Executive Summary

The Active Pharmaceutical Ingredient (API) is the foundational core of any pharmaceutical product, dictating its therapeutic efficacy, safety profile, and ultimate commercial viability. An optimized API strategy is therefore not a peripheral technical exercise but a central pillar of corporate strategy, essential for navigating the complexities of modern drug development. This report provides a comprehensive framework for architecting and executing a holistic API strategy that aligns scientific innovation with operational resilience and commercial objectives. It addresses the entire API lifecycle, from early-stage development, where decisions about the synthetic route and starting materials create long-term consequences, to late-stage commercialization and the proactive management of the patent cliff.

Key findings underscore a paradigm shift across the industry. First, the escalating molecular complexity of new therapeutic agents is the primary driver compelling a strategic re-evaluation of the entire value chain, impacting manufacturing technology, supply chain design, and regulatory pathways. Second, a myopic focus on “speed-to-clinic” in early development often creates significant “technical debt,” leading to costly delays in later stages that negate initial time savings. Third, in an era of unprecedented global disruption, supply chain resilience—achieved through strategic diversification and robust partner management—has transitioned from a cost center to a critical competitive asset. Finally, the convergence of advanced technologies such as continuous manufacturing, artificial intelligence (AI), and digital twins is creating an interconnected “Industry 4.0” ecosystem, where synergistic integration is essential to unlock full value. This report synthesizes these dynamics into actionable recommendations, providing a roadmap for pharmaceutical companies to build a robust, resilient, and value-driven API strategy that delivers sustained clinical and commercial success.

Section I: The Strategic Core of Pharmaceutical Development: Defining the API Value Proposition

The foundation of any successful pharmaceutical product is its Active Pharmaceutical Ingredient (API). This section establishes the central role of the API, framing it not merely as a chemical component but as the primary determinant of a drug’s clinical efficacy, safety, and commercial value. Every subsequent strategic decision—from manufacturing and sourcing to regulatory engagement and lifecycle management—is predicated on the intrinsic properties and quality of the API.

1.1 The API as the Foundation of Therapeutic Efficacy, Safety, and Commercial Value

An API is the biologically active component within a drug formulation that is responsible for producing the intended therapeutic effect.1 It is, in essence, the “heart and soul” of any medication, directly dictating its ability to treat a specific condition, its safety profile in patients, and, by extension, its commercial success in the marketplace.3 The quality of an API is therefore a foundational prerequisite for the final drug product. Any compromise in its purity, stability, or potency at the molecular level inherently compromises the entire therapeutic asset, creating significant risks to patient health and undermining the product’s value proposition.5

To build a coherent strategy, it is essential to distinguish the API from related but distinct terms. Raw materials are the starting substances used in manufacturing, which undergo chemical transformations to become the API.2

Intermediates are substances produced during the synthesis process before the final API is formed.7

Excipients are chemically inactive substances, such as polymers, plasticizers, or taste-masking agents, that are combined with the API to create the final drug formulation (e.g., a tablet or capsule) and facilitate its delivery in the body.2 For example, in a pain relief tablet, acetaminophen is the API, while the other ingredients that form the tablet are excipients.2 This distinction clarifies that while the entire formulation is critical, the API strategy addresses the core therapeutic agent itself.

1.2 Classifications and Complexities: From Small Molecules to Advanced Biologics

APIs are broadly classified into two main categories: small molecules and biologics.1 Small molecules are compounds with low molecular weight, typically produced through chemical synthesis, that can easily penetrate cells to interact with biological targets.1 Biologics are larger, more complex molecules, such as proteins and antibodies, that are produced using living organisms.1 The landscape is further expanding to include other complex modalities like peptides and oligonucleotides, which are used as therapeutics for illnesses such as diabetes, cancer, and neuromuscular diseases.7

A defining trend in the pharmaceutical industry is the increasing complexity of APIs being developed.4 As scientific understanding of disease pathways deepens, researchers are designing more specific and targeted molecules. This scientific advancement, however, creates significant downstream challenges. These complex APIs often involve longer and more intricate synthetic pathways, present concerns with solubility and permeability, and require highly specialized formulation techniques to ensure bioavailability.4 This trend is especially prominent in cutting-edge therapeutic areas such as oncology, neurodegenerative diseases (e.g., Alzheimer’s), and autoimmune disorders.4 The development and manufacturing of these complex molecules, particularly high-potency APIs (HPAPIs), demand specialized knowledge, advanced containment technologies, and a robust understanding of a constantly evolving regulatory environment, making strategic partnerships and meticulous early-stage planning more critical than ever.4

This growing molecular complexity is not merely a scientific hurdle; it is the central variable that forces a strategic re-evaluation of the entire pharmaceutical value chain. The initial decision to pursue a complex and highly specific molecule sets off a cascade of operational and financial consequences. The intricate chemistry necessitates more advanced and often more expensive manufacturing technologies, such as continuous manufacturing or specialized purification systems.4 The unique properties of the API demand more resilient and specialized supply chains, capable of handling sensitive materials or sourcing rare starting materials.4 Furthermore, the complexity requires more sophisticated and detailed regulatory documentation to justify the manufacturing process and control strategy to health authorities.4 Thus, an effective API strategy cannot be reactive; it must be predictive, anticipating the downstream operational, financial, and regulatory impacts of early-stage molecular design choices.

1.3 The Economic Imperative: How API Strategy Dictates Profitability and Market Competitiveness

Decisions related to the API have profound and far-reaching economic consequences that extend across the entire organization.3 Factors such as the cost of manufacturing, the reliability of the supply chain, the strength and longevity of intellectual property (IP) protection, and ultimately, the product’s profit margin are all directly influenced by the API strategy.3

A well-optimized API strategy serves as a direct lever for enhancing financial performance. By focusing on developing efficient and scalable manufacturing processes, securing a resilient and cost-effective supply chain, and building a robust IP portfolio, companies can achieve significantly reduced production costs, improve profit margins, and strengthen their overall market competitiveness.3 This perspective elevates API strategy from a siloed scientific function to a core business and financial imperative, integral to the long-term success of the company.

Section II: A Lifecycle Approach to API Strategy: From First-in-Human to Post-Exclusivity

An optimal API strategy is not a static plan but a dynamic framework that must evolve in alignment with the drug’s progression through its development lifecycle. The strategic priorities, risk tolerances, and resource allocations for an API in early clinical trials are fundamentally different from those for a product approaching commercial launch or facing generic competition. A “one-size-fits-all” approach is both inefficient and risky; a successful strategy adapts to the distinct goals of each phase.

2.1 Phase I: Early Clinical Development Strategy

The primary objective in early development is to advance a drug candidate to Phase I clinical trials as quickly as possible to establish its safety profile and obtain initial proof-of-concept data.8 This imperative for speed, however, often creates a strategic dilemma, as it can conflict with the long-term need to develop a robust, scalable, and commercially viable manufacturing process.

