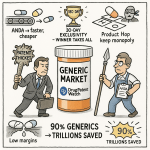

Welcome to the paradoxical world of generic pharmaceuticals. On one hand, it’s an undeniable public health triumph, a market that saves the U.S. healthcare system a staggering $445 billion in a single year and accounts for 90% of all prescriptions filled. Globally, the market is a behemoth, projected to grow from $435.3 billion in 2023 to $655.8 billion by 2028. It is, without a doubt, the bedrock of affordable medicine.

On the other hand, for the companies competing within this arena, it is a brutal, high-stakes gauntlet. The very forces that create immense societal value—intense competition, relentless price pressure, and stringent quality standards—are the same forces that threaten the industry’s long-term sustainability. As David Gaugh, Interim President and CEO of the Association for Accessible Medicines (AAM), starkly warned, “The sustainability of our industry remains fragile”.

This fragility stems from a dramatic evolution. The golden era of simply replicating blockbuster oral tablets like Lipitor is over. Today’s generic drug development landscape is defined by a formidable set of interconnected challenges that have exponentially increased the cost, risk, and complexity of bringing a product to market. We’ve moved from simple chemistry to complex biologics, from straightforward bioequivalence studies to labyrinthine regulatory submissions across multiple continents, and from predictable patent expiries to perpetual, high-stakes litigation.

This report is not a simple listicle of problems. It is a strategic deep dive into the ten most critical challenges defining the modern generics industry. We will dissect each hurdle, providing the historical context, quantifiable impact, and forward-looking analysis necessary to turn these obstacles into opportunities. For the business professional, the portfolio manager, or the R&D lead, the central question is no longer just what the challenges are, but rather: In an industry defined by such formidable barriers, how can your company not only survive but strategically navigate the gauntlet to thrive? Let’s begin.

Challenge 1: The Global Regulatory Maze – Beyond the ANDA Submission

In the past, regulatory affairs might have been seen as a downstream, box-checking exercise. Today, it has transformed into a dynamic, high-stakes risk management function that can dictate a product’s commercial viability from the earliest stages of portfolio selection. Navigating this maze requires more than just a competent regulatory team; it demands a sophisticated, forward-looking global strategy that anticipates hurdles, manages costs, and mitigates risks that can emerge from unexpected quarters.

Divergent Pathways: Navigating the FDA vs. EMA Labyrinth

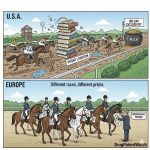

For any company with global ambitions, the two most important regulatory bodies are the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). While their goal is the same—ensuring safe and effective medicines—their pathways, data requirements, and timelines can differ significantly, creating a complex operational challenge.

The U.S. pathway for a generic is the Abbreviated New Drug Application (ANDA), so-called because it allows the applicant to rely on the safety and efficacy data of the innovator drug, requiring only proof of pharmaceutical equivalence and bioequivalence.4 The European equivalent is the Marketing Authorisation Application (MAA), which can be pursued through several procedures (Centralized, Decentralized, etc.) to gain approval across EU member states.4

While the core scientific principles are similar, the devil is in the details. The agencies may have different requirements for bioequivalence studies, particularly concerning fasting versus fed states, the selection of the reference product, and the statistical analysis of highly variable drugs. Furthermore, their criteria for granting “biowaivers” based on the Biopharmaceutics Classification System (BCS)—which allow companies to avoid costly in vivo studies for certain well-behaved drugs—have historically differed, though they have converged in recent years for Class I and Class III drugs.

A fascinating 2017-2020 study revealed a 95% concordance in the final approval decisions for applications submitted to both agencies, suggesting a high degree of scientific alignment. However, the same study noted that the timing of those approvals often differed by several years. This is not an academic curiosity; for a generic manufacturer, a multi-year delay in a major market can completely upend a product’s business case. It means duplicated effort, staggered launches, and the inability to leverage a single global development program efficiently.

Table 1: FDA vs. EMA Generic Approval Pathways at a Glance

| Feature | U.S. Food and Drug Administration (FDA) | European Medicines Agency (EMA) | Strategic Implication |

| Application Type | Abbreviated New Drug Application (ANDA) | Marketing Authorisation Application (MAA) | Different dossier structures and administrative requirements necessitate separate submission strategies. |

| Core Requirement | Demonstrate bioequivalence (BE) to a U.S. Reference Listed Drug (RLD). | Demonstrate BE to a Reference Medicinal Product (RMP) sourced from the European Economic Area (EEA). | Sourcing the correct reference product is a critical and sometimes challenging logistical first step for global studies. |

| Review Timeline | Varies; GDUFA goals aim for 10 months for standard reviews, but complex generics can take longer.11 | Centralized procedure review is ~210 days, followed by European Commission decision (~67 days).13 | The EMA’s scientific review can be faster, but the total time to market in the EU can be longer due to the two-step process. FDA review times have historically been longer but are improving under GDUFA. |

| BE Acceptance Criteria | 90% Confidence Interval for Cmax and AUC must be within 80.00-125.00%. | Same 80.00-125.00% range, but with specific, stricter criteria for narrowing the range for Narrow Therapeutic Index (NTI) drugs and a more conservative approach to widening it for Highly Variable Drugs. | A product may meet BE criteria in the U.S. but require additional studies or fail to meet the stricter criteria for certain drug types in the EU, requiring careful statistical planning. |

| Biowaivers (BCS) | Allows biowaivers for BCS Class I and III drugs, with specific criteria for excipients and dissolution. | Also allows biowaivers for BCS Class I and III, but with slightly different and sometimes stricter requirements regarding excipient composition and dissolution testing (“very rapid” dissolution for Class III). | Minor formulation differences that are acceptable to the FDA might preclude a company from obtaining a biowaiver in the EU, forcing a costly and time-consuming human BE study. |

| Post-Market Surveillance | Primarily through MedWatch and FDA Adverse Event Reporting System (FAERS). | Decentralized pharmacovigilance system (EudraVigilance) with country-specific compliance requirements and mandatory Periodic Safety Update Reports (PSURs). | Post-approval compliance is more complex and fragmented in the EU, requiring ongoing resources to manage reporting across multiple member states. |

The takeaway is clear: a modern generic portfolio strategy must abandon the notion of a one-size-fits-all regulatory package. It must incorporate a “regulatory risk score” for each candidate, weighing not just the cost of filing in one market but the fully-loaded, risk-adjusted cost to achieve and maintain global market access.

The GDUFA Effect: A Double-Edged Sword of Speed and Cost

In the U.S., the regulatory cost landscape was fundamentally reshaped by the Generic Drug User Fee Amendments (GDUFA), first signed into law in 2012.12 The goal was noble: to provide the FDA with the resources needed to clear a massive backlog of generic applications and provide more predictable review timelines. GDUFA achieved this by allowing the FDA to collect user fees from the industry to hire more reviewers and upgrade its systems.

This has been a double-edged sword. On one hand, GDUFA has undoubtedly improved the efficiency and predictability of the review process. On the other, it has introduced a significant, non-refundable, upfront cost to development. The fees for Fiscal Year 2025 are substantial:

- ANDA Filing Fee: $321,920

- Drug Master File (DMF) Fee: $95,084

- Annual Program Fee (Large Company): $1,891,664

- Annual Facility Fees: Ranging from $41,580 for a domestic API facility to $246,952 for a foreign finished dosage form (FDF) facility.

These fees have transformed the financial calculus of generic development. They act as a barrier to entry, particularly for smaller companies or those targeting niche products with modest revenue potential. The decision to pursue a generic candidate is no longer just a scientific and legal one; it’s a major capital allocation decision. Companies must now be highly selective, prioritizing products with a high probability of success and a sufficient market size to justify the six- and seven-figure upfront regulatory investment.

