Launching a generic drug is not merely about hitting the market; it’s about dominating it. In an industry where the stakes are astronomical and the competition is relentless, a well-executed launch strategy is the definitive line between a blockbuster success and a cautionary tale. For business professionals in the pharmaceutical sector, the ability to transform raw patent and market data into actionable, predictive insights is the secret to outpacing rivals and capturing sustainable market share. Are you ready to turn numbers into market domination?

The generic drug market is a behemoth of the global healthcare ecosystem. Valued at over $453 billion in 2024, it is projected to surge towards $700 billion by 2032, expanding at a compound annual growth rate (CAGR) of over 5%.1 This growth is fueled by an unrelenting demand for affordable healthcare solutions, the steady march of blockbuster drugs falling off the “patent cliff,” and government initiatives worldwide aimed at curbing healthcare spending.2

The societal impact is staggering. In the United States alone, generic and biosimilar medicines account for a remarkable 90% of all prescriptions filled, yet they represent only 17.5% of the nation’s total spending on prescription drugs. This incredible efficiency generated a record $408 billion in savings for the U.S. healthcare system in 2022, contributing to a cumulative $2.9 trillion in savings over the past decade.4

But within these impressive statistics lies the central strategic challenge of the generic industry. The vast chasm between volume (90%) and cost (17.5%) illuminates a landscape defined by ferocious price pressure and razor-thin margins. In this high-volume, low-margin reality, success is never accidental. It is the calculated outcome of a meticulously planned, data-driven, and flawlessly executed strategy. This report is your comprehensive playbook for crafting and implementing that strategy. We will dissect every phase of the generic drug lifecycle—from the earliest stages of opportunity identification buried in patent databases to the complex post-launch maneuvers required to sustain profitability. This is not just a guide; it is a strategic framework for turning the generic gambit into a decisive victory.

Part I: The Blueprint – Pre-Launch Strategy and Opportunity Identification

The seeds of a successful generic launch are sown years, sometimes even a decade, before the product reaches the pharmacy shelf. This foundational phase is where the most critical strategic decisions are made. It’s an intricate process of identifying the right targets, building an unassailable legal and scientific case for market entry, and laying the groundwork for commercial success. Rushing this stage or failing to appreciate its complexity is the single most common reason for a failed launch. Here, we will construct the blueprint for victory, focusing on the three pillars of pre-launch excellence: mastering patent intelligence, winning the legal chess match, and conquering the scientific gauntlet.

Decoding the Patent Cliff: From Originator Threat to Generic Opportunity

At the heart of the generic drug industry lies a phenomenon known as the “patent cliff.” This term refers to the dramatic and often abrupt drop in revenue that an originator (brand-name) pharmaceutical company experiences when its blockbuster drug loses patent protection.6 For the brand company, it’s a moment of existential threat; for the generic manufacturer, it is the starting pistol for a race to capture a multi-billion-dollar market.

A drug patent in the United States typically grants 20 years of market exclusivity from the date of filing, allowing the innovator to recoup the immense costs of research and development without competition.6 When this protection expires, the floodgates open. Generic competitors can enter the market with bioequivalent versions at a fraction of the cost, often siphoning off as much as 90% of the brand’s sales volume within the first year. The scale of this value transfer is immense. It is estimated that approximately $300 billion in annual revenue for major pharmaceutical companies is at risk through 2030 due to patent expiries on 190 drugs, 69 of which are blockbusters with over $1 billion in annual sales.

The history of the pharmaceutical industry is littered with examples of this dramatic shift. Pfizer’s Lipitor (atorvastatin), once the world’s best-selling drug with peak sales of $12.9 billion, faced a precipitous decline after its patent expired in 2011. Similarly, blockbusters like Plavix (clopidogrel) and Seroquel (quetiapine) saw their revenues plummet as generic competition eroded their market dominance.

However, viewing the patent cliff as a single, fixed date on a calendar is a dangerous oversimplification. Originator companies do not passively watch their revenues evaporate. They employ sophisticated lifecycle management strategies to extend their monopolies for as long as possible. This often involves creating a “patent thicket”—a dense and overlapping portfolio of secondary patents covering new formulations, new methods of use, or new delivery systems.11 These “add-on” patents are designed to create a complex and confusing legal landscape, obscuring the true date when a generic can launch without risking infringement litigation.

Therefore, the first critical step in any generic launch strategy is not merely to identify a patent’s expiration date. It is to conduct a comprehensive and sophisticated “freedom-to-operate” (FTO) analysis. This deep dive into the intellectual property landscape maps the entire portfolio of patents and regulatory exclusivities associated with a target drug. It transforms patent analysis from a simple data-lookup task into a core competitive intelligence function, providing the foundational map upon which the entire launch strategy will be built.

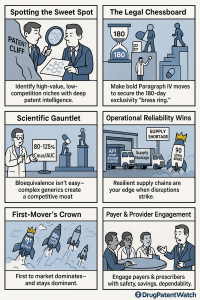

Pillar 1: Mastering Patent Intelligence and Opportunity Selection

With the patent cliff as the catalyst, the next crucial step is to identify which opportunities are worth pursuing. The generic market is not a monolith; it is a collection of thousands of distinct micro-markets, each with its own unique risk-reward profile. Selecting the right targets is arguably the most important decision a generic company will make, as it dictates the potential for profitability and the intensity of competition. This selection process must be a rigorous, data-driven discipline, not an intuitive guess.

The framework for identifying a winning generic candidate rests on a multi-faceted analysis of the market landscape:

- Patent Expiration and Exclusivity Analysis: The process begins with systematically monitoring the expiration dates of patents and other regulatory exclusivities for brand-name drugs. This initial screen identifies the universe of potential targets that will become accessible in the coming years.13

- Competitive Landscape Analysis: Once a potential target is identified, the next step is to assess the current and future competitive environment. How many other generic companies are likely to enter this market? A key indicator of a potentially lucrative opportunity is a market with low competition. Generally, a market with fewer than three existing or anticipated generic competitors is considered attractive. Resources like the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the “Orange Book,” are essential for determining the number of approved Abbreviated New Drug Applications (ANDAs) for a given drug.13

- Market Size and Growth Analysis: The ideal target exists in a financial sweet spot. The market must be large enough to justify the significant investment in development, regulatory submission, and potential litigation. However, markets that are too large (e.g., multi-billion dollar blockbusters) will inevitably attract a flood of competitors, leading to rapid and severe price erosion. Many strategic analysts identify an annual market size of $50 million to $200 million as an ideal range—profitable enough to pursue, but not so large as to guarantee a hyper-competitive “race to the bottom”.

Navigating this complex data landscape manually is inefficient and prone to error. This is where competitive intelligence platforms like DrugPatentWatch become indispensable strategic tools. These platforms provide comprehensive, curated databases of drug patents, track the real-time status of patent litigation, and offer predictive analytics on market entry opportunities. They enable companies to move beyond reactive data gathering and into proactive, strategic forecasting, allowing them to identify promising, low-competition niches that others might overlook.13

The most lucrative of these niches are often created not by legal barriers, but by scientific ones. The market for simple, oral solid generics has become highly saturated, leading to the intense price pressure that defines the industry. To escape this “downward spiral,” as a KPMG report aptly describes it, forward-thinking companies are increasingly focusing on complex generics. These are products that are inherently difficult to develop and manufacture, such as sterile injectables, long-acting formulations, inhalation devices, or transdermal patches.13 The high scientific and technical barriers to entry naturally limit the number of potential competitors, creating a more stable and profitable market for those with the capabilities to succeed.

This reality creates a fundamental strategic trade-off that must be addressed at the portfolio management level. A simple generic may offer a clearer, less risky regulatory path, but it comes with the near certainty of facing numerous competitors and watching margins evaporate within months of launch. A complex generic, on the other hand, requires a much larger upfront investment in research and development, carries greater regulatory risk, and demands specialized manufacturing capabilities. However, the reward for successfully navigating these challenges is a durable market position with fewer competitors and significantly higher, more sustainable margins. A winning long-term strategy, therefore, involves building a balanced portfolio that includes both “bread-and-butter” simple generics and higher-risk, higher-reward complex generics. This diversification ensures a steady stream of revenue while simultaneously investing in the high-value products that will drive future profitability.

