Executive Summary

The generic drug supply chain stands as a fundamental pillar of global healthcare, ensuring access to affordable and essential medications. This sector is responsible for filling a substantial majority of prescriptions, accounting for 89% of all prescriptions dispensed in the U.S. last year, yet it represents a significantly smaller proportion of total drug costs, at only 26%.1 Despite this critical role in healthcare affordability and accessibility, the generic drug supply chain is navigating a complex landscape fraught with systemic challenges. These include intense pricing pressures that lead to razor-thin profit margins, inherent supply chain vulnerabilities stemming from a concentrated global sourcing of key ingredients, and intricate regulatory hurdles that demand constant adaptation.

This report delves into these core issues, providing a comprehensive analysis of the inefficiencies and risks that impede the generic drug supply chain’s optimal functioning. It then outlines a strategic framework of best practices designed to transform these challenges into opportunities for enhanced efficiency, resilience, and transparency. By embracing advanced technologies such as Artificial Intelligence (AI) and blockchain, implementing diversified sourcing strategies, establishing robust quality management systems, and fostering collaborative partnerships across the ecosystem, the generic drug supply chain can evolve into a more reliable and sustainable model, ultimately ensuring consistent patient access to high-quality, affordable medicines.

1. Introduction: The Critical Role of Generic Drugs

Generic medicines are indispensable components of modern healthcare systems worldwide. Their widespread availability and affordability are pivotal in managing healthcare costs and expanding patient access to necessary treatments. In the United States, for instance, generic drugs constitute a remarkable 89% of all dispensed prescriptions, yet they account for only 26% of the total drug expenditures.1 This stark contrast underscores their profound impact on healthcare economics and public health, making them a cornerstone of affordable medical care.

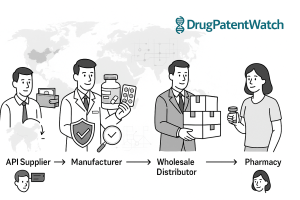

A supply chain, in its essence, encompasses all organizational, operational, and value-adding activities required to develop, manufacture, and facilitate goods to the end consumer.2 For the pharmaceutical sector, this intricate network involves manufacturers, wholesale distributors, pharmacies, and Pharmacy Benefit Managers (PBMs).2 Each entity plays a distinct role in ensuring that medications reach patients safely and efficiently.

The generic drug market possesses unique characteristics that set it apart from its brand-name counterpart. Unlike branded drugs, which often benefit from market exclusivity and are typically controlled by a single manufacturer, the generic industry operates under a multi-competitor model.1 This competitive environment inherently drives drug prices downward as more manufacturers enter the market.1 A significant operational and financial distinction lies in the negotiation of rebates: generic manufacturers rarely, if ever, negotiate rebates with PBMs and health plans. In contrast, branded drug manufacturers frequently engage in such negotiations, offering rebates in exchange for formulary placement or market share.1 These divergent financial incentives lead to different revenue distribution dynamics, with the generic supply chain capturing 64% of total revenue compared to 76% for brand market manufacturers.1

This report aims to dissect the inherent complexities and challenges within this vital generic drug ecosystem. It seeks to provide a detailed analysis of the inefficiencies that hinder its optimal performance and to propose actionable best practices. The overarching goal is to enhance the efficiency, resilience, and quality of the generic drug supply chain, thereby ensuring consistent patient access to these essential and cost-effective medications.

The generic drug supply chain operates under what can be described as an “affordability paradox.” While the high volume of generic prescriptions at a low cost is a massive societal benefit, the very mechanism that drives this affordability—intense price competition—paradoxically creates fragility within the supply network. The multi-competitor model, where prices decline with increased market entry, leads to razor-thin profit margins for generic manufacturers.1 This economic pressure severely limits the ability of manufacturers to invest in crucial areas such as robust supply chain infrastructure, building redundancy in sourcing, or implementing advanced quality improvement systems.5 In some instances, these unsustainable cost reductions can even force existing manufacturers out of the market or deter potential new entrants, further consolidating supply.3 The ultimate consequence of this underinvestment and market exit is a heightened risk of drug shortages, particularly for low-priced generics and essential medicines.5 These shortages, in turn, have direct and severe impacts on public health, leading to delays in medical care, an increased incidence of medication errors, higher rates of adverse reactions as patients are forced to switch to unfamiliar or less ideal treatments, and ultimately, higher out-of-pocket costs for patients.8 This situation underscores a fundamental tension: the relentless pursuit of the lowest price, while seemingly beneficial, can inadvertently undermine the long-term sustainability and resilience of the generic drug supply chain, creating a critical policy challenge.

2. Anatomy of the Generic Drug Supply Chain: Components and Operational Stages

The generic drug supply chain is a complex, multi-tiered network involving various stakeholders, each contributing to the journey of a medication from its inception to the patient. Understanding the roles of these key players and the intricate operational stages is fundamental to identifying areas for streamlining and improvement.

Key Stakeholders and Their Roles

At the core of the generic drug supply chain are several critical entities:

- Manufacturers: These are the companies responsible for developing and producing generic drug compounds. Their operations encompass the entire lifecycle from product development to the distribution of finished drug products. Manufacturers typically manage the initial distribution to drug wholesalers and, in some cases, directly to large retail pharmacy chains, specialty pharmacies, hospital networks, and even certain health plans.2 Their primary responsibility extends to ensuring the quality and safety of the drugs they produce.10

- Wholesale Distributors: Acting as vital intermediaries, wholesale distributors procure generic drugs from manufacturers and then distribute them to pharmacies and other healthcare providers. Their services are comprehensive, often including financial management, distribution logistics, inventory management, and data processing. These distributors typically receive a distribution service fee, often calculated as a percentage of the Wholesale Acquisition Cost (WAC), in exchange for their services. Contractual agreements between wholesalers and manufacturers may also incorporate discounts for prompt payment or bulk purchasing.2 Wholesale suppliers also play a crucial role in upholding compliance across the entire supply chain.11

- Pharmacies (Retail, Specialty, Hospital): These are the final points of dispensing in the supply chain, directly providing medications to end consumers. Pharmacies, whether retail, specialty, or hospital-based, are tasked with meticulous inventory management, including precise tracking of expiration dates and ensuring secure, environmentally controlled storage conditions for medications.12

- Pharmacy Benefit Managers (PBMs): PBMs have evolved significantly from their origins as basic claims administrators. Today, they are complex organizations that provide a wide array of services. These include claims processing and adjudication, developing and managing drug formularies, negotiating manufacturer rebates (primarily for brand-name drugs), determining generic and therapeutic substitutions, developing pharmacy networks, and offering mail-order pharmacy services.2 PBMs wield substantial leverage, particularly in securing brand-name medications with close substitutes, often through rebate negotiations with manufacturers.2 However, a key distinction in the generic market is that generic manufacturers rarely, if ever, engage in such rebate negotiations with PBMs.1

Generic Product Development Process

The journey of a generic drug from concept to market is a rigorous, multi-step process designed to ensure that it is safe, effective, and therapeutically equivalent to its branded counterpart.14

- Conceptualization and Market/Patent Analysis: The process begins with identifying a healthcare need and analyzing existing medications. This involves a meticulous study of drugs whose patents are nearing expiration and assessing their commercial viability. The objective is to pinpoint high-potential molecules and market segments where a generic version would fulfill a genuine need.10 Researchers delve into the molecular structure of the original drug, identifying its active ingredients and understanding its therapeutic effects to create a generic version that precisely mirrors the original’s performance.10

- Formulation Development: Once a suitable drug is identified, scientists embark on developing a stable and effective formulation that replicates the branded version. This phase includes extensive lab-scale experiments to fine-tune excipients (inactive ingredients), dissolution profiles (how quickly the drug dissolves in the body), and dosage forms, all while prioritizing patient compliance and ease of use.10 A critical aspect here is “de-formulation,” which involves reverse-engineering the Reference Listed Drug (RLD) to meticulously understand its critical quality attributes (CQAs) and how they are achieved, given that manufacturers do not have access to proprietary formulation details or manufacturing blueprints of the RLD.4

