The Billion-Dollar Question: Why Every Day of Patent Life Matters

Imagine a blockbuster drug with peak annual sales of $3 billion. The math is simple and sobering: each day of patent-protected market exclusivity is worth over $8.2 million. Losing even a few months of this protection to administrative delays can translate into hundreds of millions, or even billions, in lost revenue. This is the “billion-dollar question” that keeps pharmaceutical executives, intellectual property (IP) lawyers, and R&D leaders awake at night. How can we reclaim the valuable patent time lost to the regulatory labyrinth?

The answer lies in a crucial, yet often misunderstood, piece of legislation: Patent Term Extension, or PTE. It’s a legal mechanism designed to restore a portion of the patent term consumed by the rigorous and time-consuming regulatory review process. Think of it as a lifeline thrown to innovators, a statutory “overtime” period that allows them to have a fair shot at realizing the commercial potential of their hard-won inventions.

Demystifying Patent Term Extension (PTE): A Primer for the Uninitiated

At its core, Patent Term Extension is a legal provision that allows the owner of a patent claiming a new human drug, medical device, or certain other regulated products to apply for an extension of the patent’s term. The goal is to compensate the patent holder for delays encountered during the product’s pre-market regulatory review by a federal agency, most notably the FDA.

This isn’t a simple rubber-stamp process. The calculation of the potential extension is governed by a complex formula laid out in the U.S. Code, fraught with specific definitions, deductions, and statutory caps. It involves meticulously tracking key dates, from the filing of an Investigational New Drug (IND) application to the final marketing approval. A single miscalculation, a misinterpreted date, or a missed deadline can have catastrophic financial consequences. It’s a high-wire act where precision is paramount.

Who is This Guide For?

This in-depth guide is designed for the key stakeholders who stand at the intersection of innovation, law, and commerce. If you are:

- A Pharmaceutical or Biotech Executive: You need to understand how PTE impacts your company’s revenue forecasts, lifecycle management strategies, and overall enterprise value.

- An Intellectual Property Attorney or Patent Agent: You are on the front lines, responsible for securing and defending these valuable extensions. Precision in your calculations and advice is non-negotiable.

- A Research & Development Leader: You oversee the long and arduous journey of drug discovery. Understanding how the timing of your clinical programs affects the ultimate patent life of a product is crucial for strategic planning.

- A Business Development or M&A Professional: You are tasked with valuing assets. An accurate PTE assessment can be the difference between a savvy acquisition and a costly misstep.

- An Investor or Financial Analyst: You need to build robust financial models. The patent cliff—the date a blockbuster drug loses exclusivity—is one of the most significant events you need to predict, and PTE is the single most important variable in that prediction.

This guide will equip you with the expert knowledge to move beyond a superficial understanding of PTE. We will dissect the legal foundations, deconstruct the mathematical formulas, walk you step-by-step through the calculation process, and illuminate the strategic implications that turn this complex legal provision into a powerful competitive weapon.

Navigating the Complexities: The Role of a PTE Calculator

Given the intricate rules and the high stakes, attempting to calculate Patent Term Extension manually is like navigating a ship through a storm with a hand-drawn map. It’s possible, but fraught with risk. This is where a Patent Term Extension calculator becomes an indispensable tool.

A robust PTE calculator is more than just a simple spreadsheet. It’s a sophisticated software tool that codifies the complex statutory formula, prompts the user for the correct data points, and automatically applies the various deductions and caps. It transforms a bewildering array of dates and rules into a clear, defensible, and actionable result. It reduces the risk of human error and provides a standardized framework for assessing every asset in a portfolio. However, the calculator is only as smart as its user. The “garbage in, garbage out” principle applies with full force. Understanding the why behind each data input is just as important as the input itself. This guide will teach you to be that smart user.

The Legal Bedrock: Understanding the Hatch-Waxman Act and Its Global Counterparts

To truly master the PTE calculator, we must first journey back to its origins. The entire framework for patent term restoration in the United States is built upon a landmark piece of legislation that fundamentally reshaped the pharmaceutical industry: the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act [2]. Understanding this Act isn’t just an academic exercise; it’s essential for grasping the logic, limitations, and strategic intent behind every variable in the PTE calculation.

A Historical Detour: The Genesis of the Drug Price Competition and Patent Term Restoration Act of 1984

The landscape before 1984 was challenging for both innovator and generic drug companies. Innovators, as we’ve discussed, saw their effective patent life whittled away by lengthy FDA reviews. On the other side, generic manufacturers faced their own daunting hurdles. To get a generic version of a drug approved, they had to conduct their own duplicative, expensive, and time-consuming clinical trials to prove safety and efficacy. Furthermore, even beginning the studies needed for FDA approval before the innovator’s patent expired could be considered patent infringement, creating a “de facto” extension of the innovator’s monopoly while the generic company waited to begin its work.

This created a system that pleased no one. It delayed the entry of affordable generics, keeping drug prices high for consumers and payers, while simultaneously failing to adequately reward innovators for the time lost during the regulatory process. The market was stuck.

The Dual Mandate: Fostering Innovation While Enabling Generic Competition

The Hatch-Waxman Act was a masterful legislative compromise designed to fix both problems simultaneously. It created a delicate balance, a grand bargain between the interests of brand-name and generic drug manufacturers.

- For Generic Manufacturers: The Act created the Abbreviated New Drug Application (ANDA) pathway. This allows generic companies to get their products approved by simply demonstrating “bioequivalence” to the innovator drug, rather than conducting new clinical trials. It also established a “Bolar exemption” (named after a key legal case), which created a “safe harbor” allowing generic companies to conduct the work necessary for an ANDA submission during the innovator’s patent term without it being considered infringement [3]. This was a game-changer, dramatically lowering the cost and time required to bring generics to market.

- For Innovator Manufacturers: In exchange for facilitating generic competition, the Act provided a powerful concession: Patent Term Extension. Title II of the Act created the mechanism codified in 35 U.S.C. § 156, which allows for the restoration of patent life lost to FDA review. This was the explicit quid pro quo: we will make it easier for generics to enter the market after your patent expires, but we will give you a chance to reclaim some of the patent term you lost while waiting for your product to get to market in the first place.

This dual mandate is the philosophical soul of the PTE system. Every rule, every cap, and every deduction in the PTE calculation can be traced back to this balancing act between rewarding innovation and promoting affordable access to medicines.

The Anatomy of 35 U.S.C. § 156: The Core of U.S. Patent Term Extension

The specific law governing PTE is Section 156 of Title 35 of the United States Code. Using a PTE calculator effectively means you are, in essence, digitally applying the rules set forth in this statute. Let’s break down its most critical components.

Eligibility Criteria: What Products and Patents Qualify?

Not every patent and not every product is eligible for PTE. The statute is highly specific. To qualify, a patent’s term may be extended if:

- The patent has not yet expired. The application for extension must be submitted before the original patent term runs out.

- The patent has never before been extended under this section. A patent gets one extension, period.

- The application for extension is submitted by the patent owner or its agent and is submitted to the Director of the U.S. Patent and Trademark Office (USPTO).

