The pharmaceutical landscape is a complex tapestry woven with threads of innovation, regulation, and intricate supply chains. For strategic pharmaceutical executives and healthcare investors, understanding the forces that shape this industry is paramount to identifying competitive advantages and navigating potential disruptions. In recent years, an unlikely figure has emerged as a significant catalyst for change, particularly within the challenging realm of orphan drug development: Mark Cuban. His foray into healthcare, driven by a relentless pursuit of transparency and affordability, offers a compelling case study in market disruption and policy re-evaluation.

The Unlikely Catalyst: Mark Cuban’s Foray into Healthcare Reform

Mark Cuban’s journey into the pharmaceutical sector might seem unconventional for a billionaire entrepreneur known for tech ventures and sports team ownership. However, a closer examination reveals a consistent business philosophy rooted in identifying and rectifying market inefficiencies. His entry into healthcare is not a deviation but a natural extension of this disruptive ethos.

From Tech Mogul to Pharmaceutical Disruptor

Mark Cuban’s entrepreneurial spirit ignited early in life, selling garbage bags door-to-door at the age of 12 and later owning a popular bar during his college years . This early foundation laid the groundwork for a career defined by challenging the status quo and leveraging innovative solutions. His foundational successes, such as MicroSolutions, a computer consulting service sold to CompuServe in 1990, and Broadcast.com (originally Audionet), which he and Todd Wagner sold to Yahoo for $5.6 billion in 1999, underscore a consistent pattern of identifying market gaps and building disruptive models. Beyond these tech triumphs, his acquisition of the Dallas Mavericks in 2000, leading to an NBA championship in 2011, further cemented his reputation as a results-oriented leader. His prominent role on the hit show Shark Tank and investments in a diverse portfolio of businesses illustrate a broad interest in nurturing disruptive concepts. Notably, Cuban’s long-standing concern for market integrity and fairness is evident in his past initiatives, such as establishing Sharesleuth to uncover financial fraud and endowing the Electronic Frontier Foundation’s Mark Cuban Chair to Eliminate Dumbass Patents, an effort specifically aimed at combating patent trolls. These prior engagements demonstrate a deep-seated commitment to rectifying systemic flaws, a characteristic that would later define his approach to healthcare.

The spark for Cuban’s direct involvement in healthcare reform was ignited by his observations of troubling pricing practices within the pharmaceutical industry, particularly concerning drugs for rare diseases . He became increasingly disturbed by incidents like Martin Shkreli’s infamous 5,000% price increase on a parasitic infection drug, Albendazole, which the Mark Cuban Cost Plus Drug Company (MCCPDC) later offered for $35 per course compared to the previous $500 . The growing problem of generic medication shortages also fueled his concern . This recognition of fundamental market failure motivated Cuban to explore how his business acumen and financial resources could effect meaningful change. He famously articulated this frustration, stating, “I began digging in to find that the drug side of the health care industry is an inefficient market and has no transparency whatsoever. It’s impossible to find the price of a drug. I don’t mean that they make it too hard to find. I mean, you simply cannot find the price or cost of drugs” . This profound lack of transparency and the perceived predatory pricing strategies became the driving force behind his intervention.

The Genesis of Mark Cuban Cost Plus Drug Company (MCCPDC)

The true catalyst for the Mark Cuban Cost Plus Drug Company was an unexpected “cold pitch” email in 2018 from Dr. Alex Oshmyansky, a radiologist who had been working since 2015 to lower the cost of generic drugs, especially for rare diseases . Oshmyansky’s initial venture, “Osh’s Affordable Pharmaceuticals,” aimed to manufacture low-cost medications and bypass the layers of middlemen that inflate drug prices . Cuban, recognizing the profound alignment with his own concerns about market inefficiencies and the lack of transparency, invested in Oshmyansky’s public benefit corporation by 2019. This investment was accompanied by the significant decision to rebrand the company as the Mark Cuban Cost Plus Drug Company . This marked the first time Cuban had ever lent his name to a business he funded, a decision that underscored his deep personal commitment to the company’s mission and its potential to leave a lasting legacy in healthcare . This partnership effectively combined Oshmyansky’s pharmaceutical expertise with Cuban’s formidable business acumen and financial resources, setting the stage for a truly disruptive force.

A crucial strategic decision in the formation of MCCPDC was its establishment as an American Public Benefit Corporation (PBC) . This legal structure is particularly significant because it legally protects companies from stockholder lawsuits when pursuing social goals that might not maximize short-term profits . For MCCPDC, this means its social mission of improving public health is explicitly stated as being “just as important as the bottom line” . This structural choice represents a fundamental departure from the traditional pharmaceutical model, which is often criticized for prioritizing shareholder profits above all else. By adopting the PBC model, MCCPDC is not merely offering a new pricing strategy; it is presenting a strategic counter-narrative to the prevailing profit motives of the pharmaceutical industry. This decision allows the company to legally pursue its disruptive mission without the immediate financial repercussions that might otherwise arise from shareholders demanding maximum short-term returns. It signals a long-term commitment to affordability and public health, potentially attracting socially-minded investors and customers who are wary of the traditional industry’s practices. In essence, this model positions MCCPDC as an ethical alternative, aiming to redefine the very purpose and operational framework of a pharmaceutical company.

The Orphan Drug Act: A Legacy of Innovation and Controversy

To fully appreciate Mark Cuban’s impact, it is essential to understand the historical context and complexities of the Orphan Drug Act (ODA). This landmark legislation, while undeniably successful in stimulating rare disease research, has also become a focal point of debate due to its unintended consequences.

Historical Context and Legislative Intent

Before the ODA’s enactment in 1983, the landscape for rare disease treatments was bleak. These conditions, often termed “orphan conditions,” were largely ignored by pharmaceutical companies because they were deemed unprofitable due to their small patient populations . In the decade leading up to the Act, a mere 10 such products received approval . Patients grappling with rare diseases often faced “lives of helpless isolation, driven by the unending and often futile search for answers” . This dire unmet medical need spurred a powerful patient advocacy movement, with individuals like Abbey Meyers and Muriel Seligman at the forefront, who highlighted the critical necessity for treatments for diseases affecting fewer than 200,000 people in the U.S. . The ODA was a direct response to these compelling voices and the recognition that market forces alone were insufficient to address this public health crisis.

The ODA was designed to balance the competing interests of pharmaceutical companies and patients by providing significant financial incentives to encourage the development of orphan drugs . These incentives included:

- Tax Credits: Initially, the Act provided a substantial 50% tax credit for qualified clinical testing costs, a powerful inducement that was later reduced to 25% in 2017 .

- Grant Funding: The FDA’s Office of Orphan Product Development (OOPD) was established to administer grant programs, providing direct funding to cover research expenses for orphan products .

- Waiver of FDA User Fees: Manufacturers developing orphan drugs were granted an exemption from the FDA’s prescription drug user fees, a significant financial relief .

- Seven-Year Market Exclusivity: This was perhaps the most critical incentive. It granted manufacturers a seven-year period during which the FDA could not approve a “same drug for the same disease or condition” from a different manufacturer, irrespective of patent status . This exclusivity could also be extended by an additional six months for conducting pediatric studies .

- Priority FDA Review and Assistance: Sponsors of orphan-designated products also benefited from close coordination and assistance from the FDA throughout the drug’s development process .

While a legislative triumph for patient access, the ODA inadvertently created a dual pricing system within the pharmaceutical market. The very mechanisms designed to stimulate innovation for a small patient population created conditions for super-profitability. The market exclusivity, in particular, allowed companies “greater discretion in pricing” , leading to what critics describe as “astronomically high prices” for many orphan drugs. These prices were often reported to be 4.5 times greater than the cost of non-orphan drugs . This outcome presents a profound moral and economic dilemma: how does society reward critical innovation for rare diseases without rendering the resulting treatments prohibitively expensive for those who need them most, especially when public subsidies and reduced development costs are already part of the equation? The ODA, in its success, highlighted a fundamental tension between incentivizing pharmaceutical investment and ensuring equitable patient access.

