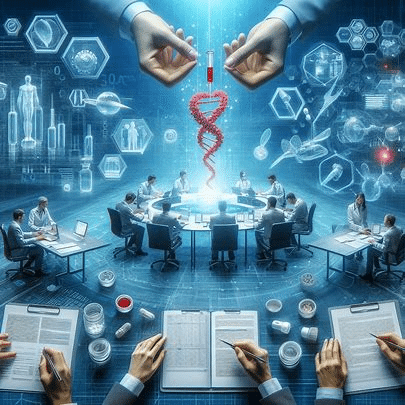

The pharmaceutical industry stands at the precipice of a transformative era, driven by the burgeoning biosimilar market. This shift is not merely an evolution in drug development but a fundamental redefinition of how biological medicines are brought to patients. For pharmaceutical and biotechnology companies, mastering the intricacies of regulatory interactions for biosimilars is no longer a mere compliance exercise; it has become a decisive strategic imperative that dictates market entry, competitive positioning, and long-term commercial success.

The Dawn of the Biosimilar Era: A Paradigm Shift in Biologics

The journey into the biosimilar era begins with a precise understanding of what these products represent. A biosimilar is fundamentally a biological product that has been rigorously demonstrated to be “highly similar” to an already approved reference biological product, exhibiting “no clinically meaningful differences” in terms of safety, purity, and potency . This foundational definition is paramount, as it fundamentally reshapes the entire regulatory paradigm. Unlike novel biologics, which require extensive de novo efficacy and safety trials, biosimilar development pivots on a meticulous demonstration of comparability to an established reference product. This reorients the scientific and regulatory focus from proving a drug’s independent therapeutic effect to proving its functional and clinical equivalence to an existing, well-characterized biologic.

The advent of biosimilars carries profound implications for both public health and global economies. They are more than just follow-on versions of complex medicines; they represent a critical pathway to enhancing patient access to life-saving and life-altering therapies, particularly in therapeutic areas previously dominated by high-cost originator biologics. By offering more affordable alternatives, biosimilars contribute significantly to reducing healthcare expenditures, thereby alleviating strain on national healthcare systems and expanding treatment options for a broader patient population. This societal benefit creates a compelling impetus for regulatory bodies worldwide to facilitate their efficient market entry, provided that the stringent scientific standards for comparability are rigorously met. The very nature of biosimilar approval, rooted in demonstrating “highly similar” characteristics and “no clinically meaningful differences” , inherently shifts the regulatory dialogue. It moves away from traditional, large-scale clinical trials designed to establish primary efficacy and safety endpoints, towards a comprehensive analytical and functional characterization, followed by targeted clinical studies designed to confirm comparability. This fundamental reorientation dictates the types of data required, the nature of questions posed by regulatory agencies, and the strategic narrative a company must meticulously construct during its interactions. Understanding this distinction is crucial for shaping pre-submission strategies and data generation plans, ensuring that scientific and financial resources are concentrated on demonstrating the robust comparability that agencies prioritize.

The High Stakes of Biosimilar Development: Why Regulatory Excellence Matters

The global biosimilar market is not merely expanding; it is experiencing explosive growth, with projections indicating a staggering rise to $83.6 billion by 2029, driven by an impressive Compound Annual Growth Rate (CAGR) of 23.4% . This remarkable statistic serves as a powerful testament to the immense commercial opportunity that biosimilars present, simultaneously underscoring the urgent need for efficient and effective regulatory pathways. This burgeoning market inevitably fosters an environment of intense competition. In such a landscape, the speed and efficiency with which a biosimilar can navigate the regulatory approval process become decisive factors in capturing market share and establishing a sustainable commercial footprint. While the average time from the initiation of the first biosimilar clinical trial to final approval remains a substantial 7-10 years , every single month saved through a meticulously executed and strategically informed regulatory approach translates directly into a significant competitive advantage and accelerated revenue capture.

The substantial investments in research and development (R&D) required for biosimilar development mean that regulatory missteps, protracted delays, or outright rejections can result in catastrophic financial losses. Therefore, effective and proactive regulatory interactions are not just about securing approval; they function as a critical risk mitigation tool, safeguarding significant corporate investments. The rapid expansion of the biosimilar market , when juxtaposed with the inherently lengthy development timeline , creates a unique and intense pressure cooker environment. Despite the market’s swift growth, the individual product development cycle remains prolonged. This means that even seemingly minor inefficiencies or delays in regulatory interactions can accrue into substantial opportunity costs and a critical loss of market share to agile competitors. This dynamic elevates the role of regulatory affairs from a purely compliance-oriented function to a core strategic business driver. A 23.4% CAGR signifies a market where first-mover advantage is paramount. If a product requires 7-10 years to reach approval , then any delay in regulatory review directly erodes the period of market exclusivity and profitability. Consequently, optimizing regulatory interactions transcends the mere objective of obtaining approval; it is fundamentally about accelerating that approval. This necessitates the cultivation of proactive, highly efficient, and strategically astute regulatory affairs teams capable of anticipating and mitigating potential roadblocks, thereby effectively shortening the “time to market” within the overall development timeline and maximizing the return on investment for the enterprise.

Beyond Compliance: Turning Regulatory Affairs into a Strategic Asset

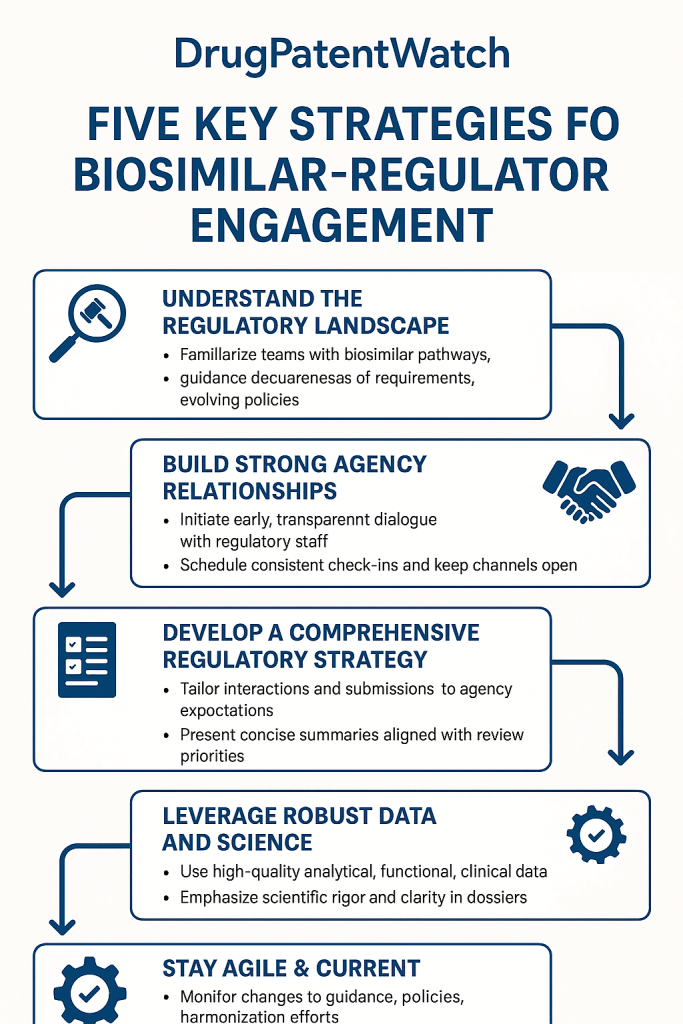

Leading pharmaceutical and biotechnology companies have recognized that achieving regulatory success extends far beyond merely reacting to agency demands. Instead, it involves a proactive approach: strategically shaping the dialogue, anticipating potential questions, and guiding the agency through a compelling and coherent data narrative. This paradigm shift transforms regulatory affairs from a necessary administrative function into a powerful strategic asset.