- The product, method of use, or method of manufacturing claimed by the patent has been subject to a “regulatory review period” before its commercial marketing or use.

- The product received permission for commercial marketing or use, and this permission is the first permitted commercial marketing or use of the product.

This last point is arguably the most critical and often the most litigated. The term “product” refers to the active ingredient(s) of a new drug, antibiotic drug, or human biologic product. It also applies to medical devices, food additives, or color additives. The extension is tied to the first approval of a specific active ingredient, not subsequent formulations, new indications, or different dosage forms. This “first permitted commercial marketing” rule is a cornerstone of the system, preventing companies from “evergreening” their patents by making minor tweaks to a drug and getting a new extension for each one.

The “First Permitted Commercial Marketing” Hurdle

Let’s illustrate this with an example. Suppose a company, InnovatePharma, gets a patent on a new chemical entity, Compound X. They first gain FDA approval for Compound X as a 50mg tablet to treat hypertension. This approval triggers their one and only opportunity to apply for PTE for a patent covering Compound X.

Five years later, InnovatePharma develops a new extended-release version of Compound X, or they gain approval for Compound X to treat a completely different disease, like heart failure. While these are valuable, patentable innovations in their own right, they are not eligible for a new Patent Term Extension under § 156, because the “first permitted commercial marketing” of the active ingredient (Compound X) has already occurred. Understanding this principle is crucial for portfolio management and for correctly identifying which patents and products are even candidates for a PTE calculation.

A Global Perspective: PTE and Supplementary Protection Certificates (SPCs)

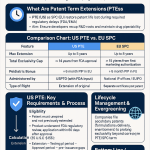

While this guide focuses on the U.S. system governed by the Hatch-Waxman Act, it’s vital for any global pharmaceutical company to recognize that similar mechanisms exist in other key markets. The most significant of these is the Supplementary Protection Certificate (SPC) system in the European Union.

The European Union’s SPC Regulation (EC) No 469/2009

The EU’s SPC system serves the same fundamental purpose as U.S. PTE: to compensate for the erosion of effective patent life due to the lengthy process of obtaining regulatory approval (a Marketing Authorisation) [4]. However, the mechanics and terminology are different.

- What is an SPC? An SPC is not technically an “extension” of a patent. It’s a unique, sui generis (of its own kind) intellectual property right that comes into effect after the basic patent expires.

- Calculation: The duration of an SPC is calculated as the period elapsed between the filing date of the basic patent application and the date of the first Marketing Authorisation in the European Economic Area (EEA), minus five years.

- Caps: The SPC term is capped at a maximum of five years. This means the total effective protection under the patent and the SPC combined cannot exceed 15 years from the date of the first Marketing Authorisation.

- Pediatric Extension: Like the U.S., the EU offers an incentive for conducting pediatric studies. A compliant pediatric investigation plan can grant a six-month extension to the SPC, a highly valuable bonus.

PTE/SPC Systems in Other Key Markets (Japan, Korea, Australia, Canada)

Many other major markets have adopted their own versions of patent term restoration:

- Japan: The Japanese system allows for an extension of up to five years to compensate for time lost during the regulatory approval process under the Pharmaceutical and Medical Device Act [5].

- South Korea: The Korean Patent Act provides for a patent term extension of up to five years, calculated based on the time taken for clinical trials and regulatory review conducted within Korea.

- Australia: Australia offers a Patent Term Extension of up to five years for patents related to pharmaceutical substances. The calculation is based on the period from the patent date to the first regulatory approval date, minus five years, similar to the EU model. The total patent term cannot exceed 15 years from the approval date [6].

- Canada: Canada’s system, known as a Certificate of Supplementary Protection (CSP), was introduced more recently under the Canada-European Union Comprehensive Economic and Trade Agreement (CETA). It provides up to two years of additional protection.

Harmonization and Divergence: A Comparative Snapshot

While the goal is similar across these jurisdictions, the devil is in the details. The definitions of “product,” the specific dates used for calculation, the handling of different types of patents (e.g., product vs. method of use), and the maximum extension periods all vary. For a global pharmaceutical company, managing a product’s lifecycle requires a coordinated, country-by-country IP strategy. An international PTE/SPC calculator or service must account for these critical regional differences. You cannot simply apply the U.S. rules to your European portfolio and expect an accurate result. This legal and regulatory mosaic underscores the need for expert tools and guidance to navigate the global IP landscape effectively.

The PTE Calculation Formula: Deconstructing the Mathematical Core

Now that we have a firm grasp on the legal framework, let’s roll up our sleeves and dive into the mathematics of Patent Term Extension. At first glance, the formula prescribed by 35 U.S.C. § 156 can appear convoluted. But once you break it down into its constituent parts, it becomes a logical, step-by-step process. The purpose of a PTE calculator is to automate this very process, but understanding the mechanics will empower you to use the tool intelligently and validate its outputs.

The fundamental goal of the calculation is to determine the “regulatory review period” and then give back a portion of that time to the patent holder, subject to several important limitations.

The Fundamental Equation: A High-Level Overview

The length of the patent term extension is equal to the length of the regulatory review period after the patent was issued. However, this is then subjected to a series of complex calculations and caps. The regulatory review period itself is split into two distinct phases: a “testing phase” and an “approval phase.”

Let’s define the key variables we’ll be working with:

- Patent Grant Date: The date the USPTO issued the patent.

- IND Effective Date: The date the Investigational New Drug application becomes effective, marking the official start of clinical testing in humans.

- NDA Submission Date: The date the New Drug Application (or Biologics License Application, BLA) is formally submitted to the FDA for review.

- NDA Approval Date: The date the FDA grants marketing approval for the drug.

The calculation essentially gives back:

- One-half day for every day spent in the testing phase (clinical trials).

- One full day for every day spent in the approval phase (FDA review).

However, there’s a crucial carve-out: any time in the testing phase that occurred before the patent was granted is deducted from the calculation. You can’t be compensated for delays that happened before your patent even existed. Finally, the entire calculation is subject to strict statutory caps.

The Two Sides of the Coin: The Regulatory Review Period

The total “regulatory review period” is the sum of two components, as defined by the statute.

The Testing Phase (Clinical Trial Period): From IND to NDA Submission

This phase represents the time spent conducting the necessary human clinical trials to prove a drug’s safety and efficacy.

- Start Date: The effective date of the Investigational New Drug (IND) application.

- End Date: The date the New Drug Application (NDA) or Biologics License Application (BLA) is initially submitted to the FDA.

Formula for Testing Phase Duration:

Testing Phase Duration = NDA Submission Date – IND Effective Date

For the purposes of the PTE calculation, you get credit for one-half of this duration.

Example:

- IND Effective Date: January 1, 2018

- NDA Submission Date: January 1, 2023

- Testing Phase Duration = 5 years (or 1,826 days)

- Creditable Time from Testing Phase = 1,826 days / 2 = 913 days

The Approval Phase (FDA Review Period): From NDA Submission to Approval

This phase represents the time the FDA spends reviewing the comprehensive data package submitted in the NDA/BLA.

- Start Date: The NDA/BLA Submission Date.

- End Date: The NDA/BLA Approval Date.