Pillar 2: The Legal Chess Match – Winning the Hatch-Waxman Game

Once a promising target has been identified, the next phase of the strategy unfolds in the legal arena. In the United States, the pathway for generic drug entry is governed by the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act. This landmark legislation was a grand compromise: it offered brand-name drug companies extensions on their patent terms to compensate for time lost during the lengthy FDA approval process, and in return, it created a streamlined approval pathway for generic drugs.5

Understanding the intricacies of Hatch-Waxman is not just a task for the legal department; it is a critical component of business strategy. The Act creates a high-stakes legal chess match where the rules, timelines, and potential rewards must be mastered to achieve a successful launch.

The Key Pieces on the Board

- The Abbreviated New Drug Application (ANDA): The cornerstone of the Act, the ANDA pathway allows generic manufacturers to gain FDA approval without having to conduct their own costly and time-consuming preclinical and clinical trials. Instead, they can rely on the FDA’s previous finding of safety and effectiveness for the brand-name drug, provided they can prove their product is bioequivalent.5

- The Paragraph IV (P-IV) Certification: This is the most powerful—and aggressive—move a generic company can make. When submitting an ANDA, the generic firm must make a certification for each patent listed for the brand drug in the FDA’s Orange Book. A Paragraph IV certification is a bold declaration that the generic company believes the brand’s patent is invalid, unenforceable, or will not be infringed by the generic product.5 Under the law, this filing is considered an “artificial act of infringement,” which allows the brand company to sue for patent infringement before the generic drug is even on the market.

- The 45-Day Window and 30-Month Stay: After the generic company notifies the brand manufacturer of its P-IV filing, the brand has a 45-day window to initiate a patent infringement lawsuit. If a suit is filed within this period, the FDA is automatically prohibited from granting final approval to the ANDA for a period of 30 months (or until the court case is resolved, whichever comes first).23 This “30-month stay” provides the brand with a significant and valuable period of continued market exclusivity, allowing time for the patent dispute to be litigated.

- The “Brass Ring”: 180-Day Exclusivity: To incentivize generic companies to take on the risk and expense of challenging patents, the Hatch-Waxman Act includes a powerful reward. The first generic applicant to file a “substantially complete” ANDA with a P-IV certification is eligible for a 180-day period of marketing exclusivity.13 During these six months, the FDA cannot approve any subsequent generic applications for the same drug. This creates a highly lucrative, temporary duopoly, allowing the first generic to capture significant market share at a price point only moderately discounted from the brand.25

The timeline for this process is rigid and unforgiving, making meticulous project management and legal coordination absolutely essential.

| Phase | Action | Timeline | Strategic Implication |

| 1. Filing | Generic company files an ANDA with a Paragraph IV certification with the FDA. | Day 0 | The “race to file” begins. Being the first substantially complete filer is the only way to secure 180-day exclusivity. |

| 2. Notification | Generic company sends a “notice letter” to the brand company and patent holder, detailing the legal basis for the P-IV certification. | Within 20 days of FDA acknowledgment of the ANDA filing. | The 45-day clock for the brand company to sue starts upon receipt of this letter. The letter must be legally and scientifically robust. |

| 3. Brand Response | Brand company reviews the notice letter and decides whether to file a patent infringement lawsuit. | Within 45 days of receiving the notice letter. | For any commercially significant drug, a lawsuit is a near certainty to trigger the automatic 30-month stay. |

| 4. Litigation & Stay | If a lawsuit is filed, an automatic 30-month stay on FDA approval of the ANDA begins. The parties engage in patent litigation. | 30 months (or until a court decision, if earlier). | This provides the brand with a guaranteed 2.5 years of additional market exclusivity, a period that must be factored into the generic’s financial models. |

| 5. Resolution | The patent litigation is resolved through a court decision or a settlement between the parties. | Varies (can be before or after the 30-month stay expires). | A win for the generic company (or a favorable settlement) clears the path for final FDA approval. |

| 6. Launch & Exclusivity | If the first-filer wins and gains FDA approval, it can launch its product and begin its 180-day period of marketing exclusivity. | 180 days from the date of first commercial marketing. | This is the most profitable period for the generic, allowing it to capture market share with limited competition. |

This framework reveals a critical strategic reality: the P-IV pathway is not merely a legal process; it is a core business strategy. The financial reward of the 180-day exclusivity is so immense that it can define a company’s entire year. The successful P-IV challenge against Eli Lilly’s blockbuster antidepressant Prozac by Barr Laboratories is a landmark case. After five years of litigation, Barr launched its generic fluoxetine in 2001 with 180-day exclusivity. During that period, the company’s gross profit margin nearly doubled to 28.7%, and its stock price surged over 35%. This case demonstrated that for the right target, patent litigation is not a risk to be avoided but a calculated investment to secure a temporary monopoly.16

Furthermore, the automatic nature of the 30-month stay has profound strategic implications. For any drug with significant revenue, the brand company has every incentive to file a lawsuit in response to a P-IV notification, regardless of the perceived strength of their patents. The lawsuit itself guarantees them an additional 2.5 years of monopoly profits, a return that will almost certainly outweigh their legal costs. This means that a generic company pursuing a P-IV strategy must treat the 30-month delay and the multi-million dollar cost of litigation not as a potential risk, but as a fixed, upfront cost of entry. This high barrier to entry makes the P-IV path a high-cost, high-reward strategy that must be reserved for the most valuable and strategically important targets in the portfolio.

Pillar 3: The Scientific Gauntlet – Overcoming Formulation and Bioequivalence Hurdles

While the legal battle rages, an equally complex and critical challenge unfolds in the laboratory. A generic drug cannot be a mere approximation of its brand-name counterpart; it must be a therapeutic equivalent. Proving this equivalence is a scientific gauntlet that requires sophisticated reverse-engineering, meticulous formulation science, and rigorous clinical testing. This scientific challenge represents the primary non-patent barrier to entry and is a key source of competitive advantage.

The core of the scientific challenge is not in re-proving the drug’s safety and efficacy—the Hatch-Waxman Act allows generic developers to rely on the brand’s data for that. Instead, the entire effort is focused on demonstrating bioequivalence (BE). This is the scientific standard used by the FDA to ensure that the generic product delivers the same amount of active ingredient into a patient’s bloodstream over the same period of time as the brand-name drug.31

Proving Sameness: The Science of Bioequivalence

To prove bioequivalence, generic companies conduct pharmacokinetic (PK) studies in a small group of healthy volunteers. These studies measure two key parameters:

- Cmax (Maximum Concentration): The highest concentration of the drug in the blood. This is a measure of the rate of absorption.

- AUC (Area Under the Curve): The total exposure to the drug over time. This is a measure of the extent of absorption.

For the FDA to grant approval, the 90% confidence interval for the ratio of the generic’s average Cmax and AUC to the brand’s must fall within the narrow range of 80% to 125%.5 This statistical standard, often referred to as the “80/125 rule,” is far more stringent than it sounds. An analysis of FDA data revealed that the average difference in absorption (

AUC) between generic and brand-name drugs was only about 3.5%.

Achieving this precise level of sameness is a formidable task because generic developers are essentially trying to replicate the performance of a Reference Listed Drug (RLD) without having access to the originator’s proprietary formulation data or manufacturing processes. This process of “de-formulation” is a sophisticated exercise in reverse-engineering, demanding deep analytical capabilities and innovative formulation expertise.

This challenge is compounded by a critical flexibility in the regulations: while the active pharmaceutical ingredient (API) must be identical, the inactive ingredients, or excipients, can differ.33 This is a double-edged sword. It provides developers with the flexibility to design a more efficient or stable formulation, but it also introduces significant risk. Excipients are not always inert. A seemingly harmless binder, filler, or coating can interact with the API, affecting its stability, its dissolution rate in the gut, and ultimately, its absorption into the bloodstream. A poor choice of excipients can lead to a failed bioequivalence study, forcing a costly and time-consuming reformulation and potentially jeopardizing the entire launch timeline.

