Introduction: The Strategic Imperative of Project Management in the Modern CDMO Ecosystem

The pharmaceutical and biotechnology industries operate at the confluence of profound scientific innovation, stringent regulatory oversight, and immense financial risk. The journey from a promising molecule to a life-saving therapy is a decade-long, multi-billion-dollar endeavor fraught with complexity.1 In this high-stakes environment, the model of how drugs are developed and manufactured has undergone a fundamental transformation. The vertically integrated pharmaceutical giant, once the sole arbiter of a drug’s lifecycle, has given way to a dynamic, interconnected ecosystem of specialized partners. At the heart of this new paradigm is the Contract Development and Manufacturing Organization (CDMO), a strategic partner that has become indispensable to the modern biopharmaceutical enterprise.

Defining the Modern CDMO

A Contract Development and Manufacturing Organization (CDMO) is a company that provides comprehensive, end-to-end services to the pharmaceutical and biotech sectors, spanning the entire product lifecycle from early-stage drug development through to commercial-scale manufacturing, packaging, and distribution.2 This integrated model represents a significant evolution from its predecessors. A Contract Manufacturing Organization (CMO), for instance, focuses almost exclusively on the large-scale production of a drug that has already been developed.4 Conversely, a Contract Research Organization (CRO) specializes in the earlier, research-intensive stages of the drug development process, such as preclinical studies and clinical trial management.4

The modern CDMO uniquely combines the functions of both, offering a “one-stop shop” that shepherds a client’s asset from concept to commercialization under a single strategic umbrella.1 This consolidation of services—encompassing formulation development, process optimization, analytical testing, clinical trial material manufacturing, scale-up, regulatory support, and commercial production—is the CDMO’s defining characteristic and the source of its strategic value.4 By providing a seamless continuum of services, CDMOs aim to eliminate the logistical hurdles, knowledge gaps, and timeline delays that often arise when handing off a project between separate development and manufacturing partners.

| Partner Type | Primary Focus | Typical Services | Key Value Proposition | Project Stage Involvement |

| CRO | Research & Clinical Trials | Drug discovery, preclinical studies, clinical trial management, regulatory submissions support | Navigates the complex clinical and regulatory landscape for drug approval | Early-stage research through clinical trials |

| CMO | Manufacturing | Large-scale, commercial manufacturing of an already-developed and approved drug | Provides manufacturing capacity and expertise for large volumes | Late-stage commercial production |

| CDMO | Development & Manufacturing | Formulation development, process scale-up, analytical services, clinical trial manufacturing, commercial manufacturing, packaging | Offers an integrated, end-to-end solution from development to commercialization, reducing complexity and accelerating timelines | Preclinical development through entire commercial lifecycle |

Table 1: Comparison of Outsourcing Partners: CRO vs. CMO vs. CDMO 4

The Strategic Value Proposition

Pharmaceutical and biotech companies, from virtual startups to global giants, partner with CDMOs to address a host of strategic challenges. The decision to outsource is no longer a purely tactical choice to acquire temporary capacity but a strategic imperative to enhance competitiveness and mitigate risk. The core value proposition of a CDMO partnership is multifaceted 4:

- Cost Management and Capital Efficiency: The cost to develop a new drug is estimated to be over $2.5 billion.1 Building and validating in-house development and manufacturing facilities requires immense capital investment. CDMOs allow sponsors to access state-of-the-art facilities, specialized equipment, and highly trained personnel without this upfront expenditure, converting a significant capital expense into a more manageable operational expense.1

- Access to Specialized Expertise and Technology: The pharmaceutical landscape is increasingly dominated by complex molecules, biologics, cell and gene therapies, and advanced delivery systems.3 Many companies, particularly smaller biotechs, lack the niche expertise or cutting-edge technology required to develop and manufacture these products. CDMOs serve as hubs of specialized knowledge, staffed by experienced chemists, engineers, and regulatory experts who can solve complex formulation and manufacturing challenges.8

- Enhanced Scalability and Flexibility: Market demand can be unpredictable. A CDMO provides the ability to rapidly scale production up or down in response to clinical trial needs or commercial demand, without the sponsor being constrained by the fixed capacity of its own facilities.4 This agility is crucial for managing the product lifecycle effectively.

- Accelerated Speed to Market: In a competitive market where patent life is finite, every day counts. By leveraging a CDMO’s existing infrastructure, established processes, and regulatory experience, sponsors can significantly shorten development and manufacturing timelines, bringing therapies to patients faster.1

- Regulatory Compliance and Risk Mitigation: Navigating the global regulatory landscape is a formidable challenge. CDMOs possess deep expertise in the requirements of agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).3 They maintain facilities and quality systems that are compliant with Current Good Manufacturing Practices (cGMP), helping to de-risk the path to regulatory approval.5

Market Context and Growth Trajectory

The strategic importance of the CDMO sector is reflected in its remarkable growth. The U.S. pharmaceutical CDMO market alone is projected to expand from an estimated $39.14 billion in 2025 to $68.57 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.43%.13 On a global scale, the market is forecast to grow from approximately $181.93 billion in 2025 to $333.79 billion by 2034, at a CAGR of 7.10%.14 Certain segments are expanding even more rapidly; the biologics CDMO market, for example, is projected to grow at a CAGR of 13.7% between 2025 and 2029.15

This rapid expansion signifies a fundamental industry shift towards outsourcing. However, it also creates an intensely competitive and complex environment. In this landscape, the ability of a CDMO to deliver on its promises—to meet timelines, stay within budget, and maintain impeccable quality—is paramount. This is where the discipline of project management becomes the critical differentiator.

Thesis Statement

In the high-stakes, capital-intensive world of pharmaceutical development, effective project management is not merely an operational discipline but the central nervous system of a successful CDMO-sponsor partnership. It is the primary mechanism for translating scientific potential into commercial reality, mitigating the myriad inherent risks, and maximizing the return on a multi-billion-dollar investment. The failure of an outsourced project is rarely a failure of science alone; more often, it is a failure of management, communication, strategic alignment, and proactive oversight.16 This report provides a comprehensive blueprint for excellence in CDMO project management, offering actionable strategies, best practices, and expert insights to navigate the complexities of this critical function and drive successful outcomes.

I. Forging the Foundation: Structuring the Sponsor-CDMO Partnership for Success

Before a single experiment is run or a batch is manufactured, the groundwork for project success or failure is laid in the structure of the relationship between the sponsor and the CDMO. A partnership built on a flimsy foundation of misaligned expectations, ambiguous responsibilities, and weak governance is destined for conflict and delays. Conversely, a collaboration architected with strategic foresight, mutual understanding, and robust frameworks can withstand the inevitable challenges of drug development. This initial phase of partner selection, contract negotiation, and governance design is not a preliminary step but the most critical investment in the project’s ultimate success.

