For business professionals aiming to transform raw data into market domination, understanding and strategically leveraging drug patents is paramount. This report delves into the intricate world of pharmaceutical IP, exploring foundational principles, advanced filing strategies, lifecycle management techniques, robust defense mechanisms, and the exciting, yet challenging, frontier of emerging technologies. The aim is to uncover how leading companies navigate this complex terrain, providing actionable insights to maximize the value of drug patents and secure a place at the forefront of medical advancement.

I. The Unseen Fortress: Understanding Drug Patents in the Biomedical Landscape

At its core, a drug patent is a powerful legal instrument, a temporary shield that allows biomedical companies to protect their monumental investments in research and development. Understanding the fundamental concepts that underpin this critical asset is essential.

A. What Exactly is a Drug Patent?

Imagine spending years, even decades, and billions of dollars on a groundbreaking discovery that could save countless lives. Without protection, that innovation could be copied overnight by competitors, leaving the innovating company unable to recoup its costs or fund future breakthroughs. This is precisely where drug patents step in.

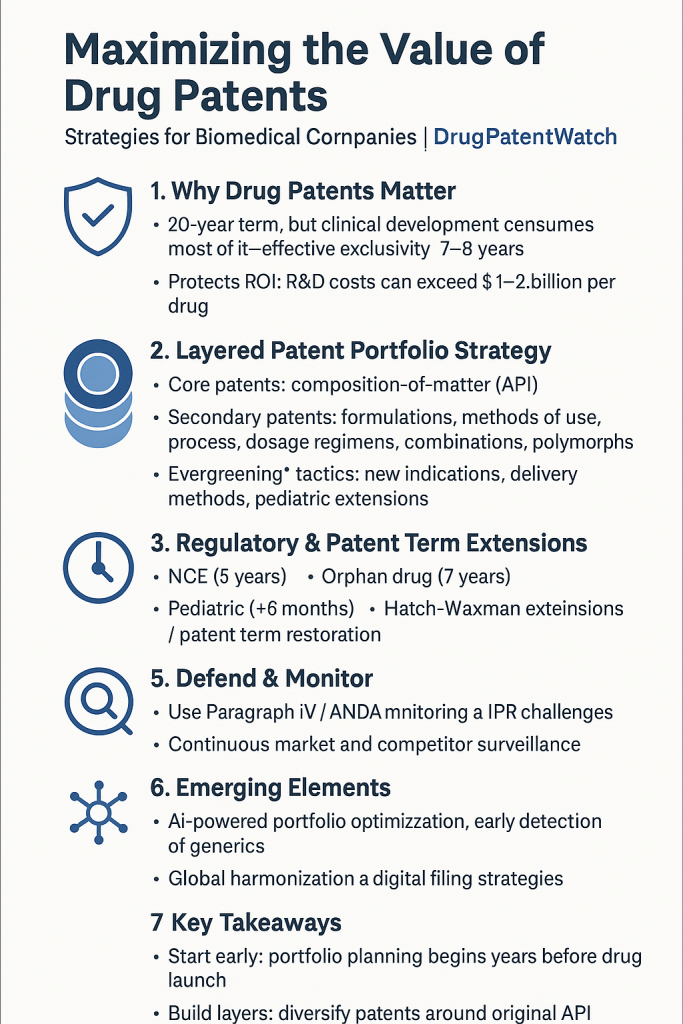

- The Core Concept: Exclusive Rights and InnovationA drug patent is a legal mechanism that grants pharmaceutical companies the exclusive right to sell a drug they have developed for a certain period, typically 20 years from the application filing date in the United States and most other countries.1 This exclusivity means no other manufacturer can make, use, sell, or import the identical drug without permission, usually through a licensing agreement.3 This exclusive right is a form of intellectual property (IP), much like a copyright or trademark.2 It represents a property right to a product, often a chemical formula, that cannot be duplicated by rivals.6The very existence of drug patents is a direct response to the unique economic realities of pharmaceutical research and development. Without this guaranteed period of exclusivity, the financial incentive to undertake such risky and expensive ventures would vanish. Consider the scenario: if a company could not exclusively market a successful drug for a period, competitors could immediately produce cheaper versions, known as generics, eroding market share and making it impossible for the innovator to recover their initial outlay. This would inevitably lead to a market failure where investment in new drug discovery would cease. Therefore, the patent system is not merely a regulatory hurdle; it stands as a foundational economic pillar. It represents a calculated trade-off: a temporary monopoly for the innovator in exchange for the public benefit of new, life-saving medicines. This understanding is crucial for business professionals, as it frames patent strategy not as a legal burden, but as a core business function for survival and growth.

- The Economic Imperative: Recouping Billions in R&DDeveloping a new drug is an astronomical undertaking. The average cost to bring a single successful drug to market ranges from $1 billion to $2.6 billion, factoring in the numerous failures along the way.7 This arduous process typically spans 10 to 15 years from initial discovery to regulatory approval.7 As one source emphasizes, “Without robust patent protection, recouping these substantial research and development (R&D) investments would be nearly impossible, stifling future innovation”.4 Patents serve as the economic catalyst, guaranteeing profit and making the immense time and cost worthwhile.6The lengthy development timeline significantly erodes the effective market exclusivity period, creating intense pressure for companies to maximize value within a compressed window. A patent term is typically 20 years from filing.3 However, since drug development consumes 10 to 15 years of this period 7, a substantial portion of the patent life is spent before the drug even reaches the market. This effectively reduces market exclusivity to approximately 7-8 years.4 This gap between nominal patent life and effective market exclusivity presents a critical challenge. It means that the window for generating revenue to cover R&D costs and fund future innovation is far shorter than the headline 20-year term suggests. This inherent time constraint necessitates aggressive and sophisticated patent strategies to extend market exclusivity as much as legally possible. Business professionals must grasp this “effective patent life” reality. It explains why strategies like “evergreening” are so prevalent and economically vital for pharmaceutical companies to achieve sustained R&D and market leadership.

B. The Legal Pillars: Foundations of Pharmaceutical IP in the US

The US intellectual property landscape for pharmaceuticals is complex, built upon a foundation of patent law intertwined with specific regulatory frameworks.

- Patents vs. Regulatory Exclusivities: A Dual ShieldIt is crucial to distinguish between patents and regulatory exclusivities. While both provide market protection, they are distinct and governed by different statutes.9 Patents are granted by the U.S. Patent and Trademark Office (USPTO) at any point during a drug’s development. They represent a property right and can cover a wide range of claims related to the invention.3 In contrast, regulatory exclusivities are granted by the FDA upon approval of a drug or certain supplements, provided statutory requirements are met. These exclusivities prevent the FDA from approving competitor drugs for a specified period, regardless of patent status.3 Some drugs enjoy both patent and exclusivity protection, while others have only one or neither. These protections may or may not run concurrently and may not cover the same aspects of the drug.9This dual system of patents and regulatory exclusivities creates a layered defense, but it also introduces complexities that demand meticulous strategic planning to maximize combined protection. This is not a simple “either/or” scenario. A company might hold a patent on a drug, but if it does not qualify for a specific regulatory exclusivity (e.g., New Chemical Entity exclusivity), a generic could theoretically be approved sooner if the patent is challenged and found invalid. Conversely, even if a patent expires, a regulatory exclusivity might still block generic entry.3 This creates a complex chessboard where both legal and regulatory moves are essential. For business professionals, understanding that a strong patent portfolio alone is insufficient is vital. They must also actively pursue and leverage all available regulatory exclusivities. This necessitates close collaboration between IP legal teams, R&D, and regulatory affairs departments from the earliest stages of drug development to ensure optimal sequencing of applications and data submissions.

