Introduction: Beyond the Crystal Ball – Forging Competitive Advantage in Pharma

In the high-stakes world of pharmaceutical innovation, the chasm between a groundbreaking scientific discovery and a commercially successful therapy is vast and treacherous. It’s an arena where the investment of billions of dollars and more than a decade of relentless effort can evaporate with a single unfavorable clinical trial result or a misread of the market. In this environment, the ability to predict a drug’s market potential is not merely a financial forecasting exercise; it is the single most critical strategic capability an organization can possess. It is the art and science of foresight, a discipline that separates market leaders from the forgotten footnotes of industry history.

The core thesis of this report is simple yet profound: accurate market prediction is the foundational pillar upon which all other strategic decisions rest. It dictates which molecules are advanced from the lab, how clinical trials are designed, where commercial resources are allocated, and how a company navigates the inevitable loss of patent exclusivity. Getting it right can lead to a blockbuster drug that transforms patient lives and generates tens of billions in revenue. Getting it wrong can lead to commercial failures of catastrophic proportions, erasing shareholder value and squandering precious R&D resources.

The scale of this challenge is immense. The global pharmaceutical market is on a trajectory to surpass $1.7 trillion by 2030, a figure that speaks to the incredible demand for innovative medicines. Yet, this opportunity is counterbalanced by staggering risk. The journey to bring a single new medicine to market takes, on average, 10 to 15 years and costs an estimated $2.6 billion, a figure that accounts for the many failures along the way.2 Indeed, the attrition rate is brutal: only about 12% of drugs that enter Phase I clinical trials will ever receive FDA approval.2 How, then, can leaders make confident investment decisions in the face of such overwhelming uncertainty?

The answer lies in a disciplined, multi-faceted, and data-driven approach to forecasting. This report is designed to be your comprehensive guide to building that capability. We will begin by deconstructing the fundamental components of the market potential equation, starting with a clear-eyed look at the costs and risks of the R&D gauntlet itself. We will then explore the three pillars of market assessment: identifying the unmet medical need, quantifying the target patient population, and analyzing the competitive arena.

From there, we will delve into the forecaster’s toolkit, examining both the indispensable qualitative insights gathered from experts and the sophisticated quantitative models that form the financial backbone of any prediction. We will demystify advanced techniques like risk-adjusted Net Present Value (rNPV) and Monte Carlo simulations, transforming them from abstract financial concepts into practical strategic instruments.

Next, we will explore the strategic edge that comes from leveraging modern data and technology. We will reframe the role of patents from a mere legal shield to a powerful predictive tool, showing how platforms like DrugPatentWatch can unlock critical competitive intelligence. We will also dive into the AI revolution, exploring how machine learning is augmenting every facet of prediction, from accelerating drug discovery to mining real-world evidence for deeper market insights. Finally, we will ground these principles and methodologies in the real world, learning from the titans and the fallen through detailed case studies of both blockbuster successes and cautionary commercial failures.

This is not a journey in search of a crystal ball. It is a strategic deep dive into building a robust, repeatable, and defensible forecasting capability—a system of integrated intelligence that transforms uncertainty into a competitive advantage and empowers you to make the bold, informed decisions that will define the future of your organization.

Part I: Deconstructing the Market Potential Equation

Before we can build a forecast, we must first understand its constituent parts. Predicting a drug’s market potential is akin to solving a complex, multi-variable equation. The variables are not static; they are dynamic, interdependent, and fraught with uncertainty. This first part of our report will systematically deconstruct this equation, establishing the foundational components that must be analyzed to build any credible market forecast. We begin with the cost of entry—the immense investment and risk inherent in the innovation process itself—before turning our gaze outward to the market opportunity, defined by the unmet need, the patient population, and the competitive landscape.

Section 1: The R&D Gauntlet – Understanding the Cost and Risk of Innovation

To predict future revenue, one must first grasp the scale of the initial investment. The pharmaceutical R&D process is not a linear path but a brutal gauntlet of scientific, regulatory, and financial hurdles. Every potential drug candidate that enters this process faces a long, expensive, and overwhelmingly uncertain journey. Understanding the economics of this gauntlet is the first and most critical step in appreciating the financial realities that shape the entire industry and drive every subsequent strategic decision.

Timelines and Costs: The Billion-Dollar, Decade-Long Marathon

The development of a new medicine is a marathon, not a sprint. From the moment a promising molecule is identified in the lab to the day it receives regulatory approval, an average of 10 to 15 years will have passed.2 This extensive timeline is a product of the rigorous, multi-stage process required to ensure a drug is both safe and effective. A 2011-2020 analysis by the Biotechnology Innovation Organization (BIO) found the average time from the start of Phase I trials to approval was 10.5 years, broken down into approximately 2.3 years for Phase I, 3.6 years for Phase II, 3.3 for Phase III, and another 1.3 years for the regulatory review itself.

This decade-plus journey is not only long but also extraordinarily expensive. Estimates for the average cost to develop a new drug vary widely, but they all point to a massive capital investment. The most frequently cited figure, from PhRMA and the Tufts Center for the Study of Drug Development, is a staggering $2.6 billion.2 Other estimates range from under $1 billion to more than $2 billion. A 2020 study in JAMA, which relied on publicly available data from smaller firms, put the median capitalized cost at $985 million.

Why the wide disparity? The key lies in how costs are calculated. The higher-end figures, like the $2.6 billion estimate, crucially include not just the out-of-pocket expenses for a single successful drug but also the capitalized costs of the numerous other candidates that fail during development.2 This concept is fundamental to the industry’s economic model. The cost of a single approved drug is not just its own development expense; it is the cost of the entire R&D program from which it emerged, including all the dead ends and failed experiments. The pharmaceutical industry is one of the most R&D-intensive sectors in the U.S. economy, investing on average six times more in R&D as a percentage of sales than all other manufacturing industries. In 2019 alone, the industry spent $83 billion on R&D, an amount roughly 10 times what it spent annually in the 1980s, adjusted for inflation. This immense investment is the ante required to even play the game.

The Brutal Reality of Attrition: Why Most Drugs Fail

The primary reason R&D is so expensive is the astonishingly high rate of failure. A drug candidate’s journey through clinical trials is a process of elimination where the odds of success are slim. Only a small fraction of molecules that show promise in the lab will ever reach a patient.

The overall likelihood of approval (LOA) for a drug entering Phase I clinical trials is distressingly low. Studies consistently place this figure between 7.9% and 12%.2 This means that for every 10 to 12 drugs that begin human testing, only one will ultimately be approved. The failure rate is not evenly distributed across the development process; each phase presents its own unique challenges and attrition points.

- Phase I (Safety): This initial phase, focused on assessing a drug’s safety and dosage in a small group of healthy volunteers, is the first major hurdle. Data from 2011-2020 shows a transition success rate of about 52% from Phase I to Phase II. The FDA reports a slightly higher success rate of approximately 70%.

- Phase II (Efficacy and Side Effects): This is often considered the largest hurdle in drug development.6 It is typically the first time the drug is tested in patients with the target disease to get an early read on its efficacy (proof-of-concept). The decision to proceed to large, expensive Phase III trials hangs in the balance. The success rate here is the lowest of all phases, with only about 28-33% of drugs successfully transitioning to Phase III.6

- Phase III (Large-Scale Efficacy and Safety): These are the large, pivotal trials involving hundreds or thousands of patients, designed to confirm efficacy, monitor side effects, and compare the drug to commonly used treatments. While extremely expensive, the success rate is higher than in Phase II, with about 58% of drugs moving on to the regulatory submission phase. The FDA suggests a lower transition rate of 25-30%.

- NDA/BLA Submission (Regulatory Review): Once a drug has successfully completed Phase III, the company submits a New Drug Application (NDA) or Biologic License Application (BLA) to the regulatory authorities. At this stage, the probability of success is very high, with over 90% of submissions ultimately receiving approval.

