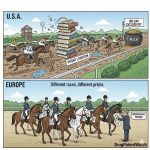

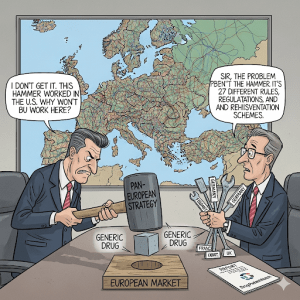

Welcome to the European pharmaceutical market. From a distance, it appears as a single, lucrative monolith—a unified economic bloc brimming with opportunity for generic drug manufacturers. But step closer, and the illusion shatters. What you thought was a solid landmass is, in fact, an intricate and dazzling mosaic, composed of more than two dozen distinct, fiercely independent tiles. Each piece—each country—has its own unique patterns, its own rules of engagement, its own deep-seated cultural and economic philosophies governing healthcare.

For any pharmaceutical executive, business development leader, or market access director eyeing this continent, this is the single most important truth to internalize: a one-size-fits-all strategy for Europe is not just suboptimal; it is a meticulously planned recipe for failure. The path to success is not a superhighway that cuts across the continent, but a series of carefully plotted country roads, each requiring its own map, its own vehicle, and its own skilled driver.

We stand at a pivotal moment. A seismic wave of patent expirations for some of the world’s biggest blockbuster drugs is set to crest between now and the end of the decade, unlocking tens of billions of dollars in market potential.1 This approaching “patent cliff” makes mastering the complexity of Europe more urgent and more rewarding than ever before. The companies that thrive will be those that reject the simplicity of a pan-European approach and embrace the challenge of tailoring their strategy—from regulatory filings and intellectual property navigation to pricing negotiations and commercial models—to the unique contours of each national market.

This report is your strategic guide to that endeavor. We will move beyond the headline numbers to deconstruct the European generic drug landscape piece by piece. We will explore the labyrinth of regulatory pathways, navigate the minefield of intellectual property law, and conduct a deep, comparative analysis of the profoundly different pricing and reimbursement systems in Europe’s key markets. Our journey will reveal that the very complexity that makes Europe so daunting is also the source of its greatest competitive advantage for those who are prepared. Let’s begin.

The European Generic Market: A Continent of Opportunity, A Mosaic of Complexity

To understand the strategic imperative of a tailored approach, we must first grasp the dual nature of the European market: it is simultaneously a colossal, growing opportunity and a landscape of bewildering fragmentation. The forces driving its growth are continental in scale, yet the mechanisms governing access and profitability are staunchly national. This inherent tension is the defining feature of the European generic drug environment.

Sizing the Prize: Market Growth and Key Drivers

The sheer scale of the European generic drugs market is compelling. While different market research reports offer slightly varied figures based on their methodologies and scope, they all paint a picture of a massive and expanding sector. Valuations for 2023 range from approximately USD 74.8 billion to USD 87.5 billion.3 More importantly, the trajectory is consistently upward. Projections show the market growing at a robust compound annual growth rate (CAGR) of between 7.0% and 8.4%, potentially reaching a staggering USD 161.7 billion to USD 228.8 billion by 2032.3

This variance in market size reporting is not a contradiction to be reconciled, but rather the first clue to the market’s underlying complexity. Discrepancies often arise from different definitions of “generic” (e.g., inclusion of branded generics or biosimilars), fluctuating currency exchange rates, and varied data collection periods. For a strategist, the key takeaway is not the precise number but the undeniable magnitude and powerful upward trend. This initial ambiguity serves as a microcosm of the market’s fragmented nature, reinforcing the need for nuanced, multi-source analysis over reliance on a single headline figure.

This powerful growth is not happening in a vacuum; it is fueled by a confluence of deep-seated, macro-level drivers that are reshaping European healthcare.

Driver 1: The Unrelenting Pressure for Cost-Containment

The primary engine powering the generics market is the relentless pressure on national healthcare budgets. Across Europe, governments and public payers are grappling with the challenge of providing high-quality care to their citizens while managing escalating costs. Generic medicines, which are typically 20% to 90% cheaper than their branded counterparts, are the most effective tool in their arsenal. This isn’t a passive trend; it’s an active policy objective. Governments across the continent are implementing policies to promote the use of generics, from prescribing mandates and substitution incentives to favorable reimbursement systems.3 As a result, generics now account for the majority of medicines dispensed in Europe by volume—around 70%—yet they represent a much smaller fraction of the total pharmaceutical expenditure, often less than 30%.9 This demonstrates their profound economic impact and why they are central to the financial sustainability of European healthcare systems.

Driver 2: The Approaching Patent Cliff

A tidal wave of opportunity is building on the horizon in the form of patent expirations. The loss of exclusivity (LOE) for numerous blockbuster drugs is set to unlock vast segments of the market for generic competition.3 The impact of brands losing exclusivity is expected to more than triple globally to USD 220 billion in the coming years, with Europe being a key theater for this shift.

This is not a distant prospect. Major, multi-billion-dollar products are facing LOE in the near term. Key examples include:

- Eliquis (apixaban): The blockbuster anticoagulant from BMS/Pfizer, with over USD 12 billion in sales, faces European patent expiry in 2026.12

- Trulicity (dulaglutide): Eli Lilly’s type 2 diabetes treatment, a USD 7 billion drug, is expected to lose protection in 2027.12

- Keytruda (pembrolizumab) and Opdivo (nivolumab): These revolutionary cancer immunotherapies from Merck and Bristol Myers Squibb, respectively, with combined sales in the tens ofbillions, both face LOE in 2028.1

- Ibrance (palbociclib) and Xtandi (enzalutamide): Key oncology treatments from Pfizer are expected to lose exclusivity in 2027.

This wave of expirations ensures a steady and lucrative pipeline of opportunities for generic and biosimilar manufacturers who are prepared to act swiftly and strategically.

Driver 3: Demographic and Epidemiological Shifts

Europe’s demographic profile provides a powerful, long-term tailwind for the generics market. The continent’s population is aging, with over 20% of EU citizens now aged 65 or over. This demographic shift is accompanied by a rising prevalence of chronic diseases such as cardiovascular conditions, cancer, diabetes, and respiratory disorders.3 These conditions often require long-term, consistent medication, creating a sustained, high-volume demand for affordable treatment options. Consequently, therapeutic areas like oncology and cardiovascular disease are among the fastest-growing segments of the generic market, driven by both high prevalence and the patent expiries of major drugs in these classes.3

Driver 4: The Evolution Towards Complex and Specialty Generics

The opportunity in Europe is evolving beyond simple, “plain vanilla” generics. The market is increasingly characterized by the rise of more complex and higher-value products. The specialty generics segment, for instance, is forecast to exhibit explosive growth, nearly doubling from an estimated USD 21.5 billion in 2024 to USD 42 billion by 2033.

Furthermore, a significant portion of the market is now held by “super generics” or value-added medicines. These are products that offer a tangible improvement over the original branded drug, such as a more convenient drug delivery system (e.g., an auto-injector instead of a vial), a modified-release formulation for less frequent dosing, or a new combination of active ingredients. These products require more sophisticated development and manufacturing capabilities but can command higher prices and create stronger market differentiation than their simpler counterparts.

This dual-engine growth—powered by both the relentless push for cost-savings on standard generics and the burgeoning demand for high-value complex generics—creates a fundamental strategic tension. A company cannot succeed in Europe by being solely a low-cost, high-volume producer or exclusively a niche, value-added player. The market demands a bifurcated capability. A winning strategy for a standard cardiovascular pill in Germany will revolve around operational excellence and winning a tender at the lowest conceivable price. In contrast, the strategy for a complex oncology injectable in France will hinge on demonstrating clinical and economic value to physicians and payers to justify a premium price. A successful European player must possess the strategic agility to tailor its portfolio, its value proposition, and its commercial model to this inherent duality.