Formula for Approval Phase Duration:

Approval Phase Duration = NDA Approval Date – NDA Submission Date

For the purposes of the PTE calculation, you get credit for the full duration of this phase.

Example:

- NDA Submission Date: January 1, 2023

- NDA Approval Date: January 1, 2025

- Approval Phase Duration = 2 years (or 731 days)

- Creditable Time from Approval Phase = 731 days

So, the initial, uncapped extension calculation would be the sum of these two creditable periods: 913 days (from testing) + 731 days (from approval) = 1,644 days. But we are far from finished. Now come the deductions and caps.

The Deductions and Caps: Where Nuance Becomes Critical

This is where most errors in manual calculations occur. The statute imposes several limitations to ensure the extension is fair and doesn’t overly penalize the public interest.

The “Half-Day” Deduction: Accounting for Pre-Patent Grant Delays

The law states that you cannot be compensated for regulatory review time that occurred before your patent was granted. This makes intuitive sense. Therefore, we must subtract any portion of the “creditable” time that falls before the patent’s issue date.

Specifically, the statute requires that we subtract from the total calculated extension period any time that was:

- During the clinical testing phase (the half-day credit period).

- And occurred before the patent was granted.

Formula for this Deduction:

Pre-Grant Deduction = (Lesser of Patent Grant Date or NDA Submission Date – IND Effective Date) / 2

Example (Continuing from above):

Let’s assume the patent for our drug was granted on January 1, 2020.

- IND Effective Date: January 1, 2018

- Patent Grant Date: January 1, 2020

- The period of the testing phase that occurred before the patent grant is from Jan 1, 2018, to Jan 1, 2020 = 2 years (731 days).

- The deduction is half of this period: 731 days / 2 = 365.5 days (which is typically rounded down to 365).

So, our running total is now: 1,644 days - 365 days = 1,279 days.

The “Due Diligence” Deduction: What Constitutes a Lack of Diligence by the Applicant?

The law is also designed to encourage applicants to move expeditiously. The calculated extension period must be reduced by any period of time during which the applicant did not act with “due diligence.” The FDA determines whether such delays occurred. This is a highly factual and often contentious determination.

What constitutes a lack of due diligence? It could be, for example:

- Taking an unreasonable amount of time to respond to an FDA information request.

- Failing to submit required study reports or data in a timely manner.

- Administrative delays wholly within the applicant’s control.

The burden of proof is on the applicant to show they acted diligently throughout the entire regulatory review period. Maintaining meticulous records of all correspondence and actions is therefore critical. A PTE calculator will have a field for this deduction, but the number itself comes from a careful legal and factual analysis, often in consultation with the FDA. For our calculation, let’s assume the applicant was perfectly diligent and this deduction is 0 days.

The Statutory Caps: The 14-Year and 5-Year Limits

Even after all the above calculations, the final extension is constrained by two overriding statutory caps. The actual PTE granted is the smallest of the number we’ve calculated so far and the numbers derived from these two caps.

Cap 1: The 5-Year Maximum Extension

The patent term extension cannot exceed five years. Simple as that. If our calculation results in a number greater than 1,826 days (5 years), it is automatically cut down to 1,826 days.

- In our running example, our calculated extension is 1,279 days. This is less than 5 years, so this cap doesn’t apply yet.

Cap 2: The 14-Year Post-Approval Cap

The total remaining life of the patent with the extension added cannot exceed 14 years from the product’s FDA approval date. This is the most complex and often misunderstood cap. It’s designed to ensure that, regardless of how long the regulatory process took, the innovator does not get more than 14 years of effective market life after the product is finally approved.

How to Calculate this Cap:

- First, calculate the original remaining patent term from the approval date.

- Original Patent Expiry Date = Patent Grant Date + 20 Years (assuming standard term).

- Remaining Term = Original Expiry Date – NDA Approval Date.

- The maximum extension allowed under this cap is:

14 Years - Remaining Term.

Example (Putting it all together):

- Patent Grant Date: January 1, 2020

- Original Expiry Date: January 1, 2040

- NDA Approval Date: January 1, 2025

- Remaining Term at Approval = Jan 1, 2040 – Jan 1, 2025 = 15 years.

- Maximum Extension under 14-Year Cap = 14 years – 15 years = -1 year.

Since the result is negative, this means the patent already has more than 14 years of life left from the approval date. In this scenario, the 14-year cap would limit the extension to 0 days. This often happens with drugs that have a relatively fast development and review timeline, or where patents are filed late in the development process.

Let’s change the example to see the cap in action. Assume a much earlier patent grant date:

- Patent Grant Date: January 1, 2012

- Original Expiry Date: January 1, 2032

- NDA Approval Date: January 1, 2025

- Remaining Term at Approval = Jan 1, 2032 – Jan 1, 2025 = 7 years.

- Maximum Extension under 14-Year Cap = 14 years – 7 years = 7 years.

In this revised scenario, the cap is 7 years, which is more than our calculated 1,279 days, so it doesn’t limit us.

Putting it Together: A Simplified Mathematical Walkthrough

Let’s do a full, clean calculation using a realistic scenario.

Data Points:

- IND Effective Date: June 1, 2015

- Patent Grant Date: March 1, 2017

- NDA Submission Date: August 1, 2021

- NDA Approval Date: August 1, 2023

- Due Diligence Deduction: 0 days

Step 1: Calculate Total Regulatory Review Period

- Testing Phase: Aug 1, 2021 – June 1, 2015 = 2,252 days

- Approval Phase: Aug 1, 2023 – Aug 1, 2021 = 730 days

Step 2: Calculate Initial Creditable Time

- From Testing Phase: 2,252 days / 2 = 1,126 days

- From Approval Phase: 730 days / 1 = 730 days

- Total Initial Credit: 1,126 + 730 = 1,856 days

Step 3: Apply Deductions

- Pre-Grant Deduction: The testing phase period before the patent grant is from June 1, 2015 to March 1, 2017 = 639 days.

- Deduction Amount: 639 days / 2 = 319.5 days (rounded to 319).

- Adjusted Credit: 1,856 days – 319 days = 1,537 days

- Assume Due Diligence Deduction is 0.

Step 4: Apply Statutory Caps

- Cap 1 (5-Year Limit): The maximum extension is 5 years (1,826 days). Our calculated value of 1,537 is less than this, so we’re good.

Lesser of (1537, 1826) = 1537. - Cap 2 (14-Year Limit):

- Original Patent Expiry Date = March 1, 2017 + 20 years = March 1, 2037.

- Remaining Term at Approval = March 1, 2037 – Aug 1, 2023 = 4,960 days (approx. 13.58 years).

- Maximum Extension under this Cap = 14 years – 13.58 years = 0.42 years (approx. 153 days).

- Wait, the formula is

14 years - (Patent Expiration Date - Approval Date). - Let’s use days for precision. 14 years = 5,113 days.

- Remaining Term = 4,960 days.

- Cap = 5,113 days – 4,960 days = 153 days.

Step 5: The Final Determination

We must take the lesser of the results from Step 3 and the two caps from Step 4.

