The path from a promising molecule to a life-changing medicine is longer, more expensive, and more fraught with peril than ever before. We operate in a world defined by a fundamental paradox: while our scientific understanding and technological capabilities have reached unprecedented heights, the productivity of our R&D engines has stagnated. This is the reality of “Eroom’s Law”—Moore’s Law spelled backward—where the cost of developing a new drug doubles roughly every nine years, a trend that has held steady for decades.

This is not a theoretical challenge; it is the strategic battlefield on which every pharmaceutical and biotech company fights for survival and growth. It is a world where a single late-stage clinical trial failure can erase billions in investment and years of scientific effort, and where the looming “patent cliff” threatens to send blockbuster revenue streams into freefall. In this high-stakes environment, the ability to make smarter, more informed, and data-driven decisions about where to place your R&D bets is not just a competitive advantage—it is the single most critical determinant of sustainable success.

This is where the discipline of White Space Analysis moves from the periphery to the very core of R&D strategy. It is far more than a simple exercise in finding “gaps” in the market. It is a rigorous, systematic methodology for charting the vast, unknown territories of medical and technological opportunity. It is about building a strategic compass that guides your pipeline away from crowded, low-return battlegrounds and toward pristine landscapes of high unmet need and defensible intellectual property. The central thesis of this report is that the systematic fusion of two powerful, yet often siloed, data streams—drug patent filings and clinical trial data—transforms R&D from a game of high-cost chance into a discipline of calculated, strategic execution. By learning to read these signals in concert, you can gain an unparalleled periscope into the future, de-risking your investments and dramatically increasing your probability of success.

Section I: The R&D Crucible – Navigating the New Landscape of Pharmaceutical Innovation

To fully appreciate the strategic power of white space analysis, we must first understand the immense pressures shaping the modern R&D landscape. The romantic image of the lone scientist’s “eureka” moment has been replaced by the stark reality of a global, hyper-competitive, and financially punishing enterprise. The decisions made by R&D leaders today are not just scientific; they are monumental capital allocation choices made under conditions of extreme uncertainty.

The Paradox of Modern Pharma: Escalating Costs vs. Stagnant Productivity

The numbers paint a sobering picture. The fully capitalized cost to bring a single new drug to market, accounting for the many failures that precede one success, now routinely exceeds $2.23 billion.1 This figure is not an abstract calculation; it represents a profound financial pressure that shapes the industry’s inherently risk-averse nature.4 A single failed Phase III trial alone can represent a write-off of between $200 million and $500 million.4

This surge in cost has not been met with a corresponding surge in output. Despite record R&D investments from the industry—PhRMA member companies alone invested an unprecedented $102.3 billion in 2021—the number of novel drug approvals remains stubbornly flat, averaging around 43 per year in the US.5 This disconnect between input and output is the essence of Eroom’s Law and the central challenge facing every R&D organization.4

While recent years have shown some signs of a productivity rebound, this recovery is fragile and requires careful interpretation. According to Deloitte’s comprehensive annual analysis, the projected return on investment (ROI) in pharma R&D has climbed from a record low of 1.2% in 2022 to 5.9% in 2024.1 While this is a welcome sign of improvement, it is heavily skewed by the phenomenal success of a few therapeutic classes, most notably GLP-1 therapies for diabetes and obesity.3 When these blockbuster assets are excluded from the analysis, the average projected return drops to just 3.8%.8 This reveals a critical vulnerability: the industry’s apparent recovery is not a broad-based tide lifting all boats, but rather a concentrated surge in a few specific areas. For companies not already dominant in these “hot” markets, the pressure to find the

next major area of unmet need is more intense than ever.

The Looming Threat of the Patent Cliff

Compounding the pressure on R&D productivity is the relentless cycle of patent expiration. The patent is the bedrock of the pharmaceutical business model, providing a finite period of market exclusivity to recoup the massive upfront investment in innovation.9 When that protection ends, the consequences are swift and severe. The entry of generic competition can cause revenues for a blockbuster drug to plummet by as much as 79% in a shockingly short period.9

This is not a distant threat. Between now and 2030, it is projected that drugs representing more than $200 billion in annual revenue will lose patent exclusivity.9 This impending “patent cliff” forces companies into a continuous, high-stakes race to replenish their pipelines and find new, defensible sources of growth. It is the primary motivating factor behind the industry’s M&A outlook, fueling a relentless search for promising new assets to acquire or license.11

Introducing White Space Analysis as a Strategic Response

In this environment of escalating costs, fragile productivity, and existential revenue threats, white space analysis emerges as a critical strategic discipline. It is a systematic methodology for identifying opportunities where a company can innovate with a greater probability of success and a lower degree of competition.13 It provides a data-driven framework for answering the most fundamental questions in R&D strategy:

- Where should we focus our finite resources to maximize our return on innovation?

- Which therapeutic areas are becoming too crowded, and where are the untapped frontiers?

- How can we de-risk our pipeline by making more informed “go/no-go” decisions at each stage of development?

As Mene Pangalos, Executive Vice President of BioPharmaceuticals R&D at AstraZeneca, aptly stated, “A selective high-quality molecule will never become a medicine if it is modulating the wrong target. This is why target selection is the most important decision we make in research”.14 White space analysis provides the intelligence necessary to make that all-important decision with the greatest possible foresight and confidence. It is the tool that allows R&D leaders to navigate the crucible of modern pharma not by luck or intuition, but by strategy.

Section II: Defining the Terrain – A Dual-Lens View of the Opportunity Landscape

The term “white space” is often used as a catch-all for any kind of market gap. However, for the purposes of pharmaceutical R&D strategy, a more precise and multi-dimensional definition is required. A true, high-value white space opportunity is not simply an area where no one is currently operating. It is an area where a significant need exists and where a path to durable, protected commercialization is visible. To identify these opportunities, we must view the landscape through two distinct but interconnected lenses: the intellectual property (IP) lens and the clinical & unmet need lens.

The Patent Lens: Mapping What is Known and Protected

The first and most foundational lens is that of intellectual property. From this perspective, a white space is an area within a technology domain characterized by a low density of patent activity or a complete absence of relevant prior art.13 This analysis is rooted in the legal concept of “freedom to operate” (FTO)—the determination that a planned commercial activity can proceed without infringing the valid IP rights of a third party.16

Conducting a patent landscape analysis is akin to creating a topographical map of the innovation terrain. Areas with a high concentration of patents—often called “patent thickets”—are the “red oceans”.9 These are crowded, highly competitive spaces where new entrants face significant barriers, including a high risk of costly and protracted patent litigation. The strategic goal of the patent lens is to identify the “blue oceans”: under-explored areas where a company can innovate with minimal risk of infringement and establish a strong, defensible patent portfolio, thereby securing a powerful first-mover advantage.13

The Clinical & Unmet Need Lens: Mapping What is Needed

While the patent lens tells us what is protected, the clinical lens tells us what is needed. This perspective is centered on the concept of Unmet Medical Need (UMN). The U.S. Food and Drug Administration (FDA) defines UMN as a condition that is serious and whose treatment is not adequately addressed by currently available therapy.19

This definition, however, is more nuanced than it first appears. An unmet need does not only exist where there is a complete absence of treatment. It also encompasses a wide range of scenarios, including 19:

- Significant Liabilities of Existing Therapies: Where current treatments are compromised by substantial safety issues, poor tolerability, or burdensome side effects at an effective dose.

