Introduction: Beyond the Pill—The New Frontier of Pharmaceutical Competition

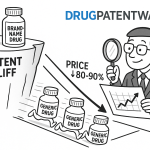

In the high-stakes world of pharmaceuticals, the narrative of competition has long been dominated by a single, dramatic event: the patent cliff. For decades, the business model was straightforward. An innovator company would develop a new molecule, protect it with a patent, and reap the rewards of market exclusivity. Upon patent expiry, generic competitors would flood the market with low-cost chemical copies, causing the brand’s revenue to plummet in a matter of months. This dynamic, enshrined in the Hatch-Waxman Act, has been an undeniable public health triumph, saving the U.S. healthcare system over $3 trillion in the last decade alone and accounting for over 90% of all prescriptions filled.1 A single generic competitor can slash a brand’s price by 30-39%, and with multiple entrants, prices can fall by over 85%.1

But what if the game itself is changing? What if the “product” is no longer just the pill?

We are in the midst of a quiet but profound revolution that is reshaping the very definition of a pharmaceutical product and, in doing so, rewriting the rules of competition. The new frontier is not just about discovering novel active pharmaceutical ingredients (APIs); it is about mastering the science of their delivery. Welcome to the era of Advanced Drug Delivery Systems (ADDS)—a world of long-acting injectables, smart patches, complex inhalers, and targeted nanoparticles. These are not mere reformulations; they are sophisticated engineering platforms designed to control a drug’s journey through the body, maximizing its therapeutic effect while minimizing its harm.5

This evolution has given rise to a powerful new strategic weapon for innovator companies: the Complexity Advantage. This is a formidable, multi-layered moat built not just on patents, but on a triumvirate of interlocking barriers: profound scientific and manufacturing difficulty, a labyrinthine regulatory gauntlet, and an impenetrable intellectual property fortress. For a generic manufacturer, the challenge is no longer simply replicating a molecule. It is about reverse-engineering and flawlessly reproducing an entire, intricate system—a task so fraught with technical, regulatory, and financial risk that it deters all but the most sophisticated and well-capitalized players.

This report is your guide to understanding and leveraging this new competitive landscape. We will move beyond the headlines to dissect the three pillars of the complexity advantage, exploring how they manifest in the real world through in-depth case studies of blockbuster products. We will examine the strategic imperatives for both innovator and generic firms, from the critical role of competitive intelligence to the rise of specialist manufacturing partners. Finally, we will look to the horizon, exploring how emerging technologies like nanomedicine are set to raise the bar of complexity even higher. For the business professional, the portfolio strategist, and the R&D leader, the message is clear: in the 21st-century pharmaceutical industry, value, and the power to defend it, lies not just in the molecule, but in the mastery of its delivery. Complexity is no longer a bug; it is the most valuable feature.

Part 1: Understanding the Landscape—From Simple Generics to Complex Systems

To grasp the strategic implications of the complexity advantage, we must first establish a common language and a clear understanding of the technologies and regulatory classifications that define this new battleground. The journey from a simple pill to a complex drug-device combination is not merely a scientific evolution; it is a strategic one that has fundamentally altered the assumptions upon which the generic industry was built.

What Are Advanced Drug Delivery Systems (ADDS)?

At its core, an Advanced Drug Delivery System (ADDS) is a formulation or device meticulously engineered to do what a simple pill cannot: control a drug’s fate after it enters the body. The fundamental goal is to move beyond the crude, immediate-release dynamics of conventional dosage forms, which often lead to fluctuating drug levels—peaks that can cause side effects and troughs that can render the treatment ineffective—requiring frequent, often inconvenient, dosing.

ADDS aim to solve this problem by achieving two primary objectives: spatial targeting and temporal control.5

- Spatial Targeting: This involves delivering the drug precisely to the site of action where it is needed, thereby maximizing its therapeutic efficacy and minimizing its exposure to healthy tissues, which is a major cause of off-target side effects.6

- Temporal Control: This refers to controlling the rate at which the drug is released over time. Instead of an immediate dump of the API, an ADDS can be designed for various release profiles, such as extended-release (often called sustained or controlled release), delayed-release (e.g., enteric-coated tablets that bypass the stomach), or even pulsatile-release, which mimics the body’s natural rhythms.

The evolution of these systems traces the history of modern pharmaceutical science. The journey began with relatively simple concepts, such as the first FDA-approved controlled-release system, Spansule, in 1952, which used coated pellets to prolong a drug’s effect. Today, the field has exploded into a diverse array of highly sophisticated platforms, including:

- Lipid-based systems: Liposomes, solid lipid nanoparticles (SLNs), and self-emulsifying drug delivery systems (SEDDS) that can encapsulate poorly soluble drugs and alter their absorption profiles.

- Polymer-based systems: Biodegradable microparticles (like those made from PLGA), polymer-drug conjugates, and hydrogels that can release a drug over weeks or months.9

- Targeted Systems: Antibody-drug conjugates (ADCs), which use a monoclonal antibody to deliver a potent cytotoxic agent directly to a cancer cell, epitomize the concept of spatial targeting.

- Drug-Device Combinations: Products like transdermal patches, drug-eluting stents, and long-acting injectables that merge a drug with a physical device to achieve a specific therapeutic outcome.

Crucially, the strategic value of ADDS extends beyond just improving existing drugs. These technologies are often “enabling,” meaning they can make previously “undruggable” compounds viable. A highly potent molecule with poor water solubility might be impossible to formulate as a pill but can become a blockbuster when encapsulated in a nanoparticle.7 Similarly, a drug with a very short biological half-life, which would require multiple injections per day, can be transformed into a once-monthly therapy through a long-acting injectable formulation. In this sense, ADDS are not just a tool for late-stage lifecycle management; they are a fundamental engine of R&D, capable of giving “new life” to old molecules and unlocking the potential of new ones.7

The Birth of the “Complex Generic”

The rise of ADDS necessitated a new regulatory vocabulary. The traditional generic model, built on the idea of simple, chemically identical copies of small-molecule drugs, began to break down. Regulators and industry needed a term to describe these new products that defied easy replication. Thus, the “complex generic” was born.

The U.S. Food and Drug Administration (FDA) has provided a broad definition, classifying a product as complex if it has one or more of the following attributes:

- Complex Active Ingredients: Peptides, polymeric compounds, complex mixtures of APIs, or naturally sourced ingredients that are difficult to fully characterize (e.g., glatiramer acetate).11

- Complex Formulations: Liposomes, colloids, or emulsions where the structure of the formulation is critical to the drug’s performance (e.g., cyclosporine ophthalmic emulsion).11

- Complex Routes of Delivery: Locally-acting drugs delivered to challenging sites like the skin (topical creams), the eye (ophthalmic suspensions), or the ear (otic gels).11

- Complex Dosage Forms: Transdermal patches, metered-dose inhalers, or extended-release injectables where the dosage form itself is an intricate system.11

- Complex Drug-Device Combinations: Products where a drug is integrated with a device, such as an auto-injector or a pre-filled syringe, and the device design affects drug delivery.11

The European Medicines Agency (EMA) takes a slightly different, though related, approach. While the FDA’s definition focuses on the inherent physical characteristics of the product, the EMA uses the term “hybrid medicines”. A hybrid medicine is one whose “authorization depends partly on the results of tests on the reference medicine and partly on new data from clinical trials”.14

This distinction is far more than semantic; it reveals a fundamental divergence in regulatory philosophy with profound strategic implications for any company planning a global launch. The FDA’s “complex generic” framework, while demanding, still operates largely within the Abbreviated New Drug Application (ANDA) pathway, aiming to prove equivalence without necessarily requiring new clinical efficacy trials. The EMA’s “hybrid” framework, by contrast, explicitly presupposes that new clinical or non-clinical data will likely be required to bridge the gap between the generic and the innovator product. This immediately raises the bar for development, pushing the program closer to that of a new drug application and significantly increasing the cost, time, and risk involved.

