Introduction: The Evolving Role of CDMOs in the Pharmaceutical Ecosystem

The pharmaceutical and biotechnology industries are undergoing a profound transformation, driven by accelerating scientific discovery, increasing regulatory complexity, and intense market pressures. In this dynamic environment, Contract Development and Manufacturing Organizations (CDMOs) have emerged as pivotal strategic partners, fundamentally reshaping how new therapies are brought to market. Understanding the intricate landscape of CDMO pricing is no longer merely a procurement exercise; it is a strategic imperative for any business professional seeking to optimize operations, mitigate risks, and gain a decisive competitive edge.

What is a CDMO? A Strategic Partner, Not Just a Vendor

At its core, a Contract Development and Manufacturing Organization (CDMO) is a specialized entity that provides comprehensive services spanning the entire drug development and manufacturing lifecycle for pharmaceutical and biotech firms . Unlike a Contract Manufacturing Organization (CMO), which historically focused solely on large-scale production, a CDMO offers a holistic suite of services, from initial product development and formulation to full-scale commercial manufacturing, packaging, and even distribution . This integrated approach signifies a fundamental shift in the outsourcing paradigm, elevating CDMOs beyond mere service providers to indispensable strategic collaborators.

This distinction between a CMO and a CDMO is not merely semantic; it reflects a deeper, more integrated partnership model. Companies engaging a CDMO are often seeking a partner to share research and development (R&D) risks, leverage highly specialized expertise, and navigate the complex journey from concept to commercialization. This comprehensive involvement across the product lifecycle, particularly for complex modern therapeutics, profoundly influences how value is perceived and, consequently, how services are priced. It suggests that CDMOs are increasingly becoming extensions of their clients’ internal R&D and manufacturing departments, necessitating tighter integration, mutual trust, and a shared vision for product success.

Why CDMOs are Revolutionizing Pharma Development and Manufacturing

CDMOs are at the forefront of revolutionizing the pharmaceutical industry by streamlining the drug development and manufacturing process, thereby enabling faster, more efficient, and more cost-effective production of pharmaceutical products . They offer critical solutions to some of the most pressing challenges faced by pharmaceutical and biotech companies today: managing escalating costs, overcoming capacity constraints, ensuring stringent regulatory compliance, gaining access to cutting-edge technology, and accelerating speed to market .

By partnering with CDMOs, companies gain access to specialized expertise, innovative technologies, and large-scale manufacturing capabilities that might be prohibitively expensive or simply unavailable in-house, especially for smaller biotech firms or even established pharmaceutical giants . This strategic outsourcing allows clients to concentrate on their core competencies, such as drug discovery and clinical research, while offloading the substantial capital investment and operational complexities associated with manufacturing infrastructure. Furthermore, CDMOs possess deep experience in navigating the labyrinthine global regulatory landscapes, a critical advantage in bringing new drugs to market efficiently and compliantly . This makes CDMOs not just a means to reduce costs, but a powerful strategic enabler for innovation and market access, particularly for emerging and highly complex therapies.

The Imperative of Understanding CDMO Pricing

For business professionals in the pharmaceutical and biotech sectors, a nuanced understanding of CDMO pricing is far more than a simple exercise in cost reduction; it is a strategic imperative for unlocking competitive advantage . The industry consensus is clear: selecting a CDMO involves a delicate balance where cost is a critical factor, but it is increasingly weighed against considerations of quality, speed, flexibility, and the CDMO’s depth of experience . As one industry expert wisely noted, “The cheapest isn’t always the best. A low bid might mean cut corners or delays” .

Many companies fall prey to common pitfalls that can significantly inflate project budgets and derail timelines. These include an exclusive focus on the lowest bid, underestimating the complexities and costs associated with technology transfer, overlooking hidden fees, insufficient due diligence on a CDMO’s true capabilities, and a general lack of clear communication and scope management throughout the project lifecycle . A profound grasp of the various pricing models and the underlying cost drivers is therefore essential for making truly informed decisions. This sophisticated evaluation framework moves beyond simple bid comparisons, recognizing that the total value proposition—encompassing risk mitigation, regulatory expertise, and technological alignment—is paramount. This shift in perspective fundamentally alters negotiation strategies, transforming them from mere price haggling into a collaborative process aimed at co-creating value, which necessitates a deeper understanding of the CDMO’s internal cost structures and specialized capabilities.

Decoding the Global CDMO Market Dynamics

The global Contract Development and Manufacturing Organization market is not merely expanding; it is undergoing a profound structural evolution, driven by a confluence of scientific, economic, and regulatory forces. Understanding these market dynamics, including its size, growth trajectories, competitive landscape, and inherent challenges, is fundamental for any organization seeking to forge strategic CDMO partnerships.

Market Size, Growth Projections, and Key Drivers

The global CDMO market is experiencing robust and sustained growth, underscoring its increasing indispensability within the pharmaceutical ecosystem. Valued at approximately USD 238.92 billion in 2024, the market is projected to reach an impressive USD 465.24 billion by 2032, demonstrating a Compound Annual Growth Rate (CAGR) of 9.0% during this forecast period . Other estimates corroborate this strong upward trend, with projections ranging from USD 245.52 billion in 2024 to USD 489.14 billion by 2034 at a CAGR of 7.13% , and from USD 161 billion in 2023 to USD 322.7 billion by 2033 at a CAGR of 7.2% .

This significant expansion is primarily fueled by a surging demand for outsourced manufacturing services from pharmaceutical and biotechnology companies . Several key factors underpin this growth:

- Increased Complexity of Biopharmaceuticals: The burgeoning pipeline of biologics, gene therapies, and personalized medicines presents an unprecedented level of complexity in development and manufacturing. These advanced therapies necessitate highly specialized equipment, stringent environmental controls, and sophisticated processing expertise that many pharmaceutical companies lack in-house. CDMOs, with their dedicated infrastructure and deep technical know-how, are uniquely positioned to meet this demand .

- Increase in R&D Spending: Pharmaceutical companies are consistently increasing their investments in research and development for innovative drugs, particularly in high-growth areas like oncology, immunotherapy, and rare diseases. To maintain focus on their core competencies of drug discovery and clinical trials, these companies frequently outsource the manufacturing and development of new drug candidates to CDMOs. This strategy allows them to manage the necessary infrastructure and scaling without diverting internal resources, a trend expected to continue as pressure mounts for shorter time-to-market for novel therapies .

- Advances in Contract Manufacturing Technology: The CDMO market is continually expanding due to ongoing advancements in contract manufacturing technology. This includes optimized processes, increased automation, and sophisticated analytical techniques that enhance production efficiency, product quality, and regulatory compliance. These innovations enable CDMOs to offer more competitive and advanced services, further driving market expansion .

- Regulatory Challenges and Expertise: The increasingly complex and stringent regulatory environment in mature markets, such as the U.S. and Europe, is a significant catalyst for CDMO growth. Pharmaceutical firms face substantial regulatory hurdles, particularly with novel therapies. CDMOs with established expertise in global Good Manufacturing Practices (GMP) norms and successful track records with regulatory bodies like the FDA offer immense value, ensuring products comply with evolving regulations, expediting market access, and minimizing costly delays .

- Capacity Constraints and Capital Investment Avoidance: For many small and medium-sized pharmaceutical companies, and even for larger firms managing fluctuating demands, the substantial capital investment required for building and maintaining state-of-the-art manufacturing facilities is a significant barrier. Partnering with CDMOs allows these companies to access necessary production capabilities without incurring massive upfront capital expenditures, thereby optimizing their financial resources and accelerating their development timelines .