A deep understanding of regulatory agency expectations, their evolving scientific perspectives, and past precedents provides invaluable intelligence. This intelligence can inform critical development strategies, optimize the design of clinical trials, and significantly strengthen intellectual property positioning. For instance, understanding the nuances of how different agencies interpret “highly similar” or what constitutes sufficient analytical comparability can directly influence early-stage development decisions, potentially saving years and millions in R&D. The modern regulatory affairs professional is no longer confined to the role of a gatekeeper or document manager. Instead, they operate as a strategic partner, collaborating intimately with R&D, manufacturing, commercial, and legal teams. Their expertise lies in translating complex scientific and regulatory requirements into actionable business strategies, ensuring that development programs are aligned with regulatory expectations from inception. The transition of regulatory affairs from a “compliance” function to a “strategic asset” necessitates a fundamental shift in organizational mindset. It requires viewing regulatory interactions not as a series of hurdles to be overcome, but as a dynamic dialogue that can be influenced and optimized. This implies a significant investment in regulatory talent—individuals who possess not only profound scientific and regulatory knowledge but also exceptional communication, negotiation, and strategic thinking skills. The high success rate of biosimilar approvals once accepted for review (exceeding 90% for the FDA) further underscores that the most critical battles are often won before the final submission. These victories are secured during the strategic interactions and data generation phases, making the proactive input of the regulatory team an invaluable contribution to the overall program success. If regulatory affairs is to be a true “strategic asset,” it must move beyond simply completing forms and submitting documents. This demands proactive engagement, a deep understanding of the agency’s perspective, and the ability to shape the narrative around the biosimilar’s comparability. Such a role necessitates a highly skilled regulatory team capable of anticipating agency questions , meticulously preparing for meetings , and effectively communicating complex scientific data . This strategic foresight and proactive engagement can significantly enhance the program’s efficiency and commercial viability.

Understanding the Global Biosimilar Ecosystem: Market Dynamics and Regulatory Foundations

To effectively navigate the biosimilar landscape, a foundational understanding of its global market dynamics and the core principles governing its regulation is essential. This section delves into these critical aspects, providing the context necessary for strategic engagement.

The Global Biosimilar Market: Drivers and Opportunities

The global biosimilar market, projected to reach $83.6 billion by 2029 , is characterized by significant growth across various therapeutic areas. Key areas ripe for biosimilar penetration include oncology, immunology, and diabetes, which often feature high-cost originator biologics facing impending patent expirations. The primary drivers fueling this growth are multifaceted: the inevitable patent expiry of blockbuster biologics, the relentless global increase in healthcare costs, and proactive government initiatives aimed at promoting biosimilar adoption through favorable policies and procurement strategies. These factors collectively create a robust environment for biosimilar development and market entry.

However, opportunities are accompanied by persistent challenges. These include complex market access dynamics, which vary significantly by region and often involve intricate pricing and reimbursement negotiations. There is also a continuous need for extensive education campaigns targeting physicians, pharmacists, and patients to build trust and overcome lingering perceptions or biases against biosimilars compared to their reference products. These educational efforts are crucial for fostering broader acceptance and uptake. The substantial market growth , coupled with the imperative for cost reduction within healthcare systems globally, creates a powerful tailwind for biosimilars. This environment suggests that regulatory agencies are increasingly receptive to efficient pathways for biosimilar approval, provided that scientific rigor and patient safety are maintained. This presents a unique opportunity for companies to engage proactively with regulatory bodies, potentially influencing the evolution of regulatory guidance through participation in pilot programs or by providing constructive feedback. Such engagement can position companies as thought leaders and early adopters in a rapidly developing regulatory space. A high Compound Annual Growth Rate (CAGR) for the biosimilar market signals strong demand and a receptive environment. If governments and healthcare systems are actively seeking cost-effective alternatives, and biosimilars are a key solution, then regulatory agencies are implicitly under pressure to facilitate their market entry, assuming safety and efficacy are assured. This suggests that agencies function not merely as gatekeepers but also as facilitators, provided the scientific and safety standards are met. Companies can strategically leverage this by demonstrating not only scientific equivalence but also the broader societal benefits of their biosimilar, potentially influencing the speed and nature of regulatory review through collaborative dialogue and a compelling narrative that extends beyond pure scientific data.

Foundational Principles of Biosimilar Regulation

The bedrock of biosimilar regulation across major global markets is the “Totality of Evidence” approach. This principle dictates that regulatory agencies assess biosimilarity based on a comprehensive package of data, encompassing extensive analytical, functional, non-clinical, and targeted clinical studies, rather than relying on a single, pivotal clinical trial . This holistic view ensures a robust and multifaceted demonstration of comparability. The ultimate goal remains to demonstrate “no clinically meaningful differences” to the reference product . This is a critical distinction from novel drug development, where independent efficacy and safety are paramount. For biosimilars, the focus is on confirming that the new product behaves essentially identically to the established reference product in terms of safety, purity, and potency.

Biosimilar development typically follows an iterative, stepwise process. This usually begins with extensive physicochemical and biological characterization, progressing to non-clinical studies, and culminating in targeted clinical trials. A significant advantage of this approach is the potential for reduction or even waiver of certain clinical trials, contingent upon the strength and comprehensiveness of robust upstream analytical and non-clinical data . The “Totality of Evidence” principle and the potential for reduced clinical trials are intrinsically linked and represent a cornerstone of biosimilar development strategy. This connection implies that the quality, depth, and sophistication of early-stage analytical and functional characterization data hold disproportionate importance. Strong, compelling early data can significantly de-risk and accelerate the entire development program by providing a robust justification for a reduced clinical burden. This means that regulatory interactions concerning the design of Phase 1 and Phase 3 clinical trials are heavily dependent on the strength and completeness of the pre-clinical and analytical package submitted. If clinical trials can be reduced or waived based on compelling comparability data, then the strategic focus for developers shifts significantly towards front-loading investment in highly sophisticated analytical and functional assays. Regulatory agencies will scrutinize these early data packages with intense rigor. Therefore, effective regulatory interactions at the pre-Investigational New Drug (IND) or scientific advice stage should concentrate on aligning with the agency regarding the sufficiency of non-clinical data to potentially reduce or eliminate later-stage clinical studies. This direct correlation impacts R&D costs and development timelines. This early investment in robust characterization and a strategic dialogue with regulators can dramatically improve a biosimilar program’s efficiency and overall commercial viability.

Deep Dive into Key Regulatory Frameworks: FDA, EMA, and Beyond

Navigating the global biosimilar landscape requires a detailed understanding of the primary regulatory pathways in major markets. While scientific principles of comparability are largely shared, the procedural aspects and specific requirements can differ significantly between regions.

The U.S. Landscape: FDA’s 351(k) Pathway

The legal framework for biosimilars in the United States was established by the Biologics Price Competition and Innovation Act (BPCIA) of 2009, which created a distinct and abbreviated pathway for the approval of follow-on biological products under section 351(k) of the Public Health Service Act . This landmark legislation carved out a unique regulatory route, acknowledging the inherent complexity of biologics compared to small molecule drugs.

Under the 351(k) pathway, the FDA distinguishes between two categories of biosimilars: “biosimilar” and “interchangeable biosimilar.” While both designations require a demonstration of biosimilarity to a reference product, interchangeability carries a higher evidentiary bar . An interchangeable biosimilar must demonstrate that it can be expected to produce the “same clinical result” as the reference product in any given patient. Furthermore, for products administered more than once, the applicant must show that the risk in terms of safety or diminished efficacy of alternating or switching between the interchangeable biosimilar and the reference product is no greater than the risk of using the reference product without such alternation or switch . This additional requirement typically necessitates specific “switching studies” to support the designation. The FDA has also issued numerous guidance documents that provide detailed expectations for biosimilar development and review. These documents elaborate on specific requirements for analytical, non-clinical, and clinical studies, continually evolving as the agency gains more experience with biosimilar applications and as scientific understanding advances.

