1. Executive Strategic Assessment: The Myth of Decoupling

The global pharmaceutical supply chain currently operates under a pervasive cognitive dissonance. On one side exists the political rhetoric of “de-risking,” “friend-shoring,” and “supply chain sovereignty,” driven by Western governments responding to the vulnerabilities exposed by the COVID-19 pandemic. On the other side lies the immutable economic and chemical reality of 2025: China’s dominance over the Active Pharmaceutical Ingredient (API) market has not only endured but, in critical sub-sectors, intensified.

As of early 2025, the global API market is valued at approximately $247.8 billion, with projections indicating a rise to $347.9 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 5.90%.1 Within this massive aggregate, China serves as the structural foundation. While India is frequently cited as the alternative “Pharmacy of the World,” the data reveals that India’s pharmaceutical prowess is heavily dependent on Chinese inputs. Approximately 70% of India’s API needs—and up to 90% for critical antibiotics like cephalosporins and penicillin—are met by Chinese imports.1

The narrative that manufacturing is simply shifting from China to other low-cost jurisdictions fails to account for the complexity of the chemical value chain. Manufacturing a finished drug is a vertical integration of Key Starting Materials (KSMs), intermediates, and APIs. China’s grip is tightest at the bottom of this pyramid—the KSMs and intermediates—where high environmental costs and low margins have driven Western and even Indian producers out of the market.

This report provides an exhaustive analysis of the Chinese generic API market in 2026. It moves beyond superficial trade statistics to examine the underlying chemical, regulatory, and financial mechanics that sustain China’s hegemony. It dissects the implications of the December 2024 export tax rebate removal, the 2025 surge in FDA data integrity enforcement, and the operational realities of the “China Plus One” strategy.

Industry Insight: “China accounts for 37.68% of the Asia-Pacific API CDMO market… From the perspective of the United States, China supplies approximately 17% of API imports, though this represents only around 6% of overall U.S. pharmaceutical imports. This statistic highlights an important nuance: while China dominates certain segments, particularly generic APIs, its penetration varies significantly across different pharmaceutical categories.” 1

The statistic above—that China supplies only 17% of US API imports—is technically accurate but strategically misleading. It measures direct shipments. It does not account for the volume of APIs entering the US from India or Europe that are chemically synthesized from Chinese KSMs. When the full “molecular passport” of a generic drug is audited, China’s effective control over the US generic supply chain is estimated to be closer to 80%.1

2. Market Structure and Quantitative Analysis

2.1 The 2026 Market Baseline

The distinction between “innovative” and “generic” APIs is crucial for understanding China’s strategic positioning. The innovative API segment, valued at $147.45 billion in 2024, is largely dominated by Western multinationals, though China is making aggressive inroads via its Contract Development and Manufacturing Organizations (CDMOs). However, the generic API segment, valued at $78.69 billion, is the arena of China’s undisputed leadership.1

This leadership is quantifiable in regulatory filings. The Drug Master File (DMF) is the standard filing submitted to the FDA to provide confidential detailed information about facilities, processes, or articles used in the manufacturing, processing, packaging, and storing of human drug products.

Table 1: Global API DMF Filing Trends (2021–2024)

| Metric | China | India | EU | United States |

| Share of Total Active DMFs (2024) | 18% (Up from 13% in 2021) | 48% (Flat) | 16% (Down from 22%) | 8% (Down from 10%) |

| Share of New DMF Filings (2024) | 45% (Top Position) | <45% | Declining | 3% |

| Primary Market Focus | Generic APIs, KSMs, Intermediates | Generic Formulations, APIs | Innovative APIs, Complex Generics | Innovative Biologics |

Data Source: 3

The surge in China’s share of new filings—surpassing India for the first time in two decades in 2024—is a leading indicator.3 It suggests that the next generation of generic drugs launching in the US and EU markets will be increasingly reliant on Chinese manufacturing processes established today. While India retains a lead in legacy files (Total Active DMFs), China is winning the race for future molecules.