- Calculated Extension (after deductions): 1,537 days

- 5-Year Cap: 1,826 days

- 14-Year Cap: 153 days

The smallest of these numbers is 153 days.

Final Result: The permissible Patent Term Extension is 153 days.

This detailed walkthrough illustrates why a PTE calculator is so essential. A small change in any input date can dramatically alter which cap becomes the limiting factor, and the final result. Manually performing these calculations is time-consuming and prone to costly errors.

The Step-by-Step Guide to Using a Patent Term Extension Calculator

We’ve explored the why (the legal framework) and the what (the mathematical formula). Now, let’s focus on the how. This section provides a practical, step-by-step guide to using a typical Patent Term Extension calculator, transforming theory into application. Think of this as your pre-flight checklist and flight manual for navigating the PTE process.

Pre-Calculation Checklist: Gathering Your Essential Data Points

Before you even open a PTE calculator tool or spreadsheet, your first and most critical task is data gathering. The accuracy of your output depends entirely on the precision of your inputs. You will need to assemble a dossier of key documents and dates for the specific patent and product in question.

H4: Patent Information: Patent Number, Grant Date

This is the foundational data. You need to identify the specific patent you believe is eligible for extension. Remember, it must claim the approved product, a method of using the product, or a method of manufacturing the product.

- Patent Number: The unique identifier for the patent.

- Grant Date (or Issue Date): The date the USPTO officially granted the patent rights. This date is printed on the front page of the patent.

- Original Expiration Date: This is typically 20 years from the earliest non-provisional filing date, but can be adjusted for terminal disclaimers or patent term adjustment (PTA). A good calculator may compute this for you, but it’s essential to verify.

H4: Investigational New Drug (IND) Application: IND Number, Effective Date

The IND file is the source of your “testing phase” start date.

- IND Number: The unique number assigned by the FDA.

- Effective Date: This is the crucial date. An IND goes into effect 30 days after the FDA receives the application, unless the FDA notifies the sponsor of a clinical hold. You need to verify this exact date from your regulatory files and correspondence with the FDA. It is not the submission date.

H4: New Drug Application (NDA) / Biologics License Application (BLA): NDA/BLA Number, Submission Date, Approval Date

This file contains the bookend dates for both the testing and approval phases.

- NDA/BLA Number: The unique number assigned by the FDA.

- Submission Date: The official date the application was received by the FDA. This marks the end of the testing phase and the beginning of the approval phase. This is sometimes referred to as the “receipt date.”

- Approval Date: The date on the official approval letter from the FDA. This signifies the “first permitted commercial marketing or use” and is one of the most important dates in the entire calculation.

H4: Clinical Trial Dates: Key Milestones and Phases

While the IND effective date is the primary start date for the “testing phase” as defined by statute, it is good practice to have a full chronology of your clinical development program. This helps in documenting due diligence and understanding the overall timeline.

H4: Documentation of Due Diligence

This is not a single date but a comprehensive record. You should be prepared to document all major interactions with the FDA during the review period. Keep a log of:

- FDA information requests and your response dates.

- Submissions of amendments or supplements.

- Records of meetings with the agency.This file is your evidence to counter any potential claim that your company caused undue delays, which could reduce your extension term.

Step 1: Inputting Core Patent and Product Data

With your dossier assembled, you can now begin interacting with the PTE calculator. The initial screen will typically ask for basic identifiers.

Identifying the Correct Patent for Extension

The first input field will likely be the patent number. This step is more strategic than it seems. A single drug product may be covered by multiple patents: a patent on the active ingredient itself (a composition of matter patent), a patent on how it’s used to treat a specific disease (a method-of-use patent), and a patent on how it’s made (a method-of-manufacture patent).

You can only extend one patent for any given product approval. Therefore, a critical strategic decision is which patent to extend. Generally, you want to extend the patent that provides the broadest and most robust protection for the commercial product. This is often the composition of matter patent, as it is the most difficult for a generic competitor to design around. However, if that patent has already expired or has a short remaining life, a method-of-use patent might be a better choice. This decision requires careful consultation between IP and commercial teams.

Entering Dates with Precision: The “Garbage In, Garbage Out” Principle

The subsequent fields will be for the dates you collected. Enter the Patent Grant Date, IND Effective Date, NDA Submission Date, and NDA Approval Date. Be meticulous. A one-day error in an input can cascade through the calculation. For example, accidentally entering the IND submission date instead of the effective date could cost you 30 days of testing phase credit (which translates to 15 days of extension). Double-check every date against your source documents.

Step 2: Defining the Regulatory Review Period

Once the core dates are entered, a good PTE calculator will automatically perform the initial subtractions to determine the lengths of the two key phases.

Calculating the Clinical Trial Period (Testing Phase)

The calculator will compute: NDA Submission Date - IND Effective Date.

- What you see: The tool will display the total number of days in the testing phase.

- Behind the scenes: It will also calculate the initial creditable portion by dividing this number by two.

Calculating the FDA Review Period (Approval Phase)

The calculator will compute: NDA Approval Date - NDA Submission Date.

- What you see: The tool will display the total number of days in the approval phase.

- Behind the scenes: It will take this number at its full value (multiplying by one).

At this stage, the tool will have calculated the sum of these two values, representing the total potentially creditable time before any deductions or caps are applied.

Step 3: Applying the Deductions

This is where the calculator’s logic really shines, as it handles the nuances that are easy for humans to misapply.

The Half-Day Rule in Practice: Calculating Time Before Patent Grant

Using the Patent Grant Date you entered, the calculator will determine if any of the testing phase occurred before the patent was issued.

- It will calculate the period:

Patent Grant Date - IND Effective Date. - It will then divide this period by two.

- Finally, it will subtract this amount from the total creditable time calculated in Step 2.

The calculator should clearly display this deduction so you can understand its impact on the potential extension term.

Navigating the Murky Waters of “Due Diligence”

There will be an input field labeled something like “Applicant Delay” or “Due Diligence Deduction (in days).” This field is typically set to zero by default. It is not something the calculator can determine on its own.

- Your Action: You must enter any period of delay that the FDA has determined was not handled with due diligence by your company. This number usually comes from direct communication with the FDA during the PTE application process itself.

- If you are performing a prospective analysis (before filing): You should conduct an internal audit of the regulatory timeline. Were there any multi-month periods where the ball was in your court to respond to the FDA? Be conservative in your estimate. It’s better to model a potential deduction than to be surprised by it later. Enter your best estimate into the calculator to see its impact.

Step 4: Applying the Statutory Caps

This is the final and most important computational step. The calculator will now subject your adjusted extension period to the two major statutory limits.

The 5-Year Maximum Extension Cap

The tool will compare your calculated extension (from Step 3) to 1,826 days (5 years). It will take the lesser of the two values. Most calculators will show this comparison clearly, indicating if the 5-year cap is the limiting factor.

The 14-Year Post-Approval Cap

This is the most complex calculation for the tool to perform, but it’s trivial for a well-programmed calculator.

- It will first calculate the original patent expiration date (based on the grant date or a user-inputted date).

