Introduction

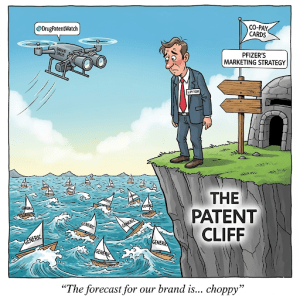

The pharmaceutical industry operates in a high-stakes environment where innovation, regulation, and competition converge. Brand-name drugs enjoy a period of market exclusivity due to patents, allowing companies to recover substantial research and development (R&D) investments, often costing billions. For instance, developing a new drug was estimated at $2.6 billion in 2014 [1]. However, when patents expire, generic versions enter the market at significantly lower prices—typically 80-85% cheaper than brand-name drugs [2]—triggering a “patent cliff” that can erode market share by up to 89% within six months [3]. This shift forces companies to rethink their marketing strategies to maintain profitability and brand relevance.

Marketing in this context is not just about promotion; it’s about sustaining brand loyalty, differentiating the product, and delivering value to patients and healthcare providers. The case of Lipitor (atorvastatin calcium), once the world’s best-selling prescription drug, exemplifies how pharmaceutical companies can navigate generic competition through innovative marketing. This article explores how marketing evolves post-generic entry, using Lipitor as a case study, while examining broader industry trends, the role of tools like DrugPatentWatch, and the ethical implications of these strategies.

The Case of Lipitor

Background on Lipitor

Lipitor, developed by Pfizer, is a statin medication used to lower cholesterol and reduce cardiovascular risks. Approved by the FDA in 1996, it quickly became a blockbuster due to its superior efficacy in reducing LDL cholesterol, supported by over 400 clinical trials involving 80,000 patients [4]. By 2011, Lipitor had generated over $125 billion in sales, making it the best-selling drug in pharmaceutical history [5]. At its peak, it held a 40% share of the global statin market, contributing nearly a quarter of Pfizer’s revenue [6].

Patent Expiration and Generic Entry

Lipitor’s primary patent expired on November 30, 2011, allowing generic versions of atorvastatin to enter the U.S. market. Ranbaxy Laboratories, through a settlement with Pfizer, gained the right to sell generics starting on this date, followed by other manufacturers after a 180-day exclusivity period [7]. The entry of generics posed a significant threat, as generics typically capture a large market share due to their lower cost. However, Pfizer’s strategic response mitigated this impact, retaining a substantial portion of the market.

Pfizer’s Marketing Strategies Post-Generic Entry

Pfizer employed a multifaceted approach to protect Lipitor’s market share, combining pricing strategies, loyalty programs, and innovative marketing tactics.

Price Reductions and Discounts

To compete with generics, Pfizer significantly reduced Lipitor’s price, offering co-pay cards that lowered patients’ out-of-pocket costs to as little as $4 per month for a 30-day supply [8]. This made brand-name Lipitor as affordable as, or cheaper than, generics in some cases. By aligning prices with generics, Pfizer aimed to retain patients who might otherwise switch, leveraging brand familiarity and trust.

Authorized Generics

Pfizer partnered with Watson Pharmaceuticals to launch an authorized generic version of Lipitor, manufactured by Pfizer but sold under Watson’s label. This allowed Pfizer to retain approximately 70% of the profits from generic sales [9]. Authorized generics enabled Pfizer to capture a portion of the generic market while maintaining control over pricing and distribution, a strategy that softened the revenue loss from independent generics.

Brand Loyalty Programs

The “Lipitor for You” program was a cornerstone of Pfizer’s strategy to maintain patient loyalty. Launched in 2010 and extended through 2012, it offered co-pay cards, direct prescription delivery, and periodic emails with health information and refill reminders [10]. This program not only reduced costs for patients but also fostered ongoing engagement, making it easier for them to continue using Lipitor.

Marketing Partnerships and Digital Strategies

In May 2012, just before generics became widely available, Pfizer partnered with EatingWell magazine to launch the “Recipes 2 Go” mobile app. Available on Apple and Android platforms, the app provided healthy recipes, a shopping list tool, a cooking timer, and a digital Lipitor co-pay card [11]. By associating Lipitor with a healthy lifestyle, Pfizer aimed to differentiate the brand and add value for patients. This digital initiative reflected a broader trend toward using technology to engage consumers directly.

