The pharmaceutical industry stands as a beacon of innovation, consistently pushing the boundaries of scientific discovery to address unmet medical needs. Yet, behind every groundbreaking drug lies a labyrinth of research, development, and stringent regulatory hurdles. At the heart of this complex ecosystem, intellectual property rights, particularly patents, play an indispensable role. They are not merely legal documents; they are the very bedrock upon which the industry’s economic model is built, providing the necessary incentive for companies to invest billions in a high-risk, high-reward endeavor.

This report delves into the intricate world of drug patent term extensions (PTEs) and Supplementary Protection Certificates (SPCs), critical mechanisms designed to safeguard innovation in the face of protracted regulatory review periods. For business professionals navigating the pharmaceutical landscape, a profound understanding of these extensions is not just advantageous—it is essential for strategic planning, market forecasting, and ultimately, achieving market leadership.

The Crucial Role of Pharmaceutical Patents in Innovation

Patents are fundamental to protecting inventions, granting innovators exclusive rights for a set period, typically 20 years from the filing date for utility patents in most jurisdictions.1 This exclusivity is not just a legal formality; it is the economic engine that drives innovation, particularly in high-risk, high-reward sectors like pharmaceuticals. The promise of a temporary monopoly allows companies to recoup the enormous investments poured into discovering, developing, and bringing new medicines to market.

The journey of a new drug from concept to patient is an arduous, time-consuming, and incredibly expensive endeavor. It is a journey fraught with uncertainty, where the vast majority of candidates fail to reach the market. Consider this: a study by the Pharmaceutical Research and Manufacturers of America (PhRMA) highlights that the average cost of developing a new drug is over $2 billion, with the process taking around 10-15 years.3 This staggering investment is made with no guarantee of success, underscoring the high stakes involved. As one industry expert succinctly puts it, “Drug development is massively time and resource intensive. While a patent will give your drug an initial 20 years’ exclusivity it’s highly likely the lion share of this term will be taken up by doing what is required to obtain the regulatory approval you need to take your drug to market”.4

This leads to a critical challenge: the “lost time” dilemma. By the time a drug navigates extensive clinical trials and secures regulatory approvals from bodies like the U.S. Food and Drug Administration (FDA), a significant portion of its initial 20-year patent term has often already elapsed.1 This effectively shortens the period during which the innovator can exclusively market the drug and recoup their massive investments. On average, drugs enjoy about 12-14 years of market exclusivity rather than the full 20 years, with the effective period after launch often being closer to 7-10 years.5

This erosion of effective patent life due to regulatory review directly impacts the economic viability of pharmaceutical research and development. If a company spends 10-15 years in R&D and regulatory review, they are left with only 5-10 years of effective market exclusivity. This truncated window makes it exceptionally difficult to justify the upfront investment, especially considering that nearly 90% of drugs entering clinical trials fail.8 Without mechanisms to restore some of this lost patent life, companies would face a significantly reduced opportunity to generate sufficient revenue to cover their R&D costs and fund future innovation. This scenario would inevitably stifle the incentive to pursue groundbreaking, but lengthy, drug development, potentially leading to fewer new drugs reaching patients, particularly for complex diseases requiring extensive testing. Patent term extensions directly address this economic disincentive by providing additional exclusivity, thereby maintaining the attractiveness of pharmaceutical R&D and ensuring a continuous pipeline of new medicines.

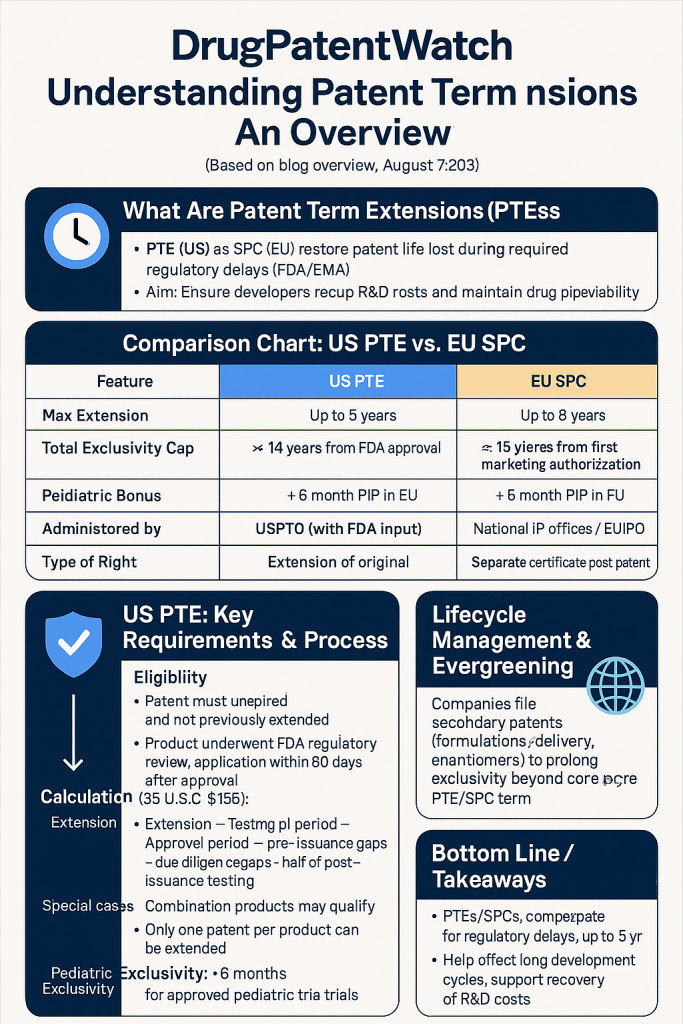

What Are Patent Term Extensions (PTEs) and Supplementary Protection Certificates (SPCs)?

At their core, Patent Term Extensions (PTEs) and Supplementary Protection Certificates (SPCs) are legal mechanisms designed to compensate patent holders for the time lost during the lengthy regulatory approval processes required for certain products, primarily pharmaceutical drugs and agricultural chemicals.1 Their fundamental purpose is to restore a portion of the effective patent term that is “lost” while a product awaits premarket government approval from regulatory bodies like the U.S. Food and Drug Administration (FDA) or European Medicines Agency (EMA).2 This ensures that innovators can have a more meaningful period of exclusive rights after their product finally enters the market.1

Imagine a pharmaceutical company that invents a new drug and successfully files for a patent. However, due to the…source This additional period is crucial for recouping the substantial investments made.

Compensating for Lost Time: The Core Purpose

The rationale behind PTEs and SPCs is straightforward: innovation in pharmaceuticals is a public good, but it comes at a high cost and with significant delays imposed by regulatory scrutiny. These extensions allow patent holders to maintain exclusivity over their inventions for a longer period, compensating for any delays that may have occurred during the regulatory approval process. In industries like pharmaceuticals, where bringing a new drug to market can take years, these extensions help restore some of the time lost to regulatory hurdles, ensuring that companies have enough time to recoup their investment and profit from their innovation.1 This mechanism promotes continued investment in research and development, which ultimately benefits patients by bringing new, safe, and effective treatments to market.

The Global Landscape: US vs. EU Frameworks

While both the United States and the European Union recognize the need for extended patent protection for regulated products, they employ distinct legal frameworks: the Hatch-Waxman Act in the US and Supplementary Protection Certificates (SPCs) in the EU.1 Both systems aim to balance innovation incentives with public access to medicines, but their specific mechanisms, eligibility, and calculation methods differ significantly.

The existence of two distinct, yet functionally similar, systems highlights a global consensus on the necessity of compensating pharmaceutical innovators for regulatory delays. However, the differences in their implementation create complexities for pharmaceutical companies operating internationally, necessitating tailored IP strategies for different markets. Why, one might ask, if the problem of lost patent time due to regulatory review is universal, aren’t the solutions identical across major jurisdictions? The variations likely stem from differing legal traditions, regulatory philosophies, and political compromises within each region. For a global pharmaceutical company, this means that a single patent strategy is insufficient; they must understand and navigate the specific nuances of each major market’s PTE/SPC system to maximize their commercial potential worldwide. This adds a layer of complexity to global market entry and intellectual property portfolio management, requiring specialized legal and strategic expertise.

