Executive Summary

In the pharmaceutical ecosystem, time is the most expensive currency. The transition of a therapeutic asset from a patent-protected monopoly to a competitive commodity market—a phenomenon colloquially termed the “patent cliff”—represents one of the most violent shifts in revenue dynamics found in any sector of the global economy. For the innovator, it is an existential precipice; for the generic entrant, it is a gold rush. However, this rush is not egalitarian. The spoils of this transition are disproportionately awarded to the first mover—the generic manufacturer that successfully navigates the labyrinth of intellectual property litigation to secure the first market entry.

This report provides an exhaustive analysis of the structural, economic, and legal advantages enjoyed by first-to-file (FTF) generic applicants. Drawing on four decades of FDA data, recent earnings reports from major generic houses like Teva, Dr. Reddy’s, and Amneal, and landmark litigation outcomes, we demonstrate that the first generic entrant captures a market share and revenue premium that is effectively insurmountable for later entrants. We explore the mechanics of the 180-day exclusivity period, the devastating impact of “at-risk” launches gone wrong, and the evolving landscape of biosimilars where the rules of engagement are being rewritten. Furthermore, we examine how data intelligence platforms like DrugPatentWatch have become indispensable for identifying the precise windows of opportunity that define these multi-million-dollar victories.

This document is designed for pharmaceutical executives, legal counsel, and investors who require a granular understanding of how patent data translates into competitive advantage. It moves beyond surface-level observations to dissect the legal strategies, economic models, and real-world case studies that define the difference between a market leader and a market follower.

The Pre-1984 Landscape vs. The Hatch-Waxman Revolution

To fully appreciate the colossal value of the first-mover advantage today, one must understand the environment that preceded it. Before 1984, the pharmaceutical market was effectively bifurcated by a regulatory wall that made generic competition nearly impossible.

The Era of Perpetual Monopolies

Prior to the enactment of the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act, the regulatory pathway for generic drugs was practically nonexistent. If a manufacturer wanted to market a generic version of a post-1962 drug, they were required to conduct their own safety and efficacy trials. This requirement was not only economically prohibitive—costing millions of dollars to prove what was already known—but arguably unethical, as it required testing drugs on human subjects to generate data that already existed in the FDA’s vaults.1

Consequently, generic drugs accounted for a mere 19% of all prescriptions filled in the United States in 1984. Innovator companies enjoyed de facto perpetual monopolies, as the barrier to entry was not just the patent, but the regulatory cost of the NDA (New Drug Application) itself.3

The Grand Compromise

The Hatch-Waxman Act was a legislative masterpiece of compromise, designed to balance two competing societal interests: the need for affordable medicines and the need to incentivize the immense investment required for pharmaceutical innovation.

For the innovators, the Act provided:

- Patent Term Restoration: Allowing companies to recover a portion of the patent life lost during the lengthy FDA review process.2

- Data Exclusivity: Guaranteed periods of market protection (e.g., 5 years for New Chemical Entities) independent of patents.

For the generic industry, the Act created the modern Abbreviated New Drug Application (ANDA). This pathway allowed generics to bypass full clinical trials. Instead, they only needed to prove bioequivalence—that their product delivered the same amount of active ingredient into the bloodstream at the same rate as the Reference Listed Drug (RLD).5

However, the most significant innovation of the Act was the creation of a mechanism to challenge patents before they expired. This mechanism, the Paragraph IV certification, is the engine that drives the entire modern generic strategy.

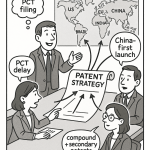

The Paragraph IV Certification: Strategic Aggression

The filing of an ANDA is not merely a submission of scientific data; it is a legal maneuver. The applicant must certify the status of the patents listed for the RLD in the FDA’s “Orange Book” (Approved Drug Products with Therapeutic Equivalence Evaluations).

The Four Certifications

- Paragraph I: No patent information has been filed.

- Paragraph II: The patent has expired.

- Paragraph III: The patent will expire on a specific date, and the generic will wait until then.

- Paragraph IV (PIV): The patent is invalid, unenforceable, or will not be infringed by the generic product.2

A Paragraph IV certification is a declaration of war. It is an “artificial act of infringement” created by the statute to confer jurisdiction on federal courts to hear patent disputes before the generic product is actually sold. It signals that the generic company intends to enter the market before the patent expiry dates listed in the Orange Book.