These attrition rates vary significantly by therapeutic area, reflecting the underlying biological complexity and scientific challenges of different diseases. For instance, the overall LOA from Phase I is highest in hematology (23.9%) and lowest in urology (3.6%) and respiratory diseases (4.5%). Oncology, a major focus of R&D investment, has a particularly low LOA of just 5.3%.6

The table below synthesizes data from multiple sources to provide a clear, consolidated view of this R&D gauntlet, offering a practical reference for the probabilities that underpin all risk-adjusted forecasting.

| Phase | Average Duration (Years) | Transition Success Rate (%) – All Diseases | Cumulative LOA from Phase I (%) – All Diseases | Cumulative LOA from Phase I (%) – Hematology | Cumulative LOA from Phase I (%) – Oncology |

| Phase I | 2.3 | 52.0% | 100.0% | 100.0% | 100.0% |

| Phase II | 3.6 | 28.9% | 52.0% | 68.3% | 62.4% |

| Phase III | 3.3 | 57.8% | 15.0% | 40.5% | 16.5% |

| NDA/BLA | 1.3 | 90.6% | 8.7% | 26.3% | 9.6% |

| Approved | – | – | 7.9% | 23.9% | 5.3% |

Data synthesized from multiple sources, primarily based on BIO 2011-2020 analysis.3 Durations are averages and can vary significantly.

This unforgiving landscape of high costs and high failure rates is not merely a set of background statistics; it is the central economic engine that drives the pharmaceutical industry’s business model. The necessity of having one successful drug pay for the nine or ten failures that preceded it directly explains the high launch prices of novel medicines. It is not an arbitrary decision but a structural requirement to sustain the R&D engine that produces future innovations. This economic imperative also fuels the intense focus on maximizing the commercial life and revenue of a successful drug through sophisticated patent strategies and lifecycle management, topics we will explore in depth later in this report. A failure to appreciate this fundamental link between R&D risk and commercial strategy leads to a profound misunderstanding of how and why the pharmaceutical market operates as it does.

Section 2: Defining the Opportunity – The Three Pillars of Market Assessment

Once we have a firm grasp of the internal costs and risks of development, the focus must shift outward to the market itself. What is the size of the prize we are chasing? A comprehensive market assessment rests on three critical, interconnected pillars: the unmet medical need, the target patient population, and the competitive arena. A weakness in any one of these pillars can undermine the entire commercial foundation of a new drug. Success requires a deep, nuanced, and data-driven understanding of all three, as it is their interplay that defines the true market potential.

Pillar 1: Unmet Medical Need (UMN) – The “Why”

At its core, the pharmaceutical industry exists to address unmet medical needs (UMN). This concept is the fundamental justification for innovation and the primary driver of value. A drug that does not address a significant UMN has no reason to exist in the market. While the FDA provides a concise definition—”a condition whose treatment or diagnosis is not addressed adequately by available therapy”—the practical assessment of UMN is far more complex and must incorporate a multi-stakeholder perspective.9

The assessment begins with three core criteria, which are already embedded in regulatory frameworks like the EU’s Orphan Regulation :

- Disease Severity/Burden: This evaluates the seriousness of the condition. Is it life-threatening? Is it chronically debilitating? What is the impact on a patient’s quality of life, daily functioning, and the lives of their families and caregivers?.9

- Availability of Alternative Treatments: This is the most universally cited criterion. A clear UMN exists where there are no approved treatments at all. However, the more common and challenging scenario is determining the degree of unmet need when existing therapies are available but considered unsatisfactory. This could be due to limited efficacy in certain patient subpopulations, significant side effects, a burdensome treatment regimen, or poor safety profiles.9

- Size of the Patient Population: While often considered as a separate pillar, the size of the affected population is also an intrinsic part of the UMN discussion, particularly in the context of rare and orphan diseases where small populations are, by definition, underserved.11

Crucially, UMN is not a static concept but a “moving target”. When a new, superior therapy becomes the standard of care, it effectively raises the bar. The previous standard of care may no longer be considered “satisfactory,” and a new, more nuanced unmet need emerges for patients who do not respond to or cannot tolerate the new therapy. Therefore, a forward-looking forecast must not only assess the UMN of today but also anticipate how the competitive landscape will redefine the UMN of tomorrow. A shared understanding of UMN among all stakeholders—regulators, payers, clinicians, and patients—is critical, as it directly influences a drug’s eligibility for expedited regulatory pathways, its perceived value in reimbursement negotiations, and its ultimate adoption in clinical practice.

Pillar 2: Target Patient Population – The “Who” and “How Many”

With a clear unmet need established, the next critical step is to precisely define and quantify the target patient population. This process is a funnel, starting with broad epidemiological data and progressively narrowing down to the specific segment of patients who are eligible for and most likely to receive the new therapy.

The process typically follows this framework :

- Establish Broad Prevalence/Incidence: The starting point is robust epidemiological data from reputable sources (e.g., CDC, WHO) to estimate the total number of people with a given disease (prevalence) or the number of new cases per year (incidence). The growing consumption of pharmaceuticals is partly driven by the needs of aging populations and the rising prevalence of chronic diseases.

- Segment by Diagnosis and Severity: Not all patients with a disease are candidates for a specific therapy. The population must be segmented by factors such as stage of disease, severity, and specific diagnostic criteria.

- Incorporate Lines of Therapy: In many chronic diseases, particularly oncology, treatments are administered in sequential lines. A new drug may be indicated only for “second-line” therapy after a patient has failed the “first-line” standard of care. This dramatically refines the addressable market at launch.

- Apply Biomarker and Comorbidity Criteria: With the rise of personalized medicine, many drugs are effective only in patients with a specific genetic marker or biomarker. The population must be filtered by the prevalence of this marker. Similarly, comorbidities (other co-existing diseases) can be critical inclusion or exclusion criteria.

- Leverage Real-World Data (RWD): This is where modern forecasting gains its precision. While high-level prevalence data is useful, it often doesn’t account for the granular details of comorbidities or current treatment patterns. RWD sources like employer-based claims databases (e.g., MarketScan) and electronic health records (EHRs) allow analysts to identify and quantify these highly specific patient profiles. For example, an analysis can identify patients with atherosclerotic cardiovascular disease (ASCVD) and diabetes, filter them by their current statin use, and then further segment them by their LDL-cholesterol levels to pinpoint the exact population for a new lipid-lowering therapy.

- Correct for Inherent Biases: RWD is powerful but imperfect. A claims database, for example, is inherently biased towards the insured, non-retiree population. To generate a robust national estimate, analysts must use statistical methods to correct for these biases, often by extrapolating the data and aligning it with published national estimates for key characteristics.

This rigorous, data-driven segmentation is crucial not only for forecasting but for the entire commercialization process. A strong understanding of the patient population informs everything from clinical trial design and physician targeting to discussions with payers about the potential budget impact of a new treatment.

Pillar 3: The Competitive Arena – The “Who Else”

No drug launches into a vacuum. The competitive landscape defines the environment in which a new product must survive and thrive. Pharmaceutical competitive intelligence (CI) is a systematic and multidimensional assessment that goes far beyond simply looking at rival products on the market. It is a forward-looking discipline that seeks to anticipate competitors’ future moves and strategies.

A comprehensive CI program involves several key components :

- Current Portfolio Assessment: The analysis begins with the present: evaluating competitors’ existing products, their market share, sales trajectories, pricing strategies, and marketing messages.17 This provides a baseline understanding of their strategic priorities and commercial strengths.

- Pipeline Analysis: This is the most critical forward-looking component. It involves systematically tracking competitors’ drugs in development across all clinical phases. Sophisticated analysis goes further, projecting approval timelines, modeling success probabilities, and identifying areas where multiple competitors are converging on the same mechanism of action or patient population. This can reveal areas of future intense competition, which may diminish the potential return on investment.

- Regulatory Strategy Evaluation: Monitoring how rivals navigate the complex regulatory pathways of the FDA and EMA provides invaluable intelligence. Are they securing expedited programs like Breakthrough Therapy Designation? How are they negotiating their label indications? Understanding their regulatory successes and failures can inform your own strategy and provide early warnings of potential shifts in the market.

- Intellectual Property (IP) and Patent Strategy: A competitor’s patent filings are a direct signal of their R&D direction and long-term commercial intentions. Analyzing their patent estate reveals their lifecycle management plans and defensive strategies against generic entry.17

- Commercial Capabilities Analysis: This involves assessing the “soft power” of competitors: the size and structure of their sales force, their relationships with key opinion leaders, their digital marketing capabilities, and their market access and pricing strategies.17

It is the dynamic interplay of these three pillars—unmet need, patient population, and competitive landscape—that ultimately defines a drug’s true market potential. A massive patient population is commercially irrelevant if the unmet need is low and the market is saturated with cheap, effective generics. Conversely, addressing a high unmet need in a small orphan disease population can be immensely profitable if there is no competition. The most successful forecasts, and by extension the most successful commercial strategies, are born from identifying opportunities where these three elements converge favorably: a significant and well-defined unmet need, a quantifiable patient population that can be reached, and a competitive landscape that either offers a clear opening or can be reshaped by a truly differentiated product.

