Introduction: The $400 Billion Shift – Navigating the Modern Generic Drug Landscape

The New Era of Generic Pharmaceuticals: Beyond Simple Replication

In the intricate and high-stakes world of global pharmaceuticals, the generic drug sector has evolved far beyond its historical perception as a mere producer of low-cost replicas. Today, it stands as a formidable force of strategic, legal, and commercial prowess, fundamentally reshaping healthcare economics and challenging the dominance of innovator drug companies. The success of a generic drug is no longer a foregone conclusion upon patent expiry; it is the culmination of a meticulously planned and aggressively executed multi-year campaign. This report deconstructs the playbooks behind some of the most consequential generic launches in history, revealing that victory in this arena is not a matter of chance, but of strategy. By dissecting these landmark cases, we can assemble a blueprint for success in one of the most competitive and impactful sectors of the global economy.

Market Dynamics and the Impending Patent Cliff: Sizing the Opportunity

The global generic drug market is currently at a strategic inflection point, poised for a period of unprecedented growth. Synthesized analysis from multiple leading research firms projects a robust expansion from a market value of approximately $450-$500 billion in the mid-2020s to well over $700 billion by the early 2030s.1 This trajectory is underpinned by a sustainable compound annual growth rate (CAGR) estimated to be between 5% and 8%, a rate that outpaces many other mature industries.1

Table 1: Comparative Analysis of Global Generic Drug Market Forecasts

| Research Firm | Base Year & Value (USD B) | Forecast Year & Value (USD B) | CAGR (%) | Forecast Period |

| Grand View Research | 2022: $361.7 | 2030: $682.9 | 8.3% | 2023-2030 |

| Precedence Research | 2024: $445.6 | 2034: $728.6 | 5.04% | 2025-2034 |

| Custom Market Insights | 2024: $491.4 | 2034: $926.5 | 6.55% | 2025-2034 |

| Stellar MR | 2024: $453.7 | 2032: $681.6 | 5.22% | 2025-2032 |

| Towards Healthcare | 2024: $425.0 | 2034: $947.7 | 8.35% | 2024-2034 |

Source: Compiled from.1

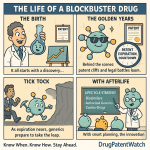

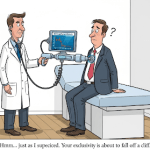

This powerful growth is not speculative; it is driven by a confluence of powerful and predictable tailwinds. The most significant of these is the cyclical expiration of patents on blockbuster brand-name drugs, a phenomenon known as the “patent cliff.” Between 2025 and 2030, the industry will witness one of the largest waves of patent expiries in its history. Estimates suggest that branded drugs generating between $217 billion and $236 billion in annual sales are set to lose their market exclusivity, creating a massive transfer of market value from innovator companies to generic competitors.1 This impending cliff represents the largest single opportunity for the generic sector in over a decade, setting the stage for the next series of high-stakes strategic battles.

Table 2: Key Blockbuster Drugs Facing Loss of Exclusivity (2025-2030)

| Drug Name (Brand) | Active Ingredient | 2023/2024 Sales (USD B) |

| Keytruda | Pembrolizumab | ~$29.5 |

| Stelara | Ustekinumab | ~$10.9 |

| Eliquis | Apixaban | ~$12.0 (BMS only) |

| Opdivo | Nivolumab | ~$9.3 |

Source: Compiled from.1

The sheer scale of this predictable opportunity functions as a cyclical economic engine for the generic industry. It allows firms to engage in long-range strategic planning, aligning their research, development, and legal investments to coincide with the expiration of these multi-billion-dollar franchises. The most sophisticated generic companies, therefore, operate on a timeline dictated not by their own discovery cycles, but by the successful innovation of the brand-name industry a decade or more in the past.

The Generic Imperative: Driving Trillions in Healthcare Savings

The strategic importance of the generic industry extends far beyond corporate balance sheets; it is a cornerstone of healthcare affordability and accessibility worldwide. In the United States, the impact is particularly profound. Generic drugs account for over 90% of all prescriptions filled, yet they represent only about 17.5% to 18% of total prescription drug spending.1 This remarkable efficiency translates into staggering savings for patients, employers, and government payers.

According to the Association for Accessible Medicines (AAM), the use of generic and biosimilar medicines saved the U.S. healthcare system a record $408 billion in 2022 alone.6 Over the past decade, these savings have accumulated to an astonishing $2.9 trillion.6 This immense economic contribution underscores the critical public health role of the generic industry. The case studies that follow are not merely stories of corporate competition; they are pivotal moments that unlocked billions of dollars in healthcare value, making essential medicines accessible to millions of patients who might otherwise have been unable to afford them. This creates a unique dynamic within the industry: while the sector as a whole generates immense societal value through cost reduction, individual companies face a brutal competitive landscape characterized by intense price erosion and razor-thin margins. After the initial period of market exclusivity for a first-to-market generic, the entry of additional competitors can drive prices down by over 95%.7 This “generic paradox”—where the industry’s value to the healthcare system is inversely proportional to the long-term profitability of its individual products—places an immense premium on the strategies required to be the

first and most effective generic entrant.

Thesis: Unpacking the Strategic Playbooks Behind Three Landmark Generic Victories

To understand how success is achieved in this high-stakes environment, it is necessary to move beyond surface-level analysis and deconstruct the intricate legal maneuvers, commercial strategies, and critical decisions that define a winning generic launch. This report will conduct a deep-dive analysis of three of the most significant generic drug launches in pharmaceutical history: atorvastatin (Lipitor), clopidogrel (Plavix), and imatinib (Gleevec).

These cases have been selected not only for their immense financial impact but because they represent three distinct and foundational strategic archetypes that every industry professional must understand:

- The Negotiated Settlement (Lipitor): A case study in strategic compromise, where a protracted legal battle over the world’s best-selling drug culminated in a carefully negotiated market entry that provided certainty for both the brand and generic challenger, albeit under a cloud of antitrust scrutiny.

- The At-Risk Launch (Plavix): A high-stakes gamble that exemplifies the most aggressive strategy in the generic playbook, where a company launches its product while patent litigation is still pending, risking massive damages for a chance at enormous profits.

- The Specialty Pharma Challenge (Gleevec): An examination of the unique dynamics of the high-cost specialty drug market, where the rules of pricing, market capture, and patient loyalty differ dramatically from those of high-volume primary care drugs.

By dissecting these seminal cases, we will illuminate the core principles of modern generic strategy and provide a comprehensive blueprint for navigating the challenges and seizing the opportunities of the blockbuster patent cliffs to come.

The Legal Gauntlet: Mastering the Hatch-Waxman Act

A Strategic Compromise: The Dual Purpose of Hatch-Waxman

At the heart of every generic drug strategy in the United States lies a single piece of landmark legislation: the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act.9 Enacted as a grand compromise, the Act was meticulously designed to address two seemingly contradictory policy goals: to preserve the powerful incentives for innovator pharmaceutical companies to invest in the risky and expensive process of developing new medicines, and to simultaneously facilitate the swift market entry of lower-cost generic drugs upon patent expiration.9

The Act fundamentally altered the legal and economic landscape, creating the modern generic drug industry as we know it.10 For any executive, legal counsel, or analyst in the pharmaceutical space, a deep and nuanced understanding of Hatch-Waxman is not a mere legal formality; it is the essential key to deciphering the strategic calculus behind every product launch, patent challenge, and business development deal. The Act is the chessboard, and its provisions are the rules of engagement that dictate the moves of both brand and generic players.

The ANDA Pathway: From Bioequivalence to Market Approval

Prior to 1984, the path to market for a generic drug was arduous and often economically unviable. Generic manufacturers were required to conduct their own extensive and expensive clinical trials to prove the safety and efficacy of their products, largely duplicating the work already done by the innovator company.9 This created a significant barrier that delayed generic competition long after patents had expired.