The Six Pillars of a Strategic Alliance

Transforming a simple vendor-client transaction into a true strategic alliance requires a commitment to a set of core principles. These pillars, as identified by industry leaders, form the bedrock of a robust and enduring CDMO relationship.17

- Mutual Benefit: The partnership must be a win-win scenario where both parties derive measurable value. For the sponsor, this value may come from cost efficiency, accelerated timelines, or access to innovation. For the CDMO, it comes from stable revenue, the opportunity to work on cutting-edge science, and the potential for a long-term commercial supply agreement. This alignment of interests is the primary driver of longevity and collaborative problem-solving.17

- Trust: In a highly regulated, high-stakes industry, trust is the indispensable currency of collaboration. It is earned through consistent performance and transparency. A CDMO must repeatedly demonstrate its commitment to regulatory compliance, quality assurance, and operational integrity. For the sponsor, trust involves sharing information openly and empowering the CDMO to leverage its expertise. Without this mutual trust, relationships devolve into micromanagement and adversarial dynamics.17

- Duration: While short-term, transactional projects have their place, the greatest value is unlocked through long-term partnerships. An enduring relationship allows for deeper operational integration, cross-functional synergies, and a shared understanding that transcends individual projects. This long-term perspective encourages co-investment in technology and continuous improvement, ultimately benefiting both organizations.17

- Communication Transparency: Open, honest, and timely communication is the lifeblood of the partnership. This involves establishing clear channels and protocols for sharing progress updates, discussing risks, and making course corrections. A lack of transparency is a leading cause of misalignment, operational friction, and the erosion of trust.17

- Reliability: The ability to consistently deliver against expectations is non-negotiable. Reliability is the tangible proof of a CDMO’s competence and commitment. It is measured through objective Key Performance Indicators (KPIs) such as on-time delivery, batch success rates, and adherence to quality specifications. Consistent reliability builds the trust necessary for a strategic partnership to flourish.17

- Growth Potential: A forward-looking partnership does not merely serve today’s needs but anticipates tomorrow’s challenges and opportunities. It involves a shared commitment to adapt to evolving market dynamics, technological advancements, and regulatory landscapes. Both parties should see the potential for the relationship to grow in scope and strategic importance over time.17

Choosing the Right Partnership Model

Recognizing that not all outsourcing needs are identical is the first step toward structuring an effective partnership. A sponsor must first identify its primary drivers for outsourcing before selecting an engagement model. This internal assessment helps prioritize needs and align them with the appropriate CDMO relationship structure.19 The primary outsourcing drivers often fall into one of these categories:

- Need for Capacity: The sponsor has the in-house expertise but lacks the physical manufacturing capacity to meet demand.

- Need for Expertise: The sponsor has a novel molecule or requires a specialized technology that is outside its core competencies.

- Need for Both: A common scenario for virtual or small biotech companies that lack both infrastructure and specialized scientific staff.

- Strategic Reasons: A sponsor may have in-house capabilities but chooses to outsource for reasons like supply chain diversification (second-sourcing) or to focus internal resources on other priorities.

Once the primary driver is understood, the sponsor can choose the most suitable partnership model 17:

- Transactional Relationship: This model is best suited for tactical, short-term needs, such as a one-off manufacturing campaign or a specific analytical testing project. It is characterized by a well-defined scope, a focus on cost and speed, and limited strategic integration.

- Balanced Partnership (or Preferred Provider Agreement): This model represents a middle ground, where a sponsor directs a significant volume of work to a select group of CDMOs. It involves a moderate level of resource integration and alignment over time, fostering a more collaborative relationship than a purely transactional one.

- Strategic Partnership (or Alliance): This is the deepest level of collaboration, requiring significant mutual investment, a shared long-term vision, and deep integration of teams and processes. These partnerships are often formed for a company’s lead assets and may span the entire product lifecycle, from clinical development to commercial supply.

Misalignment between the outsourcing driver and the partnership model is a common source of friction. A sponsor seeking deep strategic collaboration but engaging with a CDMO on a purely transactional basis will inevitably be disappointed. Clear categorization from the outset enables sharper focus, better resource allocation, and more effective management of expectations for both sides.17

Establishing a Robust Governance Framework

A well-structured governance framework is the operational blueprint that translates the principles of a strategic partnership into practice. It establishes clear expectations, defines roles and responsibilities, and creates mechanisms for oversight and issue resolution, setting the stage for effective project management.18

The Joint Steering Committee (JSC)

The cornerstone of a strong governance structure is the Joint Steering Committee (JSC), sometimes called a Joint Project Team (JPT). The JSC is a cross-functional body with senior representatives from both the sponsor and the CDMO. Its primary mandate is to provide high-level project oversight, ensure strategic alignment, and serve as the final arbiter for significant issues that cannot be resolved at the project team level.18

An effective JSC typically includes stakeholders from key departments such as research and development, manufacturing, quality assurance, regulatory affairs, supply chain, and legal/commercial.18 The committee meets regularly (e.g., quarterly) to review project progress against key milestones, assess risks, approve major changes to scope or budget, and ensure the project remains aligned with the overarching business goals of both organizations.20 The JSC acts as the ultimate decision-making body, providing strategic direction and resolving conflicts that could otherwise stall progress.22

Roles and Responsibilities

Ambiguity is the enemy of accountability. A critical function of the governance framework is the clear, documented delineation of roles and responsibilities for both the sponsor and the CDMO.18 This goes beyond the high-level terms of the contract and drills down to the operational level. It should specify who is responsible for key activities like raw material procurement, analytical method development, batch record review and approval, and regulatory filings.

To support this, many sponsor organizations establish internal Standard Operating Procedures (SOPs) for vendor management.25 These SOPs provide a consistent framework for how internal teams (e.g., tech transfer, quality) interact with external partners. However, these SOPs should be designed as guidance documents rather than rigid, overly prescriptive rules, allowing for the flexibility needed to manage diverse relationships across multiple partners.25

Escalation Pathways

Even in the best-run projects, problems will arise. A pre-defined escalation pathway provides a clear, structured roadmap for addressing risks, delays, or disputes proactively, preventing them from festering and disrupting the project.18 This pathway should:

- Identify decision-making thresholds: Define what types of issues can be resolved by the project team and what issues must be escalated.

- Designate responsible contacts: Name specific individuals at each escalation tier (e.g., Project Manager, Head of Department, JSC member) in both organizations.

- Outline response timelines: Specify the expected timeframes for acknowledgment and resolution at each level.

A well-designed escalation pathway ensures that problems are addressed by the right people at the right time, promoting timely resolution and maintaining project momentum.24

A robust governance structure should be designed not only for routine project oversight but also as a strategic tool to ensure partnership continuity and stability in a volatile and consolidating industry. The CDMO landscape is characterized by frequent mergers and acquisitions, which can introduce new leadership, change corporate priorities, and lead to significant staff turnover, particularly in critical project management roles.25 These disruptions directly threaten the foundational pillars of the partnership, such as trust and communication. In this context, a well-defined governance framework acts as a critical resilience mechanism. When an acquisition occurs, the JSC becomes the primary forum for re-aligning on strategic objectives with the new leadership. The established KPIs provide an objective, data-driven basis for discussion, preventing a complete reset of the relationship. This transforms the partnership from being person-dependent to process-dependent, making it far more resilient to the inevitable churn of the industry.

The Art of Balancing Oversight and Autonomy

One of the most delicate challenges in managing a CDMO relationship is striking the right balance between necessary oversight and empowering autonomy. A lack of trust can drive sponsors to micromanage their partners, scrutinizing every decision and demanding constant updates. This excessive control often backfires, slowing the CDMO’s progress, stifling innovation, and creating a climate of resentment.18 On the other hand, too little oversight can expose the project to significant quality and compliance risks, as the ultimate responsibility for the product always remains with the sponsor.27

The most effective approach is a risk-based “trust but verify” model.18 This model tailors the level of scrutiny to the specific risks of the project. The appropriate level of oversight is determined by weighing factors such as the complexity of the product, the criticality of the manufacturing process, and the CDMO’s historical compliance and performance record.

Under this model, sponsors should:

- Define clear parameters and KPIs: Establish clear quality agreements and define objective KPIs, such as batch success rates, on-time delivery, and deviation rates.

