In the high-stakes world of pharmaceutical and biotechnology innovation, the journey from a promising molecule to a life-changing medicine is a formidable gauntlet. It is a path defined by staggering costs, protracted timelines, and an ever-present risk of failure. The modern drug development paradox is stark: while the pressure to accelerate the delivery of novel therapies to patients has never been more intense, the complexity and expense of doing so have reached unprecedented levels. According to the Tufts Center for the Study of Drug Development, the average cost to bring a new drug to market has soared to an estimated $2.6 billion, with a timeline that can stretch from 10 to 15 years.1

This challenging environment has catalyzed a fundamental shift in the industry’s operating model. Outsourcing, once viewed as a tactical, cost-saving measure for non-essential tasks, has evolved into an indispensable strategic imperative. The decision of when, what, and how to outsource drug development is no longer a simple line item in a budget; it is a series of critical strategic choices that directly influence a company’s competitive standing, its speed-to-market, its capital efficiency, and its ultimate probability of success. The industry has decisively moved from a vertically integrated, high-fixed-cost structure to a more agile, variable-cost, networked ecosystem built on a foundation of strategic partnerships.4

The sheer scale of this transformation is reflected in the market itself. The global biotechnology and pharmaceutical services outsourcing market, a vibrant ecosystem of specialized partners, is projected to surge from approximately $76.7 billion in 2024 to over $119 billion by 2034, expanding at a compound annual growth rate (CAGR) of between 4.5% and 6.7%.6 This explosive growth is not merely a trend; it is a systemic response to the escalating complexity of drug development, the need for highly specialized expertise, and the challenge of navigating a labyrinthine global regulatory landscape.9

This report serves as a definitive guide for business professionals, R&D leaders, and strategic decision-makers aiming to master the art and science of pharmaceutical outsourcing. We will deconstruct the entire drug development lifecycle, mapping the specific inflection points where outsourcing offers the greatest strategic leverage. We will demystify the complex ecosystem of outsourcing partners, providing clarity on their distinct roles and value propositions. Most importantly, we will equip you with a robust framework for making sophisticated, data-driven decisions—transforming your outsourcing strategy from a series of transactions into a powerful engine for competitive advantage. Join us as we explore when you should keep control, and when you should cede it to a trusted champion, on the long and arduous road to bringing new medicines to the world.

Section 1: Deconstructing the Drug Development Gauntlet: A Phase-by-Phase Outsourcing Map

The journey of a new drug from laboratory bench to patient bedside is a long, sequential, and highly regulated process. As defined by authorities like the U.S. Food and Drug Administration (FDA), this path is divided into distinct stages, each with its own objectives, challenges, and risk profile.11 Understanding the specific activities and pressures at each stage is the first step in identifying the precise moments when outsourcing can provide a critical advantage. This section provides a granular, phase-by-phase map of the drug development gauntlet, highlighting the key activities and the strategic triggers that make outsourcing a compelling option.

1.1 Stage 1: Discovery and Development

This is the genesis of any new medicine, a phase characterized by high-risk, blue-sky scientific exploration. It begins not with a drug, but with an idea—an understanding of a disease’s biological underpinnings.

Core Activities: The primary goal is to identify a “lead compound,” a promising molecule that shows potential for therapeutic effect. This involves several key steps 13:

- Target Identification and Validation: Researchers first identify a specific biological target—often a gene or protein—that plays a crucial role in a disease. They must then validate that modulating this target could alter the course of the disease.3

- High-Throughput Screening (HTS): Once a target is validated, the search for a compound that can interact with it begins. This often involves HTS, where automated systems, including robotics, test thousands or even millions of chemical compounds from vast libraries to see if any produce the desired effect.16

- Lead Optimization: The initial “hits” from screening are refined. Chemists synthesize and test hundreds of related compounds to improve their effectiveness, reduce potential toxicity, and optimize their pharmacological properties for better absorption and stability in the body.

This stage is a numbers game defined by immense attrition. For every 20,000 to 30,000 compounds evaluated in this discovery phase, only one may ultimately navigate the entire development process to receive regulatory approval.

Outsourcing Triggers: The decision to outsource at this early, foundational stage is driven by the need to access specialized resources and de-risk the science as quickly and efficiently as possible.

- Access to Specialized Technology and Libraries: Many companies, especially startups and virtual biotechs, do not possess the expensive infrastructure for HTS, computational in silico modeling, or access to diverse, proprietary compound libraries. Outsourcing to a specialized discovery-focused Contract Research Organization (CRO) provides immediate access to these critical tools.1

- Need to Explore Multiple Targets: A company with a novel biological hypothesis may want to investigate several potential targets simultaneously. Outsourcing allows them to run these exploratory programs in parallel without the massive capital investment required to build multiple internal teams and labs.

- Expertise in Niche Biology: A CRO may have accumulated years of deep scientific expertise in a very specific disease pathway, target class, or therapeutic modality. Partnering with them allows a sponsor to leverage this focused knowledge, which can be far more efficient than trying to build it from scratch.

A compelling example is the case of NeuroCure Therapeutics, a small biotech startup. By partnering with a specialized CRO for its early-stage research, the company was able to screen over 100,000 compounds against its novel targets for neurodegenerative diseases in just six months—a feat that would have taken years and drained its limited resources if attempted in-house.

1.2 Stage 2: Preclinical Research

Once a promising lead compound is identified, the focus shifts squarely to safety. The preclinical stage is designed to answer one fundamental question: is this compound safe enough to test in humans?

Core Activities: Before any human testing can begin, the drug candidate must undergo rigorous laboratory and animal testing to gather essential safety data. This phase is governed by strict regulatory standards known as Good Laboratory Practices (GLP), which ensure the quality and integrity of the data generated. Key activities include:

- In Vitro and In Vivo Testing: The compound is tested in both laboratory settings (e.g., on human cell lines in test tubes) and in animal models to assess its effects.2

- Toxicology Studies: These studies are designed to identify potential risks and harmful side effects. The drug is administered to animals at increasing doses to determine its toxicity profile and to identify a safe starting dose for human trials.11

- Pharmacokinetics (PK) and Pharmacodynamics (PD): Researchers study what the body does to the drug (Pharmacokinetics: Absorption, Distribution, Metabolism, and Excretion, or ADME) and what the drug does to the body (Pharmacodynamics). This helps understand how the drug behaves and its mechanism of action.17

- Formulation Development: Work begins on developing a stable, effective formulation for the drug (e.g., a pill, injectable solution) and determining the best way to administer it.

- Investigational New Drug (IND) Application: All the data gathered during discovery and preclinical research is compiled into a comprehensive package known as an Investigational New Drug (IND) application in the U.S., or a Clinical Trial Application (CTA) in Europe. This application is submitted to regulatory authorities like the FDA for permission to begin clinical trials in humans.3

Outsourcing Triggers: The capital-intensive and highly specialized nature of preclinical research makes it a prime candidate for outsourcing.

- GLP-Compliant Facilities: Building, equipping, and maintaining laboratories that are certified to meet GLP standards is a major financial and operational undertaking. CROs offer immediate access to these pre-certified, state-of-the-art facilities, saving sponsors time and money.

- Need for Specialized Animal Models: Many diseases, particularly in areas like oncology or rare genetic disorders, require highly specific animal models, often involving genetic modification. These models are expensive to create and house. Specialized CROs often have established colonies of these models readily available.1

- Regulatory Expertise for IND Filing: Compiling an IND application is a monumental task that requires deep regulatory knowledge. Experienced CROs have dedicated teams of regulatory affairs specialists who have successfully guided numerous applications through the review process. Their expertise can be invaluable in avoiding common pitfalls and ensuring the submission is complete and compelling.1 As Dr. Michael Johnson, a preclinical research director, notes, outsourcing these studies can not only ensure compliance but also “reduce development timelines by up to 30%”.

