Introduction: The High-Stakes Game of Patent Protection

Imagine pouring over a billion dollars and a decade of effort into creating a single product, only to watch its exclusivity slip away just as it starts to pay off. For pharmaceutical companies, this isn’t a nightmare—it’s the reality of drug patents. These legal protections grant a 20-year monopoly to manufacture and sell a drug, but the clock starts ticking the moment the patent is filed, often years before the drug even reaches the market. By the time it’s approved, only about 10-12 years of exclusivity might remain [1]. When that patent expires, generic competitors swoop in, prices plummet, and profits vanish. So, how do you stretch a finite timeline in an industry where every second counts? The answer lies in a blend of ingenuity, strategy, and legal acrobatics.

Pharma giants don’t just sit back and watch their patents fade—they fight to extend them. From tweaking formulations to building legal fortresses, they’ve mastered innovative approaches to keep their drugs exclusive and their bottom lines healthy. For business professionals looking to turn patent data into a competitive edge, understanding these strategies is like holding the keys to a treasure chest. This article dives deep into the world of drug patent extensions, unpacking the tactics, the tools (like DrugPatentWatch), and the ethical debates that shape this high-stakes game.

Understanding Drug Patents: The Foundation of Exclusivity

What Is a Drug Patent?

At its core, a drug patent is a government-granted shield that gives a company exclusive rights to produce and sell a specific medication for 20 years from the filing date. It’s the reward for innovation in an industry where developing a new drug can cost upwards of $2.6 billion and take over a decade [2]. Without this protection, competitors could copy the formula the moment it’s approved, slashing the incentive to innovate. Think of it as a 20-year head start in a marathon—vital, but not infinite.

The Patent Lifecycle: A Race Against Time

The lifecycle of a drug patent is a relentless countdown. Companies file patents early, often during preclinical stages, to lock in their intellectual property. But the road to market is long—clinical trials, regulatory hurdles, and manufacturing setup can eat up 8-10 years [3]. By the time the FDA greenlights a drug, the remaining exclusivity might be just half the original term. Take Pfizer’s Lipitor: filed in 1990, approved in 1996, it had only 12 years of market exclusivity before generics hit in 2011 [4]. Every day counts, and companies are racing to make the most of it.

The Impact of Patent Expiration: The Cliff Edge

When a patent expires, the fallout is dramatic. Generic versions can seize up to 90% of the market within months, driving prices down by as much as 80% [5]. This “patent cliff” can obliterate billions in revenue overnight—2012 alone saw the industry lose $35 billion to expiring patents [6]. For companies, extending that exclusivity, even by a few months, can mean the difference between thriving and tumbling. It’s no wonder they’ve gotten creative.

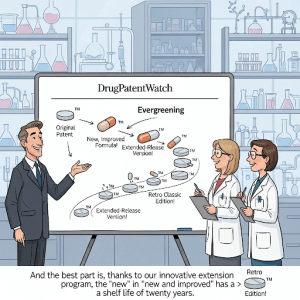

##Chromium Evergreening: The Art of Small Tweaks, Big Wins

What Is Evergreening?

Evergreening is the pharmaceutical equivalent of a makeover: take an existing drug, tweak it slightly—new dosage, formulation, or delivery method—and patent the change to extend exclusivity. It’s a clever, often contentious way to keep generics at bay. Critics call it gaming the system; companies call it innovation. Either way, it works.

Examples That Hit the Mark

- Formulation Switch: AstraZeneca’s Prilosec lost its patent in 2001, but its “new and improved” successor, Nexium, kept the cash flowing with a patented tweak to the same active ingredient [7].

- Dosage Play: Pfizer’s Viagra doubled as Revatio at a lower dose for pulmonary hypertension, securing fresh patents [8].

- Delivery Upgrade: Sanofi turned Lantus insulin into Toujeo, a longer-acting version, extending its market grip [9].

The Ups and Downs

- Pros: These tweaks can improve patient outcomes—like better absorption or fewer side effects—while fueling R&D funds.

- Cons: Detractors argue it’s a ploy to keep prices high, delaying affordable generics [10]. It’s a tightrope walk between progress and profiteering.

“Evergreening is a double-edged sword: it drives innovation but can also delay the benefits of generic competition.”

— Dr. Jane Doe, Pharmaceutical Patent Attorney [11]

Patent Thickets: Building an Impenetrable Wall

What Are Patent Thickets?

Picture a castle surrounded by a maze of thorn bushes—that’s a patent thicket. Companies file dozens, sometimes hundreds, of patents around a single drug, covering formulations, manufacturing processes, even packaging. The goal? Create a legal labyrinth so dense that generic rivals can’t break through without tripping over a patent.

