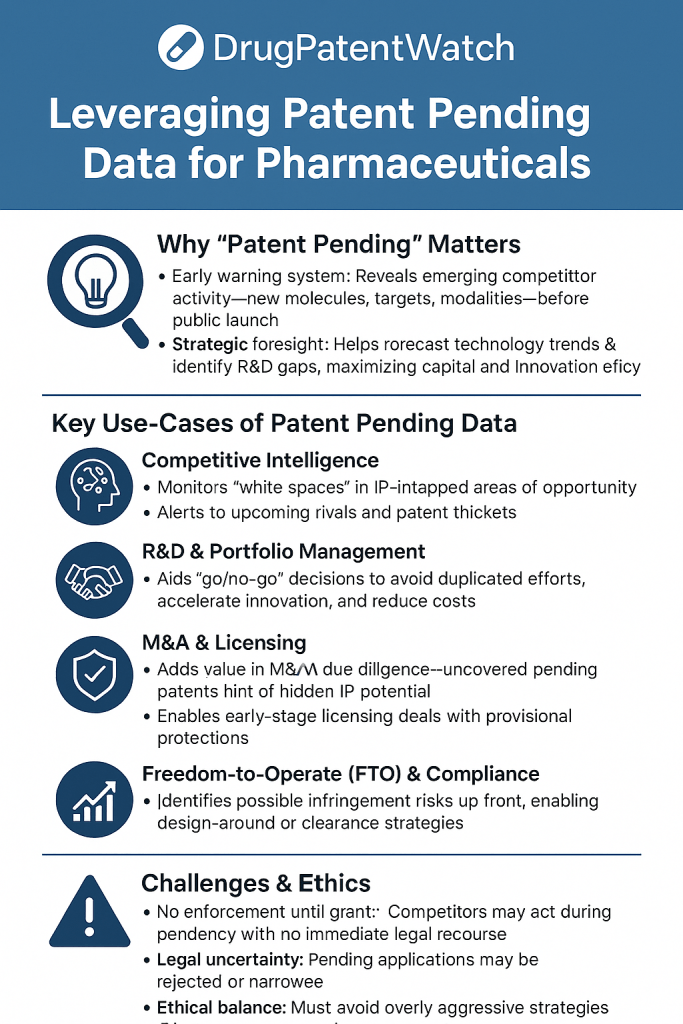

2. Strategic Applications of Patent Pending Data in Pharma

Patent pending data, despite its non-enforceable nature, represents a rich vein of strategic intelligence for pharmaceutical companies. Its systematic analysis can inform critical decisions across various business functions, providing a competitive edge in a dynamic market.

2.1 Enhancing Competitive Intelligence and Market Surveillance

Competitive intelligence (CI) involves the systematic collection, analysis, and application of data concerning competitors, market trends, and regulatory changes to inform strategic decision-making.14 Within the pharmaceutical sector, monitoring intellectual property (IP) filings, including patent pending applications, is a cornerstone of effective CI gathering.4

Analyzing patent pending data allows pharmaceutical companies to gain early insights into emerging technologies, market trends, and competitor strategies.15 This information offers a window into competitors’ research and development (R&D) investments, their future product plans, their R&D priorities, and developments within their product pipelines.16 Such intelligence is instrumental in anticipating market shifts, identifying potential threats or opportunities, and making timely adjustments to a company’s own strategic direction.15 It also aids in understanding how competitors are positioning their products and executing market access strategies.14

Patent research and intelligence provide an early warning system by enabling companies to identify emerging technologies and market trends years before products reach the market.15 This temporal advantage is invaluable. Given the extended development timelines in pharmaceuticals, knowing what competitors are filing patents on, even if those patents are still pending, provides crucial foresight into their future product launches, therapeutic areas of focus, and technological trajectories. This capability facilitates proactive strategic planning, optimized resource allocation, and the development of defensive measures, moving beyond reactive responses to competitive actions.

Beyond merely tracking competitors, patent pending data can reveal strategic opportunities, often referred to as “white spaces”.19 These are areas characterized by limited patent activity but significant therapeutic potential.19 A detailed gap analysis across the patent landscape can identify therapeutic targets with minimal patent coverage, indicating less crowded areas for innovation.17 This allows companies to strategically guide their R&D investments towards areas with higher potential for return on investment and reduced competitive pressure. Thus, competitive intelligence, informed by patent pending data, transforms from a purely defensive tool into a powerful driver of offensive innovation.

Table 1: Illustrative Competitive Intelligence Insights from Patent Pending Data

| Category of Insight | Specific Information Derived from Patent Pending Data | Strategic Application for Pharma Companies | |||||

| Competitor R&D Focus | – Identification of new molecular entities or biological targets under development.16 | – Shifts in therapeutic areas or disease indications being pursued by rivals.16 | – Emerging technological modalities (e.g., gene therapies, AI-driven drug design).17 | – Investment patterns in specific manufacturing processes or drug delivery systems.16 | – Adjusting internal R&D priorities to avoid duplication or identify differentiation opportunities.18 | – Anticipating future pipeline additions of competitors.16 | – Informing “go/no-go” decisions for internal projects.21 |

| Market Dynamics & Threats | – Early signals of potential new product launches years in advance.17 | – Anticipation of generic or biosimilar threats based on competitor filings.23 | – Understanding competitor market entry strategies and positioning.14 | – Identification of patent thickets or “evergreening” attempts by competitors.24 | – Preparing defensive strategies against future competition.26 | – Refining market access plans and product positioning.14 | – Assessing potential impact of competitor innovations on existing product lines.17 |

| Strategic Opportunities | – Identification of “white spaces” or therapeutic areas with limited patent activity.17 | – Uncovering potential licensing or collaboration opportunities with companies holding complementary pending IP.16 | – Insights for strategic mergers and acquisitions (M&A) to bolster IP portfolios.28 | – Discovering novel applications for existing technologies with minimal competitive protection.17 | – Directing R&D investments towards less crowded, high-potential areas.17 | – Proactive outreach for partnerships or in-licensing agreements.16 | – Informing M&A targets to achieve market expansion or defensive portfolio building.28 |

2.2 Informing R&D Pipeline Management and Innovation Prioritization

Patent pending data is an indispensable resource for optimizing and revitalizing pharmaceutical R&D pipelines.21 By continuously monitoring existing patent applications and grants, companies can effectively avoid duplicative research efforts, thereby ensuring that their R&D programs are focused on truly novel approaches that possess the potential for meaningful patent protection.19 This prevention of redundant work is particularly valuable given the immense costs associated with pharmaceutical R&D, where even marginal improvements in resource allocation efficiency can translate into significant financial savings.19

The analysis of patent pending data facilitates early, data-driven “go/no-go” decisions within the R&D pipeline.21 This capability is crucial for optimizing clinical trial designs and identifying promising drug candidates at an earlier stage, especially considering the persistently high attrition rates and prolonged development timelines that characterize drug discovery.21 Embracing a “fail fast” and “fail cheap” philosophy, informed by these early IP signals, allows companies to terminate less promising projects before substantial capital is expended, thereby enhancing capital efficiency and accelerating pipeline velocity.21