The Rise of Complex Generics: Where Science Becomes Strategy

The scientific gauntlet becomes exponentially more challenging with the rise of complex generics. As the market for simple oral tablets and capsules becomes increasingly commoditized, the strategic frontier has shifted towards products that are inherently more difficult to replicate.17 These include:

- Modified-Release Formulations: Products designed for extended or delayed release rely on complex polymer matrices or coatings to control the rate at which the drug is released. A failure in this system can lead to “dose dumping”—a rapid, premature release of the entire dose—which can be both ineffective and dangerous.

- Parenteral (Injectable) Formulations: These products bypass the body’s natural defenses and must be absolutely sterile and free of pyrogens (fever-inducing substances). The manufacturing process is highly specialized and requires stringent quality control.

- Inhalation Products: For drugs delivered via metered-dose inhalers (MDIs) or dry-powder inhalers (DPIs), the formulation and the delivery device are inextricably linked. Replicating the precise particle size distribution and aerosol performance needed to deliver the correct dose to the lungs is a major engineering challenge.

The immense technical difficulty of developing these complex products serves as a powerful natural barrier to entry. A company that invests in and masters the specialized scientific expertise and manufacturing capabilities required for these products can enter markets that will have far fewer competitors. This allows them to escape the brutal price erosion that plagues the simple generics market. In this context, advanced R&D and formulation science are not just support functions; they are direct drivers of long-term profitability and the ultimate expression of a sustainable competitive strategy.

Part II: The Pathway to Market – Regulatory and Operational Readiness

With a promising candidate selected and the initial legal and scientific hurdles cleared, the focus shifts to execution. This phase is about translating years of strategic planning into a tangible product ready for launch. It involves two parallel and equally critical workstreams: navigating the intricate regulatory labyrinth to secure timely approval and forging an unbreakable operational backbone capable of manufacturing and distributing the product at scale. Failures in this phase are often less dramatic than a lost court case but are no less fatal to a launch’s success. A six-month regulatory delay or a supply chain disruption on Day 1 can instantly erase the hard-won first-mover advantage.

Navigating the ANDA Labyrinth: A Practical Guide to FDA Approval

The Abbreviated New Drug Application (ANDA) is the formal submission to the U.S. Food and Drug Administration (FDA) seeking approval to market a generic drug. While “abbreviated,” the process is anything but simple. It is a rigorous, multi-stage journey that demands meticulous preparation, deep regulatory knowledge, and proactive engagement with the agency.

The ANDA submission and review process can be broken down into several key stages:

- Pre-ANDA Preparation: This is the foundational work. Before any submission is compiled, the company must have completed its formulation development, conducted the necessary bioequivalence studies to the standards discussed previously, and ensured that its manufacturing facilities and processes are in full compliance with the FDA’s Current Good Manufacturing Practices (cGMP). This stage also involves a thorough analysis of the Reference Listed Drug’s (RLD) labeling to prepare the generic label, which must be identical in most respects.

- ANDA Submission: The complete application is a massive dossier of information. It includes exhaustive data on the drug’s chemistry, manufacturing, and controls (CMC); the results of all bioequivalence studies; detailed information on the API and finished product stability; and the proposed labeling. Since 2018, all ANDAs must be submitted electronically in the eCTD (Electronic Common Technical Document) format, a standardized structure that facilitates efficient review by the agency.

- FDA Review and Decision: Upon receipt, the FDA conducts a multi-phase review. An initial administrative review ensures the application is complete and can be accepted for filing. This is followed by a detailed scientific review of the CMC, bioequivalence, and labeling data. The FDA will also typically conduct an inspection of the manufacturing facilities to verify cGMP compliance. This entire process can take, on average, around 30 months, although the agency has goals to reduce this timeline, and expedited pathways exist for “priority” generics, such as those addressing a drug shortage.31 The review culminates in one of two outcomes: an

Approval Letter, which grants marketing authorization, or a Complete Response Letter (CRL), which details deficiencies in the application that must be addressed before approval can be granted.

A significant development in this landscape has been the implementation of the Generic Drug User Fee Amendments (GDUFA). Enacted in 2012 and reauthorized since, GDUFA allows the FDA to collect fees from generic drug manufacturers to fund and expedite the review process. While GDUFA has been successful in reducing the backlog of applications and improving review predictability, it has also fundamentally altered the economics of generic development. The fees are substantial—in 2024, the ANDA filing fee alone was over $300,000, with additional annual fees for facilities and programs that can run into the millions.

This “pay-to-play” model has transformed the decision to pursue an ANDA into a major capital investment. It acts as a significant barrier to entry, particularly for smaller companies or for those targeting niche products with lower revenue potential. Consequently, generic companies must be far more selective in their portfolio choices, prioritizing candidates with a high probability of first-cycle approval and a market size sufficient to generate a return on the substantial regulatory investment.

This economic reality elevates the regulatory process from a downstream administrative hurdle to a core strategic risk management function. Receiving a CRL is not just a minor setback; it’s a costly delay that requires significant resources to rectify. More critically, in the race to be the first generic to market, a delay of even a few months can be catastrophic. It can mean losing the 180-day exclusivity window, ceding the first-mover advantage to a competitor, and being relegated to a hyper-competitive market with collapsed margins. Therefore, an obsessive focus on quality and completeness in the ANDA submission is paramount. Proactive engagement with the FDA through mechanisms like pre-ANDA meetings to clarify regulatory expectations is no longer optional; it is a critical investment in de-risking the submission and maximizing the probability of a timely, first-cycle approval.

Forging an Unbreakable Supply Chain: From API Sourcing to Distribution

A brilliant legal strategy and a flawless regulatory submission are worthless if you cannot reliably produce and deliver a high-quality product on Day 1 of your launch. A robust, scalable, and compliant supply chain is the operational backbone of any successful generic drug launch. In a market defined by intense price competition and vulnerability to disruptions, the supply chain is not just a cost center; it is a source of profound competitive advantage.

The journey begins with the sourcing of the Active Pharmaceutical Ingredient (API), the drug’s core component. This initial step requires intense and ongoing due diligence. A prospective supplier must be vetted not just on price, but on a comprehensive set of quality and reliability metrics. This includes:

- Regulatory Compliance: Verifying that the supplier’s facilities hold current Good Manufacturing Practice (cGMP) certification from the FDA and/or other major regulatory bodies. A thorough check of public databases, such as those maintained by the FDA and the European Medicines Agency (EudraGMP), for any past warning letters, import alerts, or recalls is non-negotiable.

- Quality Systems: Conducting on-site audits to assess the supplier’s quality management systems, staff training protocols, data integrity standards, and procedures for handling deviations and investigations. Seeing a facility firsthand is the only way to truly validate the claims made on paper.

- Technical Capability: Reviewing the supplier’s Drug Master File (DMF)—a confidential submission to the FDA detailing the chemistry, manufacturing, and controls of the API—to ensure it is complete and has been successfully referenced in other approved applications.

- Scalability: Assessing the supplier’s capacity to meet forecasted demand, including their ability to scale up production to handle unexpected demand spikes, which can occur in over 30% of generic launches.

This rigorous vetting process is complicated by a systemic feature of the modern pharmaceutical industry: the geographic concentration of API manufacturing. A vast majority of the API used in generic drugs sold in the United States is manufactured overseas, with India and China being the dominant producers.3 While this globalized model has been instrumental in lowering costs, it also introduces significant systemic risks. Geopolitical tensions, trade disputes, natural disasters, or a quality crisis at a major overseas facility can trigger cascading disruptions throughout the supply chain, leading to widespread drug shortages.

Indeed, drug shortages have become a persistent problem in the U.S. healthcare system, and they disproportionately affect generic drugs, particularly sterile injectables.42 These shortages are often caused by manufacturing quality issues or by the brutal economics of the market; when price erosion drives margins to unsustainable levels, manufacturers may simply exit the market, leaving only one or two suppliers.