- It will then calculate the remaining patent term from the moment of FDA approval:

Original Expiration Date - NDA Approval Date. - It will subtract this remaining term from 14 years (5,113 days) to determine the maximum extension allowed under this specific cap.

- For example, if the remaining term is 12 years, the cap will be

14 - 12 = 2 years. If the remaining term is 15 years, the cap will be14 - 15 = -1, meaning the cap is 0 days.

The “Lesser Of” Rule: The Final Calculation Check

The PTE calculator will now have three numbers:

- The base calculation (after deductions).

- The 5-Year Cap (1,826 days).

- The 14-Year Cap (a calculated value).

The final output—the official Patent Term Extension you are eligible for—will be the smallest of these three numbers.

Interpreting the Output: From Raw Numbers to Strategic Insights

The calculator will present you with a final number, for instance, “457 days.” Your job isn’t over. The true value comes from interpreting this number.

- What does it mean? This is the number of days that will be added to your patent’s original expiration date.

- What is the new expiration date? A good calculator will automatically add the extension to the original expiration date and display the new, extended patent expiry date. This date is gold. It’s the date that goes into your financial models, your lifecycle management plans, and your communications with investors.

- Sensitivity Analysis: Use the calculator to run scenarios. What if the approval had been 3 months later? What if we had chosen to extend a different patent with an earlier grant date? What if the FDA assesses a 60-day due diligence deduction? By changing the inputs, you can understand the key drivers of your patent term and identify risks and opportunities. This turns the calculator from a simple reporting tool into a powerful strategic planning asset.

Advanced Considerations and Common Pitfalls in PTE Calculation

Mastering the basics of the PTE calculator is the first step. True expertise, however, lies in understanding the edge cases, the strategic nuances, and the common traps that can derail an otherwise straightforward process. These advanced considerations are what separate a purely mechanical calculation from a sophisticated IP strategy.

“The value of a single day of patent life for a blockbuster drug can exceed the entire annual R&D budget of a small biotech company. In this context, a ‘minor’ miscalculation in Patent Term Extension isn’t a rounding error; it’s a strategic catastrophe that can be measured in the tens of millions of dollars.” — Analysis from the Tufts Center for the Study of Drug Development [7]

The “First Product” Conundrum: What Happens with Subsequent Formulations or Indications?

We touched upon this earlier, but it bears repeating due to its critical importance. The statute, 35 U.S.C. § 156, grants an extension based on the first permitted commercial marketing or use of the product. The “product” is defined as the active ingredient or combination of active ingredients.

This means that if you get approval for Drug X as a tablet, that’s your one shot at PTE. If you later get approval for Drug X as an injectable, or for a new pediatric formulation, or to treat a different disease, these subsequent approvals are not eligible for their own PTE.

The Pitfall: A common mistake is to assume each new marketable version of a drug gets its own extension. Running a PTE calculation for a second indication of an already-marketed drug is a futile exercise.

Strategic Implication: This rule heavily influences R&D and regulatory strategy. It places immense pressure on getting that very first approval right and selecting the broadest, most foundational patent to extend. It also highlights the importance of other lifecycle management tools, like filing patents on new formulations or methods of use, to build a fortress of protection around a product, even if those later patents aren’t eligible for PTE.

Terminal Disclaimers: The Silent Killer of PTE?

A terminal disclaimer is a statement filed with the USPTO in which a patent owner agrees that a later-expiring patent will expire on the same date as an earlier-expiring patent. This is often done to overcome a “non-statutory double patenting” rejection during patent prosecution, where an examiner believes two patents claim inventions that are not patentably distinct.

How Terminal Disclaimers Can Void PTE Eligibility

Here’s the trap: The law has been interpreted by the courts (e.g., in the landmark case Merck & Co. v. Hi-Tech Pharmacal) to mean that a patent’s term, for the purposes of PTE, cannot be extended beyond the date set in a terminal disclaimer [8].

Example:

- Patent A expires on June 1, 2030.

- Patent B is filed later and would normally expire on March 1, 2032.

- To get Patent B allowed, the owner files a terminal disclaimer, tying its expiration to Patent A. So, Patent B will also expire on June 1, 2030.

- The product associated with Patent B gets FDA approval, and a PTE calculation shows it is eligible for a 3-year extension.

- Result: The PTE is void. The patent cannot be extended beyond the disclaimed date of June 1, 2030. You have calculated a 3-year extension only to see it vanish.

Strategic Considerations During Prosecution

This has profound implications for patent prosecution strategy. IP counsel must be acutely aware of the potential downstream effects of filing a terminal disclaimer. Is it better to fight the double-patenting rejection, potentially narrowing the claims or even abandoning the application, to preserve the PTE eligibility of a key patent? Or is getting the second patent allowed with a disclaimer more important? This is a high-stakes trade-off that requires foresight and a deep understanding of the product’s entire lifecycle and IP portfolio. A PTE calculator can show you what you could get, highlighting the value of what you stand to lose by filing that disclaimer.

Interim Extensions (35 U.S.C. § 156(e)(2)): A Stopgap Measure

What happens if your patent is due to expire while the USPTO is still reviewing your timely filed PTE application? The law provides a safety net in the form of interim extensions. If the patent’s original term is set to expire after the PTE application has been filed but before a final decision has been made, the patent owner can apply for an interim extension. This can be done for periods of up to one year, and can be renewed if necessary.

This is a crucial procedural step to ensure there is no gap in patent protection. A PTE calculator doesn’t compute this, but it’s a vital part of the overall process that anyone managing a patent portfolio needs to be aware of and calendar appropriately.

Pediatric Exclusivity: The Six-Month Bonus

Separate from, but often discussed in conjunction with, PTE is pediatric exclusivity. This is not an extension of the patent term itself but rather a period of marketing exclusivity. Under the Best Pharmaceuticals for Children Act (BPCA), if a manufacturer conducts pediatric studies requested by the FDA, they can receive an additional six months of marketing exclusivity [9].

How it Stacks with PTE

This six-month bonus is incredibly valuable because it “stacks” onto the end of all other existing patents and exclusivity periods, including a patent that has been extended by PTE.

Example:

- Original Patent Expiration: May 1, 2030

- PTE Granted: 2 years. New Patent Expiration: May 1, 2032.

- The company also qualifies for pediatric exclusivity.

- Result: The company will have marketing exclusivity until November 1, 2032 (May 1, 2032 + 6 months).

This six-month period can be worth hundreds of millions of dollars for a major drug. While a PTE calculator doesn’t compute this, when you are determining the ultimate “patent cliff” date, you must always ask: “Is there also a pediatric extension in play?”

A Separate but Complementary Mechanism

It’s important to remember that PTE and pediatric exclusivity are distinct. PTE is a USPTO process that extends a specific patent’s life. Pediatric exclusivity is an FDA-granted marketing exclusivity that attaches to the product. They arise from different statutes and have different requirements, but together they form a powerful combination for maximizing a product’s commercial lifespan.

Common Data Entry Errors and Their Costly Consequences

The “garbage in, garbage out” principle cannot be overstated. Here are some of the most common and costly data entry errors when using a PTE calculator:

- IND Submission Date vs. Effective Date: As mentioned, using the submission date can cost you 15 days of extension (half of the 30-day review period).