The consistent high growth projections from multiple sources, coupled with these fundamental drivers, indicate a deep-seated, perhaps irreversible, shift in the pharmaceutical industry’s operational model. This movement towards outsourcing complex and capital-intensive activities suggests that CDMOs are becoming indispensable partners, solidifying their strategic importance and potentially increasing their pricing power, especially for highly specialized services. This also implies that pharmaceutical companies must integrate CDMO partnerships into their core business strategy, rather than treating them as merely transactional arrangements.

Navigating the Competitive Landscape and Regional Nuances

The global CDMO market, while experiencing robust growth, is characterized by a highly fragmented competitive landscape. Numerous small and mid-sized companies operate alongside larger, consolidating players, with increasing competition from emerging startups . In response to this fragmentation, leading CDMO operators are actively consolidating their service portfolios through mergers and acquisitions (M&A), aiming to offer more comprehensive, end-to-end integrated services across various modalities, including biologics, Active Pharmaceutical Ingredients (APIs), Antibody-Drug Conjugates (ADCs), and small molecules . This consolidation strategy allows them to achieve greater economies of scale and provide a “one-stop shop” solution for clients.

Regional Dynamics: Geographic location plays a pivotal role in CDMO pricing, influenced by variations in labor costs, utility rates, and regulatory environments . North America, with its robust infrastructure, highly skilled workforce, and established pharmaceutical ecosystem, has historically dominated the market, holding a significant share (35.1% in 2023 , 38.59% in 2024 ). This dominance is driven by the presence of large economies like the United States and Canada, and numerous major pharmaceutical companies . Consequently, specialized services in North America and Western Europe often command premium rates, ranging from $200-$300 per hour .

Conversely, the Asia-Pacific region, particularly countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period . This growth is primarily attributed to significantly lower operational costs, with rates often 30-50% less than in Western counterparts, due to more affordable labor and materials . Additionally, the region benefits from a rising prevalence of lifestyle and chronic disorders, increasing patient recruitment for clinical trials, and a growing pool of experts capable of conducting clinical trials with advanced technologies . However, this cost advantage can come with trade-offs, such as longer lead times or potential complexities in navigating diverse regulatory frameworks .

The regional cost disparities present a strategic dilemma for clients. While the allure of lower costs in certain geographies is strong, it necessitates a careful balancing act between immediate cost savings and potential indirect costs related to logistics, oversight, and regulatory alignment. A seemingly cheaper option might incur hidden expenses in terms of delayed market entry, increased quality control oversight, or the complexities of operating in unfamiliar regulatory environments. Therefore, clients must conduct a thorough risk-benefit analysis, considering their specific product’s complexity, regulatory pathway, and market entry strategy, rather than solely focusing on the hourly rate. This also highlights the growing importance of diversified supply chains, a trend further reinforced by recent geopolitical shifts and global events.

Macroeconomic Headwinds and Industry-Specific Challenges

Despite the generally optimistic outlook, the CDMO sector is not immune to macroeconomic and industry-specific headwinds. Key challenges include stringent government restrictions and a decline in the approval of certain biologics and small molecules in developed countries, which can hinder market growth . The fragmented nature of the market, with numerous small and mid-sized companies, also intensifies competition .

Labor Challenges: A significant operational challenge for CDMOs is the persistent need for highly skilled labor, including qualified scientists and specialized project managers . The industry also grapples with “staff churn” and increasing labor costs, which can directly impact operating efficiency and, consequently, pricing .

Margin Pressure: Margin pressure is a notable concern, particularly within the Active Pharmaceutical Ingredient (API) market . This pressure is compelling CDMOs to strategically shift towards higher-value services and procedures, such as the development and manufacturing of highly potent APIs (HPAPI) and antibody-drug conjugates (ADC), which inherently entail a higher degree of specialization and command premium pricing . This move towards specialization signifies that CDMOs are strategically moving away from commoditized services where margins are thin. This transition into more complex therapies requires greater R&D investment from CDMOs, more stringent regulatory adherence, and an even greater need for highly skilled personnel. Consequently, clients should anticipate that these specialized services will command premium pricing, and CDMOs will likely prioritize partnerships that align with these high-value offerings. This also suggests that smaller CDMOs without such specialization may face increasing competitive pressure.

Supply Chain Pressures: The volatility of raw material prices and ongoing supply chain disruptions, exacerbated by geopolitical tensions and lingering post-pandemic effects, have significantly impacted costs. In 2024, for instance, some API costs surged by 15-20%, with CDMOs typically passing these increases on to their clients .

Impact of COVID-19: The COVID-19 pandemic initially caused some impedance in drug development during the first half of 2020. However, the latter part of 2020 and subsequent years saw a significant ramp-up in research and production efforts for vaccines and therapeutics, leading to a substantial positive growth impact on the CDMO services market. The pandemic heightened awareness regarding the benefits of outsourcing clinical trials and manufacturing, particularly for biologics, further bolstering the industry’s growth .

Overall Outlook: Despite these headwinds, the general outlook for the CDMO sector remains optimistic. This resilience is attributed to the “essentiality” of the services CDMOs provide to the biopharma industry, coupled with good visibility from contractual income that often includes price and volume protections . The sector has demonstrated a general resilience to macroeconomic vagaries . While U.S. tariffs are expected to have a limited near-term impact, prolonged elevated tariffs could potentially affect the capacity of U.S. companies to meet domestic demand and expand their capabilities . Ultimately, CDMO growth remains closely tied to the expansion of biopharma research and development investment, with new drugs being the primary driver of growth .

Table 1: Global CDMO Market Overview (2023-2034)

| Metric | Value/Trend | Source |

| Market Size (2023) | USD 161 Billion | |

| Market Size (2024) | USD 238.92 Billion (Fortune Business Insights) / USD 245.52 Billion (Cervicorn Consulting) | |

| Projected Market Size (2032) | USD 465.24 Billion | |

| Projected Market Size (2033) | USD 322.7 Billion | |

| Projected Market Size (2034) | USD 489.14 Billion | |

| CAGR (2024-2033/34) | 9.0% (2025-2032) , 7.13% (2025-2034) , 7.2% (2024-2033) | |

| Dominant Region (2023/2024) | North America (35.1% in 2023, 38.59% in 2024) | |

| Fastest Growing Region | Asia Pacific | |

| Key Growth Drivers | Increased complexity of biopharmaceuticals, rising R&D spending, advanced manufacturing technology, stringent regulatory environment, capacity constraints, capital investment avoidance | |

| Key Challenges | Strict government restrictions, declining approvals for biologics/small molecules, fragmented market, skilled labor shortages, staff churn, increasing labor costs, margin pressure, supply chain volatility | |

| Impact of COVID-19 | Initially impeded development, then spurred significant growth due to vaccine/therapeutic efforts and increased outsourcing awareness |

This table provides a high-level, at-a-glance summary of the market’s health and trajectory. For business professionals, it quickly contextualizes the industry, highlighting its growth potential and the fundamental factors driving it. It allows for rapid understanding of the scale and direction of the market, informing strategic investment decisions or partnership evaluations. The inclusion of challenges also provides a balanced perspective, preparing organizations for potential obstacles.

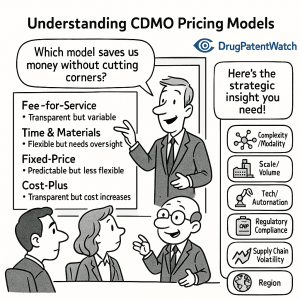

Deconstructing CDMO Pricing Models: A Strategic Toolkit

Understanding the various pricing models employed by CDMOs is paramount for pharmaceutical and biotech companies. Each model presents a unique set of advantages and disadvantages, influencing predictability, flexibility, and risk allocation. Selecting the most appropriate model requires a strategic assessment of the project’s specific characteristics, development phase, and the client’s risk appetite.