This regulatory fragmentation is, in itself, a powerful barrier. A generic developer cannot assume that a single data package will satisfy all major global regulators. They face a strategic choice: design a single, expensive global program that meets the highest bar (often the EMA’s), or run separate, potentially duplicative programs for different regions. This uncertainty and added expense are often enough to deter market entry, protecting the innovator’s revenue stream. The table below provides a clear, side-by-side comparison of these two critical regulatory frameworks.

| Feature | FDA (U.S.) | EMA (EU) |

| Terminology | Complex Generic | Hybrid Medicine |

| Legal Basis | Hatch-Waxman Act (ANDA: 505(j), 505(b)(2)) | Directive 2001/83/EC (Article 10(3)) |

| Core Requirement | Bioequivalence (BE) to the Reference Listed Drug (RLD) | Relies on data from the reference medicine, supplemented with new, applicant-generated data |

| Typical Data for Approval | Extensive in vitro characterization, pharmacokinetic (PK) studies, and sometimes comparative clinical endpoint studies | Often requires new non-clinical or clinical trial data to demonstrate similarity and address differences |

| Key Challenge for Generics | Proving “sameness” across all critical quality attributes (Q1, Q2, Q3) to establish BE | Bridging the data gap between the reference product and the follow-on version with new, costly studies |

| Harmonization Effort | Parallel Scientific Advice (PSA) Pilot Program with EMA to align on development requirements for specific products | Parallel Scientific Advice (PSA) Pilot Program with FDA to provide concurrent scientific feedback to applicants |

Part 2: The Three Pillars of the Complexity Advantage

The “complexity advantage” is not a single barrier but a reinforcing system of three distinct but interconnected pillars. A generic challenger must successfully overcome all three to bring a product to market. For the innovator, fortifying each pillar is the cornerstone of a successful lifecycle management strategy.

Pillar I: The Scientific and Manufacturing Moat

The first and most fundamental pillar is the sheer technical difficulty of creating a copy of a complex product. This goes far beyond the capabilities required for traditional small-molecule generics and ventures into the realm of advanced materials science, process engineering, and analytical chemistry.

The Challenge of Reverse-Engineering

For a simple generic tablet, reverse-engineering is straightforward: identify the API, quantify it, and identify the common, inactive excipients. For a complex product, this process is a monumental undertaking. The adage “the process is the product” becomes paramount, particularly for biologics and complex formulations. The final product’s therapeutic performance is not just determined by its ingredients, but by the precise, often proprietary, manufacturing process used to create it.

Consider a long-acting injectable based on poly(lactic-co-glycolic acid) (PLGA) microspheres, a common polymer used for extended-release formulations. A generic company cannot simply buy the same polymer. They must replicate a host of critical quality attributes (CQAs) that are invisible to the naked eye but dictate the drug’s release profile over weeks or months. These include:

- Molecular Weight and Polydispersity Index (PDI): Subtle differences in the polymer chain length and its distribution affect the degradation rate.

- Lactide-to-Glycolide Ratio: This ratio determines the polymer’s hydrophilicity and, consequently, how quickly it breaks down.

- End-capping Groups: Whether the polymer chains are “capped” or “uncapped” dramatically alters the degradation pathway and release kinetics.

Replicating this precise combination is exceptionally difficult because the innovator’s exact polymerization and purification process is a closely guarded trade secret. The generic firm is forced to engage in a lengthy, expensive, and uncertain process of trial-and-error to develop its own manufacturing process that yields a product with “sameness” in its physicochemical and structural (Q3) characteristics.

Manufacturing Complexity and Scale-Up

Even if a generic company could perfectly deconstruct a complex product in the lab, manufacturing it at a commercial scale presents another set of daunting hurdles. The equipment, environment, and expertise required are of a different order of magnitude than for simple oral solids. As Adrian Andrews, Senior Director at Teva, notes, “to produce a simple generics tablet you may have, say, five or six manufacturing steps but for some of the complex products we produce, there are up to 28 individual manufacturing steps”.

This is particularly true for sterile products like injectables and ophthalmic emulsions. These require aseptic manufacturing facilities, which are incredibly expensive to build and maintain, and demand a level of quality control and expertise that many generic firms simply do not possess.11 Any failure in sterility can have catastrophic consequences for patients and lead to immediate regulatory action.

The Nanomedicine Frontier

Nowhere is the scientific moat wider than in the field of nanomedicine. Products like liposomal doxorubicin (Doxil) or iron sucrose nanoparticles (Venofer) are not just drugs; they are complex, multi-component constructs whose behavior in the body is governed by nanoscale properties like particle size, surface charge (zeta potential), and lamellarity.24

The challenges for a would-be generic, or “nanosimilar,” are immense:

- Characterization: There is no single analytical technique that can fully characterize a nanoparticle population. A suite of orthogonal methods (e.g., dynamic light scattering, electron microscopy, chromatography) is needed, and even then, a complete picture is elusive.

- Manufacturing Sensitivity: The final properties of nanomedicines are exquisitely sensitive to minor variations in the manufacturing process (e.g., homogenization pressures, lipid composition, temperature). This makes batch-to-batch consistency a major challenge for the innovator, let alone for a generic trying to replicate it.25

- Biological Complexity: The interaction of nanoparticles with the biological environment (e.g., protein corona formation, uptake by the mononuclear phagocyte system) is incredibly complex and can be affected by subtle physicochemical differences, leading to altered biodistribution, efficacy, and potential immunotoxicity.24

Because of this complexity, the very concept of “sameness” that underpins the generic pathway is considered invalid for nanomedicines. A “similar” approach, much like that for biosimilars, is deemed necessary, which requires a far more extensive and costly demonstration of comparability. This scientific reality forms the bedrock of the next pillar: the regulatory gauntlet.

Pillar II: The Regulatory Gauntlet

The scientific hurdles of replication translate directly into a series of formidable regulatory challenges. While the goal of the generic pathway is to provide a streamlined, cost-effective route to market, the inherent complexity of ADDS forces regulators to demand a much higher burden of proof, effectively transforming the pathway into a high-risk, high-cost endeavor.

The Bioequivalence Conundrum

The cornerstone of any Abbreviated New Drug Application (ANDA) is the demonstration of bioequivalence (BE) to the innovator’s product, known as the Reference Listed Drug (RLD). For a simple oral drug that is absorbed into the bloodstream, this is typically straightforward. The generic company conducts a pharmacokinetic (PK) study in a small group of healthy volunteers, measuring the concentration of the drug in their blood over time. If the rate and extent of absorption (measured by parameters like Cmax and AUC) are the same, the products are deemed bioequivalent.16

This paradigm shatters when faced with complex products. The most significant challenge arises with locally-acting drugs, such as:

- Inhaled drugs for asthma or COPD, which act directly on the lungs.

- Topical drugs for skin conditions like eczema.

- Ophthalmic drugs for eye conditions like glaucoma or dry eye.

For these products, measuring drug concentration in the blood is often irrelevant, as the drug is not intended to work systemically. The site of action is the lung tissue, the dermal layers, or the surface of the eye. Measuring drug concentration at these specific sites in a living human is often technically infeasible, ethically problematic, or impossible. This scientific reality is one of the primary reasons that generic versions are not available for many complex brand-name products.

The “Weight of Evidence” Approach

To navigate this conundrum, the FDA has developed a “weight of evidence” approach to establish therapeutic equivalence for complex generics. Instead of relying on a single PK study, the agency requires a comprehensive data package that builds a convincing case for equivalence from multiple angles. This package can be incredibly burdensome and may include 17:

- Extensive In Vitro Characterization: The generic must prove that its formulation is qualitatively (Q1) and quantitatively (Q2) the same as the RLD. Furthermore, they must demonstrate physicochemical and structural (Q3) sameness. For an inhaler, this means matching the particle size distribution and spray pattern. For a topical cream, it means matching the rheology, globule size distribution, and other properties.

- Pharmacokinetic (PK) Studies: Even for locally-acting drugs, PK studies are often required to demonstrate comparable systemic exposure, primarily as a measure of safety to ensure the generic doesn’t lead to unexpectedly high absorption into the bloodstream.