This volatile environment means that supply chain strategy must be viewed through the lens of risk mitigation and competitive differentiation. A company that relies on a single, low-cost API supplier is dangerously exposed. In contrast, a company that builds a resilient supply chain—by qualifying multiple suppliers in different geographic regions, maintaining strategic inventory levels, and fostering deep, transparent partnerships with its suppliers—is not only insulated from disruptions but is also uniquely positioned to capitalize on them. When a competitor’s product goes into shortage due to a supply chain failure, a company with a robust and agile supply network can rapidly increase production to fill the market void, capturing valuable market share and building a reputation for reliability among pharmacies and payers. In the generic drug market, reliability is a powerful brand attribute.

Understanding the Players: Standard vs. Authorized vs. Branded Generics

Before diving into the commercial execution of the launch, it is crucial to understand that not all “generics” are the same. The market is populated by distinct categories of products, each with its own regulatory pathway, market positioning, and strategic implications. A savvy launch plan must account for which of these players will be on the field.

The three primary categories are:

- Standard Generic: This is the most common type of generic drug. It is developed and manufactured by a company that is independent of the original brand-name drug creator. It is approved via the ANDA pathway and must prove bioequivalence to the brand. Critically, while it contains the identical active ingredient, it is permitted to have different inactive ingredients (excipients), which often results in a different size, shape, or color from the brand-name product.33

- Authorized Generic (AG): An AG is a unique market participant. It is the brand-name drug, repackaged and marketed as a generic. It is produced by the brand company itself or by a third party with the brand’s permission. Because it is the exact same drug—identical in both active and inactive ingredients—it is not approved via an ANDA. Instead, it is marketed under the brand’s original New Drug Application (NDA).33 The brand company simply notifies the FDA that it is launching an AG version of its approved product.

- Branded Generic: This is more of a marketing strategy than a distinct regulatory category. A branded generic is a standard generic drug that has been approved through the ANDA process but is given a proprietary trade name by its manufacturer. The goal is to build a unique brand identity, foster physician and patient loyalty, and differentiate the product from other “unbranded” generics, often allowing it to command a slightly higher price.44

This table provides a clear, at-a-glance comparison of these three product types across their most important attributes:

| Attribute | Standard Generic | Authorized Generic (AG) | Branded Generic |

| Manufacturer | Competing generic company | Brand company or its partner | Competing generic company |

| Formulation | Same active ingredient; can have different inactive ingredients (excipients) | Identical to the brand drug (same active and inactive ingredients) | Same active ingredient; can have different inactive ingredients |

| Appearance | Often differs in size, shape, and color from the brand | Identical to the brand drug (may have different markings) | Often differs in size, shape, and color from the brand |

| Regulatory Pathway | Abbreviated New Drug Application (ANDA) | New Drug Application (NDA) of the brand drug | Abbreviated New Drug Application (ANDA) |

| Market Strategy | Compete primarily on lowest price | Compete with standard generics; retain market share for the brand company | Build brand loyalty and trust; command a premium over unbranded generics |

The strategic implications of these distinctions are profound, particularly concerning the Authorized Generic. The AG is one of the most powerful defensive weapons in the brand company’s arsenal to soften the blow of the patent cliff.47 By launching its own “generic,” the originator can accomplish several goals simultaneously. First, it allows the company to retain a significant portion of the market volume and revenue that would otherwise be lost completely to independent generic competitors. Second, by launching an AG during or immediately after the first standard generic’s 180-day exclusivity period, the brand company introduces an additional competitor into the market, which accelerates price erosion and significantly diminishes the financial value of that coveted exclusivity window for the first filer.

This creates a complex strategic dilemma. The brand’s ability to launch an AG becomes a powerful bargaining chip during patent litigation settlement negotiations. The brand company can offer a “no-AG agreement”—a promise not to launch an authorized generic—in exchange for the standard generic company agreeing to delay its market entry. This means the competitive landscape a generic will launch into is not a fixed certainty. It is a dynamic environment that is actively being shaped by high-stakes legal negotiations occurring years before the product ever becomes available. A successful generic strategy must therefore include a thorough analysis of the likelihood of an AG launch and incorporate that possibility into its forecasting and litigation strategy.

Part III: The Launch – Commercial Execution and Market Domination

After years of meticulous planning, legal maneuvering, scientific development, and operational preparation, the moment of truth arrives: the commercial launch. This is the phase where strategy is put to the test and the race for market share begins in earnest. In the unforgiving world of generics, the launch window is narrow and the stakes are incredibly high. Success requires a combination of perfect timing, intelligent pricing, savvy stakeholder engagement, and flawless execution. This is where the battle is won or lost.

The Day 1 Imperative: The Overwhelming Power of the First-Mover Advantage

If there is one immutable law in the generic drug universe, it is this: timing is everything. The company that launches the first generic version of a drug after patent expiry secures a commanding and remarkably durable competitive advantage. This “first-mover advantage” is so profound that achieving it should be the central, organizing principle of the entire launch strategy.

The data on this phenomenon is unequivocal and overwhelming. Study after study has demonstrated that the first generic to market consistently captures a dominant share of the volume, a lead that is not fleeting but persists for years.

“First movers can capture up to a 90% market share advantage over later entrants, which can persist for years, enabling them to recoup investments and establish a dominant position before full competitive pricing pressures take effect.”

This is not a minor edge; it is a market-defining reality. Research has quantified this advantage with striking precision: the initial generic entrant enjoys an 80% market share advantage over the second entrant and a staggering 225% advantage over the third. This dominance is not temporary. A McKinsey analysis of nearly 500 drug launches confirmed that first entrants, on average, maintain a higher market share even ten years after their launch. The lead time matters as well; when the first generic launches a month or more before its competitors, its market share advantage increases substantially.

Real-world examples vividly illustrate this principle. When the first generic version of the blockbuster cholesterol medication atorvastatin (Lipitor) launched, it rapidly seized over 70% of the genericized market within just a few months. Similarly, when Teva launched its generic version of Viagra in 2017, its early filing and aggressive strategy allowed it to capture 70% of the market within a single year.

This powerful advantage stems from more than just being the only option available on Day 1. It creates a deep and lasting “stickiness” in the market. Physicians, who are creatures of habit, begin prescribing the first generic and see no compelling reason to switch when subsequent, identical generics become available. Pharmacies, which value supply chain simplicity and consistency, establish ordering patterns and build inventory of the first-mover’s product. Patients become familiar with the appearance and packaging of that specific generic. Collectively, these factors create high “switching costs” that later entrants must struggle to overcome.

The strategic implication is crystal clear: the first-mover advantage is so absolute that it must be the paramount objective of the entire pre-launch process. Every decision, from the initial portfolio selection to the final details of the regulatory submission, must be optimized for speed. A strategy that sacrifices a few weeks of time to save a nominal amount on development costs is a strategically bankrupt trade-off. The lost revenue and market share from a delayed entry will dwarf any potential savings a thousand times over. The race to be first is the only race that truly matters.

The Price is Right: Crafting a Dynamic Pricing and Reimbursement Strategy

Pricing a generic drug is a masterclass in navigating a rapidly evolving, hyper-competitive environment. It is a delicate balancing act. If you price too high, you negate the core value proposition of a generic and risk losing access on payer formularies. If you price too low, you signal poor quality to physicians and patients, and you unnecessarily sacrifice margin, leaving crucial revenue on the table. A successful pricing strategy is not static; it must be dynamic and strategically segmented to reflect the different phases of the post-launch market.

The pricing journey can be divided into two distinct phases:

Phase 1: The Exclusivity/Limited Competition Window. For the first generic to market, particularly one enjoying the 180-day exclusivity period, the initial pricing strategy is focused on value capture. During this temporary duopoly with the brand, the generic manufacturer can price its product at a relatively modest discount—typically 15% to 30% below the brand’s wholesale acquisition cost (WAC). This strategy allows the company to rapidly recoup its significant development and legal costs while capturing substantial market share before the competitive landscape intensifies.

Phase 2: The Multi-Competitor Market. The moment a second generic competitor enters the market, the strategic focus must pivot instantly from value capture to market share retention. This phase is defined by rapid and severe price erosion. The relationship between the number of competitors and the decline in price is predictable and brutal.

| Number of Generic Competitors | Average Price Reduction vs. Brand Price |

| 1 | 39% |

| 2 | 54% |

| 4 | 79% |

| 6+ | >95% |

Sources: 16

As this table starkly illustrates, with just a handful of competitors, the price of a generic drug can plummet to a tiny fraction of the original brand price. In this environment, the primary pricing strategies become cost-based and market-based. Market-based pricing is reactive, involving the constant monitoring of competitor prices and adjusting accordingly to remain competitive. Cost-based pricing is foundational, ensuring that even in a price war, the selling price covers the total cost of goods sold (COGS) plus a minimal, sustainable profit margin.

