Executive Summary: Navigating Europe’s Evolving Pharmaceutical Landscape

The European pharmaceutical sector is undergoing a profound transformation, driven significantly by the increasing prominence of biosimilar medicines. This report synthesizes the core dynamics of this shift, highlighting how biosimilars, while distinct from traditional generics, are fundamentally reshaping market competition, influencing pricing strategies, and broadening patient access to essential therapies. The analysis underscores Europe’s pioneering role in establishing a robust regulatory framework for biosimilars, which has, in turn, positioned the continent as a bellwether for global pharmaceutical trends .

Key drivers propelling this evolution include the impending “patent cliff” for numerous blockbuster biologics, the escalating demand for cost-effective treatments for chronic and often debilitating conditions, and the proactive regulatory environment fostered by the European Medicines Agency (EMA) . These factors collectively create substantial opportunities for pharmaceutical companies capable of navigating this complex landscape.

However, the transition is not without its challenges. Manufacturers face hurdles such as the intricate and costly nature of biosimilar development and manufacturing, intense pricing pressures, and the variability in national adoption policies across European Union (EU) Member States . These complexities necessitate a strategic imperative for generic manufacturers to adapt their business models, diversify their product portfolios, and leverage sophisticated intellectual property intelligence to maintain a competitive edge .

Looking ahead, the market is poised for continued evolution, propelled by ongoing policy reforms, particularly the EU Pharmaceutical Strategy, and advancements in biotechnological capabilities. For industry players, a forward-looking perspective and strategic foresight are paramount to capitalizing on emerging opportunities and ensuring long-term sustainability in this dynamic environment.

Introduction: The Dawn of a New Era in European Pharma

Setting the Stage: The European Pharmaceutical Landscape

Europe holds a significant position in the global pharmaceutical market, historically contributing to innovation and maintaining a substantial share of worldwide pharmaceutical sales . However, healthcare systems across the continent are under increasing financial pressure, making the widespread availability of cost-effective medicines a critical priority . This economic imperative has set the stage for a transformative period, where market dynamics are increasingly influenced by the interplay between established drug categories and emerging therapeutic alternatives.

A critical understanding arises from Europe’s leadership in biosimilar regulation and market penetration. The EMA has been at the forefront of establishing guidelines for biosimilar approval since 2006, shaping global development pathways . This proactive stance has resulted in Europe having the highest number of biosimilar approvals worldwide and a more advanced market compared to other regions . This leadership suggests that the trends and challenges observed within Europe’s generic and biosimilar markets often provide a preview of future global developments. For business professionals, gaining a deep understanding of Europe’s trajectory offers a strategic advantage in anticipating shifts in other major pharmaceutical markets worldwide.

Defining the Pharmaceutical Ecosystem: Generics vs. Biosimilars

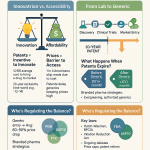

To fully grasp the impact of biosimilars, it is essential to delineate the fundamental differences between them and traditional generic medicines.

Generic Medicines: The Foundation of Cost Savings

Generic medicines are pharmaceutical products developed to be identical to an already authorized brand-name medicine . They contain the same active ingredient(s), dosage form, strength, and route of administration, and are typically chemically synthesized from small molecules . Their authorization pathway is streamlined, relying on the efficacy and safety data from studies conducted on the original branded medicine, and they can only be marketed once the 10-year exclusivity period for the original product has expired .

The primary role of generics in healthcare systems is to reduce costs significantly. Their introduction typically leads to a substantial decrease in drug prices, often by 80-90% compared to their branded counterparts . This cost-effectiveness has made generics a cornerstone of European healthcare, accounting for a high volume of prescriptions and generating substantial savings for national health budgets. For instance, generic medicines are generally 20-80% cheaper than brand-name medicines, saving Europe an estimated US$113.82 billion (€100 billion) annually . In Germany, generics account for over 75% of prescriptions by volume, yet only 36.8% of the cost .

Biosimilar Medicines: The Complex Cousins

In contrast, biosimilars are biological medicines that are “highly similar” to an already approved biological reference medicine . The EMA defines them as products with no clinically meaningful differences in terms of safety, quality, and efficacy compared to their reference product . A crucial distinction is that biosimilars are not considered “generics” of biological medicines because the natural variability and complex manufacturing processes of biological products, derived from living cells or organisms, do not allow for an exact replication of their molecular micro-heterogeneity .

The approval of biosimilars is based on comprehensive comparability studies that rigorously demonstrate this high similarity across physicochemical, biological, and clinical attributes . This approach allows for reliance on the safety and efficacy experience gained with the reference medicine, thereby avoiding unnecessary repetition of extensive clinical trials .

The nuance embedded in the term “highly similar” versus “identical” is not merely a regulatory technicality; it carries profound strategic implications. This distinction directly impacts the complexity of manufacturing, the magnitude of development costs, and the market’s perception of these products. For companies rooted in generic drug production, a pivot towards biosimilars necessitates a fundamental reorientation of their research and development, manufacturing capabilities (shifting from chemical synthesis to advanced biotechnology), and quality control paradigms. This transition demands significant investment and entails a different risk profile compared to traditional generics . Furthermore, while biosimilars do drive significant price erosion, the reduction is generally less drastic than that observed with small-molecule generics, typically ranging from 15-30% compared to 80-90% . This difference in price erosion reflects the higher development costs and the inherent complexities of biological products.

The Strategic Imperative: Why Biosimilars Matter to the Generic Industry

Biosimilars are fundamentally transforming the traditional generic drug market in Europe. Their increasing presence creates heightened competition not only for originator biologics but also indirectly for traditional small-molecule generics, while simultaneously expanding patient access to potentially life-saving treatments . This shift compels generic companies to adapt and innovate, with many already strategically focusing on developing their own biosimilar portfolios .

The advent of biosimilars represents a significant growth engine, particularly in an environment where the traditional generic market may be approaching saturation. While the European generic market is substantial, it has historically faced intense price competition and thin profit margins . Biosimilars, with their higher development costs and more stringent regulatory requirements, inherently create significant barriers to entry . This complexity leads to less aggressive price competition and offers a higher revenue potential compared to the commoditized small-molecule generic segment . For generic drug manufacturers, investing in biosimilars is therefore not just a matter of portfolio diversification; it is a strategic move to access a more lucrative and less commoditized segment of the pharmaceutical market. This strategic pivot is crucial for ensuring long-term sustainability and fostering growth amidst the persistent pressures within their traditional small-molecule domain.

Understanding the Regulatory Foundations: EMA’s Pioneering Role

The European Medicines Agency (EMA) Framework for Biosimilars

The European Medicines Agency (EMA) plays a pivotal role in the evaluation and approval of biosimilar applications within the European Union. Since approving the first biosimilar in 2006, the EU has pioneered the regulation of these complex medicines, establishing a robust framework that has influenced biosimilar development globally .

The approval process for biosimilars under the EMA is rigorous. It mandates comprehensive comparability studies that must demonstrate high similarity in terms of quality, safety, and efficacy to the reference biological product . This scientific approach allows biosimilar developers to leverage the extensive safety and efficacy experience of the originator product, thereby avoiding unnecessary repetition of costly and time-consuming clinical trials .

The EMA’s regulatory approach is dynamic and responsive to scientific advancements. A draft reflection paper currently under public consultation suggests a tailored clinical approach to biosimilar development and evaluation . This proposal indicates that robust analytical and pharmacokinetic (PK) data, demonstrating structural and functional comparability, may be sufficient for approval under specific prerequisites, potentially reducing development costs and accelerating market timelines . This adaptive stance by the EMA, acknowledging the accumulated scientific experience and advances in analytical methodologies, is more than a mere procedural adjustment. It is a strategic regulatory signal designed to foster greater competition and enhance patient access by alleviating some of the time and cost burdens associated with biosimilar development. For pharmaceutical companies, this translates into a clearer, potentially faster pathway to market, thereby incentivizing further investment in biosimilar pipelines and accelerating the availability of these cost-effective treatments.