- Grant operational flexibility: Allow the CDMO the autonomy to decide how they will meet these deliverables, provided they operate within the agreed-upon quality and regulatory frameworks. This encourages efficiency and innovation.

- Conduct periodic verification: Maintain the right to conduct periodic audits and performance reviews to verify that the CDMO is adhering to the agreed standards.

- Establish clear escalation triggers: Define which issues require immediate sponsor notification and intervention (e.g., those impacting critical timelines, product quality, or regulatory compliance) and empower the CDMO’s project team to manage routine challenges within their scope of responsibility.18

The Legal Framework: Crafting an Effective CDMO Contract

A successful partnership begins long before manufacturing starts, with the negotiation of a comprehensive contract. This document should be viewed not as a mere legal formality but as a foundational strategic tool for aligning expectations and mitigating risk.12 A well-crafted CDMO contract goes beyond standard terms and conditions to meticulously define the operational and strategic parameters of the relationship.

Key clauses that require careful attention include:

- Scope of Work (SOW): This is the blueprint of the project. It must be meticulously detailed, specifying not just the services to be performed but also the precise product specifications, quantities, deliverables, critical milestones, and objective quality criteria. A vague SOW is a primary cause of “scope creep,” leading to misunderstandings, missed timelines, and budget overruns.12

- Risk Allocation: This is often the most heavily negotiated section.

- Indemnification and Limitation of Liability: These clauses define who bears the financial burden for unforeseen issues. It is crucial to negotiate fair terms, including specific carve-outs from liability caps for issues directly within the CDMO’s control, such as cGMP failures or breaches of confidentiality.12

- Force Majeure: This clause should define unforeseeable events that may excuse performance but, more importantly, should also mandate timely communication and active mitigation efforts from the affected party to minimize disruption.12

- Intellectual Property (IP): The contract must explicitly address the ownership of all IP generated during the collaboration. This includes both “foreground IP” (new inventions created during the project) and the use of “background IP” (pre-existing technology from either party). A clear IP clause is essential to prevent future disputes and “IP contamination,” where a CDMO’s background IP becomes inseparably integrated into the client’s product, potentially limiting the client’s freedom to switch manufacturers later.12

- Confidentiality and Data Security: This clause obligates both parties to protect proprietary information. In today’s digital age, this must extend beyond traditional trade secrets to include robust provisions for data ownership, cybersecurity measures, and protocols for handling data breaches.12

- Dispute Resolution: To avoid prolonged and costly legal battles, the contract should establish a clear, multi-tiered dispute resolution mechanism. This typically starts with good-faith negotiations between project leaders, escalates to mediation with senior management, and only then proceeds to binding arbitration or litigation if necessary.12

II. The Project Management Lifecycle: A Phased Approach from Concept to Commercialization

With a strong partnership foundation in place, the focus shifts to the execution of the project itself. Effective CDMO project management is a disciplined, phased process that guides a program from initial design to final close-out. It requires a structured approach, clear communication, and the leadership of a skilled project manager who can navigate the technical, regulatory, and interpersonal complexities inherent in drug development. The project management function is not a peripheral administrative task; it is the engine that drives the project forward and the primary interface between the sponsor and the CDMO’s operational teams.

The Central Role of the Project Manager (PM)

Within the CDMO ecosystem, the Project Manager (PM) is the linchpin of a successful project. They are far more than just a scheduler or a budget tracker; they are the “main connector” in the partnership and the primary “voice of the client” within the CDMO’s organization.24 The PM serves as the central point of contact, responsible for ensuring that the sponsor’s needs and objectives are clearly understood and met by the internal technical teams.

World-class CDMOs recognize that the PM role is not an ad-hoc assignment but a professional discipline requiring a unique skill set.29 An effective PM typically possesses 30:

- A strong scientific background: An understanding of the technical aspects of drug development (e.g., Chemistry, Manufacturing, and Controls – CMC) is essential for credible leadership and effective problem-solving.

- Professional project management experience: Expertise in managing cross-functional teams of scientists and manufacturing specialists is crucial for coordinating complex activities.

- Exceptional soft skills: Leadership, negotiation, conflict resolution, and clear communication are paramount for managing the intricate dynamics of a sponsor-CDMO relationship.

Great PMs act as strategic “agents for the customer”.29 They invest time to understand the project not just from a technical perspective but from the sponsor’s business perspective. They understand the critical impact of meeting a timeline, such as securing the next round of funding for a small biotech client. By facilitating collaboration across the CDMO’s functional areas and asking the tough questions that the sponsor may not have considered, a strategic PM can avert problems, accelerate progress, and add significant value beyond simple execution.29

The project management discipline is increasingly seen as a primary differentiator in a crowded CDMO market. While many CDMOs may possess similar technical capabilities, the quality of their project management is what often determines the success of a partnership. A failed relationship is frequently the result of poor communication, a lack of visibility, and team instability—all failures of project management, not science.16 Sponsors, particularly small, investor-backed biotechs, need more than a service provider; they need a strategic partner who brings structure, transparency, and continuity to their project.16 Therefore, a CDMO that treats project management as a core capability, investing in skilled PMs and robust processes, creates a powerful competitive advantage. The PM is the human embodiment of the CDMO’s reliability and trustworthiness, and their performance is a direct reflection of the organization’s commitment to its clients.

Phase 1: Project Design & Initiation

The success of a project is often determined before the technical work even begins. The design and initiation phase lays the foundation for everything that follows.32

- Project Design: This is the strategic planning stage. The project management team collaborates closely with the business development team and the client to gain a deep understanding of the project’s objectives, requirements, and critical success factors.32 A world-class PM gets involved at this early stage, even before the contract is finalized, to help shape the scope of work, identify potential risks, and ensure that the proposed plan is realistic and achievable. This proactive engagement helps to avert problems that might otherwise only surface much later in the project.29

- Project Initiation: Once the SOW is agreed upon, the initiation phase formally kicks off the project. This involves several key activities 32:

- Assembling the Team: A dedicated, cross-functional project team is assembled, typically including experts from process development, analytical development, quality control (QC), quality assurance (QA), and GMP manufacturing.

- Alignment and Governance: A formal kick-off meeting is held with the sponsor’s team to align on project objectives, timelines, communication plans, and governance structures. It is at this stage that the project’s criticality level is formally defined, which will dictate the frequency of meetings, the level of reporting, and the intensity of oversight.

- Defining Success: Clear, measurable goals and KPIs are established so that everyone—on both the sponsor and CDMO teams—is working towards the same definition of success.

Phase 2: Project Execution

This is the phase where the project plan is brought to life. The PM’s role shifts from planning to active leadership, guiding the project through its various technical stages while managing risks, resources, and communication.32

- Technical Leadership and Risk Management: The PM leads the project through each technical phase, from process development and scale-up to GMP manufacturing. A key responsibility is the active management of risk. As the project progresses and new data becomes available, the PM must work with the technical team to assess the results, identify any deviations from the plan, and make necessary adjustments to the scope of work.32

- Communication and Collaboration: This is arguably the most critical element of the execution phase. Establishing clear, transparent, and consistent communication channels is essential for project success.24 Best practices include:

- Regular Meetings: A cadence of regular team meetings, both internal to the CDMO and joint meetings with the sponsor, should be established and adhered to.

- Clear Reporting: Providing regular, detailed progress reports that cover timelines, budget, technical progress, and any emerging risks or issues.