Impact and Evolution of Orphan Drug Development

The ODA has undeniably spurred a significant surge in orphan drug approvals. From its enactment in 1983 through 2009, 2,112 orphan designations were assigned, with 347 (16%) ultimately receiving FDA approval. The momentum continued, with 503 unique medicines targeting 731 different orphan indications approved by August 2018, 78% of which were solely for orphan diseases . As of December 2022, the FDA’s Office of Orphan Product Development (OOPD) had granted 6,340 orphan drug designations, leading to 882 initial approvals for 392 rare diseases . The annual number of orphan drug designation approvals has increased significantly in recent years, with 39% of all drugs and biologics approved by the FDA in 2017 receiving an orphan designation . By 2024, a remarkable 52% of new molecular entities (NMEs) approved by the FDA’s Center for Drug Evaluation and Research (CDER) were designated for rare or orphan diseases . These figures clearly demonstrate that orphan products now constitute approximately one-third of all FDA-approved drugs and biologics.

Despite the inherently small patient populations, a surprising phenomenon has emerged: the rise of “blockbuster” orphan drugs. Many of these medications have achieved annual sales exceeding $1 billion, a benchmark typically associated with therapies for common conditions . In 2017 alone, all orphan drug products collectively generated approximately $125 billion in sales, accounting for an estimated 16% of the total prescription drug market . This market segment is projected to continue its rapid growth, with orphan drugs forecast to represent 25% of worldwide prescription sales within the next five years . The economic realities are stark: the mean cost per patient per year for an orphan drug was estimated at $150,854 in 2018, a figure nearly 4.5 times greater than the $33,654 for a non-orphan drug . For diseases affecting fewer than 10,000 patients, drugs are often priced at or above $200,000 per year .

The emergence of “blockbuster” orphan drugs, while a testament to the ODA’s success in stimulating research and development, creates a fundamental tension between the original intent of incentivizing treatments for unprofitable conditions and the current reality of highly lucrative niche markets. The initial purpose of the ODA was to make the development of unprofitable drugs for rare diseases economically viable . However, the high prices, coupled with the seven-year market exclusivity, have made orphan drug development extraordinarily profitable, sometimes even more so than non-orphan drugs . Studies indicate that publicly listed pharmaceutical companies holding orphan drug market authorizations are associated with higher market value and greater profits than companies not producing treatments for rare diseases . The gross profit margin for the rare disease industry is reported to be over 80%, significantly higher than the pharmaceutical industry’s average of 16% . This level of profitability directly contradicts the ODA’s initial premise of “no reasonable expectation of recovering costs”. This situation has led to a “gold rush” effect, where pharmaceutical companies disproportionately focus on orphan drug development for conditions that can yield high returns, potentially diverting resources and attention from the 95% of rare diseases that still lack approved treatments . The focus appears to have shifted from addressing “unmet medical need” to exploiting “profitable niche markets,” which challenges the ODA’s ethical foundation and the efficiency of resource allocation within the broader healthcare system. This dynamic also fuels the persistent criticism that the ODA is being “manipulated by drug makers to maximize profits” .

Criticisms and Unintended Consequences

Despite the ODA’s undeniable successes in stimulating innovation, the astronomically high prices of many orphan drugs remain a significant and contentious issue . Critics argue that these prices often limit patient access, even for individuals with health insurance or those enrolled in patient assistance programs . A 2021 study by the U.S. Department of Health and Human Services (HHS) Office of the Inspector General (OIG) revealed that half of the 40 therapies with the highest Medicare Part B and Part D expenditures were orphan drugs, and a significant number of these were also used to treat common conditions . This finding raises critical questions about whether the ODA’s incentives are truly serving their intended purpose of fostering treatments exclusively for rare diseases that would otherwise be ignored, or if they are inadvertently subsidizing profitable drugs with broader market applications .

Critics frequently allege that pharmaceutical manufacturers sometimes “manipulate” the orphan drug program to maximize profits . Practices such as “evergreening”—repurposing existing, often off-patent, drugs for new rare disease indications—and “salami slicing”—arbitrarily defining small patient populations to gain orphan status for a drug that could treat a much larger population—are commonly cited examples . For instance, adalimumab (Humira), a top-selling drug, has over ten FDA-approved indications, but only four are for rare diseases, comprising a small percentage of its total sales, yet it benefits from orphan drug incentives . This suggests that the incentives may not always be necessary for drugs that would likely be developed anyway due to their broader market potential, leading to questions about the efficient allocation of public resources .

The seven-year market exclusivity granted by the ODA is a powerful incentive, but its interaction with broader patent protection laws is complex and has become a subject of significant legal debate . While patents typically provide 20 years of protection from the filing date, the effective market exclusivity for pharmaceuticals is often shorter, averaging 12-14 years, due to the extensive development and approval timelines . Orphan drug exclusivity can extend this period, particularly for drugs with weak or lapsed patents . A significant legal challenge arose from Catalyst Pharmaceuticals Inc. v. Becerra (2021), where an appeals court disagreed with the FDA’s long-standing interpretation that orphan drug exclusivity protects only the approved indication or use, rather than the entire rare disease designated at the outset of drug development . This court ruling, if widely adopted, could inadvertently limit treatment options by disincentivizing manufacturers from conducting further studies on a product for additional indications within the same rare disease (e.g., in younger patient populations) . The FDA has expressed its intent to continue tying exclusivity to approved uses, but congressional clarification may be needed to prevent ongoing uncertainty and ensure continued research for all patient subsets .

The interplay between the ODA’s market exclusivity and broader patent law, coupled with evolving interpretations by courts and regulatory bodies, creates a volatile regulatory environment that significantly impacts pharmaceutical research and development strategies and market access. The Catalyst v. Becerra case, by challenging the FDA’s long-held interpretation of exclusivity, introduced “doctrinal uncertainty” into the system. This uncertainty can have far-reaching consequences, potentially deterring orphan drug development, exacerbating high drug prices, and impeding patient access . The concern is that if exclusivity is broadly applied to an entire rare disease rather than specific indications, it could disincentivize companies from pursuing additional research for sub-populations within that disease (e.g., pediatric patients, who often respond differently to treatments and require tailored formulations ). This could stifle innovation for critical patient subgroups and reduce the overall availability of tailored treatments, directly contradicting the ODA’s original goal of addressing unmet needs across all rare disease patients. To mitigate these risks and identify opportunities in this shifting landscape, pharmaceutical companies must actively monitor legislative and judicial developments. Tools like DrugPatentWatch become indispensable for meticulously tracking patent lifecycles, exclusivity grants, and litigation outcomes, enabling businesses to adapt their development and market entry strategies to a continuously evolving regulatory and competitive environment .

Mark Cuban Cost Plus Drug Company: A Model of Radical Transparency

Against the backdrop of the complex and often controversial orphan drug landscape, Mark Cuban’s Cost Plus Drug Company (MCCPDC) has emerged with a strikingly simple yet profoundly disruptive business model: radical transparency.

The “Cost-Plus” Business Model: Simplicity in a Complex System

At its core, MCCPDC operates on a straightforward “cost-plus” pricing model. Every product sold is priced transparently: the company’s acquisition cost, plus a flat 15% markup, a $5 pharmacy service fee, and a $5 shipping fee. This model is designed to eliminate the hidden costs, complex rebates, and opaque pricing structures that have long characterized the traditional pharmaceutical supply chain . MCCPDC publicly discloses the amount it pays for each drug, a level of transparency previously unseen in the industry . As Mark Cuban himself articulated, “Everyone should know what it cost to make their medicine. Everyone should feel the price they paid for their medicine was fair”. This direct and open approach stands in stark contrast to the convoluted pricing mechanisms that have historically obscured the true cost of medications for consumers and payers alike.

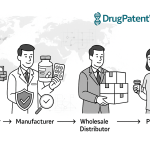

The central pillar of MCCPDC’s strategy is to bypass pharmacy benefit managers (PBMs), the powerful middlemen widely accused of inflating drug prices through their opaque rebate systems and control over drug formularies . PBMs currently control over 80% of the U.S. prescription drug market, wielding immense influence over pricing and access . Cuban has consistently criticized the pharmaceutical industry’s lack of transparency, attributing it directly to the PBM-dominated system . He argues that PBMs often pressure manufacturers to price generics “even, sometimes, above a brand price” and that the “specialty drug” label is frequently used as a marketing tactic to justify inflated prices .