Part II: The Forecaster’s Toolkit – Methodologies and Models

Having deconstructed the core components of market potential, we now turn to the practical tools and methodologies used to assemble them into a coherent forecast. The modern forecaster’s toolkit is diverse, ranging from qualitative methods that capture the indispensable human element of the market to sophisticated quantitative models that provide a rigorous financial valuation. The most robust and reliable predictions are not the product of a single method but rather an integrated approach that leverages the strengths of both. This section will explore these tools, starting with the foundational qualitative insights and building toward the industry’s gold standard for financial valuation.

Section 3: The Two Lenses of Forecasting: Qualitative vs. Quantitative Approaches

Forecasting is a blend of art and science, requiring both quantitative data analysis and qualitative market understanding. These two approaches are not mutually exclusive; they are complementary lenses that, when used together, provide a richer, more dimensional view of the future.

Qualitative Forecasting: The Human Element

Qualitative forecasting relies on expert opinion, market research, and subjective insights rather than historical numerical data.21 This approach is indispensable in situations where historical data is limited or non-existent, most notably when forecasting the potential of a first-in-class drug or a novel technology entering a new market.21 In these scenarios, the “gut feel” of seasoned experts, when systematically collected and analyzed, can be more valuable than any statistical model.

The primary techniques for qualitative forecasting include:

- The Delphi Method: This structured communication technique involves a panel of experts who answer questionnaires in two or more rounds. After each round, a facilitator provides an anonymized summary of the experts’ forecasts from the previous round as well as the reasons they provided for their judgments. Thus, experts are encouraged to revise their earlier answers in light of the replies of other members of their panel. This iterative process is designed to converge toward a consensus forecast.

- Market Research: Direct engagement with key market stakeholders through surveys, focus groups, and in-depth interviews is a cornerstone of qualitative forecasting. This is where physician-reported adoption rates for a new product profile are gathered, providing a crucial early indicator of potential uptake.

- The Role of Key Opinion Leaders (KOLs): KOLs are respected and influential physicians, researchers, and clinicians whose opinions shape the prescribing behavior of their peers.26 Engaging KOLs early and throughout the development process provides invaluable qualitative data. They help validate the initial scientific concept based on their understanding of unmet needs, provide critical input on clinical trial design, and, post-launch, their endorsement can significantly accelerate market adoption. Their insights into current treatment paradigms, frustrations with existing therapies, and expectations for new ones are essential inputs for forecasting market acceptance and penetration rates. Pharmaceutical companies rely heavily on KOLs to create awareness and lend credibility to their products.

- The Role of Advisory Boards: Pharmaceutical and payer advisory boards are formal, structured forums where companies can pressure-test their strategies with a panel of external experts.29 A clinical advisory board, composed of KOLs, can provide critical feedback on a drug’s clinical development plan and its perceived differentiation. A payer advisory board, composed of representatives from insurance companies and pharmacy benefit managers, offers direct, unfiltered insights into a drug’s potential market access hurdles. They can assess the value proposition, identify data gaps in the clinical evidence, and provide an early read on their willingness to reimburse the product at a given price point, which is a critical variable for any revenue forecast.30

Quantitative Forecasting: The Data-Driven Foundation

Quantitative forecasting uses historical data and statistical models to predict future demand. This approach is most effective for products with established sales histories or in markets with stable, predictable patterns. While less useful for truly novel drugs, it is the bedrock of forecasting for in-market products and for modeling the overall growth of a therapeutic area.

Common quantitative methodologies include:

- Time Series Analysis: These models use historical sales data to identify patterns like trends, seasonality, and cycles to project into the future.

- Moving Average and Exponential Smoothing: Simple methods used for short-term forecasts that smooth out random fluctuations in historical data.

- ARIMA (Auto-Regressive Integrated Moving Average): A more sophisticated model commonly used to forecast drug demand, especially when there are seasonal variations in sales patterns.

- Causal Models: These models go beyond historical data to identify the underlying factors (or “causes”) that drive demand.

- Regression Analysis: This statistical technique identifies the relationship between a dependent variable (e.g., drug sales) and one or more independent variables (e.g., marketing spend, patient demographics, competitor pricing).

- Econometric Models: These are complex models used for long-term forecasting that incorporate macroeconomic factors (e.g., healthcare spending, GDP growth) that impact the broader pharmaceutical market.

In practice, the most powerful forecasts do not choose one approach over the other. They begin with a quantitative, patient-based model built on epidemiological data and then use qualitative insights from KOLs and payers to refine key assumptions, such as the rate of adoption, peak market share, and price realization. This integrated approach grounds the forecast in hard data while accounting for the nuanced human factors that ultimately drive market behavior.

Section 4: The Gold Standard – Financial Valuation with Risk-Adjusted NPV (rNPV)

While qualitative insights and statistical models provide critical pieces of the puzzle, the ultimate goal for any commercial organization is to translate market potential into a concrete financial valuation. In the pharmaceutical and biotech sectors, the industry gold standard for valuing a pre-revenue, clinical-stage asset is the risk-adjusted Net Present Value (rNPV) method.33

Traditional valuation methods like a standard Discounted Cash Flow (DCF) analysis are ill-suited for drug development because they assume future cash flows are certain. This is a fundamentally flawed assumption in an industry where, as we’ve established, the vast majority of projects fail. The rNPV model is a tailored approach that directly confronts this uncertainty by integrating the probability of success into the valuation framework.

Mechanics of the rNPV Model: A Step-by-Step Guide

Building an rNPV model is a systematic process that combines market forecasting, financial projection, and risk assessment. Here is a breakdown of the core steps:

- Forecast Future Cash Flows: The first step is to build a standard financial projection for the drug, assuming it successfully reaches the market. This involves:

- Estimating Peak Sales: Based on the target patient population, anticipated market penetration, pricing per patient, and duration of treatment.

- Projecting the Revenue Curve: Modeling the sales ramp-up from launch to peak sales, and the subsequent decline following patent expiration.

- Projecting Costs: Forecasting all associated costs over the product’s lifecycle, including remaining R&D expenses for clinical trials, Cost of Goods Sold (COGS), Selling, General & Administrative (SG&A) expenses, and any potential royalties.

- Calculating Net Cash Flow: For each year of the projection, subtract total costs from total revenues to arrive at the net cash flow.

- Apply Probabilities of Success (POS): This is the crucial step that differentiates rNPV from a standard DCF. The projected net cash flows for each year are “de-risked” by multiplying them by the cumulative probability that the drug will successfully navigate the remaining development and regulatory hurdles to reach that point in its lifecycle.

- The formula is:

rNPV=∑(1+r)t(Expected Cash Flowt×Probability of Successt) - The Probability of Success is a cumulative figure calculated by multiplying the success rates of each remaining development stage. For example, for a drug currently in Phase II, the POS for its first year on the market would be: P(Phase II Success)×P(Phase III Success)×P(Approval Success). This is where the attrition rate data from Part I becomes a direct and critical input into the financial model.

- Discount to Present Value: Future cash flows are worth less than present cash flows due to the time value of money and investment risk. Therefore, each year’s risk-adjusted cash flow is discounted back to its present value using a discount rate (r). In the biotech industry, this rate is typically high, often between 10% and 15%, to reflect the high-risk nature of the sector.

- Sum the Values: The final rNPV of the asset is the sum of all the discounted, risk-adjusted cash flows over the entire projection period. This single number represents the theoretical current value of the drug candidate, accounting for its market potential, development costs, timeline, and, most importantly, its probability of ever reaching the market.

The rNPV method is the predominant valuation technique used in nearly all licensing, partnership, and M&A negotiations within the industry.33 It provides a transparent, data-driven framework that reflects the real risk profile of drug development, offering a far more realistic and conservative picture of value than a traditional DCF would. It is the essential language of biopharma valuation.

