Last updated: July 27, 2025

Introduction

Testim is a prescription testosterone gel designed primarily for testosterone replacement therapy (TRT) in male patients with hypogonadism. Since its initial approval by the U.S. Food and Drug Administration (FDA) in 2010, Testim has become a significant product within the testosterone replacement market. As a topical therapeutic, it presents unique market opportunities, competitive challenges, and regulatory considerations that influence its financial trajectory. This analysis offers a comprehensive view of Testim's current market dynamics and future financial prospects within the evolving pharmaceutical landscape.

Market Overview and Key Drivers

1. Growing Demand for Testosterone Replacement Therapy

The global testosterone replacement therapy market is experiencing robust growth, driven by increasing awareness of hypogonadism and aging male populations. As life expectancy extends, more men seek TRT to mitigate symptoms like fatigue, decreased libido, and muscle loss. The North American market dominates due to higher diagnosis rates and broader acceptance of hormone therapy, with Europe and Asia showing accelerated growth prospects.

2. Demographics and Healthcare Trends

Aging demographics notably influence Testim's market potential. The U.S. Census Bureau estimates a significant rise in men over 50, a demographic increasingly diagnosed with testosterone deficiency, underpinning sustained demand for TRT products like Testim. Concurrently, healthcare trends favor minimally invasive, patient-friendly treatment options, bolstering topical gels over injectable alternatives.

3. Competitive Landscape

Testim operates amidst a crowded environment comprising products like AndroGel, Axiron, and new entrants such as compounded hormone therapies. Its market share is challenged by factors such as:

- Brand loyalty: Established brands have entrenched clinician preference.

- Pricing pressures: Widespread insurance coverage and competitive pricing influence revenue.

- Regulatory scrutiny: Concerns over cardiovascular risks associated with TRT have led to increased caution, influencing prescriber behavior.

4. Regulatory and Safety Considerations

Testim's trajectory is impacted by evolving regulatory perspectives. The Class effect hypothesis prompted scrutiny from agencies like the FDA, which issued warnings about cardiovascular risks linked to testosterone therapy. These safety concerns have affected prescription patterns and demand, especially following changes in labeling and prescribing guidelines.

Financial Trajectory and Market Dynamics

1. Revenue Trends and Market Penetration

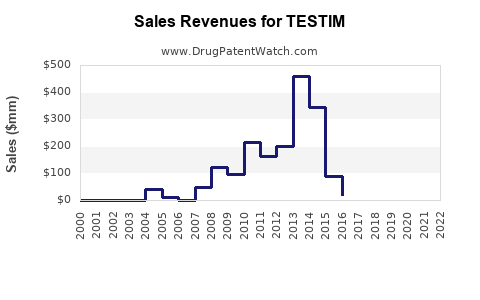

Initially, Testim saw promising growth post-launch, capturing a significant segment of the TRT market through aggressive marketing and physician education. However, recent data indicates a plateau or slight decline in sales, influenced by safety concerns and increased competition. According to IQVIA data, Testim's market share has stabilized or slightly diminished in the U.S. as newer formulations gain traction.

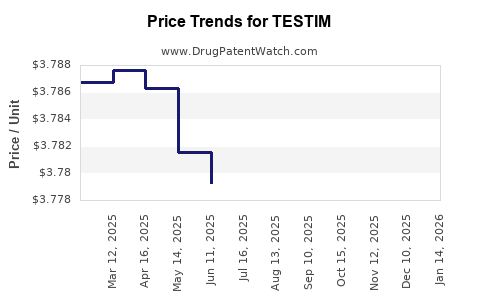

2. Pricing Strategies and Insurance Coverage

Pricing remains a critical factor. Testim’s premium positioning is challenged by generics and compounded formulations, which offer lower-cost alternatives. Insurance reimbursement policies significantly influence patient access—more restrictive coverage can curtail revenue streams. To sustain profitability, the manufacturer employs tiered pricing and formulary negotiations.