A critical early decision is the selection of the synthetic route. Choosing a suboptimal or inefficient route simply because it is the fastest path to producing the first few kilograms of API can create significant “technical debt.” Changing this route during late-stage development is exceptionally costly and time-consuming, often requiring extensive comparability studies and, in the worst-case scenario, additional clinical trials to support the change.10 To avoid this pitfall, a forward-looking approach is essential. Frameworks like the “SELECT” principles—evaluating a route based on

Safety, Environmental impact, Legal requirements, Economics, Control, and Throughput—provide a robust methodology for selecting a commercially viable route from the outset.10

Similarly, the selection of API starting materials requires a risk-based approach, as outlined in ICH Q7 guidelines.10 This involves not only defining their chemical properties and impurity profiles but also critically evaluating their security of supply. Overlooking the long-term availability and supply chain resilience of starting materials during the early phases is a common but potentially catastrophic error, as a dependency on a single or unreliable source can derail a program years later.4

The optimal early-stage strategy is therefore not about achieving maximum speed at any cost, but rather about pursuing efficient speed. This involves a phase-appropriate level of development where, while the process is not yet fully optimized, a foundational understanding of critical process parameters (CPPs) and their impact on critical quality attributes (CQAs) is established.9 Early investment in characterizing the API’s physical properties (e.g., salt form, polymorphism) and developing a scalable process can yield substantial downstream dividends, preventing costly failures and delays that would otherwise negate any initial speed advantage.9

2.2 Phase II: Late-Stage Development and Commercialization Strategy

As an API progresses from early-phase trials toward late-stage development and commercialization, the strategic focus must pivot. The emphasis shifts from speed-to-clinic to ensuring process efficiency, robustness, scalability, and deep process knowledge.13 The primary objective becomes finalizing a reproducible and cost-effective commercial manufacturing process that can consistently supply the market for years to come.

A key activity during this phase is de-risking the scale-up process. Chemical and physical processes such as mixing, mass transfer, and heat transfer behave differently in large-scale manufacturing equipment compared to laboratory glassware.11 Identifying and mitigating these scale-dependent challenges is crucial for success. This work is formalized through process validation, a documented program that provides a high degree of assurance that the manufacturing process will consistently produce an API meeting its predetermined specifications and quality attributes.13

Regulatory and safety requirements also intensify during this stage. A deep and thorough understanding of the API’s impurity profile is essential. This involves identifying potential impurities, understanding the mechanisms of their formation, and demonstrating their fate (i.e., whether they are purged or carried through the process).13 This knowledge is used to establish a robust control strategy, which includes developing and validating analytical methods to monitor and control impurities within safe, acceptable limits as defined by guidelines like ICH Q3A.13 All of this development work culminates in the preparation of the Chemistry, Manufacturing, and Controls (CMC) section of the New Drug Application (NDA). This comprehensive dossier meticulously documents the entire manufacturing process, control strategy, analytical methods, specifications, and stability data, providing the evidence necessary to assure regulatory authorities like the FDA and EMA that the process is well-understood and capable of consistently producing a high-quality product.13

2.3 Phase III: Post-Patent Exclusivity and Generic Competition

The final phase of the API lifecycle is defined by the loss of market exclusivity (LOE), an event often referred to as the “patent cliff.” Proactive planning for this phase, known as Lifecycle Management (LCM), must begin years before the patent expires to mitigate the rapid and severe revenue erosion—often up to 90%—that follows the entry of generic competitors.18 The goal of LCM is to maximize the value of the asset for as long as possible by creating new sources of revenue and defending market share.

Innovation-driven strategies are a cornerstone of effective LCM. These involve creating new, patent-protected versions of the product to which patients and prescribers can be switched before the original patent expires. Key approaches include:

- Reformulation: Developing new formulations, such as extended-release versions, or new delivery systems, like transdermal patches or inhalers, that offer improved patient convenience, compliance, or an enhanced safety profile.19

- New Indications and Combination Products: Gaining regulatory approval for the drug to be used in new therapeutic areas or in combination with other APIs. This not only extends market exclusivity but also opens up entirely new patient populations and revenue streams.18

Alongside R&D-based approaches, companies deploy a range of commercial and market access strategies to defend against generic erosion. Launching an authorized generic—a company-owned generic version of the branded drug—allows the originator to compete directly on price while retaining a portion of the market share that would otherwise be lost.21 Sophisticated

strategic pricing and rebate models are also implemented to maintain favorable formulary placement with payers and leverage brand loyalty.21 A more aggressive, and often controversial, strategy is

“evergreening,” which involves filing numerous patents on minor modifications to the drug, such as new polymorphs, metabolites, or manufacturing processes. This creates a dense “patent thicket” that can be difficult and costly for generic manufacturers to challenge, thereby delaying their market entry.20

To facilitate strategic planning, the following matrix outlines key LCM strategies and their associated characteristics.

| LCM Strategy | Primary Goal | Typical Timeline (Years) | Relative Investment | Potential ROI | Key Risks & Considerations | |

| Reformulation | Improve compliance, patient preference, new patent | 2–4 | Medium | High | Clinical and regulatory risk; market acceptance of new form. | |

| New Indication | Increase patient population, new revenue stream | 3–7 | High | Very High | High clinical trial failure risk; long development timeline. | |

| Combination Product | Enhance efficacy, simplify regimen, new patent | 4–8 | High | Very High | Complexity of co-development; regulatory hurdles for combinations. | |

| Authorized Generic | Retain market share, compete on price | <1 | Low | Medium | Can cannibalize brand sales; requires separate distribution strategy. | |

| Strategic Pricing/Rebates | Maintain formulary access, defend brand volume | Ongoing | Low-Medium | Medium-High | Payer pushback; potential for price erosion. | |

| “Evergreening” / Patent Thicket | Delay generic entry, extend market exclusivity | Ongoing | Medium-High | High | High legal costs; risk of patent invalidation; reputational risk. | |

| (Data synthesized from 18) |

Section III: Architecting the API Value Chain: Manufacturing and Sourcing

This section addresses the operational core of API strategy: the critical decisions surrounding how and where an API is manufactured and how its foundational materials are procured. It details the strategic “make vs. buy” analysis and provides a framework for constructing a supply chain that is not merely cost-effective but is fundamentally resilient to the shocks and disruptions of a volatile global landscape.

3.1 The Critical “Make vs. Buy” Decision

One of the most fundamental decisions in an API strategy is whether to manufacture the API in-house (“make”) or to outsource its development and production to a Contract Development and Manufacturing Organization (CDMO) (“buy”).23 This is not simply a procurement choice but a strategic inflection point with long-term consequences for a company’s financial structure, operational control, and strategic flexibility.

In-house manufacturing offers the primary advantages of greater control over manufacturing processes, timelines, and quality assurance.23 It also provides robust protection for sensitive intellectual property (IP) and proprietary process know-how, which is particularly crucial for innovative or complex APIs.23 Over the long term, especially for companies with a platform of multiple products, in-house capabilities can become more cost-effective.23 However, this path requires significant upfront capital investment in facilities, equipment, and a skilled workforce, and it can limit a company’s ability to scale production up or down without further substantial investment.25

Outsourcing to a CDMO, conversely, provides significant cost and time efficiencies by allowing a company to avoid massive capital expenditures and leverage the partner’s existing infrastructure and expertise.23 This model offers greater scalability and flexibility to meet fluctuating market demands and can reduce the burden of navigating complex regulatory landscapes, as experienced CDMOs possess deep expertise in this area.23 The primary disadvantages are a loss of direct control over the manufacturing process, potential risks to quality if the partnership is not managed diligently, and, most critically, the exposure of sensitive IP and confidential information to a third party.25

The increasing volatility of the global supply chain has revealed the inherent risks in relying on a single point of failure, whether internal or external. A purely “make” strategy is vulnerable if the company’s own facility is disrupted, while a purely “buy” strategy creates a critical dependency on a single external partner. This has led to the emergence of a hybrid approach as the most resilient model.23 In this strategy, a company might retain internal capabilities for critical early-stage development or proprietary process steps while partnering with a CDMO for large-scale commercial manufacturing or to serve as a qualified secondary site. This blended approach balances control with flexibility and cost, building in a layer of redundancy that is no longer seen as a mere expense but as a tangible strategic asset.