Legal and Settlement Strategies

Pfizer strategically managed generic entry through legal settlements. In 2008, it settled patent litigation with Ranbaxy, allowing Ranbaxy to sell generic Lipitor starting November 30, 2011, but with terms that gave Pfizer some control over the market transition [12]. Such settlements, while effective, have faced scrutiny for potentially delaying generic competition, as discussed later.

Exploration of Over-the-Counter Options

Pfizer explored selling Lipitor over-the-counter (OTC) to extend its market life. An OTC version could have reached a broader consumer base without prescriptions, but regulatory concerns about safety monitoring, particularly for liver and muscle damage risks associated with statins, posed significant hurdles [13]. This strategy was not fully implemented but highlights Pfizer’s willingness to explore innovative approaches.

General Pharmaceutical Marketing Strategies Post-Generic Entry

While Lipitor’s case is notable, it reflects broader industry practices for managing generic competition.

Common Strategies Used by Pharmaceutical Companies

Pharmaceutical companies employ a range of strategies to maintain market share post-generic entry:

- Price Competition: Offering discounts, rebates, or co-pay assistance to make brand-name drugs competitive with generics.

- Differentiation: Emphasizing unique benefits, such as superior clinical data or specific formulations, to distinguish the brand from generics.

- Brand Loyalty Initiatives: Implementing programs like loyalty cards, patient support services, or educational campaigns to retain customers.

- Switching Costs: Creating barriers to switching, such as requiring prior authorization or highlighting monitoring needs for generics.

- Authorized Generics: Licensing generics to capture part of the generic market, as seen with Lipitor.

- New Indications or Formulations: Developing new uses or formulations to extend patent life, a practice known as “evergreening.”

- Physician Detailing: Targeting physicians with high brand preference through sales representative visits, which research shows can increase ROI from $1.2 pre-entry to $3.2 post-entry [14].

- Digital Marketing: Leveraging digital platforms for patient and provider engagement, such as apps, social media, or online campaigns.

Effectiveness of These Strategies

The effectiveness of these strategies varies. For Lipitor, Pfizer’s approach was notably successful, with analysts estimating it retained 40% of the market through 2012, far exceeding typical post-generic retention rates [15]. A study on 72 brands found that while most reduce detailing spending post-generic entry to 57% of pre-entry levels, those that maintain or increase spending and refocus on loyal physicians see higher returns [14]. For example, Merck lowered Zocor’s price and secured preferred status with insurers when its patent expired in 2006, maintaining significant market share [16]. Conversely, Eli Lilly reduced its sales force for Cymbalta before its patent cliff, focusing on other products, which led to a faster market share decline [17].

| Strategy | Example | Effectiveness | Source |

|---|---|---|---|

| Price Reductions | Pfizer’s $4 co-pay for Lipitor | Retained 40% market share in 2012 | [15] |

| Authorized Generics | Pfizer’s deal with Watson | Captured 70% of generic profits | [9] |

| Brand Loyalty Programs | Lipitor for You | Enhanced patient retention | [10] |

| Digital Marketing | Recipes 2 Go app | Engaged patients with lifestyle content | [11] |

| Physician Detailing | Refocusing on loyal physicians | Increased ROI from $1.2 to $3.2 | [14] |

The Role of DrugPatentWatch

What is DrugPatentWatch?

DrugPatentWatch is a global biopharmaceutical business intelligence platform providing detailed data on drug patents, generic entry dates, sales, litigation, and more. Trusted by companies, payers, and wholesalers, it offers insights into patent landscapes and competitive dynamics, cited by outlets like CNN and Nature Journals [18]. It supports stakeholders in anticipating market changes and making informed decisions.

Utilizing DrugPatentWatch in Marketing Strategies

DrugPatentWatch enables companies to proactively plan for generic entry by providing precise patent expiration dates and generic entry timelines. For example, Pfizer could have used such data to time its Lipitor strategies, launching co-pay programs and digital campaigns before generics hit the market. The platform also identifies opportunities for new formulations or indications to extend exclusivity and provides competitor analysis to anticipate generic launches. For instance, knowing Ranbaxy’s entry plans allowed Pfizer to negotiate a favorable settlement [12]. By leveraging DrugPatentWatch, companies can align marketing efforts with market realities, maximizing ROI.