Furthermore, patent intelligence plays a critical role in anticipating and navigating the impending “patent cliff”—the expiration of patents on high-revenue, blockbuster drugs.21 This phenomenon poses a significant threat to revenue streams as it opens the market to lower-cost generic alternatives.21 By analyzing patent pending data, companies can drive aggressive strategies, including mergers and acquisitions (M&A) to acquire promising late-stage assets or innovative platforms, and pursuing in-licensing agreements to gain rapid access to breakthrough innovations.21 This proactive approach transforms the patent cliff from a singular financial threat into a powerful catalyst for industry-wide strategic transformation and accelerated innovation, positioning R&D as a central competitive battleground.21

Sustained investment in R&D, guided by robust IP analysis, is not merely a cost center but an indispensable engine for future growth and market leadership.21 The notion that cutting R&D spending to achieve short-term margin targets is a viable strategy is a dangerous fallacy that jeopardizes future competitiveness.21 In a patent-driven industry where market exclusivity is finite, a continuous stream of new, protected intellectual property is essential to prevent revenue erosion.21 Therefore, a stagnant R&D pipeline, uninformed by dynamic patent intelligence, directly translates to a shrinking future revenue base and a loss of competitive positioning.21

The pharmaceutical R&D process is characterized by its high cost and high failure rates.19 The need for “early, data-driven ‘go/no-go’ decisions” and a “fail fast” approach is paramount.21 Patent monitoring, which includes patent pending applications, helps companies avoid “duplicative research efforts that waste valuable resources”.19 This means that by analyzing competitor patent pending data, companies can quickly determine if their own R&D initiatives are converging on areas already claimed or highly saturated by competitors. Such early detection allows them to pivot or terminate projects, saving significant capital and accelerating pipeline development. This proactive risk mitigation, guided by pending IP information, directly enhances capital efficiency and accelerates pipeline velocity, ultimately maximizing the return on R&D investment.

Beyond merely avoiding pitfalls, patent pending data can actively shape a company’s internal innovation strategy. Patent activity provides early signals of shifting research priorities, such as new target classes appearing in competitor filings, increasing investment in specific technological approaches, or the abandonment of previously active research areas.17 By analyzing the trajectory of competitor filings, companies can identify nascent areas of scientific and technological development. This allows them to strategically direct their own R&D resources towards novel pathways that offer a higher potential for market exclusivity and less competitive crowding, thereby securing future market leadership.17

2.3 Identifying Early Market Trends and Forecasting Shifts

Patent applications are typically filed at a relatively early stage in the drug development lifecycle, often years before clinical trials commence or market approval is granted.22 This early filing timeline provides a critical signal of future market entrants and the direction of technological advancements. By systematically analyzing these early-stage filings, pharmaceutical companies can gain a significant advantage in forecasting what new drugs, therapeutic modalities, or treatment approaches are likely to emerge in the market several years down the line.17

Analyzing patent filing patterns can reveal industry shifts towards specific disease areas or treatment approaches even before these trends become widely recognized in broader market analyses.16 This capability allows businesses to anticipate significant industry shifts and adapt their strategies accordingly, ensuring they are not caught off guard by new competitive landscapes.15 For instance, a surge in patent pending applications related to a particular therapeutic area might indicate a burgeoning market interest or a breakthrough technology that will soon reshape treatment paradigms.

While the entry of generic drugs into the market is primarily triggered by the expiration of granted patents, monitoring patent pending applications from generic manufacturers can provide early indicators of their R&D focus and potential future challenges to innovator drugs.22 This foresight enables branded pharmaceutical companies to prepare defensive strategies or consider new life-cycle management initiatives well in advance of generic competition.

The explicit timeline of patent applications being filed years before clinical trials or market approval establishes patent pending data as a potent leading indicator for the future market landscape.22 This predictive capability is invaluable for long-term market planning, allowing companies to prepare for future competitive environments, identify potential partners, or proactively adjust their own R&D and commercialization strategies. This foresight is crucial for maintaining market relevance and competitive advantage in an industry with extensive lead times.

Beyond simply predicting new product launches, patent pending data offers a deeper layer of insight into competitive dynamics. Patent activity can indicate strategic moves such as the acquisition of external technologies through in-licensing agreements.17 By tracking pending patents, companies can not only forecast new products but also anticipate strategic shifts in competitors’ business models, such as their intent to acquire or license specific technologies to fill pipeline gaps or expand into new therapeutic areas. This provides a more holistic view of future competitive moves, enabling more comprehensive and agile strategic responses.

2.4 Driving Mergers & Acquisitions (M&A) Due Diligence and Valuation

In the biopharmaceutical industry, patents are often considered a cornerstone of a target company’s value during mergers and acquisitions (M&A).28 This is particularly true in innovation-driven sectors where intellectual property forms the bedrock of future revenue streams.

Thorough patent due diligence is a systematic review of a target company’s entire patent portfolio, encompassing active, expired, and critically, pending patents and applications.28 The primary objectives of this rigorous process are to evaluate the legal standing of the IP, verify ownership, assess the validity and enforceability of patents, and identify any potential infringement risks or existing litigation exposure.28 The inclusion of patent pending data in this assessment is vital because these applications, once granted, can significantly alter a company’s competitive position and financial outlook.

Patent pending data helps in identifying “red flags” that could devalue a potential acquisition or merger target.29 These red flags might include impending patent expirations, ongoing litigation, or regulatory issues that could render a patent unenforceable.29 Such factors can substantially influence the calculus of an M&A deal, affecting valuation and negotiation terms. Conversely, a strong patent portfolio, which includes promising pending applications, significantly enhances a company’s attractiveness for M&A activity.20 It can bolster the market position of the merged entity, drive innovation, and facilitate strategic partnerships.29 Metrics such as patent family size, forward citations (indicating the influence of a patent), and the breadth of claims are often correlated with a higher company valuation.32

The explicit inclusion of pending patents in M&A due diligence and the emphasis on assessing the “future potential” of patents underscore the critical role of patent pending data in evaluating the prospective value of a target company’s intellectual property assets.28 This allows the acquiring company to assess the potential for future market exclusivity, sustained revenue streams, and technological synergies. Simultaneously, it facilitates the identification of inherent risks, such as the likelihood of the patent actually being granted, the potential for third-party challenges, or a narrow scope of claims. This forward-looking risk-reward assessment is fundamental to accurate valuation and the negotiation of favorable deal terms in pharmaceutical M&A.

Furthermore, patent pending data is not solely about avoiding problematic deals; it is about proactively identifying acquisition targets whose pending IP aligns with strategic goals, such as market expansion or defensive portfolio building.28 The combined patent portfolio resulting from an M&A can create a formidable barrier to entry for competitors, solidifying the new entity’s market position.30 By acquiring companies with promising pending patents, firms can strategically build a more robust and diversified IP portfolio, preventing rivals from gaining access to key technologies and thereby maintaining or establishing market dominance.29 This strategic use of patent pending data transforms M&A from a mere financial transaction into a powerful tool for long-term competitive advantage.

2.5 Unlocking Licensing Opportunities and Structuring Deals

Even prior to a patent being fully granted, it is possible to license patent-pending inventions, although relying solely on a provisional patent application may not be sufficient for robust licensing agreements.11 Licensing negotiations can typically commence once the patent application has entered the formal examination phase, providing a more concrete basis for discussions.11

To incentivize potential licensees, it is common practice to offer discounted royalties during the patent pending phase, with clauses that may include a refund of royalties if the patent is ultimately never issued.11 This approach acknowledges the inherent risk for the licensee while providing an early revenue stream for the innovator.