- The Hatch-Waxman Act: A Balancing ActOfficially known as the Drug Price Competition and Patent Term Restoration Act of 1984, the Hatch-Waxman Act is a landmark piece of US legislation that fundamentally reshaped the pharmaceutical landscape.3 It was designed to balance two competing policy interests: incentivizing brand-name drug innovation through patent protection and facilitating the timely entry of lower-cost generic drugs.9 Key provisions include:

- Streamlined generic drug approval via Abbreviated New Drug Applications (ANDAs).13 Generics need only show bioequivalence, not repeat costly clinical trials.16

- Mechanisms for brand-name companies to extend patents for time lost during regulatory review (Patent Term Restoration/Extension).5

- Procedures for generic manufacturers to challenge brand-name patents (Paragraph IV certifications), often leading to litigation.10

- The Biologics Price Competition and Innovation Act (BPCIA)For biologics (large, complex molecules like antibodies), the BPCIA of 2009 established a distinct regulatory pathway for biosimilars, similar to Hatch-Waxman for small-molecule generics.3 This act introduced a “patent dance” process for resolving patent disputes between reference product sponsors and biosimilar applicants, which can also delay market entry.3The BPCIA, while mirroring Hatch-Waxman’s intent, introduces even greater complexity due to the inherent scientific intricacy of biologics, leading to unique patenting and litigation challenges. Unlike chemically identical generics, biosimilars are “highly similar” but not identical.20 This inherent variability, coupled with complex manufacturing processes, creates more avenues for patent claims and, consequently, more grounds for dispute. The “patent dance” is a testament to this increased complexity, requiring detailed information exchange and negotiation before litigation. For companies developing biologics, IP strategy must account for these heightened complexities. This means even more emphasis on process patents, manufacturing technologies, and detailed characterization in patent applications. The stakes in biosimilar litigation are arguably even higher, given the higher price points and market potential of biologics.

C. The Anatomy of a Patent: What Can Be Protected?

A common misconception is that a drug patent only covers the active ingredient. In reality, modern pharmaceutical patents are a multi-faceted construct designed to protect every conceivable aspect of an innovation.

- Composition of Matter: The Heart of the DrugThese are the most fundamental and valuable patents, covering the active pharmaceutical ingredient (API) itself – the core molecule responsible for the drug’s therapeutic effect.3 If a company is the first to synthesize a novel chemical compound useful for treating disease, it can patent that chemical.3 These patents are particularly robust because they are difficult to “invent around”.3Composition of Matter patents are the “crown jewels” of a drug’s IP portfolio, providing the broadest and most difficult-to-circumvent protection, making them the primary target for early filing and aggressive defense. If a competitor cannot legally produce the core active ingredient, their ability to launch a generic or biosimilar is severely hampered, regardless of other patent types. This broad protection makes these patents the most valuable in terms of market exclusivity and revenue generation. It represents the first line of defense and the most impactful. Companies should prioritize securing strong and broad composition of matter patents as early as possible in the discovery phase. This foundational protection is the bedrock upon which all subsequent lifecycle management strategies are built. Any weakness here can compromise the entire IP fortress.

- Beyond the Molecule: Formulations, Methods, and MoreA comprehensive patent strategy extends far beyond the API, creating a “complex tapestry of claims”.10 This multi-layered approach is crucial for building a “web of protection” or “patent thicket”.4 Patentable aspects can include:

- Formulation Patents: Protecting new ways a drug is prepared or delivered (e.g., extended-release tablets, inhalers, nanoparticles) to improve delivery, efficacy, or patient compliance.3 Examples include AstraZeneca’s Seroquel XR and Bristol-Myers Squibb’s Glucophage XR, which extended exclusivity by reducing dosing frequency.4

- Method of Use Patents: Covering novel therapeutic uses for an existing drug (e.g., using a heart disease drug for cancer treatment).3 GSK secured additional protection for Imitrex by patenting intranasal delivery.4

- Process Patents (Methods of Manufacture): Protecting innovative methods for manufacturing the drug or specific steps within the manufacturing process (e.g., unique purification methods, novel catalyst usage).3

- Dosage Regimen Patents: Patents for specific dosing schedules or treatment regimens using the drug.22

- Polymorphs and Enantiomers: Different crystalline structures or stereoisomers of the API that may offer improved stability or bioavailability.4 In some jurisdictions, like India, this requires demonstrating “significantly enhanced efficacy”.4

- Combinations: Combining a compound with another active ingredient to create a new combination drug.2

- Related Chemicals: Other chemicals related to the active ingredient, such as intermediates, salts, and metabolites.3

- Administration Technologies and Methods: Devices or methods used to administer the pharmaceutical (e.g., an inhaler or injector device).3

- The Power of Incremental InnovationEven small, tinkering improvements can be of significant value, both clinically and commercially.11 For example, a smaller milligram version for titration or a larger one for fewer pills a day can enhance patient compliance and preference.11 An “improvement” doesn’t necessarily have to be objectively “better” than the existing technology to be patentable; it just needs to be new and non-obvious.3The patent system incentivizes continuous, incremental innovation around existing drugs, transforming what might seem like minor enhancements into significant commercial assets. This highlights a crucial aspect of patent strategy: innovation is not always about radical breakthroughs. It is also about refining existing solutions, improving patient experience, or optimizing manufacturing. These incremental innovations can secure new patents, extending market exclusivity and providing competitive advantages in a crowded market. Biomedical companies should foster a culture of continuous improvement across their product lifecycle. R&D teams should be incentivized to identify and develop these “extended invention types” 22 as strategic IP opportunities, not just clinical enhancements.

Table 1: Key Types of Pharmaceutical Patents and Their Scope

| Patent Type | Description | Strategic Value |

| Composition of Matter | Covers the active pharmaceutical ingredient (API) itself, the core molecule. | Provides the broadest and most fundamental protection, difficult to “invent around.” Essential for initial market exclusivity and revenue generation. 3 |

| Formulation Patents | Protects new ways a drug is prepared or delivered (e.g., extended-release, nanoparticles, oral versions of injections). | Improves drug delivery, efficacy, patient compliance. Extends exclusivity by offering new product versions. 3 |

| Method of Use Patents | Covers novel therapeutic uses for an existing drug (e.g., new indications for a known compound). | Expands market reach and extends exclusivity for new applications. 3 |

| Process Patents | Protects innovative methods for manufacturing the drug or specific steps within the process. | Enhances efficiency, reduces costs, improves purity, and provides a barrier to replication of the manufacturing process. 3 |

| Dosage Regimen Patents | Patents for specific dosing schedules or treatment regimens. | Offers additional protection beyond the core molecule, potentially improving patient adherence or efficacy. 22 |

| Polymorphs & Enantiomers | Different crystalline structures or stereoisomers of the API. | Can offer improved stability, bioavailability, or other physical properties, extending patent life. 4 |

| Combination Drugs | Combining an existing compound with another active ingredient to create a new drug. | Creates new therapeutic options and secures new patent protection. 2 |

| Related Chemicals | Intermediates, salts, and metabolites related to the active ingredient. | Broadens the “web of protection” around the core compound, creating additional hurdles for competitors. 3 |

| Administration Technologies | Devices or methods used to administer the pharmaceutical (e.g., inhalers, injectors). | Provides protection for the delivery system, enhancing product value and patient experience. 3 |

This table provides a quick, structured overview of the diverse patent types, illustrating the “web of protection” concept.4 For a business professional, it immediately clarifies the various avenues for IP protection beyond just the active ingredient, highlighting the strategic depth required. It helps visualize how a multi-layered approach can build a formidable barrier against generic competition.4

II. Strategic Patent Filing: Laying the Groundwork for Market Domination

Securing a drug patent is not a one-time event; it’s a dynamic, ongoing process that begins long before clinical trials and continues throughout a product’s lifecycle. Strategic patent filing is a business-critical function, demanding foresight and precision.