- Pharmacodynamic (PD) Studies: In some cases, a study measuring a biological response to the drug (a biomarker) can be used.

- Comparative Clinical Endpoint Studies: For the most complex products where in vitro and PK/PD methods are insufficient, the FDA may require a full-blown clinical trial in patients to demonstrate that the generic produces the same therapeutic outcome as the brand. These studies are extremely expensive, time-consuming, and carry a high risk of failure, effectively erasing the cost advantage of the generic pathway.

The Paradox of FDA Support

Recognizing that these hurdles could stifle all competition for important medicines, the FDA has implemented a robust infrastructure to assist generic developers. This is a key part of its Drug Competition Action Plan (DCAP).28 Key initiatives include:

- Product-Specific Guidances (PSGs): The FDA has published nearly 1,900 PSGs, which act as detailed scientific and regulatory roadmaps for specific generic products. There is a strong focus on complex products; in one 2023 update, 25 of 47 new draft PSGs were for complex drugs. The agency even publishes its plans for upcoming PSGs to help industry plan their development programs.13

- Pre-ANDA Program: Established under the Generic Drug User Fee Amendments (GDUFA), this program allows developers of complex generics to have formal meetings and written correspondence with the FDA before submitting their ANDA. This provides an opportunity to get feedback on proposed study designs and clarify regulatory expectations, reducing the risk of a complete response letter down the line.16 To date, over 200 such meetings have been granted.

- The Center for Research on Complex Generics (CRCG): In 2020, the FDA awarded a grant to the University of Maryland and the University of Michigan to establish the CRCG. This center’s mission is to foster collaborative research between the FDA, academia, and the generic industry to tackle the most pressing scientific challenges holding back complex generic development.33

While these programs are designed to help, they create a powerful paradox. The very existence of this extensive support system serves as a public declaration by the regulator of the profound difficulty of the task. For a generic company’s board of directors or investors, the fact that a product requires a special pre-ANDA meeting or is the subject of a CRCG research project is a massive red flag. It signals that the development path is uncertain, the science is not settled, and the risk of failure is high. This is compounded by data showing that complex drugs are less likely to be approved in the first review cycle; the average generic application goes through three cycles, a process that can take years and millions of dollars in GDUFA fees.1

In this way, the FDA’s well-intentioned efforts to level the playing field inadvertently validate the innovator’s complexity advantage. The regulatory gauntlet acts as a filter, scaring away all but the largest, most technically adept, and most risk-tolerant generic players. The innovator’s moat is thus deepened not only by their own scientific prowess but also by the regulator’s public acknowledgment of that science’s formidable complexity.

Pillar III: The Intellectual Property Fortress

If scientific difficulty is the foundation and regulatory hurdles are the walls, then intellectual property (IP) is the heavily fortified gatehouse of the complexity advantage. Innovator companies have become masters at leveraging patent law to construct a defensive fortress around their most valuable ADDS-based products, creating a period of market exclusivity that can extend for years, or even decades, beyond the life of the original API patent.

The “Patent Thicket” Strategy

The core strategy is a departure from the old model of relying on a single composition-of-matter patent for the API. Instead, innovators now build a “patent thicket” (or “picket fence”)—a dense, overlapping portfolio of dozens, sometimes hundreds, of patents covering a single product.36 This strategy is particularly effective for complex products because their multi-component nature offers numerous features to patent.

The goal is not necessarily for every single patent to be unassailably strong. Rather, the objective is to create a legal “minefield” that is so dense, complex, and expensive to navigate that it deters generic challengers from even attempting to cross it. The sheer cost and risk of litigating dozens of patents simultaneously can be prohibitive, forcing a generic company to either abandon its plans or accept a “pay-for-delay” settlement, where the brand manufacturer pays the generic to postpone its market entry.36

Anatomy of the Fortress: Layers of Protection

For a complex drug-device combination product, this patent fortress is constructed in multiple layers. Each layer protects a different aspect of the product, creating a web of protection that is incredibly difficult for a competitor to design around.37 The table below illustrates this strategy using a fictional auto-injector product, “InjectaMax.”

| Patent Layer | Specific Example for “InjectaMax” | Purpose / Barrier Created |

| API | Patent on a specific crystalline polymorph of the drug molecule that exhibits superior stability. | Blocks the use of the most stable and easily manufactured form of the API. |

| Formulation | Patent claiming the specific combination of excipients (e.g., buffers, surfactants) that prevent drug aggregation at high concentrations. | Forces a generic to develop a completely new, non-infringing formulation and prove it is stable and bioequivalent. |

| Device (Utility) | Patent on a novel two-stage spring mechanism that reduces the initial needle-insertion speed, thereby minimizing patient-perceived pain. | Blocks the use of the most patient-friendly injection mechanism, creating a potential disadvantage for the generic version. |

| Device (Design) | Design patent on the unique, non-functional, ergonomic, and curved shape of the auto-injector’s body. | Prevents a visually similar copycat device, which can impact user recognition, trust, and brand identity. |

| Drug-Device Interaction | Patent claiming an auto-injector constructed from a specific cyclo-olefin polymer that is shown to reduce drug adsorption to the container walls by over 50%. | Protects the entire integrated system, making it difficult to substitute either the drug or the device component without infringing. |

| Method of Use | Patent on the use of InjectaMax for treating a newly discovered secondary indication (e.g., a rare autoimmune disorder). | Extends market exclusivity within a new and potentially lucrative patient population, even after primary patents expire. |

| Manufacturing Process | Patent on the proprietary aseptic filling process used to load the highly viscous drug formulation into the device under specific temperature and pressure conditions. | Creates a “black box” manufacturing hurdle that is difficult to reverse-engineer and design around. |

ADDS as a Cornerstone of Lifecycle Management

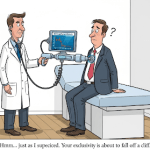

This IP strategy is central to modern pharmaceutical Lifecycle Management (LCM). The traditional LCM model focused on maximizing revenue before the primary patent expired. The new, holistic approach plans for generic competition from the earliest stages of development and uses ADDS as a primary tool for “evergreening” a franchise.

The strategy is often sequential. Years before the patent on an original blockbuster oral drug is set to expire, the innovator company will launch a new version featuring an advanced delivery system—for example, a once-daily extended-release tablet or a once-monthly injectable. This new version is not just a minor tweak; it is a new product with its own set of clinical benefits (e.g., improved adherence, better side-effect profile) and, crucially, its own new patent thicket.40 This allows the company to migrate patients and prescribers to the new, patent-protected platform before the original product faces generic erosion, effectively resetting the patent clock and extending the life of the franchise for another decade or more.

This trifecta of scientific, regulatory, and intellectual property complexity creates a self-reinforcing cycle. The scientific complexity enables the creation of numerous patentable inventions. These patents then form the basis of a legal thicket. The legal thicket, combined with the underlying scientific difficulty, creates an uncertain and demanding regulatory pathway. Together, these three pillars form a nearly insurmountable barrier to entry, solidifying the innovator’s market position and demonstrating the profound power of the complexity advantage.

Part 3: The Complexity Advantage in Action—Case Studies

Theoretical discussions of complexity are one thing; seeing it in action in the multi-billion-dollar pharmaceutical market is another. By examining real-world case studies of blockbuster drugs that leverage advanced delivery systems, we can see precisely how the three pillars—scientific, regulatory, and IP—interact to create a durable competitive advantage and delay generic entry for years beyond the expiration of the core molecule’s patent.

Case Study 1: The Long-Acting Injectable—Abilify Maintena® (Aripiprazole)

Abilify Maintena stands as a masterclass in using an ADDS not just to improve a product, but to defend an entire franchise. It perfectly illustrates how an innovator can “reset the clock” on a molecule that has already gone off-patent.

