In the world of pharmaceutical development and manufacturing, the decision to outsource is no longer a simple make-or-buy calculation. It’s a profound strategic choice. The partner you select, a Contract Development and Manufacturing Organization (CDMO), becomes an extension of your own company, a custodian of your intellectual property, and a critical linchpin in your journey from molecule to market. The performance of this partner doesn’t just impact a single production run; it reverberates through your entire value chain, influencing clinical timelines, regulatory success, market share, and ultimately, patient outcomes.

But how do you truly measure the performance of a partner so deeply integrated into your operations? Traditional supplier scorecards, focused on cost and on-time delivery, are woefully inadequate. They’re like trying to judge a symphony by only measuring its volume. Evaluating a CDMO requires a far more sophisticated, multi-faceted, and dynamic approach. It’s a discipline that blends quantitative rigor with qualitative insight, demanding a framework that is as robust as it is flexible.

This in-depth guide is designed for pharmaceutical and biotech leaders who understand that effective CDMO management is a source of significant competitive advantage. We will move beyond the superficial metrics to build a comprehensive framework for evaluating performance across the entire partnership lifecycle—from initial due diligence to ongoing strategic governance. We’ll explore the critical KPIs, the subtle cultural indicators, the role of digital technology, and the best practices that separate the sponsors who merely manage their CDMOs from those who build truly formidable, value-creating alliances. Get ready to transform your approach from transactional oversight to strategic co-creation.

The Strategic Imperative of CDMO Performance Evaluation

Before diving into the “how,” we must first profoundly understand the “why.” The shift in the pharmaceutical industry’s structure has elevated the CDMO from a peripheral vendor to a central node in the innovation network. Failing to evaluate their performance with the seriousness this role deserves isn’t just a missed opportunity; it’s an invitation for catastrophic risk.

The Evolving Role of CDMOs in the Pharmaceutical Ecosystem

A generation ago, “Big Pharma” was characterized by its vertically integrated model. R&D, clinical trials, manufacturing, and commercialization all happened under one massive corporate roof. Today, the landscape is virtually unrecognizable. The rise of virtual biotechs, the pressure for cost containment, the increasing complexity of new drug modalities (like cell and gene therapies), and the strategic focus on core R&D competencies have fueled an explosive growth in outsourcing.

CDMOs have evolved in lockstep. They are no longer just “hired hands” for simple tablet pressing or fill-finish operations. Modern CDMOs are hubs of specialized technological expertise, offering end-to-end services that span the entire drug lifecycle. They are process development experts, regulatory navigators, supply chain architects, and, in many cases, co-innovators. When you engage a CDMO for a complex biologic or a novel ADC (Antibody-Drug Conjugate), you aren’t just buying capacity; you’re buying decades of accumulated process knowledge and specialized capital investment you may not possess in-house. This evolution fundamentally changes the nature of the relationship and, therefore, the nature of its evaluation.

Why Standard Vendor Metrics Fall Short for CDMOs

If you manage your CDMO relationship using the same dashboard you use for your office supply vendor, you are steering your ship with a broken compass. Consider the limitations of a typical vendor scorecard:

- Price Focus: A standard approach heavily weights the unit price. For a CDMO, the “price” is just the tip of the iceberg. The true cost—the Total Cost of Ownership (TCO)—includes the cost of tech transfer, your own team’s management overhead, and, most critically, the immense financial impact of delays, batch failures, or quality events. A “cheaper” CDMO that has a 5% batch failure rate is infinitely more expensive than a premium-priced partner with a 0.1% failure rate.

- Lagging Indicators: Metrics like “On-Time Delivery” are important, but they are lagging indicators. They tell you what has already happened. A truly effective evaluation framework incorporates leading indicators—metrics that provide an early warning of future problems. These might include the number of open CAPAs (Corrective and Preventive Actions), staff turnover in the quality unit, or deviations in process parameters.

- Transactional Nature: Standard metrics are designed for transactional relationships. They don’t capture the collaborative essence of a successful CDMO partnership. How do you quantify a CDMO’s proactivity in solving a process challenge? How do you measure their transparency when delivering bad news? These “soft” attributes are often the most powerful drivers of “hard” results.

The High Stakes of CDMO Selection and Performance Management

The consequences of getting this wrong are not abstract. They are measured in years of delay, hundreds of millions of dollars in lost revenue, and damaged corporate reputations.

- Speed to Market: In the pharmaceutical industry, time is money on an exponential scale. For a blockbuster drug, every single day of delay in reaching the market can represent millions of dollars in lost sales. A poorly performing CDMO that struggles with tech transfer, experiences repeated batch failures, or cannot scale up effectively can single-handedly derail a launch timeline. The competitive landscape doesn’t wait. A six-month delay could mean the difference between being first-in-class and third-to-market.

- Financial and Operational Impact: A single batch failure is a direct financial hit—lost APIs, lost materials, lost labor. But the ripple effects are far greater. It can trigger exhaustive, time-consuming investigations, require additional stability studies, and consume immense resources from both the sponsor and the CDMO. If it leads to a stockout, the commercial damage is immediate and can lead to a permanent loss of market share as physicians and patients switch to alternative therapies.

- Regulatory Risk and Brand Reputation: Your CDMO’s manufacturing facility is, from a regulatory perspective, your facility. A scathing FDA Form 483 observation or, worse, a Warning Letter issued to your CDMO is a direct reflection on you, the Marketing Authorization Holder (MAH). It can delay product approvals, trigger consent decrees, and require costly remediation efforts. In the most severe cases, product recalls stemming from a CDMO’s quality lapse can do irreparable harm to a brand’s reputation and patient trust—assets that are built over decades and can be destroyed in a day.

The message is clear: CDMO evaluation is not an administrative task for the procurement department. It is a core strategic function that requires executive oversight, cross-functional collaboration, and a deep, continuous commitment to excellence.

Building the Foundation: A Framework for Comprehensive CDMO Evaluation

A world-class CDMO performance management program doesn’t begin when the first batch rolls off the line. It begins long before a contract is ever signed. A robust framework is built on a foundation of meticulous due diligence, thoughtful KPI development, and a clear understanding of what success looks like for your specific project. This foundational work prevents costly mismatches and sets the partnership on a trajectory for success from day one.

Pre-Selection Due Diligence: Setting the Stage for Success

The most common reason for CDMO partnership failure isn’t poor performance during manufacturing; it’s poor selection at the outset. Due diligence is your first, and best, opportunity to vet a potential partner against the realities of your project. This process should be structured, rigorous, and multi-phased.

Phase 1: Defining Your Needs and Creating the “Ideal Partner” Profile

Before you can find the right partner, you must intimately understand what you’re looking for. This goes far beyond a simple spec sheet. It requires deep introspection and cross-functional alignment within your own organization.

