Introduction: Beyond the Balance Sheet – Why Patents are the Heartbeat of Pharma Acquisitions

In pharmaceutical mergers and acquisitions (M&A), every decision is magnified, every detail scrutinized. Acquirers pour over financial statements, clinical trial data, and market analyses, attempting to build a complete picture of a target company’s value. Yet, beneath the layers of revenue projections and promising clinical results lies the true bedrock of value for almost every life sciences company: its intellectual property (IP) portfolio. More specifically, the strength, breadth, and defensibility of its drug patents.

For a business professional steering an M&A deal, overlooking the nuances of patent due diligence is not just a mistake; it can be a catastrophic, career-defining error. Imagine acquiring a biotech for a staggering sum, only to discover a year later that the patent on its blockbuster drug is invalid, or that a competitor holds a previously undiscovered “blocking” patent that prevents you from even selling the product. The value of your acquisition evaporates overnight. This isn’t a hypothetical scare tactic; it’s a grim reality that has played out in various forms across the industry.

This is where the paradigm must shift. Patent due diligence is not merely a legalistic checkbox to be ticked off by the attorneys in a back room. It is a core strategic function, a powerful analytical tool that, when wielded correctly, can transform from a defensive shield into an offensive weapon. It allows you to not only vet the advertised value of a target but also to uncover hidden risks, identify unforeseen opportunities, and ultimately, negotiate a better deal. It is your crystal ball, offering a glimpse into the future of a product’s market exclusivity, its vulnerability to competition, and its long-term revenue-generating potential.

The High-Stakes World of Pharmaceutical Mergers & Acquisitions

The pharmaceutical industry runs on a relentless cycle of innovation and replenishment. The largest players face the constant, looming threat of the “patent cliff,” where blockbuster drugs generating billions in annual revenue lose their patent protection, opening the floodgates to low-cost generic competition. This pressure cooker environment makes M&A not just a growth strategy, but a survival imperative.

The numbers are staggering. In recent years, the industry has seen a consistent flurry of multi-billion dollar deals. These transactions are driven by a variety of strategic imperatives:

- Pipeline Replenishment: Large pharma companies often look to acquire smaller, innovative biotechs to fill gaps in their R&D pipelines, especially in cutting-edge areas like oncology, cell and gene therapy, and rare diseases. They are, in essence, outsourcing high-risk, early-stage innovation.

- Market Entry: An acquisition can be the fastest and most effective way to enter a new therapeutic area or geographic market, instantly providing access to approved products, sales infrastructure, and established physician relationships.

- Technology Acquisition: Sometimes the prize isn’t a specific drug but a proprietary technology platform—a novel drug discovery engine, a unique delivery system, or a revolutionary manufacturing process—that can be leveraged across the acquirer’s entire portfolio.

In every one of these scenarios, the underlying asset being acquired is defined and protected by patents. The drug in Phase II trials? Its value is contingent on the pending patent application eventually being granted and withstanding challenges. The cutting-edge technology platform? Its competitive advantage is only as strong as the web of patents that prevent others from copying it.

The Double-Edged Sword of Intellectual Property

This central role makes IP a powerful double-edged sword in any pharma M&A deal. On one side, it is the primary engine of value. A robust patent portfolio for a key drug asset can grant a legal monopoly for up to 20 years from the filing date, creating a period of market exclusivity where the owner can recoup massive R&D investments and generate substantial profits without direct generic competition. This exclusivity is the fundamental economic pillar of the entire industry.

Dr. Adam J. Kessel, a partner at a prominent intellectual property law firm, often emphasizes this point: “In biotech and pharma, you’re not buying tangible assets like factories and equipment in the traditional sense. You are buying a legally-enforced right to exclude others. That right is the patent. The entire valuation of the target hinges on the quality of that right.” [1]

However, the other edge of the sword is sharp and unforgiving. A patent is not an immutable guarantee of invincibility. It is a complex legal document that can be challenged, invalidated, or cleverly circumvented. The risks are manifold:

- Validity Challenges: Competitors can challenge a patent’s validity in court or through administrative proceedings like an Inter Partes Review (IPR) at the U.S. Patent and Trademark Office (USPTO), arguing that the invention was not truly new or was obvious at the time of filing.

- Enforceability Issues: The patent might be deemed unenforceable if, for example, the inventors engaged in “inequitable conduct” by misleading the patent office during the application process.

- Freedom to Operate (FTO) Blockades: The target company might have a valid patent on its drug, but a third party could hold a broader, more dominant patent that the target’s product infringes upon. This is a classic FTO problem, and it can completely halt commercialization.

- Ownership Defects: The chain of title might be broken. Perhaps a key inventor never properly assigned their rights to the company, or a university research partner retains unexpected rights to the IP.

Any one of these issues, if undiscovered during due diligence, can detonate post-acquisition, turning a prized asset into a massive liability.

Shifting the Paradigm: From a Legal Checkbox to a Strategic Weapon

For too long, many business leaders have viewed patent due diligence as a pass/fail exercise delegated entirely to legal counsel. The report comes back with a green, yellow, or red light, and the business team proceeds accordingly. This is a dangerously simplistic approach.

A modern, strategic approach reframes the entire process. Patent due diligence is not a static check; it’s a dynamic, intelligence-gathering operation. The goal is not just to ask, “Is the patent valid?” but to ask a series of deeper, more strategic questions:

- How strong is the patent? How likely is it to withstand a well-funded legal challenge from a determined generic competitor?

- How broad is the patent protection? Does it just cover the specific molecule, or does it also protect formulations, methods of use, and manufacturing processes, creating a “picket fence” of protection that is much harder for competitors to design around?

- What is the true remaining duration of market exclusivity when we factor in patent term extensions and other regulatory exclusivities?

- What does the competitive patent landscape look like? Are there emerging threats on the horizon? Are there “white space” opportunities the target missed that we could exploit?

- How does the patent risk profile impact the financial model? Can we quantify this risk and use it as a lever in price negotiations?

Answering these questions requires a fusion of legal acuity, scientific understanding, and commercial savvy. It means transforming raw patent data—often dense and written in arcane legalese—into actionable business intelligence. This article will serve as your comprehensive guide to that transformation. We will dissect the process step-by-step, from assembling the right team to navigating the complex pillars of patent analysis, and ultimately, to using this powerful data to make smarter, more confident acquisition decisions.