MCCPDC’s “cost-plus” model is not merely a pricing strategy; it is a direct assault on the PBM-dominated pharmaceutical supply chain, aiming to fundamentally re-engineer how drugs are priced and distributed by exposing and eliminating hidden margins. By revealing the true acquisition cost and adding a fixed, transparent margin, MCCPDC directly challenges the very foundation of PBM profitability, which traditionally relies on undisclosed spreads and complex rebate programs. This transparency forces a critical re-evaluation of the “value” PBMs provide versus the “cost” they impose on the entire healthcare system. It empowers consumers and employers with unprecedented information, thereby shifting market power. This disruption has already compelled major players like CVS and Express Scripts to announce or launch their own “cost-plus” models , albeit with lingering questions about the transparency of their underlying acquisition costs . The long-term ripple effect of MCCPDC’s model could be a systemic shift towards greater price clarity across the entire pharmaceutical supply chain, fundamentally altering competitive dynamics and consumer behavior by making opaque practices unsustainable.

Impact on Generic Drug Pricing and Accessibility

The Mark Cuban Cost Plus Drug Company has already demonstrated significant, quantifiable cost savings for patients and healthcare systems. A study published in JAMA Health Forum found that nearly 12% of generic prescription drugs could have had lower out-of-pocket costs if purchased through MCCPDC compared to traditional pharmacies using health insurance . The savings were particularly pronounced for uninsured individuals, with a median saving of $6.08 per prescription . Beyond individual patient savings, studies have projected substantial benefits for public payers like Medicare. A Journal of Urology paper estimated potential annual savings of $1.29 billion for just nine popular urological drugs based on 2020 Medicare Part D expenditures if purchased at MCCPDC prices. Similarly, a Journal of Clinical Oncology study projected $661.8 million in savings for seven generic oncology drugs . A striking example is Imatinib, a cancer drug, which could be purchased for $34.50 for a 30-day supply on MCCPDC, starkly contrasting with the $2,000-$6,000 per month often billed by PBMs .

The role of transparency in reshaping consumer expectations is perhaps one of MCCPDC’s most profound contributions. Karen Van Nuys, Ph.D., a leading health policy expert, acknowledged that MCCPDC is doing a “tremendous service” by making medication prices transparent . This transparency empowers consumers to understand the true cost of their medications, enabling them to make more informed choices about their healthcare spending. It also exerts significant pressure on traditional pharmacies and PBMs to justify their existing, often inflated, pricing structures.

Beyond direct cost savings, MCCPDC’s radical transparency functions as a market-level “truth serum,” forcing traditional pharmaceutical players to either adapt their opaque pricing models or risk losing market share and public trust. The public availability of MCCPDC’s prices creates an undeniable benchmark against which traditional, often hidden, prices can be measured. This “radical transparency” exposes the hidden markups and inefficiencies deeply embedded within the existing pharmaceutical system. This is not merely about selling cheaper drugs; it is about fundamentally shifting the industry’s paradigm. By making prices that were once “impossible to find” visible, MCCPDC is setting a new expectation for affordability and accountability across the board. This competitive pressure has already compelled even major players like CVS and Express Scripts to launch their own “cost-plus” models , albeit with ongoing questions about the true transparency of their underlying acquisition costs . The long-term ripple effect could be a systemic shift towards greater price clarity across the entire pharmaceutical supply chain, fundamentally altering competitive dynamics and empowering consumers.

Expanding Horizons: MCCPDC’s Venture into Manufacturing and Rare Diseases

In a strategic move to deepen its disruptive impact, MCCPDC opened a 22,000-square-foot sterile fill-finish manufacturing facility in Dallas, Texas, in 2023. This state-of-the-art facility is equipped with advanced robotic and AI computer vision technology, allowing for rapid pivoting between different drug types, potentially within four hours, to respond swiftly to drug shortages and price hikes . The primary focus of this facility is to produce high-quality, life-saving injectable medications and address critical drug shortages, including essential pediatric cancer drugs. This vertical integration into manufacturing aims to further reduce costs by directly controlling the production process, thereby enhancing supply chain resilience and national drug security.

While MCCPDC initially focused on a selection of over 100 generic drugs, its offerings have expanded rapidly to over 2,200 drugs by December 2023 . Crucially, the company’s mission explicitly includes addressing the high cost of generic drugs, particularly those for rare diseases . Dr. Alex Oshmyansky’s initial vision, which catalyzed the company’s formation, was specifically centered on manufacturing low-cost medications for rare diseases . The Dallas manufacturing facility is explicitly designed to produce “orphan drugs,” medicines intended for rare diseases affecting small patient populations, directly addressing affordability challenges in this specialized area . Beyond generics, MCCPDC is actively working to incorporate trade-name manufacturers, single-source brands, and specialty biologics into its pharmacy offerings . This strategic expansion indicates a clear intent to move beyond common generics and penetrate the complex, often high-cost realm of branded and specialty orphan drugs.

MCCPDC’s vertical integration into manufacturing, particularly for sterile injectables and pediatric cancer drugs, represents a strategic move from merely disrupting the market to actively building supply chain resilience. This directly challenges the root causes of drug shortages and high prices in critical, often orphan, drug categories. By directly manufacturing these essential medications, MCCPDC is moving beyond simply transparently pricing existing drugs to actively creating a more reliable and affordable supply. This represents a deeper level of disruption than simply being a transparent distributor. For orphan drugs, where supply can often be precarious due to inherently small markets and complex manufacturing requirements, this vertical integration could be a game-changer. It offers the potential to ensure consistent availability and prevent the kind of price gouging seen in the past. This initiative signifies a shift from merely highlighting market failures to building alternative, more robust infrastructure, thereby enhancing national drug security and improving patient access for vulnerable populations who rely on these specialized treatments.

Mark Cuban’s Vision for Orphan Drug Reform: Beyond Transparency

Mark Cuban’s influence extends far beyond the operational success of MCCPDC. He has actively leveraged his platform to advocate for systemic reforms, connecting his business model to a broader vision for a more equitable and transparent pharmaceutical industry.

Direct Policy Proposals and Advocacy Efforts

Cuban has publicly and vocally advocated for significant reforms to the practices of Pharmacy Benefit Managers (PBMs). He proposes a fundamental shift: divorcing formularies—the lists of drugs covered by insurance—from PBM control. Instead, he suggests these formularies should be managed by “independent bodies with no financial incentives,” ensuring that drug selection is “about wellness, not pay for play like a grocery store endcap” . This aims to dismantle the existing system where rebates and profit motives often dictate which drugs are preferred, potentially at the expense of patient needs or cost-effectiveness. Furthermore, he calls for full transparency of claims data to employers, states, and drugmakers, arguing that such access would “improve outcomes and eliminate waste” and help rectify issues like 340B “double dipping,” where certain healthcare providers might benefit from multiple discounts .

Cuban also directly challenges the very definition and pricing of “specialty drugs,” labeling it a “marketing tactic to inflate prices” . He advocates for the complete elimination of the specialty tier and an end to PBMs requiring patients to purchase through specific, often PBM-owned, pharmacies . His proposals extend to ensuring fair compensation for independent pharmacies for brand-name drugs and abolishing the Generic Cost Ratio, which he contends allows wholesalers to inflate generic prices through the threat of chargebacks . Additionally, he urges the removal of confidentiality clauses that prevent direct negotiation between companies and drug manufacturers, believing this would lead to better prices and wellness plans for patients . Finally, he calls for an end to PBMs “gaming the system” by substituting lower-cost biosimilars with their in-house branded versions to secure higher margins .