- Underserved Patient Subpopulations: Where an identifiable subset of patients fails to respond to, or cannot tolerate, the current standard of care.

- Improved Convenience and Compliance: Where a new therapy could offer a less burdensome treatment regimen, such as an oral pill replacing an infusion, or less frequent dosing.20

- Disease Modification: Where existing treatments only manage symptoms, a new therapy that slows, stops, or reverses the underlying disease progression addresses a profound unmet need.20

This lens shifts the strategic focus from the purely technical question of “Can we invent this?” to the far more critical commercial and medical questions: “Is there a real-world problem to solve?” and “Will this innovation be valued by patients, physicians, and payers?”.22 The concept of UMN is not a static checklist but a dynamic landscape shaped by the evolving perspectives of these different stakeholders.19

The Strategic Intersection: Where True Opportunity Lies

The true power of this dual-lens approach comes from its synthesis. A genuine, high-value white space opportunity for R&D investment exists only at the intersection of these two landscapes: an area of significant unmet medical need that also has a clear and navigable intellectual property runway.

Plotting these two dimensions on a strategic matrix reveals the different types of R&D environments and helps guide resource allocation:

| High Patent Density (“Red Ocean”) | Low Patent Density (“Blue Ocean”) | |

| High Unmet Medical Need | The Battleground: High reward, but high risk. Requires a truly disruptive technology and a massive legal budget to clear a path. (e.g., Early PD-1/PD-L1 inhibitors in oncology). | The White Space: The “Golden Quadrant.” A clear market need with a clear path to IP protection. The prime target for R&D investment. |

| Low Unmet Medical Need | The Saturated Market: Technologically crowded and commercially unattractive. Incremental improvements offer little value. Should be actively avoided. | The R&D Trap: Technologically feasible but commercially irrelevant. A potential “science project” that can consume resources with no clear path to ROI. |

This framework demonstrates a critical organizational reality: the teams that understand the patent landscape (Legal, IP) and the teams that understand the clinical landscape (R&D, Commercial, Medical Affairs) often operate in separate silos. This separation is a primary source of poor R&D decision-making.23 A hallmark of a high-performing R&D organization is the institutionalization of a cross-functional white space analysis process that forces these two perspectives to converge, creating a shared, unified map of the true opportunity landscape. By doing so, companies can avoid the costly mistake of developing a scientifically elegant solution to a problem that doesn’t exist, or a clinically needed therapy that they can never legally sell.

Section III: The Intelligence Arsenal – Assembling Your Data Foundation

A successful white space analysis is built upon a foundation of high-quality, comprehensive, and well-understood data. The process involves assembling and interrogating information from two primary universes of data: the global patent system and the world’s clinical trial registries. Mastering these sources and understanding the strategic signals embedded within their data fields is the first critical skill in transforming raw information into actionable intelligence.

Decoding the Patent Universe: Key Databases and Data Fields

The global patent system is a treasure trove of competitive intelligence. Because patent applications are typically published 18 months after their initial filing, they provide an invaluable early warning system, revealing a competitor’s strategic intentions and technological direction years before a product reaches the market.24 Navigating this universe requires familiarity with the key international patent offices.

United States Patent and Trademark Office (USPTO)

As the authority for the world’s largest pharmaceutical market, the USPTO’s databases are a primary source of intelligence. Key searchable data fields for analysis include 26:

- Assignee: The company or entity that owns the patent. Tracking filings by assignee is the most direct way to monitor a competitor’s R&D activity.

- Patent/Application Number: The unique identifier for a granted patent or a pending application.

- Classification Codes (CPC/USPC): The Cooperative Patent Classification (CPC) and the older U.S. Patent Classification (USPC) are hierarchical systems that categorize inventions by technology area. Searching by classification code is often more effective than keyword searching for capturing all relevant patents in a specific field, such as A61K (preparations for medical purposes) or C07K (peptides).28

European Patent Office (EPO)

The EPO provides a centralized patent grant procedure for up to 40+ European and neighboring countries. Its databases, particularly Espacenet, offer a window into European IP strategy and a vast collection of global patent documents.29 Analyzing a company’s EPO filings reveals its strategy for protecting assets in the second-largest global market.

World Intellectual Property Organization (WIPO)

WIPO administers the Patent Cooperation Treaty (PCT), a system that allows applicants to seek patent protection for an invention simultaneously in a large number of countries by filing a single “international” patent application. WIPO’s PATENTSCOPE database is a critical tool for global analysis, providing access to millions of these PCT applications.31 Furthermore, WIPO hosts specialized databases like

Pat-INFORMED, a public-private partnership that provides patent status information for specific medicines, designed to assist procurement agencies in understanding the IP landscape for essential drugs.32

The Strategic Value of Patent Types

Understanding the type of patent being filed is as important as knowing who filed it. A sophisticated IP strategy is not a single wall but a multi-layered fortress designed to protect an asset throughout its lifecycle.9 This “evergreening” or “patent thicket” strategy involves layering different types of patents 9:

- Composition of Matter (CoM) Patents: These are the “crown jewels” of the portfolio. They protect the active pharmaceutical ingredient (API) itself—the core molecule. A strong CoM patent provides the broadest and most powerful protection and is the primary goal of any early-stage R&D program.33

- Method-of-Use Patents: These patents do not cover the drug itself, but a specific method of using it to treat a new disease or patient population. They are the cornerstone of drug repurposing strategies.9

- Formulation & Delivery Patents: These protect unique formulations (e.g., extended-release tablets) or novel delivery mechanisms (e.g., a proprietary auto-injector). They are crucial for lifecycle management, allowing companies to launch improved, patent-protected versions of a drug as the original CoM patent nears expiry.9

- Process Patents: These cover the specific method of manufacturing the drug. While narrower, they can create significant hurdles for competitors trying to produce a generic or biosimilar version.33

Navigating the Clinical Trial Maze: Registries and Their Signals

If patent data reveals a company’s intentions, clinical trial data reveals its actions. It shows which of the many patented ideas are being actively pursued and advanced toward the market. The two most critical registries for this analysis are ClinicalTrials.gov and the EU’s EudraCT/CTIS.