A strong patent portfolio, which includes promising pending applications, significantly enhances a company’s attractiveness for licensing deals and strategic partnerships with larger pharmaceutical companies.33 Such collaborations are often crucial for startups and smaller firms, providing access to essential resources for further development, clinical trials, and distribution.33 Licensing allows patent holders to generate continuous revenue streams without the need for extensive capital investment in marketing and sales infrastructure, thereby maximizing the return on their R&D efforts.33 Licensing agreements can also be structured with “field of use” restrictions, which limit the licensee’s rights to specific applications or uses of the technology, preserving opportunities for the licensor to exploit other potential applications of the invention.34

The possibility of licensing patent-pending inventions, particularly with provisions for discounted royalties or refunds if the patent is not granted, represents a strategic mechanism for pharmaceutical innovators to secure early revenue and external funding for their R&D efforts.11 This approach allows innovators to mitigate some of the inherent risk associated with the patent grant process by transferring a portion of that risk to the licensee, while still capitalizing on the invention’s commercial potential. This is especially valuable in the pharmaceutical sector, where R&D costs are exceptionally high and outcomes are uncertain.

From the licensee’s perspective, engaging with patent pending technology, despite the associated risks, can offer significant advantages. Acquiring licenses during the published application phase, before a patent is granted, can result in cost savings compared to licensing a fully granted patent.35 This early engagement can also facilitate earlier market entry. Furthermore, the ability to structure licensing agreements with “Field of Use” restrictions allows licensees to gain access to specific applications of a technology without committing to the entire scope of the invention.34 This targeted access enables strategic market expansion or diversification into new therapeutic areas, fostering collaboration and accelerating the diffusion of innovation across the industry.

2.6 Conducting Freedom-to-Operate (FTO) Analysis and Mitigating Infringement Risks

A Freedom-to-Operate (FTO) search is a critical legal and technical evaluation undertaken to determine whether a new product or process can be developed, manufactured, and commercialized without infringing upon the active patent rights of third parties.36 It is a distinct process from a patentability search, which assesses whether an invention itself is eligible for patent protection.36

Crucially, FTO searches must encompass both issued (granted) patents and pending patent applications.36 This is because pending applications represent potential future granted patents that, once issued, could retroactively claim infringement from their publication date.1 Failing to consider these pending applications can expose a company to substantial and costly patent infringement risks down the line, potentially leading to lawsuits, forced product redesigns, or expensive licensing fees.36

Conducting an FTO analysis early in the product design and development phase is essential.36 This proactive approach allows R&D teams sufficient time to explore alternative designs or plan licensing strategies, thereby avoiding disruptions to critical launch timelines.36 In the biopharmaceutical sector, where development timelines can stretch over a decade and costs can soar into billions of dollars, overlooking third-party intellectual property risks is a significant oversight.39

FTO analysis demands expert interpretation of complex patent claim language, legal status, and territorial rights across multiple jurisdictions.36 Patent claims can be broad, ambiguous, or written in highly technical and legalistic terms, complicating the accurate assessment of infringement risk.36 Modern FTO practices increasingly leverage AI-powered tools and semantic analysis, including specialized degenerate sequence searching for biopharma, to enhance the accuracy and efficiency of these complex evaluations.39

The explicit need to include pending patent data in FTO analysis is paramount because these applications, once granted, can retroactively claim infringement from their publication date.1 Therefore, analyzing pending applications allows pharmaceutical companies to proactively identify potential blocking patents before significant R&D and clinical trial investments are made. This enables them to “design around” existing or anticipated IP 39 or to seek necessary licenses, thereby safeguarding multi-billion dollar investments.39 This proactive risk mitigation is a cornerstone of responsible product development.

Furthermore, FTO analysis, by comprehensively examining both granted and pending patents, becomes a crucial tool for navigating complex IP landscapes often characterized by “patent thickets”.39 Patent thickets, where overlapping IP claims from competitors can derail commercialization, are a significant challenge in biopharma.39 By understanding the density and scope of competitor patent pending claims, companies can strategically identify pathways for their own innovation that minimize infringement risk. This elevates FTO from a purely defensive compliance exercise to a strategic tool for identifying less encumbered areas for R&D and market entry, transforming potential obstacles into opportunities for differentiated product development.

3. Challenges and Limitations in Leveraging Patent Pending Data

While offering significant strategic advantages, leveraging patent pending data in the pharmaceutical industry comes with inherent challenges and limitations. Acknowledging and mitigating these issues is crucial for avoiding misinformed decisions and managing associated risks.

3.1 Legal Ambiguity and Enforceability Gaps

The most significant limitation of “patent pending” status is its lack of immediate enforceable patent rights.1 An inventor cannot initiate a lawsuit for infringement until the patent is officially granted.4 This means that during the pendency period, competitors may potentially copy an invention without facing immediate legal repercussions.6

There is also no guarantee that a patent pending application will ultimately be granted.3 An application may be abandoned, rejected, or its claims may be substantially narrowed during the examination process, resulting in a much smaller scope of protection than initially envisioned.3 While the concept of “patent pending infringement” exists, allowing for potential legal liability if the patent is later granted, the practical challenges of monitoring and proving such infringement during the pending period are considerable.1

The consistent emphasis across various sources that “patent pending” offers no “concrete protection” or “legal rights” until granted, and that it is “not a guarantee that a patent will eventually be granted,” creates what can be described as an “illusion of protection” for those who misunderstand its legal standing.3 For pharmaceutical companies, this implies that while the “patent pending” designation might deter some competitors, it leaves them vulnerable to others who are astute enough to understand these legal limitations and are willing to take the risk of developing a similar product during the pendency period, knowing that immediate legal action cannot be taken against them. This necessitates a careful balance between signaling innovation and managing actual legal risk.

Furthermore, the period during which an invention is “patent pending” represents a critical window of strategic vulnerability.6 During this time, the invention is not protected by patent law, meaning competitors cannot be legally prevented from using, making, or selling the invention until the patent is granted.6 Even if a patent is eventually granted and allows for retroactive damages, the innovator could lose crucial first-mover advantage or significant market share during this unprotected interval. Competitors might establish their own market presence, making it considerably more challenging to dislodge them even after the patent issues. This highlights the necessity for robust commercial strategies during the pending phase, extending beyond mere reliance on the deterrent effect of the “patent pending” label.

3.2 Data Accuracy, Completeness, and Interpretation Complexities

Patent applications are published to make the public aware of what is seeking patent protection, but their publication does not guarantee eventual grant.35 This distinction is critical, as treating pending applications as equivalent to granted patents can lead to misleading interpretations and flawed strategic decisions.40

Some analyses, particularly those from advocacy groups, have faced criticism for presenting inaccurate or misleading data. This often involves erroneously including abandoned and pending patent applications in cumulative patent counts to suggest an exaggerated period of market exclusivity for drugs.40 Such practices underscore the imperative for critical evaluation of all data sources and methodologies.

