I. Executive Summary

Drug repurposing, also known as drug repositioning or reprofiling, represents a pivotal strategy in pharmaceutical development. This approach involves identifying novel clinical applications for existing approved or investigational drugs beyond their original intended uses.1 It offers a compelling alternative to traditional

de novo drug discovery, primarily due to significantly reduced timelines, lower costs, and a de-risked development profile.1 The inherent advantages of leveraging existing safety and pharmacokinetic data streamline the development process, making repurposed compounds an increasingly attractive investment.

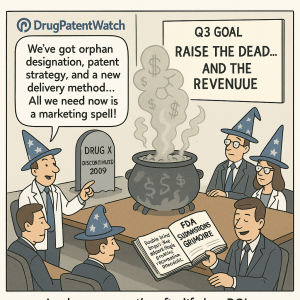

Achieving profitability in drug repurposing hinges on a multifaceted strategy that encompasses meticulous intellectual property (IP) management, efficient navigation of complex regulatory pathways, a keen focus on addressing high unmet medical needs, and the cultivation of robust collaborations across the pharmaceutical ecosystem.3 The ability to secure new method-of-use patents or leverage orphan drug designations can provide crucial market exclusivity, transforming a dormant asset into a revenue-generating product.

The global drug repurposing market is experiencing substantial growth, projected to expand from approximately USD 34.98 billion in 2024 to USD 59.30 billion by 2034, demonstrating a Compound Annual Growth Rate (CAGR) of 5.42%.9 This growth is largely fueled by the escalating demand for cost-effective therapeutic solutions and the transformative advancements in artificial intelligence (AI) and computational biology, which are revolutionizing candidate identification and development processes.9 This market trajectory underscores the strategic imperative for pharmaceutical companies to integrate drug repurposing into their core R&D and commercialization strategies.

II. Introduction to Drug Repurposing

Defining Drug Repurposing: Repositioning, Reprofiling, and Retasking

Drug repurposing, often interchangeably referred to as drug repositioning or reprofiling, is a sophisticated strategy that identifies new clinical applications for compounds already approved for other uses, or for investigational drugs that did not succeed in their initial development.1 This approach is not limited to finding new uses for a drug based on its original mechanism of action; it frequently capitalizes on serendipitous discoveries of off-target effects or newly recognized biological actions of existing drugs.1 The scope of drug repurposing is remarkably broad, extending beyond traditional pharmaceutical compounds to include chemicals, molecules, nutraceuticals, or even live biotherapeutic products for novel applications for which they were not originally designed.1

This expansive definition highlights the immense versatility and inherent potential to unlock significant value from a diverse array of existing assets, moving beyond mere salvage operations for failed clinical candidates. The inclusion of already approved drugs suggests that repurposing is an integral component of lifecycle management and patent extension strategies for successful products. Furthermore, the consideration of non-drug entities like nutraceuticals broadens the scientific and commercial horizons, potentially attracting new types of investors and developers to this innovative field. This wider applicability transforms drug repurposing from a niche activity into a proactive strategy for continuous innovation and market expansion across varied product categories.

The Core Advantages: Reduced Cost, Time-to-Market, and Risk Profile

Drug repurposing offers a compelling array of advantages over traditional de novo drug development, primarily in terms of significantly reduced costs, accelerated time-to-market, and a de-risked development profile.1 These combined benefits position drug repurposing as a financially attractive and strategically imperative approach, particularly in an era characterized by escalating R&D costs and diminishing returns from conventional drug discovery.

- Reduced Cost: Repurposing can dramatically cut R&D expenses by an estimated 50-60%, with average costs potentially around $300 million, a stark contrast to the staggering $2-3 billion often required to bring a novel drug to market.3 This substantial cost reduction is largely attributable to the ability to bypass early, resource-intensive stages of development, such as extensive preclinical compound discovery and Phase I safety studies, given that existing safety and toxicity data are already available for the repurposed compound.1

- Reduced Time-to-Market: Development timelines can be shortened significantly, typically ranging from 3-12 years for repurposed drugs, compared to 10-15 years for new chemical entities, effectively shaving off 5 to 7 years from the typical drug development timeline.1 This acceleration is primarily due to the pre-existing knowledge base concerning the drug’s safety profile, pharmacokinetics, and established manufacturing processes, which obviates the need for extensive early-stage investigations.4

- Reduced Risk of Failure: A critical advantage of drug repurposing is the lower risk of failure. Repurposed drugs have already undergone substantial testing and possess established safety and toxicity profiles in humans.1 This contrasts sharply with traditional drug development, where a significant number of candidates fail due to unacceptable safety profiles.3 Consequently, the approval rate for repurposed drugs that successfully complete Phase I trials can be as high as 30%, a notable improvement over the typical success rate of less than 10% for traditional new drug development.1 This significantly higher success rate fundamentally alters the risk-reward calculus for pharmaceutical investment.

- Addressing Unmet Medical Needs: Drug repurposing offers an economically viable and often expedited pathway to develop treatments for rare or neglected diseases. For these conditions, traditional novel drug development can be financially challenging due to small patient populations and uncertain market returns.3 Repurposing facilitates earlier access to much-needed medicines for serious and life-threatening diseases, including pediatric conditions, by providing a more economically feasible route to market.3

The combined advantages of reduced cost, time, and risk are not merely incremental improvements; they fundamentally reposition drug repurposing from a niche strategy to a core business model for pharmaceutical companies seeking sustainable growth and effective responses to market pressures. This shift implies a strategic re-evaluation of R&D investment priorities, favoring de-risked assets that promise a more reliable return on investment.

Historical Evolution: From Serendipity to Systematic Innovation

Historically, the discovery of new uses for existing drugs often occurred through serendipitous observations. Early examples of successful drug repurposing, such as sildenafil (Viagra) for erectile dysfunction or thalidomide for leprosy, largely resulted from accidental discoveries of unexpected off-target effects or retrospective clinical observations.1 This reliance on chance meant that the process was unpredictable and lacked a systematic framework for consistent replication.