Cuban’s policy proposals, directly stemming from his experience with MCCPDC, target the systemic vulnerabilities of the pharmaceutical supply chain, suggesting that transparency in pricing alone is insufficient without fundamental reforms to PBM incentives and drug classification. His direct experience with the opacity and alleged manipulation within the drug supply chain has informed his conviction that legislative intervention is necessary to complement market-based disruptions. His proposals move beyond simply offering a cheaper alternative at the retail level; they aim to dismantle the underlying incentive structures that drive high costs, particularly for high-value drugs like some orphan therapies, which are often classified as “specialty” to justify exorbitant prices. This demonstrates a mature understanding that while market innovation can expose flaws, policy intervention is crucial for comprehensive, lasting change across the entire pharmaceutical ecosystem.

The Interplay with Existing Legislation: IRA and ODA Amendments

Mark Cuban has shown a pragmatic willingness to engage with policy changes from across the political spectrum if they align with his goals of transparency and affordability. His public praise for former President Trump’s executive order targeting healthcare reform, stating it “could save hundreds of billions” , exemplifies this approach. This indicates that for Cuban, the efficacy of the policy in reducing drug prices outweighs partisan considerations.

The broader legislative landscape, particularly the Inflation Reduction Act (IRA) of 2022, has introduced significant changes, including Medicare drug price negotiation. However, the IRA includes a specific exemption for orphan drugs approved for a single indication . This narrow exemption has become a point of significant contention. Critics argue that it inadvertently disincentivizes manufacturers from developing drugs for multiple rare disease indications, as obtaining a second orphan designation would make the drug eligible for negotiation, thereby reducing its profitability . This creates a dilemma for pharmaceutical companies: should they pursue additional indications for a drug that could benefit more rare disease patients, knowing it might trigger price negotiation and reduce overall revenue?

In response to this concern, bipartisan legislation like the “ORPHAN Cures Act” (H.R. 946, S. 1862) has been introduced. This bill aims to broaden the IRA’s orphan drug exclusion, ensuring that drugs approved for multiple rare diseases remain exempt from price negotiation . The intent behind this bill is to restore incentives for research and development in rare diseases by preventing penalties for expanding indications, thereby encouraging broader patient benefit . While Cuban has not explicitly endorsed the ORPHAN Cures Act in the provided information, his broader advocacy for transparent pricing and challenging “specialty drug” labels aligns with the spirit of reducing artificial cost barriers. His focus tends to be on market-based solutions, but his public statements and direct policy proposals clearly indicate his recognition of the need for policy alignment to achieve comprehensive reform.

The legislative debates surrounding the IRA’s orphan drug exemption and proposals like the ORPHAN Cures Act highlight a fundamental policy tension: how to balance the critical need for continued innovation in rare diseases with the imperative to control escalating drug costs. The ongoing back-and-forth in Congress illustrates the inherent struggle to define “fair” pricing and “appropriate” incentives in a market where groundbreaking innovation is essential, but affordability is a growing societal demand. Cuban’s market-driven transparency efforts, by exposing the true costs of drugs, implicitly pressure policymakers to address this tension more effectively. His company, MCCPDC, serves as a real-world case study that informs the policy debate, making it increasingly difficult for the traditional pharmaceutical industry to justify high prices based solely on R&D costs when a transparent, lower-cost model exists. This dynamic suggests that market disruption and legislative reform are not mutually exclusive but rather complementary forces driving the evolution of the pharmaceutical industry.

Diverse Perspectives on Orphan Drug Development and Reform

To gain a holistic understanding of the orphan drug landscape, it is crucial to examine the often-conflicting perspectives of its key stakeholders: the pharmaceutical industry, patient advocacy groups, and policymakers alongside academic experts.

Pharmaceutical Industry: Protecting Innovation and Investment

The pharmaceutical industry consistently argues that the high prices of orphan drugs are a necessary reflection of the enormous costs and inherent risks associated with their research and development (R&D) . Developing a new drug is an exceptionally lengthy and expensive endeavor, typically averaging 10 to 15 years from discovery to market approval and costing approximately $2.6 billion . Furthermore, the odds of success are daunting, with only about 12% of drugs that enter clinical trials ultimately receiving FDA approval . While the average R&D cost for an orphan drug is estimated to be lower than for a non-orphan drug (around 27% of the cost, or $166 million in clinical costs after accounting for success probability, compared to $291 million for non-orphan drugs) , the critical difference lies in the patient population. The small number of patients with rare diseases means that these substantial development costs must be spread across far fewer units, necessitating higher per-patient prices to achieve a return on investment .

Industry groups, such as the Pharmaceutical Research and Manufacturers of America (PhRMA), emphasize that the ODA’s incentives, particularly market exclusivity, are crucial for protecting these high-risk, long-term investments and encouraging the development of treatments for conditions that would otherwise be ignored due to limited commercial viability . They frequently warn that “harmful policies like government price setting threaten future progress” and could stifle the very innovation that brings life-saving therapies to patients.

The pharmaceutical industry expresses significant concern over legislative changes that could erode these incentives. The reduction of the orphan drug tax credit from 50% to 25% in 2017 was already viewed as a detrimental move. More recently, the Inflation Reduction Act’s (IRA) drug price negotiation provisions, particularly its narrow orphan drug exemption, have raised alarms. Industry stakeholders contend that if drugs with multiple orphan indications become subject to negotiation, it would disincentivize further research into additional rare diseases, thereby limiting the overall patient benefit . PhRMA has also voiced strong criticism against “Most Favored Nation” pricing policies, arguing that such measures would ultimately stifle innovation by reducing profitability .

The pharmaceutical industry’s arguments for high orphan drug prices, while grounded in the economics of R&D, often clash with public perceptions of fairness and affordability, creating a narrative battle that Mark Cuban’s transparency model directly exploits. The industry consistently points to the immense R&D costs and the inherent risks of drug development as the primary justification for high prices . However, this narrative faces increasing scrutiny when data reveal that some orphan drugs achieve “blockbuster” sales , and studies demonstrate that orphan drug companies, on average, exhibit “higher market value and greater profits” than non-orphan drug companies . The reported gross profit margin for the rare disease industry, exceeding 80% compared to the pharmaceutical industry’s average of 16% , further complicates the industry’s justification for prices. Mark Cuban’s intervention with MCCPDC, by transparently selling generics—including some for rare diseases—at significantly lower prices , provides empirical evidence that substantial cost reductions are achievable by eliminating middlemen and opaque pricing. This creates a significant public relations challenge for traditional pharmaceutical companies and strengthens the position of policymakers and patient advocates pushing for price controls. While the industry’s concern about “chilling investment” is a legitimate consideration, the counter-argument is that current incentives may be over-incentivizing and leading to excessive profits for some, rather than solely enabling the development of treatments for truly unprofitable rare diseases.

Patient Advocacy Groups: The Imperative of Access and Affordability

Patient advocacy groups (PAGs) have played an indispensable role in the rare disease space, from the very inception of the ODA to ongoing reform efforts . Organizations like the National Organization for Rare Disorders (NORD) serve as vital bridges, connecting patients, researchers, and policymakers . These groups consistently highlight the profound human cost of rare diseases, emphasizing the “long arduous process” of diagnosis and the “life threatening” prognoses many patients face. PAGs passionately articulate that high drug prices create “significant financial barriers to access” , leading to “unprecedented increases in the cost of rare disease drugs” that burden families . They are vocal proponents of price transparency and lower drug prices, actively urging patients to “tell your story” to lawmakers to underscore the real-world impact of drug costs .

PAGs actively work to ensure that patient perspectives are deeply embedded in decision-making processes, ranging from Health Technology Assessment (HTA) bodies to regulatory agencies . They are strong supporters of initiatives like the FDA’s Accelerating Rare Disease Cures (ARC) Program, which aims to streamline the development of rare disease therapies . While not all patient groups have issued explicit endorsements of MCCPDC, many align with the company’s core goals of affordability and transparency. For instance, the Celiac Disease Foundation partnered with MCCPDC to provide resources for patients concerned about potential gluten in medications, citing a shared commitment to “making healthcare accessible and affordable for all”. This demonstrates a pragmatic willingness among patient advocates to collaborate with any model that delivers tangible savings and improves access for their communities.