- Analytical Method Development: Robust analytical methods are then developed to rigorously test the drug’s quality, stability, and performance. These methods are indispensable for ensuring that the product consistently meets regulatory specifications and maintains its quality from batch to batch throughout its shelf life.14

- Bioequivalence Studies: This is a pivotal and defining stage. Bioequivalence studies compare the absorption and performance of the generic version to that of the branded drug in human subjects.10 These studies are essential to scientifically prove that both versions are interchangeable in clinical practice, meaning they deliver the same amount of active ingredients into a patient’s bloodstream in the same timeframe.4 This phase presents a core scientific and engineering challenge, as generic formulations are permitted to differ from the RLD in their inactive ingredients, manufacturing processes, or even the specific salt or ester forms of the Active Pharmaceutical Ingredient (API), while still needing to demonstrate therapeutic equivalence.4

- Scale-Up and Tech Transfer: Following successful lab testing and bioequivalence demonstration, the manufacturing process is scaled up for commercial production. This phase involves the crucial transfer of technology from the research and development (R&D) environment to the manufacturing floor, with a stringent focus on maintaining the same quality and efficacy in large-scale batches.14

- Regulatory Submission and Approval: The culmination of the development process involves submitting comprehensive regulatory dossiers, such as an Abbreviated New Drug Application (ANDA) for the U.S. FDA or a Decentralized Procedure/Mutual Recognition Procedure (DCP/MRP) for the European Medicines Agency (EMA).10 These dossiers contain all the clinical, technical, and manufacturing data required to obtain market authorization.

- Manufacturing and Quality Control: Once regulatory approval is secured, the generic drug moves into large-scale production. Pharmaceutical companies must strictly adhere to Good Manufacturing Practices (GMP) and implement stringent quality control measures to ensure that every batch of the generic drug meets the required standards of purity, potency, and consistency.10

- Market Approval and Launch: After successfully navigating all regulatory hurdles, the generic drug is ready for market release. Marketing strategies are developed to introduce the drug to healthcare professionals and consumers, with its affordability often highlighted as a key selling point compared to the original medication.10

- Post-Market Surveillance: The process does not conclude with market launch. Post-market surveillance is a continuous and ongoing process where the generic drug’s performance is monitored. This involves tracking any adverse effects, conducting further research, and making necessary adjustments to ensure continuous safety and efficacy based on real-world patient outcomes and feedback.10

The requirement for generic drugs to be “bioequivalent” to their branded counterparts means they must deliver the active ingredient into the bloodstream at virtually the same speed and in the same amounts.4 However, a subtle yet significant aspect, often termed the “invisible equivalence,” is that regulatory definitions permit variations in inactive ingredients, manufacturing processes, or even different salt or ester forms of the active pharmaceutical ingredient.4 This creates a complex scientific and engineering challenge for generic developers, who must replicate the performance of a Reference Listed Drug (RLD) without having full access to its proprietary formulation details or manufacturing blueprints.4 This necessitates extensive reverse-engineering, often referred to as “de-formulation,” to meticulously understand the RLD’s critical quality attributes.4 This inherent difference, coupled with the intense price competition in the generic market, can lead to vulnerabilities in quality control. Past incidents, such as recalls due to adulterated heparin or carcinogenic impurities found in angiotensin II receptor blockers (ARBs), illustrate how critical quality breakdowns can occur despite regulatory oversight.16 The market’s focus on price, where manufacturers compete primarily on cost, can make variations in medication quality invisible to purchasers throughout the supply chain.16 This situation highlights that while bioequivalence ensures therapeutic sameness, the underlying “invisible equivalence” creates a continuous challenge for manufacturers and a potential blind spot for purchasers and regulators, emphasizing the need for robust quality assurance measures that extend beyond initial approval and into ongoing surveillance.

3. Navigating the Complexities: Key Challenges and Inefficiencies

The generic drug supply chain, despite its critical role in healthcare affordability, is beset by a myriad of challenges and inefficiencies across its operational stages. These complexities often stem from the unique market dynamics of generics, globalized production, and stringent regulatory demands.

3.1 Economic and Pricing Pressures

Generic drug manufacturers operate within an environment of intense price competition, which is a defining characteristic of their market.3 This fierce competition often leads to razor-thin profit margins in conventional generic segments.4 Such economic pressure can force manufacturers to reduce production costs to potentially unsustainable levels, driving existing companies out of the market and deterring new entrants.3 Furthermore, maintaining mature manufacturing quality systems requires significant investment, which becomes challenging with uncertain revenue streams.3

The impact of reimbursement methodologies further exacerbates these pressures. Pharmacy reimbursement rates for generic drugs are structured differently than for branded drugs.1 Payers, including major public programs like Medicare and Medicaid, frequently impose price ceilings, known as Maximum Allowable Costs (MACs), on what they will reimburse for a generic medication, regardless of the manufacturer.5 This mechanism intensifies price competition among generic manufacturers, pushing prices even lower.5 This limited ability to raise prices, combined with the high capital costs associated with pharmaceutical manufacturing, can compel generic drug manufacturers to operate at a loss or exit the U.S. market entirely, thereby exacerbating existing drug shortages.7 Additionally, the imposition of tariffs and trade policies can increase the cost of importing Active Pharmaceutical Ingredients (APIs) or finished products, further shrinking the already slim margins for generic manufacturers.7 This can lead to difficult inventory decisions for pharmacists, who may find it financially unsustainable to stock high-volume generics with low margins, potentially resulting in delays in treatment, non-adherence, or increased costs for patients.7

The generic drug market is characterized by a “vicious cycle of price erosion and supply instability.” The multi-competitor model, while beneficial for reducing drug costs, leads to intense price competition and razor-thin profit margins for generic manufacturers.1 This economic reality makes it exceedingly difficult for companies to invest in critical areas such as domestic production facilities, robust quality systems, or establishing redundancy within their supply chains.5 The consequence is an increased reliance on concentrated, lower-cost geographies for sourcing Key Starting Materials (KSMs) and APIs, notably from countries like China and India.3 This concentration, in turn, creates a critical lack of redundancy in the supply chain, making it highly vulnerable to disruptions.3 When unforeseen events occur, such as quality breakdowns, natural disasters, or geopolitical tensions, these vulnerabilities directly translate into drug shortages.3 It has been observed that low-priced generic medications are at a substantially greater risk of experiencing a shortage compared to higher-priced generics.5 This situation reveals that the relentless pursuit of the lowest price in the generic market creates a perverse incentive structure that undermines the very resilience of the supply chain, ultimately jeopardizing patient access and public health. This dynamic suggests that current reimbursement and purchasing models may be inadvertently destabilizing the generic drug supply.