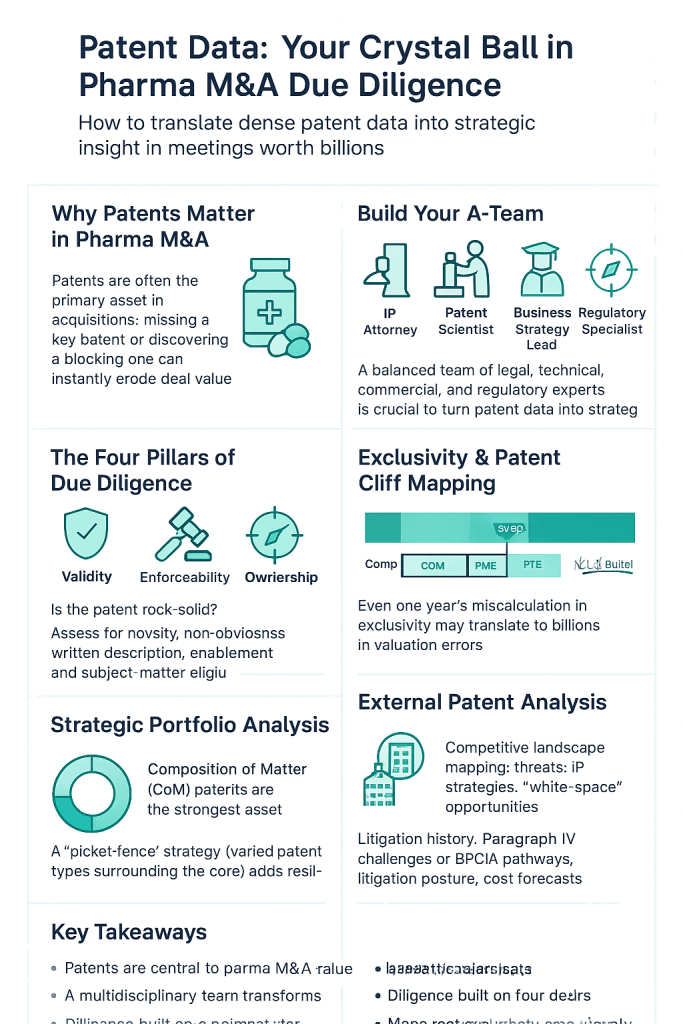

Assembling Your A-Team: The Who and Why of a Patent Due Diligence Squad

Before a single patent document is analyzed, the success of your due diligence effort hinges on the team you assemble. A common mistake is to treat patent diligence as a siloed legal task. In reality, a world-class patent diligence process is a multi-disciplinary symphony, requiring a carefully orchestrated collaboration between legal, scientific, and business experts. Each member brings a unique lens to the investigation, and their combined perspective is what uncovers the full story behind a target’s IP portfolio. Think of it less like a relay race, where one expert hands off to the next, and more like a roundtable discussion, where insights are shared, challenged, and integrated in real-time.

Core Competencies: More Than Just Lawyers

A truly effective due diligence team is a blend of specialized talents. While the exact composition may vary based on the size of the deal and the complexity of the technology, the core functions are indispensable.

The IP Attorney: The Legal Quarterback

This is the most obvious role, but its importance cannot be overstated. The IP attorney is the captain of the team, responsible for orchestrating the entire legal analysis. However, not just any patent lawyer will do. You need an attorney with deep experience in the specific technological field (e.g., small molecules, biologics, gene therapy) and a battle-hardened understanding of pharmaceutical patent litigation and USPTO post-grant proceedings.

Their key responsibilities include:

- Leading the analysis of patent validity, enforceability, and ownership.

- Directing and interpreting the results of Freedom to Operate (FTO) searches.

- Reviewing the prosecution history (the complete record of interaction with the patent office) of key patents to identify potential weaknesses or admissions that could be used by competitors.

- Assessing the strength and scope of patent claims, translating dense “patentese” into clear statements about what is, and is not, protected.

- Evaluating any existing IP-related agreements, such as licenses, collaborations, and material transfer agreements.

A seasoned IP attorney acts as the ultimate risk assessor, flagging potential legal vulnerabilities and providing an opinion on the overall defensibility of the portfolio. Their judgment forms the legal backbone of the entire diligence report.

The Patent Scientist/Technical Expert: The Substance Matter Interpreter

While the IP attorney understands the law, the patent scientist understands the science. This individual, often a Ph.D. in a relevant field like chemistry, molecular biology, or pharmacology, serves as the bridge between the legal language of the patent claims and the physical reality of the drug product and the underlying biology.

Their role is critical for several reasons:

- Prior Art Searching: They are instrumental in conducting or guiding comprehensive prior art searches. They know the scientific literature, the conference abstracts, and the obscure databases where a piece of “knockout” prior art—a reference that proves the invention wasn’t new—might be hiding.

- Technical Validation: They assess the scientific underpinnings of the patent. Do the experiments described in the patent actually support the claims being made? Is the data robust? This is crucial for evaluating the “enablement” and “written description” requirements for patentability.

- Design-Around Analysis: If an FTO search uncovers a problematic competitor patent, the technical expert can assess the feasibility of “designing around” it. Can the molecule be modified slightly? Can a different formulation be used to avoid infringement while maintaining efficacy? This analysis is vital for developing contingency plans.

As one R&D head at a major pharma company noted, “Our lawyers can tell us what the patent says. Our Ph.D.s tell us what it means in the lab and in the clinic. You absolutely need both.”

The Business Development & Strategy Lead: The Commercial Translator

This is your role, or that of your immediate team. The business development (BD) or corporate strategy professional is the ultimate consumer of the diligence information and is responsible for placing it within the broader commercial context of the deal. They are the link between the technical/legal findings and the financial valuation.

Key responsibilities include:

- Defining the Scope: Working with the team to prioritize which assets and which patents receive the most intense scrutiny, based on their commercial importance.

- Asking the “So What?” Question: Constantly pushing the legal and technical teams to translate their findings into business impact. A 50% chance of a patent being invalidated is a legal opinion; a 50% chance of losing $5 billion in projected revenue is a business catastrophe. The BD lead forces this translation.

- Integrating with Financial Models: Working with the finance team to adjust valuation models (e.g., discounted cash flow) based on the IP risk profile. This allows for scenario analysis: What is the company worth if the key patent is strong? What is it worth if it’s weak or the exclusivity period is shorter than anticipated?

- Informing Negotiation Strategy: Using the findings of the diligence to strengthen the negotiation position. A significant FTO risk could justify a lower purchase price, a special indemnity, or an escrow account to cover potential litigation costs.

The Regulatory Affairs Specialist: The FDA-Link

In the pharmaceutical world, patent exclusivity and regulatory exclusivity are two separate but deeply intertwined concepts that together define a drug’s total period of market protection. A regulatory affairs specialist is crucial for understanding the second half of this equation.

Their contributions include:

- Analyzing Regulatory Exclusivities: They determine the eligibility for and duration of various non-patent exclusivities granted by regulatory bodies like the FDA. These can include New Chemical Entity (NCE) exclusivity (5 years), Orphan Drug Exclusivity (ODE) (7 years), and pediatric exclusivity (6-month extension).

- “Orange Book” Strategy: They analyze the target’s listings in the FDA’s “Approved Drug Products with Therapeutic Equivalence Evaluations,” commonly known as the Orange Book. Are the right patents listed against the right drug? Are there opportunities to list additional patents to extend the firewall against generics?

- Patent Term Extension (PTE) Calculation: They work with the IP attorney to verify calculations for PTE, which compensates for patent term lost due to lengthy clinical trials and regulatory review processes. An error in this calculation could mean years of lost revenue.