2.2 The CDMO Pivot

China is not content with being the world’s factory for low-margin commodity chemicals. The “Made in China 2025” industrial policy has driven a pivot toward higher value-added services. China now accounts for 37.68% of the Asia-Pacific API CDMO market, which was valued at $118.6 billion in 2023.1

This shift creates a dual-track market:

- Commodity Track: Massive, state-backed enterprises (SOEs) churning out thousands of tons of penicillin, vitamins, and analgesics at razor-thin margins.

- Service Track: Agile, private-sector CDMOs (like Porton Pharma, Asymchem) offering complex chemistry services to Western biotech firms, often indistinguishable in quality from European competitors but at a fraction of the cost.

3. The Upstream Bottleneck: Key Starting Materials (KSMs)

3.1 The Chemical Hierarchy

To understand why “decoupling” is logistically improbable, one must analyze the chemical hierarchy of drug production. A finished dosage form (the pill) is made from an API. The API is synthesized from Intermediates. Intermediates are synthesized from Key Starting Materials (KSMs). KSMs are derived from Basic Chemicals.

China’s dominance increases as one moves down this chain.

- Step 1: Basic Chemicals: China is the world’s largest producer of basic chemical feedstocks (solvents, reagents, benzene, etc.).

- Step 2: KSMs: This is the chokehold. The synthesis of KSMs often involves “dirty” chemistry—nitration, chlorination, fluorination—that produces toxic byproducts. Over the last 20 years, strict environmental regulations (EPA in the US, REACH in the EU) forced the closure of Western plants capable of these reactions. China absorbed this capacity.

- Step 3: Intermediates: China produces the vast majority of advanced intermediates.

- Step 4: APIs: While India manufactures APIs, it often does so by performing only the final one or two synthetic steps, using Chinese intermediates.4

3.2 The Beta-Lactam Case Study

Antibiotics represent the most acute vulnerability. The beta-lactam class (penicillins, cephalosporins) relies on a specific KSM called 6-aminopenicillanic acid (6-APA).

- Global Dependence: China produces the vast majority of the world’s 6-APA.

- India’s Position: Despite being a major exporter of finished amoxicillin, India imports nearly all its 6-APA from China.

- Strategic Implication: If China were to restrict the export of 6-APA, global production of penicillin and amoxicillin would collapse within weeks. India’s antibiotic manufacturing capacity is effectively a downstream extension of Chinese fermentation capacity.2

Table 2: Estimated Global Share of KSM Production by Category

| Therapeutic Area | Key Molecule/Class | China’s Est. Market Share | Supply Chain Risk |

| Antibiotics | Penicillin G / 6-APA | >90% | Critical / Single Point of Failure |

| Vitamins | Vitamin C, B12, E | 70-80% | High |

| Antipyretics | Paracetamol (KSM: Para-aminophenol) | 60-70% | High |

| Statins | Atorvastatin Intermediates | >60% | Moderate (India has some capacity) |

Data Synthesis: 2

4. The Economic Moat: Cost Structures and the 2024 Tax Shock

4.1 The 30% Efficiency Gap

The primary driver of China’s dominance remains cost. Analysis indicates that production costs in China are 20-30% lower than in India, and significantly lower than in the US or Europe.6

Drivers of the Cost Advantage:

- Infrastructure Integration: Chinese chemical parks (e.g., in Zhejiang and Shandong) are highly integrated. Waste from one plant becomes feedstock for another, and steam/energy are supplied centrally at subsidized rates.

- Scale: Chinese fermenters for antibiotics are often 5-10x larger than Indian counterparts, driving massive economies of scale.

- Raw Material Proximity: Because China produces the basic chemicals domestically, Chinese API manufacturers carry lower inventory costs and face zero foreign exchange risk on inputs.6

In contrast, Indian manufacturers face raw material costs that are 25-30% higher because they must import KSMs, pay logistics costs, and manage currency volatility.6

4.2 The December 2024 Export Tax Rebate Shock

In late 2024, the Chinese government executed a policy shift that fundamentally altered the cost basis of the global API market. On November 15, 2024, the Ministry of Finance and the State Taxation Administration issued Announcement 2024/15, titled “Announcement on the Adjustment of Export Tax Rebate Policies”.7

Policy Details (Effective December 1, 2024):

- Cancellation: The export tax rebate (previously 13%) was completely eliminated for chemically modified animal, plant, or microbial oils and fats. This category includes critical feedstocks for fermentation processes used in antibiotic and vitamin production.