The Product and Its Purpose:

Aripiprazole, the active ingredient, was originally marketed as the oral tablet Abilify for treating schizophrenia and bipolar I disorder. When the patent on the oral molecule expired, it faced swift generic competition. However, Otsuka Pharmaceutical had already developed the next generation: Abilify Maintena, a long-acting injectable (LAI) formulation administered as a deep intramuscular injection just once a month.42 For patients with chronic mental illnesses, where medication adherence is a major challenge, a monthly injection offers a significant clinical advantage over a daily pill, reducing relapse rates and hospitalizations.43

Pillar I: The Scientific and Manufacturing Moat:

Abilify Maintena is not simply aripiprazole dissolved in a solution. It is a sterile, aqueous suspension of micronized aripiprazole drug crystals. Creating a generic equivalent is a formidable scientific challenge:

- Particle Engineering: The generic manufacturer must replicate the exact particle size distribution and crystal morphology of the innovator’s product. These properties directly control the surface area of the drug available for dissolution in the muscle tissue, which in turn dictates the release rate over 30 days. This is a non-trivial materials science problem.

- Sterile Manufacturing: The entire process, from crystal formation to filling the vials, must be conducted under strict aseptic conditions. The product is a suspension, not a simple solution, which complicates sterilization processes like filtration. Any microbial contamination would be catastrophic.

- Formulation and “Syringeability”: The formulation includes not just the drug but a host of excipients that keep the particles suspended and allow the product to be easily drawn into and injected from a syringe (a property known as “syringeability”). Replicating this delicate balance of viscosity and stability is key.

The difficulty of this task is underscored by the fact that the first generic approval for any complex LAI of this type (naltrexone, brand name Vivitrol) only occurred in July 2023, signaling just how challenging this technology is for the generic industry.

Pillar II: The Regulatory Gauntlet:

Proving bioequivalence for an LAI like Abilify Maintena is far more arduous than for an oral tablet. The standard, single-dose study in healthy volunteers is insufficient. The FDA requires a much more complex regulatory program:

- Patient Population: BE studies for LAIs must be conducted in the target patient population (i.e., individuals with schizophrenia or bipolar disorder), not healthy volunteers. This makes recruitment more difficult and adds ethical complexities.

- Steady-State Design: Because the drug is released slowly over a month, a single dose is not enough to assess its performance. The studies must be designed to measure drug concentrations after multiple injections, once the patient has reached “steady-state,” a process that can take several months per patient.

- High Variability: The absorption of a drug from an intramuscular depot can be highly variable between patients, influenced by factors like injection site, muscle mass, and blood flow. This pharmacological variability makes it statistically more difficult to prove that the generic and brand products are equivalent.

Pillar III: The Intellectual Property Fortress and Lifecycle Management:

The patent on the aripiprazole molecule is irrelevant to Maintena’s exclusivity. The product is protected by a robust patent thicket covering the specific formulation, the crystalline form of the drug, and its method of use.45 As of late 2021, at least one generic company had filed a Paragraph IV certification challenging these patents, signaling their intent to launch a generic, but the barriers remain high.

Most importantly, Otsuka has executed a textbook lifecycle management strategy. With the patents on Abilify Maintena (the one-month injectable) expected to expire around October 2024 in the EU and January 2025 in the US, the company has already launched its successor: Abilify Asimtufii, a two-month LAI.43 This new product, launched in the US in April 2023, has its own patent protection extending to 2033. The clear commercial strategy is to switch as many patients as possible from the one-month version to the new, more convenient, and patent-protected two-month version before generic competition for Maintena arrives.

This case perfectly demonstrates a dynamic, multi-generational franchise defense. The LAI platform created a new set of scientific, regulatory, and IP barriers that resurrected a multi-billion-dollar franchise. The subsequent launch of an even longer-acting version shows a proactive strategy to perpetually stay one step ahead of the generic lifecycle.

Case Study 2: The Drug-Device Combination—Advair Diskus® (Fluticasone/Salmeterol)

The story of Advair Diskus is a powerful testament to the idea that engineering complexity can be an even more durable barrier to competition than patent protection. It showcases the unique challenges posed by a locally-acting, inhaled drug-device combination.

The Product and Its Purpose:

Advair Diskus is a dry powder inhaler (DPI) that delivers a combination of fluticasone propionate (an inhaled corticosteroid) and salmeterol (a long-acting beta-agonist) for the treatment of asthma and COPD.50 The therapeutic effect is achieved by delivering the micronized drug powders directly to the airways in the lungs.

Pillar I: The Scientific and Manufacturing Moat:

The challenge for a generic competitor was twofold: they had to replicate both the drug formulation and the Diskus device.

- Formulation: The product consists of a precise blend of micronized active ingredients and a larger lactose carrier particle. The manufacturing process must ensure a homogenous blend and control the particle size of the APIs, as this is critical for deep lung deposition.

- The Device: The Diskus device is not a simple container. Its intricate internal geometry is engineered to perform a critical function: de-agglomeration. When a patient inhales, the device must use the force of their breath to break apart the drug-lactose blend, creating a fine particle aerosol that can travel into the small airways. A generic must develop a completely different device that achieves the exact same aerosolization performance across a range of patient inhalation flow rates. This is a significant fluid dynamics and mechanical engineering challenge.

Pillar II: The Regulatory Gauntlet:

Advair is a classic locally-acting drug, making the standard PK-based BE pathway impossible. This forced the FDA to require an arduous “weight of evidence” approach, which became the primary barrier to generic entry for nearly a decade.17 The requirements included:

- In Vitro Equivalence: Extensive testing to show that the generic device, when tested in a lab, delivers the same dose with the same aerodynamic particle size distribution as the Advair Diskus.

- Pharmacokinetic (PK) Equivalence: A study to show that the amount of drug absorbed into the bloodstream (a surrogate for the total lung dose) was comparable, primarily for safety assessment.

- Therapeutic Equivalence (Clinical Endpoint Study): The highest hurdle. The generic manufacturer had to conduct a large, randomized, placebo-controlled clinical trial in hundreds of asthma patients to prove that their product produced a statistically equivalent improvement in lung function (measured by Forced Expiratory Volume in 1 second, or FEV1) as Advair Diskus.

This multi-faceted requirement was so expensive, time-consuming, and risky that it created a de facto period of market exclusivity long after the drug patents had expired. The core patents on fluticasone and salmeterol expired in the 2000s, but the first fully substitutable generic, Mylan’s Wixela Inhub, was not approved until January 2019.27 This nearly decade-long delay was almost entirely due to the regulatory complexity. To add to the challenge, the originator, GlaxoSmithKline, filed a citizen petition in 2009 asking the FDA to impose even stricter standards on potential generics, a common tactic used to sow uncertainty and cause delays.54 Furthermore, independent research later revealed significant batch-to-batch variability in the PK profile of the branded Advair itself, making the task for generics akin to hitting a moving target.

Pillar III: The Intellectual Property Fortress:

While the regulatory hurdles were the main story, GSK also had numerous patents on the Diskus device itself. A generic could not simply copy the device; they had to invent their own unique inhaler mechanism that was different enough to avoid patent infringement but similar enough in performance to pass the FDA’s stringent equivalence tests. This “inventing around” the device patents, coupled with the need to prove therapeutic equivalence in a clinical trial, created a monumental barrier.

The Advair case is a landmark. It proves that for complex drug-device combinations, the device is not an accessory—it is the therapeutic system. The innovator’s investment in a proprietary and complex delivery device created a moat of engineering and regulatory complexity that was ultimately more valuable and durable than the patents on the drugs it delivered.

Case Study 3: The Transdermal Patch—Butrans® (Buprenorphine)

Transdermal patches represent another major class of ADDS, and the case of Butrans illustrates how complexity in the formulation’s layers and adhesive properties can be leveraged to create significant barriers to generic competition.

The Product and Its Purpose:

Butrans is a transdermal patch designed to deliver the opioid analgesic buprenorphine through the skin continuously for seven days. It is indicated for the management of severe and persistent pain that requires around-the-clock, long-term opioid treatment.56 The 7-day duration offers a significant convenience and compliance advantage over oral opioids that must be taken multiple times a day.

Pillar I: The Scientific and Manufacturing Moat:

A transdermal patch is a deceptively sophisticated multi-laminate system. A generic manufacturer must precisely replicate this entire structure, which typically includes:

- A backing layer that is impermeable to the drug.

