I. Executive Summary

The pharmaceutical industry stands at a pivotal juncture, undergoing a profound transformation away from its decades-long reliance on the “blockbuster” drug model. This traditional paradigm, characterized by high-volume sales of drugs for widespread conditions, is rapidly sunsetting. This shift is primarily driven by the imminent “patent cliff,” a period where numerous high-revenue drugs are losing their market exclusivity, exposing pharmaceutical companies to significant revenue erosion from generic and biosimilar competition. This necessitates a profound re-evaluation of established strategies across the entire pharmaceutical value chain, from early-stage research and development to commercialization and business operations.

To ensure sustained growth and maintain competitive advantage in this evolving landscape, pharmaceutical companies are compelled to adopt new strategic imperatives. These include a decisive pivot towards specialized and precision medicine, leveraging advanced technological capabilities such as Artificial Intelligence (AI) and digital biomarkers, and implementing innovative market access and pricing strategies. Furthermore, optimizing portfolios through strategic mergers, acquisitions, and divestitures, alongside evolving intellectual property strategies, are critical for navigating this complex environment. The industry’s focus is shifting from a “mass market” approach to “niche market” solutions, demanding greater agility, patient-centricity, and data-driven decision-making to deliver value in a more targeted and efficient manner.

II. The Sunset of the Blockbuster Era

Defining the Blockbuster Drug: Characteristics and Historical Significance

The term “blockbuster drug” emerged in the pharmaceutical industry to describe medications achieving extraordinary market success, typically generating over $1 billion in annual sales.1 These drugs historically addressed common, widespread health conditions such as high cholesterol, hypertension, or type 2 diabetes, enabling high sales volumes and market dominance within their therapeutic categories.1 Key characteristics included robust patent protection, which prevented generic competition and allowed manufacturers to command premium prices and profits.1 Blockbusters often represented significant advancements in medical treatment, offering improved efficacy or convenience, leading to widespread brand recognition and longevity in the market.1 Notable examples include Lipitor (cholesterol management), Viagra (erectile dysfunction), and Humira (autoimmune conditions), which not only revolutionized patient care but also generated substantial profits for their developers.1 Zantac, a peptic ulcer treatment, was the first pharmaceutical product to achieve $1 billion in annual sales in 1987, solidifying the “blockbuster” concept.3 This model was crucial for pharmaceutical companies to offset the immense costs and high failure rates associated with drug development, where bringing a new drug to market could exceed $2 billion, and only about 12% of drugs entering clinical trials ultimately gained FDA approval.2

The definition of a “blockbuster drug” (>$1 billion annual sales) has remained constant since 1987.3 However, the cost of drug development has dramatically increased over this period, often exceeding $2 billion per drug.2 If the revenue threshold for “blockbuster” status has not adjusted for inflation or the rising R&D costs over three decades, it implies that achieving this status today requires a much greater

relative market impact and profitability than it did in the past. The original blockbuster model was heavily reliant on broad market applicability and extended, unchallenged patent protection.1 The current environment, marked by patent cliffs and a strategic pivot towards specialized, often high-cost, niche therapies 4, suggests that the conditions that fostered the widespread emergence of blockbusters are no longer universally prevalent or sustainable. This indicates that the “blockbuster era” was a specific historical phase enabled by a particular market and regulatory environment, and its decline is a structural shift, not merely a temporary setback. Pharmaceutical companies must now diversify their revenue streams and innovate more consistently across a wider range of specialized products, rather than relying on the discovery of the next single, universally applicable mega-drug. This moves the industry from a “winner-take-all” mentality to a “portfolio of niche winners” approach, requiring different R&D and commercialization strategies.

The Patent Cliff: Magnitude of Revenue at Risk and its Industry-Wide Impact

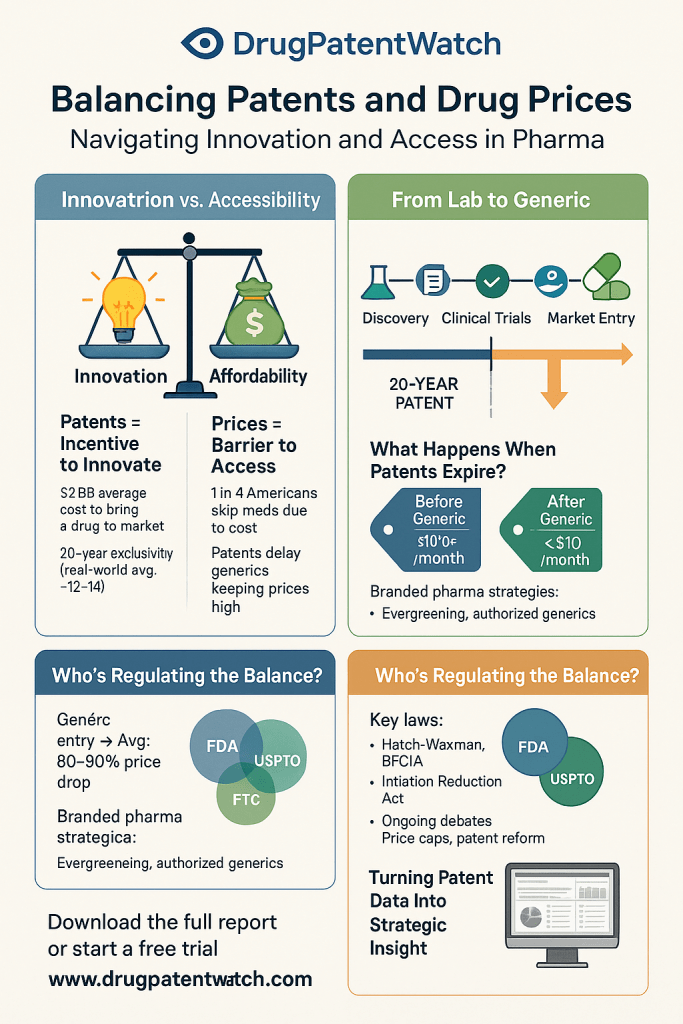

The “patent cliff” is a critical phenomenon in the pharmaceutical industry, signifying a sharp and often precipitous decline in revenue for pharmaceutical companies as their blockbuster drugs lose patent exclusivity.7 While drug patents typically offer 20 years of protection from the filing date, the lengthy process of drug development and regulatory approval significantly shortens the “effective patent life” for market exclusivity, often averaging 12-14 years.2 Once patents expire, generic and biosimilar competitors are legally permitted to enter the market, leading to a rapid and substantial erosion of the branded drug’s sales, often by 80% or more within the first year.2

The financial magnitude of the current patent cliff is immense: approximately $300 billion in annual revenue is projected to be at risk through 2030, forcing major pharmaceutical players to adapt and seek new avenues for growth.7 Specifically, 190 drugs, including 69 blockbusters, are set to lose their patent exclusivity by 2030.7 The U.S. market alone is anticipated to lose over $230 billion between 2025 and 2030.12 Key oncology drugs, such as Merck’s Keytruda (which generated over $29 billion in 2024) and Johnson & Johnson’s Darzalex/Faspro, are among the top-selling drugs forecast to lose U.S. exclusivity by 2029, with expected revenue declines.12 Companies like Bristol Myers Squibb are particularly exposed, with two major blockbuster drugs, Eliquis and Opdivo, losing exclusivity, which accounted for a significant share of their 2024 revenue.12

Historical examples underscore this impact: Pfizer’s Lipitor, a cholesterol-lowering drug, experienced predictions of an 87% reduction in U.S. sales in the year following its patent expiration in late 2012.13 Similarly, the expiration of clopidogrel’s (Plavix) patent led to intense price competition and significant market share shifts to generics, with prices falling to as low as 6.6% to 66% of the pre-expiry price.15 Esomeprazole (Nexium) also saw substantial price reductions, sometimes exceeding 40%.17 This rapid decline places immense pressure on pharmaceutical companies to develop new and innovative therapies and to accelerate their time-to-market while simultaneously enhancing operational efficiency and cutting costs.7

The sheer scale of revenue at risk and the drastic revenue loss post-patent are not merely financial challenges; they are existential threats to the traditional pharmaceutical business model. This forces companies to fundamentally “rethink revenue strategies, pipeline investments, and lifecycle management”.12 The response is multifaceted: it is not enough to simply develop new drugs; companies must also accelerate time-to-market, maintain compliance, and cut costs through operational efficiencies.7 This includes leaning into reorganization, artwork automation, AI, and automated quality checks.7 The patent cliff thus acts as a powerful external shock, compelling a rapid and comprehensive strategic transformation rather than incremental adjustments. This phenomenon drives a strategic shift from a reactive “loss mitigation” mindset to a proactive “growth reinvention” strategy. Companies are compelled to diversify their portfolios beyond single blockbuster dependence, invest in new therapeutic modalities, and optimize their operational footprint to remain competitive.