The distinction between “biosimilar” and “interchangeable biosimilar” in the U.S. creates a tiered regulatory and market access strategy for companies. While a biosimilar designation allows for market entry, achieving interchangeability provides a significant competitive advantage, primarily through pharmacy-level substitution without requiring intervention from the prescribing physician. This means that companies must strategically assess the commercial value of pursuing interchangeability against the additional regulatory burden and data requirements it entails. This assessment should then inform and tailor their early interactions with the FDA, focusing on aligning the development plan with the desired regulatory outcome. The 351(k) pathway offers two levels of approval, with interchangeability demanding a higher evidentiary standard, often involving costly and time-consuming switching studies. Companies must therefore conduct a thorough cost-benefit analysis early in development to determine if the market advantage conferred by interchangeability justifies the additional investment in clinical trials. Regulatory interactions should proactively explore the FDA’s current expectations for interchangeability data, as these can evolve. This ensures that the development plan remains aligned with the most current agency thinking and the company’s strategic commercial objectives.

The European Approach: EMA’s Centralized Procedure

In Europe, the European Medicines Agency (EMA) oversees the regulatory framework for biosimilars through its centralized procedure. This procedure allows for a single marketing authorization that is valid across all 27 European Union (EU) member states, as well as in Iceland, Liechtenstein, and Norway. This streamlined approach significantly simplifies market access within the bloc, offering a unified regulatory pathway for developers .

While sharing similar scientific principles of comparability with the U.S. FDA, the EMA’s procedural aspects and specific nuances differ significantly. For instance, the EMA has a well-established and highly utilized scientific advice mechanism, which allows developers to seek formal guidance on their development programs at various stages. Unlike the U.S., there is no direct “interchangeability” designation at the EU level. Instead, decisions regarding the substitution of biosimilars for reference products are typically made at the national level by individual member states’ healthcare systems or regulatory bodies . This necessitates a country-by-country understanding of substitution policies for market access. The EMA’s guidance documents, developed by its Committee for Medicinal Products for Human Use (CHMP), provide comprehensive scientific guidelines for biosimilar development, covering aspects from quality and non-clinical data to clinical comparability.

The EMA’s centralized procedure offers a distinct advantage for companies seeking broad European market access through a single application. However, the absence of an EU-wide interchangeability designation means that market access strategies must account for national-level substitution policies. This requires a nuanced understanding of each member state’s healthcare system and regulatory environment, adding a layer of complexity to post-approval commercialization efforts. The EMA’s emphasis on scientific advice provides a crucial opportunity for early and continuous dialogue with regulators. Companies can leverage this mechanism to gain clarity on specific data requirements, discuss novel scientific approaches, and align their development plans with EMA expectations, thereby de-risking the program and potentially accelerating the review process. The EMA’s centralized procedure provides a clear pathway for approval across the EU, but the lack of a unified interchangeability designation means that market access strategies must be tailored to individual member states. This implies that while the regulatory approval process is centralized, the commercialization strategy must be decentralized and highly adaptable to national substitution policies. Companies should engage with national authorities in parallel with EMA interactions to understand and prepare for market access challenges.

Other Key Regulatory Authorities and Emerging Markets

Beyond the FDA and EMA, several other major regulatory authorities have established robust biosimilar pathways. Health Canada, for example, has its own comprehensive guidance documents for biosimilars, emphasizing a “totality of evidence” approach similar to the FDA and EMA. Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) also has a well-defined regulatory framework, often requiring specific bridging studies to demonstrate applicability of foreign data to the Japanese population. In Australia, the Therapeutic Goods Administration (TGA) follows a similar scientific approach.

Emerging markets, such as those in Latin America, Asia-Pacific, and parts of Africa, are increasingly developing their own biosimilar regulatory frameworks. While many of these frameworks draw inspiration from the FDA and EMA models, they often present unique local requirements, including specific clinical trial populations, local manufacturing considerations, or different intellectual property landscapes. Navigating these diverse and sometimes evolving regulatory environments requires a flexible and regionally informed strategy. For companies targeting global market penetration, a “one-size-fits-all” approach to regulatory interactions is insufficient. Instead, a deep understanding of each target market’s specific regulatory nuances, cultural considerations, and local scientific expectations is paramount. This often necessitates engaging local regulatory expertise and building strong relationships with regional authorities.

Table 1: Comparative Analysis of Key Biosimilar Regulatory Pathways (FDA vs. EMA)

| Feature | FDA (U.S.) 351(k) Pathway | EMA (Europe) Centralized Procedure |

| Legal Basis | Biologics Price Competition and Innovation Act (BPCIA) | EU Directive 2001/83/EC, Regulation (EC) No 726/2004 |

| Approval Scope | Single approval for U.S. market | Single approval for all EU/EEA member states |

| Interchangeability | Specific “Interchangeable Biosimilar” designation | No EU-level interchangeability; national decisions |

| Scientific Advice | Formal meeting types (e.g., Type 2, BPD, Biosimilar) | Well-established “Scientific Advice” mechanism |

| Data Requirements | Totality of Evidence (analytical, non-clinical, clinical) | Totality of Evidence (quality, non-clinical, clinical) |

| Post-Approval | Pharmacovigilance, labeling, switching studies for IBL | Pharmacovigilance, national substitution policies |

| Key Guidance | Various FDA guidances (e.g., Q&A, Interchangeability) | EMA Guidelines on Biosimilars (e.g., general, product-specific) |

Mastering Pre-Submission Strategies: Laying the Groundwork for Success

The foundation of a successful biosimilar regulatory journey is laid long before the submission of a marketing application. Proactive and meticulous pre-submission strategies are critical for de-risking the development program, aligning with agency expectations, and ultimately accelerating the path to approval.

Early Engagement: The Power of Scientific Advice and Pre-IND Meetings

Early and consistent engagement with regulatory agencies is not merely a recommendation; it is a strategic imperative. Seeking scientific advice or holding pre-Investigational New Drug (IND) meetings allows developers to obtain formal feedback on their development plans, particularly concerning the comparability exercise. These early interactions provide an invaluable opportunity to clarify regulatory expectations, discuss the adequacy of the proposed analytical and non-clinical studies, and align on the design of clinical trials, especially regarding the potential for reduced clinical burden based on robust upstream data . Such early dialogue can prevent costly missteps and significantly streamline the entire development process. These meetings are especially crucial for novel biosimilar targets or when proposing innovative comparability approaches, where agency guidance is less established.

The importance of early engagement cannot be overstated. It allows companies to “test the waters” with their scientific rationale and proposed development plan before committing significant resources. This iterative dialogue helps refine the comparability strategy, ensuring that the data generated will meet the agency’s evolving scientific thinking. By proactively seeking feedback, companies can identify potential gaps or areas of concern early, mitigating the risk of late-stage surprises that could lead to costly delays or even rejection. This proactive approach transforms the regulatory process from a reactive response to agency queries into a collaborative dialogue aimed at mutual understanding and efficient progress.

Data Generation Strategy: Quality, Comparability, and Justification

The core of any biosimilar submission is the data package, which must meticulously demonstrate comparability. This begins with comprehensive analytical characterization, comparing the physicochemical and biological properties of the biosimilar to the reference product. This includes detailed analysis of primary, secondary, and tertiary structures, post-translational modifications, and biological activity. The depth and rigor of this analytical characterization are paramount, as strong analytical data can significantly reduce the need for extensive clinical studies .

Following analytical characterization, non-clinical studies are conducted to compare the pharmacodynamics and pharmacokinetics of the biosimilar and reference product. These studies typically involve in vitro and in vivo assays designed to detect any potential differences in biological activity or safety profiles. Finally, targeted clinical trials are designed to confirm comparability in terms of pharmacokinetics, pharmacodynamics, immunogenicity, and clinical efficacy and safety in a sensitive patient population. The strategic justification for the scope and design of these clinical studies is critical. Developers must clearly articulate why the chosen studies are sufficient to demonstrate “no clinically meaningful differences,” leveraging the strength of their analytical and non-clinical data to justify any proposed reductions in clinical burden. This data generation strategy must be robust, scientifically sound, and meticulously documented to withstand intense regulatory scrutiny.