- Technical Capabilities and Technology Fit: This is the most obvious starting point, but it requires nuance. Don’t just ask, “Can you manufacture biologics?” Ask, “Can you handle high-viscosity monoclonal antibodies at our target concentration? What is your experience with our specific expression system? Do you have analytical methods already developed for the critical quality attributes (CQAs) we’re concerned about?” The goal is to find a partner whose technical sweet spot aligns perfectly with your product’s specific needs. A CDMO that is a world leader in small molecule synthesis may be a novice in sterile fill-finish for a sensitive protein.

- Scalability and Capacity Planning: Your needs will evolve. The partner who is perfect for your Phase I clinical trial supply might not have the scale, equipment, or regulatory track record for commercial launch. You need to think several steps ahead. Does the CDMO have a credible plan for scaling your process? Is their available capacity real and dedicated, or is it contingent on other clients’ projects finishing on time? Ask for their site master plan and their capital investment roadmap. A forward-thinking partner will be able to speak fluently about how they plan to grow with you.

- Geographic and Logistical Considerations: In a post-pandemic world, supply chain resilience is paramount. The location of your CDMO matters. Consider shipping lanes, import/export regulations, geopolitical stability, and time zone differences. A partner on another continent might offer cost advantages, but how will you manage the logistics of shipping your sensitive, temperature-controlled drug substance? How will you manage oversight and communication across a 12-hour time difference? These practical considerations can have a major impact on cost, risk, and the ease of collaboration.

Phase 2: The Request for Proposal (RFP) as a Strategic Tool

The RFP is your primary data collection tool in the selection process. A poorly constructed RFP yields generic, unhelpful responses. A strategically crafted RFP forces potential partners to reveal their true capabilities and their philosophical approach to partnership.

- Crafting RFPs That Elicit Meaningful Data: Move beyond simple yes/no questions. Instead of “Do you have a quality management system?” ask, “Please provide the KPI dashboard and metrics from your last three Quality Management Reviews. Describe your CAPA process for a critical deviation, including average closure times. Provide a redacted example of a root cause analysis investigation.”

- Beyond the Boilerplate: Asking the Tough Questions: This is where you separate the contenders from the pretenders.

- “Describe a time a tech transfer project went poorly. What were the root causes, and what did your organization learn from the experience?”

- “What is the turnover rate for personnel in your Quality and Technical Operations departments over the past two years?” (High turnover can be a major red flag).

- “How do you manage resource allocation when multiple client projects are competing for the same equipment and personnel?”

- “Provide the full regulatory inspection history for this site for the past five years, including any 483s, and the complete response you provided to the agency.”

Phase 3: The Criticality of Site Audits and Face-to-Face Meetings

No amount of documentation can replace the insights gained from walking the manufacturing floor and looking your potential partners in the eye. The site audit is not a box-checking exercise; it’s an immersive diagnostic process.

- Reading the “Cultural Cues” on the Manufacturing Floor: Look beyond the gleaming stainless steel. Is the facility clean and well-organized? Do operators seem engaged and knowledgeable? Can they articulate the “why” behind their actions, or are they just following a batch record? Is data being recorded in real-time? Are visual management boards up-to-date and actively used? These observations provide a visceral sense of the company’s quality culture.

- Assessing the Quality Management System (QMS) in Action: This is where you “audit by walking around.” Ask to see the logbook for a specific piece of equipment. Pull a recently completed batch record and review it for completeness and clarity. Ask to see the training records for the team that would be assigned to your project. Challenge their thinking. Present a hypothetical deviation scenario and ask them how their system would handle it. You are looking for a QMS that is not just a set of binders on a shelf, but a living, breathing system that guides daily operations. The goal is to find a partner where quality is not just a department, but a collective mindset.

Developing a Robust Key Performance Indicator (KPI) Scorecard

Once a partner is selected, the evaluation process shifts from selection to ongoing performance management. The cornerstone of this process is a well-designed KPI scorecard. This is not a static document; it’s a dynamic dashboard that provides a balanced view of the partnership’s health and drives continuous improvement.

“What gets measured gets managed. But in the context of CDMOs, what gets measured collaboratively gets improved exponentially. The best scorecards are not report cards handed down from the sponsor; they are shared instruments used by both parties to navigate toward a common goal.” — Former Head of External Manufacturing, Top 10 Pharmaceutical Company

The Four Pillars of CDMO Performance Measurement

A comprehensive scorecard must be balanced, covering the key facets of the relationship. Organizing your KPIs into four distinct pillars ensures you don’t develop blind spots by focusing too heavily on one area.

- H4: Quality & Compliance Metrics: This is the non-negotiable foundation. It measures the CDMO’s ability to produce a safe, effective, and compliant product, every single time.

- H4: Operational & Supply Chain Metrics: This pillar focuses on efficiency, reliability, and speed. It measures the CDMO’s ability to deliver the right product, in the right quantity, to the right place, at the right time.

- H4: Financial & Commercial Metrics: This goes beyond simple cost-per-batch to assess the overall financial health and value of the partnership.

- H4: Relationship & Communication Metrics: Often considered “soft” metrics, these are the powerful leading indicators of a partnership’s long-term viability. They measure the quality of governance, transparency, and collaboration.

Customizing KPIs for Different Development Stages

The KPIs that matter most will change as your product matures. A one-size-fits-all scorecard is a recipe for frustration.

- Pre-clinical/Phase I: At this early stage, the focus is on flexibility, speed, and problem-solving. Key metrics might include:

- Time from project kickoff to GMP batch release.

- Number of process development iterations required.

- Effectiveness of initial tech transfer.

- Phase II/III: As you move into later-stage clinical trials, process robustness and regulatory compliance become more critical. The focus shifts to:

- Right-First-Time (RFT) rates.

- Deviation rates and CAPA effectiveness.

- On-Time In-Full (OTIF) delivery for clinical supply.

- Commercial: At the commercial stage, the emphasis is on supply reliability, cost efficiency, and continuous improvement. Key metrics will include:

- Production yield and cycle time consistency.

- Cost of Poor Quality (CoPQ).

- Capacity utilization and adherence to the production forecast.

The Trap of “Vanity Metrics”: Focusing on What Truly Matters

It’s easy to create a scorecard with 50 different metrics. The challenge is to create one with the 10-15 metrics that truly predict success and drive the right behaviors. Avoid “vanity metrics”—numbers that look impressive but don’t correlate with desired outcomes. For example, tracking the “number of meetings held” is pointless. Tracking the “percentage of actions from meetings completed on time” is meaningful. Always ask of any potential KPI: “If this number improves, will it necessarily mean we are in a better position to achieve our strategic goals?” If the answer isn’t a clear “yes,” it probably doesn’t belong on your primary dashboard.

By laying this meticulous foundation, you shift the odds dramatically in your favor. You enter a partnership with eyes wide open, armed with a clear definition of success and a robust tool to measure your progress toward it.