The Notification and the Trigger

Once a generic applicant files a PIV certification, they must send a “Notice Letter” to the brand owner and the patent holder. This letter must provide a detailed factual and legal basis for why the patent is invalid or not infringed.2

Upon receipt of this notice, the brand owner has a strict 45-day window to file a patent infringement lawsuit. If they sue within this window, it triggers an automatic 30-month stay of FDA approval for the generic application. This stay is the brand’s shield, freezing the regulatory clock to allow the litigation to proceed without the chaos of an at-risk launch.4

The Mechanics of Exclusivity: The 180-Day Gold Rush

Recognizing that challenging a patent is a high-risk, high-cost endeavor—often costing $2 million to $10 million in litigation fees—Congress created a potent incentive: the 180-day exclusivity period.1

The Brass Ring

The first applicant to submit a substantially complete ANDA containing a Paragraph IV certification is eligible for 180 days of market exclusivity. During this six-month window, the FDA is statutorily barred from approving any subsequent ANDAs for the same drug product.4

This creates a legally mandated duopoly. For six months, the market consists only of:

- The Brand Name Drug.

- The First-Filing Generic.

(Note: As we will discuss later, an “Authorized Generic” launched by the brand can also enter, complicating this picture).

The Financial Magnitude of the Prize

The economic value of this 180-day period cannot be overstated. Industry data and academic research consistently show that generic companies often generate 60% to 80% of their total lifetime profit for a specific molecule during this single six-month window.8

Why is this period so lucrative?

- Pricing Power: Because there is only one low-cost alternative, the first filer does not need to price at marginal cost. They typically offer a discount of 15% to 25% off the brand price, rather than the 90% discount seen in fully commoditized markets.2

- Volume Capture: PBMs and wholesalers, eager to lower costs, rapidly switch prescriptions to the generic. The first mover captures the vast majority of the generic market share—often 80% to 90%—within weeks of launch.9

- Entrenchment: Once a generic establishes its supply chain and commercial relationships, it is difficult for later entrants (who arrive six months later) to displace them without engaging in a race to the bottom on price.

“The 180-day exclusivity incentive has worked to deliver generics to patients well before brand patents expire… In 2020, generic medicines that were launched with 180 days of exclusivity saved the health care system nearly $20 billion.” — Association for Accessible Medicines.1

Economic Modeling: Price Erosion and Market Share Durability

To quantify the first-mover advantage, we must examine the economics of generic price erosion. The relationship between the number of competitors and the market price of a drug follows a non-linear curve that is well-documented by FDA and academic studies.

The Erosion Curve

FDA analysis of retail sales data reveals a consistent pattern. The price of a generic drug relative to the brand price drops precipitously as new competitors enter.

| Number of Generic Manufacturers | Generic Price as % of Brand Price | Price Reduction |

| 1 (First Mover) | 60% – 80% | 20% – 40% |

| 2 | ~50% – 55% | ~45% – 50% |

| 3 | ~33% – 40% | ~60% – 67% |

| 6 – 9 | ~10% – 20% | ~80% – 90% |

| 10+ | <5% | >95% |

10

This table illustrates the cliff. The first filer, operating in a duopoly or triopoly (if an Authorized Generic is present), enjoys prices that are substantially higher than later entrants. By the time the fourth or fifth generic enters, the price has collapsed. The “supranormal profits” available in the first six months effectively subsidize the development of the drug and the litigation costs incurred to invalidate the patent.9

Market Share Stickiness

The advantage is not just in price; it is in volume. Research indicates that the first generic entrant captures a market share advantage that persists for years. One study found that even 10 years after launch, the first entrant maintained a market share roughly 6 percentage points higher than later entrants.13

This “stickiness” is driven by several factors:

- Supply Chain inertia: Wholesalers and pharmacies prefer stability. Once they have stocked the first generic, switching to a second or third requires a compelling financial reason (i.e., a deeper discount).

- Reliability: The first mover proves their ability to supply the market. Later entrants must compete against an incumbent with a proven track record.

- Contracting: First movers often lock in long-term contracts with major purchasing consortiums during the exclusivity period.

For injectable drugs, which have higher manufacturing barriers and are often sold directly to hospitals or clinics, the first-mover advantage is even more durable. The market size for injectables is often smaller, meaning it may not support more than two or three competitors, leaving the first mover with a permanent dominant position.14

The Brand Empire Strikes Back: Authorized Generics

The 180-day exclusivity period is a monopoly on the generic side of the ledger, but it is not a total monopoly. The Hatch-Waxman Act prevents the FDA from approving other ANDAs, but it does not prevent the brand owner from launching its own generic version. This is the Authorized Generic (AG).

An AG is the exact same drug, manufactured on the brand’s production line, but packaged with a generic label. It is approved under the brand’s NDA, not an ANDA, so it is not subject to the 180-day block.15

The AG as a “Tax” on Exclusivity

Brand companies frequently launch an AG on the exact same day the first-filing generic launches. This strategic move effectively converts the generic’s monopoly into a duopoly (First Filer + AG).