Defining Roles, Responsibilities, and Communication Channels

Once the team is in place, establishing a clear operational framework is paramount to avoiding chaos and ensuring a thorough, efficient process.

Establishing a Clear Mandate and Reporting Structure

At the outset, the business lead should issue a clear diligence request memo. This document is not a formality; it’s a critical tool for focus. It should articulate:

- The primary objectives of the investigation.

- The key assets and technologies that are the focus of the deal.

- The specific questions the business team needs answered.

- The timeline and budget for the diligence process.

A clear reporting structure is equally important. Typically, the IP attorney will lead the day-to-day diligence work, but there should be regular, scheduled check-ins with the entire multi-disciplinary team. These meetings are where information is synthesized, and potential issues are escalated to the business lead.

The Importance of a Centralized Data Room and Communication Platform

In any M&A deal, the target company will provide access to a virtual data room (VDR) containing thousands of documents. The diligence team needs a secure, shared workspace to manage its own work product. This platform should be used to:

- Store and organize the documents being reviewed.

- Track the status of review for each patent and agreement.

- Maintain a running list of questions for the target company.

- House drafts of the diligence report and supporting analyses.

Effective communication is the lubricant that keeps the diligence engine running smoothly. Misunderstandings between the legal, scientific, and business team members can lead to critical oversights. A centralized platform and regular, structured meetings ensure that everyone is working from the same information and that the rich, nuanced perspective of each expert is fully integrated into the final assessment. Building this A-team and its operational cadence is the foundational first step. Without it, even the most brilliant individual analysis can get lost in translation, failing to provide the strategic insight needed to navigate a billion-dollar decision.

“Intellectual property is now the most important asset class for most businesses. In the pharmaceutical industry, it is not just the most important asset; for many companies, it is the only asset of consequence. Accordingly, the rigor applied to IP due diligence in an M&A context must be at least as great as that applied to any financial or operational aspect of the business.”— Global IP Survey, PwC [2]

The Anatomy of a Patent Investigation: A Comprehensive Framework

With your A-team assembled and your objectives defined, it’s time to plunge into the intricate world of the patent investigation itself. This is not a haphazard fishing expedition. It is a systematic process, a structured campaign designed to map the terrain, identify fortifications, probe for weaknesses, and ultimately, determine the strategic value and risk of the target’s IP. A thorough investigation can be broken down into distinct phases and core analytical pillars, moving from a high-level overview to a microscopic examination of the most critical assets.

Phase 1: The Initial Triage – Scoping the Battlefield

A mature pharmaceutical company might hold hundreds or even thousands of patents and patent applications across the globe. Attempting to conduct a full, deep-dive analysis on every single one is not only impractical but also an inefficient use of time and resources. The first step is triage: a rapid, high-level assessment to identify the most critical assets and focus your team’s efforts where they matter most.

Using Databases for a Preliminary Landscape View

Before you even get access to the target’s confidential data room, your team can begin its work using public and commercial patent databases. These tools allow you to get a preliminary lay of the land. You can search for all patents assigned to the target company, view their legal status (pending, granted, expired), and see their family relationships (i.e., corresponding patents filed in different countries). This initial search helps you build a foundational inventory of the target’s portfolio.

Identifying the Crown Jewel Patents Tied to Lead Assets

The 80/20 rule is in full effect here: 80% of the target’s value will likely be tied to 20% (or less) of its patents. Your immediate goal is to identify these “crown jewels.” These are the patents that protect the company’s lead commercial products or its most promising late-stage pipeline candidates. You can often identify them by:

- Product Name Searching: Cross-referencing the names of the target’s drugs and clinical candidates with patent databases.

- “Orange Book” Listings: For marketed drugs in the US, the FDA’s Orange Book explicitly lists the patents that the manufacturer claims cover the product. This is a direct roadmap to the most commercially significant patents.

- Target’s Disclosures: Public companies often highlight their key patents in SEC filings (like 10-K and 10-Q reports) and investor presentations.

This initial screening allows you to create a prioritized list of patents. A “Tier 1” list might include the core composition of matter and primary method of use patents for the top one or two assets. “Tier 2” could include patents on formulations, manufacturing processes, or earlier-stage pipeline assets. “Tier 3” would be everything else. Your deep-dive resources should be focused almost exclusively on Tier 1 and, to a lesser extent, Tier 2.

The Role of Services like DrugPatentWatch in Accelerating Initial Screening

The initial triage phase can be time-consuming and data-intensive. This is where specialized pharmaceutical intelligence platforms provide immense value. Services like DrugPatentWatch are designed specifically for this purpose. Instead of having your team manually piece together data from disparate sources like the USPTO, FDA, and international patent offices, these platforms provide aggregated, curated, and easily digestible information.

For an acquirer, this is a massive accelerator. You can quickly pull up a comprehensive profile of a target drug, which includes:

- A clean list of all associated patents and their estimated expiration dates.

- Details on any patent term extensions (PTE) or adjustments (PTA).

- Information on regulatory exclusivities (NCE, ODE, etc.).

- A history of any patent litigation, such as Paragraph IV challenges from generic companies.

Using a platform like DrugPatentWatch allows your team to complete the triage phase in a fraction of the time, moving more quickly to the critical deep-dive analysis. It transforms weeks of data gathering into days of strategic assessment, giving you a significant head start in the fast-paced M&A environment.

The Four Pillars of Patent Due Diligence

Once you’ve identified the crown jewel patents, the deep-dive analysis begins. This rigorous examination rests on four fundamental pillars. Each pillar addresses a distinct question, and a weakness in any one of them can severely compromise the value of the patent and, by extension, the deal itself.

Pillar 1: Patent Validity – Is the Fortress Built on Rock or Sand?

A granted patent comes with a legal presumption of validity, but this presumption is rebuttable. A determined and well-funded competitor can, and often will, challenge a patent’s validity in court. Your job is to play the role of that competitor before the acquisition, stress-testing the patent to see if it will hold up under pressure. The core requirements for validity are novelty, non-obviousness, written description, and enablement.

- Novelty and Non-Obviousness: A Deep Dive into Prior Art

- Novelty (Section 102 of the Patent Act): This is a relatively straightforward question: Was the exact same invention publicly disclosed anywhere in the world before the patent’s effective filing date? Your technical experts will conduct exhaustive searches of scientific journals, patent databases, conference proceedings, and even doctoral theses for any “prior art” that anticipates the invention.

- Non-Obviousness (Section 103): This is a far more subjective and common point of attack. Even if the invention is novel, a patent can be invalidated if the differences between the invention and the prior art would have been “obvious” to a person having ordinary skill in the art at the time. Your team must analyze the prior art not just for what it explicitly discloses, but for what it would have suggested to a skilled researcher. Would combining two known compounds to achieve a predictable result have been obvious? Would modifying a known molecule in a standard way have been an obvious path to try? Answering these questions requires a deep understanding of the scientific field and the legal precedents surrounding obviousness.