Deep Dive: The Core Metrics of CDMO Performance

With our four-pillar framework established, it’s time to dissect the specific KPIs that form the beating heart of a rigorous CDMO evaluation system. These are not just numbers on a spreadsheet; each one tells a story about a CDMO’s capabilities, culture, and commitment. We will explore the “what,” “why,” and “how” of the most critical metrics within each pillar.

Pillar 1: Unwavering Focus on Quality and Compliance

Quality is the bedrock upon which the entire pharmaceutical industry is built. For a CDMO, it is the ultimate measure of competence and trustworthiness. A failure in this pillar invalidates success in all others.

Right-First-Time (RFT) Rate: The Ultimate Process Indicator

- What it is: RFT, sometimes called “First Time Right” (FTR), measures the percentage of batches that are manufactured and released without any unplanned deviations, rework, or non-conformances. It is the ultimate holistic indicator of process control and operational discipline.

- Why it’s critical: A high RFT rate (ideally >98% for a mature commercial process) signifies a process that is well-understood, well-controlled, and executed by a proficient team. A low or declining RFT rate is a major red flag, signaling underlying issues in process design, equipment reliability, operator training, or raw material consistency. It’s a powerful leading indicator of future batch failures and supply disruptions.

- How to measure it:RFT(%)=Total Number of Batches StartedNumber of Batches Produced and Released Without Deviations×100It’s crucial to have an agreed-upon definition of “deviation.” Does this include minor documentation errors, or only events that trigger a formal investigation? This definition must be clear and consistent in your Quality Agreement. When benchmarking, ensure you’re comparing apples to apples.

Batch Failure and Deviation Rates: A Window into Process Control

- What it is: This metric tracks the number of rejected batches and the number of formal deviations logged per period or per campaign. Deviations should be trended and categorized.

- Why it’s critical: While RFT is a high-level summary, deviation analysis provides the granular detail. It allows you to see where the problems are occurring. Are they concentrated in a specific unit operation (e.g., buffer preparation, chromatography)? Are they related to human error, equipment failure, or material issues? This data is the raw material for continuous improvement.

- How to measure it: Track not just the number, but the severity.

- Classification: Minor (no product impact), Major (potential or actual product impact, requires significant investigation), and Critical (results in or is likely to result in batch rejection).

- Root Cause Analysis: Track the primary root causes (e.g., human error, equipment malfunction, procedural failure, material defect). A mature CDMO will have a robust system for this, often using methodologies like the “5 Whys” or fishbone (Ishikawa) diagrams.

- OOS/OOT Investigations: Pay special attention to the rate of Out-of-Specification (OOS) and Out-of-Trend (OOT) results from the QC lab. A high rate suggests issues with analytical method robustness or lab practices.

Regulatory Inspection Performance: FDA, EMA, and Beyond

- What it is: This is a direct measure of a CDMO’s compliance posture, as judged by the world’s most stringent regulatory bodies. It includes the history, frequency, and outcomes of inspections by agencies like the U.S. FDA, European Medicines Agency (EMA), and others.

- Why it’s critical: As the MAH, you are ultimately responsible for the compliance of your supply chain. A Warning Letter issued to your CDMO can halt production of your product and is a significant black mark on your own company’s record. A clean inspection history is a powerful third-party validation of a CDMO’s quality systems.

- How to measure it:

- Review History: During due diligence and ongoing reviews, request the complete inspection history for the specific site.

- Analyze FDA 483s and Warning Letters: Don’t just count the number of observations on a Form 483. Analyze their nature. Are they simple documentation issues or systemic failures in the quality system (e.g., data integrity, inadequate validation)? How the CDMO responded is just as important. Was their response prompt, thorough, and accepted by the agency? Publicly available databases can be a source of this information.

- Proactive vs. Reactive: Does the CDMO conduct rigorous internal audits and mock inspections to stay “inspection ready” at all times? Or do they scramble to prepare only when an inspection is announced? This cultural difference is a key indicator of compliance maturity.

Quality Management System (QMS) Maturity

- What it is: This assesses the health and effectiveness of the core processes that govern quality, such as change control and CAPA.

- Why it’s critical: A robust QMS ensures that problems are not just fixed, but that their root causes are eliminated to prevent recurrence. It also ensures that changes are managed in a controlled way that doesn’t introduce new risks.

- How to measure it:

- CAPA Effectiveness: Don’t just track the number of open CAPAs or their age. The key metric is the recurrence rate. If the same deviation occurs six months after a CAPA was “closed,” the CAPA was ineffective. A low recurrence rate (<5%) indicates a strong root cause analysis and implementation process.

- Change Control Management: Track the average cycle time for change controls. A system that is too slow can stifle improvement and agility. A system that is too fast or loose can be dangerous. Look for a balance. How many changes had to be rolled back or caused unintended consequences? This metric measures the quality of their impact assessments.

Pillar 2: Mastering Operational Excellence and Supply Chain Agility

Once quality is assured, the focus shifts to the CDMO’s ability to deliver reliably and efficiently. In a competitive market, speed and consistency are not luxuries; they are essential for survival.

On-Time In-Full (OTIF) Delivery: The Cornerstone of Supply Reliability

- What it is: OTIF is a composite metric that measures whether the correct quantity of product (In-Full) was delivered to the correct location on the agreed-upon date (On-Time).

- Why it’s critical: OTIF is the ultimate measure of supply chain performance from the customer’s perspective. A failure on either dimension has significant consequences. A late delivery can shut down a packaging line or delay a clinical trial. A short delivery (“not in-full”) can lead to stockouts.

- How to measure it: It’s crucial to break this metric down.OTIF(%)=Total Number of OrdersNumber of Orders Delivered On-Time AND In-Full×100

- Deconstructing OTIF: Many companies track “On-Time” and “In-Full” separately to diagnose problems. Is the issue with production scheduling (leading to late shipments) or with process yield (leading to short quantities)? The target for a mature commercial product should be very high, often >98%. Be sure your contract clearly defines the delivery date (e.g., ex-works date vs. arrival at destination) and the acceptable quantity tolerance (e.g., +/- 5%).

Production Cycle Time and Lead Time: Measuring Speed and Responsiveness

- What it is:

- Cycle Time: The time it takes to execute the manufacturing process itself, from the moment raw materials are staged to the moment the final bulk product is approved by QC.

- Lead Time: The total time from when you place a purchase order to when you receive the product. This includes the cycle time plus any queuing time, raw material ordering time, and shipping time.

- Why it’s critical: Shorter cycle times and lead times increase your company’s agility. They allow you to hold less safety stock (freeing up working capital), respond more quickly to upside demand forecasts, and recover faster from any supply disruptions. Trending this metric can also reveal emerging problems, like equipment degradation or process drift, that cause the cycle time to creep up.

- How to measure it:

- Value Stream Mapping: The best way to understand and improve cycle time is to map the entire process, identifying value-added steps and non-value-added waiting times.