The impact on the first filer is devastating. According to FTC data:

- Revenue Reduction: The presence of an AG reduces the first-filer’s revenue by 40% to 52% during the 180-day period.15

- Price Erosion: Wholesale prices drop by an additional 7% to 14% when an AG is present compared to when one is not.18

- Long-Term Impact: The revenue depression persists even after the exclusivity period ends. First-filer revenues are 53% to 62% lower in the 30 months following exclusivity if they faced an AG.17

For a generic strategist using DrugPatentWatch, predicting the likelihood of an AG launch is critical. If the brand company has a history of using AGs (like Pfizer or Merck), the revenue model for the Paragraph IV challenge must be discounted by roughly half.

The Settlement Lever

The threat of an AG launch is so potent that it is often used as a bargaining chip in patent settlements. Brand companies may agree not to launch an AG in exchange for the generic company delaying its entry date. The FTC views these “no-AG” agreements as a form of “reverse payment” or “pay-for-delay,” arguing that they harm consumers by delaying genuine competition.17

Calculating the Gamble: The “At-Risk” Launch Phenomenon

While the 30-month stay is designed to allow litigation to resolve before launch, the stay eventually expires. If the district court litigation is still ongoing, or if the generic wins at the district court level but the brand appeals, the generic company faces a monumental decision: Launch At Risk.

An “at-risk” launch occurs when a generic manufacturer begins selling its product before a final, non-appealable court decision has confirmed the patent is invalid or not infringed.

The Risk-Reward Calculus

- The Reward: If the generic launches early, they gain months or years of sales before competitors can enter. In the case of a blockbuster like Plavix or Protonix, this can mean hundreds of millions of dollars per month.

- The Risk: If the appellate court overturns the lower court’s decision and finds the patent valid and infringed, the generic company is liable for damages. Crucially, these damages are not based on the generic’s meager profits, but on the brand’s lost profits (price erosion + lost volume), which can be tripled for willful infringement.4

This asymmetry—generic profits vs. brand lost profits—makes the at-risk launch one of the most dangerous gambles in corporate law.

Case Study: The Protonix Catastrophe ($2.15B Lesson)

The cautionary tale that haunts every generic boardroom is the case of Protonix (pantoprazole).

The Setup

Wyeth (later acquired by Pfizer) marketed Protonix, a blockbuster proton pump inhibitor for acid reflux. Teva Pharmaceuticals and Sun Pharma both filed ANDAs with Paragraph IV certifications challenging the validity of the Protonix patent.

The Gamble

The 30-month stay expired, and although the patent litigation was ongoing, Teva and Sun decided to launch at risk in December 2007 and January 2008, respectively. They were betting that the patent would be found invalid for obviousness (double patenting).20

The impact was immediate. Protonix sales plummeted 80% as the generic entrants flooded the market. In 2008 alone, brand sales dropped from a peak of $1.9 billion to just $395 million.21

The Verdict

The gamble failed. In April 2010, a jury in New Jersey upheld the validity of the Protonix patent. Teva and Sun were found to have infringed.

The Damages

Because the launch was “at risk,” Pfizer sought damages for the immense lost profits during the period the generics were on the market. In June 2013, after years of wrangling, Teva and Sun agreed to a settlement of $2.15 billion.

- Teva’s Share: $1.6 billion.

- Sun’s Share: $550 million.22

This settlement remains one of the largest in pharmaceutical history. It wiped out years of generic profits and serves as a stark reminder that the first-mover advantage carries existential risk if the legal foundation is not rock-solid.

Case Study: The Plavix Injunction and Apotex’s Risk

Another illustrative example involves Plavix (clopidogrel), the anti-platelet blockbuster marketed by Bristol-Myers Squibb (BMS) and Sanofi.

The Failed Settlement

Apotex, a Canadian generic giant, challenged the Plavix patent. Initially, the parties attempted to settle, but the agreement was rejected by state attorneys general and antitrust regulators. Frustrated and emboldened, Apotex launched its generic clopidogrel “at risk” in August 2006.23

The Market Flood

Apotex flooded the channel. In just a few weeks, they shipped months’ worth of inventory to pharmacies. BMS/Sanofi immediately sought a preliminary injunction.

The Outcome

The court granted the injunction on August 31, 2006, ordering Apotex to stop sales. However, the court did not order a recall of the product already shipped. This created a bizarre market dynamic where Apotex had sold hundreds of millions of dollars of product in a 3-week window, which remained on pharmacy shelves for months, decimating Plavix sales even while the injunction was in place.24

Ultimately, Apotex lost the patent trial. In a final judgment years later, Apotex was ordered to pay $442 million in damages plus interest to BMS/Sanofi.25 While smaller than the Protonix payout, it reinforced the danger of at-risk launches.