The Nitrosamine Crisis: A New Era of Quality Scrutiny

Perhaps no event in recent memory better illustrates the dynamic and unpredictable nature of regulatory risk than the nitrosamine impurity crisis. In 2018, regulators discovered that certain angiotensin II receptor blockers (ARBs), like valsartan, were contaminated with N-nitrosodimethylamine (NDMA), a probable human carcinogen.17 The discovery triggered a cascade of global recalls affecting not only ARBs but also other widely used drugs like the heartburn medication ranitidine.19

The root cause was traced back to specific chemical reactions in the manufacturing process of the active pharmaceutical ingredient (API), often at facilities in China and India.20 This was not a simple case of a bad batch; it was a fundamental chemistry problem that had gone undetected for years.

The regulatory response has been swift and sweeping. The FDA and other global agencies have issued stringent guidance requiring all pharmaceutical manufacturers to conduct a comprehensive three-step mitigation strategy:

- Risk Assessment: Proactively evaluate all manufacturing processes for the potential to form nitrosamine impurities, including the newly identified and more complex Nitrosamine Drug Substance-Related Impurities (NDSRIs).

- Confirmatory Testing: If a risk is identified, conduct highly sensitive testing using advanced analytical methods to confirm the presence and quantity of any impurities.

- Reporting and Mitigation: Implement changes to the manufacturing process or formulation to eliminate or reduce impurities to acceptable levels and report these changes to the FDA.

The deadline for completing confirmatory testing and submitting required changes for NDSRIs is August 1, 2025, placing immense pressure on the industry. The nitrosamine crisis is a paradigm-shifting event. It has added significant, often unbudgeted, costs for advanced analytical testing, process re-validation, and potential reformulation across entire product portfolios. For some products, the cost and complexity of mitigation have been so high that companies have simply discontinued them, contributing to drug shortages. It serves as a stark reminder that regulatory risk is not static; a single, unforeseen quality issue can reshape industry-wide standards and impose massive new compliance burdens overnight.

The Slow March Toward Global Harmonization

In an ideal world, a single, high-quality data package for a generic drug would be acceptable to regulators everywhere. The reality is far from it. While the FDA, EMA, and other agencies are collaborating more than ever, the path to true harmonization is long and fraught with challenges.

Initiatives like the International Council for Harmonisation (ICH) and the FDA-led Generic Drug Cluster are making progress in developing common scientific and technical standards, particularly for complex generics.22 The FDA and EMA also have a Parallel Scientific Advice (PSA) pilot program, allowing developers of complex generics to get concurrent feedback from both agencies.3

However, significant hurdles remain. A primary obstacle is the common requirement for studies to be conducted using a reference product sourced from the local market. This single rule can force a company to run duplicative and expensive clinical bioequivalence studies simply to satisfy different regulators, even if the reference products are manufactured in the same facility. These divergent requirements add cost, delay development, and ultimately limit patient access to affordable medicines in smaller markets where the cost of local studies cannot be justified. While harmonization is the long-term goal, the immediate reality for manufacturers is a complex patchwork of disparate requirements that must be navigated one product and one market at a time.

Challenge 2: The Bioequivalence Minefield – Proving Sameness in a World of Complexity

If the regulatory maze is the strategic map, then bioequivalence (BE) is the scientific gateway. It is the fundamental pillar upon which the entire generic drug approval process rests. The concept is simple: prove your generic product performs in the body in the same way as the brand-name drug. The execution, however, has become a formidable scientific and financial challenge, a minefield of physicochemical complexities and clinical uncertainties that can detonate a development program, wasting millions of dollars and years of effort.

The Science and Cost of BE Testing

At its core, an ANDA hinges on demonstrating bioequivalence to the Reference Listed Drug (RLD). For most systemically acting drugs, this is achieved through a pharmacokinetic study in a small group of healthy volunteers. The goal is to show that the rate and extent of absorption of the active ingredient are not significantly different between the generic and the RLD. Statistically, this means the 90% confidence interval of the geometric mean ratios for key parameters—peak drug concentration (Cmax) and total drug exposure (Area Under the Curve, or AUC)—must fall within the prespecified limits of 80% to 125%.4

What sounds like a straightforward statistical exercise can be anything but. These studies are expensive, time-consuming, and fraught with risk. For a “highly variable drug”—one whose absorption naturally varies a great deal from person to person—a standard study design may require a very large number of subjects to achieve the required statistical power, driving up costs significantly.

The biggest limitation to generic competition, however, arises when a simple pharmacokinetic study is not feasible. For some locally acting drugs (like topical creams or inhalers), blood levels don’t reflect the drug’s action at the target site. In these cases, the FDA may require a full-blown clinical endpoint bioequivalence study, which is essentially a comparative efficacy trial. The cost of these studies can be astronomical, adding an estimated $2 million to $6 million to the development budget. This immense financial hurdle and the high risk of failure mean that many generic companies will simply avoid developing products that require such studies, leaving these markets with little to no generic competition.

The Formulation Enigma: Reverse-Engineering Performance

The central scientific challenge of generic development is what can be called the “invisible equivalence challenge”. Generic developers are tasked with creating a product that performs identically to the RLD, but they must do so without access to the innovator’s proprietary formulation recipe or manufacturing blueprints. They are not copying a formula; they are reverse-engineering a performance profile.

This requires an intricate understanding of a host of physicochemical properties. Is the active ingredient poorly soluble? Over 40% of new drug candidates are, making it difficult to achieve adequate absorption. Does the API exist in multiple crystalline forms, or polymorphs? More than half of all APIs do, and each polymorph can have a different solubility, dissolution rate, and stability, any of which can cause a BE study to fail. How stable is the drug? It must be formulated to resist degradation from heat, light, or moisture over its entire shelf life.

Compounding this complexity is the “excipient enigma.” The inactive ingredients—the binders, fillers, and coatings that make up the bulk of a tablet—are anything but inert. They can interact with the API, affect its release profile, and influence its absorption in the gut. A generic company may use different excipients than the brand, but it must prove that these differences do not affect the drug’s performance. This requires exhaustive compatibility studies and a deep knowledge of formulation science. A single misstep—choosing the wrong grade of a filler or an incompatible lubricant—can lead to a failed BE study, sending the team back to the lab for a costly and time-consuming reformulation effort.

The Rise of Quality by Design (QbD)

To tame this complexity and reduce the high rate of late-stage failures, regulators like the FDA have championed a more systematic and scientific approach to development known as Quality by Design (QbD). Instead of a trial-and-error approach, QbD compels manufacturers to “design quality in” from the very beginning.

The QbD process involves:

- Defining a Quality Target Product Profile (QTPP): What are the critical quality characteristics the final product must have to be safe and effective?

- Identifying Critical Quality Attributes (CQAs): Which physical, chemical, and biological attributes of the drug product must be controlled to ensure the desired quality?

- Understanding the Process: How do raw material attributes (Critical Material Attributes or CMAs) and manufacturing process parameters (Critical Process Parameters or CPPs) affect the CQAs?

By systematically studying these relationships, often using statistical tools like Design of Experiments (DoE), a company can define a “design space”—a multidimensional combination of process parameters that has been demonstrated to provide assurance of quality. This proactive approach aims to build a deep, predictive understanding of the product and process, making manufacturing more robust and reducing the risk of unexpected failures, including the ultimate failure of a BE study. While it requires more intensive analytical work upfront, the goal of QbD is to trade a small, planned investment in science for a massive reduction in the risk of costly, unplanned failures down the road. This represents a fundamental shift in the industry, moving from a model of reactive testing to one of predictive science, a shift that is essential for tackling the next generation of complex generic products.

Challenge 3: The Patent Gauntlet – Litigation as a Business Strategy

If regulatory approval and bioequivalence are the scientific hurdles, the patent system is the legal and economic battlefield. In the world of generic pharmaceuticals, patent litigation is not an unfortunate side effect of doing business; it is the business. It’s an unavoidable, high-stakes, and ferociously competitive gauntlet that requires immense capital, strategic foresight, and an ironclad tolerance for risk. For many generic companies, the legal budget is as critical as the R&D budget, and the outcome of a single court case can determine the fate of a billion-dollar product.