Beyond Patents: Other Factors Driving the Post-Blockbuster Transition

While the patent cliff is a primary driver, several other interconnected factors are contributing to the industry’s shift away from the blockbuster model. The escalating costs of Research & Development (R&D), often exceeding $2 billion per new drug, coupled with persistently low success rates (only about 12% of drugs entering clinical trials gain FDA approval), make the traditional, broad-market blockbuster approach increasingly unsustainable and risky.2 This high-risk, high-cost environment necessitates more efficient and targeted R&D strategies.

Furthermore, there is growing pressure from governments and insurers worldwide to reduce drug prices and demand greater demonstrable value from therapies.19 The traditional “fee-for-service” model is being challenged, with a growing emphasis on value-based care and outcomes-driven reimbursement.19 This societal and payer pressure for affordability and proven value directly impacts the commercial viability of drugs, especially high-cost innovative therapies.

The evolving regulatory landscape is also playing a significant role. Regulatory bodies globally are adapting their approval processes to accommodate advancements in drug development while maintaining stringent patient safety standards.5 This includes the development of expedited pathways for drugs addressing unmet medical needs, which influences R&D priorities.

Technological advancements, particularly in digital tools and analytics, are creating unprecedented opportunities for efficiency and innovation across the entire pharmaceutical value chain.23 These tools enable deeper insights into disease mechanisms, more efficient clinical trials, and optimized manufacturing processes. Lastly, the rise of empowered consumers, who are increasingly informed by their own health data (e.g., genetic history, wearable device data) and digital tools, are demanding more personalized and value-driven healthcare solutions.21 This shift in patient expectations is pushing companies towards patient-centric approaches in both development and commercialization.

The decline of the blockbuster era is not a singular event tied solely to patent expirations. Instead, it is a confluence of reinforcing pressures. High R&D costs and low success rates 2 make the

creation of new blockbusters economically challenging. Simultaneously, external demands from payers and governments for price reduction and value demonstration 19 reduce the

profitability of existing and future drugs, even if they achieve market success. Consumer empowerment 21 further pushes for personalized, value-driven solutions, aligning with the industry’s R&D pivot. These factors create a complex, interdependent system where a response in one area (e.g., R&D) inevitably impacts others (e.g., commercialization, business models). The “crisis as a way of life” 21 suggests that volatility and disruption are the new normal, requiring continuous, integrated adaptation rather than isolated tactical adjustments. Pharmaceutical companies must develop holistic and integrated strategies that address R&D efficiency, market access, pricing, and patient engagement simultaneously. A siloed or piecemeal approach to these challenges will likely prove ineffective. The industry is moving towards a model where success is defined by demonstrated patient outcomes and cost-effectiveness across targeted populations, rather than simply by the volume of sales from a few mass-market drugs. This necessitates a more agile and adaptive organizational structure.

Table 1: Illustrative Examples of Blockbuster Drugs and Their Patent Expiry Impact

| Drug Name | Therapeutic Area | Peak Annual Sales (Approx.) | Original Patent Expiry Year (US/EU) | Key Impact Post-Expiry | Relevant Snippets |

| Lipitor (atorvastatin) | Cholesterol Management | Billions (e.g., $12.5B in 2011) | US: Nov 2012, EU: May 2012 | Predicted 87% reduction in US sales within 1 year; significant price drops due to generic entry. | 1 |

| Humira (adalimumab) | Autoimmune Conditions (e.g., RA, Crohn’s) | $20.7B (2022) | US: 2023 | Significant decline in net prices with biosimilar competition; patent thickets used to delay generics. | 1 |

| Keytruda (pembrolizumab) | Oncology | $29B (2024) | US: 2029 | Forecasted revenue decline due to loss of exclusivity; still expected to be top-selling but with reduced market share. | 12 |

| Darzalex/Faspro (daratumumab) | Oncology | Top-selling (2024) | US: 2029 | Forecasted revenue decline due to loss of exclusivity; still expected to be top-selling but with reduced market share. | 12 |

| Flomax | Urology (BPH) | Not specified | Post-2010 | Lost market exclusivity, facing generic competition. | 12 |

| Cozaar/Hyzaar | Hypertension | Not specified | Post-2010 | Lost market exclusivity, facing generic competition. | 12 |

| Clopidogrel (Plavix) | Cardiovascular (antiplatelet) | Billions | Post-2012 (primary patent) | Profound ripple effect in pricing (6.6%-66% of original price) and market share (56%-92% generic share within years). | 15 |

| Esomeprazole (Nexium) | Gastric Acid Reflux | Billions | Varies by region, some until 2025 | Price reductions of 40%+ after generic entry; “evergreening” strategies used to extend exclusivity. | 17 |

This table serves as a central, impactful data visualization that directly addresses the core theme of the report: the “sunset of the blockbuster era.” It quantifies the problem by translating the abstract concept of the “patent cliff” into concrete, quantifiable terms, showing specific drugs, their peak revenues, and the dramatic financial impact of patent expiry. This makes the projected $300 billion revenue at risk 7 more tangible and relatable. By explicitly linking patent expiry dates to subsequent revenue declines and generic market penetration, the table clearly demonstrates the causal relationship that underpins the industry’s strategic shift. Including both drugs that

have lost exclusivity (e.g., Lipitor, Plavix) and those about to (e.g., Keytruda, Darzalex) highlights that the patent cliff is an ongoing, persistent challenge, not a past event, underscoring the continuous need for strategic adaptation. The stark figures in the “Key Impact Post-Expiry” column provide compelling evidence for why pharmaceutical companies are forced to evolve their R&D, commercialization, and business models. It sets the stage for the subsequent sections by demonstrating the urgency and necessity of the discussed strategies.

III. Reshaping Research & Development for a New Age

Strategic Pivot to Specialized and Precision Medicine: Biologics, Cell & Gene Therapies

The pharmaceutical industry is undergoing a transformative shift in its R&D strategies, moving away from broad-spectrum chemical drugs towards highly specialized and precision medicine. This pivot is marked by increased investment in novel therapeutic modalities such as biologics, cell therapies, and gene therapies.4 These new modalities represent the fastest-growing segment of the drug development pipeline, increasing from 11% to 21%.23

This strategic redirection is largely driven by the rising global prevalence of chronic and complex diseases, which necessitates more targeted and personalized solutions.6 Personalized medicine, which tailors treatments to individual patient profiles based on their unique genetic information, lifestyle, and medical history, is at the forefront of this shift.5 The global personalized medicine market is projected to grow significantly, reaching an estimated $869.9 billion by 2030 with an 8.5% Compound Annual Growth Rate (CAGR).24

Oncology remains the leading application area within personalized medicine, accounting for a 40.2% market share in 2024, propelled by increasing cancer incidences and the growing demand for customized therapies.24 Rare diseases also represent a significant and attractive focus area, often benefiting from expedited regulatory pathways and higher pricing due to unmet needs.6

Leading companies like Regeneron are leveraging a deep understanding of human biology and genetics to identify precise disease targets and pursue diverse therapeutic approaches, including protein therapeutics (antibodies), genetic medicines (gene therapy, gene editing, gene silencing), and cell therapies.29 This involves building proprietary technology platforms to improve and accelerate drug discovery and development.29 Examples of companies specializing in gene therapy include Krystal Biotech, CRISPR Therapeutics, Beam Therapeutics, Intellia Therapeutics, uniQure, Verve Therapeutics, and MeiraGTx.30 In cell therapy, pioneers include Novartis (with CAR-T cell therapy Kymriah) and Gilead Sciences/Kite Pharma (with Yescarta and Tecartus).32

The transition from blockbuster drugs (designed for mass markets) to specialized therapies like gene and cell therapies (often for rare or complex diseases) 4 signifies a strategic shift from a

volume-based R&D model to a value-based one. While the patient populations for these advanced therapies are typically smaller 26, their potential to offer “curative” or highly impactful “one-and-done” treatments 33 justifies significantly higher price tags (e.g., Zolgensma at $2.125 million, Hemgenix at $3.5 million).34 This represents a higher “value density” per patient, enabling companies to recoup substantial R&D investments despite a smaller overall market size.26 This strategic pivot is further reinforced by the emphasis on personalized medicine 6, where treatments are tailored for maximum efficacy and minimal adverse effects, thereby enhancing their perceived and actual value. This shift necessitates a fundamental change in R&D pipeline management, moving beyond traditional chemical synthesis to a deep scientific understanding of human genetics and biology.29 It requires significant investment in advanced technological platforms for drug discovery and development.29 This also alters the risk profile: while the upfront investment per drug candidate remains high, the potential for transformative outcomes in areas of high unmet need can lead to more predictable, albeit highly priced, market access.

