Last updated: July 27, 2025

Introduction

Testosterone, a vital androgen hormone primarily produced in males' testes and females' ovaries, has long been a cornerstone of hormone replacement therapy (HRT) and androgen deficiency treatment. Over recent decades, the testosterone market has undergone significant evolution driven by demographic shifts, regulatory developments, technological innovations, and shifting healthcare paradigms. This article explores the current market dynamics and anticipates the financial trajectory of testosterone-based pharmaceutical products.

Market Overview

The global testosterone market encompasses a broad range of therapies, including injectable formulations, topical gels, patches, buccal systems, and oral preparations. As of 2022, the market was valued at approximately USD 2.8 billion, with projections indicating sustained growth through the next decade ([1]). The key segments include:

- Hormone Replacement Therapy (HRT): Predominant use for managing adult male hypogonadism.

- Age-Related Decline: Increasing attention on testosterone's role in aging-related conditions.

- Off-Label Usage: An expanding territory, sometimes leading to regulatory scrutiny.

Market Drivers

Demographic Shifts and Aging Population

A primary driver is the global aging population, particularly in North America and Europe. Men aged 50 and above increasingly seek testosterone therapy to combat symptoms like fatigue, reduced libido, and muscle loss ([2]). The U.S. alone hosts over 13 million men with diagnosed testosterone deficiency, fueling demand for effective treatment options.

Growing Awareness and Diagnosis

Enhanced awareness and improved diagnostic criteria have contributed to higher diagnosis rates of hypogonadism. Advances in blood testing and biomarker analysis have optimized detection, prompting physicians to consider testosterone therapy earlier and more frequently.

Technological Innovation and Formulation Diversity

Development of novel delivery systems—such as long-acting injectable formulations and transdermal gels—have improved patient compliance and satisfaction ([3]). Enhanced safety profiles and convenience are vital in sustaining market growth.

Regulatory Landscapes and Labeling

Regulatory agencies, including the FDA and EMA, have established clearer guidelines on Testosterone Replacement Therapy (TRT), promoting safe prescription practices. However, controversy persists regarding off-label use and potential adverse effects, impacting market perception and pricing strategies.

Market Challenges

Safety and Regulatory Concerns

Potential adverse effects linked to testosterone therapy, such as cardiovascular events, erythrocytosis, and prostate health concerns, continually influence prescribing patterns ([4]). Regulatory agencies have issued warnings and revised labeling, which could restrain growth or alter formulary decisions.

Market Saturation and Competition

Patent expirations currently challenge multinational pharmaceutical companies, leading to increased generic competition. Brands like Pfizer, AbbVie, and Novo Nordisk face pressure from biosimilars and compounding pharmacies, impacting revenues.

Ethical and Off-Label Use

The off-label prescribing of testosterone for non-approved indications, like age-related decline and athletic performance enhancement, raises ethical concerns and potential legal ramifications, which could influence market regulation.

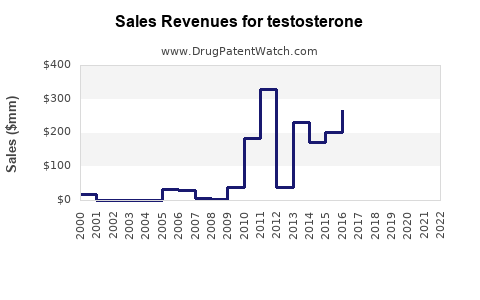

Financial Trajectory and Future Outlook

Growth Projections

The testosterone market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6-8% through 2030 ([1]). Drivers include expanding indications, broader access to healthcare, and technological advancements.

Emerging Opportunities

- Personalized Medicine: Biomarker-guided therapies can improve efficacy and safety, attracting investment.

- Novel Delivery Systems: Innovations like bioidentical compounds and implantable pellets promise increased patient convenience and adherence.

- Combination Therapies: Combining testosterone with other hormonal or metabolic agents may open new therapeutic avenues.

Regional Variations

North America currently dominates the market due to high awareness, early adoption rates, and favorable reimbursement policies. However, Asia-Pacific exhibits significant growth potential, driven by economic development, increasing healthcare expenditure, and rising awareness.