The interpretation of patent claims, especially within the highly complex technical domain of pharmaceuticals, is inherently challenging.36 Patent claims can be broad, ambiguous, or couched in highly technical and legalistic language, demanding specialized expertise to accurately assess their scope and potential implications.36

Broader data quality issues prevalent in the pharmaceutical industry, such as inaccurate or incomplete patient records or inconsistent drug formulation data, can cascade into unreliable analyses across all stages of drug development.42 These issues can jeopardize regulatory compliance and damage market trust, highlighting the pervasive challenge of managing complex, disparate data sources.42

The potential for “abandoned and pending patent applications” to be “erroneously list[ed]” and create a “misleading and inaccurate picture” of patent protection and generic entry timelines is a significant concern.35 This implies that simply relying on raw counts or the mere existence of a pending application, without a deep analysis of its content, prosecution history, and likelihood of grant, can lead to fundamentally flawed strategic decisions regarding R&D investment, market entry, or M&A. Pharmaceutical companies must implement rigorous data validation processes and apply expert scrutiny to avoid acting on inaccurate intelligence.

Furthermore, while advanced AI tools can process vast volumes of data, the nuanced, qualitative interpretation of patent pending claims, particularly in a scientifically intricate field like pharmaceuticals, cannot be fully automated.36 The need to interpret “claim language, legal status, and territorial rights across multiple jurisdictions,” where claims are often “broad, ambiguous, or written in complex, legal-technical language,” necessitates human legal and scientific expertise.36 This human element is indispensable for translating complex patent language into actionable strategic intelligence, thereby mitigating the risk of misinterpretation that could have significant commercial consequences.

3.3 Navigating Regulatory Landscapes and Patent Term Erosion

Pharmaceutical drug development is a notoriously lengthy and expensive process, often spanning 10 to 15 years and incurring costs in the billions of dollars.12 This extended timeline significantly impacts the effective life of a patent.

In the U.S., a patent generally expires 20 years from its earliest filing date.43 However, a substantial portion of this 20-year term is typically consumed during the protracted clinical trials and regulatory approval processes.12 It is not uncommon for a patent to have only a fraction of its term remaining, or even to have expired, by the time the drug receives market approval.12 This phenomenon is often referred to as “patent term erosion.”

Regulatory guidelines, such as those from the U.S. Food and Drug Administration (FDA), can further influence the scope of a patent and introduce delays in the approval process.44 Changes required to meet FDA standards may necessitate modifications to the original patent application, leading to additional costs and further delays.44

To address the issue of patent term erosion, mechanisms like Patent Term Extensions (PTEs) in the U.S. and Supplementary Protection Certificates (SPCs) in other regions exist.8 These allow companies to recover some of the time lost during regulatory review, but they are subject to strict eligibility requirements.8

Beyond patent protection, regulatory bodies grant distinct periods of market exclusivity for certain drugs. Examples include New Chemical Exclusivity (NCE) for 5 years, Orphan Drug Exclusivity (ODE) for 7 years, and Pediatric Exclusivity, which can add 6 months to existing patents or exclusivities.33 These regulatory exclusivities can run concurrently with or extend beyond patent terms, providing additional layers of protection.43

The reality that a significant portion of a patent’s term is “losing valuable patent term while the subject matter of the patent is being developed and under regulatory review” highlights the critical challenge of “effective patent life erosion”.12 For pharmaceutical companies, this means the statutory 20-year patent term from filing is rarely the actual period of market exclusivity. Strategic decisions based on patent pending data must account for this erosion, recognizing that early filing, while crucial for priority, also means the clock starts ticking sooner on a finite period of protection. This necessitates sophisticated planning to maximize return on investment within a compressed exclusivity window.

Furthermore, the clear differentiation between patent protection and various forms of “regulatory exclusivity” (e.g., NCE, Orphan Drug) implies a complex interplay.33 A drug might have a strong patent pending position but face challenges from a regulatory exclusivity perspective, or vice-versa. For instance, data exclusivity can ensure a lengthened de facto market exclusivity even if it extends beyond patent expiry.45 Therefore, pharmaceutical companies must develop a dual, integrated IP and regulatory strategy, leveraging both patent pending intelligence and regulatory foresight to secure and maximize market exclusivity. This integrated approach is vital for navigating the intricate landscape of drug development and commercialization.

3.4 Ethical Considerations: Transparency, Patent Thickets, and “Evergreening”

The strategic utilization of patents in the pharmaceutical industry, particularly during the pending phase, raises significant ethical concerns, primarily centered around practices such as “patent thickets” and “evergreening”.24

“Patent thickets” describe the practice where a brand manufacturer accumulates a large number of patents around a single drug.24 These patents often cover minor or secondary innovations, such as new formulations, delivery methods, or manufacturing processes, rather than fundamentally new chemical entities.25 The objective is to create a dense web of overlapping intellectual property rights that makes it exceedingly difficult, costly, and risky for generic competitors to enter the market or challenge existing patents.24 Critics argue that this practice unduly extends market exclusivity, thereby keeping drug prices high without commensurate benefit to consumers or innovation.24

“Evergreening” is a related strategy involving obtaining new patents for minor modifications of existing drugs, primarily to prolong market exclusivity beyond the original patent’s term.8 While some of these modifications may offer genuine clinical benefits, critics contend that many are primarily designed to extend patent protection rather than significantly improve therapeutic outcomes.24 This practice can lead to accusations of stifling true innovation by incentivizing incremental changes over groundbreaking discoveries.24

Concerns also extend to a perceived lack of transparency in clinical trial data, which some argue is maintained to protect competitive advantage and patent position.24 This secrecy can hinder information sharing and broader scientific progress within the industry.24

While competitive intelligence is a necessary business function, it must be conducted ethically.46 This means strictly avoiding illegal or unethical methods for obtaining information, such as hacking, spying, bribery, misrepresentation, or the use of inaccurate or outdated data.46 Adherence to ethical codes and legal regulations is paramount to maintain a company’s reputation and avoid severe legal repercussions.42

Regulatory initiatives, such as the Orange Book Transparency Act of 2020 and updates to the Purple Book, aim to increase the transparency of patent and exclusivity information for approved drugs and biologics.49 Additionally, the Patent Information Initiative for Medicines (Pat-INFORMED) provides a gateway to medicine patent information, facilitating access for the global health community.50

The tension between rewarding pharmaceutical innovation through patent protection and ensuring affordable public access to essential medicines is a profound ethical dilemma.24 Practices like “patent thickets” and “evergreening,” often initiated during the patent pending phase through continuous filings, are viewed by critics as strategies to “unduly extend the period of exclusivity” and “keep drug prices high”.24 This underscores that while patent pending data is a powerful strategic tool for competitive advantage, its aggressive utilization can lead to significant societal concerns about drug affordability and equitable access. Pharmaceutical companies must navigate this delicate balance, considering not only commercial gains but also their broader social responsibility.

Furthermore, the comprehensive list of “ethical considerations in competitive profiling” emphasizes that while analyzing competitor patent pending data is a strategic imperative, the means of acquiring and interpreting this data must adhere to strict ethical and legal boundaries.46 Engaging in practices that are perceived as unfair or illegal, even if they yield valuable insights, can result in severe reputational damage, significant legal repercussions, and a profound loss of public trust.42 Therefore, establishing and rigorously enforcing robust internal ethical guidelines for competitive intelligence practices is as critical as the analytical capabilities themselves.