- Centralized Information: Utilizing cloud-based solutions and shared platforms (e.g., SharePoint, secure data rooms) to provide real-time data transfer and visibility, ensuring all stakeholders have access to the latest information.32

- Overcommunication: In the context of complex CDMO projects, it is better to overcommunicate than to assume everyone is on the same page. Proactive and frequent communication helps to build trust, resolve misunderstandings quickly, and enables rapid troubleshooting when problems arise.33

- Continuous Improvement: Effective project management incorporates a culture of continuous improvement. Lessons learned from one phase of the project should be applied to subsequent phases. This involves regularly conducting retrospectives and project reviews to identify areas for improvement and optimize processes.24

Phase 3: Project Close-Out and Support

The final phase of the project lifecycle extends beyond the delivery of the last batch. A professional close-out process is crucial for capturing value from the project and strengthening the long-term partnership.32

- Formal Wrap-Up: This involves a final project review meeting with the customer and the business development team to confirm that all deliverables have been met and to formally close the project.

- Lessons Learned: A structured “lessons learned” exercise is conducted to analyze what went well and what could be improved. This knowledge is invaluable for refining the CDMO’s project management processes and improving performance on future projects.

- Ongoing Support: For many projects, particularly those involving regulatory filings or ongoing stability studies, the relationship does not end with the final shipment. Providing “endless reactive support” is a key differentiator that demonstrates a CDMO’s commitment to the long-term success of its clients and is essential for building a strategic partnership.32

Methodology Deep Dive: Agile vs. Waterfall in a GxP Environment

The choice of project management methodology can have a significant impact on a project’s execution. The pharmaceutical industry, with its stringent regulatory requirements (GxP), has traditionally favored the Waterfall methodology for its structured, sequential approach.34

- The Waterfall Model: This is a linear, phase-based model where each stage of the project (e.g., requirements, design, implementation, verification) must be completed before the next begins.35 Its primary strength lies in its emphasis on upfront planning, comprehensive documentation, and predictability, which aligns well with the need for clear, auditable records for regulatory bodies. However, its major weakness is its rigidity; once a phase is complete, making changes is difficult and costly, which can be a significant drawback in the uncertain world of drug development.35

In response to the limitations of Waterfall, the Agile methodology has emerged.

- The Agile Model: Agile is an iterative and incremental approach that breaks a project down into small, manageable cycles called “sprints”.34 Each sprint results in a potentially deliverable increment of work, and the process emphasizes continuous feedback, collaboration, and adaptability to change. Agile’s key advantages are its flexibility, its ability to detect and address risks early in the process, and its continuous engagement with stakeholders.35

While Waterfall remains a strong choice for well-defined, late-stage manufacturing projects where processes are locked, Agile is gaining traction in the life sciences, particularly for early-stage development projects where requirements are more likely to evolve based on experimental results.34 The challenge is to adapt Agile’s flexibility to the rigorous documentation and validation requirements of a GxP environment. This can be achieved through a “hybrid” approach, where the iterative nature of Agile is used for development activities, while the outputs of each sprint are documented and controlled with the rigor of a Waterfall system.

III. Proactive Risk Navigation: A Framework for Identifying, Assessing, and Mitigating Project Threats

In the complex and unpredictable landscape of pharmaceutical development, risk is not a possibility; it is a certainty. It is an accepted fact within the CDMO industry that virtually 100% of projects will encounter unforeseen challenges that can threaten timelines, inflate costs, or alter the scope of work.38 Therefore, risk management cannot be a reactive, “fire-fighting” exercise. It must be a proactive, systematic, and continuous process that is woven into the very fabric of project management. An effective risk management framework serves as a beacon, guiding the project through uncertainty and enabling the team to anticipate, prepare for, and mitigate threats before they escalate into crises.

The Inevitability and Cost of Unmanaged Risk

The failure to properly manage risk is a primary contributor to project failure. A common pitfall is not that risks are unidentified, but that they are not addressed in a substantive way during the planning phase. Often, due to pressure to meet aggressive budgets and timelines, project teams may identify potential risks in a log but fail to adequately communicate their true “gravity” or, crucially, to account for them in the project’s budget and schedule.38

This creates a project plan based on a best-case scenario rather than a realistic one. When an unbudgeted risk inevitably materializes—a batch fails and requires costly rework, a critical raw material is delayed, requiring expedited shipping and rescheduling—there are no pre-allocated funds or buffer time to absorb the impact. The project is immediately thrown into a crisis, leading to urgent requests for additional budget, painful schedule delays, and often a breakdown in the sponsor-CDMO relationship as blame is assigned. The initial failure was not in identifying the risk, but in the failure to translate that risk into tangible budget and timeline contingencies. Effective project management requires not just a risk log, but a risk-quantified project plan. This involves assigning a potential cost and time impact to high-priority risks and building a formal contingency buffer into the overall project plan, which is then approved by the Joint Steering Committee. This transforms risk management from a theoretical, check-the-box exercise into a practical financial and operational tool that prepares the project for reality.

Categorizing Project Risks

A structured approach to risk management begins with understanding the different domains from which threats can emerge. In a typical CDMO project, risks can be categorized into several key areas 38:

- People Risk: This includes issues related to the project team itself, such as the turnover of key personnel, a lack of specific expertise, insufficient training, or breakdowns in communication between the sponsor and CDMO teams.

- Process Risk: These are risks inherent in the development and manufacturing processes, such as inefficient workflows, challenges in technology transfer, unforeseen difficulties in scaling up a process from the lab to the plant, or batch failures.

- Technology Risk: This category covers risks associated with the equipment and systems used in the project. Examples include equipment malfunction, incompatibility of systems between the sending and receiving sites, software failures, or issues with data integrity.

- Regulatory Risk: The regulatory landscape is constantly evolving. Risks in this domain include changes to regulatory guidelines, failures to meet cGMP compliance standards, negative outcomes from regulatory inspections, or delays in receiving agency feedback or approval.

- Supply Chain Risk: Modern pharmaceutical supply chains are global and complex. Risks include shortages of critical raw materials, geopolitical disruptions affecting shipping routes, quality issues with a third-party supplier, or vendor financial instability.

- Market and Competition Risk: While often considered outside the direct scope of the project team, market dynamics can impact the project. For example, a competitor launching a similar product ahead of schedule could change the strategic priority or urgency of the project.

The Risk Management Lifecycle

Proactive risk management is a cyclical process, not a one-time event. It involves a continuous loop of identification, assessment, mitigation, and monitoring that persists throughout the project’s life.24

1. Risk Identification

The first step is to proactively identify potential threats before they materialize. This should be a collaborative effort involving the entire cross-functional team from both the sponsor and the CDMO. Common techniques include 39:

- Brainstorming Sessions: Structured meetings where the team collectively identifies potential risks.

- “What-If” Analysis: A systematic process of asking “what if” questions about potential deviations from the plan (e.g., “What if the lead analytical scientist resigns?”).

- Review of Past Projects: Analyzing “lessons learned” documentation from similar past projects to identify recurring issues.

- Formal Methodologies: Using structured tools like a Process Hazard Analysis (PHA) in the early stages to systematically review the proposed process for potential hazards.

2. Risk Assessment and Prioritization

Not all risks are created equal. Once a list of potential risks has been identified, they must be assessed and prioritized to focus the team’s attention on the most significant threats. This is typically done by evaluating each risk along two key dimensions 39:

- Likelihood: The probability that the risk will occur.

- Severity (or Impact): The magnitude of the negative consequences if the risk does occur (e.g., impact on patient safety, project timeline, budget, or product quality).