Case Study: Lipitor – The Perfect Launch

In contrast to the disasters of Protonix and Plavix, the launch of generic Lipitor (atorvastatin) in November 2011 represents the “perfect” execution of the first-mover strategy.

The Scenario

Lipitor was the best-selling drug in the world, with peak sales of nearly $13 billion. Ranbaxy (now Sun Pharma) was the first filer. Watson Pharmaceuticals (now Teva) was authorized by Pfizer to launch an Authorized Generic.

The Execution

Ranbaxy and Watson launched simultaneously. Because the launch was timed with patent expiration (and settlements), there was no at-risk liability.

- Market Capture: The two generics captured over 50% of the market within weeks.

- Price Stability: For the first 180 days, the price erosion was managed. The generic traded at a significant discount to the brand but far above the commodity floor.

- Revenue: This period generated hundreds of millions in revenue for the generic companies and saved the healthcare system billions.26

This case demonstrates the “system working as intended”—a duopoly period that rewards the challenger and the brand (via the AG) while transitioning the market to lower prices.

The Biosimilar Evolution: Interchangeability as the New Exclusivity

As the industry shifts from small molecules to biologics, the concept of first-mover advantage is evolving. The Biologics Price Competition and Innovation Act (BPCIA) created the pathway for biosimilars, but the dynamics are different.

The Substitution Barrier

For small-molecule drugs (like Lipitor), substitution is automatic. If a doctor writes “Atorvastatin,” the pharmacist dispenses the generic.

For biosimilars, substitution is not automatic—unless the biosimilar is designated as “Interchangeable” by the FDA. Without this designation, a pharmacist cannot swap the brand (e.g., Lantus) for the biosimilar (e.g., Basaglar) without a new prescription. This friction dramatically slows market share uptake for standard biosimilars.28

Interchangeability: The Semglee Case Study

Semglee (insulin glargine-yfgn), developed by Viatris and Biocon, became the first interchangeable biosimilar to Sanofi’s Lantus in July 2021. This designation allowed it to be substituted at the pharmacy counter.

The Impact:

- Market Share: Following the interchangeability designation and strategic formulary placement (e.g., with Express Scripts), Semglee’s market share in the commercial channel jumped significantly. In the employer-sponsored insurance market, Semglee’s share rose by over 19 percentage points in early 2022.30

- The Driver: Research indicates that while interchangeability was the technical enabler, the real driver was payer coverage. Interchangeability gave PBMs the confidence to put Semglee on the “preferred” tier, locking out Lantus.31

The Humira Wars: Why Biologics Defy Small-Molecule Logic

The launch of biosimilars for AbbVie’s Humira (adalimumab) in 2023 serves as a critical counter-example to the small-molecule trend. Humira is the highest-grossing drug of all time.

- Amjevita (Amgen) launched first in January 2023.

- Cyltezo (Boehringer Ingelheim) launched as the first interchangeable biosimilar in July 2023.

Despite a flood of 10+ biosimilars, Humira retained 96% market share a year after the first launch.32 Why?

- Rebate Walls: AbbVie used aggressive contracting to keep Humira on formularies.

- Pricing Complexity: Biosimilars launched with dual pricing (high WAC/high rebate vs. low WAC/low rebate), confusing the market.

- Inertia: Unlike a pill, switching a patient on a complex injectable biologic is clinically and psychologically difficult.

Insight: In biologics, “first mover” status is less about immediate volume capture and more about securing long-term formulary access. The “first” biosimilar gets the first crack at PBM contracts, but the erosion curve is far slower—years, not months.33

Financial Forensic Analysis: 2024-2025 Earnings Impact

Analyzing the transcripts of recent earnings calls from major generic players confirms that the “First-Filer” strategy remains the primary engine of alpha in the sector.

Teva Pharmaceutical Industries (Q3 2024 / FY 2024)

Teva’s recent financial performance highlights the critical role of “complex generics.” In their earnings calls, management explicitly cited the launch of generic Revlimid (lenalidomide) as a key revenue stabilizer.

- Revlimid Strategy: Teva was one of the first to settle with BMS, allowing for a volume-limited launch in 2022. This created a “quasi-exclusivity” where only a few players shared the market, keeping prices and margins high compared to a fully genericized drug.

- Impact: This high-margin revenue helped offset erosion in Teva’s base generic portfolio (like Copaxone). Teva’s generic revenues in North America grew, driven largely by these specific complex launches.35

Dr. Reddy’s Laboratories (FY 2024 / Q1 2025)

Dr. Reddy’s has been a standout performer, with its North American generic business crossing the $1 billion mark.