- A drug-in-adhesive layer, where the drug is mixed into a pressure-sensitive adhesive that sticks to the skin.

- A rate-controlling membrane that governs the speed at which the drug can diffuse out of the reservoir.

- A release liner that protects the adhesive before use.

The key challenges for a generic developer are to match the innovator’s choice of adhesive, which affects not only how well the patch sticks for seven days but also the potential for skin irritation, and to replicate the exact composition of the drug reservoir and the permeability of the membrane. Together, these elements control the drug’s release profile, and any deviation could lead to under-dosing or a dangerous overdose.11

Pillar II & III: The Interplay of Regulation and IP:

The story of Butrans in the United Kingdom provides a clear example of how formulation patents can be used to delay generic entry. The originator company, Napp Pharmaceuticals (a subsidiary of Purdue Pharma), held a patent not on buprenorphine itself, but on the specific formulation of the drug matrix within the patch. The patent claimed a composition comprising “10% weight buprenorphine base; 10%–15% wt levulinic acid and ~10% weight oleyloleate”.

This patent on the “recipe” of the patch became a powerful weapon. When generic companies sought to enter the market, Napp sued for patent infringement. This legal action successfully prevented the launch of most generic buprenorphine patches until the patent was ultimately invalidated in court in August 2016. This delay was costly; one study estimated that the lack of full generic competition during this period deprived the UK’s National Health Service (NHS) of approximately £1.2 million in potential savings.

From a regulatory perspective, the FDA has recognized the unique challenges of transdermal systems. The agency has issued specific draft guidances for generic developers on how to conduct the necessary studies to assess adhesion (ensuring the patch stays on for the full duration) and skin irritation and sensitization potential, adding further layers of testing and cost to the development program.29

The Butrans case powerfully illustrates that in the world of ADDS, the line between “active” and “inactive” ingredients becomes blurred. The excipients—the levulinic acid, the oleyloleate, the specific adhesive polymers—are not inert fillers. They are the enabling technology that makes the 7-day delivery possible. By patenting this novel formulation science, the innovator created a formidable barrier, forcing generic challengers into a difficult choice: either engage in a costly and risky legal battle to invalidate the patent or undertake a massive R&D effort to invent a completely new, non-infringing formulation that somehow achieves the exact same 7-day release profile. This is the complexity advantage in its purest form.

Part 4: Strategic Imperatives for a Complex World

Navigating the landscape of complex generics and advanced delivery systems is not a matter of luck; it requires a deliberate and sophisticated strategy. The immense scientific, regulatory, and IP barriers demand new tools, new partnerships, and a new way of thinking for both innovator and generic firms. Success in this arena is predicated on mastering three strategic imperatives: leveraging competitive intelligence, forging deep partnerships with specialists, and adopting a highly selective and risk-adjusted investment approach.

The Critical Role of Competitive Intelligence

In an environment defined by uncertainty and high stakes, information is the ultimate currency. Competitive intelligence (CI) has evolved from a passive, “nice-to-have” reporting function into an essential, proactive strategic weapon. It is the bedrock upon which sound portfolio and investment decisions are made.

A simple patent expiry date is no longer sufficient information. To make a multi-million-dollar investment decision on a complex generic candidate, a company needs to answer a battery of difficult questions:

- IP Landscape: How many patents are in the innovator’s thicket? What is their scope and strength? Have they been challenged before? What was the outcome?

- Regulatory Pathway: Has the FDA issued a Product-Specific Guidance (PSG) for this product? What does it require? Is a comparative clinical endpoint study needed? What is the likely review timeline and the risk of multiple review cycles?

- Competitive Environment: Who else is developing a generic version? Have they filed an ANDA? Have they made a Paragraph IV challenge? What is their track record with complex products?

Answering these questions requires the integration of disparate, highly specialized datasets—patent filings, litigation records, regulatory documents, and clinical trial data. This is where dedicated CI platforms become indispensable. Services like DrugPatentWatch provide a fully integrated database that allows companies to move beyond basic searches and build a comprehensive, multi-dimensional model of the competitive environment.61

For an innovator company, these tools are vital for defense. They allow R&D and legal teams to monitor the research paths of competitors, analyze the strategies of successful patent challengers, and proactively identify and patch vulnerabilities in their own IP fortress.37

For a generic company, these platforms are the essential toolkit for offense. They enable the identification of viable market entry opportunities, the analysis of patent strength to inform litigation strategy, and the prediction of regulatory hurdles. This allows them to build what one expert report calls a “regulatory risk score” for each candidate, weighing the fully-loaded, risk-adjusted cost of achieving global market access against the potential return. In the world of complex generics, investing in a sophisticated CI capability is not an option; it is a prerequisite for survival.

The Rise of the Specialist CDMO: Complexity as a Service

The profound scientific and manufacturing complexity of ADDS has given rise to a new and vital player in the pharmaceutical ecosystem: the specialist Contract Development and Manufacturing Organization (CDMO). The challenges of developing and producing a complex product—from reverse-engineering a reference drug to scaling up aseptic manufacturing—require a level of expertise and capital investment that many pharmaceutical companies, particularly smaller biotechs and traditional generic firms, do not possess in-house.11

Modern CDMOs have evolved far beyond the traditional role of a contract manufacturer (CMO). They are not simply “factories for hire.” Instead, they offer an integrated, end-to-end suite of services that can span the entire product lifecycle.40 These services include:

- Early-Stage Development: Formulation development, analytical method development and validation, and stability testing.64

- Regulatory Support: Deep expertise in navigating global regulatory pathways, including preparing the Chemistry, Manufacturing, and Controls (CMC) section of an ANDA for the US market.

- Process Optimization and Scale-Up: Taking a lab-scale process and efficiently scaling it up for commercial production, often using advanced technologies like continuous manufacturing or Quality by Design (QbD) principles.

- Specialized Manufacturing: Operating state-of-the-art facilities for complex dosage forms, such as sterile injectables, lyophilized products, high-potency compounds, and drug-device assembly.

For a pharmaceutical company, the relationship with a CDMO for a complex product is not a simple vendor-client transaction; it is a deep, strategic partnership.40 The CDMO’s expertise effectively becomes an extension of the pharma company’s own R&D and manufacturing capabilities. The choice of the right CDMO is therefore a critical strategic decision that can make or break a program.

For a generic firm looking to enter the complex space, a CDMO offers a way to access world-class capabilities without the massive upfront capital expenditure required to build them from scratch. It allows them to focus on their core competencies in regulatory affairs and commercialization while outsourcing the highly specialized technical work.63

For an innovator firm, a CDMO can be a source of novel delivery technologies, a partner in executing a complex lifecycle management strategy, or a way to accelerate time-to-market by leveraging existing capacity and expertise. In either case, the CDMO has become an indispensable enabler in the age of complexity.

Investment and Portfolio Strategy: A Bifurcated World

The emergence of the complexity advantage has fundamentally reshaped investment and portfolio strategy, effectively bifurcating the generic industry. The old “one-size-fits-all” model is dead. Success now requires a clear-eyed assessment of a company’s capabilities and risk tolerance, leading to one of two distinct strategic paths.

For Innovator Companies: Design for Complexity

The primary strategic shift for innovators is to treat complexity not as an afterthought but as a core design principle from the earliest stages of drug development. A holistic, cross-functional LCM team—comprising R&D, marketing, manufacturing, and legal—must be involved from the beginning. The goal is to intentionally build a product that is not only clinically superior but also inherently difficult to copy. This involves:

- Proactive IP Strategy: Building a multi-layered patent thicket from day one, covering not just the API but the formulation, the device, the manufacturing process, and all potential methods of use.

- Investing in Proprietary Delivery Platforms: Developing unique, difficult-to-replicate delivery systems that offer demonstrable patient benefits (e.g., less frequent dosing, improved tolerability) that can be used to justify premium pricing and create a durable moat.