This inevitable price erosion reveals a deeper strategic truth. While the launch price is a critical short-term decision, a company’s long-term profitability in the generic market is ultimately determined by its cost structure. In a market where prices are relentlessly driven down towards the marginal cost of production, the company with the most efficient manufacturing processes, the most optimized supply chain, and the lowest COGS will be the “last one standing.” Therefore, sustained investment in operational excellence is not merely a quality control initiative; it is the most powerful long-term pricing strategy a generic company can possess.

Gaining Access: Navigating the PBM and Payer Landscape

Securing FDA approval and setting an intelligent launch price are necessary but insufficient conditions for success. The final gatekeeper to the market is the payer—the constellation of insurance companies, government programs, and, most importantly, Pharmacy Benefit Managers (PBMs) that control which drugs patients can access and how much they will pay for them. Gaining favorable placement on their formularies is the final, critical step in the path to market domination.

PBMs are powerful and often controversial intermediaries that administer the prescription drug benefits for the vast majority of insured Americans.54 They perform several key functions: they negotiate rebates with drug manufacturers, they create networks of pharmacies, and they design and manage

drug formularies. A formulary is a tiered list of covered medications designed to steer patients and physicians toward the most cost-effective options.56 A typical formulary has multiple tiers:

- Tier 1 (Preferred Generics): This tier has the lowest patient co-payment and is reserved for most generic drugs.

- Tier 2 (Preferred Brands): This tier is for brand-name drugs that the PBM has negotiated a significant rebate for, resulting in a moderate co-payment for patients.

- Tier 3 (Non-Preferred Brands): This tier includes brand-name drugs with no or smaller rebates, carrying a much higher co-payment.

- Specialty Tier: Reserved for very high-cost drugs used to treat complex or chronic conditions, often requiring the patient to pay a percentage of the cost (coinsurance) rather than a flat co-pay.54

Historically, the model was simple: generics were automatically placed on Tier 1 to incentivize their use and drive savings. However, the modern PBM business model has introduced complexities and misaligned incentives that can create significant barriers to generic uptake. PBMs often generate a substantial portion of their profits from two sources: retaining a share of the rebates they negotiate with brand-name manufacturers, and “spread pricing” on generics, where they charge the health plan a higher price for a generic drug than they reimburse the pharmacy that dispensed it.54

This creates a perverse incentive. A high-list-price brand drug with a large rebate may be more profitable for the PBM than a low-cost generic, even if the net cost of the brand drug to the health plan is higher. This can lead PBMs to place brand-name drugs in preferred positions on their formularies or, increasingly, to place generic drugs on higher, more expensive tiers. An analysis by Avalere Health found that by 2022, a shocking 57% of generic drugs covered under Medicare Part D plans were placed on non-generic tiers with higher patient cost-sharing requirements, a 21-percentage-point increase from 2016.

This reality means that a generic manufacturer can no longer assume automatic, preferential formulary access simply by offering the lowest price. The launch strategy must include a sophisticated PBM and payer engagement plan that begins long before launch. This involves treating PBMs not as simple customers, but as complex strategic partners whose unique financial drivers must be understood and addressed. The goal is to articulate a comprehensive value proposition that goes beyond the unit price, highlighting factors like supply chain reliability, patient adherence support programs, and the total cost of care. In an increasingly competitive generic market, it may even be necessary to offer strategic contracts or rebates to secure a preferred Tier 1 position against other generic competitors, a clear sign of the evolving and complex power dynamics in the pharmaceutical supply chain.

Winning Hearts and Minds: Marketing and Education for Stakeholders

While generic drugs do not command the massive marketing budgets of their brand-name counterparts, a targeted and intelligent marketing and education strategy is essential for driving adoption and overcoming persistent skepticism among key stakeholders: physicians, pharmacists, and patients. The perception of a generic drug is often as important as its price.

Despite decades of evidence and stringent FDA oversight, misconceptions about generic drugs remain prevalent. Studies have consistently shown that a significant portion of patients harbor doubts, believing generics to be less safe, less effective, or manufactured to lower quality standards.63 These negative perceptions are often rooted in simple observations: the generic pill may have a different shape, size, or color, leading patients to believe it is a different, and therefore inferior, medicine.

Physician and pharmacist perceptions can also be a barrier. While trust in generics is generally high in mature healthcare systems like the U.S. and Europe, skepticism can arise, particularly for drugs with a narrow therapeutic index (where small differences in dose can have significant clinical effects) or in less mature healthcare systems with less trusted regulatory oversight.

The key to overcoming this “trust gap” is education, and the most effective messengers are healthcare professionals themselves. Research has shown that patients are far more comfortable with and willing to accept a generic medication when their physician or pharmacist explicitly discusses it with them and endorses the switch. Therefore, the primary goal of a generic marketing strategy is not to reach the patient directly, but to equip healthcare providers with the information, data, and confidence they need to prescribe and dispense the generic product.

The marketing and communication plan must be tailored to the specific needs and concerns of each stakeholder group :

- For Physicians: The message should be clinical and data-driven. Emphasize the FDA’s rigorous standards for bioequivalence, provide data on patient outcomes where available, and highlight the role of the generic in improving patient access and affordability, which can lead to better medication adherence.

- For Pharmacists and Payers: The focus should be on economics and logistics. Highlight the significant cost savings for both the health system and the patient. Emphasize the reliability of your supply chain and your commitment to preventing shortages, a major pain point for pharmacies.

- For Patients (via HCPs): The message must be simple and reassuring. Focus on the core concept that the generic has the same active ingredient, works in the same way, and has been approved by the same FDA that approves brand-name drugs.

In this context, the Authorized Generic (AG) emerges as a uniquely powerful marketing tool. Because an AG is physically and chemically identical to the brand-name drug in every way, it directly neutralizes the most common source of patient anxiety: the different appearance of a standard generic.33 A company launching an AG can build a marketing campaign around the compelling and easily understood message of “the exact same medicine without the brand-name price.” This can be a highly effective strategy for winning over hesitant physicians and patients, allowing the company to bridge the trust gap and accelerate market share capture. This makes the AG not just a financial and defensive strategy, but also a potent marketing and trust-building instrument.

Part IV: The Long Game – Post-Launch Strategy and Sustainability

The initial launch is a sprint, but the life of a generic product is a marathon. The weeks and months following Day 1 are a critical period of intense competition and market stabilization. However, a truly successful strategy looks beyond this initial window to the long-term sustainability of the product. This requires anticipating and neutralizing the defensive maneuvers of the brand-name company, maintaining constant market vigilance, and fulfilling the ongoing responsibilities of a drug manufacturer.

Anticipating the Counter-Attack: Neutralizing Originator Defense Tactics

Brand-name companies do not concede defeat when the first generic launches. They continue to deploy a range of defensive tactics aimed at minimizing the erosion of their market share and frustrating generic competition. A prepared generic company must anticipate these moves and have counter-strategies at the ready.

Common originator defense tactics include:

- Aggressive Brand Marketing: Originator companies often increase their marketing efforts post-generic entry, focusing their “detailing” visits on physicians who have shown strong brand loyalty in an attempt to persuade them not to switch to the generic.

- “Product Hopping”: This controversial strategy involves the originator making a minor, often clinically insignificant, change to their product (e.g., switching from a tablet to a capsule, or from a once-daily to an extended-release formulation) and then heavily marketing the “new and improved” version while pulling the old version from the market. This is timed to occur just before the original product’s patent expires, forcing patients and physicians to switch to the new, patent-protected product and disrupting the market for the impending generic.69

- Launching an Authorized Generic: As discussed, this allows the brand to compete directly with standard generics and retain a portion of the market value.48

- Citizen Petitions: An originator company may file a “citizen petition” with the FDA, raising purported safety or efficacy concerns about a pending generic application. While often without scientific merit, these petitions can trigger an FDA review that delays the generic’s approval.