Patient advocacy groups, while staunch defenders of the ODA’s original intent to spur innovation, are increasingly critical of its unintended consequence of high prices, thereby creating a powerful societal pressure that aligns with Mark Cuban’s market disruption. The core mission of PAGs is to ensure access to treatments for rare diseases . From their perspective, the ODA has been a success in increasing the number of approved treatments, from a mere 10 before its enactment to over 750 today . However, they simultaneously lament the ODA’s failure to ensure affordability, as high prices continue to create “financial barriers to access” , leaving a staggering 95% of rare diseases without approved treatments . Mark Cuban’s intervention directly addresses this affordability gap through his transparent, cost-plus model . This alignment creates a compelling dynamic: PAGs represent the moral compass of the orphan drug debate, advocating for both innovation and access. Their willingness to collaborate with diverse entities, including disruptive models like MCCPDC, if it translates into tangible benefits for their communities, creates a strong societal mandate for balancing innovation with affordability. This collective pressure urges both the pharmaceutical industry and policymakers to find sustainable solutions that transcend the limitations of current frameworks.

Policymakers and Academic Experts: Seeking Balance and Sustainability

Policymakers and academic experts are engaged in an ongoing, nuanced debate regarding the ODA’s efficacy and its unintended consequences. While some acknowledge the ODA’s “strikingly successful” role in increasing drug approvals for rare diseases , others question whether the current level of incentives remains necessary, particularly given the high sales figures and “blockbuster” status achieved by some orphan medications . There is a recognized “sustained call for reform” within academic and policy circles, often centered on principles of welfare economics and resource allocation, with many suggesting that existing incentives and regulations are insufficient to achieve equitable access and sustainable pricing .

This critical examination has led to the exploration of alternative models for pharmaceutical innovation and valuation . A prominent concept gaining traction is “delinkage,” which fundamentally aims to separate the costs of research and development (R&D) from the final price of the drug . This model proposes alternative funding mechanisms, such as expanded government funding, direct grants, or cash reward incentives (often termed “prize funds”) for successful drug development . The core idea is that by delinking R&D costs from product prices, drugs could then be sold at prices closer to their marginal production costs, dramatically increasing affordability and access . The “prize system,” for instance, is viewed as a way to reward innovation without granting monopolies, thereby fostering competition and driving down drug prices post-development . While still largely theoretical and subject to extensive debate regarding implementation, delinkage represents a more fundamental shift in how pharmaceutical R&D is financed, potentially offering a long-term solution to the persistent tension between innovation incentives and equitable access, particularly for rare diseases where patient populations are inherently small.

The academic and policy discourse is moving towards more radical, systemic reforms like “delinkage” and “prize funds,” suggesting that the current market-based incentives, even with ODA modifications, may be inherently flawed for addressing rare disease drug development sustainably and equitably. Mark Cuban’s cost-plus model, while not a “delinkage” model itself, serves as a real-world proof-of-concept that significant price reductions are achievable outside the traditional, opaque system. His success with MCCPDC, even if currently limited primarily to generics, provides empirical evidence that the cost of drugs is artificially inflated by market inefficiencies rather than solely by R&D expenditures. This strengthens the argument for delinkage models, as it demonstrates that if R&D were funded differently, drugs could be far more affordable. MCCPDC acts as a living laboratory, showcasing that profit motives can indeed be balanced with social missions, and that competition (or the credible threat of it) can drive down prices, even in highly specialized markets like orphan drugs. This pushes the policy debate beyond incremental changes to the ODA towards more fundamental restructuring of pharmaceutical R&D and pricing incentives, advocating for a system that prioritizes both innovation and broad patient access.

Leveraging Patent Data and Competitive Intelligence in the Evolving Landscape

In the dynamic and increasingly scrutinized pharmaceutical industry, the strategic application of patent data and competitive intelligence is no longer an optional luxury but a critical imperative for businesses seeking to maintain a competitive edge and navigate the evolving orphan drug market.

The Critical Role of Intellectual Property in Orphan Drug Development

Intellectual property (IP), primarily encompassing patents and regulatory exclusivities, forms the bedrock of pharmaceutical innovation and revenue generation . Patents typically provide a 20-year term from the filing date, but the effective market exclusivity period for pharmaceuticals is often shorter, averaging 12-14 years, due to the lengthy and complex development and regulatory approval processes . For orphan drugs, the Orphan Drug Exclusivity (ODE) provides an additional seven years of market protection, which is independent of patent status and serves as a crucial incentive for developing treatments for rare diseases . Other forms of exclusivity, such as New Chemical Entity (NCE) exclusivity (five years) and new clinical investigation exclusivity (three years for new uses of existing drugs), further complicate the IP landscape . Additionally, pediatric exclusivity can add another six months to existing patent or exclusivity periods, incentivizing studies in children . Understanding the intricate nuances of these overlapping protections is vital for any pharmaceutical company.

A robust patent portfolio is indispensable for establishing and maintaining a dominant competitive position, as it legally prevents competitors from developing and marketing similar products, thereby allowing the patent holder to control the market for the duration of the patent term . Companies must meticulously align their patent strategy with their core business objectives, focusing resources on high-value innovations within their chosen therapeutic areas . This involves building comprehensive, layered portfolios that incorporate various patent types, including method of use, process, and dosage regimen patents . Strategic lifecycle management is also crucial, involving efforts to maximize patent term and market exclusivity, often through the development of next-generation products or the expansion of indications, including into rare diseases .

In the orphan drug space, where market size is inherently limited, maximizing intellectual property protection through strategic patenting and leveraging ODA exclusivity becomes even more critical for achieving profitability and justifying substantial research and development investments. The core business principle of the pharmaceutical industry is driven by an “innovation-exclusivity-reinvestment cycle,” where massive R&D investments are protected by patents, conferring market exclusivity and leading to high revenues that can be reinvested . For orphan drugs, the challenge of a small patient population means that lower sales volumes are inherent to the market . Consequently, the extended periods of monopoly power granted by the ODA’s seven-year market exclusivity are particularly sensitive and essential for companies to recoup their high fixed R&D costs . This makes proactive patent landscaping and the strategic utilization of ODA incentives paramount. Businesses must meticulously track patent expiry dates and exclusivity periods using specialized tools like DrugPatentWatch to inform their development and market entry strategies, ensuring they capture sufficient market protection to justify their investment in these niche, high-need areas.

Competitive Intelligence for Strategic Advantage

Competitive intelligence is paramount for navigating the complex and rapidly evolving pharmaceutical market, particularly in the orphan drug landscape, which is increasingly shaped by disruptive forces like Mark Cuban’s initiatives. Platforms like DrugPatentWatch provide critical insights by offering a comprehensive database of drug patents, generic entry opportunities, and regulatory status across 134 countries . This type of platform allows business professionals to:

- Monitor the competitive landscape and validate investments, providing a holistic view of market dynamics .

- Understand the complete drug pipeline, including early-phase data for over 100,000 drugs, enabling early identification of competitor programs .

- Predict the likelihood and timing of competing drug launches using statistical modeling and AI-based predictive analytics .

- Access expansive coverage of clinical, deals, regulatory, and patent intelligence tied to each drug and company, sourced from global conferences and industry news .

- Identify white spaces for innovation and repurposing opportunities by analyzing existing patent landscapes .

- Track patent litigation and tentative approvals, providing early warnings of potential market shifts .

For generic manufacturers and those seeking to enter the market post-exclusivity, DrugPatentWatch is an invaluable tool. It helps identify optimal market entry timing by meticulously analyzing patent expiration dates and regulatory exclusivity periods . The platform provides detailed data on patents covering drug substances, drug products, and methods of use, along with any Patent Term Extensions (PTEs) that might alter timelines . Competitive intelligence teams can closely monitor Abbreviated New Drug Application (ANDA) filings, especially those with Paragraph IV certifications (which challenge existing patents), to assess the likely impact on market share and revenue . This proactive intelligence enables innovator companies to deploy defensive strategies, such as launching authorized generics or accelerating the development of next-generation products, to mitigate anticipated revenue loss from patent cliffs .