- Component Tracking: Measure the cycle time of key stages (e.g., fermentation, purification, conjugation, fill-finish) separately to pinpoint bottlenecks. A CDMO committed to Lean or Six Sigma principles will already be tracking this data meticulously.

Capacity Utilization and Flexibility

- What it is: This measures how much of the CDMO’s available, relevant capacity is being used. It also assesses their ability to handle fluctuations in demand.

- Why it’s critical: You need to understand if your project is a small fish in a big pond or a big fish in a small one. A CDMO running at 95% capacity has very little flexibility to accommodate an urgent upside order or recover from a batch failure. Conversely, a CDMO running at 50% capacity may have financial stability issues.

- How to measure it:

- Understanding True Capacity: Don’t accept a simple percentage. Ask for the calculation behind it. Is it based on theoretical maximums or demonstrated, practical output (often called OEE – Overall Equipment Effectiveness)?

- Scenario Planning: During business reviews, discuss hypothetical scenarios. “If our demand suddenly increased by 20% for Q4, what would be the plan? What would be the constraints?” A prepared partner will have a clear, credible answer.

Supply Chain Security and Raw Material Sourcing

- What it is: An assessment of the robustness of the CDMO’s own supply chain for the critical raw materials, consumables, and components needed to make your product.

- Why it’s critical: A CDMO’s performance is entirely dependent on the performance of its suppliers. The COVID-19 pandemic brutally exposed the fragility of global supply chains for items like filters, single-use bags, and reagents. Your CDMO’s supply chain risk is your risk.

- How to measure it:

- Supplier Vetting: Does the CDMO have a formal supplier qualification program? Do they audit their critical suppliers?

- Redundancy: Are there qualified second sources for all critical raw materials? Relying on a single, sole-source supplier for a key excipient is a massive vulnerability.

- Risk Assessment: Do they perform geopolitical and logistical risk assessments on their supply chain? Do they have contingency plans for port closures, trade disputes, or natural disasters?

Pillar 3: Analyzing Financial Health and Commercial Viability

A CDMO is a business. Its financial stability, pricing models, and investment strategy are crucial components of its long-term performance as a partner.

Total Cost of Ownership (TCO): Beyond the Price Per Batch

- What it is: TCO is a comprehensive financial model that captures all the costs associated with the partnership, not just the invoice price.

- Why it’s critical: Focusing only on the price per batch is a classic mistake that leads to “penny wise, pound foolish” decisions. A low-cost provider that requires huge amounts of your team’s time for oversight and firefighting is not a bargain.

- How to measure it: TCO is a calculation, not a single metric. It should include:

- Direct Costs: Price per batch, raw material costs (if pass-through), shipping, stability studies.

- Support Costs: Your internal team’s time for project management, quality assurance, and technical support (person-days x salary cost).

- Cost of Poor Quality (CoPQ): The quantified cost of deviations, investigations, lost materials from failed batches, and rework. This is often the largest and most overlooked component.

- Lifecycle Costs: Costs for tech transfer, validation, and process changes.By tracking TCO, you can make a true “apples-to-apples” comparison of the total value delivered by different partners.

Financial Stability and Investment Strategy

- What it is: An assessment of the CDMO’s financial health and its commitment to reinvesting in its business.

- Why it’s critical: You are entering a multi-year, sometimes multi-decade, relationship. You need a partner who will be financially viable for the long haul and who will keep their facilities and technology current. A CDMO that is starved for cash will cut corners on maintenance, training, and capital projects—all of which eventually manifest as quality and operational problems.

- How to measure it:

- Financial Review: For privately held CDMOs, this can be difficult, but you can use services like Dun & Bradstreet to get credit ratings and financial stability reports. For publicly traded ones, review their annual reports and investor calls. Look at revenue growth, profitability margins, and debt levels.

- Reinvestment Rate: What percentage of revenue is reinvested in capital expenditures (CapEx)? Are they actively adding new technologies, expanding capacity, and upgrading their facilities? A static facility is a facility that is falling behind.

Pricing Models and Contractual Flexibility

- What it is: The structure of the commercial agreement and how it aligns the incentives of both parties.

- Why it’s critical: The pricing model drives behavior. A simple fee-for-service model incentivizes the CDMO to do the work, but not necessarily to do it efficiently.

- How to measure it:

- Model Analysis: Compare different models. A Full-Time Equivalent (FTE) model might be best for early-stage development with an uncertain scope. A fixed-price-per-batch is common for commercial supply.

- Incentive Alignment: Explore more sophisticated models. Can you build in a bonus for achieving a certain RFT rate or for reducing the production cycle time? Can you implement a “gain-sharing” model where cost savings from process improvements are shared between the sponsor and the CDMO? Can you include penalties for significant delivery delays or batch failures? These structures transform the relationship from a simple transaction to a true partnership with shared risks and rewards.

Pillar 4: The ‘Soft’ Skills that Drive ‘Hard’ Results: Relationship and Communication

This final pillar is arguably the most important and the most difficult to quantify. The quality of the human-to-human interaction, the governance structure, and the cultural fit often determine whether a partnership thrives or withers.

Governance Structure: The Operating System of the Partnership

- What it is: The formal framework of teams, meetings, and rules that governs how the two organizations work together.

- Why it’s critical: A clear governance structure prevents misunderstandings, ensures issues are addressed at the right level, and provides a forum for strategic alignment. Without it, communication becomes chaotic and decision-making grinds to a halt.

- How to measure it:

- Joint Steering Committee (JSC): Is there a high-level JSC with executive sponsors from both sides that meets quarterly to review performance and discuss strategy? The existence and effectiveness of this body is a key indicator.

- Escalation Pathways: Is there a clearly defined and documented process for escalating issues that cannot be resolved at the project team level? When a problem arises, everyone should know exactly who to call and what to expect.

Communication Cadence and Transparency

- What it is: The frequency, quality, and honesty of the communication between the sponsor and the CDMO.

- Why it’s critical: Trust is the currency of partnership. Trust is built on a foundation of transparent, timely, and proactive communication. A CDMO that hides bad news or is difficult to get ahold of is a liability, regardless of their technical skill.

- How to measure it:

- Formal Cadence: Is there a rhythm of communication (e.g., weekly project team meetings, monthly operational reviews, quarterly business reviews)?

- Informal “Health Check”: This is more qualitative. Use surveys of your own team. On a scale of 1-5, how would you rate the CDMO’s proactivity? Responsiveness? Transparency?

- The “Bad News” Test: The true test of a partner is how they deliver bad news. Do they inform you immediately with a partial understanding of the problem and a plan for investigation? Or do they wait a week until they have all the answers, leaving you in the dark? The former builds trust; the latter destroys it.

Project Management Acumen

- What it is: The CDMO’s skill in managing complex projects, including timelines, resources, risks, and budgets.