3.2 Supply Chain Vulnerabilities and Disruptions

A significant vulnerability within the generic drug supply chain stems from its concentrated global sourcing. There is a heavy reliance on a limited number of countries, predominantly China and India, for the supply of Key Starting Materials (KSMs) and Active Pharmaceutical Ingredients (APIs).3 This geographic concentration creates substantial geopolitical and supply chain vulnerabilities, as disruptions in a single region can severely impact or even break the supply chain for numerous medicines.7

The concentration of pharmaceutical purchasing and distribution often results in a critical lack of redundancy within the supply chain.3 This means that if a primary supplier or production site faces an issue, there are often insufficient alternative sources readily available, rendering the entire supply chain highly susceptible to disruptions.3 Furthermore, pharmaceutical supply chains are inherently decentralized networks, involving multiple decision-makers with diverse objectives.20 This distributed nature can lead to mismatches between supply and demand, even under normal operating conditions.20

The impact of various disruptive events can be profound. Natural disasters, such as earthquakes, floods, or hurricanes, can cause significant damage to manufacturing facilities and transportation infrastructure.6 Infectious disease outbreaks, exemplified by the COVID-19 pandemic, can lead to global demand surges for certain medical products, while simultaneously causing production decreases due to lockdown measures or workforce illness.20 Manufacturing process problems are also a frequent cause of disruption, often halting production until issues are resolved.3 Geopolitical instability, including wars, trade tensions, and economic sanctions, can further interrupt the flow of goods across international borders.6 These events can push production or transport resources beyond 100% capacity, leading to declining stock levels and eventual patient shortages.20 Moreover, coordination failures, where supply cannot be matched to demand, can result in shortages even when the total theoretical supply is sufficient.20

3.3 Quality Control and Regulatory Hurdles

Quality-related breakdowns in manufacturing processes have historically been a significant cause of drug shortages.3 When such issues arise, manufacturers are compelled to halt production and resolve the problems before resuming operations. If alternative suppliers are not readily available, these quality failures directly lead to drug shortages.3

The rapid expansion and increasing globalization of the generic drug market have placed considerable strain on the ability of regulatory bodies, such as the U.S. Food and Drug Administration (FDA), to maintain effective quality oversight.16 By 2020, a substantial 74% of establishments manufacturing active ingredients were located overseas.16 This global footprint introduces bureaucratic barriers to conducting effective site visits, often requiring visa applications and prior announcements of inspections, which can allow facilities to prepare in advance.16 Furthermore, the FDA frequently relies on self-reported quality data from manufacturers, even in environments where data veracity has been questioned.16 The COVID-19 pandemic further complicated this situation, forcing the FDA to limit inspections to “mission-critical” sites and resulting in a significant backlog of surveillance inspections.16

A concerning aspect is the lack of corresponding accountability for product quality beyond the manufacturer level. Distributors, wholesalers, retailers, and Pharmacy Benefit Managers (PBMs), who all profit from the sale of pharmaceuticals, often do not bear direct responsibility for the quality of the products they sell.16 This can create a market where the primary focus is on price, making variations in medication quality “invisible” to purchasers once multiple generic manufacturers gain FDA approval.16 Past incidents, such as the adulterated heparin crisis in 2008, which resulted in 149 deaths, and the more recent discovery of carcinogenic N-nitrosamine impurities in generic angiotensin II receptor blockers (ARBs) leading to widespread recalls since 2018, underscore the persistent nature of quality control issues in the generic drug market.16 These cases highlight the urgent need for more robust quality control measures and a re-evaluation of accountability across the supply chain.

Navigating the diverse and stringent regulatory requirements across multiple regions (e.g., FDA, EMA, WHO) is another time-consuming and complex challenge for generic drug developers.11 Frequent changes in these regulations necessitate constant adaptation from manufacturers.11 While demonstrating bioequivalence is a crucial step for generic approval, it can be particularly challenging for complex formulations, such as modified-release drugs or those with a narrow therapeutic index.15 The necessity to replicate the performance of a Reference Listed Drug (RLD) without full access to its proprietary formulation details adds a layer of scientific and engineering complexity to the development process.4

The globalization of generic drug manufacturing, while enabling significant cost efficiencies, has introduced substantial challenges in quality oversight for regulatory bodies. A large proportion of Active Pharmaceutical Ingredient (API) manufacturing, for instance, is concentrated overseas, with 74% of establishments located outside the U.S. by 2020.16 This global distribution complicates the FDA’s ability to conduct effective inspections, leading to bureaucratic barriers and a reliance on self-reported quality data from manufacturers.16 The COVID-19 pandemic further exacerbated this by limiting “mission-critical” inspections and creating a backlog.16 This situation directly contributes to challenges in ensuring consistent quality across the global supply chain, leading to instances of quality-related breakdowns and product recalls, such as those involving adulterated heparin or carcinogenic impurities in ARBs.16 These quality failures are a historical and significant cause of drug shortages, as production halts until the issues are resolved, and alternative suppliers may not be immediately available.3 The consequence is a direct impact on patient access and an erosion of public trust in the reliability of generic medications. This dynamic necessitates a re-evaluation of the balance between global sourcing and strengthening domestic quality assurance capabilities.

3.4 Operational and Inventory Management Inefficiencies

Operational and inventory management inefficiencies pose significant hurdles within the generic drug supply chain. A primary concern is inaccurate demand forecasting. Traditional forecasting methods, often relying solely on historical sales data, frequently fail to accurately predict sudden fluctuations in drug demand.22 This inaccuracy leads to a detrimental cycle of either stockouts, where essential medications are unavailable when needed, or excess inventory, which results in higher storage costs and potential waste if products expire.24 Demand for pharmaceutical products can vary dramatically due to market dynamics, making precise forecasting a continuous challenge.24

Inventory inaccuracies and theft represent another critical area of inefficiency. Manufactured pharmaceutical products, being high-value goods, are frequent targets for theft or mismanagement throughout the supply chain.24 Reliance on manual processes, spreadsheets, or older inventory systems often means that discrepancies are not flagged until it is too late, leading to revenue loss and regulatory scrutiny. Regulatory agencies mandate strict controls throughout the process, making such inaccuracies a compliance risk.24

Managing expiry dates and product recalls is a complex and high-stakes task. Expired medications not only lose efficacy but also pose significant risks to patient safety.24 Furthermore, while product recalls are rare, they require immediate and precise action. Many pharmaceutical organizations struggle significantly with quickly identifying which specific batches are affected and their exact locations within the sprawling supply chain during a recall event.24

Temperature and environmental monitoring are paramount, as many pharmaceutical products, particularly biologics and vaccines, require strict environmental controls, often necessitating cold chain logistics.24 Any breach in temperature compliance during storage or transport can render these products ineffective or unsafe. Traditional inventory systems often lack the real-time monitoring capabilities to flag these critical issues instantly.24 The financial implications of cold chain failures are staggering, draining an estimated $35 billion annually from the industry, with a third of compromised shipments being destroyed due to temperature deviations.27

Finally, production inefficiencies contribute to overall supply chain sluggishness. Issues such as excessively high machine stoppage times in packing areas, frequent non-compliance with production schedules, and long setup times significantly impact operational efficiency.28 The inherent complexity of industrial processes, characterized by a multitude of variables and non-linear dynamics, makes it difficult to develop systematic models for process optimization.23 Additionally, the highly labor-intensive nature of some pharmaceutical manufacturing processes contributes to long lead times, often ranging from four to six months.29

The following table summarizes these key challenges and their far-reaching consequences within the generic drug supply chain.

Table 3.1: Key Challenges and Their Consequences in the Generic Drug Supply Chain

| Category | Challenge | Direct Consequences | Broader Implications | Relevant Snippets |

| Economic & Pricing | Intense Price Competition & Low Margins | Unsustainable cost reductions, manufacturers exit/deterred, uncertain revenue | Reduced investment in quality/resilience, increased reliance on single/low-cost sources, higher risk of shortages. | 1 |

| Static Reimbursement Rates & Tariffs | Forced operation at a loss, market exit, difficult inventory decisions for pharmacies | Exacerbated drug shortages, reduced domestic manufacturing capacity, compromised patient access. | 7 | |

| Supply Chain Vulnerabilities | Concentrated Global Sourcing (APIs/KSMs) | Lack of redundancy, susceptibility to regional disruptions (geopolitical, natural disasters) | Increased risk of widespread shortages, national security concerns regarding essential medicines. | 3 |

| Decentralized Control & Coordination Failure | Mismatches in supply/demand, difficulty responding to disruptions | Overloaded resources, declining stock levels, patient shortages even with sufficient total supply. | 20 | |

| Quality Control & Regulatory | Quality-Related Breakdowns in Manufacturing | Production halts, need for alternative suppliers, product recalls (contamination) | Drug shortages, erosion of public trust, increased healthcare costs due to errors/adverse events. | 3 |

| Strained Global Regulatory Oversight | Bureaucratic barriers to inspections, reliance on self-reported data, inspection backlogs | Inconsistent quality across global supply, higher risk of substandard/counterfeit drugs entering market. | 11 | |

| Bioequivalence Complexities | Rigorous testing requirements, “invisible equivalence” challenges, reverse-engineering needs | High R&D investment for generics, potential for subtle quality variations not immediately apparent. | 4 | |

| Operational & Inventory | Inaccurate Demand Forecasting | Stockouts, excess inventory, wasted resources, missed sales | Compromised patient care, increased storage costs, reduced supply chain efficiency. | 22 |

| Inventory Management Issues (Expiry, Theft, Traceability) | Patient safety risks, revenue loss, regulatory scrutiny, costly errors | Inefficient operations, difficulty with recalls, lack of end-to-end visibility. | 12 | |

| Temperature & Environmental Control Breaches | Product ineffectiveness/safety risks, spoilage, significant financial/environmental loss | Compromised product integrity, increased waste, higher operational costs for cold chain. | 24 | |

| Production Inefficiencies & Long Lead Times | High machine stoppage, schedule non-compliance, increased costs | Reduced responsiveness to market changes, difficulty scaling production, delayed market entry. | 23 |