3.2 A Cost-Benefit Framework for the Make vs. Buy Decision

The “make vs. buy” decision requires a comprehensive cost-benefit analysis (CBA) that extends beyond a simple comparison of unit production costs.29 A robust evaluation must weigh a range of quantitative and qualitative factors to align the decision with the company’s long-term strategic goals. The following matrix provides a structured framework for this analysis.

| Decision Factor | In-House Manufacturing (Make) | Outsourcing to CDMO (Buy) | |

| Capital Investment | High: Requires significant upfront investment in facilities, equipment, and personnel. | Low: Avoids major capital expenditures; costs are operational (OPEX) rather than capital (CAPEX). | |

| Operational Control | High: Direct control over production schedules, quality systems, and process changes. | Low: Relinquishes direct control; dependent on partner’s systems and priorities. Requires strong project management and oversight. | |

| IP & Confidentiality Risk | Low: Proprietary processes and know-how are kept in-house, minimizing risk of exposure. | High: Requires sharing sensitive IP with a third party. Mitigation depends on robust contracts and partner trustworthiness. | |

| Scalability & Flexibility | Low-Medium: Scaling up or down requires significant time and investment. Less flexible for fluctuating demand. | High: CDMOs offer access to varied scales and can more easily adapt to changes in demand. | |

| Access to Expertise | Variable: Requires hiring and retaining specialized talent, which can be challenging and costly. | High: Immediate access to a CDMO’s specialized expertise, advanced technologies, and regulatory experience. | |

| Speed-to-Market | Potentially Slower: Time required to build and validate facilities can delay initial clinical supply. | Potentially Faster: Leverages existing CDMO infrastructure to accelerate development and manufacturing timelines. | |

| Long-Term COGS | Potentially Lower: Can be more cost-effective at scale, especially with a multi-product platform, as there is no external profit margin. | Potentially Higher: Includes the CDMO’s manufacturing costs, overhead, and profit margin. | |

| (Data synthesized from 23) |

3.3 Qualifying and Managing CDMO Partnerships

Selecting the right CDMO is paramount to the success of an outsourced API strategy. This decision necessitates a rigorous and systematic due diligence process to ensure the chosen partner aligns with the project’s technical, quality, and commercial requirements. The process should begin with a broad survey of the CDMO landscape, followed by a detailed questionnaire to create a shortlist of candidates, and finally, a formal Request for Proposal (RFP) to compare detailed project plans and costs.24 The following scorecard outlines the critical criteria for this evaluation.

| Category | Evaluation Criteria | Key Considerations | |

| Technical & Manufacturing Capabilities | – Experience with specific API type (e.g., small molecule, HPAPI, biologic) – Appropriate scale of equipment (lab, pilot, commercial) – Access to advanced technologies (e.g., continuous manufacturing, biocatalysis) – Analytical development and validation capabilities | Does the CDMO have a proven track record with molecules and processes similar to yours? Can they support your project from clinical development through to commercial launch? 33 | |

| Quality Management System (QMS) | – Adherence to cGMP standards – Robust systems for deviation, CAPA, and change control – Data integrity policies and practices (e.g., 21 CFR Part 11 compliance) – Strong Quality Unit with independent authority | Is there a palpable “culture of quality” driven by senior leadership? Are their quality systems well-documented, mature, and consistently followed? 35 | |

| Regulatory Track Record | – Successful inspection history with major agencies (FDA, EMA) – Experience with regulatory submissions (e.g., DMFs, CMC sections) – No outstanding or recent warning letters – Knowledge of global regulatory requirements | Can the CDMO support your target markets? Do they have a history of timely and successful regulatory approvals? 34 | |

| Project Management & Communication | – Dedicated and experienced project manager – Clear, transparent, and regular communication protocols – Proactive problem-solving and risk management approach – Responsiveness and accessibility of the project team | Is communication effective during the RFP process? Do they treat your project as a priority, regardless of your company’s size? 38 | |

| Supply Chain & Financial Stability | – Robust raw material sourcing and supplier qualification program – Financial health and long-term viability – Capacity to meet current and future demand – Business continuity and disaster recovery plans | Is the CDMO financially stable enough to be a long-term partner? How do they manage their own supply chain risks? 33 | |

| Cultural Fit | – Alignment with your company’s values and work style – Collaborative and partnership-oriented mindset – Transparency in pricing and business practices | Is this a transactional vendor or a strategic partner? Does their approach to collaboration align with your team’s expectations? 38 | |

| (Data synthesized from 33) |

The relationship with a CDMO does not end upon selection. It requires continuous and active management. This is formalized through a Quality Agreement that clearly defines the roles, responsibilities, and expectations of both parties.34 Ongoing oversight is maintained through a combination of regular performance monitoring against key performance indicators (KPIs) and a risk-based schedule of audits to ensure sustained compliance and quality.42

3.4 Building a Resilient and Secure Supply Chain

Recent global events, including the COVID-19 pandemic and geopolitical tensions, have starkly exposed the vulnerabilities of lean, globally concentrated pharmaceutical supply chains.46 This has catalyzed a fundamental shift in strategic thinking, elevating supply chain resilience from a secondary concern to a primary strategic imperative.48 The industry is moving away from a pure “just-in-time” inventory model towards a more robust “just-in-case” approach that prioritizes security of supply.49

This resilience begins with the strategic sourcing of Key Starting Materials (KSMs) and other raw materials, as their quality and availability are foundational to the entire API manufacturing process.50 A sourcing strategy must carefully balance quality, cost, and, critically, security of supply.51 This requires a robust supplier qualification program, similar in rigor to that used for CDMOs, to vet and approve all critical material suppliers.52

To mitigate the risks of disruption, companies are increasingly adopting diversification strategies:

- Dual- and Multi-Sourcing: The practice of engaging two or more independent, qualified suppliers for critical materials is a cornerstone of modern risk management.53 This redundancy ensures that if one supplier fails due to quality issues, natural disasters, or political instability, an alternative source is already validated and available, ensuring continuity of production. This approach is now actively encouraged by regulatory bodies like the FDA as a means to prevent drug shortages.54

- Geographic Diversification: A significant vulnerability in the current supply chain is its heavy geographic concentration, with a majority of global APIs and KSMs being produced in China and India.50 To mitigate the risks associated with this over-reliance, companies are actively exploring geographic diversification, including nearshoring (moving production to nearby countries) and onshoring (reshoring production domestically) initiatives.49

These diversification tactics are complemented by building strategic partnerships with key suppliers. Moving beyond a transactional relationship to a long-term, transparent partnership fosters the trust and open communication needed for proactive risk management and collaborative problem-solving.59 This is supported by

advanced inventory management strategies, such as maintaining calculated safety stocks of critical materials and leveraging data analytics for more accurate demand forecasting, which together create a buffer against unforeseen supply disruptions.62

Section IV: The Technology Frontier: Driving Competitive Advantage through Innovation

The adoption of cutting-edge technologies is no longer a matter of choice but a strategic necessity for competing in the modern pharmaceutical landscape. These innovations are revolutionizing every aspect of API development and manufacturing, offering powerful new levers to enhance efficiency, improve quality, reduce costs, and promote sustainability. A successful technology strategy involves not just adopting individual tools, but building an integrated “Industry 4.0” ecosystem where these technologies work in synergy.

4.1 Process Optimization and Cost Reduction

A primary driver for technology adoption is the relentless pressure to optimize manufacturing processes and reduce the cost of goods sold (COGS).