Hatch-Waxman revolutionized this process by creating the Abbreviated New Drug Application (ANDA).11 The ANDA pathway allows a generic manufacturer to rely on the safety and efficacy findings of the innovator’s original New Drug Application (NDA). Instead of repeating costly clinical trials, the generic applicant need only demonstrate that its product is

bioequivalent to the brand-name reference drug—meaning it delivers the same amount of active ingredient into a patient’s bloodstream over the same period of time.9 This innovation dramatically reduced the time, cost, and risk associated with generic drug development, effectively shifting the primary barrier to market entry from a scientific and clinical hurdle to a legal and patent-centric one.

The Paragraph IV Certification: The Declaration of War on Brand Patents

The strategic core of the Hatch-Waxman Act revolves around how generic applicants must address the patents protecting the brand-name drug. The FDA maintains a publication, officially titled Approved Drug Products with Therapeutic Equivalence Evaluations, but known universally as the “Orange Book.” Brand-name companies are required to list the patents that they believe cover their approved drugs in this publication.9

When submitting an ANDA, a generic firm must make a certification for each patent listed in the Orange Book for the reference drug. While several types of certification exist (e.g., the patent has expired or the generic will wait for it to expire), the most strategically significant is the Paragraph IV (PIV) certification.13 A PIV certification is a bold declaration by the generic applicant that, in its opinion, the innovator’s listed patent is “invalid, unenforceable, or will not be infringed by the manufacture, use, or sale of the [generic] drug”.15

This certification is far more than a simple statement; under the Act, the very act of filing a PIV certification is defined as an “artificial act of infringement”.11 This clever legal mechanism grants the brand-name patent holder the right to sue the generic applicant for patent infringement immediately, long before the generic product ever reaches the market. The PIV certification is, in effect, a formal declaration of war—the primary offensive weapon in the generic company’s arsenal and the sole pathway to potentially launching a product before the innovator’s patents expire.

The Ultimate Prize: Unpacking the 180-Day Exclusivity Period

To incentivize generic companies to undertake the expensive and risky process of challenging brand-name patents, Congress embedded a powerful reward within the Hatch-Waxman Act: a 180-day period of marketing exclusivity.7 This coveted prize is granted to the

first generic applicant to file a “substantially complete” ANDA containing a PIV certification.13

During this six-month period, the FDA is prohibited from approving any subsequent ANDAs for the same drug from other generic competitors.16 This effectively creates a temporary duopoly, with only the brand-name drug and the first generic on the market. This exclusivity period is widely regarded as the “most profitable phase of a generic product’s lifecycle”.16 It allows the first generic entrant to capture significant market share at prices that are only moderately discounted from the brand price, often in the range of 15-25% lower.16 These margins are substantially higher than what is possible after the 180 days expire, when the floodgates open to multiple competitors, and intense price competition can drive the cost of the generic down by 80-90% or even more.7

The immense financial value of this exclusivity—often worth hundreds of millions of dollars for a blockbuster drug—creates a frantic, winner-take-all “race to file” among generic competitors. In this high-stakes environment, being the first to submit a valid application by even a single day can be the difference between a massive commercial success and a negligible return on investment. This dynamic forces generic firms to pour immense resources into their legal, regulatory, and R&D departments to ensure they are prepared to file a flawless application at the earliest possible moment.

The 30-Month Stay: A Defensive Moat for Innovators

While the PIV certification and 180-day exclusivity provide a powerful offensive toolkit for generics, the Hatch-Waxman Act also grants a significant defensive tool to innovator companies. Upon receiving a PIV notice letter from a generic applicant, the brand company and patent holder have a 45-day window to file a patent infringement lawsuit.13

If a suit is filed within this timeframe, it automatically triggers a 30-month stay of FDA approval for the generic’s ANDA.9 This provision effectively puts the generic application on hold for up to two and a half years, providing a critical window for the patent dispute to be litigated in court while the brand-name drug’s market exclusivity remains intact.13 This stay is a powerful defensive moat for innovators, guaranteeing a substantial period of protected revenue regardless of the ultimate outcome of the litigation and giving them valuable time to execute lifecycle management strategies. The very structure of the Act, with the PIV certification as the trigger for conflict and the 30-month stay as the immediate defensive response, ensures that for any commercially significant drug, the path to generic competition is almost certain to run directly through the federal court system. This makes legal expertise and a well-funded litigation strategy as essential to a generic company’s success as its manufacturing capabilities.

Case Study 1: The King of All Blockbusters – The Genericization of Atorvastatin (Lipitor)

The Innovator’s Reign: Pfizer’s Lipitor and the Creation of a $150 Billion Franchise

Few drugs in the history of medicine have achieved the commercial scale or cultural resonance of atorvastatin, marketed by Pfizer under the brand name Lipitor. Approved by the FDA in late 1996, Lipitor was a statin indicated for lowering high cholesterol and reducing the risk of cardiovascular events like heart attack and stroke.19 Through a combination of proven efficacy, a massive patient population, and one of the most powerful marketing machines in the industry, Pfizer transformed Lipitor into the best-selling pharmaceutical product of all time.22

The financial statistics are staggering. Over its patent life, Lipitor generated cumulative global sales exceeding $150 billion.24 At its zenith in 2006, the drug brought in peak annual revenues of $12.9 billion.27 Even in 2010, the year before its primary U.S. patent expired, it still accounted for $10.7 billion in sales, representing a full one-sixth of Pfizer’s total revenue.27 The sheer scale of this franchise meant that its loss of exclusivity was not just a challenge for one company, but a seismic event for the entire pharmaceutical industry. The financial stakes for both Pfizer, desperate to manage the decline of its crown jewel, and the generic challengers, eager to claim a piece of the largest prize in pharma history, were unprecedented.

The Challenger Emerges: Ranbaxy’s Strategic First-to-File Challenge

The first company to formally challenge Pfizer’s dominance was Ranbaxy Laboratories, an ambitious and rapidly growing generic manufacturer based in India. In a move that signaled its global aspirations, Ranbaxy was the first to file an ANDA with a Paragraph IV certification against the patents listed for Lipitor in the FDA’s Orange Book.28 This strategic filing positioned Ranbaxy as the sole contender for the immensely valuable 180-day marketing exclusivity period that would follow a successful challenge.

This was a bold and calculated move. It pitted Ranbaxy against the world’s largest pharmaceutical company and its most profitable product, initiating what would become a years-long, multi-front legal war. Pfizer defended its intellectual property vigorously, with patent infringement litigation spanning numerous countries, from the United States to Europe and Australia.25 For Ranbaxy, the potential reward was a market entry worth hundreds of millions of dollars; for Pfizer, the risk was the premature collapse of a multi-billion-dollar revenue stream.

The Art of the Deal: Deconstructing the Pfizer-Ranbaxy Settlement

After years of contentious legal battles, the conflict reached a pivotal turning point in June 2008. Rather than litigating to a final court decision, which would leave both parties exposed to a winner-take-all outcome, Pfizer and Ranbaxy entered into a comprehensive settlement agreement.28 The terms of the deal were complex, but the core provision was a license granting Ranbaxy the right to launch its generic version of Lipitor in the U.S. on a specific, agreed-upon date: November 30, 2011.28

At the time, Ian Read, then President of Worldwide Pharmaceutical Operations for Pfizer, publicly framed the agreement as a “win-win-win because it is pro-patient, pro-competition and pro-intellectual property”.28 He argued that the deal provided certainty for the market and gave patients access to a generic product earlier than if Ranbaxy had lost its patent challenges in court.28

However, the settlement quickly drew intense scrutiny from consumer groups and antitrust regulators. The agreement became the subject of class-action lawsuits alleging that it was an illegal “pay-for-delay” or “reverse payment” scheme, in which the brand-name manufacturer effectively pays the generic challenger to delay its market entry.29 Plaintiffs alleged that Pfizer had engaged in an anticompetitive scheme that included conspiring with Ranbaxy to keep a less-expensive generic off the market.30 Years later, Pfizer would agree to pay tens of millions of dollars to settle these claims without admitting wrongdoing.30

This settlement exemplifies the strategic calculus that often favors negotiation over litigation in high-stakes Hatch-Waxman disputes. For Pfizer, the deal eliminated the catastrophic risk of a court invalidating its patents years ahead of schedule, providing a firm date for the loss of exclusivity that allowed the company to manage investor expectations and meticulously plan its commercial defense. For Ranbaxy, it converted a risky legal challenge into a guaranteed, multi-hundred-million-dollar commercial opportunity, removing the possibility of losing in court and walking away with nothing. The primary strategic objective for both sides shifted from total victory to the acquisition of certainty.