The emphasis on strong analytical data to potentially reduce clinical trials underscores a crucial strategic point: investment in state-of-the-art analytical capabilities and expertise is a high-yield endeavor in biosimilar development. Companies that excel in comprehensive physicochemical and biological characterization are better positioned to justify a streamlined clinical program, thereby saving significant time and resources. This also means that regulatory interactions will heavily focus on the methodology and interpretation of these analytical data, requiring regulatory teams to possess a deep scientific understanding beyond mere procedural knowledge. This strategic allocation of resources towards robust early-stage data generation is not just about scientific rigor; it is a direct pathway to accelerated development and enhanced commercial viability.

Building a Robust Regulatory Dossier: Beyond the Data

A compelling regulatory dossier goes beyond simply presenting data; it tells a coherent and persuasive scientific story. This requires meticulous organization, clear and concise writing, and a strong emphasis on the “totality of evidence” narrative. Every section of the dossier, from the quality module to the clinical overview, must contribute to the overarching argument that the biosimilar is highly similar to its reference product.

Furthermore, anticipating agency questions and preparing proactive responses is a hallmark of a robust dossier. Regulatory agencies, particularly the FDA, are known for their detailed and challenging questions . A well-prepared dossier anticipates these queries by providing comprehensive justifications, sensitivity analyses, and clear explanations for any observed differences or deviations. This proactive approach can significantly reduce the back-and-forth during the review process, accelerating approval timelines.

Table 2: Essential Checklist for Effective Pre-Submission Meeting Preparation

| Aspect | Key Considerations |

| Define Objectives | Clearly articulate specific questions for the agency. What critical uncertainties need resolution? What guidance is sought? |

| Assemble Team | Include scientific, clinical, regulatory, and potentially manufacturing experts. Ensure a designated lead and clear roles. |

| Prepare Briefing Package | Comprehensive, concise, and well-organized. Include background, development plan summary, key data, and specific questions. Adhere to agency guidance on format and length. |

| Anticipate Questions | Brainstorm potential agency concerns or challenges to your data/strategy . Prepare detailed responses and supporting data. |

| Rehearse Meeting | Conduct mock meetings with internal experts. Practice presenting, answering tough questions, and staying on message . Refine communication strategy. |

| Understand Agency Perspective | Research previous agency decisions, guidance documents, and scientific opinions related to similar products or methodologies. |

| Logistics & Follow-up | Confirm meeting format, attendees, and presentation technology. Plan for immediate internal debriefing and timely submission of meeting minutes/follow-up actions. |

The meticulous preparation for pre-submission meetings, including anticipating agency questions and rehearsing responses , is a critical determinant of success. This level of preparation indicates a deep understanding of the agency’s scientific and regulatory priorities. By proactively addressing potential concerns, companies can build trust and demonstrate their commitment to scientific rigor, fostering a more collaborative and efficient review process. This proactive engagement transforms the meeting from a mere information exchange into a strategic dialogue where the company guides the narrative and addresses concerns before they become formal deficiencies.

Effective Regulatory Agency Interactions: Communication, Meetings, and Relationship Building

The success of a biosimilar program often hinges on the quality and effectiveness of interactions with regulatory agencies. These interactions are not merely transactional; they are opportunities to build trust, clarify expectations, and collaboratively navigate the path to approval.

Principles of Effective Communication with Agencies

Clear, concise, and scientifically accurate communication is paramount. Regulatory agencies operate under immense pressure and review vast amounts of complex data. Therefore, submissions and communications must be easy to understand, well-organized, and directly address the points of interest to the agency. Avoiding jargon where possible, using clear visuals, and structuring arguments logically can significantly enhance the effectiveness of communication.

Beyond clarity, consistency in messaging is vital. All communications, whether written or verbal, should align with the overall development strategy and the scientific narrative presented in the dossier. Any perceived inconsistencies can raise red flags and lead to delays. Furthermore, maintaining a professional and respectful tone, even when disagreeing on scientific points, helps foster a constructive working relationship.

Navigating Formal Meetings: Strategy and Execution

Formal meetings with regulatory agencies, such as pre-IND meetings, scientific advice meetings, or pre-submission conferences, are pivotal opportunities for direct dialogue. These meetings require meticulous preparation and strategic execution . Before any meeting, companies must clearly define their objectives, formulate specific questions, and prepare a comprehensive briefing package that provides the agency with all necessary background information. Anticipating potential agency questions and preparing well-reasoned responses is crucial for a productive discussion .

During the meeting, effective communication involves active listening, precise articulation of points, and a willingness to engage in scientific debate while remaining flexible. The goal is to achieve alignment on key aspects of the development program, obtain clear guidance, and build a foundation of trust. Post-meeting, prompt and accurate meeting minutes are essential, ensuring a shared understanding of agreements and action items. The meticulous preparation for pre-submission meetings, including anticipating agency questions and rehearsing responses , is a critical determinant of success. This level of preparation indicates a deep understanding of the agency’s scientific and regulatory priorities. By proactively addressing potential concerns, companies can build trust and demonstrate their commitment to scientific rigor, fostering a more collaborative and efficient review process. This proactive engagement transforms the meeting from a mere information exchange into a strategic dialogue where the company guides the narrative and addresses concerns before they become formal deficiencies.

Building and Maintaining Relationships with Regulators

While formal interactions are structured, cultivating a professional and respectful relationship with regulatory reviewers and decision-makers can yield significant long-term benefits. This does not imply undue influence but rather fostering an environment of mutual respect and open scientific exchange. Attending public workshops, participating in scientific conferences where regulators present, and engaging in industry-wide discussions on emerging regulatory science can help build rapport and demonstrate a commitment to the broader scientific community.

Consistency in regulatory personnel on the company’s side can also be beneficial, allowing for sustained relationships and a deeper understanding of individual agency perspectives over time. Ultimately, a relationship built on transparency, scientific integrity, and a shared commitment to patient safety can significantly ease the navigation of complex regulatory pathways.

The Cornerstone of Approval: Data Generation, Quality, and Submission Excellence

The approval of a biosimilar hinges fundamentally on the strength, integrity, and comprehensive nature of the data submitted. This section delves into the critical aspects of data generation, ensuring quality, and achieving submission excellence.

Comprehensive Analytical Characterization: The First Pillar of Comparability

The journey to biosimilarity begins with exhaustive analytical characterization. This involves a head-to-head comparison of the biosimilar with its reference product, employing state-of-the-art analytical techniques to assess a vast array of attributes. These include primary structure (amino acid sequence), higher-order structures (secondary, tertiary, quaternary), post-translational modifications (e.g., glycosylation, deamidation, oxidation), charge variants, aggregation, and biological activity (e.g., binding kinetics, cell-based assays). The goal is to establish a high degree of similarity across all these critical quality attributes.

The robustness of this analytical data is paramount. Any observed differences, even minor ones, must be thoroughly investigated, characterized, and scientifically justified as not impacting clinical safety or efficacy. This extensive analytical fingerprinting forms the scientific bedrock upon which all subsequent comparability assessments are built, often dictating the scope of non-clinical and clinical studies .

Non-Clinical and Clinical Comparability Studies: Targeted and Purposeful

Following the robust analytical characterization, non-clinical studies are conducted to compare the pharmacodynamic and pharmacokinetic profiles of the biosimilar and reference product. These studies, typically performed in appropriate animal models or in vitro systems, are designed to detect any potential differences in biological activity, target engagement, or safety signals that might not be apparent from analytical data alone.

The clinical comparability program is then meticulously designed to confirm that there are no clinically meaningful differences. This typically involves:

- Pharmacokinetic (PK) and Pharmacodynamic (PD) Studies: These are often the first clinical studies, conducted in healthy volunteers or a sensitive patient population, to compare the absorption, distribution, metabolism, excretion, and biological effects of the biosimilar and reference product.