- Continuous Manufacturing (CM) and Process Intensification (PI): This represents a paradigm shift from traditional, slow, and often inefficient batch processing.65 In CM, materials flow continuously through a compact, integrated system, enabling better process control, more consistent product quality, reduced waste, and a significantly smaller facility footprint.50 The modular nature of CM equipment also provides greater agility, allowing manufacturing lines to be reconfigured for new products more quickly.66 PI techniques, such as using flow chemistry in microreactors, push this further by enabling reactions under conditions (e.g., high pressure or temperature) that would be unsafe or inefficient in large batch reactors, often leading to dramatically higher yields and simpler purification processes.68

- Green Chemistry and Sustainability: Driven by both regulatory pressure and a desire for efficiency, green chemistry principles are becoming central to API process development.71 This strategic approach focuses on designing chemical processes that minimize waste, reduce energy consumption, and eliminate the use of hazardous substances.72 Key strategies include using safer, renewable solvents, recycling expensive catalysts, and designing synthetic routes with high “atom economy” to reduce byproducts.74 Adopting these principles not only mitigates environmental impact but also delivers significant economic benefits by lowering operational costs associated with raw materials, energy, and waste disposal, thereby improving the overall Process Mass Intensity (PMI) of a manufacturing process.71

- Mastering Cost of Goods Sold (COGS): For commercial APIs, effective management of COGS—which includes direct costs like raw materials and labor, plus manufacturing overhead—is vital for profitability.77 Rigorously tracking COGS allows companies to inform pricing strategies, identify process inefficiencies, and make data-driven financial decisions.79 Technologies like CM and green chemistry are powerful tools for directly reducing the core components of COGS, leading to improved margins and market competitiveness.81

4.2 Digital Transformation of the API Value Chain

The digital revolution is profoundly reshaping the API value chain, integrating data and intelligence into every step of the process.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are accelerating API development from its earliest stages. In R&D, AI algorithms can analyze vast datasets to perform predictive route scouting, suggest optimal reaction conditions, and even design novel molecules, significantly reducing development timelines and costs.3 In the manufacturing plant, ML models enable predictive maintenance of equipment to prevent costly downtime, optimize complex processes in real-time to maximize yield and quality, and use image recognition to detect defects or contamination on the production line.85

- Data Analytics and Blockchain for Supply Chain Visibility: In an increasingly complex global supply chain, visibility is key to resilience. Advanced data analytics platforms provide end-to-end transparency, enabling more accurate demand forecasting, optimized inventory management, and proactive identification of potential disruptions.87 Layered on top of this, blockchain technology offers a secure and immutable ledger for tracking materials and transactions. This enhances traceability, helps combat the scourge of counterfeit drugs, and ensures the integrity of the supply chain from the KSM supplier to the final patient.50

- The Future of Manufacturing: 3D Printing and Digital Twins:

- 3D Printing: While still an emerging technology in this space, 3D printing (or additive manufacturing) holds the revolutionary potential for on-demand, decentralized manufacturing of both APIs and personalized drug products. This could transform the supply of medicines for rare diseases, enable patient-specific dosing in clinical settings, and allow for rapid production in remote or emergency situations.3

- Digital Twins: A digital twin is a dynamic, virtual replica of a physical manufacturing process, continuously updated with real-time data from Internet of Things (IoT) sensors.95 This technology allows companies to simulate, test, and optimize processes

in silico (on a computer) before implementing them in the real world. Digital twins can be used to predict the impact of process changes, train operators, and enable predictive maintenance, all without consuming expensive raw materials or risking a physical production batch. This dramatically reduces development costs, accelerates time-to-market, and enhances quality control.50

The full potential of these technologies is realized not when they are implemented in isolation, but when they are integrated into a cohesive system. For example, a Continuous Manufacturing process generates a massive, high-velocity stream of data that is perfectly suited for real-time analysis by AI and ML algorithms. These algorithms can then develop optimized control strategies, which can be safely tested and refined on a Digital Twin before being deployed on the physical CM line. The predictable output from this intelligent manufacturing system then feeds into advanced analytics platforms that optimize the entire supply chain. This synergy creates a value far greater than the sum of the individual parts, paving the way for a truly optimized, agile, and intelligent pharmaceutical manufacturing ecosystem.

Section V: Navigating the Global Regulatory and Intellectual Property Maze

Regulatory compliance and intellectual property (IP) management are two critical, and often intertwined, pillars of a successful API strategy. These domains should not be viewed as mere hurdles to be cleared at the end of the development process, but rather as strategic assets that must be leveraged and integrated from the very beginning. A proactive and sophisticated approach to both regulatory affairs and IP is essential for ensuring market access, defending competitive advantage, and maximizing the long-term value of a pharmaceutical asset.

5.1 Integrating Regulatory Strategy from Day One

An effective regulatory strategy is not a late-stage checklist but a forward-looking plan designed to guide a product’s development toward successful approval in all desired global markets.101 This strategy must be woven into the overall product lifecycle plan from the earliest stages to optimize value, mitigate risk, and ensure compliance at every key milestone.102

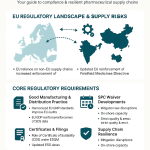

The bedrock of API manufacturing compliance is adherence to Good Manufacturing Practices (GMP).1 The global standard for this is set by the International Council for Harmonisation (ICH) guideline

ICH Q7: Good Manufacturing Practice for Active Pharmaceutical Ingredients.105 This comprehensive guideline covers all aspects of API production, from quality management systems and personnel to facilities, equipment, documentation, and material controls.105 Adherence to ICH Q7 is a fundamental expectation of major regulatory agencies, including the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), and forms the basis of their inspections and application reviews.104

A key tactical instrument in regulatory strategy is the Drug Master File (DMF). A DMF is a confidential submission made to a regulatory authority, such as the FDA, that contains complete, proprietary details about the Chemistry, Manufacturing, and Controls (CMC) of an API.103 Its primary purpose is to allow an API manufacturer to protect its trade secrets and intellectual property while simultaneously providing the necessary information for a regulatory agency to review a drug product sponsor’s application (e.g., an NDA or ANDA).110 The drug product applicant references the DMF in their submission via a Letter of Authorization, but never sees the confidential contents. Understanding the different types of DMFs (a Type II DMF is used for APIs) and the electronic submission process is a critical component of a modern API strategy.109

For innovative medicines, particularly those targeting unmet medical needs, early and continuous engagement with health authorities is crucial. Programs like the EMA’s PRIority MEdicines (PRIME) scheme and the FDA’s Breakthrough Therapy designation are specifically designed to facilitate this dialogue.112 Proactively seeking scientific advice and discussing development plans with regulators can help validate novel approaches, address potential hurdles before they become major roadblocks, and ultimately streamline the path to approval.112

5.2 Intellectual Property as a Core Strategic Asset

Intellectual property, primarily in the form of patents, is the lifeblood of the innovative pharmaceutical industry. A robust IP strategy is essential for protecting the significant investment required for drug development and securing the period of market exclusivity needed to generate a return on that investment.

A sophisticated IP strategy extends far beyond simply patenting the API’s chemical structure. The most effective approach is to create a multi-layered patent portfolio, often referred to as a “patent thicket.” This involves securing patents on various aspects of the invention, including novel manufacturing processes, specific crystalline forms (polymorphs), unique formulations, and new methods of using the drug to treat different diseases.3 This comprehensive strategy provides multiple layers of defense against competitors and is a key tool for extending a product’s commercial life as part of a broader lifecycle management plan.3

Furthermore, patent data itself is a powerful strategic tool. Leveraging patent intelligence through specialized databases and analytics platforms allows companies to monitor the competitive landscape, identify “white space” opportunities in therapeutic areas with limited patent activity, and strategically plan for generic market entry by closely tracking the expiration dates of key patents.18

When manufacturing is outsourced to a CDMO, safeguarding IP and trade secrets becomes a paramount concern.25 This requires a multi-pronged risk mitigation strategy that includes:

- Thorough Due Diligence: Carefully vetting a potential partner’s reputation, security protocols, and history of handling confidential information.119

- Robust Legal Agreements: Crafting comprehensive contracts that include strong Non-Disclosure Agreements (NDAs) and clauses that explicitly define the ownership and usage rights for all IP generated during the project.119

- Operational Security Measures: Implementing both digital and physical security protocols, such as data encryption, secure communication channels, and limiting access to only necessary sensitive information, servers, and data, to minimize the risk of theft or inadvertent disclosure.120

A fundamental tension exists in modern drug development between the push for greater supply chain transparency—demanded by regulators for safety and by companies for risk management—and the imperative to maintain the confidentiality of proprietary intellectual property. The strategic use of regulatory tools, particularly the DMF, is the primary mechanism for resolving this conflict. The DMF allows an API manufacturer to provide regulators with the detailed process information they require for review, without disclosing that same sensitive information to their commercial partners or the public. This enables a form of “controlled transparency,” satisfying regulatory and safety requirements while fiercely protecting the core IP that underpins competitive advantage. An optimized API strategy, therefore, does not view transparency and confidentiality as mutually exclusive goals, but rather leverages regulatory instruments to achieve both simultaneously.