1.3 Stage 3: Clinical Research (Phases I, II, and III)

This is the heart of the drug development journey—the point at which the candidate is finally tested in human subjects. It is by far the longest, most complex, and most expensive part of the process, accounting for an estimated 50-55% of total development costs. Clinical research is meticulously planned and executed according to a detailed study plan, or protocol, and is divided into three sequential phases.

1.3.1 Phase I: Safety and Dosage

The primary goal of Phase I is to assess the safety of the new drug in humans for the first time.

- Core Activities: These trials typically involve a small number of participants, usually 20 to 100 healthy volunteers. However, for certain diseases like cancer, Phase I trials are conducted in patients who have the condition. Participants are given the drug at increasing doses to determine how it is tolerated, to identify acute side effects, and to establish a safe dosage range. These studies are closely monitored to gather crucial information on the drug’s pharmacokinetics in humans.11

- Success Rate: This initial hurdle is significant, but a majority of drugs do pass. Approximately 70% of drugs that enter Phase I move on to the next phase.

- Outsourcing Triggers: Companies outsource Phase I trials to access specialized clinical trial units (often called Phase I units) with experience in managing the intense monitoring required for first-in-human studies. CROs also provide expertise in patient recruitment (for both healthy volunteers and specific patient populations) and navigating the ethical and regulatory approvals required to initiate a trial.

1.3.2 Phase II: Efficacy and Side Effects

Having established a preliminary safety profile, the focus of Phase II shifts to a critical question: does the drug actually work?

- Core Activities: Phase II trials are conducted in a larger group of patients with the disease or condition the drug is intended to treat, typically numbering up to several hundred individuals.11 The main purpose is to obtain the first real evidence of the drug’s efficacy and to continue evaluating its safety profile, identifying common short-term side effects. These studies also help researchers refine the dosage for larger trials.11

- Success Rate: This is a major point of attrition in the development pipeline. The leap from showing safety in a few healthy people to demonstrating a therapeutic benefit in sick patients is enormous. As a result, only about 33% of drugs successfully complete Phase II.

- Outsourcing Triggers: The need for a broader and more diverse patient population often requires a multi-site, and sometimes multi-national, approach that is difficult for a single company to manage. CROs with established networks of clinical trial sites and deep therapeutic expertise in areas like oncology, immunology, or neurology are essential partners. They also bring experience in designing the more complex study protocols often used in Phase II, such as randomized, controlled trials.1

1.3.3 Phase III: Pivotal Trials for Efficacy and Safety Monitoring

If a drug shows promise in Phase II, it must then prove its worth in large-scale, definitive studies known as Phase III, or “pivotal,” trials.

- Core Activities: These are large, often global, trials involving hundreds to thousands of patients (typically 300 to 3,000) over a period of one to four years.11 The goal is to definitively confirm the drug’s efficacy, monitor its safety in a large population, and compare it to existing standard treatments, if any exist. Because of their size and duration, Phase III trials are crucial for detecting less common or long-term side effects that may not have appeared in smaller, shorter studies.11 The data generated in these trials form the core of the submission for regulatory approval.

- Success Rate: Even after promising results in Phase II, the final hurdle of Phase III is challenging. Only about 25-30% of drugs that enter this stage will successfully move on to the next step.2

- Outsourcing Triggers: The immense scale and complexity of Phase III trials make outsourcing almost a necessity for most companies. The key drivers include:

- Global Patient Recruitment: Finding thousands of eligible patients often requires a global network of hundreds of clinical sites, a logistical capability that only large, global CROs possess.

- Massive Data Management: These trials generate enormous volumes of data that must be collected, cleaned, and analyzed with impeccable accuracy. CROs have the validated data management systems and biostatistical expertise to handle this task.

- Global Regulatory Expertise: Running a trial across multiple countries means navigating the distinct regulatory requirements of each region. Global CROs have teams on the ground with local expertise to manage this complexity.

1.4 Stage 4: FDA Review and Regulatory Approval

After successfully completing the clinical trial gauntlet, the sponsor has amassed a mountain of data. The next stage is to organize this evidence into a formal application for marketing approval.

Core Activities: The sponsor submits a New Drug Application (NDA) for small-molecule drugs or a Biologics License Application (BLA) for biologics (like proteins or gene therapies) to the relevant regulatory agency.2 This application is an exhaustive document containing all the data from preclinical and clinical studies, as well as detailed information about the drug’s manufacturing process (known as Chemistry, Manufacturing, and Controls or CMC), proposed labeling, and safety information.15 A team of experts at the agency—including doctors, chemists, statisticians, and pharmacologists—then conducts a thorough review to determine if the drug’s benefits outweigh its risks for the intended population. This review process can take anywhere from six to ten months, and sometimes longer.3

Outsourcing Triggers: Navigating the final step of regulatory submission is a highly specialized skill.

- Expertise in Complex Submissions: Specialized regulatory affairs consulting firms and the regulatory departments of large CROs have teams that do nothing but prepare and manage these submissions. They understand the intricate details and unwritten rules of the process, which can be critical for a smooth review.

- Global Harmonization: For a drug intended for launch in multiple global markets (e.g., U.S., Europe, Japan), a partner with global regulatory experience is essential to coordinate and manage simultaneous submissions to different agencies, each with its own unique requirements.

- Increasing the Likelihood of Approval: The expertise of a specialized partner can be a deciding factor in success. As regulatory consultant Sarah Thompson has pointed out, “Outsourcing regulatory affairs to specialized firms can increase the likelihood of first-cycle approval by up to 25%, saving valuable time and resources”. Avoiding a “Complete Response Letter” (a rejection that requires more data) can save a company years of delay and hundreds of millions of dollars.

1.5 Stage 5: Post-Market Safety Monitoring (Phase IV)

A drug’s approval is not the end of the story. The regulatory journey continues for as long as the product is on the market.

Core Activities: Once a drug is approved and being used by the general population, the sponsor is required to continue monitoring its safety. This is often referred to as Phase IV or post-market surveillance.2 This involves collecting and analyzing reports of adverse events from patients and healthcare providers through systems like the FDA’s Adverse Event Reporting System (FAERS) to identify any rare or long-term safety issues that were not detected in clinical trials.14 Regulators may also require the company to conduct specific post-approval studies to gather additional information on the drug’s safety or efficacy in certain populations.

Outsourcing Triggers: Pharmacovigilance—the science and activities relating to the detection, assessment, understanding, and prevention of adverse effects—is a continuous, 24/7/365 function.

- Specialized, Continuous Operations: For many companies, especially those with multiple products, it is far more efficient to outsource this function to a specialized CRO that has the dedicated staff, validated systems, and global infrastructure to manage pharmacovigilance operations around the clock.

- Scalability: As a product’s use grows, so does the volume of safety data. An outsourced partner can scale its operations to handle this increasing workload more easily than an in-house team. The case of United Therapeutics provides a real-world example of a company that chose a fully outsourced model for its pharmacovigilance case processing, integrating the vendor directly into its global safety system to manage this critical function effectively.

The decision to outsource is not a single choice but a series of choices, each mapped to a specific stage of the development lifecycle. The rationale for outsourcing evolves as the asset progresses. In the early stages, where scientific risk is high and capital is precious, outsourcing is a tool for speed, flexibility, and accessing specialized knowledge to de-risk the science itself. In the later stages, where the scientific risk is lower but the operational and financial stakes are astronomical, outsourcing becomes a strategy for flawless execution, global scale, and mitigating the immense risks of large-scale manufacturing and clinical trials. The question is not simply “should we outsource?” but rather “what specific expertise do we need at this exact moment to maximize our chances of success?”