Launch and Market Capture: Capitalizing on 180-Day Exclusivity

On December 1, 2011, Ranbaxy announced it had received final FDA approval and launched its generic atorvastatin in the U.S. market.34 Arun Sawhney, Ranbaxy’s CEO and Managing Director, stated, “We are pleased to have received FDA approval to manufacture and market a safe, effective, affordable and accessible alternative to branded Lipitor”.34 The launch was a massive commercial undertaking, coordinated with similar rollouts in several European countries and Australia, demonstrating Ranbaxy’s emergence as a global player.35

During its 180-day exclusivity period in the U.S., Ranbaxy’s launch was a resounding success. The company captured over 50% of the total atorvastatin market and generated an estimated $600 million in revenue.27 The launch was a textbook example of how to monetize a first-to-file opportunity. However, the victory was later marred by significant manufacturing and quality control issues. In November 2012, Ranbaxy was forced to recall numerous lots of its atorvastatin after discovering contamination with tiny glass particles, and it temporarily halted all production.37 This stumble allowed competitors to gain ground, and Ranbaxy’s dominant market share eroded significantly, falling from over 42% to less than 8% in the wake of the recall.37

Post-Exclusivity Shockwaves: Pfizer’s Counter-Offensive and the Realities of Price Erosion

Pfizer did not cede the market passively. Recognizing that the legal battle was over, the company shifted the conflict to the commercial front, deploying a sophisticated and aggressive strategy to manage the decline of its flagship brand. The company launched a direct-to-consumer advertising campaign with the memorable tagline, “Only Lipitor is Lipitor,” aiming to instill brand loyalty and create doubt about generic substitution.38

More substantively, Pfizer engaged directly with the gatekeepers of the U.S. drug distribution system. It offered substantial discounts and co-pay cards to patients to minimize their out-of-pocket costs.39 Crucially, it struck deals with powerful pharmacy benefit managers (PBMs) and insurance companies to keep branded Lipitor on their formularies, often with a patient co-pay equivalent to that of the generic.40 This tactic was designed to neutralize the primary economic incentive for pharmacies and payers to switch to the generic. By making the net cost to the payer and the out-of-pocket cost to the patient comparable, Pfizer attacked the generic’s core value proposition and successfully retained a significant portion of its market share—approximately 30% at the end of the 180-day period—far exceeding initial expectations.27

Despite these innovative defensive measures, the long-term economic reality of genericization was unavoidable. Once Ranbaxy’s exclusivity period ended and multiple generic manufacturers entered the market, price erosion was swift and severe. Studies consistently show that prices for oral generics fall dramatically with increased competition, often dropping by 70-80% within the first two years and by more than 95% once six or more competitors are present.8 The introduction of generic statins as a class, spearheaded by the Lipitor event, has been credited with saving the U.S. healthcare system an estimated $11.9 billion annually.44 Pfizer’s strategy demonstrated that while a brand cannot stop the tide of generic competition, it can build commercial levees to slow the flood and manage the erosion of its revenue base.

Case Study 2: The High-Stakes Gamble – The “At-Risk” Launch of Generic Clopidogrel (Plavix)

The Innovator’s Fortress: Plavix and its Dominance in Cardiovascular Care

In the landscape of blockbuster drugs, clopidogrel—marketed as Plavix by Bristol-Myers Squibb (BMS) and Sanofi-Aventis—stood as a titan of cardiovascular medicine. As a potent antiplatelet agent, it was a cornerstone therapy for preventing blood clots in patients who had suffered a heart attack or stroke, or who had peripheral artery disease.46 Its clinical importance translated into massive commercial success. At its peak, Plavix generated global annual sales approaching $10 billion and amassed over $83 billion in lifetime revenue, making it one of the best-selling drugs in the world behind Lipitor.23

This commercial success was protected by a formidable patent fortress, fiercely defended by two of the industry’s largest players. The loss of Plavix’s market exclusivity represented a monumental financial threat to both companies, setting the stage for one of the most dramatic and high-stakes confrontations in the history of generic pharmaceuticals.

The Audacious Challenger: Apotex’s Aggressive Patent Invalidation Strategy

The primary challenger to the Plavix empire was Apotex, a privately held Canadian generic manufacturer known for its aggressive legal strategies. In November 2001, Apotex became the first company to file an ANDA with a Paragraph IV certification for clopidogrel.51 However, its strategy was not merely to argue that its product did not infringe the Plavix patents; it was a direct assault on the validity of the core intellectual property itself. Apotex contended that the key composition of matter patent (U.S. Patent No. 4,847,265) was invalid because it was “anticipated” by a prior, expired patent that disclosed a broader class of compounds, and was “obvious” to a person skilled in the art.52

This legal argument kicked off nearly a decade of litigation that would span multiple courtrooms and jurisdictions, including the Supreme Court of Canada.53 Apotex’s approach was audacious, aiming not just to carve out a space for its generic but to demolish the very foundation of the brand’s exclusivity.

The “At-Risk” Decision: Launching a Generic with Litigation Still Pending

The Plavix saga took its most dramatic turn in 2006. The parties had negotiated a settlement agreement in which Apotex would delay its launch in exchange for a payment from BMS and Sanofi.52 However, the deal collapsed under the weight of intense scrutiny from the Federal Trade Commission and state attorneys general, who viewed it as a potentially illegal pay-for-delay arrangement.52

Faced with the prospect of years more of litigation and no settlement in hand, Apotex made a momentous and risky decision. On August 8, 2006, having received final FDA approval for its ANDA, the company launched its generic clopidogrel into the U.S. market “at risk”.51 An “at-risk” launch is one of the most aggressive and financially perilous maneuvers in the generic drug playbook. It involves proceeding with commercial sales before patent litigation has been finally resolved in the generic company’s favor.56 If the courts ultimately uphold the brand’s patents, the generic company can be liable for massive damages, typically based on the brand’s lost profits, which can easily run into the hundreds of millions or even billions of dollars. Apotex was making a colossal bet on the strength of its legal arguments, wagering the financial health of the company on a favorable outcome in court.

This decision was not made in a vacuum. The collapse of the negotiated settlement, driven by regulatory antitrust concerns, inadvertently funneled Apotex toward a much higher-risk, higher-impact strategy. By preventing a controlled, albeit potentially anti-consumer, resolution, regulators pushed the conflict into a more chaotic and disruptive phase.

Market Mayhem and Financial Fallout: The Immediate Impact and the $442 Million Price Tag

The market impact of Apotex’s at-risk launch was immediate and profound. Apotex moved to “flood the market” with its lower-cost generic, shipping an estimated $500 million worth of product and reportedly taking orders for over a billion dollars more within weeks.57 The move inflicted what BMS and Sanofi described in court filings as “irreparable injury,” wiping a reported $10 billion from their combined market capitalization as investors panicked.57 The loss of Plavix sales was a primary driver of BMS swinging from a net profit of $499 million in Q4 2005 to a net loss of $134 million in Q4 2006.58

BMS and Sanofi immediately sought and were granted a preliminary injunction. Just 23 days after it began, Apotex’s at-risk launch was halted by court order on August 31, 2006.51 But the damage was done. The distribution channels were saturated with generic clopidogrel, and the pricing landscape for the drug had been permanently altered.

Ultimately, Apotex’s gamble failed. In 2007, a U.S. district court upheld the validity of the Plavix patent, a decision that was later affirmed on appeal.59 The consequences for Apotex were severe. In February 2012, the company paid a staggering

$442.2 million in damages to BMS and Sanofi to compensate them for the harm caused by the three-week at-risk launch.60 The penalty was enormous, yet it was calculated as roughly half of the more than $884 million in sales that Apotex had generated during its brief, chaotic period on the market.60 This stark arithmetic reveals the incredible financial incentives that can drive a company to take such a monumental risk.