A. Foundational Principles of Patentability

Before any patent application can be drafted, the invention must meet stringent criteria for patentability. Understanding these core principles is the first step in developing an effective filing strategy.4

- Novelty, Utility, and Non-ObviousnessFor an invention to be patentable in the US, it must be:

- Novel: The invention must be completely new, meaning it has never been publicly disclosed or made available before the patent application.4

- Useful (Utility): The drug must serve a specific and useful purpose, which is generally straightforward for pharmaceuticals but still must be clearly demonstrated.4

- Non-obvious: This is often the most challenging criterion in pharmaceuticals. The invention must represent a significant step forward that would not have been obvious to a person with ordinary skill in the relevant technical field at the time of invention.4 This ensures the patent system rewards genuine innovation, not just predictable developments.4 Pharmaceutical patents often struggle with the non-obviousness requirement, especially for slight modifications of existing drugs.23

- The Disclosure Requirement: A Quid Pro QuoIn exchange for temporary market exclusivity, the inventor must fully disclose enough detail for others to understand and replicate the invention once the patent expires.4 This is the “quid pro quo” of the patent system: a limited monopoly in exchange for public knowledge.24 The sufficiency of this written description is critical to a patent’s validity.24This disclosure requirement carries a subtle but profound implication for strategic filing. Companies must walk a fine line: disclose enough to satisfy patentability without revealing too much proprietary “know-how” that could be exploited by competitors post-expiration. The goal is to maximize the scope of protection while minimizing the ease with which others can replicate the invention once it enters the public domain. This requires meticulous drafting and a deep understanding of both scientific and legal nuances.

B. Strategic Timing: Establishing and Maintaining Priority

In a “first-to-file” patent system, priority is granted to the applicant who files first, regardless of who invented it first.4 Consequently, establishing an early filing date is paramount.4

- Provisional Patent Applications: A Cost-Effective Head StartProvisional patent applications are a cornerstone of strategic patent filing for pharmaceutical companies, offering a crucial balance between speed and flexibility.4 They provide a cost-effective way to establish an early effective filing date with fewer formal requirements.4 This is particularly advantageous for lengthy R&D cycles, as the patent term is measured from the subsequent non-provisional application, providing up to an additional 12 months of protection.4 It also allows inventors to use the “patent pending” designation, which can deter competitors and attract investment.4 The 12-month window allows for further research, refinement, commercial potential assessment, and funding without jeopardizing the priority date.4The strategic imperative is clear: filing too early risks patent expiration before full commercialization, while filing too late risks being preempted by a competitor.4 Provisional applications mitigate this tension, acting as a placeholder that secures a priority date while allowing for continued development and market assessment. This flexibility is invaluable in an industry where development timelines are measured in decades.

- Non-Provisional and Continuing Applications: Expanding ProtectionNon-provisional applications are the formal applications that undergo examination and, if successful, lead to a granted patent.4 To claim the benefit of an earlier provisional filing, the non-provisional application must be filed within 12 months of the provisional application’s filing date.4 Thorough prior art searches and well-organized applications are critical for minimizing delays.4As pharmaceutical research and development progresses, inventions often evolve, or initial patent applications may encompass multiple distinct innovations.4 This is where leveraging continuing applications becomes vital.

- Continuation Applications: Filed to pursue additional claims to an invention already fully disclosed in a pending parent application, using the identical specification and claiming the parent’s priority date.4 They cannot introduce new subject matter. This is valuable when some claims are allowed but others rejected, or to explore different ways of claiming embodiments.4

- Divisional Applications: Necessary when an examiner determines an original application covers “multiple, independent inventions”.4 They retain the same filing date as the parent application, preserving the earliest priority date for all derived inventions. This allows securing separate, robust patents for distinct inventions, maximizing portfolio breadth and value.4

- Continuation-in-Part (CIP) Applications: Allow inclusion of new material not disclosed in the original parent non-provisional application, while claiming the parent’s filing date for common subject matter.4 This is beneficial in rapidly evolving fields like pharmaceuticals, enabling incorporation of new developments and potentially extending protection scope.4

C. Global Considerations: Navigating International Patent Offices

The biomedical market is inherently global. Consequently, securing patent protection requires navigating a complex web of national and international patent offices.

- Key Global Patent Offices and TreatiesGlobal patent protection is essential, requiring navigation of various national and international patent offices.4

- USPTO (United States Patent and Trademark Office): Grants U.S. patents and provides resources like Drugs@FDA, the Orange Book, and the Purple Book.4

- EPO (European Patent Office): Examines European patent applications for protection in up to 44 countries, offering the Espacenet database.4

- WIPO (World Intellectual Property Organization): Facilitates international patent protection through its Patent Cooperation Treaty (PCT) system and hosts PATENTSCOPE.4 The PCT allows applicants to file a single international application, which can then be used as a basis for filing national patent applications in participating countries, simplifying the process and reducing costs.25

- Other important treaties include the Paris Convention for the Protection of Industrial Property (1883) and the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), which lay groundwork for harmonization.25

- The Imperative of Global StrategyFor biomedical companies, a global patent strategy is not merely an option but a necessity. The cost of developing new drugs is so immense that recouping investment often requires access to multiple markets worldwide. This means anticipating international regulatory hurdles and patentability standards from the outset. A fragmented global IP landscape, with varying laws and procedures, can create significant administrative burdens and delays.26This underscores the importance of working with experienced international IP counsel who can navigate these complexities. The goal is to build a robust global portfolio that provides consistent protection across key markets, allowing for efficient market entry and sustained revenue generation.

III. Lifecycle Management: Extending the Value Horizon

The moment a drug is approved, the clock on its primary patent begins ticking down. Effective lifecycle management is the art and science of extending a drug’s commercial viability well beyond its initial patent expiration, transforming a potential “patent cliff” into a more gradual slope.

A. Navigating Patent Term Adjustments and Extensions

Even with meticulous early filing, the lengthy regulatory approval process can significantly eat into a patent’s 20-year term. Fortunately, mechanisms exist to compensate for this lost time.

- Patent Term Adjustment (PTA)PTA compensates patentees for delays caused by the USPTO during examination, ensuring an adequate period of exclusive rights despite administrative backlogs.4 It can be applied to each patent within a family.4 This mechanism acknowledges that bureaucratic delays should not unfairly penalize innovators.

- Patent Term Extension (PTE)PTE restores patent term lost due to premarket government approval processes from regulatory agencies like the FDA.4 It can add up to five years to a patent’s life, though the total effective patent term after approval cannot exceed fourteen years.4 This mechanism is a vital bridge connecting R&D and approval phases with a commercially viable period of market exclusivity.4 Obtaining a PTE requires meeting strict eligibility requirements, including demonstrating that the delay was unavoidable and that the product’s use was subject to FDA approval.23These extensions are not automatic; they require diligent monitoring and application. The ability to reclaim lost patent time is crucial for maximizing revenue, as every additional month of exclusivity for a blockbuster drug can translate into hundreds of millions, if not billions, in sales.

B. Leveraging Regulatory Exclusivities

Beyond patents, specific regulatory exclusivities granted by the FDA provide additional layers of market protection. These are distinct from patents and can run concurrently or independently, preventing submission or approval of generic drug applications for a specified period.4

- Key Exclusivity Types

- New Chemical Entity (NCE) Exclusivity: Provides a five-year market exclusivity for drugs with an active moiety not previously approved by the FDA, protecting R&D investment.4 This is a strong incentive for truly novel compounds.