4. Best Practices for Effective Utilization of Patent Pending Data

To effectively harness the strategic value of patent pending data, pharmaceutical companies must adopt a comprehensive, integrated, and technologically advanced approach. This involves implementing robust monitoring systems, fostering cross-functional collaboration, and developing proactive patent management strategies.

4.1 Implementing Robust Patent Monitoring and Intelligence Systems

Effective utilization of patent pending data necessitates continuous, systematic monitoring and analysis, rather than relying on reactive or episodic searches.6 This proactive approach ensures that companies stay abreast of the rapidly evolving intellectual property landscape.

Pharmaceutical companies should leverage advanced patent search tools and AI-based platforms to enhance the accuracy and efficiency of their searches and analyses.15 Tools such as PatSnap, Derwent Innovation, and LexisNexis TotalPatent One, along with platforms like IPD Analytics, can automate preliminary assessments, identify complex patterns, predict emerging trends, and streamline freedom-to-operate (FTO) analyses.28 These platforms can process vast amounts of data, providing deeper insights into patent landscapes.15

A more comprehensive view of the drug development landscape is achieved by integrating patent data with other forms of market intelligence.16 This includes information from scientific literature, clinical trial databases, regulatory filings, and company press releases.51 Such integration allows for a holistic understanding of competitive activities and market dynamics.

Maintaining detailed records of search processes, including search terms used, dates, and results obtained, is crucial for ensuring accuracy, reproducibility, and accountability in patent intelligence efforts.51

The emphasis on “constant vigilance” and “real-time” monitoring of filings signifies a fundamental shift from a traditional, static patent search model to a dynamic, continuous intelligence system.6 In the fast-evolving pharmaceutical industry, relying on outdated or infrequent patent data can lead to missed opportunities or unaddressed threats. Implementing robust, automated monitoring systems for patent pending data ensures that strategic decisions are based on the most current competitive landscape, enabling greater agility and responsiveness.

The repeated mention of AI and advanced software tools in patent analysis underscores a technological imperative for maintaining a competitive edge.15 AI is revolutionizing patent research by automating the analysis of vast amounts of patent data, enabling the identification of patterns and prediction of trends.15 Manual or traditional patent analysis methods are becoming insufficient to process the sheer volume and complexity of global patent data, including pending applications. Pharmaceutical companies that fail to adopt and leverage these AI-powered intelligence platforms risk being outmaneuvered by competitors who can extract deeper, faster, and more accurate information, thereby losing a significant competitive advantage.

Table 2: Key Databases and Analytical Platforms for Pharmaceutical Patent Intelligence

| Category | Database/Platform Name | Description & Utility for Pharma Patent Intelligence |

| Official Patent Offices | USPTO (United States Patent and Trademark Office) 51 | Primary source for U.S. patents and patent applications. User-friendly with various search options, including keyword and classification-based queries.51 Essential for U.S. market focus. |

| EPO (European Patent Office) – Espacenet 51 | Offers access to over 140 million patent documents globally, including machine translations. Invaluable for international patent searches.51 | |

| WIPO (World Intellectual Property Organization) – PATENTSCOPE 51 | Provides a global perspective, particularly useful for searching international patent applications filed under the Patent Cooperation Treaty (PCT).51 | |

| Regulatory Databases | FDA Orange Book 54 | Contains patent information for FDA-approved drug products with therapeutic equivalence evaluations. Crucial for understanding market exclusivity and generic entry timelines.43 |

| Pat-INFORMED (WIPO) 50 | Facilitates access to medicine patent information directly provided by biopharmaceutical companies for procurement agencies. Covers key patents for small-molecule products.50 | |

| Commercial Intelligence Platforms | PatSnap 51 | AI-powered IP and R&D intelligence platform connecting innovation datasets with AI to accelerate drug discovery and patent analysis. Offers AI agents for search, analysis, and FTO.53 |

| Derwent Innovation 51 | A comprehensive patent research and analytics platform, widely used for competitive intelligence and patent landscaping. | |

| LexisNexis TotalPatent One 51 | Provides access to global patent data, legal status, and analytics tools for comprehensive patent research. | |

| IPD Analytics 52 | Industry leader in drug life-cycle insights, offering solutions for competitive-landscape shifts, loss-of-exclusivity timing, and market impact forecasts. Integrates data from thousands of sources.52 | |

| DrugPatentWatch 16 | Web-based platform providing comprehensive and up-to-date information on FDA-approved pharmaceutical patents, drugs, and developers. Offers business intelligence on biologic and small molecule drugs, litigation, and patent expirations.55 |

4.2 Integrating Patent Intelligence into Strategic Decision-Making Frameworks

Comprehensive patent analysis, which includes data from pending applications, must directly inform strategic decision-making across all levels of a pharmaceutical organization.15 This integration elevates patent intelligence from a mere legal compliance function to a core strategic asset.

Patent intelligence helps guide R&D efforts by identifying promising areas for investment and avoiding redundant research.15 It informs decisions about market entry, product positioning, and portfolio management by providing early signals of competitive activity and market trends.15 It is crucial to align a company’s patent strategy with broader market trends and industry shifts, ensuring that patent filings protect innovations in high-potential growth areas.18

The true strategic value of patent pending data is realized not in isolation but through its seamless integration into a company’s overarching strategic decision-making framework. As indicated by the emphasis on integrating patent data with other market intelligence sources such as scientific literature, clinical trial databases, and regulatory filings, a holistic approach is essential.16 By synthesizing patent intelligence with clinical, regulatory, and market data, pharmaceutical companies can develop a more comprehensive and accurate understanding of the competitive landscape. This enables them to anticipate future challenges and identify synergistic opportunities, thereby creating a more sustainable competitive advantage.

This approach signifies a fundamental shift in IP management philosophy, moving from a reactive to a proactive stance.18 Instead of waiting for competitors to launch products or for patents to be granted, companies can use early patent filing signals to anticipate competitive moves, adjust their R&D priorities, refine their own patent filing strategies, and even initiate defensive actions, such as freedom-to-operate (FTO) analysis for design-arounds, much earlier in the development cycle.18 This proactive approach is critical for maintaining market leadership and maximizing return on investment in a dynamic and highly competitive industry.

4.3 Fostering Cross-Functional Collaboration (Legal, R&D, Business Development)

Effective utilization of patent pending data, particularly in complex areas like M&A due diligence, necessitates robust cross-functional collaboration.28 This involves assembling a team that includes patent attorneys, technical experts (such as R&D scientists), and business development or financial advisors.28 Each discipline brings a unique perspective essential for a comprehensive assessment.

Intellectual property attorneys with specialized experience in the relevant technical fields are best equipped to conduct and interpret FTO searches and provide accurate legal opinions.37 Their understanding of complex patent claim language and legal nuances is critical. Similarly, collaboration with technical experts, such as engineers and product developers, is essential for accurately defining the scope of patent searches and identifying potential overlaps with existing technologies.38 Their technical insights ensure that the patent analysis is grounded in scientific reality.