The AI Revolution in Drug Discovery and Development

Artificial Intelligence (AI) and Machine Learning (ML) are not merely incremental tools but revolutionary forces reshaping nearly every stage of the pharmaceutical drug product lifecycle, from initial discovery and nonclinical research to clinical trials, manufacturing, and post-market surveillance.25

In accelerating drug discovery, AI algorithms, particularly machine learning models like Random Forest, SVM, neural networks, and deep learning models such as Convolutional Neural Networks (CNNs), can rapidly screen vast libraries of chemical compounds, predict drug-target interactions, and model complex biological systems with unprecedented speed and precision.25 This capability significantly reduces the time and expenditure traditionally associated with identifying promising drug candidates.25 Notable examples include Google DeepMind’s AlphaFold, which accurately predicts protein 3D structures, accelerating drug target discovery, and Exscientia’s AI-designed drug candidate DSP-1181, which reached clinical trials in just 12 months, a fraction of the typical 4-5 years.25

For optimizing drug development and clinical trials, AI analyzes large datasets from previous trials, electronic health records (EHRs), and genomic data to design more effective and efficient trials.25 AI enables “in silico” (computer-based) simulations to predict drug safety and efficacy before physical trials, optimizing parameters like patient demographics and dosage.25 AI algorithms also automate patient recruitment by filtering EHRs, with companies like Mendel AI demonstrating a 24-50% increase in accurate patient identification for oncology trials.25 Real-time monitoring tools, often AI-driven, track patient outcomes and predict treatment effectiveness, shortening development cycles and cutting costs.25

In manufacturing and supply chain management, AI facilitates predictive maintenance by analyzing real-time sensor data to anticipate equipment failures, minimizing downtime.25 It optimizes production processes to ensure consistent product quality and maximize yields.25 For example, Pfizer utilized AI in its COVID vaccine manufacturing to optimize processes and supply chain logistics, ensuring timely raw material delivery.25 Novartis has implemented AI in its global manufacturing plants for process automation and predictive maintenance, significantly reducing lost time.25

AI also plays a crucial role in personalized medicine and pharmacovigilance. It processes large volumes of genetic information to identify specific biomarkers, predicting individual patient responses to drugs based on their unique genome, lifestyle, and medical history.25 Platforms like IBM Watson Health and Tempus AI integrate genomic data, EHRs, and clinical research to assist physicians in tailoring treatments.25 Furthermore, AI enhances post-market surveillance by automatically collecting and analyzing adverse event reports, EHRs, and social media data to detect safety signals more efficiently than human analysis.25

Recognizing AI’s growing impact, regulatory bodies like the FDA are actively engaging with its use. The FDA’s Center for Drug Evaluation and Research (CDER) has seen a significant increase in drug application submissions using AI components and is committed to developing a risk-based regulatory framework that promotes innovation while safeguarding patient safety.36 CDER’s AI Council, established in 2024, provides oversight and coordination for AI initiatives, aiming to expand appropriate use of AI within the agency and enhance staff knowledge.36

The pervasive impact of AI across all stages of the drug lifecycle—from discovery to development, manufacturing, supply chain, and personalized medicine 25—indicates that AI is not merely a supplementary tool but a foundational technology. Its ability to “reduce time and expenditure” 25 and increase “precision” 25 directly addresses the critical challenges of high R&D costs and low success rates that characterized the traditional blockbuster model.2 AI’s role in facilitating specialized, data-intensive therapies and patient-centric models 6 makes it an indispensable component of the post-blockbuster strategy. The proactive stance of regulatory bodies like the FDA 36 further validates AI’s transformative, rather than merely supportive, role in the industry’s future. Companies that successfully integrate AI comprehensively across their operations will gain a significant and sustained competitive advantage. This advantage will manifest not only in faster and more efficient drug development but also in optimized manufacturing, resilient supply chains, and the ability to deliver truly personalized, value-driven therapies. This necessitates substantial investment in AI talent, infrastructure, and potentially new types of strategic partnerships with AI technology providers.11 It requires a fundamental shift in organizational capabilities and a data-first mindset.

Table 2: Key AI Applications Across the Drug Development Lifecycle

| Phase of Drug Development | Specific AI Application | Key Benefit | Example/Company | Relevant Snippets |

| Drug Discovery | Chemical Screening & Candidate Identification | Rapidly sifts vast libraries, identifies promising compounds. | Deep learning models, AlphaFold (Google DeepMind) for protein structures. | 25 |

| Drug-Target Interactions & Molecular Modeling | Predicts binding likelihood, designs novel molecules with desired properties. | Recurrent Neural Networks (RNNs), Generative Adversarial Networks (GANs). | 25 | |

| Pre-clinical | Predictive Toxicology & ADME (Absorption, Distribution, Metabolism, Excretion) | Forecasts potential toxicity and drug behavior, reducing experimental burden. | AI modeling of complex biological systems. | 25 |

| Clinical Trials | Clinical Trial Design Optimization | Analyzes historical data for more effective trial parameters (patient demographics, dosage, duration). | In silico simulations, machine learning algorithms. | 25 |

| Patient Recruitment & Stratification | Automates identification of eligible patients from EHRs, predicts outcomes. | Mendel AI (oncology patient identification), Exscientia (personalized cancer treatment prediction). | 25 | |

| Real-time Monitoring & Data Analysis | Tracks patient outcomes, detects anomalies/adverse effects, extracts insights from unstructured data. | Wearables, EHRs, NLP for clinical notes, AI-driven image recognition. | 25 | |

| Manufacturing | Predictive Maintenance | Analyzes sensor data to predict equipment failures, minimizes downtime. | Novartis (global manufacturing plants), Merck (IoT sensors). | 25 |

| Process Optimization & Quality Control | Controls manufacturing factors for consistent quality, maximizes yields, flags deviations. | Reinforcement learning, neural networks, digital twin technology (Novartis). | 25 | |

| Supply Chain Management | Demand Forecasting & Inventory Optimization | Accurately forecasts demand, automates material reorders, scans for disruptions. | Pfizer (COVID vaccine supply chain), intelligent systems. | 25 |

| Post-Market / Commercialization | Personalized Medicine & Treatment Tailoring | Processes genetic/clinical data to predict individual drug responses, tailor treatments. | IBM Watson Health, Tempus AI, Roche NAVIFY, Foundation Medicine. | 25 |

| Pharmacovigilance & Safety Monitoring | Automates collection and analysis of adverse event reports, detects safety signals. | Aetion, BenevolentAI, FDA Sentinel Initiative. | 25 |

This table is crucial for an expert-level report because it provides a granular, structured understanding of AI’s transformative impact across the entire pharmaceutical value chain. It demonstrates that AI is not confined to a single function (e.g., R&D) but is a cross-cutting technology that influences every stage of a drug’s lifecycle, from initial discovery to post-market surveillance. This reinforces the “revolution” aspect mentioned in the snippets.25 The table lists concrete AI applications within each phase, making the abstract concept of “AI in pharma” actionable and understandable for strategic decision-makers. For many applications, the table highlights direct benefits like “reduced time,” “improved accuracy,” or “minimized downtime,” which directly address the challenges of high R&D costs, lengthy development cycles, and operational inefficiencies faced in the post-blockbuster era. Including specific companies (Google DeepMind, Exscientia, Pfizer, Novartis, Roche, Tempus AI, FDA) and their AI initiatives 25 adds credibility and practical relevance, showcasing that these are not theoretical concepts but actively deployed strategies. By illustrating AI’s pervasive role, the table implicitly argues that investment in AI capabilities is no longer optional but a strategic imperative for competitive advantage, efficiency, and the successful development and commercialization of the next generation of therapies.