- The Driver: The company repeatedly points to lenalidomide (gRevlimid) as a primary contributor. Like Teva, Dr. Reddy’s secured a settlement allowing early, volume-limited entry.

- Financials: The company reported “highest ever” quarterly revenues and profits in recent quarters, explicitly linking this to “new product launches” in the US, a code word for the high-value Revlimid settlement.38

- Suboxone Payout: Dr. Reddy’s also received a $72 million settlement payout from Indivior regarding Suboxone litigation, further monetizing their aggressive IP strategy.41

Amneal Pharmaceuticals (Q3 2025 Outlook)

Amneal has beaten earnings expectations by focusing on “Affordable Medicines” (generics) in complex categories.

- Strategy: Rather than fighting for the 10th slot on a commodity pill, Amneal targets complex injectables and biosimilars where they can be one of only 2-3 entrants.

- Results: Their Q3 2025 earnings showed a 12% revenue increase, driven by “new product launches” in the complex space. Their adjusted EBITDA grew, validating the strategy of prioritizing high-barrier-to-entry markets over volume.43

The Future of First-Mover Advantage: Regulatory Headwinds and Complex Generics

The landscape is shifting. Three key trends will define the next decade of first-mover advantage.

1. FTC Crackdown on “Junk Patents”

The FTC has launched a crusade against improper Orange Book listings. Brand companies often list patents on inhaler devices, caps, or distribution systems—patents that do not claim the active ingredient—to trigger the 30-month stay.

- Action: In 2023-2024, the FTC challenged over 300 such listings. In cases like Teva v. Amneal (asthma inhalers), courts have ordered these patents delisted.46

- Implication: By removing these “junk patents,” the FTC is removing the artificial barriers that delay generic entry. This accelerates the timeline for all generics, potentially shortening the window between the first filer and the rest of the pack, diluting the exclusivity value.

2. The Rise of Complex Generics

As the market for simple oral solids becomes hyper-commoditized (prices dropping >95%), the “smart money” is moving to complex generics (long-acting injectables, inhalation, transdermals).

- Higher Barriers: These products are harder to copy. Proving bioequivalence for a long-acting injectable (like Invega Sustenna or Abilify Maintena) requires complex clinical studies.

- Longer Tail: Because fewer companies can make them, the “first mover” in a complex generic might face only 1 or 2 competitors for years. This extends the “supranormal profit” window from 180 days to 3-5 years.47

3. 505(b)(2) as the Alternative

Companies are increasingly using the 505(b)(2) pathway. This allows a manufacturer to take an existing drug and change the dosage form or route of administration (e.g., turning a pill into a liquid).

- Advantage: This results in a new branded product with its own 3-year exclusivity, bypassing the generic “race to the bottom” entirely. It creates a new “first mover” category that competes on differentiation rather than just price.49

Conclusion

The axiom holds true: in the generic drug industry, speed is solvency. The first generic launch does not merely possess a competitive edge; it inhabits an entirely different economic reality than the entrants that follow. The first mover enjoys a legally protected duopoly, pricing power, and a window of supranormal profits that often funds the next decade of R&D.

However, this advantage is not guaranteed by speed alone. It is achieved through the precise calibration of legal aggression (Paragraph IV challenges), scientific excellence (bioequivalence of complex molecules), and market intelligence (predicting AG launches and patent expiries).

For pharmaceutical executives and investors, the lesson is clear: portfolio value is not defined by the number of ANDAs held, but by the number of first-to-file positions secured. In a market characterized by relentless deflation, the 180-day exclusivity period remains the single most important asset class in the generic ecosystem. Platforms like DrugPatentWatch act as the radar system for this warfare, identifying the vulnerable patents that, when successfully challenged, unlock billions in value.

Key Takeaways

- The 90% Rule: First generic entrants typically capture up to 90% of the generic market share. This advantage is “sticky” and persists for years due to supply chain inertia and long-term contracts.9

- The Duopoly Premium: During the 180-day exclusivity period, the first generic competes only with the brand (and potentially an Authorized Generic). This allows for pricing at a 20-30% discount, whereas subsequent entry drives prices down by >90%.10

- Litigation is Strategy: The Paragraph IV certification is the primary tool for creating value. However, “at-risk” launches carry existential financial risks, as evidenced by the $2.15 billion Protonix verdict against Teva and Sun.20

- The Authorized Generic Threat: Brands effectively tax the first-mover’s prize by launching Authorized Generics, which cut the first filer’s revenue by roughly 50% during the exclusivity window.15

- Biosimilars Play by Different Rules: For biologics, “first mover” status is valuable but slower to materialize due to rebate walls and lack of automatic substitution. Interchangeability is the key to unlocking “generic-like” adoption curves, as seen with Semglee.30

- Intelligence is Critical: Platforms like DrugPatentWatch are essential for identifying vulnerable patents and timing entry to maximize the probability of securing First-Filer status.6

Frequently Asked Questions (FAQ)

Q1: Does the 180-day exclusivity period guarantee a monopoly for the generic company?