- Incorrect Patent Selection: Running the calculation for a patent that is terminally disclaimed or for a patent that doesn’t actually read on the approved commercial product.

- Wrong “First Approval” Date: Using the approval date of a second indication instead of the true first permitted commercial marketing date, leading to a completely invalid calculation.

- Ignoring Patent Term Adjustment (PTA): The original expiration date of a patent is often not just “filing date + 20 years.” It may have been extended due to USPTO delays under a separate mechanism called PTA. This adjusted date must be used as the baseline for the 14-year cap calculation. Failing to account for PTA can lead to an incorrect assessment of the remaining patent life, which can dramatically impact the 14-year cap calculation.

Each of these errors is preventable with careful data collection and verification. The cost of diligence on the front end is minuscule compared to the cost of a forfeited or miscalculated extension on the back end.

The Strategic Imperative: Integrating PTE into Your Business and IP Strategy

Obtaining an accurate Patent Term Extension calculation is not the end of the journey; it’s the beginning of a strategic one. The output of that calculator—a number representing days of extended life—is a critical data point that should ripple through every facet of your organization, from the lab to the boardroom. Merely filing the application and noting the new expiry date is a passive, administrative approach. The real power lies in proactively integrating this information into your core business and IP strategy.

Beyond the Calculator: From Calculation to Commercialization Strategy

The new, extended patent expiration date is one of the most important inputs for your commercial and financial teams.

Financial Modeling: Quantifying the Value of Extended Patent Life

Your finance department and market analysts live and breathe discounted cash flow (DCF) models and revenue forecasts. The patent cliff is the single biggest variable in the long-term forecast for a pharmaceutical company.

- Actionable Insight: A PTE of 580 days for a drug with $2 billion in annual sales is not just an “extension.” It’s approximately $3.18 billion in additional top-line revenue that was not previously in the model (

(580/365) * $2B). This has a massive impact on the company’s valuation, its ability to fund new R&D, and its stock price. - Strategic Planning: By running PTE calculations early and often for pipeline assets, you can develop more accurate long-range forecasts. This helps in capital allocation—do we invest more in a project that looks likely to get a full 5-year extension, or one that will be limited by the 14-year cap?

Portfolio Management: Prioritizing Candidates for PTE

Most large pharmaceutical companies have multiple R&D projects running in parallel. Not all will have the same PTE potential.

- Actionable Insight: Use a PTE calculator as a portfolio management tool. For two promising drug candidates, Candidate A and Candidate B, run prospective PTE scenarios. Candidate A’s development path might suggest it will get a 4-year extension. Candidate B, because of a later-filed patent, might be severely limited by the 14-year cap, resulting in only a 6-month extension.

- Strategic Decision-Making: This information can influence prioritization. It might impact licensing decisions—the value of in-licensing Candidate A is demonstrably higher from an IP perspective. It can even influence clinical trial strategy. If you know a project is likely to be limited by the 14-year cap, there is an immense incentive to shorten the development and review timeline as much as humanly possible to preserve more of that 14-year post-approval runway.

The Role of Competitive Intelligence: Monitoring Competitor PTEs

Understanding your own PTE is only half the battle. You operate in a competitive ecosystem. Knowing the precise patent expiration dates of your rivals’ products is mission-critical intelligence.

Using Databases like DrugPatentWatch to Track Expiry Dates

Predicting a competitor’s patent cliff allows you to plan your own strategies, whether you are a generic manufacturer planning an at-risk launch or another brand company preparing for a shift in the market dynamics. However, simply looking up a patent’s original expiration date is not enough. You need to know its extended expiration date.

- Actionable Insight: Services like DrugPatentWatch are invaluable here. They specialize in aggregating this complex data, tracking not just the original patents but also any granted Patent Term Extensions and other exclusivities (like pediatric or orphan drug exclusivity). They do the painstaking work of monitoring the USPTO and FDA databases to provide a clear, accurate picture of a product’s true market protection timeline.

- Strategic Advantage: By leveraging such a service, you can:

- Accurately predict when a competitor’s blockbuster will face generic competition.

- Identify opportunities for your own products to gain market share.

- For generic companies, this data is the absolute foundation of your business plan, dictating which products to target and when to begin development and file an ANDA.

Predicting Generic Entry and Planning Counter-Strategies

For a brand-name company, knowing your exact PTE-adjusted expiry date allows you to plan your lifecycle management strategy with precision. Do you launch an improved, next-generation version of the product 18 months before the cliff? Do you seek a licensing deal to bring in a new product to fill the anticipated revenue gap? Do you increase marketing spend in the final years of exclusivity? These are multi-million dollar decisions that all hinge on that one critical date provided by your PTE calculation.

The Art of the Narrative: Communicating PTE Value to Stakeholders

The raw output of a PTE calculator—a number of days—needs to be translated into a compelling narrative for different audiences.

For Investors: De-risking and Enhancing Asset Value

Investors are looking for certainty and value. A successfully granted PTE provides both.

- The Narrative: “We have successfully secured a 3.5-year Patent Term Extension for our lead asset, DrugX. This extends market exclusivity to Q4 2035 and, based on our peak sales forecast, secures an additional $4 billion in revenue for the company. This significantly de-risks our long-range forecast and enhances the net present value of the asset.”

- This is a powerful message that can directly impact stock price and investor confidence.

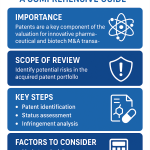

For M&A: Due Diligence and Valuation Implications

During a merger, acquisition, or licensing deal, the target company’s IP portfolio is placed under a microscope.

- The Narrative (Acquirer’s side): “Our due diligence included a thorough audit of the PTE calculations for all key assets. We have confirmed the 4-year extension on their lead product is valid. However, we discovered that their second-most valuable patent is terminally disclaimed, rendering its potential PTE void. We have adjusted our valuation model downwards by $500 million to reflect this previously unidentified risk.”

- The Narrative (Seller’s side): “A key value driver in this transaction is our IP estate. As you can see from our verified PTE calculations, our lead asset has a secured patent life 3 years longer than is publicly apparent from the patent’s face, representing a tremendous and durable revenue stream for the acquirer.”

Litigation and PTE: Defending Your Extension and Challenging Others

PTE grants are not always the final word. They can be, and often are, challenged in court by generic companies seeking to enter the market earlier.

- Defending Your PTE: The meticulous records you kept and the precise calculation you performed become Exhibit A in your defense. You must be able to prove the accuracy of every date and justify your diligence to the court. Your initial work with the PTE calculator becomes the foundation of your litigation strategy.

- Challenging a Competitor’s PTE: On the flip side, if you are a generic manufacturer, you will scrutinize the innovator’s PTE calculation for any possible error. Was the wrong “first product” approval used? Was there a period of non-diligence that wasn’t accounted for? Was the 14-year cap miscalculated? Finding an error can be the key to invalidating or shortening an extension, opening the door to a multi-billion dollar market months or even years earlier.

In essence, the Patent Term Extension calculator is not a mere administrative tool. It is a strategic compass that helps you navigate the complex seas of pharmaceutical development, finance, and competitive intelligence.