- Orphan Drug Exclusivity (ODE): Granted for drugs treating rare diseases (affecting <200,000 people in the U.S.), providing seven-year market protection and additional benefits like tax credits and fee waivers.2 This incentivizes development for conditions that might otherwise be commercially unviable.

- Pediatric Exclusivity (PED): Provides an additional six months of market exclusivity when pediatric studies are conducted in response to an FDA Written Request, incentivizing research in children.4 This adds a significant bonus to existing patent and exclusivity terms.9

- The 180-Day Generic Exclusivity: A unique incentive under Hatch-Waxman, granted to the “first” generic applicant who challenges a listed patent by filing a Paragraph IV certification, providing exclusive marketing rights for 180 days.4 This creates a “race to file” among generics, but also a valuable, albeit temporary, monopoly for the first successful challenger.

Table 2: US Regulatory Exclusivities for Pharmaceutical Products

| Exclusivity Type | Duration | Purpose/Conditions |

| New Chemical Entity (NCE) | 5 years | Granted for drugs with an active moiety not previously approved by FDA. Protects R&D investment in novel compounds. 4 |

| Orphan Drug Exclusivity (ODE) | 7 years | For drugs treating rare diseases (affecting <200,000 people/year in US). Incentivizes development for unmet needs. 2 |

| Pediatric Exclusivity (PED) | 6 months | Added to existing patents/exclusivities when pediatric studies are conducted in response to an FDA request. Encourages research in children. 4 |

| 180-Day Generic Exclusivity | 180 days | Granted to the “first” generic applicant who successfully challenges a listed patent via Paragraph IV certification. Incentivizes generic challenges. 9 |

| New Clinical Investigation Exclusivity | 3 years | For NDAs containing new clinical investigations essential to approval (not NCE). 9 |

| GAIN Exclusivity | 5 years (added to certain exclusivities) | For qualified infectious disease products. 9 |

This table demystifies the complex landscape of regulatory exclusivities 9, which are distinct from patents but equally critical for market exclusivity.3 Business professionals need to understand these specific periods to accurately forecast market entry windows and revenue streams. It highlights how these exclusivities, combined with patents, create a layered approach to market control.3

C. Strategic Evergreening and Product Life Cycle Management

“Evergreening” refers to the practice of obtaining additional patents on minor modifications of an existing drug, thereby extending its exclusivity period.3 While often a point of contention, this practice is a cornerstone of product lifecycle management (PLM) in the pharmaceutical industry.

- Common Evergreening TechniquesDrug manufacturers employ various strategies to extend product life cycle and protect revenue.5 These include:

- New Formulations and Delivery Methods: Patenting new ways a drug is prepared or administered, such as extended-release versions, inhalers, or oral versions of previously injectable drugs.2

- New Methods of Use and Indications: Securing patents for novel therapeutic uses of an existing drug, often discovered during later stages of PLM.2

- Polymorphs and Stereoisomers: Patenting different crystalline structures or spatial arrangements of the active ingredient.4

- Combination Drugs: Combining the existing product with another active ingredient to create a new fixed-dose combination.2

- New Manufacturing Processes: Patents for new processes that create greater quantities of medication more efficiently or with fewer inactive ingredients.5

- Dosage Regimens: Patents on specific dosing schedules or treatment regimens.22

- Authorized Generics: Manufacturers may produce and market their own generic version of the drug, known as an “authorized generic”.5

- The “Patent Cliff” and its MitigationThe pharmaceutical industry faces a significant challenge known as the “patent cliff,” where multiple blockbuster drugs lose patent protection within a short timeframe, leading to steep revenue declines for innovator companies.4 Industry analysts project that the coming five years will present even greater challenges, with an estimated $200 billion in revenue at risk due to patent expirations.28 Between 2025 and 2030, the pharmaceutical industry is expected to lose over $300 billion in revenue due to this phenomenon.29 For example, only 4% of global drug sales in 2030 are projected to have patent protection, a significant drop from 12% in 2022.31The strategic proliferation of secondary patents is a sophisticated response to the economic pressures of drug development and the legal framework that incentivizes generic challenges. It is about building a multi-layered legal moat. Each additional patent represents another hurdle a generic challenger must overcome, increasing the cost and complexity of litigation.3 This strategy allows companies to continue to profit from their inventions for several decades, even as generics come out for previous versions of their drug.2 This is not merely an opportunistic tactic but a necessary one for sustained R&D and market leadership.Table 3: Impact of Patent Expiration on Blockbuster Drugs (Case Examples)

| Drug Name | Company | Primary Patent Expiration (Original) | Extended Exclusivity Achieved (if any) | Key Evergreening Tactics/Strategies | Revenue Impact/Projections Post-Cliff |

| Humira (adalimumab) | AbbVie | 2016 (US main patent) | Extended US monopoly by 6 years beyond 2016, until 2023 32 | Patent thicket (approx. 250 applications, 90% after 2002 approval), new indications, formulations. 32 | Biosimilars entered Europe in 2018, US in 2023. AbbVie projects quick return to growth by 2024 with new drugs. 32 |

| Keytruda (pembrolizumab) | Merck & Co. | 2028 (US patent) | Extended exclusivity beyond 2028 via product hopping strategy 34 | Product hopping (subcutaneous formulation), patent thicket (129 applications, >50% after initial approval). 34 | Projected sales drop from $33.7B (2028) to $27.4B (2029), a 19% decline. Accounts for 40% of Merck’s pharma sales in 2023. 28 |

| Eliquis (apixaban) | Bristol Myers Squibb | Nearing expiration | – | – | BMS forecast to be highly impacted by patent cliff. 29 |

| Opdivo (nivolumab) | Bristol Myers Squibb | Nearing expiration | – | – | BMS forecast to be highly impacted by patent cliff. 29 |

This table provides concrete, real-world examples of the “patent cliff” phenomenon and how companies attempt to mitigate it.29 For business professionals, these case studies are invaluable as they illustrate the financial stakes involved (e.g., Keytruda accounting for 40% of Merck’s sales 35) and the specific strategies (product hopping, patent thickets 32) employed. It transforms abstract concepts into tangible business realities, helping to understand the magnitude of the challenge and the potential solutions.

IV. Robust Patent Portfolio Management and Defense

A patent is only as valuable as its enforceability. Building and defending a robust patent portfolio is not merely a legal necessity but a strategic imperative for survival and market domination.10 It’s about proactively building an impenetrable fortress around intellectual property, anticipating threats, and strategically leveraging patents to maintain a competitive edge.10

A. Core Elements of Effective Portfolio Management

Patent portfolio management extends far beyond maintaining a simple inventory of patents. It is an exhaustive approach to evaluating, maintaining, and leveraging intellectual property in a way that supports a company’s IP-aligned business strategy.36

- Strategic Alignment with Business GoalsTruly valuable patent portfolios require strategic planning, continuous and ongoing effective management, and careful alignment with business objectives.36 This means evaluating each patent’s technical strengths, market relevance, and alignment with the overall business strategy.36 The portfolio should actively support the company’s goals, whether for new product or market initiatives, or strategies to license or leverage IP.36This alignment is crucial. Without a clear connection to business objectives, a patent portfolio risks becoming a collection of isolated legal documents rather than a dynamic asset. Companies must continually assess which inventions are high-value, prioritizing resources towards those that offer the greatest strategic importance and potential return on investment.36

