China’s patent litigation system is a dynamic arena where businesses, particularly in the pharmaceutical industry, can protect their innovations and gain a competitive edge. With the country’s rapid rise as a global leader in patent filings—over 1.5 million applications in 2022 alone—China has become a critical battleground for intellectual property (IP) disputes [4]. The system, governed by the Patent Law of the People’s Republic of China, has evolved significantly, offering robust mechanisms for enforcement while presenting unique challenges. For business professionals aiming to turn patent data into a strategic advantage, understanding this dual nature is essential. This article delves into the opportunities and challenges of China’s patent litigation system, providing actionable insights for navigating its complexities.

Introduction

Imagine wielding a sword that can both defend your innovations and expose you to unforeseen risks. That’s the reality of China’s patent litigation system—a double-edged sword that offers immense potential for protecting IP but demands careful handling. For pharmaceutical companies, where a single patent can represent billions in R&D investment, mastering this system is not just an option; it’s a necessity. Why? Because China’s market, contributing 20.3% to the global pharmaceutical industry in 2022, is a powerhouse of opportunity and competition [4]. With tools like DrugPatentWatch, businesses can harness patent data to strategize litigation, monitor competitors, and secure their market position. This article explores the legal framework, opportunities, challenges, and strategic use of patent data, illustrated by real-world cases, to guide you through this intricate landscape.

Legal Framework and Recent Reforms

Overview of China’s Patent Law

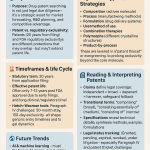

China’s patent system, established in 1984, recognizes three types of patents: invention, utility model, and design patents. Invention patents, which undergo substantive examination, offer 20 years of protection, while utility models and designs, with less rigorous scrutiny, are protected for 10 and 15 years, respectively [7]. The Patent Law, amended multiple times, governs litigation, supported by the Civil Code, Civil Procedure Law, and judicial interpretations from the Supreme People’s Court (SPC). Specialized IP courts in Beijing, Shanghai, Guangzhou, and Hainan, along with 27 IP tribunals across cities like Nanjing and Shenzhen, handle patent disputes, ensuring technical expertise [8].

Recent Amendments and Their Impact

The Fourth Amendment to the Patent Law, effective June 1, 2021, introduced transformative changes to strengthen IP enforcement:

- Punitive Damages: Courts can now award 1 to 5 times compensatory damages for willful infringement, deterring bad-faith actors [2].

- Increased Statutory Damages: The range for statutory damages rose from 10,000–1 million RMB to 30,000–5 million RMB ($4,571–$760,000 USD), addressing cases where actual losses are hard to prove [2].

- Burden of Proof Shift: Courts may order infringers to provide financial records if the patent holder has made reasonable efforts to gather evidence, easing damage calculations [2].

These reforms make litigation more attractive, particularly for pharmaceutical companies protecting high-value patents. For instance, the ability to secure punitive damages signals a stronger deterrent against infringement, aligning China’s system with global standards.

“In 2022, Chinese local courts accepted 38,970 new civil patent cases, reflecting the growing importance of intellectual property protection in China.”

— PatentPC, China Patent Litigation Statistics: Trends and Analysis [4]

Opportunities in China’s Patent Litigation System

High Success Rates for Patent Holders

China’s courts have become increasingly favorable for patent holders, both domestic and foreign. In 2022, domestic plaintiffs won 74% of cases against Chinese defendants, while foreign plaintiffs achieved a 77% success rate [4]. This high win rate, particularly for foreign companies, challenges perceptions of bias and underscores the system’s fairness in major jurisdictions like Beijing and Shanghai. For pharmaceutical companies, where 70.86% of patent cases in 2022 involved strategic emerging industries, this presents a robust platform to enforce IP rights [4].

Potential for Significant Damages

The potential for substantial damage awards is a game-changer. The average damages in Beijing rose from $80,000 in 2018 to $450,000 in 2022, reflecting courts’ growing recognition of IP value [4]. A landmark case, Spin Master v. Guangzhou Lingdong, saw a Canadian toy company awarded 15 million RMB ($2.2 million USD) for patent infringement—the largest award to a foreign patent owner at the time [1]. In pharmaceuticals, where R&D costs are astronomical, such awards can protect market exclusivity and deter generics.