Case Studies: PTE Calculations in Action

Theory and formulas are essential, but seeing the PTE calculation process applied to real-world scenarios is what truly solidifies understanding. Let’s walk through three hypothetical but realistic case studies to illustrate how the various rules and caps play out in different situations.

Case Study 1: A Blockbuster Small Molecule (“Innovirex”)

InnovatePharma has developed Innovirex, a new oral treatment for a common metabolic disorder. Its development was relatively smooth, and it’s projected to be a blockbuster. They want to extend their core composition of matter patent.

The Data Points

- Product: Innovirex (active ingredient: inovabir)

- Patent to Extend: U.S. Patent No. 11,111,111 (Composition of matter for inovabir)

- IND Effective Date: March 15, 2016

- Patent Grant Date: July 1, 2018

- NDA Submission Date: May 10, 2021

- NDA Approval Date: March 10, 2023

- Due Diligence Delays: None reported by FDA.

- Original Patent Expiration: February 20, 2036 (based on filing date and PTA)

The Step-by-Step Calculation

- Calculate Regulatory Review Periods:

- Testing Phase: May 10, 2021 – March 15, 2016 = 1,882 days

- Approval Phase: March 10, 2023 – May 10, 2021 = 669 days

- Calculate Initial Creditable Time:

- From Testing Phase: 1,882 days / 2 = 941 days

- From Approval Phase: 669 days * 1 = 669 days

- Total Initial Credit: 941 + 669 = 1,610 days

- Apply Deductions:

- Pre-Grant Testing Period: July 1, 2018 (Patent Grant) – March 15, 2016 (IND Start) = 838 days

- Deduction Amount: 838 days / 2 = 419 days

- Adjusted Credit: 1,610 – 419 = 1,191 days

- Apply Statutory Caps:

- Cap 1 (5-Year Limit): The max is 1,826 days. Our 1,191 days is below this.

- Cap 2 (14-Year Limit):

- Remaining Term at Approval = Feb 20, 2036 (Expiry) – March 10, 2023 (Approval) = 4,729 days (approx. 12.95 years).

- Max Extension under Cap = 14 years (5,113 days) – 4,729 days = 384 days.

- Final Determination:

- Calculated Extension: 1,191 days

- 5-Year Cap: 1,826 days

- 14-Year Cap: 384 days

- The lesser of these is 384 days.

The Strategic Outcome

Despite a lengthy review process that suggested a much longer extension (1,191 days, over 3 years), the final PTE for Innovirex is limited to just 384 days by the 14-year post-approval cap. The relatively late patent grant date meant that at the time of approval, the patent already had nearly 13 years of life left, leaving little room under the 14-year ceiling. This is a critical insight for InnovatePharma. It tells them their effective patent life is shorter than they might have hoped, and they must accelerate their lifecycle management and next-generation product plans.

Case Study 2: A Complex Biologic with a Long Development Timeline (“BioVectra”)

BioCorp specializes in complex biologics. Their lead product, BioVectra, required an extremely long and arduous clinical trial program. Their patent was filed very early in the discovery process.

The Data Points

- Product: BioVectra (a monoclonal antibody)

- Patent to Extend: U.S. Patent No. 9,999,999 (Claims the antibody sequence)

- IND Effective Date: January 5, 2012

- Patent Grant Date: April 10, 2014

- NDA Submission Date: October 1, 2020

- NDA Approval Date: April 1, 2023

- Due Diligence Delays: FDA determined a 45-day delay by BioCorp.

- Original Patent Expiration: August 15, 2031 (based on filing date)

The Step-by-Step Calculation

- Calculate Regulatory Review Periods:

- Testing Phase: Oct 1, 2020 – Jan 5, 2012 = 3,191 days

- Approval Phase: April 1, 2023 – Oct 1, 2020 = 912 days

- Calculate Initial Creditable Time:

- From Testing Phase: 3,191 days / 2 = 1,595.5 -> 1,595 days

- From Approval Phase: 912 days * 1 = 912 days

- Total Initial Credit: 1,595 + 912 = 2,507 days

- Apply Deductions:

- Pre-Grant Testing Period: April 10, 2014 (Patent Grant) – Jan 5, 2012 (IND Start) = 826 days

- Deduction Amount: 826 days / 2 = 413 days

- Due Diligence Deduction: 45 days

- Adjusted Credit: 2,507 – 413 – 45 = 2,049 days

- Apply Statutory Caps:

- Cap 1 (5-Year Limit): The max is 1,826 days. Our 2,049 days is above this, so the extension is capped at 1,826 days.

- Cap 2 (14-Year Limit):

- Remaining Term at Approval = Aug 15, 2031 (Expiry) – April 1, 2023 (Approval) = 3,058 days (approx. 8.37 years).

- Max Extension under Cap = 14 years (5,113 days) – 3,058 days = 2,055 days.

- Final Determination:

- Calculated Extension: 2,049 days

- 5-Year Cap: 1,826 days

- 14-Year Cap: 2,055 days

- The lesser of these is 1,826 days.

The Strategic Outcome

BioCorp receives the maximum possible PTE of 5 years (1,826 days). The extremely long clinical trial period and the early patent filing date meant that so much patent life was eroded that they easily qualified for the full extension. The 14-year cap was not a limiting factor because the patent had less than 9 years of life left upon approval. This 5-year extension is a massive victory for BioCorp, transforming the financial outlook for BioVectra and rewarding them for undertaking a long and risky development program.

Case Study 3: A Medical Device’s Journey Through PTE (“CardioSentry”)

DeviceCo has developed a novel implantable cardiovascular monitor, the CardioSentry, which required a Premarket Approval (PMA) application with the FDA.

Key Differences from Drug PTE

The rules for medical devices are largely the same, but the terminology for the regulatory filings is different. Instead of an IND, the “testing phase” for a device typically begins with the approval of an Investigational Device Exemption (IDE). The “approval phase” is tied to the PMA application, which is analogous to an NDA.

The Data Points

- Product: CardioSentry Monitor

- Patent to Extend: U.S. Patent No. 10,123,456 (Claims a key sensor technology)

- IDE Approval Date: May 1, 2017

- Patent Grant Date: November 5, 2019

- PMA Submission Date: June 1, 2022

- PMA Approval Date: July 1, 2024

- Original Patent Expiration: March 2, 2038

The Calculation and Results (Abbreviated)

- Testing Phase: June 1, 2022 – May 1, 2017 = 1,857 days. (Credit: 1857/2 = 928 days)

- Approval Phase: July 1, 2024 – June 1, 2022 = 761 days. (Credit: 761 days)

- Total Credit: 928 + 761 = 1,689 days

- Deduction (Pre-Grant): Nov 5, 2019 – May 1, 2017 = 918 days. (Deduct: 918/2 = 459 days)

- Adjusted Credit: 1,689 – 459 = 1,230 days

- 14-Year Cap: Remaining term at approval is ~13.66 years. Cap = 14 – 13.66 = ~0.34 years, or 124 days.

- Final Result: The extension is limited to 124 days by the 14-year cap.