Deconstructing the Paragraph IV Challenge

The legal framework for this battle was established by the landmark 1984 Drug Price Competition and Patent Term Restoration Act, better known as the Hatch-Waxman Act.27 The Act created the ANDA pathway, but it also designed a highly specific mechanism for generics to challenge brand-name patents before they expire. This is the Paragraph IV (P-IV) certification.

When filing an ANDA, a generic company must make a certification for each patent listed for the brand drug in the FDA’s “Orange Book.” A P-IV certification is a bold declaration: that in the generic applicant’s opinion, the brand’s patent is invalid, unenforceable, or will not be infringed by the generic product. This is not a passive statement; under U.S. law, it is considered an “artificial act of infringement,” effectively inviting a lawsuit.

Once the generic company notifies the brand manufacturer of its P-IV filing, a 45-day clock starts ticking. If the brand company files a patent infringement lawsuit within that window, it triggers an automatic 30-month stay on the FDA’s ability to grant final approval to the generic.27 This stay is a powerful tool for the brand, guaranteeing at least two and a half years of continued market exclusivity while the litigation proceeds, regardless of the patent’s ultimate strength.

This structure creates a fascinating strategic tension. The 30-month stay provides a significant defensive advantage to the brand. However, Hatch-Waxman also created a massive incentive for the generic challenger: the first company to file a substantially complete ANDA with a P-IV certification is granted 180 days of marketing exclusivity. During this six-month period, the FDA cannot approve any other generic versions of the drug, creating a lucrative duopoly between the brand and the first-filer. This 180-day prize is the engine that drives the entire P-IV litigation machine.

The High Success Rate and High Cost of Litigation

Looking at the data, one might be surprised to learn that the overall “success rate” for generic companies in P-IV challenges is a remarkably high 76%.28 This statistic, however, is deeply misleading. The definition of “success” in these studies often includes settlements and cases that are dropped. When you isolate the cases that are actually fought to a final court decision, the picture changes dramatically. At trial, the generic win rate plummets to a coin-flip, around 48%.

This is a high-risk gamble, and it’s an expensive one. A typical P-IV litigation can take 2-3 years to resolve and cost each side anywhere from $5 million to $10 million in legal fees, with costs for blockbuster drugs soaring much higher. This reveals the core strategic calculation for a generic company. The 180-day exclusivity period can be worth hundreds of millions of dollars for a major product. With a 76% chance of achieving a “successful” outcome (which is often a settlement allowing a planned market entry), the potential payoff makes the multi-million-dollar legal investment a rational, if risky, business decision. The cost of litigation is no longer just a legal expense; it is a key component of the product’s cost of goods sold.

The Murky World of “Pay-for-Delay” Settlements

The high cost and uncertainty of litigation lead many cases to be settled out of court. Some of these settlements, however, have drawn intense scrutiny from antitrust regulators. These are the so-called “reverse payment” or “pay-for-delay” agreements.31

In a typical patent settlement, the alleged infringer pays the patent holder. In a reverse payment settlement, the payment flows in the opposite direction: the brand-name pharmaceutical company pays the generic challenger, and in exchange, the generic company agrees to delay its market entry for a specified period.31 Regulators argue this is a form of collusion, where the brand and the first-filer generic effectively agree to share the brand’s monopoly profits at the expense of consumers, who are denied access to a lower-cost alternative. These deals can delay generic competition by as long as five years.

The Supreme Court weighed in on this issue in the 2013 case FTC v. Actavis. The Court ruled that these settlements are not automatically illegal but can violate antitrust laws and must be evaluated under a “rule of reason” standard. This decision, however, did not provide a clear framework for that analysis, leading to divergent interpretations in lower courts and continued legal battles over what constitutes an anticompetitive settlement.33 Navigating these murky legal waters requires not only top-tier patent lawyers but also sophisticated antitrust and economic expertise.

The Critical Role of Patent Intelligence

In this high-stakes chess game of patent litigation, information is the most valuable piece on the board. A company cannot hope to succeed without a deep, real-time understanding of the intellectual property landscape. This is where specialized business intelligence services become indispensable.

Platforms like DrugPatentWatch provide the critical data that fuels strategic decision-making. They allow companies to meticulously track patent expiration dates and other key exclusivities, identify potential P-IV challenge opportunities, and analyze the litigation history of specific patents and companies.2 By studying failed patent challenges, a generic firm can develop better legal strategies. By tracking ongoing litigation, it can anticipate early generic entry and adjust its own launch timing. For companies developing complex products like biosimilars or those using the 505(b)(2) pathway, this intelligence is even more crucial for navigating dense “patent thickets” and assessing freedom to operate. In an environment where a single day’s delay can cost millions in lost revenue, this kind of granular, up-to-the-minute intelligence is not a luxury; it is a fundamental prerequisite for competitive survival.

The 180-day exclusivity period has fundamentally reshaped the generic market. It has shifted the competitive focus from being the most efficient manufacturer to being the first, most aggressive, and best-funded litigant. This dynamic creates a massive, short-term financial prize that dwarfs the long-term profits available in a fully commoditized market. This prize is what justifies the multi-million-dollar ante required to even sit at the litigation table. Consequently, the decision to launch a generic is now as much a legal and financial calculation as it is a scientific one. This system structurally favors large, well-capitalized players who can afford to run dozens of these high-risk, high-reward legal campaigns simultaneously, creating a formidable barrier to entry for smaller firms.

Challenge 4: The Unrelenting Price Crush – Surviving Commoditization

If patent litigation is the high-stakes entry fee, then price erosion is the brutal, unforgiving reality of the game itself. The core value proposition of the generic industry to society is its ability to dramatically lower drug costs. Yet, this very success creates a crisis of profitability for the manufacturers themselves. The relentless downward pressure on prices is perhaps the most powerful and pervasive challenge in the industry, a force that dictates product lifecycles, shapes portfolio strategy, and ultimately threatens the stability of the entire supply chain.

The Economics of Erosion: Quantifying the Price Decline

The economic impact of generic entry is as predictable as it is severe. The moment a brand drug’s exclusivity ends, the clock starts ticking on its price. The decline is directly correlated with the number of competitors that enter the market. The data paints a stark picture:

- First Generic Entry: A single generic competitor typically slashes the price by 30% to 39% compared to the brand.25

- Increased Competition: With just two or three competitors in the market, the price plummets further, falling by 50% to 70%.25

- Market Saturation: Once the market becomes crowded with six, ten, or more competitors, the price collapses. It’s not uncommon to see prices fall by a staggering 85% to 95% from the original brand price.38

This isn’t a slow, gentle decline; it’s a cliff. This rapid commoditization means that the window for a generic product to be highly profitable is often very short. The entire business model is predicated on getting to market quickly to capture share before the inevitable price crush begins.

Table 2: The Economics of Generic Entry – Price vs. Competition

| Number of Generic Competitors | Approximate Price Reduction vs. Brand Price | Strategic Implication |

| 1 | 30-39% 25 | The “first-filer” enjoys a significant, albeit temporary, period of high margins. This is the primary prize of P-IV litigation. |

| 2-3 | 50-70% 25 | Profitability is still viable, but margins begin to compress rapidly. Speed to market for the second and third entrants is critical. |

| 5-6 | ~85% 25 | The market is approaching full commoditization. Price becomes the sole competitive differentiator. |

| 10+ | 70-95% 39 | Margins are razor-thin or non-existent. Only the most efficient, high-volume manufacturers can sustain profitability. |

This table tells a powerful story. It illustrates the extreme urgency of market timing and provides a clear, data-driven rationale for why companies must either be among the very first to launch or focus on products with higher barriers to entry where the competitive field is likely to remain small.