Generic Drug Approval Pathways in Europe: A Comparative View

The approval pathway for generic drugs in Europe is distinctly different from that for biosimilars, reflecting the inherent differences in their molecular structures and manufacturing processes. Generic drug applications primarily focus on demonstrating pharmaceutical equivalence—meaning they contain the same qualitative and quantitative composition of active substance(s), have the same pharmaceutical form, and are administered via the same route as the reference product . Crucially, they must also demonstrate bioequivalence, proving comparable bioavailability under similar testing conditions . A generic drug is considered bioequivalent if its mean Cmax and AUC fall within a 90% confidence interval of 80% to 125% of the branded product .

Generic medicines can only be marketed once the 10-year exclusivity period for the original medicine has expired . The regulatory process for generics is generally streamlined, with approval timelines for national procedures around 150 days .

When comparing the streamlined generic pathway with the more intricate biosimilar pathway, a clear difference in complexity and required studies emerges . This stark contrast in regulatory complexity establishes a significant competitive barrier for biosimilars. While generics typically face relatively low barriers to entry once patents expire, biosimilars inherently benefit from a higher regulatory “moat.” This structural difference protects biosimilar manufacturers from the rapid commoditization and aggressive price erosion often seen in the small-molecule generic market. This, in turn, allows for more sustainable pricing and encourages the substantial investment required for sophisticated research and development, as well as advanced manufacturing capabilities in the biologics space .

The Nuance of Interchangeability: Policy and Practice Across EU Member States

From a scientific perspective, the EMA and the Heads of Medicines Agencies (HMA) have emphasized that biosimilars approved in the EU are interchangeable . This means that a biosimilar can be used instead of its reference product, or vice versa, and a biosimilar can also be used in place of another biosimilar of the same reference product . This scientific stance is supported by extensive safety data, with over 1 million patient-treatment years demonstrating that approved biosimilars are safe and can be used interchangeably .

However, a crucial point of divergence lies in the practical application of interchangeability. While the EMA provides the scientific endorsement, the regulatory determination of interchangeability and the implementation of automatic substitution policies are made at the individual Member State level . This decentralized approach leads to varying practices across the EU. For example, most EU countries have rules prohibiting automatic substitution without the consent of the treating physician . Yet, some countries are moving towards or have implemented policies allowing for automatic substitution. Germany, for instance, initiated a new law for automatic substitution of injectable biologics with biosimilars in June 2019, with guidance for physicians published in August 2020 . In France, pharmacists have been allowed to replace prescribed biological drugs with their biosimilars for filgrastim and pegfilgrastim since April 2022, provided the physician has not explicitly excluded this option .

This fragmentation in decision-making at the Member State level, despite the EMA’s centralized scientific approval, creates a significant impediment to widespread biosimilar uptake. Such inconsistency introduces uncertainty for prescribers and pharmacists, complicating market access strategies for manufacturers . For businesses, this means that a “one-size-fits-all” market access strategy is largely ineffective. Instead, a tailored, country-specific approach is essential to maximize biosimilar penetration and fully realize the cost-saving potential these medicines offer. This necessitates deep understanding of local reimbursement frameworks, prescribing habits, and educational needs.

The European Generic Drug Market: A Pre-Biosimilar Snapshot

Market Size, Growth, and Key Economic Drivers

The European generic drugs market represents a substantial and growing segment of the pharmaceutical industry. In 2024, the market was valued at approximately USD 119.99 billion and is projected to expand significantly, reaching nearly USD 228.77 billion by 2032, demonstrating a Compound Annual Growth Rate (CAGR) of 8.4% from 2025 . Other estimates place the market size at USD 87.5 billion in 2023, with an expected growth to USD 161.7 billion by 2032 at a CAGR of 7.0% .

The robust growth of the European generic market is underpinned by several key economic drivers. Cost-effectiveness remains paramount; generic drugs are significantly more affordable than their branded counterparts, with some estimates suggesting they are 20-80% cheaper, leading to substantial savings for healthcare systems . For example, generics account for 67% of dispensed medicine prescriptions in Europe but only 29% of total expenditure, saving Europe an estimated US$113.82 billion (€100 billion) annually . The expiration of patents on branded drugs consistently creates opportunities for generic entry . Furthermore, increasing healthcare demands, particularly from a rising burden of chronic diseases, drive the need for affordable treatment options . Governments across Europe actively promote the use of generics through favorable policies, reimbursement schemes, and incentives for both manufacturers and healthcare providers, aiming to improve access to essential medicines while controlling costs .

A critical understanding emerges from the inherent tension between the drive for cost-cutting and the need for market sustainability. While generics undeniably offer significant cost savings for healthcare systems , the intense price competition and continuous pressure from governments to lower prices can lead to thin profit margins and render the production of some generic medicines unsustainable . This situation is exacerbated by rising operational costs, such as salaries and energy bills, which generic manufacturers must absorb without the ability to adjust prices upwards . This creates a fundamental dilemma: the very success of generics in reducing healthcare expenditure can, paradoxically, jeopardize the long-term supply reliability and overall competitiveness of the generic sector itself. For policymakers and industry stakeholders, this highlights the urgent need for balanced pricing mechanisms that ensure both affordability for patients and the economic viability required for a stable and innovative supply chain.

Dominant Therapeutic Areas and Routes of Administration

The European generic drugs market exhibits strong activity across several therapeutic areas. Cardiovascular and oncology segments are experiencing significant growth, largely driven by high prevalence rates of associated conditions and the expiration of patents on major drugs in these categories . Other notable areas include dermatology, respiratory, and rheumatology, all seeing increased demand for cost-effective treatments due to rising incidences of related disorders .

In terms of administration, oral generics dominate the market, holding the largest share in 2024 . This preference is attributed to their ease of manufacturing, distribution, and administration, particularly when compared to more complex forms like injectables or inhalers . Favorable regulatory frameworks by the EMA further facilitate the approval and market entry of oral generics, encouraging manufacturers to invest in this segment .

Competitive Landscape and Key Players

The European generic drugs market is characterized by a diverse competitive landscape. Prominent manufacturers include Sandoz International GmbH (a Novartis AG company), STADA Arzneimittel AG, Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd, and Viatris Inc. . These companies, along with others such as CC Pharma, Bayer AG, and PGD Profusi, contribute to a dynamic and often fragmented market .

Germany, in particular, exemplifies this fragmentation, with a high number of generic manufacturers leading to fierce competition and pricing pressures . Poland also stands out with high generics penetration, accounting for 70% by volume and 55% by value, with local manufacturers holding nearly 70% of the market share .

A significant observation concerning the competitive landscape is the dual nature of competition: intense price competition alongside a strategic focus on portfolio breadth. While the generic market is indeed characterized by aggressive pricing strategies , the presence of major pharmaceutical conglomerates like Novartis (through Sandoz) and Pfizer suggests a more nuanced approach. These large players leverage their extensive portfolios, which encompass both small-molecule generics and increasingly, biosimilars, to maintain market presence and mitigate the impact of price erosion in any single segment. This indicates that scale, broad product diversification, and the ability to operate across different pharmaceutical categories are becoming increasingly critical for survival and sustained growth within the European generic space.

Historical Challenges Facing Generic Manufacturers

Prior to the full impact of biosimilars, the European generic drug industry faced a multitude of challenges that limited its competitiveness and sustainability. Intense price competition and persistently thin profit margins were, and remain, central concerns . Legislation in many countries often mandates downward adjustments in reimbursement prices, making it difficult for manufacturers to absorb increasing operational costs such as salaries and energy bills .

Limitations on pre-empting patent expiry also posed significant hurdles. Despite the “Bolar provision” enabling development within Europe prior to patent expiry, restrictions on manufacturing commercial batches within the EU before patent expiration often forced development and manufacturing activities outside the continent . The European Commission noted that additional savings could have been 20% higher if there had been no delays in generic market entry .