Section VI: Synthesis and Strategic Recommendations

The preceding sections have detailed the multifaceted nature of a modern pharmaceutical API strategy, spanning the entire product lifecycle and integrating scientific, operational, technological, and regulatory considerations. This concluding section synthesizes these key themes into an integrated, actionable framework. It provides targeted recommendations for key stakeholders and offers a forward-looking perspective on the emerging challenges and opportunities that will shape the future of API development.

6.1 An Integrated Model for Holistic API Strategy Management

An optimized API strategy cannot be managed effectively in functional silos. Success requires the strategic integration of four key pillars: Lifecycle Planning, Manufacturing & Sourcing, Technology & Innovation, and Regulatory & IP. Decisions made in one area have direct and significant consequences for the others. For example, an early lifecycle decision to pursue a complex molecule immediately impacts the manufacturing technology required, the sourcing of specialized materials, the complexity of the regulatory filing, and the scope of the IP portfolio.

To manage these interdependencies, a cross-functional governance team is essential. This team should be comprised of senior representatives from R&D, CMC, supply chain, regulatory affairs, legal, and commercial departments.3 Its mandate is to provide holistic oversight, ensure strategic alignment across all functions, and make integrated decisions that optimize the value of the API asset over its entire lifecycle. This integrated model shifts the organizational mindset from a linear, sequential process to a dynamic, interconnected system where all functions collaborate to achieve a common set of strategic objectives.

6.2 Actionable Recommendations for Key Stakeholders

To translate this integrated model into practice, different functional leaders must champion specific strategic priorities:

- For R&D Leadership:

- Prioritize “Developability”: In early-stage candidate selection, “developability”—the ease and feasibility of manufacturing and formulating a molecule—should be weighed alongside its therapeutic potential. A brilliant molecule that cannot be manufactured efficiently or formulated effectively is a commercial failure.

- Invest in Early Process Research: Allocate resources for early-stage process research and route scouting to build a solid foundation for scalability and commercial viability, thereby avoiding the accumulation of costly “technical debt.”

- For CMC & Manufacturing Teams:

- Adopt a Quality by Design (QbD) Mindset: Embed QbD principles from the very beginning of development to build a deep understanding of the process and ensure quality is inherent, not just tested for at the end.3

- Champion Technology Adoption: Lead the evaluation and implementation of process intensification, continuous manufacturing, and digital technologies to drive step-changes in efficiency, quality, and cost-effectiveness.

- Develop a Dynamic Sourcing Strategy: Continuously evaluate the “make vs. buy” decision on a portfolio-wide basis, employing hybrid models to balance cost, control, and resilience.

- For Supply Chain & Procurement Leaders:

- Shift Focus from Cost to Resilience: Move beyond pure cost-minimization and adopt a “total cost of ownership” framework that values supply chain resilience as a key performance metric.

- Proactively Map and Diversify: Conduct end-to-end mapping of the supply chain to identify vulnerabilities. Aggressively pursue dual-sourcing and geographic diversification for all critical materials.

- Build Strategic Partnerships: Cultivate long-term, transparent relationships with key suppliers and CDMOs, treating them as strategic partners in a shared enterprise.

- For Regulatory & Legal Teams:

- Embed Strategy from Day One: Integrate regulatory and IP strategy into the earliest stages of the development plan, not as an afterthought.

- Engage Authorities Proactively: Foster an open and continuous dialogue with health authorities, especially for novel or expedited products, to align on development plans and de-risk the regulatory pathway.

- Build a Multi-Layered IP Portfolio: Work closely with R&D to construct a robust, multi-layered patent portfolio that protects not only the molecule but also its manufacturing processes, formulations, and methods of use to support long-term lifecycle management.

6.3 Future Outlook: Anticipating the Next Wave of Challenges and Opportunities

The landscape of pharmaceutical development is in constant flux. An effective API strategy must not only address today’s challenges but also anticipate the trends that will define tomorrow’s competitive environment.

- The Rise of Personalized Medicine: The industry-wide shift towards personalized and precision medicine will drive demand for more flexible, agile, and small-batch API manufacturing capabilities. This will accelerate the adoption of technologies like modular continuous manufacturing platforms and 3D printing, which are uniquely suited for producing customized therapeutics for smaller patient populations.3

- Sustainability as a Core Mandate: Environmental, Social, and Governance (ESG) considerations are rapidly moving from a corporate social responsibility initiative to a core business and regulatory mandate. This will intensify the pressure to adopt green chemistry principles and circular economy models in API manufacturing, making sustainability a key criterion in process design and partner selection.51

- Data as the Ultimate Differentiator: In an increasingly complex and competitive global market, the ability to effectively harness data will become the single greatest source of competitive advantage. Companies that successfully integrate AI, advanced analytics, and digital platforms across their entire API value chain—from predictive drug discovery to intelligent manufacturing and resilient supply chains—will be the ones to lead the next generation of pharmaceutical innovation.86

Works cited

- Enhancing Drug Development: A Comprehensive Guide to API Manufacturing – SEQENS, accessed August 1, 2025, https://www.seqens.com/knowledge-center/enhancing-drug-development-comprehensive-guide/

- Active Pharmaceutical Ingredients (APIs) and Drug Development | Blog – Biosynth, accessed August 1, 2025, https://www.biosynth.com/blog/active-pharmaceutical-ingredients-apis-and-drug-development

- Optimizing your API strategy to deliver desired results – DrugPatentWatch, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/optimizing-api-strategy-deliver-desired-results/

- Mastering Complex API and Formulations – Patheon pharma services, accessed August 1, 2025, https://www.patheon.com/us/en/insights-resources/blog/mastering-complex-api-and-formulations.html

- How to Find a Reputable Active Pharmaceutical Ingredient (API) Supplier: A Comprehensive Guide – DrugPatentWatch, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/how-to-find-a-reputable-api-supplier/

- Maintaining quality and compliance in API manufacturing – Sterling Pharma Solutions, accessed August 1, 2025, https://www.sterlingpharmasolutions.com/knowledge-hub/api-manufacturing/maintaining-quality-and-compliance-in-api-manufacturing/

- What Are APIs in Pharmaceutical Manufacturing? – Bachem, accessed August 1, 2025, https://www.bachem.com/articles/blog/what-are-apis-in-pharmaceutical-manufacturing/

- Early Phase API Development – TBD Pharmatech, accessed August 1, 2025, https://tbdpharmatech.com/services/clinical-phase-api-development/

- Simplifying Your APIs Development Journey – Patheon pharma …, accessed August 1, 2025, https://www.patheon.com/us/en/insights-resources/blog/simplifying-your-apis-development-journey.html

- Key Considerations for API Process Development and Optimization – Evotec, accessed August 1, 2025, https://www.evotec.com/sciencepool/key-considerations-for-api-process-development-and-optimization

- Scaling Up Pharma API | AbbVie CMO, accessed August 1, 2025, https://www.abbviecontractmfg.com/news-and-insights/fun-science-friday/scaling-up-down-pharma-api.html

- Critical API Attributes and the Major Impact They Can Have on Drug Product Development, accessed August 1, 2025, https://www.patheon.com/us/en/insights-resources/whitepapers/critical-api-attributes-and-the-major-impact-they-can-have-on-drug-product-development.html