- Continuous Market Analysis and Competitive IntelligenceContinuous market monitoring helps identify opportunities and risks for a specific portfolio.36 An ongoing cadence of landscape and competitive monitoring keeps a company aware of shifting market conditions and emerging technologies, and can identify whitespace in the market where innovation may thrive.36 This includes tracking competitors’ patent filings and market activities to anticipate market shifts and identify potential threats or opportunities early.37This proactive approach to market analysis transforms IP management from a reactive legal function into a forward-looking business intelligence hub. It allows companies to refine market-entry strategies, assess market potential through historic sales figures, evaluate buyer power with data on reimbursement segmentation, and align distribution methods.38

- The Role of DrugPatentWatchIn this complex landscape, tools like DrugPatentWatch become indispensable. DrugPatentWatch is a valuable resource that offers insights into global drug patents, helping stakeholders like pharmaceutical companies, legal professionals, and researchers stay informed about patent expiration, exclusivity status, and competitive landscapes for pharmaceuticals.39 The platform provides data on drug patents and litigation histories, detailed patent and generic drug manufacturer information, and alerts on upcoming patent expirations.39For businesses in the pharmaceutical industry, DrugPatentWatch can be instrumental in developing strategic approaches to product development, market entry, and patent strategy.39 It provides tools for tracking global patent statuses, analyzing competition, and identifying market opportunities, making it a key asset for informed decision-making in drug lifecycle management.39 Its features include daily updates from primary sources, a deep research engine, raw data export, an AI research assistant, global drug patent coverage in 134 countries, and automated reports and custom dashboards.38 This allows users to identify and evaluate commercial opportunities, forecast branded and generic drug pipelines, anticipate future revenue events, and track litigation to anticipate early generic entry.38

B. Defending Your Portfolio: Litigation and Challenges

Even with meticulously drafted patents, pharmaceutical companies must be prepared to defend their intellectual property against challenges to its validity.4 Patent litigation is a significant concern due to the high value of drug patents.23

- Generic Challenges: Paragraph IV and ANDA LitigationGeneric drug manufacturers frequently challenge patents under the Hatch-Waxman Act, seeking to bring lower-cost alternatives to market.23 This process is intended to balance competition and innovation, but it often results in costly and time-consuming litigation for patent holders.23 A generic firm can file an Abbreviated New Drug Application (ANDA) four years after the brand product’s approval date, claiming its product does not infringe the reference product’s patent(s), or that these patents are invalid (a “Paragraph IV challenge”).14 If the brand name files suit within 45 days, FDA approval of the generic drug is generally postponed for 30 months, allowing time for patent litigation.14 This “30-month stay” is a critical protection for brand-name manufacturers.16The financial incentive for generics is enormous if they can successfully curtail a monopoly period and secure an early market entry, sometimes even gaining a temporary period of exclusivity (such as the 180-day period awarded to the first successful challenger).18 This leads generic firms to “race to be first ANDA filer with a patent challenge, and to challenge patents even when the probability of success is low”.14

- Inter Partes Review (IPR) and Parallel ProceedingsIn addition to district court litigation, generic manufacturers are increasingly using administrative proceedings like Inter Partes Review (IPR) before the Patent Trial and Appeal Board (PTAB) to challenge drug patent validity.15 IPRs are attractive due to their lower burden of proof (preponderance of evidence) compared to district court’s clear-and-convincing standard.41The interplay between IPR and Hatch-Waxman litigation creates “parallel proceedings”.41 While IPRs can offer a faster determination, district court deadlines often outpace IPRs (30 months vs. 18 months).41 Courts rarely stay Hatch-Waxman cases for IPRs, limiting the PTAB’s ability to influence trial outcomes.41 This means brand-name companies must often defend their patents simultaneously in multiple forums, requiring careful strategic coordination.41In 2023, 18% of all patent litigation cases involved pharmaceutical patents.43 The success rate for patent owners in litigation was 32% in 2023.43 This low success rate underscores the competitive and complex nature of patent litigation, where thorough preparation and strong legal arguments are essential.43 However, the success rate for petitioners in IPR proceedings was 70% in 2023, suggesting IPR is an effective tool for challenging patents and often leading to claim invalidation.43This dynamic reveals a critical tension: while patents are presumed valid, generic challenges, particularly via IPR, have a high success rate in invalidating claims. This suggests that some drug patents, especially secondary ones, may be of “low quality”.40 The high cost of infringement and litigation can deter generic competitors from challenging original patent holders.44 This complex legal environment necessitates a robust defense strategy that includes meticulous record-keeping, strategic patent prosecution, and a deep understanding of the competitive landscape.10

C. Patent Valuation: Quantifying IP Assets

Understanding the true value of a patent portfolio is crucial for strategic decision-making, from R&D investment to mergers and acquisitions. Patent valuation is a specialized field that assesses the economic potential and strategic importance of IP assets.46

- Key Factors Influencing Patent ValueAccurately valuing pharmaceutical patents involves considering several key factors:

- R&D Costs and Investment: The high costs associated with developing new drugs are a significant factor, as patents ensure a return on this investment.46

- Market Potential and Revenue Projections: The potential market size, disease prevalence, competitive landscape, pricing strategies, and market trends are crucial.46 A larger market size indicates higher revenue potential.46

- Regulatory Environment: Regulatory approvals, compliance requirements, and potential changes in legislation significantly impact patent value.46

- Competitive Landscape: Analyzing existing treatments, pipeline drugs, and competitors’ strategies is essential for assessing a patent’s strategic value.46

- Scope and Strength of Claims: Broader and stronger claims provide wider protection and make the patent more difficult to design around.48

- Remaining Patent Life: A patent expiring in two years is less valuable than one with 15 years left.48

- Ease of Designing Around and Detectability of Infringement: These factors influence litigation costs and the likelihood of successful enforcement.48

- Valuation Methods and Strategic ApplicationsPatent valuation typically employs several approaches:

- Cost Approach: Estimates value based on the costs to develop or replace the patented technology.48

- Market Approach: Values patents by looking at comparable transactions involving similar patents.48

- Income Approach: Projects potential revenue from the drug over its patent life, including sales volume, pricing, and growth rates.46

V. Emerging Trends and Future Challenges in Drug Patent Strategy

The biomedical landscape is constantly evolving, driven by scientific breakthroughs and technological advancements. This evolution presents both unprecedented opportunities and novel challenges for drug patent strategy.

A. The Impact of Artificial Intelligence (AI) on Drug Patenting

Artificial intelligence is rapidly transforming drug discovery, accelerating the identification of drug candidates, optimizing clinical trial designs, and predicting therapeutic outcomes.52 However, its integration raises complex questions for IP.

- AI and Inventorship ChallengesA fundamental challenge lies in the concept of inventorship. Under US law, only natural persons can be inventors.54 AI needs to be assisting, not creating, the invention, requiring an “individual” to make a “significant contribution to the conception of the claimed invention”.54 The USPTO rejected patent applications naming an AI system (DABUS) as the sole inventor, a decision upheld by the US Court of Appeals for the Federal Circuit.54This legal stance means companies must maintain detailed records documenting human contributions throughout the AI-assisted drug discovery process.54 This is reminiscent of the “first to invent” patent system, where meticulous lab notebooks were critical.54

- AI and Patentability StandardsAI access has also raised the standard for what is considered “obvious” in patent law, potentially making it harder to prove innovations are non-obvious and therefore patentable.54 The “skilled person” now has access to AI, increasing the baseline of what is considered common knowledge or a predictable development.54Despite these challenges, AI can actually strengthen patent applications by generating numerous examples to support broader claims.54 For instance, instead of 10 examples, AI can produce hundreds, significantly enhancing the application.54The AI in pharma market is projected to soar to $13.1 billion by 2034, reflecting an 18.8% compound annual growth rate, and is expected to generate between $350 billion and $410 billion annually for the pharmaceutical sector by 2025.58 This growth is driven by genuine innovations in drug development, particularly in solving data harmonization challenges that have plagued pharmaceutical research for decades.58 Companies like Renovaro are building IP portfolios around these fundamental bottlenecks, protecting their data harmonization methods and creating valuable intellectual property as the industry generates larger and more complex datasets.58