The Illusion of a Single Market: Why Europe is 27+ Different Puzzles

The concept of a “European market” is a convenient fiction for headline reports, but a dangerous delusion for strategic planning. While the EU provides a framework for the free movement of goods and a harmonized system for drug approval, the reality on the ground is one of profound fragmentation. As seasoned pharmaceutical consultant Dr. Elena Kowalski astutely notes, “What works in Germany may completely fail in Italy. Each European market has its own fingerprint of regulatory, competitive, and cultural factors that must be understood independently”.

This fragmentation is not an accident; it is by design. The core levers of market access—pricing, reimbursement, and substitution policies—are the exclusive domain of the individual Member States.16 This national sovereignty is the root cause of the market’s complexity and the primary reason why a tailored approach is non-negotiable.

The most telling evidence of this fragmentation lies in the dramatic variation of generic drug penetration across the continent.

- The High-Penetration Leaders: Countries like the United Kingdom and Germany are mature, highly developed generic markets. Driven by decades of pro-generic policies, physician prescribing habits (e.g., prescribing by International Nonproprietary Name, or INN), and pharmacist substitution incentives, generics in these countries account for over 80% of the prescription volume.4

- The Lagging Markets: In stark contrast, other major economies like France and Italy have historically shown much lower rates of generic penetration. In 2014, for example, Italy’s generic volume share was a mere 19%, while France’s was around 30%. These lower rates reflect different cultural attitudes among physicians and patients, less aggressive substitution policies, and reimbursement systems that may not have historically created strong incentives for generic use.

A naive strategic analysis might conclude that Germany and the UK are the most attractive markets due to their sheer volume. However, this high penetration is a double-edged sword. It signals a market that is not only mature but also hyper-competitive. The same policies that drive high volume have also created intense and, in some cases, “unsustainable” price pressure. In Germany, for example, while consumer prices have risen by roughly 30% over the last decade, generic drug prices have actually fallen by 8%. This race to the bottom has led some manufacturers to withdraw products from the market, raising concerns about supply chain stability.

Conversely, the lower penetration rates in markets like France or Italy, while presenting initial barriers, may represent a more significant long-term growth opportunity. A company armed with a sophisticated, tailored strategy that effectively navigates the local reimbursement bodies (like France’s CEPS or Italy’s AIFA) and invests in physician and pharmacist education could potentially unlock substantial value in these less-saturated markets. The “best” market is not an absolute; it is relative to the specific product, the company’s capabilities, and its strategic goals. The choice between a high-volume, low-margin battleground like Germany and a lower-volume, higher-potential-margin market like Italy is a fundamental strategic decision that must be made on a product-by-product basis.

Industry Insight

The Regulatory Labyrinth: Harmonized Pathways, Divergent Realities

At first glance, the European Union’s regulatory system for medicines appears to be a model of harmonization. The European Medicines Agency (EMA) oversees a set of common rules designed to ensure that any medicine placed on the market—whether originator or generic—meets stringent standards of quality, safety, and efficacy.16 Before a product can be sold, it must receive a Marketing Authorisation (MA), and for a generic, this requires proving that it has the same active substance, the same pharmaceutical form, and the same biological effect (bioequivalence) as the original reference product.21

However, beneath this veneer of unity lies a complex network of choices. The EU offers not one, but four distinct pathways to securing an MA. This is not a bureaucratic quirk; it is a reflection of the EU’s dual nature, providing tools for pan-European harmonization while simultaneously accommodating national priorities. For a generic manufacturer, the choice of pathway is not a simple administrative task; it is a critical strategic decision that dictates the speed, scope, cost, and ultimate trajectory of a European launch. Obtaining the MA is not the finish line; it is merely the firing of the starting gun for the real race: securing market access in each individual country.

Gaining the Right to Sell: An Overview of Marketing Authorisation

The journey to market begins with the Marketing Authorisation Application (MAA). The EU framework provides four procedural options, each tailored to a different strategic objective.

The Centralised Procedure (CP): The Pan-European Approach

The Centralised Procedure is the most comprehensive route. A company submits a single MAA directly to the EMA in Amsterdam. The application is then scientifically assessed by the EMA’s Committee for Medicinal Products for Human Use (CHMP). Following a rigorous evaluation process, which typically takes around 210 days, the CHMP issues a scientific opinion on whether the medicine should be approved.23 This opinion is then transmitted to the European Commission, which makes a final, legally binding decision, usually within 67 days. The result is a single Marketing Authorisation that is valid across all 27 EU Member States, as well as in the European Economic Area (EEA) countries of Iceland, Liechtenstein, and Norway.20

When to Use It: The CP is mandatory for certain categories of innovative medicines, such as those derived from biotechnology, and for treatments for cancer, HIV/AIDS, and rare diseases. Crucially for generic manufacturers, it is automatically available for any generic version of a product that was itself originally approved via the CP. A company can also request access to the CP for a generic of a nationally-approved product if it can demonstrate that its product constitutes a “significant therapeutic, scientific or technical innovation” or that its approval is “in the interest of patients at Union level”.

Strategic Implication: The CP is the go-to strategy for a “big bang” launch. It is the most efficient pathway for companies that have the resources and ambition to launch a product across the entire European market simultaneously, particularly for a high-value generic of a major blockbuster drug where maximizing Day 1 entry in all markets is the primary commercial goal.

The Decentralised Procedure (DP): Simultaneous Multi-Country Launch

The Decentralised Procedure is designed for companies that wish to gain marketing authorisation in several EU countries at the same time, but for a product that does not yet have an MA in any EU country.23 In this process, the applicant submits an identical MAA to the national regulatory authorities of all the countries it wishes to enter. One of these countries is chosen to act as the Reference Member State (RMS), taking the lead on the scientific evaluation. The other countries are designated as Concerned Member States (CMS). The RMS prepares a draft assessment report, which is then reviewed and commented on by the CMS. If all states reach an agreement, simultaneous national MAs are granted in all participating countries.4

When to Use It: The DP is ideal for a targeted, multi-market launch. A company might not have the capacity or desire to launch across all 27+ markets at once. Instead, it can use the DP to focus on a strategic cluster of countries—for example, the five largest markets (Germany, France, UK, Italy, Spain), or a regional group like the Nordics or the Benelux countries.

Strategic Implication: This pathway offers a balance between scope and resource allocation. It allows for a coordinated, multi-country launch without the commitment and scale required for the full Centralised Procedure. It enables companies to align their regulatory strategy with a more focused commercial plan.

The Mutual Recognition Procedure (MRP): The Phased Rollout

The Mutual Recognition Procedure is fundamentally different because it builds upon a Marketing Authorisation that has already been granted in one EU Member State. In this scenario, the company first secures an MA in a single country using the National Procedure. That country then becomes the RMS. The company can then apply for “mutual recognition” of that existing MA in other CMS countries.4 The assessment report from the RMS forms the basis of the review in the other states, which are expected to recognize the original approval unless there are serious public health concerns.

When to Use It: The MRP is the quintessential pathway for a phased or sequential launch strategy. It allows a company to establish a “beachhead” in a single, strategically chosen market.

Strategic Implication: This is a powerful, risk-mitigating strategy, particularly for smaller companies or those new to Europe. A firm could, for instance, first use the National Procedure to enter Germany, a large and relatively predictable market. Once the product is launched and generating revenue, the company can use that established German MA as the foundation for an MRP to expand into neighboring markets like Austria, Poland, and the Netherlands. This approach allows for learning, cash flow generation, and a more manageable scaling of commercial and supply chain operations.

The National Procedure (NP): The Single-Market Focus

The National Procedure is the most straightforward pathway. The company submits an MAA directly to the competent national authority (e.g., Germany’s BfArM or France’s ANSM) of a single country. The entire assessment is handled by that authority according to its national rules, and if successful, the resulting MA is valid only within that specific country’s territory.4

When to Use It: The NP is suitable for companies whose strategic focus is limited to one or two key markets. It is also the necessary first step for any company planning a broader expansion using the MRP.