Table 1: Key Differences: US Patent Term Extension vs. EU Supplementary Protection Certificate

Understanding the nuances between these two major frameworks is paramount for any business professional involved in global pharmaceutical strategy. This table provides a side-by-side comparison that immediately highlights key distinctions in legislation, administration, calculation, and scope. This allows for a rapid grasp of the complexity of international IP strategy, informing decisions on where and how to pursue extended protection for products. It also helps identify potential pitfalls or opportunities unique to each jurisdiction, which is vital for market domination.

| Feature | US Patent Term Extension (PTE) | EU Supplementary Protection Certificate (SPC) |

| Enabling Legislation | Hatch-Waxman Act (Drug Price Competition and Patent Term Restoration Act of 1984) 2 | Council Regulation (EEC) No 1768/92 (medicinal products), Regulation (EC) No 1610/96 (plant protection products) 13 |

| Administering Body | U.S. Patent and Trademark Office (USPTO) in collaboration with FDA 9 | National intellectual property offices of EU member states, with emerging centralized procedure via EUIPO 11 |

| Nature of Right | Extension of the original patent term 16 | A separate, complementary intellectual property right that takes effect after the basic patent expires 11 |

| Maximum Extension | Up to 5 years 1 | Up to 5 years 10 |

| Total Exclusivity Cap | Total patent term (including extension) cannot exceed 14 years from FDA approval 3 | Total market exclusivity (patent + SPC) generally aims for 15 years from first marketing authorization 14 |

| Pediatric Extension | Additional 6 months (Pediatric Exclusivity) 2 | Additional 6 months for medicinal products for children (Paediatric Investigation Plan – PIP) 11 |

| Scope of Claims | Product, method of using, or method of manufacturing the product 9 | Active ingredient(s) of the authorized product; can be based on substance, process, use, or formulation patents 11 |

| Filing Deadline | Within 60 days of regulatory approval 16 | Within 6 months of marketing authorization or patent grant (whichever is later) 11 |

| Due Diligence Factor | Explicitly considered and can reduce extension period 3 | Not explicitly mentioned as a direct calculation factor in the same way as US PTE. |

| Centralized Filing | No (USPTO handles applications, but it’s a federal system) | Emerging centralized procedure for Unitary SPCs, but traditionally national filing 13 |

The Hatch-Waxman Act: A US Perspective on Patent Term Extension

Historical Context and Legislative Intent

The Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act, was a landmark piece of legislation.2 It aimed to strike a delicate balance between incentivizing pharmaceutical innovation and promoting the timely availability of more affordable generic drugs.16 This act, often referred to as a “grand bargain,” sought to eliminate two significant distortions that had impacted the effective patent term for drugs.

Prior to Hatch-Waxman, innovators faced a “lost time” problem: lengthy FDA premarket regulatory review consumed a significant portion of their 20-year patent term, reducing their period of market exclusivity.1 Concurrently, generic manufacturers were also at a disadvantage; they couldn’t begin testing or seeking FDA approval until the innovator’s patent expired, leading to an additional lag in generic market entry even after patent expiry.31 This effectively prolonged the innovator’s de facto monopoly, albeit unintentionally.

Hatch-Waxman addressed these issues through a two-pronged approach. First, it allowed patent owners to extend patent terms to compensate for time lost during regulatory review, creating the Patent Term Extension (PTE) system.2 Second, it created an expedited pathway for generic drug approval via Abbreviated New Drug Applications (ANDAs), allowing generics to rely on the innovator’s safety and efficacy data, thereby accelerating their market entry once patents expired.6 This dual approach was intended to foster both innovation and competition. As a core legal text states, “The purpose of PTE is to restore some portion of the patent term ‘lost’ during the clinical development process and review by the Food and Drug Administration (FDA) – Part of the Hatch-Waxman Act’s grand bargain, given the unique regulatory regime governing commercialization of FDA-approved products”.9

Eligibility Criteria for US Patent Term Extensions

For a patent to be eligible for a PTE under 35 U.S.C. 156(a), it must meet several stringent conditions.3 These criteria are designed to ensure that extensions are granted judiciously and in line with the Act’s compensatory intent.

The core conditions include:

- Unexpired Patent: The patent term must not have expired before the PTE application is submitted.3 This ensures that the extension builds upon an existing, valid intellectual property right.

- Single Extension: The patent term must never have been extended under this section previously.3 Critically, only one patent may be extended for a regulatory review period for any single product, even if multiple patents cover different aspects of that product.3

- Proper Applicant: The application must be submitted by the owner of record of the patent or its authorized agent.3 This ensures proper legal standing for the request.

- Regulatory Review: The product must have been subject to a “regulatory review period” by the FDA prior to its commercial marketing or use.3 This applies broadly to human drugs, biologics, medical devices, food additives, and color additives.3

- First Commercial Marketing: The permission for commercial marketing or use must be the first permitted commercial marketing or use of the product.5 This prevents extensions for subsequent approvals of the same product, reinforcing the compensatory nature for the initial regulatory delay. Exceptions exist for certain animal drugs/veterinary biologics and human drug products manufactured using recombinant DNA technology.16

Special Considerations: Combination Products and Pediatric Exclusivity

The Hatch-Waxman Act also addresses specific scenarios. For instance, drug products containing two or more active ingredients in a single dosage form (combination products) can be eligible for PTE. This applies if none of the active ingredients (or their salts/esters) have been previously approved, or if at least one active ingredient is new AND the patent claims that newly approved ingredient.9 However, a “new” combination of

two previously approved active ingredients is generally not eligible for PTE.9

Separate from standard PTE, the US offers a powerful incentive known as pediatric exclusivity. This provides an additional 6 months of market exclusivity if pediatric clinical studies are conducted in response to an FDA written request.2 This exclusivity adds to any existing patent or non-patent exclusivity for the drug, effectively extending the entire exclusivity portfolio.5

The strict eligibility criteria, particularly the “first commercial marketing” rule and the “one patent per product” limitation, compel pharmaceutical companies to make critical strategic decisions early in the drug development lifecycle. If a company holds multiple patents covering different aspects of a single drug, but can only extend one, which patent do they choose? This decision is a high-stakes gamble, requiring deep analysis of patent strength, market potential, and remaining patent life. The strictness of these rules prevents “double-dipping” on extensions, ensuring the system remains targeted at compensating for initial regulatory delays. The pediatric exclusivity, despite being a seemingly shorter extension, offers a highly lucrative incentive for blockbuster drugs. This additional six months can translate into hundreds of millions or even billions in additional revenue for top-selling drugs, making the investment in pediatric trials a strategic imperative for many companies.17 This demonstrates how specific legislative incentives can directly influence and shape R&D focus towards particular patient populations.

The Application Process for US PTEs

Navigating the US PTE regime requires a coordinated effort between the USPTO and the FDA. While the USPTO administers the PTE process, it relies heavily on the FDA’s determination of the regulatory review period.9

The timelines and required documentation are precise:

- Filing Deadline: An application for PTE must be submitted by the patent owner or their authorized agent within a strict 60-day period.3 This period commences on the date the product receives permission for commercial marketing or use.16 A crucial detail: if approval is transmitted after 4:30 PM Eastern Time on a business day, or on a non-business day, the product is deemed to have received such permission on the next business day.19

- Required Information: The application must be comprehensive, containing specific details to enable a thorough evaluation.38 This includes the identity of the approved product and the federal statute under which regulatory review occurred; the identity of the patent for which extension is sought, along with each claim covering the approved product, its method of use, or its manufacturing method; information enabling the USPTO and the relevant Secretary (Health and Human Services or Agriculture) to determine eligibility and the precise extension period; a brief description of activities undertaken during the regulatory review period with significant dates; and any other information the Director of the USPTO may require.38

- Interim Extensions: In situations where a patent is expected to expire before the product receives full regulatory approval, interim extensions of up to one year are available, provided the product is in the “approval phase”.3 These interim extensions are temporary and terminate 60 days after regulatory approval, unless a full PTE application is filed within that period.3

- Duty of Candor: Applicants are bound by a duty of candor and good faith to both the Director of the USPTO and the Secretary of Health and Human Services or Agriculture.3 This obligation ensures transparency and accuracy throughout the application process.

