The Strategic Imperative: Redefining Patent Defense in Pharma

The pharmaceutical industry, a crucible of innovation and a cornerstone of global health, operates at the intersection of groundbreaking science, immense capital investment, and complex regulatory frameworks. Within this intricate ecosystem, patent defense has undergone a profound transformation, evolving from a mere legal necessity into a critical strategic imperative. For business professionals navigating this landscape, understanding this shift is paramount to converting intellectual property (IP) into a formidable competitive advantage.

The Evolving Landscape of Pharmaceutical IP

The very concept of patents has a rich history, tracing its origins back to the 14th century when King Edward II granted letters of protection to skilled foreign workers to entice them to England and foster new industries. However, the application of these protective mechanisms to medicinal products was not always straightforward. For many years, well into the 20th century, numerous countries prohibited drug patents, driven by the belief that medicines were too vital for public welfare to be monopolized by a single entity. This historical reluctance underscores a fundamental societal bargain: a temporary monopoly (patent) is granted in exchange for incentivizing innovation and ensuring public disclosure of the invention.

The landscape began to shift dramatically after World War II, as a wave of legal changes across Europe established procedures for patenting drugs, albeit with cautious approaches such as compulsory licensing provisions. A pivotal moment arrived in the United States with the introduction of the Hatch-Waxman Act in 1984. This landmark legislation aimed to strike a delicate balance: encouraging pharmaceutical innovation by brand-name drug manufacturers while simultaneously promoting access to more affordable generic alternatives. It achieved this through mechanisms like patent term restoration, which compensates for time lost during the lengthy FDA approval process, and a streamlined Abbreviated New Drug Application (ANDA) process for generics. The FDA’s “Orange Book” further enhances transparency by listing approved drugs and their associated patents, providing a clear roadmap for generic manufacturers seeking to enter the market.

Today, patents are unequivocally recognized as far more than mere legal instruments. They are strategic business assets that fundamentally dictate market exclusivity, drive investment decisions, and ultimately shape the availability of life-saving medicines . The very existence of intellectual property rights is justified by the need for pharmaceutical manufacturers to recoup the substantial costs incurred in research and development (R&D), including extensive clinical trials and rigorous regulatory approvals. This journey from legal formality to a central business asset highlights that companies must not only understand the letter of the law but also the spirit and mechanisms of regulatory frameworks, transforming compliance into a strategic advantage or, if neglected, a significant vulnerability.

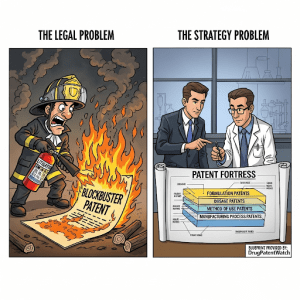

Why Patent Defense is a Business, Not Just a Legal, Problem

The shift in perspective is clear: for any pharmaceutical company, from a nimble startup to a global behemoth, mastering the art of patent defense is not merely a legal necessity; it is a strategic imperative for survival and market domination . This is not about reacting to legal challenges in isolation, but about proactively building an impenetrable fortress around intellectual property, anticipating threats before they materialize, and strategically leveraging patents to maintain a competitive edge . Patents serve as tangible assets, providing companies with the freedom to operate and maintain ownership over the drugs they develop. Effective patent strategies are therefore vital for securing a drug’s future, ensuring that the colossal effort expended in its development is appropriately recognized and rewarded.

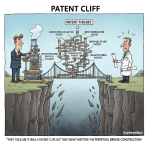

The “patent cliff” serves as a stark, real-world illustration of why patent defense is fundamentally a business problem. Between 2025 and 2030, an estimated $236 billion in global revenue is projected to evaporate as patents for blockbuster drugs expire, unleashing a flood of generic competition. Some analyses place the revenue at risk even higher, at approximately $350 billion between 2025 and 2029. This impending loss forces major pharmaceutical players like AbbVie, Bristol-Myers Squibb, and Merck & Co. to prioritize aggressive cost optimization and robust pipeline diversification. The patent cliff is not just a financial drain; it acts as a strategic stress test for a company’s entire operational and innovation apparatus. Companies that effectively navigate this challenge, like AbbVie delaying Humira’s generic competition until 2023 through a strategic “patent thicket,” demonstrate that patent defense is a critical component of broader corporate resilience and long-term survival. It necessitates deep integration across R&D, commercial, and financial teams to ensure the entire enterprise can withstand such market shocks.

The Economic Stakes: Protecting Billions in R&D Investment

The pharmaceutical industry’s business model is inherently tied to intellectual property protection due to the extraordinary costs and risks associated with drug discovery and development.

The Cost of Innovation and the Value of Exclusivity

Developing a new drug is an arduous and costly endeavor, frequently requiring upwards of $2 billion and 12 to 13 years from the initial patent filing to regulatory approval. This lengthy process significantly reduces the effective market exclusivity period for a drug to approximately 7 to 8 years. Without robust patent protection, recouping these substantial R&D investments would be nearly impossible, a reality that would inevitably stifle future innovation . The industry collectively spends over $300 billion annually on R&D , with the average cost of developing a single drug reaching $2.23 billion in 2024.

This immense investment underscores a fundamental innovation paradox: medical breakthroughs are incredibly expensive to achieve, yet their profitability is almost entirely dependent on a temporary monopoly granted by patents. This creates a financial tightrope for pharmaceutical companies, as they must constantly balance the need for massive upfront investments with a limited window to recoup those costs. This inherent pressure often incentivizes aggressive patent strategies aimed at maximizing the effective patent life, even if some of these tactics become controversial.

The value of this exclusivity is starkly evident in revenue figures: drugs protected by strong patents generate 80-90% of their lifetime revenue during their exclusivity periods. Conversely, the impact of patent expiration is immediate and severe, with average revenue drops of 80-90% post-generic entry. This rapid decline highlights the critical importance of extending exclusivity for as long as legally and ethically possible. Furthermore, R&D margins are projected to decline significantly, from 29% of total revenue down to 21% by the end of the decade. This is not merely a financial metric; it represents a strategic threat. Lower margins translate to less capital available for future innovation, potentially creating a vicious cycle where reduced profitability leads to diminished R&D capacity. In such an environment, effective patent defense becomes even more critical, not just to protect existing revenue streams, but to safeguard the viability of future drug pipelines.

Anticipating the Patent Cliff and Its Financial Impact

The impending patent cliff is perhaps the most significant financial challenge facing the pharmaceutical industry in the coming years. As noted, between 2025 and 2030, an estimated $236 billion in global revenue is expected to evaporate due to patent expirations. Other projections suggest that $350 billion in revenue is at risk between 2025 and 2029. This massive loss of exclusivity for blockbuster drugs will unleash a torrent of generic competition, fundamentally transforming market dynamics.

The financial consequences of patent expiration are profound. Post-patent expiration, drug prices typically decrease by 38% to 48% for physician-administered medications and approximately 25% for oral formulations. As additional generic competitors enter the market, prices can decline even further, sometimes reaching as little as 10-20% of the original branded price. This highlights a cascading effect: a company’s patent defense strategy must aim not only to delay the first generic entrant but also to deter subsequent waves of generic competition.