Strategic Implication: While limited in geographic scope, the NP offers focus. It allows a company to concentrate all its regulatory resources and expertise on satisfying the requirements of one specific agency, which can be an advantage when dealing with a particularly complex product or a challenging regulatory environment.

The very existence of these four distinct pathways is a testament to the EU’s fragmented nature. The system provides harmonized tools but ultimately accommodates and reinforces national-level differences. A company must recognize that even with a single, pan-European MA granted through the Centralised Procedure, the real battle for access is only just beginning. That single MA grants the legal right to market the product, but it does not grant the economic right to have it paid for. That right must be won, one country at a time, in the complex and often grueling national pricing and reimbursement negotiations. This critical disconnect is the crux of this report’s argument: regulatory approval is a necessary, but wholly insufficient, condition for market access in Europe.

Navigating the Intellectual Property Minefield

If the regulatory system is a labyrinth, the European intellectual property (IP) landscape is a minefield. For a generic manufacturer, timing is everything. The goal is a “Day 1 launch”—entering the market the very day after the originator’s market protections expire to maximize the window of opportunity. However, achieving this requires navigating a complex and treacherous terrain of interlocking IP rights that extend far beyond the basic product patent. A successful strategy demands a granular, country-by-country understanding of Supplementary Protection Certificates (SPCs), the scope of the “Bolar” R&D exemption, and the insidious threat of patent linkage. Failure to map this three-dimensional chessboard can lead to costly litigation, crippling launch delays, and a “paper launch”—holding a valid marketing authorisation but being legally barred from manufacturing, stockpiling, or selling the product.

Beyond the Basic Patent: Supplementary Protection Certificates (SPCs)

The first layer of complexity beyond the standard 20-year patent term is the Supplementary Protection Certificate, or SPC. An SPC is a unique, sui generis (of its own kind) IP right specific to the pharmaceutical and plant protection industries in Europe. Its purpose is to compensate the originator company for the effective loss of patent life that occurs during the lengthy and mandatory process of clinical trials and regulatory review required to obtain a marketing authorisation.

An SPC is not a patent extension; it is a distinct right that comes into force the moment the basic patent expires. It can extend the period of market exclusivity for a specific active ingredient for a maximum of five years.25 Furthermore, this protection can be extended by an additional six months if the originator company has completed an agreed-upon Paediatric Investigation Plan (PIP), which involves conducting specific clinical trials for the medicine’s use in children. This “paediatric extension” can bring the total SPC duration to 5.5 years, potentially extending the total market monopoly to at least 15.5 years from the date of the first MA.25

For generic companies, the SPC term was once a dead zone. However, a pivotal change came with the “SPC Manufacturing Waiver.” Introduced by Regulation (EU) 2019/933, this waiver created a crucial carve-out, allowing EU-based manufacturers to produce a generic version of an SPC-protected drug during the SPC term, but only for two specific, non-infringing purposes 25:

- For Export: To manufacture the product for sale in non-EU countries where patent or SPC protection has already expired or never existed.

- For Stockpiling: To manufacture and build up stock during the final six months of the SPC’s term, positioning the company for an immediate, Day 1 launch across the EU the moment the SPC expires.

This waiver was a significant victory for the European generics industry, leveling the playing field with manufacturers in other parts of the world. However, industry bodies like Medicines for Europe continue to advocate for the waiver’s rules to be simplified and clarified to further reduce ambiguity and ensure it fully enables timely market entry.

The “Bolar” Exemption: A Non-Harmonized Safe Harbor

The second critical piece of the IP puzzle is the “Bolar” exemption, named after a landmark U.S. court case. This provision is a legal safe harbor that allows generic companies to conduct the necessary research, development, and testing on a patented drug before the patent expires, without this being considered an act of infringement.28 The purpose of the Bolar exemption is clear: to allow a generic company to prepare its marketing authorisation application and have it ready for submission, so that it can launch on Day 1 post-expiry. Without it, the patent monopoly would be de facto extended by the several years it takes to conduct bioequivalence studies and prepare a regulatory dossier.

While the principle of the Bolar exemption was introduced at the EU level in Directive 2004/27/EC, its practical implementation is a textbook example of Europe’s fragmentation.29 There is no single, harmonized Bolar rule across the Union. Instead, its scope and interpretation vary significantly from one member state to another:

- Broad Interpretation: Some countries, such as Italy, have adopted a very broad interpretation of the exemption. Italian law allows for studies and experiments aimed at obtaining an MA not just in the EU but also in foreign countries. It covers activities for both generic and innovative medicines, and, in some court rulings, has even been extended to protect third-party suppliers of the active pharmaceutical ingredient (API) who are providing it to the generic company for regulatory purposes.

- Narrow Interpretation: Other jurisdictions have taken a much more restrictive view. In these countries, the exemption may be interpreted to cover only the activities strictly necessary for obtaining an MA for a generic or biosimilar product within the EU. Using the patented drug to develop a new innovative drug, or to prepare a submission for the U.S. FDA, could be considered infringement.28

This lack of harmonization creates significant strategic complexity. A generic company’s decision on where to locate its R&D and pre-launch manufacturing activities can be directly influenced by the local interpretation of the Bolar exemption. The EU’s proposed new Pharmaceutical Package aims to bring some clarity, suggesting an extension of the exemption to explicitly cover activities needed for Health Technology Assessment (HTA), pricing, and reimbursement applications. However, there is concern within the industry that the proposed wording, by focusing specifically on “generic, biosimilar, hybrid or bio-hybrid” products, could inadvertently narrow the scope in countries like Italy that currently permit a broader range of research.

The Hidden Barrier: Patent Linkage

The final and perhaps most pernicious IP barrier is “patent linkage.” This is the practice—deemed “unlawful” and anti-competitive by the European Commission—whereby national authorities responsible for marketing authorisation, pricing, or reimbursement link their decisions to the patent status of the originator drug.31

This practice is problematic because it fundamentally subverts the roles of different public bodies. A medicines regulatory agency’s mandate is to assess a product’s quality, safety, and efficacy. A reimbursement body’s role is to assess its value for money. Neither is equipped or mandated to adjudicate the validity of a patent; that is the exclusive role of the courts. Patent linkage forces these agencies to act as de facto patent enforcers, systematically delaying the market entry of generics, often based on weak or secondary patents that may not withstand a legal challenge.

Despite the European Commission’s clear opposition, these delaying practices persist in various forms across several Member States:

- Automatic Litigation Triggers: In Portugal, a generic MA application itself has been treated as a potential act of infringement, systematically triggering litigation from the originator company.

- P&R Notification Systems: In France, when a generic company applies for reimbursement listing, the pricing authority (CEPS) is required to inform the originator company. This notification serves as a clear signal for the originator to initiate a patent infringement lawsuit, often based on secondary patents, thereby delaying the reimbursement process.

- Declarations of Non-Infringement: Authorities in countries like Hungary and Poland have demanded that generic companies submit a formal declaration stating that they will not launch their product before the relevant patents expire, effectively holding the reimbursement process hostage to the patent status.

Patent linkage is a major strategic threat because it amplifies the impact of originator strategies like building “patent thickets”—dense webs of overlapping and often weak secondary patents designed to obstruct competition. It creates profound uncertainty, increases litigation costs, and can derail even the most carefully planned Day 1 launch.