Fee-for-Service (FFS): The A La Carte Approach

The Fee-for-Service (FFS) model is perhaps the most straightforward pricing structure, akin to an “a la carte” menu where clients pay for specific tasks or services as they are rendered . For instance, a client might pay a defined fee of $50,000 for formulation development or $100,000 for a clinical batch of material .

The primary advantage of the FFS model lies in its transparency regarding individual service costs, allowing clients to clearly see the price associated with each specific activity. This model is particularly well-suited for projects with uncertain or evolving requirements, especially in their early stages, as it offers considerable flexibility to adapt the scope as new information emerges . However, a significant disadvantage is the potential for costs to escalate rapidly if the project’s scope expands unexpectedly or if unforeseen issues arise. To mitigate this “scope creep,” clients must implement meticulous tracking and oversight of the services being performed .

Time and Materials (T&M): Flexibility with Oversight

Under the Time and Materials (T&M) model, clients are billed based on the actual labor hours expended by the CDMO and the materials consumed during the project . This model offers greater flexibility, making it ideal for complex projects where the exact scope or duration is difficult to predict upfront, such as R&D-heavy initiatives or those involving iterative development . It also provides a degree of transparency, as clients can monitor progress through regular reports on work accomplished .

However, this flexibility comes with a caveat: the T&M model necessitates strong oversight and clear communication from the client’s side to prevent cost overruns due to unexpected hours or material usage . The client assumes a higher level of responsibility for managing the overall development process, as the final cost is not fixed and can fluctuate based on the actual effort and resources deployed .

Fixed-Price Contracts: Predictability at a Premium

A Fixed-Price Contract involves locking in the total cost upfront for a clearly defined scope of work . This model is often the preferred choice for well-defined, commercial-scale manufacturing projects where the process is established, risks are well understood, and the deliverables are precisely specified .

The paramount advantage of fixed-price contracts is the budget certainty they provide. Clients have a clear understanding of the total cost from the outset, which significantly aids in financial planning and predictability. Furthermore, the financial risk associated with cost fluctuations is largely transferred to the CDMO once the contract is signed, offering the client considerable peace of mind . This model also promotes strict deadlines and overall project predictability . Conversely, CDMOs typically build in buffers to account for unforeseen risks when offering a fixed price, which can result in a higher premium compared to more variable models . Additionally, this model offers less flexibility; if the project scope requires significant changes after the contract is signed, it can be less adaptable and may necessitate costly change orders .

Cost-Plus Model: Transparency with Shared Risk

In a Cost-Plus model, the client pays for the actual cost of manufacturing, which includes a detailed breakdown of materials, labor, and overhead, plus an agreed-upon percentage or fixed fee as the CDMO’s profit . This model is designed to foster greater transparency regarding the CDMO’s underlying expenses, allowing clients to see a clear breakdown of the costs incurred .

A key advantage is the potential for lower costs if the CDMO achieves efficiencies in its operations, as these savings can theoretically be passed on to the client . However, compared to fixed-price contracts, the final cost can be less predictable, as it is directly tied to the CDMO’s actual expenditures. This model therefore requires a high degree of trust between the client and the CDMO, and clients may need strong auditing capabilities to ensure the legitimacy and accuracy of reported costs .

Performance-Based and Milestone Payments: Aligning Incentives

The Performance-Based or Milestone Payment model links payments directly to the achievement of specific, predefined milestones or performance metrics . For example, a payment might be triggered upon the successful completion of a manufacturing batch, the attainment of regulatory approval, or the achievement of a specified product yield . This approach is strategically designed to align the CDMO’s incentives with the client’s ultimate success.

The primary benefit of this model is its ability to motivate the CDMO to deliver results efficiently and on time, as their compensation is directly tied to tangible progress . It also effectively shares risk between both parties, as payment is contingent on successful outcomes . Clients appreciate paying for actual functionality delivered, gaining a degree of control over the results at each stage . The main challenge, however, lies in the necessity for clear, precise, and measurable milestones to avoid potential disputes between the parties. This model works best in established relationships built on mutual trust, where acceptance criteria for each milestone are well-defined .

Hybrid Models: Customizing for Complex Projects

Recognizing that no single pricing model is universally optimal, many global pharmaceutical companies are increasingly adopting hybrid models. These approaches combine elements of the aforementioned models or integrate external collaborations with in-house capabilities to create a bespoke solution tailored to specific project needs . For instance, a complex drug development project might begin with a Time & Materials model during the early, uncertain R&D phases, transition to milestone payments for clinical trial material production, and then shift to a fixed-price contract for large-scale commercial manufacturing once the process is well-defined and de-risked.

The proliferation of diverse and hybrid pricing models reflects the increasing complexity and variability inherent in modern drug development projects. This evolution signifies a move away from a “one-size-fits-all” approach, acknowledging that each project possesses unique characteristics, risks, and requirements. The choice of model depends heavily on factors such as the project’s development phase (early R&D versus commercialization), its inherent technical risk, the desired level of client involvement, and the need for budgetary predictability versus flexibility. This complexity underscores the critical need for clients to thoroughly understand their project’s unique characteristics and to proactively negotiate a model that optimizes for their specific needs, rather than passively accepting a CDMO’s standard offering.

Table 2: Comparison of CDMO Pricing Models

| Model Name | Explanation | Key Advantages | Key Disadvantages | Ideal Application |

| Fee-for-Service (FFS) | Client pays for specific tasks/services as rendered. | Transparency in individual service costs; good for uncertain/evolving requirements. | Costs can escalate with scope creep; requires meticulous tracking. | Early-stage projects, discrete tasks (e.g., specific analytical testing). |

| Time and Materials (T&M) | Client billed for actual labor hours and materials consumed. | High adaptability to changing project needs; ideal for R&D-heavy/iterative development. | Requires strong oversight/communication to prevent cost overruns; client carries higher responsibility. | Complex R&D projects, long-term projects with flexible scope. |

| Fixed-Price Contracts | Total cost locked in upfront for clearly defined scope. | Budget certainty; reduced financial risk for client; strict deadlines. | Potential for premium pricing (CDMO buffers risk); less flexibility for scope changes. | Well-defined, established commercial-scale manufacturing projects. |

| Cost-Plus Model | Client pays actual manufacturing costs (materials, labor, overhead) plus agreed profit margin. | Transparency in cost breakdown; potential for lower costs if CDMO achieves efficiencies. | Less predictable final cost; requires trust and strong auditing capabilities. | Projects where cost transparency is paramount, or where scope is somewhat fluid but costs need to be justified. |

| Performance-Based/Milestone Payments | Payments tied to achievement of specific milestones or performance metrics. | Motivates CDMO to deliver results efficiently; shares risk; client pays for delivered functionality. | Requires clear, measurable milestones to avoid disputes; best for established relationships. | Projects with clear, discrete phases and measurable outcomes (e.g., clinical trial phases, regulatory approvals). |

| Hybrid Models | Combination of elements from other models or in-house/outsourced capabilities. | Leverages benefits of multiple models; highly customizable for complex projects. | Can be complex to structure and manage; requires sophisticated contract negotiation. | Projects with varying phases, risks, and needs across their lifecycle. |

This table serves as a concise, comparative overview of the various CDMO pricing models. For busy professionals, it facilitates rapid comprehension of each model’s pros and cons, enabling informed decision-making when selecting the most appropriate contractual framework for their specific project. It functions as a strategic guide, helping to match project characteristics with the most suitable pricing structure, thereby optimizing cost, risk, and flexibility.

Key Factors Driving CDMO Commercial Manufacturing Costs

The cost of engaging a CDMO for commercial manufacturing is influenced by a multitude of interconnected factors, each contributing significantly to the overall price. A thorough understanding of these drivers is essential for accurate budgeting, effective negotiation, and ultimately, selecting a partner that delivers optimal value.