- Confirmatory Clinical Trial: A single, well-controlled clinical trial is typically conducted in a sensitive patient population to confirm clinical equivalence in terms of efficacy and safety. The design of this trial is crucial, often focusing on an indication where the reference product has a well-established effect and where any potential differences between the products would be most easily detected.

- Immunogenicity Assessment: A critical component of all clinical studies is the assessment of immunogenicity, comparing the potential for the biosimilar to elicit an immune response (e.g., anti-drug antibodies) relative to the reference product.

The strategic justification for the scope and design of these clinical studies is critical. Developers must clearly articulate why the chosen studies are sufficient to demonstrate “no clinically meaningful differences,” leveraging the strength of their analytical and non-clinical data to justify any proposed reductions in clinical burden. This stepwise approach, where robust early-stage data can reduce the need for extensive clinical trials , is a hallmark of efficient biosimilar development.

Quality Management Systems and Data Integrity

Beyond the scientific data itself, the integrity and reliability of that data are non-negotiable. This necessitates a robust quality management system (QMS) that governs every stage of biosimilar development, from research and manufacturing to clinical trials and post-market surveillance. Adherence to Good Manufacturing Practice (GMP), Good Laboratory Practice (GLP), and Good Clinical Practice (GCP) is fundamental.

Regulatory agencies place significant emphasis on data integrity. This includes ensuring that data are accurate, complete, consistent, attributable, legible, and contemporaneous (ALCOA principles). Any deficiencies in data integrity can lead to significant delays, rejections, or even enforcement actions. Companies must implement rigorous data governance policies, robust audit trails, and comprehensive training programs to ensure the highest standards of data quality and integrity throughout the entire development lifecycle.

Table 3: Core Data Requirements for Biosimilarity Demonstration Across Phases

| Development Phase | Key Data Requirements | Purpose |

| Early Development / Analytical | Comprehensive Physicochemical Characterization (primary, higher-order structure, charge variants, aggregation, purity); Extensive Biological Characterization (binding assays, cell-based assays, functional assays); Excipient Analysis. | Establish high similarity at molecular and functional levels; Identify critical quality attributes; Justify reduced clinical studies . |

| Non-Clinical | Comparative in vitro and in vivo studies (pharmacodynamics, pharmacokinetics, toxicology); Dose-range finding studies (if applicable). | Confirm similar biological activity and safety profiles; Provide bridging data to clinical studies. |

| Clinical (Phase 1/PK/PD) | Comparative Pharmacokinetic (PK) studies (e.g., AUC, Cmax); Comparative Pharmacodynamic (PD) studies (if sensitive PD marker exists); Immunogenicity assessment. | Demonstrate equivalent drug exposure and biological response in humans; Early immunogenicity signal detection. |

| Clinical (Phase 3/Confirmatory) | Comparative Clinical Efficacy and Safety Trial in a sensitive patient population; Immunogenicity assessment; Extrapolation justification. | Confirm no clinically meaningful differences in efficacy and safety; Support extrapolation to other indications. |

| Post-Approval | Pharmacovigilance (safety monitoring); Risk Management Plans (RMPs); Post-marketing commitments; Manufacturing changes management. | Ensure continued safety and efficacy; Monitor long-term immunogenicity; Manage lifecycle. |

Submission Excellence: Clarity, Compliance, and Completeness

The final step in data presentation is the submission itself. A well-organized, clear, and complete dossier is critical for an efficient review process. This means adhering strictly to regional electronic submission standards (e.g., eCTD), ensuring all required modules are populated correctly, and that cross-referencing is precise.

The dossier should present a coherent “totality of evidence” narrative, clearly articulating how each piece of data contributes to the demonstration of biosimilarity. Any gaps or deviations from standard expectations should be explicitly acknowledged and scientifically justified. A meticulous internal review process, involving regulatory, scientific, and medical experts, is essential to identify and rectify any deficiencies before submission. A complete and well-structured submission significantly reduces the likelihood of information requests, thereby streamlining the review timeline and accelerating the path to market.

Leveraging Intellectual Property and Patent Data for Competitive Advantage (featuring DrugPatentWatch)

In the highly competitive biosimilar landscape, intellectual property (IP) and patent data are not merely legal considerations; they are powerful strategic tools that can define market entry, shape competitive positioning, and unlock significant commercial advantage. Proactive and sophisticated IP intelligence is crucial for navigating this complex terrain.

Understanding the IP Landscape: Patents, Exclusivities, and Data Protection

The intellectual property landscape for biologics is intricate, encompassing various types of patents (e.g., compound, method of use, formulation, manufacturing process) and regulatory exclusivities (e.g., data exclusivity, orphan drug exclusivity). For biosimilar developers, a thorough understanding of these layers of protection surrounding the reference product is paramount. Patent expiry dates are critical triggers for biosimilar development, but the presence of multiple secondary patents can create a “patent thicket” that complicates market entry.

Regulatory exclusivities, granted by agencies like the FDA (e.g., 12 years for biologics under BPCIA) or EMA (e.g., 8+2+1 years), also dictate the earliest possible market entry for biosimilars, independent of patent status. A comprehensive IP strategy involves not only identifying these expiry dates but also developing strategies to challenge weak patents or design around existing ones, often through “at-risk” launches or negotiated settlements.

Strategic Applications of Patent Data: Identifying Opportunities and Mitigating Risks

Patent data provides invaluable intelligence for biosimilar developers. By meticulously analyzing the patent portfolios of originator biologics, companies can:

- Identify attractive targets: Focus on biologics with imminent patent expirations or those with weaker patent protection.

- Forecast market entry timelines: Estimate the earliest possible launch dates, factoring in both patent and exclusivity expirations.

- Inform R&D decisions: Guide the development process to avoid infringing existing patents, for example, by designing novel manufacturing processes or formulations.

- Prepare for litigation: Anticipate potential patent infringement lawsuits and develop robust defense strategies.

- Negotiate licensing agreements: Identify opportunities for strategic partnerships or licensing deals that can facilitate market access.

This proactive use of patent data transforms a potential legal hurdle into a strategic roadmap, enabling companies to make informed decisions about product selection, development pathways, and market entry timing.

The average time from first biosimilar clinical trial to approval is 7-10 years , and the average time from first clinical trial to patent expiry of the reference product is 12 years . This means that the window between biosimilar development readiness and patent expiry is often narrow, underscoring the critical need for precise patent intelligence. Companies must identify targets with sufficient remaining patent life to justify R&D investment but also with a clear path to market post-expiry. This requires sophisticated forecasting and continuous monitoring of patent landscapes.

The Role of Specialized Tools: Featuring DrugPatentWatch

Navigating the vast and complex world of pharmaceutical patents manually is an arduous, if not impossible, task. This is where specialized intellectual property intelligence platforms become indispensable. DrugPatentWatch is a prime example of such a tool, offering a comprehensive database of drug patents and exclusivities. It provides critical information on patent expiry dates, patent family details, and regulatory exclusivity periods for a wide range of approved drugs, including biologics.

By leveraging platforms like DrugPatentWatch, biosimilar developers can:

- Efficiently track patent expirations: Monitor the patent landscape for target biologics globally, identifying key dates and potential windows of opportunity.

- Analyze patent portfolios: Gain insights into the strength and breadth of an originator’s patent protection, helping to identify potential weaknesses or opportunities for challenge.

- Assess freedom-to-operate: Understand the patent landscape surrounding their own biosimilar development, minimizing the risk of infringement.

- Support business development: Identify potential biosimilar targets for in-licensing or acquisition based on patent intelligence.

Incorporating such tools into the strategic planning process empowers companies to make data-driven decisions, turning complex patent information into a tangible competitive advantage.