The strict 60-day filing deadline is a critical procedural hurdle. Missing this window, even by a single day, can result in the forfeiture of a potentially multi-year extension, leading to significant financial losses for the innovating company. Consider a scenario where a blockbuster drug, which took 12 years to develop and gain approval, could secure a 5-year PTE, adding billions in revenue. An oversight leading to a missed deadline would be a catastrophic error. This underscores the immense pressure on intellectual property and regulatory affairs departments to have robust internal processes and monitoring systems in place to track approval dates meticulously and coordinate timely filings. The inherent complexity of the application process also highlights the critical value of specialized legal counsel in navigating these intricate requirements.

Calculating the US Patent Term Extension

The calculation of the patent term extension period is a precise process based on the regulatory review period (RRP) and several other factors.3 The USPTO relies on the Secretary’s determination of the regulatory review period length and then applies statutory limitations to ensure the final extension does not exceed legal maximums.26

The Formula Explained: RRP, Due Diligence, and More

The basic formula for calculating the extension period is:

Period of Extension = RRP – PGRRP – DD – ½ (TP – PGTP) 26

Let’s break down each component:

- RRP (Regulatory Review Period): This represents the total number of days in the regulatory review period.26 This period is officially determined by the FDA (or USDA for certain products) and encompasses both the initial testing phase and the final approval phase.3

- PGRRP (Pre-Grant Regulatory Review Period): This is the number of days of the RRP that occurred before the patent was issued.3 The extension is only meant to compensate for time lost

after the patent was granted and thus theoretically able to be commercially exploited. - DD (Due Diligence): This crucial factor accounts for the number of days of the RRP during which the applicant did not act with due diligence.3 The term “due diligence” is legally defined as “that degree of attention, continuous directed effort, and timeliness as may reasonably be expected from, and are ordinarily exercised by, a person during a regulatory review period”.28 Any period of unjustified delay by the applicant reduces the potential extension.

- TP (Testing Phase): This refers to the period from the Investigational New Drug (IND) effective date to the New Drug Application (NDA)/Biologics License Application (BLA)/Premarket Approval (PMA) initial submission date.3

- PGTP (Post-Grant Testing Phase): This is the number of days of the Testing Phase that occurred before the patent was issued.26 The formula effectively halves the portion of the testing phase that occurred

after the patent issued, while fully counting the approval phase.

In essence, the PTE is derived from the sum of the approval period and half of the testing period that occurred after the patent was issued, with deductions for any lack of due diligence.3

Statutory Caps and Limitations

While PTEs offer significant benefits, they are subject to strict statutory caps to prevent excessive monopolies:

- Maximum Extension: The PTE cannot exceed 5 years, regardless of how long the regulatory review process took.3

- Total Market Exclusivity Cap: The total patent term after extension, when added to the regulatory review period, cannot exceed 14 years from the date of FDA approval.3 This 14-year period is specifically measured from the date the drug product received regulatory approval up to the date of patent expiration (with term extension).5 This cap provides a predictable outer limit for market exclusivity, which is valuable for both innovator and generic manufacturers.

- One Patent per Product: As previously noted, only one patent may be extended for a regulatory review period for any single product.3 This prevents multiple extensions for the same drug.

- Terminal Disclaimers: A notable distinction is that a patent may receive a PTE even if it is subject to a terminal disclaimer.16 This differs from patent term adjustments (PTA), which generally do not extend a patent beyond a disclaimed expiration date.39

The “due diligence” requirement introduces a critical qualitative element into an otherwise quantitative calculation. It signifies that companies cannot intentionally or negligently delay the regulatory process to gain a longer extension. This provision incentivizes efficiency in regulatory submissions and clinical trials, aligning the innovator’s operational speed with the public interest of faster market access to new therapies. Failure to demonstrate due diligence can directly reduce the economic benefit of a PTE, acting as a regulatory safeguard that pushes companies to be as efficient as possible in bringing their innovations to market, rather than exploiting the system for extended monopolies.

Table 2: Illustrative US PTE Calculation Components

This table provides a concise overview of the key components involved in calculating a US Patent Term Extension. For business professionals, understanding these individual components is crucial for accurate forecasting of market exclusivity and for identifying potential areas where due diligence might impact the final extension period. It demystifies the formula and highlights the specific factors that contribute to or subtract from the potential extension, enabling more precise strategic planning.

| Component | Definition | Impact on Extension Calculation |

| RRP | Total number of days in the regulatory review period (testing + approval) | Basis for the total potential extension period. |

| PGRRP | Days of RRP before patent issuance | Subtracted, as this time was lost before the patent was in force. |

| DD | Days of RRP where applicant lacked due diligence | Subtracted, penalizing unjustified delays by the applicant. |

| TP | Total days in the testing phase (IND effective to NDA/BLA/PMA submission) | Only half of the post-grant testing phase is counted. |

| PGTP | Days of TP before patent issuance | Used to isolate the post-grant testing phase for halving. |

Supplementary Protection Certificates (SPCs): The European Union Framework

Across the Atlantic, the European Union employs Supplementary Protection Certificates (SPCs) to address the same fundamental challenge of lost patent time due to regulatory delays. SPCs are a complementary intellectual property right to patents that provide additional years of protection for products subject to regulatory approval.11

Purpose and Genesis of SPCs

The EU’s motivation for creating SPCs mirrors that of the US Hatch-Waxman Act: to provide sufficient protection for innovative pharmaceutical and plant protection products in the interest of public health and to encourage innovation in these areas to generate smart growth and jobs.13 SPCs specifically aim to offset the loss of patent protection that occurs due to the compulsory lengthy testing and clinical trials these products require prior to obtaining regulatory marketing approval.11

The legal framework for SPCs was established through Council Regulation (EEC) No 1768/92 for medicinal products and Regulation (EC) No 1610/96 for plant protection products.18 These regulations came into force in the early to mid-1990s, recognizing that without such compensatory mechanisms, the effective commercial life of patented innovations would be severely curtailed. SPCs provide a compromise: once marketing approval is received, the patentee may exploit an extended period of protection for the regulated product beyond the 20-year lifetime of the original patent.11

The European Federation of Pharmaceutical Industries and Associations (EFPIA) underscores the value of these incentives, stating that “Pharmaceutical incentives, including Supplementary Protection Certificate (SPCs), are the foundations on which innovation is built. The objective of the SPC was to offset some of the effective patent term lost during the development of a medicine”.40 This protection from unfair competition for a limited period allows innovative companies to continue taking the significant risks and investments required to deliver new medicines to patients and healthcare systems.40

Eligibility Criteria for EU SPCs

Obtaining an SPC in the EU involves specific eligibility criteria, which are primarily centered on the relationship between the basic patent and the marketing authorization for the product. Unlike the US system, SPCs are generally applied for and granted on a country-by-country basis within the EU, although a new centralized procedure is emerging.11

The two key requirements for obtaining an SPC are 11:

- Valid Basic Patent: The applicant must hold a patent that protects the active ingredient and is in force in the specific jurisdiction where the SPC is sought. This “basic patent” can protect the product itself, a process to obtain it, or an application of the product.12

- Marketing Authorization (MA): The applicant must possess a valid marketing authorization to place the medicinal product or plant protection product containing the active ingredient on the market in that same jurisdiction.11 This MA must be the

first authorization granted to place that active ingredient on the relevant market, and the active ingredient cannot have previously been awarded an SPC.11

Pediatric Extension in the EU

Similar to the US, the EU offers an additional extension for pediatric studies. A six-month additional extension is available in accordance with Regulation (EC) No 1901/2006 if the SPC relates to a medicinal product for children for which data has been submitted according to a Paediatric Investigation Plan (PIP).11 PIPs are mandatory to support the authorization of medicines for children and compensate for the additional clinical trials and testing required.13

The nature of an SPC as a “separate, complementary intellectual property right” has significant implications for IP portfolio management in the EU. Unlike a US PTE, which literally extends the term of the existing patent, an SPC is a distinct right that comes into effect after the basic patent expires.11 This means that while the patent might cover a broad range of claims, the SPC only protects the specific active ingredient(s) for which marketing authorization has been received.11 This distinction requires careful strategic consideration regarding which patent to base an SPC application on, especially for complex drug products with multiple patents covering different aspects. It also simplifies the post-expiry landscape for generics, as the SPC’s scope is narrower than the original patent.