The Long-Term View: How the At-Risk Launch Reshaped Market Perceptions

The Plavix case became the definitive cautionary tale about the perils of an at-risk launch. The $442 million penalty served as a stark reminder of the potential for catastrophic financial losses. However, the event also provided a powerful real-world lesson in strategic game theory. Economic analyses suggest that at-risk launches, while dangerous, can be a rational business decision under specific circumstances: namely, when the potential profits from capturing even a small slice of a multi-billion-dollar market are so vast that they outweigh the risk-adjusted potential damages, and when the generic company has a high degree of confidence in its legal position.56

Moreover, the at-risk launch can be viewed as a weapon of market disruption. Even in failure, Apotex’s 23-day launch created chaos for the brand incumbents, forcing them to offer immediate price concessions and creating massive uncertainty for their investors.52 It demonstrated that a well-timed at-risk launch, even if ultimately unsuccessful, could be used as a powerful lever to inflict financial pain on an innovator and potentially force a more favorable settlement in future disputes. The Plavix saga fundamentally reshaped how both brand and generic companies calculate risk and reward in the high-stakes arena of patent litigation.

Case Study 3: The Specialty Pharma Frontier – The Complex Launch of Generic Imatinib (Gleevec)

The Innovator’s Breakthrough: Gleevec and the Dawn of Targeted Cancer Therapy

The story of imatinib, marketed by Novartis as Gleevec, is different from that of mass-market blockbusters like Lipitor and Plavix. Gleevec was not just a successful drug; it was a scientific revolution. Approved by the FDA in 2001, it was one of the very first targeted cancer therapies, a tyrosine kinase inhibitor specifically designed to shut down the abnormal protein that drives chronic myeloid leukemia (CML).62 The drug’s impact was transformative, converting CML from a rapidly fatal cancer into a chronic, manageable condition and increasing the five-year survival rate from 31% in 1993 to over 90% by 2023.62

This breakthrough clinical value was matched by its commercial success. Gleevec became a multi-billion-dollar franchise for Novartis, with peak annual sales exceeding $4.6 billion.64 Its high price—which Novartis steadily increased over the drug’s patent life from under $25,000 per year in 2003 to over $123,000 by 2016—and its life-saving role in treating a rare cancer made its eventual genericization a highly charged and globally scrutinized event, sitting at the intersection of innovation, intellectual property, and patient access.67

The Global Patent Battle: Novartis vs. Sun Pharma and the Landmark Indian Supreme Court Ruling

The legal fight over Gleevec’s patents was a global affair, with the most significant battle taking place not in the United States, but in India. In a landmark 2013 decision, the Supreme Court of India rejected a patent application from Novartis for the beta crystalline form of imatinib mesylate—the specific form used in Gleevec.68 The court ruled that this new form of the drug did not demonstrate significantly enhanced efficacy over the previously known freebase form of imatinib and therefore did not meet the higher standard for patentability required under Section 3(d) of India’s patent law.68

The ruling was a watershed moment for global intellectual property law and access to medicines. While it had no direct legal bearing on Novartis’s patents in the U.S., it was a major symbolic victory for generic manufacturers and public health advocates. It put Novartis on the defensive in the court of public opinion and highlighted the growing willingness of patent offices outside of traditional Western markets to apply stricter standards of patentability, particularly for secondary patents on existing molecules.

In the United States, the path to generic competition was ultimately resolved through negotiation. After litigation, Novartis entered into a settlement agreement with Sun Pharmaceutical Industries, the first-to-file PIV challenger. The deal permitted Sun Pharma to launch its generic version of Gleevec in the U.S. on February 1, 2016, approximately seven months after the expiration of Novartis’s basic compound patent.69 In a statement, Novartis noted that the “settlement validates the Novartis patents while allowing Sun Pharma’s subsidiary to enter the market with its generic product”.69

A Different Kind of Launch: Pricing Strategy and Market Dynamics for a High-Cost Specialty Generic

The launch of generic imatinib by Sun Pharma defied the conventional generic playbook. Unlike the deep, immediate price cuts typical for high-volume primary care drugs, Sun Pharma entered the market with a price that was only marginally lower than the brand-name Gleevec. One analysis from the period noted that the annual price for the generic was approximately $140,000, compared to about $146,000 for the brand.74 Internal Novartis documents revealed that company executives saw this high launch price as “good news”.67

This strategy was possible for several reasons unique to the specialty pharmaceutical market. First, Sun Pharma enjoyed the 180-day exclusivity period, which limited immediate competition.70 Second, the market for a specialty oncology drug is inherently smaller and less price-elastic than the market for a cholesterol drug. The number of potential generic competitors is lower due to more complex manufacturing requirements, and physicians and patients may exhibit greater loyalty or caution when switching from a trusted brand for a life-threatening disease. Sun Pharma’s strategy correctly identified that in this context, the optimal approach was to maximize revenue and margin during the exclusivity period, rather than to rapidly drive volume through aggressive price reductions. This case demonstrates that the generic launch playbook must be adapted to the specific dynamics of the therapeutic area.

The Slower Burn: Analyzing the Unique Price Erosion Curve for Generic Gleevec

The price of generic imatinib did eventually decline significantly, but the erosion curve was far less steep than for mass-market generics. While the wholesale acquisition cost of the generic fell by as much as 89% within two and a half years of its launch, these savings were slow to trickle through the complex U.S. healthcare system.76 One study found that it took two full years for payers to realize substantial savings from the generic’s availability.77 Another analysis highlighted that even two years post-launch, many state Medicaid programs were paying prices for the generic that were significantly higher than its actual acquisition cost, indicating inefficiencies and potential profit-taking within the distribution and reimbursement chain.76

The “slower burn” of Gleevec’s price erosion can be attributed to several factors. The smaller number of competitors in the specialty space creates a less intensely competitive pricing environment. Furthermore, the complex web of rebates and negotiations between manufacturers, wholesalers, PBMs, and payers can create a system where reductions in the manufacturer’s price are not fully or immediately passed on to the final payer or the patient.

“Bioequivalence does not necessarily mean therapeutic equivalence. To be therapeutically equivalent, a drug should have the same clinical effect and safety profile. These are not demonstrated in a bioequivalence test.” 75

This distinction, while technical, can contribute to physician and patient hesitancy in switching from a trusted brand to a new generic, particularly in a high-stakes field like oncology. This can slow the rate of generic uptake and allow the brand to retain market share for longer, further blunting the immediate financial impact of generic entry.

Patient Access vs. Profitability: The Enduring Debate Sparked by Generic Imatinib

The Gleevec story is inextricably linked to the broader, often contentious debate over drug pricing in the United States. Novartis’s strategy of implementing dozens of price increases throughout Gleevec’s patent life, even as it faced the loss of exclusivity, drew sharp criticism and became the subject of a congressional investigation.67 The arrival of a generic was widely anticipated as a landmark moment for patient affordability.

However, the reality of the generic launch—with its initially high price and slow decline—tempered this optimism. It highlighted the systemic challenges within the U.S. market that can prevent the full benefits of generic competition from being realized immediately. The Gleevec case serves as a microcosm of the entire drug pricing debate, touching upon controversial practices like “patent thickets” to extend exclusivity, “pay-for-delay” settlements to manage generic entry, and a convoluted reimbursement system that can obscure the true cost of medicines. It underscores the ongoing tension between rewarding breakthrough innovation and ensuring that life-saving medicines are accessible and affordable for the patients who need them.

The Modern Generic Playbook: Synthesizing a Winning Strategy

From Defense to Offense: The Centrality of Proactive Patent Intelligence

The case studies of Lipitor, Plavix, and Gleevec reveal a clear and undeniable truth about the modern generic pharmaceutical industry: success is no longer a matter of passive reaction but of proactive, offensive strategy. The outdated model of simply waiting for a patent to expire and then entering a commoditized market is a recipe for failure. The most successful generic companies operate as sophisticated intelligence-gathering and strategic planning organizations, often making their most critical moves years before a planned launch.