Furthermore, secure and transparent data exchange between different internal departments and with external vendors is crucial for managing highly sensitive patent and R&D information without compromising workflows or confidentiality.56

The call for a “Cross-Functional Team” comprising patent attorneys, technical experts, and business advisors for patent due diligence underscores that patent pending data, with its blend of legal, scientific, and commercial implications, cannot be effectively leveraged by a single department in isolation.28 Siloed approaches risk misinterpretation; for instance, R&D teams might miss critical legal nuances, while legal teams might overlook important technical details. Fostering deep, continuous collaboration between legal, R&D, and business development teams ensures that patent pending intelligence is accurately interpreted, its implications fully understood, and that strategic decisions are holistic, balancing scientific feasibility, legal defensibility, and commercial viability.

The success of leveraging patent pending data hinges on a shared understanding of its nuances across different functions. For example, R&D teams need to comprehend the legal implications of a competitor’s pending patent for their own “freedom to operate” 36, while legal teams must grasp the technical details to accurately assess claim scope and potential infringement. Business development professionals need to understand both aspects to identify viable licensing or M&A opportunities.11 By fostering cross-functional dialogue, joint training initiatives, and integrated workflows, companies can ensure that all relevant stakeholders are equipped to interpret patent pending signals, collectively assess risks and opportunities, and contribute to a more robust and integrated IP strategy.

4.4 Developing Proactive Patent Filing Strategies and Portfolio Management

In a “first-to-file” patent system, filing patent applications as early as possible is paramount to secure priority dates for inventions.3 This early filing establishes a company’s claim to an invention and can be critical in competitive races.

Provisional patent applications (PPAs) offer a cost-effective and flexible way to establish an early priority date and secure “patent pending” notice for 12 months.7 This period provides valuable time for further development, market assessment, and commercialization efforts without the immediate burden of a full non-provisional application.7

The use of “rolling provisional applications” is a best practice commonly employed in the pharmaceutical industry.10 This strategy allows companies to file successive provisional applications that incorporate new subject matter and improvements as they emerge during the iterative R&D process.10 This ensures that patent claims are continuously updated and expanded, providing comprehensive protection for evolving innovations and preventing competitors from “designing around” the original invention.8

Strategic portfolio management extends beyond initial filings to include continuous efforts to extend patent life. This often involves “evergreening” strategies, such as patenting new formulations, delivery methods, or methods of use for existing drugs.8 While these practices can be controversial, they are a common means for pharmaceutical companies to maximize the commercial lifespan of their products.8

A robust and well-managed patent portfolio, built through proactive filing and continuous refinement, is critical for attracting investment, facilitating partnerships, securing market exclusivity, and ensuring long-term profitability.20

The common use of “rolling provisional patent applications” in the pharmaceutical industry for incorporating “additional subject matter” and the strategic focus on “Extending Patent Life” through new formulations and methods of use highlight that patenting in pharma is not a one-time event but a continuous, dynamic process that mirrors the drug’s lifecycle.8 Proactive patent filing strategies, particularly leveraging patent pending applications, are essential for continuously securing and expanding protection for evolving innovations (e.g., new indications, improved formulations) throughout a drug’s development and commercial life. This approach maximizes the drug’s long-term value and helps to fend off generic competition.

Furthermore, the assertion that patents are “not just legal tools but strategic assets that provide a competitive edge” and play a “pivotal role in attracting investment” and “facilitating partnerships and licensing deals” signifies a crucial shift in perspective.33 This implies that patent pending data, as the precursor to these valuable assets, should be viewed not merely as legal documentation or a compliance burden, but as a core business asset that directly drives company valuation, attracts investment, and enables strategic collaborations. Companies that proactively manage their patent pending pipeline as a strategic asset, rather than solely a legal formality, are better positioned for sustained growth and market leadership.

5. Emerging Trends: The Impact of AI/ML on Patent Analysis and Drug Development

The advent of Artificial Intelligence (AI) and Machine Learning (ML) is profoundly transforming both the process of drug discovery and the methodologies for analyzing patent pending data in the pharmaceutical industry. This technological evolution presents new opportunities and challenges for intellectual property strategy.

5.1 AI/ML’s Role in Accelerating Drug Discovery and Patenting

AI is revolutionizing pharmaceutical R&D by significantly accelerating the drug discovery process, drastically shortening development timelines (from a traditional 10-15 years to potentially as little as 18 months for some drugs), and substantially reducing associated costs.13

AI models possess the capability to analyze vast and complex datasets, including genomic, proteomic, and chemical information.13 They can predict molecular interactions, identify novel drug targets, design new molecules, and optimize clinical trials with remarkable precision and speed.13 This enhanced efficiency and accuracy are game-changers for an industry historically characterized by high attrition rates and prolonged development cycles.21

Consequently, there has been a significant surge in AI-related patent filings across various sectors, including healthcare.60 This increase reflects the growing importance of AI technologies and the concerted efforts of companies to secure their innovations in this rapidly evolving domain.60

However, the integration of AI in drug discovery introduces new complexities for patentability. A key challenge relates to inventorship: current U.S. Patent and Trademark Office (USPTO) requirements stipulate that a human must make a “significant contribution” to the invention, as AI cannot be named as an inventor.13 Additionally, AI-generated inventions must still meet traditional patentability criteria such as novelty, non-obviousness, and utility, while overcoming challenges related to the disclosure of AI’s often opaque processes.13

AI’s ability to “significantly shorten the traditional 10-15 year drug development timeline and reduce costs” and “accelerate the identification of drug targets, designing novel molecules, and optimizing clinical trials” directly implies a causal relationship: AI will act as a powerful catalyst for the generation of intellectual property.13 The rapid identification and development of promising drug candidates, enabled by AI, will inevitably lead to a substantial increase in the volume and complexity of pharmaceutical inventions. Consequently, this will drive a surge in new patent applications, making patent pending data an even richer and more dynamic source of intelligence. AI is not merely changing drug discovery; it is fundamentally altering the landscape of patentable innovation.

The explicit requirement from the USPTO that “a human make a ‘significant contribution’ to the invention, as AI cannot be named as an inventor,” creates a legal paradox.13 While AI can effectively

create or identify an invention, a human must be recognized as the inventor for patent purposes. For pharmaceutical companies leveraging AI in R&D, this necessitates meticulous documentation of human involvement throughout the AI-driven discovery process. This includes detailing the design of AI models, the selection of specific data inputs, the validation of AI-generated outputs through wet lab experiments, and iterative modifications based on results.13 Such thorough documentation is critical to ensure that valuable AI-generated discoveries can successfully navigate the patent application process and achieve patent pending status, ultimately leading to enforceable patents. Failure to adhere to these requirements could render significant AI-driven innovations unpatentable.