Section 5: Embracing Uncertainty – The Power of Monte Carlo Simulations

The rNPV model is a powerful tool, but it has one significant limitation: it produces a single, static point estimate of value. This can create a “misplaced concreteness,” a tendency to overlook the vast uncertainties and margins of error inherent in the inputs. After all, who truly believes that peak market share will be exactly 35.0%, or that the Phase III trial will cost exactly $300 million?

This is where Monte Carlo simulation analysis provides a powerful enhancement. It is a forecasting technique that moves beyond a single-point forecast to provide a range of possible outcomes and the probability of achieving them. It is a method for explicitly modeling and quantifying uncertainty.

How Monte Carlo Simulation Works

Instead of using single-point estimates for the key variables in an rNPV model, a Monte Carlo simulation uses probability distributions. For each uncertain input, the forecaster defines a range of possible values and the shape of the distribution (e.g., normal, uniform, triangular).

For example:

- Instead of Peak Market Share = 35%, we might define it as a normal distribution with a mean of 35% and a standard deviation of 5%, indicating it’s most likely to be near 35% but could reasonably fall between 30% and 40%.

- Instead of Phase III Cost = $300M, we might use a uniform distribution between $250M and $400M, indicating that any value in this range is equally likely, reflecting higher uncertainty.

The simulation then runs the rNPV calculation thousands, or even tens of thousands, of times. In each iteration, it randomly samples a value for each input variable from its defined probability distribution. The result is not a single rNPV, but a probability distribution of thousands of possible rNPV outcomes.

The Strategic Value: From a Number to a Narrative of Risk

The output of a Monte Carlo simulation is profoundly more insightful than a single rNPV figure. It transforms the forecast from a simple number into a rich narrative about the project’s risk profile. The result might sound something like this: “The mean rNPV for this asset is $484 million. There is a 90% probability that the rNPV will be between $357 million and $627 million. Furthermore, there is an 80% probability that the project will have a positive NPV, and a 15% probability that it will exceed $600 million”.36

This probabilistic output enables far more sophisticated strategic decision-making. It allows leadership to establish “action standards” based on their appetite for risk. A risk-averse organization might only greenlight projects that have a 95% probability of achieving a positive NPV. A more aggressive, venture-backed biotech might proceed if there is a 50% chance of making a certain high-value threshold.

By analyzing the distribution of outcomes, companies can also perform sensitivity analysis to identify which variables have the greatest impact on the final valuation. Is the forecast most sensitive to price, market share, or the probability of Phase II success? This insight allows management to focus resources on mitigating the most critical risks and gathering more data on the most impactful assumptions.

The following table provides a clear comparison of these two indispensable, complementary forecasting models.

| Feature | Risk-Adjusted NPV (rNPV) | Monte Carlo Simulation |

| Core Principle | Adjusts future cash flows by the probability of success at each development stage. | Runs thousands of simulations using probability distributions for key inputs to model uncertainty. |

| Key Inputs | Point estimates for revenues, costs, timelines, discount rate, and probabilities of success. | Probability distributions (e.g., normal, uniform) for key uncertain variables (market share, price, costs, etc.). |

| Output | A single, risk-adjusted point estimate of the asset’s present value. | A probability distribution of potential outcomes (e.g., a range of possible rNPV values and their likelihoods). |

| Best For | Establishing a baseline financial valuation for an asset; standard for deal-making and licensing negotiations. | Assessing the risk profile of a project; understanding the range of possible outcomes; setting go/no-go criteria based on risk tolerance. |

| Key Limitation | Can create a false sense of precision (“misplaced concreteness”) by relying on single-point estimates for uncertain variables. | Requires informed opinions about the likelihood and range of variables; can be computationally demanding. |

Ultimately, rNPV and Monte Carlo simulations are not competing methodologies but partners in a sophisticated forecasting process. rNPV provides the essential, risk-adjusted answer to the question, “What is this asset worth?” Monte Carlo simulation provides the crucial, strategic answer to the question, “How confident are we in that valuation, and what are the key risks we need to manage?” Together, they form the quantitative core of modern pharmaceutical market potential prediction.

Part III: The Strategic Edge – Leveraging Data and Technology

A forecast is only as good as the data and assumptions that feed it. While the models discussed in the previous section provide a robust framework for valuation, the true competitive advantage lies in the ability to generate superior inputs for those models. This requires a mastery of specific, high-value data sources and the application of advanced technologies to extract predictive insights. This part of the report explores how to build that strategic edge. We will delve into the patent playbook, reframing intellectual property as a powerful predictive tool. We will then examine the AI revolution, detailing how machine learning is augmenting every step of the forecasting process. Finally, we will look to the horizon, analyzing the future market dynamics that must be integrated into any long-term strategic forecast.

Section 6: The Patent Playbook – From Legal Shield to Predictive Tool

In the pharmaceutical industry, patents are the bedrock of the business model. They provide the temporary monopoly necessary to recoup the enormous costs of R&D.39 However, to view patents merely as a legal shield is to miss their immense strategic value as a source of competitive and predictive intelligence. A company’s patenting strategy is a public declaration of its R&D priorities, its commercial ambitions, and its defensive game plan. Learning to read these signals is a critical forecasting skill.

Patent Landscape Analysis (PLA): Mapping the Innovation Battlefield

A Patent Landscape Analysis (PLA) is a comprehensive study of patenting activity within a specific technology or therapeutic area.41 It involves searching and analyzing patent databases to identify key players, emerging trends, and areas of innovation.42 While a PLA is retrospective by nature—analyzing patents that have already been filed—it provides powerful forward-looking indicators. Because patents are typically filed long before a product reaches the market, a surge in patenting activity in a particular area can be an early signal of upcoming technological shifts and future market competition.

A well-executed PLA can help an organization:

- Identify “White Space”: Pinpoint areas within a therapeutic field with little patenting activity, representing potential opportunities for innovation with less competition.

- Monitor Competitor Strategy: Track the patent filings of key rivals to understand their R&D direction, identify “stealth” programs, and anticipate their future product launches.

- Mitigate Infringement Risk: A thorough Freedom to Operate (FTO) analysis, a key component of PLA, ensures that a company’s own development program does not infringe on existing patents, avoiding costly legal battles down the road.

- Find Partners and Licensing Opportunities: Identify smaller biotechs or academic institutions with valuable IP that could be in-licensed or acquired to bolster the company’s pipeline.

Predicting the “Patent Cliff”: The Cornerstone of Revenue Forecasting

Perhaps the most direct application of patent data in forecasting is predicting the “patent cliff.” This term describes the sudden and catastrophic decline in revenue a company experiences when a blockbuster drug loses its market exclusivity and is flooded with low-cost generic or biosimilar competition.45 The financial impact is staggering, with revenues for the branded drug often plummeting by 80-90% within the first year of generic entry.

The impact on pricing is equally dramatic. Studies have shown that drug prices can decline by 30% to 80% following patent expiration.45 In the U.S., the entry of just one generic competitor can drop the wholesale price by an average of 39%; with four competitors, the price can fall by 79%. The industry is facing a monumental patent cliff, with drugs representing nearly $400 billion in revenue set to lose patent protection between 2025 and 2030. Accurately forecasting the timing of these expirations is therefore fundamental to predicting a company’s future revenue streams and identifying the urgency for pipeline replenishment.

The Role of “Patent Thickets”: Extending Commercial Life

Forecasting the patent cliff is not as simple as looking up the expiration date of a single patent. Savvy pharmaceutical companies employ a defensive strategy of building a “patent thicket”—a dense, overlapping web of secondary patents designed to protect a drug long after its core “composition of matter” patent expires.

These secondary patents do not cover the active molecule itself but protect every other conceivable aspect of the product, including:

- Formulation Patents: Protecting specific formulations, such as an extended-release version or a novel delivery system.

- Method-of-Use Patents: Protecting the use of the drug for a new disease or indication.

- Process Patents: Protecting a specific, novel method of manufacturing the drug.

- Polymorph Patents: Protecting specific crystalline structures of the drug molecule.

The strategic value of a patent thicket lies in its cumulative deterrent effect. A generic competitor must navigate a legal minefield, potentially challenging dozens of patents, which dramatically increases the cost, time, and risk of bringing a generic to market. For forecasters, this means that a drug’s effective commercial life may extend years beyond the expiration of its primary patent, a crucial variable that must be factored into any long-term revenue projection.