Efficient Litigation Process

China’s patent litigation system is notably efficient, with approximately 70% of infringement cases resolved within 12 months [5]. This speed contrasts with jurisdictions like the U.S., where litigation can drag on for years. The efficiency stems from specialized IP courts and streamlined procedures, allowing businesses to resolve disputes quickly and minimize disruptions. For instance, the patent linkage system, introduced in 2021, enables pharmaceutical companies to challenge generic drug applications within 45 days, with a 9-month stay on generic approvals [9].

Challenges in China’s Patent Litigation System

Evidence Collection and Lack of Discovery

One of the most significant hurdles in China’s patent litigation is the absence of a U.S.-style discovery process. Parties must independently collect evidence, which can be particularly challenging for complex technologies like pharmaceuticals. As noted in a Legal500 guide, “evidence collection and preservation are huge challenges in patent litigation, especially for those complicated technologies” [6]. Courts may issue orders to collect evidence from opponents or third parties, but the burden remains on the litigant, often requiring local expertise to navigate.

Local Protectionism and Regional Variations

Perceptions of local protectionism persist, particularly in inland provinces, where courts may favor local companies. However, empirical data from 2006–2011 suggests that major urban courts, handling 26% of cases in Beijing alone, are impartial, with foreign patentees winning over 70% of their cases [3]. Regional variations in judicial interpretation can still complicate outcomes, necessitating strategic venue selection. For example, the SPC’s IP Court, established in 2019, unifies standards for technical cases, but local courts may differ in approach [7].

Language and Cultural Barriers for Foreign Companies

For foreign companies, language and cultural barriers pose significant challenges. Legal proceedings are conducted in Chinese, and understanding nuanced legal terms requires fluency or expert translation. Cultural differences in negotiation and litigation strategies can also hinder effective advocacy. Engaging local counsel, as Spin Master did with Lusheng Law Firm, is critical to overcoming these barriers and achieving favorable outcomes [1].

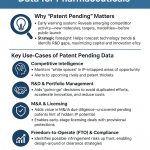

Leveraging Patent Data for Competitive Advantage

Role of Patent Data in Litigation Strategy

Patent data is a powerful tool for businesses navigating China’s litigation system. By analyzing litigation trends, companies can assess risks, identify potential infringers, and decide whether to pursue litigation or licensing. For example, understanding that 85% of patent infringement cases settle out of court can guide strategic negotiations [5]. Platforms like DrugPatentWatch provide comprehensive patent data, enabling companies to monitor competitors’ portfolios, track patent expirations, and anticipate litigation opportunities.

DrugPatentWatch as a Resource

DrugPatentWatch is particularly valuable for pharmaceutical companies operating in China, where 8,500 patent infringement cases in 2020 involved pharmaceuticals [5]. The platform offers insights into patent statuses, expiration dates, and litigation histories, helping companies strategize enforcement or defense. For instance, a company can use DrugPatentWatch to identify generics challenging their patents under the patent linkage system, enabling timely legal action. By integrating such data into their IP strategy, businesses can stay ahead in China’s competitive market.

Case Studies

Spin Master v. Guangzhou Lingdong

In 2020, the Suzhou Intermediate People’s Court awarded Spin Master, a Canadian toy company, 15 million RMB ($2.2 million USD) for patent infringement by Guangzhou Lingdong’s “Eonster Hunter” toys, which copied Spin Master’s Bakugan line [1]. The court’s decision, based on sales data, marked the largest damages award to a foreign patent owner, signaling China’s commitment to IP enforcement. Spin Master’s attorney, Doug Clark, noted, “There is a willingness of the [Chinese] courts to take a broader view of damages,” highlighting evolving judicial attitudes [10].