The Application Process for EU SPCs

The application process for SPCs in the EU has traditionally been decentralized, requiring applications to be filed at the national intellectual property office of each country where protection is desired.11 For example, an application for an SPC in the UK must be based on a granted UK patent and filed at the UKIPO.11

Key procedural aspects include:

- Filing Deadline: The application for an SPC must typically be filed within six months of receiving the relevant marketing authorization if the basic patent is already granted.11 If the patent is still pending when the marketing authorization is awarded, the six-month period commences from the date of patent grant.11 Missing this deadline can be fatal to the application.

- Required Fees: An application fee must be paid upon filing, and a cumulative renewal fee is due before the SPC comes into effect at the end of the patent’s 20-year term.11 The renewal fee is calculated based on the duration of the SPC; a longer term incurs a higher fee.11

- Emerging Centralized Procedure: The EU has introduced proposals for a new centralized procedure for granting national SPCs, particularly where the basic patent is a European patent and the product has a market authorization.13 This reform aims to reduce costs and administrative burden, and improve legal certainty and transparency.13 For unitary patents, a “unitary SPC” is also proposed, which would be granted on the basis of the same centralized procedure.13 This allows applicants to file a ‘combined application’ for both a unitary SPC and national SPCs for additional Member States not covered by the unitary patent.20

- SPC Manufacturing Waiver: A significant recent development is the SPC manufacturing waiver (Regulation (EU) 2019/933). This entitles EU-based companies to manufacture a generic or biosimilar version of an SPC-protected medicine during the certificate’s term, specifically for export purposes to non-EU countries where IP protection does not exist or has expired.13 The aim is to remove a competitive disadvantage for EU manufacturers and ensure a better deal for patients globally, while balancing the interests of innovative pharmaceutical companies.13 Safeguards, such as notification requirements and anti-diversion measures (e.g., affixing a logo to outer packaging), are in place to prevent re-importation into the EU market before SPC expiry.40

The emerging centralized procedure for SPC applications represents a significant step towards reducing administrative burden and improving legal certainty and transparency across the EU.13 Traditionally, the need to file separate national applications in different languages, with the risk of inconsistent outcomes across member states, created considerable complexity and cost for pharmaceutical companies. The new centralized system, by offering a single examination for both unitary and national SPCs, streamlines the process. This improvement allows small and medium-sized enterprises (SMEs) in particular to have a clearer picture of a product’s protection status across the EU, fostering a more predictable and efficient intellectual property landscape.

Calculating the EU SPC Term

The calculation of the Supplementary Protection Certificate (SPC) protection period in the EU is designed to compensate for the loss of patent protection time due to marketing authorization delays, with a maximum duration of up to 5 years.23

The specific formula for calculating the SPC protection period is:

SPC Protection Period = (Date of First Marketing Authorization Grant – Filing Date of Basic Patent) – 5 years 41

The interpretation of this formula’s result determines the final SPC duration:

- No SPC Protection: If the resulting duration is less than 0, or if the first marketing authorization is obtained within 5 years of the basic patent filing date, no SPC protection period is granted.41 This implies that if the regulatory review period was short, no compensation is needed.

- Calculated Duration: If the calculated period is less than 5 years but greater than or equal to 0, that calculated duration is the length of the SPC protection.41

- Maximum Duration: If the calculated duration is more than 5 years, a protection period of 5 years is provided.41 This ensures the 5-year statutory cap is respected.

The objective of the SPC system is to provide a guaranteed period of 15 years of marketing exclusivity from the time the medicinal product first obtains authorization to be placed on the market in the Community.23 The SPC makes up the difference if the effective patent life falls short of this 15-year target, up to the 5-year maximum.24 For example, if a drug’s patent effectively provides 12 years of market exclusivity post-approval, an SPC could add up to 3 years to reach the 15-year target.

If a medicinal active ingredient has passed the appropriate pediatric testing, the SPC term may be extended by a further six months.11

The predictability of SPC duration, governed by a clear formula and statutory caps, significantly impacts market entry strategies for both innovators and generic manufacturers. For innovators, knowing the maximum potential exclusivity period allows for more accurate long-term revenue forecasting and investment planning. For generic companies, this predictability provides a clearer timeline for when they can expect to enter the market, enabling them to plan their R&D, manufacturing, and regulatory approval processes with greater certainty. This transparency, while benefiting innovators, also serves the public interest by establishing a more defined pathway for generic competition.

Strategic Implications for Pharmaceutical Companies

Understanding patent term extensions is not merely a legal compliance exercise; it is a strategic imperative that directly influences a pharmaceutical company’s market position, revenue streams, and long-term viability.

Maximizing Market Exclusivity and Revenue

The primary strategic benefit of PTEs and SPCs is the extension of the market exclusivity period. While a drug patent is legally granted for 20 years from the filing date, a significant portion of this time (often 10 to 15 years) is consumed by R&D and clinical trials before the drug even reaches the market.4 This means the effective market exclusivity after launch is typically much shorter, often between 7 to 10 years.6 PTEs and SPCs can extend this crucial window, allowing the innovator to recoup the substantial investments made in research and clinical development, which can exceed billions of dollars.3 This extended period of monopoly sales directly correlates with the ability to set higher prices, making R&D investments economically viable.

The pharmaceutical industry sees an average increase of $1.2 billion in revenue per year due to patent term extensions.10 This substantial financial impact underscores the importance of extensions in maintaining market exclusivity and profitability. By extending the patent term, companies can continue to generate significant revenue from their products, supporting further research and development.10 This additional time on the market without generic competition enables companies to maximize their revenue and support ongoing R&D efforts.10

PTEs and SPCs also enhance price differentiation. During the extended exclusivity period, innovator companies can maintain high prices for their drugs without generic competition, maximizing profits and revenue. Upon generic entry, prices typically drop dramatically, often by 40% to over 80%.6 Therefore, delaying generic entry through these extensions helps sustain high-cost drug revenues for a longer duration. Furthermore, these extensions can help mitigate the impact of the “patent cliff,” a phenomenon where key drugs lose patent protection nearly simultaneously, leading to significant revenue drops for pharmaceutical companies.6 By staggering the expiration of patents, PTEs can provide more stable financial planning for the innovator.

The direct link between extended exclusivity and R&D viability is a cornerstone of pharmaceutical business strategy. Without the extended period to generate sufficient revenue, the economic rationale for investing in high-risk, long-term drug development would significantly diminish. These extensions are not just about profit; they are about securing the necessary return on investment to fund the next generation of life-saving therapies. This critical return on investment ensures that companies can continue to take the financial plunge into uncharted scientific territory.

R&D Investment and Innovation Incentives

The ability to extend patents further encourages companies to invest in groundbreaking therapies by providing additional time to maximize the commercial potential of their drugs.10 This mechanism is deeply intertwined with the fundamental incentive structure of the pharmaceutical industry. Approximately 40% of patent term extension requests in the U.S. are for pharmaceutical patents, and about 80% of all PTEs in the U.S. are related to drugs and biologics.10 These statistics highlight the industry’s profound reliance on these extensions to protect their substantial investments and maintain a competitive edge.10

The role of intellectual property incentives in fostering innovation is a subject of ongoing debate. While some argue that innovation is declining under existing law, data suggests otherwise. Real spending for pharmaceutical research and development has increased substantially over time when adjusted for inflation.43 Although R&D spending as a percentage of sales might appear to decline, this often merely indicates that sales are increasing at a faster rate, not that actual R&D investment is decreasing.43

The complex relationship between R&D spending and sales underscores the need for robust intellectual property protection. Pharmaceutical companies must earn enough revenue on their drugs during their exclusivity period to fund existing and future development projects, especially given that a large percentage of innovations will not reach the market.8 Patent term extensions contribute to this financial stability, allowing companies to sustain their R&D pipelines.