However, the field has undergone a significant transformation, moving towards more intentional and systematic innovation. This maturation is driven by profound advancements in human genomics, network biology, chemoproteomics, and computational research.1 The integration of “big data” methodologies, including the analysis of electronic health records (EHRs) and real-world evidence (RWE), has enabled researchers to identify promising drug candidates with greater precision and predictability.2 For instance, computational drug repurposing, involving in silico screening of approved drugs, leverages molecular, clinical, or biophysical data to identify serious candidates.2 Projects like Exscalate4Cov, which identified raloxifene as a potential COVID-19 treatment, exemplify the power of computational approaches in rapidly identifying repurposing candidates.2

This evolution from accidental findings to systematic, data-driven approaches, particularly with the advent and increasing sophistication of AI and omics technologies, signifies a profound shift in the drug repurposing landscape. It transforms the process from a “fishing expedition” reliant on luck to a “targeted search” guided by scientific hypotheses and advanced analytical tools. This increased predictability and scalability foster greater confidence among investors and pharmaceutical companies, allowing them to proactively integrate drug repurposing into their core R&D strategies, thereby establishing a more reliable pathway for innovation and commercial returns.

Table 1: Comparison of Traditional Drug Discovery vs. Drug Repurposing

The following table provides a comparative overview of key features distinguishing traditional drug discovery from drug repurposing, highlighting the strategic advantages offered by the latter.

| Feature | Traditional Drug Discovery | Drug Repurposing |

| Cost | >$2.5 billion 1 | <$500 million (average $300 million) 1 |

| Time-to-clinic | 10–15 years 1 | 3–12 years (average 6 years) 1 |

| Failure rate | 90–95% 1 | 25–70% (up to 30% approval rate after Phase I) 1 |

| Pre-clinical investigation | 1. Target validation |

- Compound screen

- Lead optimization (SAR, drug-like properties, solubility, etc.) 1 | 1. In silico screening

- Activity-based screens 1 |

| Clinical trial requirements | Phases I–III 1 | Phases II and III (may require Phase I if dose differs) 1 |

| IP protections | Composition of matter and method of use patents 1 | Method of use patents and composition of matter in some cases 1 |

| Commercial protections | New chemical entity protection (up to 5 years after FDA approval) 1 | New use/formulation exclusivity (up to 3 years after FDA approval) 1 |

This comparative analysis clearly illustrates why drug repurposing has gained significant traction. For pharmaceutical business strategists, this table serves as a foundational reference, quantitatively demonstrating the compelling return on investment (ROI) proposition that repurposing offers. The ability to significantly reduce financial outlay, expedite market entry, and improve success rates provides a strong strategic justification for prioritizing repurposed assets, thereby mitigating the inherent risks associated with novel drug development.

III. Scientific and Methodological Approaches for Candidate Identification

Overview of Approaches

Drug repurposing methodologies are broadly categorized into three primary strategic approaches, each offering a distinct lens through which to identify promising candidates:

- Drug-Centric Approach: This approach expands the application of an existing drug to a new indication.10 It often begins by observing off-label uses of an approved drug in new patient populations or medical conditions.10 It can also involve reviewing investigational or abandoned drugs that previously showed poor efficacy for their original indication or failed to secure regulatory approval.10 Furthermore, identifying new uses for drugs pulled from circulation due to safety or post-market issues, but which remain efficacious for other medicinal purposes, falls under this category.10 Repositioning drugs that have reached the end of their patent exclusivity period and face generic competition for new conditions is another facet.10

- Disease-Centric Approach: This strategy focuses on diseases with no effective treatments or only partially effective ones, seeking to match them with approved or failed compounds that could have a therapeutic impact.10 It is particularly valuable in drug repurposing efforts for rare diseases.10 This involves identifying diseases that share homologous underlying biological mechanisms with the indication the original drug was designed to treat. For example, a drug developed to treat cancer might also be effective against other diseases characterized by uncontrolled cell growth, such as psoriasis.10

- Target-Centric Approach: This method matches a new indication, which currently lacks a treatment, with an established drug and its known molecular target.10 The old and new indications often differ quite significantly.10 It involves investigating specific molecular targets implicated in the pathology of a disease and then identifying existing drugs already proven to modulate those targets.10 This approach is also highly useful when seeking to repurpose drugs for rare diseases.10

The existence of these distinct, yet complementary, approaches underscores the increasing sophistication and strategic depth within the drug repurposing field. This structured methodology moves beyond accidental discoveries, allowing researchers and companies to systematically probe the vast landscape of existing pharmaceutical knowledge for new therapeutic opportunities. This systematic exploration, rather than random chance, enhances the predictability and efficiency of the repurposing pipeline.

Advanced Computational and Data-Driven Methodologies

The maturation of drug repurposing into a systematic discipline has been profoundly influenced by advances in data science and computational research. These methodologies enable the rapid processing of large datasets, the identification of non-obvious connections, and improved predictive capabilities, all while being cost-effective compared to traditional screening methods.3

- Leveraging “Omics” Data and Network Biology: Modern approaches extensively utilize human genomics, network biology, and chemoproteomics to identify promising drug candidates.2 This involves finding genes implicated in a specific disease and then checking if they interact, at a cellular level, with other genes that are targets of known drugs.2 Multi-omic-based strategies integrate diverse data types like genomics, transcriptomics, proteomics, and metabolomics to comprehensively explore disease mechanisms and identify novel drug targets.17 Network-based approaches leverage complex biological networks to uncover relationships between drugs, diseases, and molecular targets, guiding precision medicine.17

- Computational Screening and Modeling:

- In Silico Screening: This involves computationally screening large databases of approved drugs to predict drug-target interactions and identify possible therapeutics for new indications.1 This significantly reduces the need for costly and time-consuming wet-laboratory work.18