Challenges and Ethical Considerations

Balancing Profit and Patient Access

Pharmaceutical companies face a delicate balance between profitability and patient access. Strategies like evergreening—filing additional patents on minor drug modifications—can delay generic entry, keeping prices high and limiting affordability [19]. For example, brand-name drugs cost patients significantly more, and studies show lower adherence due to cost, impacting health outcomes [20]. Such practices raise ethical questions about prioritizing shareholder value over patient welfare.

Regulatory Scrutiny

Regulatory bodies like the Federal Trade Commission (FTC) monitor pharmaceutical practices to prevent anti-competitive behavior. Pfizer’s settlement with Ranbaxy and its deals with pharmacy benefit managers to limit generic dispensing faced scrutiny, with retailers suing Pfizer in 2012 for allegedly delaying generic Lipitor [21]. These cases highlight the tension between business strategies and fair market competition.

“Lipitor was the first drug to exceed $10 billion a year in sales, and accounted for almost one-quarter of Pfizer’s revenue in the last decade.”

— The New York Times, 29 Nov. 2011 [6]

This statistic underscores the financial stakes involved, explaining why companies like Pfizer invest heavily in marketing to protect blockbuster drugs.

Conclusion

The entry of generics marks a critical juncture for brand-name drugs, requiring innovative marketing to maintain relevance. Pfizer’s response to Lipitor’s patent expiration in 2011—through price reductions, authorized generics, loyalty programs, and digital initiatives—demonstrates how strategic marketing can mitigate the patent cliff’s impact. Broader industry practices, such as physician detailing and new formulations, further illustrate the diversity of approaches. Tools like DrugPatentWatch empower companies to anticipate and navigate these challenges, but ethical considerations and regulatory oversight remind us of the need to balance profit with patient access. As the pharmaceutical landscape evolves, companies must adapt creatively while prioritizing affordability and health outcomes.

Key Takeaways

- Proactive Planning: Anticipating generic entry allows companies to launch timely marketing campaigns.

- Multifaceted Strategies: Combining pricing, loyalty programs, and digital marketing can retain market share.

- Data-Driven Decisions: Platforms like DrugPatentWatch provide critical insights for strategic planning.

- Ethical Balance: Companies must weigh profitability against patient access to affordable medications.

- Regulatory Awareness: Strategies like settlements face scrutiny, requiring careful navigation.

FAQ

- What is the patent cliff in the pharmaceutical industry?

The patent cliff is when a drug’s patent expires, allowing generics to enter and compete, often reducing the brand’s market share significantly. - How did Pfizer maintain Lipitor’s market share after generic entry?

Pfizer used price reductions, authorized generics, the “Lipitor for You” program, and digital initiatives like the Recipes 2 Go app to retain customers. - What is an authorized generic?

An authorized generic is a brand-name drug manufactured by the original company but sold under a generic label, allowing the brand to profit from generic sales. - How does DrugPatentWatch assist pharmaceutical companies?

DrugPatentWatch provides patent and generic entry data, helping companies plan marketing strategies and identify new opportunities. - What ethical concerns arise from post-generic marketing strategies?

Delaying generic entry or keeping prices high can limit access to affordable medications, raising ethical and regulatory concerns.

References

[1] “Generic drug.” Wikipedia, 11 Aug. 2003, https://en.wikipedia.org/wiki/Generic_drug.

[2] “Consumers could save as generic Lipitor hits the market.” Harvard Health, 1 Dec. 2011, https://www.health.harvard.edu/blog/consumers-could-save-as-generic-lipitor-hits-the-market-201112013884.

[3] “Pfizer’s 180-Day War for Lipitor.” PM360, 2012, https://www.pm360online.com/pfizers-180-day-war-for-lipitor/.

[4] “For Me There Is No Substitute: Authenticity, Uniqueness, and the Lessons of Lipitor.” Journal of Ethics, American Medical Association, Oct. 2010, https://journalofethics.ama-assn.org/article/me-there-no-substitute-authenticity-uniqueness-and-lessons-lipitor/2010-10.