Increasingly stringent regulations added further burdens, including pharmacovigilance requirements, periodic safety updates, and the necessity for Braille packaging . Rising costs associated with quality assurance, anti-counterfeit measures, and product security also had to be absorbed without the ability to counteract them with price adjustments .

Tendering systems, introduced in countries like Denmark, Germany, and the Netherlands, while yielding short-term savings, caused financial instability for some pharmacists and wholesalers and led to problems with supply continuity . In the long term, tendering could reduce investment not only in complex molecules and biosimilars but across all prospective new generic medicines . The entry of Indian and Chinese-based industries, with their capacity to produce active pharmaceutical ingredients (APIs) at very low costs, further intensified price pressures and allowed them to maximize market share at the expense of European manufacturers .

The historical challenges faced by generic manufacturers represent more than just operational hurdles; they signify a fundamental erosion of the traditional generic business model’s profitability. This sustained pressure has acted as a powerful impetus for generic companies to actively seek new avenues for growth and higher margins. This context makes the biosimilar market, despite its inherent complexities, an increasingly attractive and strategically vital pivot. It underscores that the impact of biosimilars extends beyond direct competition; it exerts indirect pressure that reshapes the entire strategic outlook for the generic business.

Table: European Generic Drug Market Overview (2023-2024 & Forecast)

| Attribute | Details |

| Market Size (2023) | USD 87.5 Billion |

| Market Size (2024) | USD 119.99 Billion |

| Forecasted Market Value (2032/2033) | USD 161.7 Billion (by 2032) , USD 228.77 Billion (by 2032) |

| CAGR (2024-2032/2033) | 7.0% (2024-2032) , 8.4% (2025-2032) |

| Key Therapeutic Areas | Cardiovascular, Oncology, Dermatology, Respiratory, Rheumatology |

| Dominant Routes of Administration | Oral , Injectables |

| Major Countries by Market Share | Germany (Dominant), UK, France, Poland (High Penetration), Italy, Spain |

| Key Players | Sandoz International GmbH, STADA Arzneimittel AG, Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd, Viatris Inc. |

The Biosimilar Revolution: Market Entry and Impact

The “Patent Cliff” and the Rise of Biologics Exclusivity Expirations

The pharmaceutical industry is currently experiencing a significant phenomenon known as the “patent cliff” for biologics. This refers to the impending or recent expiration of intellectual property protection, including patents and regulatory exclusivities, for numerous high-revenue biological medicines . This wave of patent expirations is gaining significant momentum from 2025 onwards, creating a substantial window of opportunity for biosimilar manufacturers .

In Europe, the regulatory framework provides for distinct periods of exclusivity. Data exclusivity, which prevents generic or biosimilar manufacturers from using the originator’s clinical and pre-clinical data, lasts for eight years from the initial authorization of the medicine . Concurrently, market protection rules prevent generic or biosimilar competition for ten years after the originator medicine is licensed, regardless of patent protection. This is often referred to as the “8+2” rule, with an additional one-year extension possible if the originator adds a significant new indication during its first eight years, totaling up to 11 years of protection . The EU has played a pioneering role in establishing this comprehensive framework .

Examples of key biologics whose patent expirations have opened the door for biosimilar competition include adalimumab (Humira®), whose primary patents expired in Europe earlier than in the US, and ustekinumab (Stelara®), which is facing impending patent expiration between 2023-2025 in various markets . The expiration of these protections allows biosimilars to enter the market, fostering competition and potentially democratizing access to life-saving treatments .

The biologics patent cliff, unlike unforeseen market disruptions, is a predictable event . This predictability offers a crucial strategic window. For biosimilar manufacturers, it provides the necessary lead time to prepare for market entry, including developing their products and navigating the complex regulatory landscape. For originator companies, this predictability compels them to implement robust life-cycle management strategies, such as developing new formulations or indications, or launching authorized biologics, to mitigate revenue erosion. This situation underscores that proactive patent monitoring, often facilitated by specialized tools such as DrugPatentWatch, and strategic pipeline development are not merely beneficial practices but essential mechanisms for competitive survival. The intricate legal maneuvers, such as the “patent dance” framework observed in the US , further highlight the necessity of sophisticated intellectual property strategies to precisely navigate and capitalize on this predictable window of market transformation.

Biosimilar Market Size, Growth, and Key Drivers in Europe

The European biosimilar market is experiencing rapid and substantial growth, reflecting its increasing importance in the pharmaceutical landscape. In 2024, the market was valued at approximately USD 12.3 billion and is projected to reach USD 33.5 billion by 2031, demonstrating a remarkable Compound Annual Growth Rate (CAGR) of 15.4% during this forecast period . Other analyses estimate the market size at USD 13.864 billion in 2024, with a forecast to reach USD 59.733 billion by 2033, exhibiting an even higher CAGR of 17.1% . The historical growth rate for the European biosimilars market from 2019 to 2023 was already robust at 12.5% .

This impressive growth is driven by a confluence of factors. The increasing number of patent expirations for blockbuster biologics is a primary catalyst, opening up significant market opportunities . Rising healthcare costs across Europe intensify the demand for more affordable treatment options, making biosimilars an attractive solution for national health systems . Strong regulatory support from the EMA, which has streamlined approval processes while maintaining stringent safety and efficacy standards, further facilitates market entry . Moreover, growing acceptance and confidence among healthcare providers and patients, supported by accumulating real-world evidence, contribute significantly to increased biosimilar adoption .

Leading therapeutic areas for biosimilars include oncology, autoimmune diseases, and diabetes . Molecules such as infliximab, adalimumab, rituximab, insulin glargine, and etanercept are among the most prominent biosimilars driving market growth in these areas . Germany, with its proactive regulatory environment and well-established reimbursement framework, is estimated to dominate the European biosimilars market, projected to record a considerable CAGR of 15% through 2031 . Italy also holds a significant market share, driven by the high prevalence of chronic diseases and the demand for cost-effective treatments .

The growth of the biosimilar market extends beyond mere cost-cutting; it fundamentally serves as a healthcare system enabler. While significant cost savings are a primary benefit , the broader implication is the expansion of patient access to advanced, often life-saving, biologic therapies that might otherwise be prohibitively expensive . By making these treatments more affordable, biosimilars free up valuable healthcare resources that can be reinvested into improving overall patient care, expanding treatment to a larger patient population, or funding innovative new medicines . This shifts the perception of biosimilars from simply being “cheaper versions” to being critical components for the sustainability, accessibility, and expansion of modern healthcare systems across Europe.

Table: European Biosimilar Market Overview (2023-2024 & Forecast)

| Attribute | Details |

| :— | :— | | Market Size (2023) | €9 Billion (2022) |

| Market Size (2024) | USD 12.3 Billion , USD 13.864 Billion , USD 10.13 Billion |

| Forecasted Market Value (2031/2033/2034) | USD 33.5 Billion (by 2031) , USD 59.733 Billion (by 2033) , USD 33.78 Billion (by 2034) |

| CAGR (2024-2031/2033/2034) | 15.4% (2024-2031) , 17.1% (2025-2033) , 12.80% (2025-2034) |

| Historical Growth Rate (CAGR 2019-2023) | 12.5% |

| Key Therapeutic Areas | Oncology, Autoimmune Diseases, Diabetes, Inflammatory Disorders |

| Leading Molecules | Infliximab (17.5% market share in 2024) , Adalimumab, Rituximab, Insulin Glargine, Etanercept |

| Major Countries by Market Share | Germany (Dominant), Italy (20.8% in 2024) , UK, France, Spain |

Direct Impact on Generic Drug Pricing and Market Share

The entry of biosimilars into the European market has a distinct impact on drug pricing compared to traditional generics. While biosimilars also aim to reduce costs, their typical price drop is generally less dramatic, usually ranging from 15-30% compared to the 80-90% reduction often seen with small-molecule generics . This difference reflects the higher development and manufacturing costs associated with complex biological products.