Modernizing Clinical Trials: The Rise of Digital Biomarkers and Decentralized Models

The paradigm of clinical trials is undergoing a significant modernization, driven by technological advancements and the need for greater efficiency, patient-centricity, and real-world data collection. This evolution is characterized by the increasing adoption of digital biomarkers and decentralized clinical trial (DCT) models.

Digital Biomarkers (DBx) are objective physiological and behavioral data collected continuously and remotely via digital health technologies such as wearables, sensors, and smartphones.39 Unlike traditional, intermittent clinical assessments, DBx capture disease activity and patient functioning in daily life, providing a more comprehensive and precise understanding of health and disease progression.41 This is particularly beneficial for conditions with fluctuating symptoms, such as neurological and psychiatric disorders.41 The use of DBx can lead to smaller, shorter, and more cost-effective trials by enabling earlier and more precise detection of changes in disease progression.41 Regulatory bodies like the FDA are actively providing clarity on evidence requirements for digital health, indicating growing acceptance of digital endpoints for clinical and regulatory decision-making.42 Challenges in DBx adoption include ensuring patient privacy and data security 44, optimizing user experience to maintain engagement 42, and establishing robust validation strategies for novel technologies.41

Decentralized Clinical Trials (DCTs) represent a major departure from traditional site-based trials, moving many trial activities to participants’ homes and local surroundings.37 This model leverages telemedicine, mobile apps, wearable devices, and home-based care to collect data remotely.39 The COVID-19 pandemic significantly accelerated the adoption of decentralized elements to ensure patient safety and data integrity.37 The

benefits of DCTs are substantial: they reduce the burden on participants, improve accessibility for individuals in rural areas or with mobility challenges, broaden the geographic reach of studies, and enhance the diversity and inclusivity of participant populations.37 This also allows for richer datasets through more frequent or continuous data collection in a real-world setting.37 For pharmaceutical organizations, DCTs can reduce operational costs, accelerate recruitment timelines, and improve data collection efficiency.45 They are especially beneficial for rare diseases where patient recruitment is often difficult.37 However,

challenges for DCTs include navigating complex regulatory frameworks, ensuring data integrity and security, maintaining patient privacy, and addressing concerns regarding investigator oversight and patient safety in remote settings.37 Regulators, such as the EMA, suggest gaining further experience through hybrid clinical trials that combine both decentralized and on-site activities.37 Proactive collaboration between regulators, pharmaceutical companies, and technology providers is critical to establishing clear guidelines and mitigating risks.45

The emergence of digital biomarkers and decentralized clinical trials is a direct strategic response to the inherent inefficiencies, high costs, and patient burden associated with traditional clinical trials.37 By enabling remote, continuous, and objective data collection, these technologies foster a more “patient-centric” approach 45, which is not merely an ethical consideration but a strategic imperative. Improved patient engagement and reduced participation burden lead to better recruitment, higher retention, and more representative real-world data.37 This, in turn, accelerates drug development, reduces costs 41, and provides the kind of real-world evidence (RWE) that is increasingly demanded by payers.46 The growing regulatory acceptance 42 further signals a systemic shift towards embracing these new paradigms as legitimate and valuable for drug development. This trend transforms clinical development from a rigid, site-based process into a flexible, data-rich, and patient-friendly ecosystem. It necessitates significant investment in digital health technologies, data analytics capabilities, and cybersecurity infrastructure within pharmaceutical companies. Furthermore, it implies a need for new skill sets within clinical operations teams, moving beyond traditional trial management to include expertise in digital health tools, data science, and remote patient monitoring. This shift is crucial for supporting the development of specialized and personalized medicines, which often require more targeted and flexible trial designs.

R&D Investment Trends and Focus on Unmet Medical Needs

In the post-blockbuster era, pharmaceutical R&D investment is strategically re-prioritizing therapeutic areas based on unmet medical need, scientific opportunity, and commercial potential. Recent analyses of the global drug pipeline consistently show that oncology (cancer) remains the most active and dominant field in drug development, attracting massive R&D investments.4 This intense focus is driven by the high incidence, mortality, and significant quality-of-life deficits associated with cancer, pushing companies to invest in targeted oncology solutions, including small molecules, biologics, antibody-drug conjugates, and immuno-oncology agents.48

Central Nervous System (CNS) disorders, particularly neurology (e.g., Alzheimer’s disease, Parkinson’s disease, multiple sclerosis), also command substantial attention in the drug R&D pipeline.48 Despite the inherent complexity of the central nervous system, the profound unmet therapeutic need in these conditions stimulates considerable resource allocation, including research into novel mechanisms of action, monoclonal antibodies, and gene therapies.48

Other pivotal areas receiving significant R&D focus due to their enormous public health implications and potential for novel interventions include metabolic and endocrine disorders 2,

infectious diseases, and autoimmune diseases.48

The observed intensity of research in specific therapeutic areas is shaped by multiple interrelated factors:

- Unmet Medical Need and Disease Burden: Areas with high incidence, mortality, and significant impact on quality of life attract more funding due to the potential for enormous public health impact.48

- Technological and Scientific Advances: The maturation of technologies such as high-throughput screening, genomics, proteomics, and advanced imaging facilitates precision medicine, particularly in oncology (molecular profiling, next-generation sequencing) and CNS (neurobiology understanding, biomarkers).48

- Regulatory Environment and Incentives: Regulatory push factors like Fast Track, Breakthrough Therapy, Orphan Drug designations, and Priority Review Vouchers significantly reduce development timelines in areas with high unmet need, encouraging accelerated drug development.48

- Commercial Potential and Market Forces: The economic attractiveness, evaluated by market size, growth potential, and return on investment, remains a key driver. High per capita expenditures in areas like cancer care lead to a proliferation of drug candidates.48

- Collaboration and Public-Private Partnerships: These are increasingly important for sharing risks and accelerating research.48 Companies are also increasingly relying on Contract Research Organizations (CROs) for R&D, though high-demand areas like oncology and cell therapies still face resource constraints.4

The concentrated R&D focus on therapeutic areas with high unmet needs (oncology, rare diseases, CNS disorders) 48 is a deliberate strategic shift in response to the patent cliff and the escalating costs and risks of R&D for broad-market drugs.2 These niche areas, despite smaller patient populations, often qualify for expedited regulatory pathways 48 and can command premium pricing due to the lack of existing treatment options and the significant patient benefit.26 This strategy aims to reduce the “binary outcome” risk 51 by focusing resources on areas where even a moderate clinical success can translate into substantial value and market share. It represents a pivot from seeking “broad appeal, low margin” (relative to R&D cost) to “niche appeal, high margin” opportunities. This specialization drives deeper scientific expertise within pharmaceutical companies and fosters a more collaborative R&D ecosystem, including increased reliance on Contract Research Organizations (CROs) and strategic partnerships with academic institutions and biotech firms.4 It also necessitates the development of highly sophisticated market access strategies tailored for these high-cost, specialized therapies, as their commercial success is heavily dependent on demonstrating profound value to payers and patients.

IV. Innovative Commercialization and Market Access Frameworks

Value-Based Pricing: Principles, Challenges, and Case Studies for High-Cost Therapies

Value-based pricing (VBP) represents a fundamental shift in how pharmaceutical products are priced, moving away from traditional cost-plus or volume-based models towards a system where the price is directly linked to the health benefits and outcomes delivered to patients.22 The core principle is to ensure that patients are not overpaying for therapies that do not provide sufficient value, while simultaneously allowing pharmaceutical companies to negotiate profitable price arrangements by rigorously demonstrating the value their drugs provide.22 This strategy is particularly relevant for groundbreaking and high-cost innovative therapies, as it aims to broaden patient access and enhance affordability by mitigating financial risks for payers.52 Examples of VBP models include pay-by-use, indication-specific pricing, financial risk-based contracts, health outcomes contracts, and “mortgage models” that spread payments over time.52

Despite its potential, VBP faces significant challenges in implementation:

- Measuring Value and Outcomes: A primary hurdle is defining and consistently measuring “value” and long-term outcomes, especially for complex or rare diseases where patient populations are small and data collection can be difficult.20

- Data Infrastructure: Successful implementation requires robust systems for collecting, securely sharing, and analyzing patient data across diverse healthcare settings.52