Section 2: The Outsourcing Ecosystem: Choosing Your Champion (CRO vs. CMO vs. CDMO)

Navigating the pharmaceutical outsourcing landscape requires fluency in its language. The industry is dominated by a trio of acronyms—CRO, CMO, and CDMO—that represent distinct but sometimes overlapping categories of service providers. Understanding the precise role, focus, and value proposition of each is the critical first step in selecting the right partner to advance your program. Choosing the wrong type of partner for your specific need can lead to misaligned expectations, project delays, and wasted resources. This section demystifies this alphabet soup, providing a clear guide to the champions of the outsourcing world.

2.1 Contract Research Organization (CRO): The Research & Clinical Experts

A Contract Research Organization, or CRO, is a firm that provides expert support for the research-intensive phases of drug and medical device development. Their domain is knowledge and data, not physical production.

Primary Focus: The core mission of a CRO is to plan, manage, and execute the research necessary to demonstrate a drug’s safety and efficacy.20 They are the architects and managers of preclinical and clinical studies, operating under the stringent regulatory frameworks of Good Laboratory Practice (GLP) for preclinical work and Good Clinical Practice (GCP) for human trials. Critically, CROs do not manufacture drug products for commercial sale.

Key Services: The service portfolio of a CRO spans the development lifecycle from the lab bench to regulatory submission and beyond.

- Preclinical Research: Conducting the essential GLP-compliant toxicology and safety studies in animal models required for an IND submission.20

- Clinical Trial Operations: This is the heart of a CRO’s offering. It includes everything from designing the clinical trial protocol and selecting investigation sites to recruiting patients, monitoring the trial’s progress, and ensuring data integrity.22

- Data Management and Biostatistics: Collecting the vast amounts of data generated in a clinical trial and performing the complex statistical analysis required to determine the study’s outcome.24

- Medical Writing: Authoring the numerous documents required for a clinical program, including study protocols, investigator brochures, and the final clinical study report.

- Regulatory Affairs: Providing strategic guidance and hands-on support for compiling and submitting regulatory applications like INDs, NDAs, and BLAs to agencies around the world.20

- Pharmacovigilance: Managing post-market safety surveillance and adverse event reporting once a drug is approved.

When to Choose a CRO: You should partner with a CRO when your primary need is research expertise and operational support for testing your drug candidate. This is the go-to choice for companies that have a promising molecule but lack the internal infrastructure, personnel, or specific therapeutic area expertise to run complex preclinical or clinical programs. This is particularly true for the burgeoning sector of emerging and mid-sized biotech companies, which are now responsible for a remarkable 63% of all new clinical trial starts, up from 56% in 2019. For these companies, a CRO is not just a vendor; it’s an essential partner for survival and success.

2.2 Contract Manufacturing Organization (CMO): The Manufacturing Specialists

In contrast to the research focus of a CRO, a traditional Contract Manufacturing Organization (CMO) is purely a production specialist. Their world is one of reactors, fill-finish lines, and supply chains.

Primary Focus: A CMO’s sole purpose is to manufacture pharmaceutical products on behalf of a sponsor company, adhering to the strict standards of Good Manufacturing Practice (GMP). They take a drug formula that has already been developed and produce it at scale.20

Key Services: CMO services are centered entirely on the physical production of a drug.

- Primary Manufacturing: This involves the synthesis of the Active Pharmaceutical Ingredient (API)—the core chemical component of the drug.

- Secondary Manufacturing: This is the process of taking the raw API and formulating it into the final drug product that a patient will receive. This can include creating solid dosage forms like tablets and capsules, or sterile products like injectable solutions.

- Scale-Up and Commercial Production: CMOs specialize in scaling up the manufacturing process from the small batches needed for clinical trials to the large volumes required for the commercial market.

- Packaging and Labeling: Preparing the final product for distribution, including bottling, blistering, and labeling in compliance with regulatory requirements.

When to Choose a CMO: The decision to engage a traditional CMO comes much later in the development lifecycle. This is the right partner when you have a fully developed, tested, and often regulatory-approved drug formula and simply need a high-quality, reliable manufacturer to produce it. Companies turn to CMOs to avoid the immense capital expenditure—often hundreds of millions of dollars—required to build and maintain their own GMP-compliant manufacturing facilities.

2.3 Contract Development and Manufacturing Organization (CDMO): The Integrated Solution

The modern pharmaceutical landscape, with its intense pressure to accelerate timelines, has given rise to a hybrid model that seeks to bridge the gap between research and production: the Contract Development and Manufacturing Organization (CDMO).

Primary Focus: A CDMO offers an integrated, end-to-end solution that combines the development services of a CRO with the manufacturing capabilities of a CMO.20 The goal is to provide a seamless pathway from drug development all the way through to commercial manufacturing, all under one roof.24

Key Services: A CDMO’s service list is a superset of the others, encompassing both development and production.

- Formulation and Process Development: Developing a robust, scalable, and stable formulation for a drug candidate and designing the manufacturing process to produce it consistently.22

- Analytical Method Development: Creating and validating the highly sensitive analytical tests required to ensure the identity, purity, and quality of the drug at every stage.

- Clinical Trial Material Manufacturing: Producing the drug supply needed for all phases of clinical trials, from small Phase I batches to the larger quantities required for Phase III.

- Technology Transfer and Scale-Up: Managing the critical transition of a drug’s manufacturing process from the laboratory scale to the commercial production scale—a notorious bottleneck in drug development.

- Commercial Manufacturing: Providing the full-scale GMP manufacturing services of a traditional CMO once the drug is approved.

When to Choose a CDMO: A CDMO is the partner of choice when you are looking for a “one-stop shop” to de-risk and streamline the journey from late-stage development to commercial launch. The integrated model is particularly attractive because it eliminates the need for a “technology transfer” between a separate CRO/development partner and a CMO/manufacturing partner. This handoff is a major source of potential delays, cost overruns, and quality issues, as subtle process details can get lost in translation. By keeping development and manufacturing within a single organization, CDMOs aim to provide a faster, more efficient, and less risky path to market.24

The evolution of the outsourcing market from separate CROs and CMOs to the integrated CDMO model is not just a change in terminology; it reflects a profound shift in industry strategy. The traditional, siloed approach created a significant chasm between the world of clinical development and the world of manufacturing. The technology transfer process required to bridge this gap was fraught with risk. A process that worked perfectly at the 20-liter scale in a development lab could fail spectacularly at the 2,000-liter scale in a manufacturing plant. The CDMO was born from the market’s demand to solve this very problem.

This, however, creates a central strategic dilemma for every sponsor company. Do you opt for the “one-stop-shop” convenience of a single, large CDMO, or do you pursue a “best-of-breed” strategy, piecing together a team of elite, specialized partners for each specific task?

- The Integrated “One-Stop-Shop” Path: Partnering with a single, full-service CDMO offers simplicity, a single point of accountability, and, most importantly, minimizes the perilous tech transfer risk. This is often the preferred route for virtual and small biotech companies that have limited internal staff and vendor management capacity. Their goal is to entrust the entire operational execution to a single, capable partner so they can focus on their core competencies: the science and the next round of fundraising.

- The Specialized “Best-of-Breed” Path: This strategy acknowledges that even the largest CDMO may not be the world’s best at every single thing. The world’s foremost expert in your specific type of complex biologic formulation might be at a niche development firm, while the most advanced manufacturing technology for that molecule resides at a different, specialized CDMO. A “best-of-breed” approach involves carefully selecting and managing multiple partners to access the absolute pinnacle of expertise for each critical step. This path increases the sponsor’s management burden and re-introduces tech transfer risk, but it may be the only way to solve the most complex scientific and manufacturing challenges. This is often the strategy employed by larger pharmaceutical companies with more complex portfolios and the robust internal teams needed to manage a network of partners.