This structured overview provides a clear understanding of the intricate challenges facing the generic drug supply chain. By categorizing and detailing the direct and broader consequences of each challenge, it becomes apparent that these issues are deeply interconnected and require a holistic approach to remediation. This comprehensive view is essential for developing effective strategies that address not just the symptoms but the root causes of inefficiencies and vulnerabilities.

4. Best Practices for Streamlining the Generic Drug Supply Chain

Streamlining the generic drug supply chain demands a multi-faceted approach, integrating strategic planning, technological innovation, and collaborative frameworks. The following best practices are crucial for building a more efficient, resilient, and reliable supply network.

4.1 Enhancing Supply Chain Resilience and Diversification

Building resilience into the generic drug supply chain is paramount, moving beyond a sole focus on cost-efficiency to prioritize reliability and stability.

A key strategy involves implementing multi-sourcing models. This entails moving to diverse sourcing for raw materials, including Key Starting Materials (KSMs) and Active Pharmaceutical Ingredients (APIs), as well as for finished products.3 This approach not only provides leverage to potentially reduce raw material costs but, more critically, builds essential redundancy into the supply chain. This can be achieved by developing multi-tier supply networks with pre-screened supplier profiles, making it significantly easier and faster to switch suppliers in the event of a disruption.3

Complementing multi-sourcing is geographic diversification. Reducing heavy reliance on single regions, such as China and India, for critical inputs is vital.3 This involves diversifying manufacturing facilities globally, including exploring opportunities for reshoring or near-shoring capabilities.7 Such diversification significantly reduces vulnerability to regional disruptions like natural disasters, geopolitical tensions, or trade restrictions, ensuring a more stable supply.7

Strategic buffer stock management is another critical component. Maintaining optimized buffer stocks of critical medications and supplies can extend the time from an initial disruption to a product shortage, providing a crucial buffer for response and recovery.20 Advanced mathematical models can be employed to optimize these inventory positions, balancing the cost of holding inventory with the risk of shortages.31

Finally, scenario planning is essential for proactive risk management. Engaging in regular exercises to prepare for various potential disruptions, simulating different scenarios, and developing robust contingency plans enables organizations to maintain operations during crises.22 This proactive approach builds resilience and prevents over-reliance on a single, optimistic prediction of future conditions.25

The generic drug supply chain has historically been characterized by its concentration and price sensitivity, with manufacturers often choosing lower-cost geographies for sourcing and production.3 However, recent global disruptions, including pandemics, geopolitical events, and quality issues, have starkly illuminated the inherent fragility of this purely cost-driven model.6 This realization has led to a fundamental shift in strategic thinking: building resilient sourcing models is no longer merely an option but a strategic imperative. While multi-sourcing and geographic diversification may entail higher upfront investments compared to single-source, low-cost strategies, the long-term benefits of a more reliable and higher-quality supply of generic medications—including reduced shortages and improved patient outcomes—are increasingly recognized as outweighing these initial costs.5 This shift implies a pressing need for policy incentives that reward such investments, moving beyond a singular focus on the lowest price to encourage supply chain stability and security.

4.2 Optimizing Manufacturing and Quality Assurance

Optimizing manufacturing processes and strengthening quality assurance are foundational to streamlining the generic drug supply chain, ensuring product integrity and consistent supply.

Adopting Lean Management principles can significantly enhance efficiency. This involves re-engineering production flows, implementing pull-based systems, and systematically eliminating various forms of waste, such as overproduction, rework, excess inventory, and inefficient material handling.32 Case studies demonstrate that lean practices can dramatically improve efficiency Key Performance Indicators (KPIs), reduce Work-in-Process (WIP), and shorten cycle times. For instance, an Indian startup reportedly increased production by 50% through lean practices.29

Leveraging Advanced Manufacturing Technologies is transforming the production landscape. Automation can reduce vulnerabilities associated with geographic concentration and enable new, more cost-effective synthesis methods for APIs and KSMs that were previously only viable abroad.7 AI-driven systems are optimizing pharmaceutical manufacturing by reducing errors, improving product consistency, and allowing production lines to adjust dynamically, thereby enhancing overall efficiency and quality.34

Continuous manufacturing, a shift from traditional batch-wise processes, offers benefits such as reduced costs, improved process efficiency, and greater flexibility in production capacity.32 Furthermore,

predictive maintenance, powered by AI, identifies potential equipment issues before they lead to costly delays. By analyzing sensor data from machinery, this proactive approach helps avoid downtime and maximizes operational efficiency and uptime.34 Merck, for example, improved production uptime by 20% by implementing IoT sensors and predictive analytics in its factories.35

Implementing Robust Quality Management Systems (QMS) is critical. This includes a “Quality System of Intelligence” that digitizes the batch release process and provides predictive insights, alerts, and scenario planning, significantly improving supply chain responsiveness.3 AI plays a transformative role in quality control; high-resolution cameras coupled with deep learning algorithms can inspect hundreds of tablets per minute, detecting subtle defects with remarkable accuracy (e.g., 99.2%) and substantially reducing batch rejections.36 Adherence to

Good Manufacturing Practices (GMP) is fundamental, ensuring the quality of the manufacturing process from raw materials to finished products.10

Finally, adopting Project Management Best Practices is essential for successful implementation of these manufacturing and quality improvements. This involves defining clear project goals aligned with broader business objectives, prioritizing deliverables, and actively engaging cross-functional stakeholders.37 Comprehensive risk assessments should be conducted at the outset of projects, with continuous monitoring and contingency planning to mitigate potential issues.37 Fostering clear communication, continuous training, and cross-functional collaboration builds high-performing teams that drive better outcomes and innovation.37

Quality-related breakdowns are a primary cause of drug shortages, and the globalization of manufacturing has strained the ability of regulatory bodies like the FDA to provide adequate oversight.3 Traditionally, quality assurance has relied heavily on inspections and self-reported data.16 However, the digital transformation of quality assurance is fundamentally changing this paradigm. By implementing digitized batch release processes, leveraging predictive intelligence, and deploying AI-driven quality control systems, quality assurance can transition from a reactive, compliance-driven activity to a proactive, predictive, and integrated part of the manufacturing process.3 This shift not only significantly reduces errors and the likelihood of costly recalls but also builds greater trust with patients, healthcare providers, and regulatory agencies. Given the “invisible equivalence” challenge, where generic drugs can differ in inactive ingredients and manufacturing processes while still being bioequivalent, a digitally transformed quality system becomes a powerful competitive differentiator. It allows manufacturers to demonstrate consistently high quality, potentially justifying better pricing or market share in a highly competitive environment. This evolution embeds quality directly into the operational fabric, moving beyond external oversight to intrinsic assurance.

4.3 Revolutionizing Logistics and Distribution

Revolutionizing logistics and distribution is critical for ensuring the timely, safe, and cost-effective delivery of generic drugs to patients. This requires a blend of smart technology, optimized processes, and strategic partnerships.