In a market increasingly shaped by transparency and cost-containment pressures—partially driven by players like Mark Cuban—sophisticated competitive intelligence tools become indispensable for both innovators and generic developers to maintain competitive advantage and navigate patent cliffs. The pharmaceutical market is inherently competitive, with significant revenue streams at stake upon patent expiration . Mark Cuban’s Cost Plus Drug Company demonstrates the tangible power of transparent, low-cost alternatives, thereby creating immense pressure on traditional pricing models . In this environment, the value of granular, real-time patent and market intelligence escalates dramatically. Companies that effectively leverage platforms like DrugPatentWatch will be better positioned to anticipate market shifts, mitigate risks associated with patent cliffs and new generic entrants, and strategically allocate R&D resources to truly innovative and defensible areas, including high-value orphan drug development. This data-driven approach is key to transforming market disruption into a competitive advantage.

Informing Market Entry and Development Strategies

Leveraging comprehensive market research and data is crucial for understanding patient populations, identifying unmet medical needs, and assessing payer willingness-to-pay in rare disease markets . Such data-driven insights are essential for justifying the costly initial investment required for orphan drug development . By analyzing the market share, pricing strategies, and limitations of existing orphan drugs, companies can uncover significant opportunities for differentiation, such as developing treatments with more favorable side-effect profiles, more convenient dosing schedules, or, critically, lower costs . This strategic analysis allows businesses to pinpoint areas where true innovation can create value and capture market share.

Beyond current market dynamics, business professionals must not only understand existing laws but also proactively anticipate future regulatory directions and public policy debates to adjust their intellectual property strategies . This involves continuously monitoring legislative proposals, such as those impacting the IRA’s orphan drug exclusion, and staying abreast of court interpretations of market exclusivity provisions . Predictive modeling and scenario planning are indispensable tools for forecasting market response to various pricing strategies and potential regulatory changes . This forward-looking approach enables companies to adapt swiftly to a fluid environment, ensuring that their development and market entry strategies remain robust and commercially viable in the face of evolving healthcare policies and market pressures.

The Future of Orphan Drug Development: A Path Towards Sustainable Innovation

The landscape of orphan drug development is at a pivotal juncture, shaped by rapid scientific advancements, ongoing policy debates, and the disruptive influence of new market players. Understanding these converging forces is essential for charting a sustainable path forward.

Emerging Trends and Technological Advancements

The rare disease pipeline is increasingly characterized by advanced therapeutic modalities, with a notable dominance of cell- and gene-based therapeutics . These innovative treatments represent new frontiers in medicine, offering the potential for transformative, and in some cases, curative, outcomes for rare diseases that previously had no viable treatment options . However, this groundbreaking progress comes with a significant challenge: these therapies often command extremely high price tags, exemplified by drugs like Zolgensma, which can cost $1.9 million . Such exorbitant costs introduce new complexities for affordability, reimbursement, and the overall sustainability of healthcare systems.

Simultaneously, artificial intelligence (AI) and advanced data analytics are becoming increasingly integral to biopharmaceutical research and development. These technologies are revolutionizing various stages of the drug lifecycle, from initial drug discovery and preclinical research to optimizing clinical trial design and informing patent strategy . AI, for instance, can significantly enhance patent applications by generating thousands of examples to support broader claims, thereby strengthening intellectual property protection . It also accelerates drug discovery by identifying potential compounds and predicting their efficacy with greater speed and precision . Data analytics, in turn, helps identify critical unmet needs, optimize trial designs—for example, by leveraging patient registries to reduce the required trial size and cost —and improve the overall efficiency of R&D spending .

The convergence of advanced therapeutics, such as gene therapies, and cutting-edge technologies like AI in rare disease research and development creates a profound paradox: while offering unprecedented hope for previously untreatable conditions, it also introduces new cost complexities and ethical dilemmas that current incentive structures, including the ODA, are ill-equipped to handle. AI might reduce some R&D costs by streamlining processes and improving success rates, but the inherent complexity and specialized nature of gene therapies mean their development costs remain substantial. Furthermore, their value-based pricing models push the boundaries of affordability. The ODA’s incentives, originally designed for a simpler pharmaceutical era, may not be sufficient or appropriate for these novel modalities. This creates a new and pressing challenge: how to incentivize the development of these truly transformative but incredibly expensive treatments without making them inaccessible to the very patients they are designed to help. The debate over “value” versus “cost” will undoubtedly intensify, potentially leading to the necessity for entirely new reimbursement models or even more radical delinkage proposals specifically tailored for these advanced therapies.

Policy Evolution and the Drive for Affordability

Legislative efforts continue to address the persistent challenge of drug pricing, including the ongoing debate surrounding the Inflation Reduction Act’s (IRA) drug price negotiation program and its specific orphan drug exemption . The “ORPHAN Cures Act” stands as a key example of bipartisan efforts to modify these provisions, aiming to ensure continued research and development for drugs with multiple rare disease indications without triggering price negotiation . Beyond the IRA, other legislative proposals focus on reforming Pharmacy Benefit Managers (PBMs), advocating for “pass-through” structures for pharmacy reimbursement, limiting PBM administrative fees, and enhancing overall transparency within the supply chain .

As the challenges of rare disease drug development persist—with an estimated 95% of rare diseases still lacking an FDA-approved treatment —the role of public-private partnerships and alternative funding mechanisms is becoming increasingly critical. Government grants, research design support from regulatory bodies, and waivers of FDA user fees remain vital public incentives to de-risk and accelerate rare disease R&D . Furthermore, the concept of “delinkage” and prize funds, while still largely academic, represents a more fundamental shift in how R&D is financed. These models propose separating R&D costs from the final product price, potentially offering a path to significantly lower prices and broader access by removing the traditional monopoly incentive tied to patents .

The ongoing policy evolution reflects a growing societal consensus that while innovation must be protected, affordability cannot be sacrificed. This will likely lead to a hybrid model of incentives, blending traditional market exclusivity with more direct public funding mechanisms and stringent price transparency regulations. The sheer volume and diversity of legislative and academic proposals indicate a systemic recognition that the current ODA framework, while historically effective, is no longer sufficient to address the dual challenges of innovation and affordability for rare diseases. The future likely involves a complex interplay of market-based solutions (like MCCPDC’s transparency model), targeted legislative adjustments (like the ORPHAN Cures Act), and potentially more radical, publicly-funded “delinkage” models. This suggests a move towards a more managed and socially-accountable pharmaceutical ecosystem, where the “social mission”—as explicitly embodied by MCCPDC’s Public Benefit Corporation status—becomes an increasingly explicit consideration in both public policy and corporate strategy.

Mark Cuban’s Enduring Influence: A Blueprint for Change?

Mark Cuban’s impact on the pharmaceutical industry extends far beyond the direct sales figures of his company. He has brought unprecedented public attention to the opaque practices of Pharmacy Benefit Managers and the inflated costs of generic drugs, effectively “shaking up the pharmaceutical world” . His candid and often provocative statements, such as his willingness to “f— up the drug industry in every way possible” , represent a powerful, albeit unconventional, form of advocacy that resonates with a frustrated public.

MCCPDC’s model serves as a real-world proof-of-concept that transparency and direct-to-consumer approaches can significantly reduce drug costs, even if its current primary focus is on generics. This tangible demonstration creates a blueprint and a benchmark that other players, from traditional pharmacies to large PBMs, are now compelled to consider or even emulate . While MCCPDC primarily focuses on generic medications, its strategic expansion into manufacturing and its explicit mission to address high-cost generic drugs, particularly for rare diseases, position it as a potential long-term player in the broader orphan drug reform movement . Cuban’s actions underscore a critical point: innovation in healthcare is not solely about developing new molecules; it is equally about pioneering new business models and championing ethical frameworks that prioritize patient access and affordability. His enduring influence lies in his ability to force a re-evaluation of entrenched practices and inspire a more transparent, patient-centric future for the pharmaceutical industry.