ClinicalTrials.gov (NIH)

Maintained by the U.S. National Institutes of Health, ClinicalTrials.gov is the world’s largest clinical trials database and an essential resource for competitive intelligence.37 A study record on this platform contains a wealth of strategic information. Learning to read a record is a critical skill.39 Key data elements to monitor include:

- NCT Number: The unique identifier for each study.42

- Study Status: This is a real-time indicator of a trial’s progress. A status of ‘Terminated’ or ‘Suspended’ can be a major red flag for a competitor’s program, while a change from ‘Recruiting’ to ‘Active, not recruiting’ signals that enrollment is complete and data may be forthcoming.43

- Phase: The phase of the trial (Phase I, II, III, IV) indicates how far along the development path an asset is and its proximity to a potential launch.39

- Interventions: This field specifies the exact drug, biologic, or device being tested, allowing you to link the trial directly to a known asset or a patented molecule.46

- Primary and Secondary Outcome Measures: These are the clinical endpoints the trial is designed to measure (e.g., ‘Overall Survival’, ‘Progression-Free Survival’, ‘Change in HbA1c’). Analyzing a competitor’s chosen endpoints reveals their intended label claims and their strategy for differentiating their product from the standard of care.47

EudraCT & CTIS (EMA)

The European Union Drug Regulating Authorities Clinical Trials Database (EudraCT) was the primary registry for trials conducted in the European Economic Area. It is now being superseded by the centralized Clinical Trials Information System (CTIS).48 Monitoring this system is essential for understanding a competitor’s development and regulatory strategy in the European market.50

The Power of Integration: Platforms like DrugPatentWatch

The sheer volume, complexity, and disparate nature of these data sources present a formidable challenge. Patent data is notoriously “dirty,” with frequent errors in assignee names, and clinical trial data is structured differently across registries.52 Manually collecting, cleaning, and integrating this information is an enormous, time-consuming task that can delay or derail strategic analysis.

This is where specialized business intelligence platforms become indispensable. Platforms such as DrugPatentWatch provide a fully integrated, curated, and analysis-ready database that bridges these different worlds. They consolidate global patent data, clinical trial information, regulatory status, and even patent litigation records into a single, searchable interface.53 By leveraging such a platform, teams can bypass the laborious data-wrangling phase and move directly to the high-value work of strategic analysis, identifying opportunities, tracking competitors, and making more informed decisions with greater speed and confidence.4 A crucial but often overlooked source of intelligence is the data on

pending patent applications. This information represents a company’s most recent R&D efforts and can provide signals about future strategy long before a patent is granted or a clinical program is publicly disclosed, offering a significant temporal advantage in competitive surveillance.24

Section IV: The Analytical Playbook – From Raw Data to Actionable Insight

With a solid foundation of data from patent and clinical trial databases, the next step is to execute a systematic analytical process. This is where raw data is transformed into strategic intelligence. This playbook involves a multi-step process of landscaping, triangulation, and visualization, increasingly augmented by the power of artificial intelligence.

Step 1 – Patent Landscaping and Competitive Density Analysis

The process begins with creating a patent landscape. This is a comprehensive analysis of all patent activity within a defined technology or therapeutic area.18 The goal is to create a bird’s-eye view of the innovation environment, answering fundamental questions 55:

- Who are the key players (assignees) in this space?

- What is the timeline of innovation? Is patenting activity accelerating, plateauing, or declining?

- Which specific biological targets, mechanisms of action, or formulation technologies are most heavily patented?

- Are there any dominant players whose IP creates significant barriers to entry?

This landscaping effort allows for a competitive density analysis.56 By quantifying and visualizing the concentration of patents, you can objectively assess how crowded a field is. A therapeutic area with thousands of recent patents from a dozen major players is a high-density, “red ocean” environment where differentiation will be difficult and costly. Conversely, a field with older patents and sparse recent filings may represent a lower-density opportunity.1

Step 2 – The Triangulation: Overlaying Clinical Trial Data

A patent landscape, on its own, is an incomplete picture. It shows what companies are thinking about, but not necessarily what they are doing. The critical next step is to triangulate this IP data by overlaying it with clinical trial activity.33 This synthesis provides a dynamic, multi-dimensional view of the competitive landscape.

This crucial overlay adds context and validates the signals from each dataset. For example:

- High Patent Density + Low Clinical Activity: This might indicate a field that is technologically mature but has yielded disappointing clinical results. It could be a graveyard of failed approaches, a significant warning sign. Alternatively, it could represent a trove of patented but abandoned compounds ripe for repurposing.

- Low Patent Density + High Clinical Activity: This is a rare but powerful signal. It might suggest a race to be first-to-market with a novel mechanism where the IP is still being established. It could also indicate that the primary IP is held by an academic institution, with multiple companies licensing the technology to pursue clinical development.

- Correlating Specific Patents to Specific Trials: The ultimate goal is to link a competitor’s specific patent filings (e.g., a new method-of-use patent for Drug X in Alzheimer’s disease) to a newly initiated clinical trial (e.g., a Phase II study of Drug X in Alzheimer’s patients). This direct link confirms a strategic move, transforming a potential threat into a tangible one and providing a clear picture of the competitor’s lifecycle management or repurposing strategy.

Step 3 – Visualizing the White Space: Making Complexity Intuitive

The sheer volume of data generated in this analysis can be overwhelming. Data visualization is essential for distilling this complexity into clear, intuitive formats that can be easily understood by executive decision-makers who may not be IP or clinical experts.58

Effective visualization techniques can instantly reveal patterns and opportunities that would remain hidden in spreadsheets and document lists. Common and powerful visualization methods include 58:

- Heat Maps: These are excellent for showing competitive density. A matrix can be created with technology sub-classes (e.g., different kinase targets) on one axis and key competitors on the other. The cells are then colored based on the number of patents filed, instantly highlighting “hot spots” of intense activity and “cold spots” that represent potential white spaces.

- Network Maps: These diagrams visualize relationships. For example, a citation map can show which patents are most influential (i.e., cited most often by later patents), revealing foundational technologies in a field. A collaboration map can show connections between academic institutions and companies based on co-assigned patents.

- Bubble Charts: These are useful for multi-dimensional analysis. For instance, a chart could plot therapeutic areas where the X-axis represents the number of patents, the Y-axis represents the number of active clinical trials, and the size of the bubble represents the estimated market size or patient population. White spaces would appear as large bubbles in the lower-left quadrant (high need, low activity).

- Geographic Maps: These can be used to overlay patent filing locations, showing where R&D is being conducted and which markets companies are prioritizing for protection.