Nevertheless, the introduction of biosimilars has led to significant price reductions for originator biologics. For instance, the cost of insulin glargine in Europe underwent a median 21.6% decrease overall in the last decade following biosimilar entry . In Portugal, the price of erythropoietin (EPO) saw a reduction of over 60% after biosimilar introduction . For anti-TNF therapies, visible list price reductions were around 17%, with larger confidential rebates further impacting costs . The competition spurred by biosimilars affects not only the price of the specific reference product but can also influence the pricing of the entire product class .

The “Humira Effect” serves as a compelling case study for understanding the transformation of the biologic market. When AbbVie’s Humira (adalimumab), a long-standing blockbuster drug, lost patent exclusivity in Europe in 2018, multiple biosimilars (such as Amgevita, Hulio, Hyrimoz, and Imraldi) rapidly entered the market . Despite the influx of these competitive products, Humira initially maintained a strong market position, controlling approximately 80% of the adalimumab market in 2024 . This illustrates the challenges in achieving rapid market penetration for biosimilars compared to the swift uptake often seen with small-molecule generics. However, the sustained biosimilar competition ultimately led to a significant erosion of Humira’s international net revenues, which decreased by 31.1% in 2019 . This demonstrates that while the dynamics may differ, persistent biosimilar competition fundamentally transforms the market over time, providing a valuable blueprint for anticipating the impact of future biologic patent expirations.

Table: Illustrative Biosimilar Price Reductions Post-Entry in Europe

| Reference Biologic | Biosimilar Entry Year (approx.) | Observed Price Reduction Range / Specific Example | Source/Context |

| :— | :— | :— | :— | | General Biosimilar Price Drop | N/A | 15-30% compared to originators | |

| Insulin Glargine | Post-2013 | Median 21.6% decrease overall (2013-2022) | |

| Erythropoietin (EPO) | Post-2006 | >60% in Portugal | |

| Anti-TNF Therapies | Post-2014 | 17% visible list price reduction (with larger confidential rebates) | |

| Overall Biosimilar Competition | Since 2014 | Reduced drug budgets by ~5% (visible list prices) | |

Shifting Competitive Dynamics: Generic vs. Biosimilar Strategies

The competitive dynamics between biologics and biosimilars are fundamentally different from those between branded small molecules and generics . This distinction necessitates varied strategic responses from both originator and biosimilar manufacturers.

Originator manufacturers often employ a “toolbox” of strategies to delay biosimilar entry and maintain market exclusivity. These tactics include “product hopping” (launching second-generation products around the time of patent expiry to switch patients), creating “patent thickets” (clusters of secondary patents to create legal uncertainty and raise barriers), and engaging in lengthy patent-related litigations . They may also use exclusionary rebate schemes, provide misleading information to obtain supplementary protection certificates, or engage in disparagement practices to hinder biosimilar uptake . Competition authorities in Europe have issued warnings against such practices, indicating a readiness to intervene if rebate schemes foreclose biosimilar competition .

Biosimilar manufacturers, in turn, adopt a mix of competitive pricing and value-based strategies . They emphasize the safety, efficacy, and cost-effectiveness of their products to gain market share . The development of biosimilars is considerably more expensive and time-consuming than generics, requiring 7-8 years and $100-250 million compared to $1-4 million for generics . This higher investment means fewer companies can afford to produce them, resulting in less aggressive price competition than in the generic market .

The competitive dynamics reveal a constant tension between incentivizing pharmaceutical innovation and promoting broader patient access. Originator companies, through strategies like patent thickets, aim to maximize the return on their significant R&D investments . However, these very strategies can impede biosimilar entry, thereby limiting the cost savings and patient access that biosimilars promise. This necessitates careful regulatory oversight and proactive legal strategies, such as the broadened Bolar exemption in the EU Pharma Package and enforcement against “pay-for-delay” agreements , to ensure a healthy balance that supports both continued innovation and the timely availability of affordable medicines. This complex interplay defines the strategic battleground in the biosimilar era.

Table: Key Patent Expirations for Blockbuster Biologics in Europe (2025-2032)

| Biologic Name | Reference Product | Therapeutic Area | Estimated EU Patent Expiry/LoE (Year) | Potential Market Value at LoE (if available) | Current Biosimilars (if any) |

| :— | :— | :— | :— | :— | :— | | Ustekinumab | Stelara® | Psoriasis, PsA, Crohn’s, UC | 2023-2025 (various markets) | Significant | Yes (e.g., DMB-3115) |

| Adalimumab | Humira® | Autoimmune/Inflammatory | 2018 (EU) | High | Yes (e.g., Amgevita, Hulio, Hyrimoz, Imraldi, Cyltezo, Idacio) |

| Keytruda | Keytruda® | Oncology | ~2027 (Merck’s patent) | Very High (>$30B in 2024) | Pipeline candidates expected |

| Eliquis | Eliquis® | Blood Thinning | ~2025 (US, EU likely similar) | High (>$13B in 2024) | Pipeline candidates expected |

| IL-17 & IL-6 Inhibitors | e.g., Cosentyx®, Taltz®, Actemra® | Immunology | Latter half of decade | High | Expected |

| Aflibercept | Eylea® | Ophthalmology | N/A (high cost of originator) | N/A | Expected |

| Trastuzumab | Herceptin® | Oncology | 2014 (EU) | N/A | Yes (e.g., Trazimera, Ontruzant) |

| Rituximab | Rituxan® | Oncology, Autoimmune | 2013 (EU) | N/A | Yes (e.g., Truxima, Ruxience) |

Note: Patent expiration dates can vary by jurisdiction and may be influenced by supplementary protection certificates or ongoing litigation. The information above is illustrative based on available data.

Strategic Responses from Generic Manufacturers in the Biosimilar Era

Diversification and Investment in Biosimilar Development

The evolving pharmaceutical landscape in Europe, marked by intense price competition in the small-molecule generic market, has prompted a strategic shift among traditional generic companies: diversification into biosimilar development. This move is driven by the recognition of higher revenue potential and less aggressive price erosion in the biosimilar segment compared to their traditional offerings . Many companies are actively reorienting their focus towards building robust biosimilar portfolios .

However, this transition is not without significant investment. Developing a biosimilar is a far more complex and costly undertaking than a generic drug. It typically requires 7 to 8 years of development and an investment ranging from USD 100 million to USD 250 million, a stark contrast to the USD 1 million to USD 4 million usually needed for generic development . Despite these substantial barriers to entry, major generic players like Sandoz (Novartis’s biosimilar division), Pfizer, Teva, and Biocon have made significant investments and are actively expanding their biosimilar presence across Europe . For instance, Sandoz AG is expanding its portfolios across various therapeutic areas in Germany, a leading biosimilar market . Pfizer has expanded its biosimilar portfolio with products like Zirabev (bevacizumab biosimilar) and Trazimera (trastuzumab biosimilar) .

The strategic move by generic manufacturers into biosimilars represents an evolution towards a “hybrid pharma” business model. Given the increasing pressures on traditional generics, including thin profit margins and rising operational costs , diversifying into biosimilars, which offer higher margins and a more complex, less commoditized competitive landscape , becomes a necessity for long-term resilience. This fundamental shift implies that generic companies must acquire or develop new capabilities in biologics manufacturing, advanced analytical characterization, and specialized clinical development, thereby transforming their operational and R&D footprints to secure future growth.

Adapting Business Models: From Small Molecules to Complex Biologics

The transition from small-molecule generics to complex biologics demands a fundamental adaptation of business models. Manufacturing biosimilars involves a shift from chemical synthesis to intricate biological systems, such as living cells or recombinant DNA . This necessitates strict adherence to Good Manufacturing Practices (GMP) specifically adapted for biological medicines, covering aspects like aseptic techniques, refrigeration, storage conditions, and stability . The inherent natural variability in biological production (e.g., glycosylation, folding, impurities) means that exact replication of the originator is impossible, requiring meticulous controls to ensure batch-to-batch consistency and that minor differences do not affect safety or efficacy .