By plotting risks on a matrix of likelihood versus severity, the team can create a “risk index” or “heat map.” This visual tool helps to clearly distinguish between high-priority risks that require immediate and robust mitigation plans, and low-priority risks that may only require monitoring.

3. Risk Mitigation and Contingency Planning

For each high-priority risk, the team must develop a clear plan of action. This involves two types of planning 24:

- Mitigation Plans: These are proactive actions taken to reduce the likelihood of the risk occurring or to lessen its impact if it does. For example, to mitigate the risk of a single-source raw material shortage, the team might undertake the costly but prudent action of qualifying a second supplier.

- Contingency Plans: These are reactive plans that outline the specific steps the team will take if a risk materializes despite mitigation efforts. For example, a contingency plan for a batch failure might include pre-defined protocols for investigation, rework, and communication with the sponsor.

4. Risk Monitoring and Communication

Risk management is a dynamic process. The risk landscape must be continuously monitored throughout the project lifecycle. A Risk Log (often part of a RAID log – Risks, Assumptions, Issues, Dependencies) is a critical tool for documenting and tracking all identified risks, their assessment, mitigation plans, and current status.38

Regular risk review meetings should be a standard part of the project’s communication plan. During these meetings, the team reviews the status of existing risks, identifies any new risks that have emerged, and assesses the effectiveness of the mitigation strategies. It is the project manager’s responsibility to ensure that the status and potential impact of key risks are communicated clearly and transparently to all stakeholders, including the JSC.38

Advanced Risk Assessment Tools

For highly complex manufacturing processes, more structured and rigorous risk assessment tools are often employed. These methodologies, borrowed from other high-risk industries, provide a systematic framework for analyzing processes and identifying potential failure modes 39:

- Hazard & Operability Analysis (HAZOP): A structured brainstorming technique that uses a series of guide words (e.g., “no,” “more,” “less,” “reverse”) to identify potential deviations from the design intent of a process and their consequences.

- Failure Modes & Effects Analysis (FMEA): A proactive, step-by-step approach for identifying all possible failures in a design, a manufacturing process, or a product. For each potential failure, the team estimates its severity, likelihood of occurrence, and detectability to calculate a Risk Priority Number (RPN), which helps to prioritize mitigation efforts.

Risk Mitigation Through Careful CDMO Selection

Ultimately, the most important risk mitigation activity occurs before the project even starts: the selection of the right CDMO partner. A sponsor can significantly de-risk a project by conducting thorough due diligence and choosing a CDMO that demonstrates 41:

- A strong regulatory and quality track record.

- Financial stability and a history of successful project delivery.

- Specific technical expertise and experience with similar molecules or technologies.

- A mature and proactive approach to project and risk management.

During the selection process, sponsors should ask pointed questions about a CDMO’s risk management processes, requesting examples of how they have averted potential issues on past projects. The quality of their answers is often a direct indicator of their maturity and reliability as a partner.43

IV. The Quality & Regulatory Backbone: Integrating Compliance into Every Project Phase

In the pharmaceutical industry, quality and regulatory compliance are not optional extras; they are the fundamental license to operate. A brilliant scientific breakthrough is worthless if it cannot be manufactured consistently to the highest quality standards and approved by regulatory authorities. For a CDMO project, where responsibility for manufacturing is delegated, establishing a robust and unambiguous framework for quality and compliance is paramount. This framework is built upon two pillars: a comprehensive Quality Agreement that defines responsibilities, and a rigorous adherence to global standards for Process Validation. The project manager’s role is to ensure that these pillars are not just documents on a shelf, but are actively integrated into every phase of the project lifecycle.

The Primacy of Quality Agreements (QAs)

While the Master Service Agreement (MSA) governs the commercial terms of the partnership, the Quality Agreement (QA) is the legally binding document that defines the specific roles, responsibilities, and procedures related to the quality of the product. It is rightly considered the “cornerstone of successful CDMO partnerships” because it provides the detailed roadmap for ensuring quality and regulatory compliance.27 The QA translates the broad principles of cGMP into specific, actionable commitments for both the sponsor and the CDMO.

An effective QA must be meticulously detailed. Key elements include 27:

- Delineation of Responsibilities: The QA must clearly and unambiguously state which party is responsible for each quality-related activity. This includes tasks such as raw material testing and release, in-process testing, final product release testing, batch record review and approval, stability testing, and handling of deviations and out-of-specification (OOS) results.

- Communication Protocols: It should establish formal channels and timelines for communicating quality-critical information, such as deviations, OOS results, proposed process changes, and audit findings.

- Change Control: The agreement must define a robust process for managing any changes to the manufacturing process, equipment, materials, or analytical methods. This ensures that all changes are properly assessed, documented, approved by both parties, and, if necessary, reported to regulatory agencies.

- Audits and Inspections: The QA should specify the sponsor’s right to audit the CDMO’s facilities and quality systems, as well as the procedures for cooperation during regulatory inspections by agencies like the FDA or EMA.

- Documentation and Record Keeping: This section outlines requirements for batch documentation, record retention periods, and the sponsor’s access to manufacturing and quality records.

For pharmaceutical projects, the QA must also include several industry-specific clauses to ensure full compliance 27:

- Regulatory Alignment: A clear statement that the CDMO must comply with all applicable cGMP regulations for the target markets where the product will be sold (e.g., FDA 21 CFR Parts 210/211, EU GMP Annexes).

- Technology Transfer: While the detailed plan may be in a separate document, the QA should reference the expectations for quality oversight during the technology transfer process.

- Risk Management: The agreement should incorporate principles of quality risk management (as outlined in ICH Q9), particularly for identifying and controlling risks related to Critical Quality Attributes (CQAs) and Critical Process Parameters (CPPs).

- Data Integrity: With the increasing reliance on electronic systems, the QA must establish clear expectations for electronic record-keeping, audit trails, and compliance with regulations like 21 CFR Part 11 (for the US) and EudraLex Annex 11 (for the EU).

- Supply Chain Management: The agreement should address the CDMO’s responsibility for qualifying and overseeing its own suppliers of raw materials and components, and should define the sponsor’s right to review these supply chain controls.

- Deviation and CAPA Management: The QA must define the process for investigating deviations, identifying root causes, and implementing effective Corrective and Preventive Actions (CAPAs), including timelines for resolution.

Process Validation (PV): The Lifecycle Approach

Process Validation (PV) is the documented evidence that a manufacturing process, operated within established parameters, can perform effectively and reproducibly to produce a product that consistently meets its pre-determined specifications and quality attributes.44 Both the FDA and EMA have moved away from viewing validation as a one-time event (e.g., the traditional three successful batches) to a modern, lifecycle approach that integrates validation activities from development through commercial production.45

FDA Framework for Process Validation

The FDA’s guidance, “Process Validation: General Principles and Practices,” outlines a clear, three-stage lifecycle approach that is the standard for projects targeting the US market.44

- Stage 1: Process Design: This stage occurs during development, before manufacturing is transferred to the CDMO. It involves collecting and evaluating data to establish scientific evidence that the process is capable of consistently delivering a quality product. Key activities include defining CQAs and CPPs, and using laboratory and pilot-scale studies to build process understanding.

- Stage 2: Process Qualification: This is the stage where the process is transferred to the CDMO and qualified for commercial manufacturing. It consists of two main parts:

- Design of Facility and Qualification of Utilities/Equipment: Ensuring the CDMO’s facility, utilities (e.g., water, air handling), and equipment are suitable for their intended use through Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ).