Product Complexity and Modality: The Intricacy Premium

The inherent nature and complexity of the drug product itself stand as a primary determinant of cost . Manufacturing biologics, such as cell and gene therapies, is inherently far more complex and costly than producing small molecule drugs. This is due to the need for highly specialized equipment, stringent environmental controls, and sophisticated processing requirements . The precision and bespoke nature of these advanced therapies mean that costs per dose for cell and gene therapies can range dramatically, often from $500,000 to $1 million .

The complexity of the Active Pharmaceutical Ingredient (API) also plays a critical role. The difficulty and expense associated with synthesizing or producing the API significantly impact the overall price. Novel APIs with intricate chemistry or those for which manufacturing experience is limited will naturally command higher prices . Furthermore, products requiring cold chain storage or specific environmental controls for stability add considerable complexity and logistics costs to the manufacturing process . The increasing prevalence of complex biologics and advanced therapies is fundamentally reshaping CDMO cost structures, pushing the industry towards higher-value, lower-volume, and more specialized operations. As the pharmaceutical pipeline increasingly shifts towards these intricate modalities, CDMOs must invest heavily in specialized infrastructure, highly skilled personnel, and advanced quality control systems. This implies that the “average” CDMO pricing model will become increasingly irrelevant, replaced by highly customized, premium pricing for these niche, high-value services. Clients developing such therapies must budget accordingly and prioritize CDMOs with proven expertise in these specialized areas.

Scale, Volume, and Production Frequency: Economies of Scale

The batch size and anticipated annual volume of production are pivotal factors influencing pricing . Small runs, typically required for clinical trials, are inherently pricier per unit because they do not benefit from the efficiencies achieved through large-scale production. This concept is analogous to baking: making a dozen cookies costs more per cookie than baking a hundred .

Conversely, continuous manufacturing or consistent, high-volume production campaigns are generally more cost-effective for a CDMO than intermittent, small-volume runs. This is because high-volume production allows for better resource utilization, optimizes equipment uptime, and streamlines labor allocation . While economies of scale generally drive down per-unit costs, the rising prevalence of personalized medicine and orphan drugs challenges this traditional model. These therapies often require smaller, highly specialized batches with higher per-unit costs . This suggests that for certain modalities, the traditional benefits of scale are diminished or even non-existent. CDMOs serving these markets must price their services based on the complexity and specialized nature of the work, rather than solely on volume. Clients developing highly specialized, low-volume products must understand that the “per-unit” cost might remain high, and their focus should shift to the total value and strategic importance of the CDMO partnership.

Technology, Equipment, and Automation: The Cost of Innovation

CDMOs that invest in cutting-edge technologies, such as continuous manufacturing platforms, advanced aseptic filling lines, or specialized capabilities for cell and gene therapies, will naturally factor these substantial investments into their pricing . These state-of-the-art facilities and equipment come at a considerable cost.

However, these technological advancements also bring significant efficiencies. Automation and digital tools, for instance, can substantially reduce labor costs and boost overall efficiency. A CDMO employing robotics for packaging, for example, might be able to charge less per unit compared to one relying on manual labor . Continuous manufacturing, a revolutionary approach to drug production, has been shown to cut production costs by 20-30% . While investment in advanced technologies by CDMOs represents a significant upfront cost that is reflected in initial quotes, it often translates into long-term cost-saving opportunities for clients. Clients should evaluate these technological investments not merely as an added expense, but as an investment in future efficiency, quality, and accelerated timelines, focusing on the total cost of ownership rather than just the initial bid.

Regulatory Landscape and Quality Assurance: The Price of Compliance

The pharmaceutical industry operates within a highly regulated environment, where strict compliance with requirements related to quality, safety, and efficacy is non-negotiable . CDMOs invest heavily in maintaining Good Manufacturing Practices (GMP) facilities, undergoing rigorous audits, and meticulously managing extensive documentation to meet these stringent standards .

The cost of compliance is substantial. A single regulatory error can result in millions of dollars in delays, fines, or even product recalls . Consequently, CDMO pricing inherently reflects this stringent requirement. As a CDMO executive once articulated, “You’re not just paying for production—you’re paying for peace of mind” . Regulatory compliance is a non-negotiable cost driver that significantly impacts CDMO pricing, underscoring the immense value of a CDMO’s established regulatory expertise as a critical risk mitigation strategy for clients. This means clients are not just paying for a service, but for the CDMO’s extensive investment in maintaining compliance and mitigating regulatory risks, which translates into reduced risk of delays, recalls, or fines for the client. This inherent, often hidden, value justifies higher pricing and should be a primary consideration beyond direct manufacturing costs.

Raw Material Volatility and Supply Chain Resilience

Raw materials are the indispensable lifeblood of pharmaceutical manufacturing, and their prices are anything but stable . Recent years have highlighted the fragility of global supply chains, with geopolitical tensions and lingering post-pandemic effects pushing costs up significantly. For example, in 2024, some Active Pharmaceutical Ingredient (API) costs saw increases of 15-20% . CDMOs typically pass these increases on to their clients, often with little advance warning .

However, CDMOs, particularly those with global networks, possess specialized expertise in vendor management, new vendor sourcing, and material bargaining power that can be time-consuming and costly for individual pharmaceutical innovators to replicate . This capability helps mitigate the impact of price volatility and ensures continuity of supply during disruptions . Supply chain resilience and raw material sourcing expertise are increasingly critical value-adds for CDMOs, influencing their pricing and serving as a key differentiator in a volatile global environment. While CDMOs pass on raw material increases, those with robust supply chain management capabilities offer a hidden value in reducing client risk and ensuring continuity of supply. This factor should be heavily weighed during CDMO selection, as it impacts not just cost, but also speed to market and product availability.

Geographic Location: Where in the World Matters

The geographic location of a CDMO’s operations significantly impacts pricing due to variations in labor costs, utility rates, and regulatory environments . North America and Western Europe, with their well-developed infrastructure and highly skilled workforces, typically command premium rates, with specialized services costing anywhere from $200-$300 per hour .

In contrast, the Asia-Pacific region, particularly countries like China and India, often offers substantial cost advantages, with rates that can be 30-50% lower . This is primarily due to more affordable labor and materials. However, opting for lower-cost regions can come with trade-offs, such as longer lead times or complexities in navigating different regulatory frameworks. Additionally, any initial savings can quickly evaporate when factoring in shipping costs, tariffs, and time zone differences that complicate communication and oversight . The geographic location decision involves a complex trade-off between direct cost savings and indirect costs related to logistics, oversight, and regulatory alignment. A seemingly cheaper overseas option might incur hidden costs in terms of delayed market entry, increased quality control oversight, or the challenges of navigating unfamiliar regulatory landscapes. Clients must perform a total cost of ownership analysis, considering not just the CDMO’s hourly rate, but also the logistical complexities, communication challenges, and regulatory risks associated with different regions.

Value-Added Services and Lifecycle Management Support

Beyond basic manufacturing, many CDMOs offer a comprehensive array of value-added services that contribute to their overall pricing structure . These can include specialized analytical testing beyond routine release, expedited orders or schedule changes, handling of product returns or complaints, and extensive documentation or regulatory support .

Furthermore, CDMOs that provide lifecycle management support, encompassing post-commercialization activities such as product improvements or line extensions, offer significant long-term value to their clients . These services transform a transactional relationship into a strategic partnership, justifying higher pricing by offering comprehensive support that extends far beyond basic manufacturing. While these services add to the overall cost, they reduce the operational burden on the client, streamline processes, and can accelerate product lifecycle progression. For a business professional, paying for these services is an investment in efficiency, risk reduction, and long-term product success, reinforcing the profound truth that “value is what you get,” not just “price is what you pay” .