- Reduction: The export tax rebate for refined oil products, photovoltaic products, batteries, and certain non-metallic minerals was reduced from 13% to 9%.9

Strategic Impact on Pharma:

For decades, the 13% Value Added Tax (VAT) rebate allowed Chinese exporters to price their goods aggressively in international markets. The removal of this rebate for “chemically modified oils” and the reduction for other inputs acts as an immediate cost increase of 9-13% for manufacturers.

- Inflationary Pressure: Unlike in previous years, where Chinese firms absorbed costs to maintain market share, the thin margins of 2025 mean these costs are being passed to global buyers. Importers of vitamins and antibiotic intermediates saw immediate price hikes in Q1 2025.10

- State Intent: This signals a shift in Beijing’s industrial strategy. The state is no longer willing to subsidize the export of low-value-added, energy-intensive, and environmentally taxing products. China wants to export high-value innovative drugs (which still retain support), not cheap chemical sludge.

5. Regulatory Tectonics I: The US Front

The operational environment for Chinese API manufacturers is being reshaped by two distinct forces from the United States: legislative decoupling attempts and rigorous regulatory enforcement.

5.1 The BIOSECURE Act: Scope and Limits

The BIOSECURE Act represents the most significant legislative attempt to decouple the US biopharma supply chain from China. The Act prohibits US federal agencies from contracting with, or providing grants to, entities that use biotechnology equipment or services from a “Biotechnology Company of Concern” (BCC).11

Key BCCs: The legislation specifically targeted heavyweights like WuXi AppTec, BGI Genomics, and MGI.12

Operational Reality vs. Hype:

- Focus on Services: The Act primarily targets “biotechnology services” (genomic sequencing, complex biologic CDMO work). It does not apply a blanket ban on the importation of small-molecule generic APIs.

- Safe Harbor: To prevent a drug shortage crisis, the Act includes a “grandfather clause” allowing existing contracts with designated BCCs to continue until 2032.13

- Market Inertia: While 26% of life sciences companies surveyed expressed an intent to shift away from Chinese partners, only 2% had taken concrete steps to unwind relationships by late 2024.14 The integration of firms like WuXi AppTec into the US clinical trial and manufacturing ecosystem is so deep that rapid extraction is commercially impossible without causing massive delays in US drug development.15

Conclusion: The BIOSECURE Act creates a “chilling effect” for new business, pushing US biotechs to look elsewhere for future projects. However, it leaves the massive volume of existing generic API trade largely untouched in the near term.

5.2 The 2025 FDA Inspection Surge

While the BIOSECURE Act grabbed headlines, the FDA’s on-the-ground enforcement in 2025 has had a more immediate operational impact. Clearing the backlog of inspections that built up during the COVID-19 pandemic, the FDA returned to China with aggressive scrutiny.

The Data:

- Untitled Letters: The FDA issued 58 untitled letters in Fiscal Year 2025, a dramatic increase from just five in 2024.16

- Inspection Volume: Inspections in China rose significantly, with a focus on clearing the backlog of firms uninspected for five years or more.17

Primary Enforcement Theme: Data Integrity

The recurring theme in 2025 warning letters is “Data Integrity.” The FDA is not just finding dirty floors; they are finding manipulated data.

- Case Study: Wuxi Medical Instrument Factory (April 2025): The FDA cited this firm for “insanitary conditions” and data manipulation, leading to an adulteration charge.18

- Case Study: Global Calcium (Indian firm, relevant context): Cited for deleting Excel files and falsifying production records to claim incentives. This highlights that data integrity is a regional challenge, not just a Chinese one, but FDA scrutiny is intense across Asia.19

- Common Citations: Backdating records, sharing passwords (preventing attribution of actions), deletion of raw data files, and failure to audit trails.20

Nitrosamine Enforcement:

Following the September 2024 guidance on nitrosamine impurities, the FDA has rigorously inspected Chinese manufacturers for compliance with NDSRI (nitrosamine drug substance-related impurity) testing. Manufacturers failing to conduct risk assessments for these carcinogens face immediate Import Alerts.22

6. Regulatory Tectonics II: The China Front

While the US regulates from the outside, the National Medical Products Administration (NMPA) is transforming the industry from the inside. The NMPA is no longer a passive agency; it is modernizing rapidly to align with global standards (ICH guidelines).