A: No. It guarantees that the FDA will not approve other generic applications (ANDAs) for 180 days. However, it does not prevent the brand-name company from launching its own Authorized Generic (AG). An AG is approved under the brand’s NDA and can compete directly with the first filer from day one, often capturing significant market share and forcing prices down earlier than the generic company planned.7

Q2: Why do some generic companies launch “at risk,” and what are the consequences?

A: Companies launch “at risk” when they receive FDA approval while patent litigation is still pending (usually after the 30-month stay expires) and they are confident they will win the court case. The upside is gaining months or years of revenue before the patent officially expires. The downside is that if they lose the case later (as Teva did with Protonix), they can be liable for triple the brand’s lost profits, which can amount to billions of dollars.20

Q3: How does the “First-Mover” advantage differ between simple pills and complex injectables?

A: For simple oral solids (pills), the market floods quickly after the 180-day window, driving prices down by 90% rapidly. For complex generics (injectables, inhalers), the technical barriers to entry are higher. Even after exclusivity expires, there may be only 2-3 competitors for years. This allows the first mover in a complex category to maintain high margins and market share for a much longer duration than in the commodity pill market.14

Q4: What is the role of “interchangeability” in the biosimilar first-mover advantage?

A: For small-molecule generics, substitution is automatic at the pharmacy. For biosimilars, it is not, unless the FDA deems the product “interchangeable.” A biosimilar with this designation (like Semglee) has a massive advantage because it can be swapped for the brand (Lantus) without a doctor’s new prescription. This status allows the interchangeable biosimilar to capture market share much faster than non-interchangeable competitors.30

Q5: How do “Pay-for-Delay” settlements impact first-mover advantage?

A: In these settlements, a brand company pays the first-filing generic to delay their launch until a specific date. This hurts consumers by keeping prices high, but it secures a guaranteed launch date for the generic without the risk of litigation loss. Crucially, it often “parks” the 180-day exclusivity, meaning no other generic can enter until the first filer finally launches and uses up their 180 days. This creates a bottleneck that blocks all competition, which is why the FTC aggressively scrutinizes these deals.8

Works cited

- The Hatch-Waxman 180-Day Exclusivity Incentive Accelerates Patient Access to First Generics, accessed November 26, 2025, https://accessiblemeds.org/resources/fact-sheets/the-hatch-waxman-180-day-exclusivity-incentive-accelerates-patient-access-to-first-generics/

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- EXAMINING ISSUES RELATED TO COMPETITION IN THE PHARMACEUTICAL MARKETPLACE: A REVIEW OF THE FTC REPORT, GENERIC DRUG ENTRY PRIOR TO PATENT EXPIRATION | Congress.gov, accessed November 26, 2025, https://www.congress.gov/event/107th-congress/house-event/LC17765/text

- Small Business Assistance | 180-Day Generic Drug Exclusivity – FDA, accessed November 26, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-180-day-generic-drug-exclusivity

- Inside the ANDA Approval Process: What Patent Data Can Tell You – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/inside-the-anda-approval-process-what-patent-data-can-tell-you/

- Mastering the Clock: A Strategic Guide to Timing ANDA Submissions Using Drug Patent Data – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/mastering-the-clock-a-strategic-guide-to-timing-anda-submissions-using-drug-patent-data/

- Guidance for Industry 180-Day Exclusivity When Multiple ANDAs Are Submitted on the Same Day – FDA, accessed November 26, 2025, https://www.fda.gov/files/drugs/published/180-Day-Exclusivity-When-Multiple-ANDAs-Are-Submitted-on-the-Same-Day.pdf

- Earning Exclusivity: Generic Drug Incentives and the Hatch-‐Waxman Act1 C. Scott – Stanford Law School, accessed November 26, 2025, https://law.stanford.edu/index.php?webauth-document=publication/259458/doc/slspublic/ssrn-id1736822.pdf

- First Generic Launch has Significant First-Mover Advantage Over Later Generic Drug Entrants – DrugPatentWatch – Transform Data into Market Domination, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/first-generic-launch-has-significant-first-mover-advantage-over-later-generic-drug-entrants/

- How to Use Drug Price Data for Generic Entry Portfolio Management and Prioritization, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/how-to-use-drug-price-data-for-generic-entry-pricing/