- Why it’s critical: Manufacturing your product is a complex project. Tech transfer is a complex project. A scale-up campaign is a complex project. Strong project management discipline is essential to keep these initiatives on track.

- How to measure it:

- Dedicated Resources: Does the CDMO assign a dedicated and experienced Project Manager (PM) to your project? Is this person empowered to get things done?

- Certifications and Tools: Does the PM team hold certifications like the Project Management Professional (PMP)? Do they use modern project management software (e.g., Smartsheet, MS Project) to share timelines and track progress? Ask to see examples of their project plans and risk registers.

Cultural Fit and Shared Vision

- What it is: The alignment of values, priorities, and problem-solving approaches between your two organizations.

- Why it’s critical: A cultural mismatch can create constant friction. If your organization is fast-moving and risk-tolerant, partnering with a slow, bureaucratic, and highly risk-averse CDMO will be a source of endless frustration.

- How to measure it: This is assessed primarily during the due diligence phase through deep conversations and observation.

- Problem-Solving: Present a hypothetical technical problem. Does their team get defensive, or do they immediately start whiteboarding solutions with you?

- Accountability: Inquire about past failures. Do they take ownership, or do they blame other factors?

- Shared Vision: Do they understand your product, your patients, and your company’s mission? Or do they just see you as another purchase order number? A true partner is invested in your success because they see it as their own.

By diligently measuring and managing across these four pillars, you create a holistic, 360-degree view of CDMO performance. This data-rich approach allows you to move beyond gut feelings and subjective assessments to have fact-based conversations that drive accountability, mitigate risk, and unlock continuous improvement.

Leveraging Data and Technology for Superior CDMO Management

In the 21st century, managing a complex manufacturing partnership without leveraging modern data and digital tools is like navigating the ocean with a sextant instead of GPS. It might work, but it’s inefficient, risky, and leaves you vulnerable to competitors who have embraced technology. The ability to collect, analyze, and act upon data in near real-time is a game-changer for CDMO oversight, transforming it from a reactive, retrospective exercise into a proactive, predictive discipline.

The Role of Digital Transformation in CDMO Oversight

Digitalization is breaking down the traditional walls between sponsor and CDMO, creating a more integrated and transparent manufacturing ecosystem. Companies that lead in this area gain a significant advantage in speed, quality, and efficiency.

Real-Time Data Monitoring and Process Analytical Technology (PAT)

For decades, pharmaceutical manufacturing has relied on a “test and release” model. A batch is produced, samples are taken to a QC lab, and days or weeks later, you find out if it met specifications. This is inherently reactive.

The future—and increasingly, the present—lies in real-time monitoring. This involves two key components:

- Process Analytical Technology (PAT): PAT involves embedding analytical sensors directly into the manufacturing process (e.g., in-line probes in a bioreactor that continuously measure pH, dissolved oxygen, and glucose levels). This provides a continuous stream of data about the process’s health, rather than relying on discrete offline samples.

- Manufacturing Execution Systems (MES): These digital systems collect data from PAT sensors, equipment, and operators, creating a comprehensive “electronic batch record.”

When your CDMO has these capabilities and is willing to share the data, your oversight power increases exponentially. You are no longer waiting for a Certificate of Analysis to arrive weeks after a batch is complete. You can log into a shared portal and see the critical process parameters (CPPs) for your batch as it’s being made. This allows for “management by exception.” If a parameter starts to trend towards an alert limit, both your team and the CDMO’s team can be notified instantly, allowing for corrective action before the process deviates and the batch is compromised.

The Power of Shared Digital Platforms and “Single Source of Truth”

One of the biggest sources of inefficiency and error in sponsor-CDMO relationships is information asymmetry and version control chaos. How many times has a project been delayed because someone was working off an old version of a protocol, or because critical data was buried in a 200-email chain?

Leading partnerships are now built on shared digital platforms that create a “single source of truth.” These cloud-based systems can manage:

- Document Control: Everyone has access to the latest, approved version of batch records, SOPs, Quality Agreements, and specifications.

- Project Management: Shared Gantt charts, risk registers, and action trackers ensure everyone is aligned on timelines and responsibilities.

- Quality Events: Deviations, change controls, and CAPAs are managed within the system, providing full transparency on their status, investigation progress, and closure timelines.

By centralizing this information, you eliminate ambiguity, reduce administrative overhead, and create an auditable, real-time record of the entire partnership history.

AI and Predictive Analytics in Supply Chain and Quality Risk Management

The next frontier is the application of Artificial Intelligence (AI) and machine learning to the vast datasets generated by manufacturing and supply chain operations. The potential is immense.

- Predictive Maintenance: Instead of waiting for a pump in a purification skid to fail, AI models can analyze vibration and temperature data to predict a failure weeks in advance, allowing for scheduled maintenance with zero disruption to production.

- Process Drift Detection: Machine learning algorithms can analyze hundreds of process parameters simultaneously, detecting subtle, multi-variate patterns that a human might miss. This can provide an early warning that a process is slowly “drifting” towards failure, even if every individual parameter is still within its specified range.

- Supply Chain Simulation: AI can be used to model and simulate your end-to-end supply chain. You can run “what-if” scenarios: “What is the impact on our global inventory if our CDMO’s port is closed for three weeks due to a strike?” This allows you to identify vulnerabilities and build more resilient supply networks proactively.

While still an emerging field, inquiring about a CDMO’s capabilities and roadmap in this area is a key part of evaluating their forward-thinking nature.

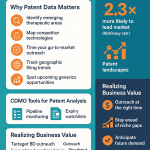

Integrating Competitive Intelligence into Your CDMO Strategy

Evaluating your current CDMO’s performance is only one side of the coin. The other is understanding their performance and capabilities relative to the broader market. Are you partnered with a leader or a laggard? Are there new players with disruptive technologies you should be aware of? This is where strategic competitive intelligence comes in.

Using Patent Data to Understand CDMO Capabilities and Specializations

Patent filings are a rich, often underutilized, source of technical intelligence. While a CDMO’s marketing materials might make broad claims about their expertise, patents provide concrete evidence of their R&D focus and specialized know-how. By analyzing patent landscapes, you can uncover:

- Niche Technologies: Is a particular CDMO patenting novel expression vectors, purification techniques, or drug delivery platforms? This can indicate a true, defensible technological edge.

- Process Innovation: Are they filing patents related to continuous manufacturing, process intensification, or novel analytical methods? This points to a culture of innovation and a commitment to improving efficiency and quality.

- Hidden Expertise: A CDMO might be publicly known for small molecules but could be quietly building a world-class cell therapy manufacturing platform, evidenced by a cluster of recent patent filings in that area.

How DrugPatentWatch Can Uncover CDMO-Client Relationships and Technology Trends

Services like DrugPatentWatch are invaluable tools for this kind of intelligence gathering. While direct contracts between sponsors and CDMOs are often confidential, the ecosystem of patents, clinical trials, and regulatory filings creates a trail of breadcrumbs that can be expertly pieced together.