- Disease Model and Pathway Analysis: Building a disease model – an investigational framework of key biological pathways and networks implicated in a disease – provides a deep understanding of underlying disease mechanisms.10 This allows researchers to match repurposing candidates that address those mechanisms, using data such as gene expression, protein-protein interaction, and scientific literature.10

- Knowledge Graphs: These organize complex biological data into networks, allowing researchers to quickly identify, visualize, and analyze direct and indirect relationships between biological concepts and molecular classes.10 This facilitates a rapid understanding of disease biology and helps focus on critical evidence for repurposing projects.10

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML, including deep learning and graph neural networks (GNNs), are revolutionizing drug repurposing by accelerating the identification of new therapeutics, reducing development timelines and costs, and improving predictive accuracy.9 These tools can screen vast datasets, identify non-obvious connections, predict drug-target interactions, and infer modes of action.3 For example, deep learning methods helped identify baricitinib as a potential COVID-19 treatment, later validated in clinical trials.15

- Real-World Evidence (RWE) and Electronic Health Records (EHRs): The use of pharmacoepidemiology and medical big data, including EHRs and real-world evidence, has gained significant popularity.2 RWE can provide insights into drug efficacy and safety in actual patient populations, facilitating the detection of adverse events not clear in limited trials.4 This data can inform pipeline strategy, optimize clinical trial design (e.g., patient recruitment, sample size reduction), and assess commercial viability.19

Despite the immense potential, challenges remain. The sheer volume and heterogeneity of data required for these computational methods can pose significant hurdles, leading to errors, inconsistencies, or inaccessibility due to privacy concerns.10 Furthermore, there is a need for specialized cross-domain expertise to effectively integrate and analyze these disparate datasets.10 However, the continuous refinement of these methodologies is transforming drug repurposing into a more robust, predictable, and scalable R&D pipeline.

IV. Regulatory Pathways and Intellectual Property Strategies

Navigating Regulatory Landscape (US & EU)

Successful drug repurposing necessitates adept navigation of established regulatory frameworks in key markets such as the United States and the European Union. While neither the FDA nor the EMA has created entirely separate pathways solely for repurposed drugs, existing mechanisms can be effectively leveraged to streamline approval.

In the United States, the 505(b)(2) New Drug Application (NDA) pathway offers a strategic opportunity to expedite development and approval timelines for repurposed drugs.1 This pathway is particularly beneficial as it allows applicants to rely, in part, on existing data from previously approved products, including findings of safety and effectiveness not generated by the applicant, or on published literature.22 This reliance can significantly reduce the need for extensive new preclinical and clinical studies, potentially bypassing Phase I trials altogether if the new dosage is comparable to or lower than the original.3 However, a tailored strategic approach is crucial, as there is no preset playbook, and sponsors must justify data reliance and establish a “bridge” to the reference product.1 Early and frequent engagement with the FDA through Pre-IND meetings is vital to validate regulatory assumptions, align on data requirements, and discuss critical aspects like Chemistry, Manufacturing, and Controls (CMC) considerations, thereby preventing costly development missteps.23 This pathway can also qualify repurposed drugs for expedited review programs like Breakthrough Therapy and Fast Track designations, or orphan drug status, which offer incentives like tax credits and market exclusivity.21

In the European Union, the European Medicines Agency (EMA) also utilizes existing pathways for drug repurposing, with a slightly greater number of options compared to the FDA.3 The EMA has introduced adaptive pathways to facilitate faster approval for drugs addressing urgent medical needs, including repurposed medicines.3 A significant development is the EMA and Heads of Medicines Agencies (HMA) pilot project, which supports not-for-profit organizations and academia in generating evidence for new indications of established medicines.26 This initiative aims to bridge the gap where marketing authorization holders lack commercial incentives for older, off-patent drugs.26 The proposed revision to EU pharmaceutical legislation, particularly

Article 48, is poised to be a crucial change. This article would allow not-for-profit entities to submit clinical evidence for new therapeutic indications to the EMA, especially for unmet medical needs.12 If favorable, the original marketing authorization holder would be required to update the product information, empowering third parties to drive label extensions.12 This legislative change could significantly incentivize clinical research into repurposing opportunities, ensuring that evidence translates into patient access.12

Despite these supportive mechanisms, obtaining regulatory approval still requires demonstrating sufficient efficacy and safety for the new indication, often necessitating additional clinical trials.3 The new indication may also demand changes in dosing or formulation, along with manufacturing adjustments.12 Early and consistent dialogue with regulatory bodies is paramount to navigating these complexities and optimizing the approval process.7

Intellectual Property Protection for Repurposed Drugs

Intellectual property (IP) rights and patentability present significant hurdles in drug repurposing, yet they are crucial for securing market exclusivity and ensuring profitability.3 While the original drug compound may no longer be patentable, new patents can be sought for novel aspects of the repurposed use.

- Challenges in Patenting: Securing patents for new medical uses of existing compounds, especially generic drugs, can be difficult due to issues like prior art and the “obviousness” of the new use.3 If the new use is implied or considered obvious based on the drug’s known characteristics, patentability is challenged.27 The expiration of the original drug’s patent also limits the period of market exclusivity for the repurposed indication, and enforcing method-of-use patents for off-patent drugs can be challenging.3

- Strategies for New Patents: To overcome these challenges, companies can pursue several patent prosecution strategies 27:

- New Medical Uses (Method-of-Use Patents): These protect the specific method by which an existing drug treats a new condition.5 While challenging, if prior art does not explicitly mention the same active agent for the exact clinical indication, a new use patent may be granted.27

- New Formulations or Delivery Systems: Developing and patenting new formulations (e.g., oral, subcutaneous) or novel delivery systems (e.g., transdermal patches, inhalation devices) can provide genuine therapeutic advantages and secure additional patent protection.27 This is particularly effective when addressing limitations of current therapy, such as patient compliance or side effect profiles.28

- New Dosing Regimens or Administration Routes: Identifying specific new ways of administering drugs or optimized dosing schedules can also lead to patentable claims, overcoming challenges of inherent anticipation.27