- Late Phase API Development and Manufacture – Almac, accessed August 1, 2025, https://www.almacgroup.com/api-chemical-development/late-phase-api-development-and-manufacture/

- 5 Common Challenges in Scaling Up an API – Neuland Labs, accessed August 1, 2025, https://www.neulandlabs.com/en/insights/stories/5-common-challenges-scaling-api

- API Drug Development Services | SK pharmteco, accessed August 1, 2025, https://www.skpharmteco.com/small-molecule/api-drug-substance-development/

- API Manufacturing: Laboratory Testing’s Essential Role in Ensuring Quality and Compliance, accessed August 1, 2025, https://contractlaboratory.com/api-manufacturing-laboratory-testings-essential-role-in-ensuring-quality-and-compliance/

- Top 10 late phase considerations – Sterling Pharma Solutions, accessed August 1, 2025, https://www.sterlingpharmasolutions.com/knowledge-hub/api-manufacturing/top-10-late-phase-considerations/

- The Art of the Second Act: A Six-Step Framework for Mastering Late-Stage Drug Lifecycle Management – DrugPatentWatch, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/6-steps-to-effective-late-stage-lifecycle-drug-management/

- Top Strategies for Pharma Profitability after Drug Patents Expire …, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/top-strategies-for-pharma-profitability-after-drug-patents-expire/

- Pharmaceutical Lifecycle Management – Torrey Pines Law Group, accessed August 1, 2025, https://torreypineslaw.com/pharmaceutical-lifecycle-management.html

- How to own a Market you Don’t Own: Market Access Strategies Post …, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/how-to-own-a-market-you-dont-own-market-access-strategies-post-patent-expiration/

- Regulatory Strategies for API going off-patent, accessed August 1, 2025, https://www.ijdra.com/index.php/journal/article/download/377/191

- Comparing In-house Vs Outsourced Manufacturing Strategies For …, accessed August 1, 2025, https://www.cellandgene.com/doc/comparing-in-house-vs-outsourced-manufacturing-strategies-for-cgts-0001

- CDMO Selection 7 Steps To Find Your Best Fit – Outsourced Pharma, accessed August 1, 2025, https://www.outsourcedpharma.com/doc/cdmo-selection-steps-to-find-your-best-fit-0001

- Outsourcing vs In-House Manufacturing of Your Products – Inventory Source, accessed August 1, 2025, https://www.inventorysource.com/outsourcing-vs-in-house-manufacturing-of-your-products/

- In-house vs. Outsourcing Ecommerce Production – Gelato, accessed August 1, 2025, https://www.gelato.com/blog/in-house-production-vs-outsourcing

- Top Reasons to Outsource Your Pharma API Manufacturing …, accessed August 1, 2025, https://www.valencelabs.co/2024/11/23/top-reasons-to-outsource-your-pharma-api-manufacturing/

- Biotech Industry and Strategic Decisions: In-house vs. Outsourcing in the – Vanguard X, accessed August 1, 2025, https://vanguard-x.com/outsourcing/strategic-decisions-in-house-vs-outsourcing-in-the-biotech-industry/

- Make or Buy Analysis: A Key Decision-Making Tool in Project …, accessed August 1, 2025, https://www.4pmti.com/learn/make-buy-analysis/

- Make or Buy Analysis: A Comprehensive Guide for Manufacturers – CADDi, accessed August 1, 2025, https://us.caddi.com/resources/insights/make-or-buy-analysis

- Reviewing the pros and cons of in-house API manufacturing versus contracting the process out – ResearchGate, accessed August 1, 2025, https://www.researchgate.net/publication/296320553_Reviewing_the_pros_and_cons_of_in-house_API_manufacturing_versus_contracting_the_process_out

- Make-or-buy analysis in a chemical & pharmaceutical company, accessed August 1, 2025, https://inverto.com/en/clients/make-or-buy-in-the-pharmaceutical-industry/

- 10 Key Factors to Consider Before Selecting an API Manufacturer, accessed August 1, 2025, https://pyglifesciences.com/10-key-factors-to-consider-before-selecting-an-api-manufacturer/

- A guide to successful CDMO collaborations – DrugPatentWatch, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/cdmo-vendor-management-best-practices/

- Robust QA And QC For Quality Management Systems – Pharmaron, accessed August 1, 2025, https://www.pharmaron.com/services/biologics-cgt/biologics-cdmo/quality/

- Building A CDMO Quality Management System – LGM Pharma, accessed August 1, 2025, https://lgmpharma.com/blog/building-a-cdmo-quality-management-system/

- Top 6 Questions to Ask When Evaluating a Biologics CDMO – Scorpius BioManufacturing, accessed August 1, 2025, https://www.scorpiusbiologics.com/blogs/top-6-questions-to-ask-when-evaluating-a-biologics-cdmo

- Key considerations when choosing a CDMO for your project, accessed August 1, 2025, https://www.news-medical.net/whitepaper/20250312/Key-considerations-when-choosing-a-CDMO-for-your-project.aspx

- Journey of an API: Pharmaceutical project management – Sterling Pharma Solutions, accessed August 1, 2025, https://www.sterlingpharmasolutions.com/knowledge-hub/api-manufacturing/journey-of-an-api-pharmaceutical-project-management/

- How to Choose the Right CDMO Partner: Key Factors to Consider – Bachem, accessed August 1, 2025, https://www.bachem.com/articles/blog/how-to-choose-the-right-cdmo-partner-key-factors-to-consider/

- API Sourcing Strategies: A Guide for Pharmaceutical Companies …, accessed August 1, 2025, https://aquigenbio.com/api-sourcing-strategies-a-guide-for-pharmaceutical-companies/

- Supplier Qualification In GMP – What Do You Need To Consider …, accessed August 1, 2025, https://gmpinsiders.com/supplier-qualification-in-gmp/

- CDMO Performance on Service Provider Selection Criteria – ISR Reports, accessed August 1, 2025, https://isrreports.com/cdmo-performance-service-provider-selection-criteria/

- Supplier Qualification: Definition, Process, and Guidelines – SimplerQMS, accessed August 1, 2025, https://simplerqms.com/supplier-qualification/

- Understanding the Importance of Supplier Qualification: Lessons from an FDA Warning Letter – Pharmalane UK, accessed August 1, 2025, https://www.pharmalaneuk.com/articles/understanding-significance-of-effective-supplier-qualification-by-taking-example-of-recent-fda-warning-letter/

- Building Resilient Pharma Supply Chains in an Uncertain World, accessed August 1, 2025, https://www.pharmasalmanac.com/articles/building-resilient-pharma-supply-chains-in-an-uncertain-world

- Potential measures to facilitate the production of active pharmaceutical ingredients (APIs) – European Parliament, accessed August 1, 2025, https://www.europarl.europa.eu/RegData/etudes/STUD/2023/740070/IPOL_STU(2023)740070_EN.pdf

- Pharmaceutical Supply Chains: Building Resilience by 2025, accessed August 1, 2025, https://www.azolifesciences.com/article/Pharma-Supply-Chains-in-2025-What-Will-It-Take-to-Build-True-Resilience.aspx

- Supply Chain Risk Management: Best Practices – AuditBoard, accessed August 1, 2025, https://auditboard.com/blog/supply-chain-risk-management-best-practices

- Sourcing Key Starting Materials (KSMs) for Pharmaceutical Active Pharmaceutical Ingredients (APIs): A Strategic Imperative for Resilience – DrugPatentWatch – Transform Data into Market Domination, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/sourcing-the-key-starting-materials-ksms-for-pharmaceutical-active-pharmaceutical-ingredients-apis/

- Diversifying the Supply of Raw Materials – Pharmaceutical Technology, accessed August 1, 2025, https://www.pharmtech.com/view/diversifying-the-supply-of-raw-materials