Lifecycle Management and “Evergreening”

Pharmaceutical companies often employ sophisticated lifecycle management strategies to extend the commercial life of their drugs beyond the initial patent term. This practice, sometimes controversially referred to as “evergreening,” involves filing numerous secondary patents covering slight variations, new formulations, alternative methods of use, or delivery systems of an existing drug.6 For example, companies might develop sustained-release formulations (like Lilly did with Prozac or Bristol-Myers Squibb with Glucophage XR) or new routes of administration (like GSK with Imitrex intranasal delivery) to secure new patents and maintain market share.45 “In fact, 78% of the drugs associated with new patents are not new drugs coming on the market; they are existing ones”.29

The practice of “racemic switching,” where a company holding a patent for a racemic drug (a mixture of mirror-image molecules) remarkets the drug as a single enantiomer under a new patent, is another example.45 This allows companies to maintain market exclusivity for the drug as a whole, even as the original patent nears expiration.45

While legally permissible, these practices raise significant ethical and legal debates. Critics argue that “evergreening” delays low-cost generic medicines from reaching the market without offering substantial additional therapeutic benefit.44 This creates a tension between legitimate lifecycle management, which can lead to improved patient outcomes (e.g., better dosing, fewer side effects), and perceived abuse of the patent system to prolong monopolies. This tension directly impacts public perception of the pharmaceutical industry and fuels calls for stricter regulatory scrutiny and patent reforms. The debate centers on whether these incremental innovations truly warrant new, lengthy periods of exclusivity, or if they primarily serve to extend market dominance, potentially at the expense of patient access and affordability.

Impact on Generic Drug Manufacturers and Market Dynamics

The landscape shaped by patent term extensions presents both challenges and opportunities for generic drug manufacturers, fundamentally altering market dynamics and competition.

Challenges for Generic Entry

Patent term extensions and Supplementary Protection Certificates directly delay the entry of generic and biosimilar competitors into the market. This prolonged exclusivity means that generic manufacturers must wait longer to introduce their often significantly cheaper versions of branded drugs.6

One of the major hurdles generic companies face is navigating “patent thickets”—dense webs of overlapping patents filed by innovator companies around a single drug.34 These thickets can cover various aspects, from the drug’s composition and manufacturing processes to its formulations and methods of use.34 This layered protection complicates generic entry, as each patent may need to be challenged or designed around, leading to costly and time-consuming litigation.44 A study found that 71% of drugs with granted patent term extensions experienced early patent challenges, indicating the aggressive nature of generic companies seeking to overcome these barriers.48

The strategic hurdles for generics are substantial, necessitating robust legal and market intelligence. Generic manufacturers must invest heavily in patent searches and analyses to identify valid pathways for market entry without infringing existing patents.49 The complexity of the patent landscape means that a generic company’s success often hinges on its ability to effectively challenge or circumvent these extended protections.

Generic Strategies to Navigate Extensions

Despite the challenges, generic manufacturers employ sophisticated strategies to navigate and accelerate their market entry.

- Abbreviated New Drug Applications (ANDAs): The primary regulatory pathway in the US for generics is the ANDA process, overseen by the FDA.7 This pathway streamlines approval by allowing generics to rely on the innovator’s safety and efficacy data, avoiding the need for extensive preclinical and clinical trials.6

- Paragraph IV Certifications: Under the Hatch-Waxman framework, generic manufacturers can challenge the patents of the originator by filing a Paragraph IV certification with their ANDA.6 This certification asserts that a listed patent is either invalid or will not be infringed by the generic product.7

- 180-Day Exclusivity: A significant incentive for generic companies is the 180-day marketing exclusivity period awarded to the first generic applicant(s) to file a substantially complete ANDA containing a Paragraph IV certification.6 This period provides a crucial temporary monopoly for the first generic entrant, offering a substantial financial reward for taking the risk of patent challenge.44

- “At-Risk” Launches: Generic companies may sometimes choose to launch their product “at-risk” before patent litigation is fully resolved.51 This means they launch commercially even while patent infringement claims are pending, accepting the risk of substantial damages if the patent holder ultimately prevails.51 This aggressive strategy can accelerate market entry but carries significant financial exposure.

- Legal Challenges: Generic companies frequently initiate invalidity challenges, arguing that a patent should not have been granted due to lack of novelty or obviousness.44 They may also pursue inequitable conduct or enforcement challenges, attacking the manner in which a patent was obtained.44 These proactive litigation strategies, sometimes called “patent prospecting,” aim to dismantle patent thickets and clear the path for competition.44

The competitive strategies employed by generics are high-stakes endeavors. The financial incentive for generics is enormous if they can successfully curtail a monopoly period and secure an early market entry, sometimes even gaining a temporary period of exclusivity.44 This drives rigorous examination of the brand’s patent strength and aggressive litigation. This dynamic legal battle is a defining feature of the pharmaceutical market, directly impacting the timing of generic entry and the subsequent availability of affordable medicines.

Price Reduction and Patient Access

When a drug patent expires, the market typically experiences a rapid influx of generic competitors, leading to dramatic price reductions.6 It is not uncommon for the price of a medication to drop by 80-90% within the first year after generic entry.52 As additional generic manufacturers join the competition, prices frequently decline further, sometimes reaching as little as 10-20% of the original branded price.42

The entry of generic drugs following patent expiry leads to substantial cost savings for healthcare systems and individual patients. In the United States alone, generic drugs saved the healthcare system $313 billion in 2019.52 These savings significantly improve access to medications and reduce the financial burden on patients and insurers alike.52 The availability of lower-cost generics also has profound implications for access to essential medicines in developing countries, making life-saving treatments accessible to populations that previously could not afford them.52

Interestingly, some studies have observed a phenomenon known as the “generic paradox,” where the price of the brand-name drug actually increases after generic entry.52 This might occur as the innovator company shifts its focus to a smaller, loyal patient base willing to pay a premium, or to offset revenue losses from the generic competition.

The balancing act between innovation and affordability is a constant challenge for regulatory bodies. Policies like the Hatch-Waxman Act aim to strike this balance by providing patent term extensions for innovator drugs while simultaneously facilitating generic entry.52 The societal benefits of generic competition are clear: increased access to affordable medicines, which directly translates to improved public health outcomes.

The Broader Economic and Societal Debate

The mechanisms of patent term extensions and supplementary protection certificates, while vital for incentivizing pharmaceutical innovation, sit at the nexus of a persistent and often contentious debate: how do we balance the need to foster groundbreaking research with the imperative of ensuring widespread access to affordable medicines?

Innovation vs. Affordability: A Persistent Tension

Views on patent protection for drugs tend to align with opinions on the value of innovation versus the urgency of affordability. Brand-name pharmaceutical companies and proponents of strong intellectual property (IP) laws argue that without the profits allowed by patent monopolies, pharmaceutical research and development (R&D) would stall, depriving patients of new medicines and the economy of new capital.53 The high costs of drug development are used to justify high prices for patented drugs, a model that is increasingly under scrutiny.52

On the other hand, generic drug companies and advocates for improved access to affordable medications often argue that brand-name companies abuse the patent system, continually tweaking old molecules to extend monopolies so that prices remain high and profits remain substantial.53 Dr. Maria Gonzalez, a Health Policy Expert at Johns Hopkins University, articulates this concern:

“The current patent system, while driving innovation, has also created barriers to access for many patients worldwide. We need to explore alternative models that balance innovation with affordability and accessibility.” 54

The HIV/AIDS crisis of the 1990s and early 2000s serves as a stark historical example of this tension. While patents incentivized the rapid development of life-saving antiretroviral drugs, their high prices initially limited access in many developing countries.54 This led to intense global debates and eventually resulted in various initiatives to increase access, including voluntary licensing agreements and compulsory licensing under TRIPS flexibilities.54