6.1 Regulatory Modernization

- 30-Day IND Approval: In 2024, the NMPA introduced a 30-working-day approval process for Clinical Trial Applications (INDs) for innovative drugs, mirroring the US FDA’s timeline. This is designed to attract global R&D to China.24

- Domestic Responsible Person (DRP): New regulations effective July 1, 2025, require overseas Marketing Authorization Holders (MAHs) to appoint a domestic Chinese entity as the “Responsible Person.” This entity bears joint liability for quality and safety. This effectively forces foreign pharma companies to deepen their legal and operational footprint in China if they wish to sell there, complicating “decoupling” strategies.25

6.2 Patent Linkage and Anti-Monopoly

China introduced a patent linkage system in 2021, allowing innovator companies to challenge generic filings before approval.

- System Performance: By 2024, thousands of patent certifications were filed, but the system is heavily weighted toward generics. The “stay” on approval is short, and brands often struggle to win challenges.

- Competitive Intelligence: For global professionals, monitoring China’s patent linkage filings (Type IV certifications) is a critical source of intelligence. A Chinese generic firm filing a Type IV certification is a signal of intent to launch a copycat drug. Tools like DrugPatentWatch are essential for tracking these filings to anticipate global generic competition years before it reaches Western markets.26

Anti-Monopoly Guidelines (2025):

In January 2025, China released new Anti-Monopoly Guidelines for the Pharmaceutical Sector. For the first time, these guidelines explicitly target “reverse payment agreements” (pay-for-delay deals), where brands pay generics to stay off the market.27 This aligns China’s antitrust regime with the US and EU, adding another layer of compliance complexity.

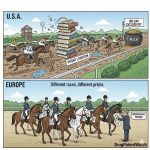

7. The “China Plus One” Reality Check

The strategy of “China Plus One”—sourcing primarily from China but maintaining a secondary supplier elsewhere—is the stated goal of almost every Western pharmaceutical board. However, the execution has proven difficult.

7.1 India: The Dependency Trap

India is the only nation with the volumetric capacity to rival China. However, as noted in Section 3, India is structurally dependent on China for KSMs.

- The PLI Scheme: India’s Production Linked Incentive (PLI) scheme aims to subsidize domestic production of critical KSMs (like Penicillin G). While some plants have come online, the cost of production remains higher than Chinese imports. Without permanent subsidies, Indian KSMs struggle to compete with Chinese scale.1

- Quality Volatility: The FDA inspection surge in 2025 also targeted India, revealing significant compliance gaps (e.g., Global Calcium) that make Indian suppliers a risk-management trade-off rather than a pure upgrade.19

7.2 Vietnam and Southeast Asia

Vietnam is frequently cited as a destination for shifted capacity.

- Current Status: Vietnam is attracting investment (e.g., Pfizer’s MOU with the Vietnam Medical Association and expansion of manufacturing partnerships).29

- Limitation: Vietnam lacks the deep chemical industrial base of China. It is excellent for “Fill and Finish” (packaging, formulation) but cannot yet support the complex chemical synthesis required for API manufacturing. It effectively functions as a downstream processor of Chinese chemicals.

7.3 Europe’s De-Industrialization: The EuroAPI Case

Europe’s attempt to re-shore API manufacturing has faced brutal economic headwinds. EuroAPI, the spin-off from Sanofi, illustrates the challenge.

- 2025 Performance: EuroAPI struggled in 2025 with declining sales to Sanofi and the suspension of production at its Brindisi, Italy site.30

- Strategy: Unable to compete on cost for high-volume generics, EuroAPI is pivoting to a “de-risking” strategy—marketing its APIs as a premium, secure, Western-made alternative. However, the market willing to pay a 40% premium for “security” is limited to specific critical medicines and government stockpiles.31

8. Environmental Factors and Supply Chain Geopolitics

8.1 The “Blue Skies” Legacy and Green Chemistry

China’s dominance was partly built on environmental arbitrage—allowing factories to pollute. However, the “Blue Skies” policies initiated in 2017 forced a massive consolidation. Small, dirty plants were shut down; large, compliant plants survived.