Leveraging Intelligence Platforms like DrugPatentWatch

Manually tracking and analyzing the vast and complex global patent landscape is a herculean task. This is where specialized business intelligence platforms become indispensable. Services like DrugPatentWatch provide a comprehensive, integrated database of pharmaceutical patents, regulatory exclusivities, clinical trials, and patent litigation.49

Such platforms transform the raw, unstructured data of the patent world into actionable intelligence by enabling users to 49:

- Automate Monitoring: Set up alerts to track patent expirations, new patent filings by competitors, and the initiation of patent challenges (e.g., Paragraph IV litigation).

- Forecast Generic Entry: Predict when generic competitors are likely to enter the market based on a holistic view of all patents and regulatory exclusivities.

- Inform Portfolio Management: Identify market entry opportunities in areas with less patent congestion and inform due diligence for licensing or M&A.

- Conduct Competitive Intelligence: Assess the strength of competitor patent portfolios and elucidate their research and lifecycle management strategies.

By using a platform like DrugPatentWatch, a company can gain early insights into a competitor’s strategic intentions. The aggressiveness and breadth of a company’s patenting strategy—the number of secondary patents filed, the number of countries covered—is a strong proxy for their commercial confidence in an asset. A company will not incur the significant expense of building a global patent fortress around a drug it does not believe has blockbuster potential. Monitoring this activity provides a powerful qualitative signal about a competitor’s internal forecast long before they release any public commercial guidance.

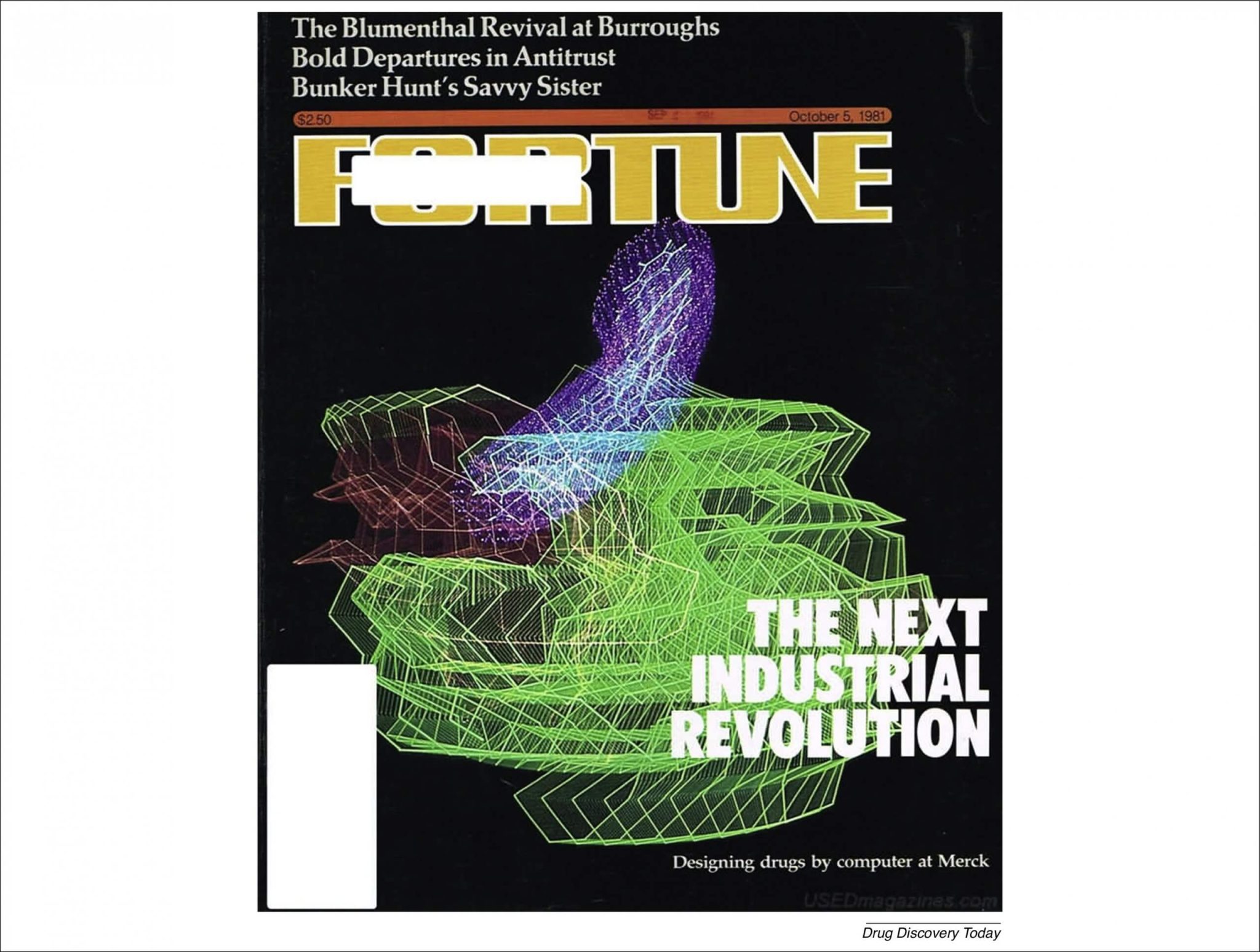

Section 7: The AI Revolution – Augmenting Prediction with Machine Learning

If patent analysis provides a strategic lens into the market, Artificial Intelligence (AI) and Machine Learning (ML) provide the computational horsepower to analyze data at a scale and speed previously unimaginable. AI is no longer a futuristic buzzword; it is a transformative force being actively deployed across the entire pharmaceutical value chain, fundamentally enhancing the accuracy, speed, and granularity of market potential prediction.52 The global market for AI in drug discovery alone is projected to grow from $6.31 billion in 2024 to $16.52 billion by 2034.

AI in R&D and Clinical Trials: Refining the Inputs

The most direct impact of AI on forecasting is its ability to improve the core inputs of our valuation models. By making the R&D process more efficient and predictable, AI can fundamentally alter the risk-reward calculation.

- Accelerating Drug Discovery: AI algorithms can analyze vast biological datasets (genomics, proteomics) to identify novel drug targets and design new molecules in silico.55 Companies like Insilico Medicine have used AI to move from target identification to clinical trials in a fraction of the traditional time. This acceleration shortens the “time to cash flow” in an rNPV model, increasing the asset’s present value.

- Predicting Success and Failure: ML models can predict a compound’s pharmacokinetic and toxicity profiles early in development, helping to weed out likely failures before they incur costly clinical trial expenses.55 This has the potential to improve the probability of success (POS) rates, which are the most sensitive variables in an rNPV calculation. AI-discovered molecules are already showing an 80-90% success rate in Phase I, a significant improvement over historical averages.

- Optimizing Clinical Trials: AI is revolutionizing clinical trials by streamlining protocol design, accelerating patient recruitment through analysis of electronic health records (EHRs), and enabling adaptive trial designs that can be modified in real-time.54 This reduces trial costs and timelines, further improving the financial profile of a developing asset.

AI in Forecasting and Commercial Operations: Sharpening the Outputs

Beyond improving R&D inputs, AI is also being directly applied to the forecasting process itself, yielding more accurate and dynamic predictions.

- Advanced Sales Forecasting: Machine learning models are proving to be superior to traditional statistical methods for sales forecasting. Models like Long Short-Term Memory (LSTM) networks and XGBoost can analyze vast, complex datasets and identify non-linear patterns that older models miss.1 Studies have shown that ML models can achieve significantly lower error rates in predicting weekly or long-term pharmaceutical sales.1 One study found that analyzing patent specifications with machine learning improved sales forecasts by 32% compared to traditional brand-based predictions.

- Mining Real-World Data (RWD) for Deeper Insights: One of the greatest challenges in market assessment is understanding the messy reality of clinical practice. AI is a game-changer here. By leveraging RWD, which includes data from sources outside of conventional clinical trials like EHRs and insurance claims, companies can generate powerful Real-World Evidence (RWE). AI and ML are essential for analyzing this data, especially the vast amounts of unstructured text found in physicians’ clinical notes. An AI model can, for example, analyze millions of clinical notes to estimate disease activity scores for conditions like lupus, providing a far richer understanding of the patient journey and unmet needs than was previously possible. This allows for more accurate market sizing and a more nuanced understanding of where a new drug might fit into the treatment paradigm.