- New Patient Populations: The discovery of a novel patient population to be treated by an existing drug can contribute to the novelty and non-obviousness of patent claims.27

- Combination Therapies: New combinations of known drugs may also be eligible for patent protection.5

- Market Exclusivity and “Evergreening”: Beyond patent protection, regulatory exclusivities play a vital role. Orphan Drug Designation, for instance, provides incentives like tax credits, grant funding, and potential seven years of market exclusivity for drugs treating rare diseases.5 Patent term extensions can also compensate for time lost during regulatory review.5 The practice of seeking secondary patents for new formulations or uses to prolong market exclusivity beyond the original patent’s expiration is sometimes referred to as “evergreening” and can face scrutiny, but it remains a strategic tool for lifecycle management.5

A robust IP strategy must align closely with business objectives, providing layered protection across multiple dimensions of the drug product.28 This requires systematic portfolio management, strategic extension mechanisms, and thoughtful navigation of legal and ethical considerations.28

Leveraging Patent Data for Competitive Advantage

In the competitive pharmaceutical landscape, effectively leveraging patent data is crucial for strategic decision-making in drug repurposing and for gaining a competitive edge.

- Competitive Intelligence: A robust patent monitoring system and thorough patent landscape analysis are foundational.29 By regularly tracking competitor patent filings and analyzing their technical content, companies can gain insights into their R&D focus areas, anticipate new market entrants, and identify shifts in their strategies.29 This allows for proactive identification of emerging drug classes, therapeutic approaches, and potential shifts in treatment paradigms.29

- Identifying Opportunities and Mitigating Risks: Patent landscape analysis can reveal “white space” opportunities where unmet needs exist or where intellectual property gaps allow for new product development without infringement.29 Furthermore, analyzing patent data helps companies mitigate legal risks by identifying potential infringement issues early, assessing the strength of competitor patents, and guiding “design-around” strategies.29 This proactive approach is critical for ensuring freedom-to-operate in key markets.31

- Informing R&D and Commercial Strategies: Patent data can directly inform R&D direction, helping to prioritize repurposing efforts by identifying new uses for existing drugs, uncovering unexpected drug-target interactions, guiding combination therapy development, and informing reformulation strategies.29 For commercial teams, patent data provides valuable insights for market entry decisions, evaluating the competitive landscape, and timing market entry for maximum impact.29 It also supports pricing and reimbursement strategies by assessing a drug’s technological uniqueness and identifying potential generic competition.29 Companies that effectively leverage patent data in their pricing strategies can achieve higher profit margins.29

- Driving Collaboration and Investment: Patent data can also facilitate open innovation initiatives by identifying potential collaboration partners, guiding crowdsourcing efforts, and supporting pre-competitive research collaborations.29 For investors, highlighting the strength of a company’s intellectual property portfolio through patent data can demonstrate innovation leadership and provide tangible evidence of R&D progress, enhancing investor relations.29

The future of patent data analysis in pharmaceuticals is increasingly moving towards AI-powered, real-time insights, enabling companies to transform raw information into strategic advantages and drive market domination.29

V. Commercialization and Market Dynamics

Market Sizing and Growth Drivers

The drug repurposing market is experiencing significant and sustained growth, underscoring its increasing importance in the pharmaceutical industry. The global drug repurposing market size was approximately USD 34.98 billion in 2024 and is projected to reach around USD 59.30 billion by 2034, demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.42% from 2025 to 2034.9 North America currently holds the largest revenue share, accounting for 47% of the market in 2024, driven by the high prevalence of chronic conditions such as cancer, Alzheimer’s, and neurodegenerative diseases, which create an urgent need for cost-effective treatments.9

Several key factors are driving this market expansion:

- Demand for Cost-Effective and Expedited Drug Development: The traditional drug discovery pipeline is notoriously slow, costly, and prone to high failure rates.1 Drug repurposing offers a more efficient and economically viable pathway to market, with significantly reduced development timelines and costs.3 This efficiency stems from leveraging existing clinical and pharmacological data, including established safety profiles, which allows researchers to bypass early-stage trials.3

- Advancements in AI and Computational Biology: Innovations in bioinformatics, machine learning, and AI are revolutionizing drug repurposing.9 These tools accelerate the identification of new therapeutics, reduce development timelines and costs, and improve predictive accuracy by integrating diverse data sources.9 AI-guided modeling, gene expression profiling, and network pharmacology enable precise targeting of existing drugs for new indications.9 The computational drug repurposing market is expanding rapidly, with approximately 30% of newly marketed drugs in the U.S. resulting from these strategies, demonstrating their clinical and commercial value.15

- Focus on Unmet Medical Needs and Rare Diseases: Drug repurposing is a key strategy for addressing unmet medical needs, particularly for rare or neglected diseases where conventional drug development is often financially unviable due to small patient populations.3 Regulatory bodies like the FDA and EMA support these efforts through fast-track and orphan drug designations, which provide incentives and reduce development complexities.6

- Strategic Shift by Pharmaceutical Companies: Facing patent expiry pressures and the high costs of novel drug development, pharmaceutical companies are increasingly integrating drug repurposing into their lifecycle management strategies to extend the value of existing assets.33 This includes exploring new uses for off-patent or low-performing drugs.33

The market is also segmented by approach type, with the disease-centric approach dominating, accounting for 43% of the market share in 2024, as it facilitates focused investigation of specific diseases and identification of drug-disease relationships.9 Biologics represent the largest revenue share by drug molecule type, at 62% in 2024.9

Pricing Strategies

Establishing an effective pricing strategy for repurposed drugs is crucial for maximizing profitability and ensuring market acceptance. Unlike novel drugs, repurposed drugs often have established safety profiles and may face different pricing dynamics.