- Green Shift: Leading Chinese manufacturers are now adopting Green Chemistry and continuous manufacturing technologies. This helps offset rising labor costs with efficiency gains.1

- Energy Costs: Fermentation (for antibiotics) is energy-intensive. China’s industrial energy subsidies remain a critical competitive advantage that “greener” Western grids struggle to match in price.1

8.2 The Red Sea Crisis: Logistics Inflation

The ongoing conflict in the Red Sea has disrupted the maritime logistics of the API trade throughout 2024 and 2025.

- Cost Impact: Spot container rates from China to the US and Europe spiked over 100% in early 2024 and remained volatile.33

- Transit Time: Diverting vessels around the Cape of Good Hope adds 10-14 days to transit.

- Inventory Impact: This forces Western buyers to hold higher inventory levels (Safety Stock), tying up working capital. This structural increase in logistics costs makes the “low cost” of Chinese goods slightly less attractive, but rarely enough to justify the massive capex of reshoring.34

9. Corporate Case Studies: Strategy in Action

9.1 Zhejiang Huahai Pharmaceutical (China)

Huahai represents the archetype of a modern Chinese pharma giant.

- Strategy: Vertical integration. Huahai controls the KSMs, manufactures the APIs, and produces Finished Dosage Forms (FDFs) for export to the US and Europe.

- Regulatory Status: Despite holding over 50 US DMFs, Huahai faced FDA scrutiny in 2025 regarding data integrity and environmental monitoring.21 Their response—investing heavily in remediation—shows the resilience of top-tier Chinese firms. They are “too big to fail” for the global supply chain.1

9.2 Teva Pharmaceuticals (Global)

Teva, one of the world’s largest generic manufacturers, is executing a “Pivot to Growth” strategy.

- 2025 Actions: Teva has classified its API business for sale/divestiture, signaling a move away from owning heavy manufacturing assets.35

- Sourcing: Teva continues to rely on a global network of suppliers, heavily weighted toward China for inputs, while focusing its own capital on innovative medicines and complex generics. This validates the trend that Western big pharma is exiting API manufacturing, not reshoring it.36

9.3 Centrient Pharmaceuticals (Global/Netherlands)

A leader in sustainable antibiotics.

- Strategy: Centrient operates a hybrid model. It utilizes large-scale fermentation in China (Yushu) for cost efficiency while maintaining sites in India (Toansa) and Mexico.

- differentiation: Centrient focuses on ESG certification. Its Indian site received “Minimized Risk of Antimicrobial Resistance” (AMR) certification in 2025.37 This allows Centrient to sell to premium buyers who demand sustainable supply chains, differentiating itself from commodity Chinese bulk sellers.

10. Future Outlook (2025-2030)

The trajectory of the global generic API market is not toward a clean break from China, but toward a complex bifurcation.

10.1 Scenario A: The Premium Tier

For critical medicines, government stockpiles, and innovative drugs, a “China-Free” or “China-Light” supply chain will emerge. This tier will tolerate higher prices (20-40% premiums) to source from Europe (EuroAPI), the US, or audited Indian facilities. This will be driven by legislation like the BIOSECURE Act and EU Critical Medicines Act.

10.2 Scenario B: The Volume Tier

For the vast majority of global generic drugs—the ibuprofen, the amoxicillin, the statins—China will remain the supplier of choice. The economics of KSM production make any other outcome unviable without massive, sustained state subsidies in the West.

- Price Floor: The era of deflation is over. The removal of Chinese export tax rebates in Dec 2024 sets a new, higher floor for global API prices.

- Tech Dominance: By 2030, Chinese API plants will likely be more automated and technologically advanced than their Western competitors, leveraging AI in chemical synthesis and continuous flow manufacturing.38

Key Takeaways

- China’s Dominance is Upstream: The true bottleneck is not the final API, but the Key Starting Materials (KSMs) and intermediates. China controls >80% of this market, rendering “reshoring” of just the final step ineffective.

- The 2024 Tax Shock: The removal of the 13% export tax rebate for chemically modified oils and other inputs in December 2024 has permanently raised the cost structure of Chinese APIs. Buyers must adjust to a new inflationary reality.