Major pharmaceutical companies, including AbbVie, Bristol-Myers Squibb, and Merck & Co., are actively bracing for this patent cliff, necessitating comprehensive strategies that include aggressive cost optimization and robust pipeline diversification. AbbVie’s use of a “patent thicket” to delay Humira’s generic competition until 2023 serves as a prime example of a proactive strategic response. The patent cliff, therefore, functions as a profound strategic stress test for a pharmaceutical company’s entire operational and innovation apparatus. It underscores that patent defense is not a standalone activity but an integral component of a larger corporate strategy for survival and growth, encompassing R&D investment, mergers and acquisitions, and operational efficiency.

Fortifying the Fortress: Proactive Patent Defense Strategies

Building a robust patent defense is akin to constructing an impenetrable fortress, requiring foresight, meticulous planning, and a multi-layered approach that extends far beyond simple legal filings.

Weaving an Impenetrable Patent Thicket

A core proactive strategy in pharmaceutical patent defense is the creation of a “patent thicket.” This involves securing numerous, often overlapping, patents on various aspects of a single drug, forming a dense and formidable web of protection . The strategic principle is clear: a multi-layered defense is crucial, extending well beyond merely patenting the active pharmaceutical ingredient (API) .

A truly defensible patent portfolio encompasses a diverse array of patent types:

- Composition of Matter Patents: These are fundamental, covering the active pharmaceutical ingredient (API) itself . They represent the core innovation.

- Formulation Patents: These protect new ways a drug is prepared or delivered, such as extended-release versions or specific excipient combinations . These can offer technical advantages like reduced dosing frequency, providing additional exclusivity.

- Method of Use Patents: These cover novel therapeutic applications for an existing drug or drug reformulation .

- Manufacturing Process Patents: These protect the unique and proprietary methods used to synthesize and produce the drug.

- Polymorph and Enantiomer Patents: These protect different crystalline structures or stereoisomers of the API, which may offer improved stability or bioavailability.

By securing these secondary patents, companies create a formidable barrier that can deter or significantly delay generic competition . Each additional patent represents another hurdle a challenger must overcome, increasing the cost and complexity of litigation . This effectively transforms legal protection into an economic deterrent, making it financially prohibitive for generic competitors to challenge the entire portfolio, even if individual patents might be perceived as weak. For instance, AbbVie’s blockbuster drug Humira was famously protected by over 100 patents, a strategy that successfully delayed biosimilar competition for years. Indeed, top-selling drugs in the U.S. now have an average of 74 granted patents. This demonstrates a powerful interplay between ongoing R&D and legal strategy: continuous innovation, even incremental, feeds into a stronger patent thicket, which in turn protects the massive investment in that R&D. The strategic challenge lies in identifying and patenting meaningful incremental innovations that will withstand legal scrutiny and provide real market value.

Evergreening and Lifecycle Management: Strategic Extensions

“Evergreening” refers to the practice of obtaining additional patents on minor modifications of an existing drug, thereby extending its patent protection and market exclusivity . This can involve developing new formulations, dosage forms, or methods of use . While critics argue that evergreening stifles competition and keeps drug prices high, proponents contend that it incentivizes incremental innovation that can provide real benefits to patients, such as improved convenience or reduced side effects. This practice is a key component of broader “life cycle management” strategies, where companies actively manage their products to maximize their period of market exclusivity .

A prominent example of evergreening is AbbVie’s extension of Humira’s patent life by two years through the release of a citrate-free version, which generated billions of dollars in additional revenue. This highlights the ethical tightrope companies must walk: balancing the significant financial benefits of extended exclusivity against potential reputational damage, regulatory scrutiny, and public backlash. Effective patent strategy, therefore, is not just about what is legally permissible but what is ethically defensible and commercially sustainable in the long run.

Beyond controversial evergreening tactics, pharmaceutical companies also strategically leverage legitimate regulatory mechanisms to extend patent life:

- Patent Term Adjustment (PTA): This compensates for delays incurred during the patent examination process at the U.S. Patent and Trademark Office (USPTO) .

- Patent Term Extension (PTE): This restores patent term lost due to pre-market government approval processes from regulatory agencies like the FDA, potentially adding up to five years to a patent’s life .

- Pediatric Exclusivity: This provides an additional six months of market exclusivity for conducting clinical trials in children .

- Orphan Drug Exclusivity: This grants a seven-year period of exclusivity for drugs that treat rare diseases, regardless of patent status .

These regulatory extensions are not “evergreening” in the controversial sense but are crucial “strategic bonus times” granted by the system. Companies must proactively plan for and pursue these extensions, integrating them into their R&D and regulatory strategies from the earliest stages of drug development. This demonstrates that understanding and leveraging the full spectrum of IP and regulatory protections is a strategic imperative for maximizing a drug’s commercial lifespan.

The Power of Preparedness: Robust Documentation and Prosecution History

The foundation of any strong patent defense lies in meticulous internal processes and intellectual rigor. Securing thorough documentation practices can greatly strengthen a pharmaceutical defense by providing clear, comprehensive records that demonstrate compliance and due diligence. This involves maintaining detailed records of all processes, from early-stage research and development to manufacturing and quality control. Regular audits of this documentation are vital to identify and rectify discrepancies before they become problematic. This transforms documentation from a mere administrative task into a “pre-litigation weapon,” as a robust paper trail can deter challenges or significantly bolster a defense by proving due diligence and the inventive step. Conversely, inconsistencies or admissions made during patent prosecution can be exploited by challengers to argue for a narrow interpretation of the patent’s claims or even its invalidity.

Equally critical is a robust prosecution history – the “file wrapper” – which contains all correspondence between the applicant and the patent office during the examination process . A clean and consistent prosecution history, detailing the arguments made to secure the patent, is a powerful defensive tool . This underscores the importance of meticulous record-keeping, including detailed lab notebooks , as a proactive measure.

Furthermore, a thorough and ongoing search for relevant prior art is not merely a good practice; it is an essential defensive maneuver . Prior art encompasses all publicly available information that existed before the filing date of a patent application and is considered the arch-nemesis of patent validity. Understanding the prior art landscape allows a company to anticipate a challenger’s arguments and prepare counter-arguments and expert testimony in advance . This proactive intelligence transforms prior art analysis into a “strategic compass” for R&D direction and competitive positioning, helping to identify “white spaces” for innovation and informing strategic decisions about whether to litigate or settle . Investing in a thorough landscape analysis can save millions in the long run by avoiding costly patent disputes.

Leveraging Competitive Intelligence for Strategic Advantage

In today’s rapidly evolving pharmaceutical landscape, competitive intelligence (CI) is no longer a niche function; it is a strategic imperative. Faced with intense global competition, looming patent cliffs, and increasingly rapid R&D cycles, pharmaceutical companies must modernize their CI practices or risk falling behind. CI helps companies gain critical market insights, make informed strategic decisions, and ultimately enhance revenue. This involves a deep analysis of competitors’ R&D strategies, product development pipelines, business development initiatives, marketing approaches, and pricing strategies. By understanding competitor moves, CI tools can help prevent companies from making the same costly errors in drug development, thereby saving precious resources.