- Written Description and Enablement: Can the Patent Be Replicated? (Section 112)

- In exchange for a limited monopoly, the inventor must provide a full and clear description of the invention. The written description requirement means the patent specification must show that the inventor was in possession of the claimed invention at the time of filing. The enablement requirement means the specification must teach a person skilled in the art how to make and use the full scope of the claimed invention without “undue experimentation.” For a broad chemical genus claim, for example, have the inventors provided enough examples and data to justify a claim covering thousands of potential compounds? If not, a court could invalidate the broad claims, shrinking the protective scope of the patent dramatically.

- Subject Matter Eligibility: Navigating Section 101 Challenges

- In the U.S., Section 101 of the Patent Act defines what types of inventions are eligible for patenting. It excludes laws of nature, natural phenomena, and abstract ideas. In recent years, particularly following a series of Supreme Court decisions, patents for diagnostic methods and personalized medicine have faced intense scrutiny under Section 101. If the target’s patent claims are directed to a method of correlating a biomarker with a disease state, for example, your team must carefully assess the risk that it could be invalidated as an ineligible “law of nature.”

A negative finding on any of these validity points for a crown jewel patent is a major red flag that must be immediately escalated to the business team.

Pillar 2: Enforceability – Can You Actually Use Your Sword?

A valid patent can be rendered unenforceable if the patentee engaged in misconduct during its prosecution. This is a potent weapon for challengers because a finding of unenforceability can taint the entire patent, not just specific claims.

- Prosecution History Estoppel and Inequitable Conduct: Your IP attorney will perform a meticulous review of the “file wrapper,” or prosecution history—the complete record of all correspondence between the applicant and the patent examiner. They are looking for two key things. First, prosecution history estoppel prevents the patent owner from later arguing for a broad claim interpretation in court that contradicts arguments they made to the patent office to get the patent allowed. Second, and more dangerously, they are looking for signs of inequitable conduct. This occurs if the applicants, with an intent to deceive, withheld material prior art from the examiner or submitted false information. Proving inequitable conduct is difficult, but if successful, it renders the entire patent unenforceable. It’s the “death penalty” for a patent.

- Maintenance Fees and Terminal Disclaimers: This is a more administrative but equally critical check. Have all the required maintenance fees been paid on time to the patent office? An accidental failure to pay can lead to the patent lapsing. Also, your team should check for any terminal disclaimers. These are filed to overcome an obviousness-type double patenting rejection and link the expiration date of a later patent to that of an earlier one. This can shorten the effective life of a key patent, a crucial detail for your financial model.

Pillar 3: Freedom to Operate (FTO) – Charting a Clear Path to Market

This is arguably the most complex and anxiety-inducing part of patent due diligence. FTO analysis answers a fundamentally different question from validity. Validity asks, “Can we stop others?” FTO asks, “Can others stop us?” A company can have a perfectly valid patent on its own innovative product and still infringe on a broader, more dominant patent held by a third party.

- Differentiating FTO from Patentability: A simple analogy helps clarify this. Imagine you invent and patent an innovative new car engine (your product is patentable). However, if someone else holds a broad, still-active patent on “a self-propelled vehicle with four wheels” (a dominant third-party patent), you cannot sell your car without infringing their patent. Your engine patent is valid, but you do not have the freedom to operate.

- The Multi-Faceted Search: An FTO analysis involves a comprehensive search for third-party patents (both granted and pending applications) whose claims could potentially be read to cover any aspect of your planned commercial product—the molecule itself, its method of use, its formulation, the manufacturing process, or even diagnostic kits that will be sold alongside it. This is a forward-looking analysis; you have to consider not only what competitors have patented but what they might have pending in secret until publication.

- Strategies for Dealing with Blocking Patents: If the FTO search reveals a significant blocking patent, it is not necessarily a deal-killer, but it requires a clear-eyed strategic response. The options include:

- Acquire or License: You can approach the third party to purchase the patent or negotiate a license. The cost of this license must be factored into the financial model of your acquisition.

- Design Around: Your technical experts can assess if it’s possible to modify your product or process to avoid the scope of the competitor’s patent claims. This can be costly and time-consuming and may require new clinical trials.

- Challenge the Patent: You can plan to challenge the validity of the blocking patent in court or at the USPTO. This is an aggressive, expensive, and uncertain path.

- Wait and See: If the blocking patent is old and nearing expiration, the simplest strategy may be to wait for it to expire before launching your product.

A major FTO issue without a clear and cost-effective resolution is one of the most serious red flags in all of due diligence.

Pillar 4: Ownership and Chain of Title – Do You Really Own the Crown Jewels?

This pillar addresses the most fundamental question of all: Does the target company actually own the patents it claims to? A perfect patent is worthless to you if you don’t acquire clean title to it. The IP attorney will meticulously trace the “chain of title” for each key patent from the original inventors to the target company.

- Verifying Assignments, Employee Agreements, and R&D Collaborations: The team will review inventor assignment documents to ensure every named inventor has properly assigned their rights to the company. They will also scrutinize the company’s employment agreements to confirm that they contain appropriate clauses automatically assigning invention rights. Any agreements with contract research organizations (CROs), consultants, or academic collaborators must be examined to ensure the target company, not the partner, secured full ownership of the resulting IP.

- The Hidden Dangers of University Collaborations and Government Funding (Bayh-Dole Act): Collaborations with universities can be a minefield. Universities are often slow or bureaucratic in executing assignments, and their policies can be complex. Furthermore, if the invention was developed using any U.S. government funding, the Bayh-Dole Act comes into play. While it allows the contractor (the university or company) to retain title to the invention, the government retains certain “march-in rights” under specific circumstances (e.g., if the invention is not being brought to market to serve public health needs). While rarely exercised, these rights represent a potential encumbrance on the title that must be understood.

A gap in the chain of title is a serious problem. While sometimes it can be fixed by going back to an inventor or a partner and getting a corrective assignment (nunc pro tunc, or “now for then”), this can be difficult and awkward, especially if the individual has left the company on bad terms. Discovering such a flaw during diligence gives you the leverage to demand the seller fix it before closing the deal.

Deconstructing the Target’s Portfolio: A Strategic Assessment

Once you’ve stress-tested the foundational legal integrity of the key patents through the four pillars, the next phase of the analysis elevates from a defensive, risk-mitigation posture to a forward-looking, strategic assessment. It’s not enough to know that a patent is valid and owned; you need to understand its commercial power, its strategic architecture, and its real-world impact on market exclusivity. This involves mapping the patents directly to products, evaluating the quality of the protection, and forecasting the precise timeline of its market longevity.

Mapping Patents to Products: The Critical Link

This may sound obvious, but it is a step where critical details can be missed. You must establish an undeniable, claim-by-claim link between the patent portfolio and the products—both those currently on the market and those in the development pipeline—that you are actually acquiring. A large patent portfolio is impressive, but it’s just expensive wallpaper if it doesn’t protect the assets that generate revenue.