This offensive posture is built on a foundation of deep patent and competitive intelligence. It involves meticulously mapping the entire patent landscape of a target drug, including the “patent thickets” of secondary patents on formulations, methods of use, and manufacturing processes that brands erect to extend their product lifecycles.78 Winning requires identifying the weakest links in this patent armor and developing a legal strategy to challenge them through Paragraph IV certifications. The decision-making process is fundamentally a data-driven, probabilistic exercise, weighing the strength of a legal challenge against the cost of litigation and the immense potential reward of a 180-day exclusivity period. The competitive advantage in the generic sector has decisively shifted from manufacturing scale alone to informational and analytical superiority.

Leveraging Modern Tools: How Services like DrugPatentWatch Inform Strategy

Executing this intelligence-driven strategy requires specialized tools that go far beyond public patent databases. This is where integrated pharmaceutical intelligence platforms like DrugPatentWatch become indispensable. These services are not merely data repositories; they are strategic dashboards that provide a multi-dimensional view of the competitive landscape.78

Specialized platforms like DrugPatentWatch give generic firms a crucial edge by connecting disparate data sets into a single, actionable framework. They integrate:

- Comprehensive Patent Data: Tracking not just expiration dates but the entire lifecycle of patents, including litigation and challenges.

- FDA Regulatory Data: Linking patents directly to drugs through Orange Book listings, and providing critical information on regulatory exclusivities (like pediatric or orphan drug exclusivity) that can affect launch timing.78

- Litigation Records: Monitoring Paragraph IV challenges, Inter Partes Review (IPR) proceedings at the Patent Trial and Appeal Board (PTAB), and district court lawsuits in near real-time, allowing companies to track their competitors’ moves and assess the strength of a brand’s patent defenses.78

By leveraging such platforms, generic companies can proactively monitor the pipeline, identify the most promising and vulnerable targets for a Paragraph IV challenge, and make data-driven decisions about where to invest their significant R&D and legal resources.79 This allows them to move from a defensive posture to an offensive one, shaping the market rather than simply reacting to it.

Building the Optimal Launch Sequence: Timing, Litigation, and Supply Chain

Synthesizing the lessons from the landmark case studies provides a clear framework for an optimal launch sequence. The process begins years in advance with target selection based on commercial potential and patent vulnerability. The next critical step is the race to be the first to file a “substantially complete” ANDA with a Paragraph IV certification to secure the 180-day exclusivity. This requires flawless execution in both product development and regulatory affairs.

Once the PIV notice letter is sent and the inevitable lawsuit is filed by the brand, triggering the 30-month stay, the generic company faces a crucial strategic decision: litigate to the end or seek a settlement. The Lipitor case shows that a settlement can provide valuable certainty, while the Plavix case demonstrates the immense risk of proceeding without a clear legal victory. The most extreme option, the at-risk launch, remains a tool for the most audacious and well-capitalized players who possess an exceptionally high degree of confidence in their legal case. Throughout this legal process, the company must also be preparing its supply chain and commercial infrastructure to be ready to launch at a moment’s notice, as a favorable court ruling or settlement can open the market window with very little lead time.

Table 3: Comparative Analysis of Landmark Generic Launches

| Metric | Atorvastatin (Lipitor) | Clopidogrel (Plavix) | Imatinib (Gleevec) |

| Peak Brand Sales (Annual) | ~$12.9 Billion 27 | ~$9.8 Billion 49 | ~$4.7 Billion 64 |

| Primary Generic Challenger | Ranbaxy Laboratories | Apotex Inc. | Sun Pharmaceutical |

| Core Generic Strategy | Negotiated Settlement | At-Risk Launch | Specialty Market Entry & Settlement |

| 180-Day Exclusivity Outcome | Secured via settlement; generated ~$600M for Ranbaxy 27 | Triggered by at-risk launch; generated >$880M in sales in 23 days 60 | Secured via settlement; high-margin launch with minimal initial discount 74 |

| Key Consequence | Provided market certainty but led to antitrust litigation 30 | Failed legal gamble resulted in a $442M damages payment 60 | Established a different pricing model for specialty generics 76 |

| Price Erosion (at ~2 years) | >70% 43 | >70% 43 | Slower initial erosion, but eventually >80% 76 |

Beyond Day 181: Competing in a Crowded, Commoditized Market

The end of the 180-day exclusivity period marks a dramatic shift in the competitive landscape. The market transforms from a lucrative duopoly into a crowded, highly commoditized space. As multiple generic competitors enter, prices plummet, and margins evaporate.7 Success in this phase is no longer dictated by legal strategy but by operational excellence. The companies that thrive are those with the most efficient manufacturing processes, the most robust and reliable supply chains, and the strongest relationships with large-scale purchasers like wholesalers, retail pharmacy chains, and group purchasing organizations (GPOs). In this environment, cost of goods and reliability of supply become the primary drivers of success.

Conclusion: The Future of Generic Competition

The generic pharmaceutical industry stands as a testament to the power of strategic execution at the intersection of law, science, and commerce. The landmark cases of Lipitor, Plavix, and Gleevec offer more than just historical anecdotes; they provide a durable blueprint of the core strategic archetypes—negotiation, aggression, and specialization—that continue to define success in the sector. The lessons are clear: victory belongs to those who are proactive, deeply informed by integrated market and patent intelligence, and capable of executing complex legal and commercial strategies with precision.

Looking forward, the landscape is poised to become even more complex. The next great patent cliff will involve not just small-molecule drugs, but a wave of blockbuster biologics. The rise of biosimilars, governed by the similar but distinct framework of the Biologics Price Competition and Innovation Act (BPCIA), will present a new frontier of scientific and legal challenges. The genericization of increasingly complex specialty drugs and sterile injectables will demand even greater manufacturing sophistication and more nuanced commercial models.

Despite these evolving challenges, the fundamental principles illuminated by these case studies will endure. The imperative to challenge patents, the immense value of being first to market, and the brutal reality of price competition will remain the central forces shaping the industry. As the financial stakes continue to climb, with hundreds of billions of dollars in brand revenue set to go off-patent, the demand for sophisticated, data-driven, and strategically audacious generic competition will only intensify. The companies that have mastered the lessons of the past will be the ones to capture the opportunities of the future, continuing the vital work of driving affordability and access to medicine for patients around the world.

Key Takeaways

- A Market of Immense Scale and Impact: The global generic drug market is a dynamic, rapidly growing sector projected to exceed $700 billion by the early 2030s, fueled by an impending patent cliff of over $200 billion in branded drugs. This industry is a critical engine of healthcare savings, reducing U.S. drug costs by over $400 billion annually.

- Hatch-Waxman is the Strategic Rulebook: The Hatch-Waxman Act is not merely a regulatory framework but the essential playbook for generic competition in the U.S. Mastering its offensive mechanisms, like the Paragraph IV certification, and understanding its defensive tools, like the 30-month stay, is non-negotiable for success.

- The 180-Day Exclusivity is the Ultimate Prize: Securing the 180-day marketing exclusivity period as the “first-to-file” generic challenger is the single most critical objective. This temporary duopoly is where the vast majority of a generic product’s profit is generated before the market becomes hyper-competitive and commoditized.

- The Lipitor Case: The Power of the Negotiated Settlement: The genericization of Lipitor demonstrates how a settlement can be a strategic victory for both brand and generic players by creating market certainty. It also highlights the critical importance of a brand’s post-launch commercial defense strategy to manage the slope of revenue decline.

- The Plavix Case: The Peril and Potential of the “At-Risk” Launch: The story of generic Plavix serves as the ultimate cautionary tale of a high-risk, high-reward “at-risk” launch. While it resulted in a massive financial penalty, it also showed how this aggressive maneuver can be used as a powerful tool of market disruption.

- The Gleevec Case: Adapting the Playbook for Specialty Pharma: The Gleevec case illustrates that the generic playbook must be adapted for high-cost specialty drugs. The market dynamics, pricing strategies, and price erosion curves for these products are fundamentally different from those of high-volume primary care medications.