Anticipating Threats with Patent Data and Analytics (Mention DrugPatentWatch)

Patent intelligence, a specialized subset of CI, offers invaluable insights into competitor activities and market opportunities. Monitoring patent filings provides an early warning system for competitive threats. The integration of artificial intelligence (AI) into CI practices further enhances effectiveness, allowing for the aggregation of global news, licensing data, analyst reports, and press releases, delivering real-time alerts and AI-generated summaries. This positions CI as a “radar system” for the competitive landscape, enabling companies to anticipate threats and identify opportunities before they fully materialize.

Platforms like DrugPatentWatch exemplify how specialized tools transform raw patent data into actionable intelligence. DrugPatentWatch provides deep knowledge on pharmaceutical drugs, covering patents, suppliers, generics, formulations, and more. It offers an integrated database of drug patents and other critical information, including litigation details, tentative approvals, patent expirations, clinical trials, Paragraph IV challenges, and top patent holders, for both US and international markets .

Table 1: DrugPatentWatch Features for Strategic Advantage

| Feature Category | Specific Features | Strategic Benefit for Pharma Companies |

| Database & Search | Integrated database (US & International patents, litigation, approvals, clinical trials, Paragraph IV, patent holders) | Comprehensive, real-time view of the global IP landscape; supports due diligence and market analysis. |

| Competitive Intelligence | Assess past successes of patent challengers; elucidate competitor research paths | Understand competitor strategies and vulnerabilities; identify potential threats and opportunities. |

| Lifecycle Management | Predict branded drug patent expiration; identify generic suppliers | Proactive supply chain management; optimize R&D investment for lifecycle extension. |

| Portfolio Management | Inform portfolio management decisions; identify market entry opportunities | Strategic allocation of resources; optimize product launch timing. |

| Alerts & Reporting | Daily email alerts; customizable watch lists; data export (Excel/CSV) | Real-time monitoring of competitive activity and regulatory changes; facilitates rapid decision-making. |

| Advanced Analytics | AI-generated summaries; predictive analytics | Transform raw data into actionable insights; identify patterns and predict trends faster than manual methods. |

*Source: DrugPatentWatch , Northern Light , Effectual Services *

DrugPatentWatch helps identify market entry opportunities, inform portfolio management decisions, assess past successes of patent challengers, elucidate research paths of competitors, and predict branded drug patent expiration . Its ability to provide email alerts and data export capabilities further streamlines the process of transforming data into actionable intelligence . This positions such platforms as “strategic navigators,” allowing companies to not only defend their own patents but also to understand and potentially exploit competitor vulnerabilities.

Identifying White Spaces and Innovation Opportunities

Beyond defensive measures, patent intelligence serves as a powerful offensive tool for identifying “white spaces” and innovation opportunities . White spaces are defined as areas with limited patent activity but significant therapeutic potential. Such areas offer substantial returns with reduced competitive pressure and stronger patent protection. Competitive intelligence, by analyzing patent landscape data, helps companies identify unmet medical needs and direct R&D efforts towards these less crowded, more profitable areas . This transforms patent data into an “R&D roadmap,” allowing companies to invest strategically rather than blindly, thereby maximizing the return on their R&D investments.

The increasing integration of AI into drug discovery further amplifies this capability. AI-based approaches can significantly reduce the pool of candidate substances, speeding up development by allowing researchers to focus on a much smaller, more promising selection. This highlights AI’s dual role: it is a tool for discovering new therapies and simultaneously a powerful tool for protecting those discoveries through strategic patenting. Companies leveraging AI in R&D must, therefore, integrate AI into their IP strategy to fully capitalize on its benefits.

Navigating the Storm: Reactive Patent Defense Tactics

Even with the most robust proactive strategies, pharmaceutical companies inevitably face patent challenges. Reactive defense involves sophisticated legal and strategic maneuvers to protect intellectual property in the courtroom and beyond.

The Hatch-Waxman Arena: Understanding Generic Challenges

The Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, is the cornerstone of pharmaceutical patent litigation in the United States . It established the Abbreviated New Drug Application (ANDA) process, which allows generic manufacturers to gain FDA approval by demonstrating bioequivalence to a brand-name drug, thereby circumventing the need for costly and time-consuming clinical trials . This framework creates a structured pathway for patent challenges, enabling generic manufacturers to assert that innovator patents are invalid, unenforceable, or will not be infringed by their generic product.

Paragraph IV Certifications and the 30-Month Stay

The critical mechanism under Hatch-Waxman for triggering litigation is the “Paragraph IV certification.” When a generic company files an ANDA, it must certify regarding the patents listed in the FDA’s “Orange Book” for the brand-name drug . A Paragraph IV certification asserts that the generic company believes the patent is invalid, unenforceable, or will not be infringed by their generic product . This certification acts as an “artificial infringement,” legally triggering a patent infringement lawsuit from the brand-name company.

Upon the brand-name company filing a lawsuit within 45 days of receiving a Paragraph IV notification, an automatic “30-month stay” of the FDA’s approval of the generic application is granted . This 30-month stay is not merely a procedural delay; it is a crucial “strategic time buffer” for the brand company. This period allows them to continue generating revenue, prepare their legal defense, and potentially launch an authorized generic. For generic companies, it represents a significant hurdle that increases the cost and time to market. The stay can be shortened if the court rules in favor of the generic company before the 30 months elapse. The Paragraph IV certification effectively acts as a “declaration of war” by the generic company, demanding swift, pre-planned responses from brand companies to secure this critical time buffer.

Inter Partes Review (IPR): A Faster Path to Validity Challenges

In addition to traditional district court litigation, the America Invents Act (AIA) introduced Inter Partes Review (IPR) proceedings before the U.S. Patent and Trademark Office’s Patent Trial and Appeal Board (PTAB). IPR allows a third party to challenge the validity of a patent on the grounds of anticipation and obviousness, based on prior art consisting of patents and printed publications .

IPRs are strategically attractive to generic and biosimilar companies because they are generally faster and less expensive than traditional district court litigation . Furthermore, the standard for proving unpatentability in an IPR is a “preponderance of the evidence,” which is a lower burden of proof than the “clear and convincing evidence” standard required in district court . This lower burden of proof is a significant strategic lever for challengers, making it easier to invalidate patents and putting more pressure on brand companies to ensure their patents are not only valid but also robust enough to withstand a less stringent challenge.

The trend of simultaneous settlement of federal court litigation and PTAB proceedings, such as IPRs, has been observed . This indicates that IPRs have become a “strategic alternative front” in the patent battle. Brand companies can no longer rely solely on district court litigation; they must develop robust strategies for defending their patents at the PTAB as well. The concurrent nature of these proceedings often leads companies to use both forums pragmatically to achieve a resolution, rather than fighting exclusively in one. The PTAB regularly releases performance benchmarks for dispositions, pendency, and inventory, providing valuable data on the efficiency and outcomes of these proceedings.