- Regulatory Bifurcation: The BIOSECURE Act chills innovative biotech collaboration, but FDA Data Integrity enforcement is the immediate threat to generic supply continuity. The FDA is actively culling non-compliant Chinese firms in 2025.

- India is Not a Substitute: With 70-90% dependency on Chinese KSMs, India functions as a downstream processor for the Chinese chemical industry rather than an independent alternative.

- Intelligence is Critical: In this volatile environment, utilizing tools like DrugPatentWatch to monitor NMPA filings and patent linkage certifications is essential for anticipating supply shifts and competitive entries.26

FAQ

Q1: How does the December 2024 removal of Chinese export tax rebates specifically impact the price of antibiotics in the US?

A: The removal of the 13% export tax rebate for “chemically modified animal, plant, or microbial oils” directly impacts the fermentation feedstocks used to produce beta-lactam antibiotics (like penicillin and cephalosporins). This effectively raises the production cost for Chinese manufacturers by approximately 9-13%. In a sector with razor-thin margins, manufacturers pass these costs to global buyers. Consequently, the US market is seeing structural price inflation for these critical medicines in 2025, distinct from temporary logistics surcharges.

Q2: Why is the “China Plus One” strategy failing to reduce dependency on Key Starting Materials (KSMs)?

A: “China Plus One” typically involves setting up a final API or formulation plant in Vietnam or India. However, the chemical synthesis of KSMs involves hazardous processes (nitration, fluorination) and high energy consumption. Vietnam lacks the industrial chemical base to do this. India has the chemistry capability but faces higher energy costs (20-30% higher than China) and lacks the integrated industrial parks that allow Chinese firms to monetize waste streams. Therefore, the new “Plus One” factories still import their KSMs from China, leaving the root dependency unsolved.

Q3: What is the operational difference between the BIOSECURE Act and FDA Warning Letters for a US pharma buyer?

A: The BIOSECURE Act is a strategic, long-term risk. It forces US companies to plan for a future (post-2032) where they cannot contract with specific Chinese biotech firms (like WuXi AppTec) for services. It does not stop current shipments. In contrast, FDA Warning Letters and Import Alerts are tactical, immediate risks. If a Chinese supplier receives an Import Alert for data integrity violations (as many did in 2025), their product is detained at the US border immediately. FDA enforcement causes instant supply shocks; BIOSECURE causes long-term strategic realignment.

Q4: How does China’s “Domestic Responsible Person” (DRP) rule affect foreign pharmaceutical companies?

A: Effective July 2025, the DRP rule requires foreign companies selling drugs in China to appoint a local Chinese entity that bears joint legal liability for product quality and safety. This removes the “offshore shield.” Foreign executives and their local partners can now be held directly accountable under Chinese law for quality issues. This forces foreign pharma companies to invest in robust local compliance teams and deepen their integration with Chinese partners, counteracting the trend of “light-footprint” decoupling.

Q5: How can competitive intelligence teams use China’s Patent Linkage system to predict global generic launches?

A: China’s patent linkage system requires generic applicants to file a “Type IV” certification if they believe the brand’s patent is invalid or not infringed. This filing is a public declaration of intent to copy a drug. Because Chinese generics often start domestic development before global development, monitoring these filings provides an early warning system. If a major Chinese firm files a Type IV certification for a blockbuster cancer drug in China, it is a strong signal they have cracked the formulation and will likely file a US ANDA (Abbreviated New Drug Application) soon. Platforms like DrugPatentWatch aggregate this data to provide global strategic foresight.

Works cited

- The Role of China in the Global Generic Drug API Market – DrugPatentWatch, accessed January 20, 2026, https://www.drugpatentwatch.com/blog/the-role-of-china-in-the-global-generic-drug-api-market/

- India’s API strength endures, China reliance persists – ICRA Limited, accessed January 20, 2026, https://www.icra.in/Media/GetNewsFile/24508

- Global manufacturing capacity for active pharmaceutical ingredients remains concentrated | Quality Matters | U.S. Pharmacopeia Blog, accessed January 20, 2026, https://qualitymatters.usp.org/global-manufacturing-capacity-active-pharmaceutical-ingredients-remains-concentrated