The market is responding to this dilemma. A growing trend is the formation of strategic collaborations between specialized CROs and CDMOs, who team up to offer clients a combined solution that aims to provide the operational efficiency of an integrated model with the deep scientific expertise of specialist partners. Ultimately, the choice between these models is a reflection of the sponsor’s own resources, risk tolerance, and the unique challenges posed by their specific drug candidate.

| Partner Type | Primary Focus | Core Services | Key Regulatory Compliance | Ideal Use Case |

| CRO (Contract Research Organization) | Research & Clinical Development | – Preclinical GLP Studies – Clinical Trial Management – Patient Recruitment – Data Management & Biostatistics – Regulatory Affairs | GCP (Good Clinical Practice) GLP (Good Laboratory Practice) | You have a drug candidate and need expert support to conduct preclinical and clinical trials to prove its safety and efficacy for regulatory approval. 22 |

| CMO (Contract Manufacturing Organization) | Manufacturing Only | – API Synthesis – Final Drug Product Formulation – Large-Scale Commercial Production – Packaging & Labeling | GMP (Good Manufacturing Practice) | You have a fully developed and approved drug formula and need a partner to manufacture it at commercial scale for the market. 20 |

| CDMO (Contract Development & Manufacturing Organization) | Integrated Development & Manufacturing | – Formulation & Process Development – Analytical Method Development – Clinical Trial Material Mfg. – Scale-Up & Tech Transfer – Commercial Manufacturing | Both GCP/GLP (for development services) and GMP (for manufacturing) | You are seeking a “one-stop-shop” partner to provide a seamless, integrated path from late-stage development through to commercial launch, minimizing tech transfer risk. 22 |

Section 3: The Partnership Playbook: Models for Modern Collaboration

Once you’ve determined which type of partner you need—a CRO, CMO, or CDMO—the next critical decision is how to structure the relationship. The nature of the collaboration can range from a simple, one-off transaction to a deeply integrated, long-term strategic alliance. The outsourcing model you choose will define the level of control you retain, the degree of flexibility you have, and the overall dynamic of the partnership. The industry has moved far beyond simple fee-for-service work, developing a sophisticated playbook of partnership models designed to meet the diverse needs of modern drug developers.

3.1 Transactional / Fee-for-Service Model

This is the oldest and most straightforward form of outsourcing. It operates on a simple principle: you pay a partner a predetermined fee to perform a specific, clearly defined task.

- Description: The relationship is tactical and typically short-term. The sponsor provides a detailed scope of work, and the service provider executes it for an agreed-upon price. There is little room for ambiguity; the deliverables are concrete and measurable.

- Use Case: This model is best suited for discrete, commoditized tasks where the scope is highly unlikely to change. Examples include running a standard set of bioanalytical assays on a batch of samples, performing a routine toxicology screen, or manufacturing a single lot of a well-characterized compound for which the process is already locked down.

- Pros: The primary advantage is its simplicity and cost predictability. The financial commitment is clear and contained.

- Cons: This model is purely tactical, not strategic. It lacks the flexibility to adapt to the inevitable unexpected challenges of drug development. It can create a “black box” dynamic, where the sponsor has limited visibility into the partner’s processes and little opportunity to build a collaborative, problem-solving relationship. This approach is ill-suited for complex, multi-stage development programs.

3.2 Full-Service Outsourcing (FSO) / End-to-End Model

At the other end of the spectrum from the transactional model is Full-Service Outsourcing (FSO), where a sponsor delegates responsibility for an entire project or program to a single partner.

- Description: In an FSO model, the service provider—typically a large CRO or CDMO—takes on the management of all or most of the activities related to a specific program. This could be a complete Phase III clinical trial, from protocol design to final report, or the entire Chemistry, Manufacturing, and Controls (CMC) development package for a new drug.5 The partner provides all the necessary personnel, infrastructure, and cross-functional expertise to execute the project.

- Use Case: This model is the lifeline for many virtual and small biotech companies. Lacking the internal staff and infrastructure to manage complex programs, they rely on an FSO partner to act as their de facto development engine. It is also used by larger companies that wish to outsource an entire non-core program to free up internal resources.

- Pros: The FSO model offers a single point of contact and clear accountability, greatly simplifying management for the sponsor. It allows a small team to oversee a large, complex program.

- Cons: The traditional FSO model can be rigid and has been criticized as a “one-size-fits-all” approach that limits agility. It creates a high level of dependency on a single vendor; if that relationship sours or the partner underperforms, the entire program is at risk.

3.3 Functional Service Provider (FSP) Model

Recognizing the limitations of the all-or-nothing FSO model, the industry has increasingly embraced a more targeted and flexible approach: the Functional Service Provider (FSP) model.

- Description: Instead of outsourcing an entire project, the FSP model allows a sponsor to outsource specific functions or capabilities.9 The FSP partner provides a dedicated team of experts in a particular area—such as clinical trial monitoring, data management, biostatistics, or pharmacovigilance—who then integrate with and work alongside the sponsor’s own internal teams.31 This is a significant evolution from simple staff augmentation; modern FSP models are often performance-based, with the CRO partner being held accountable for deliverables, timelines, and quality within their specific function.

- Use Case: The FSP model is ideal for a sponsor that wants to maintain strategic control and overall oversight of its program but needs to supplement its internal team with specialized expertise or add capacity in certain resource-intensive areas. For example, a mid-sized pharma company might have a strong in-house clinical operations team but lack the specialized biostatisticians needed for a complex trial. An FSP model allows them to “plug in” a dedicated biostatistics team from a CRO while continuing to manage the rest of the trial internally.

- Pros: The FSP model offers exceptional flexibility and scalability. The sponsor can scale resources up or down as the program’s needs change without the long-term commitment of an FSO contract.31 It provides access to world-class expertise in a targeted, cost-efficient manner while allowing the sponsor to retain control over its data and strategic direction.

- Cons: This model requires more hands-on management, coordination, and integration effort from the sponsor. Since the sponsor is acting as the central integrator of multiple functions (some internal, some outsourced), strong internal project management is essential.

3.4 Hybrid and Strategic Alliance Models

The reality of modern drug development is that no single model fits every situation. In response, the market is rapidly moving toward more sophisticated, blended approaches that combine the best features of different models.

- Description:

- Hybrid Models: These are bespoke solutions that mix and match elements of FSO and FSP to fit the specific needs of a trial or program. A sponsor might use a full-service model for site management and logistics in a large global trial but use an FSP model for data management and safety monitoring, keeping those functions more closely integrated with their internal teams. This tailored approach provides greater agility than a traditional FSO contract.

- Strategic Alliances: These represent the deepest and most integrated form of partnership. A strategic alliance is a long-term, often multi-year, collaboration between a sponsor and a preferred partner. These relationships move beyond a project-by-project basis to a portfolio-level engagement. They frequently involve shared governance structures, co-investment in technology or processes, and even risk-and-reward sharing agreements.1

- Use Case: A large pharmaceutical company with a deep pipeline in oncology might form a strategic alliance with one or two key CROs to handle all of its cancer trials. This allows the partners to develop deep institutional knowledge of the sponsor’s processes and standards, leading to significant efficiency gains over time. A small biotech that has successfully worked with a CDMO through Phase II might evolve that relationship into a strategic alliance for the Phase III and commercial launch, with terms that share in the potential upside of the product’s success.

- Market Trend: The shift towards these more flexible and strategic models is undeniable. According to a recent report from the PPD clinical research business of Thermo Fisher Scientific, the use of FSP models is growing faster than FSO, and a preference for hybrid FSP/FSO partnerships is on the rise, with 33% of sponsors now preferring a mixed-model approach, up from 26% in the previous year.