A successful European strategy requires a detailed, country-specific Freedom-to-Operate (FTO) analysis that goes far beyond simply checking the expiry date of the basic patent. It must meticulously map out all three layers of this IP chessboard for each target market: identifying all relevant SPCs and their expiry dates, understanding the precise scope of the Bolar exemption in the chosen jurisdictions for R&D, and assessing the risk of encountering patent linkage practices during the national reimbursement process. Business intelligence platforms such as DrugPatentWatch are invaluable tools in this process, providing the granular data on patent landscapes, litigation, and exclusivity periods needed to build this comprehensive strategic map. The choice of where to launch, where to conduct R&D, and where to anticipate legal battles is a high-stakes decision that must be informed by this deep, tailored IP intelligence.

The Great Divide: Pricing & Reimbursement (P&R) in Europe’s Key Markets

If the European regulatory system is a labyrinth of pathways, the pricing and reimbursement landscape is a minefield of national sovereignty. This is the stage where the concept of a “single market” for pharmaceuticals completely disintegrates. After a generic drug has cleared the hurdles of marketing authorisation and intellectual property, it faces its most formidable challenge: convincing more than two dozen different national payers to pay for it. Each country has developed its own unique, and often philosophically opposed, system for controlling drug prices and deciding which products its national health service will cover.

Understanding these differences is not an academic exercise; it is the absolute core of a successful European launch strategy. A pricing model that is perfectly adapted to Germany’s tender-driven environment will be dead on arrival in France’s regulated discount system. To illustrate this profound divergence, we will now conduct a deep-dive analysis into the P&R systems of Europe’s five largest and most influential markets: Germany, France, the United Kingdom, Spain, and Italy. This comparative journey will reveal why a single, pan-European pricing strategy is not just unwise—it is impossible.

Germany: The Power of Tenders and Rebates

Market Context: Germany stands as Europe’s largest pharmaceutical market and a global benchmark for high generic penetration. Generics account for a staggering 80% of prescription volume, making it a high-volume paradise for manufacturers.5 However, this maturity comes at a cost. The market is intensely competitive and fragmented, and the very mechanisms that drive high volume have also created extreme and sustained downward pressure on prices.5

Pricing & Reimbursement Mechanism: The German system is dominated by the power of the payers—the 110 statutory health insurance funds, or “Sickness Funds.”

- Tendering: The primary price-setting mechanism for the majority of the retail generics market is a tendering system.5 The Sickness Funds issue tenders for the supply of specific generic drugs. Companies submit bids, and the winner—almost always the one offering the lowest price—is awarded a contract that grants it volume exclusivity for a defined period, typically two years. This “winner-takes-all” dynamic is the single biggest driver of price erosion in Germany.

- Mandatory Rebates: Even for products not subject to tenders, price control is stringent. Pharmaceutical companies are legally required to pay mandatory rebates to the Sickness Funds. For generic drugs, this includes a special 10% rebate on top of the general 7% manufacturer rebate.

- Reference Pricing (Festbeträge): For groups of therapeutically comparable drugs that are not under exclusive tender contracts, Germany employs a reference pricing system. The authorities set a maximum reimbursement level, or Festbetrag, for the entire group. Any price above this level must be paid out-of-pocket by the patient, creating a powerful incentive for manufacturers to price at or below the reference price.

Key Bodies: The two most important institutions are the Federal Joint Committee (G-BA), which is responsible for the overall benefit assessment of drugs, and the National Association of Statutory Health Insurance Funds (GKV-Spitzenverband), which represents the Sickness Funds and negotiates nationwide rebate contracts.

Strategic Implication: Success in Germany is a game of operational excellence and cost leadership. The winning strategy is built around having a hyper-efficient supply chain and a cost structure that allows for aggressive, tender-winning pricing. Marketing and brand-building are secondary to the ability to deliver a quality product at the lowest possible cost.

France: The Structured Price-Cut Model

Market Context: France presents a stark contrast to Germany. It is a large market, but one historically characterized by lower generic penetration and a powerful, centralized state that exerts tight control over all aspects of healthcare spending.4 The system is less about market competition and more about top-down regulation.

Pricing & Reimbursement Mechanism: The French model is defined by predictability and rigidity.

- Mandatory Initial Discount: The price of a new generic is not negotiated; it is dictated. By law, the manufacturer’s price for the first generic to market must be set at a 60% discount to the price of the originator brand just before its patent expiry.4 In parallel, the originator’s price is automatically cut by 20% to narrow the gap.

- Tarif Forfaitaire de Responsabilité (TFR): The French authorities closely monitor generic substitution rates. If they deem the uptake of a generic to be too low, they can place the entire drug class (the originator and all its generics) under a TFR, or “Fixed Accountability Tariff”. Under a TFR, the national health insurance system will only reimburse up to the price of the cheapest generic in the class. If a patient or doctor insists on the more expensive originator brand, the patient must pay the difference out-of-pocket. This is a powerful tool to force substitution and is a constant threat for drug classes with low generic uptake.

- Negotiation and Value Assessment: All prices are ultimately negotiated with the powerful Economic Committee for Health Products (CEPS). While the initial generic price is fixed, the CEPS regularly reassesses the prices of older drugs, leading to frequent and successive price cuts over a product’s lifecycle. The perceived clinical value of a drug, as determined by the Transparency Commission’s ASMR (Improvement of Medical Benefit) rating, also heavily influences price negotiations.37

Strategic Implication: The strategy for France is one of lifecycle management and stakeholder engagement. The 60% discount provides a clear initial price target. The key challenge is managing the inevitable price erosion over time. Furthermore, the looming threat of a TFR means companies cannot be passive; they may need to invest in educational programs for pharmacists and physicians to actively drive substitution rates and demonstrate the value of their generic product to the CEPS.

The United Kingdom: A Market-Driven Approach

Market Context: The UK, like Germany, is a mature market with extremely high generic penetration, where generics account for around 83% of prescription volume.8 It is often considered an attractive entry point for Europe due to its large size, single language, and relatively low regulatory barriers.

Pricing & Reimbursement Mechanism: The UK system is unique among the major European markets for its reliance on market forces rather than direct price regulation.

- Free Market Pricing: There are no government-mandated prices for generic drugs. Manufacturers are free to set their own prices based on competition and market dynamics.6 This intense competition results in some of the lowest manufacturer selling prices in Europe, often dropping by 70-90% or more compared to the pre-expiry originator price.

- The Drug Tariff: The reimbursement price is set by the National Health Service (NHS) in a list called the Drug Tariff. This is the price the NHS pays to the pharmacy for dispensing the medicine. Crucially, the Drug Tariff price is typically set significantly higher than the actual price at which pharmacies can purchase the drug from manufacturers. This gap creates the pharmacy’s profit margin.

- Powerful Incentives: The entire system is designed to drive down manufacturer prices. Physicians are strongly encouraged to prescribe by the drug’s generic name (INN). Pharmacies, in turn, are financially incentivized to source and dispense the lowest-cost generic available, as this maximizes their profit margin (the difference between the fixed Drug Tariff reimbursement and their acquisition cost). This creates a relentless downward pressure on the prices manufacturers can charge.

Strategic Implication: The UK is a high-volume, razor-thin-margin market. Success here is not about negotiating with the government, but about winning in the commercial channel. The strategy must focus on building strong relationships and securing contracts with large pharmacy chains and pharmaceutical wholesalers. Profitability is often not viewed on a single-product basis but rather on the performance of a company’s entire portfolio of generics supplied to the UK market.34

Spain: The Reference Pricing System

Market Context: The Spanish market is a prime example of a government successfully using policy to drive generic uptake. Generics now account for over 40% of prescribed units but only 21% of the total pharmaceutical spend, a testament to the very low prices achieved through the system.

Pricing & Reimbursement Mechanism: The cornerstone of Spanish policy is its comprehensive Reference Price System (RPS).42

- Reference Price System (RPS): The Ministry of Health creates “reference groups” of medicines that are considered therapeutically similar. Historically, these groups were based on having the same active ingredient, but a controversial change now allows grouping based on the broader ATC5 classification, meaning drugs with different active ingredients can be grouped together if they have a similar therapeutic use. For each group, a single maximum reimbursement price—the reference price—is established. All products in the group, including the originator brand, will only be reimbursed up to this price.