Table 3: Key Factors Influencing CDMO Commercial Manufacturing Costs

| Factor | Description of Impact | Implications for Pricing | Strategic Considerations for Clients |

| Product Complexity & Modality | Biologics, cell/gene therapies, and complex APIs require specialized equipment, expertise, and controls. | Higher pricing due to specialized infrastructure, skilled labor, and stringent processes. | Prioritize CDMOs with proven expertise in specific modalities; budget for premium costs for advanced therapies. |

| Scale, Volume, & Frequency | Small batches (clinical trials) are less efficient, higher per-unit cost. Large, consistent runs benefit from economies of scale. | Lower per-unit costs for higher volumes; premium for small, intermittent runs. | Optimize batch sizes where possible; understand that personalized medicine may always have high per-unit costs; consider continuous manufacturing for long-term efficiency. |

| Technology, Equipment & Automation | Investment in cutting-edge tech (continuous manufacturing, robotics, advanced aseptic fill) by CDMOs. | Higher initial quotes to recoup CapEx; long-term potential for lower COGS and increased efficiency for client. | Evaluate CDMO’s tech stack for future benefits; focus on total cost of ownership rather than just initial quote. |

| Regulatory Landscape & Quality Assurance | Adherence to GMP, FDA/EMA standards, audits, documentation. | Significant cost component reflecting investment in compliance and risk mitigation. | Prioritize CDMOs with strong regulatory track records; view compliance as an investment in “peace of mind.” |

| Raw Material Volatility & Supply Chain Resilience | Fluctuating raw material costs (e.g., API price surges) and supply chain disruptions. | Increases passed to client; CDMOs with strong sourcing/bargaining power offer stability. | Partner with CDMOs demonstrating robust supply chain management; consider diversified sourcing. |

| Geographic Location | Variations in labor costs, utilities, regulatory environments across regions. | Premium rates in North America/Western Europe; lower rates in Asia-Pacific (with potential trade-offs). | Conduct total cost of ownership analysis; balance cost savings with lead times, oversight, and regulatory alignment. |

| Value-Added Services & Lifecycle Management | Additional analytical testing, expedited orders, regulatory support, post-commercialization support. | Contributes to overall pricing; transforms transactional relationship into strategic partnership. | Assess the value of bundled services; consider long-term benefits for product lifecycle management. |

This table offers a structured breakdown of the multifaceted elements that drive CDMO costs. It helps business professionals systematically analyze a CDMO’s quote, understanding the underlying reasons for pricing variations. By presenting implications and strategic considerations, it transforms raw cost factors into actionable strategies, enabling clients to negotiate more effectively and choose partners that align with their specific product and business needs.

Strategic Negotiation and Contractual Mastery

Engaging with a CDMO is a complex endeavor that extends far beyond simply comparing price quotes. It demands strategic negotiation, meticulous due diligence, and a profound understanding of contractual intricacies, particularly concerning intellectual property. Mastery in these areas can significantly influence a project’s success, cost-efficiency, and long-term strategic flexibility.

Benchmarking CDMO Prices: Informed Decision-Making

Effective benchmarking of CDMO prices is a strategic imperative, not merely a cost-cutting exercise . It requires a sophisticated approach that begins with defining requirements with absolute precision. Organizations must cast a wide, yet strategic, net for proposals, ensuring they scrutinize each offer far beyond the bottom line. Leveraging industry data and specialized benchmarking tools is crucial for gaining a comparative advantage, and finally, engaging in strategic negotiation .

A critical aspect of benchmarking is the principle of “comparing apples to apples.” Not all CDMO quotes are created equal; one CDMO might bundle analytical testing into its core price, while another might itemize it as an extra charge. To ensure a fair comparison, companies must standardize their evaluation process, often utilizing a comprehensive checklist of “must-haves” to level the playing field . Furthermore, the focus must consistently be on “assessing value, not just cost.” The cheapest bid is rarely the best; a low price might signal cut corners, compromised quality, or inevitable delays. As the renowned investor Warren Buffett famously articulated, “Price is what you pay; value is what you get” . Therefore, the emphasis should always be on the return on investment (ROI), questioning whether the CDMO can truly deliver on time and with the requisite quality . Effective benchmarking transcends simple price comparison, demanding a holistic evaluation of value, risk, and long-term partnership potential. This necessitates a sophisticated framework that weighs qualitative factors—such as quality track record, speed, flexibility, and regulatory expertise—alongside quantitative costs. It is about understanding the total cost of ownership and the strategic benefits, not just the quoted price, which requires internal clarity on requirements and a disciplined approach to proposal evaluation.

Avoiding Common Pitfalls in CDMO Pricing

Navigating CDMO pricing requires vigilance to avoid common pitfalls that can derail projects and inflate budgets. These include an exclusive focus on the lowest bid, underestimating the complexity and associated costs of technology transfer, neglecting hidden fees and “surprise” charges that emerge later, insufficient due diligence on a CDMO’s actual capabilities, and a pervasive lack of clear communication and scope management throughout the project lifecycle .

Hidden fees are a particularly insidious trap. These can encompass charges for additional analytical testing beyond routine release, expedited orders or schedule changes, the handling of product returns or complaints, or even excessive charges for documentation and regulatory support . To circumvent these unexpected costs, it is always advisable to request a detailed, line-item breakdown of all charges to identify any potential overcharges or omitted services . Many pricing pitfalls stem from a fundamental lack of clarity and foresight. This highlights the critical importance of meticulous planning and comprehensive due diligence before signing any contract. This implies that clients must invest significant time and resources in precisely defining their project scope, understanding all potential costs (both direct and indirect), and thoroughly vetting CDMO capabilities prior to entering negotiations. This proactive approach is essential for mitigating both financial and operational risks.

Intellectual Property (IP) Considerations in CDMO Agreements

Intellectual Property (IP) considerations are among the most critical and often complex aspects of CDMO agreements. Defining the ownership of IP arising under a CDMO agreement (often referred to as “Developed IP”) is paramount . IP contracts are fundamental tools for protecting brand identity and innovations, generating revenue through licensing, facilitating strategic partnerships, and ultimately enhancing a company’s competitive edge in the marketplace .

Navigating Ownership Models: Several models exist for allocating Developed IP, each with distinct implications for both the client and the CDMO:

- Jointly Owned: This model is frequently perceived as a “fair” solution because it appears not to overtly favor one party . However, joint ownership is often less than ideal in practice because the differing business objectives of the CDMO and its customers can lead to suboptimal patent prosecution and management, potentially creating future disputes .

- Customer-Owned (“I paid for it, I bought it”): CDMO customers who fund development or manufacturing often operate under the assumption that any Developed IP will automatically belong to them . However, if the CDMO relinquishes Developed IP rights to platform improvements or novel processes it developed, it could later find itself needing to license its own advancements from the customer, which can be both costly and cumbersome .

- CDMO-Owned with License Back: In this model, some CDMOs opt to have the customer own the Developed IP, but in return, the CDMO takes a license back to that Developed IP. If this license is fully paid-up, royalty-free, and sublicensable, it provides significant operational flexibility to the CDMO while maintaining a positive working relationship with the customer. An added benefit for the CDMO is that the costs associated with patent drafting and prosecution are passed on to the customer. Furthermore, if the customer chooses not to pursue or maintain the Developed IP, ownership can revert to the CDMO .

- Ownership Follows Inventorship: Under this structure, the party whose employees or resources conceived the invention retains ownership . While this model might benefit the customer in situations where they provide precise device design specifications and the CDMO builds exactly to those directions, in practice, inventions are more frequently conceived using the CDMO’s resources or employees. Consequently, the CDMO often invents the majority of the Developed IP, leading to them retaining ownership of more IP .