The Power of the Buyers: GPOs and PBMs

The natural price erosion from competition is dramatically accelerated by another powerful force: the consolidation of buyers. The demand side of the U.S. pharmaceutical market is not a fragmented collection of individual pharmacies. Instead, it is dominated by a handful of massive purchasing organizations.38

These include Group Purchasing Organizations (GPOs), which negotiate on behalf of hospitals, and Pharmacy Benefit Managers (PBMs), which manage prescription drug benefits for millions of Americans on behalf of insurance plans. The scale of these entities is immense. One 2018 analysis found that just three large buying groups—formed by joint ventures between wholesalers and retail pharmacy chains—controlled an astonishing 72% to 81% of all generic drug purchases in the United States.

This immense concentration gives buyers extraordinary leverage. They can demand steep discounts and play manufacturers off against each other to secure the lowest possible price. For a generic company, winning a contract with one of these large groups means gaining access to a huge portion of the market, but it often comes at the cost of accepting razor-thin margins. In this environment, generic manufacturers are often price-takers, not price-setters.

The Race to the Bottom and Market Withdrawals

The confluence of fierce competition among manufacturers and the immense bargaining power of buyers creates what the industry calls the “race to the bottom.” Prices are driven down so aggressively that for many mature, multi-source products, profitability vanishes entirely.43

When a company is consistently losing money on a product, the business decision is simple: stop making it. This is not a theoretical risk; it is happening at an alarming rate. According to one industry report, an estimated 3,000 generic drug products have been withdrawn from the market over the past decade precisely because they became unprofitable to produce.

This is the logical and dangerous endpoint of extreme price pressure. The very market dynamics designed to ensure affordability are simultaneously undermining the economic foundation needed to ensure a stable supply. This creates a public health paradox: the relentless pursuit of the lowest possible price for a generic drug is a primary cause of the drug shortages that plague the healthcare system. The system’s success in driving down costs is directly linked to its failure in maintaining supply reliability.

Challenge 5: The Manufacturing Tightrope – Quality, Compliance, and the Risk of Recall

The brutal economic pressures detailed in the previous chapter do not exist in a vacuum. They create a ripple effect that extends deep into the factory, placing immense strain on manufacturing operations and quality systems. When margins are measured in fractions of a cent, the temptation to cut corners on quality—whether consciously or through benign neglect—becomes a powerful force. This makes manufacturing a high-wire act, where a single misstep in quality or compliance can lead to a catastrophic fall in the form of a product recall, regulatory action, and immense damage to both patients and the company’s reputation.

The Global GMP Challenge

The foundational requirement for any drug manufacturer is adherence to Current Good Manufacturing Practices (cGMP). These are the FDA’s regulations that ensure the identity, strength, quality, and purity of drug products.41 This is a non-negotiable standard, applying equally to a state-of-the-art facility in New Jersey and a sprawling API plant in rural India.

However, ensuring compliance across a vast and fragmented global supply chain is a monumental challenge. A majority of the APIs and finished generic drugs destined for the U.S. market are produced overseas, primarily in India and China.45 While the FDA has increased its foreign inspection cadence, the logistical hurdles are significant. Surprise inspections, which are a powerful compliance tool domestically, are far more difficult to conduct on the other side of the world. This reality can create an environment where adherence to the strictest quality standards may lapse, especially when economic pressures are high. The data from a decade ago was stark: in 2010, a shocking 64% of foreign manufacturing plants supplying the U.S. had never been inspected by the FDA. While that number has improved, the fundamental challenge of remote oversight remains.

Case Study – The ARB and Ranitidine Nitrosamine Recalls

The nitrosamine crisis serves as a powerful case study in how a latent manufacturing flaw can erupt into a global public health crisis. The discovery of carcinogenic impurities in widely used blood pressure and heartburn medications led to massive, rolling recalls that affected millions of patients worldwide.20

The investigation revealed that the impurities were not the result of external contamination but were being created as an unintended byproduct of the chemical synthesis process itself at certain API manufacturing facilities. Specific reagents and reaction conditions, combined with a lack of adequate process controls, created the perfect environment for these carcinogens to form. This was a systemic failure of process chemistry and quality oversight, and it forced the entire global pharmaceutical industry to re-examine its manufacturing processes from the ground up, imposing a massive new layer of analytical testing and regulatory compliance.

Case Study – The Glenmark Manufacturing Deviations

A more recent example highlights a different, but equally dangerous, type of failure. In early 2025, Glenmark Pharmaceuticals voluntarily recalled nearly 40 different generic medications manufactured at one of its facilities in India.48 This was not due to a specific chemical impurity. Instead, an FDA inspection uncovered a systemic breakdown in the facility’s quality management system.

The inspectors’ report read like a laundry list of cGMP failures: inadequate measures to prevent cross-contamination between different drugs being produced in the same facility, a failure to properly investigate batch discrepancies, and a quality control unit that was not empowered to do its job. This case illustrates the immense operational discipline required to maintain quality in a high-volume, multi-product generic facility. It also underscores how a failure in basic quality systems can have far-reaching consequences, jeopardizing the safety of dozens of different medicines simultaneously.

The Lag in Advanced Manufacturing Technology (AMT)

One potential solution to these quality challenges is the adoption of Advanced Manufacturing Technologies (AMTs), such as continuous manufacturing. These modern processes can offer superior process control, real-time quality monitoring, and greater consistency compared to traditional batch manufacturing.

However, the adoption of AMTs in the generic sector has been sluggish, lagging far behind the branded drug industry. The reason is simple and ties directly back to Challenge 4: cost. AMTs require a prohibitively high upfront capital investment. This creates a critical investment trap. The generic companies, which operate on the thinnest of margins, are the ones who stand to benefit most from the efficiency and quality improvements of AMTs. Yet, they are the very companies that are least able to afford the initial investment. The market’s relentless focus on short-term price optimization discourages the long-term investments in technology that are essential for ensuring quality and resilience.

The direct, causal link between extreme price pressure and catastrophic quality failures is undeniable. When GPOs and PBMs award multi-million-dollar contracts based on a price difference of a fraction of a cent per tablet, they are sending an implicit but powerful message to manufacturers: cost is the only thing that matters. This incentive structure systematically de-prioritizes investments in robust quality systems, modern equipment, and supply chain redundancy. The result is a system optimized for cost, not for resilience. Major drug recalls and the resulting shortages are not random accidents; they are the predictable and inevitable outcomes of a market that relentlessly rewards the lowest price without adequately rewarding quality and reliability.

Challenge 6: The Fragile Supply Chain – From API Sourcing to Drug Shortages

The quality issues at individual manufacturing plants are symptoms of a much larger, systemic problem: the profound fragility of the global pharmaceutical supply chain. Over the past two decades, in the relentless pursuit of lower costs, the industry has constructed a hyper-efficient, “just-in-time” global network. This system, however, was built for a stable and predictable world. In an era of increasing geopolitical tension, trade disputes, and climate-related disruptions, this efficiency has come at the cost of resilience, leaving the U.S. dangerously vulnerable to drug shortages.

Geopolitical Concentration and Risk

The geographic concentration of the pharmaceutical supply chain is staggering and represents a critical national security risk. The United States is overwhelmingly dependent on just two countries—China and India—for its supply of generic medicines.

- Together, China and India supply an estimated 70-80% of the U.S.’s total generic drug volume.

- China holds a dominant, and in some cases near-monopolistic, position in the upstream production of key starting materials and active pharmaceutical ingredients (APIs). It controls 80-90% of the global production for essential inputs like those used in antibiotics.

- India, which is the largest supplier of finished generic drugs to the U.S., is itself critically dependent on China, sourcing 70-80% of its own APIs from its neighbor.46

This creates a precarious, domino-like dependency. As one report starkly puts it, “if China falters, India follows, and America is left scrambling”. A trade war, a natural disaster, a pandemic, or a political decision in Beijing could instantly sever the supply of life-saving medicines to American patients. This is not a hypothetical threat. In 2023, the shutdown of a single plant in India responsible for 50% of the U.S. supply of the chemotherapy drug cisplatin led to nationwide shortages, forcing doctors to delay or alter cancer treatments.