- Modern Success is Driven by Proactive Intelligence: The most successful generic companies operate on an offensive, not defensive, footing. This requires a deep investment in proactive patent and competitive intelligence, leveraging sophisticated tools like DrugPatentWatch to identify opportunities and plan legal challenges years in advance.

Frequently Asked Questions (FAQ)

Q1: What is the single most important factor for a successful generic drug launch?

A1: While multiple factors are critical, securing the 180-day marketing exclusivity as the “first-to-file” Paragraph IV challenger is paramount. This period of limited competition is where the vast majority of profit is made before the market becomes commoditized and prices fall dramatically. All successful strategies are ultimately aimed at capturing this prize.

Q2: How has the Hatch-Waxman Act shaped the generic industry?

A2: The Act fundamentally created the modern industry by establishing the ANDA pathway, which streamlined approvals by allowing generics to rely on the brand’s safety and efficacy data. More importantly, it created a structured legal system for patent challenges (the Paragraph IV certification) and a powerful incentive to undertake those challenges (the 180-day exclusivity), transforming the industry from a passive manufacturing business into a proactive legal and strategic one.

Q3: Is an “at-risk” launch ever a good idea?

A3: It is an extremely high-risk strategy, as evidenced by Apotex’s $442 million penalty in the Plavix case. However, from a purely financial perspective, it can be a rational business decision if the potential profits from capturing a multi-billion-dollar market—even for a few weeks—outweigh the potential damages, and if the company has an exceptionally high degree of confidence in its legal position that the brand’s patents are invalid or not infringed.

Q4: Why do generic versions of some drugs, like cancer therapies, seem to stay expensive for longer?

A4: Specialty drugs, such as the cancer therapy Gleevec, often have fewer potential generic competitors due to more complex manufacturing processes, smaller patient populations, and potentially more intricate supply chains. This leads to a less intensely competitive market, especially during the initial 180-day exclusivity period, allowing the first generic manufacturer to launch and maintain a higher price point for a longer period compared to high-volume drugs used in primary care.

Q5: How do companies like DrugPatentWatch help generic manufacturers?

A5: They provide critical competitive intelligence by integrating patent data, regulatory filings (like FDA Orange Book listings and exclusivity data), and litigation records into a single, specialized platform. This allows generic companies to move beyond basic patent searching and proactively monitor the entire competitive landscape, identify the best opportunities for a Paragraph IV challenge, track competitors’ actions, and make more informed strategic decisions years in advance of a potential launch.

References

- The Global Generic Drug Market: Trends, Opportunities, and …, accessed August 15, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Generic Drugs Market Size to Hit USD 728.64 Billion by 2034 – Precedence Research, accessed August 15, 2025, https://www.precedenceresearch.com/generic-drugs-market

- Global Generic Drug Market Size, Share 2025 – 2034, accessed August 15, 2025, https://www.custommarketinsights.com/report/generic-drug-market/

- Generic Pharmaceuticals Market Size & Share Report, 2030, accessed August 15, 2025, https://www.grandviewresearch.com/industry-analysis/generic-pharmaceuticals-market-report

- Generic Drug Market – Industry Analysis and Forecast (2025-2032), accessed August 15, 2025, https://www.stellarmr.com/report/Generic-Drug-Market/1638

- Report: 2023 U.S. Generic and Biosimilar Medicines Savings Report, accessed August 15, 2025, https://accessiblemeds.org/resources/reports/2023-savings-report-2/

- The Hatch-Waxman 180-Day Exclusivity Incentive Accelerates Patient Access to First Generics, accessed August 15, 2025, https://accessiblemeds.org/resources/fact-sheets/the-hatch-waxman-180-day-exclusivity-incentive-accelerates-patient-access-to-first-generics/

- New Evidence Linking Greater Generic Competition and Lower Generic Drug Prices – FDA, accessed August 15, 2025, https://www.fda.gov/media/133509/download

- The Hatch-Waxman Act: A Primer – Congress.gov, accessed August 15, 2025, https://www.congress.gov/crs_external_products/R/PDF/R44643/R44643.3.pdf

- What is Hatch-Waxman? – PhRMA, accessed August 15, 2025, https://phrma.org/resources/what-is-hatch-waxman

- Drug Price Competition and Patent Term Restoration Act – Wikipedia, accessed August 15, 2025, https://en.wikipedia.org/wiki/Drug_Price_Competition_and_Patent_Term_Restoration_Act

- Hatch-Waxman 101 – Fish & Richardson, accessed August 15, 2025, https://www.fr.com/insights/thought-leadership/blogs/hatch-waxman-101-3/

- Hatch-Waxman Litigation 101: The Orange Book and the Paragraph IV Notice Letter, accessed August 15, 2025, https://www.dlapiper.com/en/insights/publications/2020/06/ipt-news-q2-2020/hatch-waxman-litigation-101

- Timeline: Generic medicines in the US | USP, accessed August 15, 2025, https://www.usp.org/our-impact/generics/timeline-of-generics-in-us

- Small Business Assistance | 180-Day Generic Drug Exclusivity – FDA, accessed August 15, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-180-day-generic-drug-exclusivity

- What Every Pharma Executive Needs to Know About Paragraph IV …, accessed August 15, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- “The Law of 180-Day Exclusivity” by Erika Lietzan and Julia Post, accessed August 15, 2025, https://scholarship.law.missouri.edu/facpubs/644/

- Hatch-Waxman Act | Practical Law, accessed August 15, 2025, https://uk.practicallaw.thomsonreuters.com/9-543-2565?transitionType=Default&contextData=(sc.Default)

- Atorvastatin – Wikipedia, accessed August 15, 2025, https://en.wikipedia.org/wiki/Atorvastatin

- Atorvastatin: Uses, Interactions, Mechanism of Action | DrugBank Online, accessed August 15, 2025, https://go.drugbank.com/drugs/DB01076

- Lipitor (atorvastatin calcium) Label – accessdata.fda.gov, accessed August 15, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/label/2019/020702s073lbl.pdf

- From old behemoth Lipitor to new king Humira: Best-selling U.S. drugs over 25 years, accessed August 15, 2025, https://www.fiercepharma.com/pharma/from-old-behemoth-lipitor-to-new-king-humira-u-s-best-selling-drugs-over-25-years

- World’s 10 bestselling prescription drugs made $75bn last year | Pharmaceuticals industry, accessed August 15, 2025, https://www.theguardian.com/business/2014/mar/27/bestselling-prescription-drugs

- The 15 All-Time Best-Selling Prescription Drugs – Kiplinger, accessed August 15, 2025, https://www.kiplinger.com/slideshow/investing/t027-s001-the-15-all-time-best-selling-prescription-drugs/index.html

- When does the patent for Atorvastatin expire? – Patsnap Synapse, accessed August 15, 2025, https://synapse.patsnap.com/article/when-does-the-patent-for-atorvastatin-expire

- Drug Sales Trends for LIPITOR – DrugPatentWatch, accessed August 15, 2025, https://www.drugpatentwatch.com/p/drug-sales/drugname/LIPITOR

- Pfizer’s 180-Day War for Lipitor – PM360, accessed August 15, 2025, https://www.pm360online.com/pfizers-180-day-war-for-lipitor/

- Pfizer and Ranbaxy Settle Lipitor Patent Litigation Worldwide, accessed August 15, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_and_ranbaxy_settle_lipitor_patent_litigation_worldwide

- Frequently Asked Questions – Lipitor Antitrust Litigation, accessed August 15, 2025, https://lipitorantitrustsettlement.com/Home/FAQ

- In re Lipitor Antitrust Litigation – Cohen Milstein, accessed August 15, 2025, https://www.cohenmilstein.com/case-study/re-lipitor-antitrust-litigation/

- Case 3:12-cv-02389-PGS-DEA Document 472 Filed 10/14/13 Page 1 of 86 PageID: 9082 – Garwin Gerstein & Fisher LLP, accessed August 15, 2025, https://garwingerstein.com/wp-content/uploads/2024/02/10-14-2013-Redacted-DPP-Complaint-1.pdf