- Regulatory and Legal Barriers: “Best price” regulations in some markets (e.g., US Medicaid) can complicate VBP contracts by effectively requiring the lowest negotiated price to be applied broadly, disincentivizing manufacturers from offering risk-sharing agreements.53 Patient privacy regulations, such as GDPR in Europe, also pose obstacles to data utilization.53

- Payer Motivation and Incentives: Payers are not always motivated to embrace outcomes-driven reimbursement due to unclear incentive structures and complexity.53

- Global Complexity: Diverse and conflicting value assessment frameworks across global markets add complexity.52

Case studies and examples illustrate the application of VBP: Sanofi and Regeneron reduced the price of their cholesterol-lowering drug, Praluent, in response to an ICER analysis, improving their reputation for providing value.22 Novartis’s agreement with the National Health Service (NHS) in the United Kingdom for Lucentis (wet age-related macular degeneration) involved Novartis covering the cost of injections beyond a specified number, demonstrating a risk-sharing approach.56 GlaxoSmithKline (GSK) had an agreement for its epilepsy drug Trobalt (no longer marketed) where payment was contingent on patients being treated for at least 12 months, with full reimbursement for early discontinuation.56 More recently, Novartis has engaged with Colorado Medicaid for an outcomes-based contract for Zolgensma, a gene therapy.33 Bluebird bio has similarly engaged with payers for an outcomes-based contract for Zynteglo, another gene therapy.33 For high-cost gene therapies like exagamglogene autotemcel (exa-cel) and lovotibeglogene autotemcel (lovo-cel), which have one-off list prices of $2.2 million and $3.1 million respectively, outcome-based rebates are being explored to potentially save Medicaid significant amounts per patient.57

VBP is presented as a fundamental shift “linking cost to therapeutic benefit” 52 and a way to “broaden patient access to groundbreaking and highly effective therapies”.52 This aligns perfectly with the shift to high-cost, specialized therapies. However, the numerous challenges (measuring value, data infrastructure, regulatory hurdles, payer motivation) 20 indicate that while the

concept is strategically sound and necessary for the new pharma landscape, its implementation is severely hampered by legacy systems, regulatory frameworks, and a lack of cross-stakeholder collaboration. The fact that some VBP contracts are “sophisticated discounting programs” 53 suggests that the industry is still struggling to move beyond price negotiations to true value alignment. Successful VBP implementation requires not just pharmaceutical innovation, but also systemic healthcare reform, greater data interoperability, and a fundamental shift in how payers, providers, and manufacturers collaborate. Pharmaceutical companies need to invest in capabilities to collect and analyze real-world outcomes data to support VBP models effectively.

Leveraging Real-World Evidence (RWE) for Enhanced Market Access and Reimbursement

Real-World Evidence (RWE) is clinical evidence derived from the analysis of Real-World Data (RWD), which is routinely collected outside the controlled environment of traditional clinical trials.46 Sources of RWD are diverse and include electronic health records (EHRs), medical claims data, product and disease registries, patient-generated data from wearables and health diaries, and even social media.46

RWE is becoming increasingly crucial for pharmaceutical companies as it provides insights into how drugs perform in “outside-the-lab” settings across diverse patient groups.46 It helps companies to validate drug safety post-approval, explore expanded applications, strengthen marketing claims, and build confidence among healthcare professionals (HCPs) by demonstrating effectiveness in day-to-day practice.46 For market access and reimbursement, RWE is a powerful tool to persuade insurers and regulatory bodies to include a drug on reimbursement lists, particularly for newer, high-cost innovative treatments that payers may be hesitant to cover based solely on clinical trial data.46 It is essential for building a compelling value story, especially for orphan drugs and advanced therapies.61 The FDA has a long history of using RWD/RWE for post-market safety monitoring and is increasingly utilizing it to support effectiveness claims and new indications.47 The 21st Century Cures Act of 2016 further accelerated the FDA’s framework for evaluating the potential use of RWE to support regulatory decisions.47 Methods for generating RWE include cohort studies, cross-sectional studies, case-control studies, and registry analyses.59 For instance, Verily’s Project Baseline collects RWD from wearable devices and health records to identify new biomarkers and improve trial efficiency for pharma partners.39 While RWE offers significant advantages, companies must leverage it cautiously due to potential biases in the data.46

In an era where drug prices are scrutinized and value-based models are emerging 22, clinical trial data alone (focused on efficacy in controlled settings) is often insufficient to convince payers of real-world effectiveness and cost-benefit.46 RWE provides the necessary “messier” data from everyday life 46 to validate value, support reimbursement, and demonstrate long-term outcomes.60 The FDA’s increasing reliance on RWE 47 signifies a systemic shift in what constitutes “proof” of a drug’s value. RWE moves the burden of proof from just “does it work?” to “does it work

in the real world and is it worth the cost?”. This necessitates continuous data collection, advanced analytics capabilities, and strong collaborations with healthcare providers and payers to build robust RWE datasets, fundamentally changing post-market surveillance and commercialization strategies. Pharmaceutical companies must invest heavily in RWD collection and RWE generation capabilities, including partnerships with data analytics firms and leveraging digital health technologies. This is no longer a “nice-to-have” but a “must-have” for commercial success, especially for high-cost specialized therapies, and implies a need for internal expertise in data science and real-world evidence generation.

Deepening Patient Engagement and Fostering Patient-Centric Innovation

Patient engagement refers to the active involvement of patients in the development, delivery, and evaluation of healthcare products and services.62 This deepened involvement is becoming a critical strategic imperative for pharmaceutical companies in the post-blockbuster era. It offers multifaceted benefits, including improving the drug development process, enhancing patient outcomes (e.g., better medication adherence), building trust and loyalty, and driving patient-centric innovation.62 Patient insights are invaluable for informing improvements beyond the drug itself, such as optimizing drug delivery methods, packaging designs, and support services, thereby enhancing the overall patient experience.62

Pharmaceutical companies are implementing various strategies to deepen patient engagement:

- Prioritizing Customer Support: A significant 71% of consumers consider good customer support from pharmaceutical companies very important. Companies are expanding support channels to include phone, SMS/text, web chat, email, and social media, aiming for a unified customer view to deliver personalized and relevant service.62

- Providing Comprehensive Medical Education and Support: Patients expect pharmaceutical companies to provide medication education (62%) and ongoing support for managing medications (57%). Companies should offer resources that empower patients with knowledge about their condition, treatment options, and medication usage.62

- Personalizing Communication: Utilizing targeted messaging tailored to specific demographics and conditions, including personalized educational materials and medication reminders, can significantly enhance patient understanding and adherence.62

- Leveraging Offers and Rebates: Financial considerations play a significant role, with 51% of healthcare consumers valuing offers and rebates. Companies can integrate these into broader patient support initiatives.62

- Utilizing Digital Tools and Building Communities: Digital engagement tools, such as patient portals and mobile applications, facilitate direct communication.39 Creating online patient communities fosters a sense of belonging and provides platforms for sharing experiences and peer support.62

- Collaborating with Patient Advocacy Groups: Partnering with patient organizations (e.g., NORD, EURORDIS) enhances engagement strategies by leveraging their insights and networks, influencing policies, and accelerating clinical trials.28 Examples include Boehringer Ingelheim’s partnership with Walgreens and Emvenio Research to improve clinical trial recruitment diversity for obesity and type 2 diabetes.63 Amgen led a consortium for cardiovascular disease patients, utilizing digital tele-rehabilitation via Liva Healthcare’s app.63

Regulatory bodies are also integrating patient perspectives. The US FDA’s Patient-Focused Drug Development Initiative (PFDDI) and “Voice of the Patient” series aim to gather qualitative information from patients on disease impact and treatment value.64 Patient advocacy efforts, for instance, played a crucial role in the FDA approval of a Duchenne muscular dystrophy treatment.64 While regulatory constraints can be a barrier, the overall trend is towards greater patient involvement.62

Patient engagement is no longer a “nice-to-have” or a mere regulatory requirement.62 In a world of specialized therapies and high costs, patient insights are critical for identifying unmet needs, designing relevant clinical trials 64, and demonstrating real-world value.62 This moves beyond simply informing patients to actively involving them in the entire product lifecycle, from R&D prioritization to post-market support.62 This shift transforms patients from passive recipients of care into active stakeholders and co-creators of solutions. It demands a cultural change within pharma, requiring cross-functional collaboration and agile approaches to integrate patient feedback continuously. Successful patient engagement programs can lead to better adherence, improved outcomes, and stronger market positioning, especially for complex and rare diseases where patient voice is paramount.