The Anatomy of a Drug Shortage

Drug shortages are the direct, tangible consequence of this fragile system, and they are getting worse. In 2023, the U.S. experienced an average of 301 ongoing drug shortages per quarter, the highest level in a decade. The primary root cause, cited in over 60% of cases, is manufacturing or quality problems.42

The impact on the healthcare system is severe and costly.

- Patient Harm: Shortages lead to delayed treatments, medication errors as staff work with unfamiliar alternatives, and in some documented cases, increased patient mortality.53

- Financial Strain: Hospitals are forced to dedicate enormous resources to managing shortages. One study estimated the annual labor costs for hospitals to manage shortages at $216 million. They often have to purchase drugs on the “grey market” from secondary distributors at massively inflated prices—markups of 300% to 500% are common. Managing shortages can add as much as 20% to a hospital’s total drug expenses.

Generic sterile injectable drugs, such as those used in chemotherapy and critical care, are particularly vulnerable. They are complex to manufacture and often have low profit margins, making their supply chains especially brittle. In 2024, 69% of active drug shortages were for sterile injectable products.

The Push for Onshoring and Resilience

In response to these vulnerabilities, there is a growing chorus of calls from policymakers and public health experts to “onshore” or “re-shore” pharmaceutical manufacturing, bringing it back to the United States. The goal is to create a more secure and resilient domestic supply chain that is less susceptible to foreign disruptions.

However, this is a monumental undertaking. The same economic forces that drove manufacturing overseas in the first place—namely, the pursuit of the lowest possible cost—remain firmly in place. Rebuilding a domestic manufacturing base for low-margin generic drugs would require massive capital investment and would be economically unviable without a fundamental shift in policy and purchasing practices. The tension is clear: the hyper-efficient, low-cost global supply chain is also hyper-fragile. Building a resilient one will require accepting that reliability has a cost, a concept that runs counter to the decades-long focus on price above all else.

The generic drug supply chain is a system that has been financially punished for any form of redundancy. In a market where contracts are won or lost over fractions of a penny, holding buffer inventory is a financial liability. Qualifying a second API supplier is an expensive regulatory burden. A manufacturer with a resilient but slightly more expensive supply chain will consistently lose business to a competitor with a lean, single-source, but brittle one. The market has, therefore, systematically selected for fragility. The drug shortage crisis is the predictable result. A sustainable solution requires a paradigm shift in how we value and pay for medicines—moving from a model that rewards only the lowest price to one that also explicitly rewards and incentivizes supply chain reliability, quality, and geographic diversity.

Challenge 7: The Rise of Complex Generics – Higher Risk, Higher Reward

Faced with the brutal economics of the traditional generic market, where high-volume oral solids are quickly commoditized, savvy pharmaceutical companies are strategically pivoting. They are moving up the value chain, away from the “race to the bottom” and toward a more defensible and potentially more profitable frontier: complex generics. This strategic shift represents a fundamental evolution of the generic business model, trading the relative simplicity of copying tablets for the higher risks—and higher rewards—of tackling more scientifically and technically challenging products.

Defining the “Complex” Landscape

What exactly is a “complex generic”? The FDA defines it as a product that has one or more of the following features:

- Complex active ingredients (e.g., peptides, complex mixtures)

- Complex formulations (e.g., liposomes, long-acting injectables)

- Complex routes of delivery (e.g., topical, inhaled, ophthalmic)

- Complex drug-device combinations (e.g., auto-injectors, metered-dose inhalers).3

Recent examples of complex generic approvals include cyclosporine ophthalmic emulsion (a generic version of Restasis) for dry eye and an inhalation aerosol containing budesonide and formoterol (a generic version of Symbicort) for asthma and COPD.

The key strategic advantage of these products is that their inherent complexity creates higher barriers to entry. It is far more difficult for a competitor to develop a generic inhaler than a simple tablet. This naturally limits the number of players in the market, slowing the pace of price erosion and allowing for more sustainable and potentially higher profit margins.25 This is the strategic escape hatch from the commoditization trap described in Challenge 4.

Navigating the 505(b)(2) Pathway

Many of these complex and value-added medicines find their regulatory home in the 505(b)(2) pathway.59 This “hybrid” application is a unique and powerful strategic tool within the FDA’s framework. It is a New Drug Application (NDA), not an ANDA, but it allows a developer to rely, in part, on the FDA’s previous findings of safety and effectiveness for an already approved drug.60

This means a company can create a modified version of an existing drug—perhaps changing its dosage form, strength, or route of administration—without having to conduct the full suite of expensive and time-consuming preclinical and clinical trials required for a brand-new molecule (a 505(b)(1) NDA). The developer only needs to conduct the necessary “bridging studies” to demonstrate the safety and efficacy of their specific modification.

Crucially, because it is an NDA, a product approved via the 505(b)(2) pathway can be granted its own period of market exclusivity—typically three years for a new clinical investigation, but potentially up to seven years for an orphan drug indication.60 This provides a protected period to recoup R&D investment, a benefit not available to traditional generics. The 505(b)(2) pathway thus represents a strategic sweet spot, balancing innovation with efficiency and offering a route to market for differentiated products that are neither simple copies nor entirely new chemical entities.

The Heightened Scientific and Manufacturing Hurdles

The trade-off for higher margins and market exclusivity is a significant increase in scientific and technical risk. While the 505(b)(2) pathway can shorten the clinical development timeline, the upstream challenges of formulation and manufacturing are magnified.

Proving bioequivalence for a transdermal patch, for example, requires not only measuring drug levels in the blood but also demonstrating equivalent skin adhesion and irritation properties. For an inhaled product, the developer must match the particle size distribution and aerosol dynamics of the reference product, a complex interplay between the drug formulation and the delivery device.

Manufacturing these products also requires a leap in capability. The equipment, facilities, and expertise needed to produce a sterile, long-acting injectable or a complex ophthalmic emulsion are far more specialized and expensive than those required for standard tablet production. This technical hurdle is a major reason why the field of competitors for complex generics remains small. Only companies with deep scientific expertise and the capital to invest in specialized manufacturing can successfully compete in this space.

This pivot towards complex generics marks a profound evolution in the industry. The traditional generic business model was built on being the fastest and cheapest to copy a simple molecule. The key corporate competencies were efficient process chemistry, high-volume manufacturing, and aggressive litigation. The commoditization of that market has rendered that model insufficient for sustainable growth. Success in the complex generics arena requires a completely different set of skills: advanced formulation science, a deep understanding of novel drug delivery systems, expertise in navigating ambiguous regulatory pathways like 505(b)(2), and the capability to design and execute more sophisticated clinical studies. The generic companies that will thrive in the coming decade are those that are successfully transforming their R&D organizations to look less like high-volume copiers and more like nimble, science-driven specialty pharma companies.

Challenge 8: The Biosimilar Frontier – A Different Beast Entirely

If complex generics represent an evolution of the traditional model, then biosimilars represent a completely different species. While often referred to as “generic” versions of biologic drugs, this shorthand is dangerously misleading. Biologics—large, complex molecules like monoclonal antibodies that are produced in living cell systems—cannot be copied with the same precision as small-molecule chemical drugs. The path to developing, manufacturing, and marketing a biosimilar is so fraught with unique scientific, regulatory, and commercial challenges that it constitutes a distinct and formidable industry segment of its own.