- Generic Price Link: Upon launch, the first generic must be priced at least 40% below the originator’s price. The originator, in turn, is forced to lower its price to compete.

- Recent Reforms: Recognizing that the old system could stifle competition once all products hit the reference price floor, recent reforms are designed to create a more dynamic market. They aim to allow generic companies to price their products below the reference price without automatically forcing the originator brand to match, thereby rewarding the most efficient producers.

- Fragmented Payers: A final layer of complexity is Spain’s political structure. While the national Inter-Ministerial Pricing Committee (CIPM) sets the national price, the ultimate payers are the 17 autonomous regions. This means that after securing national reimbursement, a company often faces a second round of access hurdles, such as individual hospital tenders and formulary inclusions at the regional level.45

Strategic Implication: The key to Spain is mastering the intricacies of the Reference Pricing System. The shift to ATC5 grouping requires a more sophisticated analysis to understand which products a new generic will be benchmarked against. Furthermore, the strategy must be two-tiered: a national strategy to secure a favorable price from the CIPM, followed by a series of tailored regional strategies to ensure access and uptake in the hospitals and clinics of the key autonomous communities.

Italy: The Negotiated Discount Model

Market Context: Italy has long been one of Europe’s most challenging markets for generics, characterized by historically low penetration rates and a complex, negotiation-heavy access process.4 It is a market that rewards patience, local expertise, and strong negotiation skills.

Pricing & Reimbursement Mechanism: The Italian system is centralized and driven by its powerful national medicines agency, AIFA.

- Negotiation with AIFA: Unlike the formulaic systems in France or Spain, pricing and reimbursement in Italy are determined through direct negotiation between the pharmaceutical company and the Italian Medicines Agency (Agenzia Italiana del Farmaco, AIFA).48

- Mandatory Discount: While the final price is negotiated, there is a floor. A new generic must enter the market with a price that is at least 20% lower than the reference originator medicine.

- Protracted Timelines: The negotiation process is notoriously lengthy and complex. The average time from the submission of a marketing authorisation application to a final pricing and reimbursement decision being published can be well over 400 days, and in some cases, much longer.

Strategic Implication: The strategy for Italy must be built for a marathon, not a sprint. Companies must invest in building a robust value dossier and be prepared for a protracted and detailed negotiation with AIFA. This requires significant local regulatory and market access expertise. While the barriers are high and timelines are long, the relatively low existing generic penetration suggests that there is untapped growth potential for companies that have the stamina and sophistication to successfully navigate the Italian system.

Comparative Synthesis: A Continent of Contrasts

The profound differences between these five key markets underscore the central thesis of this report. They are not merely variations on a theme; they are fundamentally different systems built on opposing philosophies. Germany and the UK leverage market competition to drive down prices, while France and Spain rely on stringent top-down regulation. Italy, in turn, opts for a model of direct, centralized negotiation. A single European value proposition or pricing strategy is therefore an impossibility. A company’s approach must be meticulously tailored, not just to the rules of each country, but to the underlying philosophy that shapes them.

To crystallize these differences, the following table provides a comparative summary of the key features and strategic imperatives for each market.

Valuable Table: Comparative Analysis of Key European Generic Markets

| Feature | Germany | France | UK | Spain | Italy |

| Generic Penetration (Vol.) | Very High (~80%) | Moderate (~30%) | Very High (~83%) | High (~47%) | Low (~19%) |

| Primary P&R Mechanism | Tenders & Rebates 5 | Fixed Discount (-60%) & TFR | Market-Based Pricing 6 | Reference Pricing System (RPS) | AIFA-led Negotiation |

| Key P&R Body | Sickness Funds / G-BA | CEPS | NHS (via Drug Tariff) | CIPM / Regional Gov’ts | AIFA |

| Pricing Dynamic | Intense price competition | Predictable but rigid | Highly competitive, low margins | Regulated price erosion | Protracted negotiation |

| Primary Challenge | Unsustainable price pressure | Lifecycle price cuts | Low profitability | Regional access hurdles | Lengthy approval times |

| Strategic Imperative | Cost leadership & supply chain efficiency | Lifecycle management & substitution drivers | Channel management & portfolio strategy | Navigating RPS & regional payers | Patience & negotiation expertise |

This table serves as a strategic compass. A market access director can immediately see that the capabilities, resources, and talent required to win in Germany (e.g., world-class supply chain managers and tender specialists) are fundamentally different from those needed to succeed in Italy (e.g., experienced government affairs professionals and negotiators). This directly informs organizational design, hiring priorities, and budget allocation, providing a clear framework for building a truly tailored European market access function.

The Rise of HTA and the Future of Value Assessment

A new and powerful force is reshaping the European market access landscape: Health Technology Assessment (HTA). While the immediate impact of new HTA regulations will be felt most acutely by innovators launching brand-new medicines, the ripple effects will inevitably touch the entire pharmaceutical ecosystem, including the generics and biosimilars sectors. For forward-thinking companies, understanding the principles of HTA and the direction of European policy is no longer optional; it is a prerequisite for future-proofing their market access strategies. The era of simply being “cheaper” is evolving into an era of demonstrating “cost-effective value,” and HTA is the language in which that value must be communicated.

What is Health Technology Assessment (HTA)?

At its core, HTA is a systematic and multidisciplinary process designed to evaluate the added value of a new health technology—be it a drug, a medical device, or a diagnostic test—compared to existing alternatives. It moves beyond the fundamental regulatory questions of safety, quality, and efficacy (“Does it work?”) to address the critical payer question: “Is it worth paying for, and if so, how much?”.

HTA bodies, which operate at the national level, conduct these assessments by considering a wide range of evidence, including 51:

- Clinical Value: How does the new treatment’s effectiveness and safety profile compare to the current standard of care?

- Economic Value: Is the treatment cost-effective? Does its price reflect the health benefits it provides?

- Social and Ethical Implications: What is the broader impact on patients’ quality of life, on caregivers, and on society?

The recommendations from these HTA bodies are a critical input for the national authorities that make the final decisions on pricing and reimbursement.53 While historically the focus has been on high-priced innovative medicines, the methodologies and mindset of HTA are becoming increasingly relevant for the entire market, especially for high-value complex generics, value-added medicines, and biosimilars.

The New EU HTA Regulation (HTAR): A Step Towards Harmonization?

For years, the HTA process in Europe was as fragmented as the P&R systems it informed. Each country conducted its own complete assessment, leading to massive duplication of effort for both national agencies and pharmaceutical companies, and contributing to significant delays in patient access.51

To address this, the European Union has introduced the Regulation on Health Technology Assessment (EU) 2021/2282, which becomes applicable in phases starting from January 2025.51 The central pillar of this new regulation is the creation of

Joint Clinical Assessments (JCAs).51

The JCA process aims to harmonize the clinical part of the assessment. For qualifying new medicines, instead of 27 separate reviews of the clinical trial data, there will be a single, EU-wide assessment of the medicine’s relative clinical effectiveness and safety compared to existing treatments. This joint report will then be shared with all Member States, who are obliged to give it “due consideration” in their national HTA processes.

However, it is crucial to understand the regulation’s limitations. The HTAR creates a collaborative framework but explicitly respects the sovereignty of Member States in managing their own healthcare systems.51 The JCA is a

clinical assessment only. The subsequent, and arguably more decisive, steps—the economic evaluation, the appraisal of overall value for money, and the final pricing and reimbursement negotiations—remain firmly within the remit of national authorities.51

The rollout of the HTAR is phased:

- From January 2025: It applies to new cancer medicines and advanced therapy medicinal products (ATMPs).

- From January 2028: The scope expands to include orphan drugs (medicines for rare diseases).