- Planning for the “Second Act”: Actively planning for the next-generation version of the product (e.g., the two-month injectable to succeed the one-month version) years before the first version’s patents expire, creating a clear path for patient migration and franchise extension.

For Generic Companies: The Great Divide

The generic industry is now splitting into two distinct camps:

- The Traditional Players: These companies will continue to focus on the high-volume, low-margin market for simple, oral solid generics. Their business model is predicated on operational efficiency, low-cost manufacturing, and speed to market. They will largely avoid the high-risk, high-cost world of complex generics.

- The “Specialty” or “Complex” Generic Players: A new class of company is emerging to tackle the complexity advantage head-on. These firms (or specialized divisions within large players like Teva, Viatris, and Sandoz) operate more like innovative R&D organizations than traditional generic manufacturers. Their strategy is one of selective targeting:

- High-Risk, High-Reward Portfolio: They recognize that developing complex generics requires a massive investment in R&D, clinical trials, and regulatory fees.1

- Deep Technical Expertise: They must build or acquire deep in-house expertise in areas like polymer chemistry, device engineering, and sterile manufacturing, or forge strategic partnerships with top-tier CDMOs.

- Rigorous Candidate Selection: They cannot afford to chase every opportunity. They must use sophisticated CI and risk-assessment models to prioritize products with the highest probability of technical and regulatory success and a market size large enough to justify the enormous upfront investment.1

This bifurcation is a direct consequence of the complexity advantage. Innovators of complex products now face a much smaller, more sophisticated, and more rational pool of potential competitors. The days of facing a dozen generic challengers on day one after patent expiry are over for these products. Instead, they may face only one or two well-prepared competitors, or none at all, leading to a much more durable and profitable market position.

Part 5: The Future of Complexity—What’s on the Horizon?

The relentless pace of scientific innovation ensures that the landscape of drug delivery will only grow more complex. The technologies that are in research labs today will become the blockbuster products of tomorrow, presenting an even higher set of barriers for follow-on competition. Understanding these emerging platforms is critical for any long-term strategic planning in the pharmaceutical industry.

Emerging Delivery Technologies: Raising the Bar

Three areas, in particular, promise to redefine the limits of drug delivery and, in doing so, create the next generation of the complexity advantage.

1. Nanomedicine: The Ultimate Formulation Challenge

As we have touched upon, nanomedicine represents a revolutionary leap in formulation science. By engineering materials at the nanoscale (typically 1-100 nm), scientists can create nanocarrier systems—such as liposomes, polymeric nanoparticles, and solid lipid nanoparticles—that can dramatically improve a drug’s solubility, protect it from degradation, and deliver it to specific tissues or even specific cells within the body.25

However, this sophistication comes at the price of extreme complexity. The regulatory and scientific challenges are so profound that they threaten to break the existing generic paradigm entirely:

- The “Nanosimilar” Problem: As noted by leading researchers and regulatory bodies, the concept of “sameness” used for simple generics is not applicable to nanomedicines. Their biological behavior is a function of a complex interplay of size, shape, surface chemistry, and manufacturing process that is impossible to replicate perfectly.20 This has led to the proposed term “nanosimilars” or Non-Biological Complex Drugs (NBCDs), for which a follow-on product would need to be proven “similar,” not “same”.14

- Lack of a Harmonized Regulatory Framework: There is currently no globally harmonized regulatory pathway for nanosimilars. Regulators are grappling with fundamental questions: What characterization tests are sufficient? What level of difference is acceptable? When are new clinical trials required to ensure safety and efficacy? This uncertainty creates massive risk for developers.24

- Nanotoxicology: The unique properties of nanomaterials can lead to unique toxicities, such as unintended accumulation in organs like the liver and spleen, or the potential to cross the blood-brain barrier and cause neurological effects. A follow-on manufacturer would have to conduct extensive toxicology studies to prove their product does not introduce new safety risks.

The inevitable conclusion is that the regulatory pathway for follow-on nanomedicines will look far more like the rigorous, data-intensive biosimilar pathway than the traditional ANDA pathway. It will require a “totality of the evidence” approach, including extensive comparative analytical data and, most likely, new clinical safety and efficacy studies. This will raise the barrier to entry to a level that may be insurmountable for all but a handful of the most specialized and well-funded companies, ensuring that the markets for these innovative products are oligopolies, not commoditized generic free-for-alls.

2. Microneedle Arrays: The “Smart” Patch

Microneedle arrays are another frontier technology poised to revolutionize drug delivery. These are small patches containing hundreds of microscopic needles that painlessly penetrate the outermost layer of the skin (the stratum corneum), creating microchannels for the delivery of drugs, vaccines, and other biologics.68 This approach bypasses the gastrointestinal tract and first-pass metabolism, offering a minimally invasive alternative to traditional injections.

The future of this technology is even more complex. Researchers are developing “smart” microneedles that can respond to biological or external stimuli. For example:

- Thermo-responsive patches could release an anti-fever drug when a patient’s temperature rises.

- Glucose-responsive patches could release insulin in response to elevated blood sugar levels, creating a “closed-loop” system for diabetes management.

For a follow-on competitor, the challenges would be immense. They would need to replicate not only the physical aspects of the patch—the precise needle geometry, the biocompatible materials, the drug formulation—but also the “smart” release mechanism itself. This would involve reverse-engineering the responsive polymer or biosensor system, a task that combines materials science, chemistry, and bioengineering. The IP fortress around such a product would be multi-layered, covering the drug, the patch design, and the proprietary responsive technology.

3. Smart Implants and In-Situ Forming Depots

The evolution of long-acting delivery is moving toward implantable systems that can release a drug over many months or even years. This includes pre-formed implants that are inserted surgically and in-situ forming depots, where a liquid polymer solution is injected and solidifies into a solid implant inside the body.

These technologies present next-level challenges for generic replication:

- Predicting Long-Term Release: The in-vivo performance of these systems is incredibly difficult to predict and model. The degradation of the polymer and the release of the drug are influenced by the complex physiological environment over a very long period.

- Biocompatibility and Removal: Ensuring the implant is biocompatible and does not cause a chronic inflammatory response is critical. For non-biodegradable implants, a plan for removal must also be considered.

- Combination with Nanocarriers: The future may see implants that do not just release a drug, but release drug-loaded nanocarriers, adding another layer of complexity to the system.

The table below summarizes and compares the key challenges a generic developer would face when attempting to create a follow-on version of these major ADDS platforms, providing a strategic risk assessment for portfolio managers.

| ADDS Platform | Primary Scientific/Manufacturing Challenge | Primary Regulatory/BE Challenge | Key IP Hurdle |

| Long-Acting Injectables (LAIs) | Aseptic manufacturing of suspensions, controlling particle size/crystal form, ensuring depot consistency and managing PK variability.23 | Lengthy and expensive steady-state PK studies in patient populations; high inter-patient variability makes proving equivalence difficult. | Patents on the specific formulation (e.g., polymer type, drug crystal form) and manufacturing process. |

| Drug-Device Inhalers | Precisely replicating the mechanics of the proprietary device to achieve identical de-agglomeration and fine particle fraction.11 | “Weight of evidence” approach requiring extensive in vitro testing, PK studies, and large, comparative clinical endpoint studies in patients. | A thicket of utility patents on the device’s novel mechanisms and design patents on its ornamental appearance. |

| Transdermal Patches | Matching the specific adhesive properties (adhesion and irritation profile) and the complex multi-laminate structure that controls the release rate.11 | Must conduct PK studies plus specific clinical studies to assess skin adhesion and irritation/sensitization potential over the full wear period. | Patents on the specific formulation of the drug-in-adhesive matrix, including the unique combination of excipients. |

| Nanomedicines | Lack of standardized methods for full characterization, controlling batch-to-batch variability in size/surface charge, and assessing potential nanotoxicology.20 | The traditional “sameness” concept is invalid. A “similar” or biosimilar-like pathway with a “totality of the evidence” approach, likely including new clinical data, is expected.20 | Patents on nanoparticle composition, surface modifications (e.g., PEGylation), targeting ligands, and proprietary manufacturing methods. |

Conclusion: Complexity as an Enduring Value Driver

The pharmaceutical industry is at a strategic inflection point. The simplistic model of competition, centered on the chemical structure of a pill, is giving way to a new paradigm where the delivery system is as important—and often more valuable—than the drug molecule it carries. Advanced Drug Delivery Systems have fundamentally reshaped the competitive landscape, creating a powerful and durable “complexity advantage” for innovator companies.