- Natural Language Processing (NLP) for Competitive Intelligence: A significant portion of competitive intelligence is buried in unstructured text: scientific literature, patent filings, press releases, and conference abstracts. Natural Language Processing (NLP), a branch of AI, can “read” and understand this text at massive scale. NLP-powered tools can be used to automatically extract key information, such as a competitor’s clinical trial endpoints, their stated R&D focus, or sentiment around a new product launch.67 This automates and supercharges the CI process, providing real-time insights that can be fed directly into strategic and forecasting models.

The integration of AI is creating a virtuous cycle: AI-driven R&D produces better drug candidates with a higher probability of success, and AI-powered forecasting models provide a more accurate assessment of their market potential, leading to better capital allocation and a more efficient and productive pharmaceutical ecosystem.

Section 8: The Shifting Landscape – Integrating Future Market Dynamics

A forecast is a snapshot in time, built upon a set of assumptions about how the market will behave in the future. However, the pharmaceutical landscape is in a state of constant, and often radical, evolution. A robust, long-term forecast must therefore look beyond the current state and actively model the impact of powerful macro-trends that are reshaping the very foundations of the industry. Failing to account for these shifts is a recipe for strategic obsolescence.

The Rise of Personalized Medicine: From Blockbusters to Niche-busters

The 20th-century pharmaceutical model was built on the “one-size-fits-all” blockbuster drug, designed for large, heterogeneous patient populations. The 21st century is increasingly defined by personalized (or precision) medicine, which tailors treatments to individuals based on their unique genetic, biomarker, or lifestyle characteristics. This paradigm shift has profound implications for market potential forecasting.

- Impact on the Market Model: Personalized medicine fundamentally changes the forecasting equation. Instead of a large patient population (N) and a moderate price, the model shifts to a much smaller, biomarker-defined N and a potentially much higher price per patient. This is justified by the higher efficacy and improved safety profile in the targeted population, creating a compelling value proposition for payers. The global personalized medicine market is growing rapidly, projected to expand from approximately $573 billion in 2024 to over $1.2 trillion by 2034.

- Portfolio Strategy Implications: This shift presents both opportunities and challenges. While smaller market sizes may seem less attractive, they can be de-risked by higher probabilities of clinical success and the potential for expedited regulatory pathways. Research suggests that the optimal portfolio mix for a pharmaceutical company may be around 30% personalized medicine. Firms that venture too far above or below this proportion tend to see lower returns and higher risk. However, companies with strong marketing capabilities—defined as a deep understanding of patient needs and physician relationships—can successfully support a higher mix of personalized therapies while minimizing the commercial risks.

The Dawn of Digital Therapeutics (DTx): A New Therapeutic Modality

A new class of therapy is emerging that exists entirely as software. Digital Therapeutics (DTx) are evidence-based therapeutic interventions delivered through high-quality software programs to prevent, manage, or treat a medical condition. These can be standalone treatments or used in combination with traditional medications to enhance patient outcomes, often by improving treatment adherence or providing cognitive behavioral therapy.73

- Expanding the Definition of “Treatment”: DTx are blurring the lines between technology and medicine. They are being developed and approved for a wide range of chronic conditions, including diabetes, hypertension, and mental health disorders like anxiety and depression. Pfizer, for example, has released a digital application for migraine management.

- Unique Forecasting Challenges: Predicting the market potential for DTx requires a different playbook. Adoption curves are driven not just by clinical efficacy but also by user experience, physician integration into clinical workflows, and data privacy concerns. Most critically, the reimbursement landscape for DTx is still nascent and highly fragmented, making price realization a major uncertainty. While the potential is vast, forecasters must carefully model these unique adoption and market access hurdles.

The Payer and Regulatory Gauntlet: Navigating a More Demanding Environment

The two most powerful gatekeepers to market access—regulators and payers—are becoming increasingly sophisticated and demanding. Their evolving requirements represent major variables that must be factored into any global forecast.

- Evolving Regulatory Hurdles (FDA vs. EMA): While there is a high degree of harmonization, significant differences remain between the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The FDA often has faster review times and is more willing to use expedited pathways like Accelerated Approval based on surrogate endpoints.77 The EMA, conversely, often requires more comprehensive clinical data and larger trials before granting approval. A study of oncology drugs found that median review times at the EMA (426 days) were more than double those at the FDA (200 days). These regional divergences mean that a global launch strategy and its associated revenue forecast must account for different timelines and probabilities of success in each major market.

- The Growing Impact of Value-Based Pricing (VBP): The era of payers simply reimbursing a drug based on the manufacturer’s list price is ending. In an environment of rising healthcare costs, payers are increasingly shifting towards Value-Based Pricing models, where the price of a drug is tied to the clinical benefit and outcomes it delivers to patients.79 This means that simply gaining regulatory approval is no longer enough. To secure favorable market access, companies must generate compelling evidence—often including real-world evidence—that their drug is not only effective but also cost-effective compared to the standard of care. This shift places immense pressure on demonstrating a drug’s value proposition and makes the health economics and outcomes research (HEOR) function a critical component of market potential assessment. A forecast that assumes a high price without a clear strategy to justify that price to payers is a forecast built on a foundation of sand.

Part IV: Learning from the Titans and the Fallen

Theory and methodology provide the framework, but the real-world application is where the most valuable lessons are learned. The history of the pharmaceutical industry is a rich tapestry of monumental successes and spectacular failures. By deconstructing these case studies, we can see the principles of market potential prediction in action. This final part of our report will examine the blueprints of blockbuster success and the cautionary tales of commercial flops, grounding our strategic discussion in the harsh and unforgiving reality of the market.

Section 9: Case Studies in Success – The Blockbuster Blueprint

A “blockbuster” drug, traditionally defined as a product generating over $1 billion in annual sales, is the ultimate prize in the pharmaceutical industry. Achieving this status requires more than just good science; it demands a masterful orchestration of clinical development, regulatory strategy, and commercial execution. The following cases reveal the strategic foresight that turns a promising molecule into a market-defining titan.

Case Study 1: Lipitor (Pfizer) – Dominating a Crowded Market

When Pfizer launched Lipitor (atorvastatin) in 1997, it was the fifth statin to enter the market for high cholesterol, a field already crowded with established competitors from Merck and Bristol-Myers Squibb. Yet, within a few years, Lipitor became the best-selling drug in the world, eventually generating over $164 billion in lifetime sales.82 Its success was a masterclass in commercial strategy.

- Clinical Differentiation and Aggressive Marketing: Lipitor’s core strategy was built on a clear message of superior efficacy. Pfizer armed its massive sales force with clinical data demonstrating that Lipitor lowered “bad” LDL-cholesterol more effectively than its competitors, even at lower doses.83 This clinical advantage was then broadcast directly to the public through a massive direct-to-consumer (DTC) advertising campaign, a newly permitted strategy at the time. The iconic “I take Lipitor” campaign featuring Dr. Robert Jarvik embedded the drug’s name in the public consciousness, creating a powerful “pull” from patients to complement the “push” from the sales force.

- Masterful Lifecycle Management: As Lipitor’s 2011 patent expiration loomed, Pfizer executed a multi-pronged strategy to manage the cliff. They engaged in legal battles to delay generic entry, most notably a “pay-for-delay” settlement with Ranbaxy. In the crucial 180-day period after the first generic launched, Pfizer implemented the “Lipitor-For-You” program, offering the branded drug for a copay as low as $4, effectively undercutting the generic price for many insured patients and retaining significant market share. Simultaneously, they launched their own “authorized generic” through a partner to capture a portion of the generic market, demonstrating a sophisticated understanding of post-exclusivity market dynamics.

Lipitor’s story demonstrates that being first to market is not always a prerequisite for success. A clear, data-backed value proposition combined with relentless and innovative commercial execution can unseat even the most entrenched incumbents.

Case Study 2: Humira (AbbVie) – The Master of Lifecycle Management

Humira (adalimumab) stands as arguably the most commercially successful drug in history, with peak annual sales exceeding $20 billion. Its longevity as a blockbuster was not an accident; it was the result of one of the most deliberate and effective lifecycle management and patenting strategies the industry has ever seen.

- Relentless Indication Expansion: Humira was initially approved for rheumatoid arthritis in 2002. Over the next two decades, AbbVie systematically invested in clinical trials to expand its label to include nine additional indications, spanning psoriatic arthritis, Crohn’s disease, ulcerative colitis, and psoriasis. This strategy transformed Humira from a niche product into a versatile therapy that could be prescribed by a wide range of specialists, dramatically expanding its addressable market.