- Value-Based Pricing: This approach links the drug’s price to its perceived effectiveness and the clinical benefits it offers to patients and the broader healthcare system.34 It shifts away from a simple cost-plus model towards one that aligns cost with actual health improvements.35 For repurposed drugs, particularly those addressing high unmet medical needs or offering significant therapeutic advantages (e.g., improved patient convenience, different administration routes), value-based pricing can justify a premium price.36 Case studies indicate that addressing unmet needs and offering new administration routes can lead to a positive price change for repurposed products.36 This model encourages the development of medications that provide genuine and substantial therapeutic value.35

- Cost-Plus Pricing: This straightforward method calculates the price by adding a predetermined profit margin to the total costs incurred during production, including R&D and regulatory expenses.35 While simpler and transparent, it may not fully capture the value a repurposed drug brings, especially if it addresses a critical unmet need or offers significant patient benefits.35 This method is often favored by generic drug manufacturers.35

- Competitive-Based Pricing: This strategy involves setting prices based on competitors’ pricing for similar treatments.38 For repurposed drugs, this might involve pricing against existing therapies for the new indication.

- Impact of Reformulation and Administration Routes: Studies show that reformulations, particularly those involving a change in administration route, can significantly impact pricing. For instance, a change to a hospital administration setting can lead to a substantial price increase.36 Similarly, new formulations adapted for different administration routes (e.g., subcutaneous or oral) can be sufficient to obtain new patents, further influencing pricing potential.27

- Challenges in Pricing: Repurposing off-patent drugs often yields limited financial returns due to generic competition.3 Insurance companies and healthcare systems may also be reluctant to pay premium prices for repurposed drugs, especially if the original version is available at a lower cost.7 Furthermore, policies like Medicaid’s “best-price rule” can complicate the adoption of novel value-based pricing arrangements in the US.39

An effective drug pricing strategy requires early planning, close monitoring of legislative and regulatory reforms, and cross-functional collaboration to understand and establish fair pricing in each market.40

Addressing Market Acceptance and Reimbursement Challenges

Despite the inherent advantages, drug repurposing faces significant challenges related to market acceptance and reimbursement, particularly for off-patent drugs.

- Lack of Financial Incentives for Generics: A primary barrier is the insufficient financial incentive for pharmaceutical companies to explore and formally approve new indications for generic drugs.2 Doctors can prescribe drugs off-label, and pharmacists can switch to cheaper generic alternatives, which limits the opportunity for developers to recoup investment in new indications.2 This often means that research into new uses for generic drugs is primarily conducted by academic or non-profit institutions with limited funding.41

- Off-Label Use vs. Regulatory Approval: While off-label use is common and can be beneficial, it presents challenges for widespread adoption and reimbursement. Off-label use requires individual prescribers and patients to evaluate new data, slowing uptake and potentially introducing medico-legal risks.42 Regulatory approval, on the other hand, formalizes the new indication in labeling, which accelerates adoption and facilitates patient access, as payers’ coverage is generally less restrictive for on-label uses.42

- Reimbursement Policies: Reimbursement policies are not always adapted to repurposed drugs, leading to market access issues.6 This can be particularly challenging if the repurposed drug is perceived as a “cheap” generic, even if it offers significant value for a new indication.

- Strategies for Market Acceptance and Reimbursement:

- Formal Regulatory Approval: Seeking formal FDA or EMA approval for the new indication is paramount. This legitimizes the new use, provides clear prescribing information, and enhances patient access by facilitating payer coverage.14

- Leveraging Expedited Pathways: Utilizing expedited regulatory pathways like Orphan Drug Designation, Fast Track, and Breakthrough Therapy can accelerate approval for repurposed drugs, especially for unmet medical needs.7 Orphan drug designation, in particular, provides market exclusivity incentives.5

- Physician Education and Guidelines: While regulatory approval is key, educating physicians about the new on-label indications is crucial for uptake. For off-label uses, clinical practice guidelines (e.g., NCCN Guidelines in oncology) can help, but they don’t exist for every disease, limiting broader acceptance.42

- Patient Advocacy and Crowdfunding: Patient advocacy groups and crowdfunding platforms play an increasing role in financing repurposing projects, particularly for rare or underserved populations.7 Their involvement can also drive awareness and demand, influencing market acceptance.

- Value-Based Contracting: Implementing value-based pricing approaches that tie drug prices to patient outcomes can align incentives between manufacturers, payers, and providers, potentially improving reimbursement for repurposed drugs.34

- Strategic Partnerships: Collaborations between academic institutions, non-profit organizations, and pharmaceutical companies can pool resources and expertise to navigate regulatory and financial hurdles, ultimately improving the likelihood of market acceptance.7

Overcoming these challenges requires a concerted effort from all stakeholders, including regulators, industry, academia, and patient groups, to create a more supportive ecosystem for repurposed drugs.

VI. Collaborative Ecosystem and Future Outlook

Roles of Key Stakeholders

The drug repurposing landscape is a complex ecosystem, thriving on the synergistic efforts of diverse stakeholders. Each plays a critical role in identifying, developing, and bringing repurposed therapies to market.

- Pharmaceutical Companies: Large pharmaceutical companies are increasingly integrating drug repurposing into their lifecycle management strategies to extend the value of existing assets, especially those nearing patent expiry.33 They bring significant capital, established R&D infrastructure, manufacturing capabilities, and global distribution networks.45 Their involvement often focuses on “soft repurposing” (extending to related indications) or “hard repurposing” (entirely new conditions) for drugs still under patent protection or those that can be reformulated for new patents.12 Collaborations with smaller biotechs and academic institutions are common, leveraging external innovation while providing necessary resources for later-stage development and commercialization.45

- Biotechnology Firms: Biotech companies are at the forefront of accelerating drug discovery by developing innovative platform technologies, often leveraging AI and computational methods.48 These platforms enable more efficient and cost-effective identification of new drug candidates and repurposing opportunities.48 Smaller biotechs frequently partner with larger pharmaceutical companies to access critical resources, accelerate clinical development, expand market reach, and leverage regulatory expertise, particularly for complex or rare disease therapies.45 Examples include Recursion Pharmaceuticals’ collaborations with Bayer for fibrotic diseases and oncology, and Healx’s AI-powered repurposing efforts for rare diseases.47