- How To Overcome Challenges In API Sourcing – LGM Pharma, accessed August 1, 2025, https://lgmpharma.com/blog/how-to-overcome-challenges-in-api-sourcing/

- What is Dual Sourcing and Why is it Important?, accessed August 1, 2025, https://www.fanruan.com/en/glossary/supply-chain/what-is-dual-sourcing

- (PDF) INTEGRATED PROGRAM PLANNING FOR DUAL …, accessed August 1, 2025, https://www.researchgate.net/publication/392098080_INTEGRATED_PROGRAM_PLANNING_FOR_DUAL_SOURCING_IN_PHARMA_OPERATIONS

- Five Advantages of Dual-Sourcing in Pharmaceutical Fill/Finish – Understanding the Imperative – Argonaut Manufacturing Services, accessed August 1, 2025, https://www.argonautms.com/blog/dual-sourcing-in-pharmaceutical-fill-finish/

- Building a Resilient and Secure Pharmaceutical Supply Chain: The Role of Geographic Diversification – Duke-Margolis Institute for Health Policy, accessed August 1, 2025, https://healthpolicy.duke.edu/publications/building-resilient-and-secure-pharmaceutical-supply-chain-role-geographic

- Building a Resilient and Secure Pharmaceutical Supply Chain: The Role of Geographic Diversification – Duke-Margolis Institute for Health Policy, accessed August 1, 2025, https://healthpolicy.duke.edu/sites/default/files/2024-11/Building%20a%20Resilient%20and%20Secure%20Pharmaceutical%20Supply%20Chain.pdf

- Strengthening US-Mexico Quality Pharmaceutical Supply Chains | Wilson Center, accessed August 1, 2025, https://gbv.wilsoncenter.org/article/strengthening-us-mexico-quality-pharmaceutical-supply-chains

- Building A Pharmaceutical API Procurement Strategy That Delivers – LGM Pharma, accessed August 1, 2025, https://lgmpharma.com/blog/building-a-pharmaceutical-api-procurement-strategy-that-delivers/

- Supplier Partnerships: Your Key to Supply Chain Resilience – Capstone Logistics, accessed August 1, 2025, https://www.capstonelogistics.com/blog/supplier-relationships-matter/

- Fostering High-Performing Supplier Partnerships: Strategies for a Resilient Supply Chain, accessed August 1, 2025, https://www.compliancequest.com/blog/fostering-high-performing-supplier-partnerships/

- Risk Management Practices To Address Pharmaceutical Sourcing Challenges, accessed August 1, 2025, https://lgmpharma.com/blog/risk-management-practices-to-address-pharmaceutical-sourcing-challenges/

- Inventory Management for Pharmaceutical Distributors – Acctivate, accessed August 1, 2025, https://acctivate.com/inventory-management-for-pharmaceutical-distributors/

- Pharmaceutical Supply Chain: Optimizing Operations in the MEA Region – Slimstock, accessed August 1, 2025, https://www.slimstock.com/blog/pharmaceutical-supply-chain-management-in-the-mea-region/

- Optimizing API Manufacturing: Lessons from the Industry – DrugPatentWatch, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/optimizing-api-manufacturing-lessons-from-the-industry/

- 5 reasons to adopt continuous processing in pharmaceutical manufacturing – WSP, accessed August 1, 2025, https://www.wsp.com/en-gb/insights/how-continuous-processing-can-optimise-pharmaceutical-manufacturing

- Five API manufacturing trends you need to know in 2025, accessed August 1, 2025, https://manufacturingchemist.com/five-api-manufacturing-trends-you-need-to-know

- Achieving Efficient Pharmaceutical Synthesis with Process Intensification, accessed August 1, 2025, https://www.pharmasalmanac.com/articles/achieving-efficient-pharmaceutical-synthesis-with-process-intensification

- Microreactors for continuous processing – How close to commercial utility? – PubMed, accessed August 1, 2025, https://pubmed.ncbi.nlm.nih.gov/21105486/

- Streamlining Pharmaceutical Synthesis: The Science of Process …, accessed August 1, 2025, https://pharmafeatures.com/streamlining-pharmaceutical-synthesis-the-science-of-process-intensification-in-high-yield-api-production/

- Evolving the Green Chemist’s Toolbox for APIs Manufacturing – SEQENS, accessed August 1, 2025, https://www.seqens.com/knowledge-center/evolving-the-green-chemists-toolbox-for-apis-manufacturing/

- Sustainable Pharma Labs Using Green Chemistry | Pharmaceutical Engineering – ISPE, accessed August 1, 2025, https://ispe.org/pharmaceutical-engineering/ispeak/sustainable-pharma-labs-using-green-chemistry

- Green Pharma Revolution: Eco-Friendly Strategies for API Manufacturing in Modern Medicine – PharmaFeatures, accessed August 1, 2025, https://pharmafeatures.com/green-pharma-revolution-eco-friendly-strategies-for-api-manufacturing-in-modern-medicine/

- Green Chemistry in API Production – Bulat Pharmaceutical, accessed August 1, 2025, https://bulatpharmaceutical.com/blog/green-chemistry-in-api-manufacturing/

- Environmental Sustainability Strategy of Active Pharmaceutical Ingredient Manufacturing: A Perspective from the American Chemical Society Green Chemistry Institute Pharmaceutical Roundtable, accessed August 1, 2025, https://pubs.acs.org/doi/10.1021/acssuschemeng.5c01094

- API Sustainability Strategy – ACSGCIPR, accessed August 1, 2025, https://acsgcipr.org/focus-areas/api-sustainability-strategy/

- Cost of Goods Sold: How to Calculate with Formula – Katana MRP, accessed August 1, 2025, https://katanamrp.com/cost-of-goods-sold/

- Cost of Goods Sold (COGS) Explained With Methods to Calculate It – Investopedia, accessed August 1, 2025, https://www.investopedia.com/terms/c/cogs.asp

- SaaS COGS: Factors To Determine Your Cost Of Goods Sold – CloudZero, accessed August 1, 2025, https://www.cloudzero.com/blog/saas-cogs/

- Cost of Goods Sold: What Is COGS and What’s Included? – ShipBob, accessed August 1, 2025, https://www.shipbob.com/blog/cost-of-goods-sold/

- Economic Analysis of Batch and Continuous Biopharmaceutical Antibody Production: A Review – PMC, accessed August 1, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6432653/

- A Comparative Investment Analysis of Batch Versus Continuous Pharmaceutical Manufacturing Technologies – PMC, accessed August 1, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8802271/

- AI and ML in API Production: 6 Powerful Ways to Transform, accessed August 1, 2025, https://bulkdrugsdirectory.com/ai-and-ml-in-api-production/

- Automating Development of Small-Molecule APIs – Pharmaceutical Technology, accessed August 1, 2025, https://www.pharmtech.com/view/automating-development-of-small-molecule-apis

- How to Build a Resilient Active Pharmaceutical Ingredient …, accessed August 1, 2025, https://nexocode.com/blog/posts/artificial-intelligence-in-api-manufacturing/

- AI-driven innovations in pharmaceuticals: optimizing drug discovery and industry operations, accessed August 1, 2025, https://pubs.rsc.org/en/content/articlehtml/2025/pm/d4pm00323c

- Supply Chain Analytics in Pharma: Aligning Efficiency with …, accessed August 1, 2025, https://www.compunnel.com/blogs/supply-chain-analytics-in-pharma/

- 8 Use Cases For Data Analytics In Pharmaceutical Industry – Polestar Solutions, accessed August 1, 2025, https://www.polestarllp.com/blog/analytics-in-pharmaceutical-companies

- Top 10 Supply Chain Analytics Softwares For Pharma Industry – Ceres Technology, accessed August 1, 2025, https://www.cerestech.co/supply-chain-analytics-software-solution-for-pharma-industry/