5.2 Leveraging AI-Powered Tools for Enhanced Patent Analysis

AI is revolutionizing patent research by automating the analysis of vast amounts of patent data, enabling the identification of intricate patterns, the prediction of emerging trends, and the provision of deeper, more actionable insights into complex patent landscapes.15

Specialized AI-powered platforms, such as PatSnap, are specifically designed to connect the world’s largest proprietary innovation datasets with next-generation AI technologies.53 This integration accelerates R&D, intellectual property management, materials science, and drug discovery processes.53

These advanced tools feature “AI agents” capable of performing a wide range of tasks that traditionally required extensive manual effort.53 These tasks include searching patents, scientific papers, and industry trends; exploring new technologies, potential partners, and competitors; drafting patent applications and reports; monitoring markets and filings in real-time; and conducting highly sophisticated Freedom-to-Operate (FTO) analyses.53

AI significantly enhances the accuracy and efficiency of complex analyses, such as degenerate sequence searching in biopharma.39 By utilizing Natural Language Processing (NLP) models, AI tools can parse ambiguities in complex chemical structures or biological sequences, thereby reducing oversight risks by as much as 40% in some cases.39

The capabilities of AI agents to “analyze billions of data points, surface key insights, and streamline decision-making” and to “Enhanc[e] human ingenuity” indicate that AI is not intended to replace human patent analysts but rather to augment their capabilities significantly.53 By automating tedious, data-intensive tasks such as large-scale data processing and pattern recognition, AI allows human experts to dedicate their time and cognitive resources to higher-level interpretation, strategic thinking, and nuanced decision-making. Pharmaceutical companies that effectively integrate AI-powered tools into their patent intelligence workflows will gain a substantial competitive advantage by extracting deeper, faster, and more accurate information from patent pending data, enabling more informed and agile strategic responses.

Furthermore, the emphasis on how “Modern FTO demands AI-powered tools and semantic analysis,” specifically noting how NLP models enhance “Degenerate Sequence Searching” in biopharma and “reducing oversight risks by 40%,” demonstrates that AI’s capabilities extend beyond mere data volume processing to improving the precision of complex analyses crucial for pharmaceutical intellectual property.39 By accurately parsing intricate chemical structures or biological sequences within patent pending applications, AI tools can significantly reduce the risk of overlooking potential infringements or missing subtle opportunities for innovation. This enhanced precision is critical for safeguarding investments and optimizing R&D direction in a highly technical and competitive industry, allowing companies to make more confident strategic moves.

6. Conclusion and Recommendations

Patent pending data, while lacking the immediate legal enforceability of a granted patent, is an indispensable strategic asset in the pharmaceutical industry. Its true value lies in its capacity to provide early signals and foresight, enabling companies to anticipate competitive moves, identify nascent market trends, and optimize internal innovation pathways. The inherent legal ambiguities and complexities of interpretation necessitate a sophisticated approach, but the strategic advantages far outweigh these challenges when managed effectively. The transformative impact of AI and Machine Learning is further amplifying the utility of this data, making advanced analytical capabilities a competitive imperative.

To strategically leverage patent pending data for sustained competitive advantage and innovation, pharmaceutical companies should implement the following recommendations:

- Develop a Proactive and Integrated IP Intelligence Framework: Companies must transition from reactive patent searches to continuous, AI-powered patent monitoring systems. These systems should seamlessly integrate patent pending data with other critical intelligence streams, including clinical trial results, regulatory updates, and market sales data. This holistic approach ensures real-time insights, enabling agile R&D prioritization, accurate market forecasting, and comprehensive competitive analysis.

- Foster Cross-Functional IP Collaboration: Break down traditional departmental silos by establishing dedicated cross-functional teams comprising legal, R&D, and business development professionals. This collaborative structure ensures that patent pending intelligence is accurately interpreted from multiple perspectives, its implications are fully understood across the organization, and strategic decisions are holistic, balancing scientific feasibility, legal defensibility, and commercial viability. Investment in continuous training is vital to ensure a shared understanding of both the legal nuances and strategic implications of this data.

- Optimize Patent Filing and Portfolio Management Strategies: Embrace dynamic patent filing strategies, such as the use of “rolling provisional applications,” to continuously secure and expand intellectual property protection for evolving innovations throughout their development lifecycle. The patent portfolio, including pending applications, should be viewed as a core business asset that actively drives company valuation, attracts investment, and facilitates strategic partnerships, rather than merely a legal compliance burden.

- Prioritize Early Freedom-to-Operate (FTO) Analysis: Conduct comprehensive FTO searches, explicitly including pending applications, as early as possible in the drug development lifecycle. Leverage advanced analytical tools, particularly AI-powered solutions, to identify and mitigate potential infringement risks proactively. This early identification enables timely design-arounds or facilitates necessary licensing discussions, safeguarding multi-billion dollar investments.

- Adhere to Ethical Standards in Competitive Intelligence: While aggressively pursuing competitive advantage, ensure that all data collection and analysis practices related to patent pending information strictly adhere to ethical guidelines and legal boundaries. This commitment to ethical conduct is crucial for maintaining a strong corporate reputation, avoiding legal repercussions, and fostering long-term trust within the industry and with the public.

- Invest in AI/ML Capabilities for IP and R&D: Recognize AI as a transformative force that can accelerate both drug discovery and patent analysis. Strategic investment in AI-powered tools and specialized expertise is essential to enhance the precision of patent analysis, expedite the innovation process, and effectively navigate the evolving legal landscape surrounding AI-generated inventions. This technological adoption is key to maintaining a leading position in the competitive pharmaceutical market.

By embracing these strategic imperatives, pharmaceutical companies can transform patent pending data from a mere legal formality into a powerful engine for innovation, risk mitigation, and sustained market leadership.

Works cited

- Pending Patent Status: What First Time Inventors Must Know …, accessed July 24, 2025, https://thompsonpatentlaw.com/pending-patent-status/

- www.alacrita.com, accessed July 24, 2025, https://www.alacrita.com/blog/pharmaceutical-patents-an-overview#:~:text=Once%20you’ve%20filed%20a,hasn’t%20been%20granted%20yet.

- What Does Patent Pending Mean? – TraskBritt, accessed July 24, 2025, https://www.traskbritt.com/what-does-patent-pending-mean/

- Does Patent Pending Mean Anything? | PatentPC, accessed July 24, 2025, https://patentpc.com/blog/does-patent-pending-mean-anything

- Does Patent Pending Offer Protection – PatentPC, accessed July 24, 2025, https://patentpc.com/blog/does-patent-pending-offer-protection

- Patent Pending Infringement: Identification and Action Guide – TT Consultants, accessed July 24, 2025, https://ttconsultants.com/patent-pending-infringement-how-to-identify-it-what-you-can-do-about-it/

- Provisional Application for Patent – USPTO, accessed July 24, 2025, https://www.uspto.gov/patents/basics/apply/provisional-application

- Filing Strategies for Maximizing Pharma Patents: A Comprehensive Guide for Business Professionals – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- Patent application – Wikipedia, accessed July 24, 2025, https://en.wikipedia.org/wiki/Patent_application

- Rolling Provisional Patent Applications – Neustel Law Offices, accessed July 24, 2025, https://neustel.com/rolling-provisional-patent-applications/

- Can I License My Patent-Pending Invention? – Founders Legal, accessed July 24, 2025, https://founderslegal.com/can-i-license-my-patent-pending-invention/

- A deep dive into patent law and exclusivity in the United States | Lowenstein Sandler LLP, accessed July 24, 2025, https://www.lowenstein.com/news-insights/publications/articles/a-deep-dive-into-patent-law-and-exclusivity-in-the-united-states

- Patenting Drugs Developed with Artificial Intelligence: Navigating the Legal Landscape, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/patenting-drugs-developed-with-artificial-intelligence-navigating-the-legal-landscape/

- What is Competitive Intelligence in the pharmaceutical industry …, accessed July 24, 2025, https://www.lifesciencedynamics.com/press/articles/what-is-competitive-intelligence-in-the-pharma-industry/