- The Patent Fortress: The cornerstone of Humira’s commercial durability was its formidable “patent thicket.” While its primary patent expired in 2016, AbbVie had built a fortress of over 70 additional patents covering the drug’s formulation, manufacturing methods, and methods of use. This dense web of IP made it extraordinarily difficult and risky for biosimilar competitors to challenge, effectively delaying their entry into the lucrative U.S. market until 2023—a full seven years after the primary patent expired.

- Transitioning the Franchise: Facing the inevitable entry of more than a dozen biosimilars in 2023, AbbVie’s strategy shifted. Having maximized Humira’s revenue for as long as possible, the company focused on transitioning the market to its next-generation immunology drugs, Skyrizi and Rinvoq, which are projected to collectively generate over $31 billion by 2027.

Humira’s saga is the ultimate testament to the power of proactive lifecycle management and strategic patenting. It shows how a company can extend a drug’s commercial life far beyond initial expectations, creating immense value and funding the next wave of innovation.

Case Study 3: Keytruda (Merck) – The “Narrow-First” Path to Dominance

Merck’s Keytruda (pembrolizumab) entered the revolutionary new field of immuno-oncology as a follower. Its rival, Bristol Myers Squibb’s Opdivo, was the first to market. Yet today, Keytruda is the dominant force in the class and the world’s best-selling drug, with sales exceeding $29 billion. This victory was engineered through a brilliant clinical and regulatory strategy.

- The “Narrow-First” Strategy: While Opdivo initially launched into a broader patient population, Merck pursued a highly targeted “narrow-first” approach. They focused their initial pivotal trials on a specific sub-segment of non-small cell lung cancer (NSCLC) patients whose tumors expressed high levels of the PD-L1 biomarker. By demonstrating overwhelming efficacy in this well-defined population, Keytruda established a clear and defensible beachhead.

- Strategic Indication Expansion: From this initial, narrow approval, Merck systematically expanded. They used the strong data to secure approval in the much larger first-line NSCLC market for PD-L1 positive patients, and then progressively moved into other tumor types and earlier lines of therapy.90 This methodical, evidence-driven expansion built deep confidence among oncologists and established Keytruda as the standard of care and the go-to backbone for combination therapies.

- Winning in Business Through Science: The sales of Keytruda eventually surpassed and then doubled those of Opdivo, not because of a first-mover advantage, but because of a superior R&D and life cycle management strategy that centered on trial collaboration and a deep understanding of the drug’s mechanism of action.

Keytruda’s rise demonstrates that in a competitive market, a smarter clinical development strategy can be more powerful than a head start. By identifying the patient population most likely to benefit and building an irrefutable evidence base, a company can create its own market and redefine the standard of care.

Section 10: Case Studies in Failure – Heeding the Cautionary Tales

For every blockbuster success, the pharmaceutical landscape is littered with the wreckage of commercial failures—drugs that, despite scientific promise and regulatory approval, failed to gain traction in the market. These cautionary tales are arguably more instructive than the successes, as they reveal the critical pitfalls that can derail a product. A recurring theme emerges from these failures: they are often not failures of science, but failures of forecasting—a fundamental misjudgment of the market’s needs, behaviors, and priorities.

Case Study 1: Exubera (Pfizer’s Inhaled Insulin) – When Innovation Misses the Mark

In 2006, Pfizer launched Exubera with massive expectations. As the first inhaled insulin, it promised to free diabetes patients from the burden of daily injections. Analysts projected blockbuster sales exceeding $1.5 billion annually. Instead, the product was a colossal flop, capturing only 1% of the insulin market before being pulled just over a year after launch, resulting in a $2.8 billion write-off for Pfizer.

The failure of Exubera was a classic case of a technology-driven solution that ignored the realities of the end-user :

- Cumbersome and Inconvenient Device: The primary flaw was the inhaler itself. It was large, bulky—often compared to the size of a can of tennis balls or a flashlight—and conspicuous to use in public.94 Patients found it embarrassing and inconvenient, a fatal flaw for a product intended to improve quality of life.

- Complex Dosing and Administration: Dosing was complicated, requiring patients to use combinations of different-sized blisters, and the units were in milligrams instead of the standard insulin units, causing confusion for both patients and physicians.

- High Price, No Clear Clinical Advantage: Exubera was priced at a premium to injectable insulin but offered no improvement in glycemic control. Payers and patients were unwilling to pay more for a product that was less convenient and offered no tangible clinical benefit.

- Safety Concerns: Post-launch, concerns emerged about a potential decline in lung function and a small but worrying signal for lung cancer, further eroding confidence in the product.

Exubera’s failure was a direct result of a flawed market potential forecast that vastly overestimated patient willingness to adopt a novel technology that solved a perceived problem (needle phobia) with a solution that created bigger, more practical problems (inconvenience, complexity, and cost).

Case Study 2: Provenge (Dendreon’s Prostate Cancer Vaccine) – The Commercialization Challenge

Provenge (sipuleucel-T) was a true scientific breakthrough: the first-ever therapeutic cancer vaccine, approved by the FDA in 2010 for metastatic prostate cancer. Hailed as the dawn of a new era in immuno-oncology, expectations were sky-high. Yet, the product’s sales stalled, and its manufacturer, Dendreon, filed for bankruptcy in 2014.99

Provenge’s failure was not one of efficacy—it demonstrated a modest but statistically significant four-month survival benefit—but of commercialization. The forecast failed to account for immense practical and psychological hurdles:

- Logistical Nightmare: The treatment process was extraordinarily complex. Each dose was personalized, requiring patients to undergo apheresis to have their immune cells collected, which were then shipped to a central facility, engineered, and shipped back for infusion. This three-cycle process was a significant burden for patients and a logistical challenge for oncology practices.99

- Prohibitive Upfront Cost and Reimbursement Uncertainty: At $93,000 for a course of treatment, Provenge was one of the most expensive drugs on the market at the time.101 It was a “buy-and-bill” product, meaning physicians had to purchase the expensive treatment upfront and then seek reimbursement from Medicare, a process fraught with uncertainty and financial risk for their practices.99

- Lack of a Surrogate Biomarker: Perhaps the most critical failure was psychological. Unlike chemotherapy, which often lowers Prostate-Specific Antigen (PSA) levels, Provenge showed no effect on PSA.101 Without this tangible, early sign that the treatment was working, both physicians and patients struggled to have confidence in the expensive and burdensome therapy, even with the long-term survival data.

The Provenge story is a stark reminder that a forecast must model not just clinical data and patient numbers, but also the complexities of the healthcare delivery system and the psychology of physicians and patients. A failure to accurately model these “soft” qualitative factors can lead directly to commercial disaster.

The Risk Beyond Approval: When Success Isn’t Final

Even a successful launch is no guarantee of long-term success. The R&D gauntlet extends beyond regulatory approval, and forecasters must account for post-market risks.

- Divergent Phase 2 and Phase 3 Results: A significant source of late-stage failure occurs when promising results from smaller Phase 2 trials are not replicated in larger, more rigorous Phase 3 studies. An FDA analysis of 22 such cases found that this divergence could be due to a lack of efficacy, unexpected safety issues, or both.104 This underscores the inherent risk that remains even after a positive proof-of-concept study.

- Approval Despite Failure: In some cases, particularly for diseases with high unmet need, the FDA may approve a drug even if it misses its primary endpoint in a pivotal trial. A 2023 study found that 10% of drugs approved between 2018 and 2021 had pivotal trials with null findings.106 These approvals are often based on positive secondary endpoints or favorable subgroup analyses. While this provides a path to market, it can create commercial uncertainty, as payers and physicians may be skeptical of the drug’s value proposition.

- Post-Market Safety and Recalls: The ultimate commercial failure is a post-market recall due to unforeseen safety issues. The case of Vioxx, a blockbuster painkiller that was withdrawn in 2004 after being linked to an increased risk of heart attack and stroke, is a prime example. This event cost its manufacturer, Merck, billions in litigation and erased a major revenue stream. The history of drug recalls, from Thalidomide to Fen-Phen, serves as a constant reminder that safety monitoring is a continuous process and that long-term risk must be a component of any comprehensive market assessment.