The AI Co-Pilot: Automating and Deepening the Analysis

The manual execution of this playbook is resource-intensive. The rise of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing the process, turning it from a static, project-based analysis into a dynamic, continuous intelligence function.60

AI’s impact is felt across the entire workflow:

- Automated Landscaping: AI algorithms can now read and classify millions of patent documents and clinical trial records in minutes, using Natural Language Processing (NLP) to understand the technical content and group related documents, even if they don’t share the same keywords.62

- Predictive Analytics: ML models can be trained on historical data to predict the probability of clinical trial success, identify potential safety signals, or even forecast the likelihood of a patent being granted.62

- Human-in-the-Loop (HITL) Synergy: The most effective model is not a full replacement of human experts but a synergistic partnership. AI acts as a powerful “co-pilot,” performing the massive-scale data processing and pattern recognition. This frees up human analysts to focus on the highest-value tasks: interpreting the results, applying strategic context, and making the final nuanced judgments that machines cannot.54

To make this process tangible, the following matrix provides a framework for linking common strategic questions to the specific data points and synthesized insights needed to answer them.

| Strategic Question | Key Patent Data Points | Key Clinical Trial Data Points | Synthesized Insight & Recommended Action |

| Is this new therapeutic target a viable ‘white space’ or a hidden trap? | Number of granted CoM patents; Filing velocity of new applications; Top assignees; Forward citation trends. | Number of trials by phase targeting this mechanism; Status of lead competitor trials; Endpoints being used. | Insight: Low patent density but one competitor has a fast-tracked Phase IIb trial. This is a closing window of opportunity, not an open white space. Action: Consider in-licensing or pivot to a different target. |

| Should we pursue a next-generation version of our competitor’s drug? | Expiration date of core CoM patent; Density of secondary patents (formulation, delivery); Recent filings for new polymorphs or methods of use. | Number of trials for the original drug vs. any new formulations; Patient enrollment status for next-gen trials; Reported adverse events for the current drug. | Insight: The competitor’s core patent expires in 3 years, but they have a dense thicket of formulation patents and an active Phase III trial for a once-weekly version. A direct generic challenge is high-risk. Action: Focus R&D on a novel delivery mechanism (e.g., patch) that is not covered by their IP. |

| Is there an opportunity to repurpose our failed oncology drug? | Review our own patent portfolio for broad method-of-use claims; Search for patents from others citing our original compound in different therapeutic areas. | Search for investigator-initiated trials or published case studies using our drug off-label; Analyze trials for drugs with similar mechanisms of action in other diseases. | Insight: Our drug failed for efficacy in oncology, but its mechanism is relevant to autoimmune disorders. A small academic group has published a case series showing promise, and the patent landscape in that indication is sparse. Action: Initiate a small, focused Phase IIa proof-of-concept trial for rheumatoid arthritis. |

| Which small biotech is the most attractive acquisition target in the gene therapy space? | Strength and breadth of the target’s core platform patents; FTO analysis of their lead candidate; Inventor pedigree and citation velocity. | Phase and status of their lead clinical program; Quality of early clinical data (safety and biomarkers); Alignment of their trial endpoints with regulatory expectations. | Insight: Target A has exciting early data but a weak, narrow patent portfolio. Target B is pre-clinical but holds broad, foundational platform patents with a clear FTO. Action: Prioritize Target B for due diligence; the long-term strategic value of their IP outweighs Target A’s near-term clinical lead. |

Section V: Strategic Execution – Translating White Space into Pipeline Value

The ultimate goal of white space analysis is not to produce an interesting report, but to drive better, more profitable R&D decisions. A well-executed analysis provides a strategic roadmap that can be applied across the entire spectrum of the R&D enterprise, from high-level portfolio choices to the tactical management of individual assets.

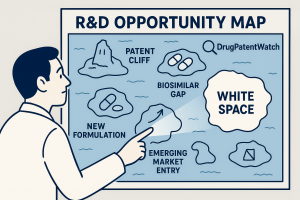

Informing Therapeutic Area (TA) Selection and Portfolio Strategy

One of the most consequential decisions a pharmaceutical company can make is which therapeutic areas to enter, invest in, or exit. These are multi-billion-dollar, decade-long commitments. A macro-level white space analysis, conducted across multiple disease areas, provides a powerful, data-driven framework for making these choices.64

The analysis allows leadership to compare and contrast different TAs based on objective criteria:

- Degree of Scientific Opportunity: Where is the biological understanding of disease rapidly advancing, and where is the science stagnant?

- Level of Competitive Saturation: Which TAs are dominated by a few entrenched players with formidable IP, and which are more fragmented and open to new entrants?

- Magnitude of Unmet Need: Where do patients and healthcare systems have the most pressing needs that are not being met by current standards of care?

By focusing resources on therapeutic areas that score favorably across these dimensions—areas of high unmet need and manageable competitive and IP landscapes—companies can significantly improve their odds of success. This data-driven approach aligns with findings from top-tier strategy consultants. McKinsey, for example, found that first-time launchers with assets in “white space” indications (defined as having no competitors) are 1.7 times more likely to exceed launch expectations than those entering markets with three or more competitors.67 Similarly, research from BCG underscores the value of focus, showing that biopharma companies deriving 70% or more of their revenue from their top two TAs delivered significantly higher total shareholder returns than more diversified firms.68 White space analysis provides the map to identify and build these defensible, high-value franchises.

De-Risking Go/No-Go Decisions for Individual Assets

Moving from the portfolio level to the project level, white space analysis is a critical input for the stage-gate decisions that govern an asset’s progression through the pipeline.13 At each major milestone—such as the transition from preclinical to Phase I, or from Phase II to Phase III—a project team must make a compelling case to continue investing what will become an exponentially larger amount of capital.

Traditionally, these “go/no-go” decisions are heavily weighted toward the asset’s own scientific and clinical data. White space analysis introduces an essential external context. A project might have stellar Phase IIa data, but the decision to launch a hugely expensive Phase III program looks very different if the analysis reveals that three competitors with similar mechanisms of action have just entered Phase III and have already secured broad, blocking patents.71

This objective, external view of the competitive and IP reality serves as a powerful antidote to the internal biases that often plague R&D decision-making. Cognitive traps like the “sunk-cost fallacy” (continuing a project because so much has already been invested), “champion bias” (over-weighting the opinion of an influential internal advocate), and “not invented here” syndrome can lead to what is known as a Type I error: incorrectly advancing a flawed candidate that is destined for commercial failure.4 By forcing teams to confront the external landscape, white space analysis helps to instill a more rigorous, “truth-seeking” culture and improves the quality of capital allocation.14

Uncovering “Hidden Gems”: Drug Repurposing and M&A/Licensing

White space analysis is not only about de-risking existing projects but also about sourcing new ones in a capital-efficient manner. It is a powerful engine for identifying two types of “hidden gems”: drug repurposing candidates and external licensing or acquisition targets.