Biosimilar developers must possess robust analytical and clinical capabilities to demonstrate “high similarity” to the reference product . This involves rigorous head-to-head analytical evaluations of physicochemical and biological properties, supported by comparative pharmacokinetic (PK) trials, and in some cases, clinical equivalence studies to confirm comparable efficacy, safety, and immunogenic potential . The EMA’s evolving guidelines, which may reduce the need for extensive clinical efficacy studies based on strong analytical and PK data, highlight the increasing importance of advanced analytical methods .

The implications extend to supply chain management, quality assurance, and regulatory affairs, all of which become significantly more intricate for biologics compared to small molecules . Companies must manage cold chain logistics, ensure product integrity across complex distribution networks, and navigate a more demanding pharmacovigilance landscape .

The transition from small-molecule generics to complex biosimilars is not merely a product line extension; it demands a profound organizational transformation. This includes a significant investment in specialized talent, such as bioprocess engineers, protein chemists, and immunologists, who possess the expertise required for biologics development and manufacturing . Simultaneously, it necessitates the adoption of cutting-edge technologies, including advanced analytical methods, sophisticated bioprocessing facilities, and innovative formulation strategies (e.g., buffer-free systems for improved stability and patient comfort) . For generic companies, this implies a strategic imperative to either develop these capabilities in-house, as evidenced by the dominance of in-house manufacturing in the biosimilar market , or to engage in strategic partnerships and acquisitions to bridge the capability gap, fundamentally altering their operational and R&D strategies.

Leveraging Patent Data for Competitive Advantage: Insights from DrugPatentWatch

Intellectual property (IP) intelligence plays an exceptionally critical role in the biosimilar landscape, particularly given the intricate and often contentious patent environment surrounding biological medicines . Tracking patent expiry dates, understanding data exclusivity periods, and identifying potential “patent thickets”—clusters of secondary patents strategically deployed by originator companies—are essential for biosimilar developers to ensure timely market entry and avoid costly litigation .

Platforms like DrugPatentWatch provide invaluable tools for business professionals to monitor this complex patent landscape. By offering comprehensive data on patent expiry dates, regulatory exclusivities, and related intellectual property, DrugPatentWatch enables companies to identify upcoming patent expirations for blockbuster biologics, analyze the competitive environment surrounding these molecules, and inform strategic decisions regarding biosimilar development and market entry . This includes understanding the nuances of frameworks like the “patent dance” in the US, which, while not directly applicable in Europe, illustrates the strategic information exchange and legal maneuvers that define the competitive window for biosimilars .

In the biosimilar arena, intellectual property functions not merely as a defensive shield for originator companies but also as a potent strategic weapon for biosimilar developers. By meticulously analyzing patent data through platforms like DrugPatentWatch, companies can identify “white space” for development, strategically design their products around existing patents, and precisely time their market entry to maximize first-mover or early-mover advantage . This proactive approach transforms the focus from simply complying with intellectual property laws to leveraging intellectual property intelligence for a proactive competitive strategy and effective market capture. This shift is paramount for securing a strong position in the highly competitive biosimilar market.

Case Studies of Successful Biosimilar Launches in Europe

Europe has been a fertile ground for successful biosimilar launches, providing valuable lessons for the industry.

- Humira (Adalimumab) Biosimilars: The launch of multiple biosimilars for Humira (adalimumab) in Europe starting in October 2018, following the expiration of its primary patents, marked a significant milestone . Companies like Amgen (Amgevita), Mylan (Hulio), Sandoz (Hyrimoz), and Samsung Bioepis (Imraldi) introduced their versions, leading to substantial competition . While Humira initially maintained a strong market position, biosimilar entry ultimately led to significant price reductions and increased patient access to this widely used anti-TNF alpha therapy . The “Humira effect” demonstrated that despite an originator’s initial resilience, sustained biosimilar competition fundamentally transforms the market, albeit with different dynamics than small-molecule generics.

- Infliximab Biosimilars (Remsima, Inflectra): The approval of infliximab biosimilars, Remsima (Celltrion) and Inflectra (Hospira, now Pfizer), by the EMA in 2013 was a pioneering moment for monoclonal antibody biosimilars in Europe . These launches were instrumental in demonstrating the viability and acceptance of complex biosimilars. Their early market entry and proven clinical efficacy contributed to significant market penetration, making expensive cancer and autoimmune disease treatments more affordable and raising awareness of biosimilars . Infliximab stands as the largest molecule in the European biosimilar market in 2024, holding 17.5% of the market share .

- Filgrastim Biosimilars (Zarxio/Filgrastim-sndz): Although Zarxio (filgrastim-sndz) is often cited for its FDA approval, filgrastim biosimilars have been approved in Europe since 2006 . These early biosimilars in oncology, used to stimulate white blood cell production, demonstrated the potential for significant cost savings and improved patient access to vital cancer treatments . Their success set a precedent for future biosimilar development and adoption in the EU.

The consistent success observed in these biosimilar launches points to two critical factors: early market entry immediately following patent expiry and a compelling demonstration of comparability in terms of safety, efficacy, and quality . For future biosimilar developers, this implies that speed to market, underpinned by rigorous scientific evidence, is paramount. Furthermore, building strong relationships with healthcare professionals and payers early in the product lifecycle is crucial to overcome initial hesitancy and drive widespread adoption. This highlights that commercial success extends beyond regulatory approval to effective stakeholder engagement and education.

Analyzing Challenging Biosimilar Launches and Lessons Learned

While Europe has seen numerous successful biosimilar launches, some products have faced challenges or even market withdrawals, offering valuable lessons for the industry. For instance, Cyltezo, an adalimumab biosimilar from Boehringer Ingelheim, was withdrawn from the European market prior to its full commercial launch, with the company reportedly focusing its efforts on its interchangeable status in the United States . This decision highlights the complexities of global market strategies and the varying regulatory and commercial priorities across regions.

Common barriers contributing to challenging biosimilar launches or slower uptake include:

- Resistance from Originator Companies: Originator companies often employ aggressive competitive strategies, such as competitive rebates, disparagement practices, and legal challenges (e.g., patent litigation), to protect their market share . These tactics can significantly impede biosimilar market penetration .

- Skepticism from Healthcare Professionals: A persistent challenge is the hesitancy among some healthcare professionals to prescribe biosimilars, often stemming from a lack of confidence in their long-term efficacy and safety, or knowledge gaps regarding biosimilar development and interchangeability . This skepticism can lead to reluctance to switch stable patients from originator biologics to biosimilars .

- Inconsistencies in Patient Access Across Member States: Despite EMA’s scientific endorsement of interchangeability, the fragmented national policies on pricing, reimbursement, and automatic substitution create uneven market access across the EU . This lack of harmonization complicates market entry strategies for manufacturers and can hinder widespread adoption .

These challenging launches underscore that price alone is insufficient for biosimilar success. Overcoming physician resistance and patient hesitancy requires a significant, sustained investment in education, real-world evidence generation, and building trust . This implies that biosimilar manufacturers must adopt a multi-faceted market access strategy that extends beyond simply offering a lower price. It necessitates a focus on robust data dissemination, proactive stakeholder engagement, and directly addressing specific concerns regarding long-term safety, efficacy, and interchangeability. This approach marks a critical difference from the dynamics of the generic market, where trust in the “identical” active ingredient is largely assumed.

Challenges and Opportunities for the European Generic and Biosimilar Industries

Navigating Regulatory Hurdles and Market Access Barriers

The European pharmaceutical industry, particularly the generic and biosimilar sectors, faces ongoing challenges related to regulatory complexities and market access. Despite the EMA’s efforts to streamline processes, a persistent lack of harmonization across EU Member States can cause delays and significantly increase costs for manufacturers . This fragmentation is evident in varying national policies on pricing, reimbursement, and interchangeability, which can undermine the efficiency gained from centralized EMA approvals .