- Process Performance Qualification (PPQ): This is the core of traditional validation. It involves manufacturing a number of commercial-scale batches (typically a minimum of three is recommended by the FDA) under normal operating conditions to demonstrate that the process is reproducible and in a state of control. The PPQ is executed according to a pre-approved protocol and requires a higher level of sampling and testing than routine production.

- Stage 3: Continued Process Verification (CPV): This is an ongoing program, conducted during routine commercial production, to collect and analyze process data. The goal of CPV is to provide continual assurance that the process remains in a state of control. This is a data-driven stage that relies on statistical process control (SPC), trend analysis, and regular review of process performance.

FDA vs. EMA Guidelines: A Comparative Analysis

While the FDA and EMA share the fundamental lifecycle principle, there are important differences in their terminology, structure, and specific requirements that project managers overseeing global projects must understand.45

| Aspect | FDA Guideline | EMA Guideline | Implication for CDMO Project Manager |

| Lifecycle Structure | Clearly defined 3-stage model (Design, Qualification, CPV). | Implicit lifecycle approach, covering prospective, concurrent, and retrospective validation concepts. Not formally staged. | The PM must structure validation documentation differently depending on the target market, following the FDA’s 3-stage format for US filings. |

| Validation Master Plan (VMP) | Not explicitly mandatory, but an equivalent structured document is expected. | A formal VMP is considered a key GMP document and is mandatory under EU GMP Annex 15. | For any project with an EU component, the PM must ensure a comprehensive VMP is created and maintained, which requires dedicated resources and planning upfront. |

| Number of PQ Batches | Recommends a minimum of 3 successful commercial batches as a general guideline. | Does not mandate a specific number. The number of batches must be justified based on a risk assessment. | The PM must work with the technical and quality teams to develop and document a scientific, risk-based justification for the number of validation batches for EU filings, which may be more or less than three. |

| Ongoing Verification | Continued Process Verification (CPV): A formal, data-driven program focused on real-time monitoring and statistical process control. | Ongoing Process Verification (OPV): A concept integrated into the Product Quality Review (PQR), which can be based on real-time or retrospective data analysis. | The PM must ensure that the data collection and analysis strategy for ongoing verification meets the specific expectations of each agency, with a stronger emphasis on formal statistical trending for the FDA. |

| Retrospective Validation | Strongly discouraged and generally not accepted for new products. | Permitted in certain circumstances with strong justification (e.g., for well-established legacy processes). | For new product projects, this difference is largely academic, as prospective validation is the standard for both agencies. |

Table 2: Key Differences in FDA vs. EMA Process Validation Guidelines 45

Navigating Regulatory Submissions (IND, NDA, ANDA)

A key advantage of partnering with a full-service CDMO is leveraging their expertise in navigating the complex process of regulatory submissions. As drug development has become more reliant on outsourcing, many CDMOs have built strong regulatory affairs departments to support their clients, often as part of a “virtually-outsourced” model for smaller companies that lack in-house regulatory teams.48

The scope of this support is comprehensive and critical for project success 49:

- Regulatory Strategy: Providing expert guidance on the most efficient regulatory pathway for a product, including advice on requirements for different markets (e.g., US, EU, Japan).

- Dossier Compilation: Assisting in the preparation and compilation of the regulatory dossier, such as an Investigational New Drug (IND) application to begin clinical trials, or a New Drug Application (NDA) or Abbreviated New Drug Application (ANDA) for market approval. This includes authoring and reviewing the critical Chemistry, Manufacturing, and Controls (CMC) sections of the filing.

- Health Authority Interactions: Managing communications and meetings with regulatory agencies like the FDA and EMA on behalf of the sponsor.

- Submission Management: Ensuring that the final submission is complete, accurate, formatted correctly (e.g., in the electronic Common Technical Document – eCTD format), and submitted on time.

- Post-Submission Support: Assisting with responses to queries from regulatory agencies during their review of the application.

The primary advantage of using a CDMO for regulatory support is the seamless integration of manufacturing knowledge and regulatory documentation. The CDMO has the most intimate and detailed scientific knowledge of the manufacturing process, the equipment, the analytical methods, and the control strategy.48 This firsthand expertise is invaluable for writing a robust and defensible CMC section, which is often the most scrutinized part of a regulatory filing. This integration avoids the knowledge gaps and potential inaccuracies that can occur when a separate regulatory consultant, unfamiliar with the manufacturing details, is brought in late in the process. This leads to a higher quality submission and a faster, more efficient path to approval.48

V. Mastering Technical Execution: Best Practices for Technology and Analytical Method Transfer

The theoretical success of a partnership, codified in contracts and governance charters, is ultimately realized on the laboratory bench and the manufacturing floor. The transfer of complex scientific processes from a sponsor’s research environment to a CDMO’s manufacturing facility is a critical and high-risk phase of any outsourced project. This transition is accomplished through two distinct but deeply interconnected activities: Technology Transfer (TT), which moves the manufacturing process, and Analytical Method Transfer (AMT), which moves the methods used to test and release the product. Mastery of these technical disciplines is non-negotiable for project success. A failure in either can lead to significant delays, budget overruns, and even complete project failure.

Technology Transfer (TT) as a Critical Milestone

Technology Transfer is the formal, documented process of transferring product and process knowledge from the sending unit (typically the sponsor or another CDMO) to the receiving unit (the CDMO) to achieve successful and reproducible manufacturing at the new site.51 The success of a TT is not just a technical achievement; it is the foundation upon which all subsequent GMP manufacturing and process validation activities are built. The quality of the transfer is directly dependent on two factors: the robustness of the process being transferred and the clarity of communication between the two parties.52

The Technology Transfer Protocol

A successful TT is guided by a comprehensive protocol or plan that serves as the roadmap for the entire activity. Key components of a robust TT protocol include 51:

- Detailed Manufacturing Process Description: An explicit, step-by-step description of the entire manufacturing process, including all process parameters, operating ranges, and conditions.

- Identification of Critical Parameters and Attributes: A clear definition of the Critical Process Parameters (CPPs)—those parameters that must be controlled to ensure the product meets its quality targets—and the Critical Quality Attributes (CQAs)—the physical, chemical, or biological characteristics of the product that define its quality.

- Technical Gap Analysis: This is a critical risk assessment document. It involves a systematic comparison of the sending and receiving sites’ capabilities, including equipment, facilities, personnel expertise, and procedures. The goal is to proactively identify any gaps or differences that could impact the process and to develop a mitigation plan to address them before the transfer begins.

- Change Control Management: A formal system for documenting and approving any necessary changes or adaptations to the process that arise from the gap analysis or during the transfer itself.

Best Practices for Execution

The sponsor, as the sending unit, bears the primary responsibility for providing a complete and transparent document package. This should include not only the process description and batch records but also the process development reports, which explain the scientific rationale and the “why” behind key process decisions. This deeper knowledge empowers the CDMO’s team to make more informed decisions during the transfer and to troubleshoot more effectively.52

The execution of the TT itself should follow a staged, risk-based approach 51:

- Small-Scale/Pilot Batches: Before attempting a full-scale GMP run, the CDMO should first execute the process at a smaller, laboratory or pilot scale. The purpose of these runs is to familiarize their team with the process, confirm the technical feasibility of the process on their equipment, and identify any unforeseen challenges in a lower-cost environment.

- Engineering/Technical Run: Following successful small-scale runs, a full-scale engineering run is typically performed. This batch is manufactured using the GMP equipment and draft GMP batch records but is not typically intended for human use. It serves as the final dress rehearsal, confirming that the process is robust and reproducible at the target commercial scale.