Correlating Patent Claims to Approved Drugs and Pipeline Candidates

The goal here is precision. For a marketed drug, your technical and legal experts must read the specific claims of the patent and confirm that they cover the commercial product. Does Claim 1 cover the active pharmaceutical ingredient (API)? Does Claim 15 cover the exact dosage and formulation being sold? Does Claim 22 cover the FDA-approved method of treating a specific disease? Any mismatch is a concern. For example, if the company is commercializing a crystalline Form II of a drug, but the primary patent only has data supporting and claiming Form I, you have a potential gap in your core protection.

For pipeline candidates, this analysis is even more crucial and more speculative. You need to assess whether the claims in pending patent applications are likely to be granted and, if so, whether they will be broad enough to cover the product that ultimately emerges from clinical trials. Drugs often undergo formulation or even minor structural changes during development. Will the patent portfolio be flexible enough to protect the final, optimized version of the product?

Understanding the “Orange Book” and its International Equivalents

In the United States, the Orange Book is the definitive source for this mapping exercise for approved drugs. It is the manufacturer’s public declaration of which patents protect its product. Your diligence team must scrutinize these listings.

- Are all relevant patents listed? Sometimes companies fail to list valuable formulation or method-of-use patents, a missed opportunity that can be corrected post-acquisition.

- Are any patents listed incorrectly? Improperly listing a patent (e.g., a manufacturing process patent, which is not listable) can lead to legal penalties and is a sign of a sloppy IP strategy.

- What is the timing? A generic company (an ANDA filer) wishing to challenge a patent must send a Paragraph IV certification notice to the patent holder. The listing in the Orange Book is what triggers this entire process and the potential for a 30-month stay of regulatory approval for the generic. Understanding the dynamics of Orange Book listings is central to predicting the timing and nature of generic competition.

Similar systems exist in other jurisdictions, such as the Patent Register in Canada, and understanding the local nuances is critical for a global acquisition.

Analyzing Patent Strength and Breadth

Not all patents are created equal. A single, powerful patent can be worth more than a hundred weak ones. Evaluating the qualitative strength and strategic breadth of the portfolio is key to understanding its ability to deter competitors.

Composition of Matter vs. Method of Use vs. Formulation Patents. Which is King?

Patents in pharma generally fall into several categories, each with varying levels of strength:

- Composition of Matter (CoM) Patents: These are the undisputed crown jewels. A CoM patent covers the drug molecule itself, regardless of how it’s made, formulated, or used. It provides the broadest and most powerful protection. If you have a valid CoM patent, no one can sell that molecule for any purpose without infringing. This is the gold standard.

- Method of Use (MoU) Patents: These patents cover a specific method of using a drug to treat a particular disease or patient population. They are very valuable, especially for expanding a drug’s label into new indications. However, they can sometimes be more difficult to enforce than CoM patents, as proving that a competitor is inducing physicians to prescribe a drug for your patented use can be complex.

- Formulation Patents: These protect the specific drug product formulation—the combination of the active ingredient with inactive excipients, the delivery mechanism (e.g., extended-release tablet, injectable solution), or a specific crystalline form (polymorph) of the API. These are essential for lifecycle management, often extending exclusivity for years after the original CoM patent expires.

- Manufacturing Process Patents: These cover a specific, novel method of synthesizing the drug. They are generally considered the weakest form of protection for the final drug product, as a competitor can often avoid infringement by developing a different, non-infringing manufacturing process.

Your diligence should categorize the target’s key patents and assess the balance. A portfolio built only on process patents is fragile. A portfolio with a strong CoM patent, later layered with multiple MoU and formulation patents, is a formidable fortress.

The Value of a “Picket Fence” Patent Strategy

The most sophisticated companies don’t rely on a single patent “wall.” They build a “picket fence” or “patent estate” around their key assets. This involves filing for numerous patents covering many different aspects of the invention:

- The broad chemical genus and the specific species being commercialized.

- Intermediate compounds used in the synthesis.

- Multiple crystalline forms and polymorphs.

- Various formulations and delivery systems.

- All commercially viable methods of use.

- Combination therapies with other drugs.

- Dosage regimens.

This strategy makes it incredibly difficult for a competitor to find a path to market. Even if they successfully invalidate one patent (one “picket” in the fence), they still have to contend with all the others. During diligence, you are not just looking for the existence of a key patent; you are assessing the quality and density of this defensive picket fence. A well-constructed fence is a powerful indicator of a savvy IP strategy and adds significant value to the acquisition.

The Ticking Clock: Patent Term and Exclusivity Analysis

A patent’s value is intrinsically linked to its lifespan. The entire financial model of a drug is based on a projection of its period of market exclusivity. A mistake of even one year in this calculation can translate to billions of dollars in lost revenue and a wildly inaccurate company valuation. This analysis requires integrating patent law with regulatory law.

Calculating Patent Term Adjustment (PTA) and Patent Term Extension (PTE)

The nominal term of a U.S. patent is 20 years from its earliest non-provisional filing date. However, this is almost never the final expiration date for a drug patent. Two key mechanisms can adjust this term:

- Patent Term Adjustment (PTA): The USPTO can experience delays in examining a patent application. PTA is a mechanism to add days back to the patent’s term to compensate for these administrative delays. Your team must verify the USPTO’s PTA calculation, as errors can and do occur.

- Patent Term Extension (PTE): This is a much more significant adjustment under the Hatch-Waxman Act. It aims to restore a portion of the patent term that was lost while the drug was undergoing lengthy clinical trials and FDA review. The calculation is complex: half the time spent in clinical trials plus the full time the application was under review at the FDA, with various caps and limits. Only one patent can be extended for a given drug. Your team must meticulously verify that the target has chosen the best patent for extension and that the PTE calculation is correct.

As an expert from a leading life sciences consulting firm states, “The difference between a correctly calculated PTE and an incorrectly calculated one can be the difference between a good deal and a great deal. It’s found money, but only if you know where to look and how to count.” [3]

Weaving in Non-Patent Exclusivities: Orphan Drug Exclusivity (ODE), New Chemical Entity (NCE), etc.

Market exclusivity is not derived solely from patents. Regulatory bodies grant their own forms of exclusivity that run in parallel. A complete timeline must layer these on top of the patent term. Key U.S. regulatory exclusivities include:

- New Chemical Entity (NCE) Exclusivity: 5 years of data exclusivity for a drug containing an active moiety never before approved by the FDA. A generic application cannot even be submitted for 4 of these years (the Paragraph IV route).

- Orphan Drug Exclusivity (ODE): 7 years of market exclusivity for a drug approved to treat a rare disease (affecting fewer than 200,000 people in the U.S.). This exclusivity blocks the FDA from approving the same drug for the same orphan indication.

- New Clinical Investigation Exclusivity: 3 years of exclusivity for a new application or supplement containing new clinical studies essential to approval (e.g., for a new indication or formulation).

- Pediatric Exclusivity: A valuable 6-month extension added to all existing patent and regulatory exclusivities for a drug if the sponsor completes requested pediatric studies.