The Science of “Similarity”

The first and most fundamental challenge lies in the science. A traditional generic must prove it is “bioequivalent” to the brand drug, meaning it is chemically identical and behaves the same way in the body. A biosimilar, however, cannot be identical. Because biologics are produced by living organisms, there is inherent variability in the final product. The regulatory standard is therefore different: a biosimilar must be proven to be “highly similar” to the reference biologic, with “no clinically meaningful differences” in terms of safety, purity, and potency.62

Meeting this standard is a monumental scientific undertaking. It requires a massive battery of sophisticated analytical tests to compare hundreds of structural and functional attributes between the biosimilar and the reference product. This is followed by preclinical studies and, typically, at least one large, comparative clinical trial in patients to confirm safety and efficacy. The entire development process is far longer and more expensive than for a traditional generic, taking an estimated 7 to 8 years and costing between $100 million and $250 million.63 This is an order of magnitude higher than the $1 million to $4 million it might take to develop a simple generic.

Manufacturing and Scale-Up Complexity

For biologic drugs, the manufacturing process is the product. The specific cell line, the nutrient media, the bioreactor conditions, and the complex multi-step purification process all contribute to the final structure and function of the molecule. A biosimilar developer must reverse-engineer this entire process from scratch, without access to the innovator’s proprietary cell line or production secrets.

This is an immense technical challenge that requires world-class expertise in cell biology, protein chemistry, and bioprocess engineering. Even minor, seemingly insignificant changes in the manufacturing process can lead to subtle differences in the final product that could affect its efficacy or, more dangerously, its immunogenicity—the risk that it will provoke an unwanted immune response in patients. Scaling up production from lab-scale bioreactors to commercial-scale manufacturing tanks presents another set of formidable hurdles related to equipment, facility validation, and the availability of a highly specialized workforce. These manufacturing complexities represent one of the highest barriers to entry in the biosimilar space.

Market Access and the “Rebate Trap”

Even after a company has invested hundreds of millions of dollars and successfully navigated the arduous scientific and regulatory path to get a biosimilar approved, its biggest challenges may still lie ahead. Gaining market access in the U.S. has proven to be incredibly difficult due to a combination of regulatory and commercial factors.

Unlike in the small-molecule world, a pharmacist cannot automatically substitute a biosimilar for a prescribed brand biologic unless the FDA has designated it as “interchangeable.” Achieving this designation requires the manufacturer to conduct additional, expensive “switching studies” to prove that alternating between the brand and the biosimilar is safe and effective.62 Few companies have pursued this, meaning the decision to use a biosimilar rests almost entirely with the prescribing physician and the patient’s insurance plan.

This is where the commercial battlefield is fought. Brand-name biologic manufacturers have become masters of defending their market share. A key tactic is the “rebate trap” (or “rebate wall”). The brand manufacturer offers a large, volume-based rebate to PBMs on its high-list-price biologic. To get the best rebate, the PBM must place the brand drug in a preferred position on its formulary and effectively block or disadvantage the lower-priced biosimilar. This creates a perverse incentive where it can be more profitable for the PBM to stick with the expensive brand than to promote the cost-saving biosimilar.

The chaotic and slow launch of biosimilars for Humira (adalimumab), the best-selling drug in the world, is a stark case study. Despite nearly a dozen biosimilars launching in the U.S., it took almost 18 months for them to gain any meaningful market share, largely due to the originator’s aggressive contracting and rebate strategies with PBMs.

Physician and Patient Acceptance

Finally, there is the challenge of “clinical inertia.” Many physicians, particularly for patients who are stable and doing well on a brand-name biologic, are hesitant to switch to a biosimilar. They may have concerns—often unfounded, but persistent—about subtle differences in efficacy or safety. A 2023 survey found that 42% of specialist physicians still expressed concerns about the safety of biosimilars compared to reference biologics. Patients, too, can be anxious about switching from a medication they know and trust.

Overcoming this inertia requires a significant investment in physician education, the generation of real-world evidence, and patient support programs—commercial activities that are more typical of a branded product launch than a generic one. The successful launches of early biosimilars like Zarxio (a biosimilar to Neupogen) and Truxima (a biosimilar to Rituxan) depended heavily on presenting strong clinical data and building trust with the oncology community.

The biosimilar market is not a generic market; it is a branded competitive market. Success is not determined by being the cheapest copy. It is determined by a complex interplay of scientific credibility, manufacturing excellence, and, most importantly, sophisticated commercial strategies for navigating payer negotiations and winning the confidence of prescribers. This requires a completely different corporate structure and mindset than a traditional generic company possesses, which explains why the promise of massive biosimilar savings has been so slow to materialize in the U.S. compared to Europe, where different policies have encouraged faster uptake.68

Challenge 9: The International Competitor Onslaught – A Double-Edged Sword

No discussion of the challenges facing the generic drug industry would be complete without a deep analysis of the role of international competitors, particularly those from India and China. These manufacturing powerhouses are not just rivals; they are integral, indispensable parts of the global pharmaceutical ecosystem. Their rise has been a double-edged sword for the U.S. market: they are the primary engine of the cost savings that benefit American patients, but their dominance also introduces significant risks related to quality, supply chain security, and competitive pressure for domestic manufacturers.

Dominance in Supply and Market Share

The scale of India’s role in the U.S. generic market is breathtaking. According to a 2022 analysis, Indian pharmaceutical companies supply a staggering four out of every ten prescriptions filled in the United States. Their dominance in the generic space is even more pronounced, accounting for 47% of all U.S. generic prescriptions. This massive volume of affordable medicine is the single biggest driver of the hundreds of billions of dollars in savings that generics provide to the U.S. healthcare system annually. The intense price competition that defines the U.S. market is, in large part, a direct result of the efficiency and scale of these Indian manufacturers.

The Quality and Safety Equation

This deep reliance, however, comes with well-documented risks. While many overseas facilities operate at the highest standards, the sheer volume of production and the intense pressure on costs have led to notable quality control failures. FDA inspections have repeatedly uncovered significant cGMP violations at some facilities in both India and China, leading to warning letters, import alerts, and product recalls.45

The data on patient outcomes is concerning. One 2025 study concluded that generic drugs manufactured in India were associated with a 54% higher likelihood of causing a severe adverse event compared to their U.S.-made counterparts. This is not to say all imported drugs are of lower quality, but it highlights a systemic risk. The economic pressure to be the lowest-cost producer can create an environment where investment in quality systems and rigorous process controls may be compromised. This presents a difficult dilemma for U.S. payers and policymakers: the very competition that drives down prices may, in some cases, come at the cost of quality and safety.

Strategic Implications for U.S. Manufacturers

For the remaining generic drug manufacturers based in the U.S. and Europe, this competitive landscape is incredibly challenging. It is exceedingly difficult to compete on price for a simple, high-volume oral solid against an Indian competitor that benefits from lower labor costs, different environmental regulations, and economies of scale.

This intense competitive pressure from overseas is a primary strategic driver pushing Western firms up the value chain. It is a major reason why so many U.S. and European companies have shifted their focus away from the commoditized oral solid market and toward the higher-margin, higher-barrier-to-entry segments of complex generics and biosimilars. In these areas, the key competitive advantages are scientific expertise, advanced technology, and regulatory savvy—domains where they can still maintain a competitive edge.

The relationship between the U.S. generic industry and manufacturers in India and China is not one of simple rivalry but of complex, symbiotic codependence. A U.S.-based generic company might decide to develop a new product. To be cost-competitive, it will almost certainly source its API from a manufacturer in China or India. It will then formulate the finished drug in its U.S. facility and file its ANDA. At the same time, a large Indian generic company, perhaps sourcing its API from the very same supplier, will file its own ANDA for the same product. When both are approved, the U.S. company finds itself in direct competition with the Indian firm, yet both are critically dependent on the same upstream supply chain.

This creates a tangled web of shared risks. A quality failure at the Chinese API plant could halt production for both competitors. A trade dispute or tariff could raise costs for both. The challenge, therefore, is not simply “competition from India and China.” It is the far more complex task of managing the risks and opportunities of a deeply integrated, interdependent, and often fragile global ecosystem where today’s supplier can be tomorrow’s competitor.