There is a recognized need for faster pricing and reimbursement timelines for biosimilars to ensure their timely entry and uptake . Public procurement rules and local manufacturing preferences in some countries can also disadvantage foreign manufacturers, creating additional barriers to market entry and competition .

The paradox of EU harmonization is evident in its current state: centralized approval at the EMA level is undermined by decentralized market access. While the EMA provides a unified scientific assessment and approval pathway for biosimilars , the actual market access and uptake are heavily influenced by fragmented national policies concerning pricing, reimbursement, and interchangeability . This creates a “bottleneck” where the efficiency of the EU-level regulatory process is not fully translated into widespread patient access and cost savings. For the industry, this means that even with EMA approval, substantial resources must be dedicated to navigating diverse and often opaque national market access landscapes, hindering the full realization of biosimilar benefits across Europe.

Addressing Pricing Pressures and Ensuring Market Sustainability

Both the generic and biosimilar industries in Europe are grappling with intense pricing pressures. In the generic market, legislation in many countries often dictates that reimbursement prices can only decrease, making it increasingly difficult for manufacturers to absorb rising operational costs . This downward price spiral, coupled with aggressive tendering systems, while delivering short-term savings for healthcare budgets, poses a significant threat to market sustainability . Tendering can lead to reduced investment in research and development, particularly for more complex molecules like biosimilars, and may even jeopardize the continuity of supply for essential medicines .

For biosimilars, while they offer substantial savings compared to originator biologics, their inherently higher development and manufacturing costs mean that the price reductions are less drastic than for generics . Concerns about profitability persist, especially with the potential for intense price wars post-launch . The sustainability of biosimilars is particularly challenging for products with lower annual sales (less than €500 million) or those designated as orphan drugs .

The relentless pursuit of immediate cost savings through aggressive pricing and tendering policies, while seemingly beneficial in the short term, risks undermining the long-term sustainability of both the generic and biosimilar industries in Europe . If profit margins become excessively thin, manufacturers may be compelled to reduce investment in research and development, withdraw products from the market, or shift production facilities outside Europe. Such actions could lead to critical drug shortages and a reduction in future competition, ultimately harming patients and healthcare systems . This situation highlights the urgent need for a more nuanced policy approach that carefully balances the imperative of cost-containment with the provision of sufficient incentives to foster a robust and resilient domestic manufacturing base and to ensure a healthy pipeline of new generic and biosimilar medicines.

Overcoming Physician and Patient Hesitancy

A significant barrier to wider biosimilar adoption in Europe remains the skepticism among some healthcare professionals. This hesitancy often stems from a lack of confidence in the long-term efficacy and safety of biosimilars, as well as knowledge gaps concerning their development, approval process, and interchangeability . Despite extensive real-world evidence demonstrating the safety and effectiveness of biosimilars, some physicians remain reluctant to switch stable patients from originator products .

Patient education and awareness are equally crucial to improving acceptance and increasing biosimilar uptake . Patients and healthcare professionals often have questions on practical aspects of biosimilar interchangeability, necessitating clear and unbiased information from national health authorities .

Overcoming this hesitancy requires more than just regulatory approval; it demands the continuous generation and transparent dissemination of real-world evidence (RWE) that unequivocally demonstrates biosimilar safety and efficacy across diverse patient populations . This data, combined with targeted and comprehensive educational campaigns for both physicians and patients, becomes paramount. For manufacturers, this implies an ongoing commitment to post-marketing surveillance and transparent communication, shifting from a purely product-centric sales approach to a more patient- and provider-centric engagement model. This is a critical difference from generic market dynamics, where the “identical” active ingredient largely bypasses the need for extensive trust-building efforts.

The Role of Emerging Technologies in Drug Development and Manufacturing

Technological advancements are profoundly influencing both generic and biosimilar drug development and manufacturing in Europe. In the biosimilar space, innovations in bioprocessing and analytical methods are reducing production costs and accelerating development timelines . Advanced techniques such as Quality-by-Design (QbD), Process-Analytical-Technology (PAT), and in silico modeling are being integrated into biosimilar development to anticipate immunogenic risks and optimize bioequivalence . Furthermore, innovative formulation strategies, including buffer-free and high-concentration systems, are improving product stability and patient tolerability .

For generic drugs, digital and analytics tools, including artificial intelligence (AI) and natural language processing, are being explored to streamline development and approval processes . These technologies can enhance efficiency in bioequivalence assessment, automate labor-intensive tasks, and expedite data collection and preparation . The FDA’s initiatives, such as the Bioequivalence Assessment Mate (BEAM) tool and the Innovative Science and Technology Approaches for New Drugs (ISTAND) program, illustrate the global trend towards leveraging technology to improve generic drug development .

Emerging technologies are not just incremental improvements; they are transformative forces. For generic manufacturers, these advancements can streamline the complex biosimilar development process, potentially lowering costs and accelerating time-to-market. This can act as an “equalizer,” enabling them to compete more effectively with established biologic companies . For biosimilar manufacturers, these technologies also present significant opportunities for differentiation. Through improved product stability (e.g., buffer-free formulations), enhanced patient tolerability, and optimized manufacturing processes, companies can create “bio-betters” or “biosuperiors” . This represents a strategic move beyond mere replication, allowing for innovation within the biosimilar framework.

Supply Chain Resilience and Geopolitical Considerations

Recent global events, including the COVID-19 pandemic and geopolitical shifts, have brought critical attention to the vulnerabilities within the pharmaceutical supply chain in Europe. Concerns have been raised about the continent’s reliance on single suppliers for critical generics, with Teva’s research indicating that 46% of critical generics in the EU rely on a single supplier, and 83% depend on suppliers holding over 60% of the market share . This concentration, coupled with rising production costs and intense pricing pressures, has made the production of some generic medicines “unsustainable,” leading to market withdrawals .

There is a growing recognition of the need for policies that provide targeted support for sustainable and resilient manufacturing within the EU . The European Commission’s proposed Critical Medicines Act (CMA) is a step in this direction, aiming to shore up the availability, supply, and production of essential drugs within the bloc . This legislation seeks to enable strategic projects for critical medicines and their ingredients, and there are calls for revising procurement programs to reflect the “true value of medicines” and for harmonizing national medicine stockpile requirements .

The recent focus on supply chain resilience and security marks a significant paradigm shift from a sole emphasis on cost-efficiency. The vulnerabilities exposed by global disruptions are compelling a re-evaluation of manufacturing strategies. For generic and biosimilar manufacturers, this presents a strategic opportunity to invest in European manufacturing capabilities. While this may entail slightly higher production costs compared to outsourcing to low-cost regions, it aligns with new government incentives and policies aimed at de-risking supply chains and ensuring national health security. This represents a long-term strategic play for market stability and reduced reliance on external factors.

Future Outlook: Policy Changes and Market Evolution

Upcoming EU Pharmaceutical Policy Reforms and Their Implications

The European Union is embarking on a significant overhaul of its pharmaceutical legislation, known as the “Pharma Package,” with the Council agreeing on its position in June 2025 . This historic legislative revamp, the first major update in 20 years, aims to create a fairer, more competitive market by introducing new rules on drug approvals, exclusivities, and obligations .

Key changes include:

- Adjusted Regulatory Market Protection (RMP): The default RMP period, during which a generic or biosimilar cannot enter the market even with an approved application, will be reduced from the current two years to one year . This can be extended to two years if certain predefined objectives are met, such as addressing an “Unmet Medical Need” or ensuring broad launches across EU markets . This means a new drug typically gets 9 years of protection (8 years data exclusivity + 1 year RMP) instead of 10, but can reach 10 years if public health targets are achieved .