- Academic Institutions: Academic researchers play a foundational role in early-stage drug repurposing, often identifying potential drug candidates through basic research, assessing safety and efficacy in preclinical models, and conducting early-stage clinical trials.50 Their expertise in understanding disease mechanisms and uncovering new modes of action for approved drugs is invaluable.51 Academic institutions are particularly active in repurposing for orphan and neglected diseases, where commercial incentives are often limited.51 They frequently engage in multi-partner collaborations with industry and non-profit organizations to bridge the “valley of death” and translate research findings into clinical applications.50 Public institutions have contributed to nearly 90% of new indications for previously approved drugs.52

- Contract Research Organizations (CROs): CROs are vital partners across the pharmaceutical, biotechnology, and medical device industries, providing outsourced research services on a contractual basis.54 In drug repurposing, CROs offer comprehensive support, including preclinical testing, clinical trial management (site selection, patient recruitment, data collection, safety monitoring), pharmacovigilance, and regulatory submissions.54 Their specialized expertise and resources help streamline the drug development process, ensure adherence to regulatory requirements, and reduce costs and timelines for their clients.54 Many CROs actively seek collaborations with pharma and academia to advance repurposing projects.58

The consensus across the industry is that multi-partner collaborations are essential facilitators for successful drug repurposing.18 By pooling resources, expertise, and data, these collaborations can overcome financial, regulatory, and scientific barriers, ultimately accelerating the delivery of new treatments to patients.7

Future Trends and Opportunities

The drug repurposing landscape is dynamic, with several emerging trends and opportunities poised to shape its future and further enhance its profitability potential.

- Increasing Role of Artificial Intelligence (AI) and Real-World Data (RWD): AI and machine learning will continue to revolutionize drug repurposing by enabling more precise and rapid identification of new therapeutic uses.9 The integration of diverse data sources, including genomics, proteomics, and especially real-world data from electronic health records (EHRs) and claims databases, will improve predictive accuracy and inform clinical trial design.4 This data-driven approach allows for the identification of unexpected drug-target interactions and potential new uses based on observed patient outcomes.29

- Focus on Precision Medicine: Drug repurposing will increasingly align with precision medicine, leveraging genetic insights and molecular pathways to identify specific patient subgroups that may benefit most from a repurposed drug.15 This targeted approach can enhance efficacy and reduce side effects, leading to more personalized treatments.9

- Addressing Emerging Public Health Threats and Rare Diseases: The strategic value of drug repurposing became particularly evident during the COVID-19 pandemic, where existing drugs were rapidly investigated and deployed.3 This highlights its potential as a rapid response mechanism for future public health crises.57 Furthermore, repurposing remains a key alternative for developing treatments for the vast majority of rare diseases that currently lack approved therapies, offering a faster and more cost-effective solution.6

- Innovative Financing Models and Regulatory Support: To overcome financial hurdles, particularly for off-patent drugs, innovative financing models like “megafunds” and social impact bonds are being explored.7 Regulatory bodies are also evolving, with initiatives like the EMA’s pilot project and proposed legislative changes (e.g., Article 48) aiming to provide greater support and incentives for repurposing, especially from non-profit and academic sectors.12 Increased regulatory involvement and collaboration are recommended to mitigate pitfalls and encourage repurposing initiatives.11

- New Formulations and Combination Therapies: Developing new formulations, delivery systems, or combination therapies for existing drugs will continue to be a significant avenue for repurposing, offering new patent opportunities and improved therapeutic outcomes.5 This can lead to enhanced patient compliance, reduced dosing frequency, or more favorable side-effect profiles.28

The future of drug repurposing points towards a highly integrated, technology-driven, and collaborative ecosystem. By systematically combining diverse data types, leveraging advanced computational tools, and fostering multi-stakeholder partnerships, the pharmaceutical industry can unlock the full potential of dormant assets, addressing critical unmet medical needs while achieving sustainable commercial success.

VII. Conclusion

Drug repurposing has evolved from an opportunistic phenomenon to a sophisticated, systematic strategy, offering a compelling blueprint for pharmaceutical innovation and commercial success. Its inherent advantages—significantly reduced costs, accelerated timelines, and a de-risked development profile—make it an indispensable approach in today’s challenging pharmaceutical landscape. The global market’s projected growth underscores the increasing recognition of its value in addressing unmet medical needs, particularly for rare diseases and emerging public health threats.

To effectively “bring a dead drug back to life (and profit),” a holistic and integrated strategy is essential. This involves:

- Strategic Candidate Identification: Employing advanced computational and data-driven methodologies, including AI, network biology, and real-world evidence analysis, to systematically identify promising drug-disease associations, moving beyond serendipity to predictable discovery.

- Proactive Regulatory Engagement: Navigating regulatory pathways such as the FDA’s 505(b)(2) and leveraging EMA initiatives and proposed legislative changes through early and continuous dialogue with regulatory agencies to streamline approval processes and secure expedited designations.

- Robust Intellectual Property Management: Developing comprehensive patent strategies that focus on new method-of-use, formulation, delivery system, dosing regimen, or patient population patents to secure market exclusivity, and actively leveraging patent data for competitive intelligence.

- Value-Driven Commercialization: Implementing pricing strategies that reflect the true clinical value and unmet medical need addressed by the repurposed drug, while actively engaging with payers, physicians, and patient advocacy groups to ensure market acceptance and favorable reimbursement.

- Fostering Collaborative Ecosystems: Actively engaging in multi-partner collaborations involving pharmaceutical companies, biotech firms, academic institutions, and Contract Research Organizations (CROs) to pool expertise, share resources, and collectively overcome development and commercialization hurdles.

By embracing these strategic imperatives, stakeholders in the pharmaceutical industry can unlock substantial value from existing assets, transforming dormant compounds into life-saving and profitable therapies, thereby contributing significantly to global health while achieving sustainable business growth.