Navigating Market Access Complexities for Orphan Drugs and Advanced Therapies

The increasing focus on orphan drugs and advanced therapies, such as cell and gene therapies (CGTs), presents unique and significant market access challenges due to their inherent characteristics.

Key Challenges:

- High Costs: CGTs can cost millions for a single dose (e.g., Zolgensma for spinal muscular atrophy at $2.125 million, Hemgenix for hemophilia B at $3.5 million).34 This creates a “high-cost vs. high-impact” dilemma for payers operating with already stretched budgets.61

- Limited Market Size: Orphan medicines, designed for rare diseases, often have very small patient populations, which limits economies of scale in production and drives high per-patient costs.26

- Fragmented Reimbursement Landscape: In regions like Europe, market access is complicated by a highly fragmented reimbursement landscape, with each country conducting its own Health Technology Assessments (HTAs) and having diverse regulatory requirements. This leads to longer approval and launch times.60 Pricing a drug too low in one country can trigger forced price cuts elsewhere due to International Reference Pricing (IRP) policies.60

- Data and Evidence Gaps: Demonstrating long-term value and cost-effectiveness for rare diseases can be challenging due to small patient populations in clinical trials, necessitating robust follow-up data to address inherent uncertainties.20

- Patient Portability: The high upfront costs of one-time gene therapies pose challenges for reimbursement if patients switch health insurers after receiving treatment.27

Strategies for Success:

- Early Market Access Planning: Companies must integrate market access strategy from the earliest stages of ideation, even before clinical trials begin.61 This involves adapting clinical trial design and other studies (e.g., health economic outcomes research, RWE studies) to align with payer, physician, and patient perspectives from the clinical development phase.67

- Building a Compelling Value Story: It is crucial to develop a strong value proposition that highlights the unmet medical need addressed by the product and demonstrates real-world evidence (RWE) of its benefits beyond controlled clinical trial settings.60

- Innovative Pricing Models: Employing value-based pricing, tiered pricing, and various risk-sharing agreements (e.g., annuity-based payments, outcomes-based payments or rebates) is essential to spread costs and mitigate financial risk for payers.33 For example, Novartis engaged with payers to create installment- and outcomes-based payment options for Zolgensma.54

- Patient-Centric Approach: Manufacturers must place the patient at the center of their market access journeys, anticipating and addressing all potential barriers patients might face in accessing treatment at every touchpoint in the product lifecycle.61

- Strategic Partnerships: Collaborating with partners who possess deep understanding of the rare and orphan disease landscape, including local market expertise and established relationships with governing bodies, clinical experts, and patient advocacy groups, can be hugely beneficial.61

- Manufacturing Efficiency: For CGTs, innovative, high-throughput, and low-cost manufacturing processes (e.g., automation, decentralized manufacturing models) are key to enabling widespread patient access and ensuring commercial viability.35

While R&D is successfully generating high-value, specialized therapies, market access emerges as a significant bottleneck.34 The high upfront costs 34 and small patient populations 26 challenge traditional reimbursement models. This means that scientific breakthrough alone is insufficient; commercialization success hinges on sophisticated, early-stage market access planning 61 and innovative pricing models that share risk.54 The withdrawal of products from markets due to pricing disputes (e.g., Bluebird Bio in Europe) 35 highlights the critical nature of this challenge. Pharmaceutical companies must integrate market access considerations into R&D from day one. This requires cross-functional teams (R&D, commercial, legal, regulatory) to work collaboratively to build a compelling value story supported by robust data (including RWE) that resonates with diverse payers globally. It also implies that market access capabilities are becoming a core competitive differentiator.

Strategic Utilization of Expedited Regulatory Pathways (FDA, EMA)

Regulatory bodies worldwide have established expedited pathways to accelerate the development and approval of critically needed medicines, particularly those addressing serious conditions with unmet medical needs. These pathways are strategically important for pharmaceutical companies, especially in the context of high-cost, specialized therapies.

In the United States, the FDA offers several key pathways:

- Fast Track (introduced 1988): Designed to expedite the review of drugs that treat serious conditions and fill an unmet medical need. It facilitates more frequent communication between the company and the FDA and allows for a “rolling review” of the drug’s application.49

- Priority Review (introduced 1992): Shortens the FDA’s review time for drugs that, if approved, would offer significant improvements in treatment, prevention, or diagnosis over existing therapies. This pathway also includes incentives like Priority Review Vouchers for drugs developed for neglected tropical diseases, rare pediatric diseases, and medical countermeasures, which can be used or sold to expedite the review of another product.49

- Accelerated Approval (introduced 1992, expanded 2012): Allows for earlier approval of drugs for serious conditions that fill an unmet medical need, based on a “surrogate endpoint” (e.g., tumor shrinkage) or an “intermediate clinical endpoint” that is reasonably likely to predict a clinical benefit. Post-market studies are typically required to confirm the clinical benefit, and approval can be withdrawn if these benefits are not confirmed.49

In the European Union, the European Medicines Agency (EMA) provides similar mechanisms:

- PRIME (PRIority MEdicines) Scheme: Launched by the EMA to enhance support for the development of medicines targeting an unmet medical need. It offers early and proactive support to developers, including enhanced interaction and scientific advice, to optimize development plans and speed up evaluation. Eligibility requires preliminary clinical evidence of promising activity or proof of concept.50

- Conditional Marketing Authorization (introduced 2006): Allows for the approval of medicines that address unmet medical needs based on more limited clinical data than normally required, provided the benefits outweigh the risks and the data are expected to become comprehensive. The marketing authorization holder must fulfill specific obligations to provide comprehensive data post-approval, and the authorization is valid for one year, renewable annually, until converted to a standard authorization.70

- Exceptional Circumstances Approval: This pathway is available when comprehensive data cannot be obtained even after authorization, typically due to the rarity of the disease or ethical considerations.70

These expedited pathways accelerate access to innovative therapies for patients with high unmet needs.49 They incentivize R&D in challenging disease areas 48, offering a faster route to market, which is crucial given the high R&D costs and shorter effective patent lives.2 However, this accelerated access often comes with increased regulatory oversight post-approval, demanding continuous data collection and confirmation of long-term benefits.49

The existence and increasing use of expedited regulatory pathways 49 demonstrate a global regulatory commitment to accelerating access to innovative therapies, especially for unmet medical needs. This acts as a significant incentive for pharmaceutical companies to invest in these challenging areas.48 The trade-off is often approval based on surrogate endpoints or limited data, requiring robust post-market surveillance and data collection 49, which ties into the growing importance of RWE. Pharmaceutical companies must strategically align their R&D and clinical development plans with these expedited pathways to maximize speed to market. This requires early and continuous engagement with regulatory bodies, a deep understanding of their evolving requirements, and a commitment to post-market data generation. This also highlights the evolving role of regulatory affairs from a compliance function to a strategic enabler.

V. Strategic Business Model Evolution and Operational Excellence

Portfolio Optimization Through M&A, Strategic Partnerships, and Divestitures

In the post-blockbuster era, pharmaceutical companies are actively reshaping their business models through dynamic portfolio optimization, leveraging mergers and acquisitions (M&A), strategic partnerships, and targeted divestitures. This approach is essential for maintaining growth, diversifying revenue streams, and adapting to the evolving market landscape.