- Broadened “Bolar Exemption”: The scope of the Bolar exemption, which allows generic and biosimilar manufacturers to conduct trials and prepare regulatory dossiers on a patented drug, is being expanded . Crucially, this now includes submissions for procurement tenders, enabling generic manufacturers to complete Health Technology Assessment (HTA) submissions and bid for hospital contracts even before the originator’s exclusivity expires, provided actual product sale occurs only after expiry . This reform aims to ensure “day-1 availability” of generics and biosimilars once patent or exclusivity periods end, without bureaucratic delays .

- Transferable Exclusivity Vouchers (TEVs): A high-profile, albeit controversial, new incentive is the introduction of TEVs to reward the development of crucial antimicrobials . These vouchers grant up to one additional year of data exclusivity to a drug and can be transferred (sold) once to another product, subject to strict conditions to prevent market distortion .

The EU Pharma Package, particularly the broadened Bolar exemption and adjusted market protection periods, signals a deliberate and aggressive policy push to ensure “day-1 availability” of generics and biosimilars immediately after patent expiry . This is a direct response to historical delays in generic market entry and is designed to maximize cost savings and patient access. For manufacturers, this implies an even greater urgency for early pipeline development, regulatory dossier preparation, and meticulous market access planning to capitalize on this accelerated competition window. Originator companies must now anticipate generic and biosimilar competition earlier and more synchronously across Europe, necessitating earlier contracting with payers and strengthened lifecycle management strategies.

Anticipated Patent Expirations and New Biosimilar Opportunities

The coming years promise a significant wave of new biosimilar opportunities driven by a robust pipeline of biologics facing patent expiry. It is estimated that 110 biological medicines in Europe are expected to lose intellectual property protection by the end of 2032, with Loss of Exclusivity (LoE) opportunities peaking at around €30 billion between 2030 and 2032 . This represents a massive market potential for biosimilar manufacturers.

Specific blockbuster molecules nearing patent expiry that present new opportunities include Merck’s PD-1 inhibitor Keytruda, whose patent is set to expire around 2027, and the blood-thinning medication Eliquis, which faces patent expiration next year . Other significant biologics like ustekinumab (Stelara®) and various IL-17 and IL-6 inhibitors are also approaching their patent cliffs in the latter half of the decade .

Beyond these major players, the biosimilar market is also expected to expand into new therapeutic areas. Opportunities are emerging for biosimilars targeting conditions such as asthma, osteoporosis, and ophthalmology, along with continued demand for affordable insulin analogs and hormonal therapies .

The upcoming patent expirations represent a massive opportunity, but the market will become increasingly crowded. Success in this “next wave” will require biosimilar manufacturers to move beyond merely developing “me-too” copies. Strategic differentiation will become crucial to capture and sustain market share. This could involve developing improved formulations, such as the subcutaneous version of Keytruda that Merck is developing to extend its profitability , or focusing on enhanced patient convenience . Furthermore, targeted market access strategies tailored to specific therapeutic areas and national reimbursement policies will be essential to gain a competitive edge in this evolving landscape.

The Trajectory of Innovation: Next-Generation Biosimilars and “Bio-Betters”

The evolution of the biosimilar market is not confined to mere replication; it is increasingly moving towards innovation within the biosimilar framework. This trajectory includes the development of “bio-betters” or “biosuperiors”—improved biosimilars that offer enhanced characteristics over their reference products . These improvements might include greater stability, reduced immunogenicity, or more convenient formulations (e.g., buffer-free and high-concentration systems that improve patient comfort and product shelf life) .

The higher revenue potential associated with biosimilars, compared to the razor-thin margins of traditional generics, is actively encouraging ongoing investment in biopharmaceutical innovation and advanced manufacturing technologies . This includes the adoption of sophisticated techniques like Quality-by-Design (QbD) and Process-Analytical-Technology (PAT) to optimize production protocols and ensure consistent quality .

The development of “bio-betters” signifies a blurring of the traditional lines between biosimilar and innovator companies. Biosimilar manufacturers are no longer solely focused on creating direct copies; they are actively innovating within the biosimilar paradigm to produce products that offer tangible improvements over the original biologic . This suggests a future where biosimilar companies could become significant drivers of incremental innovation, further intensifying competition and pushing the boundaries of what constitutes a “generic” alternative in the biologics space. This evolution will likely lead to a more dynamic and competitive market that benefits patients through both affordability and enhanced product attributes.

Strategic Imperatives for Long-Term Success in a Converging Market

To achieve long-term success in Europe’s converging generic and biosimilar markets, manufacturers must adopt a multi-faceted strategic approach. The impending policy changes, particularly the EU Pharma Package, necessitate a focus on earlier launches in more markets to secure regulatory rewards and build trust with authorities and patients . This requires generic and biosimilar manufacturers to invest significantly in agility and internal capabilities for parallel launches and simultaneous Health Technology Assessment (HTA) submissions across multiple European countries .

A critical imperative is the strategic evaluation of individual European markets. Given the varying national policies on interchangeability, pricing, and reimbursement, a “one-size-fits-all” approach is ineffective . Companies must thoroughly assess measures that facilitate or impede successful market entry, consulting and educating relevant stakeholders to maximize biosimilar potential in each specific market .

Furthermore, the critical role of data and digital tools cannot be overstated. Leveraging advanced analytics and artificial intelligence can streamline development processes, optimize production, and refine market strategies by providing real-time insights into market dynamics and competitive landscapes . This ensures that decision-making is data-driven and responsive to rapid market shifts.

In a rapidly evolving market characterized by converging generic and biosimilar dynamics, the ability to rapidly analyze market intelligence, including patent data via platforms like DrugPatentWatch, adapt to policy changes, and execute agile market entry strategies will be the ultimate competitive differentiator . This means investing not just in R&D and manufacturing capabilities, but equally in data analytics, market access intelligence, and fostering organizational flexibility to respond swiftly and effectively to both opportunities and challenges. Companies that master this data-driven agility will be best positioned for sustained success.

Key Takeaways: Charting a Course for Competitive Advantage

The European pharmaceutical landscape is undergoing a profound transformation, significantly influenced by the rise of biosimilar medicines. For business professionals seeking to leverage patent data for competitive advantage, several critical observations emerge:

- Biosimilars are a Distinct, Transformative Force: Biosimilars are not merely “generic biologics” but represent a unique class of medicines with fundamentally different regulatory pathways, manufacturing complexities, and market dynamics compared to traditional small-molecule generics. Their impact is profound, driving significant cost savings for healthcare systems and expanding patient access to advanced biological therapies .

- Europe: A Regulatory Pioneer and Market Leader: Europe has consistently led the way in establishing a robust regulatory framework for biosimilars and has achieved the highest adoption rates globally. This makes the European market a crucial bellwether for understanding global biosimilar trends and a prime target for strategic engagement .

- The Patent Cliff: A Predictable Opportunity: The impending “patent cliff” for blockbuster biologics presents a predictable and massive opportunity for biosimilar market entry. Leveraging intellectual property intelligence, particularly tracking patent expiry dates and data exclusivity periods through specialized tools like DrugPatentWatch, is indispensable for identifying high-value targets, timing market launches, and gaining a crucial competitive advantage .

- Beyond Price: Trust, Education, and Real-World Evidence are Paramount: Success in the biosimilar market extends beyond offering a lower price. It critically depends on building confidence among healthcare professionals and patients through robust real-world evidence of safety and efficacy, coupled with targeted and transparent educational initiatives. Overcoming inherent skepticism and fragmented national interchangeability policies requires a multi-faceted approach .

- Strategic Diversification and Adaptation are Essential: Traditional generic manufacturers, facing intense price competition and thin margins in their core business, are increasingly diversifying into biosimilars. This necessitates a fundamental adaptation of business models, involving significant investment in complex biotechnology manufacturing, advanced analytical capabilities, and specialized clinical development. This strategic pivot towards a “hybrid pharma” model is crucial for long-term competitiveness and sustainability .