Litigation as a Strategic Lever: Defenses and Counterclaims

Successfully defending a patent infringement case requires careful planning and early strategic thinking. Defense in litigation is not a passive act; it involves a dynamic interplay of substantive and procedural maneuvers designed to gain leverage and achieve the most favorable business outcome.

Defendants in patent infringement cases typically raise a mix of defenses:

- Substantive Defenses: These challenge the core validity or enforceability of the patent. Common arguments include invalidity due to prior art (the invention was not new or was obvious), indefiniteness of the patent claims, lack of enablement (the patent does not sufficiently describe how to make or use the invention), or unenforceability due to misconduct during the patent application process (known as inequitable conduct). A defendant may also assert that they have a license or other right to use the patented technology.

- Procedural Defenses: These challenge the court’s jurisdiction or the plaintiff’s pleading. Examples include lack of personal jurisdiction, improper venue, or pleading deficiencies.

Beyond defensive postures, defendants often benefit from “going on the offensive” by asserting counterclaims that shift leverage and put the plaintiff on the defensive. Common counterclaims include declaratory judgments seeking a ruling of non-infringement or patent invalidity. Additionally, if the defendant owns relevant patents that the plaintiff may be infringing, they can assert patent infringement counterclaims. Such counterclaims can strategically open the door to cross-licensing discussions or provide significant settlement leverage.

Pre-trial motions to dismiss unfounded claims early on are also critical tactics. These motions not only reduce the scope of the litigation but also send a strong message to the opposition about the defendant’s commitment to a robust defense. Furthermore, companies increasingly consider alternative dispute resolution methods like mediation or arbitration as a means to resolve disputes more efficiently, minimizing costs and business disruption . Settlement negotiations themselves are a strategic art, requiring the leveraging of expert opinions and data, a readiness to compromise for a quicker resolution, and ensuring confidentiality of discussions and agreements to avoid influencing other ongoing or future negotiations. This approach frames litigation as a “chess match” of leverage, where each legal action is carefully considered for its impact on the overall business objective, often prioritizing early resolution as a sound cost-benefit calculation.

The Indispensable Role of Expert Witnesses

In the highly technical realm of pharmaceutical patent litigation, expert witnesses are not just helpful; they are indispensable. Leveraging expert witnesses can significantly enhance a pharmaceutical defense strategy by providing credible, specialized knowledge during legal proceedings. These experts play a crucial role in explaining complex scientific issues in a way that judges and juries can understand, making a company’s case more compelling.

Beyond courtroom testimony, expert witnesses can prepare detailed reports that bolster a defense, clarifying a company’s position and providing a strong foundation for legal arguments. Successful defense often depends on precise interpretations of patent claims and credible expert analysis. During the expert discovery phase, each side presents expert witnesses, who submit written reports and are deposed on issues such as infringement and validity.

Experts function as “translators of complexity” and “credibility anchors” in patent disputes. Their ability to simplify highly technical scientific issues for non-technical audiences is a strategic advantage. Their detailed reports and testimony provide a strong, credible foundation for legal arguments, adding significant weight to a company’s defense. This means that the selection and preparation of expert witnesses are critical strategic decisions, not merely logistical ones. Given that patent litigation often involves a “battle of the experts,” the quality, clarity, and persuasiveness of their testimony can be decisive, necessitating investment in identifying, training, and strategically deploying the best possible experts to support a case.

Table 2: Hatch-Waxman Litigation Milestones and Strategic Implications

| Milestone | Description | Strategic Implication for Brand | Strategic Implication for Generic |

| ANDA Filing with Paragraph IV Certification | Generic company files Abbreviated New Drug Application, asserting brand patent is invalid, unenforceable, or not infringed . | Triggers 45-day window to file lawsuit to secure 30-month stay; immediate need for legal readiness. | Signals intent to enter market; initiates legal process to challenge exclusivity. |

| Brand Lawsuit Filed (within 45 days) | Brand company files patent infringement lawsuit against generic, typically in District of Delaware or New Jersey . | Secures automatic 30-month stay of FDA approval for generic; buys crucial time for defense and market strategy. | Initiates formal litigation; begins clock on 30-month stay, which must be overcome for early market entry. |

| 30-Month Stay Period | FDA approval of generic is automatically stayed for up to 30 months while litigation proceeds. | Continues market exclusivity and revenue generation; allows time for legal preparation, authorized generic launch planning. | Delays market entry; increases costs due to prolonged litigation; incentivizes seeking early resolution. |

| Inter Partes Review (IPR) Filing | Generic or third party challenges patent validity at PTAB, often in parallel with district court litigation . | Faces a faster, less expensive challenge with a lower burden of proof; requires robust PTAB defense strategy . | Offers a quicker, more cost-effective avenue to invalidate patents; can be used to gain leverage in parallel district court cases . |

| Fact Discovery Phase | Parties exchange documents and take depositions of key witnesses; involves substantial technical and financial discovery. | Gathers evidence to support infringement claims and rebut invalidity arguments; assesses opponent’s case strength. | Uncovers evidence to support non-infringement or invalidity arguments; prepares for expert testimony. |

| Claim Construction (Markman) Hearing | Court interprets the meaning of disputed patent terms, heavily influencing case outcome. | Critical stage; favorable interpretation strengthens infringement claims; unfavorable interpretation can weaken case. | Seeks narrow interpretation of claims to avoid infringement; can lead to early dismissal or settlement. |

| Expert Discovery Phase | Each side presents expert witnesses, who submit written reports and are deposed on infringement and validity issues. | Leverages scientific and technical expertise to explain complex issues; prepares experts for rigorous cross-examination. | Challenges brand’s experts; presents own expert analysis to support invalidity or non-infringement. |

| Trial / Summary Judgment | Case proceeds to trial (bench trial for Hatch-Waxman) or may be decided on summary judgment. | Aims for finding of infringement and patent validity; seeks injunctions and damages. | Aims for finding of non-infringement or patent invalidity; seeks to overturn 30-month stay. |

| Resolution / Termination | Case concludes via settlement, court decision, or other procedural means . | May involve licensing, damages, or continued exclusivity; outcomes influence future market strategy. | Determines market entry timing; may involve royalty payments or early launch. |

*Source: Venable , DrugPatentWatch , FTC , NatLawReview , MHM Firm *

Adapting to a Dynamic Landscape: Future Trends and Regulatory Impacts

The pharmaceutical industry is in a constant state of flux, driven by technological advancements and evolving regulatory environments. Adapting patent defense strategies to these dynamics is crucial for long-term success.

The Inflation Reduction Act (IRA): Reshaping R&D and IP Strategy

The Inflation Reduction Act (IRA) has introduced significant changes to the biopharmaceutical industry, particularly in how patents are managed and strategized. By implementing price controls and incentivizing the development of biologics over small molecules, the IRA is fundamentally reshaping the landscape of drug development and intellectual property management .

Small vs. Large Molecules: A Shifting Focus

A key provision of the IRA is its differential treatment of small-molecule drugs and biologics (large-molecule drugs) regarding price controls. Price controls for small-molecule drugs kick in after nine years of market pricing, whereas for biologics, they begin after thirteen years . This disparity creates a clear incentive for companies to focus on biologic drugs, which are afforded a longer period of market exclusivity before price negotiations can commence .