M&A activity has seen a resurgence, driven by the imperative to strengthen market positions, diversify pipelines, gain access to innovative technologies, and accelerate time-to-market by bypassing lengthy in-house R&D phases.71 Large-cap biopharma players are increasingly adopting a “string-of-pearls” strategy, acquiring early- to mid-stage innovation, particularly in high-growth areas like oncology, immunology, and rare diseases, to fill pipeline gaps and hedge against the impact of patent cliffs.72 Notable examples include Pfizer’s acquisition of Seagen to advance cancer therapies and Amgen’s purchase of Horizon Therapeutics to expand its presence in rare diseases.71 Sanofi’s acquisition of Blueprint Medicines and GSK’s purchase of IDRx also exemplify this trend.72 Pfizer’s acquisition of Global Blood Therapeutics further reflects a strategic aim to capture value in niche markets.74

Strategic partnerships are also gaining prominence, with an increasing preference for alternative deal structures such as earn-outs, royalties, licensing agreements, and joint ventures. These structures are used to finance innovation and build new platforms, especially in the biotech and diagnostics sectors, and help mitigate regulatory and reimbursement risks.72 Examples include the strategic partnership between Pfizer and BioNTech in mRNA technology discovery, and the collaboration between AstraZeneca and Huma to scale innovation in digital health.23 Pfizer’s regional collaborations demonstrate a commitment to global market expansion and equitable access.74

Conversely, divestitures are being strategically utilized to optimize portfolios. Companies are divesting non-core assets to release capital, which can then be reinvested in new, higher-growth products, drive overall growth, and facilitate business restructuring.11 This allows companies to strategically shift their business focus in response to market volatility, competition, and emerging trends, shedding underperforming units to enhance overall business value.75 Prominent examples include Johnson & Johnson’s decision to separate its business into two global leaders to pursue more targeted strategies.75 Similarly, Novartis obtained most of GlaxoSmithKline’s oncology products while divesting its vaccine business to GSK, and Bristol-Myers Squibb divested its diabetes business to AstraZeneca to concentrate on immuno-oncology.76 Divestitures can also free up managerial attention, serving as an innovation tool by allowing companies to focus on core competencies.77 This often leads to a narrowing of therapeutic focus, with some pharma companies consolidating their efforts on specific areas like oncology, neurology, or rare diseases, building “Franchise Fiefdoms” or “Strategically-Owned Areas” to achieve deeper expertise and enhanced stakeholder relationships.48

The snippets show M&A, partnerships, and divestitures are not just opportunistic transactions but strategic tools for navigating the patent cliff 11 and adapting to the shift towards specialized therapies and new modalities.11 This indicates that continuous portfolio optimization—buying, partnering, and selling—is becoming a core, ongoing competency for pharmaceutical companies to maintain relevance and growth. This is a move from organic growth-centric to a more inorganic, dynamic growth strategy. This dynamic portfolio management requires robust due diligence capabilities, strong integration teams, and a clear strategic vision for their core therapeutic areas. It also highlights the increasing importance of financial engineering and deal structuring (e.g., earn-outs, royalties) to manage risk in a volatile market.72

Evolving Intellectual Property Strategies: Lifecycle Management and Patent Thickets

In the post-blockbuster world, intellectual property (IP) strategy has evolved from a mere compliance function to a proactive, strategic imperative deeply integrated into every stage of the drug development lifecycle.78 This shift is critical for maintaining market leadership and profitability in a highly competitive and time-constrained industry.

Pharmaceutical companies are now building diverse and layered patent portfolios, often referred to as “patent thickets,” rather than relying solely on the initial “composition of matter” (primary) patent.8 These thickets involve securing patents on a wide array of innovations related to their drug, creating a “dense and overlapping network of protection”.8 This multi-pronged approach serves as both a “shield,” protecting a company’s own innovation, and a “sword,” preventing competitors from infringing.78

Secondary and tertiary patents, sometimes pejoratively termed “evergreening” by critics, cover auxiliary features such as new drug formulations, delivery mechanisms, manufacturing processes, or new therapeutic uses/indications for existing compounds.8 While critics argue this practice extends monopolies and maintains high drug prices, industry proponents contend that these patents incentivize “incremental innovation” that can improve patient experience, expand therapeutic horizons, or enhance efficacy and safety.8 Examples include patenting new therapeutic uses or combination therapies.8

Beyond patent terms, regulatory exclusivities also play a role in extending market exclusivity. These include regulatory data protection (RDP) in the EU and new clinical investigation exclusivity in the US.8 Additionally, Patent Term Extensions (PTE) in the US and Supplementary Protection Certificates (SPC) in the EU compensate for patent term lost during lengthy regulatory approval processes, though these extensions are capped, typically resulting in an effective market exclusivity of 14-15 years.10

Competitive intelligence is paramount in this dynamic IP landscape. Tools like DrugPatentWatch provide deep knowledge on pharmaceutical patents, suppliers, generics, and litigation, enabling companies to anticipate patent expirations, identify generic sources, assess competitor research paths, and inform portfolio management decisions.80 This proactive monitoring is essential for adapting to evolving legal and regulatory frameworks globally.78

The pharmaceutical industry also engages in various responses to generic and biosimilar competition. While some practices, such as the strategic use of “patent thickets,” are criticized as anti-competitive tactics to delay lower-cost alternatives 79, generic companies and Pharmacy Benefit Managers (PBMs) advocate for streamlining biosimilar approvals and eliminating regulatory barriers to boost competition.79

The concept of “patent thickets” 8 and “evergreening” 8 reveals that IP strategy is highly aggressive and competitive. It is not merely about protecting one’s own innovation but actively

delaying generic/biosimilar entry.79 This creates a tension between incentivizing innovation (industry view) and promoting affordable access (payer/public view). The use of competitive intelligence tools 80 further highlights the proactive, almost combative, nature of modern IP strategy. Legal and IP departments must be deeply integrated into strategic decision-making, not just compliance. Companies need to continuously monitor the competitive IP landscape and be prepared for legal challenges. This also implies that regulatory bodies will face increasing pressure to balance innovation incentives with public health needs and competition.

Driving Operational Efficiency and Resilience Through Digital Transformation

Operational excellence and resilience, underpinned by comprehensive digital transformation, are critical for pharmaceutical companies to navigate the financial pressures of the post-blockbuster era and support the development and commercialization of complex, high-cost therapies.

End-to-end digitization is rapidly being adopted across pharma operations, utilizing digital tools, robots, and sensors to capture raw data, enable real-time optimization, and improve transparency.23 Scaling the adoption of full-scale digital solutions, though requiring substantial investment (e.g., $50-100 million per year for 2-3 years), yields significant returns in cost savings, improved quality, and increased resilience.23 Companies are moving towards network-wide and end-to-end digitization, with “lighthouses” like Johnson & Johnson demonstrating advanced application of Industry 4.0 technologies focused on patient connectivity and order fulfillment.23

AI-driven automation is integral to enhancing efficiency in manufacturing and supply chain processes. It enables inventory optimization, predictive maintenance, and improved quality control.25 For example, Merck implemented IoT sensors across its facilities to collect real-time data on equipment performance, using predictive analytics to cut unexpected downtime by 20%.39 Novartis adopted digital twin technology to simulate production processes and validate changes virtually, reducing tech transfer time across its global manufacturing sites.39 AI also powers process automation, with robotics handling repetitive and hazardous operations, ensuring consistent production and minimizing human errors.25

Supply chain resilience has become a top corporate priority following recent disruptions. Companies are moving beyond reactive, short-term measures like building inventory to implement longer-term actions such as network design and dual sourcing, embedding resilience into their core operations strategy.23

The integration of digital health solutions is transforming product development and patient care.83 These technologies enable personalized medicine through the use of real-world data and digital biomarkers, allowing for remote patient monitoring and tailored interventions.39 Digital health also facilitates new business segments and enhances competitive advantage.84

Digitalization in regulatory affairs is streamlining processes, reducing errors, and expediting approval timelines. Electronic Common Technical Documents (eCTD) and electronic submission gateways have become standard, and AI-powered tools are increasingly used to streamline submission, review, and approval processes, enhancing efficiency and data exchange.38 The European Medicines Agency (EMA) is actively exploring and proposing digitalization initiatives, including a central repository for standardized product information and the Digital Application Dataset Integration (DADI) project for online submission forms.85

Furthermore, simplifying organizational structures, such as consolidating regions into larger units, can enhance agility and decision-making, bringing decisions closer to customers and fostering quicker responses.86

The pressures of the patent cliff 7 and rising costs 2 demand not just new products but also radical operational efficiency. Digital transformation 23 provides the means to achieve this, from optimizing manufacturing 25 to streamlining regulatory submissions.38 It allows for faster decision-making, reduced waste, and enhanced resilience in a volatile environment.23 This indicates that companies that fail to fully scale digital and automation across their end-to-end operations will struggle to compete on cost, speed, and quality. This requires significant investment, talent acquisition (e.g., AI/GenAI skills) 11, and a cultural shift towards data-driven decision-making and continuous improvement. Digital transformation is not an optional add-on but a strategic imperative for survival and growth in the post-blockbuster era. It enables companies to be more agile, data-driven, and responsive to market changes, creating a leaner, more efficient operational backbone that supports the development and delivery of high-cost, specialized therapies.