The choice of a partnership model is not merely a procurement decision; it is a direct reflection of a company’s internal capabilities, its corporate culture, and its fundamental strategic philosophy. A fully virtual biotech, whose core competency lies in discovery science and fundraising, will almost certainly rely on a full-service (FSO) model. They lack the internal personnel to do otherwise; their strategy is to outsource the entire operational execution to a trusted partner.1 Conversely, a mid-sized pharmaceutical company with a robust internal clinical operations department but a specific gap in, for instance, medical writing, is a perfect candidate for an FSP model. This allows them to leverage their existing organizational strengths while surgically addressing a specific weakness.

Finally, a large pharma organization, managing a vast and complex portfolio, may find the greatest value in forging long-term strategic alliances with a select few CROs or CDMOs. By moving the relationship from a series of individual transactions to a deeply integrated partnership, they can drive portfolio-level efficiencies, standardize processes, and create a collaborative environment that is far more powerful than the sum of its parts. There is no single “best” model. The optimal choice is always contingent on a company’s honest and rigorous self-assessment of its own strengths, weaknesses, and ultimate strategic goals. In this sense, a company’s outsourcing playbook is a mirror of its corporate identity.

Section 4: The Decision Framework: When to Keep and When to Cede Control

Making the decision to outsource is one of the most critical strategic choices a pharmaceutical company can make. It’s a decision that impacts everything from scientific integrity and intellectual property to operational agility and financial performance. A successful outsourcing strategy is not built on ad-hoc choices but on a disciplined, structured framework that systematically evaluates when to retain activities in-house and when to entrust them to an external partner. This section provides that framework, moving beyond a simple cost-benefit analysis to a multi-faceted evaluation of the key strategic drivers.

4.1 The Core vs. Context Analysis

At the heart of any sophisticated outsourcing decision is the concept of “core versus context.” This framework forces a company to differentiate between the activities that create its unique competitive advantage and those that are necessary but not differentiating.

- Core Activities: The Crown Jewels: These are the functions and capabilities that define a company’s soul. They are the source of its unique value proposition and its most precious intellectual property (IP). For an innovative, discovery-focused biotech, the core is almost always its early-stage research: the target identification, lead optimization, and novel science that underpin its future commercial rights and patent portfolio. Keeping these activities in-house, or in very close collaboration with academic founders, is paramount. Outsourcing the “secret sauce” risks diluting the company’s scientific edge, weakening its negotiating position, and hollowing out its long-term competitive identity.

- Contextual Activities: The Essential Machinery: These are the activities that are absolutely essential for drug development but are not unique to the company. They represent the “how,” not the “what.” Examples are abundant throughout the development lifecycle: conducting toxicology studies in a GLP-compliant facility, manufacturing a clinical trial batch according to GMP standards, or managing the complex global logistics of a Phase III trial. While critical, these are often standardized processes. Contextual activities are ideal candidates for outsourcing to specialized partners who have made it their core business to perform these functions with maximum efficiency, quality, and regulatory compliance.34

A company that fails to distinguish between core and context makes one of two classic mistakes: it either wastes precious resources trying to build world-class capabilities in a non-core, contextual area where a partner could do it better, faster, and cheaper; or, even more dangerously, it outsources a core competency and, in the process, gives away the very thing that makes it special.

4.2 Key Decision-Making Factors

With the core vs. context framework as a guide, the decision can be further refined by weighing a series of critical factors. The following table provides a direct comparison of the implications of keeping a function in-house versus outsourcing it, serving as a practical tool for strategic planning sessions.

| Decision Factor | In-House Implications | Outsourcing Implications |

| Cost Structure | High fixed costs (facilities, equipment, salaries). Significant upfront capital expenditure required. | Converts fixed costs to variable, project-based costs. Reduces capital outlay and improves financial flexibility. 4 |

| Access to Expertise | Relies on internal domain knowledge, which may be deep but is often narrow. Risk of knowledge gaps in specialized areas. | Immediate access to a broad, global pool of specialized talent and state-of-the-art technologies. 5 |

| Speed & Time-to-Market | Can be slower due to internal resource constraints, recruitment cycles, and the learning curve for new processes. | Can significantly accelerate timelines as partners have trained staff, established processes, and infrastructure ready to deploy. 4 |

| Scalability & Flexibility | Scaling operations up or down is slow, difficult, and costly. Internal capacity is relatively fixed. | Provides immense flexibility to scale resources in alignment with project needs, adapting to trial expansions or changing demands. 34 |

| Risk Profile | Sponsor bears 100% of the operational and execution risk. Success or failure rests entirely on the internal team. | Allows for risk sharing with an experienced partner who can help navigate potential pitfalls. Sponsor retains ultimate regulatory accountability. 34 |

| IP & Control | Maximum control over processes and intellectual property. Direct and immediate oversight. | Shared oversight requires strong contracts and monitoring. IP protection becomes a critical aspect of vendor management. |

| Strategic Focus | Requires significant internal management bandwidth and resources, potentially distracting from core scientific or commercial goals. | Frees up internal teams to concentrate on core competencies like discovery, innovation, and market strategy. 34 |

Let’s delve deeper into these factors:

4.2.1 Cost and Capital Efficiency

The financial argument is often the most immediate driver for outsourcing. Building and maintaining the infrastructure for drug development—from GLP labs to GMP manufacturing plants—requires a monumental capital investment. Outsourcing effectively transforms these high fixed costs into more manageable variable costs that are directly tied to project deliverables. This shift is particularly vital for small, pre-revenue biotech companies that operate on venture capital and must allocate every dollar with extreme prejudice. By outsourcing, they can avoid the need for massive capital outlays and instead pay for services as they are needed, preserving precious cash for their core research activities.4

4.2.2 Access to Expertise and Technology

The sheer complexity of modern medicine means that no single company can be the best at everything. Drug development now involves a dizzying array of specialized disciplines, from computational biology and complex biostatistics to the highly specialized manufacturing of cell and gene therapies.39 Outsourcing provides a gateway to a global talent pool and state-of-the-art technologies that would be prohibitively expensive and time-consuming to develop in-house.4 A partner organization has made it its business to invest in the latest equipment and to hire and train the world’s leading experts in a specific niche. Tapping into this expertise on demand is a powerful competitive accelerator.

4.2.3 Speed and Time-to-Market

In the pharmaceutical industry, time is not just money; it’s a critical competitive differentiator. Being first to market with a new therapy can secure a dominant market position for years. Outsourcing can be a powerful tool for accelerating development timelines.4 A CRO or CDMO has trained staff, validated systems, and established processes ready to go. They can often initiate a project in a fraction of the time it would take a sponsor to hire a new team, qualify a new facility, or develop a new process from scratch.25 This ability to hit the ground running can shave months, or even years, off the long road to approval.

4.2.4 Scalability and Flexibility

The needs of a drug development program are not static; they evolve dramatically from one phase to the next. The small quantity of drug substance needed for a Phase I trial is orders of magnitude less than what’s required for a global Phase III program. An in-house facility built for early-phase work may be completely inadequate for late-phase needs. Outsourcing provides the critical ability to scale operations up or down in response to these changing demands.34 This flexibility allows a company to remain agile, adapting its resources to match the precise needs of its portfolio without being locked into the fixed capacity of its own infrastructure.

4.2.5 Risk Management

While outsourcing introduces new types of risk (which we will explore in the next section), it can also be a powerful tool for mitigating others. Development is fraught with risk, and an experienced outsourcing partner has navigated the potential pitfalls of hundreds of projects. They have seen what can go wrong and have developed processes to prevent it. By partnering with them, a sponsor can share the burden of execution risk.35 However, it is a non-negotiable principle that the sponsor company

always retains ultimate accountability for the program in the eyes of regulatory agencies like the FDA. The responsibility can be delegated, but the accountability cannot.