- From January 2030: It will cover all new medicines that are approved via the EU’s Centralised Procedure.51

While standard generics approved through national or decentralized routes will not be subject to mandatory JCAs in the near future, the new regulation signals a profound shift in the European market access paradigm. The very concept of demonstrating comparative clinical and economic value is becoming deeply embedded in the decision-making culture of every national payer. For companies developing complex generics, value-added medicines, or biosimilars, the ability to generate and communicate a compelling value narrative, akin to what is required for a JCA, will become a significant competitive differentiator. The bar for evidence generation is being raised for everyone.

Paradoxically, this move toward harmonizing the clinical assessment will likely intensify the need for tailored national strategies. By providing every national HTA body with the exact same clinical report (the JCA), the regulation effectively standardizes the “what.” This forces companies to compete more fiercely on the “so what?”—the national-level value proposition. The key differentiating factor for success will be how effectively a company can translate the harmonized clinical data into a compelling and locally relevant economic and budgetary impact argument for the French CEPS, the German G-BA, or the Italian AIFA. The demand for sophisticated, country-specific market access and health economics expertise will become more critical, not less.

Beyond the Basics: Tailoring for Complex Generics and Biosimilars

The European generics market is not a monolith of simple, easy-to-replicate small molecules. A growing and increasingly important segment of the market consists of complex generics and biosimilars. These products represent a significant commercial opportunity but also come with a unique set of development, regulatory, and market access challenges. For these higher-value products, a tailored strategy is not just about adapting to different pricing systems; it’s about building trust, educating stakeholders, and proving value in a way that goes far beyond a simple “same as the original, but cheaper” message.

The Unique Challenges of Complex Generics

Complex generics are a broad category of products that are more difficult to develop and manufacture than traditional generics. This complexity can stem from a variety of factors, including a complex active ingredient, a sophisticated formulation, a complex route of administration (e.g., injectables, inhalers), or a complex drug-device combination.

The primary challenge lies in demonstrating bioequivalence. While complex generics must meet the same stringent regulatory standards as simple generics, proving that they perform in the body in the exact same way as the reference product can be far more difficult and expensive. This often requires more than standard pharmacokinetic studies and may involve intricate in-vitro tests, and in some cases, additional clinical data. Recognizing these hurdles, regulatory agencies like the U.S. FDA and the EMA have established a Parallel Scientific Advice (PSA) pilot program specifically to provide guidance to developers of complex generic and hybrid products, helping them navigate the challenging path to approval.59

From a market access perspective, this complexity creates a double-edged sword. On one hand, the high development barriers mean that there will be fewer competitors, which can lead to more sustainable pricing and higher margins. On the other hand, these products still face all the same national pricing, reimbursement, and HTA hurdles as any other medicine. Payers may not automatically recognize or reward the added development cost and complexity. Therefore, the market access strategy for a complex generic must include a clear narrative that explains the product’s value and justifies its price point relative to both the originator and any potential simpler alternatives.

The Biosimilar Battleground

Europe is, without question, the world’s most mature and successful biosimilar market. Since the first biosimilar was approved in 2006, these products have delivered enormous value to European healthcare systems, generating an estimated €56 billion in cumulative savings and providing around seven billion patient-treatment days that might not have otherwise been possible.61 The success of biosimilars for molecules like adalimumab and infliximab has fundamentally changed the treatment landscape in immunology and other areas.

However, despite this success, the European biosimilar market is fraught with persistent challenges that demand a highly sophisticated and tailored approach.

- Deep Disparities in Uptake: The adoption of biosimilars is far from uniform. Access and uptake rates vary dramatically from one country to another, and even between different therapeutic areas within the same country.62 This reflects differences in national policies, payer incentives, and physician attitudes.

- The Trust and Education Gap: A significant barrier to uptake is the lingering skepticism among some healthcare professionals and patients. Concerns about the scientific principle of biosimilarity, the extrapolation of indications (where a biosimilar is approved for all of the originator’s indications based on studies in just one), and the concept of interchangeability (whether a pharmacist can substitute a biosimilar for the prescribed originator) remain prevalent.64 Overcoming this requires more than just a low price; it requires sustained investment in education and evidence dissemination.

- The Threat to the Pipeline: The economic viability of the future biosimilar pipeline is a growing concern. The high cost and complexity of developing a biosimilar mean that manufacturers tend to target only the biggest blockbuster biologics. Products with lower annual sales (e.g., below €500 million in Europe) or those designated as orphan drugs for rare diseases are often not commercially attractive targets. This creates potential “gaps” in competition, where originator biologics could retain their monopoly and high prices long after patent expiry simply because no company is willing to invest in developing a biosimilar.

- The Need for Holistic Policies: The most successful biosimilar markets in Europe are those that have implemented a comprehensive and holistic set of policies. It’s not enough to simply have a low price. Success requires a multi-pronged approach that includes physician prescribing targets or incentives, clear guidelines on interchangeability and substitution, and national education campaigns to build confidence among all stakeholders.62

For a company launching a biosimilar, a tailored strategy must therefore extend far beyond the pricing and reimbursement department. It requires a deep and integrated collaboration with the medical affairs team. The “it’s the same, just cheaper” argument is wholly insufficient. The launch plan for a biosimilar in a market like France, where physician loyalty to established brands can be particularly strong, must be built around a robust medical education strategy. This involves deploying medical science liaisons (MSLs) to engage with key opinion leaders, presenting the totality of the evidence from the rigorous comparability exercise, explaining the science behind extrapolation, and building trust in the product’s quality and reliability. The “tailoring” is not just about the price submitted to the payer; it is about the entire commercial and medical engagement model designed for that specific country’s unique ecosystem of prescribers, pharmacists, and patients.

Building the Blueprint: A Framework for a Tailored European Launch Strategy

Having established the profound complexity of the European generic market, we now turn to the practical question: How does a company translate this understanding into a winning strategy? The answer lies in a systematic, phased approach that treats Europe not as a single target, but as a portfolio of distinct market entry projects. A successful blueprint must integrate strategic market selection, country-specific value demonstration, and a resilient, adaptable supply chain. This is not a linear process, but a cascade, where early strategic choices have profound downstream consequences on everything from regulatory filings to packaging lines.

Phase 1: Strategic Market Selection and Launch Sequencing

The first and most critical decision is not how to launch in Europe, but where and when. The default strategy of simply targeting the five largest markets (Germany, France, UK, Spain, Italy) in sequence is often a recipe for misallocated resources and missed opportunities. The selection of initial markets and the sequence of the subsequent rollout must be a deliberate strategic choice, tailored to the specific product profile and the company’s capabilities.

This requires a multi-factor analysis that goes beyond market size to include the local P&R environment, the specific IP landscape, the intensity of competition, and the cultural fit for the product. Based on this analysis, a company can choose from several strategic launch archetypes:

- The “Big Bang” Launch: This approach involves using the Centralised Procedure (CP) to gain a single MA and aiming for a simultaneous or near-simultaneous launch across most or all of the EU. This is a high-risk, high-reward strategy best suited for a generic version of a major global blockbuster, where the company has significant financial backing and a robust pan-European infrastructure to manage the immense operational complexity.

- The “Beachhead” Strategy: This is a more cautious, phased approach. The company uses the National Procedure (NP) to enter a single, carefully chosen “beachhead” market. This market might be selected for its size and volume (like Germany), its speed to market (like the UK), or its favorable pricing environment. Once a foothold is established and the product is generating revenue, the company can then use the Mutual Recognition Procedure (MRP) to expand into other countries from this established base. This strategy mitigates risk, allows for organizational learning, and provides a more manageable scaling of operations.