[5] “Statins, Food, and a Mobile App: Pfizer and Eating Well Partner Up as Generic Lipitor Hits the Market.” Health Populi, 23 May 2012, https://www.healthpopuli.com/2012/05/23/statins-food-and-a-mobile-app-pfizer-and-eating-well-partner-up-as-generic-lipitor-hits-the-market/.

[6] “Facing Generic Lipitor Rivals, Pfizer Battles to Protect Its Cash Cow.” The New York Times, 29 Nov. 2011, https://www.nytimes.com/2011/11/30/health/generic-lipitor-sets-off-an-aggressive-push-by-pfizer.html.

[7] “Pfizer and Ranbaxy Settle Lipitor Patent Litigation Worldwide.” Pfizer, 16 Jun. 2008, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_and_ranbaxy_settle_lipitor_patent_litigation_worldwide.

[8] “Pfizer continues to fight for Lipitor.” GaBI Online, 2011, https://www.gabionline.net/generics/news/Pfizer-continues-to-fight-for-Lipitor.

[9] “Patent Docs: Pfizer’s Lipitor: A New Model for Delaying the Effects of Patent Expiration.” Patent Docs, 30 Nov. 2011, https://www.patentdocs.org/2011/12/pfizers-lipitor-a-new-model-for-delaying-the-effects-of-patent-expiration.html.

[10] “Pfizer taps brand loyalty to protect Lipitor from generics.” PMLiVE, 29 Nov. 2011, https://www.pmlive.com/pharma_news/pfizer_taps_brand_loyalty_to_protect_lipitor_from_generics_351622.

[11] “Statins, Food, and a Mobile App: Pfizer and Eating Well Partner Up as Generic Lipitor Hits the Market.” Health Populi, 23 May 2012, https://www.healthpopuli.com/2012/05/23/statins-food-and-a-mobile-app-pfizer-and-eating-well-partner-up-as-generic-lipitor-hits-the-market/.

[12] “Pfizer and Ranbaxy Settle Lipitor Patent Litigation Worldwide.” Pfizer, 16 Jun. 2008, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_and_ranbaxy_settle_lipitor_patent_litigation_worldwide.

[13] “Pfizer interested in over-the-counter Lipitor: report.” Reuters, 4 Aug. 2011, https://www.reuters.com/article/us-pfizer-lipitor/pfizer-interested-in-over-the-counter-lipitor-report-idUSTRE7735YV20110804.

[14] “Branded response to generic entry: Detailing beyond the patent cliff.” ScienceDirect, 2023, https://www.sciencedirect.com/science/article/abs/pii/S0167811623000861.

[15] “Facing Generic Lipitor Rivals, Pfizer Battles to Protect Its Cash Cow.” CNBC, 30 Nov. 2011, https://www.cnbc.com/id/45490931.

[16] “Merck to Drop Price as Zocor Patent Lapses.” NPR, 23 Jun. 2006, https://www.npr.org/transcripts/5507163.

[17] “To promote or not to promote? The mixed fate of branded drugs when generics arrive.” IESE Insight, 13 Jan. 2025, https://www.iese.edu/insight/articles/branded-drugs-generics-pharmaceutical-marketing/.

[18] “DrugPatentWatch: Drug Prices • Investigational Drugs • Patents • Annual Sales • Litigation.” DrugPatentWatch, https://www.drugpatentwatch.com/.

[19] “Strategies That Delay Market Entry of Generic Drugs.” The Commonwealth Fund, 17 Sep. 2017, https://www.commonwealthfund.org/publications/journal-article/2017/sep/strategies-delay-market-entry-generic-drugs.

[20] Shrank et al., “The implications of choice: prescribing generic or preferred pharmaceuticals improves medication adherence for chronic conditions.” Arch Intern Med, 2006, https://pubmed.ncbi.nlm.nih.gov/16476868/.

[21] “Retailers sue Pfizer over generic Lipitor delay.” CBS News, 6 Jul. 2012, https://www.cbsnews.com/news/retailers-sue-pfizer-over-generic-lipitor-delay/.