Chugai v. Haihe

The first patent linkage litigation in China, Chugai v. Haihe, involved Chugai Pharmaceutical suing Wenzhou Haihe for a generic version of Eldecalcitol Soft Capsules [9]. Filed in 2021 at the Beijing IP Court, the case tested China’s new patent linkage system, which allows patent holders to challenge generic approvals. The SPC’s decision underscored the system’s role in protecting pharmaceutical innovations, offering a blueprint for future cases.

AstraZeneca v. Zhejiang Haizheng

In this pharmaceutical case, AstraZeneca secured a preliminary injunction against Zhejiang Haizheng, supported by a 15 million yuan litigation preservation guarantee [11]. The court’s swift action and subsequent settlement demonstrated the effectiveness of injunctive relief in pharmaceutical disputes, where timing is critical to prevent generic market entry.

Conclusion

China’s patent litigation system is a double-edged sword, offering robust opportunities for IP protection while presenting significant challenges. Legal reforms, high success rates, and efficient processes make it an attractive venue for patent holders, particularly in pharmaceuticals. However, evidence collection difficulties, potential regional biases, and language barriers require strategic navigation. By leveraging patent data through platforms like DrugPatentWatch, businesses can turn these challenges into opportunities, protecting their innovations and gaining a competitive edge. As China continues to strengthen its IP framework, staying informed and proactive is key to success.

Key Takeaways

- Robust Legal Framework: The 2021 Patent Law amendments, including punitive damages and increased statutory damages, enhance IP enforcement.

- High Success Rates: Domestic and foreign plaintiffs enjoy win rates of 74% and 77%, respectively, in major jurisdictions [4].

- Efficient Resolution: 70% of cases resolve within 12 months, minimizing business disruptions [5].

- Evidence Challenges: The lack of discovery complicates evidence collection, especially for complex technologies [6].

- Data-Driven Strategy: Tools like DrugPatentWatch enable businesses to monitor patents and strategize litigation effectively.

FAQ

1. How has the introduction of punitive damages changed the landscape of patent litigation in China?

The introduction of punitive damages, allowing up to five times compensatory damages for willful infringement, has made litigation more attractive for patent holders. This deters infringers and increases potential financial rewards, as seen in the Spin Master case, where 15 million RMB was awarded [1].

2. What strategies can foreign companies employ to overcome language and cultural barriers in Chinese courts?

Foreign companies should engage local counsel fluent in Chinese and familiar with local legal practices. Partnering with firms like Lusheng, as Spin Master did, ensures effective navigation of cultural and linguistic nuances [1].

3. In what ways does the lack of a discovery process impact patent litigation in China?

The absence of discovery places the burden on litigants to collect evidence independently, which can be challenging for complex technologies. Courts may issue evidence collection orders, but parties often rely on local expertise to gather proof [6].

4. How do China’s specialized IP courts differ from regular courts in handling patent cases?

Specialized IP courts in Beijing, Shanghai, Guangzhou, and Hainan, along with 27 IP tribunals, employ technical judges with IP expertise, ensuring consistent and informed rulings. Regular courts may lack this specialization, leading to varied outcomes [8].

5. What are the implications of the high settlement rate in patent infringement cases for businesses?

With 85% of cases settling out of court, businesses can pursue cost-effective resolutions through negotiation, avoiding lengthy litigation. This encourages strategic use of patent data to assess settlement viability [5].

References

- IPWatchdog: Canadian Toymaker Spin Master Scores Big Chinese Patent Victory

- Armstrong Teasdale: Revised China Patent Law Makes Litigation More Attractive

- Vanderbilt Journal of Entertainment and Technology Law: Patent Litigation in China

- PatentPC: China Patent Litigation Statistics: Trends and Analysis

- PatentPC: China Patent Infringement Statistics: A Deep Dive

- Legal500: China: Patent Litigation – Country Comparative Guides

- WIPO: Patent System of China

- Legal500: China: Patent Litigation – Country Comparative Guides

- Jones Day: Patent Linkage and Article 76 Proceedings in China

- Lexology: Chinese court sends IP enforcement signal by awarding record patent damages

- IAM: Leveraging injunctive relief in pharmaceutical patent disputes in China