- The “Clustering” Strategy: This approach uses the Decentralised Procedure (DP) to target a specific group of strategically aligned markets simultaneously. For example, a company might target the Nordic countries (Denmark, Sweden, Finland, Norway), which often collaborate on HTA and have similar market dynamics. Another cluster could be the Benelux region. This strategy focuses resources on a manageable number of similar markets, allowing for efficiencies in regulatory and commercial activities.

This crucial decision cannot be made on instinct. It must be rigorously data-driven. A deep, country-by-country analysis of all the access hurdles is essential. This is where leveraging comprehensive business intelligence becomes paramount. Companies must use sophisticated patent intelligence platforms, such as DrugPatentWatch, to get a crystal-clear picture of the entire IP landscape—including basic patent expiry dates, the existence and duration of any Supplementary Protection Certificates (SPCs), and the history of patent litigation in each country. This intelligence is the foundation upon which the entire launch sequence—the “when” and the “where”—must be built.

Phase 2: Developing Country-Specific Dossiers and Commercial Models

Once the launch sequence is determined, the focus shifts to execution at the national level. A core mistake is believing that a single European value dossier can be created and simply translated for each market. While the core clinical data demonstrating bioequivalence will be the same, this data is merely the starting point for the national access negotiations.

The core clinical package must be wrapped in a country-specific value dossier.55 This means tailoring the economic argument to the specific requirements and priorities of each national HTA and P&R body.

- For Germany’s Sickness Funds, the dossier must focus on price and budget impact.

- For France’s CEPS, it must address the ASMR rating and demonstrate value relative to the established comparators.

- For the UK’s NICE (for more complex products) or the NHS, it must demonstrate cost-effectiveness within the context of the UK health system.

- For Italy’s AIFA, it must be a comprehensive package prepared for a detailed, face-to-face negotiation.

Similarly, the commercial model—the structure and focus of the field teams—must be adapted to the local environment.

- In Germany, the focus will be on Key Account Managers with the skills to negotiate tender contracts with powerful Sickness Funds.

- In France and Italy, where physician prescribing habits are key, the model will lean more heavily on Medical Science Liaisons (MSLs) and sales representatives who can build trust and educate clinicians.

- In the UK, the emphasis will be on commercial managers who can forge strong relationships and strike favorable supply agreements with the major pharmacy chains and wholesalers.

Phase 3: Optimizing the Pan-European Supply Chain

The final piece of the strategic puzzle is the supply chain. A tailored launch strategy places immense demands on a company’s logistics and manufacturing operations. The recent wave of drug shortages across Europe, exacerbated by soaring energy costs, geopolitical instability, and fragile global supply lines, has brutally exposed the vulnerabilities of overly lean, just-in-time supply chains.19

A modern European supply chain strategy must be built on principles of resilience and redundancy. This may involve strategically dual-sourcing critical APIs, diversifying manufacturing sites between Europe and other regions, and building up appropriate levels of safety stock to buffer against unexpected disruptions.

Furthermore, the operational complexity is immense. A pan-European supply chain must be capable of managing:

- Linguistic Diversity: Handling packaging and patient information leaflets in up to 24 different official languages.

- Country-Specific Pack Formats: Complying with unique national requirements, such as the mandatory inclusion of Braille on packaging in the EU.

- Serialization and Traceability: Ensuring full compliance with the EU’s Falsified Medicines Directive (FMD), which requires a unique identifier on each pack and an end-to-end verification system to prevent counterfeit medicines from entering the supply chain.27

A truly integrated strategy connects these three phases. The choice of launch sequence in Phase 1 directly dictates the number and type of P&R dossiers required in Phase 2, and the level of complexity the supply chain must manage in Phase 3. For example, pursuing a “Beachhead” strategy by launching first in the UK dramatically simplifies the initial supply chain challenge (one language, one pack format, one set of regulations). This allows the company to gain valuable operational experience and generate revenue before tackling the much greater complexity of a multi-language, multi-format launch on the continent. The strategy is a cascade, and foresight in the early phases is essential to ensure success in the later ones.

Conclusion: From Complexity to Competitive Advantage

The European generic drug market presents a compelling paradox. It is a space defined by harmonized regulatory ideals yet governed by fragmented, fiercely nationalistic economic realities. It offers the promise of a vast, unified market of nearly 450 million people, but delivers the operational challenge of 27-plus distinct healthcare systems. For any pharmaceutical company seeking to capitalize on the immense opportunities this continent holds, the central message of this analysis is unequivocal: success is impossible without acknowledging and adapting to this paradox.

The evidence laid out in this report is overwhelming. A tailored, country-by-country approach is not merely a “nice-to-have” or a minor optimization. It is the fundamental prerequisite for a viable European business. From the four divergent regulatory pathways that shape the very structure of a launch, to the three-dimensional IP chessboard of patents, SPCs, and Bolar exemptions, to the profoundly different philosophies underpinning the pricing and reimbursement systems of Germany, France, the UK, Spain, and Italy—every critical determinant of market access is nationally defined. To ignore this reality is to court failure.

Yet, within this daunting complexity lies a powerful strategic opportunity. The very barriers that make Europe so challenging to navigate also serve as a formidable competitive moat. The investment required to master this landscape—to build the local P&R and government affairs expertise, to develop the flexible and resilient supply chains, to craft the tailored value stories for each national payer, and to navigate the unique IP minefields of each jurisdiction—is substantial. Companies that make this investment, that embrace the complexity rather than fighting it, can build a durable and defensible market position. They create a competitive advantage that less sophisticated, one-size-fits-all competitors simply cannot replicate.

The prize for this effort is not just market share in a few key countries. It is sustainable, profitable growth in the world’s second-largest, and arguably most sophisticated, pharmaceutical market. The companies that will win in Europe in the coming decade are those that see the mosaic not as a fractured mess, but as a beautiful and intricate puzzle, and have the patience, intelligence, and strategic discipline to solve it, one piece at a time.

Key Takeaways

- Europe is Not One Market: The single most critical success factor is recognizing that Europe is a mosaic of 27+ distinct national markets, each with its own P&R system, IP interpretation, and cultural attitudes. A one-size-fits-all strategy is doomed to fail.

- Tailoring is Non-Negotiable: Success requires a meticulously tailored strategy for each target country, adapting the regulatory pathway, pricing model, commercial approach, and value proposition to local realities.

- Regulatory MA is Just the Start: Obtaining a Marketing Authorisation (MA) from the EMA or a national agency grants the legal right to sell, but not the economic right to be reimbursed. The real battle for access is fought at the national P&R level after the MA is secured.

- IP is a 3D Chessboard: A launch strategy must navigate a complex IP landscape that includes not only basic patents but also Supplementary Protection Certificates (SPCs), the non-harmonized Bolar R&D exemption, and the threat of anti-competitive “patent linkage” practices, which vary by country.

- P&R Philosophies are Opposed: Key markets use fundamentally different mechanisms to control prices. Germany and the UK rely on market competition (tenders, channel incentives), while France and Spain use top-down regulation (fixed discounts, reference prices), and Italy uses direct negotiation. The commercial strategy must align with the local philosophy.

- Complexity is a Competitive Moat: The high barriers to entry in Europe can be turned into a strategic advantage. Companies that invest in mastering the local complexities of P&R, IP, and supply chain can build a defensible market position that less sophisticated competitors cannot easily challenge.

Frequently Asked Questions (FAQ)

1. With the new EU HTA Regulation (HTAR) starting in 2025, will I eventually only need one value dossier for all of Europe?

No, this is a critical misconception. The new HTAR harmonizes only the clinical assessment part of the evaluation through Joint Clinical Assessments (JCAs). The JCA will result in a single, EU-wide report on a drug’s relative clinical effectiveness and safety. However, the subsequent and most crucial parts of the process—the economic evaluation, the overall value appraisal, and the final pricing and reimbursement negotiations—remain the exclusive responsibility of each individual Member State.51 Therefore, you will still need to prepare a tailored

economic value dossier for each country, translating the findings of the harmonized clinical report into a compelling argument that meets the specific requirements and budget priorities of that nation’s payers. The HTAR actually makes this local tailoring more important, as the economic argument will become the key point of differentiation.