This inherent trade-off means that finding the appropriate patent term is unlikely to satisfy everyone.55 The pharmaceutical patent system is designed to provide a limited period of exclusivity to reward past research and fund existing and future R&D, and then open the field to low-cost generics for all time.8 However, the lengthening of patent monopolies, partly due to PTEs, has contributed to skyrocketing pharmaceutical drug prices and healthcare costs.56 This dynamic has prompted calls for alternative models that could potentially separate R&D costs from drug prices, such as prize systems for drug development.54

The Role of Regulatory Bodies and Policy Reform

Regulatory agencies like the FDA and EMA play a crucial role in balancing the need to incentivize pharmaceutical innovation with the imperative to ensure access to affordable medications.52 However, the current system is not without its critics. For instance, an HIV-prevention group, PrEP4All, challenged Gilead Sciences’ application to extend the patent on an HIV drug compound, alleging that Gilead was intentionally manipulating the patent term through delay tactics.56 The group argued that “To reward this behavior with additional years of patent term would be fundamentally inequitable and would incentivize future drug companies to copy Gilead’s unethical playbook”.57

Lawmakers and public health advocates have increasingly called for substantial changes to the patent system that would weaken pharmaceutical patents, arguing that blaming the patent system for high drug prices overstates its impact.8 Professor Jacob Sherkow, for example, noted that proposed rule changes targeting “patent thickets” could speed generic entry, but cautioned that companies may still find clever ways to circumvent rules.58 Professor Peter Lee also commented on how drug companies have found “workarounds” to Hatch-Waxman, leading to increased prices on drugs still under patent.59

The ongoing evolution of intellectual property policy reflects the continuous struggle to strike this balance. Proposed reforms, such as the Terminating the Extension of Rights Misappropriated (TERM) Act, aim to crack down on companies obtaining multiple patents on the same drug to extend protection.60 These proposals suggest shifting the burden to branded drug companies to prove their later patents are distinct from the first patent, a significant change that would effectively undo the presumption of validity for later-issued drug patents.60 These discussions highlight that the IP landscape is not static; it is constantly being shaped by legal interpretations, economic realities, and public health demands. Stakeholders across the pharmaceutical ecosystem must actively engage in these policy discussions to shape future frameworks that genuinely foster innovation while ensuring equitable access to life-saving medicines.

Leveraging Data for Market Domination: The Role of DrugPatentWatch

In the complex and rapidly evolving world of pharmaceutical intellectual property, access to accurate, actionable, and timely intelligence is not just a luxury—it is a competitive necessity. This is where specialized platforms like DrugPatentWatch become indispensable tools for businesses aiming to transform data into market domination.

DrugPatentWatch provides deep knowledge on pharmaceutical drugs, including patents, suppliers, generics, and formulation information.61 It offers a fully integrated database of drug patents and other critical information, allowing subscribers to perform freeform searches and dynamic browsing of data pertaining to pharmaceuticals and patents, both in the US and international countries.61

How does such a platform empower business professionals?

- Market Entry Opportunities: DrugPatentWatch helps identify generic entry opportunities by providing information on patent expiration dates, allowing companies to time their market entry strategically.5

- Portfolio Management: It enables branded pharmaceutical manufacturers to assess past successes of patent challengers and elucidate the research paths of competitors, informing their portfolio management decisions.61 For generic and API manufacturers, it helps anticipate future budget requirements and proactively identify generic sources.61

- Litigation and Challenges: The platform provides data on patent litigation, tentative approvals, Paragraph IV challenges, and top patent holders.61 This intelligence is crucial for understanding the competitive landscape and preparing for potential legal battles.61

- Forecasting and Strategic Planning: By offering insights into patent term extensions and their impact, DrugPatentWatch helps companies understand and leverage these mechanisms to prolong market exclusivity.48 It also assists in biopharmaceutical forecasting and predicting branded drug patent expiration, allowing for proactive strategic planning to prevent overstocking of off-patent drugs.61

The ability to access and analyze such comprehensive data is a significant competitive differentiator in the complex pharmaceutical intellectual property landscape. It allows businesses to move beyond reactive responses to market changes and instead adopt proactive strategies based on informed predictions. This data-driven approach is essential for identifying lucrative opportunities, mitigating risks, and ultimately, securing a dominant position in the global pharmaceutical market.

Conclusion

Understanding drug patent term extensions and supplementary protection certificates is paramount for any entity operating within or interacting with the pharmaceutical industry. These complex legal mechanisms are not mere footnotes in patent law; they are fundamental pillars that underpin the economic viability of pharmaceutical innovation, directly influencing the trajectory of drug development, market competition, and patient access.

The US Hatch-Waxman Act and the EU’s SPC system, while distinct in their legislative frameworks and procedural nuances, share a common objective: to compensate innovators for the significant time lost during lengthy regulatory approval processes. This compensation is a critical incentive, ensuring that the colossal investments in R&D, often spanning over a decade and costing billions, can yield a reasonable return. Without these extensions, the effective market exclusivity for many drugs would be drastically curtailed, potentially stifling the pursuit of novel, life-saving therapies.

However, the benefits of extended exclusivity for innovators are inextricably linked to the challenges faced by generic manufacturers and, ultimately, the affordability of medicines for patients. The strategic maneuvers employed by innovator companies, including lifecycle management and the creation of “patent thickets,” necessitate sophisticated counter-strategies from generics, leading to a dynamic and often litigious market environment. This constant tension between innovation incentives and public health affordability fuels an ongoing societal debate, prompting calls for policy reforms that seek a more equitable balance.

For business professionals, navigating this intricate landscape demands more than just a superficial understanding of patent law. It requires a deep appreciation of the historical context, the precise eligibility and calculation criteria, the procedural complexities, and the strategic implications for all market players. Leveraging advanced data intelligence platforms, such as DrugPatentWatch, becomes indispensable for identifying opportunities, forecasting market shifts, managing IP portfolios effectively, and making informed decisions that drive market leadership. In an industry where innovation is the currency and market exclusivity is the prize, mastering the intricacies of patent term extensions is not just a legal necessity, but a strategic imperative for sustained success.

Key Takeaways

- PTEs and SPCs are vital compensatory mechanisms: They restore lost patent time due to lengthy regulatory approval processes, directly incentivizing pharmaceutical R&D.

- US and EU systems differ significantly: The Hatch-Waxman Act (US) and Supplementary Protection Certificates (EU) have distinct rules, eligibility, and application processes, requiring tailored global IP strategies.

- Strict eligibility and deadlines are critical: Missing application deadlines or failing to demonstrate “due diligence” can lead to forfeiture of valuable exclusivity.

- Extensions are capped: Both US PTEs (max 5 years, 14-year total exclusivity from approval) and EU SPCs (max 5 years, aiming for 15 years total from first MA) have strict limits.

- Pediatric extensions offer lucrative incentives: Additional 6-month extensions in both regions encourage R&D for pediatric populations.

- Strategic lifecycle management is key: Innovators use extensions and secondary patents (“evergreening”) to prolong market exclusivity, impacting generic entry.

- Generics employ aggressive counter-strategies: ANDAs, Paragraph IV certifications, and “at-risk” launches are common tactics to challenge patents and secure market entry.

- Generic entry drives significant price reductions: Competition from generics dramatically lowers drug prices, leading to substantial cost savings for healthcare systems and improved patient access.

- The innovation vs. affordability debate persists: The balance between incentivizing R&D and ensuring affordable access to medicines remains a central policy challenge.

- Data intelligence is crucial for market domination: Platforms like DrugPatentWatch provide essential insights for navigating patent landscapes, identifying opportunities, and informing strategic business decisions.

Frequently Asked Questions (FAQs)

What is the primary reason for drug patent term extensions?

The primary reason for drug patent term extensions is to compensate pharmaceutical companies for the effective patent life lost during the lengthy and mandatory regulatory review processes (e.g., clinical trials and FDA approval) that occur before a new drug can be commercially marketed. This ensures innovators have a sufficient period of market exclusivity to recoup their substantial research and development investments and continue funding future innovations.

How do US Patent Term Extensions (PTEs) differ from EU Supplementary Protection Certificates (SPCs)?