For example, by using DrugPatentWatch, you can:

- Identify Probable Manufacturing Partners: By cross-referencing patent assignees, drug pipelines, and manufacturing-related filings, it’s often possible to deduce which CDMO is likely working with which drug sponsor on a particular product, especially for novel technologies. This helps you benchmark your own CDMO against the partners chosen by your direct competitors.

- Track Technology Adoption: You can monitor which specific manufacturing technologies (e.g., a particular type of single-use bioreactor, a new chromatography resin) are being cited in patents and filings associated with newly approved drugs. This gives you a real-world view of which technologies are gaining traction and regulatory acceptance, helping you guide your CDMO’s technology choices for your own product.

- Assess a CDMO’s Experience: Before engaging a new CDMO, you can use the platform to research their historical involvement with products similar to yours. Have they been associated with successful, approved drugs in your therapeutic area? This provides a level of third-party validation that goes beyond their marketing pitch.

By integrating this external, data-driven perspective, you can make much more informed decisions about both CDMO selection and the ongoing evaluation of your current partners.

Benchmarking CDMO Performance Against Industry Peers

You track your CDMO’s Right-First-Time rate, and it’s 95%. Is that good or bad? Without context, the number is meaningless. Effective performance management requires benchmarking.

- Formal Benchmarking Consortia: Some industry groups and consulting firms organize formal benchmarking programs where anonymized data on KPIs like RFT, OTIF, and deviation rates are pooled. This allows you to see how your CDMO stacks up against the industry average, the top quartile, and the best-in-class performers for similar types of manufacturing.

- Informal Network Benchmarking: Leverage your professional network. At industry conferences and in trade association meetings, talk to your peers at other companies. While you can’t discuss confidential details, you can have general conversations about challenges, best practices, and the reputations of various players in the CDMO space.

- Self-Benchmarking: Always benchmark a CDMO’s current performance against its own historical performance. Is the RFT rate trending up or down? Is the cycle time improving or getting worse? The trajectory of the metrics is often more important than the absolute number.

By embracing a data-centric, technology-enabled approach, you elevate your CDMO management from a subjective art to a rigorous science. You can identify problems earlier, make decisions faster, and build a truly resilient and high-performing external supply network that becomes a lasting source of competitive advantage.

Best Practices in Action: Case Studies and Expert Insights

Theory and metrics are essential, but the real world is messy, complex, and nuanced. To bring these concepts to life, let’s explore two realistic case studies that illustrate the challenges and triumphs of CDMO management. We’ll also incorporate insights from seasoned industry leaders on what they truly look for in a strategic partner.

Case Study 1: The Successful Turnaround of a Troubled CDMO Partnership

The Situation:

“VirtuBio,” a mid-sized biotech, had a promising monoclonal antibody in Phase III trials. They had partnered with “ChemSynth,” a well-established CDMO, for their clinical and planned commercial supply. However, the partnership was on the rocks. The Right-First-Time (RFT) rate was a dismal 75%, plagued by recurring deviations in the downstream purification process. Timelines were slipping, and the relationship between the technical teams was becoming adversarial, characterized by finger-pointing and defensive emails. The VirtuBio leadership team was considering the drastic and costly step of finding and qualifying a new CDMO just two years before their planned BLA submission.

The Intervention:

Before pulling the plug, VirtuBio’s new Head of Operations, Dr. Alisha Reza, insisted on a final, structured attempt to salvage the relationship. Her approach was rooted in the principles of comprehensive evaluation and collaborative governance.

- Joint “Gemba” Walk and Data Deep Dive: Dr. Reza flew to the ChemSynth site, but not for a confrontational audit. She requested a “Gemba walk” (a core Lean manufacturing principle of going to the actual workplace) with the combined VirtuBio and ChemSynth technical teams. They stood on the production floor and walked through the entire purification process, batch record in hand. They didn’t just review data in a conference room; they looked at the equipment, talked to the operators, and observed the workflow firsthand.

- Root Cause Re-analysis: The teams jointly re-analyzed the data from the last five deviations. The previous “root cause” was often listed as “operator error.” Dr. Reza challenged this, pushing the team to ask the “5 Whys.” Why did the operator make the error? The procedure was confusing. Why was it confusing? It was poorly written. Why was it poorly written? The person who wrote it didn’t fully understand the process intricacies. This deeper analysis revealed the true root causes were a combination of inadequate training, poorly designed procedures, and a subtle but critical difference in a buffer component’s grade that wasn’t specified in the original tech transfer package.

- Resetting Governance and KPIs: A new, streamlined governance structure was implemented. The weekly project team meeting was refocused from status updates to proactive risk management. A shared KPI dashboard was projected at the start of every meeting, focusing on just five critical metrics: RFT, Deviation Rate (by root cause), CAPA Closure Effectiveness, Cycle Time, and Production Schedule Adherence. The goal was no longer to “blame” ChemSynth for red metrics but for the joint team to own the action plan for turning them green.

- Investing in the Partnership: Based on the findings, VirtuBio invested in sending two of their own process development scientists to the ChemSynth site for a month to help rewrite SOPs and co-train the operators. ChemSynth, in turn, invested in upgrading a controller on a chromatography skid that was identified as a source of variability.

The Result:

The turnaround was remarkable. Within six months, the RFT rate for the purification process climbed to 96%. The cycle time was reduced by 15% by eliminating process dead-legs and streamlining documentation. Most importantly, the relationship transformed from adversarial to collaborative. With the manufacturing process stabilized, VirtuBio successfully filed their BLA on time and achieved a first-cycle approval. The partnership became a model of operational excellence for both companies.

The Takeaway: Often, the solution to a “performance problem” isn’t to fire the partner, but to redefine the partnership. Deep, collaborative diagnosis, robust governance, and a focus on systemic root causes can turn even a failing relationship into a strategic asset.

Case Study 2: De-Risking a High-Stakes Commercial Launch with a New CDMO

The Situation:

“GeneVect Therapeutics,” a small startup, had a breakthrough gene therapy for a rare pediatric disease. They had no internal manufacturing capabilities and needed to select a CDMO partner for their pivotal trial and commercial launch. The stakes were incredibly high: the process was novel, the patient population was vulnerable, and there would be no room for error at launch.

The Proactive Approach:

The CEO of GeneVect, a veteran of the biotech industry, knew that their CDMO selection and management process had to be bulletproof.

- Multi-Dimensional Due Diligence: They didn’t just send out an RFP. They created a cross-functional team (Process Development, Quality, Regulatory, Supply Chain) that developed a 100-point scoring matrix. They evaluated three potential CDMOs not just on cost and stated capacity, but on their specific experience with AAV vectors, their regulatory inspection history (analyzing every single Form 483 observation), their staff turnover rates in key departments, and their demonstrated project management methodology.