The generic manufacturer’s playbook must include robust counter-strategies to neutralize these tactics.17 This requires an integrated approach where legal, R&D, and commercial teams work in concert. The most effective counter-strategy, however, is often an offensive one. The aggressive pursuit of a Paragraph IV patent challenge, as detailed in Part I, is the ultimate proactive maneuver. By challenging and potentially invalidating the brand’s core patents, a generic company can put the originator on the defensive from the outset. A successful legal challenge can render subsequent “product hopping” or “patent thicket” strategies irrelevant, as they are often based on a foundation of intellectual property that has been proven to be weak or invalid. This reframes the generic company not as a passive reactor to the brand’s moves, but as a proactive challenger that actively shapes the competitive landscape in its favor.

Vigilance and Adaptation: Post-Launch Monitoring and Pharmacovigilance

The launch is not the end of the strategic journey. The post-launch environment is dynamic and requires continuous monitoring and adaptation to ensure long-term success and compliance. This involves two key activities: market intelligence and pharmacovigilance.

Continuous Market Monitoring: The generic market does not stand still. After the initial launch, new competitors will continue to enter, driving further price erosion. Payer formularies will change. Competitors may experience supply chain disruptions. A successful company must have a robust market intelligence system in place to track these developments and adapt its strategy accordingly.39 For example, the intense price competition in a crowded market often leads to some manufacturers exiting due to unsustainable margins. This can create a drug shortage situation. A company that is actively monitoring supply chain data and competitor activity can anticipate these market shifts. It can proactively scale up its own production to meet the resulting demand, potentially allowing it to stabilize its pricing or even capture a larger market share at more favorable terms.43

Pharmacovigilance: Beyond commercial concerns, every drug manufacturer has a fundamental and legally mandated responsibility to monitor the safety of its products once they are on the market. This is the science and activity of pharmacovigilance: the detection, assessment, understanding, and prevention of adverse effects.73 Both U.S. and European law require all marketing authorization holders to operate a comprehensive pharmacovigilance system. This involves collecting and analyzing reports of suspected adverse drug reactions (ADRs) from patients, healthcare providers, and other sources, and reporting serious events to regulatory authorities in a timely manner.

A robust pharmacovigilance system is not just a regulatory burden; it is a critical tool for building and maintaining trust. In a market where skepticism about generic quality can be a barrier to adoption, any real or perceived safety issue can be devastating to a product’s reputation.75 A company that demonstrates a strong commitment to post-market safety monitoring reinforces the quality of its products and builds confidence among the physicians, pharmacists, and patients who are the ultimate arbiters of its success.

Conclusion: Synthesizing the Winning Formula for Generic Launch Success

The journey from a line item in a patent database to a market-leading generic drug is one of the most complex and challenging endeavors in the modern business world. It is a multi-year marathon that demands a rare blend of scientific ingenuity, legal audacity, regulatory precision, and commercial acumen. As we have seen, success in this arena is not the result of a single brilliant move, but the culmination of a thousand strategic decisions, flawlessly executed in concert.

The winning formula is not a secret; it is a discipline. It begins with Pillar 1: Mastering Patent Intelligence, where data-driven analysis using powerful tools like DrugPatentWatch uncovers the most promising opportunities hidden within the patent cliff, favoring complex products in low-competition niches. It builds upon this foundation with Pillar 2: Winning the Legal Chess Match, where a deep understanding of the Hatch-Waxman Act is leveraged to proactively challenge patents and pursue the game-changing 180-day exclusivity. This legal strategy is supported by Pillar 3: Conquering the Scientific Gauntlet, where world-class formulation expertise overcomes the immense technical hurdles of bioequivalence, creating a scientific moat that insulates the product from intense competition.

This strategic blueprint is then brought to life through operational excellence. It requires Navigating the ANDA Labyrinth with meticulous preparation to ensure a timely, first-cycle approval, and Forging an Unbreakable Supply Chain that provides not just a cost advantage, but a crucial reputation for reliability.

Finally, at the moment of launch, the strategy culminates in a focused commercial assault. It is defined by the Day 1 Imperative, recognizing the overwhelming and durable power of the first-mover advantage. It is executed through a Dynamic Pricing Strategy that balances value capture with market share defense, and a sophisticated Payer Engagement Plan that secures access by understanding and addressing the complex incentives of PBMs. And it is sustained by Winning the Hearts and Minds of healthcare providers and patients through targeted education that builds the essential currency of trust.

The landscape is constantly evolving. The rise of even more complex biosimilars, the increasing sophistication of brand defense strategies, and the relentless pressure from consolidated buyers will continue to raise the bar for success. As outlined in strategic roadmaps like KPMG’s “Generics 2030,” the future will likely belong to companies that can achieve greater scale through mergers and acquisitions, gain more control over their supply chains through vertical integration, and continue to shift their portfolios toward higher-value, differentiated products.

In this dynamic and demanding environment, one truth remains constant: data is the ultimate competitive weapon. The companies that thrive in the decades to come will be those that can most effectively transform the vast ocean of patent, regulatory, clinical, and market data into clear, actionable intelligence. They will be the ones who master the generic gambit, not by playing the game, but by rewriting its rules.

Key Takeaways

- Strategy is Paramount in a Low-Margin World: The generic drug market is characterized by high volume and intense price pressure. Success is impossible without a comprehensive, multi-year strategy that integrates legal, scientific, regulatory, and commercial functions.

- The First-Mover Advantage is Absolute: Being the first generic to market provides a massive and durable market share advantage (up to 90%). Every strategic decision should be optimized to achieve the earliest possible launch date.

- Patent Intelligence is the Starting Point: A successful launch begins years in advance with a sophisticated “freedom-to-operate” analysis to navigate brand “patent thickets.” The most lucrative opportunities often lie in scientifically complex, low-competition niches.

- Litigation is a Strategic Investment: The Paragraph IV patent challenge is a high-risk, high-reward strategy. The potential 180-day exclusivity period is so valuable that the cost and time of the ensuing litigation should be viewed as a calculated business investment to secure a temporary monopoly.

- Scientific Capability Creates a Competitive Moat: The ability to overcome complex formulation and bioequivalence challenges is a primary non-patent barrier to entry. Expertise in areas like sterile injectables or inhalation devices allows entry into less crowded, more profitable markets.

- The Supply Chain is a Strategic Weapon: In a market plagued by shortages, a resilient, multi-source, and high-quality supply chain is not just a defensive necessity but an offensive tool to capture market share when competitors falter.

- PBMs are Complex Gatekeepers, Not Simple Customers: Gaining formulary access requires a sophisticated engagement strategy that understands and addresses the often-perverse financial incentives of Pharmacy Benefit Managers, which may not always favor the lowest-cost drug.

- Long-Term Profitability is Driven by COGS: While launch pricing is critical, the relentless post-launch price erosion means that the company with the lowest cost of goods sold (COGS) will ultimately win the war of attrition. Operational excellence is the ultimate long-term pricing strategy.

Frequently Asked Questions (FAQ)

1. What is the single most common mistake companies make in their generic launch strategy?

The most common and costly mistake is underestimating the absolute importance of being the first to market. Many companies get bogged down in internal processes or try to shave small costs off their development budget, causing delays of a few weeks or months. They fail to internalize that in the generic world, a one-month delay is not a one-month loss of revenue; it can be the loss of the entire profitable lifecycle of the product. If a competitor launches first and captures the 180-day exclusivity and the durable first-mover market share, your product, when it finally launches, enters a completely different, far less profitable market. Every day of delay has an exponential, not linear, negative impact on the product’s net present value.

2. How should a smaller generic company with a limited budget approach portfolio selection and litigation strategy?

Smaller companies must be exceptionally strategic. They cannot afford to engage in multi-front patent wars with large pharmaceutical companies across a dozen products. Their strategy should focus on precision and asymmetry.