Conclusion: Integrating Foresight into the Corporate DNA

Throughout this comprehensive exploration, a central theme has emerged: predicting drug market potential is far more than a technical exercise in financial modeling. It is a deeply strategic, multi-disciplinary capability that must be woven into the very DNA of a pharmaceutical organization. It is the art of synthesizing disparate data points—from the molecular to the macroeconomic—and the science of applying rigorous, risk-adjusted methodologies to translate that synthesis into a coherent vision of the future.

We began by confronting the stark realities of the R&D gauntlet, where decade-long timelines, billion-dollar investments, and staggering attrition rates form the economic bedrock of the industry. We established that the high cost of failure is the primary driver of the entire pharmaceutical business model, dictating everything from launch pricing to the relentless pursuit of lifecycle extension. We then deconstructed the market opportunity into its three essential pillars: the fundamental “why” of unmet medical need, the quantitative “who and how many” of the target patient population, and the dynamic “who else” of the competitive arena. It is at the intersection of these three pillars that true market potential is found.

We journeyed through the forecaster’s toolkit, acknowledging the irreplaceable value of qualitative, human-centric insights gleaned from Key Opinion Leaders and Payer Advisory Boards. These inputs provide the essential context and real-world texture to the “hard” numbers. We then demystified the industry’s quantitative gold standards—Risk-Adjusted Net Present Value (rNPV) and Monte Carlo simulations—transforming them from complex formulas into powerful strategic tools for valuing assets and quantifying uncertainty.

Finally, we explored the modern strategic edge, detailing how patent landscapes can be read as a predictive map of competitor intentions and how the AI revolution is supercharging every facet of this process. From accelerating R&D to mining real-world evidence and automating competitive intelligence, AI is no longer on the horizon; it is a present-day imperative for anyone serious about forecasting. We also looked ahead, recognizing that any robust forecast must account for the transformative market dynamics of personalized medicine, digital therapeutics, and an ever-more-demanding payer and regulatory environment.

The case studies of titans like Lipitor, Humira, and Keytruda revealed that blockbuster success is not a matter of luck, but the result of masterful, long-term strategic foresight. Conversely, the cautionary tales of failures like Exubera and Provenge taught us the most critical lesson of all: commercial failure is almost always a failure of forecasting. It is a failure to accurately model the needs, behaviors, and constraints of the real-world healthcare ecosystem.

Therefore, the ultimate conclusion is a call to action. Organizations must break down the silos that separate R&D, clinical, commercial, regulatory, and business development. Best-in-class forecasting requires a seamless, continuous flow of information and insight between these functions. It must be an iterative, living process, constantly updated with new data and new intelligence.

To thrive in the coming decade, pharmaceutical companies must elevate forecasting from a periodic financial task to a core, integrated strategic capability. They must invest in the data, the technology, and—most importantly—the cross-functional talent to master this discipline. For in an industry defined by risk, the ability to see the future more clearly than your competitors is the ultimate and most durable competitive advantage. It is the art and science of foresight, and it is the key to delivering transformative medicines to patients while creating sustainable value for the enterprise.

Key Takeaways

- R&D Economics Drive Strategy: The high cost ($2.6B) and high failure rate (~90%) of drug development are not just statistics; they are the fundamental drivers of the pharmaceutical business model, necessitating high launch prices and aggressive lifecycle management to ensure a return on investment.

- Market Potential is a Triad: Accurate forecasting requires a holistic assessment of three interconnected pillars: the depth of the Unmet Medical Need, the precise size of the Target Patient Population, and the dynamics of the Competitive Landscape. A strength or weakness in one area directly impacts the others.

- Integrate Qualitative and Quantitative Methods: The most robust forecasts blend quantitative models with qualitative insights. Financial valuations like Risk-Adjusted NPV (rNPV) are essential, but their assumptions must be refined by real-world input from Key Opinion Leaders (KOLs) and Payer Advisory Boards.

- Embrace Uncertainty with Advanced Modeling: Move beyond single-point estimates. Monte Carlo simulations are a powerful tool for modeling the range of potential outcomes and their probabilities, providing a richer understanding of an asset’s risk profile and enabling better go/no-go decisions.

- Patents are Predictive, Not Just Protective: A company’s patent strategy is a rich source of competitive intelligence. Patent Landscape Analysis reveals R&D trends, while tracking patent expirations is critical for revenue forecasting. Platforms like DrugPatentWatch are vital for turning this data into actionable insights.

- AI is a Forecasting Supercharger: Artificial Intelligence and Machine Learning are enhancing every aspect of prediction. They accelerate R&D (improving rNPV inputs), generate more accurate sales forecasts, and extract deep insights from unstructured Real-World Data (RWD) and competitive documents.

- Forecast Future Market Dynamics: Long-term predictions must account for transformative trends. The shift to Personalized Medicine changes the “blockbuster” equation, the rise of Digital Therapeutics (DTx) introduces a new product category, and the increasing power of payers through Value-Based Pricing makes market access a critical variable.

- Commercial Failure is a Forecasting Failure: High-profile commercial flops like Exubera and Provenge were not primarily scientific failures but failures to accurately predict market realities, such as user convenience, reimbursement hurdles, and physician psychology. Robust forecasting is the ultimate risk mitigation tool.

Frequently Asked Questions (FAQ)

1. What is the single biggest mistake companies make when forecasting the potential of a new drug?

The most common and costly mistake is developing a forecast in a silo, focusing excessively on the clinical efficacy and the total epidemiological size of a disease, while underestimating or misjudging “softer” commercial and market access factors. This leads to what the case of Provenge illustrates perfectly: a drug can be scientifically successful and FDA-approved but fail commercially because the forecast didn’t accurately model the burdens on the healthcare system (complex logistics, buy-and-bill risk for physicians) and the psychological needs of the end-users (lack of a tangible biomarker like PSA reduction). A successful forecast must be an integrated effort, giving equal weight to clinical data, patient population size, competitive positioning, physician workflow, and the payer value proposition from the very beginning.

2. Our company is developing a first-in-class therapy with no historical data. How can we build a credible quantitative forecast using models like rNPV?

For a first-in-class therapy, the forecast is an exercise in building a robust set of assumptions through rigorous qualitative research. While you lack direct historical sales data, you can build the rNPV model piece by piece:

- Patient Population: Use the detailed segmentation framework (epidemiology, refined by RWD and clinical criteria) to build a patient-flow model.

- Adoption Curve & Peak Share: This is where qualitative input is paramount. Conduct market research with physicians (showing them the target product profile) to estimate initial adoption rates and potential peak market share against the current standard of care. Use analog analysis—how did previous first-in-class drugs in similar therapeutic areas perform?

- Pricing: Convene payer advisory boards. Present your clinical data and value proposition to get direct feedback on their willingness to reimburse and at what price level. This is far more reliable than internal assumptions.

- Probability of Success (POS): While your specific drug is novel, you can use industry benchmark POS data for the same therapeutic area and modality (e.g., small molecule vs. biologic in oncology) as a starting point, adjusting based on the strength of your preclinical and early clinical data.

The credibility of the rNPV for a novel drug comes not from historical certainty, but from the transparency and defensibility of each assumption, backed by thorough primary research with the stakeholders who will ultimately decide its fate.

3. How can we effectively forecast the impact of a “patent thicket” on our revenue projections for a competitor’s drug?

Forecasting the impact of a patent thicket is a complex but critical task that requires a combination of legal and strategic analysis. The first step is to use a comprehensive intelligence platform, such as DrugPatentWatch, to map the entire patent estate around the drug—not just the core composition of matter patent, but all secondary patents (formulation, method-of-use, process, etc.) and their respective expiration dates across key geographies. The next step is to assess the strength of these secondary patents. Not all patents are created equal. A patent on a novel extended-release formulation that offers a clear clinical benefit (e.g., once-daily vs. twice-daily dosing) is a much stronger barrier to entry than a more tenuous process patent. This assessment often requires input from patent attorneys. Finally, model different scenarios. Your base case might assume generic entry after the core patent expires. Then, build scenarios where key secondary patents delay entry by 2, 4, or 6 years. You can assign probabilities to these scenarios based on the perceived strength of the patents and the litigation history of the generic challengers. This transforms the forecast from a single “cliff” date into a more realistic, probabilistic range of potential exclusivity loss.