Works cited

- Drug Repurposing Strategies, Challenges and Successes | Technology Networks, accessed July 23, 2025, https://www.technologynetworks.com/drug-discovery/articles/drug-repurposing-strategies-challenges-and-successes-384263

- Drug repositioning – Wikipedia, accessed July 23, 2025, https://en.wikipedia.org/wiki/Drug_repositioning

- Drug Repurposing: An Overview – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/drug-repurposing-an-overview/

- Drug-Repositioning Approaches Based on Medical and Life Science Databases – Frontiers, accessed July 23, 2025, https://www.frontiersin.org/journals/pharmacology/articles/10.3389/fphar.2021.752174/full

- Biopharmaceuticals: The Patent Implications of Drug Repurposing – PatentPC, accessed July 23, 2025, https://patentpc.com/blog/patent-implications-of-drug-repurposing

- Drug Repurposing Market Size, Share, Trends, Analysis & Forecast, accessed July 23, 2025, https://www.verifiedmarketresearch.com/product/drug-repurposing-market/

- Overcoming Regulatory and Financial Hurdles in Repurposing Approved Drugs As Cancer Therapeutics – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/giving-drugs-a-second-chance-overcoming-regulatory-and-financial-hurdles-in-repurposing-approved-drugs-as-cancer-therapeutics/

- Intellectual property and other legal aspects of drug repurposing – ResearchGate, accessed July 23, 2025, https://www.researchgate.net/publication/241120780_Intellectual_property_and_other_legal_aspects_of_drug_repurposing

- Drug Repurposing Market Size to Hit USD 59.30 Billion by 2034 – Precedence Research, accessed July 23, 2025, https://www.precedenceresearch.com/drug-repurposing-market

- Drug repurposing: approaches, methods and considerations – Elsevier, accessed July 23, 2025, https://www.elsevier.com/industry/drug-repurposing

- International regulatory and publicly-funded initiatives to advance drug repurposing, accessed July 23, 2025, https://www.frontiersin.org/journals/medicine/articles/10.3389/fmed.2024.1387517/full

- Drug repurposing: EU legislative changes could speed up new …, accessed July 23, 2025, https://cancerworld.net/drug-repurposing-eu-legislative-changes-speed-up/

- Drug repurposing: progress, challenges and recommendations – PharmaKure, accessed July 23, 2025, https://pharmakure.com/wp-content/uploads/2022/07/Drug-Repurposing-Review.pdf

- Drug repurposing for rare: progress and opportunities for the rare disease community – PMC, accessed July 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10828010/

- Computational Drug Repurposing: Approaches and Case Studies – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/computational-drug-repurposing-approaches-and-case-studies/

- Drug repurposing: a promising tool to accelerate the drug discovery process – PMC, accessed July 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11920972/

- The landscape of the methodology in drug repurposing using human genomic data: a systematic review – Oxford Academic, accessed July 23, 2025, https://academic.oup.com/bib/article/25/2/bbad527/7590313

- Drug repurposing: a systematic review on root causes, barriers and facilitators – PMC, accessed July 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9336118/

- (PDF) Use of Real‐World Evidence to Drive Drug Development Strategy and Inform Clinical Trial Design – ResearchGate, accessed July 23, 2025, https://www.researchgate.net/publication/356599600_Use_of_Real-World_Evidence_to_Drive_Drug_Development_Strategy_and_Inform_Clinical_Trial_Design

- Use of Real‐World Evidence to Drive Drug Development Strategy and Inform Clinical Trial Design – PubMed Central, accessed July 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9299990/

- 505(b)(2) Pathway | CRO Services | Consulting | Premier Research, accessed July 23, 2025, https://premier-research.com/expertise/505b2-development-pathway/

- overview of the 505(b)(2) regulatory pathway for new drug … – FDA, accessed July 23, 2025, https://www.fda.gov/media/156350/download

- Maximizing the Value of FDA Pre-IND Meetings for Successful 505(b)(2) NDA Submissions, accessed July 23, 2025, https://www.propharmagroup.com/thought-leadership/fda-pre-ind-meetings-for-successful-505b2-nda-submissions

- Small Business and Industry Assistance: Frequently Asked Questions on the Pre-Investigational New Drug (IND) Meeting | FDA, accessed July 23, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-and-industry-assistance-frequently-asked-questions-pre-investigational-new-drug-ind

- Designating an Orphan Product: Drugs and Biological Products | FDA, accessed July 23, 2025, https://www.fda.gov/industry/medical-products-rare-diseases-and-conditions/designating-orphan-product-drugs-and-biological-products

- Repurposing of authorised medicines: pilot to support not-for-profit …, accessed July 23, 2025, https://www.ema.europa.eu/en/news/repurposing-authorised-medicines-pilot-support-not-profit-organisations-and-academia

- Strategic Patenting for Repurposed GLP-1RA Drugs, accessed July 23, 2025, https://natlawreview.com/article/glp-1-receptor-agonists-and-patent-strategy-securing-patent-protection-new-use-old

- The Patent Playbook for Pharma: Protect Your Drug. Protect Your …, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/the-patent-playbook-for-pharma-protect-your-drug-protect-your-profits/

- Leveraging Patent Pending Data for Pharmaceuticals …, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/leveraging-patent-pending-data-for-pharmaceuticals/

- Uncovering Opportunities in the Pharma Patent Landscape – Innoplexus, accessed July 23, 2025, https://www.innoplexus.com/blog/uncovering-opportunities-in-the-pharma-patent-landscape

- The Influence of Patent Laws on Private Equity in the Biotech Sector | PatentPC, accessed July 23, 2025, https://patentpc.com/blog/the-influence-of-patent-laws-on-private-equity-in-the-biotech-sector

- How to Protect Intellectual Property in Generic Drug Development – PatentPC, accessed July 23, 2025, https://patentpc.com/blog/how-to-protect-intellectual-property-generic-drug-development