Your regulatory specialist and IP attorney must work together to create a comprehensive timeline that shows the expiration of every key patent (with PTA/PTE) and every applicable regulatory exclusivity. The actual date of generic entry will be determined by the last of these to expire.

Projecting the “Patent Cliff” for Key Assets

The culmination of this analysis is the creation of a clear “Exclusivity Map” or “Patent Cliff” projection for each major product. This is a visual timeline that becomes a cornerstone of the M&A valuation model. It should clearly state:

- The final, verified expiration date of the key CoM patent.

- The expiration dates of key secondary patents (formulation, MoU).

- The expiration dates of all applicable regulatory exclusivities (NCE, ODE, Pediatric).

- The date when you anticipate the first generic challenger will be able to launch.

This map is not a static legal document. It is a dynamic strategic tool. It informs the revenue projections, quantifies the duration of the asset’s peak value, and provides the business team with the concrete data needed to model the financial future of the acquisition with confidence.

Beyond the Target: Sizing Up the Competitive and Litigation Landscape

A thorough patent due diligence cannot be conducted in a vacuum. The target’s patent portfolio doesn’t exist on a deserted island; it’s situated in a crowded, competitive, and often contentious ecosystem. To truly understand the value and risk of the IP you’re acquiring, you must look outward and analyze the patent activities of competitors and the history of legal challenges in the space. This external view provides critical context, revealing potential threats that lurk just over the horizon and highlighting the true battle-readiness of the target’s assets.

Who Else is in the Sandbox? Competitive Patent Intelligence

Understanding the competitive patent landscape is like having a map of your entire neighborhood, not just the blueprints to your own house. It allows you to anticipate the moves of others, identify strategic chokepoints, and even uncover new avenues for growth that the target may have overlooked.

Identifying Key Competitors and Their IP Strategies

The first step is to identify the key players. This includes:

- Companies with competing drugs already on the market in the same therapeutic class.

- Companies with pipeline candidates that could become future competitors.

- Generic and biosimilar manufacturers known for being aggressive challengers.

- Universities and research institutions that are highly active in the relevant scientific field.

Once you have your list of players, your team will conduct a deep dive into their patent portfolios. The goal is to understand their IP strategy. Are they building their own “picket fences”? Are they patenting technologies that could block future improvements to your acquired drug? Are they focusing on next-generation mechanisms of action that could render your new asset obsolete in five to ten years? This analysis helps you answer critical strategic questions. For example, if you find that three major competitors have all filed patent applications on combination therapies involving a drug like yours, it signals a clear direction for future market evolution and a necessary area for your own R&D focus post-acquisition.

Uncovering White Space Opportunities the Target May Have Missed

Competitive intelligence isn’t just about identifying threats; it’s also about finding opportunities. A “white space” analysis involves mapping the entire patent landscape for a given technology or disease area to see what isn’t being patented. This can reveal untapped potential.

For instance, your analysis might show that while the target and its main competitors have heavily patented oral and intravenous formulations, no one has secured strong protection for a transdermal patch delivery system. This could represent a significant, unexploited lifecycle management opportunity for the acquiring company. You could potentially develop a next-generation version of the acquired drug that offers greater patient convenience and is protected by a fresh set of patents, extending the franchise for years. Similarly, a white space analysis might reveal unmet needs in specific patient subpopulations or related therapeutic indications that are not covered by existing method-of-use patents, providing a ready-made roadmap for post-acquisition clinical development. These are the kinds of value-added insights that transform due diligence from a cost center into a profit center.

The Litigation Gauntlet: A History and Forecast of Legal Battles

In the world of blockbuster drugs, patent litigation is not a possibility; it’s a near certainty. For a small molecule drug, the Hatch-Waxman Act creates a formal pathway for generic companies to challenge patents prior to their expiration (the Paragraph IV certification process). For biologics, the Biologics Price Competition and Innovation Act (BPCIA) creates a similar, though more complex, pathway for biosimilar litigation known as the “patent dance.” Your due diligence must therefore include a thorough assessment of the target’s litigation risk profile and its preparedness for the inevitable legal onslaught.

Analyzing Past and Ongoing Litigation (e.g., ANDA Paragraph IV challenges)

First, your team must review the complete litigation history for the target’s key patents.

- What challenges have been brought before? If a key patent has already survived a court challenge from one generic company, it is significantly “de-risked.” The legal arguments have been tested, and a positive court ruling creates a powerful precedent that can deter future challengers or encourage them to settle early.

- How have the cases been resolved? Did the target win a decisive victory? Did they settle? If so, what were the terms of the settlement? An “at-risk” launch, where a generic company launches while litigation is still pending, can be a sign of the generic’s confidence in its invalidity case. The settlement date is also crucial, as it often determines the date of first generic entry. Platforms like DrugPatentWatch are particularly useful here, as they track litigation events and settlements, providing a concise history that is essential for your financial modeling.

- What arguments were used? Your legal team should dissect the arguments used in past cases. Were the attacks focused on obviousness, enablement, or written description? Understanding the prior lines of attack helps you gauge the strength of the patent against future challenges that will likely use similar arguments.

Assessing the Target’s Litigation Posture: Aggressive Enforcer or Defensive Player?

Beyond the case specifics, you should assess the target’s overall philosophy and track record in IP enforcement. Are they known for being an aggressive plaintiff, quickly suing any potential infringer? Do they have a history of taking cases all the way to trial and appeal, or do they prefer to settle early? Do they have an experienced, in-house legal team and established relationships with top-tier litigation firms?

An acquirer generally prefers a target that has shown a willingness and ability to vigorously defend its IP. A history of successful enforcement adds a layer of intangible value to the patents themselves; it sends a clear signal to the market that challenging this portfolio will be a long, expensive, and likely unsuccessful endeavor for competitors. Conversely, a history of weak enforcement or unfavorable settlements can be a red flag, suggesting that the portfolio may be more vulnerable than it appears on paper.

Using Litigation Data to Predict Future Challenges and Costs

The final step is to synthesize all this information into a forward-looking risk assessment. Based on the strength of the patents, the aggressiveness of known generic/biosimilar competitors, and the outcomes of past litigation in the same therapeutic class, your team can build a predictive model.

- Likelihood of Litigation: What is the probability (often near 100% for a successful drug) that the key patents will be challenged?

- Timing of Litigation: When do you expect the first Paragraph IV notices to arrive?

- Projected Costs: What is the estimated budget for defending the patents through trial and potential appeals? This can easily run into the tens of millions of dollars per case and must be factored into the overall cost of the acquisition.

- Probability of Success: This is the most difficult but most important judgment call. Based on the four pillars of validity, enforceability, FTO, and ownership, what is the team’s confidence level that the patents will be upheld? The IP attorney’s opinion here is a critical input for the final business decision.

By looking beyond the target’s own portfolio and embracing this external, 360-degree view, you gain a much more realistic and sophisticated understanding of the asset you are buying. You move from simply appraising the quality of the fortress walls to understanding the number of cannons aimed at them, the skill of the opposing generals, and the likely outcome of the coming siege.