- Patent research as a tool for competitive intelligence in brand protection – RWS, accessed July 24, 2025, https://www.rws.com/blog/patent-research-as-a-tool/

- How CDMOs Can Use Patent Data to Win More Pharmaceutical Clients – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/how-cdmos-can-use-patent-data-to-win-more-pharmaceutical-clients/

- How to Track Competitor R&D Pipelines Through Drug Patent Filings, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- Leveraging Data Analytics to Prioritize Patent Filings: A Case Study | PatentPC, accessed July 24, 2025, https://patentpc.com/blog/leveraging-data-analytics-to-prioritize-patent-filings-a-case-study

- Maximizing ROI on Drug Development by Monitoring Competitive Patent Portfolios, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- Managing Patent Portfolios in the Pharmaceutical Industry – PatentPC, accessed July 24, 2025, https://patentpc.com/blog/managing-patent-portfolios-in-the-pharmaceutical-industry

- The Imperative to Innovate: Revitalizing the Pharmaceutical R&D …, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/reviving-an-rd-pipeline/

- Generic Drug Entry Timeline: Predicting Market Dynamics After …, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-timeline-predicting-market-dynamics-after-patent-loss/

- Predicting patent challenges for small-molecule drugs: A cross-sectional study – PMC, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11867330/

- Problems with Drug Patents – DebateUS, accessed July 24, 2025, https://debateus.org/problems-with-drug-patents/

- Pharmaceutical Patenting Practices: A Legal Overview – Congress.gov, accessed July 24, 2025, https://www.congress.gov/crs-product/IF11561

- How drugmakers exploit the patent system to delay competition and inflate prices | Evernorth, accessed July 24, 2025, https://www.evernorth.com/articles/how-drugmakers-exploit-patent-system-delay-competition-and-inflate-prices

- Pharmaceutical companies and their patent expiries – Erasmus University Thesis Repository, accessed July 24, 2025, https://thesis.eur.nl/pub/9779/Looveren,%20Henriette%20van%20(348044).doc

- M&A Patent Due Diligence: Comprehensive Guide – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/ma-patent-due-diligence-comprehensive-guide/

- The Role of Patents in Biopharmaceutical Mergers and Acquisitions | PatentPC, accessed July 24, 2025, https://patentpc.com/blog/patents-in-biopharmaceutical-mergers-and-acquisitions

- The Impact of Mergers and Acquisitions on Patent Portfolios – PatentPC, accessed July 24, 2025, https://patentpc.com/blog/the-impact-of-mergers-and-acquisitions-on-patent-portfolios

- Strategic M&A Moves in Pharmaceuticals: Navigating Patent Cliffs and Growth Opportunities, accessed July 24, 2025, https://www.ainvest.com/news/strategic-moves-pharmaceuticals-navigating-patent-cliffs-growth-opportunities-2507/

- Leveraging Drug Patent Data for Strategic Investment Decisions: A Comprehensive Analysis, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/leveraging-drug-patent-data-for-strategic-investment-decisions-a-comprehensive-analysis/

- Patent Considerations for Drug Regulatory Approval – PatentPC, accessed July 24, 2025, https://patentpc.com/blog/patent-consideration-for-drug-regulatory-approval

- Life Sciences Patent Licensing – Morse Law, accessed July 24, 2025, https://www.morse.law/news/biotech-patent-licensing/

- Patent Granted vs Published: Everything You Need to Know – UpCounsel, accessed July 24, 2025, https://www.upcounsel.com/patent-granted-vs-published

- Understanding Freedom to Operate Search – Lumenci, accessed July 24, 2025, https://lumenci.com/blogs/fto-search-understanding-freedom-to-operate/

- What is Freedom To Operate? – Why Cognition IP?, accessed July 24, 2025, https://www.cognitionip.com/what-is-freedom-to-operate-and-why-does-it-matter-to-med-device-startups/

- Avoid FTO Pitfalls: Best Practices for Patent Searches | TTC – TT Consultants, accessed July 24, 2025, https://ttconsultants.com/the-road-to-freedom-to-operate-fto-search-best-practices/

- Conducting a Biopharmaceutical Freedom-to-Operate (FTO) Analysis: Strategies for Efficient and Robust Results – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/conducting-a-biopharmaceutical-freedom-to-operate-fto-analysis-strategies-for-efficient-and-robust-results/

- Debunking Patent Disinformation: Insights from the USPTO’s Drug Patent and Exclusivity Study – Council for Innovation Promotion (C4IP), accessed July 24, 2025, https://c4ip.org/debunking-patent-disinformation-insights-from-the-usptos-drug-patent-and-exclusivity-study/

- Pharmaceutical Patent Regulation in the United States – The Actuary Magazine, accessed July 24, 2025, https://www.theactuarymagazine.org/pharmaceutical-patent-regulation-in-the-united-states/

- Data Quality Issues Affecting the Pharmaceutical Industry: Finding a Solution – FirstEigen, accessed July 24, 2025, https://firsteigen.com/blog/data-quality-issues-affecting-the-pharmaceutical-industry-finding-a-solution/

- Patents and Exclusivity | FDA, accessed July 24, 2025, https://www.fda.gov/media/92548/download

- Unique Challenges for Patents in the Pharmaceutical Industry | Gearhart Law, LLC, accessed July 24, 2025, https://gearhartlaw.com/unique-challenges-for-patents-in-the-pharmaceutical-industry/

- Raising the Barriers to Access to Medicines in the Developing World – The Relentless Push for Data Exclusivity – PubMed Central, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5347964/

- Ethical Considerations In Competitive Intelligence And Benchmarking – FasterCapital, accessed July 24, 2025, https://fastercapital.com/topics/ethical-considerations-in-competitive-intelligence-and-benchmarking.html/1

- Pharmaceutical Competitive Intelligence | 2025 Guide – BiopharmaVantage, accessed July 24, 2025, https://www.biopharmavantage.com/competitive-intelligence

- Navigating Patent Pending Ethics – Number Analytics, accessed July 24, 2025, https://www.numberanalytics.com/blog/navigating-patent-pending-ethics

- New Orange & Purple Book laws increase transparency of patent information for drugs, biologics – Hogan Lovells, accessed July 24, 2025, https://www.hoganlovells.com/en/publications/new-orange-purple-book-laws-increase-transparency-of-patent-information-for-drugs-biologics

- Pat-INFORMED – The Gateway to Medicine Patent Information – WIPO, accessed July 24, 2025, https://www.wipo.int/pat-informed/en/

- The basics of drug patent searching – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/the-basics-of-drug-patent-searching/

- IPD Analytics | The Industry Leader in Drug Life-Cycle Insights, accessed July 24, 2025, https://www.ipdanalytics.com/

- Patsnap | AI-powered IP and R&D Intelligence, accessed July 24, 2025, https://www.patsnap.com/

- Orange Book Data Files – FDA, accessed July 24, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/orange-book-data-files

- DrugPatentWatch Review – Crozdesk, accessed July 24, 2025, https://crozdesk.com/software/drugpatentwatch/review

- CyberGrant case study – protecting pharma R&D and clinical data, accessed July 24, 2025, https://www.cybergrant.net/en/industry-case-pharma

- Patent protection strategies – PMC, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3146086/