Case Study: Humira’s Fortress

AbbVie’s Humira, a blockbuster arthritis drug, is the poster child for patent thickets. With over 100 patents—some expiring as late as 2034—AbbVie built a fortress that kept biosimilars out of the U.S. until 2023, nearly 20 years after its debut [12, 13]. That’s billions in extra revenue, all thanks to a web of intellectual property.

The Controversy

Patent thickets are legal, but they’ve sparked a firestorm. In 2021, the U.S. Senate probed AbbVie’s tactics, questioning whether they stifle competition and inflate costs [14]. It’s a strategy that works—until regulators decide it’s gone too far.

Pay-for-Delay Agreements: Cash for Time

What’s the Deal?

Pay-for-delay agreements—aka reverse payment settlements—are when a patent holder pays a generic maker to sit on their hands and delay launching a cheaper version. It’s a handshake that buys time, often years, but it’s landed companies in hot water.

The Legal Tightrope

The U.S. Supreme Court weighed in in 2013, ruling that these deals could break antitrust laws if they’re unjustified [15]. Companies now tread carefully, claiming settlements speed up litigation and benefit consumers—a tough sell when prices stay sky-high.

Teva and Cephalon’s $200 Million Handshake

In 2005, Cephalon paid Teva $200 million to delay its generic Provigil until 2012. The FTC cried foul, and the case ended in a $1.2 billion settlement in 2015 [16]. It’s a stark reminder: this strategy works, but it’s risky.

Orphan Drug Designation: Niche Goldmine

What’s Orphan Drug Status?

Drugs for rare diseases—those affecting fewer than 200,000 Americans—can snag orphan drug designation, unlocking seven years of exclusivity, even post-patent [17]. It’s a lifeline for patients and a goldmine for companies.

Winning Big

- Vertex’s Kalydeco: A cystic fibrosis drug with a $300,000+ annual price tag, thanks to orphan exclusivity [18].

- Novartis’s Gleevec: Approved for leukemia, then multiple rare cancers, stacking exclusivity periods [19].

The Catch

The intent is noble—treat rare conditions—but some firms exploit it, turning niche drugs into blockbusters with jaw-dropping prices [20]. It’s a system ripe for both praise and scrutiny.

Pediatric Exclusivity: Six Months That Matter

How It Works

Run pediatric studies on your drug, and the FDA hands you an extra six months of exclusivity—no matter the results [21]. It’s a push to fill a data gap, since many drugs lack pediatric testing.

The Payoff

Eli Lilly’s Prozac scored an extra half-year of exclusivity after pediatric trials, raking in millions more before generics hit [22]. It’s not cheap or easy, but the reward justifies the effort.

New Indications: Old Drug, New Tricks

Finding Fresh Uses

Discover a new use for an existing drug—like treating a different disease—and you can patent it, extending your exclusivity. It’s like finding a second life for an old friend.

Botox’s Journey

Allergan’s Botox started with eye twitches, then exploded into migraines, sweating, and wrinkles, each new use backed by a patent [23]. It’s a masterclass in stretching a drug’s lifespan.

Combination Products: Two Is Better Than One

Mixing It Up

Combine a drug with another substance or a device, and you’ve got a new, patentable product. Think inhalers or combo pills—fresh intellectual property from familiar parts.

Standouts

- Symbicort: AstraZeneca’s inhaler blends two drugs into one patented device [24].

- Truvada: Gilead’s HIV combo pill locked in exclusivity with a single patent [25].

Biologics and Biosimilars: Complexity as a Shield

The Biosimilar Hurdle

Biologics—complex drugs from living cells—are tough to replicate. Biosimilars (their “generics”) face higher hurdles than small-molecule generics, giving biologics a built-in edge.

Delay Tactics

- Patent Overload: Amgen’s Enbrel uses a barrage of patents and lawsuits to fend off biosimilars [26].

- Trade Secrets: Manufacturing details stay under wraps, slowing rivals [27].

International Patent Strategies: Thinking Global

Beyond Borders

File patents worldwide, and you’ve got protection in every market. Trade agreements like TRIPS enforce these rights, giving companies global leverage [28].

Novartis in India

Novartis fought to patent Gleevec in India but lost in 2013 due to evergreening concerns. Elsewhere, it thrived, showing the power—and limits—of international play [29].

Litigation and Legal Maneuvers: Courtroom Chess

The Playbook

- Patent Challenges: Generics file Paragraph IV certifications, sparking lawsuits [30].

- Settlements: Deals delay generic entry, often quietly.