Table 4: Strategic Applications of Patent Data in Biosimilar Development (Leveraging Tools like DrugPatentWatch)

| Strategic Objective | How Patent Data Helps (e.g., using DrugPatentWatch) |

| Target Selection | Identify biologics with imminent primary patent expiry and manageable patent thickets. |

| Timeline Forecasting | Accurately predict earliest possible market entry dates, considering both patent and regulatory exclusivity expirations . |

| R&D De-risking | Inform process development to avoid infringing manufacturing or formulation patents. |

| Litigation Preparedness | Anticipate potential “patent dance” scenarios and prepare legal strategies. |

| Market Access Strategy | Identify opportunities for “at-risk” launches or negotiated settlements. |

| Competitive Intelligence | Understand competitors’ patent strategies and potential market moves. |

| Investment Decisions | Support due diligence for M&A or licensing deals by assessing IP strength. |

Navigating the “Patent Dance” and Litigation Risks

In the U.S., the Biologics Price Competition and Innovation Act (BPCIA) introduced a complex information exchange process known as the “patent dance,” designed to facilitate early resolution of patent disputes between biosimilar applicants and reference product sponsors. Navigating this process effectively requires sophisticated legal and IP expertise, as strategic decisions made during the patent dance can significantly impact market entry timelines and potential litigation outcomes.

Litigation risk is an inherent part of the biosimilar landscape. Originator companies often vigorously defend their intellectual property. Biosimilar developers must be prepared for potential patent infringement lawsuits, developing robust invalidity or non-infringement arguments. Proactive engagement with patent data and legal counsel from the earliest stages of development is crucial for mitigating these risks and ensuring a clear path to market.

Post-Approval Vigilance and Lifecycle Management: Sustaining Market Presence

Regulatory success for a biosimilar does not end with market authorization. Sustaining market presence and ensuring long-term patient confidence require continuous post-approval vigilance and proactive lifecycle management. This phase is critical for maintaining regulatory compliance and adapting to evolving market dynamics.

Pharmacovigilance and Risk Management Plans

Once a biosimilar is on the market, robust pharmacovigilance systems are essential. Companies must continuously monitor the safety profile of their product, collecting and analyzing adverse event reports, and comparing them to the safety profile of the reference product. This ongoing surveillance is crucial for detecting any rare or long-term safety signals that may not have been apparent during clinical trials.

Regulatory agencies require comprehensive Risk Management Plans (RMPs) or Risk Evaluation and Mitigation Strategies (REMS) for biologics, including biosimilars. These plans outline specific activities designed to identify, characterize, prevent, or minimize risks associated with the product. Proactive management of these plans, including regular updates and communication with agencies, is vital for maintaining market authorization.

Managing Post-Approval Changes and Variations

Biological products, including biosimilars, are complex to manufacture, and changes to the manufacturing process, site, or raw materials can impact the product’s quality, safety, and efficacy. Regulatory agencies require stringent oversight of such post-approval changes or variations. Companies must have robust change control systems in place and proactively engage with agencies to determine the appropriate regulatory pathway for any proposed changes. This often involves submitting comparability data to demonstrate that the change has not introduced any clinically meaningful differences.

Failure to properly manage post-approval changes can lead to significant regulatory issues, including warning letters, product recalls, or even withdrawal of market authorization. A proactive approach, involving early discussions with regulatory bodies, can prevent costly delays and ensure continuous supply.

Labeling Updates and Communication

Maintaining accurate and up-to-date product labeling is an ongoing regulatory responsibility. This includes updating prescribing information based on new safety data, changes to the reference product label, or new scientific understanding. Biosimilar labels are typically highly similar to their reference product labels, with some specific differences related to the biosimilarity pathway.

Effective communication with healthcare professionals and patients about any labeling changes or new safety information is also critical. Transparency and clear communication build trust and ensure that the product is used safely and effectively in clinical practice.

Lifecycle Management and Portfolio Expansion

Beyond maintaining compliance, post-approval lifecycle management for biosimilars also involves strategic considerations for portfolio expansion. This may include pursuing additional indications (extrapolation), new dosage forms, or new routes of administration. Each of these expansions typically requires additional data and regulatory submissions, necessitating further interactions with agencies.

Strategic lifecycle management also involves continuously monitoring the competitive landscape and adapting to market shifts. This proactive approach ensures that the biosimilar remains competitive and continues to meet evolving patient and healthcare system needs, maximizing its long-term commercial value.

Global Harmonization vs. Regional Divergence: Navigating the Complexities

The global biosimilar landscape is characterized by a tension between the desire for regulatory harmonization and the reality of regional divergence. While major regulatory bodies share fundamental scientific principles for biosimilarity, significant differences in procedural requirements, data expectations, and national policies necessitate a nuanced global strategy.

Areas of Harmonization and Shared Principles

Despite regional differences, there is a broad consensus among major regulatory authorities (e.g., FDA, EMA, Health Canada, PMDA) on the core scientific principles underpinning biosimilar approval. These include:

- Totality of Evidence: The reliance on a comprehensive package of analytical, non-clinical, and clinical data to demonstrate biosimilarity .

- Comparability Exercise: The fundamental requirement to show “no clinically meaningful differences” to a reference product .

- Stepwise Approach: The iterative development process, starting with extensive analytical characterization and potentially reducing clinical burden based on strong early data .

- Emphasis on Quality: The critical importance of robust manufacturing processes and quality management systems.

This shared scientific foundation allows for a degree of global alignment in development strategies, particularly in the early analytical and non-clinical phases.

Key Areas of Regional Divergence

Despite the shared principles, significant divergences persist, primarily in procedural aspects and national policies:

- Interchangeability Designations: As discussed, the U.S. has a specific interchangeability designation , whereas the EU does not have a centralized equivalent , leaving substitution decisions to national authorities.

- Clinical Trial Requirements: While the principle of reduced clinical trials is accepted, the specific types, sizes, and populations for confirmatory clinical studies can vary. Some regions may require local bridging studies or specific ethnic considerations.

- Reference Product Sourcing: Requirements for the sourcing of the reference product can differ, with some regions requiring a locally approved reference product for comparability studies.

- Intellectual Property and Patent Linkage: The interaction between regulatory approval and patent litigation varies significantly. The U.S. “patent dance” is a unique feature of its system.

- Post-Approval Surveillance and Risk Management: While all regions require pharmacovigilance, the specific requirements for RMPs or REMS can differ in scope and detail.

- Labeling Requirements: While biosimilar labels generally mirror reference product labels, specific disclaimers, naming conventions, or national requirements can introduce variations.

These divergences necessitate a highly adaptable regulatory strategy.

Developing a Global Regulatory Strategy: Centralized Oversight, Local Execution

Navigating this complex landscape requires a global regulatory strategy that balances centralized oversight with flexible local execution. A core global regulatory team should be responsible for defining the overarching development strategy, ensuring alignment with key scientific principles, and managing interactions with major regulatory bodies (e.g., FDA, EMA). This central team should also be responsible for maintaining a global regulatory intelligence function, continuously monitoring evolving requirements across different jurisdictions.

However, successful global execution requires strong regional regulatory teams or partners who possess deep local expertise. These local teams are crucial for understanding and navigating country-specific nuances, managing interactions with national authorities, and ensuring compliance with local requirements related to submissions, labeling, and post-market activities. A robust communication framework between global and local teams is essential to ensure consistency in messaging and alignment on strategic objectives. This dual approach allows companies to leverage efficiencies where harmonization exists while effectively managing complexities arising from regional divergence.

Risk Mitigation and Crisis Management in Regulatory Affairs

In the complex and highly scrutinized world of biosimilar development, regulatory risks are inherent. Proactive risk mitigation and a robust crisis management framework are essential for safeguarding investments, maintaining regulatory compliance, and protecting corporate reputation.

Identifying and Assessing Regulatory Risks

The first step in mitigation is comprehensive risk identification. This involves systematically assessing potential risks across the entire biosimilar development lifecycle, from early-stage analytical characterization to post-market surveillance. Common regulatory risks include:

- Scientific Disagreement: Discrepancies in interpretation of comparability data with agencies.

- Data Gaps or Deficiencies: Insufficient or poor-quality data to support biosimilarity.