- Comparability Assessment: The success of the TT is determined by comparing the product made at the CDMO against the product made at the sending site. This requires establishing clear, pre-defined comparability and acceptance criteria for key CQAs before the transfer begins. The data from the engineering run is assessed against these criteria to formally declare the TT a success.52

Analytical Method Transfer (AMT): Ensuring Data Comparability

A manufacturing process is only as good as the methods used to measure it. Analytical Method Transfer is the formal process used to demonstrate that the receiving laboratory (at the CDMO) is qualified to perform a specific analytical method and can generate results that are accurate, precise, and equivalent to those produced by the transferring laboratory.53 AMT is a regulatory requirement and a scientific necessity. Without a successful AMT, there is no reliable way to assess the quality of the product being manufactured, release batches, or validate the manufacturing process.

The project management of these distinct activities must recognize their profound interdependence. A project plan that treats Technology Transfer, Analytical Method Transfer, and Process Validation as independent, sequential milestones is fundamentally flawed. In reality, these activities are deeply intertwined. A successful Process Performance Qualification (PPQ) is impossible without a successfully transferred and robust manufacturing process (TT). However, one cannot prove that the TT was successful or that the PPQ batches meet their specifications without having reliable, fully qualified analytical methods in place at the CDMO. The data generated from the analytical methods is the objective evidence used to judge the success of both the TT and the PV.

Consequently, a delay or failure in the AMT creates a direct, cascading negative impact on the entire project timeline. If the analytical methods are not ready and qualified, the engineering batches from the TT cannot be fully assessed, and the PPQ batches for process validation cannot be initiated. Therefore, the AMT should not be viewed as a secondary, lab-to-lab handoff. It resides firmly on the critical path of the entire manufacturing campaign. Effective project management demands an integrated strategy that prioritizes the AMT, ensuring it is initiated early in the project, resourced adequately, and its progress is tracked with the same rigor as the manufacturing activities themselves. A failure in AMT is not merely an analytical problem; it is a direct and immediate blocker to the entire manufacturing and validation program, making it one of the highest-leverage risk areas in any CDMO project.

Four Key Transfer Strategies

The United States Pharmacopeia (USP) General Chapter “Transfer of Analytical Procedures” outlines the accepted strategies for conducting an AMT. The choice of strategy depends on the complexity of the method, its validation status, and the experience of the receiving laboratory.54

- Comparative Testing: This is the most common and preferred strategy. It involves both the transferring and receiving labs analyzing the same set of homogeneous samples. The results are then statistically compared against pre-defined acceptance criteria to demonstrate equivalence.53

- Co-validation: In this approach, the receiving lab participates in a portion of the original method validation study, typically by executing the inter-laboratory reproducibility assessment. This can be efficient but requires close coordination.54

- Revalidation (Partial or Full): The receiving lab conducts a complete or partial revalidation of the analytical method according to ICH Q2(R1) guidelines. This is often necessary when the transferring lab is unable to participate, when there are significant differences in equipment, or when the original validation is outdated.54

- Transfer Waiver: In rare, low-risk situations, a formal transfer study may be waived. This is only acceptable for very simple or compendial methods (e.g., pH, loss on drying) where the receiving lab can provide documented evidence of their existing expertise and proficiency with the technique. A strong scientific justification is required.53

Critical Success Factors for AMT

Experience shows that most AMT failures are not due to fundamental flaws in the science but to preventable errors in planning, communication, and execution. Critical success factors include 54:

- A Comprehensive Transfer Package: The transferring lab must provide a complete package of information, including the detailed analytical method procedure, the method validation report, historical performance data (e.g., system suitability trends), and all relevant SOPs.54

- Open Communication: Poor communication is a leading cause of AMT failure. Establishing single points of contact at each lab and holding a formal kick-off meeting and regular update meetings are essential for clarifying ambiguities and resolving issues quickly.54

- Thorough Gap Analysis: Before the transfer, a detailed evaluation of the receiving lab’s equipment, software, columns, reagents, and analyst training must be conducted to identify and mitigate any potential differences that could affect method performance.54

- Analyst Training: The receiving lab analysts must be adequately trained on the nuances of the method. For complex methods, on-site, hands-on training by an expert from the transferring lab is highly recommended.54

- Meaningful Acceptance Criteria: The acceptance criteria for the transfer should not be arbitrary. They must be statistically sound and based on the method’s known performance and variability, as determined during method validation. Setting criteria that are too wide can result in the transfer of a biased method, while criteria that are too tight can lead to unnecessary failures.55

VI. The Digital Toolkit: Leveraging Technology for Enhanced Project Control and Collaboration

In an industry defined by data, complexity, and the relentless pressure for speed, the digital transformation of project management is no longer an option but a necessity. CDMOs and their sponsors are increasingly turning to a sophisticated digital toolkit to manage projects, facilitate collaboration, and ensure compliance. These technologies, ranging from enterprise-wide planning systems to specialized cloud platforms and artificial intelligence, are reshaping how projects are executed. However, for CDMOs, digitalization presents a unique challenge: they must implement systems that are robust and standardized enough to drive internal efficiency, yet flexible enough to accommodate the diverse needs of a multitude of clients and products.59

The Core Systems: ERP and PPM

At the heart of a CDMO’s digital infrastructure are two core types of systems that provide the backbone for planning and operations.

- Enterprise Resource Planning (ERP) Systems: An ERP system is an integrated software suite that manages a company’s core business processes. For a CDMO, an ERP system provides a centralized platform to control the entire product lifecycle, from the procurement of raw materials and management of inventory to production planning, quality control, and financial accounting.61 Implementing a robust ERP system, such as SAP, allows a CDMO to streamline operations, improve visibility across the supply chain, enhance regulatory compliance through better traceability, and make more informed, data-driven decisions. A case study of an SAP transformation at a mid-sized CDMO highlighted its ability to efficiently document end-to-end business processes and seamlessly connect with other critical systems like Manufacturing Execution Systems (MES) and Laboratory Information Management Systems (LIMS).62

- Project Portfolio Management (PPM) Solutions: While an ERP manages the operational flow of materials and finances, a PPM system is designed to manage the projects themselves. CDMOs and their large pharma clients often juggle a vast portfolio of projects simultaneously, creating immense challenges in resource allocation and prioritization.63 A PPM solution provides a centralized view of all projects, enabling management to track progress, monitor resource utilization, manage budgets, and make strategic decisions about the project portfolio. This helps to ensure that resources are allocated to the most critical projects and provides transparency to senior leadership on the status of all development activities.63

GxP-Compliant Cloud Collaboration Platforms

The days of shipping hard drives or exchanging uncontrolled documents via email are over. Modern pharmaceutical development is a global, collaborative effort that requires secure, compliant, and efficient platforms for sharing vast amounts of sensitive data between sponsors, CDMOs, and other partners.