Implementing Smart Logistics Solutions is paramount. Cold chain monitoring is crucial for temperature-sensitive medications, which represent a rapidly growing sector of pharmaceutical products.24 Real-time monitoring systems, often powered by Internet of Things (IoT) sensors, maintain optimal conditions during storage and transport, preventing spoilage and significantly reducing product loss.26

Lot and batch level traceability are essential for regulatory compliance and patient safety. This is achieved through end-to-end, multi-party networks with robust chain of custody, allowing for precise tracking of individual units.3 Advanced

tracking technologies, including Radio-Frequency Identification (RFID), GPS tracking, and barcoding, provide highly accurate information for improved inventory management and in-transit product tracing.26

Optimizing transportation routes and last-mile delivery is another key area. AI-driven routing systems can process real-time data on traffic conditions, weather, and specific delivery constraints to ensure the fastest and most cost-effective transportation.36 This is particularly vital for time-sensitive or critical care drugs, where delays can have severe patient consequences.26

Exploring innovative distribution models can bypass traditional intermediaries, leading to reduced costs and improved efficiency. Direct-to-consumer and online ordering models are examples of approaches that can streamline the delivery process.40

Collaborating with logistics providers offers significant advantages. Partnering with experienced courier delivery and Third-Party Logistics (3PL) providers grants access to specialized expertise, standardized warehousing techniques, and efficient transportation networks.26 These partnerships provide scalable solutions to accommodate fluctuating demand or seasonal variations without requiring significant internal investment in additional resources.26 Adherence to

Good Distribution Practices (GDP), a set of European guidelines, is also essential for ensuring the proper distribution of medicinal products, including maintaining specified temperature ranges during storage and transit.11

Cold chain failures alone result in a staggering $35 billion in product loss annually for the pharmaceutical industry, with approximately one-third of compromised shipments being destroyed.27 This not only represents a significant financial drain but also carries substantial environmental costs, as the production and expedited transport of replacement products can double greenhouse gas emissions.27 The adoption of smart logistics, particularly through real-time visibility and monitoring technologies like IoT sensors, directly addresses these issues.26 Beyond merely preventing financial losses, these solutions contribute directly to sustainability goals by reducing waste and minimizing the carbon footprint associated with product spoilage and inefficient transport.27 This transformation elevates logistics from a mere cost center to a strategic enabler, aligning financial objectives with environmental and social governance (ESG) principles. Furthermore, by enabling proactive intervention to prevent spoilage and delays, smart logistics significantly enhances supply chain resilience, ensuring that essential medications reach patients reliably and safely.

4.4 Harnessing Technology and Data Analytics for Visibility and Prediction

Leveraging cutting-edge technology and sophisticated data analytics is fundamental to achieving true streamlining in the generic drug supply chain, providing unprecedented levels of visibility and predictive capabilities.

Real-time visibility platforms are critical for understanding the flow and condition of products across the entire supply chain. Gaining real-time visibility across all trading partners is essential for effective management.3 This is achieved through multi-party networks utilizing standardized API interfaces, Internet of Things (IoT) solutions, and cloud platforms that enable continuous tracking of location, environmental conditions (such as temperature and humidity), and movement of goods.3 The impact of real-time visibility is substantial: companies with such capabilities can reduce product recalls by up to 70% and improve delivery times by 25%.38 Furthermore, Real-World Data (RWD) provides granular insights into the supply chain, enabling the mapping of risks, pinpointing of bottlenecks, and facilitating proactive responses to potential delays before they escalate into widespread shortages.42 RWD can also provide feedback from actual patient experiences, helping to flag unexpected side effects and build trust in generic drug effectiveness.42

Advanced demand forecasting is revolutionized by the application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These tools analyze vast datasets, including historical sales data, current market trends, seasonal changes, and external factors like social media sentiment and epidemiological data, to predict future demand with significantly greater accuracy.25 This can reduce forecast error by up to 50% compared to traditional methods 31, effectively preventing both costly stockouts and wasteful overstocking.24

Blockchain technology offers a secure and unalterable record of transactions, enhancing traceability and transparency throughout the medicine supply chain.26 Its inherent immutability and transparency make it an exceptionally effective tool for combating counterfeit drugs, a persistent and dangerous issue in the pharmaceutical industry.45 Blockchain implementation is projected to reduce counterfeiting in tracked products by as much as 80% 31 and has been shown to reduce compliance delays by 25% in some European applications.29

Beyond forecasting and traceability, data analytics plays a strategic role in enhancing overall operational efficiency. It streamlines procurement, manufacturing, inventory management, logistics, and compliance processes.48 By identifying bottlenecks, managing risks, and optimizing resource allocation, data analytics empowers pharmaceutical companies to make more informed and agile decisions.48

Fragmented data systems and inadequate communication historically lead to significant visibility gaps and impede timely decision-making within the pharmaceutical supply chain.22 Manual processes are prone to errors and can exacerbate compliance issues.24 The sheer volume and complexity of data generated daily in the pharmaceutical industry, from clinical trials to patient outcomes, necessitate a fundamental shift from traditional, reactive management to proactive, data-driven orchestration.49 Real-time visibility platforms, advanced analytics, and blockchain technology are the foundational tools for this transformation.3 This paradigm shift transforms data from a mere record-keeping function into an actionable asset, enabling predictive capabilities, automated compliance, and rapid response to disruptions. This is not merely an incremental efficiency gain but a profound shift in how supply chain risk is managed, moving from a state of “known unknowns” to one of “known knowns” by illuminating the entire product journey. Data, in this context, becomes the new currency of supply chain resilience, enabling a level of control and foresight previously unattainable.

The following table details the key technologies and their applications, along with quantifiable benefits, in streamlining the generic drug supply chain.

Table 4.1: Key Technologies and Their Applications in Streamlining the Generic Drug Supply Chain

| Technology | Key Applications in Generic Drug Supply Chain | Quantifiable Benefits/Impact | Relevant Snippets | |||

| Artificial Intelligence (AI) / Machine Learning | – Advanced Demand Forecasting & Inventory Optimization | – 94% forecast accuracy (pharmacy chain) 36 | – 15% reduction in stockouts (cold/flu season) 36 | – 23% reduction in inventory holding costs (hospital network) 36 | – Up to 50% reduction in forecast error 31 | 25 |

| – Manufacturing Optimization & Predictive Maintenance | – Reduced errors, improved consistency 34 | – Avoids downtime, maximizes efficiency 34 | – 20% improvement in production uptime (Merck) 35 | 34 | ||

| – Quality Control & Anomaly Detection | – 99.2% accuracy in tablet inspection (Switzerland facility) 36 | – 35% reduction in batch rejections 36 | 36 | |||

| – Logistics & Route Optimization | – Transformed delivery efficiency, reduced operational costs 36 | – Optimized routes for sensitive therapies 39 | 36 | |||

| Blockchain Technology | – Enhanced Traceability & Anti-Counterfeiting | – Secure, unalterable transaction records 26 | – 47% reduction in counterfeit incidents (major pharma company) 36 | – Projected 80% reduction in counterfeiting 31 | 26 | |

| – Regulatory Compliance & Data Interoperability | – Transparent, tamper-proof record of activities 47 | – Streamlines audits, reduces errors 48 | 44 | |||

| Internet of Things (IoT) / Sensors | – Real-time Visibility & Condition Monitoring | – Track location and condition (temp, humidity, shock) 26 | – Reduced operational costs by 20%, improved delivery times by 25% 38 | – Reduced temperature excursions by 30% (pilot programs) 31 | 26 | |

| Real-World Data (RWD) | – Supply Chain Risk Mapping & Emergency Response | – Pinpoints bottlenecks, proactive response to delays 42 | – Reroutes resources, identifies urgent gaps in crises 42 | 42 | ||

| – Regulatory Compliance & Effectiveness Measurement | – Localized patient outcomes for compliance 42 | – Flags unexpected side effects, builds trust 42 | 42 |

This table serves as a powerful illustration of the tangible benefits derived from integrating advanced technologies into the generic drug supply chain. By providing quantifiable impacts, it helps to build a compelling business case for investment in these areas, demonstrating how technological adoption translates directly into improved operational efficiency, enhanced quality and safety, and strengthened resilience.