- Ownership Defined by Nature of Invention: This approach assigns Developed IP based on its nature: IP solely related to the product typically belongs to the customer, while IP related to the process or technology platform typically belongs to the CDMO . However, this can be problematic due to ambiguity in determining whether an invention “solely” or “predominantly” relates to a product versus a process, often leading to disagreements .

Licensing Agreements and Background IP: CDMO customers frequently request a license to the CDMO’s existing “Background IP” (pre-existing intellectual property) to provide them with the flexibility to shift production to a different contract manufacturer if needed . In response, CDMOs can strategically offer a limited “springing license” to their Background IP, which only becomes effective if specific conditions are met, such as a lack of supply from the CDMO, capacity constraints, or the emergence of new market entrants . Crucially, CDMOs must ensure they possess enforceable IP rights, such as patents, trademarks, and copyrights, to effectively license them to their customers .

IP ownership in CDMO agreements is a complex, high-stakes negotiation point that can significantly impact long-term strategic flexibility and competitive positioning for both parties. The detailed breakdown of IP ownership models reveals that there is no simple “fair” solution, and each model carries significant implications. The common customer perspective of “I paid for it, I bought it” can often clash with a CDMO’s fundamental need to protect its proprietary platform IP. This is not merely a legal detail; it represents a strategic asset. How IP is allocated determines future revenue streams, market exclusivity, and the client’s ability to switch partners or bring manufacturing in-house. Therefore, clients must engage legal experts and clearly define their IP strategy before negotiating, recognizing that seemingly minor contractual clauses can have massive, long-term ripple effects on their product’s lifecycle and market value.

Crafting Robust Contracts: Definitions, Scope, and Dispute Resolution

A robust contract is the bedrock of any successful CDMO partnership. Key elements of effective IP contracts include clear definitions and scope of the IP assets involved, precise ownership and licensing terms, explicit outlining of obligations and responsibilities for each party, well-defined dispute resolution mechanisms, and clear conditions for termination and renewal .

Ambiguities within a contract can lead to costly disputes and potential legal issues. For instance, a contract that vaguely defines the IP assets can result in unintentional infringement or misuse . A well-defined scope, conversely, ensures that all parties understand their rights and obligations, thereby minimizing the risk of conflicts .

Negotiation Best Practices: To navigate these complex negotiations effectively, organizations should:

- Understand their Goals: Clearly define what they aim to achieve with the contract, whether it’s protecting their brand, securing a licensing agreement, or ensuring freedom to operate .

- Know their Counterparty: Understanding the other party’s needs, limitations, and negotiation style can significantly aid in crafting a mutually beneficial agreement .

- Be Flexible: Negotiation inherently involves finding a middle ground; inflexibility can lead to a breakdown in discussions .

- Seek Professional Advice: Engaging legal experts specializing in IP law is invaluable for providing critical insights and helping to avoid potential pitfalls .

Managing IP Contracts: Effective management of IP contracts is as crucial as their initial negotiation. This involves:

- Ensuring Compliance: Regular audits and monitoring are essential to ensure ongoing compliance with the terms of IP agreements. This includes tracking the use of licensed IP, adhering to reporting requirements, and maintaining strict confidentiality .

- Monitoring and Enforcing IP Rights: Active monitoring of IP rights is vital to prevent infringement. Organizations should work closely with their legal teams to identify potential infringements and take swift, decisive action when necessary .

- Reviewing and Updating Contracts Regularly: IP contracts should be reviewed and updated regularly to reflect changes in the business environment, evolving IP laws, or shifts in marketing strategies, ensuring they remain relevant and effective in protecting the company’s intellectual assets .

A robust contract is the bedrock of a successful CDMO partnership, requiring proactive legal and business alignment to anticipate and mitigate future risks. The emphasis on “clear definitions and scope,” robust “dispute resolution” mechanisms, and “regular review” of agreements suggests that the contract is not a static document but a living agreement that must evolve with the project. Many potential “hidden fees” or “surprises” can be avoided with meticulous contract drafting. This implies that clients should view contract negotiation as a critical strategic phase, investing in legal expertise to ensure all contingencies are covered, thereby safeguarding their interests and fostering a stable, long-term partnership.

Table 4: Intellectual Property Ownership Models in CDMO Agreements

| Ownership Model | Description | Advantages/Benefits (for Client/CDMO) | Disadvantages/Problematic Aspects |

| Jointly Owned | IP developed under agreement is co-owned by client and CDMO. | Perceived as “fair”; avoids in-depth negotiation. | Differing business objectives can lead to suboptimal patent process; potential for future disputes. |

| Customer-Owned (“I paid for it, I bought it”) | Client assumes full ownership of Developed IP. | Client has full control over product IP. | CDMO risks losing rights to platform improvements; may need costly license back for its own advancements. |

| CDMO-Owned with License Back | CDMO owns Developed IP, but grants client a license (e.g., fully paid-up, royalty-free, sublicensable). | CDMO: Operational flexibility, cost of patent prosecution passed to client, IP reverts if client abandons. Client: Access to IP for product. | Client may prefer direct ownership; requires trust in CDMO’s IP management. |

| Ownership Follows Inventorship | Party whose employees/resources conceived the invention retains ownership. | Clear allocation based on contribution. | Often benefits CDMO as inventions frequently use their resources; may not align with client’s strategic product ownership. |

| Ownership Defined by Nature of Invention | Product-related IP to client, process/platform-related IP to CDMO. | Aims to align IP with core business of each party. | Ambiguity in defining “solely related” or “predominantly related” can lead to disputes. |

This table provides a structured comparison of complex IP ownership models. For business professionals, it demystifies a critical and often contentious aspect of CDMO agreements, enabling them to understand the nuances and implications of each model. This clarity is essential for negotiating favorable terms that protect their intellectual assets and ensure long-term strategic flexibility.

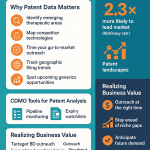

Leveraging Data Analytics and Competitive Intelligence for Advantage

In today’s hyper-competitive pharmaceutical landscape, the ability to transform raw data into actionable intelligence is a formidable competitive advantage. This is particularly true in the rapidly expanding CDMO market, where strategic utilization of patent data and other forms of competitive intelligence can significantly influence client acquisition, partnership optimization, and overall market positioning.

The Power of Patent Data: Unlocking Hidden Understandings

The global CDMO market is experiencing explosive growth, projected to reach $465.14 billion by 2032 . In such a dynamic environment, differentiating capabilities and identifying strategic opportunities becomes paramount. One often-underestimated tool for achieving this is the strategic utilization of patent data .

Systematic analysis of patent data offers a unique window into the future of pharmaceutical innovation. It reveals invaluable understandings concerning:

- Research and Development Priorities: What therapeutic areas are companies investing in?

- Emerging Therapeutic Areas: Where are the next breakthroughs likely to occur?

- Product Pipeline Developments: Which drugs are progressing through the development stages?

- Manufacturing Challenges and Solutions: What technical hurdles are innovators facing, and how might CDMOs provide solutions?

- Market Entry Strategies: Which geographic markets are companies targeting?

- Competitive Positioning: How are competitors securing their innovations?

- Potential Collaboration Opportunities: Where might partnerships be mutually beneficial?

For CDMOs specifically, patent data related to manufacturing processes, drug delivery systems, formulation technologies, and analytical methods is particularly valuable. These areas frequently present technical challenges that demand specialized expertise—precisely the kind of expertise that CDMOs are designed to provide . Patent data serves as a forward-looking indicator of market trends and client needs, offering a proactive competitive intelligence tool rather than merely a reactive market analysis. By analyzing patent filings, a CDMO can anticipate which therapies will require manufacturing support, what technological challenges will arise, and which companies will be seeking partners. This allows for proactive capability development and highly targeted business development efforts, providing a significant lead over competitors relying on traditional market research.