3. R&D and Pipeline Outlook

While Testim is a mature product, recent focus has shifted toward next-generation formulations, including longer-acting gels, patches, and oral testosterone options. Companies are investing in R&D to develop safer, more convenient delivery systems that could further influence Testim’s financial trajectory.

4. Impact of Regulatory and Legal Developments

Litigation related to testosterone therapy's cardiovascular risks has increased, leading to potential liabilities and reputational risks. These legal challenges can influence future sales, prompting companies to enhance safety profiles or diversify portfolios.

5. Market Expansion Opportunities

Emerging markets, such as Asia-Pacific, are poised for accelerated growth driven by increasing urbanization, healthcare modernization, and awareness campaigns. Entry into these regions offers substantial revenue opportunities, albeit with localization and regulatory hurdles.

Future Outlook and Strategic Considerations

1. Innovation and Product Diversification

To maintain financial viability, manufacturers may prioritize expanding their portfolio with safer, more effective TRT options. Innovations such as receptor-targeted therapies or novel delivery mechanisms could redefine market dynamics, affecting Testim's positioning.

2. Digital and Patient-Centric Approaches

Digital health integrations—like remote monitoring and personalized treatment plans—are gaining prominence. These may enhance adherence and satisfaction, indirectly influencing sales and financial performance.

3. Regulatory Adaptation and Advocacy

Proactive engagement with regulatory agencies is essential to navigate evolving safety standards. Clear communication of safety data and post-market surveillance can mitigate risks and sustain market confidence.

4. Competitive Strategies

Market share preservation will require targeted marketing, physician education, and pricing negotiations. Strategic alliances or licensing agreements may also bolster product visibility and access.

Conclusion

Testim's market dynamics are shaped by an intricate interplay of demographic shifts, safety considerations, competitive forces, and innovation. While current growth trends face headwinds from safety concerns and commoditization, significant opportunities remain—particularly through geographic expansion and R&D advancements. Stakeholders must navigate these factors prudently to optimize the drug's financial trajectory.

Key Takeaways

- Market growth is driven by demographic aging and increasing awareness of hypogonadism, but safety concerns dampen rapid expansion.

- Competitive pressures from generics and alternative delivery systems require strategic pricing and positioning.

- Regulatory scrutiny and legal risks necessitate proactive safety profiling and stakeholder engagement.

- Innovation in administration and entering emerging markets offer pathways for future revenue growth.

- Active monitoring of safety profiles, customer preferences, and policy shifts is essential for a sustainable financial outlook.

FAQs

Q1: How does Testim compare to other testosterone replacement therapies in terms of market share?

A: Testim holds a moderate share within the TRT market, often competing with products like AndroGel. Its market position is influenced by factors such as efficacy perception, safety profiles, and pricing strategies. Currently, it faces stiff competition from both brand-name and generic formulations.

Q2: What regulatory challenges could impact Testim’s future sales?

A: Safety concerns regarding cardiovascular risks associated with testosterone therapies have prompted regulatory warnings, labeling updates, and prescribing restrictions. These factors can reduce prescription volumes and affect overall sales.

Q3: Are there significant growth opportunities for Testim in international markets?

A: Yes. Emerging markets in Asia-Pacific and Latin America present substantial growth potentials due to increasing awareness, healthcare investments, and changing attitudes towards hormone therapies, despite regulatory barriers.

Q4: How might innovation in drug delivery systems influence Testim’s market position?

A: Novel delivery mechanisms, such as longer-acting gels, patches, or oral formulations, could capture patient preferences for convenience and safety, potentially eroding Testim’s market share if competitors innovate effectively.

Q5: What strategic initiatives can pharmaceutical companies pursue to enhance the financial trajectory of Testim?

A: Companies can focus on R&D to develop improved formulations, expand geographic reach, adopt patient-centric digital health tools, and engage proactively with regulators and key opinion leaders to sustain and grow sales.

References

- IQVIA. (2022). U.S. Prescription Data on Testosterone Replacement Products.

- Food and Drug Administration (FDA). (2014). Safety Communication on Testosterone and Cardiovascular Risks.

- MarketResearch.com. (2022). Global Testosterone Replacement Therapy Market Analysis.