- Inventory Management in Pharmaceutical Supply Chains – Pharma Now, accessed August 1, 2025, https://www.pharmanow.live/knowledge-hub/research/inventory-management-pharma-supply-chain

- Supply Chain Visibility Software and Solutions | IBM, accessed August 1, 2025, https://www.ibm.com/solutions/supply-chain-visibility

- The Future of Medicine: How 3D Printing Is Transforming … – MDPI, accessed August 1, 2025, https://www.mdpi.com/1999-4923/17/3/390

- A Review of 3D Printing Technology in Pharmaceutics: Technology and Applications, Now and Future – PMC, accessed August 1, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9962448/

- The Impact Of 3D Printing On Pharmaceutical Manufacturing And The Potential For Personalised Dosage Forms And Drug Delivery Systems – Indus Net Technologies, accessed August 1, 2025, https://www.indusnet.co.in/the-impact-of-3d-printing-on-pharmaceutical-manufacturing-and-the-potential-for-personalised-dosage-forms-and-drug-delivery-systems/

- Process Digital Twin for Pharma – Siemens Global, accessed August 1, 2025, https://www.siemens.com/global/en/company/stories/digital-transformation/digital-twin-pharma.html

- cleanroomtechnology.com, accessed August 1, 2025, https://cleanroomtechnology.com/what-are-digital-twins-and-what-is-their#:~:text=In%20drug%20manufacturing%2C%20by%20simulating,refine%20its%20vaccine%20adjuvant%20production.

- Pharma & Regulatory – Digital Twin Consortium, accessed August 1, 2025, https://www.digitaltwinconsortium.org/working-groups/pharma-and-regulatory/

- What is a Bioprocess Digital Twin? – Körber Pharma, accessed August 1, 2025, https://www.koerber-pharma.com/en/blog/what-is-a-bioprocess-digital-twin

- Digital twin and simulation – Siemens Xcelerator Global, accessed August 1, 2025, https://xcelerator.siemens.com/global/en/industries/pharmaceutical-life-science-industries/pharma-industry/focus-topics/digital-twin.html

- The Potential Of Digital Twins In Biopharmaceutical Manufacturing – Avenga, accessed August 1, 2025, https://www.avenga.com/magazine/how-digital-twins-transform-biopharmaceutical/

- Strategic planning in Regulatory Affairs – TOPRA, accessed August 1, 2025, https://www.topra.org/CMDownload.aspx?ContentKey=6ef6c81e-c2ff-4328-862a-91ab46d2ccc8&ContentItemKey=b5f8ef42-ddda-4a0a-9c81-e3af945436b6

- Optimizing Regulatory Lifecycle Management – IQVIA, accessed August 1, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/optimizing-regulatory-lifecycle-management.pdf

- Regulatory Compliance in API Manufacturing – The Pharma Master, accessed August 1, 2025, https://www.thepharmamaster.com/regulatory-compliance-in-api-manufacturing

- Blog | Navigating API Manufacturing Compliance – Ricago, accessed August 1, 2025, https://www.ricago.com/blog/ensuring-excellence-navigating-api-manufactuirng-compliance

- The complete guide to the ICH Q7 guidelines – Qualio, accessed August 1, 2025, https://www.qualio.com/blog/ich-q7

- GMPs for APIs: “How to do” document – APIC (CEFIC), accessed August 1, 2025, https://apic.cefic.org/wp-content/uploads/2022/03/ICH-Q7-How-To-Do-version15_final-version.pdf

- ICH Q7 Good manufacturing practice for active pharmaceutical ingredients – Scientific guideline | European Medicines Agency (EMA), accessed August 1, 2025, https://www.ema.europa.eu/en/ich-q7-good-manufacturing-practice-active-pharmaceutical-ingredients-scientific-guideline

- Regulatory Compliance in API Drug Production of Different Countries – PharmaSources.com, accessed August 1, 2025, https://m.pharmasources.com/industryinsights/regulatory-compliance-in-api-drug-produc-76256.html

- What is a Drug Master File and Its Types? – DDReg Pharma, accessed August 1, 2025, https://www.ddregpharma.com/what-is-a-drug-master-files

- A Comprehensive Guide to FDA Drug Master Files (DMF) – Registrar …, accessed August 1, 2025, https://www.registrarcorp.com/blog/drugs/drug-master-files/drug-master-file-dmf/

- Drug Master File – Wikipedia, accessed August 1, 2025, https://en.wikipedia.org/wiki/Drug_Master_File

- EMA–FDA joint Q&As on Quality and GMP aspects of PRIME …, accessed August 1, 2025, https://www.ema.europa.eu/en/documents/other/ema-fda-joint-qas-quality-and-gmp-aspects-prime-breakthrough-therapy-applications_en.pdf

- Accelerating Biologics Approval: FDA Breakthrough Therapy vs EMA PRIME, accessed August 1, 2025, https://synapse.patsnap.com/article/accelerating-biologics-approval-fda-breakthrough-therapy-vs-ema-prime

- Meeting Report: Workshop with stakeholders on support to quality development in early access approaches (ie PRIME, Breakthrough Therapies) – EMA, accessed August 1, 2025, https://www.ema.europa.eu/en/documents/report/report-workshop-stakeholders-support-quality-development-early-access-approaches-ie-prime-breakthrough-therapies_en.pdf

- The Importance of Regulatory Strategy – Scendea, accessed August 1, 2025, https://www.scendea.com/articles/blog-post-title-one-25srn-58l3m-hef63-4brtc-6k9ll

- Transcript: Early Engagement with FDA to Discuss Novel Surrogate Endpoints, accessed August 1, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/transcript-early-engagement-fda-discuss-novel-surrogate-endpoints

- Are the European Medicines Agency, US Food and Drug Administration, and Other International Regulators Talking to Each Other? – PMC, accessed August 1, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7028217/

- Cortellis Generics & Products Intelligence – Clarivate, accessed August 1, 2025, https://clarivate.com/life-sciences-healthcare/manufacturing-supply-chain-intelligence/product-intelligence-analytics/

- How to Protect Intellectual Property when Outsourcing? – SoftKraft, accessed August 1, 2025, https://www.softkraft.co/how-to-protect-intellectual-property-when-outsourcing/

- 5 Ways To Protect Your IP When Outsourcing Development – The Rapacke Law Group, accessed August 1, 2025, https://arapackelaw.com/intellectual-property/5-ways-to-protect-your-ip-when-outsourcing-development/

- Protect Your Software IP: Outsourcing Risks & Solutions, accessed August 1, 2025, https://www.valuecoders.com/blog/software-engineering/guide-to-safeguarding-your-intellectual-property-when-outsourcing/

- innovatureinc.com, accessed August 1, 2025, https://innovatureinc.com/how-to-protect-outsourcing-intellectual-property/#:~:text=Keep%20your%20data%20stored%20solely,of%20the%20tasks%20in%2Dhouse.

- 4 essential components when designing an enterprise-wide API program, accessed August 1, 2025, https://resources.axway.com/accelerate-digital-projects/checklist-enterprise-wide-api-program

- Decision-making in product portfolios of pharmaceutical research and development – DrugPatentWatch – Transform Data into Market Domination, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/decision-making-product-portfolios-pharmaceutical-research-development-managing-streams-innovation-highly-regulated-markets/

- Green Chemistry for Sustainable API development – Patheon pharma services, accessed August 1, 2025, https://www.patheon.com/us/en/insights-resources/blog/green-chemistry-for-sustainable-api-development-and-manufacturing.html

- Overview of the Active Pharmaceutical Ingredient Market – IQVIA, accessed August 1, 2025, https://www.iqvia.com/library/articles/overview-of-the-active-pharmaceutical-ingredient-market