Drug Repurposing

Drug repurposing (or repositioning) is the strategy of finding new therapeutic uses for existing drugs.73 Its primary advantage is that it starts with a de-risked asset that already has a well-characterized safety and manufacturing profile, dramatically reducing development time and cost.74 Landmark successes like sildenafil (Viagra), originally studied for angina, and thalidomide, repurposed for multiple myeloma, demonstrate the transformative potential of this approach.73

Patent analysis is a cornerstone of this strategy. By searching for new method-of-use patents, companies can protect a repurposed drug for its new indication, creating a fresh period of market exclusivity.36 A white space analysis can systematically identify these opportunities by:

- Analyzing a company’s own portfolio of shelved or failed compounds for new applications in less crowded therapeutic areas.

- Screening the patent literature for academic or small company filings that disclose a new use for an established, off-patent drug, creating an opportunity to develop a proprietary formulation and clinical program around it.

M&A and In-Licensing

For larger companies, white space analysis is a primary tool for corporate and business development, specifically for identifying M&A and in-licensing targets.15 After a strategic analysis identifies a high-potential white space where the company lacks internal capabilities, the next logical step is to scan the landscape for smaller biotech or academic groups that

do have relevant assets.

The analysis can pinpoint early-stage companies with strong, foundational IP in a desired area, making them attractive targets for acquisition, licensing, or partnership.18 The detailed patent and clinical trial data gathered during the white space analysis then becomes the foundation for the subsequent due diligence process, allowing the acquirer to rigorously assess the strength of the target’s IP, the stage of its clinical programs, and its overall strategic fit.76

Proactive Lifecycle Management (LCM)

Finally, the value of white space analysis extends beyond the initial R&D phase into the full lifecycle of a commercialized drug. For a mature product facing the patent cliff, a forward-looking analysis is essential for proactive lifecycle management.25

By mapping the landscape around their own successful drug, a company can identify white space opportunities for next-generation improvements. This could involve developing and patenting 77:

- A new, more convenient formulation (e.g., changing from a twice-daily pill to a once-weekly injection).

- A new delivery device (e.g., a smart auto-injector with better usability).

- A new combination therapy that pairs the existing drug with another compound to enhance efficacy or address a new patient population.

Each of these line extensions, if successful, can generate new intellectual property, build upon the established brand equity and safety profile of the original drug, and extend the product franchise’s revenue stream for years beyond the expiration of the initial composition of matter patent. This transforms LCM from a reactive, defensive posture into a proactive, innovation-driven strategy.

Section VI: The Future Horizon – The Next Generation of White Space Analysis

The methodology of fusing patent and clinical trial data has already proven to be a powerful strategic tool. However, the landscape of data and analytics is evolving at a breathtaking pace. The R&D leaders who will win in the coming decade will be those who not only master the current playbook but also anticipate and integrate the next wave of innovation. The future of white space analysis will be defined by three key trends: the integration of a third dimension of data, the profound impact of AI on the very nature of intellectual property, and the transition from static analysis to a dynamic, real-time intelligence engine.

The Third Dimension: Integrating Real-World Evidence (RWE)

The current dual-lens model is powerful: patent data reveals what is protected, and clinical trial data shows what is in development. The next frontier is the integration of a third, equally potent data stream: Real-World Evidence (RWE). Derived from the massive, anonymized datasets of electronic health records (EHRs), insurance claims, and patient registries, RWE reveals how existing treatments are actually performing in the messy, heterogeneous environment of everyday clinical practice.78

Integrating RWE adds a profound layer of granularity to the identification of unmet needs. While a clinical trial might show that a standard-of-care drug is effective on average, RWE can pinpoint specific, well-defined subpopulations of patients who respond poorly, experience intolerable side effects, or discontinue therapy at high rates. This allows for the identification of hyper-specific white spaces that were previously invisible.78

The white space of the future will not be as broad as “a new treatment for non-small cell lung cancer.” Instead, it will be as precise as “a new treatment for non-small cell lung cancer patients with a KRAS G12C mutation who have progressed after first-line immunotherapy.” RWE provides the map to find these high-value, targeted opportunities, enabling the development of precision medicines that deliver superior outcomes to the right patients.

The Shifting Sands of IP: AI and the Future of “Obviousness”

The rise of AI in drug discovery is not just an efficiency tool; it is a force that will fundamentally reshape the intellectual property landscape. One of the core tenets of patent law is that an invention must be “non-obvious” (in the U.S.) or possess an “inventive step” (in Europe) to be patentable. This standard is judged through the eyes of a hypothetical “Person Having Ordinary Skill in The Art” (PHOSITA), who is presumed to have knowledge of all existing prior art.63

As AI tools for target identification, molecule design, and literature analysis become standard and ubiquitous in the industry—with over 90% of companies now investing in AI for drug discovery—the legal definition of what constitutes “ordinary skill” will inevitably rise to include proficiency with these tools.63

This has profound implications. In the near future, a new molecule that could be predictably generated by a standard AI model, given a known biological target and public chemical databases, may be deemed “obvious to try” and therefore unpatentable. Securing a patent will require a demonstration of human ingenuity that goes beyond what a standard AI could generate.

This means that future white space analysis will need to evolve. It will no longer be sufficient to ask, “Is anyone else patenting this?” The new, critical question will be, “Could a standard AI model have discovered this?” This will push R&D strategy away from crowded, “AI-obvious” chemical spaces and toward truly novel, paradigm-shifting science that is both clinically valuable and legally defensible.

From Static Report to Dynamic Intelligence Engine

Finally, the very nature of how white space analysis is conducted is transforming. Historically, it has been a project-based activity—a comprehensive landscape report commissioned at a specific point in time to inform a major strategic decision. The future, however, lies in transforming this process into a continuous, real-time, and dynamic intelligence function.70

AI-powered platforms will continuously monitor the global flow of patent filings, clinical trial updates, scientific publications, and regulatory news. Instead of a static report, R&D and business development teams will have access to a live dashboard with real-time alerts, flagging 62:

- A competitor’s new patent filing in a key area of interest.

- The initiation or termination of a critical clinical trial.

- An emerging technology trend signaled by a cluster of new academic publications.

- A newly opening white space created by the clinical failure of a competitor’s lead asset.

This shift from periodic, static analysis to an always-on, dynamic intelligence engine represents the ultimate maturation of the discipline. It embeds data-driven foresight directly into the daily workflow of the R&D organization, enabling teams to anticipate, adapt, and act with unprecedented speed and agility. In the relentless race of pharmaceutical innovation, the ability to see the landscape not as it was, but as it is becoming, will be the ultimate competitive advantage.

A Sobering Reality: The Compression of Pharmaceutical Lifecycles

“The window for a new drug to achieve 50% of its lifetime sales has shrunk by a staggering 18 to 24 months since the year 2000.”