B. Patenting Personalized Medicine, Gene Therapy, and Digital Therapeutics

Emerging technologies like personalized medicine, gene therapy (e.g., CRISPR, CAR-T), and digital therapeutics present unique and complex patentability challenges.50 Current patent laws are often inadequate to deal with their unique characteristics.61

- Personalized Medicine and Gene TherapyPersonalized medicine involves tailoring treatments based on an individual’s genetic, environmental, and lifestyle factors.50 The cornerstone is genetics, allowing prediction of drug response.50

- Complexity of Treatments: These therapies often involve intricate biotechnological processes and deep understanding of genetic interactions, making it difficult to meet novelty, non-obviousness, and utility requirements.50

- Patent Eligibility of Genetic Information: The legal landscape regarding patentability of genes and genetic sequences is complex and varies by jurisdiction. Naturally occurring genetic sequences often cannot be patented, raising questions about protecting innovations based on them.50 Landmark cases like Association for Molecular Pathology v. Myriad Genetics have had significant implications.60

- CAR-T Therapy Example: The Juno Therapeutics vs. Kite Pharma Inc. case (2021) illustrates challenges with CAR-T cell therapy patents. The court reversed a $1.1 billion jury verdict, finding the patent’s written description insufficient because it failed to provide a representative sample of species or defining characteristics for a broad genus of binding elements.24 This case highlights the importance of including many working examples and detailed structural/sequence information in patent applications.24

- Digital TherapeuticsDigital therapeutics, which combine software, hardware, and medical knowledge, also face unique patenting challenges.59

- Defining the Invention: Capturing the novelty and inventiveness of these multi-component inventions can be difficult.59

- Software Patents: Many digital therapeutics involve software algorithms, which can be difficult to patent in some jurisdictions due to strict guidelines.59

- Obviousness and Prior Art: The rapid evolution of digital health technology makes thorough prior art searches challenging, and inventions may be deemed obvious if underlying technologies (like mobile apps) are well-known.59

C. Global Patent Harmonization Efforts

The global patent landscape is a complex and ever-evolving field.25 As technology advances and global trade increases, the need for a harmonized patent system has become more pressing.25

- Benefits and Challenges of HarmonizationPatent harmonization aims to create a more unified and consistent global patent system by aligning laws and practices across different countries.25

- Benefits: Simplified patent filing processes (e.g., PCT system allows a single international application for multiple countries 25), reduced administrative burden and costs, enhanced patent quality and consistent examination standards, and increased efficiency through work-sharing programs like the Patent Prosecution Highway (PPH).25 Harmonization can also lead to faster market access for new medicines and potentially lower drug development costs.27

- Challenges: Despite efforts by organizations like WIPO, inconsistencies and complexities persist across jurisdictions.25 For instance, some countries still require local testing or specific numbers of their nationals in clinical trials, creating logistical difficulties.27

- Future Outlook for Global IP StrategyAs technology continues to evolve and global trade patterns shift, the patent landscape is likely to undergo significant changes.25 Emerging trends like AI and biotechnology will continue to challenge existing patent law.25 Future reforms may include unitary patent protection systems and patent eligibility reforms to address software and business methods.25For biomedical companies, this means IP strategies must reflect the nature of the technologies involved; as technology changes, so do ways of protecting, enforcing, and monetizing IP rights.64 Innovators must be adaptable, undertaking freedom-to-operate analyses and licensing decisions on a continuous basis throughout the product development process.64 The goal is to ensure consistent IP protection that allows firms to bring life-enhancing goods and services to global markets, setting price points that ensure profitability while also ensuring access to life-changing treatments.63

Key Takeaways

Maximizing drug patent value in the biomedical industry is a multifaceted endeavor, far more intricate than simply filing a single patent. It is a strategic imperative woven into the very fabric of drug development and commercialization.

- Patents are the Economic Lifeblood: The astronomical costs and lengthy timelines of R&D make robust patent protection non-negotiable. Patents are not just legal documents; they are the financial engine that allows companies to recoup multi-billion dollar investments and fund future innovations. The short effective market exclusivity period (7-8 years) intensifies the need for every strategic advantage.

- Dual Protection is Paramount: Understanding the interplay between USPTO-granted patents and FDA-granted regulatory exclusivities is critical. These distinct yet often overlapping protections form a layered defense, and maximizing their combined effect requires meticulous planning and cross-functional collaboration from discovery through commercialization.

- Embrace Multi-Layered Patenting: Beyond the core active ingredient, strategically patenting formulations, methods of use, manufacturing processes, polymorphs, and delivery devices creates a formidable “patent thicket.” While often controversial, this “evergreening” is a sophisticated, and often necessary, tactic to extend market exclusivity and mitigate the impact of the “patent cliff,” which threatens billions in revenue for major pharmaceutical companies.

- Proactive Portfolio Management is Key: A robust IP strategy involves continuous market analysis, competitive intelligence (leveraging tools like DrugPatentWatch), and proactive defense against generic challenges. The complex landscape of Hatch-Waxman litigation, including Paragraph IV challenges and IPRs, demands a highly skilled legal team capable of navigating parallel proceedings and adapting to evolving legal precedents.

- Adapt to Emerging Technologies: New frontiers in personalized medicine, gene therapy, digital therapeutics, and AI-driven drug discovery introduce novel patentability challenges, particularly around inventorship and the “non-obviousness” standard. Companies must develop flexible IP strategies that account for these rapidly evolving scientific and legal landscapes, focusing on human contributions in AI-assisted inventions and detailed disclosures for complex biological therapies.

- Global Strategy is Non-Negotiable: Given the global nature of drug development and markets, a cohesive international patent strategy is essential. Harmonization efforts, though imperfect, aim to simplify global filing and enforcement, underscoring the need for companies to align their IP efforts across jurisdictions to ensure consistent protection and efficient market access.

Frequently Asked Questions

Q1: How do pharmaceutical companies balance the need for patent protection with public concerns about high drug prices?

A1: Pharmaceutical companies argue that strong patent protection is essential to incentivize the massive, risky investments in R&D required to discover and develop new medicines, many of which fail. Without the prospect of recouping these billions of dollars, innovation would significantly decline. While patents grant temporary monopolies leading to higher prices, the system is designed to balance this with eventual generic entry, which drastically lowers costs. The debate often centers on the duration and scope of these monopolies, particularly practices like “evergreening” and “patent thickets,” which critics argue unduly extend exclusivity.

Q2: What is the “patent cliff” and how do companies typically prepare for it?

A2: A “patent cliff” occurs when blockbuster drugs lose their patent protection, leading to a significant and often rapid decline in revenue as lower-cost generic or biosimilar versions enter the market. Companies prepare for this by employing comprehensive lifecycle management strategies, such as developing new formulations, discovering new indications for existing drugs, creating fixed-dose combinations, and securing patents on manufacturing processes. They also invest heavily in new R&D pipelines and strategic acquisitions to diversify their portfolios and offset anticipated revenue losses.

Q3: How has the rise of AI and personalized medicine complicated drug patenting?

A3: AI and personalized medicine introduce several complexities. For AI, the primary challenge is inventorship, as current US law requires a human inventor. Companies must meticulously document human contributions in AI-assisted discoveries to secure patents. AI also raises the “non-obviousness” bar, as AI-generated insights might make certain innovations seem more obvious. For personalized medicine and gene therapies, challenges include the patentability of naturally occurring genetic information, the complexity of the treatments themselves, and the need for highly detailed disclosures in patent applications to cover broad therapeutic classes.