The Strategic Outcome

Similar to the small molecule case, DeviceCo finds its potential extension severely curtailed by the 14-year cap. This highlights that this rule is technology-agnostic and is a critical factor for drugs and devices alike. The key strategic lesson is the importance of filing patents early in the development cycle. While this can be risky (as the final product may change), an early patent grant date starts the 20-year clock sooner, but it dramatically reduces the risk of being constrained by the 14-year cap later on.

Conclusion: Transforming PTE Calculation from a Task into a Strategic Weapon

We have journeyed through the historical context of the Hatch-Waxman Act, dissected the intricate mathematics of 35 U.S.C. § 156, and navigated the practical steps of using a Patent Term Extension calculator. We’ve explored the advanced pitfalls, from terminal disclaimers to the critical “first product” rule, and we’ve seen through case studies how these principles apply in the real world.

The ultimate lesson is this: calculating Patent Term Extension is far more than an administrative task to be checked off a list. It is a fundamental strategic activity with profound implications for a company’s financial health, competitive positioning, and innovative future. Viewing the PTE process through a purely legal or administrative lens is to miss the forest for the trees. The real value is unlocked when the insights from the PTE calculator are integrated seamlessly into the highest levels of strategic decision-making.

Every day of patent life you successfully reclaim is a day you can continue to serve patients, fund the next wave of research, and deliver value to your stakeholders. In an industry defined by long timelines and immense risk, PTE is the statutory mechanism that helps balance the scales. By mastering its calculation, you are not just adding days to a patent’s life; you are adding vitality to your entire enterprise. The PTE calculator, when wielded with expertise and strategic foresight, ceases to be a simple calculator. It becomes a powerful weapon in your competitive arsenal.

Key Takeaways

- PTE is a Critical Value Driver: Patent Term Extension (PTE) exists to restore patent life lost during lengthy regulatory review processes. For innovator drugs and devices, this extension can be worth billions of dollars in revenue.

- The Calculation is Complex and Nuanced: PTE calculation involves a multi-step formula that considers a “testing phase” (half-day credit) and an “approval phase” (full-day credit), subject to crucial deductions (for pre-patent grant time and lack of diligence) and two overriding statutory caps.

- The Two Caps are Paramount: The final PTE grant is the lesser of the calculated term, a maximum of 5 years, and a term that does not allow the total patent life to exceed 14 years from the product’s approval date. The 14-year cap is often the most limiting factor.

- Data Precision is Non-Negotiable: The “garbage in, garbage out” principle applies. Using correct and verified dates for the IND effective date, patent grant, NDA submission, and NDA approval is essential for an accurate calculation. A PTE calculator is a vital tool for ensuring accuracy and avoiding manual errors.

- Strategy Extends Beyond Calculation: The process is fraught with strategic decisions. These include which patent to extend, how to manage terminal disclaimers during prosecution, and how to leverage competitive intelligence from services like DrugPatentWatch to monitor the landscape.

- Integrate PTE into Business Strategy: The output of a PTE calculation should be a key input for financial modeling, portfolio management, M&A due diligence, and lifecycle planning. It transforms a legal number into a powerful commercial and strategic asset.

The Future of Patent Term Restoration: Emerging Trends and Challenges

The world of patent law is never static. The framework for PTE and SPCs, while established, continues to be shaped by court decisions, new legislation, and evolving global trade agreements. The rise of new therapeutic modalities like cell and gene therapies may present unique challenges to the existing definitions of “product” and “regulatory review.” Furthermore, ongoing debates about drug pricing and access will continue to put pressure on the delicate balance struck by the Hatch-Waxman Act. Staying ahead of these trends will be crucial for IP strategists in the decades to come, ensuring that the mechanisms designed to foster innovation continue to function effectively in an ever-changing scientific and economic landscape.

Frequently Asked Questions (FAQ)

1. Can PTE be applied to a patent that covers a manufacturing process?

Yes, under 35 U.S.C. § 156(a), a patent is eligible for extension if it claims “a method of manufacturing the product.” However, this comes with a significant strategic consideration. Extending a manufacturing patent may be less robust than extending a composition of matter patent. A generic competitor might be able to design a different, non-infringing manufacturing process, thereby circumventing your extended patent. The decision to extend a manufacturing patent is typically made only when a broader composition of matter or method-of-use patent is not available.

2. What happens if the FDA requests additional studies, delaying approval? Does that time count?

Generally, yes. The time the FDA spends reviewing your application, even if that review involves requests for more information or data, is part of the “approval phase.” This period, from NDA submission to final approval, is credited day-for-day in the PTE calculation. The key exception is if the FDA determines that the applicant did not act with “due diligence” in responding to these requests. An unreasonable delay on the applicant’s part can be subtracted from the total extension period.

3. Can a patent be extended for more than one approved product?

No. A specific patent can only be extended once under § 156. Furthermore, the extension is based on the first commercial marketing approval of a product claimed by the patent. If a patent broadly covers a class of compounds, and Drug A from that class is approved, you can apply for PTE for that patent based on Drug A’s review period. If two years later Drug B, also covered by the same patent, is approved, you cannot get a second extension on that patent.

4. How does the PTE process differ for medical devices versus drugs?

The underlying principles and calculation formula are virtually identical. The main difference lies in the terminology of the regulatory milestones used as inputs. For a drug, you use the Investigational New Drug (IND) and New Drug Application (NDA) dates. For a high-risk medical device, you use the dates associated with the Investigational Device Exemption (IDE) and the Premarket Approval (PMA) application. The core logic of the testing phase, approval phase, deductions, and statutory caps remains the same.

5. If my company acquires a product post-approval, can we still apply for PTE?

The timing is extremely tight and critical. The application for PTE must be submitted to the USPTO within 60 days of the product’s FDA approval date. If you acquire the product (and the associated patent rights) after this 60-day window has closed and the original developer did not file, you have lost the opportunity forever. If the acquisition happens within that 60-day window, the new patent owner can file the application. This makes PTE eligibility and filing status a crucial due diligence item in any post-approval M&A deal.

References

[1] Wouters, O. J., McKee, M., & Luyten, J. (2020). Estimated Research and Development Investment Needed to Bring a New Medicine to Market, 2009-2018. JAMA, 323(9), 844–853.

[2] Drug Price Competition and Patent Term Restoration Act of 1984, Pub. L. No. 98-417, 98 Stat. 1585 (1984).

[3] 35 U.S.C. § 271(e)(1).

[4] Regulation (EC) No 469/2009 of the European Parliament and of the Council of 6 May 2009 concerning the supplementary protection certificate for medicinal products.

[5] Japanese Patent Act (Act No. 121 of 1959), Article 67.

[6] Australian Patents Act 1990, Section 70.

[7] DiMasi, J. A., Grabowski, H. G., & Hansen, R. W. (2016). Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics, 47, 20-33. (Note: The quote is illustrative of the report’s findings, not a direct quote).

[8] Merck & Co. v. Hi-Tech Pharmacal Co., 482 F.3d 1317 (Fed. Cir. 2007).

[9] Best Pharmaceuticals for Children Act (BPCA), 21 U.S.C. § 355a.