- Concentrated origins, widespread risk: New USP insights on key starting materials, accessed January 20, 2026, https://qualitymatters.usp.org/concentrated-origins-widespread-risk-new-usp-insights-key-starting-materials

- Global Active Pharmaceutical Ingredient (API) Market Trends: Comparative Analysis of India and China (2025 Outlook) – TJCY, accessed January 20, 2026, https://www.tjcy.com/industry-information/global-active-pharmaceutical-ingredient-(api)-market-trends.html

- India’s API Industry in 2025: Rising Powerhouse amid Global Shifts, accessed January 20, 2026, https://api.omrglobal.com/indias-api-industry-in-2025-rising-powerhouse-amid-global-shifts/

- China to adjust or cancel export tax rebates for various products, accessed January 20, 2026, https://english.www.gov.cn/news/202411/15/content_WS67374d69c6d0868f4e8ed074.html

- Navigating China’s Latest Export Tax Rebate Adjustments: What Are the Implications?, accessed January 20, 2026, https://www.china-briefing.com/news/navigating-chinas-latest-export-tax-rebate-adjustments-implications/

- China – Export Tax Rebate Reduced or Eliminated for Various Products – BDO Global, accessed January 20, 2026, https://www.bdo.global/en-gb/insights/tax/indirect-tax/china-export-tax-rebate-reduced-or-eliminated-for-various-products

- China’s Export Tax Changes: Impact on Importers & Prices | Tiroflx, accessed January 20, 2026, https://tiroflx.com/tiroflx-services/

- BIOSECURE Act Update – Morrison Foerster, accessed January 20, 2026, https://www.mofo.com/resources/insights/251218-biosecure-act-update

- The BIOSECURE Act and Its Potential Implications | Insights & Resources – Goodwin, accessed January 20, 2026, https://www.goodwinlaw.com/en/insights/publications/2024/03/alerts-lifesciences-the-biosecure-act-and-its-potential-implications

- BIOSECURE Act Becomes Law Limiting Grants With Biotechnology Companies of Concern, accessed January 20, 2026, https://www.lw.com/en/insights/biosecure-act-becomes-law-limiting-grants-with-biotechnology-companies-of-concern

- Impact of the US BIOSECURE Act on Biopharmas, Contract Services and Investors – L.E.K. Consulting, accessed January 20, 2026, https://www.lek.com/sites/default/files/PDFs/impact-us-biosecure.pdf

- The BIOSECURE Act’s Impact May Outlive the Bill Itself – Precision for Medicine, accessed January 20, 2026, https://www.precisionformedicine.com/blog/the-biosecure-acts-impact-may-outlive-the-bill-itself

- FDA inspections in 2025: Heightened rigor, data-driven… – Reed Smith LLP, accessed January 20, 2026, https://www.reedsmith.com/articles/fda-inspections-in-2025-heightened-rigor-data-driven-targeting-and-increased-surveillance/

- FDA Foreign Inspections: Key developments and strategic shifts | White & Case LLP, accessed January 20, 2026, https://www.whitecase.com/insight-alert/fda-foreign-inspections-key-developments-and-strategic-shifts

- Wuxi Medical Instrument Factory Co., Ltd. MARCS-CMS 701044 — April 04, 2025 – FDA, accessed January 20, 2026, https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/wuxi-medical-instrument-factory-co-ltd-701044-04042025

- FDA warns Indian API supplier or data integrity lapses, Chinese contract lab for inadequate testing | RAPS, accessed January 20, 2026, https://www.raps.org/news-and-articles/news-articles/2025/2/fda-warns-indian-api-supplier-or-data-integrity-la

- FDA Warning Letters 2025: Trends, violations, and how to avoid them – Scilife, accessed January 20, 2026, https://www.scilife.io/blog/worst-fda-warning-letters-pharma

- Zhejiang Huahai Pharmaceutical Co., Ltd. – 707145 – 06/06/2025 – Warning Letters – FDA, accessed January 20, 2026, https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/zhejiang-huahai-pharmaceutical-co-ltd-707145-06062025

- CDER Nitrosamine Impurity Acceptable Intake Limits – FDA, accessed January 20, 2026, https://www.fda.gov/regulatory-information/search-fda-guidance-documents/cder-nitrosamine-impurity-acceptable-intake-limits