Conclusion: Redefining the Future of Rare Disease Treatment

Mark Cuban’s unexpected emergence as a leader in orphan drug development reform is a testament to the transformative power of disruptive innovation, even within highly regulated and entrenched industries. His Mark Cuban Cost Plus Drug Company, with its radical transparency and direct-to-consumer model, has not only delivered tangible cost savings for patients but has also illuminated the systemic inefficiencies and opaque practices that inflate drug prices, particularly for vulnerable patient populations.

The Orphan Drug Act, while a monumental success in spurring rare disease research and bringing hundreds of new therapies to market, faces legitimate criticisms regarding its unintended consequences: the rise of “blockbuster” orphan drugs and the persistence of astronomically high prices. This inherent tension between incentivizing life-saving innovation and ensuring equitable patient access lies at the heart of the ongoing policy debate. Cuban’s market-based approach acts as a powerful catalyst, forcing traditional pharmaceutical players, Pharmacy Benefit Managers, and policymakers to confront these complex issues head-on.

The future of orphan drug development will undoubtedly be shaped by a complex interplay of forces. Continued scientific breakthroughs in gene therapies and personalized medicine promise unprecedented treatment options, yet they also introduce new cost complexities. Evolving legislative frameworks will continue to seek a delicate balance between fostering innovation and ensuring affordability. The enduring influence of disruptive models like MCCPDC will compel greater transparency and efficiency across the supply chain. For business and pharmaceutical professionals navigating this intricate landscape, leveraging advanced competitive intelligence tools like DrugPatentWatch will be indispensable. These platforms provide the granular patent data, market insights, and pipeline intelligence necessary to understand regulatory complexities, identify strategic opportunities, and adapt to a landscape where transparency and patient value are increasingly paramount. Ultimately, the shared goal remains clear: to ensure that groundbreaking treatments for rare diseases are not only developed but are also accessible and affordable for every patient who needs them, fostering a more sustainable and equitable healthcare ecosystem.

Key Takeaways

- Mark Cuban: A Disruptive Force: Mark Cuban’s entry into the pharmaceutical sector is a calculated disruption, driven by his core business philosophy of identifying and solving market inefficiencies, particularly the pervasive lack of transparency in drug pricing.

- ODA’s Dual Legacy: The Orphan Drug Act has successfully spurred rare disease drug development, leading to hundreds of new approvals. However, it has also inadvertently fostered a highly profitable niche market with persistently high prices, raising questions about its original intent and current effectiveness.

- Transparency as a Catalyst for Change: The Mark Cuban Cost Plus Drug Company’s “cost-plus” model directly challenges the opaque, middleman-heavy pharmaceutical supply chain. It demonstrates that significant cost savings are achievable by eliminating hidden fees and rebates, thereby setting a new benchmark for pricing.

- Systemic Reform is Imperative: Mark Cuban’s advocacy extends beyond his company’s operations, as he proposes concrete policy changes targeting PBM practices, “specialty drug” designations, and data transparency. This highlights that market disruption alone cannot fully resolve all systemic issues within the pharmaceutical ecosystem.

- Policy Tensions Endure: Legislative debates, such as those surrounding the Inflation Reduction Act and the proposed ORPHAN Cures Act, reflect the ongoing struggle to balance the critical need for innovation incentives with the imperative of drug affordability. This tension is further exacerbated by the high costs associated with novel therapies like gene treatments.

- Competitive Intelligence is Essential: In this evolving landscape, robust patent data and competitive intelligence platforms like DrugPatentWatch are crucial. They provide businesses with the necessary tools to understand market dynamics, anticipate regulatory shifts, identify strategic opportunities (e.g., generic entry, new indications), and proactively manage their intellectual property portfolios.

- Towards a Hybrid Future: The future of orphan drug development will likely involve a blend of traditional incentives, market-driven transparency, and potentially new models like “delinkage” and public-private partnerships. This multi-faceted approach is necessary to ensure both sustainable innovation and equitable patient access to life-saving therapies.

Frequently Asked Questions (FAQ)

1. How does Mark Cuban Cost Plus Drug Company (MCCPDC) directly impact the affordability of orphan drugs, given its primary focus on generics?

MCCPDC primarily focuses on generic drugs, which represent a substantial portion of overall prescription drug spending. While many orphan drugs are branded, MCCPDC’s transparent “cost-plus” model directly addresses the lack of transparency and the inflated costs introduced by middlemen, factors that contribute to high prices across the entire pharmaceutical market. Dr. Alex Oshmyansky, MCCPDC’s co-founder, initially aimed to lower generic drug costs “particularly for rare diseases whose prices had increased dramatically” . Furthermore, MCCPDC’s manufacturing facility is explicitly designed to produce “orphan drugs,” aiming to address critical shortages and affordability challenges for these specialized medications . By demonstrating radical price reduction potential for generics, MCCPDC establishes a benchmark that implicitly pressures the entire pharmaceutical industry, including branded orphan drug manufacturers, to justify their pricing structures and potentially adapt their models.

2. What are the main criticisms leveled against the Orphan Drug Act (ODA) despite its success in spurring rare disease drug development?

Despite its undeniable success in significantly increasing the number of approved orphan drugs—from a mere 10 in the decade prior to its enactment to over 600 indications since —the ODA faces substantial criticism . The primary concerns revolve around the “astronomically high prices” of many orphan drugs, which critics argue are not always justified solely by R&D costs, especially when some of these drugs achieve “blockbuster” sales status . Allegations of “misuse of incentives” persist, including “evergreening” (repurposing existing drugs for new rare disease indications) and “salami slicing” (creating narrow indications for drugs that could treat broader populations) . These practices suggest that the program is sometimes manipulated for profit maximization rather than solely addressing truly unmet medical needs for rare diseases.

3. How do Mark Cuban’s policy recommendations align with or diverge from current legislative efforts to reform orphan drug development?

Mark Cuban’s policy recommendations, such as divorcing formularies from PBM control, requiring full claims data transparency, and eliminating the “specialty drug” tier , largely align with the broader legislative push for PBM reform and drug price transparency currently debated in Congress . However, Cuban’s approach is often more direct and market-driven, focusing on dismantling the role of middlemen. Current legislative efforts, like the Inflation Reduction Act (IRA), have introduced Medicare drug price negotiation but with a narrow orphan drug exemption that applies only to drugs with a single indication . Bills such as the “ORPHAN Cures Act” seek to broaden this exemption to protect multi-indication orphan drugs from negotiation . While Cuban supports overall drug price reduction, his direct proposals emphasize structural market changes rather than specific ODA amendments, though his efforts implicitly support the overarching goal of making all drugs, including orphan drugs, more affordable and accessible.

4. What role does patent data and competitive intelligence play in navigating the orphan drug market, especially with new players like MCCPDC?

Patent data and competitive intelligence are crucial for both innovator and generic pharmaceutical companies operating in the orphan drug market . For innovators, understanding patent lifecycles and regulatory exclusivity periods (including the ODA’s 7-year exclusivity) is essential for protecting substantial R&D investments and strategically managing product lifecycles . For generic manufacturers, analyzing patent expiration dates and regulatory exclusivity periods—often facilitated by specialized tools like DrugPatentWatch—helps identify optimal market entry opportunities and assess potential competition . The emergence of new players like MCCPDC, by introducing transparent pricing, intensifies the need for robust competitive intelligence across the board. This compels all market participants to continuously re-evaluate their pricing and market strategies in light of increased transparency and the potential for further disruption.

5. What are “delinkage” models, and how might they offer a long-term solution for orphan drug affordability beyond current reforms?

“Delinkage” models are academic and policy proposals that aim to separate the cost of pharmaceutical research and development (R&D) from the final price of the drug . Instead of relying on patent-granted monopolies and high prices to recoup R&D costs, these models propose alternative funding mechanisms. These can include expanded government grants, direct subsidies, or “prize funds” awarded for successful drug development and innovation . Under such a system, drugs, including orphan drugs, could then be sold at prices closer to their marginal manufacturing cost, leading to a radical increase in affordability and access. While still largely theoretical and subject to complex implementation challenges, delinkage offers a fundamental shift from the current market-based system. It addresses the core tension between incentivizing innovation and ensuring equitable access, particularly for rare diseases where small patient populations make traditional market-driven profitability challenging.