4.5 Strengthening Regulatory Compliance and Harmonization

Robust regulatory compliance and international harmonization are not merely burdens but essential enablers for a streamlined and trustworthy generic drug supply chain.

Adhering to Good Practices is fundamental. Strict adherence to Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) is paramount for ensuring the integrity, safety, and efficacy of drugs throughout their entire lifecycle, from production to patient delivery.11 These practices establish the baseline for quality and operational excellence.

Leveraging digital transformation for compliance can significantly reduce the administrative burden and improve accuracy. AI-powered tools and digital platforms can automate documentation and reporting processes, minimizing human error and staff workload.11 This is particularly crucial for meeting complex regulatory requirements such as the Drug Supply Chain Security Act (DSCSA) in the United States.44 The DSCSA mandates a nationwide system for pharmaceutical traceability, requiring serialization of individual drug packages, electronic data interoperability (often using Electronic Product Code Information Services – EPCIS), robust verification mechanisms, and strict adherence to authorized trading partner (ATP) requirements.44 These measures collectively ensure secure tracking and authentication, significantly reducing the risks of counterfeit or stolen drugs entering circulation.44

Promoting international regulatory harmonization is another critical strategy. Efforts by leading regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) to harmonize standards, such as the ICHM13A guideline for bioequivalence study design, are vital.40 Such harmonization reduces duplication of efforts, improves efficiency in drug development and approval, and enhances global quality and safety standards.40 Collaboration among these agencies can streamline approval processes and foster greater global alignment in regulatory expectations.51

Finally, continuous training and development are indispensable. Providing ongoing training programs for employees on the latest regulatory updates and compliance protocols fosters a deeply ingrained culture of compliance throughout the organization.11 This proactive approach ensures that all stakeholders are well-informed and capable of adhering to evolving standards.

Regulatory complexities and frequent changes often pose significant hurdles for pharmaceutical companies, with non-compliance leading to severe penalties, product recalls, and reputational damage.11 Historically, compliance has often been perceived as a cost center or a bureaucratic necessity. However, by embracing digital transformation, implementing automated systems, and actively pursuing international harmonization, regulatory adherence can be transformed from a reactive chore into a proactive enabler of efficiency and trust. Digital tools reduce human error, accelerate processes such as drug approvals, and, crucially, build and reinforce trust with patients, healthcare providers, and regulatory agencies.11 This shift reframes the narrative from merely the “cost of compliance” to recognizing the profound “value of compliance” in securing the supply chain, ensuring market access, and ultimately enhancing public health.

4.6 Fostering Collaboration and Strategic Partnerships

No single entity can fully streamline the generic drug supply chain; its inherent complexity and global reach necessitate robust collaboration and strategic partnerships across all stakeholders.

Building transparent relationships is a foundational step. Increased transparency among manufacturers, distributors, logistics providers, and healthcare facilities is critical for effective supply chain management.26 This involves establishing clear service-level agreements, adopting transparent pricing models, and openly sharing pipeline development plans and future business needs with critical suppliers.53

Joint planning and data governance are essential for aligning efforts and improving predictive capabilities. Engaging in collaborative planning processes, such as Sales and Operations Planning (S&OP), with suppliers and distributors leads to better alignment between demand and supply and more accurate demand predictions.22 Establishing joint data governance protocols and integrated data platforms enables seamless and secure sharing of critical information, allowing for deeper insights and accelerated research progress.53

Strategic alliances represent a shift from traditional transactional partnerships to relationships aimed at creating long-term value, fostering innovation, and streamlining processes.54 These alliances are particularly beneficial for smaller firms, providing access to larger resources, funding, advanced technology, and established distribution networks, as well as valuable expertise in regulatory affairs and manufacturing.54 For larger pharmaceutical companies, partnering with smaller entities allows them to tap into innovative research, diversify their product pipelines, and explore niche markets with reduced risk.54

Engaging policymakers is a crucial aspect of fostering a supportive environment for supply chain streamlining. Pharmaceutical companies should proactively communicate the inherent complexities and global interdependencies of the supply chain.21 They should advocate for government partnerships, including incentives such as fast-tracked permitting, tax incentives, and long-term contracts that de-risk investments in domestic manufacturing and diversified sourcing.7 Sharing case studies of successful public-private partnerships can further illustrate the benefits of such collaborations.21

Shared responsibility models are necessary to address systemic issues like drug shortages. Recognizing that these shortages are not solely a manufacturing issue, stakeholders must engage in nuanced discussions about shared accountability, including the sensitive topic of drug pricing.21 Solutions can include incentives for hospitals to maintain buffer inventories and enhanced notification requirements to proactively avoid shortages.21

Finally, developing a best-in-class procurement and contracting function is vital for effective supplier management. This involves equipping internal teams with skilled negotiators and implementing systems for monitoring supplier performance, ensuring regulatory compliance, and managing risks effectively.53

The generic drug supply chain is characterized by its complexity, fragmentation, and the involvement of numerous stakeholders, each often operating with different objectives.20 This siloed approach frequently leads to coordination failures and heightened vulnerabilities.20 The path to true resilience and efficiency requires a fundamental shift from isolated efforts to a collaborative ecosystem where information is shared transparently, incentives are aligned, and risks are collectively managed. This “interdependence imperative” extends beyond individual companies to encompass public-private partnerships, recognizing that policy frameworks must actively support industry investments in resilience, rather than solely driving cost reduction. This collaborative model is indispensable for addressing pervasive issues like drug shortages and ensuring the long-term sustainability and reliability of the generic drug supply for patients worldwide.

5. Quantifiable Benefits and Illustrative Case Studies

The adoption of best practices and advanced technologies in the generic drug supply chain yields significant, quantifiable benefits across efficiency, cost savings, quality, safety, and resilience. These improvements are not merely theoretical but are demonstrated through various industry applications and case studies.

Evidence of Improved Efficiency and Cost Savings

Overall supply chain optimization leads to tangible gains. Reducing complexity and inefficiency directly translates into faster and more reliable delivery of generic drugs to patients, alongside significant cost savings for healthcare systems.40

The implementation of Lean Manufacturing principles has shown remarkable results. Case studies indicate that lean practices can increase production by as much as 50% in certain manufacturing settings, such as an Indian startup.29 Furthermore, lean methodologies lead to improved efficiency KPIs, reduced Work-in-Process (WIP), shortened cycle times, and more efficient space utilization.32

AI-driven optimization provides substantial benefits:

- In inventory management, AI systems have achieved a 94% forecast accuracy rate for a major pharmacy chain, a significant improvement over traditional methods.36 During a cold and flu season, an AI system automatically adjusted reorder points, resulting in a 15% reduction in stockouts.36 A hospital network reduced its inventory holding costs by 23% while simultaneously decreasing emergency orders by 35% through AI-driven inventory optimization.36 Overall, AI is projected to reduce forecast error by up to 50%.31

- In manufacturing, AI-driven systems reduce errors and improve product consistency.34 Merck, for instance, improved production uptime by 20% in its IoT-powered factories through predictive maintenance.35

- Integrating AI and IoT into logistics can reduce operational costs by up to 20% and improve delivery times by 25%.38

Advanced Planning & Scheduling (APS) systems have demonstrated their value by achieving a 30% reduction in lead times and a 25% decrease in inventory carrying costs within the pharmaceutical industry.31 Additionally, optimizing packaging through the use of biodegradable insulation and recyclable containers can lower shipping costs by up to 10% due to weight savings.27

Reduced Shortages and Enhanced Quality

Technological advancements also directly contribute to mitigating drug shortages and enhancing product quality:

- Real-time visibility platforms are highly effective in preventing issues, with companies reporting up to a 70% reduction in product recalls.38

- AI for quality control offers unprecedented precision. At a leading pharmaceutical facility in Switzerland, high-resolution cameras coupled with deep learning algorithms achieved 99.2% accuracy in tablet inspection, significantly surpassing manual methods.36 Such systems have also led to a 35% reduction in batch rejections by identifying subtle patterns indicative of potential quality problems.36

- Blockchain technology plays a crucial role in combating counterfeiting, with one major pharmaceutical company implementing an AI-powered system that reduced counterfeit incidents by 47% across its distribution network.36 Blockchain implementation is projected to reduce counterfeiting in tracked products by 80% 31 and has been shown to reduce compliance delays by 25% in Europe.29

- Resilient supply chains, built on these best practices, have demonstrated the ability to recover 50% faster from disruptions and maintain approximately 15% higher service levels during crisis periods.31

- Predictive analytics in cold chain management has reduced temperature excursions by up to 30% in pilot programs, preserving product integrity.31 Optimal safety stock models are expected to reduce stockouts by 85% while decreasing overall inventory costs by 30%.31

Illustrative Case Studies

Several real-world examples underscore the transformative impact of these strategies:

- Lupin Pharmaceuticals and UPS Healthcare: Faced with the challenge of managing thousands of pallets of generic pharmaceuticals imported annually with low tolerance for delays, Lupin partnered with UPS Healthcare. UPS successfully converted Lupin’s entire U.S. supply chain in just seven weeks, a process that typically takes up to five months, moving 5,000 pallets with minimal interruption.55 UPS now manages Lupin’s generic drug inventory, effectively avoiding back-orders and delays, and adeptly handling fluctuating demand. This partnership significantly improved Lupin’s speed-to-market and reliability, enabling quicker new product launches and enhancing their competitiveness.55 Furthermore, UPS helped Lupin reduce transportation costs by converting 6% of its air volume to ground transport at the same speed, resulting in savings of $0.50 per pound.55

- Merck’s IoT-Powered Factories: Merck implemented Internet of Things (IoT) sensors across its manufacturing facilities to collect real-time data on equipment performance and environmental variables. By utilizing predictive analytics on this data, Merck was able to cut unexpected downtime and reduce production variability, leading to a 20% improvement in production uptime.35

- Novartis and Digital Twins: Novartis adopted digital twin technology to simulate production processes and test changes virtually before physical implementation. This approach enabled the company to reduce tech transfer time and efficiently validate process changes across its global manufacturing sites.35

- Pfizer and Moderna (Cloud/AI for Vaccine Development): While not generic drugs, the rapid development of COVID-19 vaccines by companies like Pfizer and Moderna showcases the power of advanced technologies in pharmaceutical supply chains. Both companies accelerated vaccine development by scaling analytics pipelines, simulating compound interactions, and analyzing vast amounts of clinical trial data using cloud-based infrastructure and AI models.35 This demonstrates the potential for similar technological applications in streamlining generic drug development and supply.

The following table provides a concise summary of the quantifiable benefits observed from generic drug supply chain optimization efforts.

Table 5.1: Quantifiable Benefits of Generic Drug Supply Chain Optimization

| Area of Optimization | Specific Benefit | Quantifiable Impact / Metric | Source |

| Operational Efficiency | Reduced Operational Costs | Up to 20% reduction (AI & IoT integration) | 38 |

| Improved Delivery Times | 25% improvement (AI & IoT integration) | 38 | |

| Reduced Lead Times | 30% reduction (Advanced Planning & Scheduling) | 31 | |

| Reduced Inventory Carrying Costs | 25% decrease (Advanced Planning & Scheduling) | 31 | |

| Increased Production / Yield | 50% increase (Lean practices in Indian startup) | 29 | |

| Production Uptime Improvement | 20% improvement (Merck’s IoT-powered factories) | 35 | |

| Quality & Safety | Reduced Product Recalls | Up to 70% reduction (Real-time visibility) | 38 |

| Improved Quality Control Accuracy | 99.2% accuracy in tablet inspection (AI) | 36 | |

| Reduced Batch Rejections | 35% reduction (AI-driven predictive analytics) | 36 | |

| Reduced Counterfeiting | 47% reduction (AI-powered system); Projected 80% reduction (Blockchain) | 31 | |

| Reduced Compliance Delays | 25% reduction (Blockchain in Europe) | 29 | |

| Resilience & Risk Management | Faster Recovery from Disruptions | 50% faster recovery (Resilient supply chains) | 31 |

| Higher Service Levels during Crisis | 15% higher (Resilient supply chains) | 31 | |

| Reduced Temperature Excursions | Up to 30% reduction (Predictive analytics in cold chain) | 31 | |

| Reduced Stockouts | 15% reduction (AI inventory management); 85% reduction (Optimal Safety Stock models) | 31 | |

| Reduced Inventory Holding Costs | 23% reduction (AI-driven inventory optimization) | 36 | |

| Forecasting Accuracy | Improved Forecast Accuracy | 94% accuracy (AI-based system); 20-30% improvement (Advanced analytics); Up to 50% reduction in forecast error (AI) | 31 |

These quantifiable benefits and illustrative case studies provide compelling evidence of the strategic and operational advantages gained by implementing the outlined best practices. They underscore that investment in streamlining the generic drug supply chain translates directly into improved performance, enhanced patient safety, and greater resilience against future disruptions.

6. Future Outlook and Strategic Imperatives

The generic drug supply chain is at an inflection point, driven by evolving market dynamics, technological advancements, and a heightened focus on global health security. The future trajectory will be shaped by several converging trends and strategic imperatives.

Emerging Trends in Generic Drug Supply Chain Management

The industry is poised for a significant transformation, largely propelled by continued digitalization. Artificial Intelligence (AI), the Internet of Things (IoT), and predictive analytics are revolutionizing various aspects of the supply chain, from demand forecasting to inventory optimization and real-time monitoring.19 AI, in particular, is projected to generate hundreds of billions of dollars annually for the pharmaceutical sector by 2025.34

The adoption of advanced manufacturing technologies is gaining momentum. Increased use of techniques like continuous manufacturing for Key Starting Materials (KSMs) and Active Pharmaceutical Ingredients (APIs) can reduce vulnerabilities associated with geographic concentration and improve cost-effectiveness.7 These technologies enable new synthesis methods that were historically more cost-effective to produce abroad.7

Blockchain technology is maturing and will play an increasingly vital role. It is expected to provide tamper-evident records of product journeys, significantly enhancing traceability and combating counterfeit drugs.31 The market for blockchain in pharmaceutical supply chain management is projected to grow substantially in the coming years.45

Finally, the integration of Real-World Data (RWD) will become essential for future-proofing the generic drug ecosystem.42 RWD provides real-time, granular insights for mapping supply chain risks, navigating complex regulatory landscapes, and powering emergency responses during crises.42 It allows for a more dynamic and responsive approach to supply chain management, moving beyond historical data to incorporate real-time patient outcomes and market shifts.

The Ongoing Push for Domestic Manufacturing and Supply Chain Resilience

Recent global events have underscored the critical need for greater supply chain resilience, leading to a concerted policy focus on bringing more pharmaceutical manufacturing stateside.19 Governments and policymakers are increasingly recognizing the strategic importance of reducing dependence on overseas suppliers, particularly for essential medicines, to mitigate risks associated with geopolitical tensions, trade disputes, and natural disasters.19

The drive for domestic production is rooted in the belief that it can lead to fewer quality concerns, fewer shortages, and a more predictable supply and pricing for generic drugs.30 This localization effort is viewed as a crucial step towards national health security and preparedness for future public health emergencies. To facilitate this shift, policymakers are actively considering various

investment incentives, including fast-tracked permitting, tax breaks, and long-term government contracts designed to de-risk significant capital investments in domestic production facilities.7 Such incentives aim to make domestic manufacturing financially viable despite the razor-thin margins often associated with generic drugs.