- The “Live Fire” Exercise: The final stage of selection for the top two candidates was a unique “live fire” exercise. GeneVect paid both CDMOs to perform a small-scale engineering run of a non-critical part of their process. This allowed GeneVect to observe how each CDMO’s team communicated, solved problems in real-time, documented their work, and handled unexpected deviations. The winning partner, “BioCell One,” excelled not because their run was perfect, but because when a filter fouled unexpectedly, their team was transparent, collaborative, and systematic in their investigation.

- Contracting for Partnership: The manufacturing services agreement (MSA) was meticulously crafted. It included not just pricing, but clauses defining the governance structure (JSC, project teams), data transparency requirements (mandating access to the MES), and a shared risk/reward model. BioCell One would receive a bonus payment for every month they beat the target BLA submission date and a success fee upon approval. Conversely, penalties were in place for controllable major deviations or significant launch delays.

- Embedding Personnel: From day one of the tech transfer, GeneVect didn’t just “throw the process over the wall.” They embedded one of their own senior process scientists at the BioCell One facility. This “person-in-plant” acted as a real-time bridge between the two organizations, facilitating communication, speeding up decision-making, and ensuring the subtle nuances of the process were transferred effectively.

The Result:

The tech transfer was completed ahead of schedule. The pivotal manufacturing campaign had a 100% success rate. The close collaboration allowed them to quickly generate data requested by the FDA during the review process. GeneVect’s therapy was approved and launched successfully, and the seamless supply from BioCell One ensured that every patient who needed the life-saving treatment received it.

The Takeaway: For high-stakes projects, front-loading the effort in due diligence, contract structuring, and tech transfer pays enormous dividends. Creating alignment and testing the partnership under real-world conditions before you’re in a GMP environment is the ultimate de-risking strategy.

Expert Perspectives: What Industry Leaders Look For

To add further color, here are some synthesized perspectives echoing common themes from interviews and discussions with pharmaceutical executives:

- On Transparency: “I don’t need my CDMO partner to be perfect, but I demand that they be honest. The first call I get when there’s a deviation on the line should be from my CDMO’s Head of Quality, not from my own person-in-plant. Bad news must travel fast and unfiltered. The moment I sense that information is being managed or delayed, trust is irrevocably broken.”

- On Proactivity: “The difference between a vendor and a partner is proactivity. A vendor waits for me to tell them what to do. A partner comes to me and says, ‘We’ve been analyzing your process trends and we think there’s an opportunity to improve the yield in Step 3 by 10%. Here’s our proposal and the data to back it up.’ They should be thinking about my business as if it were their own.”

- On Technical Depth: “When we audit a potential partner, I have my sharpest scientists lead the technical deep dive. We don’t want to hear the marketing pitch. We want to whiteboard reaction mechanisms with their senior chemists. We want to debate chromatography column loading with their downstream engineers. We are looking for genuine peer-to-peer technical respect. If their team isn’t as smart or smarter than our team in their specific area of manufacturing, it’s a non-starter.”

- On the Quality Mindset: “I look for what I call ‘chronic unease’ in a CDMO’s quality unit. I don’t want them to be complacent. The best quality leaders are always a little paranoid. They are constantly looking for what could go wrong, challenging assumptions, and driving a culture where anyone on the floor feels empowered to stop the line if they see something that isn’t right. It’s a palpable culture, and you can feel it within the first hour of a site visit.”

These case studies and perspectives underscore a universal truth: successful CDMO relationships are not built on contracts and purchase orders alone. They are built on a foundation of mutual respect, shared goals, rigorous data analysis, and a relentless, collaborative pursuit of excellence.

Conclusion: From Transactional Oversight to Strategic Partnership Co-Creation

We’ve journeyed through the complex, multi-faceted landscape of CDMO performance evaluation. We’ve moved from the strategic imperative of getting it right to the granular details of KPI scorecards, from the foundational importance of due diligence to the forward-looking potential of digital technology and competitive intelligence.

The central thesis that emerges is a powerful call to action for a fundamental shift in mindset. The old paradigm of a simple, transactional client-vendor relationship is obsolete and dangerously inadequate for the realities of modern drug development. Managing a CDMO by merely reviewing a quarterly report on cost and delivery is like trying to drive a Formula 1 car by only looking in the rearview mirror. You’ll see the problems you’ve already hit, but you’ll have no visibility into the hairpin turns and competitive threats that lie just ahead.

The new paradigm is one of strategic partnership co-creation. This approach recognizes the CDMO as an integral extension of your own organization, a co-steward of your product and your company’s future. It replaces siloed oversight with integrated governance. It replaces lagging indicators with predictive analytics. It replaces confrontational audits with collaborative problem-solving. It replaces a focus on unit price with a sophisticated understanding of Total Cost of Ownership and shared value creation.

Implementing this framework is not easy. It requires a significant investment of time and resources. It demands a culture of cross-functional collaboration within your own company—breaking down the walls between procurement, quality, technical operations, and regulatory affairs. It requires executive-level commitment to view external manufacturing not as a cost center to be squeezed, but as a strategic capability to be nurtured.

The rewards for making this commitment, however, are immense. A well-managed, high-performing CDMO partnership becomes a powerful engine for competitive advantage. It accelerates your speed to market, enhances the quality and reliability of your supply, mitigates regulatory and operational risk, and ultimately frees your own organization to focus on its core mission: discovering and developing the next generation of life-changing medicines.

The journey to mastering CDMO performance evaluation is a continuous one. The technologies, the metrics, and the best practices will continue to evolve. But the core principles—strategic alignment, radical transparency, data-driven decision-making, and a foundation of mutual trust—will remain the timeless cornerstones of any successful partnership. By embracing them, you don’t just hire a manufacturer; you build an alliance capable of navigating the immense challenges of the pharmaceutical industry and achieving extraordinary results together.

Key Takeaways

- Shift from Vendor to Partner: Treat your CDMO as a strategic partner, not a transactional vendor. Standard procurement metrics are insufficient; a holistic evaluation framework is essential.

- Foundation is Everything: The most critical phase is pre-selection due diligence. A rigorous, multi-faceted process focusing on technical, cultural, and operational fit prevents costly mismatches later.

- Use a Balanced Scorecard: Evaluate performance across four key pillars: Quality & Compliance, Operations & Supply Chain, Financial & Commercial, and Relationship & Communication. This prevents blind spots.

- Focus on Meaningful Metrics: Prioritize leading indicators (e.g., Right-First-Time, CAPA effectiveness) over lagging ones. Avoid “vanity metrics” and focus on KPIs that directly correlate with strategic success. Total Cost of Ownership (TCO) is a more accurate measure than simple price-per-batch.

- Governance is the Operating System: A formal governance structure with joint steering committees and clear escalation paths is crucial for alignment, transparency, and effective problem-solving.