- If you purchased brand or generic Lipitor® (atorvastatin calcium) directly from Pfizer Inc., Pfizer Manufacturing Ireland, War, accessed August 15, 2025, https://llz8rh0l.cdn.imgeng.in/wp-content/uploads/Lipitor-Notice.pdf

- West Virginia AG Reaches $17M Settlement With Pfizer and Ranbaxy Over Antitrust and Consumer Protection Violation Claims | Regulatory Oversight, accessed August 15, 2025, https://www.regulatoryoversight.com/2025/01/west-virginia-ag-reaches-17m-settlement-with-pfizer-and-ranbaxy-over-antitrust-and-consumer-protection-violation-claims/

- RANBAXY ANNOUNCES LAUNCH OF ATORVASTATIN, GENERIC LIPITOR(R), IN THE U.S. – Press Releases – Media – Daiichi Sankyo, accessed August 15, 2025, https://www.daiichisankyo.com/media/press_release/detail/index_3727.html

- Ranbaxy launches generic Lipitor in Europe – Pharmafile, accessed August 15, 2025, https://pharmafile.com/news/ranbaxy-launches-generic-lipitor-europe/

- RANBAXY BECOMES THE FIRST COMPANY TO LAUNCH GENERIC ATORVASTATIN IN ITALY, NETHERLANDS & SWEDEN | Fierce Pharma, accessed August 15, 2025, https://www.fiercepharma.com/pharma/ranbaxy-becomes-first-company-to-launch-generic-atorvastatin-italy-netherlands-sweden

- Ranbaxy loses market share in the wake of generic atorvastatin withdrawal, accessed August 15, 2025, https://www.manufacturingchemist.com/ranbaxy-loses-market-share-in-the-wake-of-generic-atorvastatin-withdrawal-83617

- “For Me There Is No Substitute”: Authenticity, Uniqueness, and the Lessons of Lipitor, accessed August 15, 2025, https://journalofethics.ama-assn.org/article/me-there-no-substitute-authenticity-uniqueness-and-lessons-lipitor/2010-10

- Ranbaxy Makes Three: The Battle for Generic Lipitor Profits – Drug Channels, accessed August 15, 2025, https://www.drugchannels.net/2011/12/ranbaxy-makes-three-battle-for-generic.html

- Pfizer’s Lipitor: A New Model for Delaying the Effects of Patent Expiration, accessed August 15, 2025, https://www.patentdocs.org/2011/12/pfizers-lipitor-a-new-model-for-delaying-the-effects-of-patent-expiration.html

- Generic Atorvastatin and Health Care Costs – PMC, accessed August 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3319770/

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – ASPE.hhs.gov, accessed August 15, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Price Declines after Branded Medicines Lose Exclusivity in the US – IQVIA, accessed August 15, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/price-declines-after-branded-medicines-lose-exclusivity-in-the-us.pdf

- Ending Market Exclusivity for Statins Saves U.S. $12 Billion and Individuals Nearly $1000 Annually, accessed August 15, 2025, https://www.gmu.edu/news/2021-11/ending-market-exclusivity-statins-saves-us-12-billion-and-individuals-nearly-1000

- Trends in Use and Expenditures for Brand-name Statins After Introduction of Generic Statins in the US, 2002-2018 – PMC, accessed August 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8609409/

- Clopidogrel – Wikipedia, accessed August 15, 2025, https://en.wikipedia.org/wiki/Clopidogrel

- PLAVIX clopidogrel bisulfate tablets – accessdata.fda.gov, accessed August 15, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/label/2009/020839s044lbl.pdf

- Clopidogrel Market Size, Share, Scope, Trends, Growth & Forecast, accessed August 15, 2025, https://www.verifiedmarketresearch.com/product/clopidogrel-market/

- Drug Sales Trends for PLAVIX – DrugPatentWatch, accessed August 15, 2025, https://www.drugpatentwatch.com/p/drug-sales/drugname/PLAVIX

- Clinical Outcomes of Plavix and Generic Clopidogrel for Patients Hospitalized With an Acute Coronary Syndrome | Circulation – American Heart Association Journals, accessed August 15, 2025, https://www.ahajournals.org/doi/10.1161/circoutcomes.117.004194

- Apotex Sues FDA to Recover 180-Day Exclusivity on Generic Plavix – Orange Book Blog, accessed August 15, 2025, https://www.orangebookblog.com/2008/04/apotes-sues-fda.html

- Plavix fzzranchise in jeopardy – PMC, accessed August 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7096798/

- Apotex Inc. v. Sanofi-Synthelabo Canada Inc. – SCC Cases, accessed August 15, 2025, https://decisions.scc-csc.ca/scc-csc/scc-csc/en/item/2575/index.do

- 35562 – Supreme Court of Canada, accessed August 15, 2025, https://www.scc-csc.ca/cases-dossiers/search-recherche/35562/

- Being Old and Obvious: Apotex v. Sanofi SCC – Osgoode Digital Commons, accessed August 15, 2025, https://digitalcommons.osgoode.yorku.ca/cgi/viewcontent.cgi?article=1016&context=ohrlp

- NBER WORKING PAPER SERIES NO FREE LAUNCH: AT-RISK ENTRY BY GENERIC DRUG FIRMS Keith M. Drake Robert He Thomas McGuire Alice K. N, accessed August 15, 2025, https://www.nber.org/system/files/working_papers/w29131/w29131.pdf

- BMS and Sanofi-Aventis Start Battle to Block Generic Plavix – S&P Global, accessed August 15, 2025, https://www.spglobal.com/marketintelligence/en/mi/country-industry-forecasting.html?id=106599028

- BMS Swings to a US$134 mil. loss in Q4 2006 on Generic Challenges, Charges, accessed August 15, 2025, https://www.spglobal.com/marketintelligence/en/mi/country-industry-forecasting.html?id=106598464

- Sanofi, BMS collect their $444M in Plavix damages – Fierce Pharma, accessed August 15, 2025, https://www.fiercepharma.com/sales-and-marketing/sanofi-bms-collect-their-444m-plavix-damages

- Apotex clopidogrel at-risk launch costs US$442 million – Generics and Biosimilars Initiative, accessed August 15, 2025, https://www.gabionline.net/generics/news/Apotex-clopidogrel-at-risk-launch-costs-US-442-million

- Sanofi and Bristol-Myers Squibb Collect Damages in Plavix Patent Litigation with Apotex, accessed August 15, 2025, https://news.bms.com/news/details/2012/Sanofi-and-Bristol-Myers-Squibb-Collect-Damages-in-Plavix-Patent-Litigation-with-Apotex/default.aspx

- Imatinib – Wikipedia, accessed August 15, 2025, https://en.wikipedia.org/wiki/Imatinib

- Imatinib mesylate – Drug Targets, Indications, Patents – Patsnap Synapse, accessed August 15, 2025, https://synapse.patsnap.com/drug/501970a66fcf449aaa8bcaa03f60d6ff

- Generic imatinib — impact on frontline and salvage therapy for CML – PMC, accessed August 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5450934/

- The Post-Gleevec Era – Drug Hunter, accessed August 15, 2025, https://drughunter.com/articles/the-post-gleevec-era

- The world’s most sold cancer drugs in 2015 – Pharmaceutical Technology, accessed August 15, 2025, https://www.pharmaceutical-technology.com/features/featurethe-worlds-most-sold-cancer-drugs-in-2015-4852126/

- Drug Pricing Investigation – The Committee on Oversight and Accountability Democrats | – House.gov, accessed August 15, 2025, https://oversightdemocrats.house.gov/sites/evo-subsites/democrats-oversight.house.gov/files/Novartis%20Staff%20Report%2010-1-2020.pdf

- Novartis v. Union of India & Others – Wikipedia, accessed August 15, 2025, https://en.wikipedia.org/wiki/Novartis_v._Union_of_India_%26_Others

- Novartis agrees Gleevec patent deal – Pharmafile, accessed August 15, 2025, https://pharmafile.com/news/novartis-agrees-gleevec-patent-deal/