This regulatory distinction is actively steering R&D investment. Since the IRA’s drug pricing provisions were first drafted in September 2021, small-molecule drug funding has dropped by 70% . In the first seven months of 2024, biologics received ten times more funding than small molecules. Major pharmaceutical companies, including Pfizer and Bristol Myers Squibb, are already re-evaluating their strategies, shifting away from small molecules due to economic non-viability. An estimated 78% of companies expect to cancel early-stage small-molecule pipeline projects. This suggests that the IRA is not merely a pricing regulation but a “market re-shaper,” undermining innovation in small-molecule drugs. Companies must strategically align their R&D pipelines and patenting efforts with these new incentives to remain competitive and profitable. This also highlights a “hidden cost” of policy interventions: stifled innovation in a crucial drug class, underscoring the need for patent defense strategies to consider broader policy environments and engage in advocacy.

Impact on Post-Approval Research and Investment

The IRA’s influence extends beyond initial R&D to post-approval research. The Act can discourage post-approval trials, which are crucial for identifying additional indications or patient populations for existing drugs. More than half of small-molecule medicines receive at least one additional indication, with almost 50% of these occurring after the seven-year mark. The shortened exclusivity window under the IRA makes it financially prohibitive for small-molecule drugs to conduct these post-approval studies. This creates a situation where patients with additional indications or rare diseases, who might benefit from an existing small-molecule drug, become “unseen victims” of shortened exclusivity. Companies may forgo valuable market segments and patient populations if the economics of further research are no longer viable. Consequently, patent strategy shifts towards maximizing the value of the initial patent window, as subsequent extensions through new indications become less attractive.

Emerging Technologies: Patenting Challenges and Opportunities

The advent of cutting-edge biotechnologies and digital innovations is creating new IP landscapes that demand different strategic thinking from traditional pharma IP paradigms.

Personalized Medicine: Tailoring IP to Individualized Therapies

Personalized medicine, also known as precision medicine, involves creating treatments and drugs based on an individual’s genetic, environmental, and lifestyle factors . This approach is transforming healthcare and has led to a surge in patents for diagnostic methods, targeted therapies, and biomarker identification. Annual patent applications related to personalized medicine, for example, grew an astounding 2,000% between 2000 and 2017 .

However, patenting personalized medicine presents unique challenges. The complexity of genetic-based treatments makes it difficult to meet traditional patent requirements of novelty, non-obviousness, and utility . Proving novelty is particularly challenging due to the vast amount of existing genetic research, and demonstrating non-obviousness for treatments built on known genetic information can be a complex endeavor . Furthermore, the patent eligibility of genetic information itself is a contentious legal issue, with landmark cases like Association for Molecular Pathology v. Myriad Genetics having significant implications for what is considered patentable in genetics . The Mayo Collaborative Services v. Prometheus Laboratories, Inc. case, for instance, highlighted that claiming a natural law or correlation and well-known means of observing it is not eligible for patenting .

These challenges have led to a strategic emphasis on “novel biotechnological processes” rather than attempting to patent genetic sequences themselves . Companies are incentivized to increase their focus on “combination products that pair a diagnostic with a device or drug, or both” . This creates a “diagnostic-therapeutic IP nexus,” where IP departments must work closely with R&D to ensure that diagnostic components or methods are integrated into the patent claims for the therapeutic, creating a stronger, more defensible IP position. Detailed and clear patent applications, leveraging collaboration and data, navigating evolving regulatory landscapes, and addressing data protection and privacy are key strategies for success . The ability to generate insights and patterns from vast quantities of patient data, often through computer-implemented methods and AI, may spark more personalized treatments and open new avenues for patentability . This positions data itself as a “new IP frontier,” expanding patent defense to include data management, privacy, and the underlying computational methods.

Digital Therapeutics: Protecting Software-Driven Healthcare

Digital therapeutics (DTx), an emerging field where software programs are used to treat medical conditions, are becoming increasingly patentable. The novelty in these therapies lies in their software-driven approach to treatment, which can often be protected as a medical method, provided it offers a significant therapeutic benefit.

However, patenting DTx presents several unique challenges. Defining the invention can be complex, as DTx often involve a combination of software, hardware, and medical knowledge . Software patents themselves can be difficult to obtain in some jurisdictions, with the USPTO and European Patent Office (EPO) having strict guidelines . The “obviousness trap” is particularly acute for DTx, as many underlying technologies (e.g., mobile apps, wearable devices) are well known . This means the strategic focus for patenting must be on the novel application of these technologies to achieve a specific medical outcome, rather than the technologies themselves. Companies need to demonstrate how their DTx goes beyond mere data collection or general wellness apps to provide a unique and non-obvious therapeutic intervention. Finally, conducting a thorough prior art search is challenging due to the rapidly evolving nature of digital health technology .

To maximize the chances of securing patent protection for DTx innovations, companies should clearly define the invention, focusing on its novel and inventive aspects and detailing algorithms if software is involved . Considering different jurisdictions, conducting thorough prior art searches, and consulting patent professionals with expertise in digital health technology are also crucial . It is paramount to describe the technical effect or contribution of the invention in the patent application to overcome objections related to software patentability or obviousness . This “software-as-a-drug” paradigm necessitates meticulous patenting of the technical effect and therapeutic benefit of the software, requiring close collaboration between software developers, medical experts, and IP lawyers.

The AI Revolution: New Frontiers in Drug Discovery and IP

The rise of artificial intelligence (AI) is arguably the most transformative force impacting pharmaceutical R&D and, consequently, IP strategy . AI’s rapidly expanding role in diagnostics, treatment, and disease analysis makes patents even more critical for safeguarding pharmaceutical innovations . A convincing 66% of IP-industry panelists believe that the use of AI in drug discovery will increase the patenting of drug candidates generated by computer models . AI can significantly reduce the cost, risk, and time taken for drug discovery and development, speeding up the process by narrowing down the pool of candidate substances .

However, the AI revolution introduces profound challenges to the existing patent system:

- The “Inventor Paradox”: A major hurdle is the question of inventorship. Courts worldwide have affirmed that AI systems cannot hold IP rights . This creates an “inventor paradox”: it would be ironic if the dream of purely computational drug discovery were to come to life, but the new drugs it discovers are unpatentable because no human inventor is involved . This issue forces a re-evaluation of patent law’s foundational principles, and it is anticipated that IP laws will need to be amended to address AI advances . The UK Supreme Court, for instance, is currently considering whether AI neural networks are excluded from patentability .

- Data Ownership and Strategic Patenting: With AI’s growing role, 69% of panelists foresee IP challenges related to data ownership . AI also facilitates “strategic patenting,” where companies use AI to hasten turnover and potentially prevent competitors from introducing alternatives . This intensifies the debate over enforced exclusivity and its impact on consumers if AI significantly speeds up drug development .