While both PTEs and SPCs serve to extend market exclusivity due to regulatory delays, they differ in their legal nature and administration. US PTEs are extensions of the original patent term, administered by the USPTO in collaboration with the FDA. EU SPCs are separate, complementary intellectual property rights that take effect after the basic patent expires and are traditionally applied for nationally, though a centralized procedure is emerging. Their calculation formulas and total exclusivity caps also vary.

Can a pharmaceutical company extend a patent indefinitely through these mechanisms?

No, patent term extensions and supplementary protection certificates are subject to strict statutory limitations. In the US, a PTE cannot exceed 5 years, and the total patent term after extension generally cannot exceed 14 years from the date of FDA approval. Similarly, in the EU, an SPC has a maximum duration of 5 years (with an additional 6 months for pediatric studies), aiming for a total market exclusivity of 15 years from the first marketing authorization. These caps prevent indefinite monopolies.

What is the “due diligence” requirement in US Patent Term Extension calculations?

The “due diligence” requirement in US PTE calculations refers to the expectation that the patent applicant acted with a “degree of attention, continuous directed effort, and timeliness as may reasonably be expected” during the regulatory review period. Any period during which the applicant failed to exercise due diligence, thereby unnecessarily prolonging the regulatory review, will be subtracted from the potential patent term extension. This incentivizes efficiency in the regulatory process.

How do patent term extensions impact the availability and pricing of generic drugs?

Patent term extensions directly delay the entry of generic drugs into the market by prolonging the innovator’s period of market exclusivity. This means generic manufacturers must wait longer to launch their products. However, once patents and extensions expire, generic entry typically leads to dramatic price reductions (often 80-90% within the first year) and significantly increases patient access to more affordable medications, generating substantial cost savings for healthcare systems.

Works cited

- Patent term extensions: Overview, definition, and example – Cobrief, accessed July 16, 2025, https://www.cobrief.app/resources/legal-glossary/patent-term-extensions-overview-definition-and-example/

- Pharmaceutical Patent Term Extensions: A Brief Explanation – Every CRS Report, accessed July 16, 2025, https://www.everycrsreport.com/reports/RS21129.epub

- Patent Term Extension Calculator: Step-by-Step Expert Guide – DrugPatentWatch, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/patent-term-extension-calculator-step-by-step-expert-guide/

- Patent Term Extensions & Exclusivity Amid Blockbuster Drug Patent Expirations, accessed July 16, 2025, https://www.potterclarkson.com/insights/patent-term-extensions-and-exclusivity-amid-blockbuster-drug-patent-expirations/

- How Long Does a Patent Last for Drugs? A Comprehensive Guide to Pharmaceutical Patent Duration – DrugPatentWatch, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/how-long-does-a-patent-last-for-drugs/

- How long is the patent on a new drug before generic brands are …, accessed July 16, 2025, https://synapse.patsnap.com/article/how-long-is-the-patent-on-a-new-drug-before-generic-brands-are-made-available

- Generic Drug Entry Timeline: Predicting Market Dynamics After Patent Loss, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/generic-drug-entry-timeline-predicting-market-dynamics-after-patent-loss/

- Patents and Drug Pricing: Why Weakening Patent Protection Is Not in the Public’s Best Interest – American Bar Association, accessed July 16, 2025, https://www.americanbar.org/groups/intellectual_property_law/resources/landslide/2025-spring/drug-pricing-weakening-patent-protection-not-best-interest/

- PATENT TERM EXTENSION FOR FDA-APPROVED PRODUCTS – Mayer Brown, accessed July 16, 2025, https://www.mayerbrown.com/-/media/files/perspectives-events/publications/2024/04/240410-wdc-webinar-lifesci-successfully-navigating-slides.pdf?rev=537cb0623a9841a1ad320d7e52889377

- Patent Term Extension Statistics: What Innovators Need to Know – PatentPC, accessed July 16, 2025, https://patentpc.com/blog/patent-term-extension-statistics-what-innovators-need-to-know

- Supplementary Protection Certificates – HLK, accessed July 16, 2025, https://www.hlk-ip.com/knowledge-hub/supplementary-protection-certificates-additional-protection-for-regulated-products/

- Supplementary Protection Certificates (SPCs) & Patent Term Extensions (PTEs), accessed July 16, 2025, https://www.mewburn.com/law-practice-library/supplementary-protection-certificates-patent-term-extensions

- Supplementary protection certificates for pharmaceutical and plant protection products – European Commission – Internal Market, Industry, Entrepreneurship and SMEs, accessed July 16, 2025, https://single-market-economy.ec.europa.eu/industry/strategy/intellectual-property/patent-protection-eu/supplementary-protection-certificates-pharmaceutical-and-plant-protection-products_en

- Patent Term Extensions | Merck.com, accessed July 16, 2025, https://www.merck.com/wp-content/uploads/sites/124/2023/12/Patent-Term-Extensions_MRK_DEC11.pdf

- Federal Circuit Affirms Patent Term Extension Calculation, accessed July 16, 2025, https://natlawreview.com/article/whats-reissue-patent-term-extensions-reissue-patents

- Understanding the Statute on Patent Term Extension – IPWatchdog.com, accessed July 16, 2025, https://ipwatchdog.com/2024/10/28/understanding-statute-patent-term-extension/id=182598/

- The Role of Patent Extensions in U.S. Health Policy: Legal Considerations – PatentPC, accessed July 16, 2025, https://patentpc.com/blog/the-role-of-patent-extensions-in-u-s-health-policy-legal-considerations

- Supplementary Protection Certificates – Guide for Applicants, accessed July 16, 2025, https://www.gnaipr.com/NoticeGnaipr/Supplementary%20Protection%20Certificates%20-%20Mar%2009.pdf

- How can I request a patent term extension under the Hatch-Waxman …, accessed July 16, 2025, https://blueironip.com/ufaqs/how-can-i-request-a-patent-term-extension-under-the-hatch-waxman-act/

- Q&A on the Supplementary Protection Certificates – European Commission, accessed July 16, 2025, https://ec.europa.eu/commission/presscorner/detail/pl/qanda_23_2455

- Pharmaceutical Patent Term Extension: An Overview – Alacrita, accessed July 16, 2025, https://www.alacrita.com/whitepapers/pharmaceutical-patent-term-extension-an-overview

- Patent Term Extension under 35 USC § 156, accessed July 16, 2025, https://www.aipla.org/docs/default-source/committee-documents/bcp-files/mtill_pte.pdf

- Supplementary Protection Certificates in the European Union: Briefing Document – Medicines Law & Policy, accessed July 16, 2025, https://medicineslawandpolicy.org/wp-content/uploads/2019/06/European-Union-Review-of-Pharma-Incentives-Supplementary-Protection-Certificates.pdf

- Supplementary Protection Certificates (SPCs) | MPA Business Services, accessed July 16, 2025, http://mpasearch.co.uk/supplementary-protection-certificates-spcs

- 37 CFR § 1.710 – Patents subject to extension of the patent term. – Law.Cornell.Edu, accessed July 16, 2025, https://www.law.cornell.edu/cfr/text/37/1.710

- How is the patent term extension period calculated? – BlueIron IP, accessed July 16, 2025, https://blueironip.com/ufaqs/how-is-the-patent-term-extension-period-calculated/

- 2758-Notice of Final Determination – Calculation of Patent Term Extension – USPTO, accessed July 16, 2025, https://www.uspto.gov/web/offices/pac/mpep/s2758.html

- 2757-Regulatory Agency Determination of the Length of the …, accessed July 16, 2025, https://www.uspto.gov/web/offices/pac/mpep/s2757.html

- Patent Term Extensions and the Last Man Standing | Yale Law & Policy Review, accessed July 16, 2025, https://yalelawandpolicy.org/patent-term-extensions-and-last-man-standing

- The Statutory and Regulatory Scheme* – American Bar Association, accessed July 16, 2025, https://www.americanbar.org/content/dam/aba-cms-dotorg/products/inv/book/392632497/chap1-5370243.pdf

- The Hatch-Waxman (Im)Balancing Act – Harvard DASH, accessed July 16, 2025, https://dash.harvard.edu/bitstream/handle/1/10015297/Paper1.html