From Data to Dollars: Quantifying Patent Value and Risk

At the end of the day, an M&A transaction is a financial decision. The exhaustive legal, technical, and strategic analysis performed during patent due diligence is ultimately in service of one primary goal: to inform and refine the financial valuation of the target company. The true art of strategic due diligence lies in this final translation—converting complex patent data and risk assessments into concrete numbers that can be plugged into a spreadsheet. This is where the diligence team’s findings directly impact the negotiation of the purchase price and the ultimate “go/no-go” decision.

Building the Financial Model: Tying Patent Exclusivity to Revenue Streams

The standard tool for valuing a company based on its future earnings is the discounted cash flow (DCF) model. This model projects a company’s future revenues and costs, calculates the resulting cash flow for each year, and then “discounts” those future cash flows back to their present-day value. For a pharmaceutical asset, the single most important variable in this entire model is the duration of market exclusivity. The patent diligence findings are the primary input for this variable.

Scenario Planning: Strong vs. Weak Patent Scenarios

A single DCF model based on a single “best guess” exclusivity date is brittle and fails to capture the uncertainty inherent in patent law. A much more robust approach is to use scenario analysis. The diligence team provides the inputs for several different scenarios, which are then modeled by the finance team.

- The “Best Case” (High-Value) Scenario: This scenario assumes that all key patents are upheld in litigation, that the calculated PTE/PTA is confirmed, and that the full period of regulatory exclusivity is granted. This results in the longest possible period of monopoly pricing and represents the maximum potential value of the asset.

- The “Base Case” (Most Likely) Scenario: This is the team’s most realistic projection. It might, for example, assume that the core composition of matter patent is strong but that a key method-of-use patent is likely to be invalidated. It might incorporate a settlement with a generic competitor that allows for market entry a year or two before the final patent expiration. The inputs for this case are derived from the team’s blended assessment of validity, litigation risk, and competitive pressures.

- The “Worst Case” (Low-Value) Scenario: This scenario models the financial impact of a significant negative outcome. What if the primary patent is invalidated early in litigation? What if a major FTO issue requires a costly license or forces a delayed launch? This scenario establishes the “floor” for the valuation and helps the acquiring company understand the magnitude of the downside risk.

By running these different scenarios, the business team can see a range of potential valuations. This range is far more useful for decision-making than a single point estimate. It frames the negotiation, allowing you to understand how much you can afford to pay while still ensuring a positive return even if some of the patent risks materialize.

Discounted Cash Flow (DCF) Analysis Adjusted for Patent Risk

Beyond just modeling different time horizons, the patent risk assessment can be used to adjust the DCF model itself. This is typically done by modifying the discount rate. The discount rate reflects the riskiness of the future cash flows—the higher the risk, the higher the rate, and the lower the present value.

If the patent diligence uncovers significant, unresolved risks—for example, a very strong obviousness argument against the main patent or a problematic FTO issue with no clear solution—the finance team can apply a higher, risk-adjusted discount rate to the projected cash flows. This has the direct effect of lowering the calculated net present value (NPV) of the asset. This method provides a sophisticated way to quantify the team’s qualitative assessment of patent risk and directly translate it into a lower valuation, providing a clear, data-driven justification for a lower offer price. An executive might say, “The base case revenue projection is $10 billion over the life of the patent, but our diligence team puts the odds of a successful legal challenge at 30%. We need to discount that valuation accordingly.”

Red Flags and Deal-Breakers: When to Walk Away

While most diligence findings can be quantified and factored into the price, some issues are so severe that they represent fundamental “deal-breakers.” These are the red flags that should cause the acquiring team to pause, and potentially, to walk away from the negotiating table entirely, regardless of the price. Identifying these showstoppers is one of the most critical functions of the due diligence process.

Critical FTO Issues without a Clear Resolution

Discovering a third-party “blocking” patent that prevents you from commercializing your acquired product is one of the most serious red flags. If there is no clear, viable, and cost-effective path to resolving this Freedom to Operate issue, the deal is likely dead. If the owner of the blocking patent is a direct competitor who is unwilling to license the patent at any reasonable price, and your team’s assessment is that the patent is strong and unlikely to be invalidated, then you are acquiring a product you cannot sell. There is no financial model that can justify such an acquisition.

A Fatal Flaw in a Crown-Jewel Patent’s Validity

During the validity analysis, the team may uncover a piece of “knockout” prior art that was never considered by the patent office and that clearly anticipates the core invention of the target’s most important patent. Or, they may find irrefutable evidence of inequitable conduct in the prosecution history. Such a finding essentially means the cornerstone of the target’s value is an illusion. While the patent is presumed valid today, the discovery of this flaw means it is almost certain to be invalidated once challenged. Acquiring a company whose main asset is protected by such a fragile patent is an unacceptable risk. This is not a matter of negotiation; it’s a fundamental defect in the asset itself.

A Broken Chain of Title That Cannot Be Repaired

Ownership issues can also be deal-breakers. Imagine discovering that a key inventor on the primary patent, a disgruntled former employee, never signed their assignment agreement and is now refusing to cooperate. Or perhaps a university collaborator, due to a poorly drafted research agreement, has a credible claim to co-ownership of the crown jewel IP and is demanding exorbitant terms. If these ownership defects cannot be definitively cured before the deal closes, the acquirer faces the prospect of co-owning its most important asset with a hostile party, or worse, not owning it at all. This level of uncertainty about the fundamental right to own and control the IP is often a bridge too far for any prudent acquirer.

The ability to raise these red flags requires not just analytical rigor but also courage from the due diligence team. It can be difficult to be the voice of caution in a deal-fevered environment, but it is the team’s primary responsibility. Ultimately, the successful conversion of patent data into financial insight is what separates a merely compliant due diligence process from a truly strategic one. It ensures that the price you pay reflects the reality of the asset’s strengths and weaknesses, protecting your company from overpaying and, in the most critical cases, from making a disastrous investment.

Conclusion: Weaving Patent Diligence into the Fabric of M&A Strategy

In the complex tapestry of a pharmaceutical M&A deal, patent due diligence is not a decorative border; it is the core thread that runs through the entire fabric, giving it strength and value. We’ve journeyed from the strategic necessity of M&A in the face of the patent cliff to the tactical assembly of a multi-disciplinary diligence A-team. We’ve dissected the anatomy of a comprehensive investigation, exploring the four foundational pillars—Validity, Enforceability, Freedom to Operate, and Ownership—that form the bedrock of any rigorous analysis.

We have seen how to move beyond a simple risk assessment to a strategic deconstruction of the target’s portfolio, mapping patents to products, evaluating the layered strength of a “picket fence” strategy, and meticulously calculating the true duration of market exclusivity. We’ve learned the importance of looking outward, using competitive intelligence to understand the broader landscape and litigation analysis to forecast the inevitable legal challenges.