Policy Recommendations for Sustainable Generic Drug Markets

To foster truly sustainable generic drug markets, policy interventions must address the underlying economic incentives that currently undermine supply chain resilience.

One critical area is reforming reimbursement models. Current models, which often prioritize the lowest price, can inadvertently destabilize the supply chain. Policymakers should consider shifting towards payment models that explicitly incentivize supply chain quality, resilience, and the maintenance of strategic reserves.5 This could involve offering higher reimbursement rates to manufacturers who demonstrate high quality and resilience, or by excluding essential medicines from Maximum Allowable Cost (MAC) lists that cap prices, thereby allowing prices for critical drugs to rise and provide greater incentive for investment.5 Additionally, unbundling reimbursement for essential medicines in outpatient centers or hospitals could empower healthcare providers to choose higher-quality medications without financial penalties.5

Another avenue for policy intervention is lowering regulatory costs. Policymakers could consider reducing or restructuring the Generic Drug User Fee Amendments (GDUFA) fees as an incentive for manufacturers willing to invest in supply chain resilience, increase production scale, or enter markets with drug shortages.5 This would directly reduce manufacturers’ expenses, boosting their financial incentive to invest in a more robust supply chain.5

However, any financial incentives must be coupled with increased FDA oversight. This is crucial to ensure that companies receiving subsidies are committed to long-term quality and resilience, preventing them from claiming benefits for short-term gains and then exiting the market.5 Such oversight would transform these incentives into enforceable agreements that guarantee a safe, high-quality, and accessible supply of prescription medications.

The Increasing Role of Sustainability Initiatives (ESG) in Supply Chain Decisions

Beyond economic and operational considerations, sustainability initiatives, encompassing Environmental, Social, and Governance (ESG) principles, are increasingly influencing supply chain decisions in the pharmaceutical sector. The pharmaceutical industry is a significant contributor to global carbon emissions, with a majority (approximately 4.4%) stemming from supply chain activities.41

This environmental footprint is driving a push for more sustainable practices. Embracing end-to-end visibility, innovating in cold chain logistics, and optimizing packaging through the use of biodegradable and recyclable materials are key strategies to reduce environmental impact and waste.27 For instance, adopting reusable shippers has prevented millions of pounds of waste from landfills.41

Collaborative ESG goals are becoming standard. Fostering collaboration with suppliers, Third-Party Logistics (3PL) providers, and technology partners is essential for driving progress towards sustainability objectives.27 Integrating sustainability metrics into supplier scorecards encourages partners to reduce their carbon footprints and improve environmental performance.27 This collective effort is vital for shaping a greener future for the pharmaceutical industry.

The generic drug supply chain faces persistent challenges, including chronic shortages, quality concerns, and intense cost pressures, all of which are driving a push for greater resilience.5 Simultaneously, the pharmaceutical industry is undergoing a profound wave of digitalization, characterized by the widespread adoption of AI, blockchain, IoT, and Real-World Data (RWD).19 Concurrently, there is growing societal and regulatory pressure for enhanced sustainability and adherence to Environmental, Social, and Governance (ESG) principles.27 These three seemingly distinct trends—resilience, digitalization, and sustainability—are not isolated but are converging and mutually reinforcing. Digital technologies provide the foundational tools for enhanced visibility, predictive capabilities, and automated processes, which are indispensable for building supply chain resilience. Furthermore, resilient supply chains, by their very nature, contribute to sustainability through reduced waste, optimized resource utilization (e.g., preventing spoilage in cold chains), and more efficient operations. This alignment means that investments in resilience often yield positive environmental outcomes. Moreover, the pursuit of sustainability goals frequently necessitates greater transparency and deeper collaboration across the supply chain, which are also key enablers of resilience. This convergence suggests a holistic strategic imperative for the future: a truly streamlined generic drug supply chain will be one that is digitally advanced, inherently resilient against disruptions, and deeply committed to environmental and social governance. This integrated approach is critical not only for long-term viability and profitability but also for ensuring public health and patient access to essential medications.

Conclusion: A Resilient and Efficient Future for Generic Drugs

The generic drug supply chain is an indispensable component of global healthcare, providing affordable and accessible medications that form the backbone of modern treatment paradigms. Despite its critical role, this sector faces persistent and complex systemic vulnerabilities, including intense pricing pressures, a concentrated global manufacturing footprint for key ingredients, and intricate regulatory landscapes. These challenges frequently manifest as drug shortages, quality control issues, and operational inefficiencies, ultimately impacting patient access and public trust.

Streamlining this vital supply chain is not merely an operational goal but a strategic imperative. As this report has detailed, achieving this requires a comprehensive, multi-pronged approach. This encompasses the strategic adoption of advanced technologies, such as Artificial Intelligence, blockchain, and IoT, to enhance real-time visibility, predictive capabilities, and automated quality control. It demands a fundamental shift towards diversified sourcing models and geographic manufacturing, moving beyond a singular focus on cost-efficiency to prioritize resilience and redundancy. Furthermore, robust quality management systems, continuously improved through digital transformation, are essential to ensure product integrity and build confidence. Finally, fostering deep collaboration and strategic partnerships across the entire ecosystem—from manufacturers and distributors to healthcare providers and policymakers—is crucial for aligning incentives and collectively managing risks.

The future of the generic drug supply chain lies in this integrated approach. By embracing digitalization, investing in resilience, and embedding sustainability into every facet of operations, the industry can move towards a future where generic drugs are not only cost-efficient but also consistently available, of the highest quality, and delivered through a transparent and robust network. This vision of a streamlined, resilient, and efficient generic drug supply chain is attainable through continued innovation, strategic investment, and a shared commitment from all stakeholders to prioritize patient health and access above all else.

Works cited

- Sourcing Key Starting Materials (KSMs) for Pharmaceutical Active Pharmaceutical Ingredients (APIs): A Strategic Imperative for Resilience – DrugPatentWatch – Transform Data into Market Domination, accessed July 26, 2025, https://www.drugpatentwatch.com/blog/sourcing-the-key-starting-materials-ksms-for-pharmaceutical-active-pharmaceutical-ingredients-apis/

- The Generic Drug Supply Chain | Association for Accessible Medicines, accessed July 26, 2025, https://accessiblemeds.org/resources/blog/generic-drug-supply-chain/

- Datex Blog | How Does The Pharmaceutical Supply Chain Work?, accessed July 26, 2025, https://www.datexcorp.com/pharmaceutical-supply-chain-2/

- Optimizing the Generic Drug Supply Chain: Strategies for Success – DrugPatentWatch, accessed July 26, 2025, https://www.drugpatentwatch.com/blog/optimizing-the-generic-drug-supply-chain-strategies-for-success/

- Overcoming Formulation Challenges in Generic Drug Development – DrugPatentWatch, accessed July 26, 2025, https://www.drugpatentwatch.com/blog/overcoming-formulation-challenges-in-generic-drug-development/

- Ensuring a high-quality and resilient supply chain of essential …, accessed July 26, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10372977/

- Building Resilient Pharma Supply Chains in an Uncertain World, accessed July 26, 2025, https://www.pharmasalmanac.com/articles/building-resilient-pharma-supply-chains-in-an-uncertain-world

- USP Expert Discusses Balancing Drug Cost, Quality, and Access in a Changing Trade Landscape – Pharmacy Times, accessed July 26, 2025, https://www.pharmacytimes.com/view/usp-expert-discusses-balancing-drug-cost-quality-and-access-in-a-changing-trade-landscape

- Analysis of Drug Shortages, 2018-2023 – NCBI Bookshelf, accessed July 26, 2025, https://www.ncbi.nlm.nih.gov/books/NBK611681/

- Analysis of Drug Shortages, 2018-2023 – HHS ASPE, accessed July 26, 2025, https://aspe.hhs.gov/reports/drug-shortages-2018-2023