Pipeline Monitoring and Geographic Targeting with Patent Intelligence

Transforming raw patent data into actionable competitive intelligence allows CDMOs to refine their business development strategies and target potential clients with unprecedented precision.

- Pipeline Monitoring: By systematically tracking patent applications from pharmaceutical and biotech companies, CDMOs can identify potential clients whose products are likely to require manufacturing support in the near future. This enables proactive outreach, allowing the CDMO to engage with prospects before manufacturing partners have even been selected . For example, a CDMO specializing in sterile injectable products can monitor patent applications related to parenteral formulations to identify companies approaching the clinical manufacturing phase, initiating discussions at an optimal time.

- Technology Alignment: Patent documents reveal specific technical challenges and requirements faced by potential clients. CDMOs can analyze these requirements to align their unique capabilities with client needs, leading to highly targeted business development efforts. A CDMO with expertise in highly potent compounds, for instance, can identify patents describing such compounds and focus its outreach on companies needing that specific expertise .

- Geographic Targeting: Patent filing patterns also provide clear indications of the markets companies consider strategically important. CDMOs can leverage this information to target potential clients based on geographical alignment, regulatory expertise, or specific market entry strategies .

- Development Stage Analysis: The progression of patent filings—from composition of matter to formulation to manufacturing process patents—often signals a product’s development stage. CDMOs can utilize this information to optimize the timing of their outreach efforts, ensuring they engage with clients when their manufacturing needs are becoming critical .

Integrating patent intelligence into business development processes transforms client acquisition from a broad-net approach to a precision-guided strategy. Instead of passively waiting for Requests for Proposals (RFPs), CDMOs can identify potential clients much earlier in their product lifecycle, understand their specific technical needs, and tailor their value proposition accordingly. This proactive, data-driven approach significantly increases the probability of securing new contracts and optimizing sales efforts, thereby providing a clear competitive edge.

Enhancing Business Development with DrugPatentWatch

Specialized platforms like DrugPatentWatch provide access to critical patent data, which can be systematically analyzed to generate actionable intelligence . Such tools are instrumental in:

- Identifying Emerging Opportunities: Pinpointing new areas for client engagement.

- Revealing Capability Gaps: Highlighting areas where investment in new technologies or expertise might be necessary.

- Detecting Competitive Threats: Understanding competitor strategies and potential market shifts.

- Informing Strategic Shifts: Identifying broader market trends that suggest a need for strategic adjustments in service offerings .

CDMOs can integrate this intelligence into their daily operations through various processes. This might include providing pre-meeting briefings on prospect patent activities for business development teams, establishing patent-informed targeting criteria for prospecting activities, conducting regular patent trend reviews to inform capability development decisions, and creating patent-based segmentation of their prospect database . Tools like DrugPatentWatch democratize access to sophisticated patent intelligence, enabling CDMOs of all sizes to implement advanced competitive strategies previously reserved for larger entities. This is crucial because raw patent data is vast and complex. A specialized tool simplifies the analysis, allowing CDMOs to efficiently extract valuable understandings into competitor R&D, client pipelines, and market white spaces. This empowers CDMOs to make more informed strategic decisions on capability development and client targeting, ultimately enhancing their market position.

Measuring ROI from Patent-Informed Strategies

To ensure the sustained value and integration of patent intelligence initiatives, it is crucial to measure their return on investment (ROI). Quantifying the impact of patent intelligence reinforces its strategic value, elevating it from a “nice-to-have” to a measurable driver of business growth. Potential metrics for evaluating the effectiveness of patent-informed strategies include:

- New Qualified Leads Generated: Tracking the number of new leads directly attributable to patent-informed targeting.

- Increased Proposal Success Rates: Comparing success rates for proposals developed with patent intelligence versus traditional approaches.

- Revenue from Contracts Won: Quantifying the revenue generated from contracts secured through patent intelligence initiatives.

- Market Share Gains: Assessing market share increases in growth areas identified through patent analysis .

By demonstrating tangible results—such as increased leads, higher win rates, and new revenue streams—CDMOs can justify continued investment in patent intelligence tools and the teams required to leverage them. This transforms patent analysis from an abstract research activity into a core, performance-driven business development function, ensuring its sustained integration into strategic planning and decision-making.

Real-World Applications and Case Studies

Theoretical frameworks and market analyses provide a crucial foundation, but real-world examples illuminate how CDMO pricing principles and strategic approaches play out in practice. These case studies offer valuable lessons for both CDMOs and their pharmaceutical clients.

Navigating Complex Biologics Pricing: A BioPharma Inc. Example

The development of complex biologics often presents unique pricing challenges, as demonstrated by the experience of BioPharma Inc., a mid-sized firm developing a novel biologic. BioPharma Inc. sought CDMO services and received three distinct quotes: $1.2 million, $1.5 million, and $2 million . Upon closer examination, it became evident that the cheapest bid ($1.2M) skimped significantly on critical analytical testing, which could introduce substantial risks down the line. Conversely, the priciest option ($2M) offered comprehensive, end-to-end support that exceeded BioPharma Inc.’s immediate needs and budget. After careful consideration, BioPharma Inc. strategically chose the $1.5 million option, which provided robust services at a fair price, aligning well with their specific requirements and risk profile. The outcome was highly positive: the project was delivered on time and came in 10% under budget .

This case study powerfully illustrates the importance of balancing cost with capability, reinforcing the principle that the lowest bid is not always the best value. It provides a concrete scenario where a higher initial investment (not the cheapest option) led to superior outcomes (on-time delivery, under budget). This reinforces the understanding that a thorough assessment of the full scope of services, including potentially hidden analytical or support costs, is crucial for making an economically sound decision that prioritizes long-term success over short-term savings.

Alacrita’s Approach to Cell Therapy Pricing Parameters

Pricing for highly novel and complex therapies, such as cell therapies, demands an exceptionally granular and comprehensive understanding of all contributing factors. This was highlighted in a case study involving Alacrita, a consulting firm, which was engaged by a biotech company to provide input on critical financial terms for a cell therapy licensing negotiation . The client faced a significant challenge due to their lack of commercial experience with cell therapy and an urgent need for information on Chemistry, Manufacturing, and Controls (CMC) costs and timelines for the product.

In response, Alacrita developed an extensive list of over 40 parameters and assumptions, categorized across six specific domains, that influence CDMO pricing for various cell therapy services. These parameters covered everything from technology transfer and process development to engineering runs and Good Manufacturing Practice (GMP) batches . To provide the client with actionable intelligence, Alacrita also created a high-level time and cost model to estimate the probable ranges of expenses the client would encounter . While the client utilized this detailed input in their negotiations, the deal ultimately did not proceed, as the proposed terms were deemed too expensive . This outcome, though not a successful deal, underscores a critical understanding: pricing complex, novel therapies like cell therapies requires an exceptionally granular and comprehensive understanding of all contributing factors, far beyond traditional manufacturing cost models. The development of “over 40 individual sub-items” across “six specific domains” for cell therapy pricing parameters emphasizes that these are not simple manufacturing jobs. This implies that clients entering such agreements must be prepared for highly detailed and bespoke pricing models, and CDMOs must be able to articulate the value of each granular component. The deal’s failure due to cost also reinforces the significant challenge of aligning expectations for these high-value, high-cost therapies.

Success Stories in CDMO Negotiation and Client Acquisition

Beyond individual project pricing, strategic approaches to negotiation and client acquisition can significantly impact a CDMO’s growth and a client’s overall competitiveness.