Most critically, we have bridged the gap between complex legal data and hard financial reality. The ultimate purpose of this entire endeavor is to inform the valuation, to move beyond hope and hype, and to build financial models grounded in the quantifiable realities of patent strength and risk. By creating best-case, base-case, and worst-case scenarios, you transform patent analysis from a legal opinion into a dynamic tool for negotiation and decision-making.

The modern business professional in the pharmaceutical space cannot afford to view patent due diligence as a delegated, back-office function. You must be an active and engaged participant, capable of asking the right questions, understanding the answers, and appreciating their profound commercial implications. You must champion the shift from a defensive, check-the-box mentality to an offensive, intelligence-driven strategy. When you do, drug patent data ceases to be an arcane legal abstraction and becomes what it truly is: your crystal ball, offering the clearest possible view of the future value, risks, and opportunities of your billion-dollar decision.

The Future of Patent Diligence: AI and Predictive Analytics

Looking ahead, the field of patent due diligence is on the cusp of another transformation, driven by artificial intelligence and machine learning. AI-powered tools are becoming increasingly sophisticated, capable of sifting through millions of patent and scientific documents in minutes to identify potential prior art. Predictive analytics platforms are beginning to model litigation outcomes based on historical case data, judge’s rulings, and law firm track records. While these tools will not replace the nuanced judgment of an experienced legal and scientific team, they will undoubtedly augment it, allowing for faster, more comprehensive, and more data-driven analysis. The acquirer who embraces these new technologies will have an even sharper edge in the perpetual, high-stakes quest for innovation.

Key Takeaways

- Patents are the Core Asset: In pharmaceutical M&A, the primary asset being acquired is almost always the intellectual property. Patent due diligence is therefore not an ancillary task but a central component of valuation.

- Build a Multi-Disciplinary Team: An effective diligence team requires more than just lawyers. It needs a blend of IP attorneys, technical/scientific experts, business development leads, and regulatory affairs specialists to get a complete picture.

- Systematic Analysis is Crucial: A rigorous investigation is built on four pillars: assessing Patent Validity (is it strong?), Enforceability (are there conduct issues?), Freedom to Operate (can you sell the product without infringing others?), and Ownership (do you have clean title?).

- Strategic Assessment Drives Value: Go beyond risk mitigation. Analyze the portfolio’s strategic strength, including the types of patents (CoM is king), the “picket fence” structure, and the precise duration of exclusivity by combining patent term (PTE/PTA) with regulatory exclusivities (NCE, ODE).

- Context is Everything: Look outside the target’s own portfolio. Analyze the competitive patent landscape to identify threats and “white space” opportunities. Scrutinize litigation history to forecast future challenges and costs.

- Connect Data to Dollars: The ultimate goal is to inform the financial model. Use the diligence findings to create best-case, base-case, and worst-case valuation scenarios. Quantify risk to justify the offer price and negotiation strategy.

- Identify Deal-Breakers: Be prepared to walk away. Unresolvable FTO issues, fatal validity flaws in crown-jewel patents, or incurable ownership defects are red flags that often cannot be overcome by a lower price.

Frequently Asked Questions (FAQ)

1. How early in the M&A process should we begin patent due diligence?

You should begin as early as possible, often even before signing a non-disclosure agreement (NDA). A preliminary, high-level analysis using public data sources and platforms like DrugPatentWatch can be done on any potential target. This initial screen can help you identify major red flags (like an already-expired key patent) and prioritize your acquisition targets before you invest significant time and resources. Once an NDA is signed and you gain access to the virtual data room, the deep-dive analysis should begin immediately.

2. Our target is a small, pre-clinical biotech with only patent applications, no granted patents. How does this change the due diligence process?

The process becomes more focused on prediction and risk assessment. Instead of analyzing an issued patent, you are analyzing the likelihood that the pending applications will be granted and what the scope of their claims will be. The focus shifts heavily to:

- Prosecutability: A thorough analysis of the prior art and the arguments made so far to the patent office to predict the probability of allowance.

- Claim Scope: Assessing whether the claims, if granted, will be broad enough to protect the eventual commercial product.

- FTO on the Horizon: A forward-looking FTO analysis becomes even more critical, as you need to anticipate competitor patents that may issue while your target’s application is still pending.Valuation will involve heavier risk-weighting due to the uncertainty of the asset not yet being granted.

3. What is the single biggest mistake companies make in patent due diligence?

The biggest mistake is over-relying on the target’s own representations about their IP. A target company will always present its patent portfolio in the best possible light. A buyer must maintain professional skepticism and conduct their own independent, “unfriendly” review. This means actively trying to find invalidating prior art, searching for blocking patents the target may have missed or downplayed, and meticulously verifying the chain of title. Simply accepting the seller’s IP summary at face value is an invitation for a post-acquisition disaster.

4. We’ve identified a significant FTO risk, but we love the target’s science. What are our options besides walking away?

If the science is truly compelling, you have several strategic paths, but they all involve cost and risk that must be baked into the deal terms.

- Negotiate the Price: The most direct approach is to significantly lower the purchase price to reflect the future cost of licensing or litigating the blocking patent.

- Use an Escrow: You can structure the deal to hold a portion of the purchase price in escrow, to be released only if the FTO issue is favorably resolved (e.g., the blocking patent is invalidated or a license is secured below a certain cost).

- Make the Deal Contingent: You could make the closing of the acquisition contingent on the seller first securing a license for the blocking patent. This places the burden of negotiation on the seller.

- Acquire the Blocker: If feasible, you could explore a parallel strategy of acquiring the company that holds the blocking patent, although this can be complex and expensive.

5. How does patent due diligence differ for a biologic (e.g., a monoclonal antibody) versus a traditional small molecule drug?

While the core principles are the same, the specifics differ significantly. For biologics:

- Manufacturing is Key: Manufacturing processes for biologics are incredibly complex and are themselves a source of valuable trade secrets and patents. Diligence must focus heavily on patents covering the specific cell line, culture media, and purification processes.

- “Picket Fence” is More Critical: Because it can be harder to get a single, dominant composition of matter patent on a large molecule, a dense “picket fence” of patents covering the target epitope, specific amino acid sequences, formulations, and methods of use is even more important.

- Litigation is Different: Biosimilar litigation follows the complex BPCIA “patent dance” pathway, which is procedurally very different from Hatch-Waxman litigation for small molecules. Your legal team must have specific experience in BPCIA.

- Enablement/Written Description Challenges are Common: The complexity of biologics often leads to challenges that the patent specification does not adequately describe or enable the full scope of the antibody claims, making this a key area of focus for validity analysis.

References

[1] Kessel, A. J. (2022). Intellectual Property Strategies for Life Sciences Companies. Remarks from industry panel discussion.

[2] PwC. (2021). Powering value: The rising importance of intellectual property in M&A. PricewaterhouseCoopers Global IP Survey.

[3] Miller, G. (2023). Maximizing Pharmaceutical Asset Value: The PTE and Exclusivity Nexus. BioPharma Strategic Consulting Group White Paper.