The GxP Mandate for Digital Systems

Any electronic system used in the development or manufacturing of pharmaceutical products must comply with stringent regulations designed to ensure data integrity. This set of regulations is broadly known as GxP, where the ‘x’ stands for the specific area (e.g., Manufacturing for GMP, Laboratory for GLP, Clinical for GCP).65 A core principle of GxP is data integrity, often summarized by the acronym

ALCOA+, which requires data to be Attributable, Legible, Contemporaneous, Original, Accurate, and also Complete, Consistent, Enduring, and Available.67 Furthermore, systems must comply with specific regulations for electronic records and signatures, such as 21 CFR Part 11 in the US and EudraLex Annex 11 in the EU.68

Benefits of Validated Cloud Platforms

To meet these demanding requirements, the industry has embraced validated cloud-based content management and collaboration platforms. Services like Box GxP Validation, Google Cloud, and Amazon Web Services (AWS) offer GxP-compliant environments that provide numerous benefits for CDMO-sponsor collaboration 65:

- Secure Collaboration: These platforms provide a single, secure, and validated repository for all project-related content. This allows CDMOs to work securely with internal teams and external partners, eliminating inefficient data silos. Features like granular user permissions, version control, and complete audit trails ensure that sensitive data is protected and all activities are traceable.70

- Virtual Audits and Inspections: A centralized, GxP-compliant platform facilitates virtual audits and regulatory inspections. Sponsors and regulators can be granted secure, read-only access to relevant documentation (e.g., SOPs, batch records, validation reports), with a full audit trail of what was reviewed.69

- Streamlined Workflows: Modern platforms integrate with e-signature capabilities (compliant with 21 CFR Part 11) and workflow automation tools. This allows CDMOs to digitize and automate paper-based processes like document review and approval, significantly improving efficiency and reducing the risk of errors.70

- Reduced Validation Burden: Leading cloud providers often offer a “validation accelerator package,” which includes baseline validation documentation and automated testing tools. This can dramatically reduce the time and cost for a CDMO to validate the platform for their specific use, accelerating project start-up.69

Many CDMOs also leverage more common collaboration tools like Microsoft SharePoint and Teams to facilitate day-to-day communication, data sharing, and joint teamwork with their clients, integrating these into their overall project management framework.74

The Rise of Artificial Intelligence (AI) in Project Management

Artificial intelligence is rapidly moving from a futuristic buzzword to a practical tool that is transforming pharmaceutical project management. AI’s ability to analyze vast datasets, identify patterns, and predict outcomes offers powerful new capabilities for optimizing project execution.76

Practical applications of AI in CDMO project management include:

- Predictive Analytics for Risk Management: AI algorithms can analyze data from hundreds of past projects to identify early warning signs of potential risks. For example, an AI tool could flag a project as having a high risk of regulatory delay or resource shortages based on the characteristics of the molecule and the proposed development plan, allowing the PM to implement mitigation strategies proactively.76

- Automated Reporting and Scheduling: AI can automate the time-consuming task of compiling progress reports, pulling data from various systems to generate accurate, real-time summaries of budget, timeline, and milestone completion. AI can also optimize project schedules by analyzing resource availability and task dependencies, and can automatically adjust the schedule in response to delays in one area to minimize the impact on the overall project timeline.77

- Enhanced Manufacturing and Process Control: AI is being integrated directly into the manufacturing process. AI-powered monitoring systems can analyze sensor data in real-time to detect deviations, predict equipment failures before they happen (predictive maintenance), and recommend process adjustments to optimize for quality and yield.78

AI-driven platforms like Benchling, TetraScience, and Veeva Vault are already being used to improve transparency, accelerate timelines, and provide real-time project tracking through intelligent dashboards.79 This shift from reactive to proactive, data-driven project management is poised to deliver significant gains in efficiency and success rates.

The cumulative effect of this digital transformation is a fundamental shift in the CDMO’s value proposition. Traditionally, a sponsor contracted a CDMO for a physical service (manufacturing a batch) and a physical product (vials of a drug). The data generated, such as batch records and analytical results, was a necessary but secondary output. With the integration of sophisticated digital systems, the data itself becomes a primary, high-value deliverable. A CDMO utilizing AI-powered real-time process monitoring is not just delivering a product; they are delivering the product accompanied by a rich, structured dataset detailing process performance, variability, and optimization opportunities. This data is immensely valuable to the sponsor for future regulatory filings, lifecycle management, and continuous process improvement. This evolution transforms the CDMO-sponsor relationship. The sponsor is no longer merely purchasing manufacturing capacity; they are gaining access to a sophisticated data generation and analytics engine. Consequently, the most advanced CDMOs will compete not just on their physical capabilities but on the strength of their digital infrastructure and their ability to provide clients with high-quality, accessible, and actionable data. A CDMO’s digital maturity is thus becoming a critical new criterion in the partner selection process.

VII. The Competitive Edge: Harnessing Market and Patent Intelligence for Strategic Advantage

In the hyper-competitive pharmaceutical industry, success depends not only on executional excellence but also on strategic foresight. For Contract Development and Manufacturing Organizations (CDMOs), operating in a rapidly growing and consolidating market, the ability to anticipate market trends and identify new business opportunities is a critical differentiator. A reactive CDMO that simply waits for Requests for Proposals (RFPs) will be perpetually at the mercy of the market. A proactive, strategic CDMO, however, leverages sophisticated market and patent intelligence to understand the landscape, identify potential clients before they even begin their search, and position itself as an indispensable partner. This strategic use of intelligence transforms the business development process from a transactional sales function into a consultative, value-added engagement.

The Strategic Role of Patents in Pharma

To understand the power of patent intelligence, one must first appreciate the central role of patents in the pharmaceutical business model. Pharmaceutical patents grant a period of market exclusivity (typically 20 years from the filing date) for a new invention, such as a novel drug molecule or a unique formulation.81 This temporary monopoly is the primary mechanism that allows companies to recoup the enormous costs of research and development, which can exceed $2.5 billion per drug, and to generate the profits necessary to invest in future innovation.1 Without the promise of patent protection, the financial incentive to undertake such high-risk ventures would be severely diminished.82 Patents are, therefore, the fundamental “backbone of pharmaceutical innovation and investment”.82

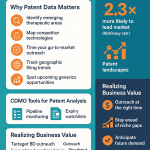

Patent Intelligence for CDMO Business Development

Because patents are public documents that contain a wealth of technical and commercial information, they serve as a powerful window into the strategies, pipelines, and challenges of pharmaceutical companies. For a CDMO, systematically analyzing patent data from specialized services like DrugPatentWatch provides a rich source of competitive intelligence that can be used to drive business development.83

When analyzed effectively, patent data can reveal valuable insights into a potential client’s 83:

- Research and development priorities

- Emerging therapeutic areas of focus

- Specific product pipeline developments

- Technical and manufacturing challenges

- Market entry strategies and geographic priorities

- Potential needs for collaboration

This intelligence can be translated into several actionable business development strategies for CDMOs:

- Proactive Pipeline Monitoring: By tracking the patent applications of pharmaceutical and biotech companies, a CDMO can identify promising new molecules as they move through the development pipeline. This allows the CDMO to identify potential clients whose products are likely to require outsourced development and manufacturing support in the near future. This proactive outreach, often years before a formal RFP process begins, allows the CDMO to build a relationship early and position itself as the partner of choice.83

- Targeted Technology Alignment: Patents are highly technical documents. A careful analysis of a patent’s claims and descriptions can reveal the specific technical challenges a sponsor is facing. For example, a patent might describe a highly potent compound that requires specialized handling, a poorly soluble molecule that will need advanced formulation technologies, or a complex biologic that requires a specific expression system. A CDMO can use this information to determine where its unique capabilities align with the client’s specific needs, allowing for a highly targeted and compelling business development approach.83

- Strategic Capability Investment: Monitoring broad trends in patent filings can provide invaluable strategic guidance for a CDMO’s own investment decisions. For instance, a surge in patents related to mRNA vaccines or antibody-drug conjugates (ADCs) would signal a growing market demand for manufacturing capabilities in these areas. By using patent trends to anticipate future market needs, a CDMO can make informed decisions about investing in new technologies, equipment, and expertise, ensuring its service offerings remain relevant and competitive.83