- Leverage Data and Technology: Embrace digital tools for real-time monitoring (PAT, MES), shared platforms for a “single source of truth,” and competitive intelligence from sources like DrugPatentWatch to benchmark and inform your strategy.

- Culture and Communication Matter Most: The “soft” aspects of a partnership—transparency, proactivity, cultural fit, and how bad news is handled—are often the strongest predictors of long-term success.

- It’s a Continuous Journey: CDMO evaluation is not a one-time event but an ongoing process of measurement, collaboration, and continuous improvement that drives value across the entire product lifecycle.

Frequently Asked Questions (FAQ)

1. Our company is a small virtual biotech with limited resources. How can we implement such a comprehensive evaluation framework without a large team?

This is a common and critical challenge. The key is to be highly strategic and focused.

- Prioritize Ruthlessly: You can’t do everything. For a pre-clinical asset, focus intensely on the CDMO’s scientific problem-solving ability, flexibility, and experience with similar molecules. For a late-stage asset, prioritize their regulatory history and commercial-scale experience.

- Leverage Expertise: Use highly experienced consultants for critical activities like the on-site quality audit and the negotiation of the Quality Agreement. The cost of a few days of expert help is trivial compared to the cost of selecting the wrong partner.

- Focus on Governance: A small team can be highly effective with a robust governance structure. A well-run weekly project team meeting and a direct line to the CDMO’s leadership can provide tremendous leverage and visibility.

- Ask for the Data: You don’t need to build the systems yourself. Insist that the CDMO provide you with direct access to their quality and production dashboards. The best CDMOs who want to work with innovative companies will see this transparency as a strength.

2. We’re in a long-term relationship with a CDMO and performance has started to decline. What are the first steps to take besides just threatening to leave?

Leaving a CDMO is a last resort due to its immense cost and time implications. The first step is a structured “reset.”

- Objective Data Review: Schedule a face-to-face Quarterly Business Review (QBR) and present the performance data unemotionally. Trend lines are powerful—show them the decline in RFT, the increase in deviations, etc.

- Joint Diagnosis: Frame the problem as a shared challenge. Use the phrase, “How can we solve this?” Initiate a joint root cause analysis session to dig deeper than superficial causes.

- Re-commit to Governance: Re-establish the weekly and monthly meeting cadence if it has lapsed. Ensure the right people are attending and are empowered to make decisions.

- Agree on a Performance Improvement Plan (PIP): Create a formal, written PIP with specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, “Increase RFT from 85% to 95% within 6 months.” Track progress against this PIP weekly. This shows you are serious and gives the CDMO a clear path to redemption.

3. How do you effectively measure the “cultural fit” of a CDMO? It seems very subjective.

While subjective, cultural fit can be diagnosed with objective behaviors and pointed questions during due diligence.

- Scenario-Based Questions: Instead of asking “Are you proactive?”, present a scenario: “Imagine a key raw material fails incoming QC on a Friday afternoon, and the backup supplier is three weeks out. Your team for our project is scheduled to start manufacturing on Monday. Walk me through your exact communication and contingency planning process, step-by-step.” The answer will reveal their transparency, problem-solving style, and sense of urgency.

- Observe Team Dynamics: During the site visit, pay close attention to how their team members interact with each other. Do they speak openly? Do junior members defer to senior members, or are they encouraged to contribute? Does the Head of Quality have a strong, respected voice in meetings with Operations?

- Reference Checks: Go beyond the provided reference list. Use your network to find other companies who have worked with them. Ask specific questions like, “Tell me about a time you had a major disagreement with them. How was it resolved?”

4. Our CDMO is being acquired by a larger network or a private equity firm. What should we immediately be concerned about and evaluate?

This is a critical inflection point. You need to immediately assess the potential impact on your project.

- Leadership and Team Retention: Will the site leadership and, most importantly, the project team dedicated to your product remain? A mass exodus of talent post-acquisition is a huge red flag. Seek immediate commitments on key personnel retention.

- System Integration: How will their quality systems be integrated? Moving to a new, corporate-level QMS (like a different LIMS or deviation management system) can cause significant disruption and require re-training. Understand the timeline and validation plan.

- Capital Investment and Strategy: Does the new owner share the same vision? A PE firm might be focused on short-term cost-cutting, which could mean reduced maintenance and travel budgets. A larger CDMO network might “re-allocate” your project to a different site in their network to “optimize” capacity, which would be a disastrous change for you. Seek clarity on their 3-year site plan.

- Contractual Security: Review your contract. Does it have a “change of control” clause that gives you certain rights or protections in this event?

5. How much weight should be placed on a CDMO’s adoption of new technologies like continuous manufacturing or AI-driven analytics? Are these real differentiators or just marketing buzz?

This depends entirely on your product and long-term strategy.

- For Established Products: If you have a well-understood, legacy small molecule product, a CDMO’s prowess in traditional batch manufacturing and proven reliability is far more important than their experimental AI platform. Don’t pay a premium for technology you don’t need.

- For Novel Modalities and Competitive Markets: For products like cell & gene therapies or biologics in highly competitive classes, these technologies can be massive differentiators. Continuous manufacturing can drastically reduce the facility footprint, lower cost of goods, and increase flexibility. AI-driven analytics can de-risk a complex process and provide a level of assurance that traditional methods cannot.

- The Litmus Test: The key is to separate marketing from reality. Ask for data. “You say you use AI for predictive analytics. Show me a validated case study where your model predicted a deviation that was then prevented. What is the predictive accuracy of your model?” A truly capable CDMO will have the data to back up their claims. A CDMO that is just “marketing” will give you vague, forward-looking statements.

References

[1] Pharmaceutical Outsourcing: The CDMO Market Outlook. (2023). Pharma Manufacturing.

[2] U.S. Food and Drug Administration. (2004). PAT — A Framework for Innovative Pharmaceutical Development, Manufacturing, and Quality Assurance.

[3] Association for Supply Chain Management. (2022). The APICS Dictionary, 17th ed.

[4] International Society for Pharmaceutical Engineering (ISPE). (2021). Good Practice Guide: Technology Transfer, 3rd Edition.

[5] McKinsey & Company. (2022). Pharma operations: A tale of two futures.

[6] L. M. D. C. Mendis, M. A. K. V. W. Soysa, and K. G. A. P. Kariyawasam. (2021). “The Concept of Total Cost of Ownership (TCO) in Supply Chain Management.” Journal of Business and Management.

[7] FDA.gov. (2023). Warning Letters Database.

[8] Project Management Institute. (2021). A Guide to the Project Management Body of Knowledge (PMBOK® Guide) – Seventh Edition.

[9] DrugPatentWatch. (2024). Pharmaceutical Industry Intelligence Services. Retrieved from https://www.drugpatentwatch.com.

[10] Lean Enterprise Institute. (2023). What is a Gemba Walk?.