This advantage is not a single wall but a multi-layered fortress, built upon three reinforcing pillars:

- Profound Scientific and Manufacturing Difficulty: The technical challenges of reverse-engineering and replicating complex formulations, devices, and manufacturing processes create a formidable moat that is beyond the capabilities of many traditional generic firms.

- A Demanding and Uncertain Regulatory Gauntlet: The breakdown of the simple bioequivalence model for complex products has forced regulators to demand a higher, more costly, and riskier burden of proof, filtering out all but the most determined and well-resourced challengers.

- A Formidable Intellectual Property Fortress: Innovators have mastered the art of building “patent thickets” around their ADDS products, using a web of overlapping patents on the formulation, device, and methods of use to create a legal minefield that deters litigation and delays competition for years.

The real-world impact of this advantage is undeniable, as seen in the multi-year delays for generics of products like Abilify Maintena and Advair Diskus. This has forced a strategic evolution on both sides of the aisle. Innovators now proactively design for complexity as a core part of their lifecycle management strategy. The generic industry, in turn, has bifurcated, with a new class of specialized players emerging to take on the high-risk, high-reward challenge of complex generics. Success for either side now depends on new strategic imperatives: deep investment in competitive intelligence platforms like DrugPatentWatch, and the formation of deep, strategic partnerships with specialist CDMOs who provide “complexity as a service.”

Looking forward, the trend is clear. Emerging technologies like nanomedicines and smart implants will only increase the level of complexity, further challenging the traditional model of generic competition and driving the evolution of regulatory science. In the modern pharmaceutical industry, complexity is no longer an ancillary characteristic or a late-stage tactic. It is a core element of therapeutic innovation, a primary driver of commercial value, and the most enduring defense against the forces of commoditization. Mastering it is the key to winning the future.

Industry Insight:

The market for complex generics, often termed “specialty generics,” is a testament to the high-risk, high-reward nature of this sector. The global specialty generics market was valued at approximately $69.90 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.9% to reach $148.72 billion by 2030. Injectable formulations dominate this market, accounting for over 64% of the revenue share, highlighting the immense value and challenge associated with developing these complex products.

Key Takeaways

- Complexity is the New Moat: Advanced Drug Delivery Systems (ADDS) create a “complexity advantage” for innovator drugs, built on scientific, regulatory, and intellectual property barriers that deter generic competition far more effectively than a simple API patent.

- Three Pillars of Defense: The advantage rests on (1) the immense scientific and manufacturing difficulty of replicating complex systems; (2) the demanding and uncertain regulatory gauntlet of proving bioequivalence for non-systemic or complex products; and (3) the use of “patent thickets” to create a formidable legal fortress.

- The Generic Paradigm is Broken for Complex Drugs: The traditional generic model of simple chemical copying and a straightforward bioequivalence study does not apply. Complex generics require a “weight of evidence” or “similar” approach, often involving new clinical trials, which dramatically increases cost, risk, and time to market.

- Lifecycle Management (LCM) is Redefined: Innovators now use ADDS as a primary LCM tool to “evergreen” franchises. By launching a new, complex delivery version of a drug before the original’s patent expires, they can migrate patients to a new, patent-protected platform, effectively resetting the clock on exclusivity.

- The Generic Industry is Bifurcating: The rise of complexity has split the generic industry into traditional players focused on low-margin oral solids and a new class of “specialty generic” companies with the R&D, regulatory, and financial resources to tackle complex products.

- Strategic Partnerships are Essential: The technical demands of ADDS have made specialist Contract Development and Manufacturing Organizations (CDMOs) critical partners for both innovator and generic firms, providing essential expertise and capabilities.

- Competitive Intelligence is Non-Negotiable: Navigating this landscape requires sophisticated competitive intelligence. Platforms like DrugPatentWatch are essential for assessing the multi-faceted risks (IP, regulatory, scientific) and making informed investment decisions.

- The Future is More Complex: Emerging technologies like nanomedicine, smart patches, and long-acting implants will raise the bar even higher, likely requiring a “nanosimilar” regulatory pathway akin to biosimilars, further solidifying the complexity advantage as an enduring driver of value.

Frequently Asked Questions (FAQ)

1. How can an innovator company best leverage the “complexity advantage” in its R&D and commercial strategy?

An innovator should embed a “design for complexity” philosophy into its entire product development lifecycle. This starts with R&D selecting not just the most potent API, but the one that can be paired with a proprietary, difficult-to-replicate delivery system that offers a clear clinical benefit (e.g., improved adherence via a long-acting injectable). The legal team must work in parallel to build a multi-layered “patent thicket” around every aspect of the final product—the formulation, the device, the manufacturing process, and methods of use. Finally, the commercial team should plan for a multi-generational franchise, developing the next advanced delivery version (e.g., a two-month injectable to follow a one-month version) years before the first one faces patent expiry, creating a clear strategy to migrate patients and preserve the franchise.40

2. As a generic drug manufacturer, what are the most critical factors to consider before deciding to invest in developing a complex generic?

A generic manufacturer must conduct a rigorous, multi-faceted risk assessment. The three most critical factors are: (1) Regulatory Pathway Clarity: Is there a clear FDA Product-Specific Guidance (PSG)? Does it require a costly and high-risk clinical endpoint study? The lack of a clear regulatory path is a major red flag.15 (2)

IP Landscape Integrity: How dense is the patent thicket? A thorough freedom-to-operate (FTO) analysis is crucial. The cost and probability of success in challenging multiple patents must be realistically modeled.36 (3)

Technical Feasibility and Cost: Do you have the in-house scientific expertise and manufacturing capability (e.g., for sterile injectables), or can you secure a partnership with a reliable, high-quality CDMO? The total R&D and manufacturing investment must be weighed against the potential market size and the number of other potential generic competitors.1 A “regulatory risk score” that combines these factors is an essential decision-making tool.

3. How does the FDA’s approach to complex generics differ from the EMA’s, and what is the key implication for a global launch?

The key difference lies in their foundational definitions. The FDA defines a “complex generic” based on the product’s inherent characteristics (e.g., complex formulation, drug-device combo) and generally seeks to approve it via an enhanced ANDA pathway. The EMA uses the term “hybrid medicine,” defined by the data required for approval, which explicitly includes “new data from clinical trials” in addition to data from the reference product. The implication for a global launch is significant: a development program designed to meet the FDA’s bioequivalence standards may be insufficient for the EMA, which may require a separate, costly clinical trial. This regulatory fragmentation acts as a major deterrent and forces developers to either create a more expensive global program to satisfy the highest bar or run two separate programs, increasing cost and complexity. The FDA/EMA Parallel Scientific Advice (PSA) pilot program is an attempt to mitigate this, but the fundamental difference remains.

4. Why is a “patent thicket” a more effective deterrent for complex products than for simple oral drugs?

A patent thicket is more effective for complex products because their multi-component nature provides far more “inventions” to patent. For a simple pill, patents are largely limited to the molecule, its use, and perhaps a simple formulation. For a complex auto-injector, an innovator can patent the drug formulation, multiple novel mechanical components of the device, the way the drug and device interact, the ergonomic design of the device, and the specific manufacturing process. This creates a dense web of IP. A generic challenger cannot simply invalidate the main drug patent; they must fight a war of attrition on multiple legal fronts, a process that is astronomically expensive and time-consuming. The sheer density of the thicket can deter a challenge altogether, even if some of the individual patents within it are relatively weak.