Challenge 10: The Shifting Policy Landscape – Navigating New Rules and Future Headwinds

The final and perhaps most unpredictable challenge is the ever-shifting landscape of government policy and technology. The rules of the game for the generic industry are not static; they are constantly being rewritten by new legislation, evolving regulatory science, and disruptive technologies. Companies that fail to anticipate and adapt to these future headwinds risk being left behind, while those that can navigate them strategically will find new avenues for growth and innovation.

The Inflation Reduction Act (IRA) and its Unintended Consequences

One of the most significant policy shifts in decades is the U.S. Inflation Reduction Act (IRA) of 2022. A key provision of the law allows Medicare, for the first time, to directly negotiate prices for a selection of high-spend drugs. Crucially, this includes small-molecule drugs that have been on the market for seven or more years—often well before their patents are set to expire.

While aimed at lowering costs for seniors, this policy has the potential to create a profound and likely unintended consequence for the generic industry. The entire economic model of the P-IV challenge is built on the financial prize represented by the large price gap between an expensive brand drug and a low-cost generic. The IRA fundamentally alters this equation. By empowering Medicare to negotiate a lower price for the brand drug before it faces generic competition, the law dramatically shrinks the potential savings a generic can offer and, therefore, the potential profit for the generic manufacturer.

If the financial incentive to challenge a patent is significantly eroded, fewer companies may be willing to undertake the multi-million-dollar cost and risk of P-IV litigation. This could lead to less patent-challenging, delayed generic entry, and ultimately, less competition in the long run—a perverse outcome for a law designed to lower drug costs.

The Rise of Artificial Intelligence (AI) in Generic R&D

On the technology front, Artificial Intelligence (AI) is emerging as a transformative force with the potential to reshape pharmaceutical R&D.70 AI and machine learning algorithms can analyze vast datasets to accelerate drug discovery, predict the success of clinical trials, and optimize complex manufacturing processes.

For the generic industry, AI offers a powerful toolkit to tackle many of the challenges we’ve discussed.

- Formulation: AI-powered modeling could predict how different formulations will behave in the body, reducing the risk of costly bioequivalence study failures.

- Manufacturing: AI-driven analytics can monitor production lines in real-time, predicting and preventing quality deviations before they occur.

- Portfolio Management: AI can sift through patent databases, clinical trial data, and market trends to help companies identify the most promising generic candidates and better assess their risk profiles.

The FDA is actively engaged in this space, developing a regulatory framework to govern the use of AI in drug development and decision-making. However, harnessing the power of AI requires significant investment in new technology, data infrastructure, and specialized talent—a challenge for an industry already under intense margin pressure.

The global AI in pharmaceutical market is estimated at $1.94 billion in 2025 and is forecasted to reach around $16.49 billion by 2034, accelerating at a CAGR of 27% from 2025 to 2034. By 2025, it’s estimated that 30% of new drugs will be discovered using AI, marking a significant shift in the drug discovery process.

The Intersection with Digital Therapeutics (DTx) and Personalized Medicine

Looking further ahead, the entire paradigm of medicine is shifting. The future is moving away from “one-size-fits-all” blockbuster drugs and toward personalized medicine, where treatments are tailored to an individual’s genetic makeup or specific disease characteristics. This trend is increasingly intertwined with the rise of Digital Therapeutics (DTx)—software-based interventions, often delivered via smartphone apps, that are clinically validated to prevent, manage, or treat a medical condition.74

This presents both a profound threat and a unique opportunity for the generic industry. The threat is that a healthcare system focused on highly targeted therapies for small, specific patient populations will have less need for mass-market, commoditized generic drugs. The market for a generic version of a drug used by only a few thousand patients may be too small to be commercially viable.

The opportunity, however, is for the generic industry to innovate and redefine its value proposition. The future may lie in creating “generic+” or “value-added” products. Imagine a company pairing a low-cost generic medication with a simple, FDA-cleared digital app that helps patients with adherence, tracks their symptoms, or provides behavioral support. This combination product, potentially approved via the 505(b)(2) pathway, would no longer be competing solely on the price of the pill. It would be competing on the overall value it provides to the patient and the healthcare system.

The traditional generic drug—a simple chemical copy of a blockbuster pill—is slowly becoming a relic of a bygone era. The policy landscape, as evidenced by the IRA, is eroding the old business model. At the same time, new technologies like AI are providing the tools to design more complex and effective products, while the rise of personalized medicine and DTx is shifting the market’s focus from the pill itself to the overall patient outcome.

The ultimate challenge for the generic industry, therefore, is to evolve. The companies that will lead the next generation will be those that move beyond being mere copycats. They will become innovators in the off-patent space, using science, technology, and data to create products that are not only affordable but are also demonstrably better—more effective, easier to use, and more valuable to patients and the healthcare system as a whole.

Key Takeaways

- Regulatory Complexity is a Core Business Risk: Navigating the divergent requirements of the FDA and EMA, the high upfront costs of GDUFA, and emerging quality mandates like nitrosamine testing has transformed regulatory compliance from a technical function into a primary strategic and financial consideration that must be factored into early-stage portfolio decisions.

- The Economics of Commoditization are Unsustainable: The combination of intense multi-source competition and the consolidated power of buyers (GPOs/PBMs) drives prices down so aggressively that it makes many essential medicines unprofitable, leading directly to market withdrawals and drug shortages. The system’s success in lowering costs is the root cause of its supply instability.

- Patent Litigation is an Inescapable Cost of Entry: The 180-day exclusivity for the first P-IV filer has made high-stakes, multi-million-dollar patent litigation a standard and necessary business strategy for early market entry, favoring well-capitalized players with a high tolerance for legal risk.

- Quality Failures are Often Symptoms of Economic Distress: The relentless pressure to lower costs directly disincentivizes long-term investments in modern manufacturing technology and robust quality systems, making catastrophic quality failures and recalls a predictable, systemic outcome rather than a random accident.

- The Global Supply Chain is Optimized for Cost, Not Resilience: The heavy concentration of API and finished drug manufacturing in China and India has created a hyper-efficient but dangerously fragile supply chain, leaving the U.S. vulnerable to geopolitical, economic, and public health disruptions.

- The Future is Complex and Value-Added: The commoditization of simple oral solids is forcing the industry to pivot to higher-barrier-to-entry products. Success now depends on scientific and technical expertise in developing complex generics, navigating the 505(b)(2) pathway, and mastering the unique commercial challenges of the biosimilar market.

- Biosimilars are Not Generics: The scientific, manufacturing, regulatory, and commercial hurdles for biosimilars are an order of magnitude greater than for traditional generics. Success requires the infrastructure and mindset of a branded pharmaceutical company, not a high-volume copier.

- Policy and Technology are Reshaping the Landscape: New policies like the IRA are altering the fundamental economic incentives for generic development, while emerging technologies like AI and Digital Therapeutics (DTx) present both disruptive threats and opportunities for the industry to innovate and create new forms of value beyond the pill.

Frequently Asked Questions (FAQ)

1. How should a mid-sized generic company reallocate its R&D budget in light of these challenges?

A mid-sized company should strategically shift its R&D focus from high-volume, soon-to-be-commoditized oral solids towards a balanced portfolio of “value-added” products. This means allocating a greater percentage of the budget to developing capabilities in complex generics (e.g., long-acting injectables, topical formulations) and products suitable for the 505(b)(2) pathway. This requires investment in three key areas: (1) Talent: Hiring formulation scientists and regulatory experts with experience in complex drug delivery systems and NDA submissions, not just ANDAs. (2) Technology: Investing in advanced analytical characterization equipment and potentially computational modeling (PBPK) software to de-risk development and reduce reliance on costly in vivo studies. (3) Partnerships: Collaborating with specialized Contract Development and Manufacturing Organizations (CDMOs) that possess the unique manufacturing capabilities for these complex products, rather than trying to build every capability in-house.