Ultimately, this decision framework reveals a deeper truth: the choice to outsource is fundamentally a decision about what a company wants to be. Is its core value proposition rooted in its groundbreaking discovery science? If so, its strategy should be to protect that core at all costs and aggressively outsource the contextual activities of clinical execution and manufacturing. This is the classic model of the virtual biotech, a small, science-driven core team leveraging a global network of partners to bring its IP to life.

Or perhaps a company’s strength lies not in novel discovery but in best-in-class clinical development. Such a company might choose to in-license promising molecules and build a world-class internal team for clinical and regulatory execution, outsourcing discovery and commercial manufacturing. Its identity is that of a flawless executor.

Even a large, established pharmaceutical company must make these choices. It might determine that its true core competency is no longer R&D but its global commercialization and market access machine. In this case, it may strategically outsource significant portions of its development and manufacturing pipeline to focus its immense resources on what it does best: bringing approved drugs to patients worldwide.

The in-house vs. outsource framework, therefore, is not a simple checklist. It is a corporate identity exercise. It forces a leadership team to be brutally honest about where its true value lies. A failure to perform this rigorous self-assessment is the root cause of most poor outsourcing decisions—either by clinging to contextual tasks the company is not good at, or by carelessly outsourcing the very functions that are critical to its long-term competitive soul.

Section 5: The Double-Edged Sword: Navigating the Benefits and Risks of Outsourcing

The decision to outsource is a strategic balancing act. On one side of the scale are the immense potential benefits: cost savings, accelerated timelines, and access to world-class expertise. On the other side lie significant risks: loss of control, threats to intellectual property, and the potential for quality failures. Mastering outsourcing is not about finding a risk-free path—one does not exist. It is about maximizing the strategic advantages while proactively identifying, mitigating, and managing the inherent risks. This section provides a clear-eyed assessment of both sides of this double-edged sword.

5.1 The Strategic Advantages (The “Pros”)

The upsides of a well-executed outsourcing strategy are compelling and have been the driving force behind the industry’s systemic shift toward a partnership-based model.

- Cost Efficiency and Capital Preservation: This is often the most cited and most immediately quantifiable benefit. Outsourcing converts the heavy, fixed overhead of in-house facilities, equipment, and specialized personnel into flexible, variable costs tied to specific projects.5 This is more than just a line-item saving; it fundamentally changes a company’s financial structure, preserving precious capital for core R&D activities. The impact can be substantial. Data indicates that companies leveraging strategic manufacturing partnerships can achieve a 25-30% reduction in quality-related investigation costs and an even more impressive 30-35% reduction in compliance-related capital expenditure.

- Accelerated Timelines and Speed-to-Market: In a competitive therapeutic landscape, getting to market months or even years ahead of a rival can be the difference between a blockbuster and an also-ran. Outsourcing partners provide access to ready-to-deploy infrastructure and trained, experienced teams, allowing projects to start faster and progress more efficiently. This can dramatically shorten the punishingly long drug development timeline.4

- Access to World-Class Expertise and Technology: No company, no matter how large, can possess cutting-edge expertise in every scientific discipline and manufacturing technology. The outsourcing ecosystem represents a vast, global reservoir of specialized knowledge.5 Whether it’s a CRO with two decades of experience in a rare pediatric disease or a CDMO with a proprietary platform for manufacturing complex biologics, outsourcing provides on-demand access to capabilities that would be impossible or impractical to build internally.

- Increased Focus on Core Competencies: By delegating essential but non-differentiating “contextual” activities, outsourcing frees up a company’s most valuable resource: the time and attention of its internal leaders and scientists. This allows the organization to concentrate its energy on the “core” activities that truly drive innovation and competitive advantage, such as novel discovery research, clinical strategy, and commercialization planning.5

- Enhanced Flexibility and Scalability: The drug development pipeline is unpredictable. A promising candidate might fail, requiring resources to be rapidly reallocated. A successful trial might necessitate a sudden scale-up of manufacturing. Outsourcing provides the strategic agility to navigate this volatility. Partners can scale resources up or down to match the evolving needs of a project, providing a level of flexibility that fixed in-house infrastructure simply cannot match.4

5.2 The Inherent Risks (The “Cons”)

While the benefits are significant, they come with a corresponding set of risks that must be managed with discipline and foresight. A naive approach to outsourcing can lead to disastrous consequences, including project delays, budget overruns, regulatory rejection, and even the loss of a company’s most valuable assets.

5.2.1 Loss of Control and Oversight

- The Risk: This is perhaps the most significant concern for any sponsor company. When you hand over a critical function to a partner, you inherently lose a degree of direct, day-to-day control and visibility into the process.34 This can create a “black box” effect, where problems can fester undetected until they become critical. According to one analysis, these “oversight deficiencies” can become so significant that the cost of managing the vendor relationship can, in some cases, exceed the cost of keeping the function in-house.

- Mitigation: The antidote to loss of control is a robust framework of governance and communication. This includes:

- Ironclad Contracts: Legally binding contracts and detailed service-level agreements (SLAs) that clearly define the scope of work, timelines, deliverables, and performance metrics are the foundation of the relationship.

- Dedicated Vendor Management: Successful outsourcers invest in strong internal teams of alliance and project managers whose sole job is to oversee their partners.

- Regular Audits and Governance: A schedule of regular audits, performance reviews, and joint steering committee meetings ensures alignment and provides formal channels for issue resolution.

- The “Man in the Plant” Model: For critical manufacturing activities, some companies embed one of their own employees at the partner’s facility. This “man in the plant” serves as an extension of the internal team, ensuring direct oversight and seamless communication.

5.2.2 Intellectual Property (IP) Security

- The Risk: A company’s intellectual property—its patents, trade secrets, and proprietary know-how—is its lifeblood. Sharing this sensitive information with a third party creates an inherent risk of misuse, theft, or accidental disclosure.34

- Mitigation: Protecting IP in an outsourced relationship requires a multi-layered legal and operational defense:

- Rigorous Due Diligence: Thoroughly vet a potential partner’s data security practices, confidentiality protocols, and track record before signing any agreement.

- Strong Legal Agreements: Non-disclosure agreements (NDAs) are essential, but they are just the starting point. The main contract must contain explicit clauses defining ownership of all IP generated during the project, ensuring that the sponsor retains full rights to its core technology and any improvements made.45

- Principle of Least Privilege: Limit the information shared with the partner to only what is absolutely necessary for them to perform their tasks. Avoid sharing the “full recipe” unless it is unavoidable.

5.2.3 Quality and Regulatory Compliance Failures

- The Risk: This is a risk with catastrophic potential. While a partner may execute the work, the sponsor company remains 100% accountable to regulatory agencies for the quality and compliance of its product. A significant GMP or GCP failure by a vendor can lead to a clinical hold, the rejection of a drug application, or a product recall, jeopardizing the entire program. This is not a theoretical concern; according to one survey, nearly half of all biopharma companies have faced vendor-related quality problems.

- Mitigation: A culture of quality must be a non-negotiable prerequisite for any partnership.

- Vet the Track Record: Scrutinize a partner’s regulatory history, including their FDA Form 483 inspection observations and warning letters. A clean track record is a strong positive signal.