Q4: What is the significance of the Hatch-Waxman Act in US drug patent strategy?

A4: The Hatch-Waxman Act of 1984 is pivotal because it created a pathway for generic drugs to enter the market more quickly while also providing mechanisms for brand-name companies to extend patent terms for time lost during regulatory review. It established the Abbreviated New Drug Application (ANDA) process for generics and the Paragraph IV certification, which allows generics to challenge brand patents, often leading to litigation. This act fundamentally shaped the strategic interplay between innovator and generic companies, making patent litigation a central feature of the pharmaceutical landscape.

Q5: How can a company best leverage competitive intelligence in its patent strategy?

A5: Leveraging competitive intelligence is crucial for proactive patent strategy. This involves continuous monitoring of competitors’ patent filings, pipeline developments, and litigation activities. Tools like DrugPatentWatch provide comprehensive data on global drug patents, exclusivity statuses, and litigation histories, enabling companies to identify market opportunities, anticipate generic entry, assess competitive landscapes, and refine their own filing and defense strategies. By understanding competitor moves, a company can identify white space for innovation, strengthen its own portfolio, and make more informed business decisions.

References

- DrugPatentWatch. (n.d.). Filing Strategies for Maximizing Pharma Patents. Retrieved from https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- McKendree University. (n.d.). The Importance of Pharmaceutical Patents. Retrieved from https://www.mckendree.edu/academics/scholars/issue11/bodem.htm

- Tikamobile. (n.d.). Pharmaceutical R&D Explained: Costs, Challenges, and the Future of Innovation. Retrieved from https://www.tikamobile.com/resources/blog/pharmaceutical-research-and-development-explained

- U.S. Food and Drug Administration. (n.d.). Frequently Asked Questions on Patents and Exclusivity. Retrieved from https://www.fda.gov/drugs/development-approval-process-drugs/frequently-asked-questions-patents-and-exclusivity

- DrugPatentWatch. (n.d.). Generic Portfolio Management: Partnering with Brands and Staying Competitive. Retrieved from https://www.drugpatentwatch.com/blog/generic-portfolio-management-partnering-with-brands-and-stay-competitive/

- Yale Law and Policy Review. (n.d.). Patent Term Extensions and “Last Man Standing”. Retrieved from https://yalelawandpolicy.org/patent-term-extensions-and-last-man-standing

- The University of Chicago Press. (n.d.). The Incentives for Patent Challenges. Retrieved from https://www.journals.uchicago.edu/doi/10.1162/AJHE_a_00066

- Congress.gov. (n.d.). IF13028: Drug Patents and Generic Drug Entry: An Overview. Retrieved from https://www.congress.gov/crs-product/IF13028

- Commonwealth Fund. (2017, September 13). Determinants of Market Exclusivity for Prescription Drugs in the United States. Retrieved from https://www.commonwealthfund.org/publications/journal-article/2017/sep/determinants-market-exclusivity-prescription-drugs-united

- PatSnap. (n.d.). What is a Patent Challenge and Why is it Common in Generics?. Retrieved from https://synapse.patsnap.com/article/what-is-a-patent-challenge-and-why-is-it-common-in-generics

- U.S. Food and Drug Administration. (n.d.). Patent Certifications and Suitability Petitions. Retrieved from https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- PatentPC. (n.d.). Addressing Patent Challenges: Biologics and Biosimilars. Retrieved from https://patentpc.com/blog/addressing-patent-challenges-biologics-and-biosimilars

- Torrey Pines Law Group. (n.d.). Pharmaceutical Lifecycle Management. Retrieved from https://torreypineslaw.com/pharmaceutical-lifecycle-management.html

- Gearhart Law. (n.d.). Unique Challenges for Patents in the Pharmaceutical Industry. Retrieved from https://gearhartlaw.com/unique-challenges-for-patents-in-the-pharmaceutical-industry/

- Parlee. (n.d.). Patenting Personalized Medicine: Lessons from CAR T-Cell Therapy in the U.S.. Retrieved from https://www.parlee.com/news/patenting-personalized-medicine-lessons-from-car-t-cell-therapy-in-the-u-s/

- PatentPC. (n.d.). Understanding Patent Harmonization and Its Global Impact. Retrieved from https://patentpc.com/blog/understanding-patent-harmonization-and-its-global-impact

- NCBI Bookshelf. (n.d.). International Harmonization: An Industry Perspective. Retrieved from(https://www.ncbi.nlm.nih.gov/books/NBK174222/)

- AJMC. (2017, January 20). Drug Life-Cycle Management Patent Strategies. Retrieved from https://www.ajmc.com/view/a636-article

- SenPharma. (n.d.). Patent Cliff: Challenges and Opportunities. Retrieved from https://senpharma.vn/en/patent-cliff-challenges-and-opportunities/

- Pharmaceutical Technology. (2025, July 4). Big pharma braces for revenue headwinds as patent expiries loom. Retrieved from https://www.pharmaceutical-technology.com/news/big-pharma-braces-for-revenue-headwinds-as-patent-expiries-loom/

- BioPharma Dive. (n.d.). AbbVie’s Humira Monopoly: How It Stretched for Years. Retrieved from https://www.biopharmadive.com/news/humira-abbvie-biosimilar-competition-monopoly/620516/

- I-MAK. (2020, October 6). Overpatented, Overpriced: How AbbVie’s Humira Monopoly Costs Patients Billions. Retrieved from(https://www.i-mak.org/wp-content/uploads/2020/10/i-mak.humira.report.3.final-REVISED-2020-10-06.pdf)

- CSRxP. (2025, January 27). BIG PHARMA WATCH: MERCK EXPEDITES ANTI-COMPETITIVE STRATEGY ON BLOCKBUSTER CANCER DRUG. Retrieved from https://www.csrxp.org/big-pharma-watch-merck-expedites-anti-competitive-strategy-on-blockbuster-cancer-drug/

- Ainvest. (n.d.). Merck’s $10 Billion Gamble: Respiratory Diversification to Offset Keytruda Patent Cliff. Retrieved from https://www.ainvest.com/news/merck-10-billion-gamble-respiratory-diversification-offset-keytruda-patent-cliff-2507/

- Dilworth IP. (n.d.). What is Patent Portfolio Management?. Retrieved from https://www.dilworthip.com/resources/news/patent-portfolio-management/

- PatentPC. (n.d.). Managing Patent Portfolios in the Pharmaceutical Industry. Retrieved from https://patentpc.com/blog/managing-patent-portfolios-in-the-pharmaceutical-industry

- DrugPatentWatch. (n.d.). About DrugPatentWatch. Retrieved from https://www.drugpatentwatch.com/about.php

- American University Washington College of Law. (n.d.). Administrative Patent Challenge Proceedings and Drug Patents. Retrieved from https://digitalcommons.wcl.american.edu/cgi/viewcontent.cgi?article=3248&context=facsch_lawrev

- DrugPatentWatch. (n.d.). Parallel Proceedings: Coordinating IPR and Para IV Challenges. Retrieved from https://www.drugpatentwatch.com/blog/parallel-proceedings-coordinating-ipr-and-para-iv-challenges/

- University of Alabama School of Law. (n.d.). Hatch-Waxman Patent Litigation and Inter Partes Review. Retrieved from(https://law.ua.edu/wp-content/uploads/2011/07/Hatch-Waxman-Patent-Litigation-and-Inter-Partes-Review.pdf)

- PatentPC. (n.d.). Patent Litigation Statistics: An Overview of Recent Trends. Retrieved from https://patentpc.com/blog/patent-litigation-statistics-an-overview-of-recent-trends