- Immunogenicity Concerns: Unexpected or higher rates of immunogenicity compared to the reference product.

- Manufacturing Issues: Deviations from GMP, quality control failures, or supply chain disruptions.

- Intellectual Property Challenges: Patent infringement lawsuits or injunctions delaying market entry.

- Labeling Disputes: Disagreements with agencies on appropriate labeling or extrapolation claims.

- Post-Market Safety Signals: New adverse events identified after approval requiring regulatory action.

Each identified risk should be assessed for its likelihood and potential impact, allowing for prioritization and the allocation of appropriate mitigation resources.

Proactive Mitigation Strategies

Once risks are identified, proactive strategies can be implemented:

- Early and Frequent Agency Engagement: As discussed, pre-submission meetings and scientific advice sessions help align expectations and address potential concerns early .

- Robust Quality by Design (QbD): Integrating QbD principles into manufacturing and development ensures product quality from the outset, reducing manufacturing-related regulatory risks.

- Comprehensive Data Generation: Investing in high-quality analytical and clinical studies reduces the likelihood of data deficiencies.

- Strong IP Strategy: Proactive patent landscaping, freedom-to-operate analyses, and strategic patent challenges or settlements can mitigate litigation risks (leveraging tools like DrugPatentWatch).

- Contingency Planning: Developing alternative strategies for key development steps or regulatory pathways in case of unforeseen challenges.

- Internal Regulatory Audits: Regularly auditing internal processes and dossiers to identify and rectify non-compliance issues before agency inspections.

Crisis Management in Regulatory Affairs

Despite best efforts, regulatory crises can emerge. A well-defined crisis management plan is crucial for responding effectively. This plan should include:

- Clear Communication Protocols: Establishing internal and external communication channels, defining spokespersons, and preparing holding statements.

- Cross-Functional Crisis Team: Assembling a dedicated team with representatives from regulatory, legal, medical, manufacturing, and communications departments.

- Rapid Data Assessment: The ability to quickly gather, analyze, and interpret relevant data to understand the scope and nature of the crisis.

- Proactive Agency Communication: Transparent and timely communication with regulatory agencies, even when information is incomplete, helps maintain trust.

- Remediation and Corrective Actions: Swiftly implementing corrective and preventive actions (CAPA) to address the root cause of the crisis.

Effective crisis management minimizes the impact of regulatory setbacks, preserves corporate reputation, and ensures continued patient access to essential medicines.

Table 5: Common Pitfalls in Biosimilar Regulatory Interactions and Proactive Mitigation Strategies

| Common Pitfall | Proactive Mitigation Strategy |

| Insufficient Comparability Data | Invest heavily in comprehensive analytical and non-clinical characterization; leverage stepwise development to justify clinical trial scope . |

| Misinterpretation of Agency Guidance | Seek early and frequent scientific advice/pre-submission meetings; engage experienced regulatory consultants. |

| Poor Communication with Agency | Prepare clear, concise briefing documents; rehearse meetings ; establish consistent internal messaging . |

| Unexpected Immunogenicity | Implement robust immunogenicity testing strategies throughout development; proactively discuss immunogenicity assays with agencies. |

| Manufacturing Deficiencies | Implement robust Quality Management Systems (QMS) and Quality by Design (QbD) principles from early development. |

| Underestimating IP Challenges | Conduct thorough patent landscaping (e.g., using DrugPatentWatch); develop strong legal strategies; prepare for “patent dance” . |

| Lack of Global Strategy | Develop a centralized global strategy with flexible local execution; engage local regulatory experts. |

Building an Agile and Responsive Regulatory Organization

In the dynamic biosimilar landscape, a static regulatory affairs function is a liability. Companies that succeed are those that cultivate an agile and responsive regulatory organization, capable of adapting to evolving scientific understanding, changing regulatory requirements, and emerging market opportunities.

Cultivating Regulatory Intelligence and Foresight

An agile regulatory organization is built on a foundation of robust regulatory intelligence. This involves continuously monitoring global regulatory developments, tracking new guidance documents, understanding emerging scientific trends, and analyzing competitor strategies. This intelligence should not merely be collected but actively analyzed and disseminated throughout the organization, informing R&D, manufacturing, and commercial decisions.

Foresight goes beyond intelligence; it involves anticipating future regulatory challenges and opportunities. This might include predicting the impact of new technologies (e.g., AI in drug discovery, advanced analytics), shifts in global health priorities, or changes in political landscapes. Regulatory professionals with foresight can proactively prepare the organization for future challenges, turning potential obstacles into strategic advantages.

Cross-Functional Collaboration and Integration

Regulatory affairs cannot operate in a silo. An agile organization fosters deep cross-functional collaboration, integrating regulatory expertise into every stage of the product lifecycle. This means:

- Early Involvement in R&D: Regulatory input from the outset ensures that development programs are designed with regulatory requirements in mind, minimizing late-stage rework.

- Seamless Manufacturing Integration: Close collaboration with manufacturing ensures that quality and compliance are built into production processes.

- Strategic Commercial Partnership: Regulatory teams work with commercial teams to align market access strategies with regulatory feasibility and labeling claims.

- Legal and IP Alignment: Close coordination with legal and IP teams ensures a coherent strategy for patent challenges and litigation risks.

This integrated approach ensures that regulatory considerations are embedded in strategic decision-making, rather than being an afterthought.

Investing in Regulatory Talent and Training

The complexity of biosimilar regulation demands highly skilled regulatory professionals. An agile organization invests in continuous training and development for its regulatory team, ensuring they possess not only deep knowledge of current regulations but also strong scientific understanding, critical thinking, communication, and negotiation skills.

Cultivating a culture of continuous learning, encouraging participation in industry forums, and providing opportunities for cross-functional exposure strengthens the capabilities of the regulatory team. Empowering regulatory professionals to act as strategic partners, rather than just compliance officers, is key to building a truly agile and responsive organization.

Case Studies and Best Practices: Learning from Industry Leaders

Examining successful biosimilar development programs and regulatory interactions provides invaluable lessons and highlights best practices that can be emulated. While specific company names may not be disclosed, the underlying strategies offer universal applicability.

Case Study 1: Accelerating Approval Through Robust Comparability Data

One leading pharmaceutical company successfully achieved rapid approval for a complex biosimilar by heavily front-loading its development efforts into comprehensive analytical and non-clinical characterization. Their strategy involved investing in cutting-edge analytical technologies and employing a multidisciplinary team of scientists to generate an exceptionally robust comparability package. This allowed them to present a compelling “totality of evidence” that significantly reduced the need for extensive clinical trials, leading to a streamlined and accelerated regulatory review. Their pre-submission meetings focused on demonstrating the strength of their analytical data and justifying the proposed reduced clinical program, which the agency ultimately accepted. This approach underscores the principle that strong early-stage data can directly translate into faster market entry .

Case Study 2: Navigating Patent Thickets with Strategic IP Intelligence

Another company faced a formidable patent thicket surrounding a blockbuster originator biologic. Instead of abandoning the target, they leveraged sophisticated patent intelligence tools (akin to DrugPatentWatch) to meticulously map the originator’s patent portfolio. They identified several weak process patents and developed an alternative manufacturing process that avoided infringement. Simultaneously, their legal team prepared a robust invalidity challenge against a key method-of-use patent. This dual strategy of design-around and patent challenge, informed by precise patent data , allowed them to launch their biosimilar shortly after the primary patent expiry, gaining a significant first-mover advantage. Their effective communication with the agency regarding their IP strategy also helped manage expectations during the review process.

Case Study 3: Building Trust Through Proactive Communication and Transparency

A company encountered a significant safety signal during the post-market surveillance of its biosimilar, a common challenge in pharmacovigilance. Instead of delaying or downplaying the issue, their regulatory and medical teams immediately initiated a thorough investigation. They proactively communicated their findings and proposed risk mitigation strategies to the relevant regulatory agencies, even before completing their full analysis. This transparent and proactive approach, coupled with a clear action plan, helped maintain the agencies’ trust and confidence. The crisis was managed effectively, minimizing negative impact on patient confidence and ensuring the continued availability of the biosimilar. This demonstrates the critical role of transparent and timely communication in crisis management.