- Robust Quality Agreements: A detailed, legally binding Quality Agreement is a regulatory requirement and a critical document that outlines the specific quality and compliance responsibilities of each party.37

- Continuous Monitoring: Do not rely solely on the partner’s internal reports. The sponsor must conduct its own continuous monitoring and periodic audits to independently verify compliance with all relevant GxP (GMP, GCP, GLP) standards.23

5.2.4 Communication and Cultural Misalignment

- The Risk: The “soft” risks of poor communication and cultural clashes are often the most insidious. Misunderstandings, especially across different time zones, languages, and corporate cultures, can lead to friction, rework, and significant delays.41 A fundamental cultural disconnect can also exist between a science-first, innovation-driven sponsor and a service-first, business-driven CDMO, leading to misaligned priorities and expectations.

- Mitigation: Proactive relationship management is key.

- Prioritize Cultural Fit: During the selection process, assess the partner’s communication style, problem-solving approach, and transparency. A cultural fit can be just as important as technical capability.

- Establish a Clear Communication Plan: From the outset, define the channels, frequency, and format for all project communications, including regular meetings and issue escalation protocols.

- Appoint “Cultural Ambassadors”: Effective project and alliance managers act as bridges between the two organizations, translating needs and managing expectations on both sides to ensure a smooth and collaborative relationship.

| Potential Risk/Pitfall | Primary Mitigation Strategies |

| Loss of Oversight & Control | – Establish robust governance with joint steering committees.- Implement detailed Service Level Agreements (SLAs) with clear performance metrics.- Appoint dedicated internal vendor/alliance managers.- Conduct regular performance reviews and audits. 34 |

| Intellectual Property (IP) Security Breach | – Conduct thorough due diligence on partner’s security systems.- Implement strong, comprehensive Non-Disclosure Agreements (NDAs).- Include explicit IP ownership clauses in all contracts.- Limit access to sensitive information on a need-to-know basis. 34 |

| Quality & Regulatory Compliance Failure | – Rigorously vet partner’s regulatory history (e.g., FDA inspection record).- Execute a detailed, legally binding Quality Agreement.- Conduct independent, periodic audits of partner facilities and systems.- Ensure clear understanding and adherence to all relevant GxP standards. 34 |

| Communication Breakdown & Cultural Misalignment | – Prioritize cultural fit and communication style during the selection process.- Establish a clear, formal communication plan from the project’s start.- Appoint skilled project managers to act as liaisons between organizations.- Encourage transparency and a collaborative, joint problem-solving mindset. 41 |

| Vendor Instability & Continuity Risk | – Evaluate the partner’s financial stability and long-term viability during due diligence.- Diversify critical suppliers where feasible to avoid single-source dependency.- Structure contracts with clear contingency and exit clauses in case of vendor failure.- Build redundancy into critical processes like technology transfer. 34 |

A sophisticated understanding of outsourcing recognizes that risk is not eliminated; it is transformed. The decision to outsource is an exchange of internal risks (e.g., “Can our scientists solve this?”) for external risks (e.g., “Can we effectively manage this partner?”). This means that a company’s investment in outsourcing must be matched by a corresponding investment in its own internal vendor management capabilities. The need for professionals who can bridge the scientific and business worlds—who understand both the technical intricacies and the principles of good project management and business relationships—has never been greater. A company that outsources heavily without building a strong internal team of alliance managers, project leaders, and quality oversight experts is not mitigating risk; it is merely ignoring it.

Section 6: The Complexity Conundrum: Tailoring Outsourcing to Your Molecule

Not all drugs are created equal. The very nature of a therapeutic molecule—its size, structure, stability, and method of production—is a fundamental driver of the entire development and manufacturing strategy. As molecular complexity increases, so do the technical challenges, the regulatory hurdles, and the stakes of the outsourcing decision. The choice of a partner and the structure of the relationship must be precisely tailored to the specific demands of the molecule. What works for a simple, stable small molecule is wholly inadequate for a living cell therapy. This section explores how the outsourcing calculus changes dramatically across the spectrum of modern therapeutics.

6.1 Small Molecules: The Established Path

Small molecules are the bedrock of the pharmaceutical industry. These are the traditional, chemically synthesized drugs like aspirin or Lipitor. Their development pathway is the most mature and well-understood.

- Characteristics: Small molecules are defined by their low molecular weight. They are typically stable, can often be taken orally, and are produced through well-established chemical synthesis processes. While their chemistry can be complex, the manufacturing principles are deeply understood.

- Outsourcing Landscape: The market for small molecule development and manufacturing is mature, robust, and highly competitive. A vast ecosystem of CROs and CDMOs exists to support every stage of their lifecycle. In fact, an estimated 90% of all CDMOs worldwide are engaged in some form of small molecule manufacturing. The global market for just small molecule discovery outsourcing is projected to grow impressively, demonstrating the vibrancy of this sector.

- Strategic Considerations: Because the “how-to” of small molecule development is so well-established, the outsourcing decision is often driven less by a search for unique capabilities and more by factors of efficiency and capacity. The key questions are not “Can anyone do this?” but rather “Who can do this with the highest quality, at the fastest speed, and at the most competitive cost?” While finding a partner is relatively easy, selecting the right one still requires rigorous diligence to ensure quality and reliability.

6.2 Biologics (Large Molecules): The Rise of Specialization

Biologics, or large molecules, represent a major leap in complexity. These are therapeutic proteins, such as monoclonal antibodies (mAbs) or recombinant enzymes, that are produced not in a chemical reactor but in living biological systems, typically mammalian cell cultures.

- Characteristics: Biologics are thousands of times larger than small molecules. Their complex, three-dimensional structure is essential to their function, and they are inherently less stable. Manufacturing them is a delicate art, involving the genetic engineering of cells, large-scale cell culture in bioreactors, and highly sophisticated purification processes to isolate the desired protein from a complex biological soup.

- Outsourcing Landscape: The development and manufacturing of biologics require highly specialized expertise and facilities that are far less common than those for small molecules. The market for biologics outsourcing is booming as a result, with one report projecting it to reach $87.1 billion by 2028. However, this high demand can lead to capacity constraints and long wait times at top-tier CDMOs. Furthermore, the technical challenges are immense; problems like low protein expression (yield), aggregation (clumping), and instability are common and can derail a program.

- Strategic Considerations: The decision to outsource biologics manufacturing is driven by a critical need for specialized technical expertise. Sponsors seek partners with proven track records in areas like cell line development, upstream process optimization (growing the cells), and downstream purification. Access to advanced technologies, such as high-throughput process development platforms and single-use bioreactors, is also a key factor. The selection of a CDMO for a biologic is a much higher-stakes decision than for a small molecule, as the partner’s technical skill is directly linked to the success or failure of the manufacturing process.

6.3 Cell and Gene Therapies (CGTs): The New Frontier

Cell and Gene Therapies (CGTs) represent the pinnacle of molecular and manufacturing complexity. These are not just drugs; they are living therapeutics (in the case of cell therapies) or sophisticated biological machines for delivering genetic material (in the case of gene therapies).

- Characteristics:

- Cell Therapies: These therapies involve administering living cells to a patient to treat a disease. They can be autologous (using the patient’s own cells, which are extracted, modified, and re-infused) or allogeneic (using cells from a healthy donor).

- Gene Therapies: These therapies aim to treat disease by introducing, deleting, or editing genetic material within a patient’s cells, often using a modified virus (a viral vector) as a delivery vehicle.

The manufacturing process for CGTs is extraordinarily complex, sensitive, and often bespoke for each patient. It involves intricate cell culture, genetic modification, and a highly controlled, sterile “chain of custody” to track patient-specific materials from the clinic to the manufacturing facility and back again.53

- Outsourcing Landscape: The CGT field is nascent, and the outsourcing landscape is still evolving. Outsourcing is the default model, as very few companies, even large ones, have the in-house capability to develop and manufacture these products. The demand for experienced CGT CDMOs is intense. However, the ecosystem faces significant challenges. There is a limited number of CDMOs with true, proven experience in bringing a CGT product all the way to commercial approval. The market is also experiencing structural imbalances, with potential overcapacity in some areas (like manufacturing for AAV vectors, a common gene therapy tool) and severe under-capacity and bottlenecks in others (like the labor-intensive world of autologous cell therapy).