- 2750-Patent Term Extension for Delays at other Agencies under 35 U.S.C. 156 – USPTO, accessed July 16, 2025, https://www.uspto.gov/web/offices/pac/mpep/s2750.html

- Hatch-Waxman Litigation 101: The Orange Book and the Paragraph IV Notice Letter, accessed July 16, 2025, https://www.dlapiper.com/en/insights/publications/2020/06/ipt-news-q2-2020/hatch-waxman-litigation-101

- How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management, accessed July 16, 2025, https://www.ajmc.com/view/a636-article

- Applications for patent term extension and patent terms extended under 35 U.S.C. § 156, accessed July 16, 2025, https://www.uspto.gov/patents/laws/patent-term-extension/patent-terms-extended-under-35-usc-156

- Patents and Exclusivities for Generic Drug Products – FDA, accessed July 16, 2025, https://www.fda.gov/drugs/cder-conversations/patents-and-exclusivities-generic-drug-products

- Understanding Patent Term Extensions: An Overview – DrugPatentWatch, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/understanding-patent-term-extensions-an-overview/

- Unlocking Market Dominance: A Comprehensive Guide to Pharmaceutical Patent-Term Extensions in Russia – DrugPatentWatch, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/getting-the-most-out-of-pharmaceutical-patent-term-extensions-in-russia/

- MPEP – Chapter 2700 – Patent Terms, Adjustments, and Extensions – USPTO, accessed July 16, 2025, https://www.uspto.gov/web/offices/pac/mpep/mpep-2700.pdf

- Supplementary protection certificates – EFPIA, accessed July 16, 2025, https://www.efpia.eu/about-medicines/development-of-medicines/intellectual-property/supplementary-protection-certificates/

- How to calculate the extension of SPC protection time?, accessed July 16, 2025, https://synapse.patsnap.com/blog/how-to-calculate-the-extension-of-spc-protection-time

- The Impact of Drug Patent Expiration: Financial Implications …, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Patent Term Extension: An Expensive and Unnecessary Giveaway – Health Affairs, accessed July 16, 2025, https://www.healthaffairs.org/doi/10.1377/hlthaff.1.2.25

- What is a patent challenge, and why is it common in generics?, accessed July 16, 2025, https://synapse.patsnap.com/article/what-is-a-patent-challenge-and-why-is-it-common-in-generics

- Patent protection strategies – PMC, accessed July 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3146086/

- Big Pharma Can Tweak Drugs to Keep Generics Off the Market – Jacobin, accessed July 16, 2025, https://jacobin.com/2025/06/big-pharma-generic-drug-prices

- How can we discourage pharmaceutical companies like Novo Nordisk from extending the lifespan of their patents? – Quora, accessed July 16, 2025, https://www.quora.com/How-can-we-discourage-pharmaceutical-companies-like-Novo-Nordisk-from-extending-the-lifespan-of-their-patents

- Early Patent Challenges Impact 71% of Drugs with Patent Term Extensions, Study Finds., accessed July 16, 2025, https://www.geneonline.com/early-patent-challenges-impact-71-of-drugs-with-patent-term-extensions-study-finds/

- How to Protect Intellectual Property in Generic Drug Development – PatentPC, accessed July 16, 2025, https://patentpc.com/blog/how-to-protect-intellectual-property-generic-drug-development

- Patent Certifications and Suitability Petitions – FDA, accessed July 16, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- Intricacies of the 30-Month Stay in Pharmaceutical Patent Cases | Articles – Finnegan, accessed July 16, 2025, https://www.finnegan.com/en/insights/articles/intricacies-of-the-30-month-stay-in-pharmaceutical-patent-cases.html

- The Impact of Patent Expiry on Drug Prices – DrugPatentWatch, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-patent-expiry-on-drug-prices-a-systematic-literature-review/

- Drug patents: innovation v. accessibility – PMC, accessed July 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3680575/

- Driving Innovation: Drug Patents vs. Prizes – DrugPatentWatch, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/driving-innovation-drug-patents-vs-prizes/

- How are pharmaceutical patent term extensions justified? Australia’s evolving scheme – Productivity Commission, accessed July 16, 2025, https://www.pc.gov.au/__data/assets/pdf_file/0003/194223/sub007-intellectual-property-annex12.pdf

- Recommendations for Statutory Reform of the Patent Term Extension System to Increase Public Accountability and Fight Soaring Drug Prices – NYU Law, accessed July 16, 2025, https://www.law.nyu.edu/sites/default/files/recommendations-for-statutor-reform-of-the-patent-term-extension-system-2021-03.pdf

- Gilead, seeking HIV patent extension, faces ‘gamesmanship’ claims from patient group, accessed July 16, 2025, https://www.fiercepharma.com/pharma/gilead-seeking-patent-extension-hiv-meds-runs-into-pushback-from-patient-advocates

- STAT quotes Sherkow on pharmaceutical patents – College of Law, accessed July 16, 2025, https://law.illinois.edu/stat-quotes-sherkow-on-pharmaceutical-patents/

- Law360 Quotes Professor Lee on Hatch-Waxman Act, 40 Years Later | School of Law, accessed July 16, 2025, https://law.ucdavis.edu/news/law360-quotes-professor-lee-hatch-waxman-act-40-years-later

- Law360 Quotes Ha Kung Wong on the TERM Act’s Possible Ramifications for Patent Law, accessed July 16, 2025, https://www.venable.com/about/news/2019/06/law360-ha-kung-wong-term-act-possible-ramification

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 16, 2025, https://crozdesk.com/software/drugpatentwatch

- DrugPatentWatch Review – Crozdesk, accessed July 16, 2025, https://crozdesk.com/software/drugpatentwatch/review

- DrugPatentWatch – 2025 Company Profile & Competitors – Tracxn, accessed July 16, 2025, https://tracxn.com/d/companies/drugpatentwatch/__J3fvnNbRBdONp_-p-gLex5dxrrF6shPqUenXhHlGHHM

- DrugPatentWatch Analysis: Pharmaceutical Patents Key to Market, accessed July 16, 2025, https://www.geneonline.com/drugpatentwatch-analysis-pharmaceutical-patents-key-to-market-exclusivity-and-profitability/

- DrugPatentWatch Article: Patent Term Extensions and 505(b)(2) Applications Highlighted as Key Strategies in Post-ANDA Generic Drug Development – GeneOnline, accessed July 16, 2025, https://www.geneonline.com/drugpatentwatch-article-patent-term-extensions-and-505b2-applications-highlighted-as-key-strategies-in-post-anda-generic-drug-development/

- DrugPatentWatch: 505(b)(2) Applications and Patent Extensions Offer Strategies for Post-ANDA Market Exclusivity. – GeneOnline, accessed July 16, 2025, https://www.geneonline.com/drugpatentwatch-505b2-applications-and-patent-extensions-offer-strategies-for-post-anda-market-exclusivity/

- DrugPatentWatch: Pharmaceutical Companies Use Patent Thickets and Lifecycle Filings to Protect Drug Market Share. – GeneOnline, accessed July 16, 2025, https://www.geneonline.com/drugpatentwatch-pharmaceutical-companies-use-patent-thickets-and-lifecycle-filings-to-protect-drug-market-share/

- Hatch-Waxman Requires Patent Term Extension for Reissued Patents To Be Based on Original Patent | Sterne Kessler, accessed July 16, 2025, https://www.sternekessler.com/news-insights/insights/hatch-waxman-requires-patent-term-extension-for-reissued-patents-to-be-based-on-original-patent/

- Patent term calculator – USPTO, accessed July 16, 2025, https://www.uspto.gov/patents/laws/patent-term-calculator

- DrugPatentWatch Pricing, Features, and Reviews (Jun 2025) – SoftwareSuggest, accessed July 16, 2025, https://www.softwaresuggest.com/drugpatentwatch

- Pharma Patent Term Extensions: The good, the bad, and the ugly | Sterne Kessler, accessed July 16, 2025, https://www.sternekessler.com/news-insights/events/pharma-patent-term-extensions-good-bad-and-ugly/