- Portfolio Selection: They should prioritize opportunities in niche or complex generic markets where the scientific barriers to entry are high, naturally limiting the number of competitors. This might mean investing in a specific technology platform (e.g., long-acting injectables) to become a leader in a smaller pond. They should avoid “me-too” simple generics for blockbuster drugs, as they will be crushed by larger, more efficient manufacturers.

- Litigation Strategy: They should be highly selective with Paragraph IV challenges, reserving this expensive strategy for only the most promising targets where the brand’s patents are demonstrably weak and the market potential is significant enough to justify the risk. Partnering with a larger company on a high-risk litigation case can also be a viable strategy to share costs and risks.

3. Is launching an “Authorized Generic” (AG) always a good defensive strategy for a brand company?

Not necessarily. While launching an AG can help retain revenue and disrupt the first standard generic’s exclusivity, it also has downsides. It accelerates the price erosion of your own brand and can cannibalize sales of the higher-priced originator product faster than a standard generic might. Furthermore, it legitimizes the “generic” version in the eyes of physicians and patients, potentially making it easier for them to switch to other standard generics later on. The decision to launch an AG is a complex financial trade-off: you are sacrificing high margins on your brand for higher volume on your AG. It is often most effective for blockbuster drugs where retaining even a fraction of the market volume at a lower price is worth hundreds of millions of dollars.

4. How is the rise of biosimilars changing the generic launch playbook?

Biosimilars are “generics” for large-molecule biologic drugs, and they add several layers of complexity. While the core strategic principles (first-mover advantage, navigating patents) are similar, the execution is far more difficult.

- Scientific Challenge: Biologics are large, complex molecules made in living cells, and it’s impossible to create an identical copy. Developers must prove their product is “highly similar” with “no clinically meaningful differences,” which often requires extensive and costly clinical trials—something standard generics avoid.

- Regulatory Pathway: The approval pathway (the BPCIA in the U.S.) is more complex and less tested than the Hatch-Waxman Act.

- Marketing: Because biosimilars are not identical, there is a much greater need for marketing and education to convince physicians to prescribe them. Automatic substitution at the pharmacy is less common unless the biosimilar has an “interchangeable” designation from the FDA, which requires even more data.

Essentially, launching a biosimilar is a hybrid between a generic and a new brand launch, requiring a much larger investment in clinical development and commercialization.

5. With prices eroding so quickly, how can any generic company remain profitable in the long run?

Long-term profitability in the generic industry depends on moving beyond a strategy of simply copying and selling on price. Sustainable companies are built on three pillars:

- Operational Excellence: A relentless focus on driving down the cost of goods sold (COGS) through manufacturing efficiency, supply chain optimization, and scale. This is the only way to survive in commoditized markets.

- Portfolio Evolution: Continuously moving up the value chain by shifting the R&D focus from simple generics to more complex, difficult-to-make products (complex generics, biosimilars). These products have higher barriers to entry and thus more sustainable, higher margins.

- Strategic Agility: Building a world-class business development and competitive intelligence function that can identify market shifts, anticipate competitor moves, and capitalize on opportunities like drug shortages or strategic partnerships. Profitability is no longer guaranteed by a single successful launch; it requires continuous adaptation and portfolio renewal.

References

Stellar Market Research. (n.d.). Generic Drug Market – Global Industry Analysis and Forecast (2025-2032). Retrieved from https://www.stellarmr.com/report/Generic-Drug-Market/1638

Precedence Research. (n.d.). Generic Drugs Market Size, Share, and Trends 2025 to 2034. Retrieved from https://www.precedenceresearch.com/generic-drugs-market

Chiang, M. (2025, April 14). Global Generic Drug Market Projected to Reach $1 Trillion by 2025. GeneOnline. Retrieved from https://www.geneonline.com/global-generic-drug-market-projected-to-reach-1-trillion-by-2025/

ResearchAndMarkets.com. (2025, May 19). United States Generic Drugs Market Forecast and Company Analysis Report 2025-2033. Business Wire. Retrieved from https://www.businesswire.com/news/home/20250519734589/en/United-States-Generic-Drugs-Market-Forecast-and-Company-Analysis-Report-2025-2033-Featuring-Teva-Pharma-Aurobindo-Pharma-Sun-Pharma-Abbott-Laboratories-Lupin-Pharma-Viatris-Sandoz-Dr.-Reddys—ResearchAndMarkets.com

GlobeNewswire. (2025, April 16). Generic Drugs Market Size Worth $728.64 Bn by 2034 | Driven by Affordability, Patent Expirations, and Government Support. Retrieved from https://www.globenewswire.com/news-release/2025/04/16/3062706/0/en/Generic-Drugs-Market-Size-Worth-728-64-Bn-by-2034-Driven-by-Affordability-Patent-Expirations-and-Government-Support.html

Vision Research Reports. (2025, February 28). Generic Drugs Market Size to Hit USD 775.61 Billion by 2033. BioSpace. Retrieved from https://www.biospace.com/press-releases/generic-drugs-market-size-to-hit-usd-775-61-billion-by-2033

Association for Accessible Medicines. (2023). 2023 U.S. Generic and Biosimilar Medicines Savings Report. Retrieved from https://accessiblemeds.org/resources/reports/2023-savings-report-2/

DrugPatentWatch. (n.d.). The Impact of Generic Drugs on Healthcare Costs. Retrieved from https://www.drugpatentwatch.com/blog/the-impact-of-generic-drugs-on-healthcare-costs/

U.S. Food and Drug Administration. (n.d.). Generic Competition and Drug Prices. Retrieved from https://www.fda.gov/about-fda/center-drug-evaluation-and-research-cder/generic-competition-and-drug-prices

U.S. Food and Drug Administration. (2022). Office of Generic Drugs 2022 Annual Report. Retrieved from https://www.fda.gov/drugs/generic-drugs/office-generic-drugs-2022-annual-report

Aitken, M., & Berndt, E. R. (2019). Do generic medications really save money?. Managed care (Langhorne, Pa.), 28(1), 36–41.

Clark, B., & Callis, J. (2022, March 24). Generic Drugs Help Hold Down Costs, But Slowdowns in Development and Review Present Challenges. The Commonwealth Fund. Retrieved from https://www.commonwealthfund.org/blog/2022/generic-drugs-help-hold-down-costs-slowdowns-development-and-review-present-challenges

Wikipedia. (n.d.). Patent cliff. Retrieved from https://en.wikipedia.org/wiki/Patent_cliff

Esko. (n.d.). The Patent Cliff: From Threat to Competitive Advantage. Retrieved from https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

Investopedia. (n.d.). Patent Cliff: Definition, How It Works, and Example. Retrieved from https://www.investopedia.com/terms/p/patent-cliff.asp

Calo-Fernández, B., & Martínez-Hurtado, J. L. (2012). Biosimilars: company strategies to capture value from the patent cliff. Pharmaceutical medicine, 26(6), 359–365.

U.S. Pharmacist. (2012, June 20). Drug Patent Expirations and the “Patent Cliff”. Retrieved from https://www.uspharmacist.com/article/drug-patent-expirations-and-the-patent-cliff

Desai, R. J., Sarpatwari, A., Dejene, S., Khan, N. F., Lii, J., Rogers, J. R., & Fischer, M. A. (2018). Comparative effectiveness of generic and authorized generic drugs: a cohort study. Pharmacoepidemiology and drug safety, 27(3), 295–304.

Wikipedia. (n.d.). Authorized generics. Retrieved from https://en.wikipedia.org/wiki/Authorized_generics

Barlas, S. (2021). Authorized generics: what do we know about them?. P & T : a peer-reviewed journal for formulary management, 46(4), 210–229.

U.S. Pharmacist. (2020, June 18). Authorized Generics: What Pharmacists Should Know. Retrieved from https://www.uspharmacist.com/article/authorized-generics-what-pharmacists-should-know

Pharmacy Times. (n.d.). The FDA, Generics, and Differentiating Authorized from Branded Types. Retrieved from https://www.pharmacytimes.com/view/the-fda-generics-and-differentiating-authorized-from-branded-types-

GoodRx. (n.d.). What Are Authorized Generics?. Retrieved from https://www.goodrx.com/drugs/medication-basics/what-are-authorized-generics

DrugPatentWatch. (n.d.). The Simple Framework for Finding Generic Drug Winners. Retrieved from https://www.drugpatentwatch.com/blog/opportunities-for-generic-drug-development/

DrugPatentWatch. (n.d.). Uncovering Lucrative, Low-Competition Generic Drug Opportunities. Retrieved from https://www.drugpatentwatch.com/blog/uncovering-lucrative-low-competition-generic-drug-opportunities/

Yu, L. X., & Gupta, S. (2009). Critical path opportunities for generic drugs. The AAPS journal, 11(2), 223–228.