2. What is the most critical, non-obvious risk factor to consider when evaluating a new generic candidate today?

Beyond the obvious patent and market size analysis, the most critical non-obvious risk factor is the stability of the upstream API supply chain and the inherent chemical risk of the molecule itself. The nitrosamine crisis taught the industry that a seemingly straightforward molecule can harbor latent chemical risks that can emerge years later, triggered by a specific manufacturing process. Therefore, due diligence on a new candidate must now include a deep dive into the API’s route of synthesis. Does it use reagents or conditions known to pose impurity risks? How many qualified API suppliers exist globally? Are they all located in the same geographic region? A product with a single, geographically concentrated API source and a high-risk chemical synthesis profile is a far riskier bet than one with a diverse supply chain and a robust, clean chemistry, even if the patent landscape for the former looks slightly more attractive.

3. With the rise of biosimilars, is there still a future for small-molecule generics?

Absolutely. While biosimilars represent a major growth area, the small-molecule market remains the backbone of the pharmaceutical industry by volume. The future, however, is not in simple, high-competition molecules. The sustainable future for small-molecule generics lies in three areas: (1) Complex Generics: As discussed, products that are difficult to formulate or manufacture and will therefore face limited competition. (2) 505(b)(2) Innovations: Creating new value from existing small molecules through new formulations, combinations, or indications. (3) Niche/Orphan Drugs: Targeting smaller-market drugs where competition is less intense and pricing can be more stable. The era of chasing every blockbuster oral solid is over; the future is about strategic specialization in higher-barrier segments of the small-molecule market.

4. How can a generic company realistically compete with the low-cost manufacturing base in India and China without moving all its operations offshore?

Competing purely on the cost of labor is a losing battle. A U.S. or European-based manufacturer must compete on value, quality, and reliability. The strategy involves: (1) Focusing on Complex Products: Specializing in sterile injectables, controlled-release products, or other complex generics where technical expertise and proximity to regulatory agencies are key advantages. (2) Investing in Advanced Manufacturing: Adopting continuous manufacturing and automation (AMT) to increase efficiency and quality, thereby offsetting higher labor costs. (3) Marketing Reliability: Positioning the company as a reliable, high-quality domestic supplier to hospitals and GPOs that are increasingly concerned about drug shortages and supply chain fragility. This requires a shift in the purchasing paradigm, where buyers are willing to pay a small premium for supply chain security, a trend that is slowly gaining traction.

5. Given the pressures from the Inflation Reduction Act (IRA), is P-IV litigation still a viable strategy for generic market entry?

P-IV litigation will remain a critical tool, but its application will become more selective and strategic. The IRA’s price negotiation provision will undoubtedly shrink the potential profitability of challenging patents on some of the highest-spend Medicare drugs. This means companies will need to be far more rigorous in their financial modeling. The strategy will likely shift in two ways: (1) Focus on Commercially Insured Blockbusters: P-IV challenges will increasingly target drugs whose sales are concentrated in the commercial insurance market, which is not directly affected by Medicare price negotiation. (2) Higher Bar for Litigation: For drugs subject to negotiation, a company will only pursue a P-IV challenge if the brand’s patents are exceptionally weak and the probability of a quick legal victory is very high. The days of challenging every major patent in the hope of securing a lucrative settlement may be numbered; the IRA forces a more disciplined, ROI-driven approach to litigation.

References

- 2024 U.S. Generic & Biosimilar Medicines Savings Report …, accessed July 28, 2025, https://accessiblemeds.org/resources/reports/2024-savings-report/

- The Global Generic Drug Market: Trends, Opportunities, and …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Expanding global access to complex generics: The case for regulatory convergence – RAPS, accessed July 28, 2025, https://www.raps.org/news-and-articles/news-articles/2025/2/expanding-global-access-to-complex-generics-the-ca

- How Generic Drugs Are Approved: A Step-by-Step Guide to FDA and EMA Regulations, accessed July 28, 2025, https://www.coherentmarketinsights.com/blog/how-generic-drugs-are-approved-a-step-by-step-guide-to-fda-and-ema-regulations-1254

- Abbreviated New Drug Application (ANDA) – FDA, accessed July 28, 2025, https://www.fda.gov/drugs/types-applications/abbreviated-new-drug-application-anda

- Comparative Study of Generic Drug Approvalprocess in EU, USA …, accessed July 28, 2025, https://globalresearchonline.net/journalcontents/v42-2/14.pdf

- Bioequivalence Requirements in the European Union: Critical …, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3475855/

- BCS Biowaivers: Similarities and Differences Among EMA, FDA, and …, accessed July 28, 2025, https://pubmed.ncbi.nlm.nih.gov/26943914/

- Comparing FDA and EMA Decisions for Market Authorization of …, accessed July 28, 2025, https://www.fda.gov/media/156611/download

- Journal of Chemical Health Risks Regulatory Frameworks Adopted …, accessed July 28, 2025, https://jchr.org/index.php/JCHR/article/download/6930/4122/13039

- Generic Drug Entry Timeline: Predicting Market Dynamics After …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-timeline-predicting-market-dynamics-after-patent-loss/

- Generic Drug User Fee Amendments – FDA, accessed July 28, 2025, https://www.fda.gov/industry/fda-user-fee-programs/generic-drug-user-fee-amendments

- Food and Drug Administration vs European Medicines Agency: Review times and clinical evidence on novel drugs at the time of approval – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6983504/

- EMA Marketing Authorisation vs FDA New Drug Application – Somerville Partners, accessed July 28, 2025, https://somerville-partners.com/marketing-authorisation-application-ema-vs-new-drug-application-fda/

- FDA vs. EMA: Navigating Divergent Regulatory Expectations for Cell …, accessed July 28, 2025, https://cromospharma.com/fda-vs-ema-navigating-divergent-regulatory-expectations-for-cell-and-gene-therapies-what-biopharma-companies-need-to-know/

- What is a GDUFA? – DDReg Pharma, accessed July 28, 2025, https://www.ddregpharma.com/what-is-a-gdufa

- Is Nitrosamine Impurities Posing the Regulatory Threat? – SAVA …, accessed July 28, 2025, https://savaglobal.com/is-nitrosamine-impurities-posing-the-regulatory-threat/

- A collaborative study of the impact of N-nitrosamines presence and …, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10229727/

- Nitrosamine Contamination Claims Continue to Mount for Big Pharma, accessed July 28, 2025, https://www.drugdangers.com/news/nitrosamine-contamination-claims-continue-to-mount-for-big-pharma/

- Recalls, research for generic drug safety | I.M. Matters from ACP, accessed July 28, 2025, https://immattersacp.org/archives/2020/01/recalls-research-for-generic-drug-safety.htm

- Control of Nitrosamine Impurities in Human Drugs – FDA, accessed July 28, 2025, https://www.fda.gov/media/141720/download

- FDA’s Efforts to Achieve Global Regulatory Harmonization of …, accessed July 28, 2025, https://www.fda.gov/international-programs/global-perspective/fdas-efforts-achieve-global-regulatory-harmonization-generic-drug-programs

- Global Generic Drug Affairs | FDA, accessed July 28, 2025, https://www.fda.gov/drugs/generic-drugs/global-generic-drug-affairs

- Global Harmonization of Biosimilar Development by Overcoming …, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11880096/

- Overcoming Formulation Challenges in Generic Drug Development …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/overcoming-formulation-challenges-in-generic-drug-development/

- FDA Critical Path Initiatives: Opportunities for Generic Drug …, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC2751455/

- Patents and Exclusivities for Generic Drug Products – FDA, accessed July 28, 2025, https://www.fda.gov/drugs/cder-conversations/patents-and-exclusivities-generic-drug-products

- What Every Pharma Executive Needs to Know About Paragraph IV …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- www.drugpatentwatch.com, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/#:~:text=One%20study%20cited%20in%20the,the%20specific%20legal%20arguments%20advanced.