— McKinsey & Company 25

This dramatic compression of commercial lifecycles underscores the critical need for speed, efficiency, and strategic foresight in R&D. The traditional, linear model of drug development is no longer sufficient. Companies must identify high-potential opportunities earlier, de-risk them faster, and make go/no-go decisions with greater confidence. The integrated, data-driven approach of white space analysis is not a luxury; it is a core capability required to win in this accelerated environment.

Key Takeaways

- White Space Analysis is a Strategic Imperative: In an era of escalating R&D costs (averaging over $2.23 billion per new drug) and stagnant productivity, white space analysis is no longer a niche IP function but a core strategic discipline for risk management and capital allocation.

- A Dual-Lens Approach is Essential: True R&D opportunities lie at the intersection of two landscapes: the Patent Landscape (what is protected and legally feasible) and the Clinical & Unmet Need Landscape (what is medically necessary and commercially valuable). Analyzing one without the other leads to strategic blind spots.

- Data Integration is the Key to Insight: The power of this analysis comes from the triangulation of disparate data sources. Fusing intelligence from patent databases (USPTO, EPO, WIPO) with signals from clinical trial registries (ClinicalTrials.gov, CTIS) transforms raw data into a predictive, multi-dimensional view of the competitive environment.

- It Informs the Entire R&D Value Chain: White space analysis provides critical, data-driven inputs for a wide range of strategic decisions, including high-level Therapeutic Area Selection, project-level Go/No-Go Decisions, opportunity scouting for Drug Repurposing and M&A, and proactive Lifecycle Management.

- Visualization and AI are Force Multipliers: Given the immense volume and complexity of the data, visualization techniques (heat maps, network maps) are crucial for communicating insights effectively. AI and Machine Learning are automating the heavy lifting of data analysis and creating a “human-in-the-loop” model where experts can focus on high-level strategy.

- The Future is Dynamic and Multi-Dimensional: The discipline is evolving to incorporate a third data stream—Real-World Evidence (RWE)—to identify hyper-specific patient populations. Furthermore, the rise of AI in drug discovery is raising the legal bar for “non-obviousness,” pushing future innovation toward truly groundbreaking science.

Frequently Asked Questions (FAQ)

1. How does the application of white space analysis differ for a small, venture-backed biotech versus a large, established pharmaceutical company?

While the core principles remain the same, the strategic application differs significantly. For a small biotech, white space analysis is primarily a tool for survival and validation. It is used to identify a highly focused, defensible niche where they can establish a strong IP position and demonstrate a clear path to value with limited resources. Their analysis is often used to build a compelling case for investors, proving that their chosen target is not only scientifically sound but also sits in a “blue ocean” with manageable competitive threats. For large pharma, white space analysis is a tool for portfolio management and strategic growth. They use it at a macro level to decide which therapeutic areas to enter or exit, and at a micro level to identify external assets for acquisition or in-licensing to fill gaps in their existing pipeline. It also informs their extensive lifecycle management strategies for blockbuster drugs.

2. What is the single biggest mistake companies make when implementing a white space analysis program?

The most common and costly mistake is organizational siloing. The analysis is often commissioned by either the IP/Legal department or the R&D/Commercial strategy team, but not by both in a truly integrated fashion. When the IP team runs the analysis, it can become an overly technical patent-counting exercise that misses the clinical and commercial context of unmet need. When the commercial team runs it, they may identify a massive market opportunity without fully appreciating the insurmountable patent thicket that makes it inaccessible. The failure to create a cross-functional team from the outset is the primary reason these initiatives fail to deliver actionable, strategic value.

3. Can white space analysis predict the next “hot” therapeutic area, or is it better suited for finding incremental innovations?

It can do both, but its strength lies in providing a data-driven foundation for either path. For identifying the next “hot” area, the analysis would focus on macro trends: looking for emerging biological targets with a sudden acceleration in academic publications and early patent filings, but with few clinical trials yet underway. This points to a nascent, potentially transformative field. For incremental innovation, the analysis is more focused. It might look at an established market (like TNF-alpha inhibitors) and identify a white space for a new formulation (e.g., a long-acting injectable) or a new indication where the mechanism is plausible but has not been clinically tested or patented by competitors. The former is a high-risk, high-reward bet on a new frontier; the latter is a lower-risk, data-rich strategy to optimize value in a known territory.

4. How can a company measure the Return on Investment (ROI) of its white space analysis activities?

Measuring the ROI of an intelligence function can be challenging but is not impossible. It can be assessed through both quantitative and qualitative metrics. Quantitatively, a company can track the “cost avoidance” from “no-go” decisions made on projects that the analysis revealed to have high IP or competitive risk, saving potentially hundreds of millions in failed late-stage development costs. Conversely, for projects that were initiated based on the analysis, the company can track their success rates, time-to-market, and eventual revenue, attributing a portion of that value to the initial strategic decision. Qualitatively, ROI can be measured through improvements in decision-making speed and confidence, enhanced cross-functional alignment between R&D, legal, and commercial teams, and a more focused and strategically sound R&D portfolio.

5. With the rapid advancement of AI, will the role of the human analyst in white space analysis become obsolete?

No, the role will not become obsolete; it will become more strategic. AI is exceptionally powerful at the “what”—processing and finding patterns in vast datasets at a scale and speed no human can match. However, human experts will remain indispensable for the “so what.” The future is a “human-in-the-loop” model where AI acts as a co-pilot. The human analyst’s role will shift from laborious data collection and manual classification to higher-level tasks: asking the right strategic questions, interpreting the AI’s output within a complex business and legal context, identifying the subtle nuances and “weak signals” that algorithms might miss, and ultimately, weaving the data into a compelling strategic narrative to guide executive decision-making. AI will handle the computation; humans will provide the wisdom.