VI. Conclusion and Strategic Imperatives for Sustainable Growth

Synthesizing the Transformative Landscape

The pharmaceutical industry is definitively reshaping itself from a volume-driven, blockbuster-dependent model to a value-driven, innovation-centric ecosystem. The “patent cliff” serves as a powerful catalyst, forcing companies to move beyond traditional revenue streams and embrace a future defined by scientific breakthroughs, technological integration, and patient-focused strategies.

This profound transformation is characterized by a decisive pivot towards specialized and precision medicine, including biologics, cell, and gene therapies, which target high-unmet-need areas like oncology and rare diseases. Technological advancements, particularly in Artificial Intelligence and digital health solutions, are not merely supportive tools but fundamental enablers of this new paradigm. AI permeates every aspect of the value chain, from accelerating drug discovery and optimizing clinical trials to enhancing manufacturing efficiency and enabling personalized medicine. Digital biomarkers and decentralized clinical trials are modernizing research, making it more patient-centric and data-rich.

Commercial success in this new environment hinges on demonstrating real-world value, necessitating the adoption of innovative pricing models, such as value-based pricing and risk-sharing agreements, supported by robust real-world evidence. Deepening patient engagement is crucial, transforming patients from passive recipients to active partners in innovation and care.

Business models are evolving to prioritize strategic portfolio curation through targeted mergers and acquisitions, collaborative partnerships, and disciplined divestitures of non-core assets. This dynamic approach, coupled with sophisticated intellectual property strategies that extend beyond primary patents to include layered protection (“patent thickets”), is essential for mitigating risk and capturing new opportunities. Regulatory bodies are adapting in parallel, offering expedited pathways for innovative therapies while simultaneously requiring more comprehensive post-market data.

The entire analysis highlights how the pharmaceutical industry is moving beyond simply developing and selling drugs. The focus on personalized medicine 6, value-based pricing 22, real-world evidence 46, patient engagement 62, and strategic partnerships 23 indicates a shift towards understanding and influencing the entire healthcare ecosystem. Companies are becoming orchestrators of solutions, not just manufacturers of products. This implies a need for new competencies in data science, digital health, and stakeholder collaboration. Success will depend not just on scientific prowess but on the ability to integrate seamlessly into complex healthcare delivery systems, demonstrate holistic value, and build enduring relationships with patients, payers, and providers.

Actionable Recommendations for Pharmaceutical Leaders

To navigate the complexities of the post-blockbuster world and ensure sustainable growth, pharmaceutical leaders must adopt a multi-faceted and integrated strategic approach:

- R&D Reinvention:

- Prioritize R&D investments in specialized therapeutic areas with high unmet needs, particularly biologics, gene, and cell therapies.48 This focus on “value density” per patient can yield higher returns despite smaller market sizes.

- Aggressively integrate AI and machine learning across the entire R&D pipeline, from target identification and lead optimization to clinical trial design and patient stratification.21 This will enhance efficiency, reduce costs, and unlock new therapeutic avenues.

- Embrace digital biomarkers and decentralized clinical trial models to improve data quality, enhance patient engagement, and streamline trial efficiency.37 Proactive engagement with regulatory bodies to address data privacy and validation concerns in these new paradigms is essential.

- Commercial and Market Access Innovation:

- Shift towards value-based pricing models, investing in robust capabilities to collect and analyze real-world outcomes data to demonstrate the long-term value of high-cost therapies.52 This requires deep collaboration with payers and providers.

- Proactively generate and leverage real-world evidence (RWE) throughout the product lifecycle to support market access, strengthen reimbursement negotiations, and identify new indications.46

- Deepen patient engagement beyond traditional marketing, involving patients in R&D, product design, and support programs to foster trust, improve adherence, and drive patient-centric innovation.62 This transforms patients into strategic partners in value co-creation.

- Develop sophisticated, country-specific market access strategies for high-cost, specialized therapies, engaging payers and regulatory bodies early in the development process to build a compelling value story.61

- Business Model and Operational Agility:

- Implement dynamic portfolio management, utilizing strategic M&A (e.g., a “string-of-pearls” approach for acquiring specialized innovation and filling pipeline gaps), partnerships (e.g., risk-sharing, co-development), and targeted divestitures of non-core assets to maintain strategic focus and financial flexibility.11

- Develop robust, proactive intellectual property strategies, building layered patent portfolios (“patent thickets”) to extend market exclusivity and defend against generic competition, while continuously navigating evolving regulatory landscapes.8 Investment in competitive intelligence tools is crucial for this.

- Drive end-to-end digital transformation across operations, including manufacturing, supply chain, and regulatory affairs, to enhance efficiency, resilience, and data-driven decision-making.23 This includes investing in digital infrastructure, data governance, and cybersecurity.

- Foster a culture of continuous learning and adaptation, recognizing that the “crisis as a way of life” 21 demands constant innovation and strategic flexibility across all organizational levels.

Across all these recommendations, the underlying enabler is integrated digital technology and data analytics. AI in R&D, digital biomarkers in trials, RWE for market access, digital transformation in manufacturing—all rely on robust data infrastructure and analytical capabilities.6 Without these foundational capabilities, implementing the other strategies will be significantly hampered or impossible. Investment in digital infrastructure, data governance, cybersecurity, and data science talent is no longer an IT function but a strategic business imperative that underpins all other evolving strategies. This is the new competitive battleground for the pharmaceutical industry.

Works cited

- What Is a Blockbuster Drug? – Patsnap Synapse, accessed July 26, 2025, https://synapse.patsnap.com/blog/what-is-a-blockbuster-drug

- What Is a Blockbuster Drug? | The Motley Fool, accessed July 26, 2025, https://www.fool.com/terms/b/blockbuster-drug/

- www.iqvia.com, accessed July 26, 2025, https://www.iqvia.com/blogs/2023/11/aiming-higher-a-blockbuster-ambition-fit-for-our-times#:~:text=In%201987%2C%20Zantac%2C%20a%20treatment,over%20%241Bn%20annual%20sales.

- Enhance R&D Efficiency – Inverto, accessed July 26, 2025, https://inverto.com/en/insights/rd-sourcing-excellence-unlocking-strategic-value-in-procurement/

- Pharmaceutical Industry Adapts: Increased R&D Investment Drives Novel Therapies Amid Evolving Regulations. – GeneOnline News, accessed July 26, 2025, https://www.geneonline.com/pharmaceutical-industry-adapts-increased-rd-investment-drives-novel-therapies-amid-evolving-regulations/

- Personalized Medicine Market Size | Industry Report, 2033, accessed July 26, 2025, https://www.grandviewresearch.com/industry-analysis/personalized-medicine-market

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed July 26, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed July 26, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- One product, many patents: Imperfect intellectual property rights in the pharmaceutical industry – UCLA Anderson Review, accessed July 26, 2025, https://anderson-review.ucla.edu/wp-content/uploads/2024/04/Gupta-Drug-Patents.pdf

- How does patenting protect pharmaceutical products? – EFPIA, accessed July 26, 2025, https://www.efpia.eu/news-events/the-efpia-view/blog-articles/121128-the-degree-to-which-patenting-and-in-particular-secondary-patenting-protect-pharmaceutical-products-during-their-lifecycle-is-often-misconstrued/

- Life Sciences M&A, divestments and Restructuring – Deloitte, accessed July 26, 2025, https://www.deloitte.com/in/en/Industries/life-sciences-health-care/research/life-sciences-mergers-acquisitions-divestitures-and-restructuring.html

- Big Pharma prepare for next patent cliff as blockbuster drugs …, accessed July 26, 2025, https://www.globaldata.com/media/pharma/big-pharma-prepare-next-patent-cliff-blockbuster-drugs-revenue-losses-loom-says-globaldata/

- www.the-scientist.com, accessed July 26, 2025, https://www.the-scientist.com/lipitor-patent-expires-41658#:~:text=While%20the%20introduction%20of%20generic,in%201985%20by%20Bruce%20D.

- When does the patent for Atorvastatin expire? – Patsnap Synapse, accessed July 26, 2025, https://synapse.patsnap.com/article/when-does-the-patent-for-atorvastatin-expire

- When does the patent for Clopidogrel expire? – Patsnap Synapse, accessed July 26, 2025, https://synapse.patsnap.com/article/when-does-the-patent-for-clopidogrel-expire