- Balancing Innovation and Access: The potential for AI to accelerate drug development intensifies the tension between IP protection and affordable access. When asked how to balance these two, only 8% of respondents favored relying solely on traditional patent exclusivity . A significant majority preferred investing in open innovation and public-private partnerships (49%) or leveraging compulsory licensing (46%), highlighting a demand for patent laws that more nimbly address the needs of an AI-driven world . This indicates that AI is a catalyst for “IP policy friction,” pushing for new policy approaches.

Beyond these challenges, AI is also a transformative tool for IP management itself. AI is now “embedded in the DNA of pharma CI” , capable of extracting critical information from vast datasets. AI and machine learning enhance patent analysis, improving search capabilities, semantic analysis, identification of non-obvious connections, trend prediction, and patent classification. Predictive analytics, powered by AI, can estimate the success probability for R&D investments and optimize patent filing strategies. Integrating patent data with other market intelligence provides a holistic view of therapeutic areas and competitive dynamics. This means AI is not just impacting what is patented but how patents are managed, offering enhanced analytics, predictive capabilities, and integrated intelligence for more effective IP strategies. As Dr. Edwin Land, founder of Polaroid, famously stated, “The only thing that keeps us alive is our brilliance. The only way to protect our brilliance is our patents” . In an AI-powered future, the very definition and protection of that “brilliance” will continue to evolve, demanding diligence and adaptability from IP professionals.

Case Studies in Pharmaceutical Patent Defense

Examining real-world patent litigation provides invaluable lessons in the strategic complexities of pharmaceutical IP defense.

Moderna vs. Pfizer & BioNTech: The mRNA Vaccine Battle

The global race for COVID-19 vaccines brought pharmaceutical patent defense into sharp focus, exemplified by the litigation between Moderna and Pfizer & BioNTech. In 2024, a Düsseldorf court in Germany found that Pfizer and BioNTech infringed Moderna’s mRNA patent (EP 949) with their Comirnaty vaccine . Moderna had initiated the lawsuit in August 2022, alleging infringement of two patents (EP 949 and EP 565), though it notably did not seek an injunction to ensure continued vaccine access .

This case highlighted a significant tension: Moderna had initially pledged not to enforce its COVID-19 patents at the pandemic’s outset but later limited this pledge to 92 low- and middle-income countries in March 2022 . The German court upheld EP 949 and rejected Pfizer/BioNTech’s defense based on Moderna’s earlier pledge, with compensation still to be determined . BioNTech plans to appeal, stating the ruling has no immediate impact . However, on the same day as the German ruling, the U.S. patent board invalidated two of Moderna’s mRNA patents, with a related U.S. lawsuit ongoing .

This case vividly illustrates the “global IP chessboard,” where differing outcomes in various jurisdictions underscore the complexities of international IP enforcement and the critical need for multi-jurisdictional patent strategies. It also brings to the forefront the ongoing societal debate about balancing commercial intellectual property rights with public health needs, particularly during global crises. The question of whether companies should “give away their patent on the vaccines for the greater good” or if governments should force compulsory licensing remains a topical and contentious issue .

Centocor vs. Abbott Laboratories: Humira’s Early IP Battle

The 2009 litigation between Centocor (a Johnson & Johnson subsidiary) and Abbott Laboratories concerning the Humira drug patent for autoimmune diseases stands as a landmark case. Centocor was awarded a staggering $1.67 billion, a verdict that powerfully underscored the “enormous stakes involved in pharmaceutical intellectual property” .

This early legal victory for Humira set the stage for one of the most aggressive and comprehensive patent defense strategies in pharmaceutical history. AbbVie, which later spun off from Abbott, subsequently protected Humira with “over 100 patents,” creating a formidable “patent thicket” that successfully delayed biosimilar competition in the U.S. until 2023 . Furthermore, AbbVie employed “evergreening” tactics, such as releasing a citrate-free version of Humira, which extended its patent life by two years and generated billions in additional revenue. While AbbVie was also accused of “pay-for-delay” tactics for Humira, it was found innocent of those specific charges.

Humira’s journey serves as a masterclass in pharmaceutical lifecycle management and strategic patent defense. It exemplifies how companies can evolve their IP strategies from initial core patent protection to complex thickets and evergreening, maximizing exclusivity and revenue over decades. This case study demonstrates how early legal victories can reinforce a company’s commitment to long-term IP protection, shaping a product’s entire market trajectory.

Incyte Corporation v. Sun Pharmaceutical Industries, Inc.: Standing and Development Risks

The recent case of Incyte Corporation v. Sun Pharmaceutical Industries, Inc. (Appeal No. 2023-1300, Fed. Cir. May 7, 2025) provides crucial insights into pharmaceutical patent protections, particularly concerning drugs in development . The case involved a deuterium modification of ruxolitinib, a compound used to treat autoimmune disorders, with the patent at issue specifically treating hair loss disorders like alopecia areata . Sun Pharmaceuticals obtained the ‘659 patent, and Incyte filed a petition for post-grant review (PGR) of this patent at the PTAB .

The PTAB found in favor of Sun, ruling that Incyte failed to prove the patent was unpatentable . Incyte appealed this decision, arguing that its injury stemmed from potential infringement liability due to its development of a topical deuterated ruxolitinib product for treating alopecia areata, providing evidence of its development process . However, the Federal Circuit agreed with Sun, finding no Article III standing because Incyte’s plans were deemed “too speculative” .

Judge Hughes concurred with the panel’s decision but voiced significant concerns about this precedent, noting that the Federal Circuit has disproportionately found a lack of standing in pharmaceutical cases . He argued that requiring substantial investments in drug development before finding standing is “inefficient and contradicts the spirit of Article III standing as setting a minimum threshold to ensure the party initiating suit has a real personal stake in the outcome” . This case highlights a critical “Catch-22” for generic and biosimilar developers: they need to invest significantly to challenge patents, but these investments are often deemed too “speculative” to establish legal standing, thereby creating a barrier to early legal challenge. The judicial interpretation of Article III standing directly impacts the risk profile for generic developers and the strategic leverage of brand companies, influencing when and how challenges can be mounted.

In a related but distinct case, the Federal Circuit dissolved a preliminary injunction that a district court had granted against Sun, which would have prohibited Sun from launching its competing product . The Federal Circuit noted that Incyte’s patent was set to expire in 2026, and its own product launch was still several years away, meaning Sun would have a head start regardless . Consequently, the Federal Circuit held it was clearly erroneous to find irreparable injury under these circumstances and reversed the preliminary injunction . This further emphasizes the nuanced considerations of market timing and competitive advantage in pharmaceutical patent disputes.

Conclusion: The Evolving Nexus of Law, Business, and Innovation

The landscape of pharmaceutical patent defense is undeniably complex, dynamic, and increasingly strategic. It is a domain where legal acumen must converge seamlessly with astute business foresight to ensure sustained innovation, market leadership, and corporate resilience. The journey of intellectual property in pharma has evolved from a historical skepticism towards patenting medicines to a modern recognition of patents as indispensable strategic assets, vital for recouping the billions invested in R&D and driving future breakthroughs.