References

- Maximizing ROI on Drug Development by Monitoring Competitive Patent Portfolios, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- Measuring the return from pharmaceutical innovation 2024 | Deloitte US, accessed August 16, 2025, https://www.deloitte.com/us/en/Industries/life-sciences-health-care/articles/measuring-return-from-pharmaceutical-innovation.html

- Drug development cost pharma $2.2B per asset in 2024 as GLP-1s drive financial return: Deloitte – Fierce Biotech, accessed August 16, 2025, https://www.fiercebiotech.com/biotech/drug-development-cost-pharma-22b-asset-2024-plus-how-glp-1s-impact-roi-deloitte

- Mastering Strategic Decision-Making in the Pharmaceutical R&D Portfolio – DrugPatentWatch – Transform Data into Market Domination, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/decision-making-product-portfolios-pharmaceutical-research-development-managing-streams-innovation-highly-regulated-markets/

- Accelerating clinical trials to improve biopharma R&D productivity – McKinsey, accessed August 16, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/accelerating-clinical-trials-to-improve-biopharma-r-and-d-productivity

- The Biopharmaceutical Industry Fueling the U.S. Economy … – PhRMA, accessed August 16, 2025, https://phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Refresh/Industry-Profile-2022/The-Biopharmaceutical-Industry-Fueling-the-US-Economy-and-Global-Competitiveness-2.pdf

- Global pharma R&D returns rise as GLP-1 drugs help drive forecast growth – Deloitte, accessed August 16, 2025, https://www.deloitte.com/uk/en/about/press-room/global-pharma-rd-returns-rise-as-one-glp-drugs-help-drive-forecast-growth.html

- Deloitte’s 15th Annual Pharmaceutical Innovation Report: Pharma R&D Returns Continue Upward for Second Consecutive Year – PR Newswire, accessed August 16, 2025, https://www.prnewswire.com/news-releases/deloittes-15th-annual-pharmaceutical-innovation-report-pharma-rd-returns-continue-upward-for-second-consecutive-year-302410138.html

- Navigating Pharmaceutical Sales Forecasting for Strategic Advantage – DrugPatentWatch – Transform Data into Market Domination, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/annual-pharmaceutical-sales-estimates-using-patents-a-comprehensive-analysis/

- Managing Patent Portfolios in the Pharmaceutical Industry – PatentPC, accessed August 16, 2025, https://patentpc.com/blog/managing-patent-portfolios-in-the-pharmaceutical-industry

- A Strategic Analysis of Mergers and Acquisitions in Generic Drug Development, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/mergers-and-acquisitions-opportunities-and-challenges-in-generic-drug-development/

- Acquisitions, Licensing Deals Take Centerstage in Pharma/Biotech Space | Nasdaq, accessed August 16, 2025, https://www.nasdaq.com/articles/acquisitions-licensing-deals-take-centerstage-pharma-biotech-space

- White Space Analysis And Patent Landscape Analysis – IIPRD, accessed August 16, 2025, https://www.iiprd.com/white-space-analysis/

- Transforming AstraZeneca’s R&D productivity, accessed August 16, 2025, https://www.astrazeneca.com/what-science-can-do/topics/disease-understanding/transforming-astrazenecas-rd-productivity.html

- Patent Landscape: Extracting the Whitespaces – XLSCOUT, accessed August 16, 2025, https://xlscout.ai/patent-landscape-extracting-the-whitespaces/

- How to Conduct a Drug Patent FTO Search: A Strategic and Tactical …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/how-to-conduct-a-drug-patent-fto-search/

- Best Practices for Drug Patent Portfolio Management: Maximizing Value in Pharmaceutical Innovation – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/best-practices-for-drug-patent-portfolio-management-maximizing-value-in-pharmaceutical-innovation/

- Patent Landscaping for Tech Giants: Identifying White Space – TT CONSULTANTS, accessed August 16, 2025, https://ttconsultants.com/patent-landscaping-for-tech-giants-identifying-white-space/

- Unmet Medical Need – Industry’s Perspective – Biocurate, accessed August 16, 2025, https://www.biocurate.com/resources/unmet-medical-need-industrys-perspective/

- Let’s dig deeper on Unmet Medical Need (Guest Blog) – EFPIA, accessed August 16, 2025, https://www.efpia.eu/news-events/the-efpia-view/blog-articles/let-s-dig-deeper-on-unmet-medical-need/

- Addressing Unmet Medical Need: A Guide for Pharmaceutical Industries, accessed August 16, 2025, https://adragos-pharma.com/unmet-medical-need/

- Towards a New Understanding of Unmet Medical Need – PMC – PubMed Central, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8545781/

- Biopharma’s Patent Cliff Puts Costs Front and Center – Boston Consulting Group, accessed August 16, 2025, https://www.bcg.com/publications/2025/patent-cliff-threatens-biopharmaceutical-revenue

- Strategic Imperatives: Leveraging Patent Pending Data for Competitive Advantage in the Pharmaceutical Industry – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/leveraging-patent-pending-data-for-pharmaceuticals/

- The Art of the Second Act: A Six-Step Framework for Mastering Late …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/6-steps-to-effective-late-stage-lifecycle-drug-management/

- United States Patent and Trademark Office – Patent Assignment Search – USPTO, accessed August 16, 2025, https://assignment.uspto.gov/patent/index.html

- Searchable indexes | USPTO, accessed August 16, 2025, https://www.uspto.gov/patents/search/patent-public-search/searchable-indexes

- Patent Classification – USPTO, accessed August 16, 2025, https://www.uspto.gov/patents/search/classification-standards-and-development

- Pharmaceutical patenting in the European Union: reform or riddance – PMC, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8592279/

- Data | epo.org – European Patent Office, accessed August 16, 2025, https://www.epo.org/en/searching-for-patents/data

- PATENTSCOPE – WIPO, accessed August 16, 2025, https://www.wipo.int/en/web/patentscope

- Pat-INFORMED – The Gateway to Medicine Patent Information – WIPO, accessed August 16, 2025, https://www.wipo.int/pat-informed/en/

- Leveraging Drug Patent Data for Strategic Investment Decisions: A …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/leveraging-drug-patent-data-for-strategic-investment-decisions-a-comprehensive-analysis/

- The Pharmaceutical Patent Playbook: Forging Competitive Dominance from Discovery to Market and Beyond – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/developing-a-comprehensive-drug-patent-strategy/

- Beyond the Bench: Transforming Biopharmaceutical Strategy with Patent Intelligence, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/beyond-the-bench-transforming-biopharmaceutical-strategy-with-patent-intelligence/

- Biopharmaceuticals: The Patent Implications of Drug Repurposing – PatentPC, accessed August 16, 2025, https://patentpc.com/blog/patent-implications-of-drug-repurposing

- ClinicalTrials.gov Program – Human Research Protections, accessed August 16, 2025, https://hrp.weill.cornell.edu/regulatory-compliance/clinicaltrialsgov-program

- Finding a Clinical Trial | National Institutes of Health (NIH), accessed August 16, 2025, https://www.nih.gov/health-information/nih-clinical-research-trials-you/finding-clinical-trial

- How to Read a Study Record | ClinicalTrials.gov, accessed August 16, 2025, https://clinicaltrials.gov/study-basics/how-to-read-study-record

- Getting the Full Picture with ClinicalTrials.gov: Why and How to Take Advantage of Transparency in Your Research, accessed August 16, 2025, https://www.nlm.nih.gov/oet/ed/ct/full_picture.html

- About ClinicalTrials.gov, accessed August 16, 2025, https://clinicaltrials.gov/about-site/about-ctg

- Study Data Structure | ClinicalTrials.gov, accessed August 16, 2025, https://clinicaltrials.gov/data-about-studies/study-data-structure