Case Study 1: Small CDMO Secures $28M+ in Quotes: A smaller CDMO, initially struggling with low brand recognition and a fragmented marketing approach characterized by “random acts of marketing,” implemented a targeted digital marketing strategy. This strategy focused on leveraging high-quality content and engaging Subject Matter Experts (SMEs) to connect with potential clients . The results were remarkable: within just six months, the CDMO secured 130 one-to-one virtual meetings for its sales team. These meetings led to 84 Confidential Disclosure Agreements (CDAs) and generated over $28 million in quotes. Ultimately, the CDMO won more than $6.2 million in new business by securing 10 new partnerships . This success story demonstrates the profound power of strategic marketing and targeted lead generation in a highly competitive CDMO market, proving that even smaller players can achieve significant business growth through a data-driven approach. This example highlights how proactive, data-driven marketing can generate substantial revenue, linking directly to the earlier discussions on leveraging patent data for competitive advantage.

Case Study 2: CDMO Increasing Product Competitiveness: CDMOs play a crucial role in enhancing the competitiveness of their clients’ products, particularly by optimizing the Cost of Goods Sold (COGS). They achieve this through their expertise in global material vendor sourcing and strong material bargaining power, which can be challenging and time-consuming for individual pharmaceutical innovators . Furthermore, CDMOs are adept at vendor and inventory management, ensuring the availability of raw materials and excipients, which is vital during supply chain disruptions . This expertise helps reduce overall costs and ensures a stable supply of drug products to patients. Partnering with a trusted CDMO can therefore significantly reduce COGS and enhance a product’s market competitiveness . This case underscores how operational efficiencies, such as robust supply chain and vendor management, directly contribute to client competitiveness. These examples reinforce that CDMOs are not just service providers but active participants in their clients’ success, and their pricing often reflects these value-added capabilities.

These real-world applications underscore that strategic investments in marketing, lead generation, and supply chain expertise by CDMOs directly translate into tangible business growth and enhanced client value, influencing their long-term viability and pricing power.

The Future of CDMO Pricing: Trends and Innovations

The CDMO landscape is continuously evolving, driven by technological advancements, shifting market demands, and a growing emphasis on collaborative partnerships. Understanding these emerging trends is crucial for both CDMOs shaping their service offerings and pharmaceutical companies seeking future-proof manufacturing solutions.

AI, Digital Tools, and Continuous Manufacturing

The future of CDMO pricing will be profoundly influenced by the accelerating integration of artificial intelligence (AI) and advanced digital tools across the development and manufacturing lifecycle. These technologies promise to enhance efficiency, optimize processes, and enable more precise decision-making .

Continuous manufacturing, a revolutionary approach that replaces traditional batch processing, is poised to be a game-changer for efficiency, with studies indicating its potential to cut production costs by 20-30% . CDMOs that proactively invest in and adopt these cutting-edge technologies—such as AI-driven process optimization, robotics for automated tasks, and continuous manufacturing platforms—will inevitably factor these significant capital investments into their pricing structures . However, these higher initial price points are often offset by long-term cost benefits for clients, including reduced operational expenses, faster timelines, and improved product quality. The accelerating adoption of AI and continuous manufacturing will likely create a bifurcation in the CDMO market. Technologically advanced CDMOs will command higher prices but deliver superior long-term value and efficiency. While these technologies require substantial upfront investment from CDMOs, they promise significant efficiency gains and cost reductions over the long run. This implies that clients will increasingly face a strategic choice: a lower-cost, traditional CDMO or a higher-cost, technologically advanced one. The latter, despite higher initial prices, will likely offer greater predictability, faster time-to-market, and potentially lower total cost of goods over the product’s lifecycle, making them a more attractive strategic partner for innovative therapies.

Focus on Value-Based Pricing and Strategic Partnerships

A significant trend shaping the future of CDMO pricing is a growing emphasis on value-based pricing and customer-centric approaches, moving beyond traditional transactional models . This paradigm shift reflects a deeper understanding of the symbiotic relationship between CDMOs and their clients.

Strategic partnerships and risk-sharing models are becoming increasingly prevalent, designed to align the incentives of both the CDMO and their clients more closely . Examples include the broader adoption of performance-based or milestone payment models, where compensation is directly tied to the achievement of specific project outcomes or key performance indicators . This shift towards value-based pricing and strategic partnerships signifies a maturation of the CDMO-client relationship, emphasizing shared risk and reward over simple service provision. This means CDMOs will increasingly price their services based on the tangible value they deliver—such as accelerated timelines, higher yields, or successful regulatory outcomes—rather than solely on inputs like labor hours or material costs. For clients, this necessitates a more rigorous vetting process to ensure the CDMO’s incentives are truly aligned with their own success, potentially leading to more complex but ultimately more rewarding contractual agreements.

Adaptability to Shifting Market Requirements

The pharmaceutical landscape is characterized by rapid innovation and evolving demands, particularly with the emergence of novel therapeutic modalities. Consequently, adaptability and flexibility will become premium attributes for CDMOs. To effectively serve these dynamic market requirements, CDMOs will need to continuously adapt their equipment and facilities to accommodate changes in production volume, scale, and technology . Furthermore, maintaining robust and agile supply chain management capabilities will be crucial for navigating global complexities and ensuring uninterrupted production .

The industry will continue to adapt to the increasing demand for novel therapeutics and the growing complexity of therapies, which often require bespoke manufacturing solutions and rapid adjustments . Agility and adaptability will become premium attributes for CDMOs, as the pharmaceutical landscape continues its rapid evolution, particularly in advanced therapies. The necessity for “flexibility” and “adaptability to shifting market requirements” is a direct response to the dynamic nature of drug development. As new modalities emerge and regulatory landscapes change, CDMOs that can quickly pivot their capabilities and processes will be highly sought after. This agility will likely be factored into their pricing, reflecting the inherent value of responsiveness and future-proofing in a fast-paced industry.

Key Takeaways

The journey through the intricate world of CDMO pricing reveals several fundamental principles that business professionals must embrace to optimize their pharmaceutical development and manufacturing strategies:

- CDMOs are indispensable strategic partners, offering specialized expertise, advanced technology, and regulatory navigation that enable pharmaceutical companies to accelerate drug development and commercialization, extending far beyond mere cost reduction.

- CDMO pricing is a multi-faceted construct, driven by a complex interplay of factors including product complexity (especially for biologics and advanced therapies), production volume, the level of technology and automation employed, stringent regulatory demands, the volatility of raw material costs, and geographic location. A thorough understanding of these drivers is crucial for informed decision-making and effective negotiation.

- Diverse pricing models such as Fee-for-Service, Time & Materials, Fixed-Price, Cost-Plus, and Performance-Based/Milestone payments offer various degrees of flexibility, predictability, and risk allocation. Each model comes with its own trade-offs, necessitating careful selection based on the specific project phase and inherent risks.

- Strategic negotiation and robust contracts are paramount. Companies must transcend the simplistic pursuit of the lowest bid, instead conducting comprehensive due diligence, meticulously scrutinizing for hidden fees, and clearly defining the scope of work to preempt common pitfalls and ensure long-term project success.

- Intellectual Property (IP) ownership in CDMO agreements is a critical, high-stakes negotiation point that profoundly impacts long-term strategic flexibility and competitive positioning. Careful consideration and expert legal counsel regarding various IP models are essential to safeguard valuable intellectual assets.

- Leveraging data analytics, particularly patent data (e.g., through DrugPatentWatch), provides a powerful competitive advantage. It empowers CDMOs to identify emerging R&D priorities, monitor client pipelines, target geographically aligned opportunities, and tailor their value propositions with precision, ultimately leading to higher client acquisition rates and measurable return on investment.

- The future of CDMO pricing will be shaped by accelerating technological advancements (including AI and continuous manufacturing) and a greater emphasis on value-based pricing and strategic, risk-sharing partnerships. This evolving landscape will demand increased agility and adaptability from both CDMOs and their clients to navigate the complexities and capitalize on emerging opportunities.

Frequently Asked Questions (FAQs)

What is the single biggest factor influencing CDMO pricing, and why?