- Drug Repurposing Strategic Research Business Report 2024-2025 & 2030 – Patent Expiry Pressures Encourage Pharma Companies to Extend Value of Existing Assets via New Indications – ResearchAndMarkets.com, accessed July 23, 2025, https://www.businesswire.com/news/home/20250528921205/en/Drug-Repurposing-Strategic-Research-Business-Report-2024-2025-2030—Patent-Expiry-Pressures-Encourage-Pharma-Companies-to-Extend-Value-of-Existing-Assets-via-New-Indications—ResearchAndMarkets.com

- How Health Plans Use Value-Based Drug Pricing, accessed July 23, 2025, https://advisory.avalerehealth.com/insights/how-health-plans-use-value-based-approaches-to-drug-pricing

- Decoding Drug Pricing Models: A Strategic Guide to Market Domination – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/decoding-drug-pricing-models-a-strategic-guide-to-market-domination/

- Drug repurposing in pharmaceutical industry and its impact on market access, accessed July 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4865758/

- Full article: Drug repurposing in pharmaceutical industry and its impact on market access, accessed July 23, 2025, https://www.tandfonline.com/doi/full/10.3402/jmahp.v2.22814

- Cost-plus versus value-based pricing | nibusinessinfo.co.uk, accessed July 23, 2025, https://www.nibusinessinfo.co.uk/content/cost-plus-versus-value-based-pricing

- Case Study: Pharmaceutical Pricing and Innovation – July 18, 2018 – USC Schaeffer Center, accessed July 23, 2025, https://schaeffer.usc.edu/research/case-study-pharmaceutical-pricing-and-innovation/

- Establishing a Drug Pricing Strategy | Insights – Sidley Austin LLP, accessed July 23, 2025, https://www.sidley.com/en/insights/publications/2024/06/establishing-a-drug-pricing-strategy

- Incentivizing Generic Drug Repurposing in the United States – Market Shaping Accelerator, accessed July 23, 2025, https://marketshaping.uchicago.edu/wp-content/uploads/2025/04/Generic-drug-repurposing-AMC.pdf

- Clearing the Path for New Uses for Generic Drugs – Federation of American Scientists, accessed July 23, 2025, https://fas.org/publication/clearing-the-path-for-new-uses-for-generic-drugs/

- Comparing Pathways for Making Repurposed Drugs Available In The EU, UK, And US, accessed July 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11788669/

- Repurposing medicines: the opportunity and the challenges – LifeArc, accessed July 23, 2025, https://www.lifearc.org/wp-content/uploads/2021/06/LifeArc-Repurposing-digital_FINAL.pdf

- Biotech Partnerships: How Partnering with Big Pharma Can Support R&D – Excedr, accessed July 23, 2025, https://www.excedr.com/blog/how-biotech-partnerships-support-research

- Drug Repurposing: Realities and Roadblocks – Alacrita, accessed July 23, 2025, https://www.alacrita.com/blog/drug-repurposing

- Top 5 Companies Working to Repurpose Drugs in the U.S. – Persistence Market Research, accessed July 23, 2025, https://www.persistencemarketresearch.com/blog/top-companies-in-us-drug-repurposing.asp

- Biotechs are Accelerating Drug Discovery by Repurposing Platforms: What This Means for Investors | Nasdaq, accessed July 23, 2025, https://www.nasdaq.com/articles/biotechs-are-accelerating-drug-discovery-by-repurposing-platforms-what-this-means-for

- Drug repurposing emerges as viable option for rare disease treatment – Labiotech.eu, accessed July 23, 2025, https://www.labiotech.eu/in-depth/drug-repurposing-viable-option-rare-disease-treatment/

- The Role of Academic Research in Pharmaceutical Innovation – Parabolic Drugs, accessed July 23, 2025, https://parabolicdrugs.com/the-role-of-academic-research-in-pharmaceutical-innovation/

- (PDF) Drug Repurposing from an Academic Perspective – ResearchGate, accessed July 23, 2025, https://www.researchgate.net/publication/221864945_Drug_Repurposing_from_an_Academic_Perspective

- The Role of Academic Institutions in the Development of Drugs for Rare and Neglected Diseases | Request PDF – ResearchGate, accessed July 23, 2025, https://www.researchgate.net/publication/228114537_The_Role_of_Academic_Institutions_in_the_Development_of_Drugs_for_Rare_and_Neglected_Diseases

- Join the Repurposing Bootcamp for Academics – REMEDi4ALL, accessed July 23, 2025, https://remedi4all.org/repurposing-bootcamp-for-academics/

- A Comprehensive Guide to Contract Research Organizations (CROs) – ICON Plc, accessed July 23, 2025, https://careers.iconplc.com/blogs/2024-1/a-comprehensive-guide-to-contractresearch-organizations-cros

- The Role of CRO Research Organizations in Advancing Medical Science – bioaccess, accessed July 23, 2025, https://www.bioaccessla.com/blog/the-role-of-cro-research-organizations-in-advancing-medical-science

- CROs in Clinical Trials: The Role They Play – Lindus Health, accessed July 23, 2025, https://www.lindushealth.com/blog/cros-in-clinical-trials

- Drug Repurposing Market: Strategic Approaches, Technological, accessed July 23, 2025, https://www.maximizemarketresearch.com/market-report/drug-repurposing-market/273130/

- The risk-reward balance in drug repurposing – Alacrita, accessed July 23, 2025, https://www.alacrita.com/blog/the-risk-reward-balance-in-drug-repurposing

- From repurposing to business through successful collaborations, accessed July 23, 2025, https://drugrepocentral.scienceopen.com/hosted-document?doi=10.14293/S2199-rexpo22009.v1

- Q&A: How can drug repurposing lower drug costs and improve care? | Penn State University, accessed July 23, 2025, https://www.psu.edu/news/research/story/qa-how-can-drug-repurposing-lower-drug-costs-and-improve-care