5. What will the regulatory pathway for a “generic” version of a nanomedicine product likely look like in the future?

The regulatory pathway for a follow-on nanomedicine is highly unlikely to resemble the traditional generic (ANDA) pathway. The scientific consensus is that the “sameness” principle is not applicable to these complex systems, where minor, undetectable manufacturing variations can lead to significant changes in biological performance and safety.20 Therefore, the future pathway will almost certainly mirror the biosimilar pathway (BPCIA in the US). It will be a “similar” pathway, requiring a “totality of the evidence” approach. A developer of a “nanosimilar” will need to provide an extensive data package including: (1) exhaustive physicochemical and structural characterization demonstrating a high degree of similarity to the reference product; (2) comprehensive non-clinical studies to assess toxicology and immunogenicity; and (3) new clinical data, at minimum a PK similarity study and likely a clinical safety/efficacy study, to prove there are no clinically meaningful differences from the innovator product.20 This will make development extremely costly and will reserve the market for only a few highly specialized players.

References

- Top 10 Challenges in Generic Drug Development – DrugPatentWatch, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/top-10-challenges-in-generic-drug-development/

- The Global Generic Drug Market: Trends, Opportunities, and …, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Office of Generic Drugs 2022 Annual Report – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/generic-drugs/office-generic-drugs-2022-annual-report

- The Generic Drug Approval Process – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/cder-conversations/generic-drug-approval-process

- www.slideshare.net, accessed August 4, 2025, https://www.slideshare.net/slideshow/advanced-drug-delivery-systems/62095251#:~:text=Advanced%20drug%20delivery%20systems%20aim,and%20controlling%20the%20temporal%20delivery.

- Advances in drug delivery systems, challenges and future directions …, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10320272/

- Advanced Drug Delivery Systems: Market Trends You Need To Know – BCC Research Blog, accessed August 4, 2025, https://blog.bccresearch.com/advanced-drug-delivery-systems-market-trends-you-need-to-know

- Advanced Drug delivery systems | PPT – SlideShare, accessed August 4, 2025, https://www.slideshare.net/slideshow/advanced-drug-delivery-systems/62095251

- (PDF) Introductory Chapter: Advanced Drug Delivery Systems – ResearchGate, accessed August 4, 2025, https://www.researchgate.net/publication/368561420_Introductory_Chapter_Advanced_Drug_Delivery_Systems

- Advanced drug delivery – Drug Discovery, accessed August 4, 2025, https://drugdiscovery.dsfarm.unipd.it/pharmaceutical-preparation/advanced-drug-delivery/

- Addressing Barriers to the Development of Complex Generics: – US Pharmacopeia (USP), accessed August 4, 2025, https://www.usp.org/sites/default/files/usp/document/ea83b_complex-generics_wp_2023-07_v3.pdf

- Newly Approved Complex Drug Products and Potential Challenges to Generic Drug Development – FDA, accessed August 4, 2025, https://www.fda.gov/media/137513/download

- Upcoming Product-Specific Guidances for Generic Drug Product Development – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/guidances-drugs/upcoming-product-specific-guidances-generic-drug-product-development

- A deep dive into the development of complex generics: A comprehensive review, accessed August 4, 2025, https://japsonline.com/admin/php/uploads/4400_pdf.pdf

- Complex Generics: Charting a new path – IQVIA, accessed August 4, 2025, https://www.iqvia.com/-/media/library/white-papers/complex-generics-charting-a-new-path.pdf

- The Regulatory Pathway for Generic Drugs: A Strategic Guide to …, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/the-regulatory-pathway-for-generic-drugs-explained/

- Impact Story: Overcoming Challenges to Evaluating Bioequivalence …, accessed August 4, 2025, https://www.fda.gov/drugs/science-and-research-drugs/impact-story-overcoming-challenges-evaluating-bioequivalence-complex-drugs

- Quality Considerations for Developing Complex Generics – FDA, accessed August 4, 2025, https://www.fda.gov/media/168931/download

- CDER’s OGD and EMA’s Parallel Scientific Advice Pilot Program for …, accessed August 4, 2025, https://www.fda.gov/drugs/our-perspective/cders-ogd-and-emas-parallel-scientific-advice-pilot-program-complex-generics-works-increase

- Regulatory challenges of nanomedicines and their follow-on versions: A generic or similar approach? – ResearchGate, accessed August 4, 2025, https://www.researchgate.net/publication/326084363_Regulatory_challenges_of_nanomedicines_and_their_follow-on_versions_A_generic_or_similar_approach

- Reverse engineering challenge for high molecular … – TIJER.org, accessed August 4, 2025, https://tijer.org/tijer/papers/TIJER2307241.pdf

- Complex Generics: Facts, Figures and Who They Benefit – Teva Pharmaceuticals, accessed August 4, 2025, https://www.tevapharm.com/news-and-media/feature-stories/what-are-complex-generics/

- Patient-Centric Long-Acting Injectable and Implantable Platforms An Industrial Perspective | Molecular Pharmaceutics – ACS Publications, accessed August 4, 2025, https://pubs.acs.org/doi/10.1021/acs.molpharmaceut.4c00665

- Full article: Regulating nanomedicines: challenges, opportunities …, accessed August 4, 2025, https://www.tandfonline.com/doi/full/10.1080/17435889.2025.2533107?src=

- Challenges in Development of Nanoparticle-Based Therapeutics – PMC, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3326161/

- The regulation of nanomaterials and nanomedicines for clinical application: current and future perspectives – RSC Publishing, accessed August 4, 2025, https://pubs.rsc.org/en/content/articlehtml/2020/bm/d0bm00558d

- Clinical Bioequivalence of Wixela Inhub and Advair Diskus in Adults With Asthma – PMC, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7133441/

- FDA Drug Competition Action Plan, accessed August 4, 2025, https://www.fda.gov/drugs/guidance-compliance-regulatory-information/fda-drug-competition-action-plan

- FDA Drug Competition Action Plan | Maximizing scientific and regulatory clarity with respect to complex generic drugs, accessed August 4, 2025, https://www.fda.gov/drugs/guidance-compliance-regulatory-information/fda-drug-competition-action-plan-maximizing-scientific-and-regulatory-clarity-respect-complex

- Generic Drugs in the 21st Century: FDA’s Actions Create Transparency and Value for Complex Generic Product Development | FDA, accessed August 4, 2025, https://www.fda.gov/drugs/our-perspective/generic-drugs-21st-century-fdas-actions-create-transparency-and-value-complex-generic-product

- Complex Generics News – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/generic-drugs/complex-generics-news

- Additional Resources – The Center for Research on Complex Generics (CRCG), accessed August 4, 2025, https://www.complexgenerics.org/collaboration-resources/additional-resources/

- Research and Education Needs for Complex Generics – PMC, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8732887/

- The Center for Research on Complex Generics – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/guidance-compliance-regulatory-information/center-research-complex-generics

- Generic Drug Applications: FDA Should Take Additional Steps to Address Factors That May Affect Approval Rates in the First Review Cycle – GAO, accessed August 4, 2025, https://www.gao.gov/products/gao-19-565

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed August 4, 2025, https://www.congress.gov/crs-product/R46679

- Patents for Drug/Device Combination Products: A Strategic Guide to …, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/patents-combination-products-challenges-opportunities/

- Strategies that delay or prevent the timely availability of affordable generic drugs in the United States, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4915805/

- The 5 biggest issues in patenting combo products – Medical Design and Outsourcing, accessed August 4, 2025, https://www.medicaldesignandoutsourcing.com/5-biggest-issues-patenting-combo-products/

- Pharmaceutical Life Cycle Management – Contract Pharma, accessed August 4, 2025, https://www.contractpharma.com/pharmaceutical-life-cycle-management/

- The Art of the Second Act: A Six-Step Framework for Mastering Late …, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/6-steps-to-effective-late-stage-lifecycle-drug-management/

- Aripiprazole Injection: MedlinePlus Drug Information, accessed August 4, 2025, https://medlineplus.gov/druginfo/meds/a615048.html

- Otsuka and Lundbeck Published Study Results Showing …, accessed August 4, 2025, https://www.otsuka-us.com/news/otsuka-and-lundbeck-published-study-results-showing-aripiprazole-2-month-ready-use-long-acting