Proactive patent defense is no longer an option but a necessity. Building an “impenetrable fortress” around pharmaceutical innovations involves a multi-layered approach, extending beyond the core API to encompass formulations, methods of use, and manufacturing processes, thereby creating formidable “patent thickets.” Strategic lifecycle management, including leveraging legitimate regulatory extensions like PTA, PTE, pediatric, and orphan drug exclusivities, is crucial for maximizing market exclusivity. Furthermore, meticulous documentation and a clean patent prosecution history serve as foundational “pre-litigation weapons,” while comprehensive prior art analysis acts as a “strategic compass” for R&D direction and competitive positioning.

The integration of competitive intelligence, particularly through specialized platforms like DrugPatentWatch, has become paramount. These tools function as a “radar system” for the competitive landscape, transforming raw patent data into actionable intelligence that anticipates threats, identifies “white spaces” for innovation, and guides strategic investment decisions.

When reactive defense becomes necessary, navigating the Hatch-Waxman arena requires a sophisticated understanding of Paragraph IV certifications and the critical “30-month stay,” which serves as a vital “strategic time buffer” for brand companies. The rise of Inter Partes Review (IPR) at the PTAB has opened a “strategic alternative front,” demanding robust defense strategies in a faster, less burdensome forum. Litigation itself is a “chess match” of leverage, where proactive defenses, counterclaims, and the judicious use of expert witnesses are employed not just to win, but to achieve the most favorable business outcomes, often through early resolution driven by a clear cost-benefit calculation.

Looking ahead, the pharmaceutical IP landscape is being profoundly reshaped by significant regulatory changes, such as the Inflation Reduction Act (IRA), which is actively steering R&D investment towards biologics due to differential market exclusivity periods. This creates a “market re-shaper” effect, with potential “hidden costs” in stifled small-molecule innovation and reduced post-approval research. Concurrently, emerging technologies like personalized medicine, digital therapeutics, and artificial intelligence present both unprecedented opportunities and complex patenting challenges. Personalized medicine introduces a “diagnostic-therapeutic IP nexus” and positions data as a “new IP frontier,” while digital therapeutics grapple with the “software-as-a-drug” IP challenge and the “obviousness trap.” The AI revolution, while promising to accelerate drug discovery, creates an “inventor paradox” and intensifies “IP policy friction” regarding affordability, pushing for re-evaluation of patent law’s foundational principles.

Ultimately, effective patent defense in the pharmaceutical industry is a continuous, adaptive process that requires a holistic strategic vision. It necessitates seamless collaboration across legal, R&D, commercial, and regulatory functions, underpinned by advanced analytics and a deep understanding of evolving market dynamics and public expectations. For pharmaceutical companies, mastering this strategic art is not merely about protecting assets; it is about ensuring long-term survival, fostering groundbreaking innovation, and delivering life-saving medicines to patients worldwide.

Key Takeaways

- Strategic Imperative: Patent defense has evolved from a purely legal function into a core business strategy, essential for market exclusivity, R&D recoupment, and overall corporate resilience in the pharmaceutical industry.

- Proactive Fortification: Building an “impenetrable fortress” around IP assets involves proactive strategies such as weaving “patent thickets” (multi-layered protection beyond the API), employing lifecycle management tactics like evergreening (within ethical boundaries), maintaining robust documentation and prosecution histories, and conducting thorough prior art analyses.

- Intelligence-Driven Defense: Advanced competitive intelligence, particularly through platforms like DrugPatentWatch, is critical for transforming raw patent data into actionable insights, enabling companies to anticipate threats, identify innovation “white spaces,” and guide strategic investment.

- Navigating Reactive Challenges: Effective reactive defense in the Hatch-Waxman arena demands a sophisticated understanding of Paragraph IV certifications and the critical 30-month stay, alongside robust strategies for Inter Partes Reviews (IPRs) and strategic litigation tactics that leverage expert witnesses and prioritize early, cost-effective resolutions.

- Adapting to Future Trends: The pharmaceutical IP landscape is profoundly shaped by regulatory changes (e.g., the Inflation Reduction Act’s impact on small vs. large molecules) and emerging technologies (personalized medicine, digital therapeutics, and AI). Companies must develop adaptable, forward-thinking IP strategies to navigate these evolving complexities, including challenges related to inventorship for AI-generated discoveries and the patentability of software-driven therapies.

- Balancing Innovation and Access: The inherent tension between incentivizing pharmaceutical innovation through IP protection and ensuring affordable access to medicines remains a central challenge, continuously influencing both corporate strategy and public policy debates.

Frequently Asked Questions (FAQ)

Q1: How has the perception of patent defense in the pharmaceutical industry evolved from being solely a legal issue to a strategic business problem?

A1: Historically, pharmaceutical patents were viewed primarily as legal instruments to protect inventions. However, with the immense and escalating costs of drug R&D (often exceeding $2 billion per drug) and the dramatic revenue drops (80-90%) post-patent expiration, patents have become critical business assets. Patent defense is now seen as a strategic imperative for market exclusivity, recouping investments, and ensuring a company’s long-term survival and competitiveness, particularly in the face of significant events like the “patent cliff” .

Q2: What are “patent thickets,” and why are they considered a crucial proactive defense tactic for pharmaceutical companies?

A2: A “patent thicket” is a multi-layered defense strategy where pharmaceutical companies secure numerous, often overlapping, patents on various aspects of a single drug, extending beyond just the active pharmaceutical ingredient (API). This includes patents on formulations, dosage regimens, methods of use, and manufacturing processes . Patent thickets are crucial because each additional patent creates another legal and economic hurdle for generic challengers, significantly increasing the cost and complexity of litigation and thereby deterring or delaying generic market entry .

Q3: How does the Hatch-Waxman Act influence both brand-name and generic pharmaceutical companies’ patent strategies?

A3: The Hatch-Waxman Act established the ANDA process, allowing generics to gain FDA approval by demonstrating bioequivalence to brand-name drugs. For brand-name companies, the Act provides a critical “30-month stay” of generic FDA approval if they file a patent infringement lawsuit within 45 days of a Paragraph IV certification, buying them crucial time. For generic companies, the Paragraph IV certification is a strategic tool to challenge patents and gain early market entry, often aiming for the valuable “first-to-file” exclusivity . The Act thus creates a structured arena for strategic patent challenges and defenses.

Q4: What are the primary challenges and opportunities presented by Artificial Intelligence (AI) in pharmaceutical patent defense?

A4: AI presents both challenges and opportunities. Opportunities include accelerating drug discovery, identifying new patentable candidates, and enhancing competitive intelligence through advanced analytics and predictive modeling . Challenges arise from the “inventor paradox,” as current patent laws do not recognize AI as an inventor, potentially rendering AI-discovered drugs unpatentable . This also intensifies debates over data ownership and the balance between IP protection and affordable access, pushing for potential amendments to patent laws .

Q5: In what ways can competitive intelligence, particularly through platforms like DrugPatentWatch, provide a strategic advantage in pharmaceutical patent defense?

A5: Competitive intelligence, especially through platforms like DrugPatentWatch, provides a strategic advantage by acting as a “radar system” for the competitive landscape. It offers deep insights into competitor R&D, product pipelines, litigation trends, and patent expiration dates . This intelligence enables companies to anticipate competitive threats, identify “white spaces” for innovation, inform portfolio management decisions, and strategically time market entries or defensive actions, transforming raw patent data into actionable business intelligence .