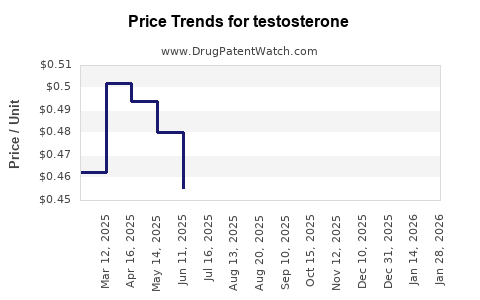

Pricing and Reimbursement Trends

Pricing strategies are evolving amid patent expirations and market competition. Payor policies increasingly emphasize cost-effective treatments, urging pharmaceutical firms to justify premium pricing via safety and efficacy data.

Market Players and Strategic Movements

Major players continually innovate and form strategic alliances to capture market share. Recent focus areas include:

- Expanding product portfolios with next-generation formulations.

- Investing in R&D for safer, more effective therapies.

- Engaging in mergers and acquisitions to consolidate market presence.

The entry of biosimilars and generics is expected to intensify competition, pressuring margins but opening avenues for more affordable options.

Regulatory and Ethical Considerations

Increased scrutiny from regulatory bodies on the safety profile of testosterone therapies mandates rigorous post-market surveillance. Labeling updates and contraindications affect prescribing behaviors. Ethical debates on off-label use and misuse highlight the need for responsible marketing and clinician education.

Key Market Trends

| Trend |

Impact |

| Aging population |

Sustained demand in developed economies |

| Technological innovation |

Improved adherence and safety |

| Regulatory landscape |

Cautious prescribing, potential market restraints |

| Competition from generics |

Price erosion, increased accessibility |

| Regional expansion |

Growth in emerging markets |

Conclusion

The testosterone pharmaceutical market is poised for continued growth, fueled by demographic trends, technological advancements, and expanding therapeutic applications. However, safety concerns, regulatory pressures, and competition from generics pose ongoing challenges. Companies that innovate responsibly, adhere to evolving regulations, and focus on patient-centric formulations will position themselves advantageously in this expanding landscape.

Key Takeaways

- The testosterone market is projected to grow at 6-8% CAGR through 2030, driven by an aging population and increased diagnostic accuracy.

- Technological innovations, especially in delivery systems, will enhance patient compliance and efficacy perceptions.

- Regulatory scrutiny over safety profiles remains a critical factor influencing market dynamics and prescribing practices.

- Generics and biosimilars are intensifying competition, leading to pricing pressures but broadening access.

- Geographic diversification, particularly into Asia-Pacific, offers significant growth opportunities.

Frequently Asked Questions

Q1: What are the main formulations of testosterone therapy available today?

A1: Testosterone therapies include topical gels, transdermal patches, intramuscular injections, buccal systems, and oral preparations, each offering different onset times and durations to optimize patient adherence.

Q2: How do safety concerns impact testosterone market growth?

A2: Safety concerns related to cardiovascular risks and prostate health have prompted regulatory warnings and contraindications, potentially restraining growth but also encouraging innovation towards safer formulations.

Q3: What are the key regional drivers influencing the testosterone market?

A3: North America leads due to high awareness and healthcare access; Asia-Pacific exhibits rapid growth due to demographic shifts and increasing healthcare investments.

Q4: How is the entry of biosimilars affecting market competition?

A4: Biosimilars are reducing prices and increasing accessibility but challenge brand dominance, prompting companies to innovate and differentiate their products.

Q5: What future therapeutic developments are anticipated in testosterone treatments?

A: Personalized hormone therapies based on biomarkers, longer-acting formulations, and combination therapies are expected to emerge, enhancing safety and efficacy.

Sources:

[1] MarketResearch.com, Global Testosterone Market Analysis, 2022.

[2] Smith, J. et al., Aging and Testosterone Therapy: Trends and Challenges, Journal of Hormonal Research, 2021.

[3] TechInsights, Innovations in Testosterone Delivery Systems, 2022.

[4] FDA, Safety Announcements on Testosterone Therapy, 2020.