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – https: // aspe . hhs . gov., accessed November 26, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- New Evidence Linking Greater Generic Competition and Lower Generic Drug Prices – FDA, accessed November 26, 2025, https://www.fda.gov/media/133509/download

- Pharma’s first-to-market advantage | McKinsey, accessed November 26, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/pharmas-first-to-market-advantage

- Quantifying the First-Mover Advantage in Generic Pharmaceutical Markets, accessed November 26, 2025, https://ashecon.confex.com/ashecon/2020/meetingapp.cgi/Paper/9883

- Authorized Generic Drugs: Short-Term Effects and Long-Term Impact | Federal Trade Commission, accessed November 26, 2025, https://www.ftc.gov/sites/default/files/documents/reports/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission.pdf

- FTC Issues Long-Awaited Final Report on Authorized Generics; Report Examines Both the Short-Term Effects and Long-Term Impact on Competition and Drug Prices – FDA Law Blog, accessed November 26, 2025, https://www.thefdalawblog.com/2011/08/ftc-issues-long-awaited-final-report-on-authorized-generics-report-examines-both-the-short-term-effe/

- FTC Report Examines How Authorized Generics Affect the Pharmaceutical Market, accessed November 26, 2025, https://www.ftc.gov/news-events/news/press-releases/2011/08/ftc-report-examines-how-authorized-generics-affect-pharmaceutical-market

- Antitrust Alert: FTC Releases Report on Authorized Generic Drugs | Insights – Jones Day, accessed November 26, 2025, https://www.jonesday.com/en/insights/2011/09/antitrust-alert–ftc-releases-report-on-authorized-generic-drugs

- Antitrust and Authorized Generics – Stanford Law Review, accessed November 26, 2025, https://review.law.stanford.edu/wp-content/uploads/sites/3/2020/03/Peelish-72-Stan.-L.-Rev.-791.pdf

- Teva and Sun pay dearly for ‘at-risk’ generic Protonix launch – PMLiVE, accessed November 26, 2025, https://pmlive.com/pharma_news/teva_and_sun_pay_dearly_for_at-risk_generic_protonix_launch_482954/

- Teva’s at-risk Protonix launch could cost $2B-plus | Fierce Pharma, accessed November 26, 2025, https://www.fiercepharma.com/regulatory/teva-s-at-risk-protonix-launch-could-cost-2b-plus

- Pfizer Obtains $2.15 Billion Settlement From Teva And Sun For Infringement Of Protonix® Patent, accessed November 26, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_obtains_2_15_billion_settlement_from_teva_and_sun_for_infringement_of_protonix_patent

- Plavix fzzranchise in jeopardy – PMC – NIH, accessed November 26, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7096798/

- Preliminary injunction ordered in PLAVIX® patent infringement case – Apotex to halt sales of unauthorized generic – Sanofi US News, accessed November 26, 2025, https://www.news.sanofi.us/press-releases?item=118385

- Sanofi and Bristol-Myers Squibb Collect Damages in Plavix Patent Litigation with Apotex, accessed November 26, 2025, https://news.bms.com/news/details/2012/Sanofi-and-Bristol-Myers-Squibb-Collect-Damages-in-Plavix-Patent-Litigation-with-Apotex/default.aspx

- Managing the challenges of pharmaceutical patent expiry: a case study of Lipitor, accessed November 26, 2025, https://www.researchgate.net/publication/309540780_Managing_the_challenges_of_pharmaceutical_patent_expiry_a_case_study_of_Lipitor

- Trends in use of Lipitor after introduction of generic atorvastatin, accessed November 26, 2025, https://www.gabionline.net/generics/research/Trends-in-use-of-Lipitor-after-introduction-of-generic-atorvastatin

- Will interchangeable insulin be more affordable in the U.S.? | MDedge – The Hospitalist, accessed November 26, 2025, https://blogs.the-hospitalist.org/content/will-interchangeable-insulin-be-more-affordable-us

- Pharmacist’s Corner: Semglee vs. Lantus: What’s the Difference? – Veterinary Medicine at Illinois, accessed November 26, 2025, https://vetmed.illinois.edu/2022/05/29/pharmacists-corner-semglee-vs-lantus-whats-the-difference/

- Insurance Coverage, Not Substitution Rules, Fueled Semglee’s Adoption, accessed November 26, 2025, https://www.managedhealthcareexecutive.com/view/insurance-coverage-not-substitution-rules-fueled-semglee-s-adoption

- Improved Insurance Coverage Increased Biosimilar Semglee’s Market Share After The FDA’s Interchangeability Designation | Health Affairs, accessed November 26, 2025, https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.2025.00443

- AbbVie’s Humira Loses Only 4% of Market Share to Biosimilars: Report – BioSpace, accessed November 26, 2025, https://www.biospace.com/abbvie-s-humira-has-lost-only-4-percent-of-market-share-to-biosimilars-report