- Center for Instrumental Analysis of China Pharmaceutical University – 696906 – 01/23/2025, accessed January 20, 2026, https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/center-instrumental-analysis-china-pharmaceutical-university-696906-01232025

- NMPA Announcement on Optimizing of the Review and Approval Process for Clinical Trials of Innovative Drugs ([2025] No. 86), accessed January 20, 2026, https://english.nmpa.gov.cn/2025-10/14/c_1132769.htm

- China Life Sciences: 2024 Year in Review | Advisories – Arnold & Porter, accessed January 20, 2026, https://www.arnoldporter.com/en/perspectives/advisories/2025/01/china-life-sciences-2024-year-in-review

- Patent linkage: Balancing patent protection and generic entry – DrugPatentWatch, accessed January 20, 2026, https://www.drugpatentwatch.com/blog/patent-linkage-resolving-infringement/

- China Unveils New Anti-Monopoly Guidelines for the Pharmaceutical Sector – Jones Day, accessed January 20, 2026, https://www.jonesday.com/en/insights/2025/02/china-unveils-new-antimonopoly-guidelines-for-pharmaceutical-sector

- To Be The Global Pharmacy India Must Detach From China First – World Pharma Today, accessed January 20, 2026, https://www.worldpharmatoday.com/news/to-be-the-global-pharmacy-india-must-detach-from-china-first/

- Pfizer Vietnam and VMA collaborate across multiple therapeutic areas to improve the quality of healthcare in Vietnam., accessed January 20, 2026, https://www.pfizer.com.vn/en/news/pfizer-vietnam-and-vma-collaborate-across-multiple-therapeutic-areas-to-improve-the-quality-of-healthcare-in-vietnam

- Press Release – EUROAPI, accessed January 20, 2026, https://www.euroapi.com/sites/default/files/2025-03/euroapi_press-release_march-3-2025_0.pdf

- API SUPPLY CHAIN RESILIENCE BY DESIGN – EUROAPI, accessed January 20, 2026, https://www.euroapi.com/sites/default/files/2025-06/2025_04_euroapi_article-api-supply-chain-resilience-by-design.pdf

- Green Chemistry in API Manufacturing | CDMOs Driving Sustainability – Lupin, accessed January 20, 2026, https://www.lupin.com/LMS/green-chemistry-api-manufacturing/

- The Impacts of the Red Sea Shipping Crisis | J.P. Morgan, accessed January 20, 2026, https://www.jpmorgan.com/insights/global-research/supply-chain/red-sea-shipping

- The ongoing ripple effects of Red Sea shipping disruptions – Maersk, accessed January 20, 2026, https://www.maersk.com/insights/resilience/2024/07/09/effects-of-red-sea-shipping

- Teva’s Innovative Portfolio Fuels 10th Consecutive Quarter of Growth in Q2 2025; Increases 2025 Revenue Outlook for Key Innovative Products and EPS, and Reaffirms All Other Components – Teva’s Investor, accessed January 20, 2026, https://ir.tevapharm.com/news-and-events/press-releases/press-release-details/2025/Tevas-Innovative-Portfolio-Fuels-10th-Consecutive-Quarter-of-Growth-in-Q2-2025-Increases-2025-Revenue-Outlook-for-Key-Innovative-Products-and-EPS-and-Reaffirms-All-Other-Components/default.aspx

- Teva Reaffirms “Pivot to Growth” Strategy Progress with Launch of Acceleration Phase at 2025 Innovation a, accessed January 20, 2026, https://www.tevausa.com/news-and-media/press-releases/teva-reaffirms-pivot-to-growth-strategy-progress-with-launch-of-acceleration-phase-at-2025-innovation-a/

- Centrient Pharmaceuticals* awarded second independent Minimized Risk of Antimicrobial Resistance (AMR) certification for Toansa, India Site, accessed January 20, 2026, https://centrient.com/media/centrient-pharmaceuticals-awarded-second-independent-minimized-risk-antimicrobial-resistance

- Continuous Manufacturing Systems Market Strategic Insights and Key Players, accessed January 20, 2026, https://www.towardshealthcare.com/insights/continuous-manufacturing-systems-market-sizing