- UCLA Anderson Review. (n.d.). $52.6 Billion: Extra Cost to Consumers of Add-On Drug Patents. Retrieved from https://anderson-review.ucla.edu/52-6-billion-extra-cost-to-consumers-of-add-on-drug-patents/

- BrainyQuote. (n.d.). Intellectual Property Quotes. Retrieved from https://www.brainyquote.com/topics/intellectual-property-quotes

- PatentPC. (n.d.). Patent Valuation in the Pharmaceutical Industry: Key Considerations. Retrieved from https://patentpc.com/blog/patent-valuation-in-the-pharmaceutical-industry-key-considerations

- J.S. Held. (n.d.). Intellectual Property Valuation. Retrieved from https://www.jsheld.com/areas-of-expertise/financial-investigations-valuation-risk/economic-damages-valuations/intellectual-property/valuation

- Prof Wurzer. (n.d.). Understanding Patent Value. Retrieved from https://profwurzer.com/understanding-patent-value/

- Ocean Tomo. (n.d.). Patent Valuation. Retrieved from https://oceantomo.com/services/patent-valuation/

- Evalueserve. (n.d.). AI in Drug Discovery: Why IP Searches Are the Key to Securing Market Leadership. Retrieved from https://iprd.evalueserve.com/blog/ai-in-drug-discovery-why-ip-searches-are-the-key-to-securing-market-leadership/

- Citeline. (n.d.). AI in Drug Discovery: The Patent Implications. Retrieved from(https://insights.citeline.com/in-vivo/new-science/ai-in-drug-discovery-the-patent-implications-W5UIZKA5Z5F2FAV3LWL2L4WPWQ/)

- Drug Discovery Trends. (n.d.). The Challenge of AI Inventorship in Healthcare. Retrieved from(https://www.drugdiscoverytrends.com/the-challenge-of-ai-inventorship-in-healthcare/#:~:text=AI%2Dassisted%20drug%2Ddiscovery%20raises,to%20securing%20and%20defending%20patents)

- Citeline. (n.d.). AI In Drug Discovery: The Patent Implications. Retrieved from(https://insights.citeline.com/in-vivo/new-science/ai-in-drug-discovery-the-patent-implications-W5UIZKA5Z5F2FAV3LWL2L4WPWQ/#:~:text=AI%20access%20has%20raised%20the,non%2Dobvious%20and%20therefore%20patentable)

- Winsome Marketing. (n.d.). Renovaro’s New AI Drug Discovery Patent. Retrieved from https://winsomemarketing.com/ai-in-marketing/renovaros-new-ai-drug-discovery-patent

- PatentPC. (n.d.). Addressing Patent Challenges in Digital Therapeutics. Retrieved from https://patentpc.com/blog/addressing-patent-challenges-in-digital-therapeutics

- ResearchGate. (n.d.). Patentability challenges associated with emerging pharmaceutical technologies. Retrieved from https://www.researchgate.net/publication/353223080_Patentability_challenges_associated_with_emerging_pharmaceutical_technologies

- Washington University Law Review. (n.d.). Patent Infringement and the Medical Procedure Exemption in the Era of Personalized Medicine. Retrieved from https://openscholarship.wustl.edu/law_lawreview/vol96/iss3/4/

- Dechert. (n.d.). New Dawn for Life Sciences IP Strategy. Retrieved from(https://www.dechert.com/content/dam/dechert%20files/people/bios/h/katherine-a–helm/IAM-Special-Report-New-Dawn-for-Life-Sciences-IP-Strategy.pdf)

- Goodreads. (n.d.). Intellectual Property Quotes. Retrieved from https://www.goodreads.com/quotes/tag?id=intellectual-property&page=3

- Larksuite. (n.d.). Top 5 Interview Questions for Intellectual Property Specialists. Retrieved from https://www.larksuite.com/en_us/topics/interview-questions/interview-questions-for-intellectual-property-specialists

- TogetherSC. (n.d.). Intellectual Property Lawyer Interview Questions and Answers. Retrieved from https://jobs.togethersc.org/interview-questions/intellectual-property-lawyer

- Managing IP. (n.d.). Interview: How to Manage an In-House IP Team. Retrieved from https://www.managingip.com/article/2a5c5ei489swxneewo9vk/interview-how-to-manage-an-in-house-ip-team

- TealHQ. (n.d.). Intellectual Property Lawyer Interview Questions and Answers. Retrieved from https://www.tealhq.com/interview-questions/intellectual-property-lawyer

- GeneOnline. (n.d.). Google Patents Analysis Highlights Four Key Features for Drug Patent Research. Retrieved from https://www.geneonline.com/google-patents-analysis-highlights-four-key-features-for-drug-patent-research/

- Goodwin Law. (n.d.). DOJ and FTC Host Listening Sessions on Competition in Pharmaceutical Markets. Retrieved from https://www.goodwinlaw.com/en/insights/publications/2025/07/alerts-practices-cldr-doj-and-ftc-host-listening-sessions

- Congress.gov. (n.d.). R46679: Intellectual Property Rights and Access to Medicines. Retrieved from(https://www.congress.gov/crs-product/R46679)

- DrugPatentWatch. (n.d.). The Impact of Drug Patent Expiration: Financial Implications, Lifecycle Strategies, and Market Transformations. Retrieved from https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- PatentPC. (n.d.). The Challenge of Patenting Personalized Medicine. Retrieved from https://patentpc.com/blog/challenge-of-patenting-personalized-medicine

- PatentPC. (n.d.). How to Commercialize Patents in the Biotech Industry. Retrieved from https://patentpc.com/blog/how-to-commercialize-patents-in-the-biotech-industry

- PatentPC. (n.d.). The Role of IP Valuation in M&A Due Diligence. Retrieved from https://patentpc.com/blog/the-role-of-ip-valuation-in-ma-due-diligence

- Ballard Spahr. (n.d.). Patents. Retrieved from https://www.ballardspahr.com/services/practices/patents

- Sterne Kessler. (n.d.). PTAB’s Doors Would Be Closed to Generics Under Hatch Bill. Retrieved from https://www.sternekessler.com/news-insights/news/ptabs-doors-would-be-closed-generics-under-hatch-bill/

- IQVIA. (n.d.). Alternative Pathways for Challenging Patent Validity in the US. Retrieved from https://www.iqvia.com/blogs/2019/05/alternative-pathways-for-challenging-patent-validity-in-the-us

- Emory Law Journal. (n.d.). The Thirty-Month Stay in Hatch-Waxman Litigation. Retrieved from https://scholarlycommons.law.emory.edu/cgi/viewcontent.cgi?article=1098&context=elj

- U.S. Food and Drug Administration. (n.d.). International Regulatory Harmonization. Retrieved from https://www.fda.gov/drugs/cder-international-program/international-regulatory-harmonization

- Mintz. (n.d.). IPR Victories for Innovators in Hatch-Waxman Battles. Retrieved from https://www.mintz.com/industries-practices/case-studies/ipr-victories-innovators-hatch-waxman-battles

- IPMall. (n.d.). Quotes on Patent Lawyers – Compiled by Homer Blair. Retrieved from http://ipmall.law.unh.edu/content/quotes-patent-lawyers-compiled-homer-blair

- PMC. (n.d.). The Impact of Patent Expiry on Drug Prices: A Systematic Literature Review. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC6132437/

- PatentPC. (n.d.). The Cost of Drug Development: How Much Does It Take to Bring a Drug to Market? (Latest Data). Retrieved from https://patentpc.com/blog/the-cost-of-drug-development-how-much-does-it-take-to-bring-a-drug-to-market-latest-data