- Strategic Considerations: For CGTs, outsourcing is a necessity, not a choice. The primary challenge is finding a partner with demonstrable, hands-on experience with the specific cell type or viral vector being used. The selection process must be incredibly rigorous, focusing on the partner’s quality systems, their ability to manage the complex logistics and chain of custody, and their experience with the unique regulatory challenges of these novel therapies.29 The concept of a “plug-and-play” platform for viral vector or plasmid production is becoming a key offering from leading CDMOs in this space.

The journey from small molecules to biologics to CGTs is a journey of escalating risk and deepening partnership. As the molecule becomes more complex, the cost of a manufacturing failure skyrockets, and the nature of the sponsor-partner relationship must fundamentally change.

For a small molecule, a manufacturing error might result in a lost batch of API. This is a costly setback, but it is often recoverable. The underlying science of the molecule itself is generally robust.

For a biologic, a mistake in the manufacturing process—such as an error in the cell culture conditions that causes the protein to misfold—can render the drug biologically inactive or, worse, cause it to trigger an immune reaction in patients. Such a failure can jeopardize the entire clinical program, representing a loss of hundreds of millions of dollars and years of work.

For an autologous cell therapy, the stakes are even higher. A manufacturing failure—contamination, for example—doesn’t just mean the loss of a “batch.” It means the irreversible loss of a single patient’s one-and-only chance at a potentially curative treatment. The cost is not just financial; it is a direct and devastating impact on a human life.

This escalating risk profile demands a corresponding escalation in the depth and transparency of the outsourcing partnership. For a simple small molecule, a transactional, fee-for-service relationship might suffice. For a complex biologic, a more collaborative partnership built on shared goals and open communication is required. For a cell or gene therapy, the relationship must be a true strategic alliance. The CDMO must operate as a seamless, fully integrated extension of the sponsor’s own quality and manufacturing organization. The level of transparency, data sharing, and joint problem-solving must be absolute. This reality means that the due diligence process for a CGT partner is exponentially more rigorous. It’s not enough to audit a facility’s GMP compliance; one must audit the entire end-to-end process, from the collection of a patient’s cells at a distant hospital to the cryopreservation and final delivery of the finished, living drug product back to that patient’s bedside.

Section 7: The Partner Selection Masterclass: Best Practices for Due Diligence

Choosing an outsourcing partner is one of the most consequential decisions a drug development company will make. A great partner can accelerate your program, enhance its quality, and increase its probability of success. A poor partner can lead to costly delays, catastrophic quality failures, and the potential demise of a promising asset. The selection process, therefore, must be a masterclass in diligence, moving far beyond a simple comparison of price quotes. It is a multi-faceted investigation into a potential partner’s technical prowess, quality culture, project management discipline, and, most importantly, their trustworthiness.

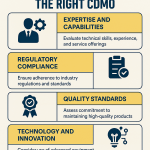

7.1 Building Your Selection Criteria: Beyond the RFP

A successful partnership begins with a clear and comprehensive definition of what you are looking for. While a Request for Proposal (RFP) is a necessary tool for gathering basic information, your internal selection criteria must be far more nuanced.

- Technical Capabilities and Scientific Expertise: This is the foundational requirement. Does the potential partner have the specific equipment, technology platforms, and scientific know-how required for your molecule at its current stage of development?.47 This evaluation should be granular. It’s not enough to know they work with “biologics”; you need to confirm they have hands-on experience with your specific expression system (e.g., CHO cells) or your specific type of formulation. Assess their capabilities in crucial support areas like Chemistry, Manufacturing, and Controls (CMC) and analytical development.

- Quality and Regulatory Track Record: This is a non-negotiable pillar. A partner’s commitment to quality is paramount. Your due diligence must include a thorough review of their quality management system (QMS) and their history with global regulatory agencies like the FDA and EMA.47 Don’t hesitate to ask for their recent audit reports, their responses to any regulatory observations (like FDA Form 483s), and concrete examples of successful regulatory submissions they have supported. A strong history of compliance is one of the most reliable indicators of a quality partner.

- Project Management and Communication: A brilliant scientific team is useless if the project is poorly managed. Strong project management is the backbone of a successful collaboration. Evaluate the partner’s project management systems and methodologies. Who will be your primary point of contact? What is their process for tracking progress, managing risks, and communicating updates? One of the hallmarks of a great partner is a culture of proactive communication, or even “overcommunication”. You want a partner who keeps you informed of progress and, more importantly, brings potential problems to your attention early, rather than hiding them.

- Cultural Fit and Trustworthiness: This “soft” criterion is often the deciding factor in the long-term success of a partnership. Is this an organization you can build a collaborative, trust-based relationship with?.49 During your interactions, assess their communication style, their transparency, their approach to problem-solving, and their overall alignment with your company’s values. Trust is the ultimate currency in an outsourcing relationship. You must trust their competence, their integrity, and their commitment to protecting your intellectual property.

- Financial Stability and Long-Term Vision: An outsourcing partnership is a long-term commitment. The last thing you want is for your critical partner to face financial distress or be acquired midway through your pivotal trial. It is essential to evaluate a potential partner’s financial health and stability to ensure they are a viable long-term collaborator.40

7.2 The Due Diligence Process in Action

Once you have established your selection criteria, the investigative process begins. This should be a systematic, multi-step process.

- The Detailed Request for Proposal (RFP): Your RFP should be more than a request for a price. It should be a detailed document that clearly outlines your project’s scope, technical requirements, timelines, and expectations for communication and governance. A thorough RFP allows the potential partner to fully understand your needs and provide a comprehensive, realistic proposal.

- Site Audits and Visits: There is no substitute for seeing a facility and meeting the team with your own eyes. A physical site visit (or a highly detailed virtual audit, if necessary) is essential for assessing the state of the equipment, the workflow on the manufacturing floor, and the overall culture of the organization.

- Deep Reference Checks: Go beyond the curated list of references provided by the potential partner. Ask to speak with both current and former clients—especially those who have worked on projects similar to yours. Ask pointed questions about the partner’s performance, their communication during challenging times, their responsiveness, and their overall reliability.

- Meet the “A-Team”: It is a classic sales tactic for a service provider to put their top executives and scientists in the initial meetings, only for you to discover later that your project has been assigned to a more junior team. Insist on meeting the actual project manager and key technical leads who will be assigned to your project. You need to be confident in their specific experience and ensure they have the capacity to give your project the attention it deserves.

7.3 Contracting and Governance: Setting the Stage for Success

The final stage of the selection process is to translate all your diligence and expectations into a set of robust, legally binding agreements that will govern the partnership.

- The Quality Agreement: This is a cornerstone document and a regulatory requirement. The Quality Agreement is a formal, legally binding contract that clearly defines the specific quality, compliance, and regulatory responsibilities of both the sponsor and the service provider. It leaves no room for ambiguity on who is responsible for what, from batch release and deviation management to regulatory reporting.37

- The Master Services Agreement (MSA): The main contract should be meticulously negotiated. It must include clear terms on the overall scope of work, specific milestones and deliverables, performance metrics that will be used to measure success, payment schedules, and, critically, contingency plans and exit clauses that define what happens if things go wrong.

- The Governance Structure: A successful partnership is actively managed. The agreements should establish a formal governance structure, such as a joint steering committee composed of leaders from both organizations. This committee should have a regular meeting schedule and clear roles, responsibilities, and decision-making authority to oversee the partnership, track progress against goals, and provide a forum for resolving any high-level issues that may arise.