- ClinicalTrials.gov: Home, accessed August 16, 2025, https://clinicaltrials.gov/

- How to Edit Your Study Record | ClinicalTrials.gov, accessed August 16, 2025, https://clinicaltrials.gov/submit-studies/prs-help/how-edit-record

- The New Paradigms in Clinical Research: From Early Access Programs to the Novel Therapeutic Approaches for Unmet Medical Needs – Frontiers, accessed August 16, 2025, https://www.frontiersin.org/journals/pharmacology/articles/10.3389/fphar.2019.00111/full

- Protocol Registration Data Element Definitions for Interventional and Observational Studies, accessed August 16, 2025, https://clinicaltrials.gov/policy/protocol-definitions

- Results Data Element Definitions for Interventional and Observational Studies | ClinicalTrials.gov, accessed August 16, 2025, https://clinicaltrials.gov/policy/results-definitions

- EudraCT Public website – Home page, accessed August 16, 2025, https://eudract.ema.europa.eu/

- Clinical trials in human medicines | European Medicines Agency (EMA), accessed August 16, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/research-development/clinical-trials-human-medicines

- Detailed guidance on the European clinical trials database (EUDRACT Database) April 2003 – Public Health – European Commission, accessed August 16, 2025, https://health.ec.europa.eu/document/download/578b6178-f693-486f-8da3-d9cbe460d86b_en?filename=13_cp_and_guidance_eudract_april_04_en.pdf

- The European Union Clinical Trials Register allows you to search for protocol and results information on, accessed August 16, 2025, https://www.clinicaltrialsregister.eu/ctr-search/search

- A Handbook for Patent Data Quality | LexisNexis IP, accessed August 16, 2025, https://www.lexisnexisip.com/wp-content/uploads/2022/04/A-Handbook-for-Patent-Data-Quality.pdf

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed August 16, 2025, https://crozdesk.com/software/drugpatentwatch

- Revolutionizing Patent Landscaping: Combining Human Supervision and AI in Identifying Tech Clusters for Pharmaceutical and Biotechnology Innovation – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/revolutionizing-patent-landscaping-a-human-supervised-ai-approach-to-identify-tech-clusters/

- Patent landscape analysis—Contributing to the identification of technology trends and informing research and innovation funding policy – PubMed Central, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10034625/

- Understanding Pharmaceutical Competitor Analysis – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/the-importance-of-pharmaceutical-competitor-analysis/

- Charting the path to patients: Optimizing drug pipelines | McKinsey, accessed August 16, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/charting-the-path-to-patients

- Patent visualisation – Wikipedia, accessed August 16, 2025, https://en.wikipedia.org/wiki/Patent_visualisation

- Patent Landscape Visualization: Intellectual Property Analysis Tools : r/AnalyticsAutomation, accessed August 16, 2025, https://www.reddit.com/r/AnalyticsAutomation/comments/1llgk8b/patent_landscape_visualization_intellectual/

- AI in Biopharma Innovation and Regulatory Challenges – with Nishtha Jain of Takeda Pharmaceuticals – Emerj Artificial Intelligence Research, accessed August 16, 2025, https://emerj.com/ai-in-biopharma-innovation-and-regulatory-challenges-nishtha-jain-takeda-pharmaceuticals/

- How AI Is Reshaping Pharma: Use Cases, Challenges – Whatfix, accessed August 16, 2025, https://whatfix.com/blog/ai-in-pharma/

- How to Leverage Pharma Competitive Intelligence for Growth …, accessed August 16, 2025, https://amplyfi.com/blog/how-to-leverage-pharma-competitive-intelligence-for-growth/

- How AI and Machine Learning are Forging the Next Frontier of …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/how-ai-and-machine-learning-are-forging-the-next-frontier-of-pharmaceutical-ip-strategy/

- Whitespace in business: All about Whitespace Analysis, accessed August 16, 2025, https://www.demandfarm.com/blog/whitespace-in-business/

- Therapeutic Areas in Clinical Trials: Why Is It Important – ClinMax, accessed August 16, 2025, https://clinmax.com/therapeutic-areas-in-clinical-trials/

- How to Track Competitor R&D Pipelines Through Drug Patent …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- Small but mighty: Priming biotech first-time launchers to … – McKinsey, accessed August 16, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/small-but-mighty-priming-biotech-first-time-launchers-to-compete-with-established-players

- Biopharma Trends: Focus on Innovation Amid Complexity | BCG, accessed August 16, 2025, https://www.bcg.com/publications/2025/biopharma-trends

- Focusing on Innovation amid Complexity – Boston Consulting Group, accessed August 16, 2025, https://web-assets.bcg.com/61/cd/f2a99e6e4ea4bf4857c19e87734d/focusing-on-innovation-amid-complexity-jan-2025.pdf

- White Space Analysis: What it is & Why it Matters – Minesoft, accessed August 16, 2025, https://minesoft.com/white-space-analysis-what-it-is-why-it-matters/

- White Space Analysis: Expanding Your R&D Potential – Ingenious-e-Brain, accessed August 16, 2025, https://www.iebrain.com/white-space-analysis-expanding-your-rd-potential/

- How debunking biases in research and development decisions could lead to more equitable healthcare? – PMC, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11252826/

- Drug Repurposing: An Overview – DrugPatentWatch – Transform …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/drug-repurposing-an-overview/

- The Repositioning Revolution: Transforming Patent Data into Pharmaceutical Competitive Advantage – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/review-of-drug-repositioning-approaches-and-resources/

- Drug Repositioning in the Mirror of Patenting: Surveying and Mining Uncharted Territory, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5736531/

- A Comprehensive Guide to Pharmaceutical Patent Due Diligence in Mergers & Acquisitions, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/ma-patent-due-diligence-comprehensive-guide/

- Effective Strategies for Post-Approval Lifecycle Management and Local Pharmacovigilance – IQVIA, accessed August 16, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/effective_strategies_for_post-approval_lcm.pdf

- Real-world clinico-genomic evidence can fill knowledge gaps and identify unmet needs for patients with lung cancer – Flatiron Health, accessed August 16, 2025, https://resources.flatiron.com/real-world-evidence/real-world-clinico-genomic-evidence-can-fill-knowledge-gaps-and-identify-unmet-needs-for-patients-with-lung-cancer

- IP trends in the pharmaceutical industry | Dennemeyer.com, accessed August 16, 2025, https://www.dennemeyer.com/ip-blog/news/ip-trends-in-the-pharmaceutical-industry/

- The State of Competitive Intelligence in Pharma: Key Trends for 2025 | Northern Light – Machine learning AI-powered knowledge management, accessed August 16, 2025, https://northernlight.com/competitive-intelligence-in-pharma-key-trends/