- Policy and Technology: Key Enablers of Future Growth: Supportive regulatory frameworks, such as the EU Pharma Package’s broadened Bolar exemption and adjusted market protection periods, are designed to accelerate competition and ensure “day-1” availability of biosimilars . Concurrently, the adoption of emerging technologies like advanced bioprocessing, AI, and data analytics will be critical for streamlining development, optimizing production, and refining market strategies, acting as both an equalizer and a differentiator in this evolving landscape .

- Agility and Data-Driven Decision Making: Navigating this complex, dynamic landscape requires continuous market analysis, strategic foresight, and the ability to leverage data for agile decision-making. Companies that can swiftly adapt to policy changes, capitalize on patent expirations, and effectively engage diverse stakeholders will be best positioned for sustained success in the European pharmaceutical market.

Frequently Asked Questions (FAQ)

- How do biosimilars fundamentally differ from traditional generic drugs in Europe, and why does this matter for market strategy?Biosimilars are “highly similar” biological medicines, derived from living systems and characterized by complex, large molecules that exhibit natural variability . In contrast, traditional generics are exact chemical copies of small-molecule drugs, synthesized through chemical processes . This distinction is critical for market strategy because biosimilars require intricate, costly manufacturing processes and extensive regulatory comparability studies to demonstrate their similarity to a reference product . Consequently, biosimilars typically face higher barriers to entry, leading to less aggressive price erosion (15-30% compared to 80-90% for generics) . Companies entering the biosimilar space must invest in specialized biotechnology capabilities, and their competitive strategy shifts from pure price competition to a blend of pricing, value demonstration, and building trust among healthcare professionals and patients.

- What is the “patent cliff” for biologics, and how can businesses leverage patent data to capitalize on these opportunities in Europe?The “patent cliff” for biologics refers to the impending or recent expiration of intellectual property protections, including patents and regulatory exclusivities, for numerous high-revenue biological drugs, with significant opportunities emerging from 2025 onwards . Businesses can strategically leverage patent data, often through specialized platforms like DrugPatentWatch, to identify specific molecules with expiring patents . This intelligence allows for the anticipation of market entry windows, enabling proactive research and development, the formation of strategic partnerships, and precise timing of market launches to gain a crucial competitive edge . This forward-looking approach is vital for pipeline prioritization and market capture.

- Despite EMA’s scientific endorsement, why does biosimilar interchangeability vary so much across EU Member States, and what are the implications for market uptake?While the EMA scientifically considers biosimilars interchangeable with their reference products, the decision regarding automatic substitution at the pharmacy level is delegated to individual EU Member States . This decentralization results in significant variations in policy and practice across Europe. Some countries are actively implementing policies to encourage substitution, such as Germany and France exploring or allowing automatic substitution for certain molecules , while others exhibit more hesitancy due to a lack of confidence or knowledge gaps among healthcare professionals . For manufacturers, this fragmentation necessitates tailored, country-specific market access strategies and substantial investment in educating local healthcare professionals and patients to overcome skepticism and drive widespread adoption, as a unified approach is not feasible .

- How are traditional generic drug manufacturers adapting their business models to compete in the biosimilar era in Europe?Faced with intense price competition and increasingly thin profit margins in the small-molecule generic market, many traditional generic manufacturers are strategically diversifying into biosimilars . This adaptation involves a significant overhaul of their business models and capabilities. It requires substantial investment in new areas, including complex biotechnology manufacturing, advanced analytical characterization techniques to prove “high similarity,” and specialized clinical development programs . These companies are evolving towards a “hybrid pharma” model, leveraging their existing market access and distribution networks while simultaneously building deep expertise in biologics to access a more lucrative, less commoditized segment of the pharmaceutical market and ensure long-term sustainability .

- What impact will the new EU Pharmaceutical Strategy have on the future competitive dynamics of generics and biosimilars in Europe?The new EU Pharmaceutical Strategy, or “Pharma Package,” aims to accelerate competition and enhance patient access to medicines across Europe . Key reforms, such as the broadened “Bolar exemption,” will allow generic and biosimilar manufacturers to conduct necessary trials and even bid in procurement tenders before the originator’s patent expiry . Additionally, adjusted regulatory market protection periods are designed to facilitate “day-1” availability of competitive products . These changes are expected to intensify the competitive landscape immediately following loss of exclusivity for both generics and biosimilars. This will necessitate even more agile strategic planning, earlier pipeline development, and rapid market execution from all industry players to capitalize on these accelerated competition windows .

References

- European Medicines Agency. Biosimilar medicines overview. URL: https://www.ema.europa.eu/en/human-regulatory-overview/biosimilar-medicines-overview

- The Insight Partners. Europe Generic Drugs Market Forecast to 2031. URL: https://www.theinsightpartners.com/pr/europe-generic-drugs-market

- IMARC Group. Europe Biosimilar Market Size and Share. URL: https://www.imarcgroup.com/europe-biosimilar-market

- Persistence Market Research. Europe Biosimilars Market Size and Share Analysis. URL: https://www.persistencemarketresearch.com/market-research/europe-biosimilars-market.asp

- Biopatrika. The Biosimilar Tsunami: Biologics Approach Patent Expiry. URL: https://biopatrika.com/industry/pharma-biopharma/the-biosimilar-tsunami-biologics-approach-patent-expiry/

- European Pharmaceutical Review. New Biosimilar Pathways: Key Takeaways from the EMA’s Draft Reflection Paper. URL: https://www.europeanpharmaceuticalreview.com/article/259680/new-biosimilar-pathways-key-takeaways-from-the-emas-draft-reflection-paper/

- Center for Biosimilars. Revolutionizing Biopharmaceuticals: The EU’s Biosimilar Success and Remaining Challenges. URL: https://www.centerforbiosimilars.com/view/revolutionizing-biopharmaceuticals-the-eu-s-biosimilar-success-and-remaining-challenges

- Artixio. Biosimilars vs. Generics: Key Differences and Market Implications. URL: https://www.artixio.com/post/biosimilars-vs-generics-key-differences-and-market-implications

- i-MAK. Biologics, Biosimilars, and Patents Guide. URL: https://www.i-mak.org/wp-content/uploads/2024/05/Biologics-Biosimilars-Guide_IMAK.pdf

- EFPIA. The Pharmaceutical Industry in Figures 2022. URL: https://www.efpia.eu/media/637143/the-pharmaceutical-industry-in-figures-2022.pdf

- EFPIA. The Pharmaceutical Industry in Figures 2024. URL: https://efpia.eu/media/2rxdkn43/the-pharmaceutical-industry-in-figures-2024.pdf

- EMA. Human Regulatory Overview: Biosimilar Medicines Marketing Authorisation. URL: https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/biosimilar-medicines-marketing-authorisation

- PMC. The biosimilar revolution alters the biopharmaceutical environment. URL: https://pmc.ncbi.nlm.nih.gov/articles/PMC11438530/

- Center for Biosimilars. Revolutionizing Biopharmaceuticals: The EU’s Biosimilar Success and Remaining Challenges. URL: https://www.centerforbiosimilars.com/view/revolutionizing-biopharmaceuticals-the-eu-s-biosimilar-success-and-remaining-challenges

- Xcenda. HTAQ Spring 2023: The Road to Successful Biosimilar Uptake in Europe. URL: https://www.xcenda.com/insights/htaq-spring-2023-the-road-to-successful-biosimilar-uptake-in-europe

- SPS NHS. Understanding data exclusivity and market protection. URL: https://www.sps.nhs.uk/articles/understanding-data-exclusivity-and-market-protection/

- EMA. Generic medicine definition. URL: https://www.ema.europa.eu/en/glossary-terms/generic-medicine

- FDA. Differences Between Biosimilars and Generic Drugs. URL: https://www.fda.gov/media/154912/download