Duane Morris LLP. (2015, April). Bringing a Generic Drug to Market. Retrieved from https://www.duanemorris.com/articles/static/ball_gallagher_generics_0415.pdf

Dusetzina, S. B., & Keating, N. L. (2016). Strategies That Delay or Prevent the Timely Availability of Affordable Generic Drugs in the United States. JAMA internal medicine, 176(11), 1605–1606.

Abbreviated New Drug Application (ANDA) Development, Best Practices for Utilizing Modeling Approaches to Support Generic Product Development. (n.d.). Complexgenerics.org. Retrieved from https://www.complexgenerics.org/education-training/best-practices-for-utilizing-modeling-approaches-to-support-generic-product-development/

KPMG. (2023). Generics 2030: Three strategies to curb the downward spiral. Retrieved from https://kpmg.com/us/en/articles/2023/generics-2030-curb-downward-spiral.html

DrugPatentWatch. (n.d.). How to Implement a Successful Generic Drug Launch Strategy. Retrieved from https://www.drugpatentwatch.com/blog/how-to-implement-a-successful-generic-drug-launch-strategy/

Federation of American Scientists. (n.d.). Clearing the Path for New Uses for Generic Drugs. Retrieved from https://fas.org/publication/clearing-the-path-for-new-uses-for-generic-drugs/

Phil. (n.d.). Launching a New Drug in a Category with Generic Alternatives. Retrieved from https://phil.us/launching-a-new-drug-in-a-category-with-generic-alternatives/

Prasad, V., & Mailankody, S. (2017). Research and Development Spending to Bring a single Cancer Drug to Market and Revenues After Approval. JAMA internal medicine, 177(11), 1569–1575.

U.S. Food and Drug Administration. (n.d.). Patent Certifications and Suitability Petitions. Retrieved from https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

Lydigsen, L., & He, J. (2023, May 16). Tips For Drafting Paragraph IV Notice Letters. Crowell & Moring LLP. Retrieved from https://www.crowell.com/a/web/v44TR8jyG1KCHtJ5Xyv4CK/tips-for-drafting-paragraph-iv-notice-letters.pdf

World Intellectual Property Organization. (n.d.). An International Guide to Patent Case Management for Judges. Retrieved from https://www.wipo.int/patent-judicial-guide/en/full-guide/united-states/10.13.2

DLA Piper. (2020, June 29). Hatch-Waxman Litigation 101: The Orange Book and the Paragraph IV Notice Letter. Retrieved from https://www.dlapiper.com/insights/publications/2020/06/ipt-news-q2-2020/hatch-waxman-litigation-101

Fish & Richardson. (2024, April 15). Hatch-Waxman 101. Retrieved from https://www.fr.com/insights/thought-leadership/blogs/hatch-waxman-101-3/

Association for Accessible Medicines. (n.d.). The 180-Day Rule Supports Generic Competition. Here’s How. Retrieved from https://accessiblemeds.org/resources/blog/180-day-rule-supports-generic-competition-heres-how/

U.S. Food and Drug Administration. (2023, October 26). Small Business Assistance | 180-Day Generic Drug Exclusivity. Retrieved from https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-180-day-generic-drug-exclusivity

Lietzan, E., & Post, J. (2016). The Law of 180-Day Exclusivity. Food and Drug Law Institute (FDLI). Retrieved from https://www.fdli.org/2016/09/law-180-day-exclusivity/

Association for Accessible Medicines. (n.d.). The Hatch-Waxman 180-Day Exclusivity Incentive Accelerates Patient Access to First Generics. Retrieved from https://accessiblemeds.org/resources/fact-sheets/the-hatch-waxman-180-day-exclusivity-incentive-accelerates-patient-access-to-first-generics/

U.S. Food and Drug Administration. (n.d.). Small Business Assistance: New 180-Day Generic Drug Exclusivity Regulations. Retrieved from https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-new-180-day-generic-drug-exclusivity-regulations

DrugPatentWatch. (2025, June 2). What Every Pharma Executive Needs to Know About Paragraph IV Challenges. Retrieved from https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

Filson, D., & Oweis, R. (2009). The impacts of the rise of Paragraph IV challenges on startup alliance formation and firm value in the pharmaceutical industry. ResearchGate. Retrieved from https://www.researchgate.net/publication/45096237_The_impacts_of_the_rise_of_Paragraph_IV_challenges_on_startup_alliance_formation_and_firm_value_in_the_pharmaceutical_industry

DrugPatentWatch. (n.d.). ANDA Litigation: Strategies and Tactics for Pharmaceutical Patent Litigators. Retrieved from https://www.drugpatentwatch.com/blog/anda-litigation-strategies-and-tactics-for-pharmaceutical-patent-litigators/

ParagraphFour.com. (n.d.). Paragraph IV Explained. Retrieved from https://paragraphfour.com/paragraph-iv-explained/

Higgins, M. J., & Graham, S. J. H. (2009). The Effect of ‘Paragraph IV’ Decisions and Early Generic Entry on Brand Pharmaceutical Firms. ResearchGate. Retrieved from https://www.researchgate.net/publication/254069412_The_Effect_of_’Paragraph_IV’_Decisions_and_Early_Generic_Entry_on_Brand_Pharmaceutical_Firms

DrugPatentWatch. (2025, July 27). First Generic Launch has Significant First-Mover Advantage Over Later Generic Drug Entrants. Retrieved from https://www.drugpatentwatch.com/blog/first-generic-launch-has-significant-first-mover-advantage-over-later-generic-drug-entrants/

DrugPatentWatch. (2025, February 25). How to Implement a Successful Generic Drug Launch Strategy. Retrieved from https://www.drugpatentwatch.com/blog/how-to-implement-a-successful-generic-drug-launch-strategy/

GreyB. (n.d.). An Effective Strategy for Generic Pharma Companies. Retrieved from https://www.greyb.com/blog/strategy-for-generic-pharma-companies/

Dusetzina, S. B., & Keating, N. L. (2016). Strategies that delay or prevent the timely availability of affordable generic drugs in the United States. JAMA internal medicine, 176(11), 1605–1606.

Reddit. (n.d.). What is the strategy employed by generic drug manufacturers…. Retrieved from https://www.reddit.com/r/pharmacy/comments/17m0jzx/what_is_the_strategy_employed_by_generic_drug/

Umbrex. (n.d.). Generics Portfolio Strength and Market Share. Retrieved from https://umbrex.com/resources/industry-analyses/how-to-analyze-a-pharmaceutical-company/generics-portfolio-strength-and-market-share/

Umbrex. (n.d.). Intellectual Property (IP) Portfolio and Patent Expiry Risk. Retrieved from https://umbrex.com/resources/industry-analyses/how-to-analyze-a-pharmaceutical-company/intellectual-property-ip-portfolio-and-patent-expiry-risk/

DrugPatentWatch. (2025, July 26). The Simple Framework for Finding Generic Drug Winners. Retrieved from https://www.drugpatentwatch.com/blog/opportunities-for-generic-drug-development/

Ingenious e-Brain. (n.d.). Generic Pharma Industry Opportunity Analysis. Retrieved from https://www.iebrain.com/case-study/opportunity-analysis-for-generic-pharmaceutical-industry/

PatentPC. (n.d.). The Impact of Patent Expirations on Generic Drug Market Entry. Retrieved from https://patentpc.com/blog/the-impact-of-patent-expirations-on-generic-drug-market-entry

PatentPC. (2025, June 24). Patent Litigation in the Pharmaceutical Industry: Key Considerations. Retrieved from https://patentpc.com/blog/patent-litigation-in-the-pharmaceutical-industry-key-considerations