Key Best Practices Summarized:

- Prioritize Early Engagement: Initiate dialogue with regulatory agencies as early as possible to align on development plans and mitigate risks .

- Invest in Analytical Excellence: Recognize that robust analytical and non-clinical data are the cornerstone of biosimilarity and can significantly reduce clinical burden .

- Leverage IP Intelligence: Utilize specialized tools and expertise to understand the patent landscape, identify opportunities, and mitigate litigation risks .

- Foster Cross-Functional Collaboration: Ensure seamless integration of regulatory affairs with R&D, manufacturing, legal, and commercial teams.

- Cultivate a Culture of Quality and Data Integrity: Implement stringent quality management systems throughout the product lifecycle.

- Embrace Proactive Communication: Be transparent, consistent, and timely in all interactions with regulatory agencies.

- Build an Agile Organization: Continuously monitor the regulatory landscape, invest in talent, and adapt strategies to evolving requirements.

Future Trends and Emerging Challenges in Biosimilar Regulation

The biosimilar landscape is dynamic, continuously evolving with scientific advancements, changing healthcare needs, and shifts in regulatory philosophy. Staying abreast of these trends and anticipating future challenges is crucial for sustained success.

Evolution of Regulatory Science and Analytical Technologies

As analytical technologies become more sophisticated, their ability to characterize complex biologics with unprecedented detail will continue to grow. This could lead to:

- Further Reduction in Clinical Burden: Stronger analytical and functional data may increasingly justify further reductions or even waivers of clinical trials for certain biosimilars, particularly for well-understood molecules.

- Increased Focus on Novel Comparability Methods: Agencies may become more open to innovative in vitro or in silico methods for demonstrating biosimilarity, provided they are rigorously validated.

- Enhanced Immunogenicity Prediction: Advances in immunogenicity assays and predictive modeling could lead to more refined strategies for assessing and mitigating immune responses.

Regulatory agencies will need to adapt their guidance to incorporate these scientific advancements, requiring continuous dialogue between industry and regulators.

Regulatory Approaches to Next-Generation Biologics and Complex Biosimilars

The next wave of biosimilars will likely involve more complex molecules, such as antibody-drug conjugates (ADCs), gene therapies, or cell therapies. These products present unique challenges for comparability:

- Increased Complexity of Characterization: ADCs, for example, involve multiple components (antibody, linker, cytotoxic drug) each requiring detailed characterization.

- Novel Mechanisms of Action: Gene and cell therapies introduce entirely new considerations for demonstrating similarity and ensuring safety.

- Manufacturing Complexity: The manufacturing processes for these advanced biologics are inherently more intricate, posing greater challenges for demonstrating comparability of process and product.

Regulatory agencies are already grappling with how to apply biosimilar principles to these highly complex products, and new guidance will undoubtedly emerge. Companies developing these “complex biosimilars” will need to engage even more closely with regulators to shape appropriate pathways.

Global Regulatory Harmonization Efforts and Realities

While a complete global harmonization of biosimilar regulations remains elusive, efforts continue to bridge gaps between major jurisdictions. Initiatives like those by the International Coalition of Medicines Regulatory Authorities (ICMRA) or the World Health Organization (WHO) aim to foster greater convergence in scientific principles and procedural aspects. However, national healthcare priorities, legal frameworks, and political considerations will likely ensure that some level of regional divergence persists. Companies must therefore continue to navigate this dual reality: leveraging harmonization where it exists while meticulously adapting to regional specificities.

The Impact of Digital Health, Real-World Evidence (RWE), and AI

The increasing availability of real-world evidence (RWE) from electronic health records, claims databases, and patient registries could play a growing role in post-market surveillance and potentially even in supporting biosimilarity claims. Regulatory agencies are exploring how RWE can complement traditional clinical trial data. Artificial intelligence (AI) and machine learning (ML) are also poised to revolutionize drug development, from optimizing clinical trial design to enhancing pharmacovigilance. Regulatory bodies are beginning to develop frameworks for the use of AI/ML in submissions, and biosimilar developers will need to understand how to leverage these technologies responsibly and compliantly.

Evolving Market Access and Policy Landscape

Beyond regulatory approval, the market access landscape for biosimilars continues to evolve. Policies promoting biosimilar uptake, such as tendering processes, prescribing incentives, and substitution policies, vary widely by country and can significantly impact commercial success. Companies must integrate regulatory strategy with market access strategy from the earliest stages of development, understanding that regulatory approval is a necessary but not sufficient condition for commercial viability. The interplay between regulatory approval, intellectual property, and market access policies will continue to shape the competitive dynamics of the biosimilar market.

Key Takeaways

- Strategic Imperative: Effective biosimilar regulatory interactions are not merely a compliance task but a critical driver of competitive advantage and market success, especially given the rapid growth of the biosimilar market and the lengthy development timelines .

- Comparability is King: The “Totality of Evidence” approach, focusing on demonstrating “no clinically meaningful differences” , is the bedrock of biosimilar approval. Robust analytical and non-clinical data can significantly reduce the need for extensive clinical trials .

- Proactive Engagement: Early and continuous dialogue with regulatory agencies through scientific advice and pre-submission meetings is crucial for aligning expectations, de-risking development, and accelerating the review process .

- Intellectual Property as a Strategic Asset: A deep understanding of the patent landscape and strategic use of patent data (e.g., via DrugPatentWatch) are essential for identifying opportunities, forecasting market entry, and mitigating litigation risks .

- Global Nuance: While scientific principles are largely harmonized, significant regional divergences in regulatory pathways (e.g., FDA’s interchangeability vs. EMA’s national substitution policies ) necessitate a flexible global strategy.

- Quality and Data Integrity: Rigorous quality management systems and unwavering commitment to data integrity are non-negotiable for successful submissions and post-approval vigilance.

- Organizational Agility: Building an agile, cross-functional regulatory organization that invests in talent, embraces regulatory intelligence, and fosters proactive communication is vital for long-term success in this dynamic environment.

- Beyond Approval: Post-approval pharmacovigilance, lifecycle management, and adaptation to evolving market access policies are critical for sustaining market presence and maximizing commercial value.

Frequently Asked Questions (FAQ)

1. What is the primary difference in the regulatory approach for biosimilars compared to novel biologics?

The fundamental difference lies in the objective of the development program. For novel biologics, the goal is to independently establish safety and efficacy through extensive clinical trials. For biosimilars, the primary goal is to demonstrate “biosimilarity” – that the product is “highly similar” to an approved reference product with “no clinically meaningful differences” in terms of safety, purity, and potency . This shifts the focus from independent proof of concept to a comprehensive comparability exercise, leveraging analytical, non-clinical, and targeted clinical data.

2. How can early engagement with regulatory agencies benefit a biosimilar development program?

Early engagement, through mechanisms like scientific advice or pre-submission meetings, offers several critical benefits. It allows developers to obtain formal feedback on their proposed development plans, clarify regulatory expectations, and align on the scope and design of comparability studies . This proactive dialogue can help identify and address potential scientific or regulatory concerns early, preventing costly missteps, reducing the likelihood of significant delays, and potentially justifying a reduced clinical burden based on robust analytical data .

3. Why is intellectual property intelligence, particularly patent data, so crucial for biosimilar developers?

Intellectual property intelligence, including detailed patent data, is crucial because it directly impacts market entry timelines and competitive strategy. By analyzing patent expiry dates, patent types, and regulatory exclusivities (e.g., via tools like DrugPatentWatch), biosimilar developers can identify attractive targets, forecast the earliest possible launch dates, design around existing patents, and prepare for potential litigation . This proactive approach transforms patent information from a legal hurdle into a strategic tool for competitive advantage.