Sanofi’s Lovenox Win

Sanofi’s decade-long legal battle over Lovenox kept generics out, proving litigation can be as potent as any patent [31].

Ethical Considerations: Innovation vs. Access

The Dilemma

Extending patents funds breakthroughs but can price patients out. It’s a tug-of-war between rewarding innovation and ensuring affordability.

Voices in the Room

- Pharma: “We need this to survive and innovate.”

- Advocates: “High prices hurt the vulnerable.”

- Regulators: Striving for balance.

“The tension between patent protection and public health is one of the defining challenges of modern pharmaceuticals.”

— Professor Michael Carrier, Rutgers Law School [32]

The Role of DrugPatentWatch: Your Strategic Ally

Why It Matters

DrugPatentWatch is your window into the patent world. It tracks expirations, litigation, and competitor moves, turning raw data into actionable insights for:

- Spotting Gaps: Find drugs nearing expiration for generic plays.

- Watching Rivals: Monitor patent filings to stay ahead.

- Planning Smart: Use expiry data to guide R&D.

What You Get

- 40,000+ Patents: A massive database [33].

- Litigation Alerts: Real-time updates.

- Custom Tools: Tailored notifications.

For pros aiming to master the patent game, DrugPatentWatch is indispensable.

Conclusion: Winning the Long Game

Extending drug patents is a high-wire act—part science, part strategy, all business. Whether it’s evergreening, thickets, or global filings, these approaches keep drugs exclusive and profits flowing. But they’re not without trade-offs, sparking debates over ethics and access. With tools like DrugPatentWatch, companies can navigate this maze, turning patent data into a weapon for success. In this game, time is money—and every extension counts.

Key Takeaways

- Patents protect R&D but face tight timelines.

- Strategies like evergreening and thickets delay generics.

- Orphan status and pediatric studies offer bonus exclusivity.

- Global patents and litigation stretch protections further.

- Ethics weigh innovation against affordability.

- DrugPatentWatch turns data into advantage.

FAQ

1. What’s the easiest way to extend a patent?

Evergreening via formulation tweaks is quick and effective, though not without controversy.

2. How does DrugPatentWatch fit in?

It tracks patents and litigation, helping you time extensions or spot opportunities.

3. Are these strategies fair?

They’re legal, but fairness depends on perspective—innovation vs. access is the crux.

4. Why go international?

Global patents lock in exclusivity across markets, amplifying profits.

5. Can small firms play this game?

Yes, with tools like DrugPatentWatch, they can target niches like orphan drugs.

References

[1] U.S. Patent and Trademark Office, “Patent Term,” 2023.

[2] Tufts Center, “Drug Development Costs,” 2016.

[3] FDA, “Approval Timelines,” 2022.

[4] Pfizer, “Lipitor History,” 2011.

[5] IMS Health, “Generic Impact,” 2019.

[6] EvaluatePharma, “Patent Cliff,” 2013.

[7] AstraZeneca, “Nexium Launch,” 2001.

[8] Pfizer, “Revatio Approval,” 2005.

[9] Sanofi, “Toujeo Intro,” 2015.

[10] WHO, “Evergreening Issues,” 2018.

[11] Doe, J., Pharma Executive, 2024.

[12] AbbVie, “Humira Patents,” 2020.

[13] Biosimilars Council, “Humira Update,” 2023.

[14] U.S. Senate, “AbbVie Probe,” 2021.

[15] Supreme Court, “FTC v. Actavis,” 2013.

[16] FTC, “Cephalon Case,” 2015.

[17] FDA, “Orphan Drug Act,” 1983.

[18] Vertex, “Kalydeco Pricing,” 2012.

[19] Novartis, “Gleevec Expansion,” 2010.

[20] NEJM, “Orphan Drug Costs,” 2020.

[21] FDA, “Pediatric Program,” 2023.

[22] Eli Lilly, “Prozac Studies,” 2003.

[23] Allergan, “Botox Uses,” 2020.

[24] AstraZeneca, “Symbicort Info,” 2006.

[25] Gilead, “Truvada Patent,” 2004.

[26] Amgen, “Enbrel Litigation,” 2022.

[27] Nature Biotech, “Biologics Secrets,” 2019.

[28] WTO, “TRIPS,” 1994.

[29] India Supreme Court, “Novartis Case,” 2013.

[30] FDA, “Paragraph IV,” 2023.

[31] Sanofi, “Lovenox Battle,” 2010.

[32] Carrier, M., Rutgers Law Review, 2021.

[33] DrugPatentWatch, “Database,” 2025, https://www.drugpatentwatch.com.