References

- Pharmaceutical Patents: an overview, accessed July 23, 2025, https://www.alacrita.com/blog/pharmaceutical-patents-an-overview

- The Evolution of Patent Claims in Drug Lifecycle Management …, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/the-evolution-of-patent-claims-in-drug-lifecycle-management/

- Filing Strategies for Maximizing Pharma Patents: A Comprehensive Guide for Business Professionals – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- Patent Laws and Their Impact on Drug Pricing Regulations in the U.S., accessed July 23, 2025, https://patentpc.com/blog/patent-laws-and-their-impact-on-drug-pricing-regulations-in-the-u-s

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed July 23, 2025, https://www.congress.gov/crs-product/R46679

- Dominating the Market: Unveiling the Ultimate Arsenal of Patent Defense Tactics for Every Pharmaceutical Company – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/generic-portfolio-management-partnering-with-brands-and-staying-competitive/

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- Navigating the Patent Cliff: How Big Pharma’s Defensive Strategies Will Shape the Next Decade – AInvest, accessed July 23, 2025, https://www.ainvest.com/news/navigating-patent-cliff-big-pharma-defensive-strategies-shape-decade-2507/

- Biopharma R&D Faces Productivity And Attrition Challenges In 2025 – Clinical Leader, accessed July 23, 2025, https://www.clinicalleader.com/doc/biopharma-r-d-faces-productivity-and-attrition-challenges-in-2025-0001

- Leveraging Drug Patent Data for Strategic Investment Decisions: A …, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/leveraging-drug-patent-data-for-strategic-investment-decisions-a-comprehensive-analysis/

- The Impact of Drug Patent Expiration: Financial Implications …, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Patent Litigation in the Pharmaceutical Industry: Key Considerations, accessed July 23, 2025, https://patentpc.com/blog/patent-litigation-in-the-pharmaceutical-industry-key-considerations

- Unmasking Big Pharma: Patent Manipulation | by Mark Temeres …, accessed July 23, 2025, https://medium.com/@matthew.seremet/unmasking-big-pharma-patent-manipulation-f22defad7f86

- Pharmaceutical Lifecycle Management & Patent Strategy, accessed July 23, 2025, https://www.pharmalawgrp.com/lifecycle-management/

- The Future of Biopharmaceuticals: Patent Trends to Watch – PatentPC, accessed July 23, 2025, https://patentpc.com/blog/the-future-biopharmaceuticals-patents-trends-to-watch

- Top 7 Strategies for Pharmaceutical Defense – McCallum, Hoaglund …, accessed July 23, 2025, https://mhmfirm.com/articles/top-7-strategies-for-pharmaceutical-defense/

- The State of Competitive Intelligence in Pharma: Key Trends for 2025 | Northern Light – Machine learning AI-powered knowledge management, accessed July 23, 2025, https://northernlight.com/competitive-intelligence-in-pharma-key-trends/

- Role of Competitive Intelligence in Pharma and Healthcare Sector – DelveInsight, accessed July 23, 2025, https://www.delveinsight.com/blog/competitive-intelligence-in-healthcare-sector

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 23, 2025, https://crozdesk.com/software/drugpatentwatch

- DrugPatentWatch Pricing, Features, and Reviews (Jul 2025) – Software Suggest, accessed July 23, 2025, https://www.softwaresuggest.com/drugpatentwatch

- IP trends in the pharmaceutical industry | Dennemeyer.com, accessed July 23, 2025, https://www.dennemeyer.com/ip-blog/news/ip-trends-in-the-pharmaceutical-industry/

- Patent Litigation Defense 101: What to Know When You’ve Been Sued for Infringement, accessed July 23, 2025, https://www.venable.com/insights/publications/2025/05/patent-litigation-defense-101-what-to-know-when

- Then, now, and down the road: Trends in pharmaceutical patent …, accessed July 23, 2025, https://www.ftc.gov/enforcement/competition-matters/2019/05/then-now-down-road-trends-pharmaceutical-patent-settlements-after-ftc-v-actavis

- Statistics – USPTO, accessed July 23, 2025, https://www.uspto.gov/patents/ptab/statistics

- 2024 Hatch-Waxman Litigation Trends and Key Federal Circuit Decis, accessed July 23, 2025, https://natlawreview.com/article/2024-hatch-waxman-year-review

- The Impact of the Inflation Reduction Act on Patent Strategies in the …, accessed July 23, 2025, https://www.patlytics.ai/blog/the-impact-of-the-inflation-reduction-act-on-patent-strategies-in-the-biopharmaceutical-industry

- The Inflation Reduction Act Is Negotiating the United States Out of …, accessed July 23, 2025, https://itif.org/publications/2025/02/25/the-inflation-reduction-act-is-negotiating-the-united-states-out-of-drug-innovation/

- NEW DAWN FOR LIFE SCIENCES IP STRATEGY, accessed July 23, 2025, https://www.dechert.com/content/dam/dechert%20files/people/bios/h/katherine-a–helm/IAM-Special-Report-New-Dawn-for-Life-Sciences-IP-Strategy.pdf

- Biopharmaceuticals: The Challenge of Patenting Personalized …, accessed July 23, 2025, https://patentpc.com/blog/challenge-of-patenting-personalized-medicine

- Patenting of Multi-Disciplinary Subject Matter – Personalized Medicine | Oblon Life Science, accessed July 23, 2025, https://www.lifesciencesipblog.com/patenting-of-multidisciplinary-subject-matter-personalized-medicine

- Addressing Patent Challenges in Digital Therapeutics | PatentPC, accessed July 23, 2025, https://patentpc.com/blog/addressing-patent-challenges-in-digital-therapeutics

- Pharmaceutical patents and data exclusivity in an age of AI-driven drug discovery and development | Medicines Law & Policy, accessed July 23, 2025, https://medicineslawandpolicy.org/2025/04/pharmaceutical-patents-and-data-exclusivity-in-an-age-of-ai-driven-drug-discovery-and-development/

- Patent Litigation 2025 | Global Practice Guides – Chambers and Partners, accessed July 23, 2025, https://practiceguides.chambers.com/practice-guides/patent-litigation-2025

- Quotes on Patent Lawyers – Compiled by Homer Blair – IP Mall – University of New Hampshire, accessed July 23, 2025, https://ipmall.law.unh.edu/content/quotes-patent-lawyers-compiled-homer-blair

- Patent Infringement & Case studies – Effectual Services, accessed July 23, 2025, https://www.effectualservices.com/article/patent-infringement-and-case-studies

- Jonas Salk , inventor of the polio vaccine, “Could You Patent The Sun?”, accessed July 23, 2025, https://www.ipeg.com/jonas-salk-inventor-of-the-polio-vaccine-could-you-patent-the-sun/

- Latest Federal Court Cases: Pharmaceutical Patent Protections …, accessed July 23, 2025, https://www.schwabe.com/publication/latest-federal-court-cases-pharmaceutical-patent-protections/