References

- Mark Cuban – Texas Business Hall of Fame, accessed July 24, 2025, https://texasbusiness.org/hall-of-fame-old/mark-cuban/

- The Success Story of Mark Cuban: From Garbage Bags to Entrepreneur – Health Evolution, accessed July 24, 2025, https://www.healthevolution.com/bios/speaker/mark-cuban/

- Cost Plus Drugs – Wikipedia, accessed July 24, 2025, https://en.wikipedia.org/wiki/Cost_Plus_Drugs

- Mark Cuban: Unexpected Leader in Orphan Drug Development Reform – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/mark-cuban-unexpected-leader-in-orphan-drug-development-reform/

- Hi guys, Alex Oshmyansky here, CEO of the Mark Cuban Cost Plus Drug Company. Cra… | Hacker News, accessed July 24, 2025, https://news.ycombinator.com/item?id=25935913

- Meet the Genius Who Convinced Mark Cuban to Sell Drugs – D Magazine, accessed July 24, 2025, https://www.dmagazine.com/publications/d-magazine/2022/october/mark-cuban-cost-plus-drugs-alex-oshmyansky/

- Mark Cuban Cost Plus Drug Company, accessed July 24, 2025, https://markcubancompanies.com/companies/mark-cuban-cost-plus-drug-company/

- Why the Mark Cuban Cost Plus Drug Company Is a Boon for the …, accessed July 24, 2025, https://www.trillianthealth.com/strategy/counterpoint/why-the-mark-cuban-cost-plus-drug-company-is-a-boon-for-the-pharmaceutical-industry

- Mark Cuban Cost Plus Drugs’ Biggest Benefit May Be Transparency …, accessed July 24, 2025, https://aishealth.mmitnetwork.com/blogs/radar-on-drug-benefits/mark-cuban-cost-plus-drugs-biggest-benefit-may-be-transparency-not-savings

- Mission of Mark Cuban Cost Plus Drugs, accessed July 24, 2025, https://www.costplusdrugs.com/mission/

- Questions Frequently Asked and Answers | Mark Cuban Cost Plus Drugs Company, accessed July 24, 2025, https://www.costplusdrugs.com/faq/

- The Good, The Bad, and the Missed Opportunity of Mark Cuban Cost Plus Drug Company, accessed July 24, 2025, https://www.drugtopics.com/view/the-good-the-bad-and-the-missed-opportunity-of-mark-cuban-cost-plus-drug-company

- Mark Cuban Cost Plus Drug Company Collaborates with RJ Dynamics, LLC (DiseaseHQ.com) to Help Rare Disease Patients – FirstWord Pharma, accessed July 24, 2025, https://firstwordpharma.com/story/5713970

- Patient-Level Savings on Generic Drugs Through the Mark Cuban Cost Plus Drug Company, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11179122/

- The Orphan Drug Act: Legal Overview and Policy Considerations …, accessed July 24, 2025, https://www.congress.gov/crs-product/IF12605

- Innovation and the Orphan Drug Act, 1983-2009: Regulatory and Clinical Characteristics of Approved Orphan Drugs – Rare Diseases and Orphan Products – NCBI, accessed July 24, 2025, https://www.ncbi.nlm.nih.gov/books/NBK56187/

- Understanding Market Exclusivity for Orphan Drug Products – Cytel, accessed July 24, 2025, https://cytel.com/perspectives/understanding-market-exclusivity-for-orphan-drug-products/

- Designating an Orphan Product: Drugs and Biological Products | FDA, accessed July 24, 2025, https://www.fda.gov/industry/medical-products-rare-diseases-and-conditions/designating-orphan-product-drugs-and-biological-products

- Impact of the Orphan Drug Act on Rare Disease Patients and the Pharmaceutical Industry, accessed July 24, 2025, https://alirahealth.com/education-hub/the-impact-of-the-orphan-drug-act-on-rare-disease-patients-and-the-pharmaceutical-industry/

- The Orphan Drug Act: An Appropriate Approval Pathway for Treatments of Rare Diseases?, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6751978/

- Rare Diseases at FDA, accessed July 24, 2025, https://www.fda.gov/patients/rare-diseases-fda

- Pricing Orphan Drugs | Health Affairs, accessed July 24, 2025, https://www.healthaffairs.org/do/10.1377/hpb20170721.588081/

- Patents and Exclusivity | FDA, accessed July 24, 2025, https://www.fda.gov/media/92548/download

- How Long Does a Patent Last for Drugs? A Comprehensive Guide to Pharmaceutical Patent Duration – DrugPatentWatch, accessed July 24, 2025, https://www.drugpatentwatch.com/blog/how-long-does-a-patent-last-for-drugs/

- The Orphan Drug Act at 35: Observations and an Outlook for the Twenty-First Century, accessed July 24, 2025, https://www.journals.uchicago.edu/doi/full/10.1086/699934

- Orphan Drug Act: 42 Yrs. & Impact on the Rare Disease Community, accessed July 24, 2025, https://lgdalliance.org/news-events/newsroom.html/article/2025/01/03/reflecting-on-42-years-of-the-orphan-drug-act

- How Big Pharma Makes Big Profits on Orphan Drugs – AHIP, accessed July 24, 2025, https://www.ahip.org/how-big-pharma-makes-big-profits-on-orphan-drugs

- Orphan Drug Credit: What It Is, How It Works – Investopedia, accessed July 24, 2025, https://www.investopedia.com/terms/o/orphan-drug-credit.asp

- The economics of moonshots: Value in rare disease drug development – PubMed Central, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9010265/

- Orphan Drug Pricing and Cost Trends in USA, accessed July 24, 2025, https://www.ijper.org/sites/default/files/IndJPhaEdRes-57-1s-1.pdf

- Incentives for orphan drug research and development in the United States – PMC, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC2631478/

- Orphan Products Grants Program – FDA, accessed July 24, 2025, https://www.fda.gov/industry/grant-programs-support-development-medical-products-rare-diseases/orphan-products-grants-program

- Continuing Innovation for Rare Conditions Under the Orphan Drug Act, accessed July 24, 2025, https://www.npcnow.org/resources/continuing-innovation-rare-conditions-under-orphan-drug-act

- Rare Diseases | PhRMA, accessed July 24, 2025, https://phrma.org/policy-issues/innovative-medicines/rare-diseases

- 4 things to know on Rare Disease Day – PhRMA, accessed July 24, 2025, https://phrma.org/blog/4-things-to-know-on-rare-disease-day

- The Orphan Drug Act at 40: Legislative Triumph and the Challenges …, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10938927/

- From Patients to Partners: The Rising Power of Advocacy in Drug Development, accessed July 24, 2025, https://www.pharmasalmanac.com/articles/from-patients-to-partners-the-rising-power-of-advocacy-in-drug-development

- Full article: A 30-year retrospective: National Organization for Rare Disorders, the Orphan Drug Act, and the role of rare disease patient advocacy groups – Taylor & Francis Online, accessed July 24, 2025, https://www.tandfonline.com/doi/full/10.2147/ODRR.S41070

- Drug Pricing, a Complex Issue Affecting the Rare Disease Community, accessed July 24, 2025, https://www.gaucherdisease.org/blog/drug-pricing-a-complex-issue-affecting-the-rare-disease-community/

- Orphan Drug Pricing and Payer Management in the United States: Are We Approaching the Tipping Point?, accessed July 24, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4106547/

- Mark Cuban Praises Trump’s New Healthcare Executive Order, Saying It ‘Could Save Hundreds of Billions’ – Bison Coop -, accessed July 24, 2025, https://bisoncoop.com/news/story/32012465/mark-cuban-praises-trump-s-new-healthcare-executive-order-saying-it-could-save-hundreds-of-billions

- Mark Cuban calls out Minnesota bill on prescription drug pricing – FOX 9, accessed July 24, 2025, https://www.fox9.com/news/mark-cuban-calls-out-minnesota-legislation-pharmacy-benefit-managers