- Gleevec® (imatinib mesylate) – First-time Generic • On December 4, 2015, Sun Pharma announced the FDA approval of its AB-ra, accessed August 15, 2025, https://professionals.optumrx.com/content/dam/optum3/professional-optumrx/vgnlive/HCP/Assets/RxNews/New%20Generics_Gleevec_2015-1204.pdf

- Novartis settles patent litigation on Gleevec with Sun Pharma subsidiary, accessed August 15, 2025, https://www.expresspharma.in/novartis-settles-patent-litigation-on-gleevec-with-sun-pharma-subsidiary/

- Novartis statement on Gleevec patent lawsuit – Fierce Pharma, accessed August 15, 2025, https://www.fiercepharma.com/pharma/novartis-statement-on-gleevec-patent-lawsuit

- Press Release Settlement of litigation for generic Gleevec – Sun Pharma, accessed August 15, 2025, https://sunpharma.com/wp-content/uploads/2020/12/Press-Release-Settlement-of-litigation-for-generic-Gleevec-1.pdf

- Why Are Generic Cancer Drugs Out of Reach for Many Patients?, accessed August 15, 2025, https://www.bloodcancerstoday.com/post/why-are-generic-cancer-drugs-out-of-reach-for-many-patients

- Generic Imatinib Approved in the US for CML: What does it mean for GIST patients?, accessed August 15, 2025, https://liferaftgroup.org/2016/02/generic-imatinib-available-in-the-us/

- The cancerous design of the U.S. drug pricing system – 46brooklyn Research, accessed August 15, 2025, https://www.46brooklyn.com/research/2018/7/23/the-cancerous-design-of-the-us-drug-pricing-system

- Realized and Projected Cost-Savings from the Introduction of Generic Imatinib Through Formulary Management in Patients with Chronic Myelogenous Leukemia – American Health & Drug Benefits, accessed August 15, 2025, https://www.ahdbonline.com/issues/2019/november-2019-vol-12-no-7/2860-realized-and-projected-cost-savings-from-the-introduction-of-generic-imatinib-through-formulary-management-in-patients-with-chronic-myelogenous-leukemia

- A Business Professional’s Guide to Drug Patent Searching …, accessed August 15, 2025, https://www.drugpatentwatch.com/blog/the-basics-of-drug-patent-searching/

- Secretary leal – Spotless of Utah, accessed August 15, 2025, http://spotlessofutah.com/Skb

- DrugPatentWatch Highlights 5 Strategies for Generic Drug …, accessed August 15, 2025, https://www.geneonline.com/drugpatentwatch-highlights-5-strategies-for-generic-drug-manufacturers-to-succeed-post-patent-expiration/

- Generic Pharmaceuticals Market Surges 8.35% CAGR by 2034 – Towards Healthcare, accessed August 15, 2025, https://www.towardshealthcare.com/insights/generic-pharmaceuticals-market-sizing

- The Law of 180-Day Exclusivity (Open Access) – Food and Drug Law Institute (FDLI), accessed August 15, 2025, https://www.fdli.org/2016/09/law-180-day-exclusivity/

- 180-Day Generic Drug Exclusivity – Forfeiture – UC Berkeley Law, accessed August 15, 2025, https://www.law.berkeley.edu/wp-content/uploads/2024/05/180-Day-Generic-Drug-Exclusivity-%E2%80%93-Forfeiture.pdf

- List of largest selling pharmaceutical products – Wikipedia, accessed August 15, 2025, https://en.wikipedia.org/wiki/List_of_largest_selling_pharmaceutical_products

- Conclusions We Can Draw from Recent Successful Drug Launches – DrugPatentWatch, accessed August 15, 2025, https://www.drugpatentwatch.com/blog/conclusions-we-can-draw-from-recent-successful-drug-launches/

- Pharmaceutical blockbusters: the past, present, and future(?) | Alex’s blog, accessed August 15, 2025, https://atelfo.github.io/2023/02/26/pharmaceutical-blockbusters-the-past-present-and-future.html

- Top 15 Drug Launch Superstars | Fierce Pharma, accessed August 15, 2025, https://www.fiercepharma.com/special-report/top-15-drug-launch-superstars

- List – 65 Drug Patents Expiring in 2025 – GreyB, accessed August 15, 2025, https://www.greyb.com/blog/drug-patents-expiring-2025/

- Ranbaxy begins shipping generic Lipitor to US from Indian facility – FirstWord Pharma, accessed August 15, 2025, https://firstwordpharma.com/story/1409015

- When does the patent for Clopidogrel expire? – Patsnap Synapse, accessed August 15, 2025, https://synapse.patsnap.com/article/when-does-the-patent-for-clopidogrel-expire

- Plavix Lawsuit In 2025 | 5000+ People Filed Lawsuit – Ethen Ostroff Law, accessed August 15, 2025, https://ethenostrofflaw.com/plavix-lawsuit/

- Global Clopidogrel Bisulfate Market Set for Steady Price Drop in 2025 – ChemAnalyst, accessed August 15, 2025, https://www.chemanalyst.com/NewsAndDeals/NewsDetails/global-clopidogrel-bisulfate-market-set-for-steady-price-drop-in-2025-32628

- Clopidogrel goes off-patent: last of the old-style blockbusters, accessed August 15, 2025, https://www.gabionline.net/generics/general/Clopidogrel-goes-off-patent-last-of-the-old-style-blockbusters

- Gleevec patent expiration – Pharsight, accessed August 15, 2025, https://pharsight.greyb.com/drug/gleevec-patent-expiration

- Product sales | Novartis, accessed August 15, 2025, https://www.novartis.com/investors/financial-data/product-sales

- Gleevec Market Size, Scope, Growth, Trends and Forecast, accessed August 15, 2025, https://www.verifiedmarketresearch.com/product/gleevec-market/

- Hatch-Waxman Litigation – Rothwell Figg, accessed August 15, 2025, https://www.rothwellfigg.com/whatwedo-legal-hatch-waxman-litigation

- Hatch-Waxman & Biologics – Cozen O’Connor, accessed August 15, 2025, https://www.cozen.com/practices/intellectual-property/hatch-waxman-litigation

- Report: 2022 U.S. Generic and Biosimilar Medicines Savings Report, accessed August 15, 2025, https://accessiblemeds.org/resources/reports/2022-savings-report/

- Generic Competition and Drug Prices | FDA, accessed August 15, 2025, https://www.fda.gov/about-fda/center-drug-evaluation-and-research-cder/generic-competition-and-drug-prices

- Office of Generic Drugs 2022 Annual Report – FDA, accessed August 15, 2025, https://www.fda.gov/drugs/generic-drugs/office-generic-drugs-2022-annual-report

- Can generic competition succeed at reducing cost of atorvastatin?, accessed August 15, 2025, https://gabionline.net/generics/research/Can-generic-competition-succeed-at-reducing-cost-of-atorvastatin

- Novartis to maintain Gleevec exclusivity until early 2016 – BioPharma Dive, accessed August 15, 2025, https://www.biopharmadive.com/news/novartis-to-maintain-gleevec-exclusivity-until-early-2016/264848/

- (PDF) Effects of Generic Entry on Market Shares and Prices of Originator Drugs: Evidence from Chinese Pharmaceutical Market – ResearchGate, accessed August 15, 2025, https://www.researchgate.net/publication/390020840_Effects_of_Generic_Entry_on_Market_Shares_and_Prices_of_Originator_Drugs_Evidence_from_Chinese_Pharmaceutical_Market

- Clinical outcomes of generic versus brand‐name clopidogrel for secondary prevention in patients with acute myocardial infarction: A nationwide cohort study, accessed August 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10499421/

- Clopidogrel – Drug Usage Statistics, ClinCalc DrugStats Database, accessed August 15, 2025, https://clincalc.com/drugstats/Drugs/Clopidogrel

- Clopidogrel Bisulfate Market Report | Global Forecast From 2025 To 2033 – Dataintelo, accessed August 15, 2025, https://dataintelo.com/report/global-clopidogrel-bisulfate-market

- Trend of sales revenue by year for top selling cancer drugs in the US and the effect of loss of market exclusivity, accessed August 15, 2025, https://escholarship.org/content/qt2x9611sz/qt2x9611sz.pdf