- AbbVie’s Humira loses some ground in high-stakes battle against biosimilars: report, accessed November 26, 2025, https://www.fiercepharma.com/pharma/shrinking-market-share-abbvies-humira-loses-ground-battle-against-biosimilars-report

- The Rise of Humira Biosimilars and the Battle for Market Share – Healthcare Huddle, accessed November 26, 2025, https://www.healthcarehuddle.com/p/rise-humira-biosimilars-battle-market-share

- Earnings call transcript: Teva’s Q2 2025 shows steady growth, stock rises By Investing.com, accessed November 26, 2025, https://www.investing.com/news/transcripts/earnings-call-transcript-tevas-q2-2025-shows-steady-growth-stock-rises-93CH-4325804

- TEVJF – Teva Pharmaceutical Industries Ltd Earnings Call Transcripts | Morningstar, accessed November 26, 2025, https://www.morningstar.com/stocks/pinx/tevjf/earnings-transcripts

- Teva Reports Fourth Quarter and Full Year 2022 Financial Results, accessed November 26, 2025, https://ir.tevapharm.com/news-and-events/press-releases/press-release-details/2023/Teva-Reports-Fourth-Quarter-and-Full-Year-2022-Financial-Results/default.aspx

- Dr. Reddy’s Laboratories Limited (RDY) Earnings Call Transcripts – Discounting Cash Flows, accessed November 26, 2025, https://discountingcashflows.com/company/RDY/transcripts/2024/4/

- Dr. Reddy’s Q2 & H1FY26 Financial Results, accessed November 26, 2025, https://www.drreddys.com/cms/sites/default/files/2025-10/EarningsRelease_Q2FY26_24102025_Final.pdf

- Dr. Reddy’s Q3 & 9MFY25 Financial Results – Business Wire, accessed November 26, 2025, https://www.businesswire.com/news/home/20250123328098/en/Dr.-Reddys-Q3-9MFY25-Financial-Results

- Dr. Reddy’s To Get $72-Million Settlement Pay In Opioid Patent Dispute – NDTV Profit, accessed November 26, 2025, https://www.ndtvprofit.com/business/dr-reddys-to-get-72-million-settlement-pay-in-opioid-patent-dispute

- Dr Reddy’s Gets $72m Payout From Suboxone Settlement – Citeline News & Insights, accessed November 26, 2025, https://insights.citeline.com/GB151984/Dr-Reddys-Gets-$72m-Payout-From-Suboxone-Settlement/

- Earnings call transcript: Amneal Pharma Q3 2025 beats EPS forecast, stock rises, accessed November 26, 2025, https://www.investing.com/news/transcripts/earnings-call-transcript-amneal-pharma-q3-2025-beats-eps-forecast-stock-rises-93CH-4320192

- Amneal Reports Third Quarter 2025 Financial Results, accessed November 26, 2025, https://investors.amneal.com/news/press-releases/press-release-details/2025/Amneal-Reports-Third-Quarter-2025-Financial-Results/default.aspx

- Amneal Reports Fourth Quarter and Full Year 2024 Financial Results, accessed November 26, 2025, https://investors.amneal.com/news/press-releases/press-release-details/2025/Amneal-Reports-Fourth-Quarter-and-Full-Year-2024-Financial-Results/default.aspx

- Recent Developments in Orange Book Litigation: How Patent Disputes Shape Prescription Drug Affordability – O’Neill Institute for National and Global Health Law, accessed November 26, 2025, https://oneill.law.georgetown.edu/recent-developments-in-orange-book-litigation-how-patent-disputes-shape-prescription-drug-affordability/

- Abilify Maintena Market Size & Share [2033], accessed November 26, 2025, https://www.marketgrowthreports.com/market-reports/abilify-maintena-market-102668

- Otsuka’s Longer-Acting Schizophrenia Injection to Offset Abilify Patent Loss – BioSpace, accessed November 26, 2025, https://www.biospace.com/otsuka-s-longer-acting-schizophrenia-injection-to-offset-abilify-patent-loss-globaldata

- The Art of the Nudge: Timing Your 505(b)(2) NDA with Precision Using Drug Patent Data, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-art-of-the-nudge-timing-your-505b2-nda-with-precision-using-drug-patent-data/

- The Role of Litigation Data in Predicting Generic Drug Launches – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-role-of-litigation-data-in-predicting-generic-drug-launches/

- FDA Approves First Generic to Restasis Eye Drops | Managed Healthcare Executive, accessed November 26, 2025, https://www.managedhealthcareexecutive.com/view/fda-approves-first-generic-to-restasis-eye-drops