2. What is the single biggest mistake companies make when entering the European generic market?

The biggest and most common mistake is underestimating the fragmentation of the market and attempting to apply a single, pan-European strategy. This often manifests as a “US-centric” mindset, where a company assumes that securing a central regulatory approval (the MA) is the main event, similar to getting FDA approval. In Europe, the MA is just the ticket to the game; it doesn’t get you on the field.55 The real work begins post-MA, navigating the 27+ different pricing, reimbursement, and HTA systems. Companies that fail to dedicate sufficient resources and local expertise to this national-level access phase are often surprised by long delays, poor pricing outcomes, and low uptake, despite having a fully approved product.

3. How can I use the SPC Manufacturing Waiver to my strategic advantage?

The SPC Manufacturing Waiver is a powerful strategic tool for EU-based manufacturers. It allows you to legally manufacture a generic version of a drug that is still under an SPC in Europe, for two key purposes.25 First, you can manufacture for

export to markets outside the EU where patent/SPC protection has already expired. This allows you to start generating revenue from the product before the European market opens up. Second, and more critically for your European launch, you can use the waiver for stockpiling. In the final six months of the SPC term, you can manufacture and build up inventory. This enables you to execute a true “Day 1 launch” across the EU, ensuring your product is in the distribution channel and available to patients the very day the originator’s exclusivity ends, maximizing your first-mover advantage.

4. Is it better to launch in a high-volume/low-price market like Germany or a lower-volume/higher-potential-price market like Italy first?

There is no single “better” option; the choice depends entirely on your company’s product, capabilities, and risk tolerance.

- Launching in Germany first (a “Beachhead” strategy) offers the advantage of immediate high-volume potential in a large, well-established generics market. However, it requires you to be extremely cost-competitive to win tenders in a hyper-competitive, low-margin environment. This strategy is best for companies with highly optimized, low-cost manufacturing and supply chains.

- Launching in Italy first presents a different challenge and opportunity. You will face a much longer, more complex negotiation process with AIFA and achieve lower initial volumes due to lower generic penetration.18 However, if you have a strong value dossier and skilled negotiators, you may be able to secure a more sustainable price than is possible in Germany. This route is often better for more complex or value-added generics where the company is prepared to invest in a longer, more resource-intensive market access process.

5. What is “patent linkage” and why is it a major threat to my launch timeline in certain EU countries?

Patent linkage is an anti-competitive practice where a national regulatory or reimbursement authority improperly links its decision-making process to the patent status of the originator drug. For example, an authority might refuse to grant reimbursement for your generic until a secondary patent on the originator—which may be weak or invalid—has expired or been resolved in court. The European Commission considers this practice unlawful because regulatory and reimbursement bodies are not patent courts; their job is to assess a drug’s safety, efficacy, and value, not its patent status.31 It is a major threat because it can systematically and unpredictably delay your market entry, sometimes for years, even after you have full marketing authorisation and the core patent has expired. It is crucial to assess the risk of patent linkage in each target country as part of your IP and launch strategy.

References

- 15 Biologics are Going Off Patent (2025–2029) – Clival Database, accessed July 27, 2025, https://clival.com/blog/15-biologics-are-going-off-patent-2025-to-2029

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What They’re Doing About It, accessed July 27, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Europe Generic Drugs Market Report and Forecast 2024-2032, accessed July 27, 2025, https://www.researchandmarkets.com/report/europe-generics-market

- Generic Drug Market Entry in Europe: Why a Tailored Approach Is Best – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/generic-drug-market-entry-in-europe-why-a-tailored-approach-is-best/

- Europe Generic Drugs Market- Industry Analysis and Forecast (2025-2032), accessed July 27, 2025, https://www.stellarmr.com/report/Europe-Generic-Drugs-Market/1802

- The Role of Generic Medicines in Sustaining Healthcare Systems: A European Perspective – IQVIA, accessed July 27, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/the-role-of-generic-medicines-in-sustaining-healthcare-systems.pdf

- Europe Generic Drugs Market Size and Forecasts 2030 – Mobility Foresights, accessed July 27, 2025, https://mobilityforesights.com/product/europe-generic-drugs-market

- Comparing Generic Drug Markets in Europe and the United States: Prices, Volumes, and Spending – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/comparing-generic-drug-markets-europe-united-states-prices-volumes-spending/

- Beneath the Surface: Unravelling the True Value of Generic Medicines – IQVIA, accessed July 27, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/iqvia-true-value-of-generic-medicines-04-24-forweb.pdf

- Press release Generic medicines: 70% of dispensed medicines and critical to healthcare, accessed July 27, 2025, https://www.medicinesforeurope.com/wp-content/uploads/2024/04/Press-release-Beneath-the-Surface-100424.pdf

- The Global Use of Medicines Outlook Through 2029 – IQVIA, accessed July 27, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/the-global-use-of-medicines-outlook-through-2029

- Expected Patent Expiry Drugs List: Top Drugs Losing Patent Protection By 2030 – Artixio, accessed July 27, 2025, https://www.artixio.com/post/patent-expiry-alert-drugs-expected-to-lose-protection-in-the-next-five-years

- Top Drugs Losing Patent Exclusivity Soon – Pharma Now, accessed July 27, 2025, https://www.pharmanow.live/knowledge-hub/market-trends/pharmaceutical-drugs-losing-patent-exclusivity

- Europe Pharmaceutical Market Size | Companies – Nova One Advisor, accessed July 27, 2025, https://www.novaoneadvisor.com/report/europe-pharmaceutical-market

- Finding Generic Drug Entry Opportunities in Emerging Markets …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-emerging-markets/

- Market Review-2023-11-07.cdr – Medicines for Europe, accessed July 27, 2025, https://www.medicinesforeurope.com/wp-content/uploads/2023/06/Market-Review-2023-29-06.pdf

- New pricing models for generic medicines to ensure long-term healthy competitiveness in Europe, accessed July 27, 2025, https://www.medicinesforeurope.com/wp-content/uploads/2022/06/New-pricing-models-for-generic-medicines.pdf

- Comparing Generic Drug Markets in Europe and the United States: Prices, Volumes, and Spending, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5594322/

- Amid pricing squeeze and market withdrawals, Europe must prioritize generic manufacturing, Teva exec says | Fierce Pharma, accessed July 27, 2025, https://www.fiercepharma.com/manufacturing/amid-geopolitical-pressures-and-market-withdrawals-europe-must-prioritize-generic

- Medicines Approval system, accessed July 27, 2025, https://www.hma.eu/about-hma/medicines-approval-system.html

- Generic and hybrid applications | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/generic-hybrid-medicines/generic-hybrid-applications

- Generic and hybrid medicines – EMA – European Union, accessed July 27, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/generic-hybrid-medicines

- Authorisation of medicines – EMA – European Union, accessed July 27, 2025, https://www.ema.europa.eu/en/about-us/what-we-do/authorisation-medicines

- How Generic Drugs are Registered in Europe, United Kingdom, Australia and New Zealand? – International Journal of Pharmaceutical Investigation, accessed July 27, 2025, https://jpionline.org/storage/2023/07/IntJPharmInvestigation-13-3-440.pdf

- Supplementary protection certificate – Wikipedia, accessed July 27, 2025, https://en.wikipedia.org/wiki/Supplementary_protection_certificate

- Supplementary protection certificates for pharmaceutical and plant protection products – European Commission – Internal Market, Industry, Entrepreneurship and SMEs, accessed July 27, 2025, https://single-market-economy.ec.europa.eu/industry/strategy/intellectual-property/patent-protection-eu/supplementary-protection-certificates-pharmaceutical-and-plant-protection-products_en